Private Equity An Overview Clark L. Maxam, Ph. D. Director of Research – Braddock Financial Corporation and El Pomar Professor of Entrepreneurial Finance – University of Colorado, Colorado Springs

Private Equity An Overview Clark L. Maxam, Ph. D. Director of Research – Braddock Financial Corporation and El Pomar Professor of Entrepreneurial Finance – University of Colorado, Colorado Springs

Private Equity – Broadly Defined • Technically refers to any type of equity investment in an asset in which the equity is not freely tradable on a public market. • Less liquid • Long Term in nature

Private Equity – Broadly Defined • Technically refers to any type of equity investment in an asset in which the equity is not freely tradable on a public market. • Less liquid • Long Term in nature

Private Equity – Categories and Players • Angel – Early Stage: Seed, Start-up • Professional Venture Capital – Early Stage, Expansion, Later Stage • Private Equity – Later Stage, Buyout, Special Situations • Hedge Funds – All Stages

Private Equity – Categories and Players • Angel – Early Stage: Seed, Start-up • Professional Venture Capital – Early Stage, Expansion, Later Stage • Private Equity – Later Stage, Buyout, Special Situations • Hedge Funds – All Stages

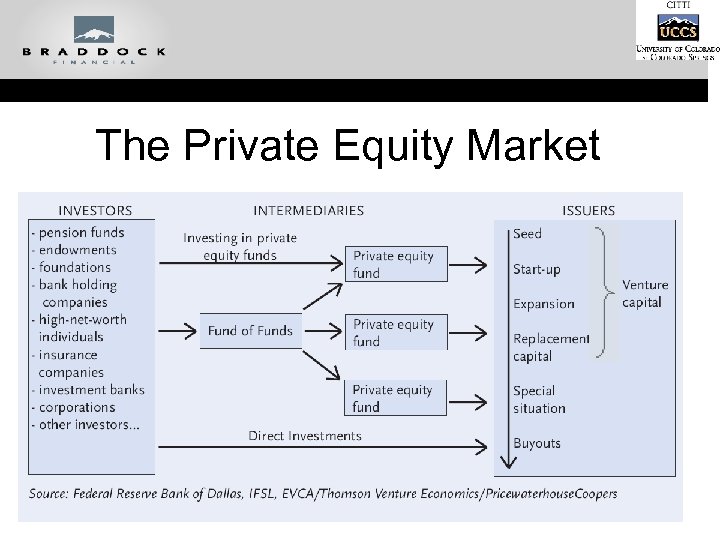

The Private Equity Market

The Private Equity Market

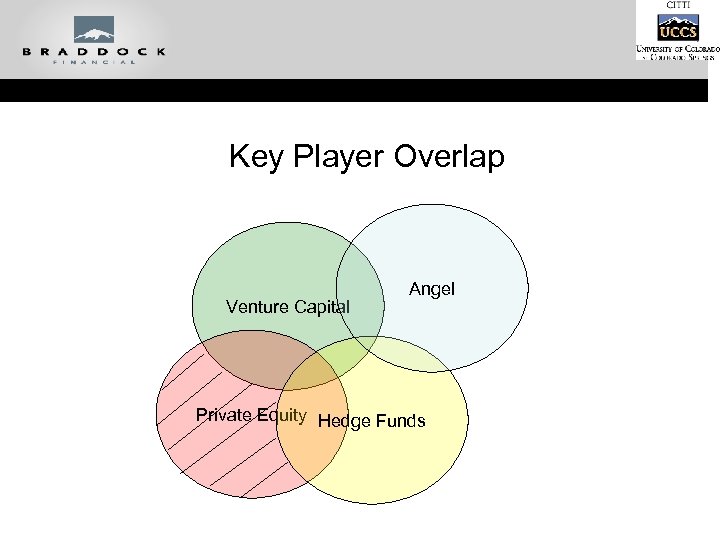

Key Player Overlap Venture Capital Angel Private Equity Hedge Funds

Key Player Overlap Venture Capital Angel Private Equity Hedge Funds

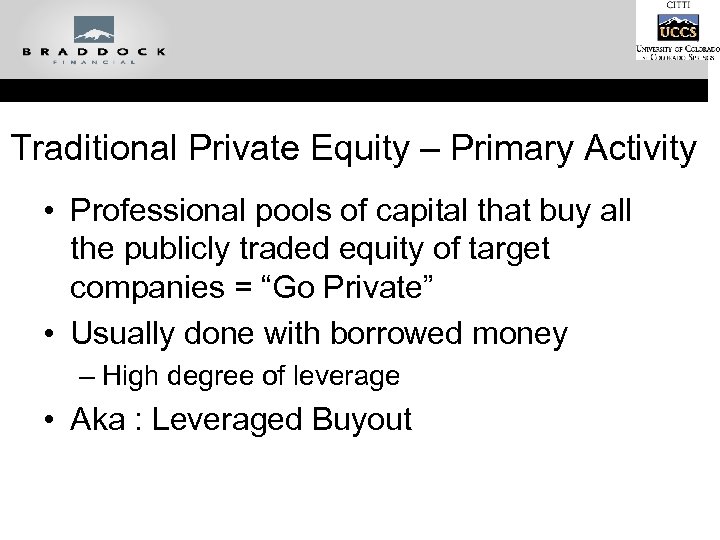

Traditional Private Equity – Primary Activity • Professional pools of capital that buy all the publicly traded equity of target companies = “Go Private” • Usually done with borrowed money – High degree of leverage • Aka : Leveraged Buyout

Traditional Private Equity – Primary Activity • Professional pools of capital that buy all the publicly traded equity of target companies = “Go Private” • Usually done with borrowed money – High degree of leverage • Aka : Leveraged Buyout

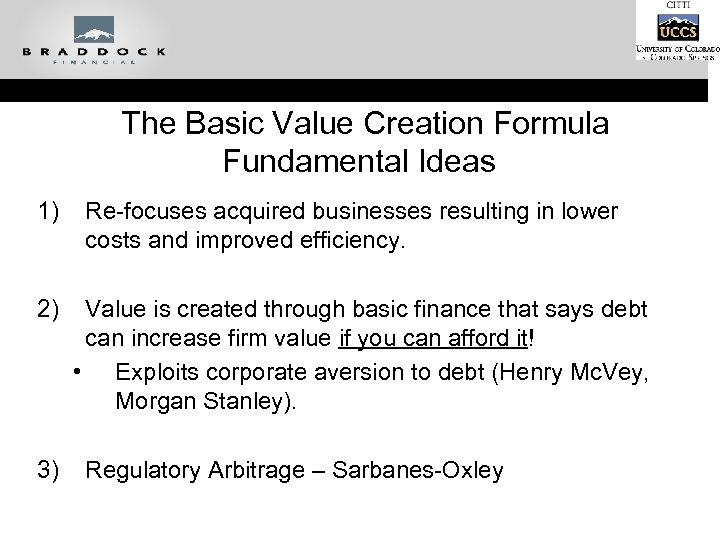

The Basic Value Creation Formula Fundamental Ideas 1) 2) 3) Re-focuses acquired businesses resulting in lower costs and improved efficiency. Value is created through basic finance that says debt can increase firm value if you can afford it! • Exploits corporate aversion to debt (Henry Mc. Vey, Morgan Stanley). Regulatory Arbitrage – Sarbanes-Oxley

The Basic Value Creation Formula Fundamental Ideas 1) 2) 3) Re-focuses acquired businesses resulting in lower costs and improved efficiency. Value is created through basic finance that says debt can increase firm value if you can afford it! • Exploits corporate aversion to debt (Henry Mc. Vey, Morgan Stanley). Regulatory Arbitrage – Sarbanes-Oxley

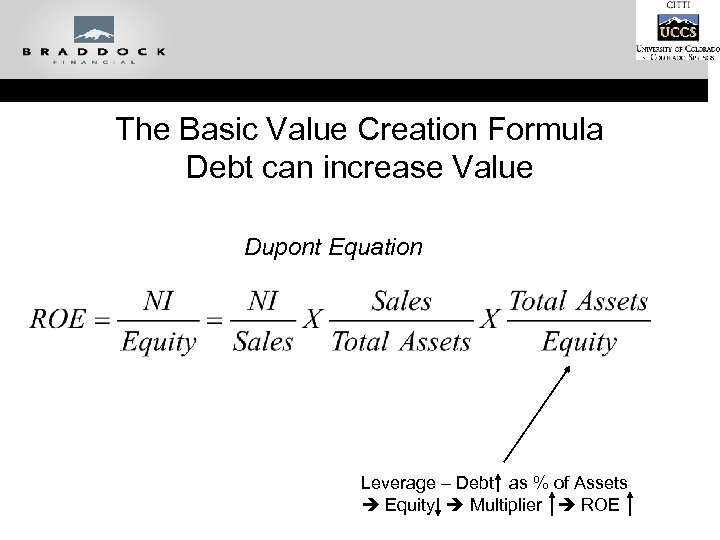

The Basic Value Creation Formula Debt can increase Value Dupont Equation Leverage – Debt as % of Assets Equity Multiplier ROE

The Basic Value Creation Formula Debt can increase Value Dupont Equation Leverage – Debt as % of Assets Equity Multiplier ROE

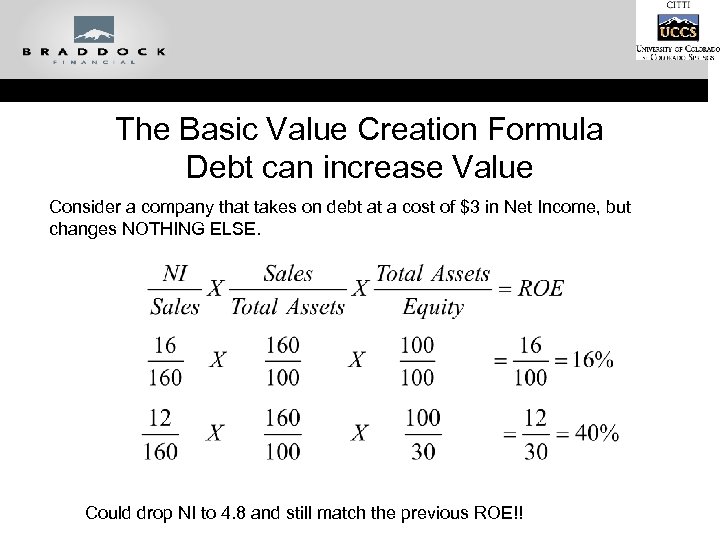

The Basic Value Creation Formula Debt can increase Value Consider a company that takes on debt at a cost of $3 in Net Income, but changes NOTHING ELSE. Could drop NI to 4. 8 and still match the previous ROE!!

The Basic Value Creation Formula Debt can increase Value Consider a company that takes on debt at a cost of $3 in Net Income, but changes NOTHING ELSE. Could drop NI to 4. 8 and still match the previous ROE!!

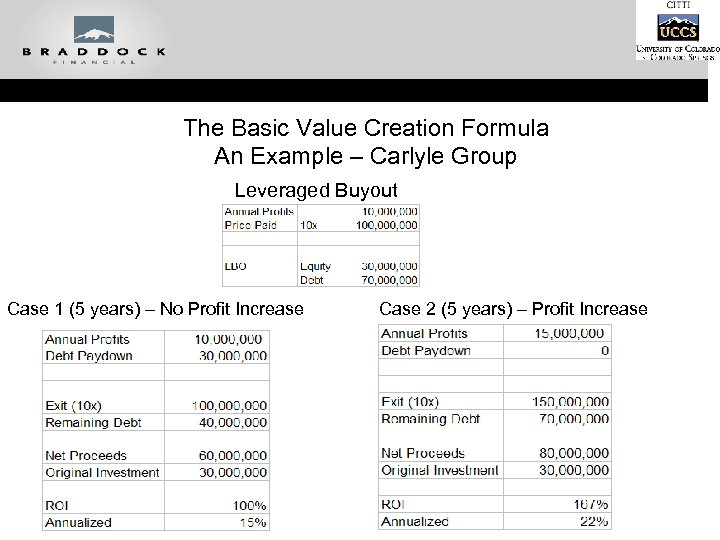

The Basic Value Creation Formula An Example – Carlyle Group Leveraged Buyout Case 1 (5 years) – No Profit Increase Case 2 (5 years) – Profit Increase

The Basic Value Creation Formula An Example – Carlyle Group Leveraged Buyout Case 1 (5 years) – No Profit Increase Case 2 (5 years) – Profit Increase

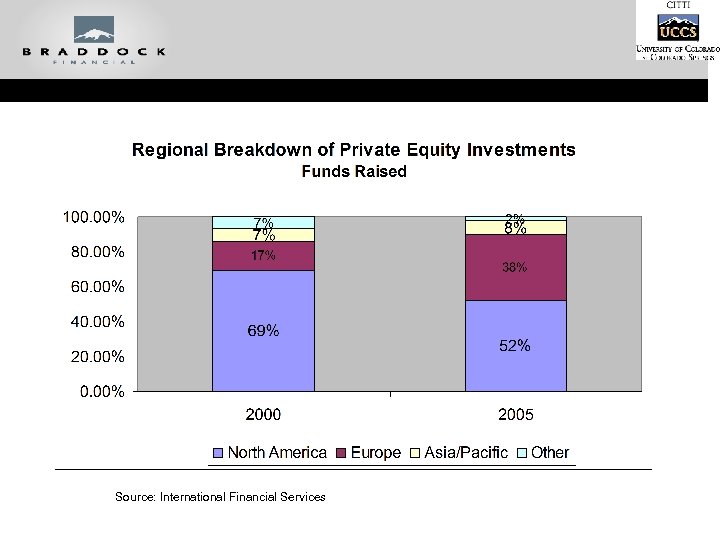

Source: International Financial Services

Source: International Financial Services

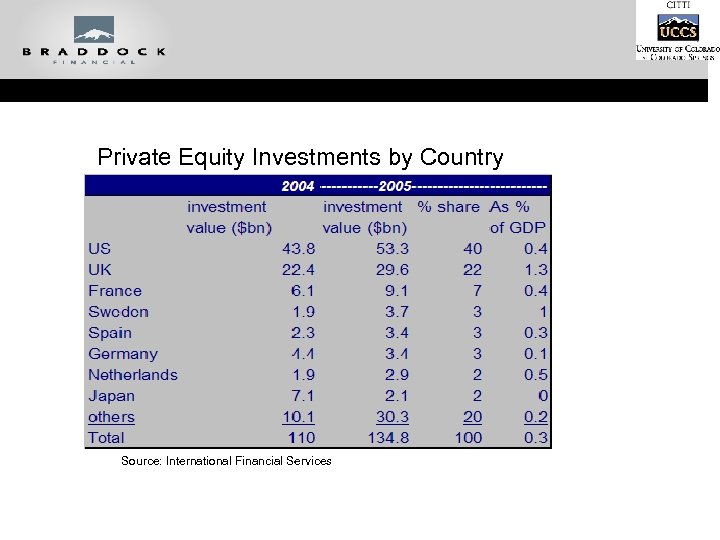

Private Equity Investments by Country Source: International Financial Services

Private Equity Investments by Country Source: International Financial Services

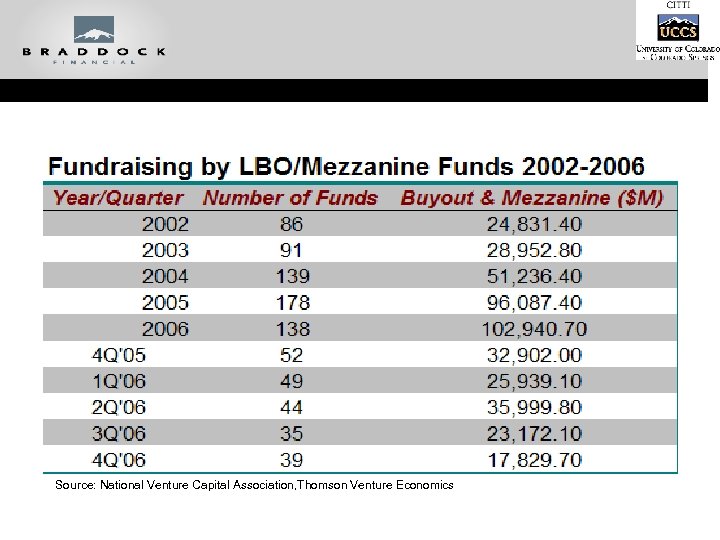

Source: National Venture Capital Association, Thomson Venture Economics

Source: National Venture Capital Association, Thomson Venture Economics

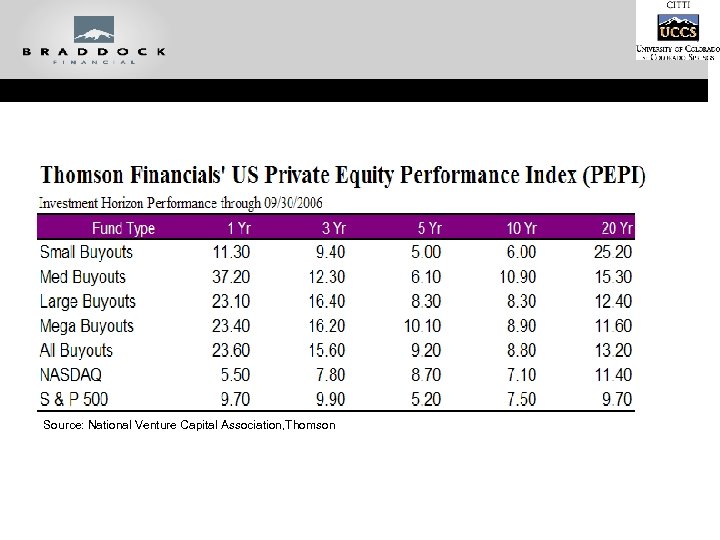

Source: National Venture Capital Association, Thomson

Source: National Venture Capital Association, Thomson

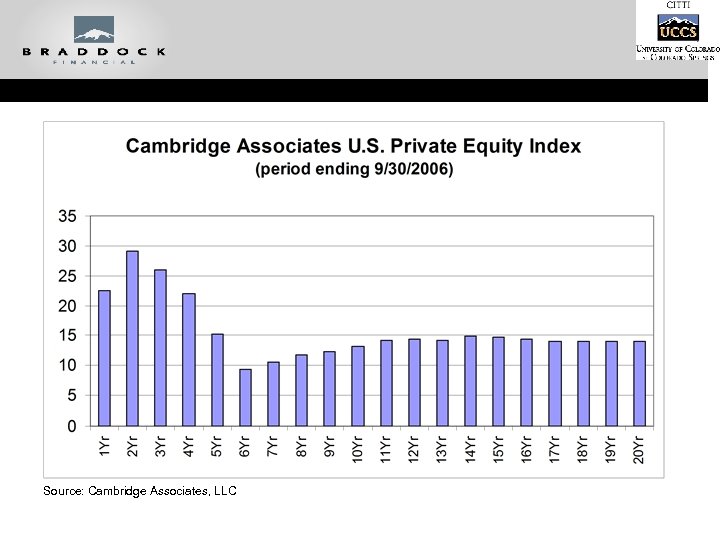

Source: Cambridge Associates, LLC

Source: Cambridge Associates, LLC

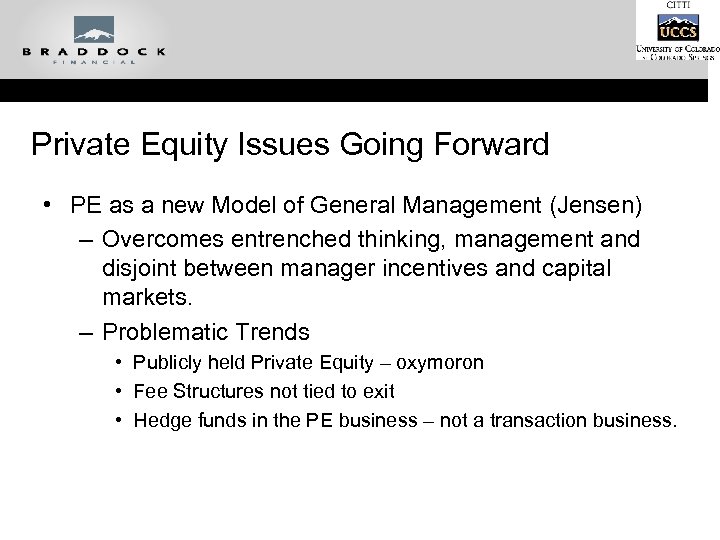

Private Equity Issues Going Forward • PE as a new Model of General Management (Jensen) – Overcomes entrenched thinking, management and disjoint between manager incentives and capital markets. – Problematic Trends • Publicly held Private Equity – oxymoron • Fee Structures not tied to exit • Hedge funds in the PE business – not a transaction business.

Private Equity Issues Going Forward • PE as a new Model of General Management (Jensen) – Overcomes entrenched thinking, management and disjoint between manager incentives and capital markets. – Problematic Trends • Publicly held Private Equity – oxymoron • Fee Structures not tied to exit • Hedge funds in the PE business – not a transaction business.

Private Equity Issues Going Forward • 2007 estimate of$160 B in dry powder $750 B $590 B in debt appetite. – Banking capacity is finite and already extended. – Potential regulatory limits

Private Equity Issues Going Forward • 2007 estimate of$160 B in dry powder $750 B $590 B in debt appetite. – Banking capacity is finite and already extended. – Potential regulatory limits

Private Equity Issues Going Forward • PE Boom has been fueled by – Historically low rates – Regulatory arbitrage • Both could reverse quickly and change the metrics dramatically

Private Equity Issues Going Forward • PE Boom has been fueled by – Historically low rates – Regulatory arbitrage • Both could reverse quickly and change the metrics dramatically