0c0ccf0312e4af359b4aa18d4b21118d.ppt

- Количество слайдов: 26

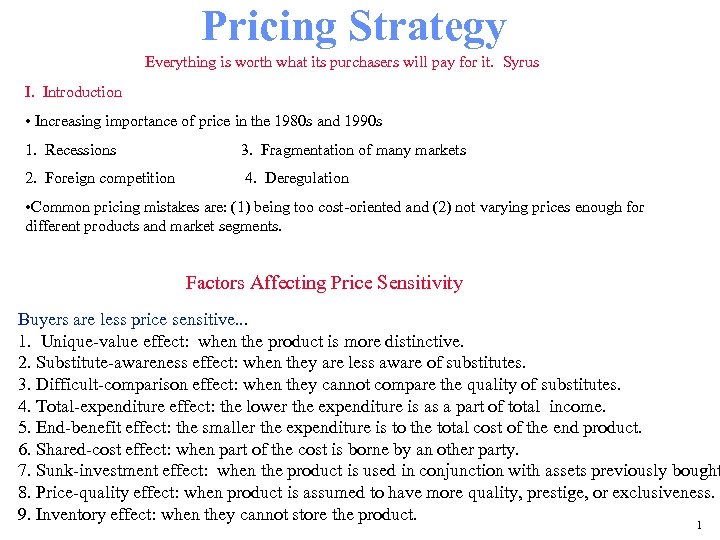

Pricing Strategy Everything is worth what its purchasers will pay for it. Syrus I. Introduction • Increasing importance of price in the 1980 s and 1990 s 1. Recessions 3. Fragmentation of many markets 2. Foreign competition 4. Deregulation • Common pricing mistakes are: (1) being too cost-oriented and (2) not varying prices enough for different products and market segments. Factors Affecting Price Sensitivity Buyers are less price sensitive. . . 1. Unique-value effect: when the product is more distinctive. 2. Substitute-awareness effect: when they are less aware of substitutes. 3. Difficult-comparison effect: when they cannot compare the quality of substitutes. 4. Total-expenditure effect: the lower the expenditure is as a part of total income. 5. End-benefit effect: the smaller the expenditure is to the total cost of the end product. 6. Shared-cost effect: when part of the cost is borne by an other party. 7. Sunk-investment effect: when the product is used in conjunction with assets previously bought 8. Price-quality effect: when product is assumed to have more quality, prestige, or exclusiveness. 9. Inventory effect: when they cannot store the product. 1

Pricing Strategy Everything is worth what its purchasers will pay for it. Syrus I. Introduction • Increasing importance of price in the 1980 s and 1990 s 1. Recessions 3. Fragmentation of many markets 2. Foreign competition 4. Deregulation • Common pricing mistakes are: (1) being too cost-oriented and (2) not varying prices enough for different products and market segments. Factors Affecting Price Sensitivity Buyers are less price sensitive. . . 1. Unique-value effect: when the product is more distinctive. 2. Substitute-awareness effect: when they are less aware of substitutes. 3. Difficult-comparison effect: when they cannot compare the quality of substitutes. 4. Total-expenditure effect: the lower the expenditure is as a part of total income. 5. End-benefit effect: the smaller the expenditure is to the total cost of the end product. 6. Shared-cost effect: when part of the cost is borne by an other party. 7. Sunk-investment effect: when the product is used in conjunction with assets previously bought 8. Price-quality effect: when product is assumed to have more quality, prestige, or exclusiveness. 9. Inventory effect: when they cannot store the product. 1

Marketing Objectives that Affect Pricing Decisions Survival Low Prices to Cover Variable Costs and Some Fixed Costs to Stay in Business. Current Profit Maximization Marketing Choose the Price that Produces the Maximum Current Profit, Cash Flow or ROI. Objectives Market Share Leadership Low as Possible Prices to Become the Market Share Leader. Product Quality Leadership High Prices to Cover Higher Performance Quality and R & D. 2

Marketing Objectives that Affect Pricing Decisions Survival Low Prices to Cover Variable Costs and Some Fixed Costs to Stay in Business. Current Profit Maximization Marketing Choose the Price that Produces the Maximum Current Profit, Cash Flow or ROI. Objectives Market Share Leadership Low as Possible Prices to Become the Market Share Leader. Product Quality Leadership High Prices to Cover Higher Performance Quality and R & D. 2

3

3

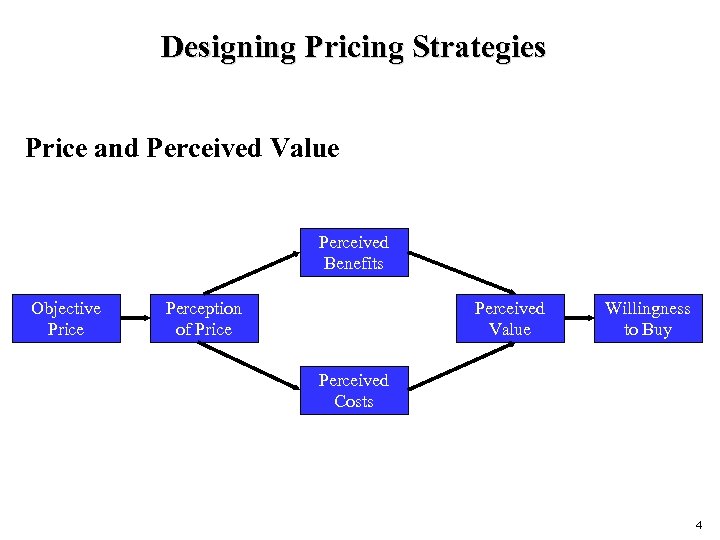

Designing Pricing Strategies Price and Perceived Value Perceived Benefits Objective Price Perception of Price Perceived Value Willingness to Buy Perceived Costs 4

Designing Pricing Strategies Price and Perceived Value Perceived Benefits Objective Price Perception of Price Perceived Value Willingness to Buy Perceived Costs 4

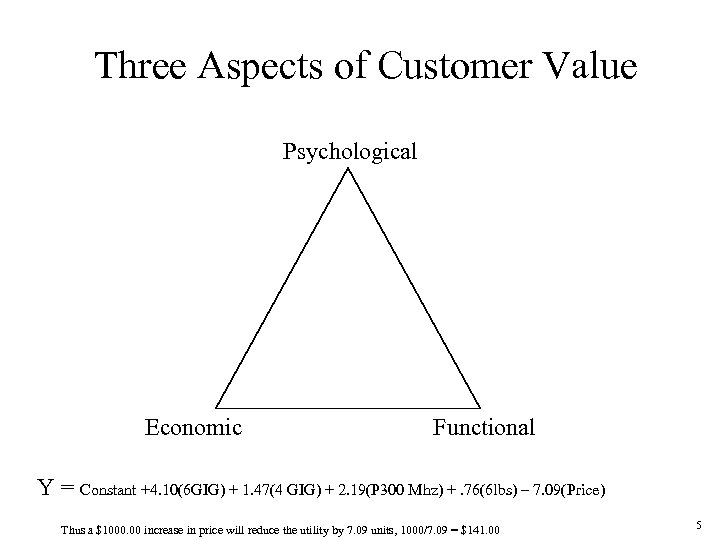

Three Aspects of Customer Value Psychological Economic Functional Y = Constant +4. 10(6 GIG) + 1. 47(4 GIG) + 2. 19(P 300 Mhz) +. 76(6 lbs) – 7. 09(Price) Thus a $1000. 00 increase in price will reduce the utility by 7. 09 units, 1000/7. 09 = $141. 00 5

Three Aspects of Customer Value Psychological Economic Functional Y = Constant +4. 10(6 GIG) + 1. 47(4 GIG) + 2. 19(P 300 Mhz) +. 76(6 lbs) – 7. 09(Price) Thus a $1000. 00 increase in price will reduce the utility by 7. 09 units, 1000/7. 09 = $141. 00 5

Designing Pricing Strategies How do I go about setting the right price for products and services? Price is determined by what the consumer will pay, not what the product cost to manufacture, distribute, and promote. The buying situation or context as well as the core dimension of product determine what a consumer is willing to pay. For example, consumers are willing to pay much more for a hot dog they buy at a sporting event than for a hot dog they buy from a local grocery store. They are willing to pay more for clothing they buy at Nordstrom than for clothing they buy at Wal-Mart. They pay more for “hot” items like Tickle-Me Elmo dolls than they should. They want to purchase expensive perfume for gifts and for themselves rather than cheap perfume even though the cost of manufacturing is not much different. To price correctly, you must understand the buying situation and the heart of the consumer. 6

Designing Pricing Strategies How do I go about setting the right price for products and services? Price is determined by what the consumer will pay, not what the product cost to manufacture, distribute, and promote. The buying situation or context as well as the core dimension of product determine what a consumer is willing to pay. For example, consumers are willing to pay much more for a hot dog they buy at a sporting event than for a hot dog they buy from a local grocery store. They are willing to pay more for clothing they buy at Nordstrom than for clothing they buy at Wal-Mart. They pay more for “hot” items like Tickle-Me Elmo dolls than they should. They want to purchase expensive perfume for gifts and for themselves rather than cheap perfume even though the cost of manufacturing is not much different. To price correctly, you must understand the buying situation and the heart of the consumer. 6

Designing Pricing Strategies How do I go about setting the right price for products and services? Learning Points • Price is like a thermometer in that the higher we can push the price, the better job we have done with uncovering consumer needs and designing the marketing mix. • It doesn’t take any marketing skill to sell a product at a “fire sale” price. Marketers earn their keep by getting a premium price for products and services. • Reference price is an important concept in pricing strategy. There is an external reference price—what everyone else is paying for the product—and an internal reference price—what you think you should pay given your past experience and the buying situation. • There are four basic pricing approaches—cost plus, value-in-use, penetration, and skimming, but ultimately price depends on core, context, and how well you’ve done the rest of your marketing. • Price is the most abstract of any of the four marketing mix elements. It is a signal of product quality and status. It is inherently subjective and tied to consumer perceptions rather than objective reality. 7

Designing Pricing Strategies How do I go about setting the right price for products and services? Learning Points • Price is like a thermometer in that the higher we can push the price, the better job we have done with uncovering consumer needs and designing the marketing mix. • It doesn’t take any marketing skill to sell a product at a “fire sale” price. Marketers earn their keep by getting a premium price for products and services. • Reference price is an important concept in pricing strategy. There is an external reference price—what everyone else is paying for the product—and an internal reference price—what you think you should pay given your past experience and the buying situation. • There are four basic pricing approaches—cost plus, value-in-use, penetration, and skimming, but ultimately price depends on core, context, and how well you’ve done the rest of your marketing. • Price is the most abstract of any of the four marketing mix elements. It is a signal of product quality and status. It is inherently subjective and tied to consumer perceptions rather than objective reality. 7

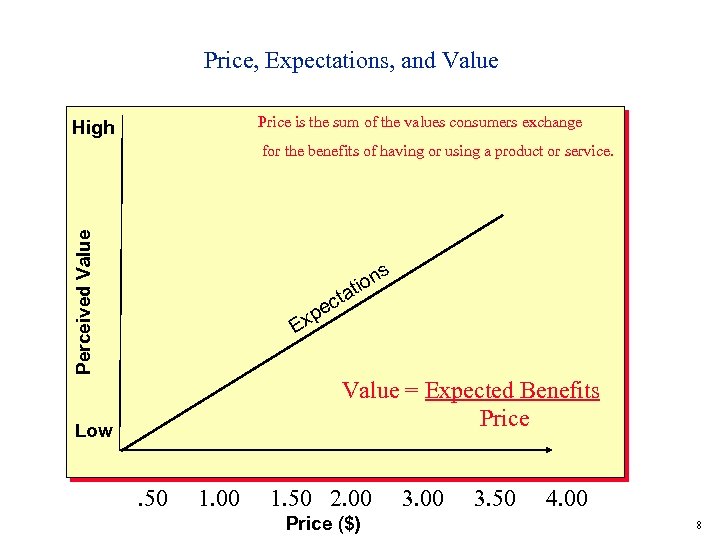

Price, Expectations, and Value Price is the sum of the values consumers exchange High Perceived Value for the benefits of having or using a product or service. s n tio ta Ex c pe Value = Expected Benefits Price Low . 50 1. 00 1. 50 2. 00 Price ($) 3. 00 3. 50 4. 00 8

Price, Expectations, and Value Price is the sum of the values consumers exchange High Perceived Value for the benefits of having or using a product or service. s n tio ta Ex c pe Value = Expected Benefits Price Low . 50 1. 00 1. 50 2. 00 Price ($) 3. 00 3. 50 4. 00 8

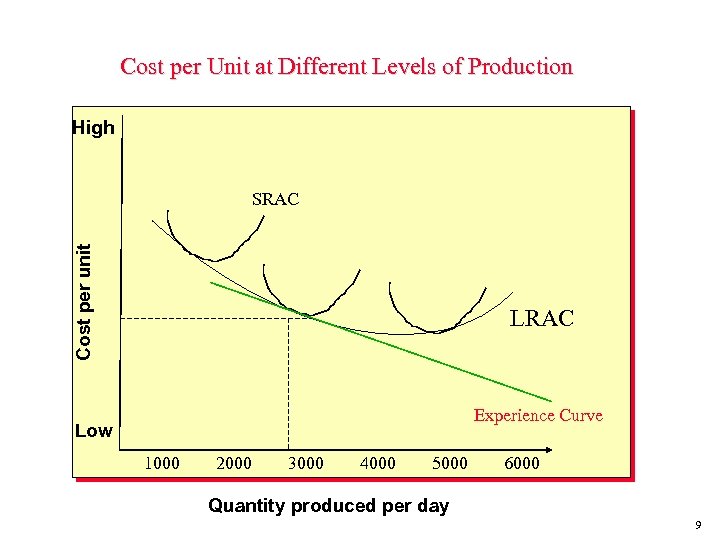

Cost per Unit at Different Levels of Production High Cost per unit SRAC LRAC Experience Curve Low 1000 2000 3000 4000 5000 6000 Quantity produced per day 9

Cost per Unit at Different Levels of Production High Cost per unit SRAC LRAC Experience Curve Low 1000 2000 3000 4000 5000 6000 Quantity produced per day 9

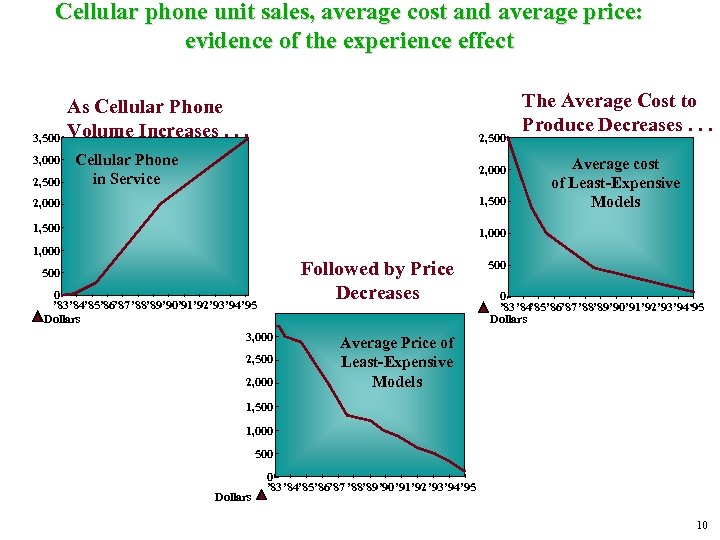

Cellular phone unit sales, average cost and average price: evidence of the experience effect 3, 500 3, 000 2, 500 As Cellular Phone Volume Increases. . . 2, 500 Cellular Phone in Service 2, 000 1, 500 The Average Cost to Produce Decreases. . . Average cost of Least-Expensive Models 1, 000 500 0 ’ 83’ 84’ 85’ 86’ 87 ’ 88’ 89’ 90’ 91’ 92’ 93’ 94’ 95 Dollars 3, 000 2, 500 2, 000 Followed by Price Decreases 500 0 ’ 83’ 84’ 85’ 86’ 87 ’ 88’ 89’ 90’ 91’ 92’ 93’ 94’ 95 Dollars Average Price of Least-Expensive Models 1, 500 1, 000 500 Dollars 0 ’ 83’ 84’ 85’ 86’ 87 ’ 88’ 89’ 90’ 91’ 92’ 93’ 94’ 95 10

Cellular phone unit sales, average cost and average price: evidence of the experience effect 3, 500 3, 000 2, 500 As Cellular Phone Volume Increases. . . 2, 500 Cellular Phone in Service 2, 000 1, 500 The Average Cost to Produce Decreases. . . Average cost of Least-Expensive Models 1, 000 500 0 ’ 83’ 84’ 85’ 86’ 87 ’ 88’ 89’ 90’ 91’ 92’ 93’ 94’ 95 Dollars 3, 000 2, 500 2, 000 Followed by Price Decreases 500 0 ’ 83’ 84’ 85’ 86’ 87 ’ 88’ 89’ 90’ 91’ 92’ 93’ 94’ 95 Dollars Average Price of Least-Expensive Models 1, 500 1, 000 500 Dollars 0 ’ 83’ 84’ 85’ 86’ 87 ’ 88’ 89’ 90’ 91’ 92’ 93’ 94’ 95 10

Setting the Price--Six Steps 1. Selecting the pricing objective 2. Determining demand 3. Estimating costs 4. Analyzing competitors’ costs, prices, and offers 5. Selecting a pricing method 6. Selecting final price 11

Setting the Price--Six Steps 1. Selecting the pricing objective 2. Determining demand 3. Estimating costs 4. Analyzing competitors’ costs, prices, and offers 5. Selecting a pricing method 6. Selecting final price 11

Nine Price/Quality Strategies Price High Premium strategy Product Quality Medium Overcharging strategy Low Rip-off strategy Medium High-value strategy Low Super-value strategy Medium-value strategy Good-value strategy False economy strategy Economy strategy 12

Nine Price/Quality Strategies Price High Premium strategy Product Quality Medium Overcharging strategy Low Rip-off strategy Medium High-value strategy Low Super-value strategy Medium-value strategy Good-value strategy False economy strategy Economy strategy 12

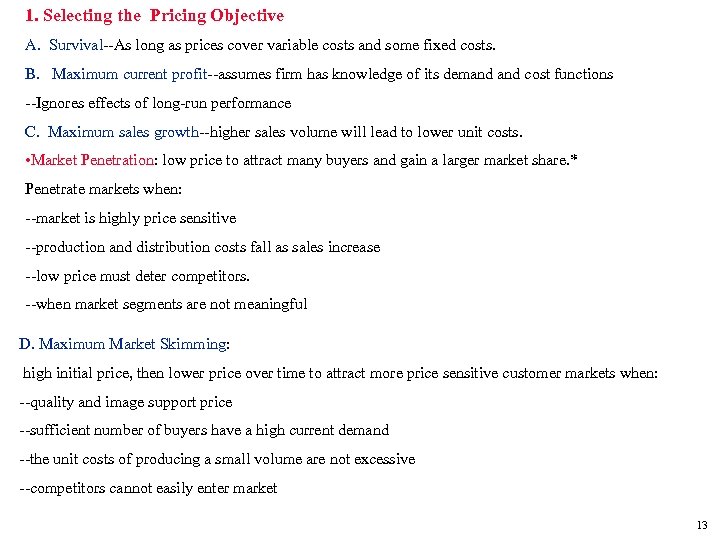

1. Selecting the Pricing Objective A. Survival--As long as prices cover variable costs and some fixed costs. B. Maximum current profit--assumes firm has knowledge of its demand cost functions --Ignores effects of long-run performance C. Maximum sales growth--higher sales volume will lead to lower unit costs. • Market Penetration: low price to attract many buyers and gain a larger market share. * Penetrate markets when: --market is highly price sensitive --production and distribution costs fall as sales increase --low price must deter competitors. --when market segments are not meaningful D. Maximum Market Skimming: high initial price, then lower price over time to attract more price sensitive customer markets when: --quality and image support price --sufficient number of buyers have a high current demand --the unit costs of producing a small volume are not excessive --competitors cannot easily enter market 13

1. Selecting the Pricing Objective A. Survival--As long as prices cover variable costs and some fixed costs. B. Maximum current profit--assumes firm has knowledge of its demand cost functions --Ignores effects of long-run performance C. Maximum sales growth--higher sales volume will lead to lower unit costs. • Market Penetration: low price to attract many buyers and gain a larger market share. * Penetrate markets when: --market is highly price sensitive --production and distribution costs fall as sales increase --low price must deter competitors. --when market segments are not meaningful D. Maximum Market Skimming: high initial price, then lower price over time to attract more price sensitive customer markets when: --quality and image support price --sufficient number of buyers have a high current demand --the unit costs of producing a small volume are not excessive --competitors cannot easily enter market 13

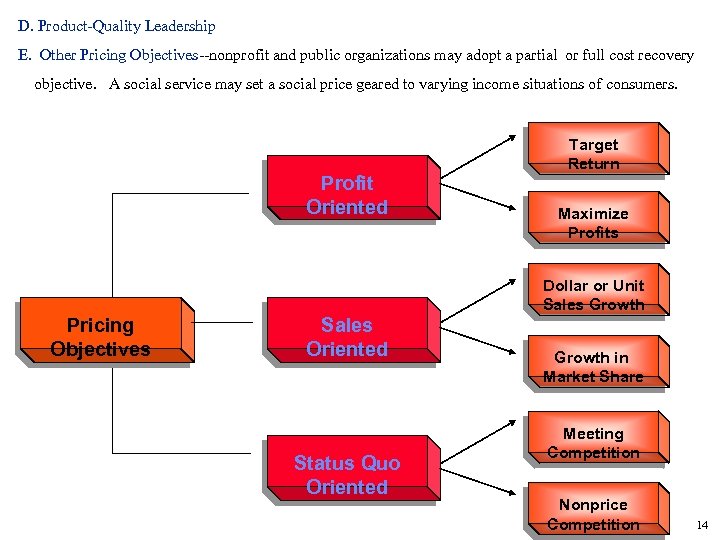

D. Product-Quality Leadership E. Other Pricing Objectives--nonprofit and public organizations may adopt a partial or full cost recovery objective. A social service may set a social price geared to varying income situations of consumers. Profit Oriented Target Return Maximize Profits Dollar or Unit Sales Growth Pricing Objectives Sales Oriented Status Quo Oriented Growth in Market Share Meeting Competition Nonprice Competition 14

D. Product-Quality Leadership E. Other Pricing Objectives--nonprofit and public organizations may adopt a partial or full cost recovery objective. A social service may set a social price geared to varying income situations of consumers. Profit Oriented Target Return Maximize Profits Dollar or Unit Sales Growth Pricing Objectives Sales Oriented Status Quo Oriented Growth in Market Share Meeting Competition Nonprice Competition 14

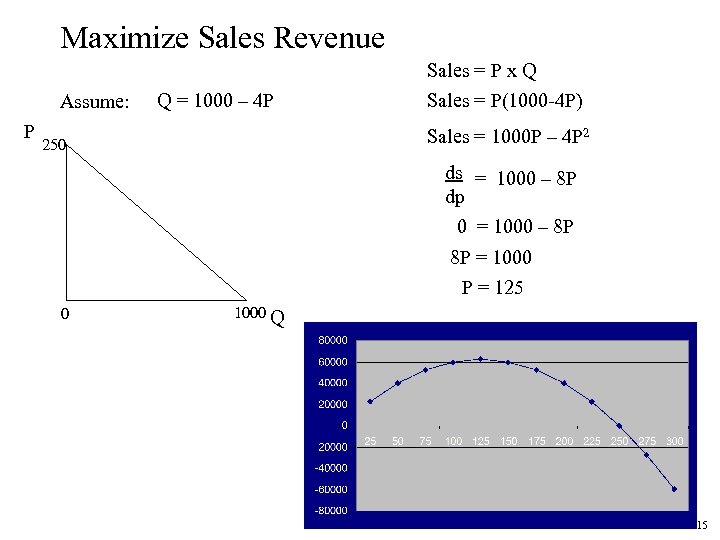

Maximize Sales Revenue Assume: P Q = 1000 – 4 P Sales = P x Q Sales = P(1000 -4 P) Sales = 1000 P – 4 P 2 250 ds = 1000 – 8 P dp 0 = 1000 – 8 P 8 P = 1000 P = 125 0 1000 Q 15

Maximize Sales Revenue Assume: P Q = 1000 – 4 P Sales = P x Q Sales = P(1000 -4 P) Sales = 1000 P – 4 P 2 250 ds = 1000 – 8 P dp 0 = 1000 – 8 P 8 P = 1000 P = 125 0 1000 Q 15

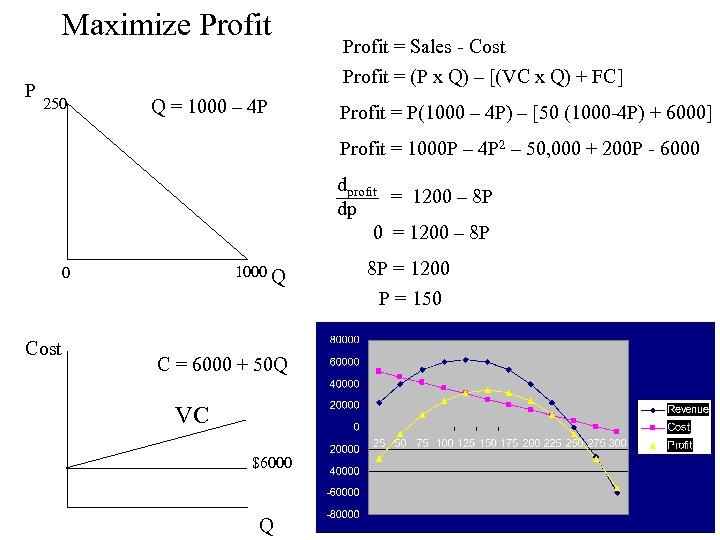

Maximize Profit P 250 Q = 1000 – 4 P Profit = Sales - Cost Profit = (P x Q) – [(VC x Q) + FC] Profit = P(1000 – 4 P) – [50 (1000 -4 P) + 6000] Profit = 1000 P – 4 P 2 – 50, 000 + 200 P - 6000 dprofit = 1200 – 8 P dp 0 = 1200 – 8 P 1000 Q 0 Cost 8 P = 1200 P = 150 C = 6000 + 50 Q VC $6000 Q 16

Maximize Profit P 250 Q = 1000 – 4 P Profit = Sales - Cost Profit = (P x Q) – [(VC x Q) + FC] Profit = P(1000 – 4 P) – [50 (1000 -4 P) + 6000] Profit = 1000 P – 4 P 2 – 50, 000 + 200 P - 6000 dprofit = 1200 – 8 P dp 0 = 1200 – 8 P 1000 Q 0 Cost 8 P = 1200 P = 150 C = 6000 + 50 Q VC $6000 Q 16

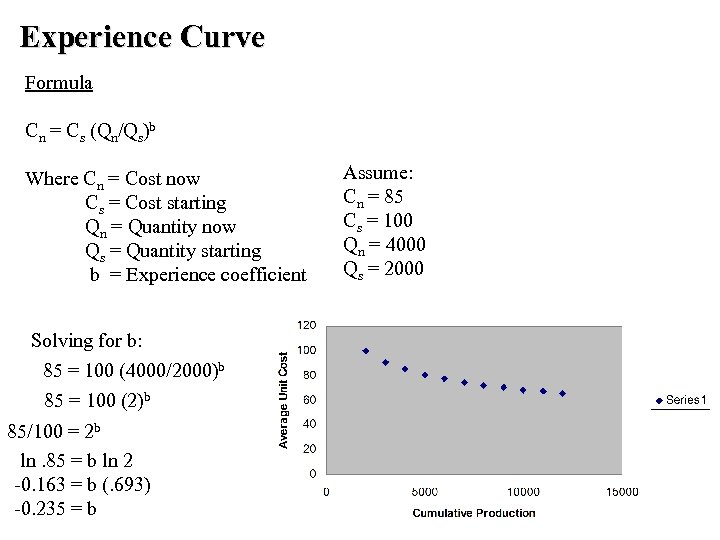

Experience Curve Formula Cn = Cs (Qn/Qs)b Where Cn = Cost now Cs = Cost starting Qn = Quantity now Qs = Quantity starting b = Experience coefficient Assume: Cn = 85 Cs = 100 Qn = 4000 Qs = 2000 Solving for b: 85 = 100 (4000/2000)b 85 = 100 (2)b 85/100 = 2 b ln. 85 = b ln 2 -0. 163 = b (. 693) -0. 235 = b 17

Experience Curve Formula Cn = Cs (Qn/Qs)b Where Cn = Cost now Cs = Cost starting Qn = Quantity now Qs = Quantity starting b = Experience coefficient Assume: Cn = 85 Cs = 100 Qn = 4000 Qs = 2000 Solving for b: 85 = 100 (4000/2000)b 85 = 100 (2)b 85/100 = 2 b ln. 85 = b ln 2 -0. 163 = b (. 693) -0. 235 = b 17

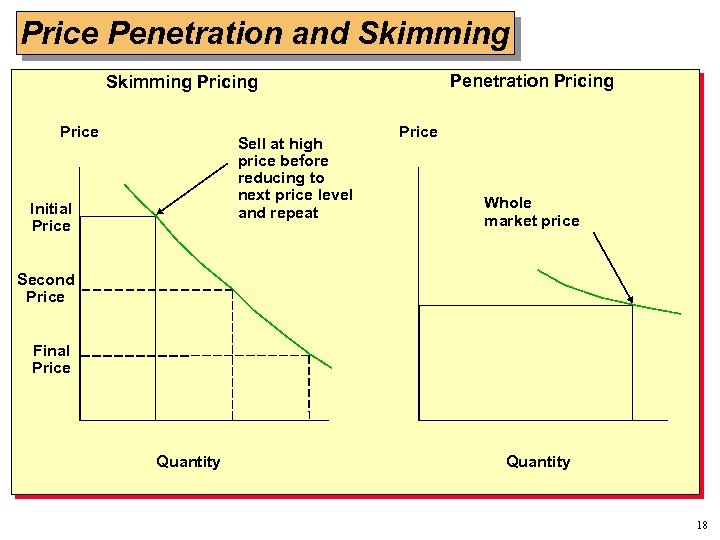

Price Penetration and Skimming Penetration Pricing Skimming Price Sell at high price before reducing to next price level and repeat Initial Price Whole market price Second Price Final Price Quantity 18

Price Penetration and Skimming Penetration Pricing Skimming Price Sell at high price before reducing to next price level and repeat Initial Price Whole market price Second Price Final Price Quantity 18

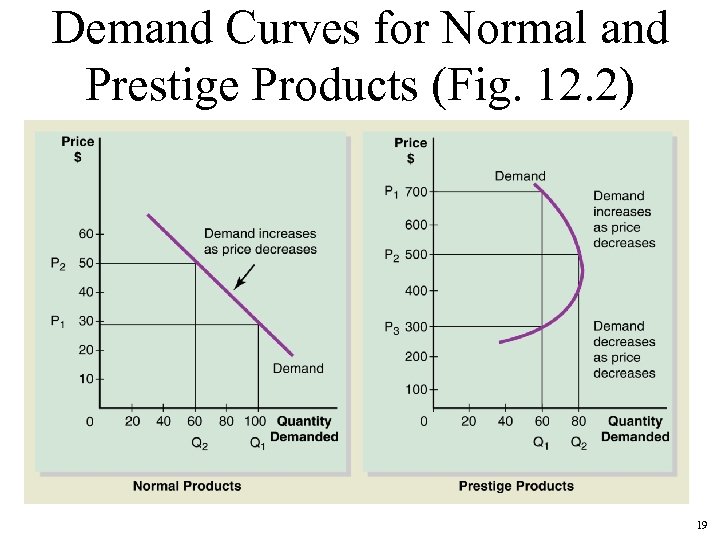

Demand Curves for Normal and Prestige Products (Fig. 12. 2) 19

Demand Curves for Normal and Prestige Products (Fig. 12. 2) 19

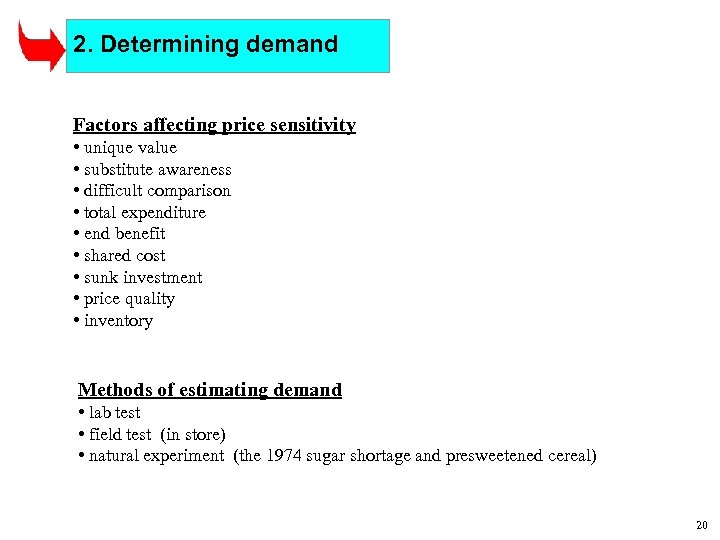

2. Determining demand Factors affecting price sensitivity • unique value • substitute awareness • difficult comparison • total expenditure • end benefit • shared cost • sunk investment • price quality • inventory Methods of estimating demand • lab test • field test (in store) • natural experiment (the 1974 sugar shortage and presweetened cereal) 20

2. Determining demand Factors affecting price sensitivity • unique value • substitute awareness • difficult comparison • total expenditure • end benefit • shared cost • sunk investment • price quality • inventory Methods of estimating demand • lab test • field test (in store) • natural experiment (the 1974 sugar shortage and presweetened cereal) 20

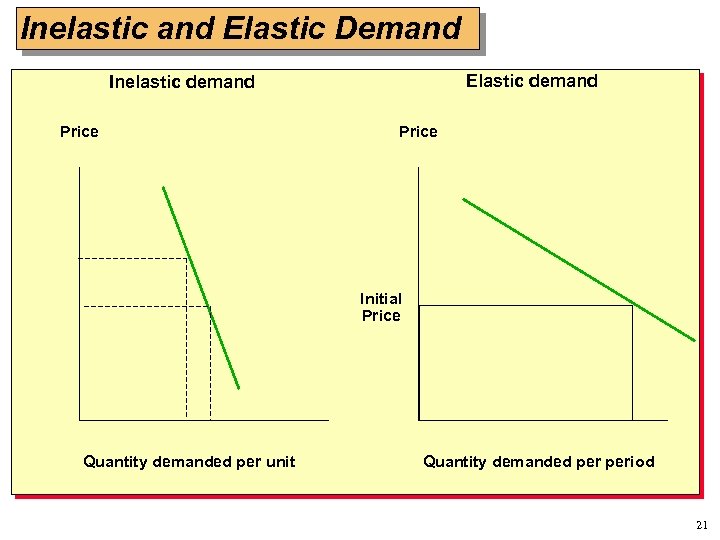

Inelastic and Elastic Demand Elastic demand Inelastic demand Price Initial Price Quantity demanded per unit Quantity demanded period 21

Inelastic and Elastic Demand Elastic demand Inelastic demand Price Initial Price Quantity demanded per unit Quantity demanded period 21

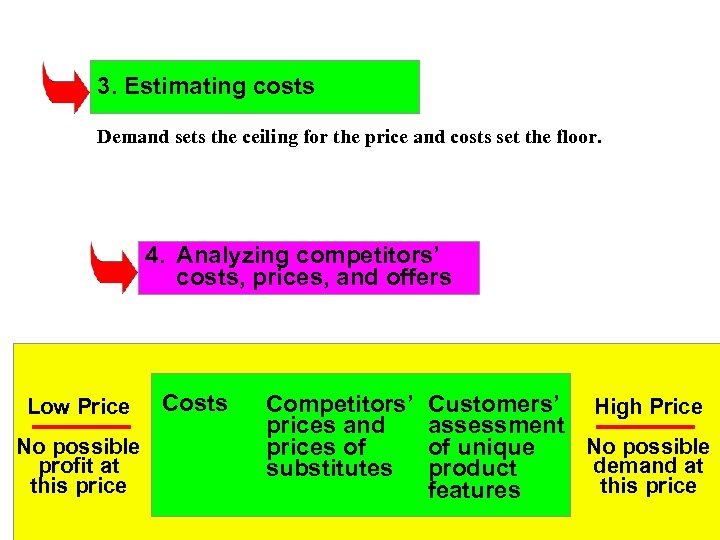

3. Estimating costs Demand sets the ceiling for the price and costs set the floor. 4. Analyzing competitors’ costs, prices, and offers Low Price No possible profit at this price Costs Competitors’ prices and prices of substitutes Customers’ High Price assessment No possible of unique demand at product this price features 22

3. Estimating costs Demand sets the ceiling for the price and costs set the floor. 4. Analyzing competitors’ costs, prices, and offers Low Price No possible profit at this price Costs Competitors’ prices and prices of substitutes Customers’ High Price assessment No possible of unique demand at product this price features 22

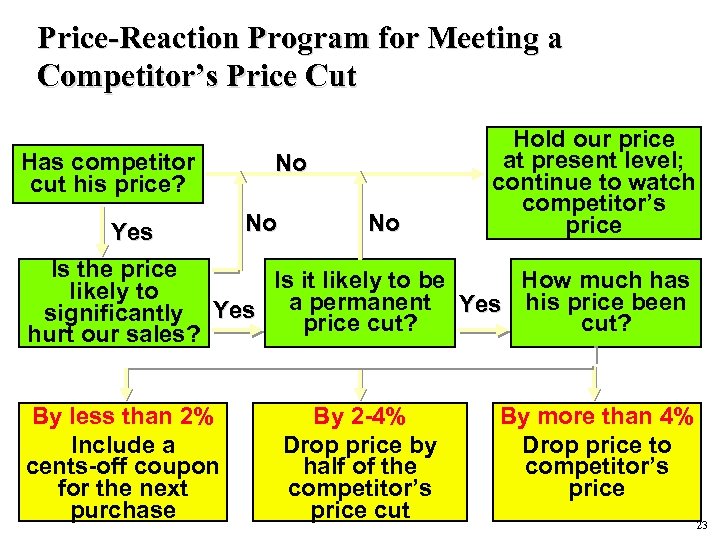

Price-Reaction Program for Meeting a Competitor’s Price Cut Has competitor cut his price? Yes No No No Hold our price at present level; continue to watch competitor’s price Is the price Is it likely to be How much has likely to permanent Yes his price been significantly Yes aprice cut? hurt our sales? By less than 2% Include a cents-off coupon for the next purchase By 2 -4% Drop price by half of the competitor’s price cut By more than 4% Drop price to competitor’s price 23

Price-Reaction Program for Meeting a Competitor’s Price Cut Has competitor cut his price? Yes No No No Hold our price at present level; continue to watch competitor’s price Is the price Is it likely to be How much has likely to permanent Yes his price been significantly Yes aprice cut? hurt our sales? By less than 2% Include a cents-off coupon for the next purchase By 2 -4% Drop price by half of the competitor’s price cut By more than 4% Drop price to competitor’s price 23

5. Selecting a pricing method • • • Markup Pricing Target Return Pricing Perceived Value Pricing Going-Rate Pricing Sealed-Bid Pricing 24

5. Selecting a pricing method • • • Markup Pricing Target Return Pricing Perceived Value Pricing Going-Rate Pricing Sealed-Bid Pricing 24

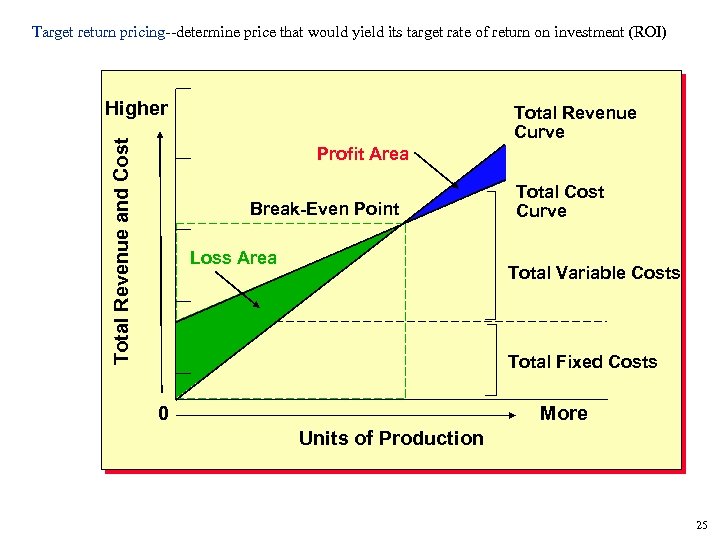

Target return pricing--determine price that would yield its target rate of return on investment (ROI) Total Revenue and Cost Higher Total Revenue Curve Profit Area Break-Even Point Loss Area Total Cost Curve Total Variable Costs Total Fixed Costs 0 More Units of Production 25

Target return pricing--determine price that would yield its target rate of return on investment (ROI) Total Revenue and Cost Higher Total Revenue Curve Profit Area Break-Even Point Loss Area Total Cost Curve Total Variable Costs Total Fixed Costs 0 More Units of Production 25

6. Selecting final price • Influence of other marketing mix elements • Impact of price on other parties Promotional Pricing • • Loss-leader pricing Special-event pricing Cash rebates Low-interest financing Longer payment terms Warranties & service contracts Psychological discounting 26

6. Selecting final price • Influence of other marketing mix elements • Impact of price on other parties Promotional Pricing • • Loss-leader pricing Special-event pricing Cash rebates Low-interest financing Longer payment terms Warranties & service contracts Psychological discounting 26