af5e2c87d0a7183ecb55d877cbe9d161.ppt

- Количество слайдов: 54

Principles of Managerial Finance 9 th Edition Chapter 7 Bond & Stock Valuation

Principles of Managerial Finance 9 th Edition Chapter 7 Bond & Stock Valuation

Learning Objectives • Describe the key inputs and basic model used in the valuation process. • Apply the basic bond valuation model to bonds and describe the impact of required return and time to maturity on bond values. • Explain yield to maturity (YTM), its calculation, and the procedure used to value bonds that pay interest semiannually.

Learning Objectives • Describe the key inputs and basic model used in the valuation process. • Apply the basic bond valuation model to bonds and describe the impact of required return and time to maturity on bond values. • Explain yield to maturity (YTM), its calculation, and the procedure used to value bonds that pay interest semiannually.

Learning Objectives • Understand the concept of market efficiency and basic common stock valuation under each of three cases: zero growth, constant growth, and variable growth. • Discuss the use of book value, liquidation value, and price/earnings (PE) multiples to estimate common stock values. • Understand the relationships among financial decisions, return, risk, and the firm’s value.

Learning Objectives • Understand the concept of market efficiency and basic common stock valuation under each of three cases: zero growth, constant growth, and variable growth. • Discuss the use of book value, liquidation value, and price/earnings (PE) multiples to estimate common stock values. • Understand the relationships among financial decisions, return, risk, and the firm’s value.

Valuation Fundamentals • The (market) value of any investment asset is simply the present value of expected cash flows. • The interest rate that these cash flows are discounted at is called the asset’s required return. • The required return is a function of the expected rate of inflation and the perceived risk of the asset. • Higher perceived risk results in a higher required return and lower asset market values.

Valuation Fundamentals • The (market) value of any investment asset is simply the present value of expected cash flows. • The interest rate that these cash flows are discounted at is called the asset’s required return. • The required return is a function of the expected rate of inflation and the perceived risk of the asset. • Higher perceived risk results in a higher required return and lower asset market values.

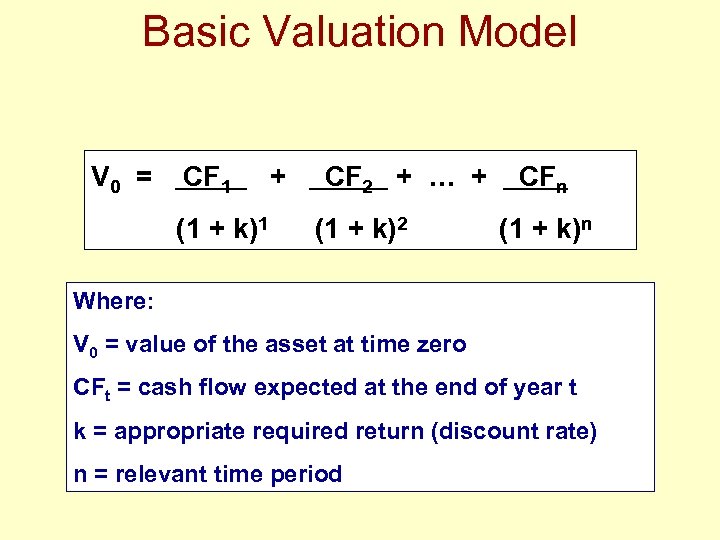

Basic Valuation Model V 0 = CF 1 (1 + k)1 + CF 2 + … + (1 + k)2 CFn (1 + k)n Where: V 0 = value of the asset at time zero CFt = cash flow expected at the end of year t k = appropriate required return (discount rate) n = relevant time period

Basic Valuation Model V 0 = CF 1 (1 + k)1 + CF 2 + … + (1 + k)2 CFn (1 + k)n Where: V 0 = value of the asset at time zero CFt = cash flow expected at the end of year t k = appropriate required return (discount rate) n = relevant time period

What is a Bond? A bond is a long-term debt instrument that pays the bondholder a specified amount of periodic interest over a specified period of time. (note that a bond = debt)

What is a Bond? A bond is a long-term debt instrument that pays the bondholder a specified amount of periodic interest over a specified period of time. (note that a bond = debt)

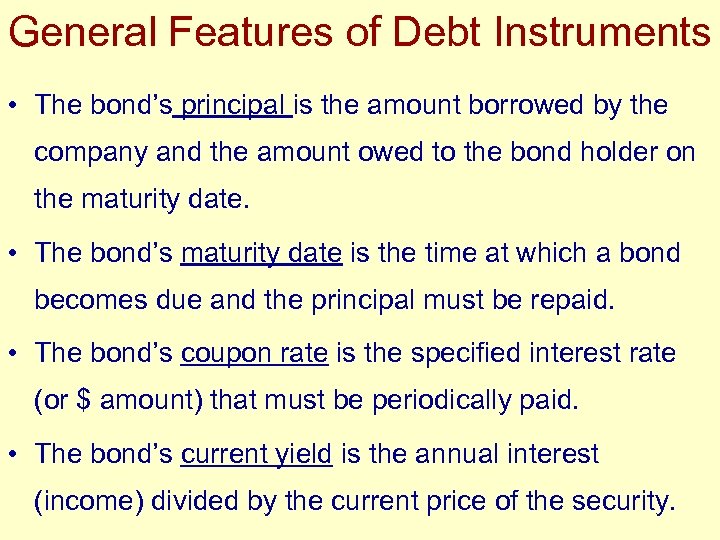

General Features of Debt Instruments • The bond’s principal is the amount borrowed by the company and the amount owed to the bond holder on the maturity date. • The bond’s maturity date is the time at which a bond becomes due and the principal must be repaid. • The bond’s coupon rate is the specified interest rate (or $ amount) that must be periodically paid. • The bond’s current yield is the annual interest (income) divided by the current price of the security.

General Features of Debt Instruments • The bond’s principal is the amount borrowed by the company and the amount owed to the bond holder on the maturity date. • The bond’s maturity date is the time at which a bond becomes due and the principal must be repaid. • The bond’s coupon rate is the specified interest rate (or $ amount) that must be periodically paid. • The bond’s current yield is the annual interest (income) divided by the current price of the security.

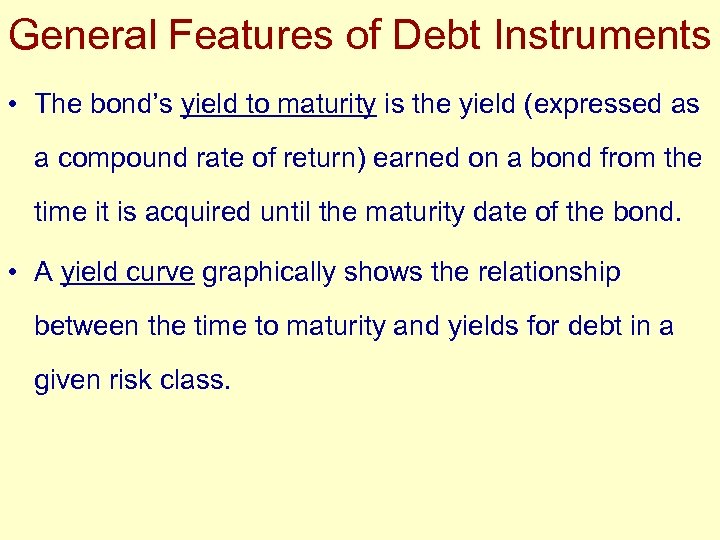

General Features of Debt Instruments • The bond’s yield to maturity is the yield (expressed as a compound rate of return) earned on a bond from the time it is acquired until the maturity date of the bond. • A yield curve graphically shows the relationship between the time to maturity and yields for debt in a given risk class.

General Features of Debt Instruments • The bond’s yield to maturity is the yield (expressed as a compound rate of return) earned on a bond from the time it is acquired until the maturity date of the bond. • A yield curve graphically shows the relationship between the time to maturity and yields for debt in a given risk class.

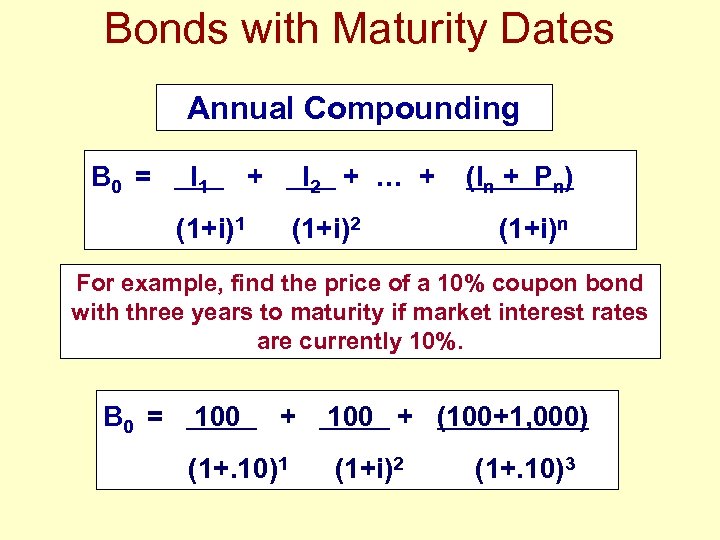

Bonds with Maturity Dates Annual Compounding B 0 = I 1 + I 2 + … + (1+i)1 (1+i)2 (In + Pn) (1+i)n For example, find the price of a 10% coupon bond with three years to maturity if market interest rates are currently 10%. B 0 = 100 + (1+. 10)1 100 + (100+1, 000) (1+i)2 (1+. 10)3

Bonds with Maturity Dates Annual Compounding B 0 = I 1 + I 2 + … + (1+i)1 (1+i)2 (In + Pn) (1+i)n For example, find the price of a 10% coupon bond with three years to maturity if market interest rates are currently 10%. B 0 = 100 + (1+. 10)1 100 + (100+1, 000) (1+i)2 (1+. 10)3

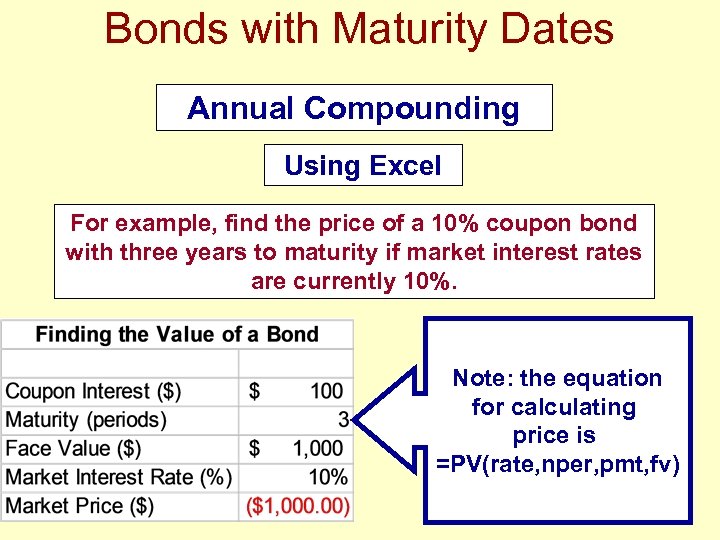

Bonds with Maturity Dates Annual Compounding Using Excel For example, find the price of a 10% coupon bond with three years to maturity if market interest rates are currently 10%. Note: the equation for calculating price is =PV(rate, nper, pmt, fv)

Bonds with Maturity Dates Annual Compounding Using Excel For example, find the price of a 10% coupon bond with three years to maturity if market interest rates are currently 10%. Note: the equation for calculating price is =PV(rate, nper, pmt, fv)

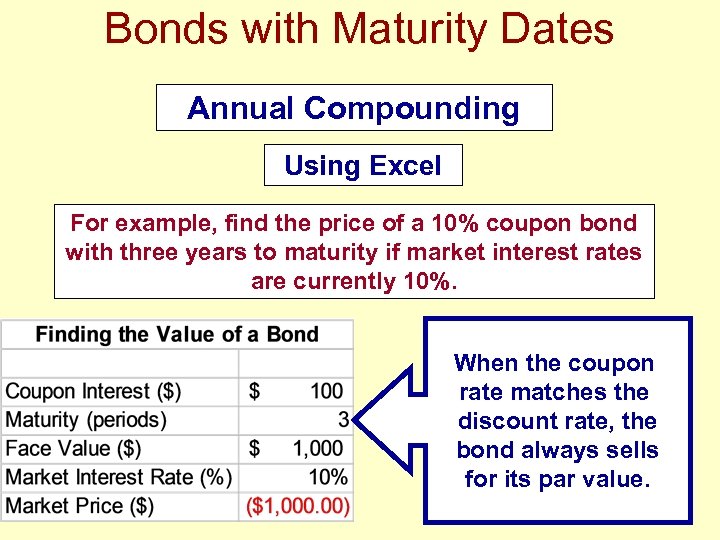

Bonds with Maturity Dates Annual Compounding Using Excel For example, find the price of a 10% coupon bond with three years to maturity if market interest rates are currently 10%. When the coupon rate matches the discount rate, the bond always sells for its par value.

Bonds with Maturity Dates Annual Compounding Using Excel For example, find the price of a 10% coupon bond with three years to maturity if market interest rates are currently 10%. When the coupon rate matches the discount rate, the bond always sells for its par value.

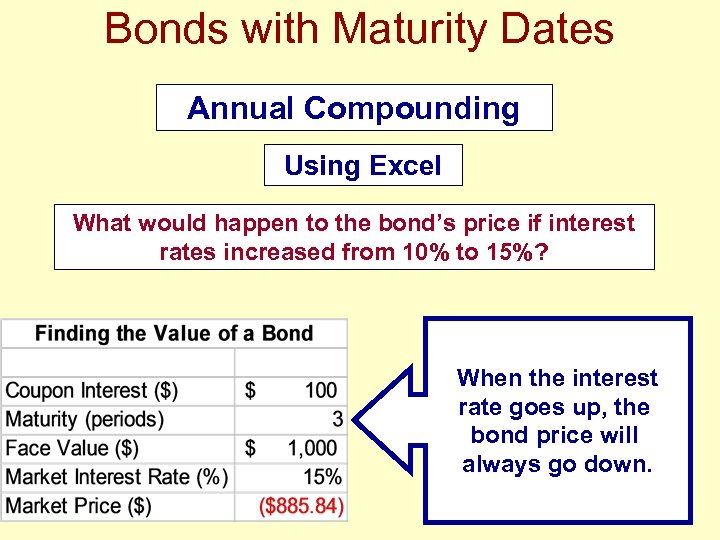

Bonds with Maturity Dates Annual Compounding Using Excel What would happen to the bond’s price if interest rates increased from 10% to 15%? When the interest rate goes up, the bond price will always go down.

Bonds with Maturity Dates Annual Compounding Using Excel What would happen to the bond’s price if interest rates increased from 10% to 15%? When the interest rate goes up, the bond price will always go down.

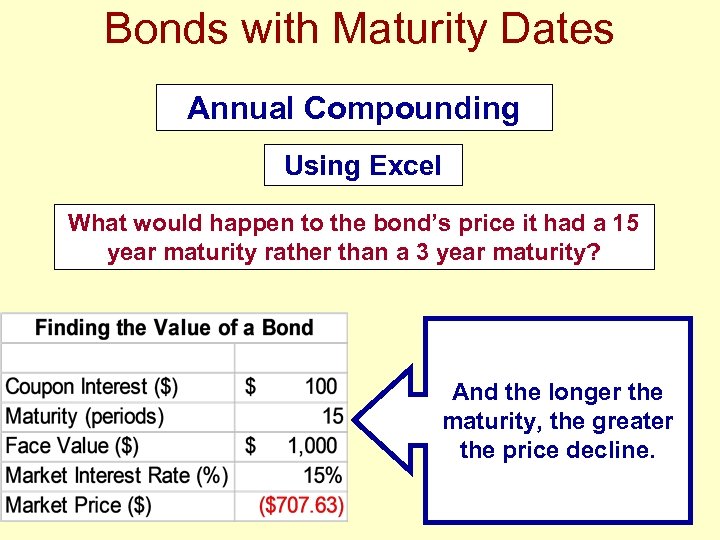

Bonds with Maturity Dates Annual Compounding Using Excel What would happen to the bond’s price it had a 15 year maturity rather than a 3 year maturity? And the longer the maturity, the greater the price decline.

Bonds with Maturity Dates Annual Compounding Using Excel What would happen to the bond’s price it had a 15 year maturity rather than a 3 year maturity? And the longer the maturity, the greater the price decline.

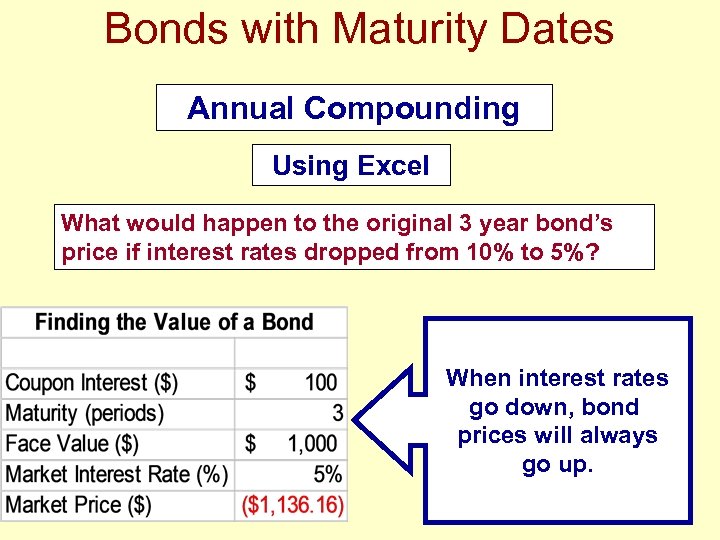

Bonds with Maturity Dates Annual Compounding Using Excel What would happen to the original 3 year bond’s price if interest rates dropped from 10% to 5%? When interest rates go down, bond prices will always go up.

Bonds with Maturity Dates Annual Compounding Using Excel What would happen to the original 3 year bond’s price if interest rates dropped from 10% to 5%? When interest rates go down, bond prices will always go up.

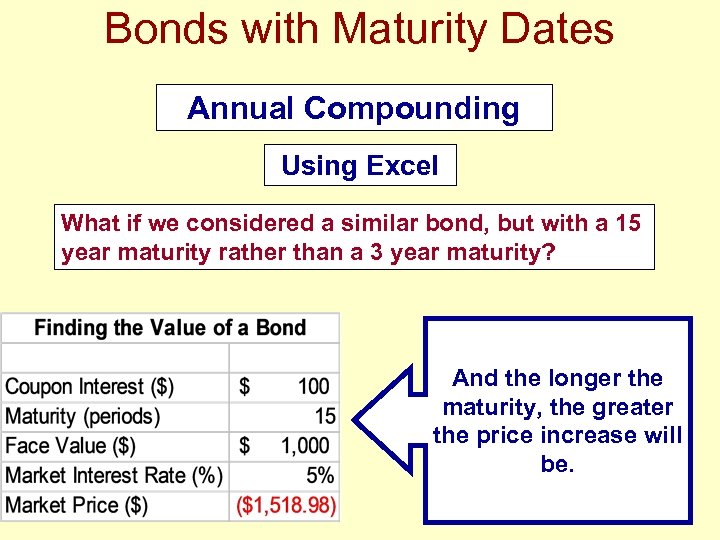

Bonds with Maturity Dates Annual Compounding Using Excel What if we considered a similar bond, but with a 15 year maturity rather than a 3 year maturity? And the longer the maturity, the greater the price increase will be.

Bonds with Maturity Dates Annual Compounding Using Excel What if we considered a similar bond, but with a 15 year maturity rather than a 3 year maturity? And the longer the maturity, the greater the price increase will be.

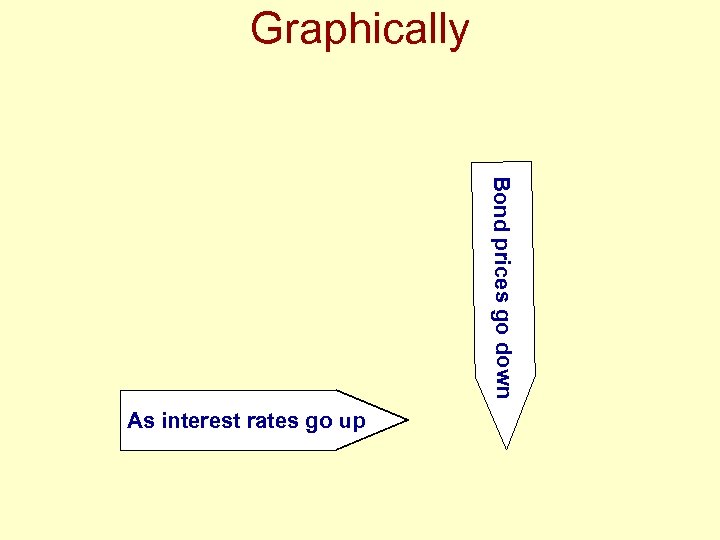

Graphically Bond prices go down As interest rates go up

Graphically Bond prices go down As interest rates go up

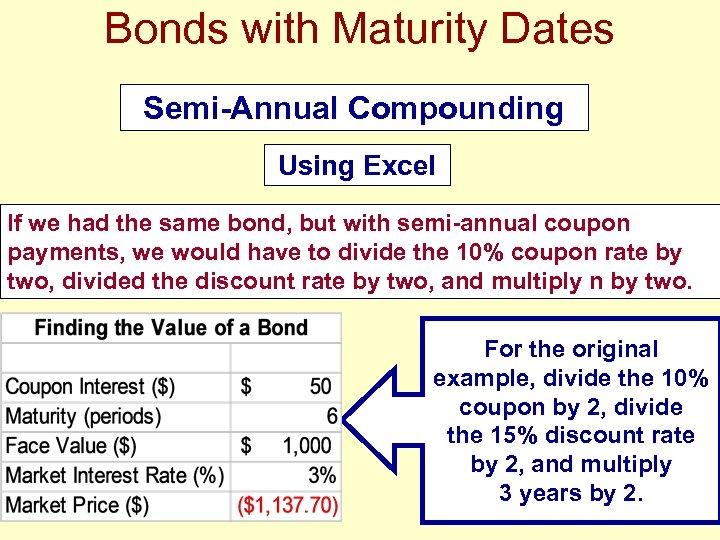

Bonds with Maturity Dates Semi-Annual Compounding Using Excel If we had the same bond, but with semi-annual coupon payments, we would have to divide the 10% coupon rate by two, divided the discount rate by two, and multiply n by two. For the original example, divide the 10% coupon by 2, divide the 15% discount rate by 2, and multiply 3 years by 2.

Bonds with Maturity Dates Semi-Annual Compounding Using Excel If we had the same bond, but with semi-annual coupon payments, we would have to divide the 10% coupon rate by two, divided the discount rate by two, and multiply n by two. For the original example, divide the 10% coupon by 2, divide the 15% discount rate by 2, and multiply 3 years by 2.

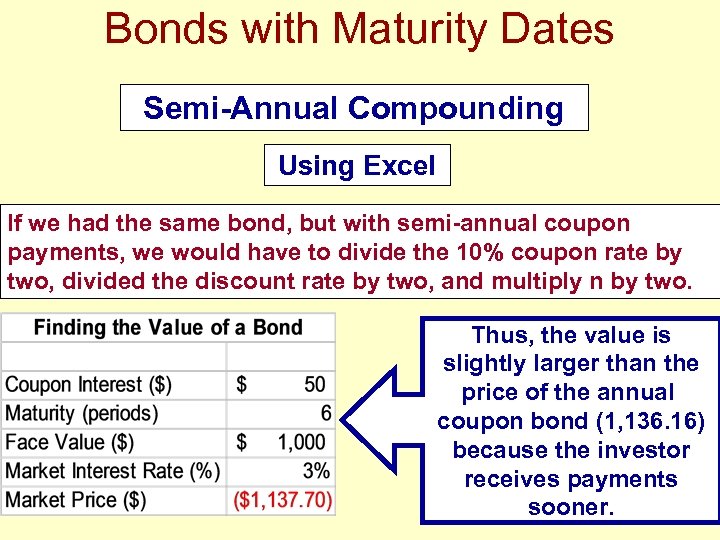

Bonds with Maturity Dates Semi-Annual Compounding Using Excel If we had the same bond, but with semi-annual coupon payments, we would have to divide the 10% coupon rate by two, divided the discount rate by two, and multiply n by two. Thus, the value is slightly larger than the price of the annual coupon bond (1, 136. 16) because the investor receives payments sooner.

Bonds with Maturity Dates Semi-Annual Compounding Using Excel If we had the same bond, but with semi-annual coupon payments, we would have to divide the 10% coupon rate by two, divided the discount rate by two, and multiply n by two. Thus, the value is slightly larger than the price of the annual coupon bond (1, 136. 16) because the investor receives payments sooner.

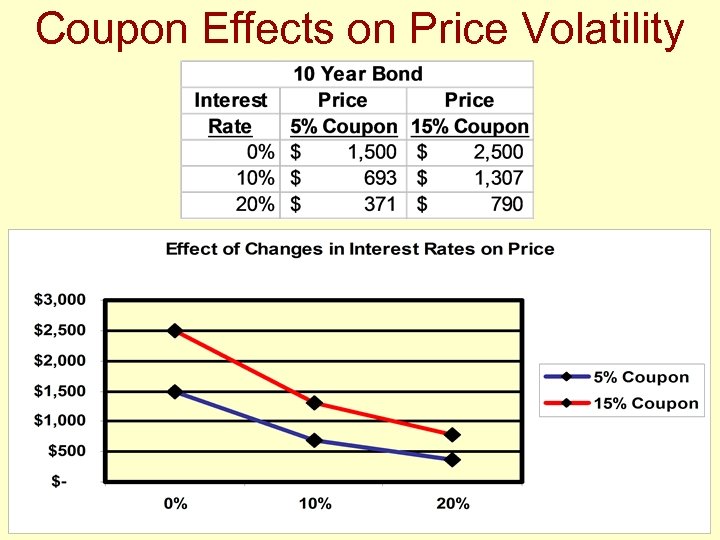

Coupon Effects on Price Volatility • The amount of bond price volatility depends on three basic factors: – length of time to maturity – risk – amount of coupon interest paid by the bond • First, we already have seen that the longer the term to maturity, the greater is a bond’s volatility • Second, the riskier a bond, the more variable the required return will be, resulting in greater price volatility.

Coupon Effects on Price Volatility • The amount of bond price volatility depends on three basic factors: – length of time to maturity – risk – amount of coupon interest paid by the bond • First, we already have seen that the longer the term to maturity, the greater is a bond’s volatility • Second, the riskier a bond, the more variable the required return will be, resulting in greater price volatility.

Coupon Effects on Price Volatility • The amount of bond price volatility depends on three basic factors: – length of time to maturity – risk – amount of coupon interest paid by the bond • Finally, the amount of coupon interest also impacts a bond’s price volatility. • Specifically, the lower the coupon, the greater will be the bond’s volatility, because it will be longer before the investor receives a significant portion of the cash flow from his or her investment.

Coupon Effects on Price Volatility • The amount of bond price volatility depends on three basic factors: – length of time to maturity – risk – amount of coupon interest paid by the bond • Finally, the amount of coupon interest also impacts a bond’s price volatility. • Specifically, the lower the coupon, the greater will be the bond’s volatility, because it will be longer before the investor receives a significant portion of the cash flow from his or her investment.

Coupon Effects on Price Volatility

Coupon Effects on Price Volatility

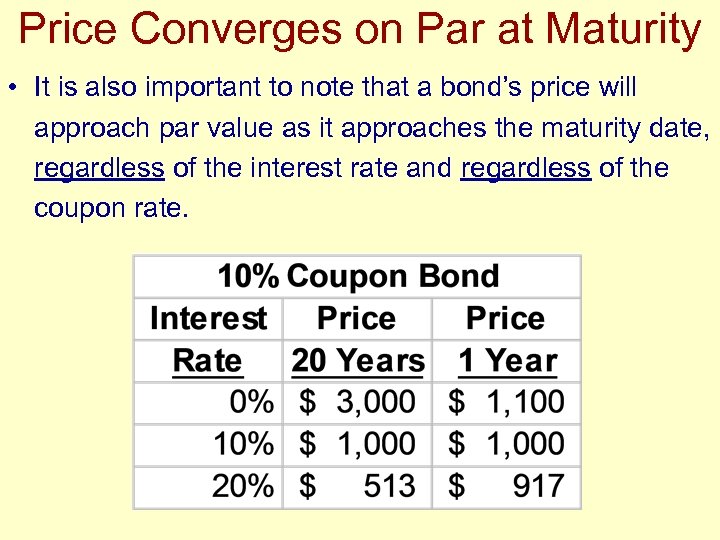

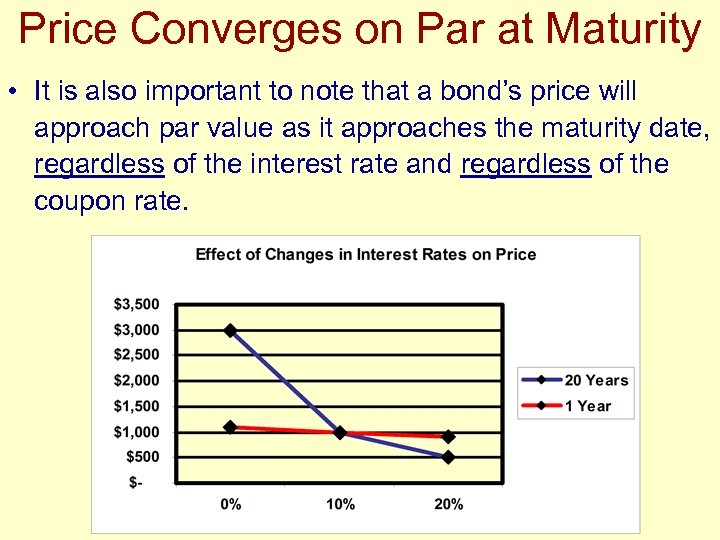

Price Converges on Par at Maturity • It is also important to note that a bond’s price will approach par value as it approaches the maturity date, regardless of the interest rate and regardless of the coupon rate.

Price Converges on Par at Maturity • It is also important to note that a bond’s price will approach par value as it approaches the maturity date, regardless of the interest rate and regardless of the coupon rate.

Price Converges on Par at Maturity • It is also important to note that a bond’s price will approach par value as it approaches the maturity date, regardless of the interest rate and regardless of the coupon rate.

Price Converges on Par at Maturity • It is also important to note that a bond’s price will approach par value as it approaches the maturity date, regardless of the interest rate and regardless of the coupon rate.

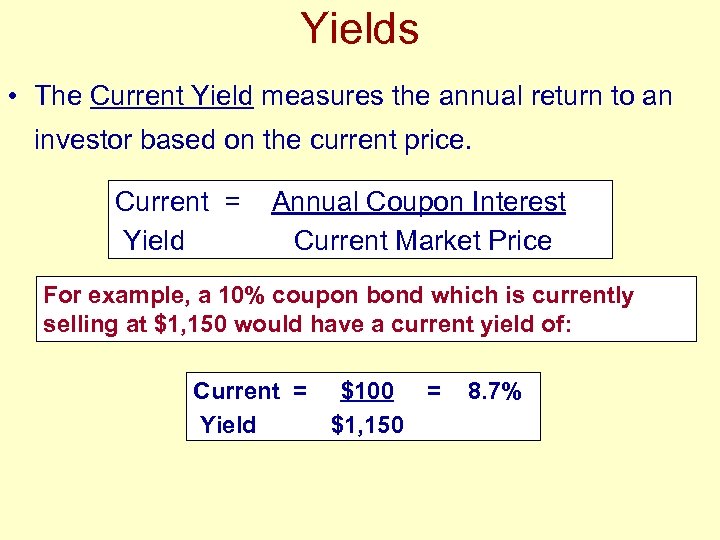

Yields • The Current Yield measures the annual return to an investor based on the current price. Current = Yield Annual Coupon Interest Current Market Price For example, a 10% coupon bond which is currently selling at $1, 150 would have a current yield of: Current = $100 = Yield $1, 150 8. 7%

Yields • The Current Yield measures the annual return to an investor based on the current price. Current = Yield Annual Coupon Interest Current Market Price For example, a 10% coupon bond which is currently selling at $1, 150 would have a current yield of: Current = $100 = Yield $1, 150 8. 7%

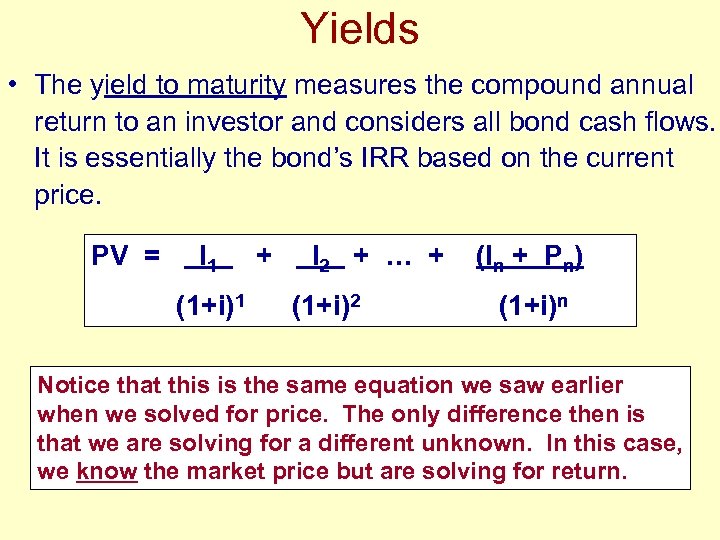

Yields • The yield to maturity measures the compound annual return to an investor and considers all bond cash flows. It is essentially the bond’s IRR based on the current price. PV = I 1 (1+i)1 + I 2 + … + (1+i)2 (In + Pn) (1+i)n Notice that this is the same equation we saw earlier when we solved for price. The only difference then is that we are solving for a different unknown. In this case, we know the market price but are solving for return.

Yields • The yield to maturity measures the compound annual return to an investor and considers all bond cash flows. It is essentially the bond’s IRR based on the current price. PV = I 1 (1+i)1 + I 2 + … + (1+i)2 (In + Pn) (1+i)n Notice that this is the same equation we saw earlier when we solved for price. The only difference then is that we are solving for a different unknown. In this case, we know the market price but are solving for return.

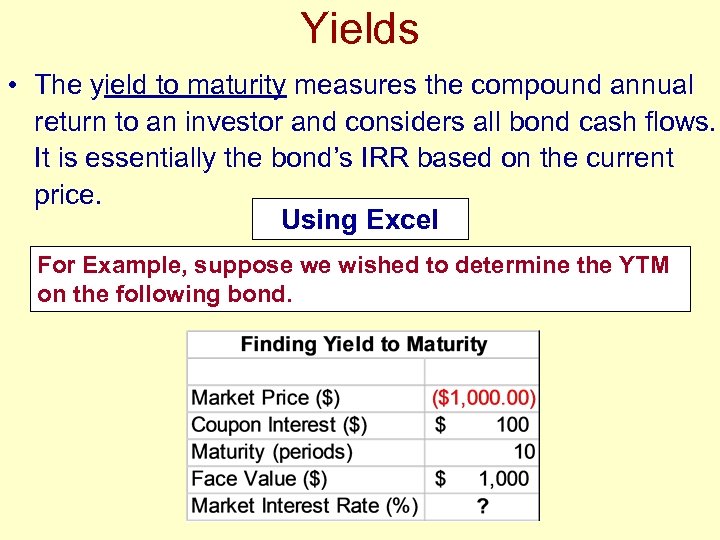

Yields • The yield to maturity measures the compound annual return to an investor and considers all bond cash flows. It is essentially the bond’s IRR based on the current price. Using Excel For Example, suppose we wished to determine the YTM on the following bond.

Yields • The yield to maturity measures the compound annual return to an investor and considers all bond cash flows. It is essentially the bond’s IRR based on the current price. Using Excel For Example, suppose we wished to determine the YTM on the following bond.

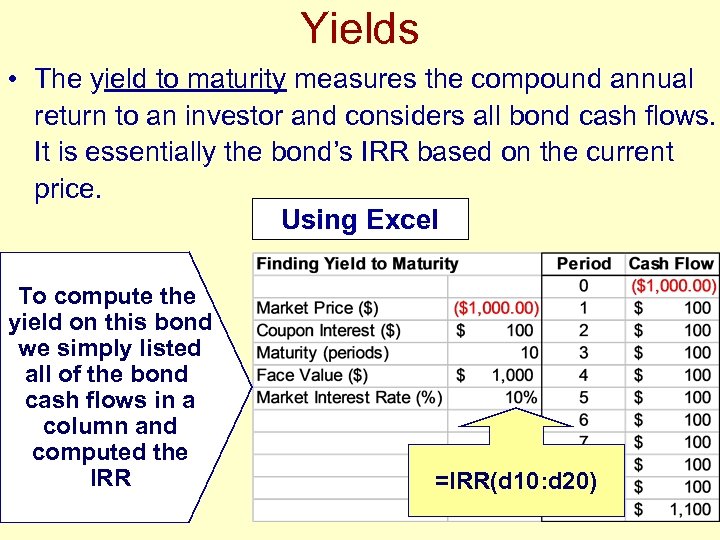

Yields • The yield to maturity measures the compound annual return to an investor and considers all bond cash flows. It is essentially the bond’s IRR based on the current price. Using Excel To compute the yield on this bond we simply listed all of the bond cash flows in a column and computed the IRR =IRR(d 10: d 20)

Yields • The yield to maturity measures the compound annual return to an investor and considers all bond cash flows. It is essentially the bond’s IRR based on the current price. Using Excel To compute the yield on this bond we simply listed all of the bond cash flows in a column and computed the IRR =IRR(d 10: d 20)

Yields • The yield to maturity measures the compound annual return to an investor and considers all bond cash flows. It is essentially the bond’s IRR based on the current price. • Note that the yield to maturity will only be equal if the bond is selling for its face value ($1, 000). • And that rate will be the same as the bond’s coupon rate. • For premium bonds, the current yield > YTM. • For discount bonds, the current yield < YTM.

Yields • The yield to maturity measures the compound annual return to an investor and considers all bond cash flows. It is essentially the bond’s IRR based on the current price. • Note that the yield to maturity will only be equal if the bond is selling for its face value ($1, 000). • And that rate will be the same as the bond’s coupon rate. • For premium bonds, the current yield > YTM. • For discount bonds, the current yield < YTM.

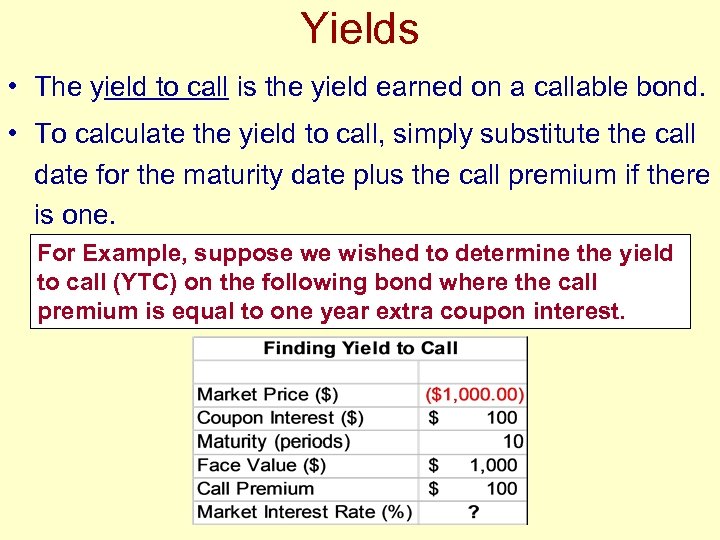

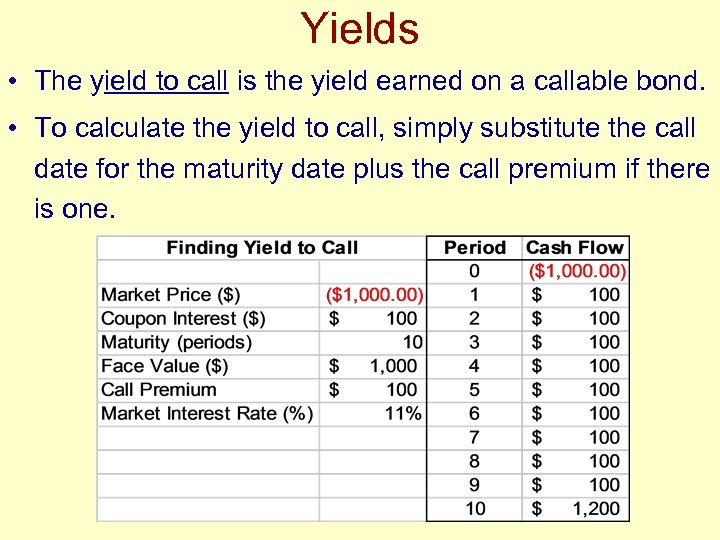

Yields • The yield to call is the yield earned on a callable bond. • To calculate the yield to call, simply substitute the call date for the maturity date plus the call premium if there is one. For Example, suppose we wished to determine the yield to call (YTC) on the following bond where the call premium is equal to one year extra coupon interest.

Yields • The yield to call is the yield earned on a callable bond. • To calculate the yield to call, simply substitute the call date for the maturity date plus the call premium if there is one. For Example, suppose we wished to determine the yield to call (YTC) on the following bond where the call premium is equal to one year extra coupon interest.

Yields • The yield to call is the yield earned on a callable bond. • To calculate the yield to call, simply substitute the call date for the maturity date plus the call premium if there is one.

Yields • The yield to call is the yield earned on a callable bond. • To calculate the yield to call, simply substitute the call date for the maturity date plus the call premium if there is one.

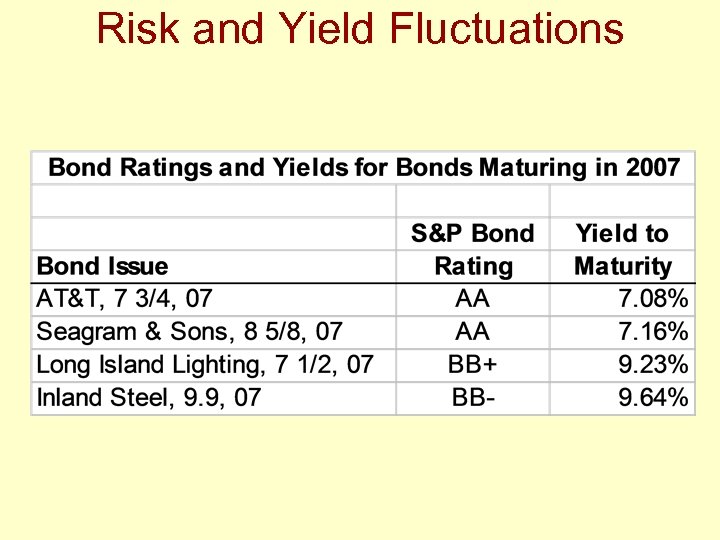

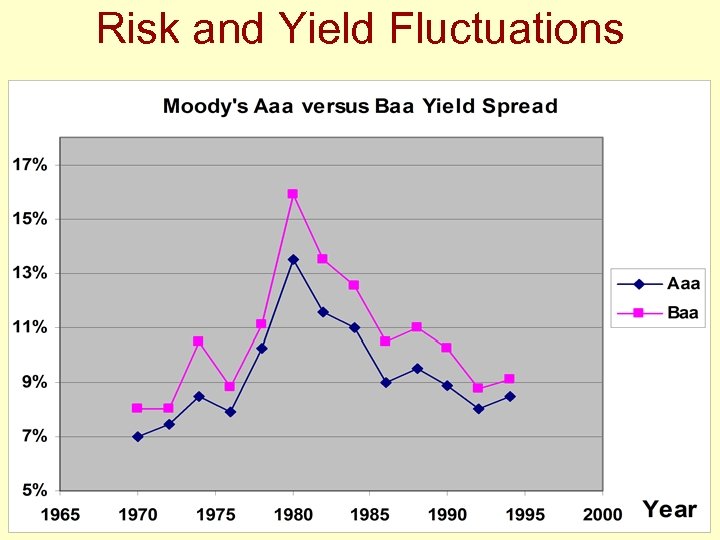

Risk and Yield Fluctuations

Risk and Yield Fluctuations

Risk and Yield Fluctuations

Risk and Yield Fluctuations

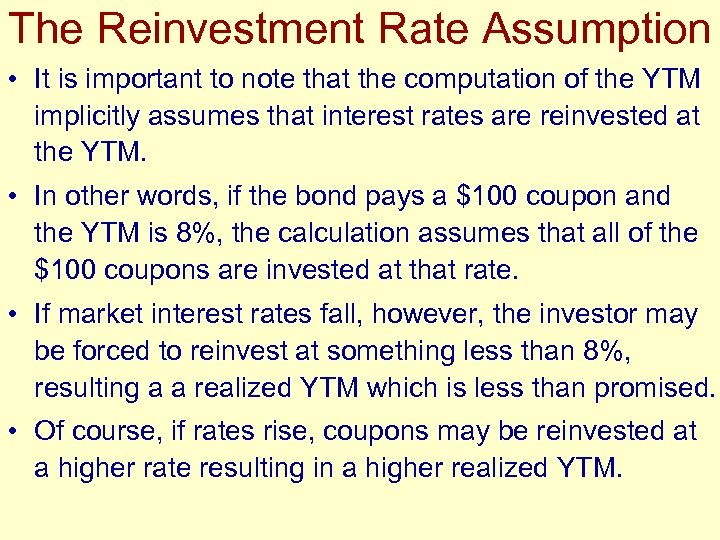

The Reinvestment Rate Assumption • It is important to note that the computation of the YTM implicitly assumes that interest rates are reinvested at the YTM. • In other words, if the bond pays a $100 coupon and the YTM is 8%, the calculation assumes that all of the $100 coupons are invested at that rate. • If market interest rates fall, however, the investor may be forced to reinvest at something less than 8%, resulting a a realized YTM which is less than promised. • Of course, if rates rise, coupons may be reinvested at a higher rate resulting in a higher realized YTM.

The Reinvestment Rate Assumption • It is important to note that the computation of the YTM implicitly assumes that interest rates are reinvested at the YTM. • In other words, if the bond pays a $100 coupon and the YTM is 8%, the calculation assumes that all of the $100 coupons are invested at that rate. • If market interest rates fall, however, the investor may be forced to reinvest at something less than 8%, resulting a a realized YTM which is less than promised. • Of course, if rates rise, coupons may be reinvested at a higher rate resulting in a higher realized YTM.

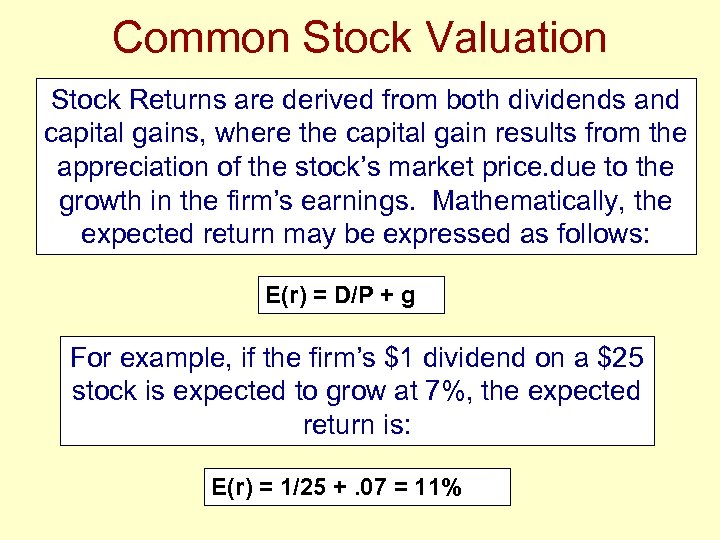

Common Stock Valuation Stock Returns are derived from both dividends and capital gains, where the capital gain results from the appreciation of the stock’s market price. due to the growth in the firm’s earnings. Mathematically, the expected return may be expressed as follows: E(r) = D/P + g For example, if the firm’s $1 dividend on a $25 stock is expected to grow at 7%, the expected return is: E(r) = 1/25 +. 07 = 11%

Common Stock Valuation Stock Returns are derived from both dividends and capital gains, where the capital gain results from the appreciation of the stock’s market price. due to the growth in the firm’s earnings. Mathematically, the expected return may be expressed as follows: E(r) = D/P + g For example, if the firm’s $1 dividend on a $25 stock is expected to grow at 7%, the expected return is: E(r) = 1/25 +. 07 = 11%

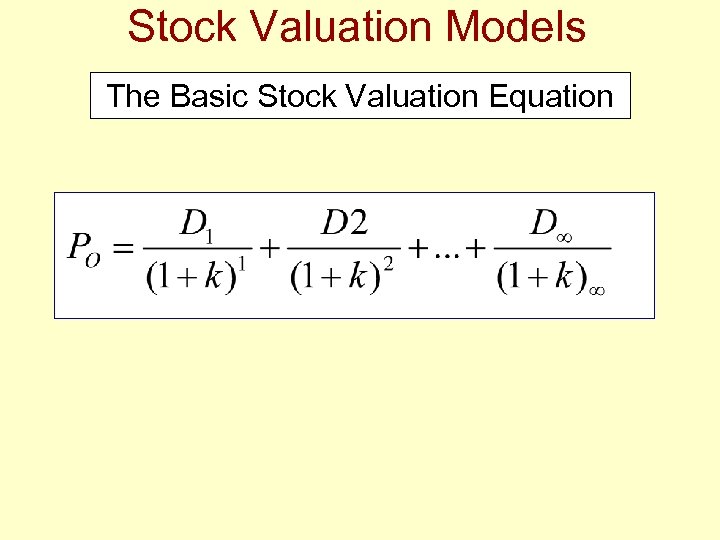

Stock Valuation Models The Basic Stock Valuation Equation

Stock Valuation Models The Basic Stock Valuation Equation

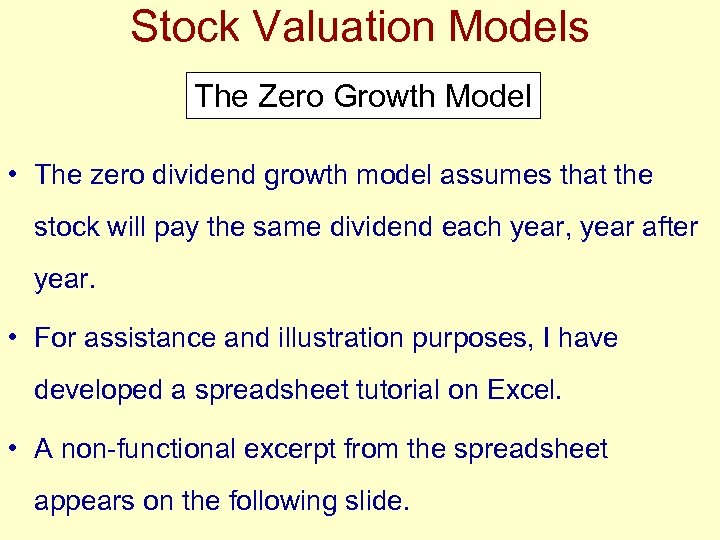

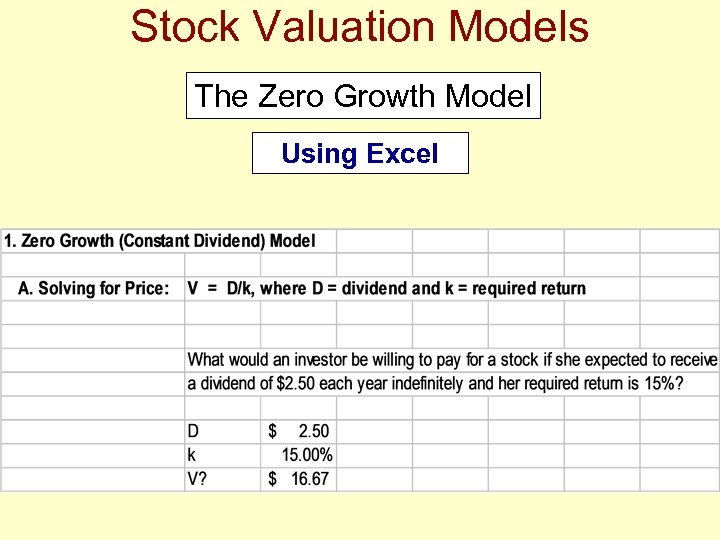

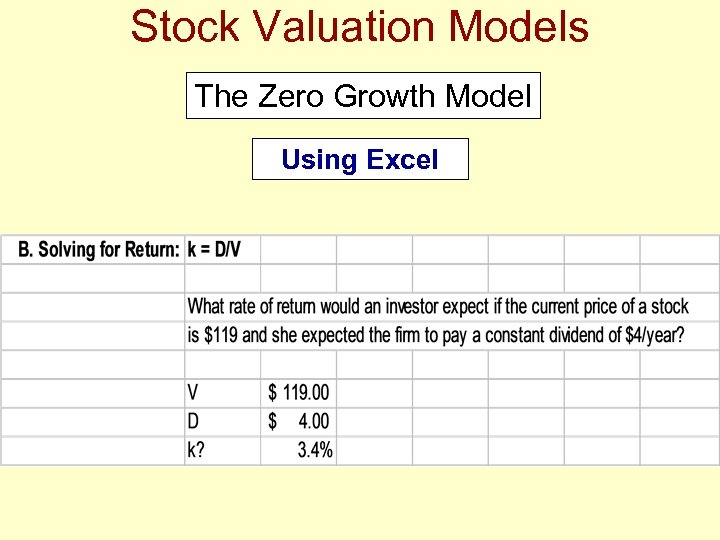

Stock Valuation Models The Zero Growth Model • The zero dividend growth model assumes that the stock will pay the same dividend each year, year after year. • For assistance and illustration purposes, I have developed a spreadsheet tutorial on Excel. • A non-functional excerpt from the spreadsheet appears on the following slide.

Stock Valuation Models The Zero Growth Model • The zero dividend growth model assumes that the stock will pay the same dividend each year, year after year. • For assistance and illustration purposes, I have developed a spreadsheet tutorial on Excel. • A non-functional excerpt from the spreadsheet appears on the following slide.

Stock Valuation Models The Zero Growth Model Using Excel

Stock Valuation Models The Zero Growth Model Using Excel

Stock Valuation Models The Zero Growth Model Using Excel

Stock Valuation Models The Zero Growth Model Using Excel

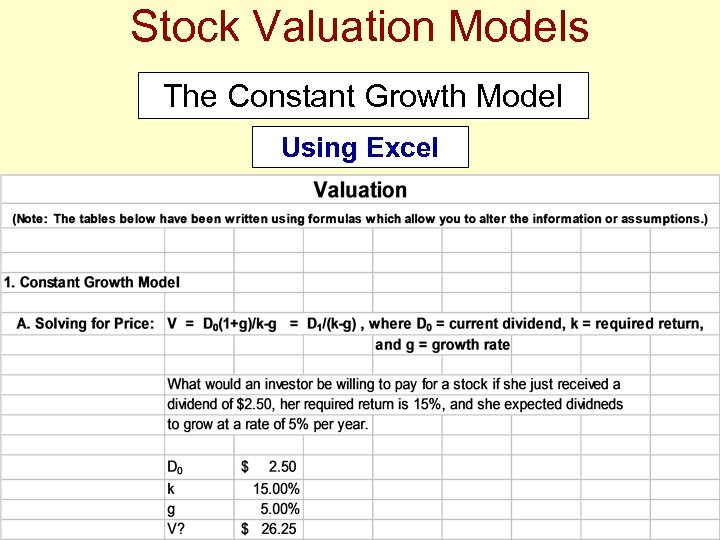

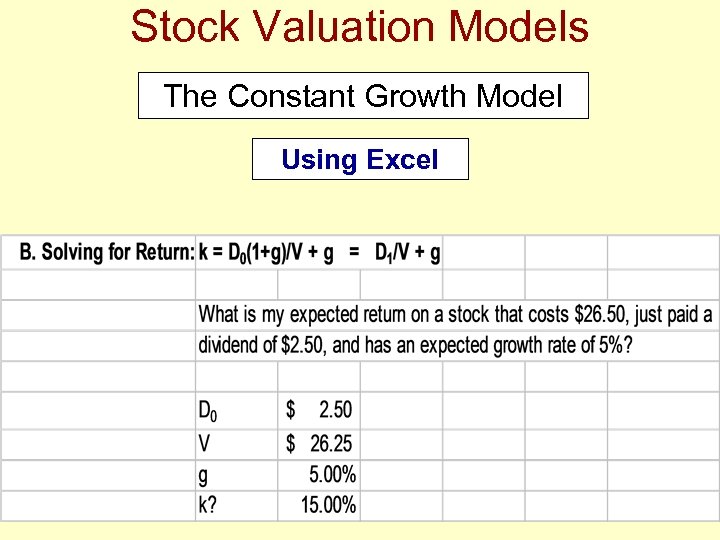

Stock Valuation Models The Constant Growth Model • The constant dividend growth model assumes that the stock will pay dividends that grow at a constant rate each year -- year after year. • For assistance and illustration purposes, I have developed a spreadsheet tutorial using Excel • A non-functional excerpt from the spreadsheet appears on the following slide.

Stock Valuation Models The Constant Growth Model • The constant dividend growth model assumes that the stock will pay dividends that grow at a constant rate each year -- year after year. • For assistance and illustration purposes, I have developed a spreadsheet tutorial using Excel • A non-functional excerpt from the spreadsheet appears on the following slide.

Stock Valuation Models The Constant Growth Model Using Excel

Stock Valuation Models The Constant Growth Model Using Excel

Stock Valuation Models The Constant Growth Model Using Excel

Stock Valuation Models The Constant Growth Model Using Excel

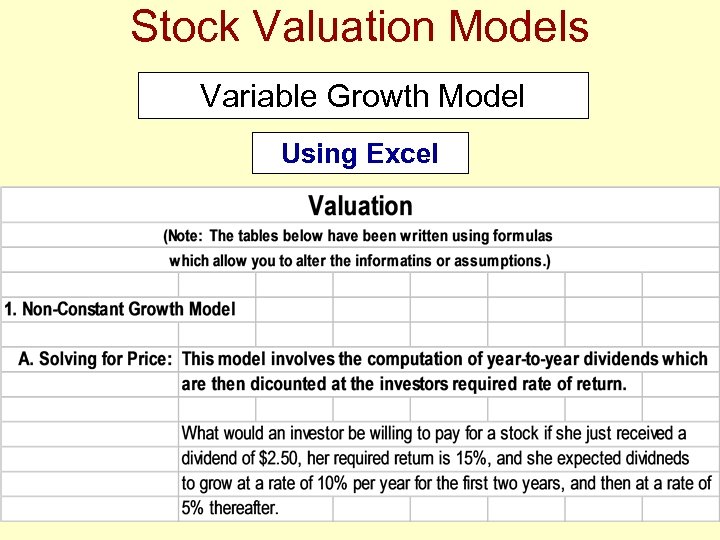

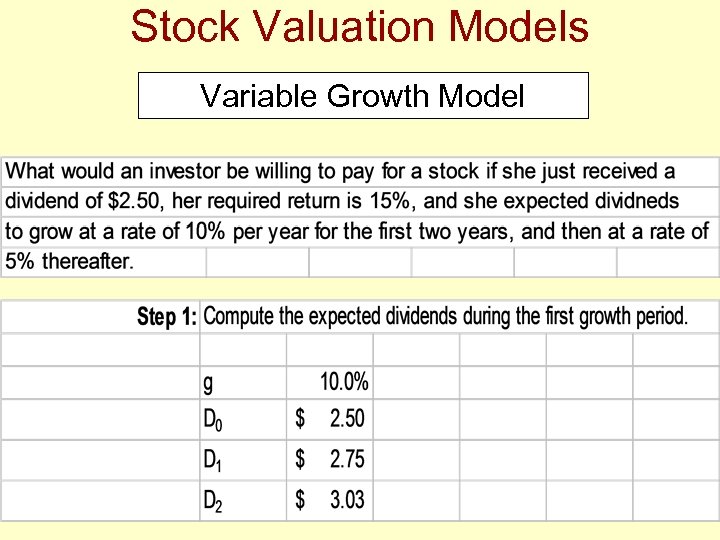

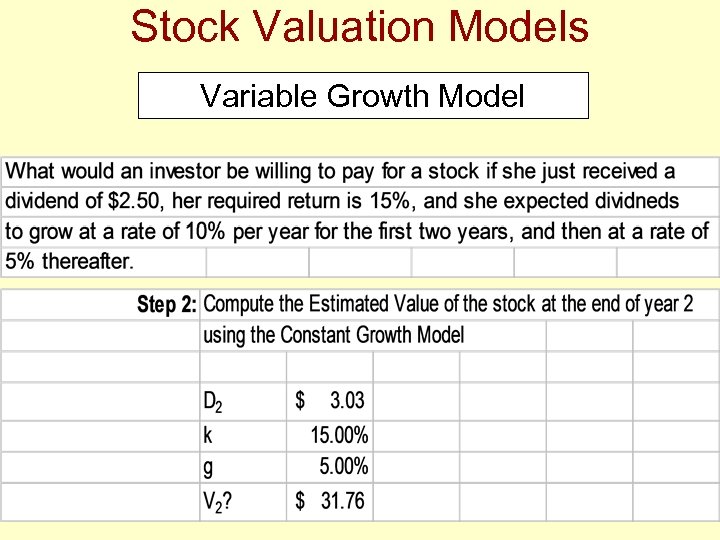

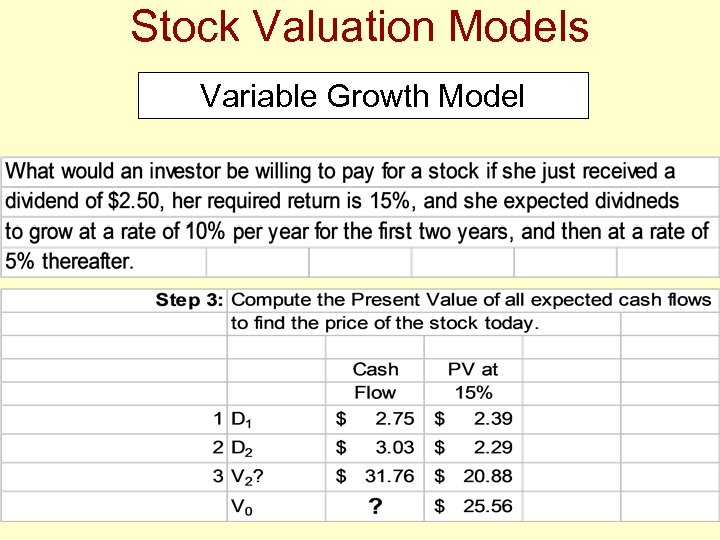

Stock Valuation Models Variable Growth Model • The non-constant dividend growth model assumes that the stock will pay dividends that grow at one rate during one period, and at another rate in another year or thereafter. • For assistance and illustration purposes, I have developed a spreadsheet tutorial available under the heading “Course Materials” on Course Web-Page. • A non-functional excerpt from the spreadsheet appears on the following slide.

Stock Valuation Models Variable Growth Model • The non-constant dividend growth model assumes that the stock will pay dividends that grow at one rate during one period, and at another rate in another year or thereafter. • For assistance and illustration purposes, I have developed a spreadsheet tutorial available under the heading “Course Materials” on Course Web-Page. • A non-functional excerpt from the spreadsheet appears on the following slide.

Stock Valuation Models Variable Growth Model Using Excel

Stock Valuation Models Variable Growth Model Using Excel

Stock Valuation Models Variable Growth Model

Stock Valuation Models Variable Growth Model

Stock Valuation Models Variable Growth Model

Stock Valuation Models Variable Growth Model

Stock Valuation Models Variable Growth Model

Stock Valuation Models Variable Growth Model

Other Approaches to Stock Valuation Book Value • Book value per share is the amount per share that would be received if all the firm’s assets were sold for their exact book value and if the proceeds remaining after paying all liabilities were divided among common stockholders. • This method lacks sophistication and its reliance on historical balance sheet data ignores the firm’s earnings potential and lacks any true relationship to the firm’s value in the marketplace.

Other Approaches to Stock Valuation Book Value • Book value per share is the amount per share that would be received if all the firm’s assets were sold for their exact book value and if the proceeds remaining after paying all liabilities were divided among common stockholders. • This method lacks sophistication and its reliance on historical balance sheet data ignores the firm’s earnings potential and lacks any true relationship to the firm’s value in the marketplace.

Other Approaches to Stock Valuation Liquidation Value • Liquidation value per share is the actual amount per share of common stock to be received if al of the firm’s assets were sold for their market values, liabilities were paid, and any remaining funds were divided among common stockholders. • This measure is more realistic than book value because it is based on current market values of the firm’s assets. • However, it still fails to consider the earning power of those assets.

Other Approaches to Stock Valuation Liquidation Value • Liquidation value per share is the actual amount per share of common stock to be received if al of the firm’s assets were sold for their market values, liabilities were paid, and any remaining funds were divided among common stockholders. • This measure is more realistic than book value because it is based on current market values of the firm’s assets. • However, it still fails to consider the earning power of those assets.

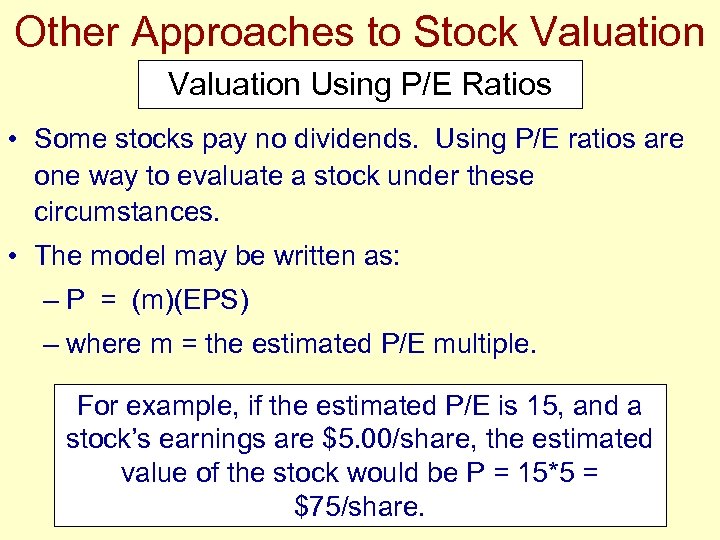

Other Approaches to Stock Valuation Using P/E Ratios • Some stocks pay no dividends. Using P/E ratios are one way to evaluate a stock under these circumstances. • The model may be written as: – P = (m)(EPS) – where m = the estimated P/E multiple. For example, if the estimated P/E is 15, and a stock’s earnings are $5. 00/share, the estimated value of the stock would be P = 15*5 = $75/share.

Other Approaches to Stock Valuation Using P/E Ratios • Some stocks pay no dividends. Using P/E ratios are one way to evaluate a stock under these circumstances. • The model may be written as: – P = (m)(EPS) – where m = the estimated P/E multiple. For example, if the estimated P/E is 15, and a stock’s earnings are $5. 00/share, the estimated value of the stock would be P = 15*5 = $75/share.

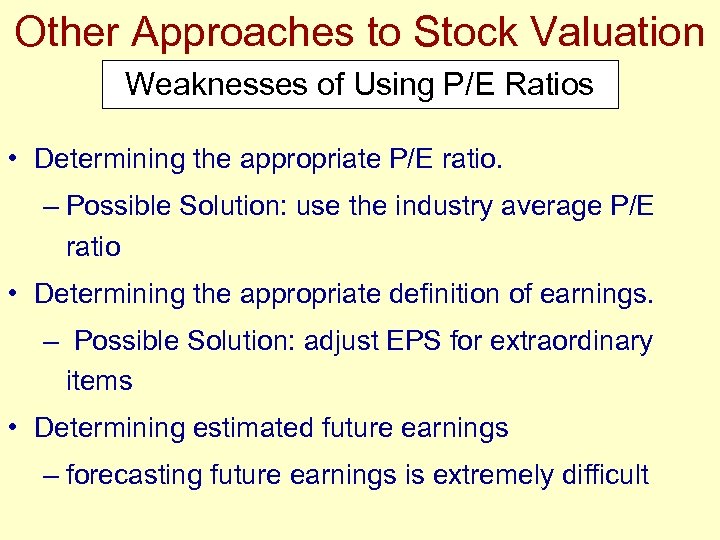

Other Approaches to Stock Valuation Weaknesses of Using P/E Ratios • Determining the appropriate P/E ratio. – Possible Solution: use the industry average P/E ratio • Determining the appropriate definition of earnings. – Possible Solution: adjust EPS for extraordinary items • Determining estimated future earnings – forecasting future earnings is extremely difficult

Other Approaches to Stock Valuation Weaknesses of Using P/E Ratios • Determining the appropriate P/E ratio. – Possible Solution: use the industry average P/E ratio • Determining the appropriate definition of earnings. – Possible Solution: adjust EPS for extraordinary items • Determining estimated future earnings – forecasting future earnings is extremely difficult

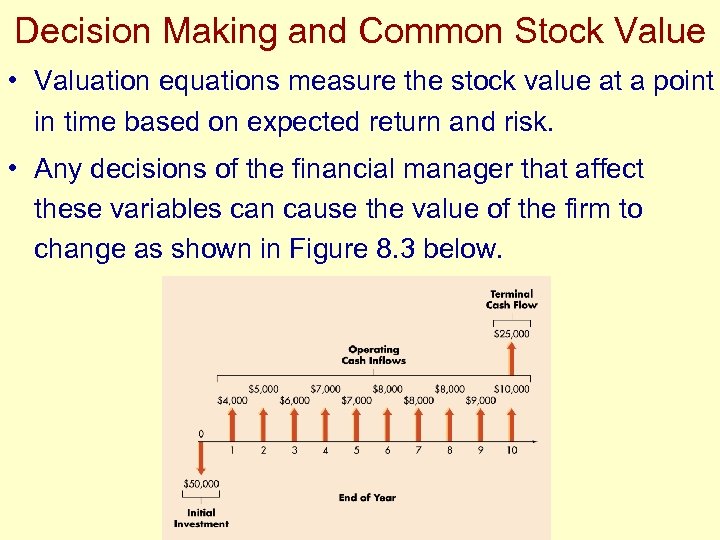

Decision Making and Common Stock Value • Valuation equations measure the stock value at a point in time based on expected return and risk. • Any decisions of the financial manager that affect these variables can cause the value of the firm to change as shown in Figure 8. 3 below.

Decision Making and Common Stock Value • Valuation equations measure the stock value at a point in time based on expected return and risk. • Any decisions of the financial manager that affect these variables can cause the value of the firm to change as shown in Figure 8. 3 below.

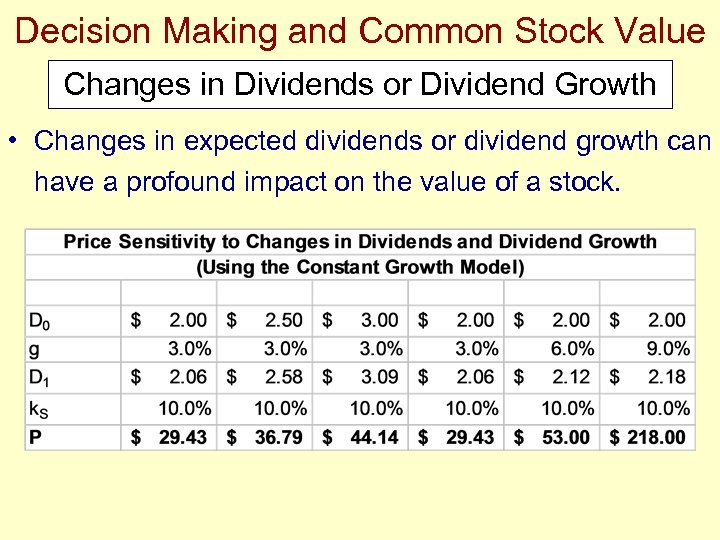

Decision Making and Common Stock Value Changes in Dividends or Dividend Growth • Changes in expected dividends or dividend growth can have a profound impact on the value of a stock.

Decision Making and Common Stock Value Changes in Dividends or Dividend Growth • Changes in expected dividends or dividend growth can have a profound impact on the value of a stock.

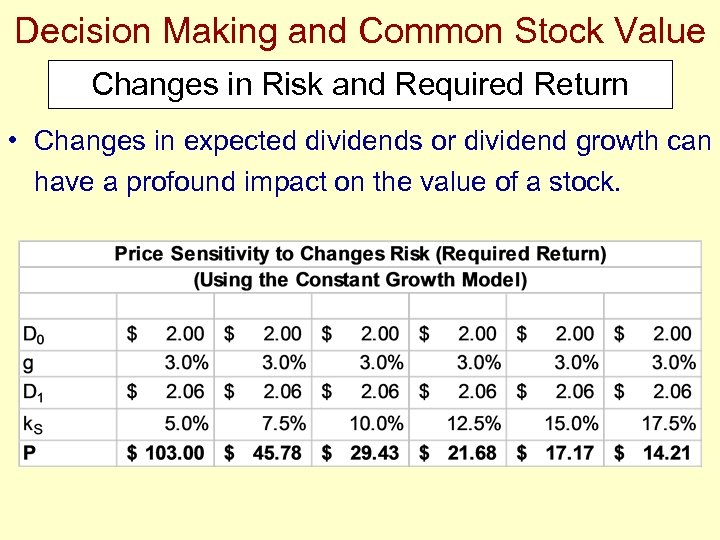

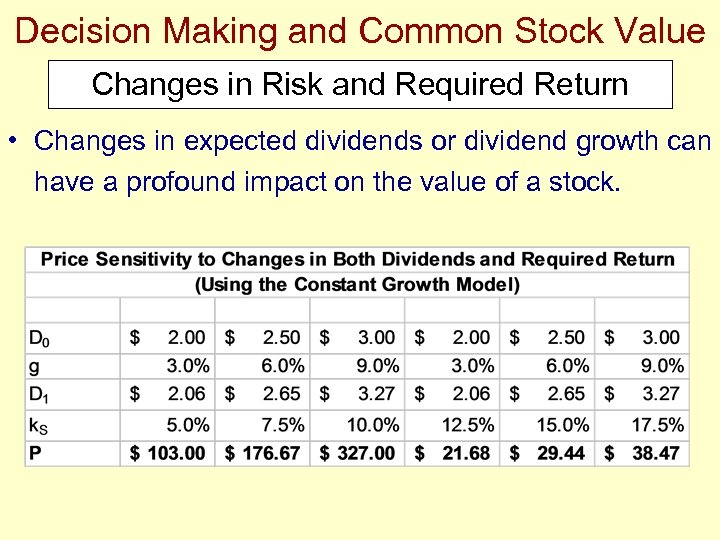

Decision Making and Common Stock Value Changes in Risk and Required Return • Changes in expected dividends or dividend growth can have a profound impact on the value of a stock.

Decision Making and Common Stock Value Changes in Risk and Required Return • Changes in expected dividends or dividend growth can have a profound impact on the value of a stock.

Decision Making and Common Stock Value Changes in Risk and Required Return • Changes in expected dividends or dividend growth can have a profound impact on the value of a stock.

Decision Making and Common Stock Value Changes in Risk and Required Return • Changes in expected dividends or dividend growth can have a profound impact on the value of a stock.