84c9a5388e896e98b8a846f9859cff01.ppt

- Количество слайдов: 33

Principles of Corporate Finance Brealey and Myers u Sixth Edition Spotting and Valuing Options Slides by Matthew Will Irwin/Mc. Graw Hill Chapter 20 ©The Mc. Graw-Hill Companies, Inc. , 2000

20 - 2 Topics Covered w Calls, Puts and Shares w Financial Alchemy with Options w What Determines Option Value w Option Valuation Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

20 - 3 Option Terminology Call Option Right to buy an asset at a specified exercise price on or before the exercise date. Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

20 - 4 Option Terminology Call Option Right to buy an asset at a specified exercise price on or before the exercise date. Put Option Right to sell an asset at a specified exercise price on or before the exercise date. Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

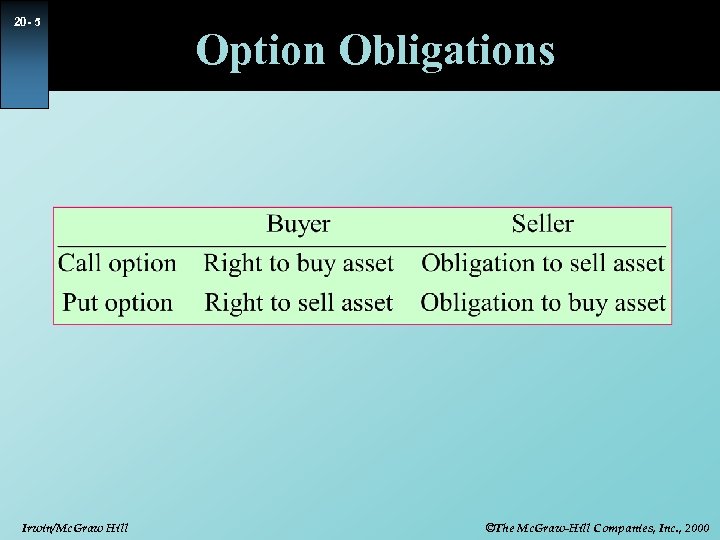

20 - 5 Irwin/Mc. Graw Hill Option Obligations ©The Mc. Graw-Hill Companies, Inc. , 2000

20 - 6 Option Value w The value of an option at expiration is a function of the stock price and the exercise price. Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

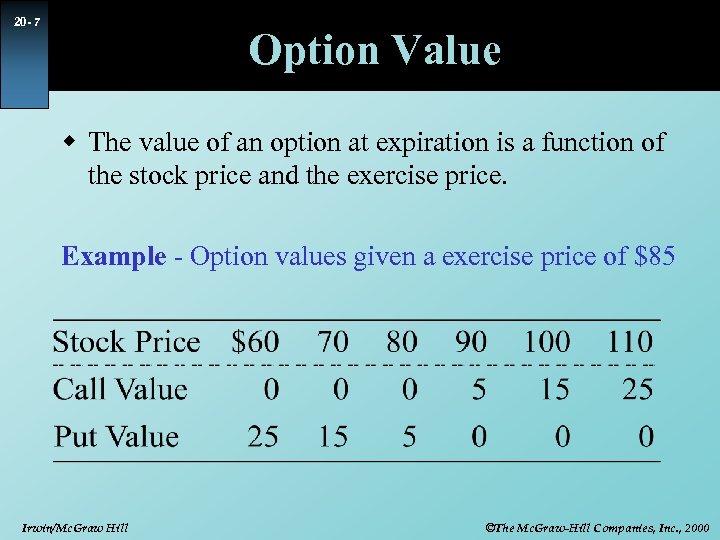

20 - 7 Option Value w The value of an option at expiration is a function of the stock price and the exercise price. Example - Option values given a exercise price of $85 Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

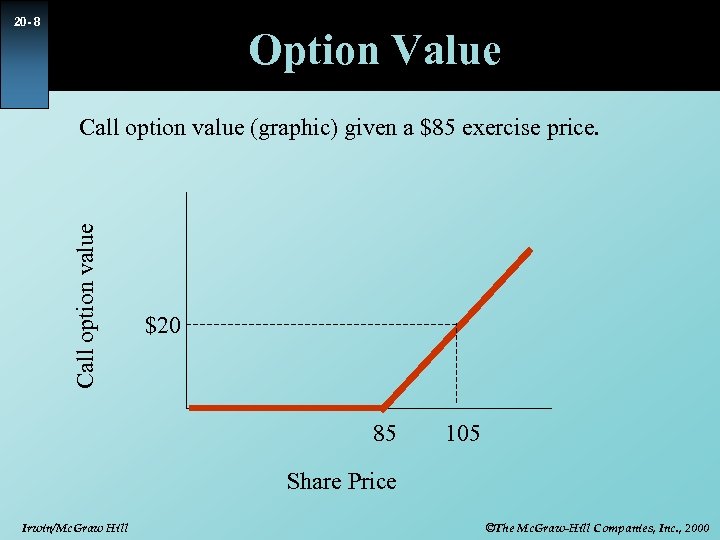

20 - 8 Option Value Call option value (graphic) given a $85 exercise price. $20 85 105 Share Price Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

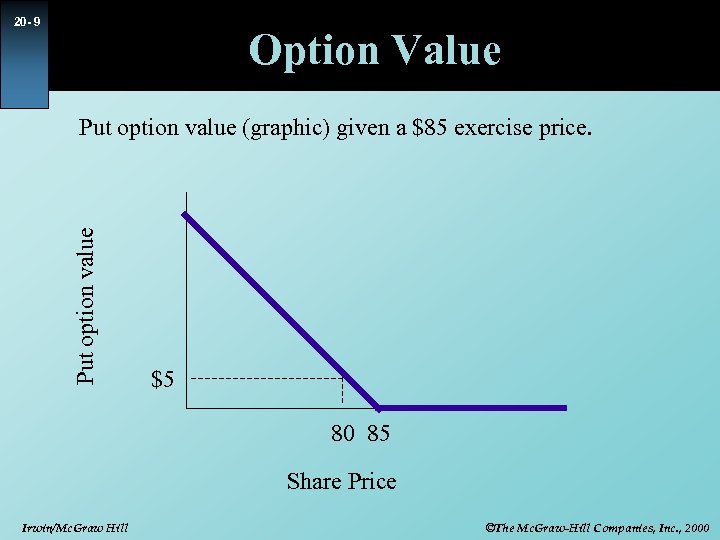

20 - 9 Option Value Put option value (graphic) given a $85 exercise price. $5 80 85 Share Price Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

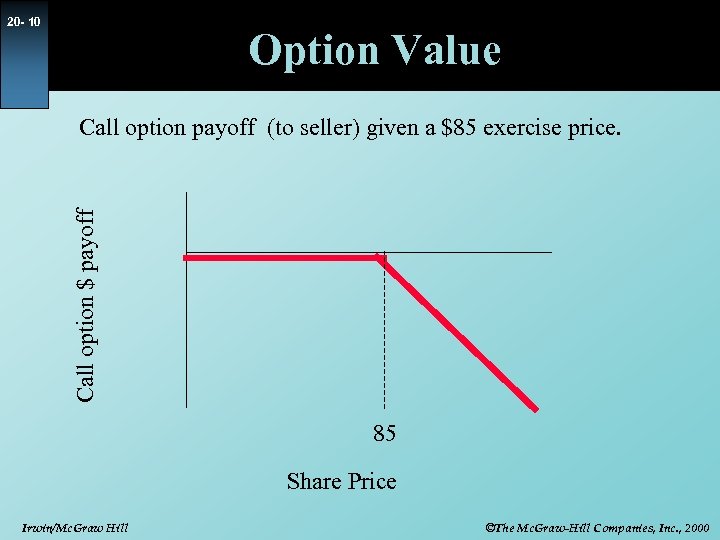

20 - 10 Option Value Call option $ payoff Call option payoff (to seller) given a $85 exercise price. 85 Share Price Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

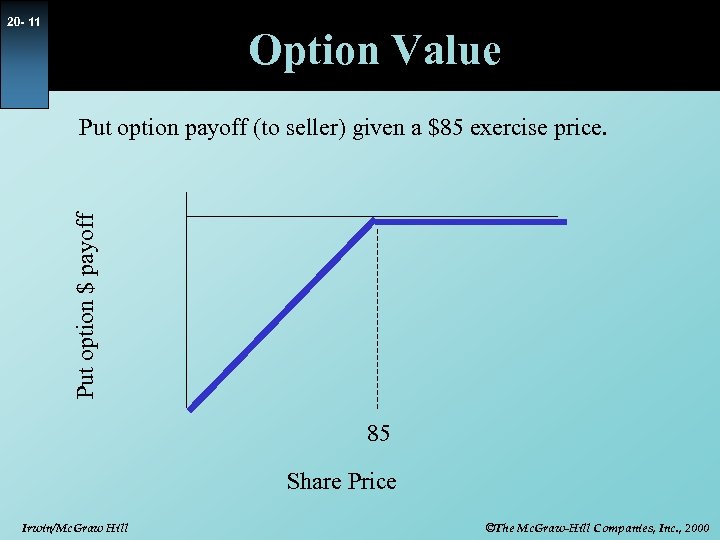

20 - 11 Option Value Put option $ payoff Put option payoff (to seller) given a $85 exercise price. 85 Share Price Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

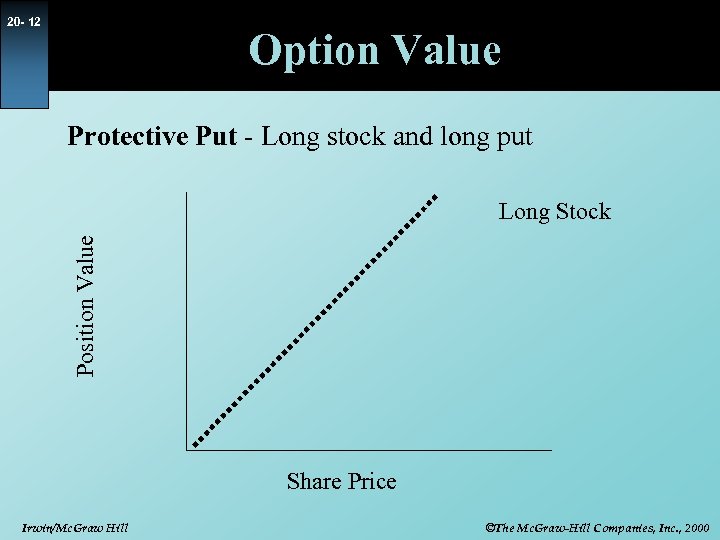

20 - 12 Option Value Protective Put - Long stock and long put Position Value Long Stock Share Price Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

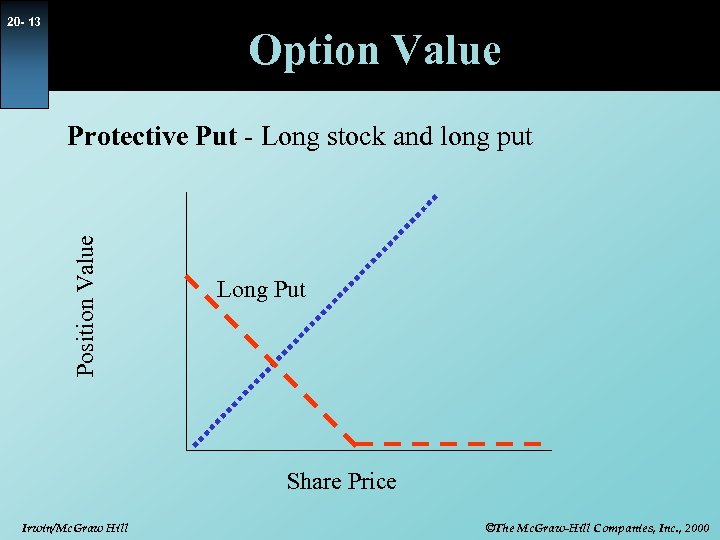

20 - 13 Option Value Position Value Protective Put - Long stock and long put Long Put Share Price Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

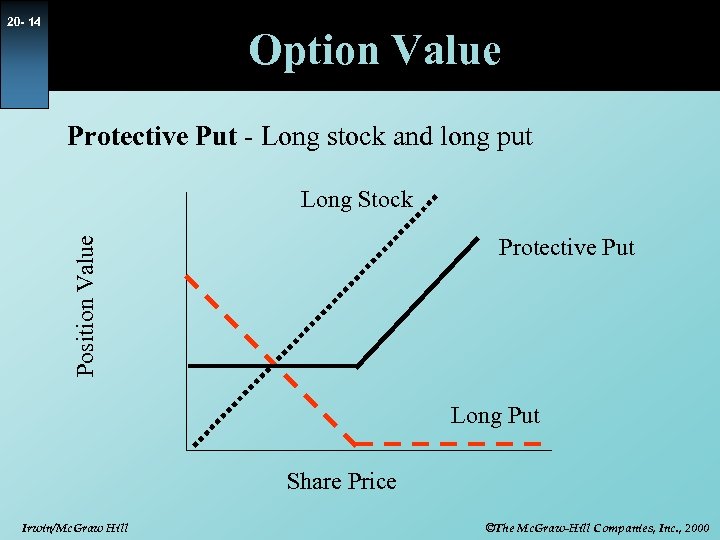

20 - 14 Option Value Protective Put - Long stock and long put Long Stock Position Value Protective Put Long Put Share Price Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

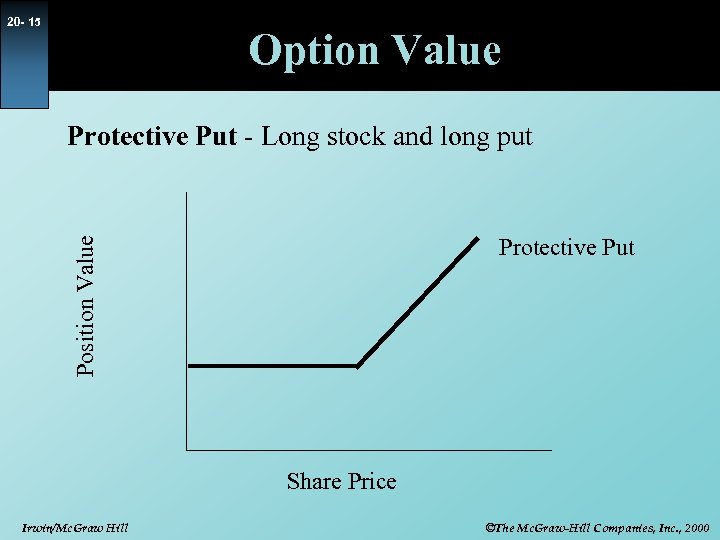

20 - 15 Option Value Protective Put - Long stock and long put Position Value Protective Put Share Price Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

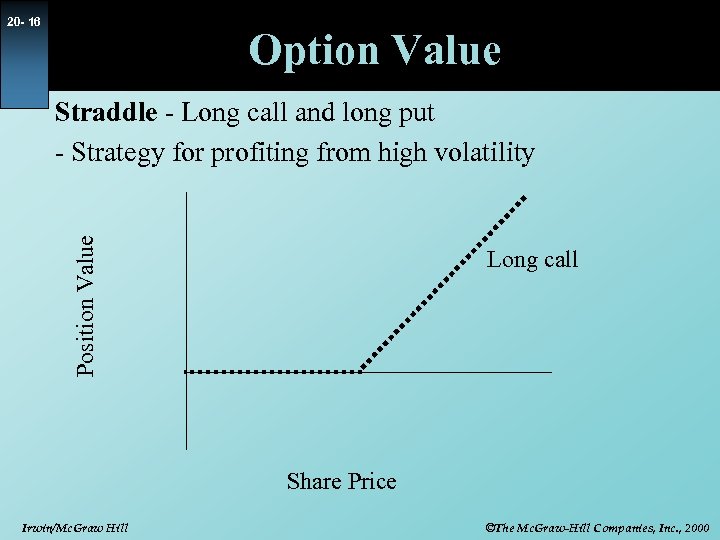

20 - 16 Option Value Position Value Straddle - Long call and long put - Strategy for profiting from high volatility Long call Share Price Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

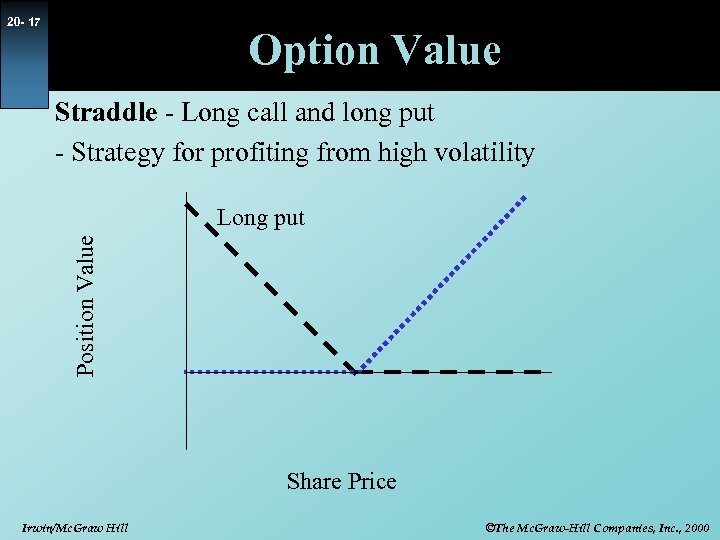

20 - 17 Option Value Straddle - Long call and long put - Strategy for profiting from high volatility Position Value Long put Share Price Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

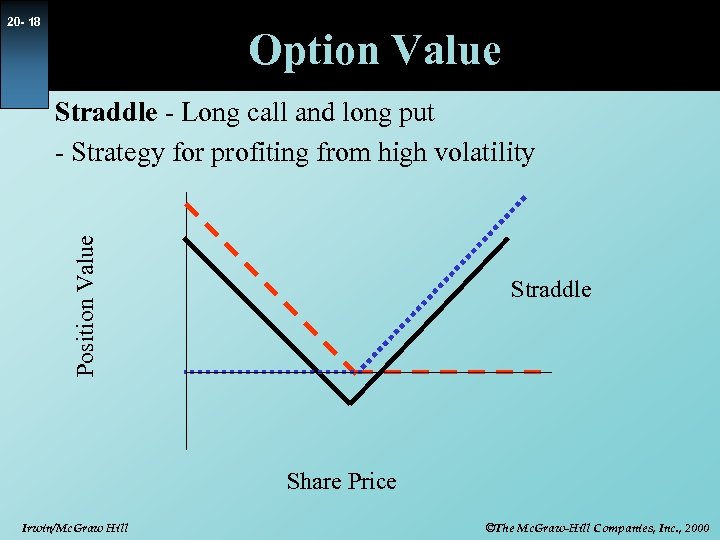

20 - 18 Option Value Position Value Straddle - Long call and long put - Strategy for profiting from high volatility Straddle Share Price Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

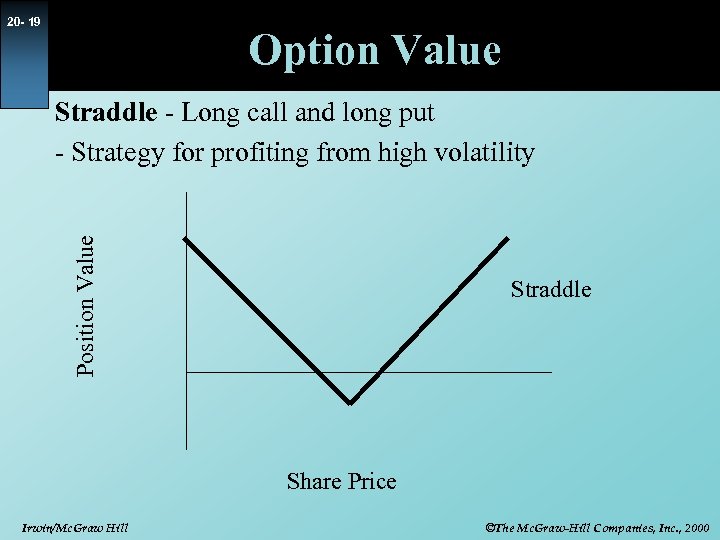

20 - 19 Option Value Position Value Straddle - Long call and long put - Strategy for profiting from high volatility Straddle Share Price Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

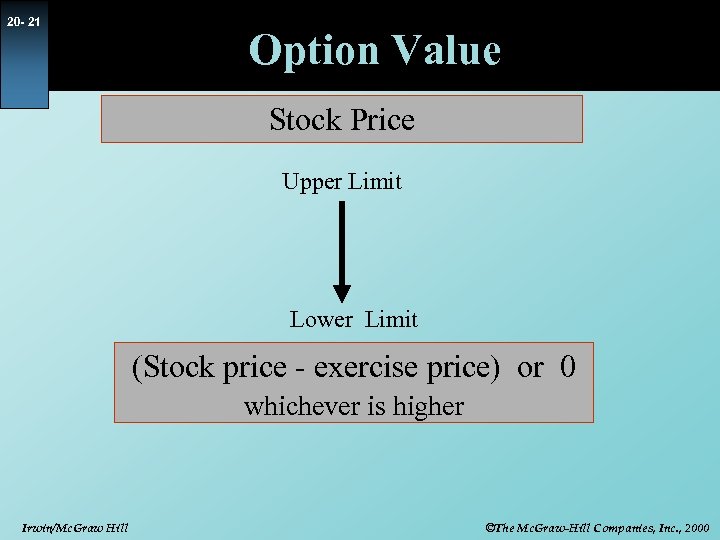

20 - 20 Option Value Stock Price Upper Limit Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

20 - 21 Option Value Stock Price Upper Limit Lower Limit (Stock price - exercise price) or 0 whichever is higher Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

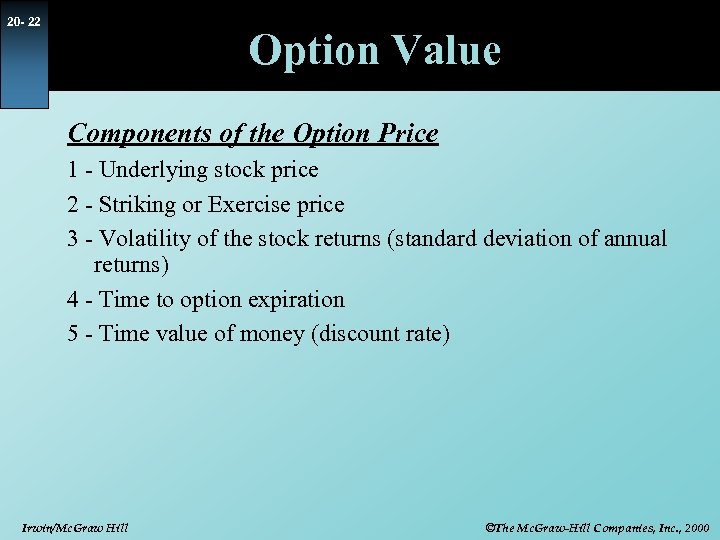

20 - 22 Option Value Components of the Option Price 1 - Underlying stock price 2 - Striking or Exercise price 3 - Volatility of the stock returns (standard deviation of annual returns) 4 - Time to option expiration 5 - Time value of money (discount rate) Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

![20 - 23 Option Value Black-Scholes Option Pricing Model OC = Ps[N(d 1)] - 20 - 23 Option Value Black-Scholes Option Pricing Model OC = Ps[N(d 1)] -](https://present5.com/presentation/84c9a5388e896e98b8a846f9859cff01/image-23.jpg)

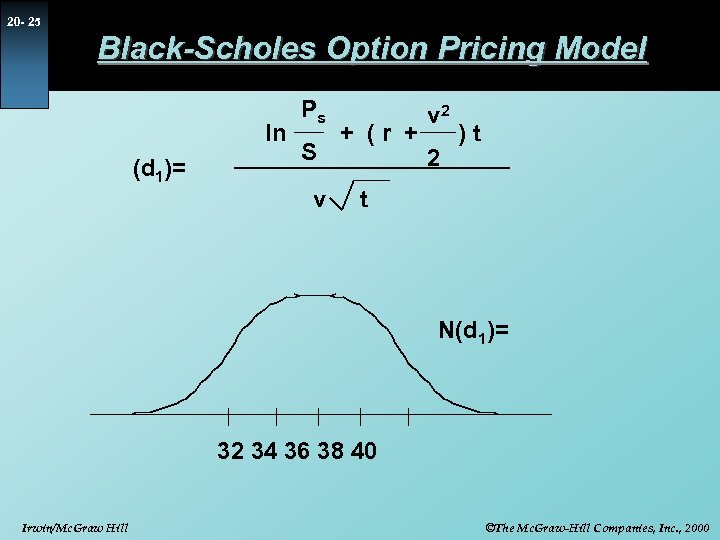

20 - 23 Option Value Black-Scholes Option Pricing Model OC = Ps[N(d 1)] - S[N(d 2)]e-rt Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

![20 - 24 Black-Scholes Option Pricing Model OC = Ps[N(d 1)] - S[N(d 2)]e-rt 20 - 24 Black-Scholes Option Pricing Model OC = Ps[N(d 1)] - S[N(d 2)]e-rt](https://present5.com/presentation/84c9a5388e896e98b8a846f9859cff01/image-24.jpg)

20 - 24 Black-Scholes Option Pricing Model OC = Ps[N(d 1)] - S[N(d 2)]e-rt OC- Call Option Price Ps - Stock Price N(d 1) - Cumulative normal density function of (d 1) S - Strike or Exercise price N(d 2) - Cumulative normal density function of (d 2) r - discount rate (90 day comm paper rate or risk free rate) t - time to maturity of option (as % of year) v - volatility - annualized standard deviation of daily returns Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

20 - 25 Black-Scholes Option Pricing Model ln (d 1)= Ps S v + (r + v 2 2 )t t N(d 1)= 32 34 36 38 40 Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

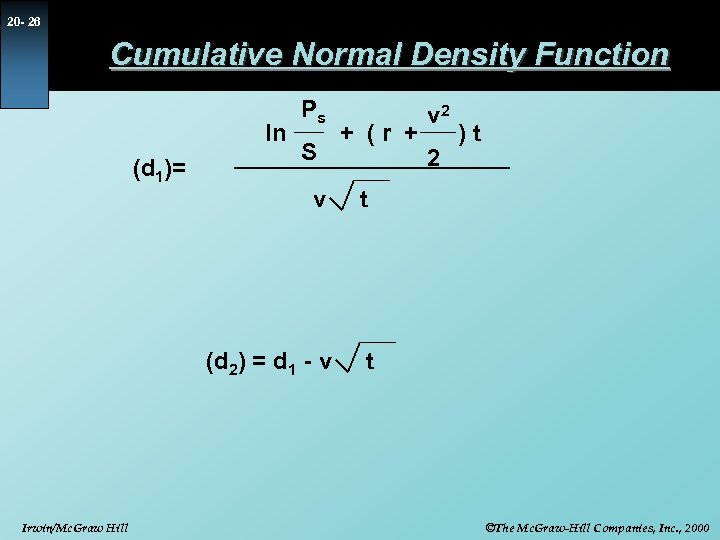

20 - 26 Cumulative Normal Density Function ln (d 1)= Ps S + (r + v Irwin/Mc. Graw Hill 2 )t t (d 2) = d 1 - v v 2 t ©The Mc. Graw-Hill Companies, Inc. , 2000

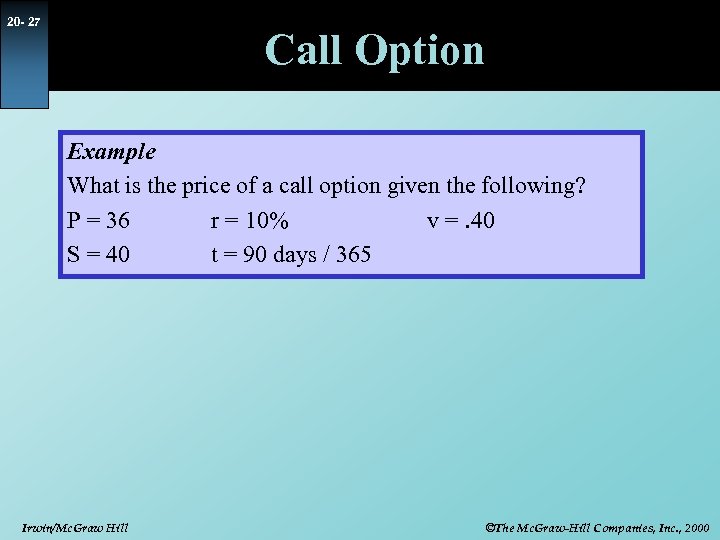

20 - 27 Call Option Example What is the price of a call option given the following? P = 36 r = 10% v =. 40 S = 40 t = 90 days / 365 Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

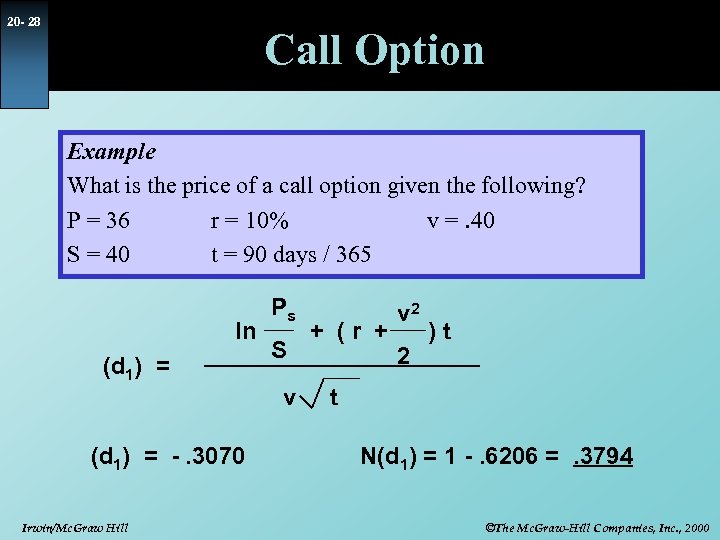

20 - 28 Call Option Example What is the price of a call option given the following? P = 36 r = 10% v =. 40 S = 40 t = 90 days / 365 ln (d 1) = Ps S v (d 1) = -. 3070 Irwin/Mc. Graw Hill + (r + v 2 2 )t t N(d 1) = 1 -. 6206 =. 3794 ©The Mc. Graw-Hill Companies, Inc. , 2000

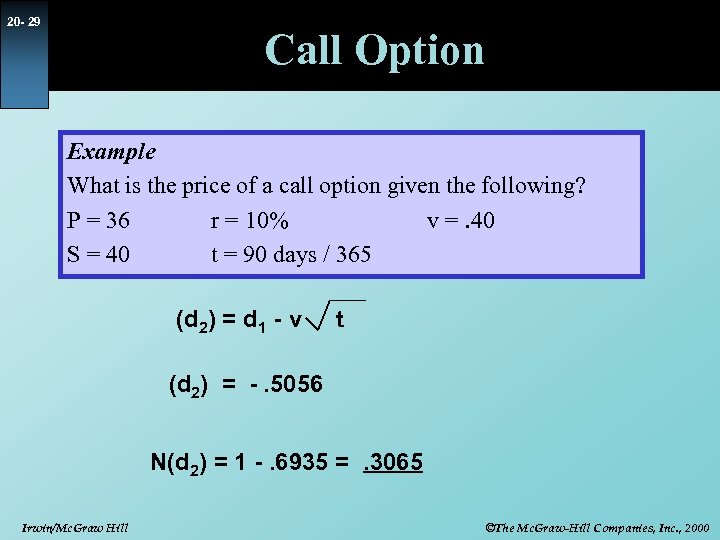

20 - 29 Call Option Example What is the price of a call option given the following? P = 36 r = 10% v =. 40 S = 40 t = 90 days / 365 (d 2) = d 1 - v t (d 2) = -. 5056 N(d 2) = 1 -. 6935 =. 3065 Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

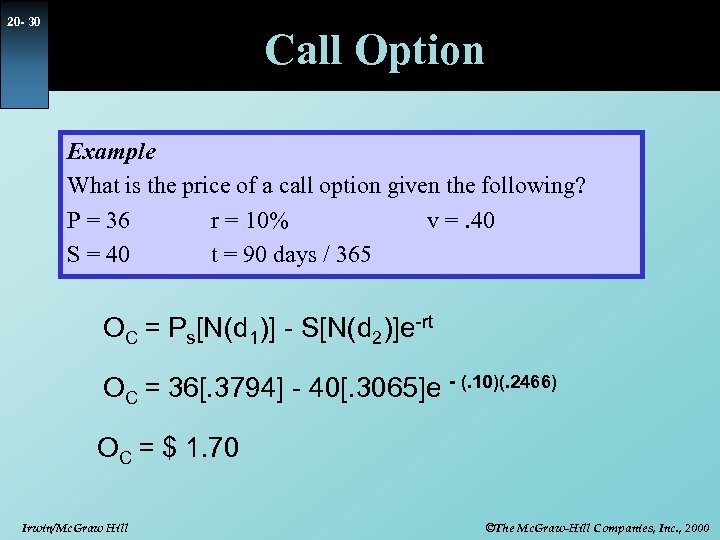

20 - 30 Call Option Example What is the price of a call option given the following? P = 36 r = 10% v =. 40 S = 40 t = 90 days / 365 OC = Ps[N(d 1)] - S[N(d 2)]e-rt OC = 36[. 3794] - 40[. 3065]e - (. 10)(. 2466) OC = $ 1. 70 Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

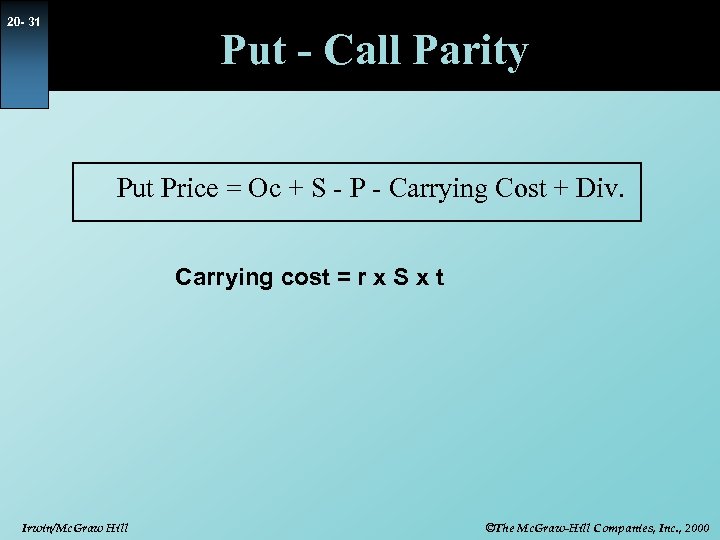

20 - 31 Put - Call Parity Put Price = Oc + S - P - Carrying Cost + Div. Carrying cost = r x S x t Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

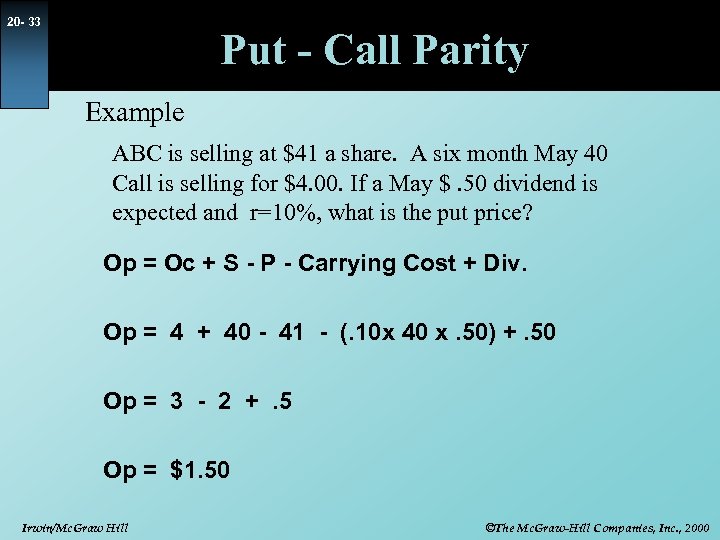

20 - 32 Put - Call Parity Example ABC is selling at $41 a share. A six month May 40 Call is selling for $4. 00. If a May $. 50 dividend is expected and r=10%, what is the put price? Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

20 - 33 Put - Call Parity Example ABC is selling at $41 a share. A six month May 40 Call is selling for $4. 00. If a May $. 50 dividend is expected and r=10%, what is the put price? Op = Oc + S - P - Carrying Cost + Div. Op = 4 + 40 - 41 - (. 10 x 40 x. 50) +. 50 Op = 3 - 2 +. 5 Op = $1. 50 Irwin/Mc. Graw Hill ©The Mc. Graw-Hill Companies, Inc. , 2000

84c9a5388e896e98b8a846f9859cff01.ppt