aa0324ff5fb847bed9d0e61db667c5a7.ppt

- Количество слайдов: 25

Principles of Taxation Chapter 3 Taxes as Transaction Costs Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Principles of Taxation Chapter 3 Taxes as Transaction Costs Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Objectives Slide 3 -2 Ø Compute tax costs of income and tax savings from deductions. Ø Compute net present value of after-tax cash flows. Ø Identify sources of tax uncertainty Ø Maximize after-tax values versus minimize taxes. Ø Tax planning in private market transactions. Ø Distinguish arm’s length from related-party transactions. Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Objectives Slide 3 -2 Ø Compute tax costs of income and tax savings from deductions. Ø Compute net present value of after-tax cash flows. Ø Identify sources of tax uncertainty Ø Maximize after-tax values versus minimize taxes. Ø Tax planning in private market transactions. Ø Distinguish arm’s length from related-party transactions. Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Taxes as transaction cost Slide 3 -3 Ø Goal - MAXIMIZE AFTER-TAX values, Ø NOT MINIMIZE TAXES Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Taxes as transaction cost Slide 3 -3 Ø Goal - MAXIMIZE AFTER-TAX values, Ø NOT MINIMIZE TAXES Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Time Value of Money Slide 3 -4 Ø Ø Ø Irwin/Mc. Graw-Hill Terminology Present Value Example Future Value Example Present Value of an Annuity Example Future Value of an Annuity Example ©The Mc. Graw-Hill Companies, Inc. , 2000

Time Value of Money Slide 3 -4 Ø Ø Ø Irwin/Mc. Graw-Hill Terminology Present Value Example Future Value Example Present Value of an Annuity Example Future Value of an Annuity Example ©The Mc. Graw-Hill Companies, Inc. , 2000

Time Value of Money Slide 3 -5 Ø Terminology Ø Time Value of Money: this refers to the notion that a dollar available today is worth more than a dollar to be received in some future period. Ø Present value: the value of a dollar today. Ø Discount Rate Ø the rate of interest on invested funds for the deferral period. Ø As r increases, what does the present value do? How is r related to risk? Should you always use the same r to evaluate 2 different planning schemes? Ø Net Present Value: the sum of the present values of cash inflows and outflows relating to a transaction. Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Time Value of Money Slide 3 -5 Ø Terminology Ø Time Value of Money: this refers to the notion that a dollar available today is worth more than a dollar to be received in some future period. Ø Present value: the value of a dollar today. Ø Discount Rate Ø the rate of interest on invested funds for the deferral period. Ø As r increases, what does the present value do? How is r related to risk? Should you always use the same r to evaluate 2 different planning schemes? Ø Net Present Value: the sum of the present values of cash inflows and outflows relating to a transaction. Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Time Value of Money Slide 3 -6 Ø Terminology Ø Future Value Ø The value at a future date of a sum increased by an interest rate. Ø Present Value of an Ordinary Annuity Ø The value today of a series of constant dollar payments available at the end of each period for a specific number of periods. Ø Future Value of an Ordinary Annuity Ø The value at a future date of a series of constant dollar payments available at the end of each period for a specific number of periods increased by an interest rate. Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Time Value of Money Slide 3 -6 Ø Terminology Ø Future Value Ø The value at a future date of a sum increased by an interest rate. Ø Present Value of an Ordinary Annuity Ø The value today of a series of constant dollar payments available at the end of each period for a specific number of periods. Ø Future Value of an Ordinary Annuity Ø The value at a future date of a series of constant dollar payments available at the end of each period for a specific number of periods increased by an interest rate. Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Time Value of Money Slide 3 -7 Ø Present Value example Ø Assume that at the beginning of your freshman year your great Uncle makes the following offer ØReceive $20, 000 on your graduation day 4 years hence, or ØReceive $15, 000 now. Ø How do you decide? ØTo compare the $20, 000 with the $15, 000 you must compare them in present value terms. In other words, what is the present value of the $20, 000 and how does that compare to $15, 000. Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Time Value of Money Slide 3 -7 Ø Present Value example Ø Assume that at the beginning of your freshman year your great Uncle makes the following offer ØReceive $20, 000 on your graduation day 4 years hence, or ØReceive $15, 000 now. Ø How do you decide? ØTo compare the $20, 000 with the $15, 000 you must compare them in present value terms. In other words, what is the present value of the $20, 000 and how does that compare to $15, 000. Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

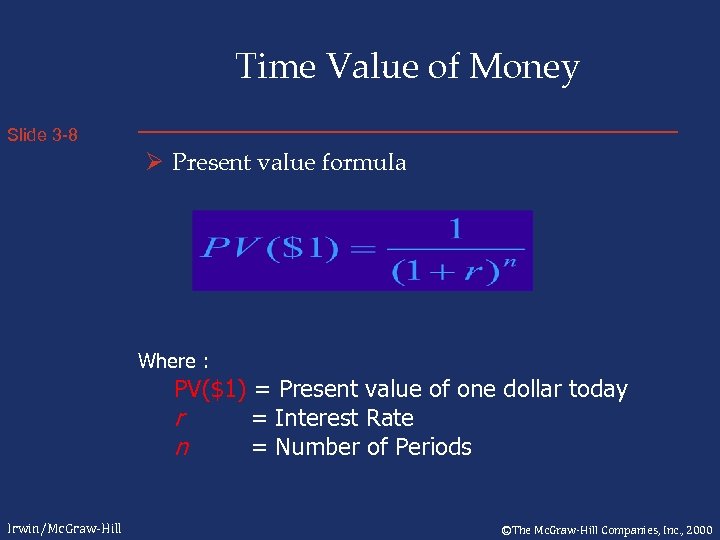

Time Value of Money Slide 3 -8 Ø Present value formula Where : PV($1) = Present value of one dollar today r = Interest Rate n = Number of Periods Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Time Value of Money Slide 3 -8 Ø Present value formula Where : PV($1) = Present value of one dollar today r = Interest Rate n = Number of Periods Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Time Value of Money Slide 3 -9 Ø Present Value Ø Let’s assume you expect an annual interest rate of 10% on invested funds. Specifying an annual rate also determines the number of periods 4 (4 years till graduation). Use 10% for R, and 4 for n. Ø The present value of the $20, 000 using a 10 percent discount rate is $13, 660. Thus, should you take your Uncle’s offer of $15, 000 today? Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Time Value of Money Slide 3 -9 Ø Present Value Ø Let’s assume you expect an annual interest rate of 10% on invested funds. Specifying an annual rate also determines the number of periods 4 (4 years till graduation). Use 10% for R, and 4 for n. Ø The present value of the $20, 000 using a 10 percent discount rate is $13, 660. Thus, should you take your Uncle’s offer of $15, 000 today? Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Time Value of Money Slide 3 -10 Ø Future Value Ø Assume that you accepted your Uncle’s offer of $15, 000 today. What would that amount accumulate to by your graduation 4 years hence if you invest the money in an activity that provided an annual return of 10%? Ø Specifically, you need to determine the future value of the $15, 000. For that we need yet another formula: Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Time Value of Money Slide 3 -10 Ø Future Value Ø Assume that you accepted your Uncle’s offer of $15, 000 today. What would that amount accumulate to by your graduation 4 years hence if you invest the money in an activity that provided an annual return of 10%? Ø Specifically, you need to determine the future value of the $15, 000. For that we need yet another formula: Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

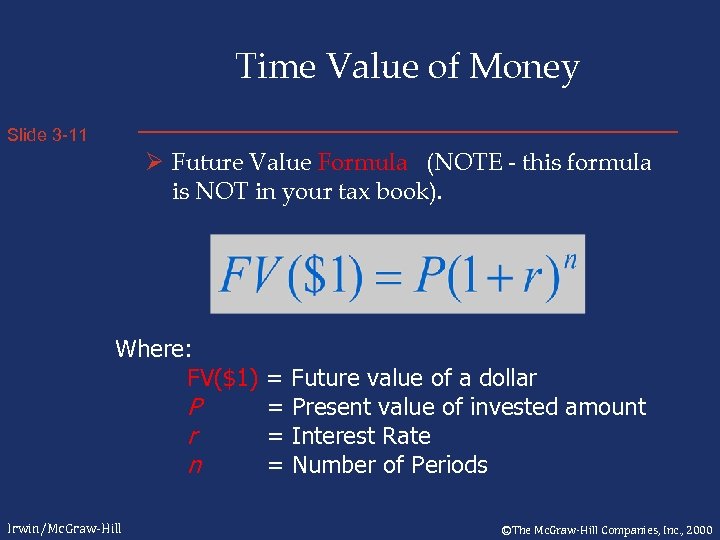

Time Value of Money Slide 3 -11 Ø Future Value Formula (NOTE - this formula is NOT in your tax book). Where: FV($1) = Future value of a dollar P = Present value of invested amount r = Interest Rate n = Number of Periods Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Time Value of Money Slide 3 -11 Ø Future Value Formula (NOTE - this formula is NOT in your tax book). Where: FV($1) = Future value of a dollar P = Present value of invested amount r = Interest Rate n = Number of Periods Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Time Value of Money Slide 3 -12 Ø Future Value Ø Using 4 periods and $15, 000 we can use the formula on the previous slide to determine that the future value of the $15, 000 at graduation is $21, 962. It is clear that your decision to take the $15000 NOW is the wiser decision. Ø Conclusion is the same whether compare PV or FV. KEY is to compare both choices at the SAME point in time. Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Time Value of Money Slide 3 -12 Ø Future Value Ø Using 4 periods and $15, 000 we can use the formula on the previous slide to determine that the future value of the $15, 000 at graduation is $21, 962. It is clear that your decision to take the $15000 NOW is the wiser decision. Ø Conclusion is the same whether compare PV or FV. KEY is to compare both choices at the SAME point in time. Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Time Value of Money Slide 3 -13 Ø Present Value of an Ordinary Annuity Ø Assume your great Uncle feels particularly generous and makes the following offer: ØReceive 4 payments of $15, 000 at the end of your freshman through senior year, or ØReceive $46, 000 now ØThe first option is an example of an ordinary annuity. Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Time Value of Money Slide 3 -13 Ø Present Value of an Ordinary Annuity Ø Assume your great Uncle feels particularly generous and makes the following offer: ØReceive 4 payments of $15, 000 at the end of your freshman through senior year, or ØReceive $46, 000 now ØThe first option is an example of an ordinary annuity. Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

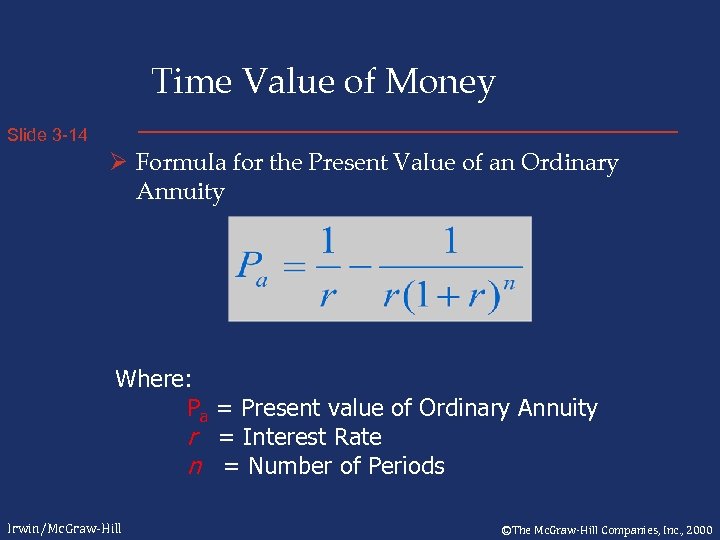

Time Value of Money Slide 3 -14 Ø Formula for the Present Value of an Ordinary Annuity Where: Pa = Present value of Ordinary Annuity r = Interest Rate n = Number of Periods Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Time Value of Money Slide 3 -14 Ø Formula for the Present Value of an Ordinary Annuity Where: Pa = Present value of Ordinary Annuity r = Interest Rate n = Number of Periods Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Time Value of Money Slide 3 -15 Ø Present Value of an Ordinary Annuity ØKeeping with our previous examples (a 10 percent annual interest rate for 4 periods) the present value of the annuity is $47, 548. Thus, you should choose the ANNUITY. Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Time Value of Money Slide 3 -15 Ø Present Value of an Ordinary Annuity ØKeeping with our previous examples (a 10 percent annual interest rate for 4 periods) the present value of the annuity is $47, 548. Thus, you should choose the ANNUITY. Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Time Value of Money Slide 3 -16 Ø Future Value of an Ordinary Annuity Ø Not to be out done by your great Uncle, your grandmother (who wants you to be a doctor and not an accountant) makes the following offer Ø she will invest $16, 000 at the end of your freshman through senior year. The money, if you make the right decision, will go toward paying medical school tuition and expenses. You can keep anything in excess of the medical school costs. How much will you have to pay for medical school? Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Time Value of Money Slide 3 -16 Ø Future Value of an Ordinary Annuity Ø Not to be out done by your great Uncle, your grandmother (who wants you to be a doctor and not an accountant) makes the following offer Ø she will invest $16, 000 at the end of your freshman through senior year. The money, if you make the right decision, will go toward paying medical school tuition and expenses. You can keep anything in excess of the medical school costs. How much will you have to pay for medical school? Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

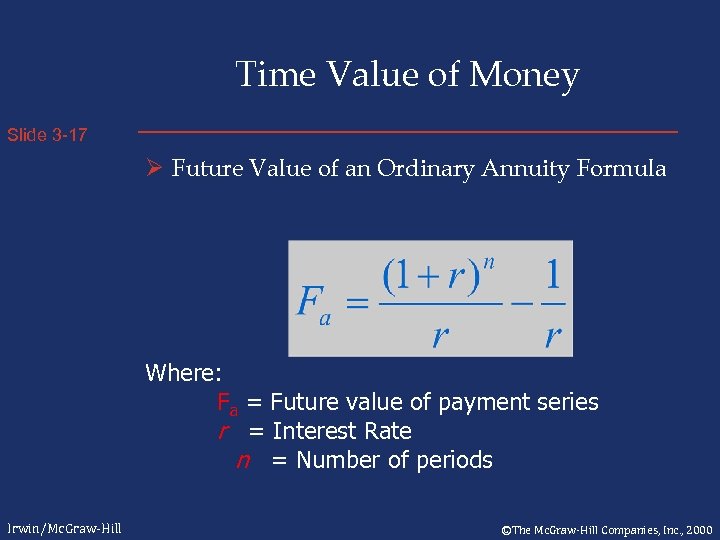

Time Value of Money Slide 3 -17 Ø Future Value of an Ordinary Annuity Formula Where: Fa = Future value of payment series r = Interest Rate n = Number of periods Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Time Value of Money Slide 3 -17 Ø Future Value of an Ordinary Annuity Formula Where: Fa = Future value of payment series r = Interest Rate n = Number of periods Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Time Value of Money Slide 3 -18 Ø Future Value of an Ordinary Annuity Ø Assuming a 10 percent return on grandma’s invested funds and 4 periods. Your medical school fund will be worth $74256. Is there a doctor in the house? Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Time Value of Money Slide 3 -18 Ø Future Value of an Ordinary Annuity Ø Assuming a 10 percent return on grandma’s invested funds and 4 periods. Your medical school fund will be worth $74256. Is there a doctor in the house? Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Risk Slide 3 -19 Ø Many classroom examples (like the ones above) assume that all cash flows are equally risky. Ø Higher risk projects demand higher expected returns = higher discount rate. Ø Assume that discount rates state in examples already reflect the relative risk of the transaction, and that the risk does not change over time. Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Risk Slide 3 -19 Ø Many classroom examples (like the ones above) assume that all cash flows are equally risky. Ø Higher risk projects demand higher expected returns = higher discount rate. Ø Assume that discount rates state in examples already reflect the relative risk of the transaction, and that the risk does not change over time. Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Relation between taxes and cash flows - step by step Slide 3 -20 Ø 1) determine yearly PRE-TAX cash inflows and outflows. Ø 2) determine yearly TAXABLE income and deductions. Taxable income may not be equal to cash inflows. Deductible expenses may not be equal to cash outflows (e. g. depreciation). Ø 3) compute yearly cash outflows to pay TAX on taxable income and cash inflow from tax deductions = 2) x MTR Ø 4) Compute yearly net AFTER-TAX cash inflows or outflows. 1) - 3) Ø 5) Compute NPV of yearly net cash flows. Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Relation between taxes and cash flows - step by step Slide 3 -20 Ø 1) determine yearly PRE-TAX cash inflows and outflows. Ø 2) determine yearly TAXABLE income and deductions. Taxable income may not be equal to cash inflows. Deductible expenses may not be equal to cash outflows (e. g. depreciation). Ø 3) compute yearly cash outflows to pay TAX on taxable income and cash inflow from tax deductions = 2) x MTR Ø 4) Compute yearly net AFTER-TAX cash inflows or outflows. 1) - 3) Ø 5) Compute NPV of yearly net cash flows. Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Relation between taxes and cash flows - step by step Slide 3 -21 Ø George buys a computer for $3000 in 1998. He expects to earn $4000 in cash revenues each of the next three years designing web pages. For tax purposes, he can deduct the cost of the computer as follows: year 1: $1000, year 2: $1500, year 3: 500. He expects to be in a 28% tax bracket for all three years. Assume a discount rate of 10%. What is the net present value of his after-tax cash flows? Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Relation between taxes and cash flows - step by step Slide 3 -21 Ø George buys a computer for $3000 in 1998. He expects to earn $4000 in cash revenues each of the next three years designing web pages. For tax purposes, he can deduct the cost of the computer as follows: year 1: $1000, year 2: $1500, year 3: 500. He expects to be in a 28% tax bracket for all three years. Assume a discount rate of 10%. What is the net present value of his after-tax cash flows? Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

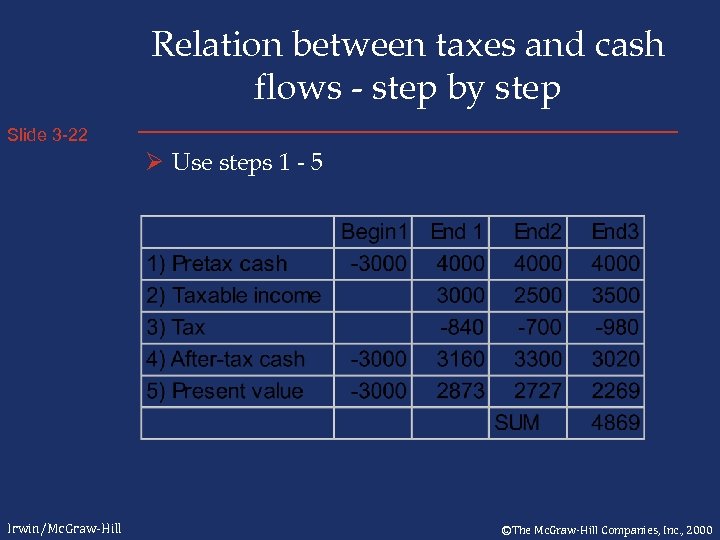

Relation between taxes and cash flows - step by step Slide 3 -22 Ø Use steps 1 - 5 Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Relation between taxes and cash flows - step by step Slide 3 -22 Ø Use steps 1 - 5 Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Relation between taxes and cash flows - other issues Slide 3 -23 Ø The marginal tax rate that applies (Step 3) may differ by type of income. Ø See AP 2, 3, Q 5. Ø Most of the problems and examples in the text assume that payments occur at the BEGINNING of the year. Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Relation between taxes and cash flows - other issues Slide 3 -23 Ø The marginal tax rate that applies (Step 3) may differ by type of income. Ø See AP 2, 3, Q 5. Ø Most of the problems and examples in the text assume that payments occur at the BEGINNING of the year. Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Tax Uncertainty Slide 3 -24 Ø Audit risk - the tax law may be unclear - risk that the IRS may disagree with taxpayer treatment. Possible interest plus penalties plus tax. Ø Tax law uncertainty - the tax law may change. For example, the capital gains rates and holding periods have changed frequently. See Q 7. Ø Marginal rate uncertainty - the taxpayer may not be able to predict annual income and tax position at the time transaction happens. See Q 10. Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Tax Uncertainty Slide 3 -24 Ø Audit risk - the tax law may be unclear - risk that the IRS may disagree with taxpayer treatment. Possible interest plus penalties plus tax. Ø Tax law uncertainty - the tax law may change. For example, the capital gains rates and holding periods have changed frequently. See Q 7. Ø Marginal rate uncertainty - the taxpayer may not be able to predict annual income and tax position at the time transaction happens. See Q 10. Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Structuring Transactions Slide 3 -25 Ø Private market - both parties can customize the transaction. Examples: executive and employer, merger target and acquirer. See TPC 1. Ø Public market - without direct negotiation, tax planning is one-sided. Ø Related party markets - extreme tax avoidance may create suspicion of tax evasion. Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

Structuring Transactions Slide 3 -25 Ø Private market - both parties can customize the transaction. Examples: executive and employer, merger target and acquirer. See TPC 1. Ø Public market - without direct negotiation, tax planning is one-sided. Ø Related party markets - extreme tax avoidance may create suspicion of tax evasion. Irwin/Mc. Graw-Hill ©The Mc. Graw-Hill Companies, Inc. , 2000