ba1c4a15eec50ecbf4b7ad53ebed6f0b.ppt

- Количество слайдов: 25

Principles to Guide Sound State Budget Decisions Kathy Ryg DATE, 2011

Overview of Illinois State Budget • General Funds (GF) – General Revenue Fund (GRF) – Common School Fund – Education Assistance Fund • Other state funds • Federal trust funds General Funds are the state’s main checking account; GF and “other state funds” contain revenue from both state and federal sources.

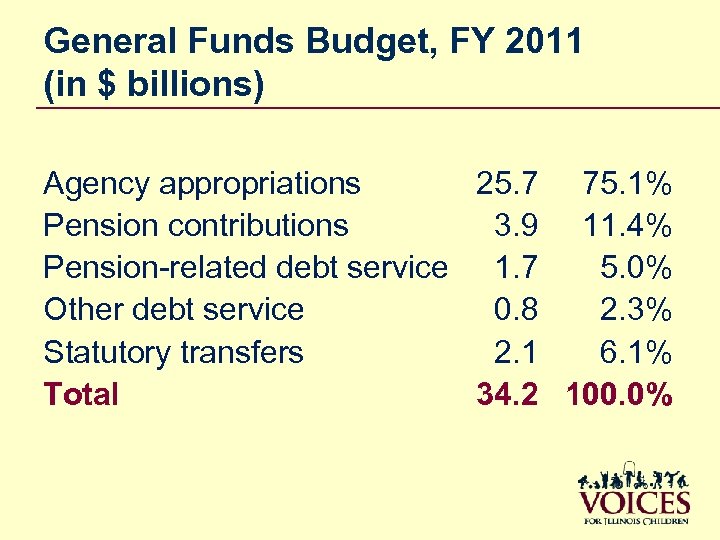

General Funds Budget, FY 2011 (in $ billions) Agency appropriations 25. 7 75. 1% Pension contributions 3. 9 11. 4% Pension-related debt service 1. 7 5. 0% Other debt service 0. 8 2. 3% Statutory transfers 2. 1 6. 1% Total 34. 2 100. 0%

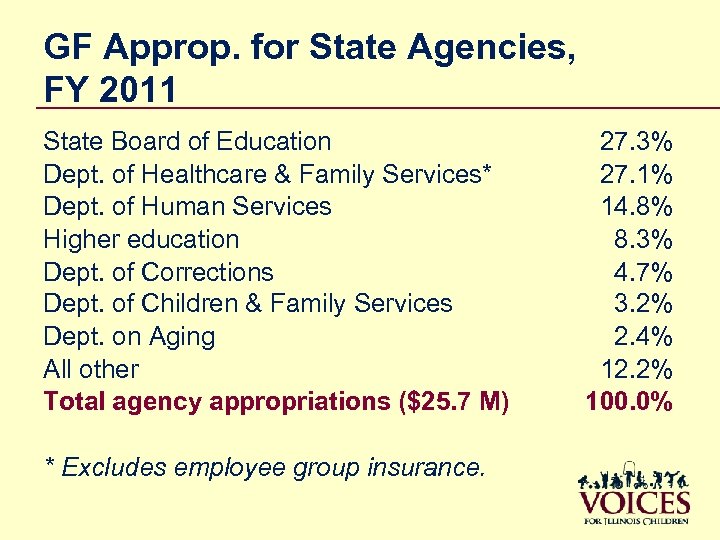

GF Approp. for State Agencies, FY 2011 State Board of Education Dept. of Healthcare & Family Services* Dept. of Human Services Higher education Dept. of Corrections Dept. of Children & Family Services Dept. on Aging All other Total agency appropriations ($25. 7 M) * Excludes employee group insurance. 27. 3% 27. 1% 14. 8% 8. 3% 4. 7% 3. 2% 2. 4% 12. 2% 100. 0%

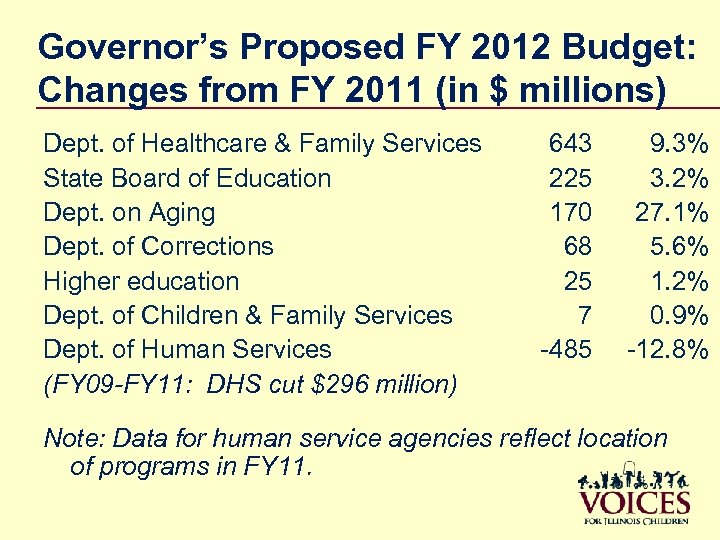

Governor’s Proposed FY 2012 Budget: Changes from FY 2011 (in $ millions) Dept. of Healthcare & Family Services State Board of Education Dept. on Aging Dept. of Corrections Higher education Dept. of Children & Family Services Dept. of Human Services (FY 09 -FY 11: DHS cut $296 million) 643 225 170 68 25 7 -485 9. 3% 3. 2% 27. 1% 5. 6% 1. 2% 0. 9% -12. 8% Note: Data for human service agencies reflect location of programs in FY 11.

State Constitution (Article VIII) “Proposed expenditures shall not exceed funds estimated to be available for the fiscal year as shown in the [Governor’s] budget. ” “Appropriations for a fiscal year shall not exceed funds estimated by the General Assembly to be available during that year. ”

Commission on Government Forecasting & Accountability Act • In March of each year, CGFA shall issue a set of revenue estimates reflecting latest available information. • House and Senate shall adopt or modify CGFA estimates by joint resolution. • Joint resolution shall constitute General Assembly’s estimate of available funds during next fiscal year (under Article VIII).

Budget Process Changes • General Assembly has typically passed appropriations bills without addressing revenue side of state budget. • For FY 2012, both House and Senate have adopted revenue estimates prior to determining appropriations.

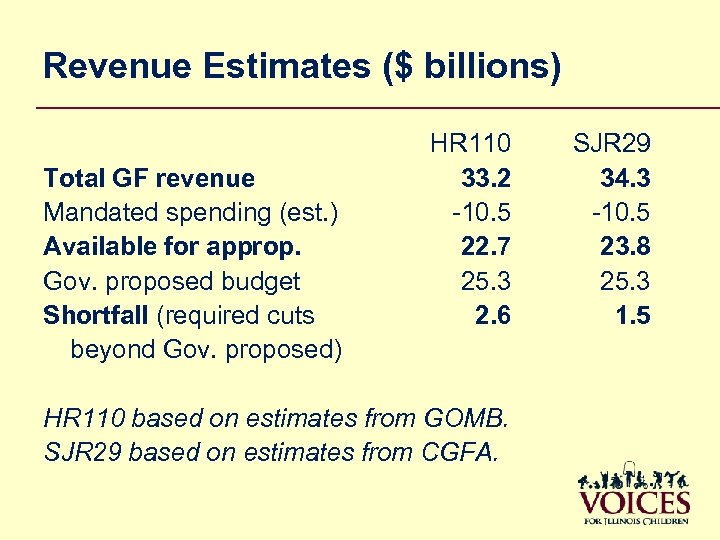

Revenue Estimates ($ billions) Total GF revenue Mandated spending (est. ) Available for approp. Gov. proposed budget Shortfall (required cuts beyond Gov. proposed) HR 110 33. 2 -10. 5 22. 7 25. 3 2. 6 HR 110 based on estimates from GOMB. SJR 29 based on estimates from CGFA. SJR 29 34. 3 -10. 5 23. 8 25. 3 1. 5

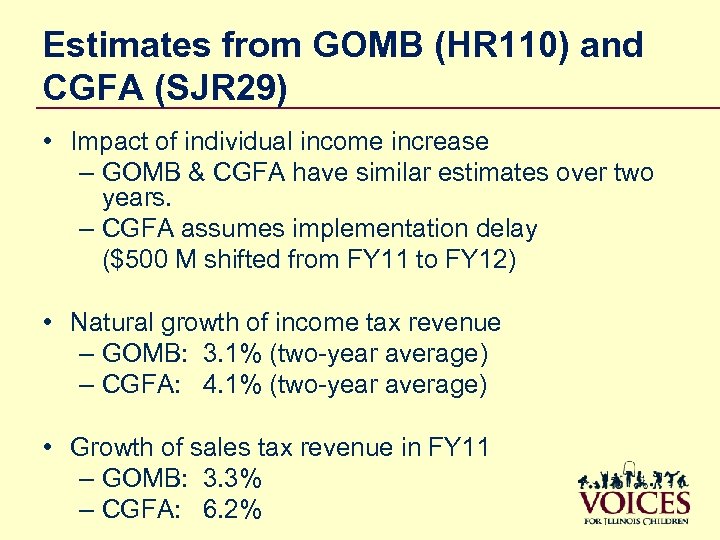

Estimates from GOMB (HR 110) and CGFA (SJR 29) • Impact of individual income increase – GOMB & CGFA have similar estimates over two years. – CGFA assumes implementation delay ($500 M shifted from FY 11 to FY 12) • Natural growth of income tax revenue – GOMB: 3. 1% (two-year average) – CGFA: 4. 1% (two-year average) • Growth of sales tax revenue in FY 11 – GOMB: 3. 3% – CGFA: 6. 2%

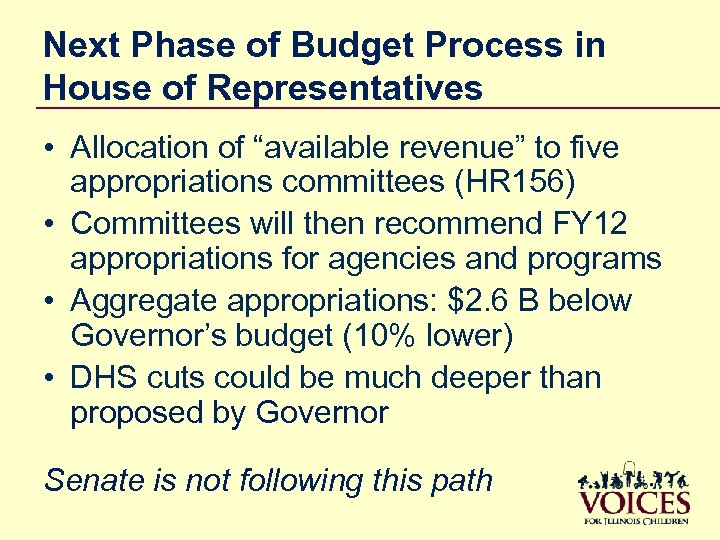

Next Phase of Budget Process in House of Representatives • Allocation of “available revenue” to five appropriations committees (HR 156) • Committees will then recommend FY 12 appropriations for agencies and programs • Aggregate appropriations: $2. 6 B below Governor’s budget (10% lower) • DHS cuts could be much deeper than proposed by Governor Senate is not following this path

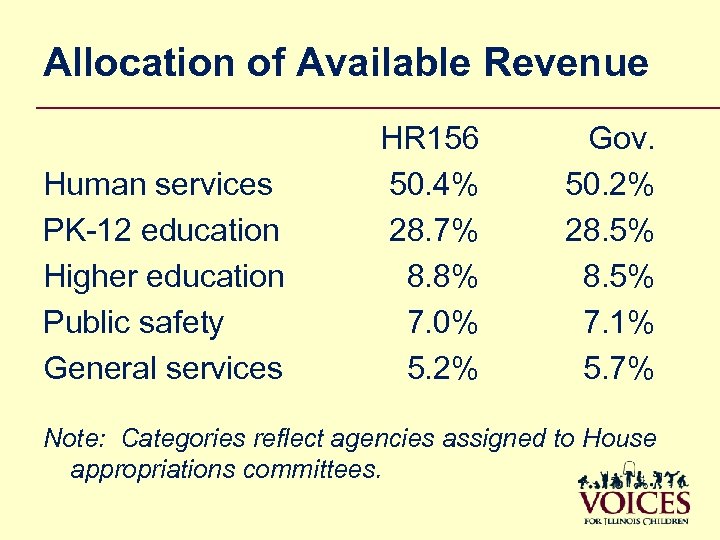

Allocation of Available Revenue Human services PK-12 education Higher education Public safety General services HR 156 50. 4% 28. 7% 8. 8% 7. 0% 5. 2% Gov. 50. 2% 28. 5% 7. 1% 5. 7% Note: Categories reflect agencies assigned to House appropriations committees.

Principles for sound budget decisions include: • Equitable and responsible allocation of resources - a balanced approach to spending decisions • Maximize available revenue - to ensure all reasonable resources are available These principles should guide policymakers’ FY 12 decisions

Equitable and Responsible Allocation of Resources (1) • Balanced approach to allocating limited resources • Shared sacrifice among state agencies and functions of government • Minimize additional cuts in human services, which already have been cut disproportionately

Equitable and Responsible Allocation of Resources (2) • Avoid “fixed allocations” for human services or other broad budget categories – Don’t pit human service agencies and programs against each other – Don’t artificially limit scope of overall budget discussions

Equitable and Responsible Allocation of Resources (3) • Dept. of Healthcare & Family Services should be treated separately from other human service agencies – Medicaid spending cannot be controlled simply by limiting appropriations – Budgetary effects of Medicaid spending growth should not be confined to other human service agencies

Maximize Available Revenue (1): Look Outside General Funds • “Funds sweeps” from special state funds – Used by administration of both parties – $283 M in FY 10 • Statutory transfers – School Infrastructure Fund ($63 M) – Capital Litigation Trust Fund ($15 M) • Appropriations from Road Fund to GRF – Secretary of State ($130 M in FY 09) – State Police ($115 M in FY 09)

Maximize Available Revenue (2): Federal “Bonus Depreciation” • Change in federal law: In figuring taxes, business can immediately deduct entire cost of capital investments from federal gross income • Illinois, like many other states, uses federal definition of income as starting point for state taxes • Change in federal tax code would result in loss of state revenue: est. $600 M in FY 12 • Prevent revenue loss by “decoupling” from federal bonus depreciation, as done in 2002

Maximize Available Revenue (3): Debt Restructuring • Authorize debt restructuring bonds to reduce backlog of state bills (SB 3): $8. 75 B • At least $4. 5 B needed to pay human service providers, local governments, school districts, etc. • The state must meet its contractual obligations to partners and vendors

Investments at Risk • Early Childhood Block Grant – FY 09 -FY 11: budget cuts and payment delays – Pre-K enrollment down by almost 8, 000 kids • Child Care Assistance Program – Income eligibility to be lowered from 200% to 185% FPL – Affects 15, 000 children • Children’s Mental Health Partnership – ISBE: funding cut 45%, FY 09 -FY 11 – DHS: GRF funding cut 36%, FY 09 -FY 11; Gov proposes elimination in FY 12 • Teen REACH after-school programs – FY 12: Gov proposed cut of 88%

But what’s our policy aim? • Simply reducing the state’s deficit? • Or strengthening economic recovery by focusing on effective investments? They’re not the same thing - but each can complement and support the other

Wanted: a balanced approach • A deficit-reduction strategy, and • An economic strategy that maximizes our investments by prioritizing researchproven options Both can be pursued through thoughtful fiscal restraints that protect our investments in research-proven priorities supporting our economic vitality: education, health care, human services & public safety

Voices for Illinois Children works across all issue areas to improve the lives of children of all ages throughout our state so they grow up healthy, happy, safe, loved and well educated. www. voices 4 kids. org

For more information Kathy Ryg President Voices for Illinois Children 312 -516 -5550 kryg@voices 4 kids. org To stay informed, sign up for e-alerts and learn how you can take action, please visit www. voices 4 kids. org

ba1c4a15eec50ecbf4b7ad53ebed6f0b.ppt