455c7d2950d7d6f43f3d15a821e98926.ppt

- Количество слайдов: 47

Pricing Techniques and Analysis Chapter 16 • Value-based more than cost-based pricing often helps build profits. • Firms charge different customers different prices, which is known as price discrimination. • This chapter also looks at pricing within a firm called transfer pricing. • Pricing techniques that are used by many multiproduct firms, such as full-cost pricing and target return pricing. 2002 South-Western Publishing Slide 1

Proactive Value-based Pricing • If the price doesn’t fit what customers are willing to pay, then the product may not be profitable. » Customer value is the focus for pricing, not just the costs associated with the product. » Apple Computer lost market share by ignoring this. » The Ford Mustang was a success, as Ford found that people wanted a sports car, but didn’t want it to be too expensive. The started with a price and designed the product. • The Mustang used value-based, not cost-plus pricing Slide 2

Differential Pricing • If at peak rush hour, the toll is higher than at the off-peak, we are using different prices at different time periods. • The peak toll can encourage shifting travel patterns to off-peak times or discourage some commuting altogether. • Differential pricing appears more frequently than one thinks. This we call price discrimination. Slide 3

Price Discrimination l Price Discrimination -- Goods which are NOT priced in proportion to their marginal cost, even though technically similar l Some Necessary Conditions: 1. Some Monopoly Power • In Perfect Competition, P = MC 2. Ability to Arbitrage • Separate Customers and Prevent Reselling Slide 4

Arbitrage - Buy Low to Sell Higher • Arbitrage of Goods is Easy » Price discrimination of goods is ineffective » Little price discrimination of grocery items • Arbitrage of Services is Difficult » Price discrimination of services is effective » Price discrimination at restaurants by age, a service » Lawyers charge different prices for wills, based on ability to pay Slide 5

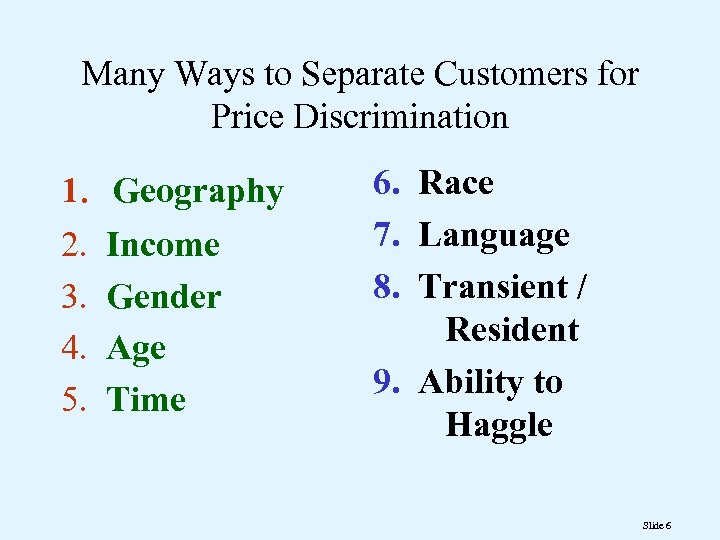

Many Ways to Separate Customers for Price Discrimination 1. 2. 3. 4. 5. Geography Income Gender Age Time 6. Race 7. Language 8. Transient / Resident 9. Ability to Haggle Slide 6

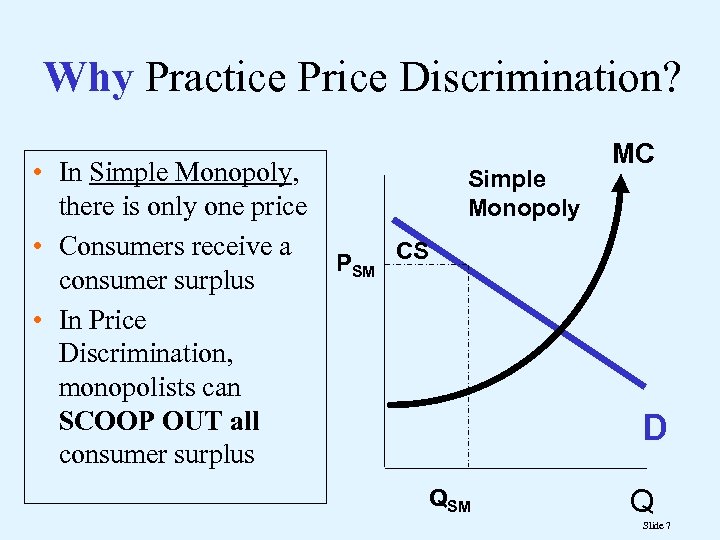

Why Practice Price Discrimination? • In Simple Monopoly, there is only one price • Consumers receive a PSM CS consumer surplus • In Price Discrimination, monopolists can SCOOP OUT all consumer surplus Simple Monopoly QSM MC D Q Slide 7

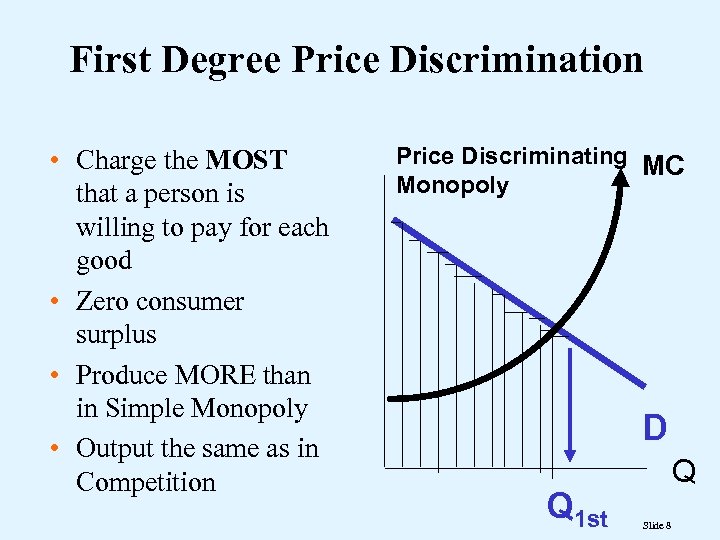

First Degree Price Discrimination • Charge the MOST that a person is willing to pay for each good • Zero consumer surplus • Produce MORE than in Simple Monopoly • Output the same as in Competition Price Discriminating MC Monopoly D Q 1 st Q Slide 8

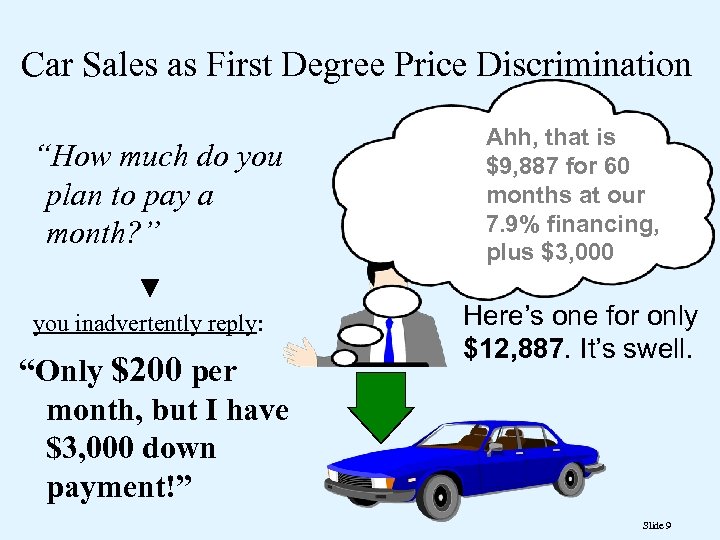

Car Sales as First Degree Price Discrimination “How much do you plan to pay a month? ” you inadvertently reply: “Only $200 per month, but I have $3, 000 down payment!” Ahh, that is $9, 887 for 60 months at our 7. 9% financing, plus $3, 000 Here’s one for only $12, 887. It’s swell. Slide 9

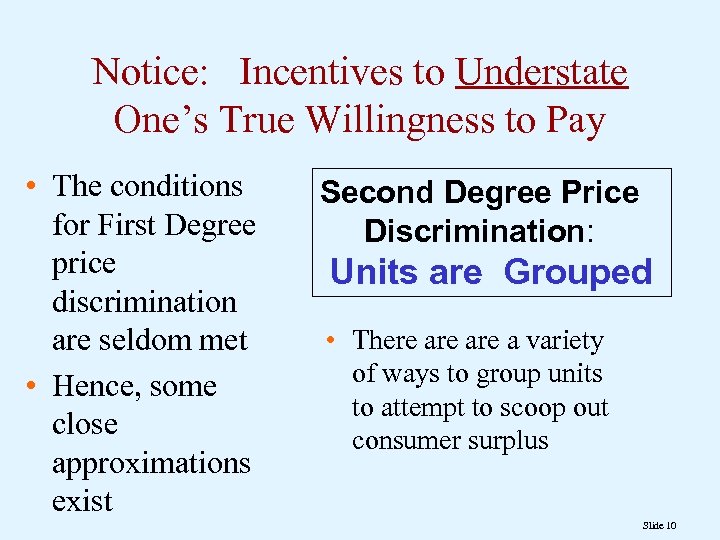

Notice: Incentives to Understate One’s True Willingness to Pay • The conditions for First Degree price discrimination are seldom met • Hence, some close approximations exist Second Degree Price Discrimination: Units are Grouped • There are a variety of ways to group units to attempt to scoop out consumer surplus Slide 10

Second Degree Price Discrimination Methods We look at four examples: • Block rate setting • Two part pricing • Unlimited access • Bundling methods Slide 11

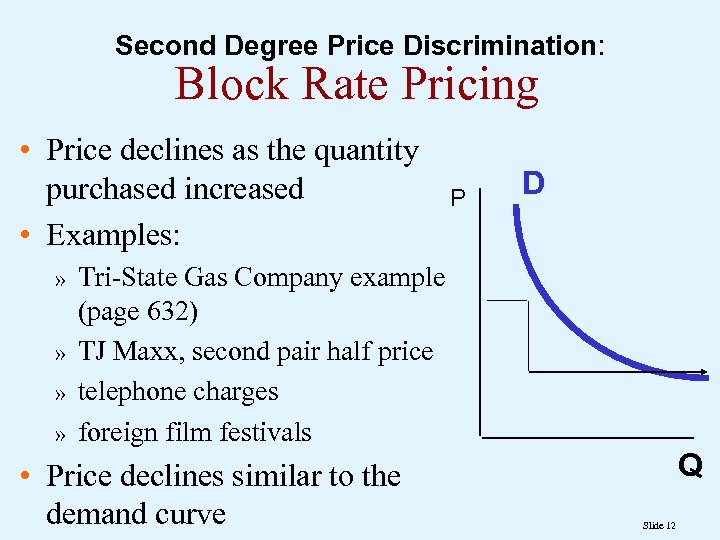

Second Degree Price Discrimination: Block Rate Pricing • Price declines as the quantity purchased increased • Examples: » » P D Tri-State Gas Company example (page 632) TJ Maxx, second pair half price telephone charges foreign film festivals • Price declines similar to the demand curve Q Slide 12

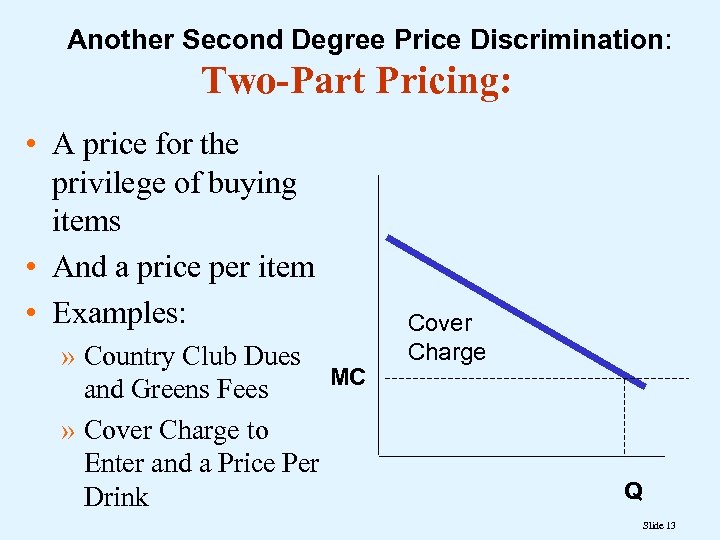

Another Second Degree Price Discrimination: Two-Part Pricing: • A price for the privilege of buying items • And a price per item • Examples: » Country Club Dues MC and Greens Fees » Cover Charge to Enter and a Price Per Drink Cover Charge Q Slide 13

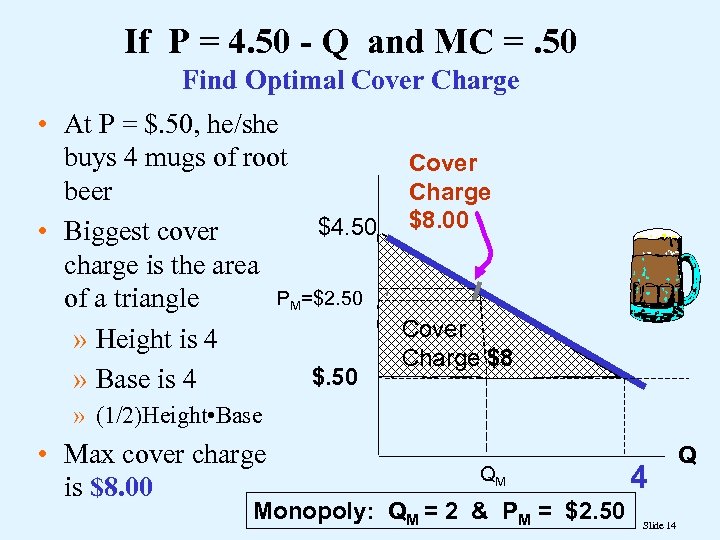

If P = 4. 50 - Q and MC =. 50 Find Optimal Cover Charge • At P = $. 50, he/she buys 4 mugs of root Cover Charge beer $4. 50 $8. 00 • Biggest cover charge is the area PM=$2. 50 of a triangle Cover » Height is 4 Charge $8 $. 50 » Base is 4 » (1/2)Height • Base • Max cover charge is $8. 00 QM Monopoly: QM = 2 & PM = $2. 50 4 Slide 14 Q

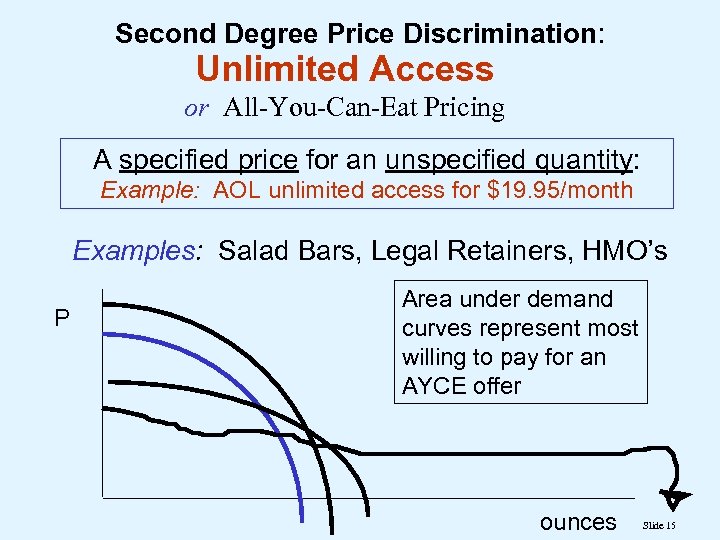

Second Degree Price Discrimination: Unlimited Access or All-You-Can-Eat Pricing A specified price for an unspecified quantity: Example: AOL unlimited access for $19. 95/month Examples: Salad Bars, Legal Retainers, HMO’s P Area under demand curves represent most willing to pay for an AYCE offer ounces Slide 15

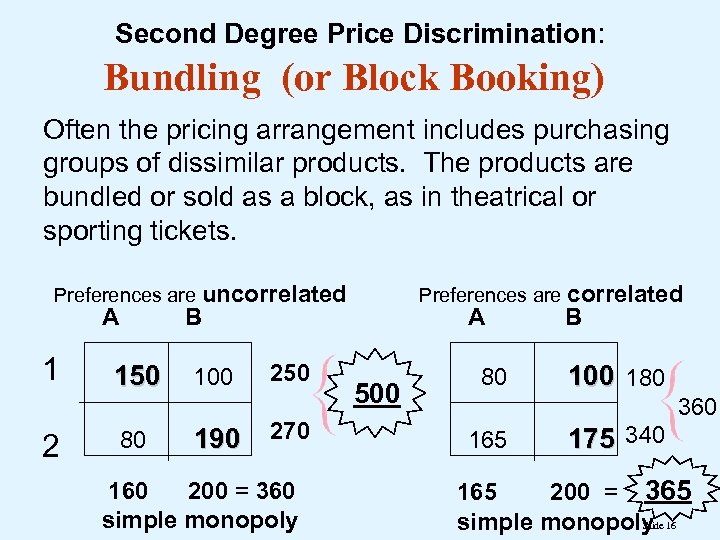

Second Degree Price Discrimination: Bundling (or Block Booking) Often the pricing arrangement includes purchasing groups of dissimilar products. The products are bundled or sold as a block, as in theatrical or sporting tickets. Preferences are uncorrelated A 1 2 Preferences are correlated B 150 80 100 190 250 270 160 200 = 360 simple monopoly A 500 80 B 100 180 360 165 175 340 165 200 = 365 Slide simple monopoly 16

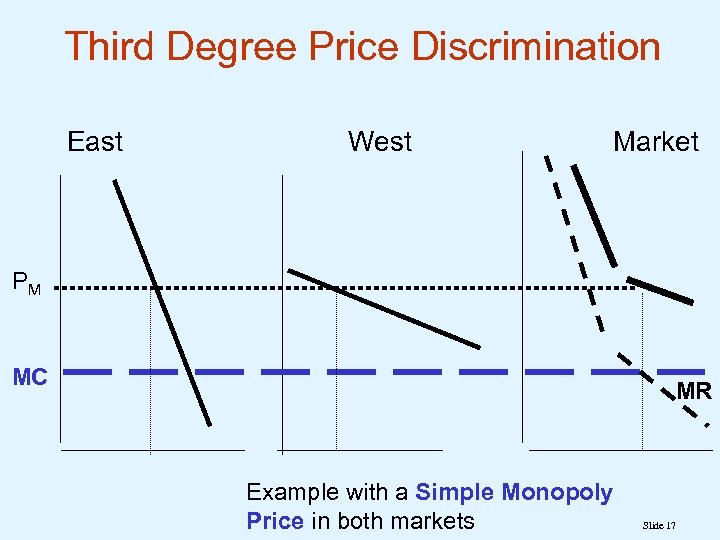

Third Degree Price Discrimination East West Market PM MC MR Example with a Simple Monopoly Price in both markets Slide 17

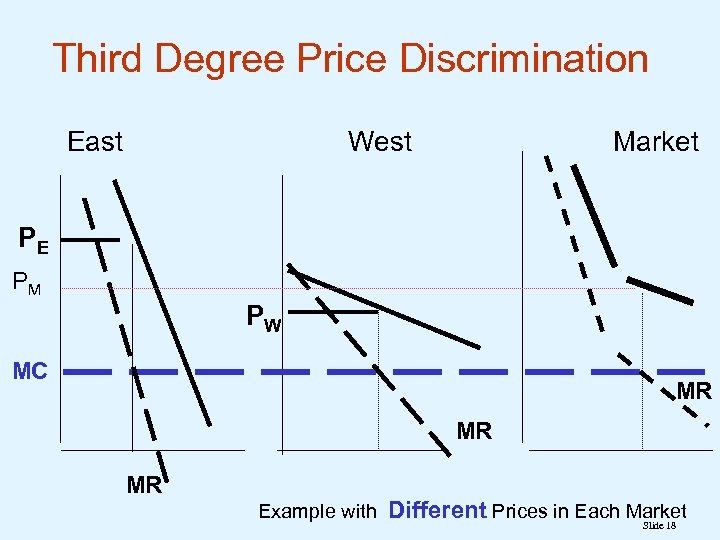

Third Degree Price Discrimination East West Market PE PM PW MC MR MR MR Example with Different Prices in Each Market Slide 18

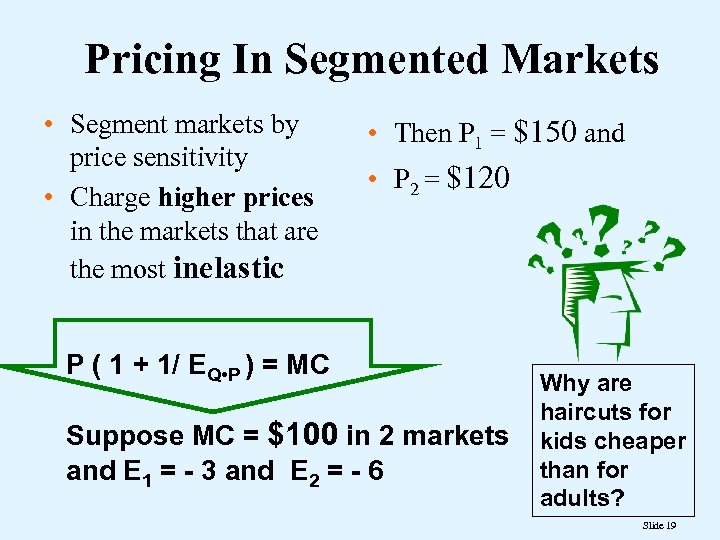

Pricing In Segmented Markets • Segment markets by price sensitivity • Charge higher prices in the markets that are the most inelastic • Then P 1 = $150 and • P 2 = $120 P ( 1 + 1/ EQ • P ) = MC Suppose MC = $100 in 2 markets and E 1 = - 3 and E 2 = - 6 Why are haircuts for kids cheaper than for adults? Slide 19

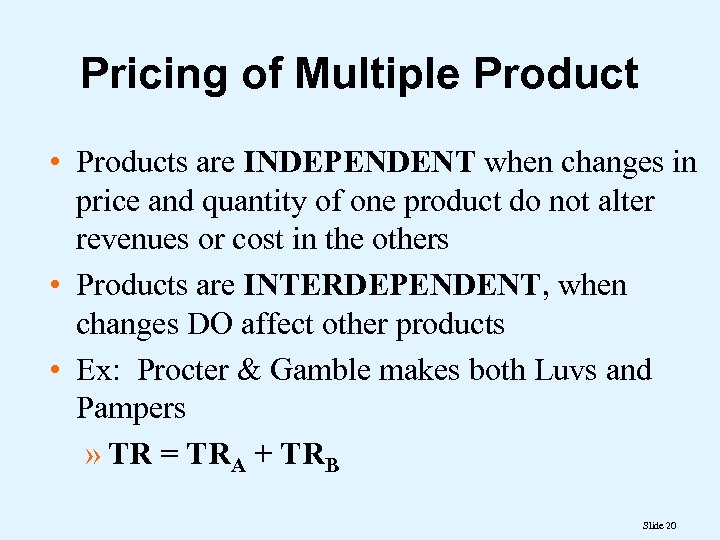

Pricing of Multiple Product • Products are INDEPENDENT when changes in price and quantity of one product do not alter revenues or cost in the others • Products are INTERDEPENDENT, when changes DO affect other products • Ex: Procter & Gamble makes both Luvs and Pampers » TR = TRA + TRB Slide 20

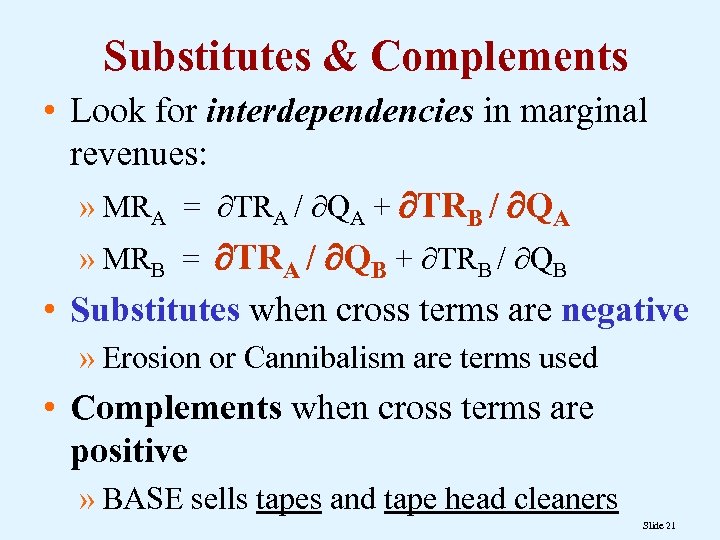

Substitutes & Complements • Look for interdependencies in marginal revenues: » MRA = TRA / QA + TRB / QA » MRB = TRA / QB + TRB / QB • Substitutes when cross terms are negative » Erosion or Cannibalism are terms used • Complements when cross terms are positive » BASE sells tapes and tape head cleaners Slide 21

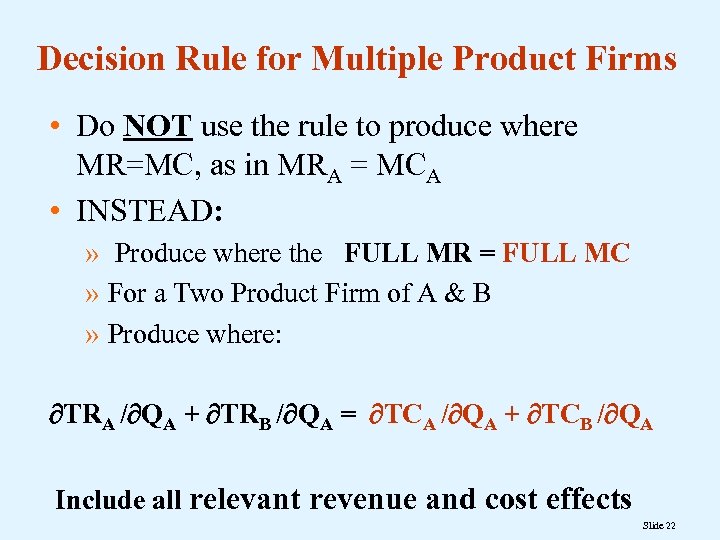

Decision Rule for Multiple Product Firms • Do NOT use the rule to produce where MR=MC, as in MRA = MCA • INSTEAD: » Produce where the FULL MR = FULL MC » For a Two Product Firm of A & B » Produce where: TRA / QA + TRB / QA = TCA / QA + TCB / QA Include all relevant revenue and cost effects Slide 22

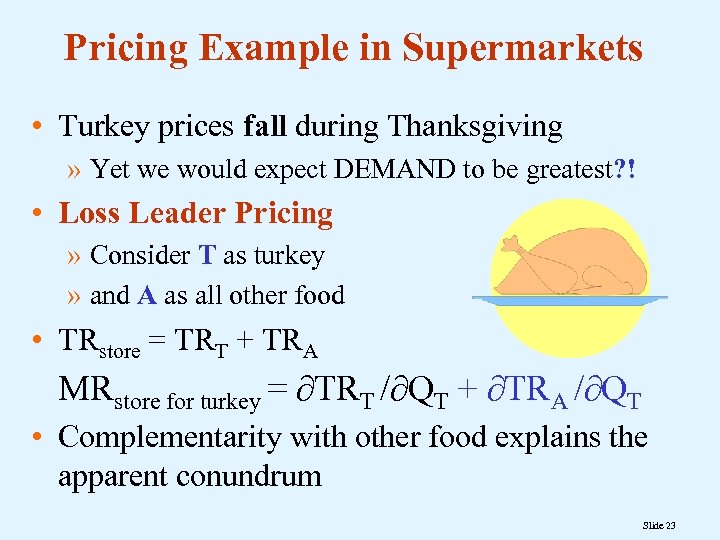

Pricing Example in Supermarkets • Turkey prices fall during Thanksgiving » Yet we would expect DEMAND to be greatest? ! • Loss Leader Pricing » Consider T as turkey » and A as all other food • TRstore = TRT + TRA MRstore for turkey = TRT / QT + TRA / QT • Complementarity with other food explains the apparent conundrum Slide 23

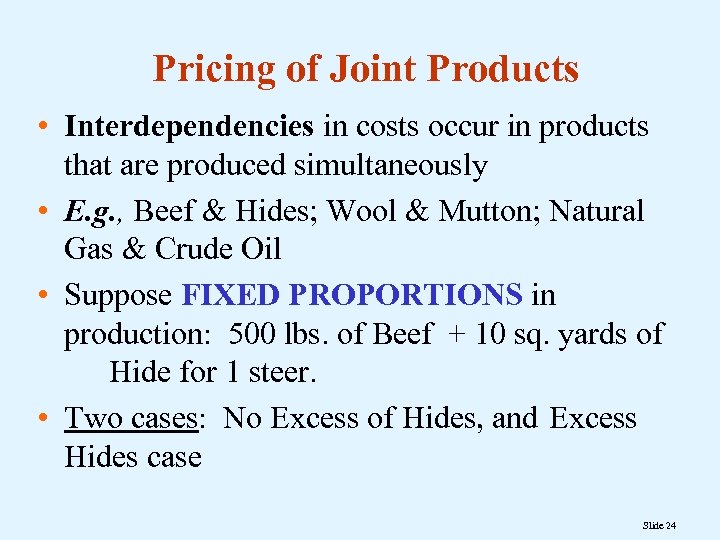

Pricing of Joint Products • Interdependencies in costs occur in products that are produced simultaneously • E. g. , Beef & Hides; Wool & Mutton; Natural Gas & Crude Oil • Suppose FIXED PROPORTIONS in production: 500 lbs. of Beef + 10 sq. yards of Hide for 1 steer. • Two cases: No Excess of Hides, and Excess Hides case Slide 24

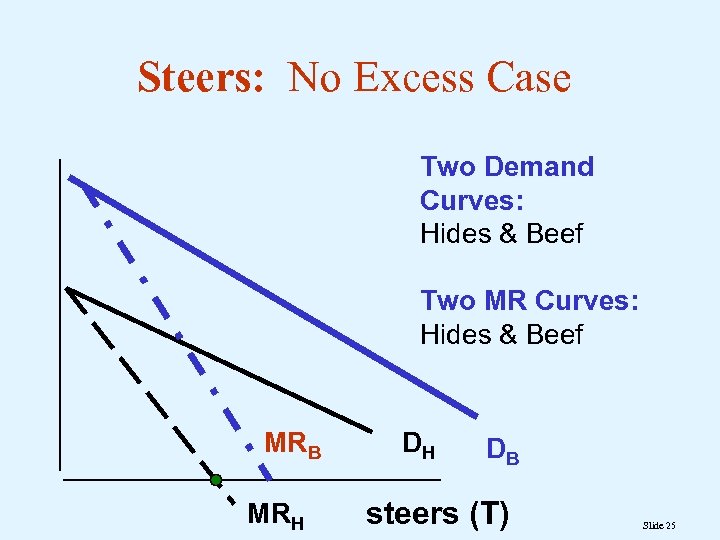

Steers: No Excess Case Two Demand Curves: Hides & Beef Two MR Curves: Hides & Beef MRB MRH DH DB steers (T) Slide 25

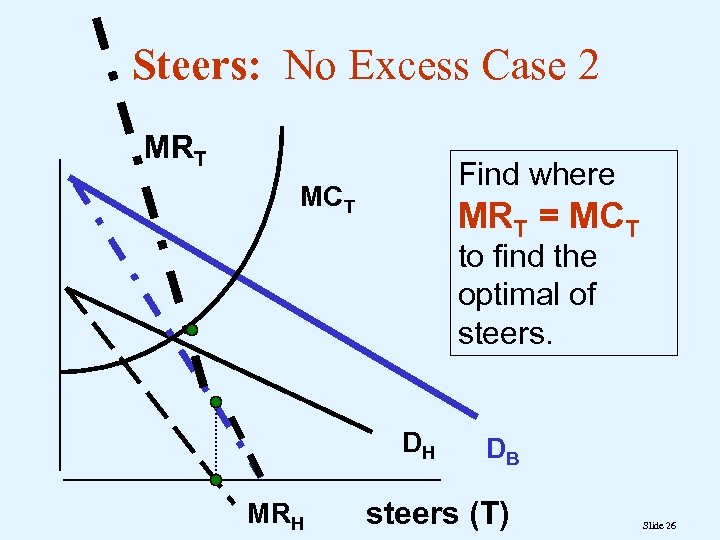

Steers: No Excess Case 2 MRT Find where MCT MRT = MCT to find the optimal of steers. DH MRH DB steers (T) Slide 26

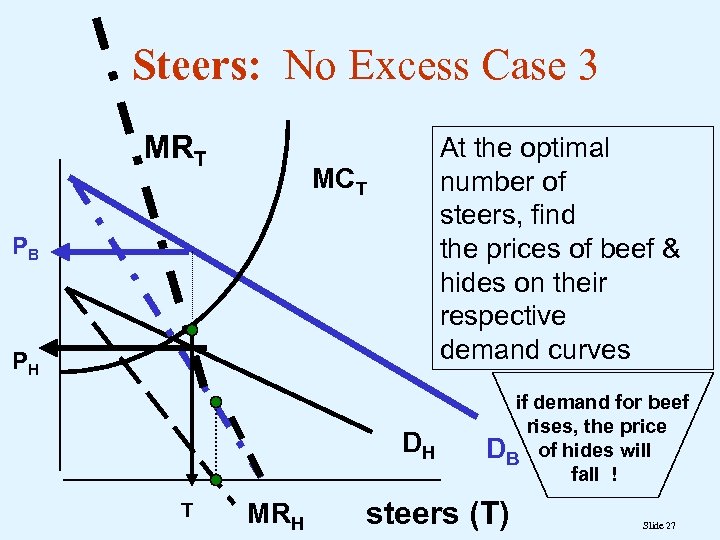

Steers: No Excess Case 3 MRT At the optimal number of steers, find the prices of beef & hides on their respective demand curves MCT PB PH DH T MRH if demand for beef rises, the price DB of hides will fall ! steers (T) Slide 27

Excess of One of the Joint Products • Excess means the price would be ZERO • The solution is to hold back some of the excess to reach the Unit Elastic Point on the Demand Curve. • This Maximizes Total Revenue. Slide 28

Multi-Divisional Firms and the Economics of Transfer Pricing serves two functions: 1. Measure of the marginal value of the resource 2. Provides a performance measures of resources used For international firms, transfer pricing may assist in reducing worldwide taxation, but the ability to reduce taxation is limited because the IRS requires arm’s length prices. Slide 29

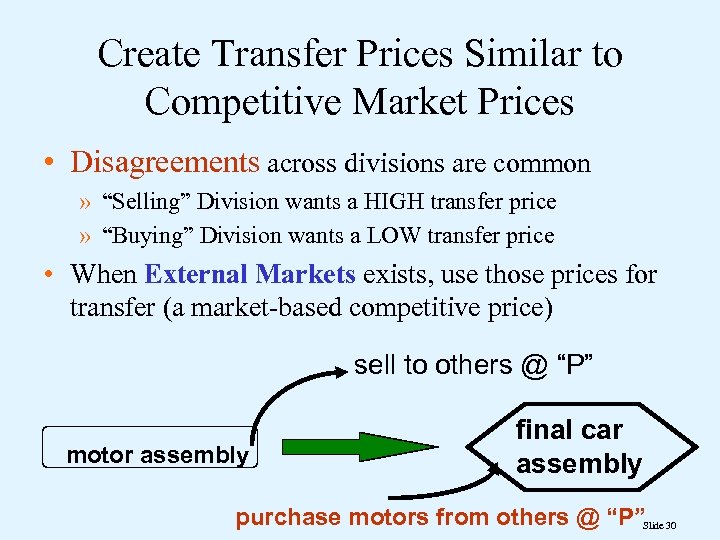

Create Transfer Prices Similar to Competitive Market Prices • Disagreements across divisions are common » “Selling” Division wants a HIGH transfer price » “Buying” Division wants a LOW transfer price • When External Markets exists, use those prices for transfer (a market-based competitive price) sell to others @ “P” motor assembly final car assembly purchase motors from others @ “P”Slide 30

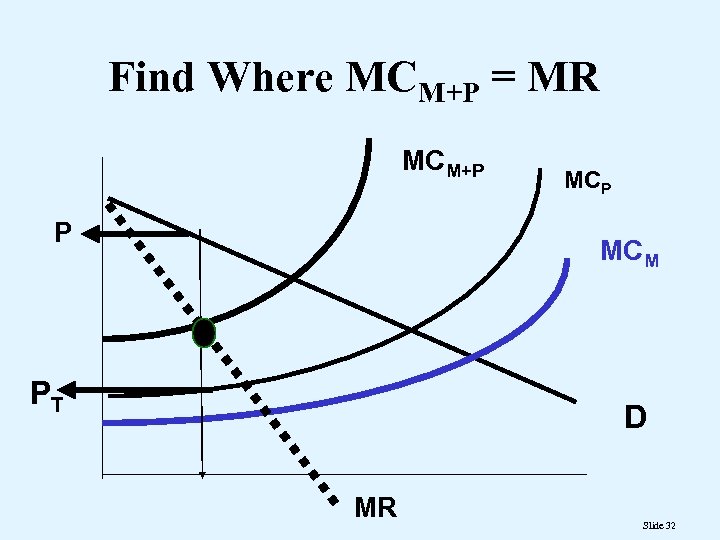

Transfer Pricing With No External Markets • When no external markets exist, use the MC of the transferred good. • Often, however, the MC is a function of output. • Marketing and Production steps (M & P) • Transfer price is PT = MC P on following figure Slide 31

Find Where MCM+P = MR MCM+P P MCM PT D MR Slide 32

Pricing in Practice • In practice, pricing strategy involves the whole life-cycle of the product. • Managers report wide use of cost-plus pricing methods because it: » Streamlines pricing of multiple products » Streamlines pricing of retail prices Slide 33

Cost-Plus and Full Cost Pricing P = ACn + Markup or P = ACn(1 + m) where ACn is average cost at a normal output and m is a percentage markup • Notice: Little reliance on MC pricing or use of elasticities, as in: P( 1 + 1/Ep ) = MC Slide 34

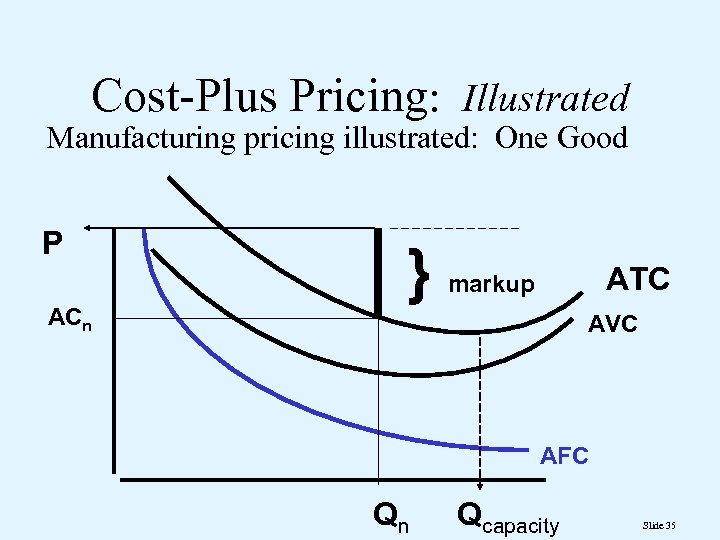

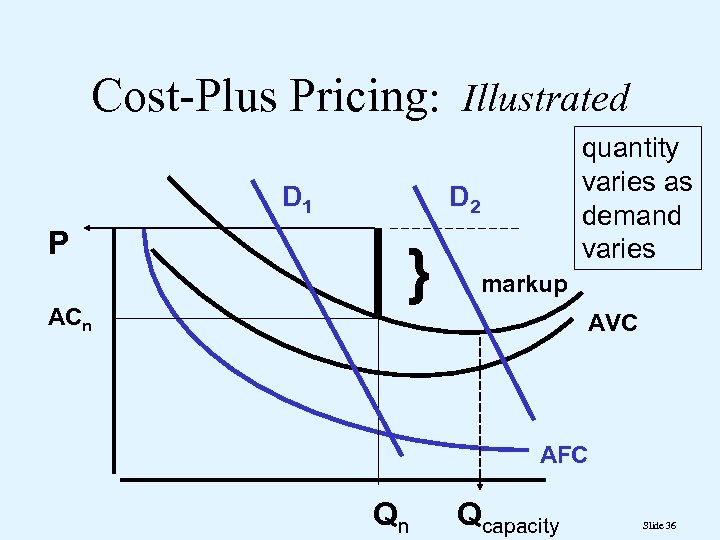

Cost-Plus Pricing: Illustrated Manufacturing pricing illustrated: One Good P ACn } ATC markup AVC AFC Qn Qcapacity Slide 35

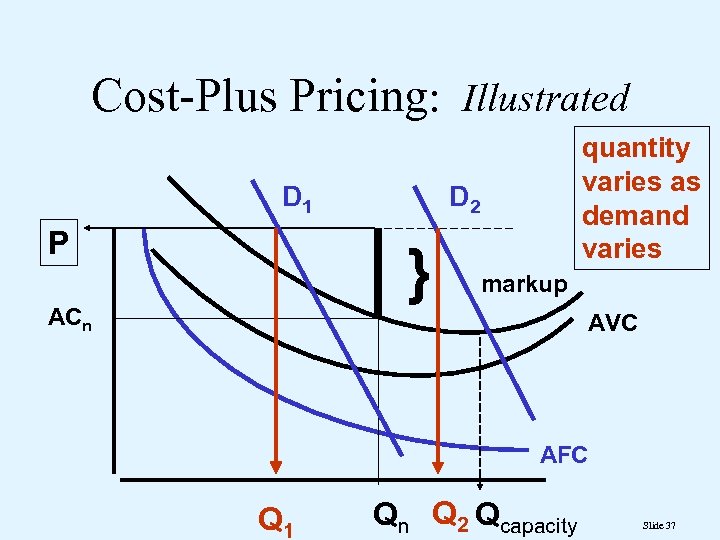

Cost-Plus Pricing: Illustrated D 1 P ACn quantity varies as demand varies D 2 } markup AVC AFC Qn Qcapacity Slide 36

Cost-Plus Pricing: Illustrated D 1 P D 2 } ACn quantity varies as demand varies markup AVC AFC Q 1 Qn Q 2 Qcapacity Slide 37

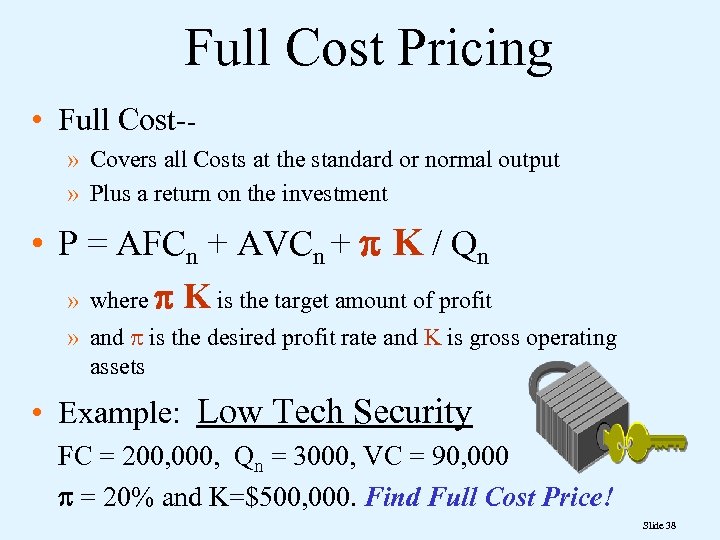

Full Cost Pricing • Full Cost-» Covers all Costs at the standard or normal output » Plus a return on the investment • P = AFCn + AVCn + p K / Qn » where p K is the target amount of profit » and p is the desired profit rate and K is gross operating assets • Example: Low Tech Security FC = 200, 000, Qn = 3000, VC = 90, 000 p = 20% and K=$500, 000. Find Full Cost Price! Slide 38

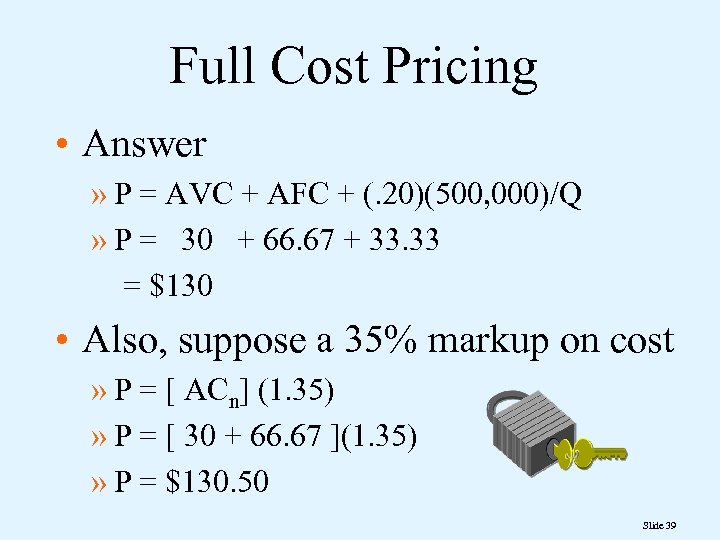

Full Cost Pricing • Answer » P = AVC + AFC + (. 20)(500, 000)/Q » P = 30 + 66. 67 + 33. 33 = $130 • Also, suppose a 35% markup on cost » P = [ ACn] (1. 35) » P = [ 30 + 66. 67 ](1. 35) » P = $130. 50 Slide 39

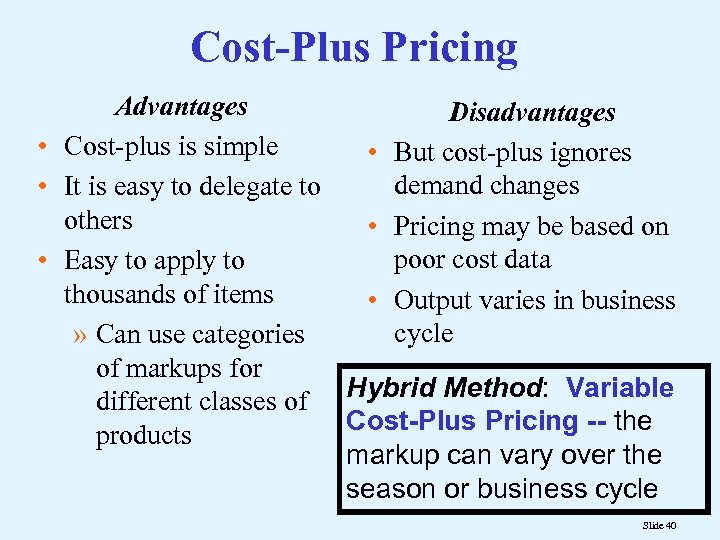

Cost-Plus Pricing Advantages Disadvantages • Cost-plus is simple • But cost-plus ignores demand changes • It is easy to delegate to others • Pricing may be based on poor cost data • Easy to apply to thousands of items • Output varies in business cycle » Can use categories of markups for different classes of Hybrid Method: Variable Cost-Plus Pricing -- the products markup can vary over the season or business cycle Slide 40

Optimal Markups in Practice • Grocery stores have • Demand is therefore low markups highly elastic • Many close substitutes -- • Optimal markup would at other grocery stores consequently be small (bread varieties and qualities are standardized) • Frequent purchase, so customers are knowledgeable about prices & quality 1999 South-Western College Publishing Slide 41

Markups on Jewelry • Jewelry Markups are known to be large • Difficult to make comparisons across jewelry stores • Little repeat purchases, so knowledge about prices is low • Consequently, lower price elasticity for jewelry • The optimal markup is larger 1999 South-Western College Publishing Slide 42

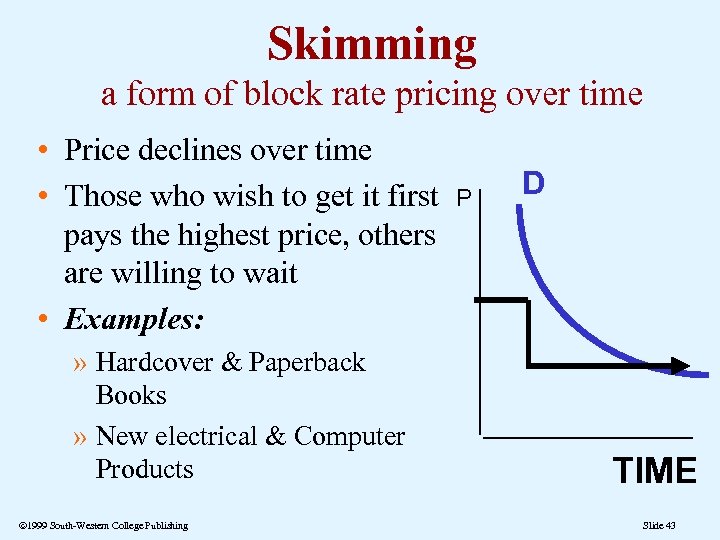

Skimming a form of block rate pricing over time • Price declines over time • Those who wish to get it first pays the highest price, others are willing to wait • Examples: » Hardcover & Paperback Books » New electrical & Computer Products 1999 South-Western College Publishing P D TIME Slide 43

Revenue Management: Appendix 16 A • Revenue Management is the problem of the disappearing inventory. • Managers must be flexible to change their predicted sales by market segment as information arrives. • Airlines price discriminates between business and non-business travelers. If too few business travelers have booked tickets compared to the amount expected, then more non-business tickets should be released. Slide 44

Optimal Overbooking • Managers may authorize reservation clerks to sell more seats (rooms) than are available. • The greater the overbooking, the lower are the costs of spoilage. • Spoilage is an inventory NOT sold. If capacity is large, an airline or hotel will have high spoilage. • The greater the overbooking, the greater are the costs of spillage, making customers unhappy by finding that they have no seat or reservation. Slide 45

Spillage • Spillage is the excess demand that cannot be met. • If the service industry has low capacity, the spillage will be great • Customers leave the hotel or airline unable to get a room or an airplane seat. Slide 46

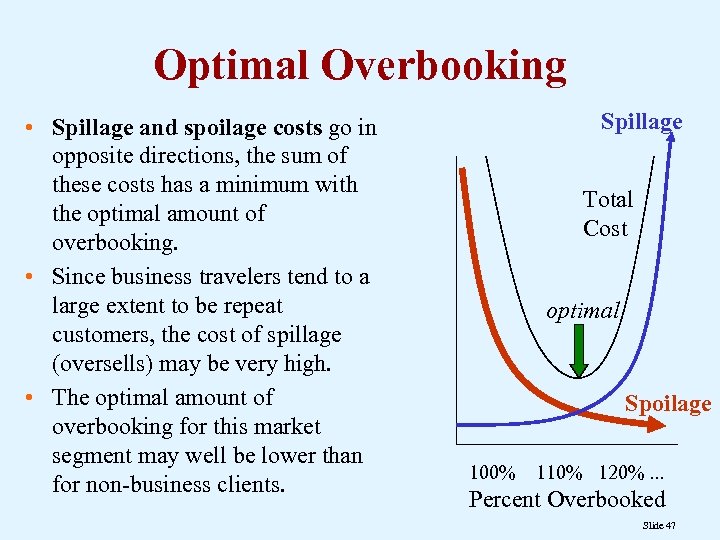

Optimal Overbooking • Spillage and spoilage costs go in opposite directions, the sum of these costs has a minimum with the optimal amount of overbooking. • Since business travelers tend to a large extent to be repeat customers, the cost of spillage (oversells) may be very high. • The optimal amount of overbooking for this market segment may well be lower than for non-business clients. Spillage Total Cost optimal Spoilage 100% 110% 120%. . . Percent Overbooked Slide 47

455c7d2950d7d6f43f3d15a821e98926.ppt