75ce7707bbdaf6f250046f79a70ae720.ppt

- Количество слайдов: 32

Private Equity and Narratives

Private Equity and Narratives

Agenda • • PE industry Positions of EVCA and BVCA PE Narratives in the Hearings Findings from the Academia Effects by Interventions Case Analysis : AA, Cases in Korea Implications Conclusion

Agenda • • PE industry Positions of EVCA and BVCA PE Narratives in the Hearings Findings from the Academia Effects by Interventions Case Analysis : AA, Cases in Korea Implications Conclusion

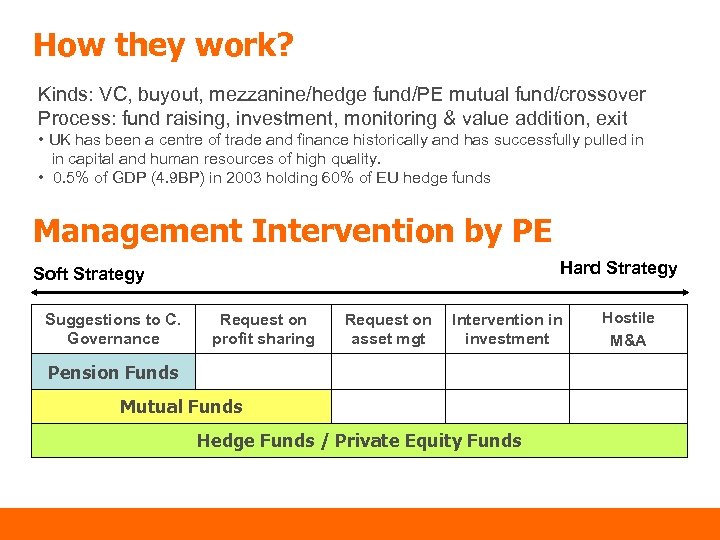

How they work? Kinds: VC, buyout, mezzanine/hedge fund/PE mutual fund/crossover Process: fund raising, investment, monitoring & value addition, exit • UK has been a centre of trade and finance historically and has successfully pulled in in capital and human resources of high quality. • 0. 5% of GDP (4. 9 BP) in 2003 holding 60% of EU hedge funds Management Intervention by PE Hard Strategy Soft Strategy Suggestions to C. Governance Request on profit sharing Request on asset mgt Intervention in investment Pension Funds Mutual Funds Hedge Funds / Private Equity Funds Hostile M&A

How they work? Kinds: VC, buyout, mezzanine/hedge fund/PE mutual fund/crossover Process: fund raising, investment, monitoring & value addition, exit • UK has been a centre of trade and finance historically and has successfully pulled in in capital and human resources of high quality. • 0. 5% of GDP (4. 9 BP) in 2003 holding 60% of EU hedge funds Management Intervention by PE Hard Strategy Soft Strategy Suggestions to C. Governance Request on profit sharing Request on asset mgt Intervention in investment Pension Funds Mutual Funds Hedge Funds / Private Equity Funds Hostile M&A

Trend in the PE Industry • Large institutional investors and financial service companies have increasingly set up PEFs - Goldman Sachs, Merrill Lynch, Morgan Stanley, Cal. PERS • • Fund of Funds and Event-Driven Funds are 45% Increasing scale both in LBO and hostile M&A by PE No differentiation in business model by fund types Diversified investment into emerging markets • Increasing pressure from the public - Intensifying regulation ex. registration of general partners in hedge funds by FSA (Financial Service Authority) Business Development Company (BDC) : open to the public and tax benefits

Trend in the PE Industry • Large institutional investors and financial service companies have increasingly set up PEFs - Goldman Sachs, Merrill Lynch, Morgan Stanley, Cal. PERS • • Fund of Funds and Event-Driven Funds are 45% Increasing scale both in LBO and hostile M&A by PE No differentiation in business model by fund types Diversified investment into emerging markets • Increasing pressure from the public - Intensifying regulation ex. registration of general partners in hedge funds by FSA (Financial Service Authority) Business Development Company (BDC) : open to the public and tax benefits

Strong Fund Activism • Funds are prescriptive, strategic, and aggressive • This type of funds consists of 5% and 7. 5 BD of all funds - 140 cases (90%) with 5% of ownership in US occurred for the last 3 years • Influencing decisively in the M&A, more than 60% successful rate with institutional investors - Cal. PERS Effectives ex. TCI (the Children’s Investment Fund, UK), Third Point (Star Gas CEO) • Backgrounds - Intensive and focused investment with low costs in monitoring No regulation on the management Incentive pay structure

Strong Fund Activism • Funds are prescriptive, strategic, and aggressive • This type of funds consists of 5% and 7. 5 BD of all funds - 140 cases (90%) with 5% of ownership in US occurred for the last 3 years • Influencing decisively in the M&A, more than 60% successful rate with institutional investors - Cal. PERS Effectives ex. TCI (the Children’s Investment Fund, UK), Third Point (Star Gas CEO) • Backgrounds - Intensive and focused investment with low costs in monitoring No regulation on the management Incentive pay structure

Central Issues Regarding PE Management of PE funds - Financial engineering vs. value extraction vs. creation - Lack of Transparency, accountability - Fee and Carried Interests for the managers • Tax Rate • Public Interests and Welfare – Impact on employment / job destruction through value extraction Role in the market Improvement in CG, management, and shareholders’ right - Contribution to economic growh, stability and efficiency in resources • • • Conflicts of interest between PE partners and other investors Conflicts of interest between PE partners and companies Short investment horizon • Higher leverage creates higher risks and vulnerability – less emphasis on long-term growth

Central Issues Regarding PE Management of PE funds - Financial engineering vs. value extraction vs. creation - Lack of Transparency, accountability - Fee and Carried Interests for the managers • Tax Rate • Public Interests and Welfare – Impact on employment / job destruction through value extraction Role in the market Improvement in CG, management, and shareholders’ right - Contribution to economic growh, stability and efficiency in resources • • • Conflicts of interest between PE partners and other investors Conflicts of interest between PE partners and companies Short investment horizon • Higher leverage creates higher risks and vulnerability – less emphasis on long-term growth

PE Firms on value creation • Higher postinvestment performance “We have 30 million pensioners in our pension funds and millions of them are in the UK. For instance, we have at least one million local government employees, past and present, who invest in our funds, and we have produced world-class returns for them in an era when pension fund deficits are a big issue. I believe that is a big positive for the country. ” “Our firm has produced over £ 2 billion of value for UK pension funds over the past three years” • Job creation “My experience in private equity in this country has been only positive…. . £ 250 million into a brand new bio-ethanol plant in Teesside which has created 800 jobs” “In terms of jobs, the most important safeguard for jobs is to build successful companies, and that is what private equity does. ”

PE Firms on value creation • Higher postinvestment performance “We have 30 million pensioners in our pension funds and millions of them are in the UK. For instance, we have at least one million local government employees, past and present, who invest in our funds, and we have produced world-class returns for them in an era when pension fund deficits are a big issue. I believe that is a big positive for the country. ” “Our firm has produced over £ 2 billion of value for UK pension funds over the past three years” • Job creation “My experience in private equity in this country has been only positive…. . £ 250 million into a brand new bio-ethanol plant in Teesside which has created 800 jobs” “In terms of jobs, the most important safeguard for jobs is to build successful companies, and that is what private equity does. ”

PE Firms on value creation (Contd. ) • Active involvement provides strategic advice and credibility – Positive from the company perspective (EVCA survey) – Ensuring healthy cash flow – New product development – Gaining market acceptance – Employing highly trained personnel “…managed to double sales in a company in Sheffield in four years and we still have the same number of people in that company. By doing so we have created a low-cost world leader in that industry by making it productive. We have the same number of people with double the sales. ” “The Alliance Boots story is all about growth. There are loads of unexploited potential…”

PE Firms on value creation (Contd. ) • Active involvement provides strategic advice and credibility – Positive from the company perspective (EVCA survey) – Ensuring healthy cash flow – New product development – Gaining market acceptance – Employing highly trained personnel “…managed to double sales in a company in Sheffield in four years and we still have the same number of people in that company. By doing so we have created a low-cost world leader in that industry by making it productive. We have the same number of people with double the sales. ” “The Alliance Boots story is all about growth. There are loads of unexploited potential…”

Summary of positions of witnesses • Arguments for PE – Active role of PE partners in running the company – Shorter chain of ownership – Reduced reporting requirements – Management incentives – Job creation through sustainable growth in the companies

Summary of positions of witnesses • Arguments for PE – Active role of PE partners in running the company – Shorter chain of ownership – Reduced reporting requirements – Management incentives – Job creation through sustainable growth in the companies

BVCA and EVCA • A sense of ownership is at the heart of private equity philosophy. • Growth Over the past five years, jobs and sales in private-equity backed companies have grown faster than in FTSE 100 and FTSE 250 companies Exports and investment have also grown faster than the national average Over 90% of companies in which private equity has invested say that without private equity their business either would not exist or would have grown far less rapidly • Strategic business advice, financial advice and practical support.

BVCA and EVCA • A sense of ownership is at the heart of private equity philosophy. • Growth Over the past five years, jobs and sales in private-equity backed companies have grown faster than in FTSE 100 and FTSE 250 companies Exports and investment have also grown faster than the national average Over 90% of companies in which private equity has invested say that without private equity their business either would not exist or would have grown far less rapidly • Strategic business advice, financial advice and practical support.

BVCA and EVCA • Debt Issue – – • What is “Excessive” More important issues are – Strong management, commitment and growth Taxation • • • increasing international competition attract talent encourage enterprise and long term investment UK as a hub for international PE Transparency • Fully negotiated and agreed by all investors • Flow of information and disclosure is much higher than Public Companyes • Availability of information to other parties including employees of investee companies and the wider public: • UK as a hub for international PE. • Long term outlook – Private Equity firms tend to hold on to companies for longer than the average length of time that institutional investors hold shares.

BVCA and EVCA • Debt Issue – – • What is “Excessive” More important issues are – Strong management, commitment and growth Taxation • • • increasing international competition attract talent encourage enterprise and long term investment UK as a hub for international PE Transparency • Fully negotiated and agreed by all investors • Flow of information and disclosure is much higher than Public Companyes • Availability of information to other parties including employees of investee companies and the wider public: • UK as a hub for international PE. • Long term outlook – Private Equity firms tend to hold on to companies for longer than the average length of time that institutional investors hold shares.

Principals of PE Narratives • Investments typically involve a transformational, value-added, active management strategy. • Consistent with the risks, private equity can provide high returns, with the best private equity managers significantly outperforming the public markets. • PEF investment is for those who can afford to have their capital locked in for long periods of time and who are able to risk losing significant amounts of money. This is balanced by the potential benefits of annual returns which range up to 30% for successful funds. PEF Acronym (SLIM) • • Sourcing, specialty Long, leverage Incentive, integrity Management, monitoring

Principals of PE Narratives • Investments typically involve a transformational, value-added, active management strategy. • Consistent with the risks, private equity can provide high returns, with the best private equity managers significantly outperforming the public markets. • PEF investment is for those who can afford to have their capital locked in for long periods of time and who are able to risk losing significant amounts of money. This is balanced by the potential benefits of annual returns which range up to 30% for successful funds. PEF Acronym (SLIM) • • Sourcing, specialty Long, leverage Incentive, integrity Management, monitoring

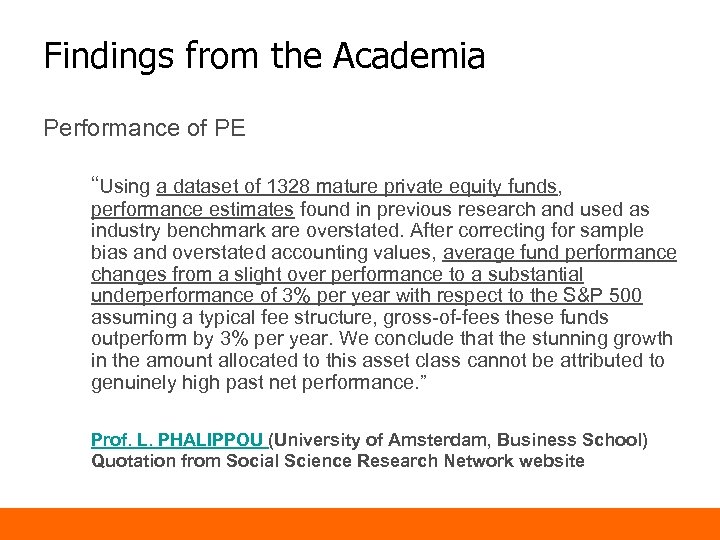

Findings from the Academia Performance of PE “Using a dataset of 1328 mature private equity funds, performance estimates found in previous research and used as industry benchmark are overstated. After correcting for sample bias and overstated accounting values, average fund performance changes from a slight over performance to a substantial underperformance of 3% per year with respect to the S&P 500 assuming a typical fee structure, gross-of-fees these funds outperform by 3% per year. We conclude that the stunning growth in the amount allocated to this asset class cannot be attributed to genuinely high past net performance. ” Prof. L. PHALIPPOU (University of Amsterdam, Business School) Quotation from Social Science Research Network website

Findings from the Academia Performance of PE “Using a dataset of 1328 mature private equity funds, performance estimates found in previous research and used as industry benchmark are overstated. After correcting for sample bias and overstated accounting values, average fund performance changes from a slight over performance to a substantial underperformance of 3% per year with respect to the S&P 500 assuming a typical fee structure, gross-of-fees these funds outperform by 3% per year. We conclude that the stunning growth in the amount allocated to this asset class cannot be attributed to genuinely high past net performance. ” Prof. L. PHALIPPOU (University of Amsterdam, Business School) Quotation from Social Science Research Network website

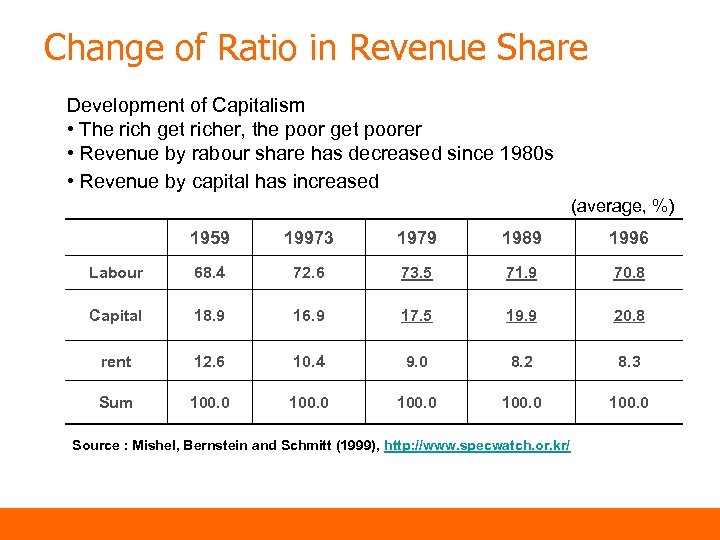

Change of Ratio in Revenue Share Development of Capitalism • The rich get richer, the poor get poorer • Revenue by rabour share has decreased since 1980 s • Revenue by capital has increased (average, %) 1959 19973 1979 1989 1996 Labour 68. 4 72. 6 73. 5 71. 9 70. 8 Capital 18. 9 16. 9 17. 5 19. 9 20. 8 rent 12. 6 10. 4 9. 0 8. 2 8. 3 Sum 100. 0 Source : Mishel, Bernstein and Schmitt (1999), http: //www. specwatch. or. kr/

Change of Ratio in Revenue Share Development of Capitalism • The rich get richer, the poor get poorer • Revenue by rabour share has decreased since 1980 s • Revenue by capital has increased (average, %) 1959 19973 1979 1989 1996 Labour 68. 4 72. 6 73. 5 71. 9 70. 8 Capital 18. 9 16. 9 17. 5 19. 9 20. 8 rent 12. 6 10. 4 9. 0 8. 2 8. 3 Sum 100. 0 Source : Mishel, Bernstein and Schmitt (1999), http: //www. specwatch. or. kr/

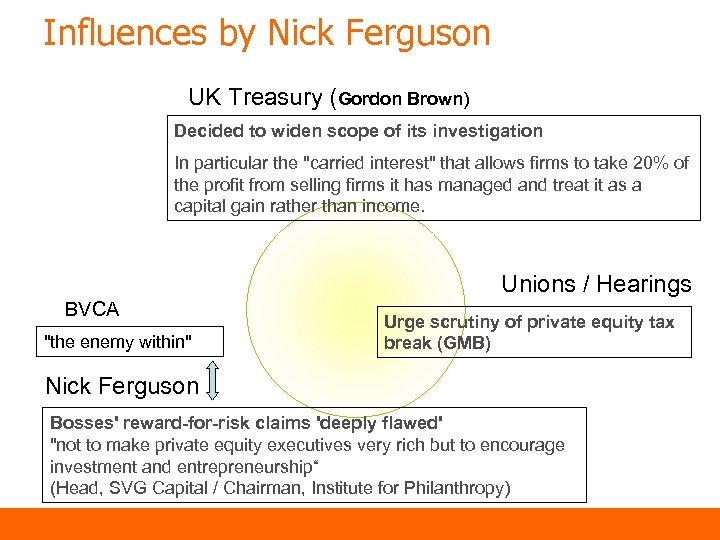

Influences by Nick Ferguson UK Treasury (Gordon Brown) Decided to widen scope of its investigation In particular the "carried interest" that allows firms to take 20% of the profit from selling firms it has managed and treat it as a capital gain rather than income. Unions / Hearings BVCA "the enemy within" Urge scrutiny of private equity tax break (GMB) Nick Ferguson Bosses' reward-for-risk claims 'deeply flawed' "not to make private equity executives very rich but to encourage investment and entrepreneurship“ (Head, SVG Capital / Chairman, Institute for Philanthropy)

Influences by Nick Ferguson UK Treasury (Gordon Brown) Decided to widen scope of its investigation In particular the "carried interest" that allows firms to take 20% of the profit from selling firms it has managed and treat it as a capital gain rather than income. Unions / Hearings BVCA "the enemy within" Urge scrutiny of private equity tax break (GMB) Nick Ferguson Bosses' reward-for-risk claims 'deeply flawed' "not to make private equity executives very rich but to encourage investment and entrepreneurship“ (Head, SVG Capital / Chairman, Institute for Philanthropy)

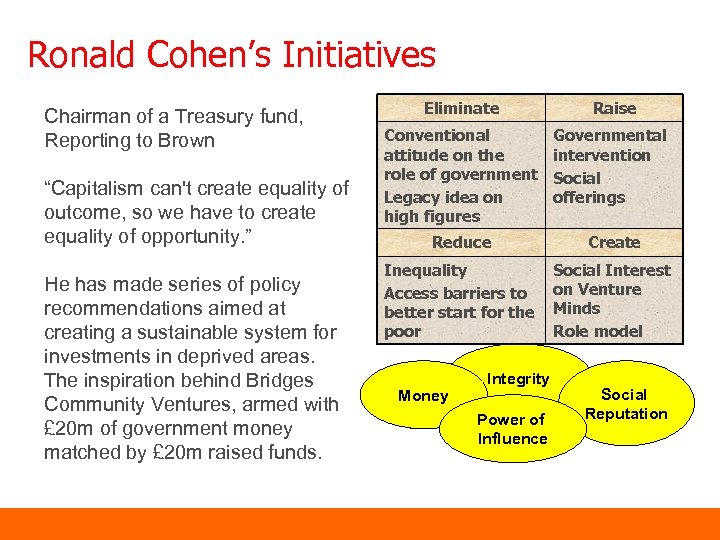

Ronald Cohen’s Initiatives Chairman of a Treasury fund, Reporting to Brown “Capitalism can't create equality of outcome, so we have to create equality of opportunity. ” He has made series of policy recommendations aimed at creating a sustainable system for investments in deprived areas. The inspiration behind Bridges Community Ventures, armed with £ 20 m of government money matched by £ 20 m raised funds. Eliminate Raise Conventional attitude on the role of government Legacy idea on high figures Governmental intervention Social offerings Reduce Create Inequality Access barriers to better start for the poor Social Interest on Venture Minds Role model Money Integrity Power of Influence Social Reputation

Ronald Cohen’s Initiatives Chairman of a Treasury fund, Reporting to Brown “Capitalism can't create equality of outcome, so we have to create equality of opportunity. ” He has made series of policy recommendations aimed at creating a sustainable system for investments in deprived areas. The inspiration behind Bridges Community Ventures, armed with £ 20 m of government money matched by £ 20 m raised funds. Eliminate Raise Conventional attitude on the role of government Legacy idea on high figures Governmental intervention Social offerings Reduce Create Inequality Access barriers to better start for the poor Social Interest on Venture Minds Role model Money Integrity Power of Influence Social Reputation

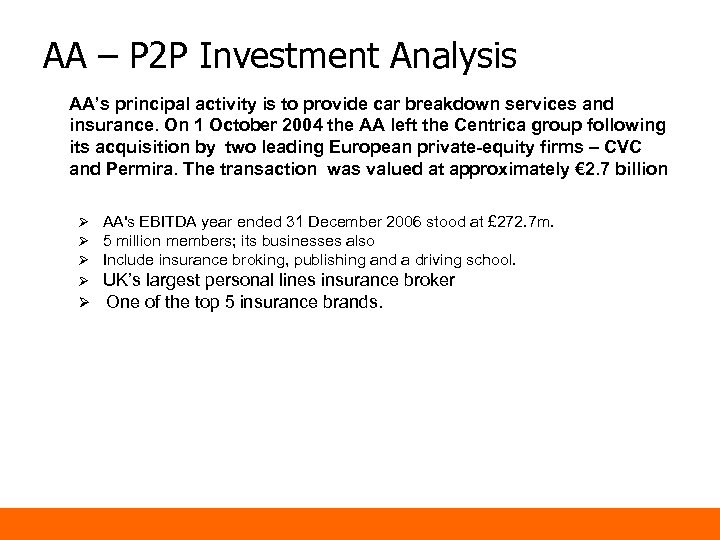

AA – P 2 P Investment Analysis AA’s principal activity is to provide car breakdown services and insurance. On 1 October 2004 the AA left the Centrica group following its acquisition by two leading European private-equity firms – CVC and Permira. The transaction was valued at approximately € 2. 7 billion Ø AA's EBITDA year ended 31 December 2006 stood at £ 272. 7 m. Ø 5 million members; its businesses also Ø Include insurance broking, publishing and a driving school. Ø UK’s largest personal lines insurance broker Ø One of the top 5 insurance brands.

AA – P 2 P Investment Analysis AA’s principal activity is to provide car breakdown services and insurance. On 1 October 2004 the AA left the Centrica group following its acquisition by two leading European private-equity firms – CVC and Permira. The transaction was valued at approximately € 2. 7 billion Ø AA's EBITDA year ended 31 December 2006 stood at £ 272. 7 m. Ø 5 million members; its businesses also Ø Include insurance broking, publishing and a driving school. Ø UK’s largest personal lines insurance broker Ø One of the top 5 insurance brands.

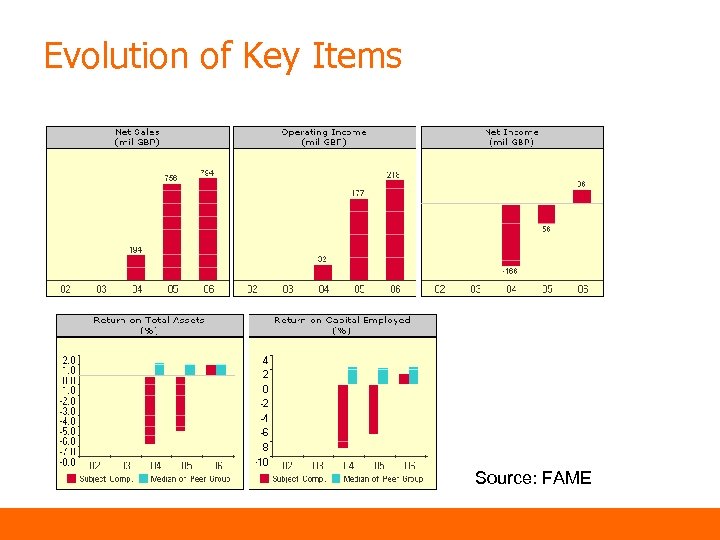

Evolution of Key Items Source: FAME

Evolution of Key Items Source: FAME

Management’s Narrative • “Having remoulded the business, our priorities for the future are to develop our core activities and to seek new opportunities for growth through acquisition. We also see great potential for the AA as the leading brand for motoring-related business online. ” - CEO

Management’s Narrative • “Having remoulded the business, our priorities for the future are to develop our core activities and to seek new opportunities for growth through acquisition. We also see great potential for the AA as the leading brand for motoring-related business online. ” - CEO

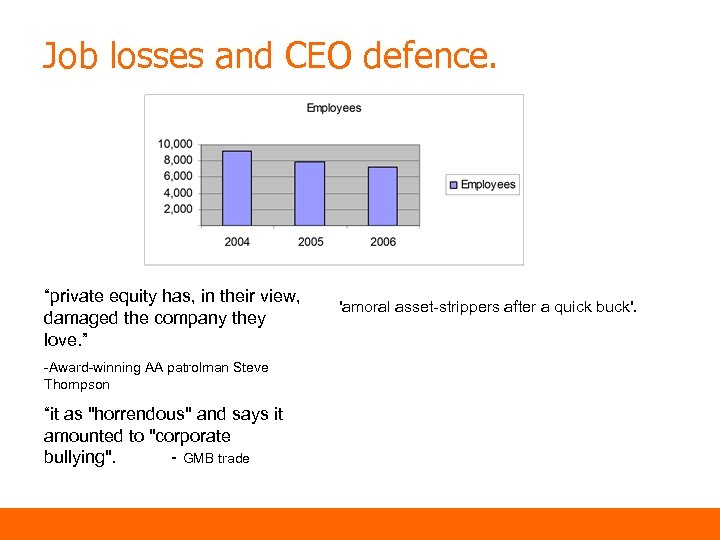

Job losses and CEO defence. “private equity has, in their view, damaged the company they love. ” -Award-winning AA patrolman Steve Thompson “it as "horrendous" and says it amounted to "corporate bullying". - GMB trade 'amoral asset-strippers after a quick buck'.

Job losses and CEO defence. “private equity has, in their view, damaged the company they love. ” -Award-winning AA patrolman Steve Thompson “it as "horrendous" and says it amounted to "corporate bullying". - GMB trade 'amoral asset-strippers after a quick buck'.

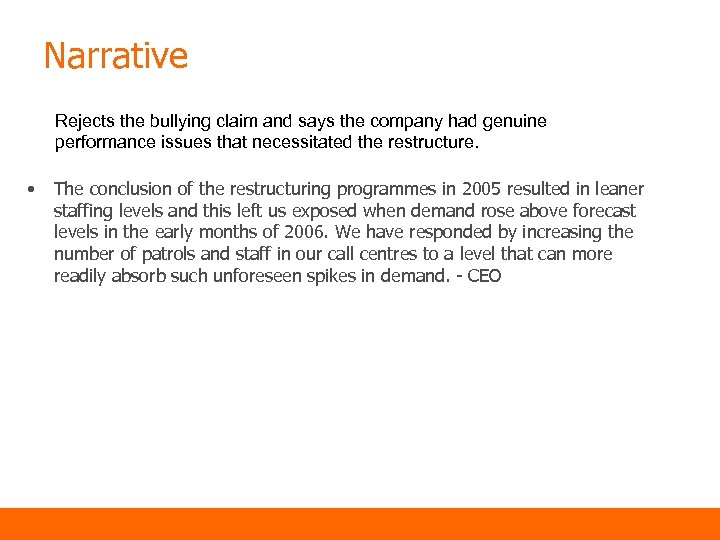

Narrative Rejects the bullying claim and says the company had genuine performance issues that necessitated the restructure. • The conclusion of the restructuring programmes in 2005 resulted in leaner staffing levels and this left us exposed when demand rose above forecast levels in the early months of 2006. We have responded by increasing the number of patrols and staff in our call centres to a level that can more readily absorb such unforeseen spikes in demand. - CEO

Narrative Rejects the bullying claim and says the company had genuine performance issues that necessitated the restructure. • The conclusion of the restructuring programmes in 2005 resulted in leaner staffing levels and this left us exposed when demand rose above forecast levels in the early months of 2006. We have responded by increasing the number of patrols and staff in our call centres to a level that can more readily absorb such unforeseen spikes in demand. - CEO

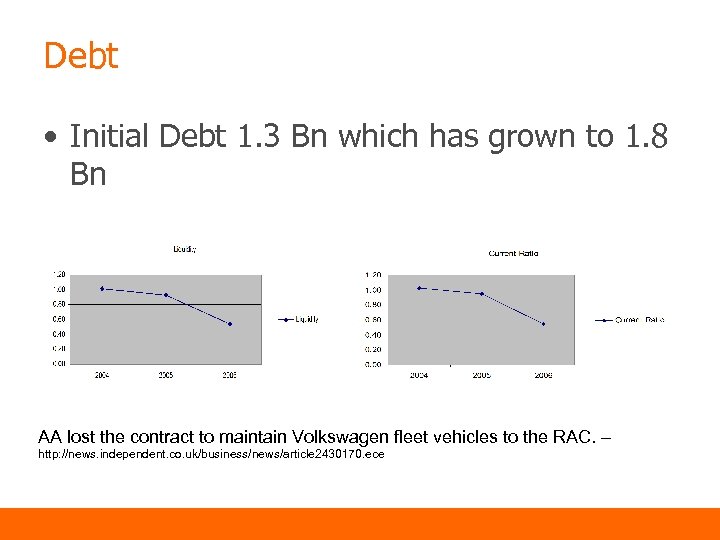

Debt • Initial Debt 1. 3 Bn which has grown to 1. 8 Bn AA lost the contract to maintain Volkswagen fleet vehicles to the RAC. – http: //news. independent. co. uk/business/news/article 2430170. ece

Debt • Initial Debt 1. 3 Bn which has grown to 1. 8 Bn AA lost the contract to maintain Volkswagen fleet vehicles to the RAC. – http: //news. independent. co. uk/business/news/article 2430170. ece

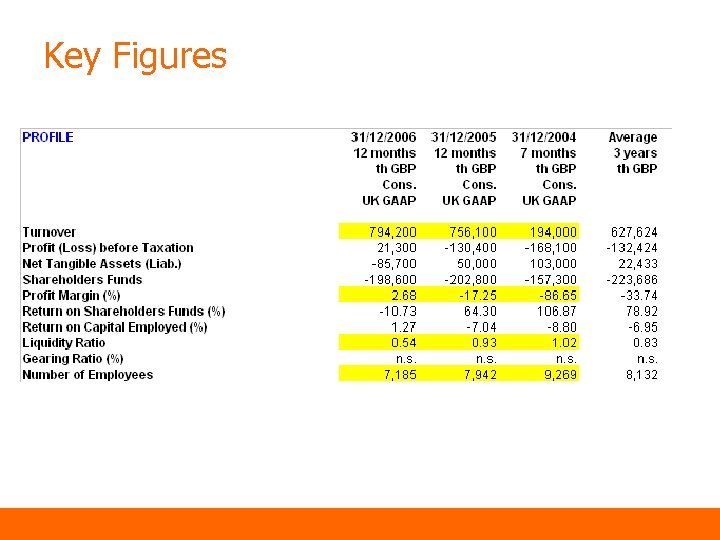

Key Figures

Key Figures

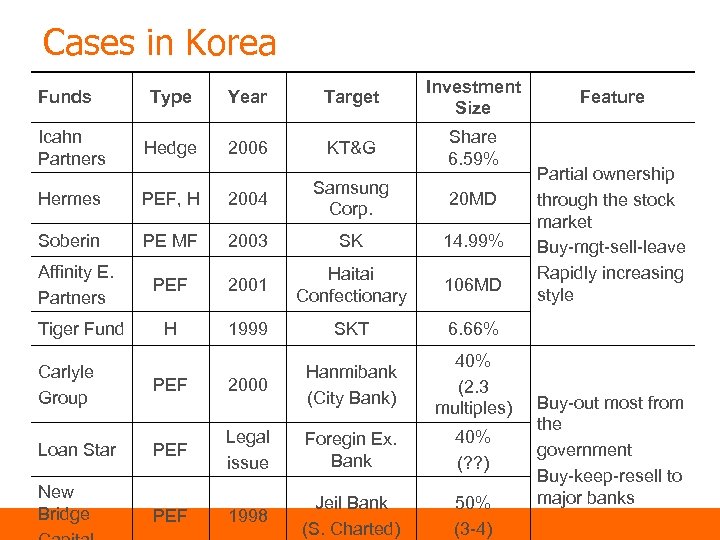

Cases in Korea Funds Icahn Partners Type Year Target Investment Size Hedge 2006 KT&G Share 6. 59% 20 MD Hermes PEF, H 2004 Samsung Corp. Soberin PE MF 2003 SK 14. 99% PEF 2001 Haitai Confectionary 106 MD H 1999 SKT PEF 2000 40% (2. 3 multiples) Loan Star PEF Legal issue Foregin Ex. Bank 40% (? ? ) New Bridge PEF 1998 Jeil Bank (S. Charted) 50% (3 -4) Partial ownership through the stock market Buy-mgt-sell-leave Rapidly increasing style 6. 66% Hanmibank (City Bank) Feature Affinity E. Partners Tiger Fund Carlyle Group Buy-out most from the government Buy-keep-resell to major banks

Cases in Korea Funds Icahn Partners Type Year Target Investment Size Hedge 2006 KT&G Share 6. 59% 20 MD Hermes PEF, H 2004 Samsung Corp. Soberin PE MF 2003 SK 14. 99% PEF 2001 Haitai Confectionary 106 MD H 1999 SKT PEF 2000 40% (2. 3 multiples) Loan Star PEF Legal issue Foregin Ex. Bank 40% (? ? ) New Bridge PEF 1998 Jeil Bank (S. Charted) 50% (3 -4) Partial ownership through the stock market Buy-mgt-sell-leave Rapidly increasing style 6. 66% Hanmibank (City Bank) Feature Affinity E. Partners Tiger Fund Carlyle Group Buy-out most from the government Buy-keep-resell to major banks

PE Industry Environments in Korea Governmental Policy for PE industry • Introduction PEF by laws (Jan. 2005) with regulatory attitude • Focus on value addition by PEF(CRC, CRV, VCF, PE M&AF) - Support for industrial stability through capital market - Consideration on connecting Private Banking with PE • Incentives for Institutional Investors such as pension funds Foreign PE has so far enjoyed with several multiples • Lack of systematic governance like 5% rule of stock ownership, and lower developing stage of investment banking • Relatively favorable toward PE experiencing IMF Foreign Exchange Crisis • Increasing acknowledgement on the problems of PE and its narratives esp. form Loan Star

PE Industry Environments in Korea Governmental Policy for PE industry • Introduction PEF by laws (Jan. 2005) with regulatory attitude • Focus on value addition by PEF(CRC, CRV, VCF, PE M&AF) - Support for industrial stability through capital market - Consideration on connecting Private Banking with PE • Incentives for Institutional Investors such as pension funds Foreign PE has so far enjoyed with several multiples • Lack of systematic governance like 5% rule of stock ownership, and lower developing stage of investment banking • Relatively favorable toward PE experiencing IMF Foreign Exchange Crisis • Increasing acknowledgement on the problems of PE and its narratives esp. form Loan Star

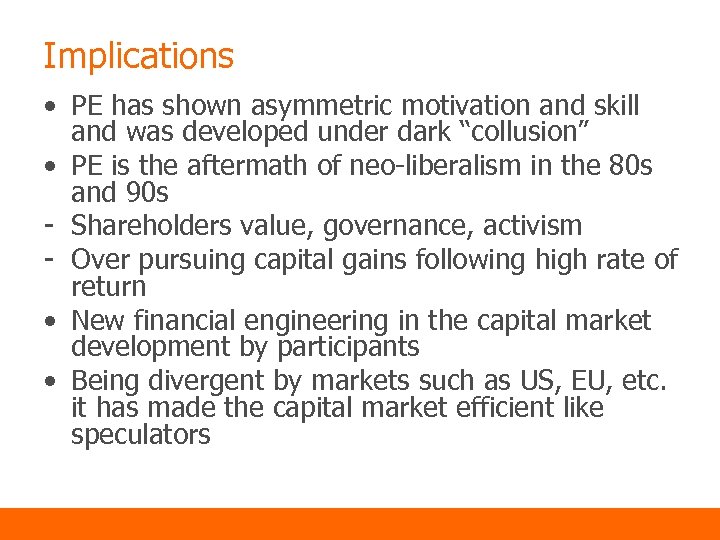

Implications • PE has shown asymmetric motivation and skill and was developed under dark “collusion” • PE is the aftermath of neo-liberalism in the 80 s and 90 s - Shareholders value, governance, activism - Over pursuing capital gains following high rate of return • New financial engineering in the capital market development by participants • Being divergent by markets such as US, EU, etc. it has made the capital market efficient like speculators

Implications • PE has shown asymmetric motivation and skill and was developed under dark “collusion” • PE is the aftermath of neo-liberalism in the 80 s and 90 s - Shareholders value, governance, activism - Over pursuing capital gains following high rate of return • New financial engineering in the capital market development by participants • Being divergent by markets such as US, EU, etc. it has made the capital market efficient like speculators

Conclusions • PE should comply with its narratives - Value creation by SLIM, social contribution, etc. • A new regime for the management of PE - Increase in transparency and accountability through market regulation - New rules regarding stock trades like a 5% rule • Introduction of a policy to contain greedy capitalists in alignment of sustainability • “We do not know about the truth on PE as outsiders as it has no formalized process”

Conclusions • PE should comply with its narratives - Value creation by SLIM, social contribution, etc. • A new regime for the management of PE - Increase in transparency and accountability through market regulation - New rules regarding stock trades like a 5% rule • Introduction of a policy to contain greedy capitalists in alignment of sustainability • “We do not know about the truth on PE as outsiders as it has no formalized process”

Thanks.

Thanks.

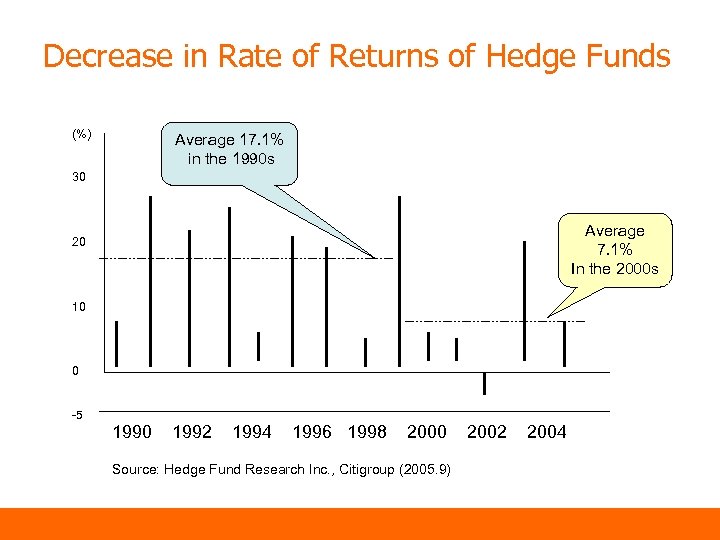

Decrease in Rate of Returns of Hedge Funds (%) Average 17. 1% in the 1990 s 30 Average 7. 1% In the 2000 s 20 10 0 -5 1990 1992 1994 1996 1998 2000 Source: Hedge Fund Research Inc. , Citigroup (2005. 9) 2002 2004

Decrease in Rate of Returns of Hedge Funds (%) Average 17. 1% in the 1990 s 30 Average 7. 1% In the 2000 s 20 10 0 -5 1990 1992 1994 1996 1998 2000 Source: Hedge Fund Research Inc. , Citigroup (2005. 9) 2002 2004

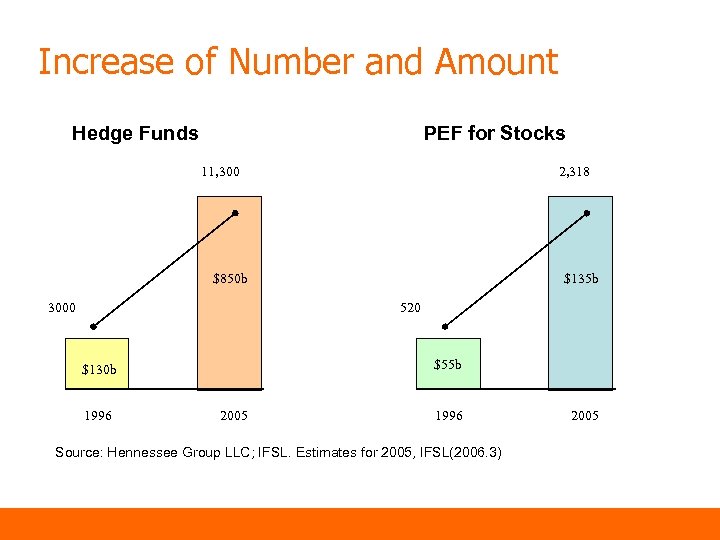

Increase of Number and Amount Hedge Funds PEF for Stocks 11, 300 2, 318 $850 b 3000 $135 b 520 $55 b $130 b 1996 2005 1996 Source: Hennessee Group LLC; IFSL. Estimates for 2005, IFSL(2006. 3) 2005

Increase of Number and Amount Hedge Funds PEF for Stocks 11, 300 2, 318 $850 b 3000 $135 b 520 $55 b $130 b 1996 2005 1996 Source: Hennessee Group LLC; IFSL. Estimates for 2005, IFSL(2006. 3) 2005

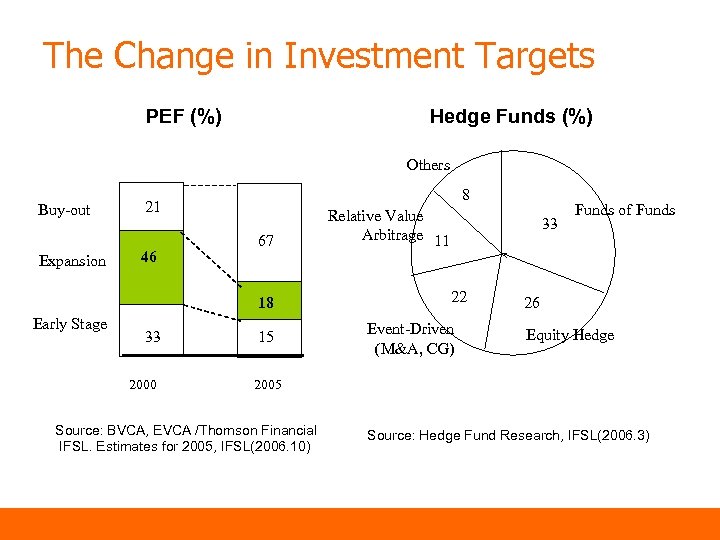

The Change in Investment Targets PEF (%) Hedge Funds (%) Others Buy-out Expansion 8 21 46 67 18 Early Stage 33 2000 15 Relative Value Arbitrage 11 33 22 Event-Driven (M&A, CG) Funds of Funds 26 Equity Hedge 2005 Source: BVCA, EVCA /Thomson Financial IFSL. Estimates for 2005, IFSL(2006. 10) Source: Hedge Fund Research, IFSL(2006. 3)

The Change in Investment Targets PEF (%) Hedge Funds (%) Others Buy-out Expansion 8 21 46 67 18 Early Stage 33 2000 15 Relative Value Arbitrage 11 33 22 Event-Driven (M&A, CG) Funds of Funds 26 Equity Hedge 2005 Source: BVCA, EVCA /Thomson Financial IFSL. Estimates for 2005, IFSL(2006. 10) Source: Hedge Fund Research, IFSL(2006. 3)

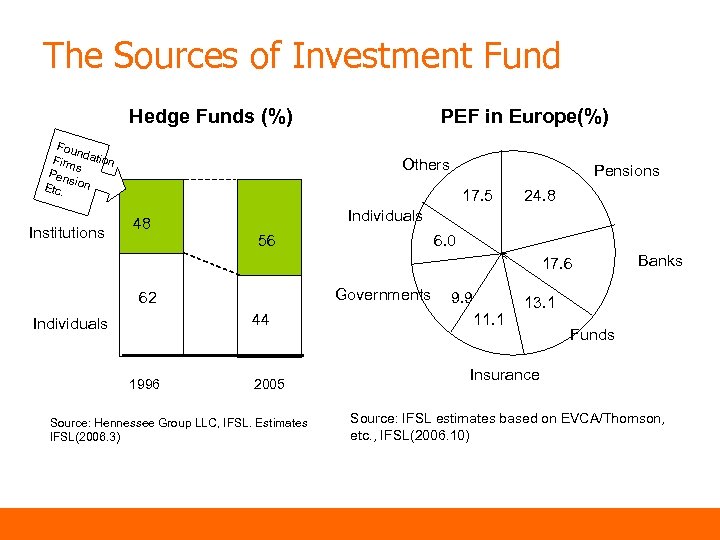

The Sources of Investment Fund Hedge Funds (%) Fou n Firm dation s Pen sion Etc. Institutions PEF in Europe(%) Others Pensions 17. 5 48 24. 8 Individuals 56 6. 0 17. 6 Governments 62 44 Individuals 1996 2005 Source: Hennessee Group LLC, IFSL. Estimates IFSL(2006. 3) 9. 9 11. 1 Banks 13. 1 Funds Insurance Source: IFSL estimates based on EVCA/Thomson, etc. , IFSL(2006. 10)

The Sources of Investment Fund Hedge Funds (%) Fou n Firm dation s Pen sion Etc. Institutions PEF in Europe(%) Others Pensions 17. 5 48 24. 8 Individuals 56 6. 0 17. 6 Governments 62 44 Individuals 1996 2005 Source: Hennessee Group LLC, IFSL. Estimates IFSL(2006. 3) 9. 9 11. 1 Banks 13. 1 Funds Insurance Source: IFSL estimates based on EVCA/Thomson, etc. , IFSL(2006. 10)