b1a4b07b1a4ca1f2a6f687c6a3ecb1ca.ppt

- Количество слайдов: 67

Principles of option pricing

Principles of option pricing

Option A contract that gives the holder the right - not the obligation - to buy (call), or to sell (put) a specified amount of the underlying asset, at a set exchange rate and expiration date.

Option A contract that gives the holder the right - not the obligation - to buy (call), or to sell (put) a specified amount of the underlying asset, at a set exchange rate and expiration date.

Glossary of terms The investor buying the option is called the buyer or holder. The investor selling the option is called the writer or seller. When the holder of the option decides to buy (sell) the asset at maturity, it is said that he/she is exercising the option. The asset to be bought or sold is called the underlying asset. Since the holder enjoys a privilege - the option to buy or sell - he/she must pay a premium to acquire the option. The price agreed upon for buying or selling the underlying asset is called exercise price or strike price.

Glossary of terms The investor buying the option is called the buyer or holder. The investor selling the option is called the writer or seller. When the holder of the option decides to buy (sell) the asset at maturity, it is said that he/she is exercising the option. The asset to be bought or sold is called the underlying asset. Since the holder enjoys a privilege - the option to buy or sell - he/she must pay a premium to acquire the option. The price agreed upon for buying or selling the underlying asset is called exercise price or strike price.

Glossary of terms (con’t) Options are traded on options exchanges. The number of outstanding option contracts at any time is called open interest.

Glossary of terms (con’t) Options are traded on options exchanges. The number of outstanding option contracts at any time is called open interest.

American vs. European options American options can be exercised at any time during their life span European options can be exercised only at maturity

American vs. European options American options can be exercised at any time during their life span European options can be exercised only at maturity

Option valuation basics Like with any other financial asset, the option premium or market value or option price is a function of future expected cash flows.

Option valuation basics Like with any other financial asset, the option premium or market value or option price is a function of future expected cash flows.

Notation C: price of an American call c: price of an European call P: price of an American put p: price of an European put E: exercise or strike price S: stock price before maturity ST: stock price at maturity T: time to maturity r: risk-free rate

Notation C: price of an American call c: price of an European call P: price of an American put p: price of an European put E: exercise or strike price S: stock price before maturity ST: stock price at maturity T: time to maturity r: risk-free rate

![Boundaries to option prices: Call options. At expiration: C = max[0, (ST -E)] Before Boundaries to option prices: Call options. At expiration: C = max[0, (ST -E)] Before](https://present5.com/presentation/b1a4b07b1a4ca1f2a6f687c6a3ecb1ca/image-8.jpg) Boundaries to option prices: Call options. At expiration: C = max[0, (ST -E)] Before expiration Upper bound: A call cannot sell for more than the stock: C < S and c < S Lower bound: C > = max[0, (S -E)] c > = max[0, (S - E/(1+r)T)]

Boundaries to option prices: Call options. At expiration: C = max[0, (ST -E)] Before expiration Upper bound: A call cannot sell for more than the stock: C < S and c < S Lower bound: C > = max[0, (S -E)] c > = max[0, (S - E/(1+r)T)]

What happens if this relationship is not satisfied?

What happens if this relationship is not satisfied?

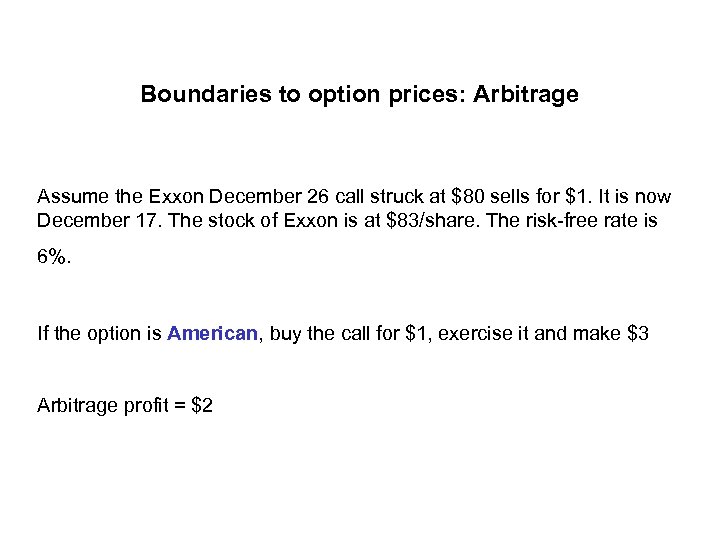

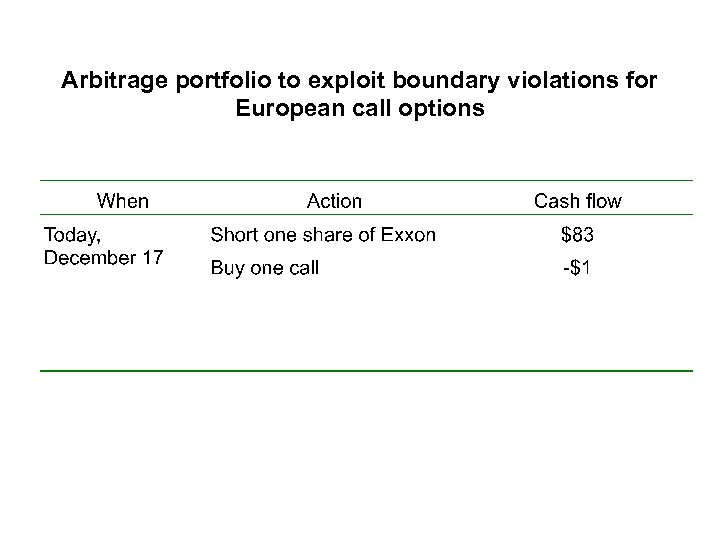

Boundaries to option prices: Arbitrage Assume the Exxon December 26 call struck at $80 sells for $1. It is now December 17. The stock of Exxon is at $83/share. The risk-free rate is 6%. If the option is American, buy the call for $1, exercise it and make $3 Arbitrage profit = $2

Boundaries to option prices: Arbitrage Assume the Exxon December 26 call struck at $80 sells for $1. It is now December 17. The stock of Exxon is at $83/share. The risk-free rate is 6%. If the option is American, buy the call for $1, exercise it and make $3 Arbitrage profit = $2

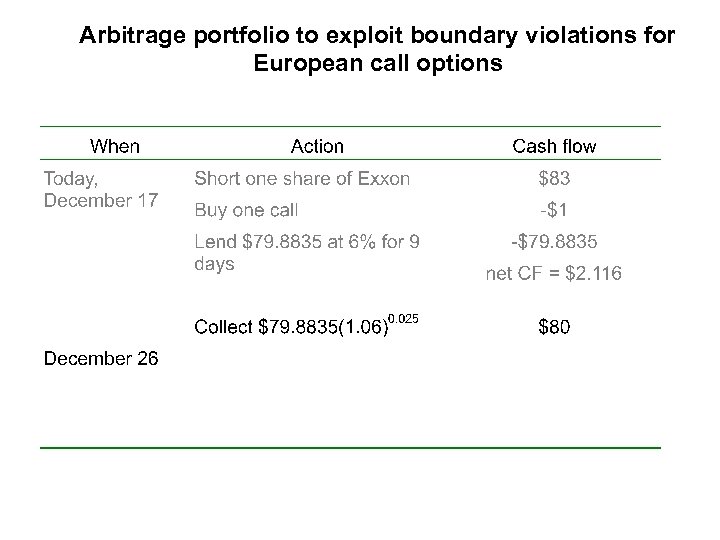

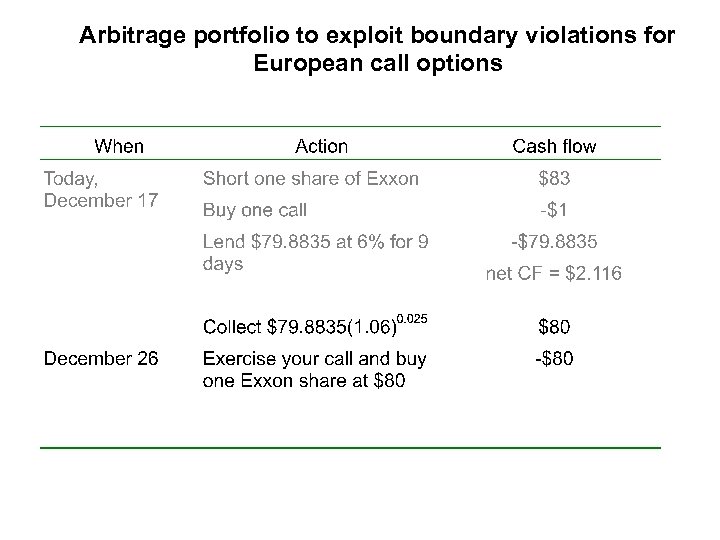

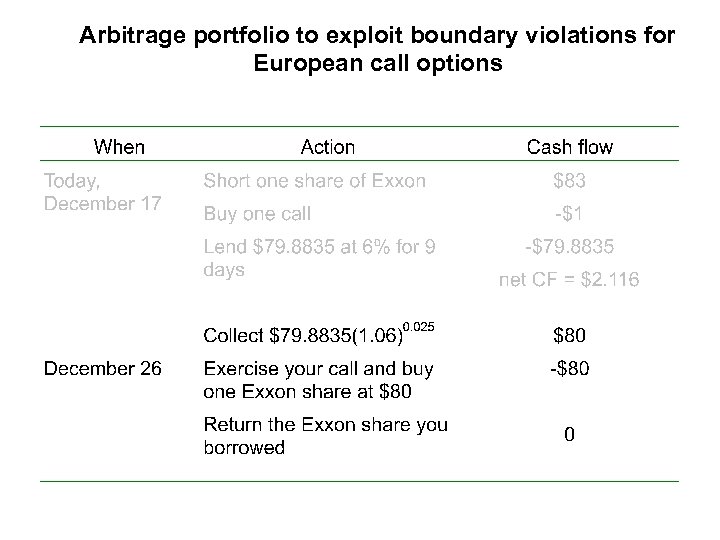

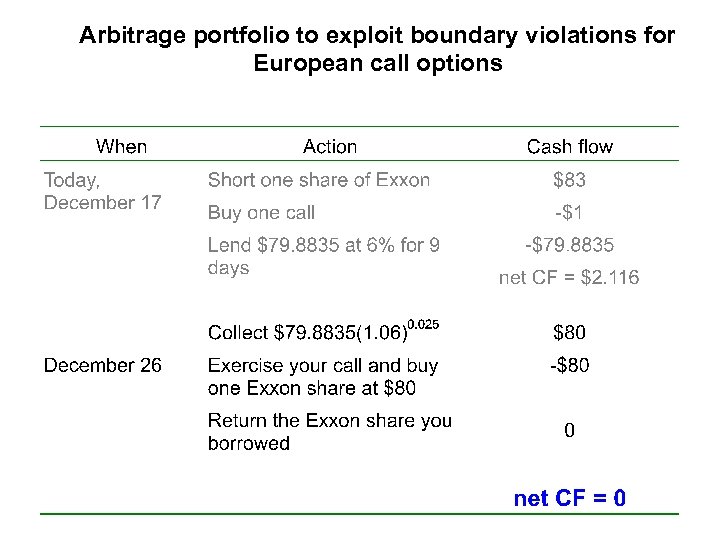

What if the option is European? Construct an arbitrage portfolio

What if the option is European? Construct an arbitrage portfolio

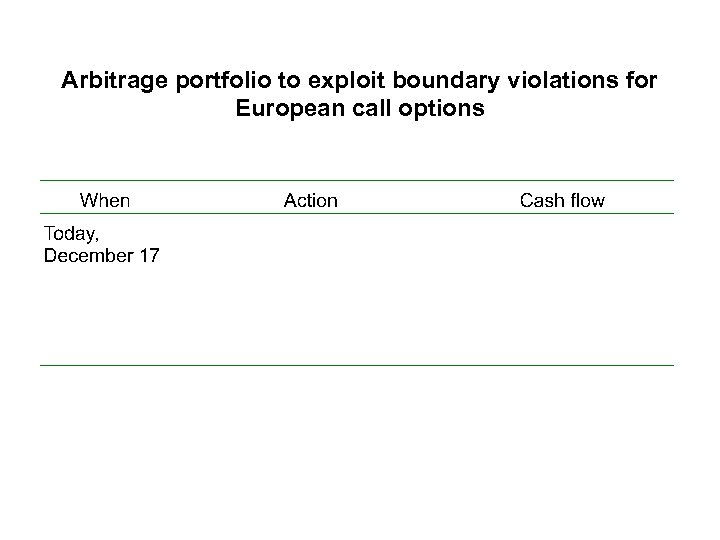

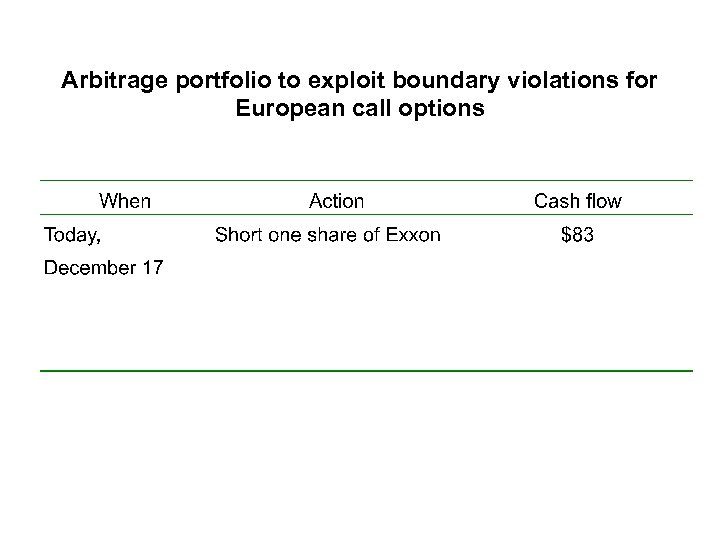

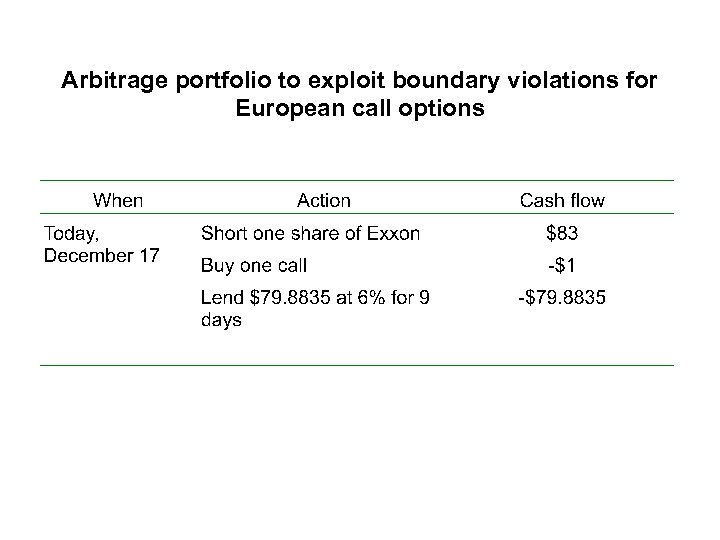

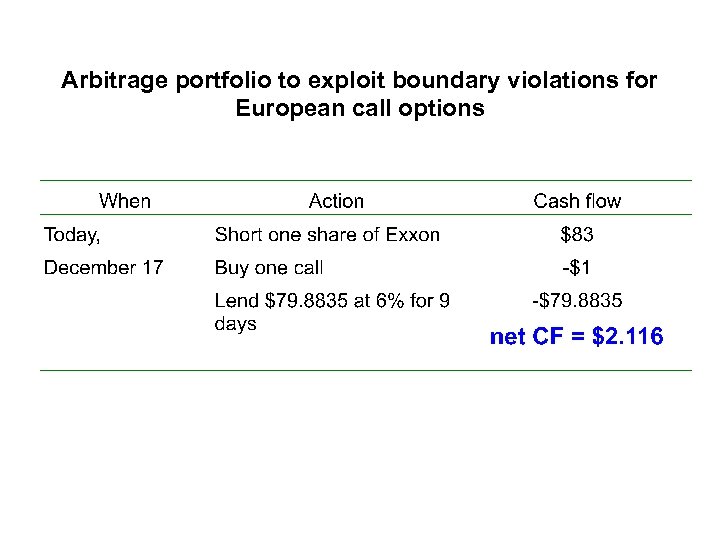

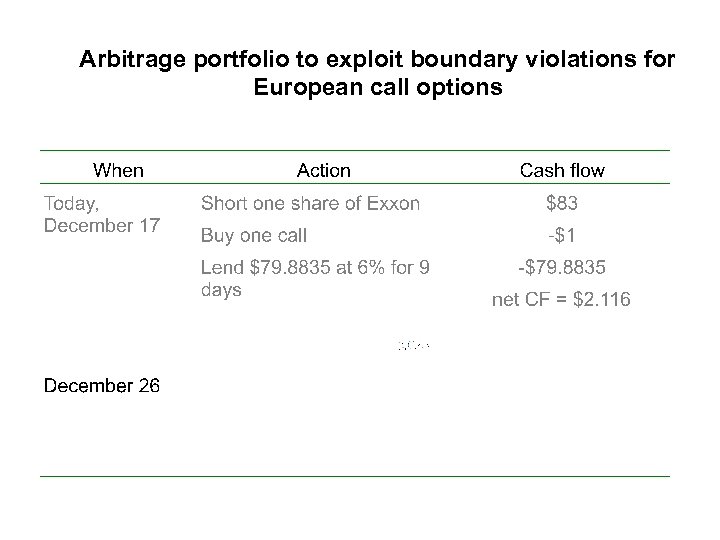

Arbitrage portfolio to exploit boundary violations for European call options

Arbitrage portfolio to exploit boundary violations for European call options

Arbitrage portfolio to exploit boundary violations for European call options

Arbitrage portfolio to exploit boundary violations for European call options

Arbitrage portfolio to exploit boundary violations for European call options

Arbitrage portfolio to exploit boundary violations for European call options

Arbitrage portfolio to exploit boundary violations for European call options

Arbitrage portfolio to exploit boundary violations for European call options

Arbitrage portfolio to exploit boundary violations for European call options

Arbitrage portfolio to exploit boundary violations for European call options

Arbitrage portfolio to exploit boundary violations for European call options

Arbitrage portfolio to exploit boundary violations for European call options

Arbitrage portfolio to exploit boundary violations for European call options

Arbitrage portfolio to exploit boundary violations for European call options

Arbitrage portfolio to exploit boundary violations for European call options

Arbitrage portfolio to exploit boundary violations for European call options

Arbitrage portfolio to exploit boundary violations for European call options

Arbitrage portfolio to exploit boundary violations for European call options

Arbitrage portfolio to exploit boundary violations for European call options

Arbitrage portfolio to exploit boundary violations for European call options

Analysis We have created a riskless portfolio: the terminal cash flow is zero, regardless of the stock price, while the up-front cash flow is positive. We made $2. 116 in pure arbitrage profits.

Analysis We have created a riskless portfolio: the terminal cash flow is zero, regardless of the stock price, while the up-front cash flow is positive. We made $2. 116 in pure arbitrage profits.

![Boundaries to option prices: Put options. At expiration: P = max[0, (E -ST)] Before Boundaries to option prices: Put options. At expiration: P = max[0, (E -ST)] Before](https://present5.com/presentation/b1a4b07b1a4ca1f2a6f687c6a3ecb1ca/image-23.jpg) Boundaries to option prices: Put options. At expiration: P = max[0, (E -ST)] Before expiration Upper bound: A put cannot sell for more than the stock: P < S and p < S Lower bound: P > = max[0, (E - S)] p > = max[0, (E/(1+r)T -S)]

Boundaries to option prices: Put options. At expiration: P = max[0, (E -ST)] Before expiration Upper bound: A put cannot sell for more than the stock: P < S and p < S Lower bound: P > = max[0, (E - S)] p > = max[0, (E/(1+r)T -S)]

Boundary violations By now, we know that if price boundaries are violated, we might be able to construct an arbitrage portfolio.

Boundary violations By now, we know that if price boundaries are violated, we might be able to construct an arbitrage portfolio.

Boundary violations: American put options Assume the Exxon December 26 put struck at $80 sells for $2. It is now December 17. The stock of Exxon is at $75/share. The risk-free rate is 6%. If the option is American, we can buy it for $2 and exercise it. Arbitrage profit = $3.

Boundary violations: American put options Assume the Exxon December 26 put struck at $80 sells for $2. It is now December 17. The stock of Exxon is at $75/share. The risk-free rate is 6%. If the option is American, we can buy it for $2 and exercise it. Arbitrage profit = $3.

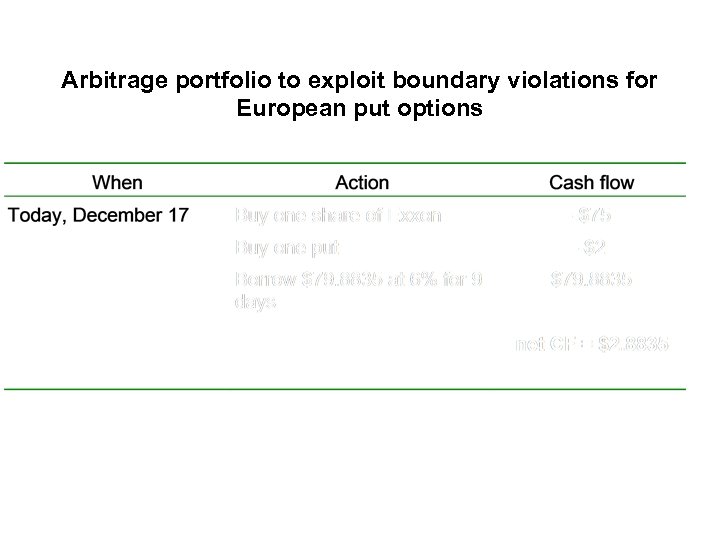

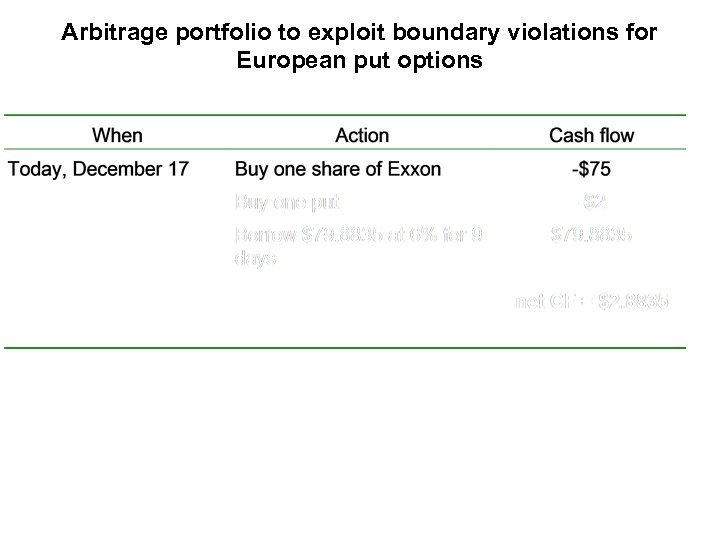

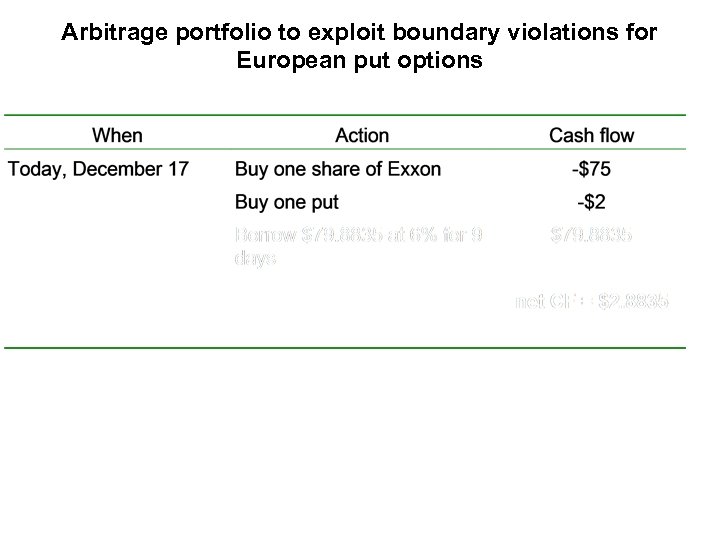

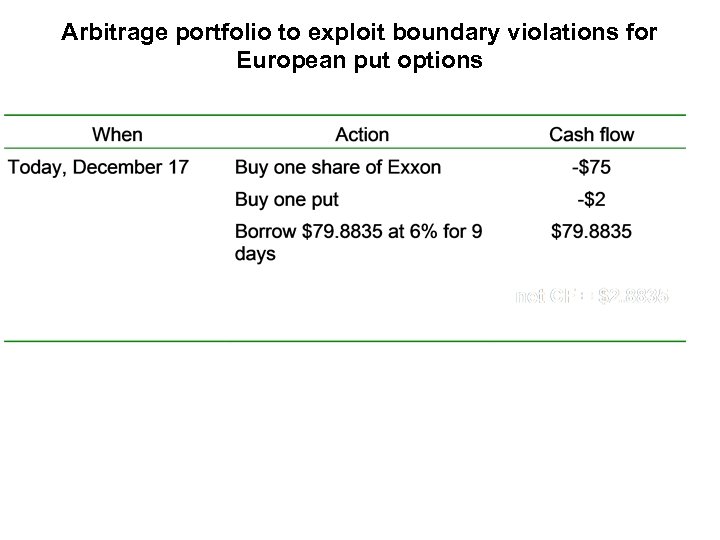

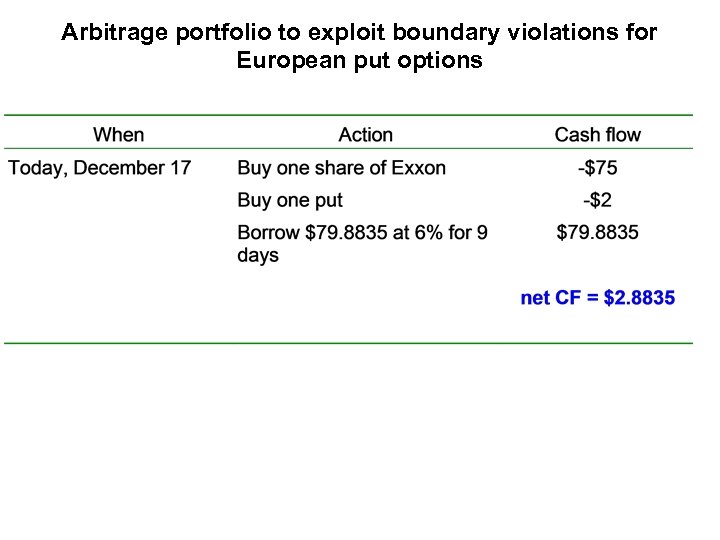

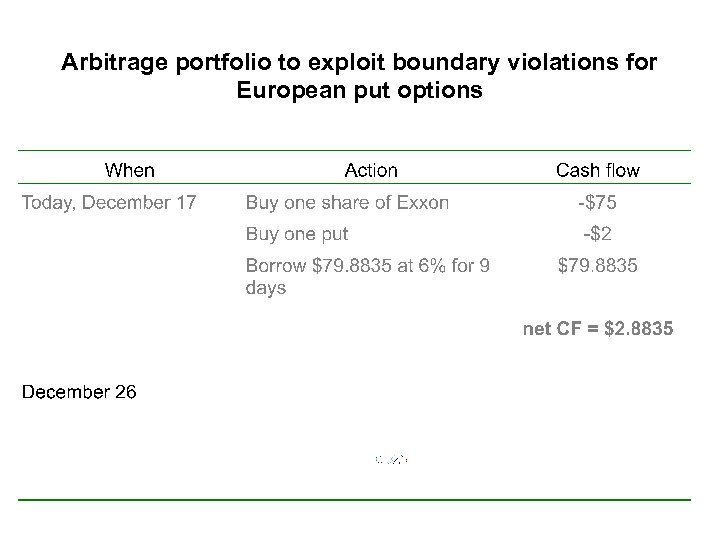

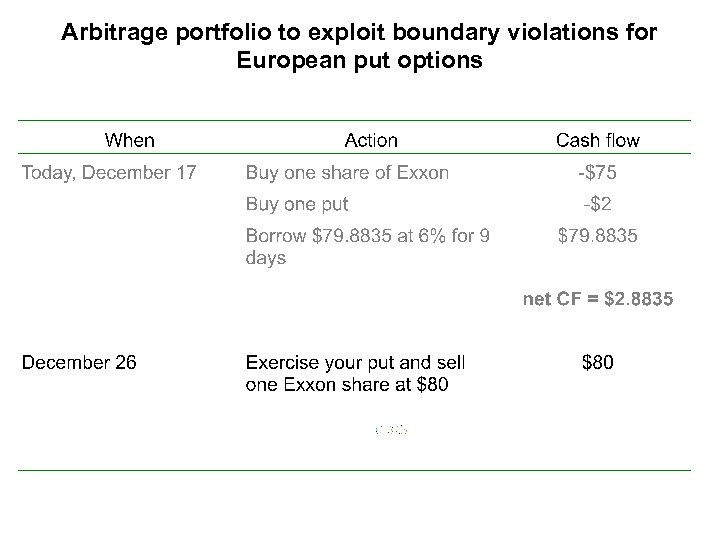

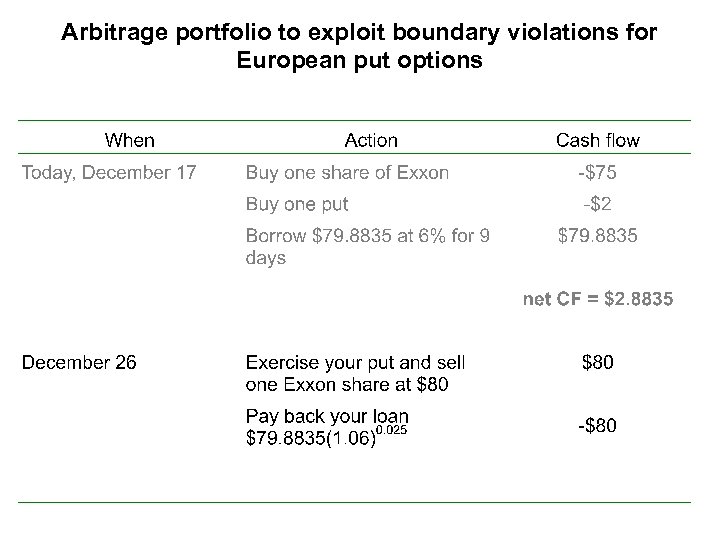

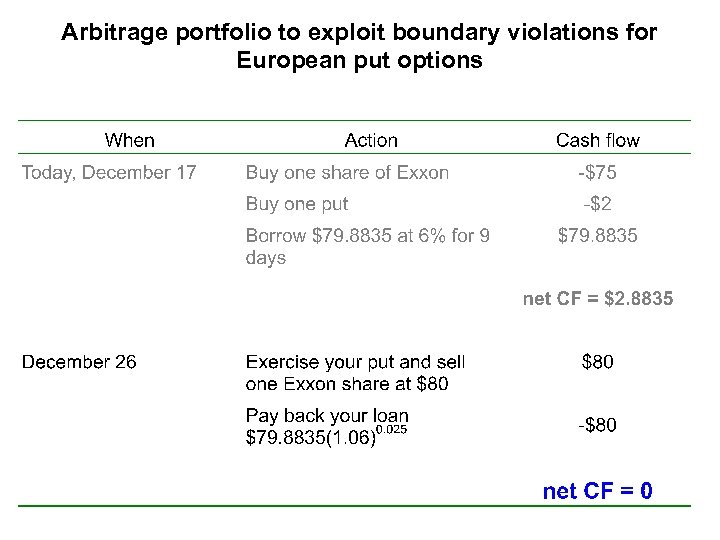

Arbitrage portfolio to exploit boundary violations for European put options

Arbitrage portfolio to exploit boundary violations for European put options

Arbitrage portfolio to exploit boundary violations for European put options

Arbitrage portfolio to exploit boundary violations for European put options

Arbitrage portfolio to exploit boundary violations for European put options

Arbitrage portfolio to exploit boundary violations for European put options

Arbitrage portfolio to exploit boundary violations for European put options

Arbitrage portfolio to exploit boundary violations for European put options

Arbitrage portfolio to exploit boundary violations for European put options

Arbitrage portfolio to exploit boundary violations for European put options

Arbitrage portfolio to exploit boundary violations for European put options

Arbitrage portfolio to exploit boundary violations for European put options

Arbitrage portfolio to exploit boundary violations for European put options

Arbitrage portfolio to exploit boundary violations for European put options

Arbitrage portfolio to exploit boundary violations for European put options

Arbitrage portfolio to exploit boundary violations for European put options

Arbitrage portfolio to exploit boundary violations for European put options

Arbitrage portfolio to exploit boundary violations for European put options

Analysis We have created a riskless portfolio: the terminal cash flow is zero, regardless of the stock price, while the up-front cash flow is positive. We made $2. 8835 in pure arbitrage profits.

Analysis We have created a riskless portfolio: the terminal cash flow is zero, regardless of the stock price, while the up-front cash flow is positive. We made $2. 8835 in pure arbitrage profits.

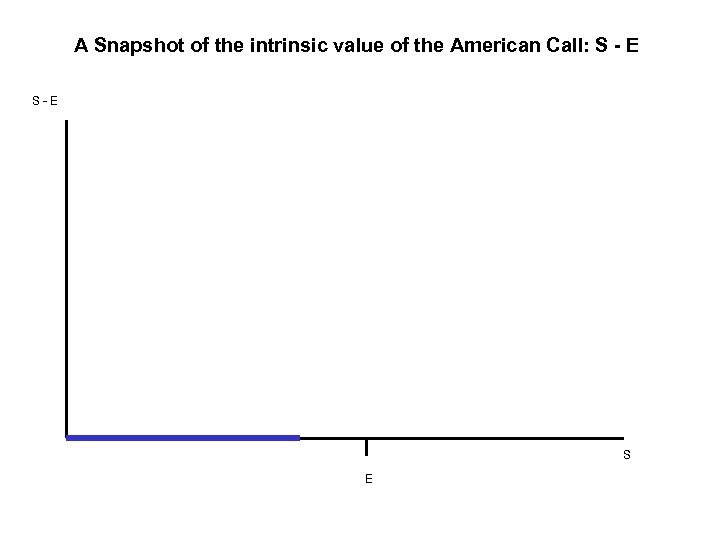

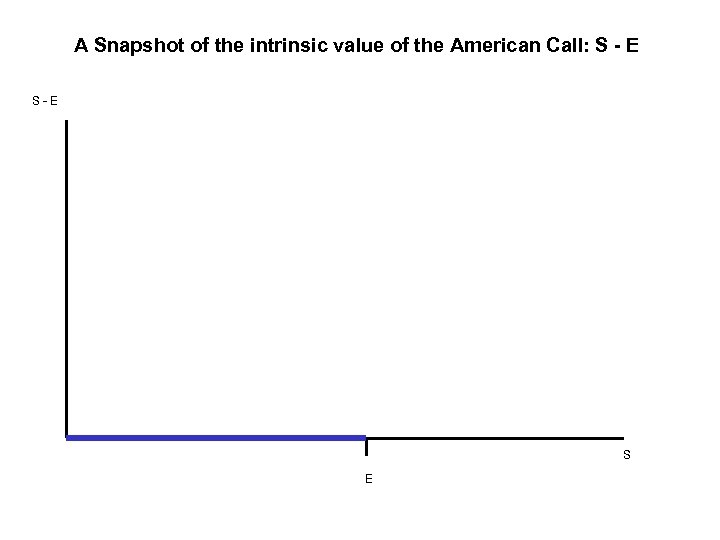

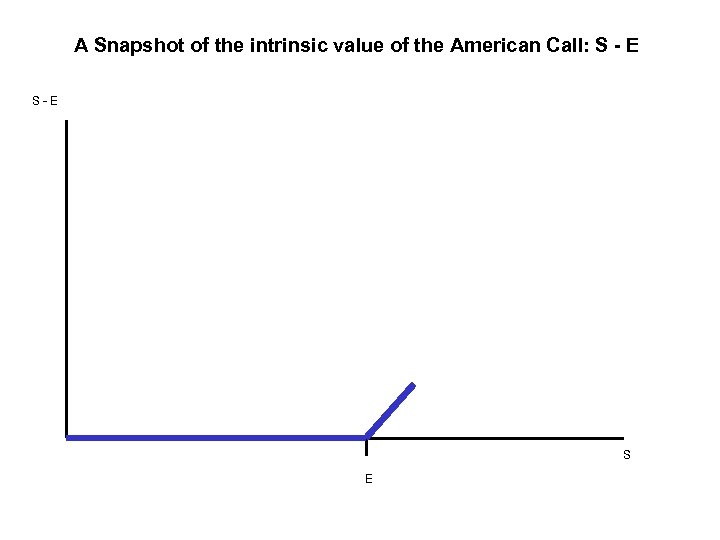

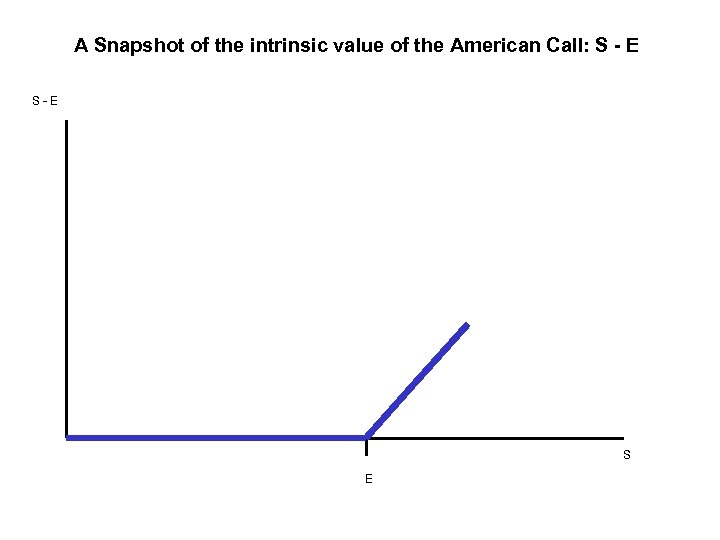

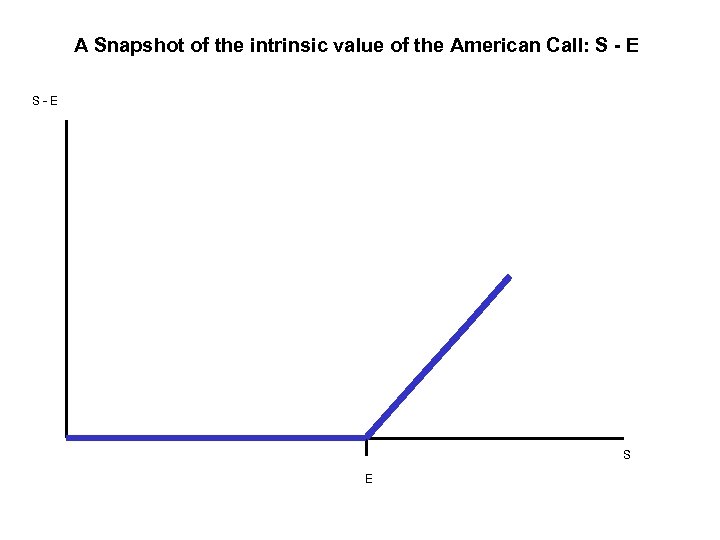

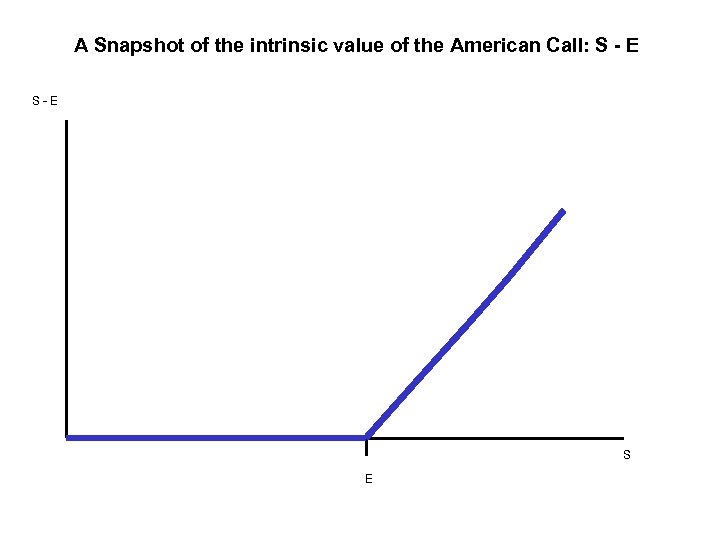

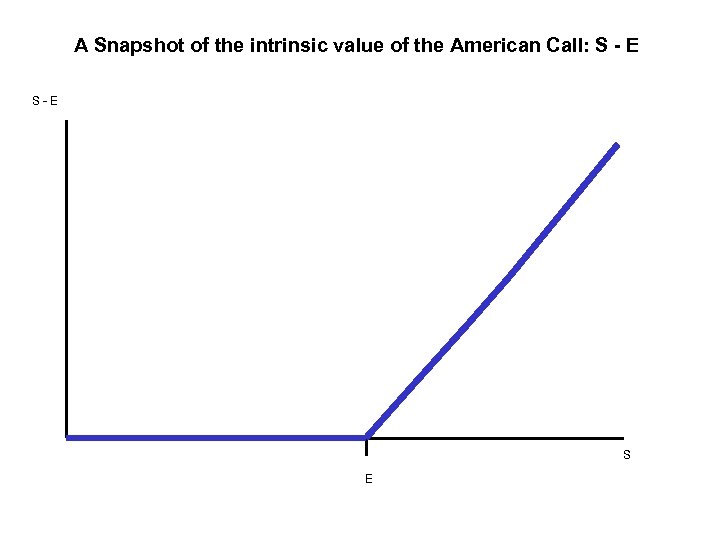

Three important concepts Intrinsic value - how much the call is worth if exercised. Market value, price, or premium - the price at which the call can be sold/purchased in the market. Time value - the difference between premium and intrinsic value

Three important concepts Intrinsic value - how much the call is worth if exercised. Market value, price, or premium - the price at which the call can be sold/purchased in the market. Time value - the difference between premium and intrinsic value

A Snapshot of the intrinsic value of the American Call: S - E S E

A Snapshot of the intrinsic value of the American Call: S - E S E

A Snapshot of the intrinsic value of the American Call: S - E S E

A Snapshot of the intrinsic value of the American Call: S - E S E

A Snapshot of the intrinsic value of the American Call: S - E S E

A Snapshot of the intrinsic value of the American Call: S - E S E

A Snapshot of the intrinsic value of the American Call: S - E S E

A Snapshot of the intrinsic value of the American Call: S - E S E

A Snapshot of the intrinsic value of the American Call: S - E S E

A Snapshot of the intrinsic value of the American Call: S - E S E

A Snapshot of the intrinsic value of the American Call: S - E S E

A Snapshot of the intrinsic value of the American Call: S - E S E

A Snapshot of the intrinsic value of the American Call: S - E S E

A Snapshot of the intrinsic value of the American Call: S - E S E

A Snapshot of the intrinsic value of the American Call: S - E S E

A Snapshot of the intrinsic value of the American Call: S - E S E

A Snapshot of the intrinsic value of the American Call: S - E S E

A Snapshot of the intrinsic value of the American Call: S - E S E

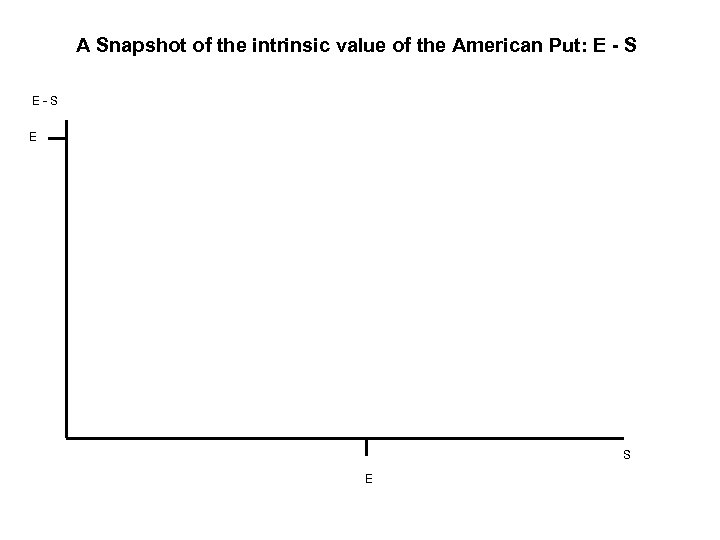

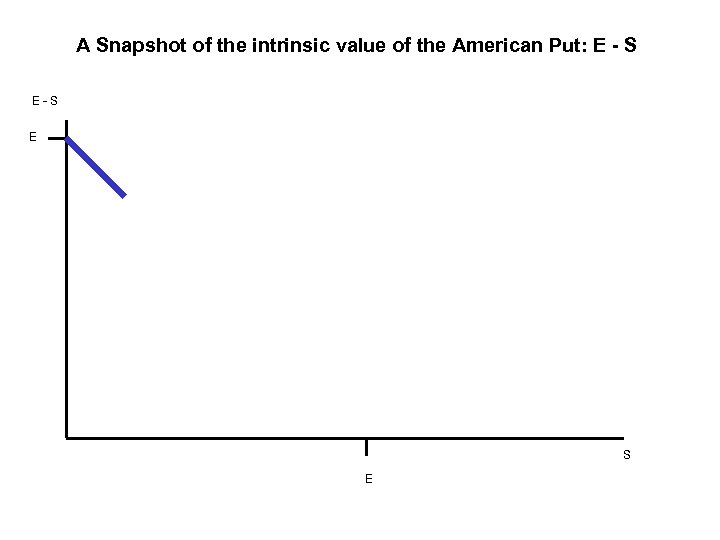

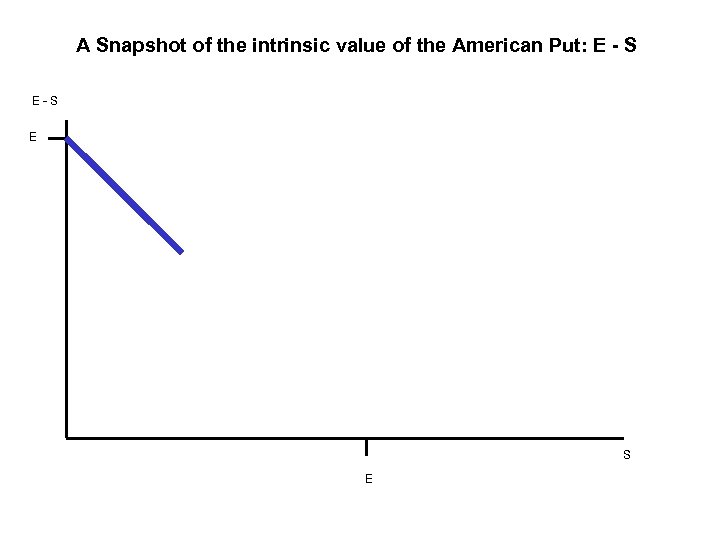

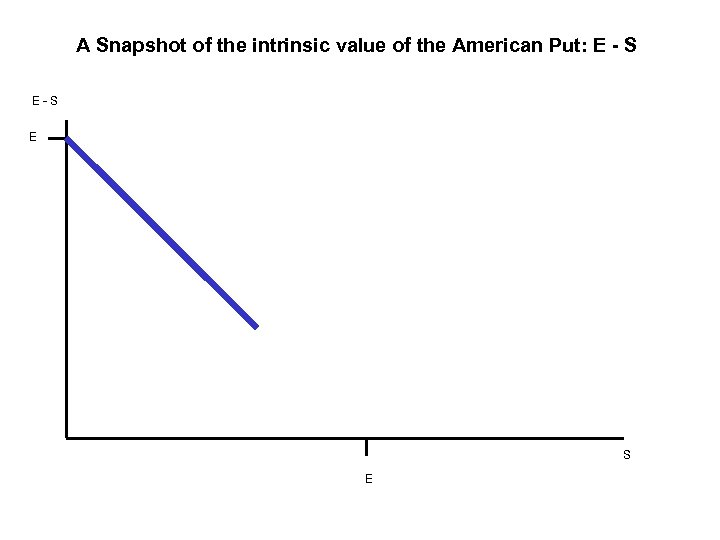

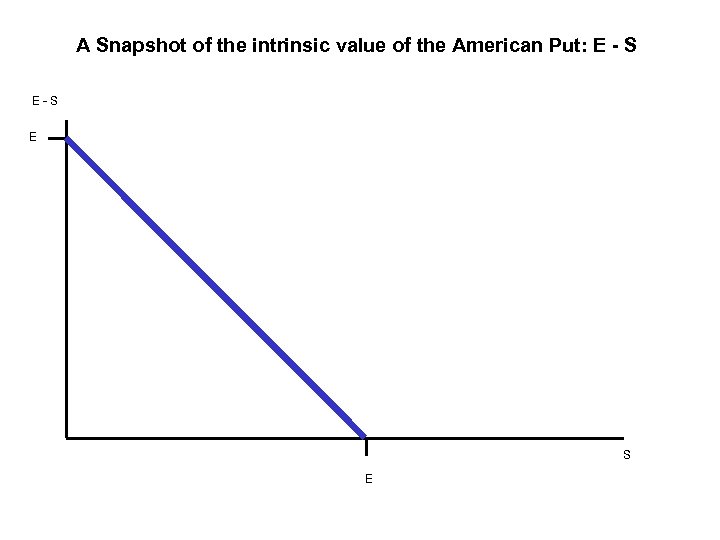

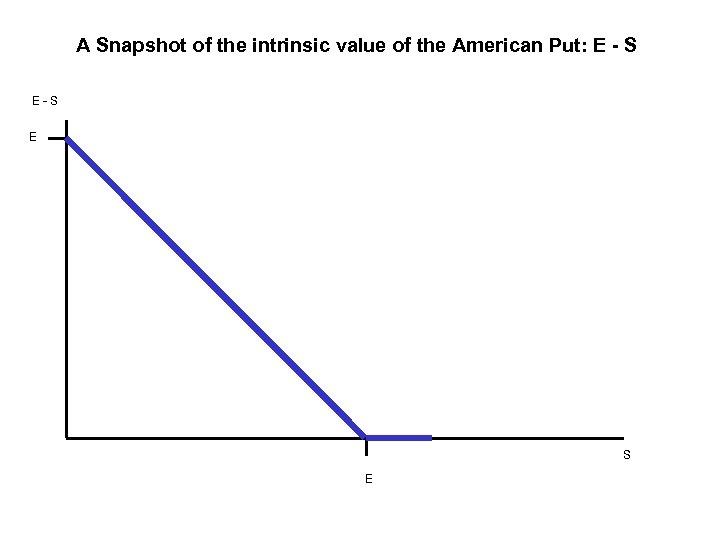

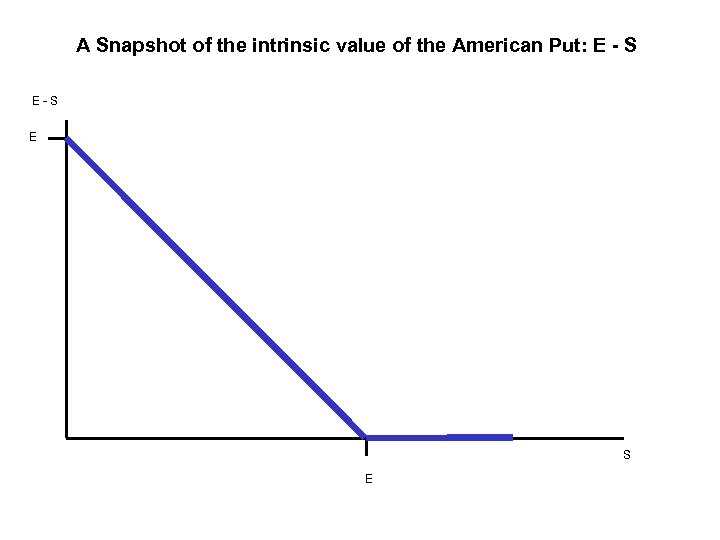

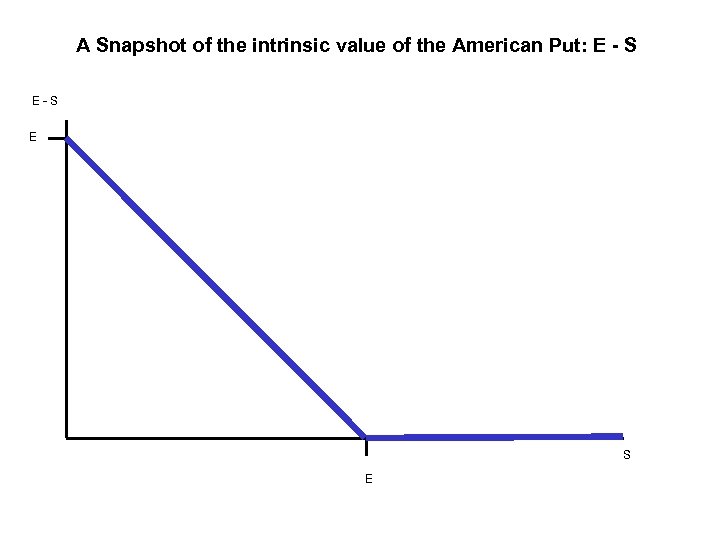

A Snapshot of the intrinsic value of the American Put: E - S E S E

A Snapshot of the intrinsic value of the American Put: E - S E S E

A Snapshot of the intrinsic value of the American Put: E - S E S E

A Snapshot of the intrinsic value of the American Put: E - S E S E

A Snapshot of the intrinsic value of the American Put: E - S E S E

A Snapshot of the intrinsic value of the American Put: E - S E S E

A Snapshot of the intrinsic value of the American Put: E - S E S E

A Snapshot of the intrinsic value of the American Put: E - S E S E

A Snapshot of the intrinsic value of the American Put: E - S E S E

A Snapshot of the intrinsic value of the American Put: E - S E S E

A Snapshot of the intrinsic value of the American Put: E - S E S E

A Snapshot of the intrinsic value of the American Put: E - S E S E

A Snapshot of the intrinsic value of the American Put: E - S E S E

A Snapshot of the intrinsic value of the American Put: E - S E S E

A Snapshot of the intrinsic value of the American Put: E - S E S E

A Snapshot of the intrinsic value of the American Put: E - S E S E

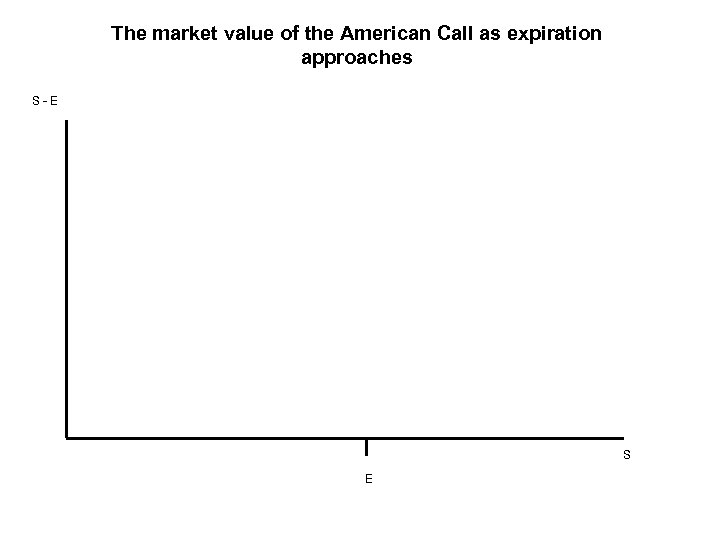

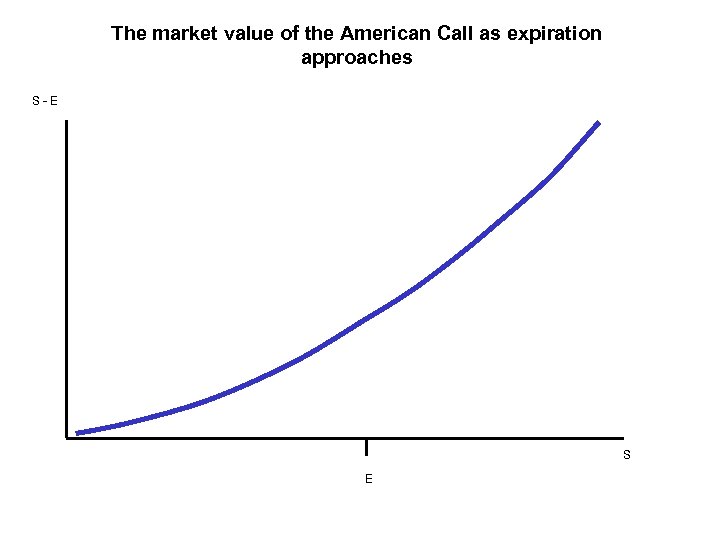

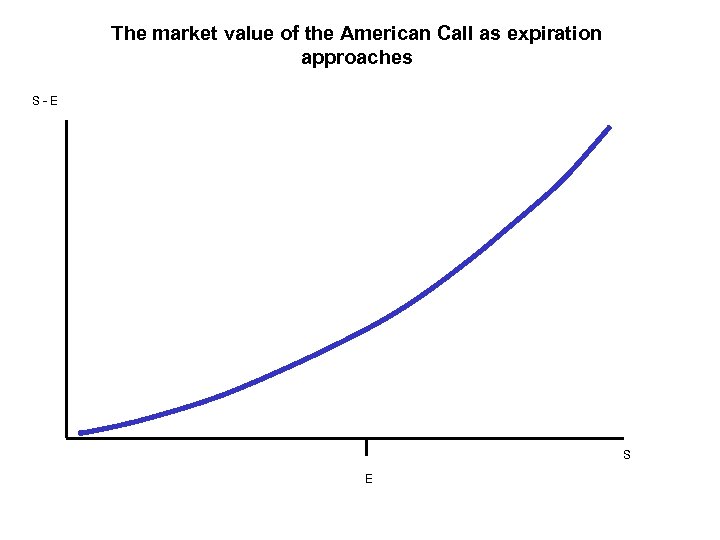

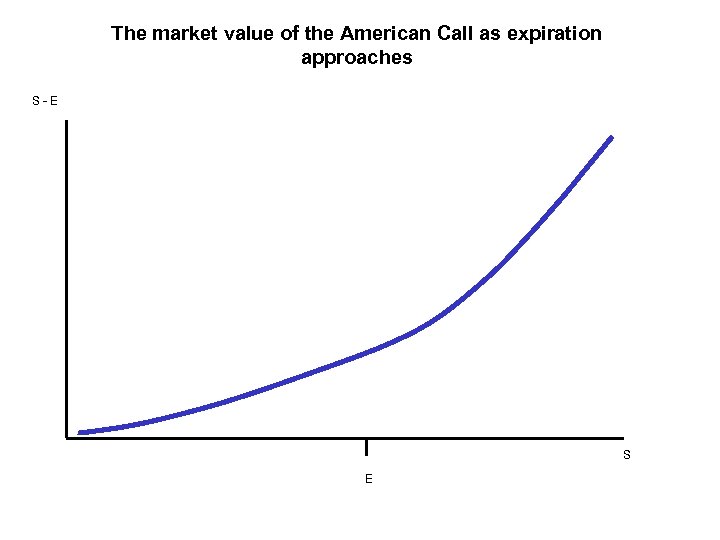

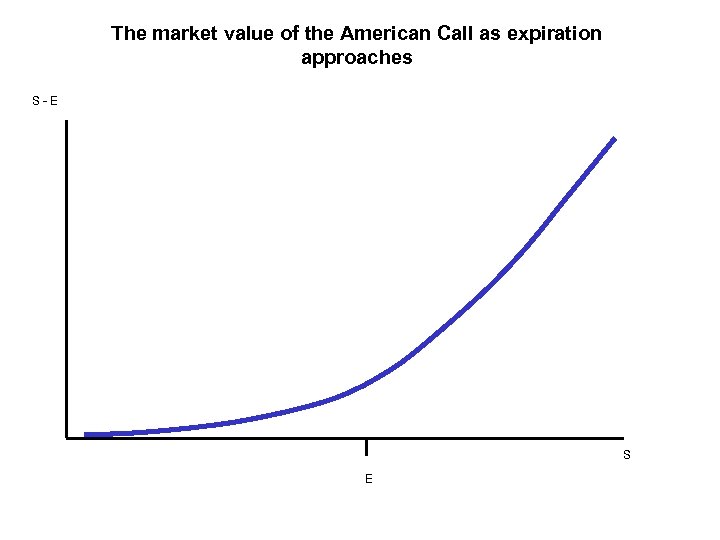

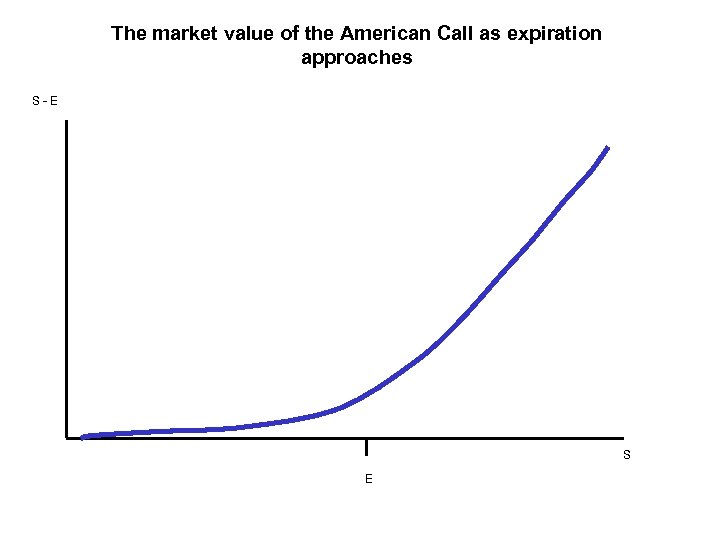

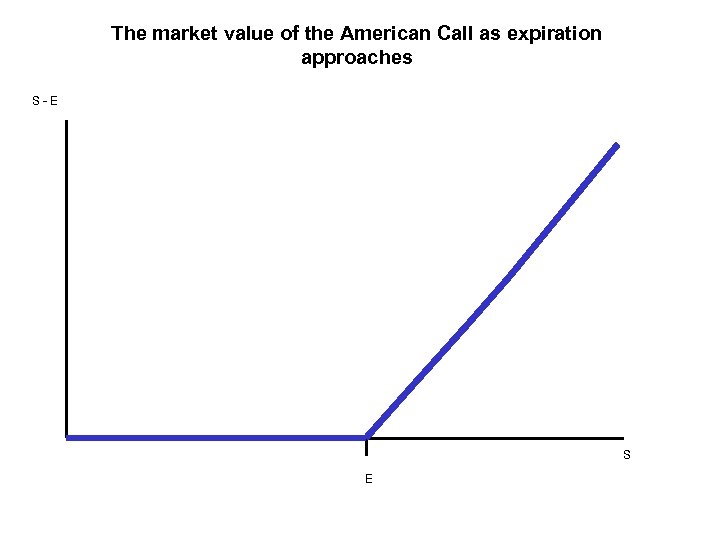

The market value of the American Call as expiration approaches S - E S E

The market value of the American Call as expiration approaches S - E S E

The market value of the American Call as expiration approaches S - E S E

The market value of the American Call as expiration approaches S - E S E

The market value of the American Call as expiration approaches S - E S E

The market value of the American Call as expiration approaches S - E S E

The market value of the American Call as expiration approaches S - E S E

The market value of the American Call as expiration approaches S - E S E

The market value of the American Call as expiration approaches S - E S E

The market value of the American Call as expiration approaches S - E S E

The market value of the American Call as expiration approaches S - E S E

The market value of the American Call as expiration approaches S - E S E

The market value of the American Call as expiration approaches S - E S E

The market value of the American Call as expiration approaches S - E S E

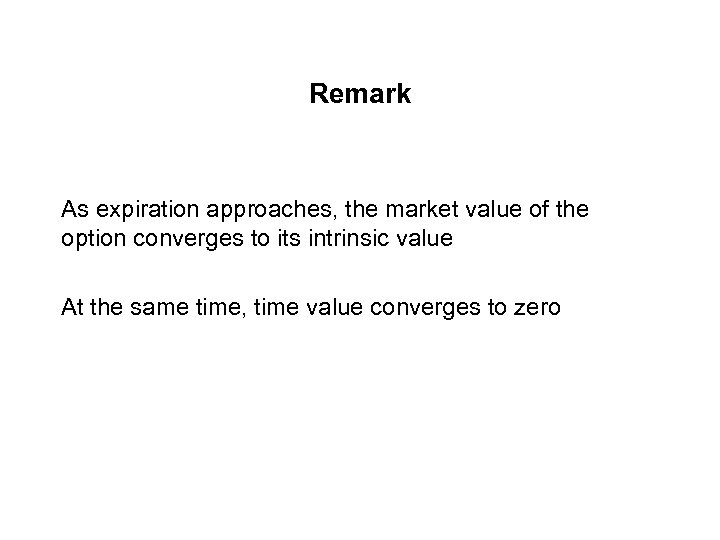

Remark As expiration approaches, the market value of the option converges to its intrinsic value At the same time, time value converges to zero

Remark As expiration approaches, the market value of the option converges to its intrinsic value At the same time, time value converges to zero

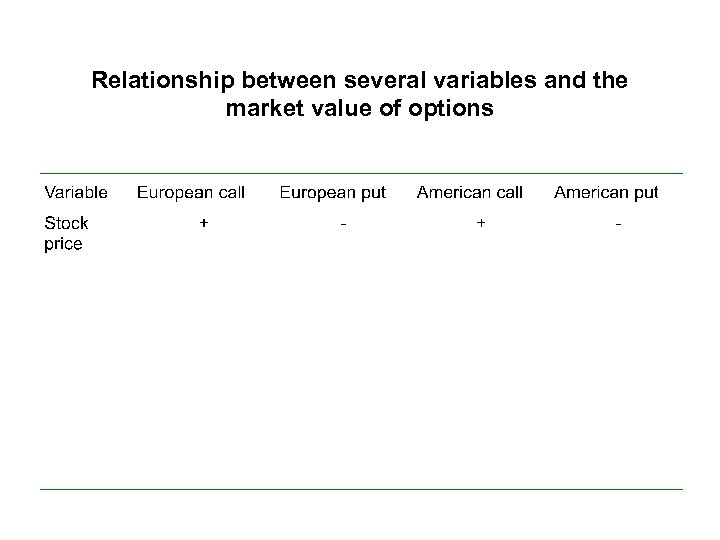

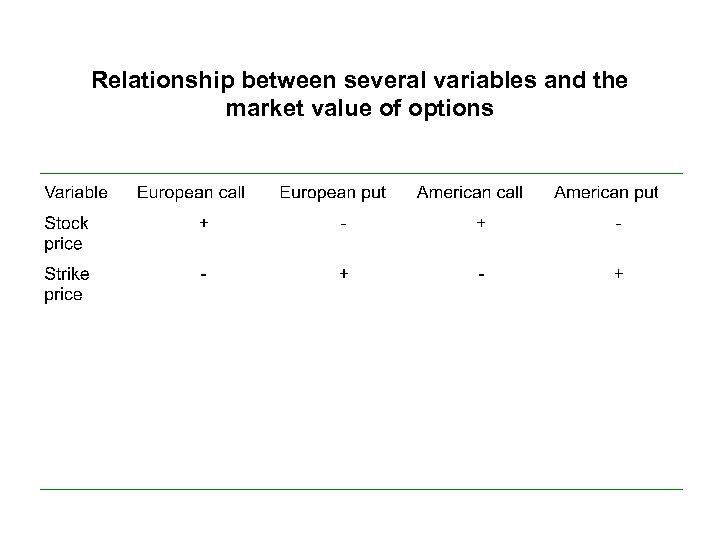

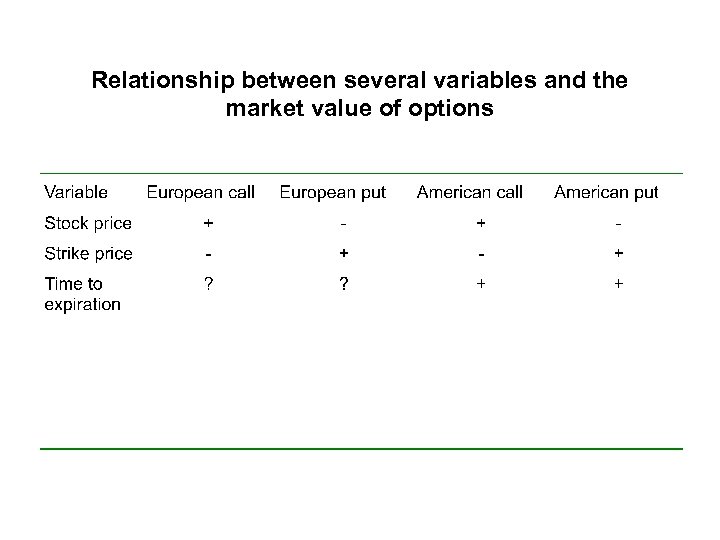

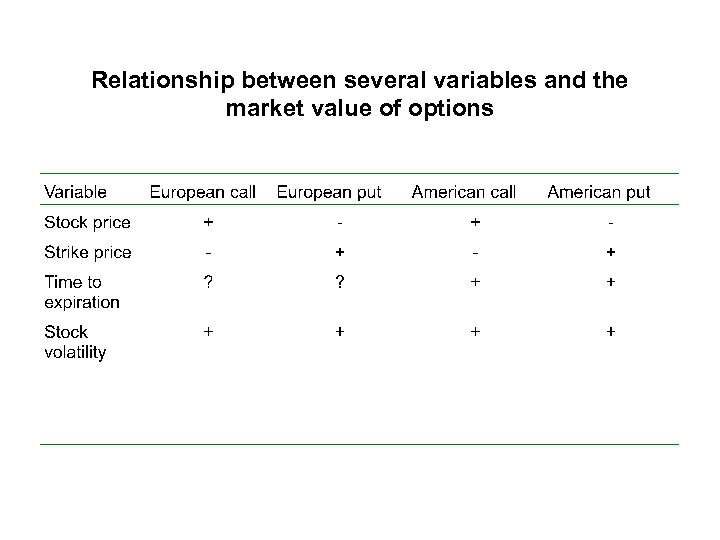

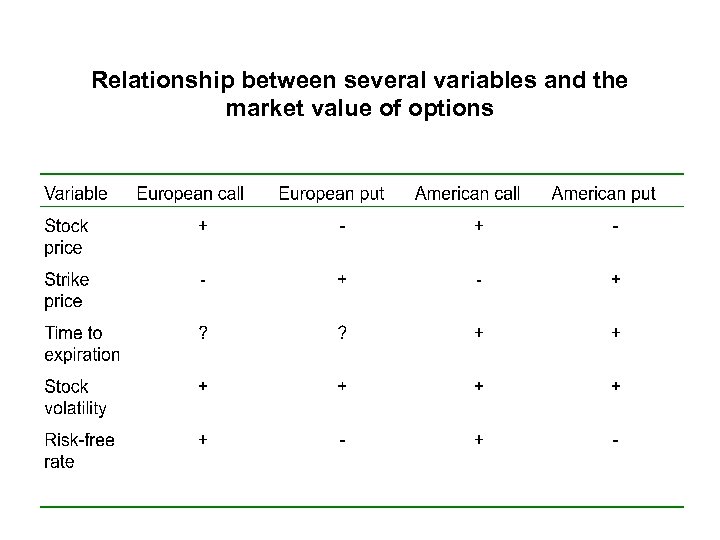

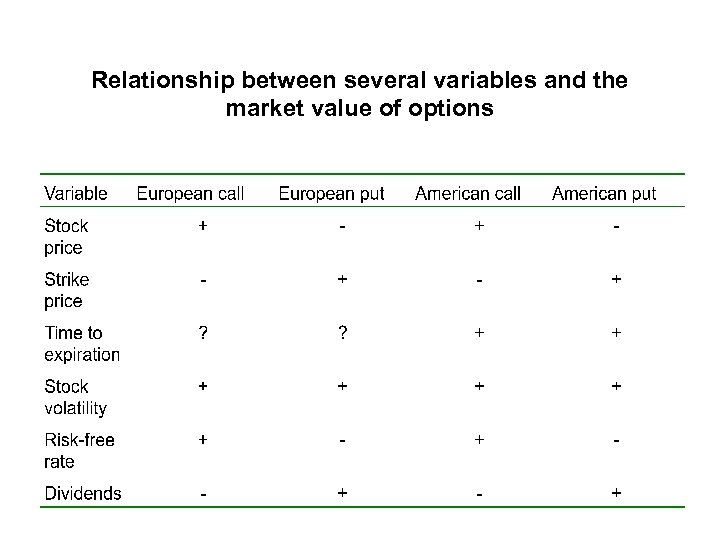

Relationship between several variables and the market value of options

Relationship between several variables and the market value of options

Relationship between several variables and the market value of options

Relationship between several variables and the market value of options

Relationship between several variables and the market value of options

Relationship between several variables and the market value of options

Relationship between several variables and the market value of options

Relationship between several variables and the market value of options

Relationship between several variables and the market value of options

Relationship between several variables and the market value of options

Relationship between several variables and the market value of options

Relationship between several variables and the market value of options