88fab0f0b3b68c365e3feb66e50dddce.ppt

- Количество слайдов: 28

Pricing Policy: Time Customization I. Economic and Behavioral Foundations of Pricing II. Power Pricing Concepts October 8, 2003 Teck H. Ho 1

Outline q. Time customization of prices: The short term q. Trial and accelerate purchase q. Potential demand buildup q. Peak and off-peak pricing q. Demand probing and yield management q. Potential negative consequences q. The long-term dynamic effects October 8, 2003 Teck H. Ho 2

Examples q. Campbell offered trade deals to retailers during summer (a eight-week period) q. Introductory offer on a new product q. Varying airfares over time q. Early bird specials q. Hotels’ winter specials October 8, 2003 Teck H. Ho 3

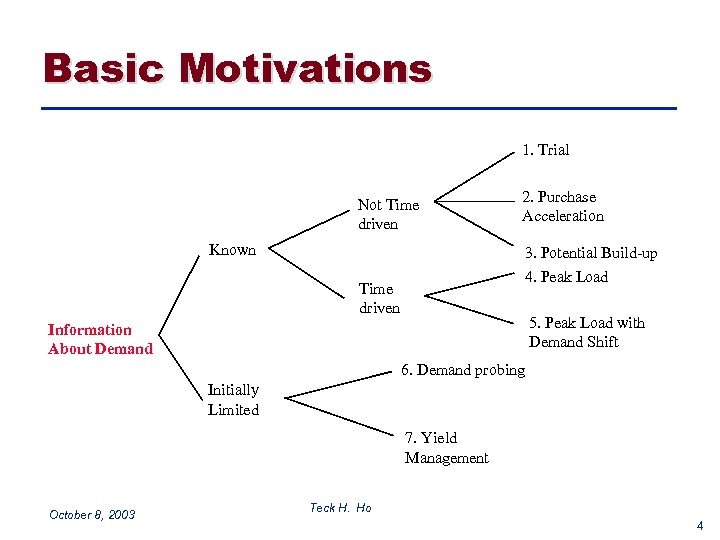

Basic Motivations 1. Trial Not Time driven Known 2. Purchase Acceleration 3. Potential Build-up 4. Peak Load Time driven 5. Peak Load with Demand Shift Information About Demand 6. Demand probing Initially Limited 7. Yield Management October 8, 2003 Teck H. Ho 4

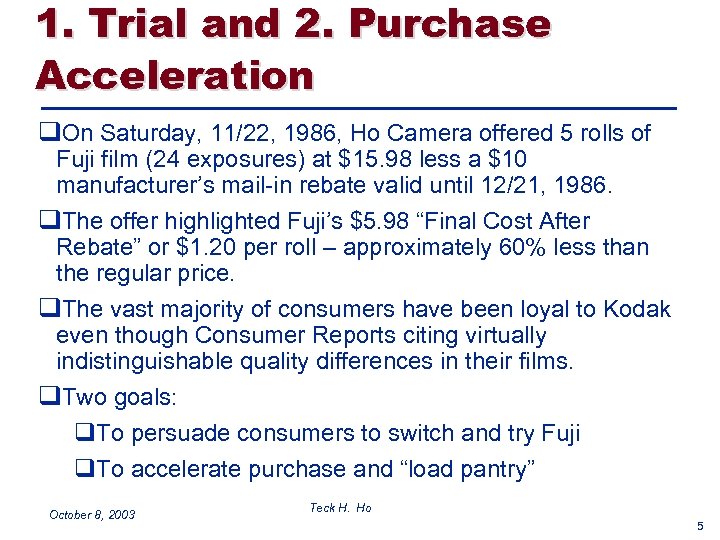

1. Trial and 2. Purchase Acceleration q. On Saturday, 11/22, 1986, Ho Camera offered 5 rolls of Fuji film (24 exposures) at $15. 98 less a $10 manufacturer’s mail-in rebate valid until 12/21, 1986. q. The offer highlighted Fuji’s $5. 98 “Final Cost After Rebate” or $1. 20 per roll – approximately 60% less than the regular price. q. The vast majority of consumers have been loyal to Kodak even though Consumer Reports citing virtually indistinguishable quality differences in their films. q. Two goals: q. To persuade consumers to switch and try Fuji q. To accelerate purchase and “load pantry” October 8, 2003 Teck H. Ho 5

1. Trial and 2. Purchase Acceleration q. Two other mechanisms for enacting price customization: q. Coupon q. On-shelf price cut q These mechanisms differ in two important respects: q. Reference price q. Selectivity (areas, price-sensitive consumers, and Kodak consumers) October 8, 2003 Teck H. Ho 6

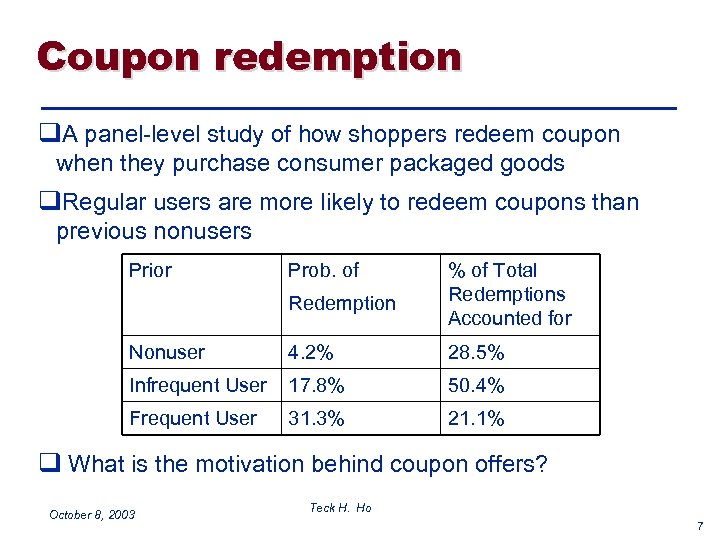

Coupon redemption q. A panel-level study of how shoppers redeem coupon when they purchase consumer packaged goods q. Regular users are more likely to redeem coupons than previous nonusers Prior Prob. of Redemption % of Total Redemptions Accounted for Nonuser 4. 2% 28. 5% Infrequent User 17. 8% 50. 4% Frequent User 31. 3% 21. 1% q What is the motivation behind coupon offers? October 8, 2003 Teck H. Ho 7

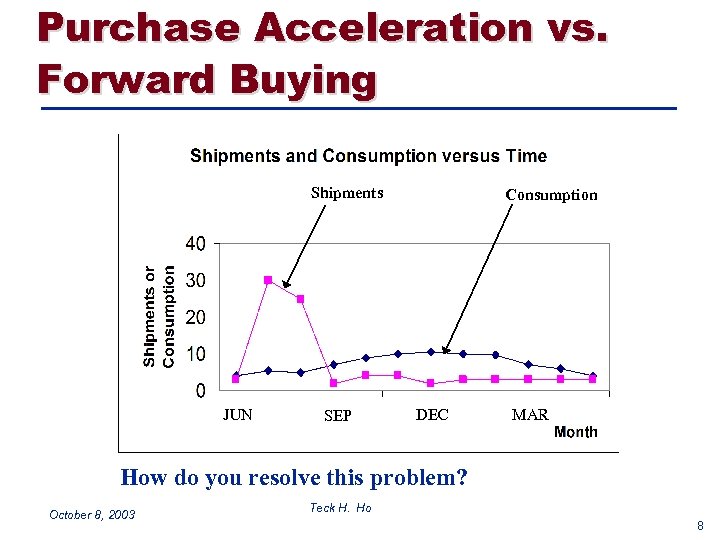

Purchase Acceleration vs. Forward Buying Shipments JUN SEP Consumption DEC MAR How do you resolve this problem? October 8, 2003 Teck H. Ho 8

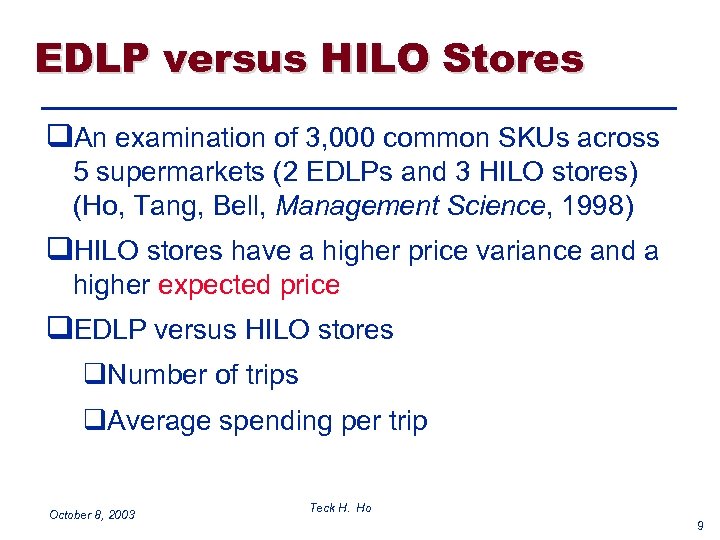

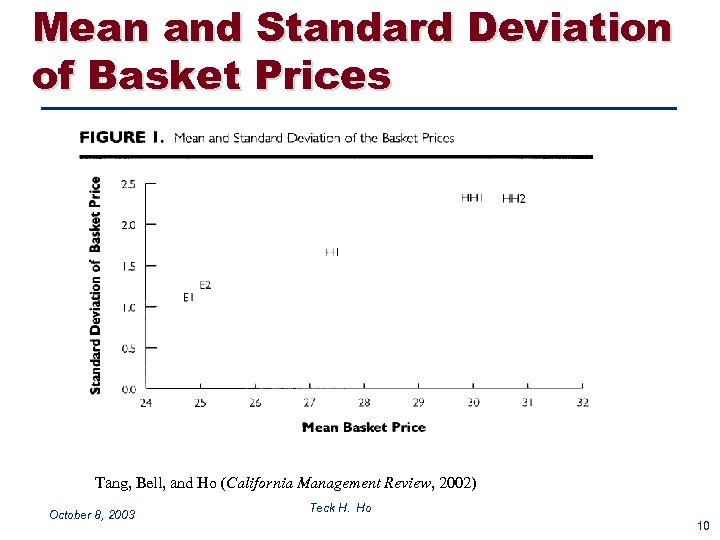

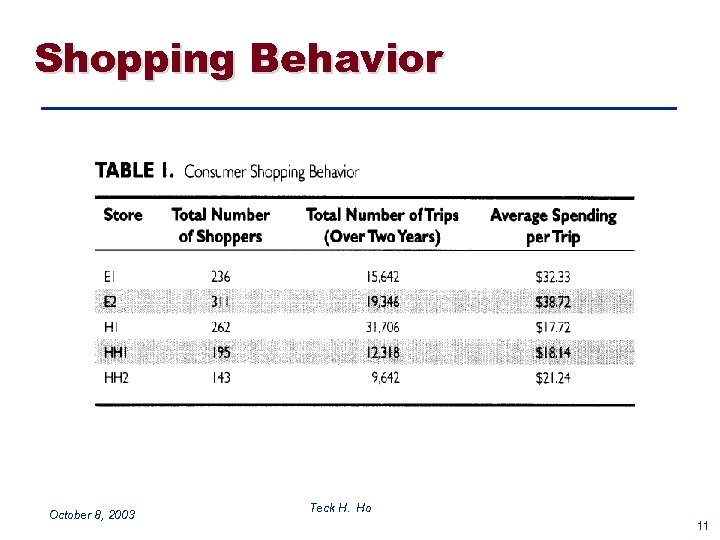

EDLP versus HILO Stores q. An examination of 3, 000 common SKUs across 5 supermarkets (2 EDLPs and 3 HILO stores) (Ho, Tang, Bell, Management Science, 1998) q. HILO stores have a higher price variance and a higher expected price q. EDLP versus HILO stores q. Number of trips q. Average spending per trip October 8, 2003 Teck H. Ho 9

Mean and Standard Deviation of Basket Prices Tang, Bell, and Ho (California Management Review, 2002) October 8, 2003 Teck H. Ho 10

Shopping Behavior October 8, 2003 Teck H. Ho 11

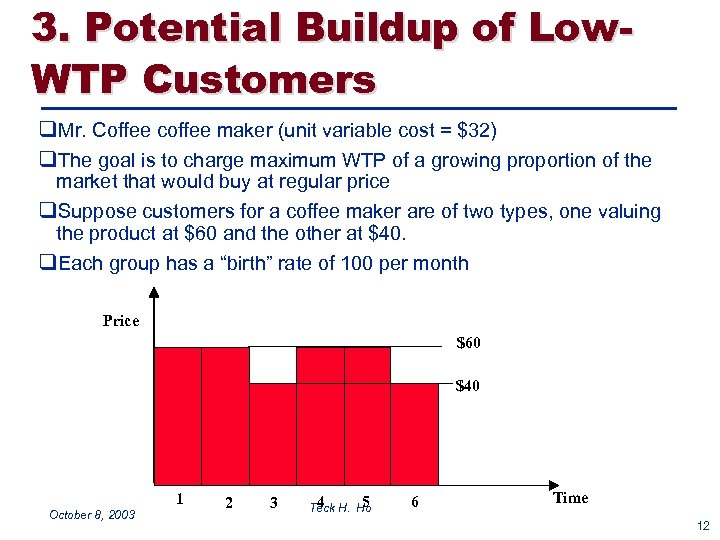

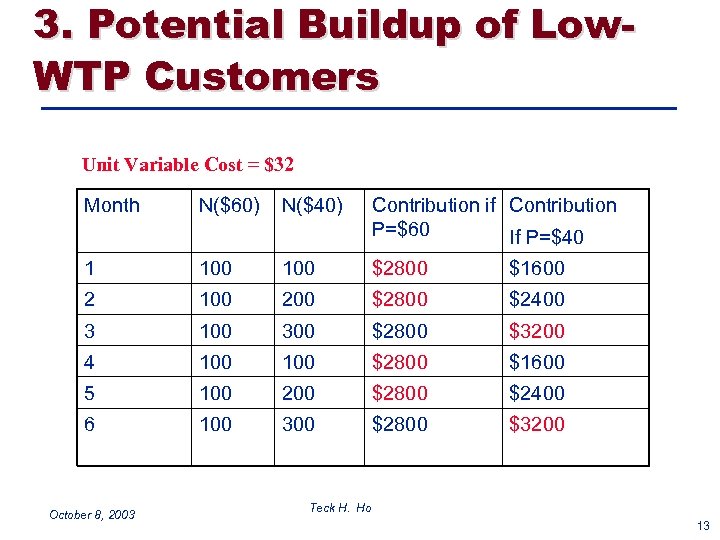

3. Potential Buildup of Low. WTP Customers q. Mr. Coffee coffee maker (unit variable cost = $32) q. The goal is to charge maximum WTP of a growing proportion of the market that would buy at regular price q. Suppose customers for a coffee maker are of two types, one valuing the product at $60 and the other at $40. q. Each group has a “birth” rate of 100 per month Price $60 $40 1 October 8, 2003 2 3 4 5 Teck H. Ho 6 Time 12

3. Potential Buildup of Low. WTP Customers Unit Variable Cost = $32 Month N($60) N($40) Contribution if Contribution P=$60 If P=$40 1 100 $2800 $1600 2 100 200 $2800 $2400 3 100 300 $2800 $3200 4 100 $2800 $1600 5 100 200 $2800 $2400 6 100 300 $2800 $3200 October 8, 2003 Teck H. Ho 13

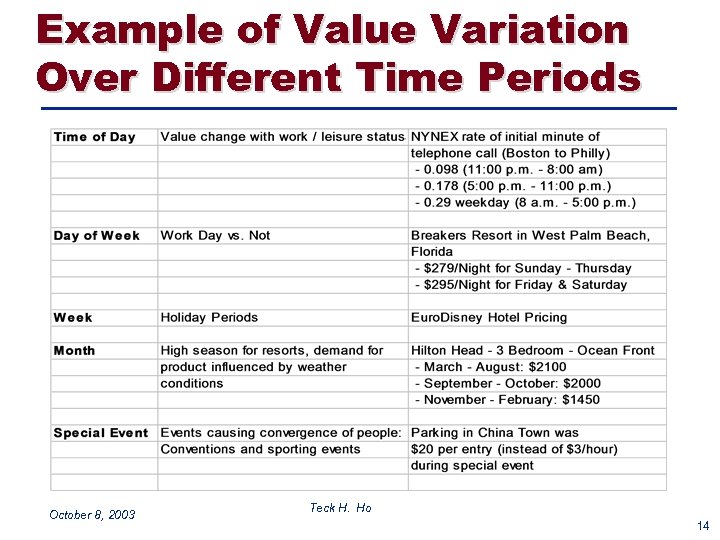

Example of Value Variation Over Different Time Periods October 8, 2003 Teck H. Ho 14

Euro. Disney Hotel Pricing Hotel Rating Hotel **** *** ** ** October 8, 2003 Adjacent Holiday Premium (Francs) Hotel New York 2395 2480 6% Disneyland Hotel 2035 2455 21% Newport Bay Club 965 1330 38% Sequoia 865 1230 42% Hotel Cheyenne 735 1120 52% Hotel Santa Fe 635 1020 61% Teck H. Ho 15

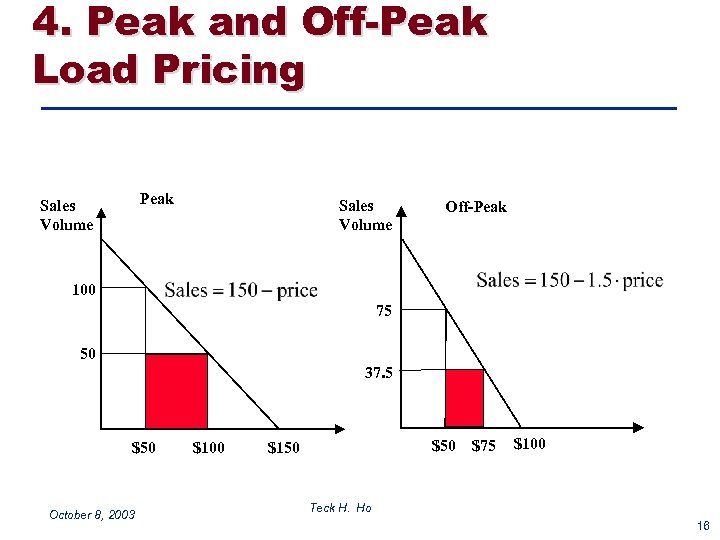

4. Peak and Off-Peak Load Pricing Peak Sales Volume Off-Peak 100 75 50 37. 5 $50 October 8, 2003 $100 $50 $75 $150 $100 Teck H. Ho 16

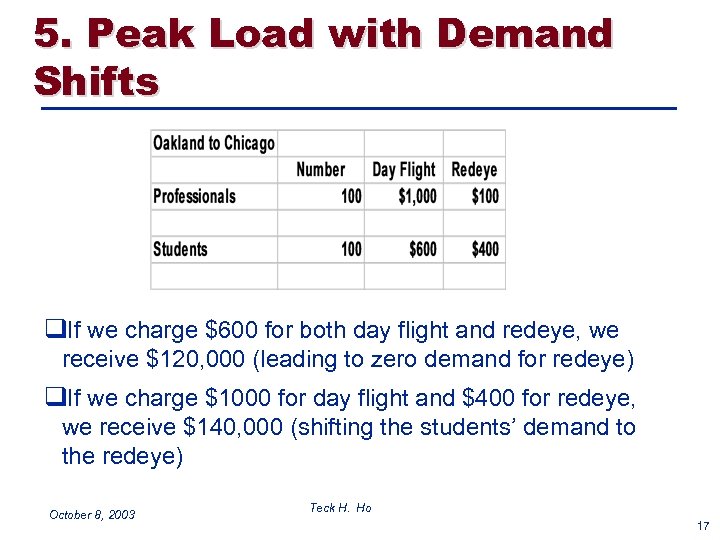

5. Peak Load with Demand Shifts q. If we charge $600 for both day flight and redeye, we receive $120, 000 (leading to zero demand for redeye) q. If we charge $1000 for day flight and $400 for redeye, we receive $140, 000 (shifting the students’ demand to the redeye) October 8, 2003 Teck H. Ho 17

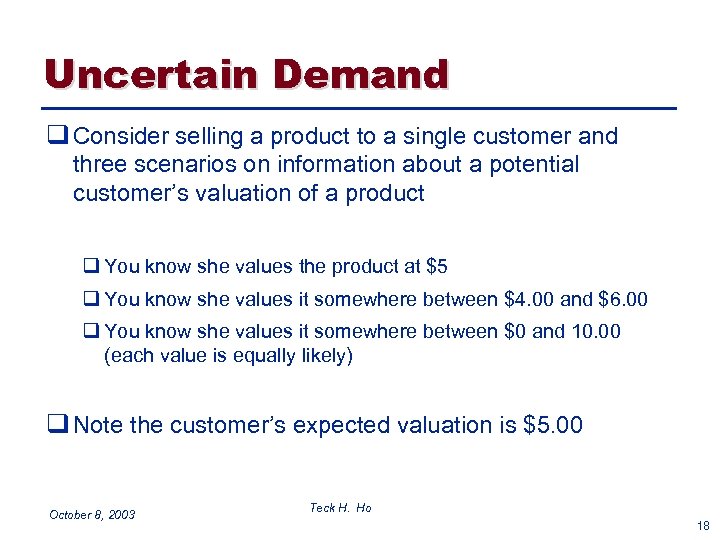

Uncertain Demand q Consider selling a product to a single customer and three scenarios on information about a potential customer’s valuation of a product q You know she values the product at $5 q You know she values it somewhere between $4. 00 and $6. 00 q You know she values it somewhere between $0 and 10. 00 (each value is equally likely) q Note the customer’s expected valuation is $5. 00 October 8, 2003 Teck H. Ho 18

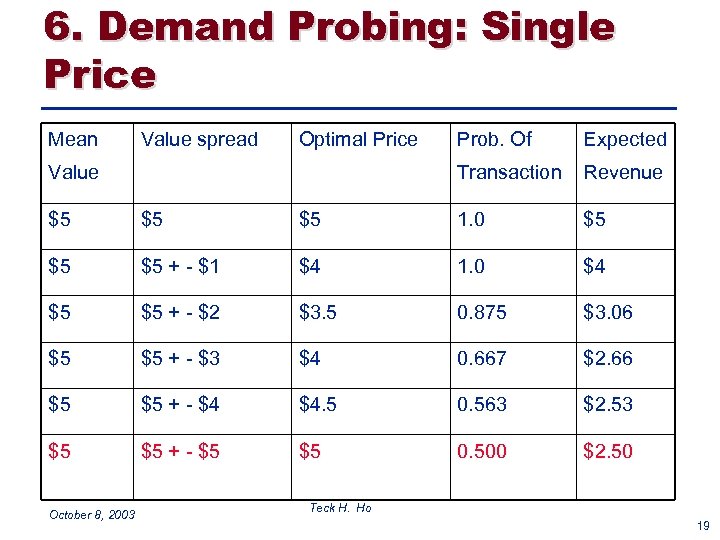

6. Demand Probing: Single Price Mean Value spread Optimal Price Expected Transaction Value Prob. Of Revenue $5 $5 $5 1. 0 $5 $5 $5 + - $1 $4 1. 0 $4 $5 $5 + - $2 $3. 5 0. 875 $3. 06 $5 $5 + - $3 $4 0. 667 $2. 66 $5 $5 + - $4 $4. 5 0. 563 $2. 53 $5 $5 + - $5 $5 0. 500 $2. 50 October 8, 2003 Teck H. Ho 19

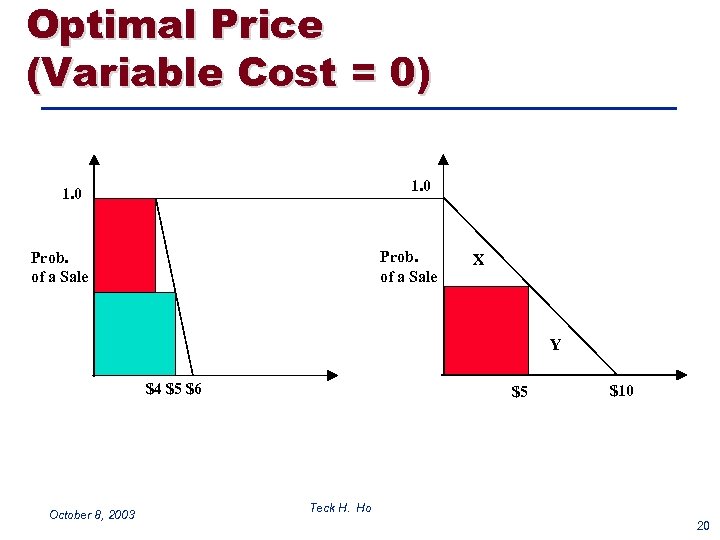

Optimal Price (Variable Cost = 0) 1. 0 Prob. of a Sale X Y $4 $5 $6 October 8, 2003 $5 $10 Teck H. Ho 20

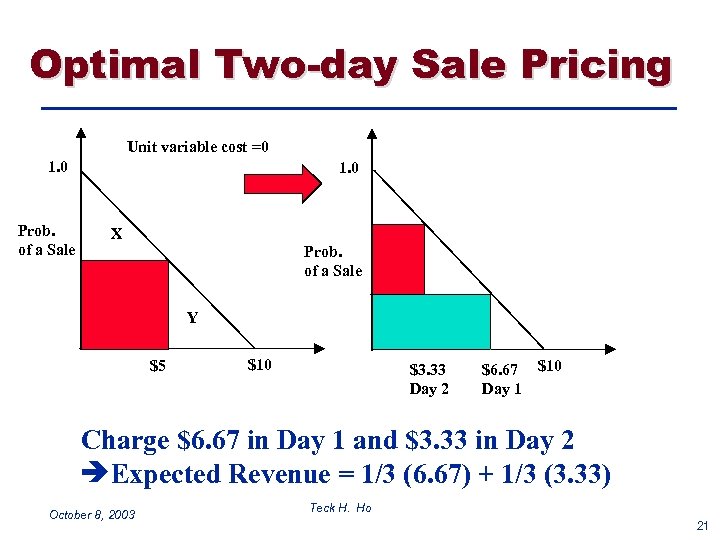

Optimal Two-day Sale Pricing Unit variable cost =0 1. 0 Prob. of a Sale 1. 0 X Prob. of a Sale Y $5 $10 $3. 33 Day 2 $6. 67 Day 1 $10 Charge $6. 67 in Day 1 and $3. 33 in Day 2 Expected Revenue = 1/3 (6. 67) + 1/3 (3. 33) October 8, 2003 Teck H. Ho 21

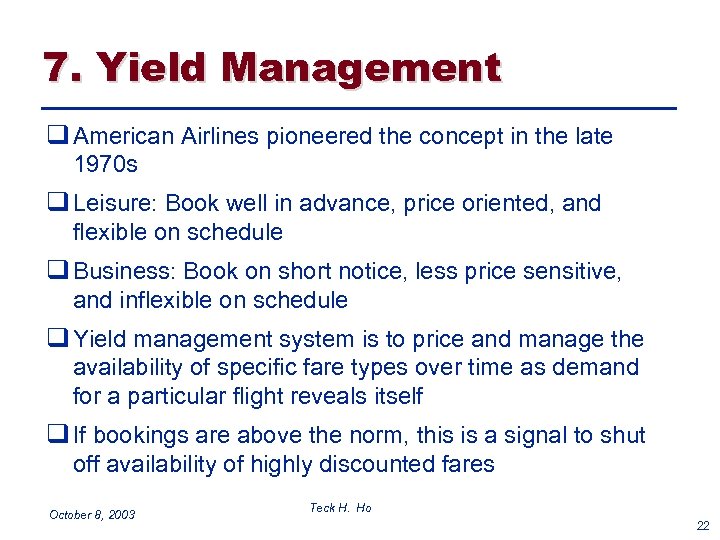

7. Yield Management q American Airlines pioneered the concept in the late 1970 s q Leisure: Book well in advance, price oriented, and flexible on schedule q Business: Book on short notice, less price sensitive, and inflexible on schedule q Yield management system is to price and manage the availability of specific fare types over time as demand for a particular flight reveals itself q If bookings are above the norm, this is a signal to shut off availability of highly discounted fares October 8, 2003 Teck H. Ho 22

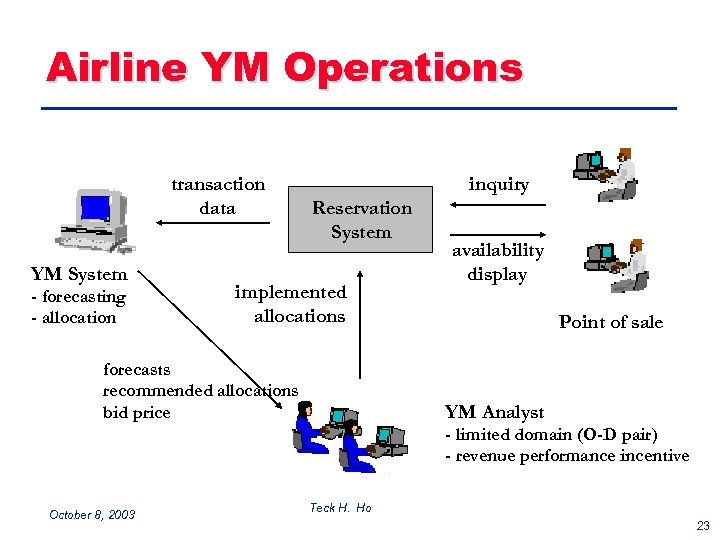

Airline YM Operations transaction data YM System - forecasting - allocation inquiry Reservation System implemented allocations forecasts recommended allocations bid price availability display Point of sale YM Analyst - limited domain (O-D pair) - revenue performance incentive October 8, 2003 Teck H. Ho 23

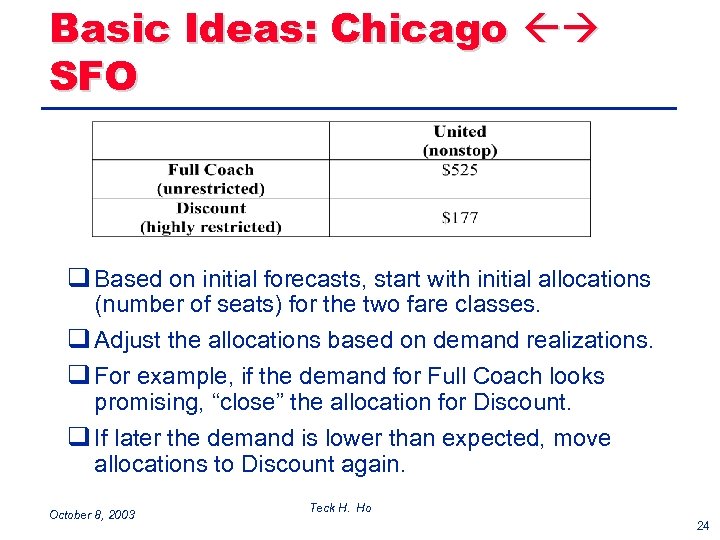

Basic Ideas: Chicago SFO q Based on initial forecasts, start with initial allocations (number of seats) for the two fare classes. q Adjust the allocations based on demand realizations. q For example, if the demand for Full Coach looks promising, “close” the allocation for Discount. q If later the demand is lower than expected, move allocations to Discount again. October 8, 2003 Teck H. Ho 24

Examples: What motivations? q. Campbell offered trade deals to retailers during summer (a eight-week period) q. Introductory offer on a new product q. Varying airfares over time q. Early bird specials q. Hotels’ winter specials October 8, 2003 Teck H. Ho 25

Potential Negative Consequences q. Incremental or substitute sale (e. g. , negligible increase in consumption) q. Cost of customization (e. g. , production and inventory costs) q. System effect q. Reference price effect q. Wait for sale mentality q. Fairness October 8, 2003 Teck H. Ho 26

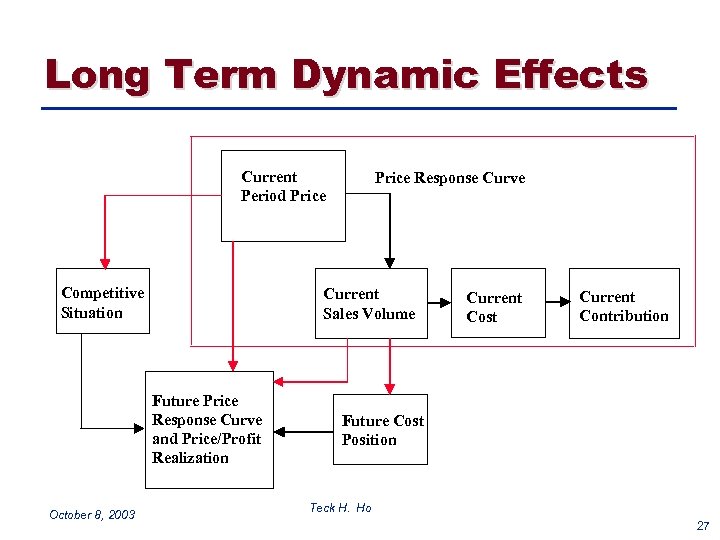

Long Term Dynamic Effects Current Period Price Competitive Situation Current Sales Volume Future Price Response Curve and Price/Profit Realization October 8, 2003 Price Response Curve Current Cost Current Contribution Future Cost Position Teck H. Ho 27

Punch-line q. Clearly understand the underlying motivation q. Design the time-customization plan based on the motivation q. Consider the potential negative consequences and long-term dynamic effects October 8, 2003 Teck H. Ho 28

88fab0f0b3b68c365e3feb66e50dddce.ppt