aee068f7dff83f347b5d3b6f8e9929ee.ppt

- Количество слайдов: 30

Principles of Taxation Chapter 15 Investment and Personal Financial Planning Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Principles of Taxation Chapter 15 Investment and Personal Financial Planning Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Objectives Slide 15 -2 Ø Ø Ø Ø Mc. Graw-Hill/Irwin Business versus investment Interest income Tax deferral: Insurance and annuities Capital gains and losses Investment interest expense Passive losses Estate and gift rules ©The Mc. Graw-Hill Companies, Inc. , 2002

Objectives Slide 15 -2 Ø Ø Ø Ø Mc. Graw-Hill/Irwin Business versus investment Interest income Tax deferral: Insurance and annuities Capital gains and losses Investment interest expense Passive losses Estate and gift rules ©The Mc. Graw-Hill Companies, Inc. , 2002

Business versus Investment Slide 15 -3 Ø What describes a business activity? Ø What describes an investment activity? Ø Is managing a portfolio investment activity? Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Business versus Investment Slide 15 -3 Ø What describes a business activity? Ø What describes an investment activity? Ø Is managing a portfolio investment activity? Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Investments in Financial Assets Slide 15 -4 Ø Securities include: Ø Return on investment includes: Ø interest Ø dividends Ø What do you do with reinvested dividends? Ø gains (losses) Ø Mutual funds may report ‘distributed’ capital gains/losses. These are still taxable but increase basis even if no cash received. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Investments in Financial Assets Slide 15 -4 Ø Securities include: Ø Return on investment includes: Ø interest Ø dividends Ø What do you do with reinvested dividends? Ø gains (losses) Ø Mutual funds may report ‘distributed’ capital gains/losses. These are still taxable but increase basis even if no cash received. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Interest Income Slide 15 -5 Ø Municipal bond interest income is tax-free at _______ level for regular tax. Ø If the bond is a private activity bond, the interest is an _____ preference. Ø See AP 2 for an interesting problem with interaction of federal and state rates. Ø U. S. debt (bills, notes, bonds) are taxable at federal level (often exempt at ____level). Most pay interest every six months - taxable on receipt. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Interest Income Slide 15 -5 Ø Municipal bond interest income is tax-free at _______ level for regular tax. Ø If the bond is a private activity bond, the interest is an _____ preference. Ø See AP 2 for an interesting problem with interaction of federal and state rates. Ø U. S. debt (bills, notes, bonds) are taxable at federal level (often exempt at ____level). Most pay interest every six months - taxable on receipt. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Interest Income - Discount Bonds Slide 15 -6 Ø Cash basis generally says recognized interest income when_____. Ø Interest income rules are exception - must recognize when earned, such as when original issue discount ACCRUES. Ø Exception for Series EE U. S. savings bond delay income tax until_________. Ø Exception allows ELECTION to be taxed currently on EE bonds. Ø OID is amortized using _________ method. Market discount recognized when bond______. See AP 3. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Interest Income - Discount Bonds Slide 15 -6 Ø Cash basis generally says recognized interest income when_____. Ø Interest income rules are exception - must recognize when earned, such as when original issue discount ACCRUES. Ø Exception for Series EE U. S. savings bond delay income tax until_________. Ø Exception allows ELECTION to be taxed currently on EE bonds. Ø OID is amortized using _________ method. Market discount recognized when bond______. See AP 3. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Deferral with Life Insurance or Annuities Slide 15 -7 Ø Are life insurance proceeds taxable income at death to the recipient? Ø Life insurance policies (but not TERM life policies) build up cash surrender value (CSV). If liquidate policy, excess of ______ over _____ is taxable. Ø Annuity contracts are not taxed until annuity payments are made. Taxation is like installment sales rules: portion of annuity excluded = _____ x ratio of ______ /__________. See AP 6 and 7. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Deferral with Life Insurance or Annuities Slide 15 -7 Ø Are life insurance proceeds taxable income at death to the recipient? Ø Life insurance policies (but not TERM life policies) build up cash surrender value (CSV). If liquidate policy, excess of ______ over _____ is taxable. Ø Annuity contracts are not taxed until annuity payments are made. Taxation is like installment sales rules: portion of annuity excluded = _____ x ratio of ______ /__________. See AP 6 and 7. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Gains/Losses on Securities Slide 15 -8 Ø Realization requires a sale or exchange Ø Gain/loss = _____ -______ Ø Character is capital; time period matters Ø Basis issues: Ø How do reinvested dividends affect basis? Ø Sale of stock uses either specific ID or _______ method of matching basis with sales. Ø Mutual fund shares sold use an ____ basis. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Gains/Losses on Securities Slide 15 -8 Ø Realization requires a sale or exchange Ø Gain/loss = _____ -______ Ø Character is capital; time period matters Ø Basis issues: Ø How do reinvested dividends affect basis? Ø Sale of stock uses either specific ID or _______ method of matching basis with sales. Ø Mutual fund shares sold use an ____ basis. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Capital Losses on Worthless Securities and Bad Debts Slide 15 -9 Ø Worthless securities are treated as if they are sold on the ______ day of the tax year for $0. Capital loss results often long-term. Ø Nonbusiness bad debts are treated as a short-term _____ loss. See AP 9. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Capital Losses on Worthless Securities and Bad Debts Slide 15 -9 Ø Worthless securities are treated as if they are sold on the ______ day of the tax year for $0. Capital loss results often long-term. Ø Nonbusiness bad debts are treated as a short-term _____ loss. See AP 9. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Exchanging Securities Slide 15 -10 Ø General rule is that exchanges are taxable. (e. g. Intel for Nike) Ø Nontaxable if the stocks are in the SAME corporation, or Ø part of the ______ reorganization. Ø Keep your old basis - this creates DEFERRAL of gain or loss. Ø See AP 10, 11. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Exchanging Securities Slide 15 -10 Ø General rule is that exchanges are taxable. (e. g. Intel for Nike) Ø Nontaxable if the stocks are in the SAME corporation, or Ø part of the ______ reorganization. Ø Keep your old basis - this creates DEFERRAL of gain or loss. Ø See AP 10, 11. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

What to Do with Capital Gains and Losses Slide 15 -11 Ø SHORT TERM asset held for <=____ year. Ø LONG TERM asset held for >____ year. Ø Separate ____ % rate category for collectibles and sale of qualified small business stock. Ø Net the gains and losses in each class (net ST, net LT, net 28%LT). Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

What to Do with Capital Gains and Losses Slide 15 -11 Ø SHORT TERM asset held for <=____ year. Ø LONG TERM asset held for >____ year. Ø Separate ____ % rate category for collectibles and sale of qualified small business stock. Ø Net the gains and losses in each class (net ST, net LT, net 28%LT). Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Netting and Tax Rates - Net Loss Slide 15 -12 Ø Net the net ST gain/loss with the net LT gain/loss Ø IF the total net capital gain/loss is a LOSS Ø deduct $______ against _____ income Ø carryforward remainder for how long? Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Netting and Tax Rates - Net Loss Slide 15 -12 Ø Net the net ST gain/loss with the net LT gain/loss Ø IF the total net capital gain/loss is a LOSS Ø deduct $______ against _____ income Ø carryforward remainder for how long? Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

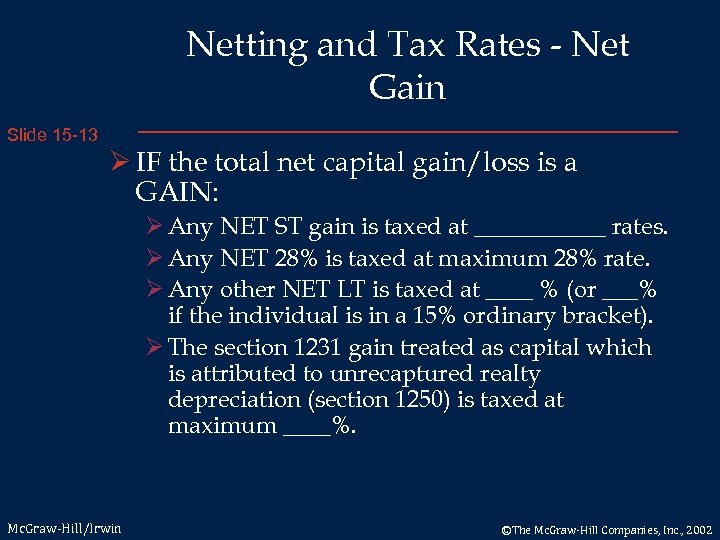

Netting and Tax Rates - Net Gain Slide 15 -13 Ø IF the total net capital gain/loss is a GAIN: Ø Any NET ST gain is taxed at ______ rates. Ø Any NET 28% is taxed at maximum 28% rate. Ø Any other NET LT is taxed at ____ % (or ___% if the individual is in a 15% ordinary bracket). Ø The section 1231 gain treated as capital which is attributed to unrecaptured realty depreciation (section 1250) is taxed at maximum ____%. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Netting and Tax Rates - Net Gain Slide 15 -13 Ø IF the total net capital gain/loss is a GAIN: Ø Any NET ST gain is taxed at ______ rates. Ø Any NET 28% is taxed at maximum 28% rate. Ø Any other NET LT is taxed at ____ % (or ___% if the individual is in a 15% ordinary bracket). Ø The section 1231 gain treated as capital which is attributed to unrecaptured realty depreciation (section 1250) is taxed at maximum ____%. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

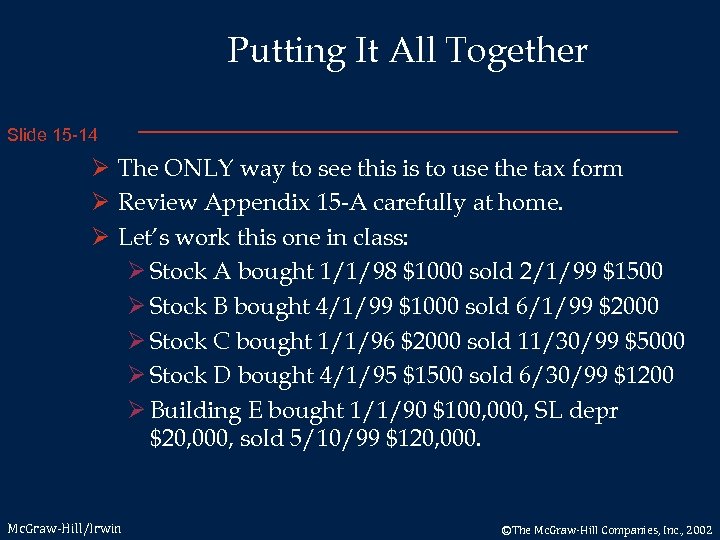

Putting It All Together Slide 15 -14 Ø The ONLY way to see this is to use the tax form Ø Review Appendix 15 -A carefully at home. Ø Let’s work this one in class: Ø Stock A bought 1/1/98 $1000 sold 2/1/99 $1500 Ø Stock B bought 4/1/99 $1000 sold 6/1/99 $2000 Ø Stock C bought 1/1/96 $2000 sold 11/30/99 $5000 Ø Stock D bought 4/1/95 $1500 sold 6/30/99 $1200 Ø Building E bought 1/1/90 $100, 000, SL depr $20, 000, sold 5/10/99 $120, 000. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Putting It All Together Slide 15 -14 Ø The ONLY way to see this is to use the tax form Ø Review Appendix 15 -A carefully at home. Ø Let’s work this one in class: Ø Stock A bought 1/1/98 $1000 sold 2/1/99 $1500 Ø Stock B bought 4/1/99 $1000 sold 6/1/99 $2000 Ø Stock C bought 1/1/96 $2000 sold 11/30/99 $5000 Ø Stock D bought 4/1/95 $1500 sold 6/30/99 $1200 Ø Building E bought 1/1/90 $100, 000, SL depr $20, 000, sold 5/10/99 $120, 000. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Investments in Small Business Slide 15 -15 Ø Qualified small business stock (<=$____ million assets after issue; issued after 8/10/93). Ø Exclude _____ gain if held >___ years. Ø Remaining gain is ____% rate gain. Ø Loss on Section 1244 stock (1 st $__ million issued stock) is ____ up to $100, 000 for married filing joint returns. Excess loss is _____ loss. Ø Gains still qualify as capital. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Investments in Small Business Slide 15 -15 Ø Qualified small business stock (<=$____ million assets after issue; issued after 8/10/93). Ø Exclude _____ gain if held >___ years. Ø Remaining gain is ____% rate gain. Ø Loss on Section 1244 stock (1 st $__ million issued stock) is ____ up to $100, 000 for married filing joint returns. Excess loss is _____ loss. Ø Gains still qualify as capital. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

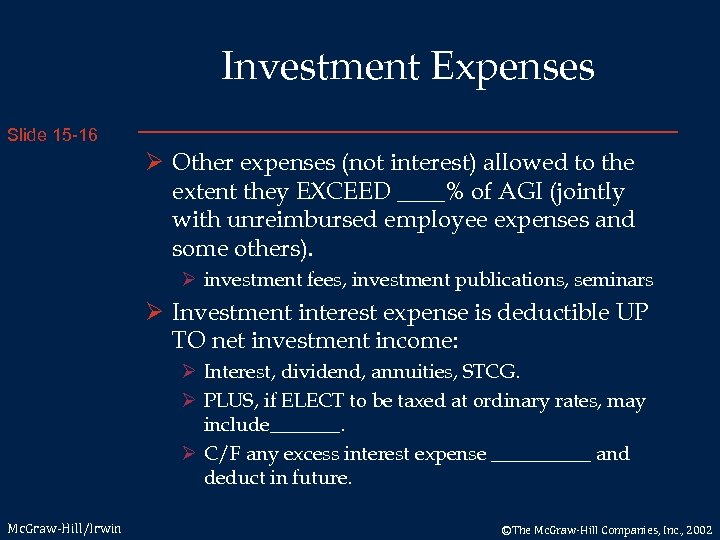

Investment Expenses Slide 15 -16 Ø Other expenses (not interest) allowed to the extent they EXCEED ____% of AGI (jointly with unreimbursed employee expenses and some others). Ø investment fees, investment publications, seminars Ø Investment interest expense is deductible UP TO net investment income: Ø Interest, dividend, annuities, STCG. Ø PLUS, if ELECT to be taxed at ordinary rates, may include_______. Ø C/F any excess interest expense _____ and deduct in future. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Investment Expenses Slide 15 -16 Ø Other expenses (not interest) allowed to the extent they EXCEED ____% of AGI (jointly with unreimbursed employee expenses and some others). Ø investment fees, investment publications, seminars Ø Investment interest expense is deductible UP TO net investment income: Ø Interest, dividend, annuities, STCG. Ø PLUS, if ELECT to be taxed at ordinary rates, may include_______. Ø C/F any excess interest expense _____ and deduct in future. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

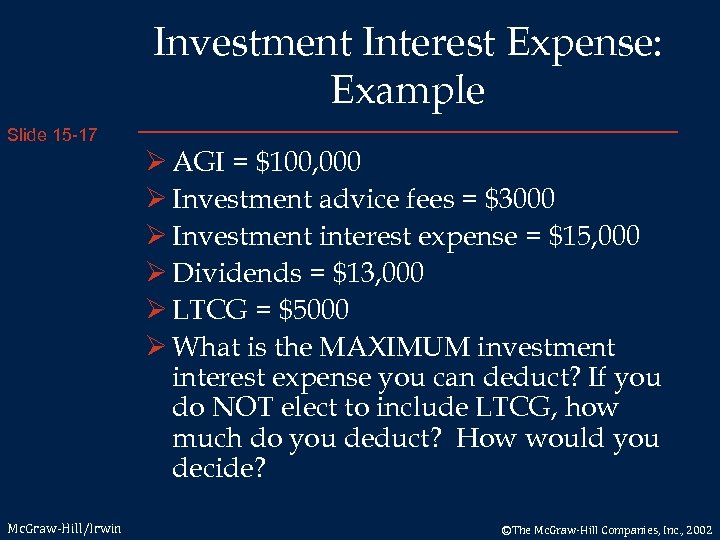

Investment Interest Expense: Example Slide 15 -17 Mc. Graw-Hill/Irwin Ø AGI = $100, 000 Ø Investment advice fees = $3000 Ø Investment interest expense = $15, 000 Ø Dividends = $13, 000 Ø LTCG = $5000 Ø What is the MAXIMUM investment interest expense you can deduct? If you do NOT elect to include LTCG, how much do you deduct? How would you decide? ©The Mc. Graw-Hill Companies, Inc. , 2002

Investment Interest Expense: Example Slide 15 -17 Mc. Graw-Hill/Irwin Ø AGI = $100, 000 Ø Investment advice fees = $3000 Ø Investment interest expense = $15, 000 Ø Dividends = $13, 000 Ø LTCG = $5000 Ø What is the MAXIMUM investment interest expense you can deduct? If you do NOT elect to include LTCG, how much do you deduct? How would you decide? ©The Mc. Graw-Hill Companies, Inc. , 2002

Real Estate Investments Slide 15 -18 Ø Land is generally a capital asset appreciation is taxed at favorable rates on sale. Ø RE taxes paid are deductible. Ø Mortgage interest payments are investment interest expense. Ø Frequent sales of land may cause land to be viewed as______. Ø No depreciation - other expenses may be deductible. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Real Estate Investments Slide 15 -18 Ø Land is generally a capital asset appreciation is taxed at favorable rates on sale. Ø RE taxes paid are deductible. Ø Mortgage interest payments are investment interest expense. Ø Frequent sales of land may cause land to be viewed as______. Ø No depreciation - other expenses may be deductible. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Rental RE Slide 15 -19 Ø Report rent income and expenses on Schedule E. Rental property is depreciated using residential rates. Ø Allocate deductions to rental income in proportion of days rented/days used (by you or tenant). Ø Exception: may allocate interest expense and tax expense to rental income in proportion of days rented/365. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Rental RE Slide 15 -19 Ø Report rent income and expenses on Schedule E. Rental property is depreciated using residential rates. Ø Allocate deductions to rental income in proportion of days rented/days used (by you or tenant). Ø Exception: may allocate interest expense and tax expense to rental income in proportion of days rented/365. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Rental RE and Personal Use Slide 15 -20 Ø Losses are limited to rental income IF you use the house personally for more than the greater of: Ø 1) 14 days Ø 2) 10% of the rental days. Ø Even if not violate above test, net losses may be limited due to basis rules (remember Chapter 9) or passive activity limits (see below). Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Rental RE and Personal Use Slide 15 -20 Ø Losses are limited to rental income IF you use the house personally for more than the greater of: Ø 1) 14 days Ø 2) 10% of the rental days. Ø Even if not violate above test, net losses may be limited due to basis rules (remember Chapter 9) or passive activity limits (see below). Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Rental RE Example Slide 15 -21 Ø Rental income = $10, 000 Ø Depreciation = $5, 000 Ø Interest expense = $8, 000 Ø Utilities = $2, 000 Ø What would we do if rental days = 190 and personal days = 10? Ø What would we do if rental days = 200 and personal days = 50? Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Rental RE Example Slide 15 -21 Ø Rental income = $10, 000 Ø Depreciation = $5, 000 Ø Interest expense = $8, 000 Ø Utilities = $2, 000 Ø What would we do if rental days = 190 and personal days = 10? Ø What would we do if rental days = 200 and personal days = 50? Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Passive Activities Slide 15 -22 Ø Definition: an interest in a business where the owner does not MATERIALLY PARTICIPATE - what does this mean? Ø LOSS on passive activity is ONLY deductible to the extent of OTHER _____ INCOME. (Excludes active income - e. g. wages, material activities; excludes portfolio income - e. g. interest, dividends. ) See AP 19. Ø Excess losses are carried forward ______ - can deduct unused losses against future passive income or at disposition. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Passive Activities Slide 15 -22 Ø Definition: an interest in a business where the owner does not MATERIALLY PARTICIPATE - what does this mean? Ø LOSS on passive activity is ONLY deductible to the extent of OTHER _____ INCOME. (Excludes active income - e. g. wages, material activities; excludes portfolio income - e. g. interest, dividends. ) See AP 19. Ø Excess losses are carried forward ______ - can deduct unused losses against future passive income or at disposition. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Passive Activity Exception for Rental RE. Slide 15 -23 Ø Passive rental losses up to $_______ can be deducted if: Ø active management, Ø married AGI less than $100, 000 (phases out fully at $____). Ø The passive activities rules are far more complex than this text explores. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Passive Activity Exception for Rental RE. Slide 15 -23 Ø Passive rental losses up to $_______ can be deducted if: Ø active management, Ø married AGI less than $100, 000 (phases out fully at $____). Ø The passive activities rules are far more complex than this text explores. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Wealth Transfer Planning Slide 15 -24 Ø Gift, estate, and generation skipping transfer taxes Ø The unified gift and estate tax is based on cumulative transfers over time (life + death). Ø Graduated rates up to ____% Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Wealth Transfer Planning Slide 15 -24 Ø Gift, estate, and generation skipping transfer taxes Ø The unified gift and estate tax is based on cumulative transfers over time (life + death). Ø Graduated rates up to ____% Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Gift Tax Slide 15 -25 Ø Remember, all receipts of gifts are excluded from INCOME taxation. We are now discussing GIFT taxation. Ø Exclude $_____ per year per donee from taxable gifts. Ø No gift tax on gifts to spouse, charity, paying tuition or medical costs. Ø Can treat gift by one spouse as made 1/2 by other spouse. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Gift Tax Slide 15 -25 Ø Remember, all receipts of gifts are excluded from INCOME taxation. We are now discussing GIFT taxation. Ø Exclude $_____ per year per donee from taxable gifts. Ø No gift tax on gifts to spouse, charity, paying tuition or medical costs. Ø Can treat gift by one spouse as made 1/2 by other spouse. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Lifetime Transfer Tax Exclusion Slide 15 -26 Ø Lifetime exclusion Ø 2001 $_____ Ø 2006 $1, 000 Ø Tax legislation may change estate and gift in 2001. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Lifetime Transfer Tax Exclusion Slide 15 -26 Ø Lifetime exclusion Ø 2001 $_____ Ø 2006 $1, 000 Ø Tax legislation may change estate and gift in 2001. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Income Tax Effects of Gifts Slide 15 -27 Ø Gift is not taxable income to donee. Ø How does the donee determine his or her basis in gift property received? Ø Exception - use FMV if less than adjusted basis. Ø After gift, any income derived from the property belongs to the donee. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Income Tax Effects of Gifts Slide 15 -27 Ø Gift is not taxable income to donee. Ø How does the donee determine his or her basis in gift property received? Ø Exception - use FMV if less than adjusted basis. Ø After gift, any income derived from the property belongs to the donee. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Kiddie Tax Slide 15 -28 Ø Unearned income of children < 14 years old Ø In excess of $_____ in 2001 Ø is taxed at the _____ marginal tax rate. Ø Child < 14 standard deduction is limited to GREATER of Ø $_____ , or Ø earned income + $250. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Kiddie Tax Slide 15 -28 Ø Unearned income of children < 14 years old Ø In excess of $_____ in 2001 Ø is taxed at the _____ marginal tax rate. Ø Child < 14 standard deduction is limited to GREATER of Ø $_____ , or Ø earned income + $250. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Estate Tax Slide 15 -29 Ø Taxed at unified estate and gift rate schedule. Ø FMV of estate is taxed. Ø Unlimited marital deduction. Ø Reduce estate by taxes, charity, administrative expenses See AP 23. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Estate Tax Slide 15 -29 Ø Taxed at unified estate and gift rate schedule. Ø FMV of estate is taxed. Ø Unlimited marital deduction. Ø Reduce estate by taxes, charity, administrative expenses See AP 23. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Income Tax Effect of Bequests Slide 15 -30 Ø Receipt of a bequest is not taxable income to heir. Ø Basis = _______ at date of death = free income tax step-up in basis. Ø Trade-off: Ø Gift now at low basis, perhaps avoid some transfer tax. Ø Keep and include in estate, but heirs get high basis. Ø See AP 24. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002

Income Tax Effect of Bequests Slide 15 -30 Ø Receipt of a bequest is not taxable income to heir. Ø Basis = _______ at date of death = free income tax step-up in basis. Ø Trade-off: Ø Gift now at low basis, perhaps avoid some transfer tax. Ø Keep and include in estate, but heirs get high basis. Ø See AP 24. Mc. Graw-Hill/Irwin ©The Mc. Graw-Hill Companies, Inc. , 2002