6ff2b8859ffa11074628ef539607380a.ppt

- Количество слайдов: 24

Private and Confidential Get It Done !! Corporate Finance Transactions June 15, 2016 for Contact – Greg Buck, 734. 678. 0483 or gbuck 48103@gmail. com. Mo

Private and Confidential Get It Done !! Corporate Finance Transactions June 15, 2016 for Contact – Greg Buck, 734. 678. 0483 or gbuck 48103@gmail. com. Mo

Get It Done - Table of Contents 1) Arbor Capital Markets 2) Completing a Corporate Finance Event • Preparation • Company Value 3) Transaction Characteristics • Company Sale • Bank Debt • Subordinated and Convertible Debt • Preferred Stock or Member Interests with Priority Return • Common Stock 4) Recent Transactions Page 2

Get It Done - Table of Contents 1) Arbor Capital Markets 2) Completing a Corporate Finance Event • Preparation • Company Value 3) Transaction Characteristics • Company Sale • Bank Debt • Subordinated and Convertible Debt • Preferred Stock or Member Interests with Priority Return • Common Stock 4) Recent Transactions Page 2

Professional Background Gregory S. Buck, Managing Director, Arbor Capital Markets FINRA Series 7 & 63 Registered Representative with Still. Point Capital As the founder of Arbor Capital Markets, Greg provides professional services to middle market companies seeking to maximize shareholder value through M&A activity, private placements, strategic consulting and troubled company assistance. Prior to forming ACM he began his business career in 1978 as a Credit Officer at Citibank. His career included positions as CEO of Simplerate. com, as the Managing Director of Alternative Investments at Telemus Capital, as Partner in M Group, Inc. an early stage venture capital firm, and as Senior Director of Content and Product Development at Ameritech, Inc. where he led the team that developed and launched Ameritech. net. Mr. Buck also has significant experience as an investment banker, having performed mergers and acquisitions, capital raising, management buyouts, general business consulting and private equity investments both domestically and in Europe and Asia, as a Partner in the Ernst & Young Corporate Finance Group, and as a Vice President of the Sterling Group. Mr. Buck is a frequent speaker and panelist for local and International organizations including the Tokyo Capital Markets Institute and has been a contributing author to Well Servicing magazine. Mr. Buck graduated from the University of Michigan with a B. A. in Secondary Education/Political Science and holds a M. B. A. degree from Western Michigan University. Page 3

Professional Background Gregory S. Buck, Managing Director, Arbor Capital Markets FINRA Series 7 & 63 Registered Representative with Still. Point Capital As the founder of Arbor Capital Markets, Greg provides professional services to middle market companies seeking to maximize shareholder value through M&A activity, private placements, strategic consulting and troubled company assistance. Prior to forming ACM he began his business career in 1978 as a Credit Officer at Citibank. His career included positions as CEO of Simplerate. com, as the Managing Director of Alternative Investments at Telemus Capital, as Partner in M Group, Inc. an early stage venture capital firm, and as Senior Director of Content and Product Development at Ameritech, Inc. where he led the team that developed and launched Ameritech. net. Mr. Buck also has significant experience as an investment banker, having performed mergers and acquisitions, capital raising, management buyouts, general business consulting and private equity investments both domestically and in Europe and Asia, as a Partner in the Ernst & Young Corporate Finance Group, and as a Vice President of the Sterling Group. Mr. Buck is a frequent speaker and panelist for local and International organizations including the Tokyo Capital Markets Institute and has been a contributing author to Well Servicing magazine. Mr. Buck graduated from the University of Michigan with a B. A. in Secondary Education/Political Science and holds a M. B. A. degree from Western Michigan University. Page 3

Advisory Services ACM provides a full range of investment banking and corporate finance solutions. ACM Service Offerings Mergers & Acquisitions Capital Raising Sell Side/Buy Side Private Offering Ø Identify, analyze and initiate Financial Advisory Management Valuations/Fairness Opinions General Ø Private Equity Placements Ø Corporate Infrastructure Ø ESOP Programs Ø M&A Due Diligence Ø Private Debt Placements Development Ø Business Plans Ø Estate Planning Ø Recapitalizations Ø Bank/Lending Institution Debt Ø Financial Reporting Ø Leveraged Buyouts Ø Transaction Options Ø Strategic alliances/joint Ø Financial Forecast Models Ø Strategic Alternatives Ø Family Disputes venture assistance Ø Special Committee assignments Ø Cash Flow Management transaction Ø Advise on transaction structure Ø Assist with negotiations Advisory Services (Senior & Subordinated) ACM’s Primary Industries of Focus include Transportation, Manufacturing, Technology, Retail, He Software, Energy, Distribution and Services. Page 4

Advisory Services ACM provides a full range of investment banking and corporate finance solutions. ACM Service Offerings Mergers & Acquisitions Capital Raising Sell Side/Buy Side Private Offering Ø Identify, analyze and initiate Financial Advisory Management Valuations/Fairness Opinions General Ø Private Equity Placements Ø Corporate Infrastructure Ø ESOP Programs Ø M&A Due Diligence Ø Private Debt Placements Development Ø Business Plans Ø Estate Planning Ø Recapitalizations Ø Bank/Lending Institution Debt Ø Financial Reporting Ø Leveraged Buyouts Ø Transaction Options Ø Strategic alliances/joint Ø Financial Forecast Models Ø Strategic Alternatives Ø Family Disputes venture assistance Ø Special Committee assignments Ø Cash Flow Management transaction Ø Advise on transaction structure Ø Assist with negotiations Advisory Services (Senior & Subordinated) ACM’s Primary Industries of Focus include Transportation, Manufacturing, Technology, Retail, He Software, Energy, Distribution and Services. Page 4

Operational and Principal Investment Experience Traditional Middle Market Investment Bank + = ØBuy and Sell-Side Advisory ØProduct Development ØCapital Raising ØTechnology Assessment ØNegotiation ØLeadership Team Review ØDue Diligence ØCreative Transaction Structuring ØFinancial Modeling ØProfessional positions as senior bank credit officer, subordinated debt lender and private equity/venture capital investor ØValuation Advantage Investment Bankers with Operating and Principal Investment Experience The principals at ACM have acted as operators and investors in many businesses offering the ability to provide unique insight to clients beyond the scope of typical investment banking firms. Page 5

Operational and Principal Investment Experience Traditional Middle Market Investment Bank + = ØBuy and Sell-Side Advisory ØProduct Development ØCapital Raising ØTechnology Assessment ØNegotiation ØLeadership Team Review ØDue Diligence ØCreative Transaction Structuring ØFinancial Modeling ØProfessional positions as senior bank credit officer, subordinated debt lender and private equity/venture capital investor ØValuation Advantage Investment Bankers with Operating and Principal Investment Experience The principals at ACM have acted as operators and investors in many businesses offering the ability to provide unique insight to clients beyond the scope of typical investment banking firms. Page 5

Get It Done - Table of Contents 1) Arbor Capital Markets 2) Get It Done – Corporate Finance • Preparation • Company Value 3) Transaction Characteristics • Company Sale • Bank Debt • Subordinated and Convertible Debt • Preferred Stock or Member Interests with Priority Return • Common Stock 4) Recent Transactions Page 6

Get It Done - Table of Contents 1) Arbor Capital Markets 2) Get It Done – Corporate Finance • Preparation • Company Value 3) Transaction Characteristics • Company Sale • Bank Debt • Subordinated and Convertible Debt • Preferred Stock or Member Interests with Priority Return • Common Stock 4) Recent Transactions Page 6

Get It Done - What is a Corporate Finance Event? I. Sale of the your company a) Internal b) External II. Capital Raise a) Senior Debt b) Subordinated Debt or Convertible Debt c) Preferred Stock or Priority Member Interest d) Common Stock III. Primary success elements a) Leadership b) Preparation c) Understanding Your Value Page 7

Get It Done - What is a Corporate Finance Event? I. Sale of the your company a) Internal b) External II. Capital Raise a) Senior Debt b) Subordinated Debt or Convertible Debt c) Preferred Stock or Priority Member Interest d) Common Stock III. Primary success elements a) Leadership b) Preparation c) Understanding Your Value Page 7

Get It Done Preparation Winners Prepare I. Develop a Dynamic Business Plan II. Understand your 4 P’s a) Product b) Price c) Promotion d) Place (sales) III. Good record keeping IV. Secure IT systems V. Well defined HR policies VI. Appropriate insurance VII. Hire, train and retain VIII. Understand yourr Value Page 8

Get It Done Preparation Winners Prepare I. Develop a Dynamic Business Plan II. Understand your 4 P’s a) Product b) Price c) Promotion d) Place (sales) III. Good record keeping IV. Secure IT systems V. Well defined HR policies VI. Appropriate insurance VII. Hire, train and retain VIII. Understand yourr Value Page 8

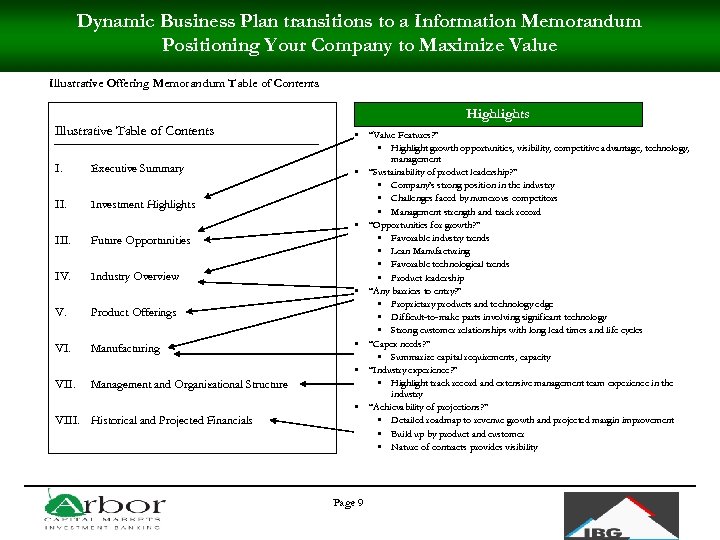

Dynamic Business Plan transitions to a Information Memorandum Positioning Your Company to Maximize Value Illustrative Offering Memorandum Table of Contents Highlights Illustrative Table of Contents I. Executive Summary II. Investment Highlights III. Future Opportunities IV. Industry Overview V. Product Offerings VI. Manufacturing VII. Management and Organizational Structure VIII. Historical and Projected Financials • “Value Features? ” • Highlight growth opportunities, visibility, competitive advantage, technology, management • “Sustainability of product leadership? ” • Company’s strong position in the industry • Challenges faced by numerous competitors • Management strength and track record • “Opportunities for growth? ” • Favorable industry trends • Lean Manufacturing • Favorable technological trends • Product leadership • “Any barriers to entry? ” • Proprietary products and technology edge • Difficult-to-make parts involving significant technology • Strong customer relationships with long lead times and life cycles • “Capex needs? ” • Summarize capital requirements, capacity • “Industry experience? ” • Highlight track record and extensive management team experience in the industry • “Achievability of projections? ” • Detailed roadmap to revenue growth and projected margin improvement • Build up by product and customer • Nature of contracts provides visibility Page 9

Dynamic Business Plan transitions to a Information Memorandum Positioning Your Company to Maximize Value Illustrative Offering Memorandum Table of Contents Highlights Illustrative Table of Contents I. Executive Summary II. Investment Highlights III. Future Opportunities IV. Industry Overview V. Product Offerings VI. Manufacturing VII. Management and Organizational Structure VIII. Historical and Projected Financials • “Value Features? ” • Highlight growth opportunities, visibility, competitive advantage, technology, management • “Sustainability of product leadership? ” • Company’s strong position in the industry • Challenges faced by numerous competitors • Management strength and track record • “Opportunities for growth? ” • Favorable industry trends • Lean Manufacturing • Favorable technological trends • Product leadership • “Any barriers to entry? ” • Proprietary products and technology edge • Difficult-to-make parts involving significant technology • Strong customer relationships with long lead times and life cycles • “Capex needs? ” • Summarize capital requirements, capacity • “Industry experience? ” • Highlight track record and extensive management team experience in the industry • “Achievability of projections? ” • Detailed roadmap to revenue growth and projected margin improvement • Build up by product and customer • Nature of contracts provides visibility Page 9

Understand Your Value WHY? Every Corporate Finance Event is influenced by the provi perception of your value. I. Sale of the your company a) Internal b) External II. Capital Raise a) Senior Debt b) Subordinated Debt or Convertible Debt c) Preferred Stock d) Common Stock Page 10

Understand Your Value WHY? Every Corporate Finance Event is influenced by the provi perception of your value. I. Sale of the your company a) Internal b) External II. Capital Raise a) Senior Debt b) Subordinated Debt or Convertible Debt c) Preferred Stock d) Common Stock Page 10

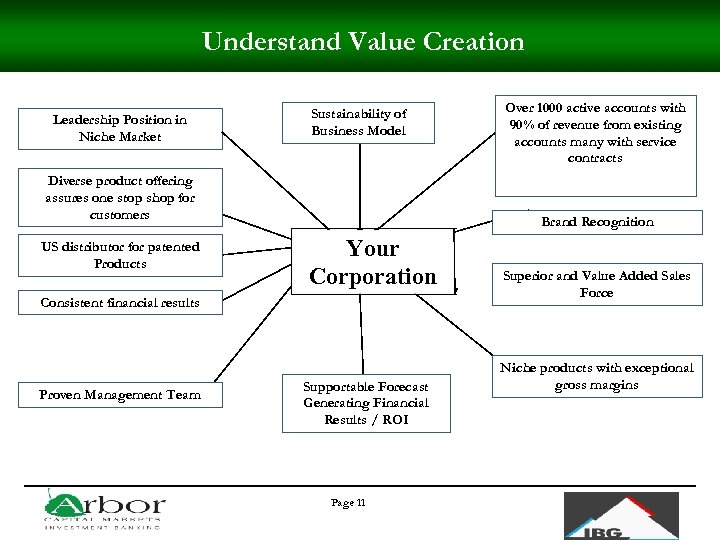

Understand Value Creation Leadership Position in Niche Market Sustainability of Business Model Diverse product offering assures one stop shop for customers US distributor for patented Products Brand Recognition Your Corporation Consistent financial results Proven Management Team Over 1000 active accounts with 90% of revenue from existing accounts many with service contracts Supportable Forecast Generating Financial Results / ROI Page 11 Superior and Value Added Sales Force Niche products with exceptional gross margins

Understand Value Creation Leadership Position in Niche Market Sustainability of Business Model Diverse product offering assures one stop shop for customers US distributor for patented Products Brand Recognition Your Corporation Consistent financial results Proven Management Team Over 1000 active accounts with 90% of revenue from existing accounts many with service contracts Supportable Forecast Generating Financial Results / ROI Page 11 Superior and Value Added Sales Force Niche products with exceptional gross margins

Traditional Valuation Techniques I. Comparable Company a) Sales Multiple b) EBITDA or P/E Multiple c) Private Company Discount II. Discounted Cash Flow a) Financial Projections b) Discount Rate III. Asset Value a) Working Capital b) Equipment c) Real Estate Page 12

Traditional Valuation Techniques I. Comparable Company a) Sales Multiple b) EBITDA or P/E Multiple c) Private Company Discount II. Discounted Cash Flow a) Financial Projections b) Discount Rate III. Asset Value a) Working Capital b) Equipment c) Real Estate Page 12

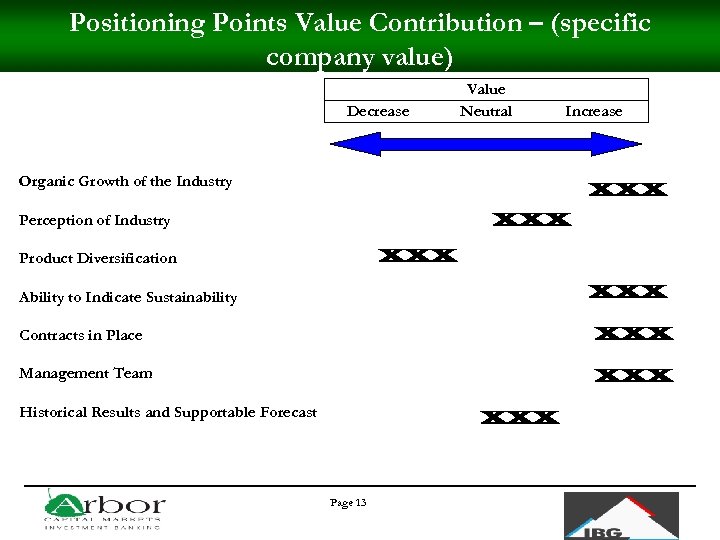

Positioning Points Value Contribution – (specific company value) Decrease Value Neutral Increase Organic Growth of the Industry XXX Perception of Industry XXX Product Diversification XXX Ability to Indicate Sustainability Contracts in Place XXX Management Team XXX Historical Results and Supportable Forecast XXX Page 13

Positioning Points Value Contribution – (specific company value) Decrease Value Neutral Increase Organic Growth of the Industry XXX Perception of Industry XXX Product Diversification XXX Ability to Indicate Sustainability Contracts in Place XXX Management Team XXX Historical Results and Supportable Forecast XXX Page 13

Get It Done - Table of Contents 1) Arbor Capital Markets 2) Completing a Corporate Finance Event • Preparation • Company Value 3) Transaction Characteristics • Company Sale • Senior Debt • Subordinated and Convertible Debt • Preferred Stock or Member Interests with Priority Return • Common Stock 4) Recent Transactions Page 14

Get It Done - Table of Contents 1) Arbor Capital Markets 2) Completing a Corporate Finance Event • Preparation • Company Value 3) Transaction Characteristics • Company Sale • Senior Debt • Subordinated and Convertible Debt • Preferred Stock or Member Interests with Priority Return • Common Stock 4) Recent Transactions Page 14

Company Sale To I. Internal • Management Buyout • Family Succession II. External • Strategic – Corporate • Private Equity Fund Transaction Consideration I. Cash II. Seller Notes • 5 to 8% Interest Rate • 3 to 5 year term • Subordinate to Senior Lender III. Stock • Tax Free • Freely tradeable versus holding period IV. Non-Compete’s & Employment Contracts Page 15

Company Sale To I. Internal • Management Buyout • Family Succession II. External • Strategic – Corporate • Private Equity Fund Transaction Consideration I. Cash II. Seller Notes • 5 to 8% Interest Rate • 3 to 5 year term • Subordinate to Senior Lender III. Stock • Tax Free • Freely tradeable versus holding period IV. Non-Compete’s & Employment Contracts Page 15

Senior Debt 1) Traditional Government Regulated Banks a) Working Capital Lines b) Term Loans c) Asset Based Loans d) Unsecured e) Cash Flow loans 2) Business Development Corporations (BDC’s) Hedge Funds, Pension Funds & Insurance Companies a) Acquisition and Real Estate Funding b) Uni-tranche Loan c) Structured Finance Page 16

Senior Debt 1) Traditional Government Regulated Banks a) Working Capital Lines b) Term Loans c) Asset Based Loans d) Unsecured e) Cash Flow loans 2) Business Development Corporations (BDC’s) Hedge Funds, Pension Funds & Insurance Companies a) Acquisition and Real Estate Funding b) Uni-tranche Loan c) Structured Finance Page 16

Subordinated or Convertible Debt I. Who Provides? • Private Equity groups • BDC’s • Hedge Funds II. Used For? • Acquisition funding • Seller Note • Growth Capital • Private and Public opportunities III. Cost • Requires Current or Payment in Kind Interest Rate; range 6 to 12% • Equity Component • Total yield 15 to 25% IRR IV. Moderate risk with upside Page 17

Subordinated or Convertible Debt I. Who Provides? • Private Equity groups • BDC’s • Hedge Funds II. Used For? • Acquisition funding • Seller Note • Growth Capital • Private and Public opportunities III. Cost • Requires Current or Payment in Kind Interest Rate; range 6 to 12% • Equity Component • Total yield 15 to 25% IRR IV. Moderate risk with upside Page 17

Preferred Stock or Member Interest with Priority I. Who Provides? • Venture Capital • Private Equity • High Net Worths II. Used For? • Early Stage Funding • Acquisition Funding • Growth Funding III. Cost and Characteristics? • Cumulative Dividend or Priority return; range 5 to 8% • Subordinate to everyone but Common • Liquidity Right • High Risk with High Reward Page 18

Preferred Stock or Member Interest with Priority I. Who Provides? • Venture Capital • Private Equity • High Net Worths II. Used For? • Early Stage Funding • Acquisition Funding • Growth Funding III. Cost and Characteristics? • Cumulative Dividend or Priority return; range 5 to 8% • Subordinate to everyone but Common • Liquidity Right • High Risk with High Reward Page 18

Common Stock I. Who Provides? • Friends & Family • Angel Investors and High Net Worths II. Used For? • Initial Capital Formation • Product Development • Patent Filing • Building a Team III. Cost and Characteristics? • No Dividend or Priority return • Subordinate to everyone • Highest dilution risk • Highest Risk with High Reward Page 19

Common Stock I. Who Provides? • Friends & Family • Angel Investors and High Net Worths II. Used For? • Initial Capital Formation • Product Development • Patent Filing • Building a Team III. Cost and Characteristics? • No Dividend or Priority return • Subordinate to everyone • Highest dilution risk • Highest Risk with High Reward Page 19

Contact Us Gregory S. Buck, Managing Director, Arbor Capital Markets FINRA Series 7 & 63 Registered Representative Email: gbuck 48103@gmail. xom Cell: 734. 678. 0483 Address: 2654 Englave, Ann Arbor Michigan, 48103 www. arborcapitalmarkets. com Page 20

Contact Us Gregory S. Buck, Managing Director, Arbor Capital Markets FINRA Series 7 & 63 Registered Representative Email: gbuck 48103@gmail. xom Cell: 734. 678. 0483 Address: 2654 Englave, Ann Arbor Michigan, 48103 www. arborcapitalmarkets. com Page 20

Recapitalization of a Private Company July 2014 NRG Dynamix (“NRG”: The Company utilizing its extensive patent portfolio focuses on delivering design engineering, prototype development and contract manufacturing for Piston Energy Accumulators or Pressure Vessels to the mobile and industrial marketplace and performs the same for customized Hydraulic Hybrid solutions to the Off Highway market. NRG Dynamix Has Completed a Management Buyout Principals of Arbor Capital Markets invested and facilitated the transaction Securities transactions conducted through Still. Point Capital LLC, Member FINRA/SIPC The Transaction NRG founder Jim O’Brien teamed with Arbor Capital Markets founder Gregory Buck to purchase the company. The transaction included the original and venture capitalists retaining ownership. Jim O’Brien will continue to lead the company with Greg providing business development assistance and he will also serve as Chairman of the Board. Arbor Capital Markets (“ACM”) ACM provide a broad range of investment banking and corporate finance solutions to small and middle market private and public companies, including: buy and sell-side transaction advisory, strategic partnership formation, capital raising, valuations, fairness opinions and due diligence support. ACM partner Gregory Buck is a registered representative of Still. Point Capital LLC, Member FINRA/SIPC. A more detailed review of ACM member experience is found at www. arborcapitalmarkets. com. Page 21

Recapitalization of a Private Company July 2014 NRG Dynamix (“NRG”: The Company utilizing its extensive patent portfolio focuses on delivering design engineering, prototype development and contract manufacturing for Piston Energy Accumulators or Pressure Vessels to the mobile and industrial marketplace and performs the same for customized Hydraulic Hybrid solutions to the Off Highway market. NRG Dynamix Has Completed a Management Buyout Principals of Arbor Capital Markets invested and facilitated the transaction Securities transactions conducted through Still. Point Capital LLC, Member FINRA/SIPC The Transaction NRG founder Jim O’Brien teamed with Arbor Capital Markets founder Gregory Buck to purchase the company. The transaction included the original and venture capitalists retaining ownership. Jim O’Brien will continue to lead the company with Greg providing business development assistance and he will also serve as Chairman of the Board. Arbor Capital Markets (“ACM”) ACM provide a broad range of investment banking and corporate finance solutions to small and middle market private and public companies, including: buy and sell-side transaction advisory, strategic partnership formation, capital raising, valuations, fairness opinions and due diligence support. ACM partner Gregory Buck is a registered representative of Still. Point Capital LLC, Member FINRA/SIPC. A more detailed review of ACM member experience is found at www. arborcapitalmarkets. com. Page 21

Private Placement of Preferred Stock September 2012 has completed a private placement of Series C 1 Preferred Stock Arbor Capital Markets facilitated this transaction as exclusive financial advisor to Nextek. Securities transactions conducted through Still. Point Capital, LLC, Member FINRA/SIPC. Nextek Power Systems, Inc. ("Nextek") Nextek, headquartered in Detroit, MI, has developed, patented and commercialized a power server that creates an ideal path where DC sources are matched to DC loads, removing unnecessary power conversions, and increasing the overall system efficiency. The company has trademarked this topology as “Direct Coupling® “ and has a strategic partnership with Armstrong Ceiling and is a founder of the Emerge Alliance. www. nextekpower. com The Transaction Nextek has completed a private placement of Series C 1 Preferred Stock to fund product development and growth working capital. Arbor Capital Markets facilitated the transaction and as registered representatives of Still. Point Capital acted as Nextek's exclusive financial advisor, initiating and assisting in transaction negotiations. Arbor Capital Markets ACM provides a broad range of investment banking and corporate finance solutions to small and middle market private and public companies, including: buy and sell-side transaction advisory, strategic partnership formation, capital raising, valuations, fairness opinions and due diligence support. ACM's principals have led or been involved in over 100 transactions ranging from manufacturing and transportation to software and healthcare. In addition, it's partners are registered representatives of Still. Point Capital LLC, Member FINRA/SIPC. A more detailed review of their experience can be found at the ACM website. r 20. rs 6. net/tn. jsp? e=001 x 3 ITcf. Xo. Xlj 2 s. YMuw. Ok. Mqy 4 VLZF 2 Vnw. Wzr. Wh. HHOUDKYIRi. Li 3 Qg 6 I 3 Ugx. IAm. Z 3 rcm. Bh 2 d. Df. IMDL 9 w. EWMU 2 d. BPq. IKLob. RB_l. XMZJWYw. UGn. JQWq. Sq 67 Page 22 GCw. F 8 tf. YYq. SPz.

Private Placement of Preferred Stock September 2012 has completed a private placement of Series C 1 Preferred Stock Arbor Capital Markets facilitated this transaction as exclusive financial advisor to Nextek. Securities transactions conducted through Still. Point Capital, LLC, Member FINRA/SIPC. Nextek Power Systems, Inc. ("Nextek") Nextek, headquartered in Detroit, MI, has developed, patented and commercialized a power server that creates an ideal path where DC sources are matched to DC loads, removing unnecessary power conversions, and increasing the overall system efficiency. The company has trademarked this topology as “Direct Coupling® “ and has a strategic partnership with Armstrong Ceiling and is a founder of the Emerge Alliance. www. nextekpower. com The Transaction Nextek has completed a private placement of Series C 1 Preferred Stock to fund product development and growth working capital. Arbor Capital Markets facilitated the transaction and as registered representatives of Still. Point Capital acted as Nextek's exclusive financial advisor, initiating and assisting in transaction negotiations. Arbor Capital Markets ACM provides a broad range of investment banking and corporate finance solutions to small and middle market private and public companies, including: buy and sell-side transaction advisory, strategic partnership formation, capital raising, valuations, fairness opinions and due diligence support. ACM's principals have led or been involved in over 100 transactions ranging from manufacturing and transportation to software and healthcare. In addition, it's partners are registered representatives of Still. Point Capital LLC, Member FINRA/SIPC. A more detailed review of their experience can be found at the ACM website. r 20. rs 6. net/tn. jsp? e=001 x 3 ITcf. Xo. Xlj 2 s. YMuw. Ok. Mqy 4 VLZF 2 Vnw. Wzr. Wh. HHOUDKYIRi. Li 3 Qg 6 I 3 Ugx. IAm. Z 3 rcm. Bh 2 d. Df. IMDL 9 w. EWMU 2 d. BPq. IKLob. RB_l. XMZJWYw. UGn. JQWq. Sq 67 Page 22 GCw. F 8 tf. YYq. SPz.

Sale of Private Company October 2013 & other Affiliated Companies Completed a sale to Arbor Capital Markets facilitated the transaction Securities transactions conducted through Still. Point Capital LLC, Member FINRA/SIPC Trompeter Enterprises and affiliated companies: Trompeter: delivers robotic line engineering and simulation. Motion Mekanix: provides on-site programming and consulting for a wide range of robots and applications and customizable robotics courses. . TEa. MM Workforce: offers contract, contract to hire, direct hire, or project based workforce support. The Transaction Jacobs Engineering. Inc. , a publicly traded company on the NYSE (JEC), provides technical, professional, and construction services to various industrial, commercial, and governmental clients worldwide. acquired Trompeter and its affiliated companies Motion Mekanix and TEa. MM Workforce. Arbor Capital Markets facilitated the transaction and as registered representatives of Still. Point Capital acted as Trompeter’s exclusive financial advisor, initiating and assisting transaction negotiations. Arbor Capital Markets (“ACM”) ACM provide a broad range of investment banking and corporate finance solutions to small and middle market private and public companies, including: buy and sell-side transaction advisory, strategic partnership formation, capital raising, valuations, fairness opinions and due diligence support. ACM’s principals have led or been involved in over 100 transactions ranging from manufacturing and transportation to software and healthcare. In addition, it’s partners are registered representatives of Still. Point Capital LLC, Member FINRA/SIPC. A more detailed review of their experience is found at www. arborcapitalmarkets. com. Page 23

Sale of Private Company October 2013 & other Affiliated Companies Completed a sale to Arbor Capital Markets facilitated the transaction Securities transactions conducted through Still. Point Capital LLC, Member FINRA/SIPC Trompeter Enterprises and affiliated companies: Trompeter: delivers robotic line engineering and simulation. Motion Mekanix: provides on-site programming and consulting for a wide range of robots and applications and customizable robotics courses. . TEa. MM Workforce: offers contract, contract to hire, direct hire, or project based workforce support. The Transaction Jacobs Engineering. Inc. , a publicly traded company on the NYSE (JEC), provides technical, professional, and construction services to various industrial, commercial, and governmental clients worldwide. acquired Trompeter and its affiliated companies Motion Mekanix and TEa. MM Workforce. Arbor Capital Markets facilitated the transaction and as registered representatives of Still. Point Capital acted as Trompeter’s exclusive financial advisor, initiating and assisting transaction negotiations. Arbor Capital Markets (“ACM”) ACM provide a broad range of investment banking and corporate finance solutions to small and middle market private and public companies, including: buy and sell-side transaction advisory, strategic partnership formation, capital raising, valuations, fairness opinions and due diligence support. ACM’s principals have led or been involved in over 100 transactions ranging from manufacturing and transportation to software and healthcare. In addition, it’s partners are registered representatives of Still. Point Capital LLC, Member FINRA/SIPC. A more detailed review of their experience is found at www. arborcapitalmarkets. com. Page 23

Sale of Private Company May 2014 Completed a sale to Instru. Medics, LLC. : Instru. Medics is a leading provider of surgical instrument repair and management services to acute care hospitals, ambulatory surgery centers, and other alternative site providers in the United States. Founded in 2003, the Company has established a leadership position in the market and offers a range of services, including surgical instrument repair and outsourced surgical instrument management programs. The Company’s repair services address a broad of range of product categories from reusable instruments for general surgery to specific instruments used for diagnostics and minimally-invasive surgery. The Company is headquartered in Ann Arbor, Michigan. The Transaction Stryker Corporation, is a publicly traded company on the NYSE (SYK), offers a diverse array of innovative medical technologies, including reconstructive, medical and surgical, and neurotechnology and spine products Styker acquired Instru. Medics to expand their instrument service and management business. Arbor Capital Markets facilitated the transaction and as registered representatives of Still. Point Capital acted as Instru. Medics’ exclusive financial advisor, initiating and assisting transaction negotiations. Arbor Capital Markets facilitated the transaction Securities transactions conducted through Still. Point Capital LLC, Member FINRA/SIPC Arbor Capital Markets (“ACM”) ACM provide a broad range of investment banking and corporate finance solutions to small and middle market private and public companies, including: buy and sell-side transaction advisory, strategic partnership formation, capital raising, valuations, fairness opinions and due diligence support. ACM’s principals have led or been involved in over 100 transactions ranging from manufacturing and transportation to software and healthcare. In addition, it’s partners are registered representatives of Still. Point Capital LLC, Member FINRA/SIPC. A more detailed review of their experience is found at www. arborcapitalmarkets. com. Page 24

Sale of Private Company May 2014 Completed a sale to Instru. Medics, LLC. : Instru. Medics is a leading provider of surgical instrument repair and management services to acute care hospitals, ambulatory surgery centers, and other alternative site providers in the United States. Founded in 2003, the Company has established a leadership position in the market and offers a range of services, including surgical instrument repair and outsourced surgical instrument management programs. The Company’s repair services address a broad of range of product categories from reusable instruments for general surgery to specific instruments used for diagnostics and minimally-invasive surgery. The Company is headquartered in Ann Arbor, Michigan. The Transaction Stryker Corporation, is a publicly traded company on the NYSE (SYK), offers a diverse array of innovative medical technologies, including reconstructive, medical and surgical, and neurotechnology and spine products Styker acquired Instru. Medics to expand their instrument service and management business. Arbor Capital Markets facilitated the transaction and as registered representatives of Still. Point Capital acted as Instru. Medics’ exclusive financial advisor, initiating and assisting transaction negotiations. Arbor Capital Markets facilitated the transaction Securities transactions conducted through Still. Point Capital LLC, Member FINRA/SIPC Arbor Capital Markets (“ACM”) ACM provide a broad range of investment banking and corporate finance solutions to small and middle market private and public companies, including: buy and sell-side transaction advisory, strategic partnership formation, capital raising, valuations, fairness opinions and due diligence support. ACM’s principals have led or been involved in over 100 transactions ranging from manufacturing and transportation to software and healthcare. In addition, it’s partners are registered representatives of Still. Point Capital LLC, Member FINRA/SIPC. A more detailed review of their experience is found at www. arborcapitalmarkets. com. Page 24