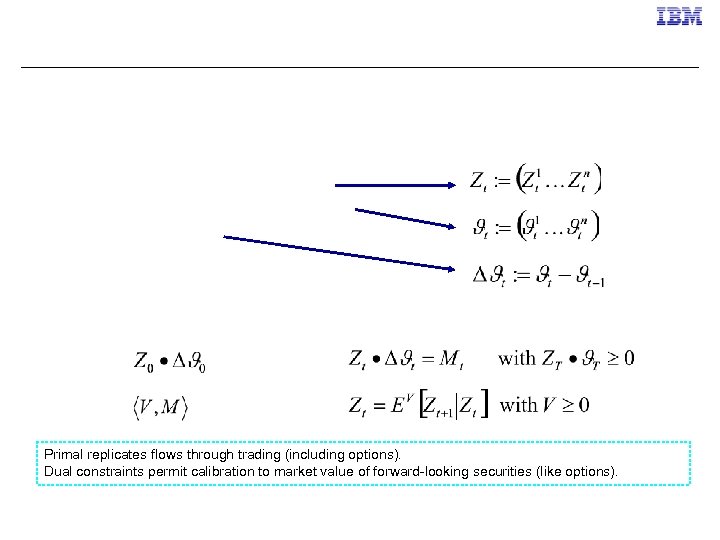

Primal replicates flows through trading (including options). Dual constraints permit calibration to market value of forward-looking securities (like options).

Primal replicates flows through trading (including options). Dual constraints permit calibration to market value of forward-looking securities (like options).

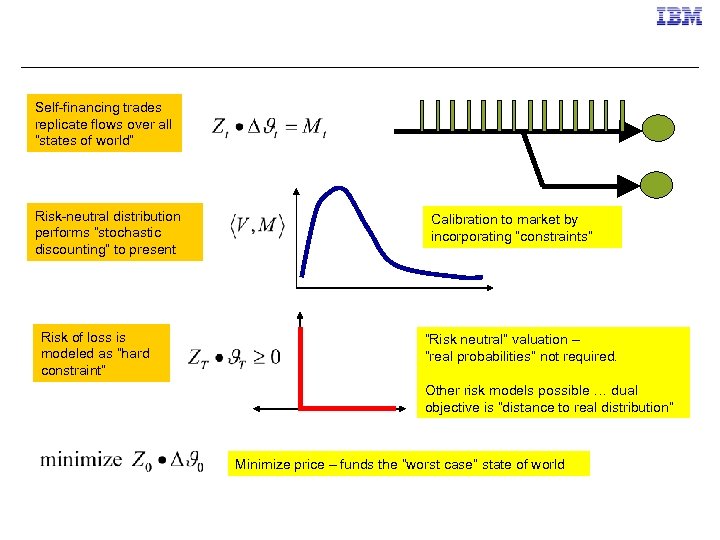

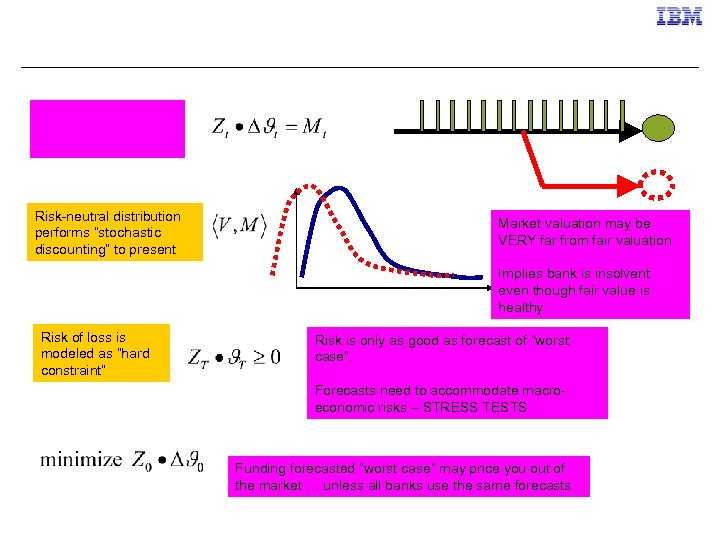

Self-financing trades replicate flows over all “states of world” Risk-neutral distribution performs “stochastic discounting” to present Risk of loss is modeled as “hard constraint” Calibration to market by incorporating “constraints” “Risk neutral” valuation – “real probabilities” not required. Other risk models possible … dual objective is “distance to real distribution” Minimize price – funds the “worst case” state of world

Self-financing trades replicate flows over all “states of world” Risk-neutral distribution performs “stochastic discounting” to present Risk of loss is modeled as “hard constraint” Calibration to market by incorporating “constraints” “Risk neutral” valuation – “real probabilities” not required. Other risk models possible … dual objective is “distance to real distribution” Minimize price – funds the “worst case” state of world

Money Supply

Money Supply

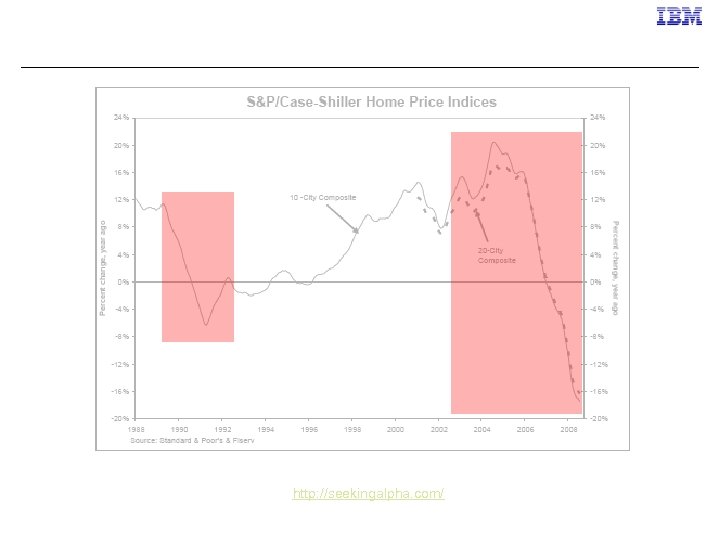

From http: //seekingalpha. com/

From http: //seekingalpha. com/

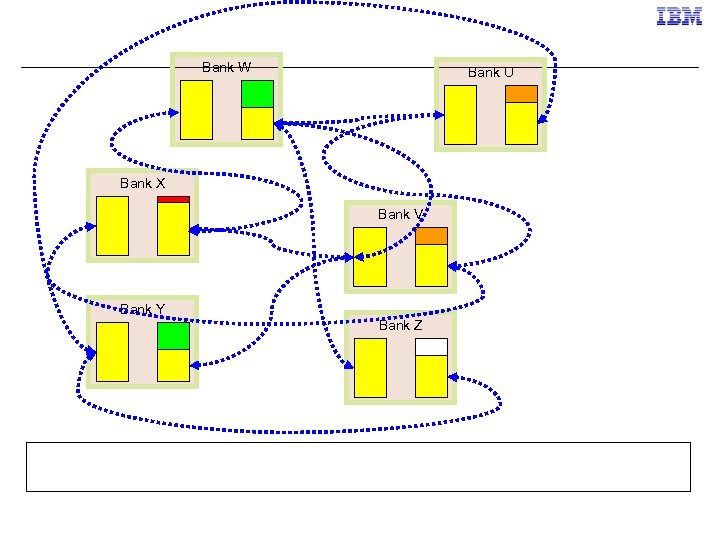

Bank W Bank U Bank X Bank V Bank Y Bank Z

Bank W Bank U Bank X Bank V Bank Y Bank Z

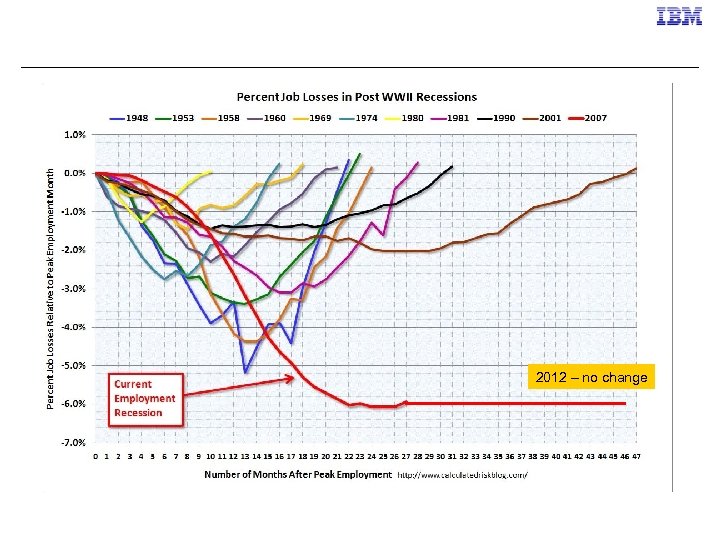

2012 – no change

2012 – no change

Risk-neutral distribution performs “stochastic discounting” to present Market valuation may be VERY far from fair valuation Implies bank is insolvent even though fair value is healthy Risk of loss is modeled as “hard constraint” Risk is only as good as forecast of “worst case”. Forecasts need to accommodate macroeconomic risks – STRESS TESTS Funding forecasted “worst case” may price you out of the market … unless all banks use the same forecasts.

Risk-neutral distribution performs “stochastic discounting” to present Market valuation may be VERY far from fair valuation Implies bank is insolvent even though fair value is healthy Risk of loss is modeled as “hard constraint” Risk is only as good as forecast of “worst case”. Forecasts need to accommodate macroeconomic risks – STRESS TESTS Funding forecasted “worst case” may price you out of the market … unless all banks use the same forecasts.

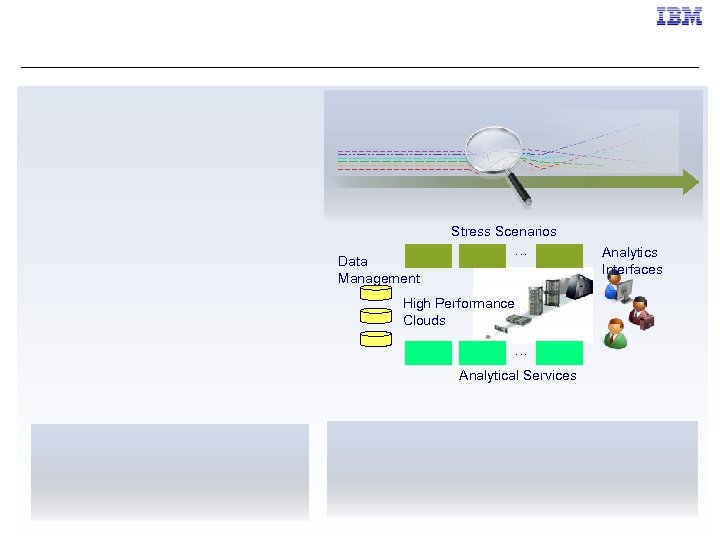

Data Management Stress Scenarios … High Performance Clouds … Analytical Services Analytics Interfaces

Data Management Stress Scenarios … High Performance Clouds … Analytical Services Analytics Interfaces