3292aa96c5ef1cc2b5bc6890a5fb4532.ppt

- Количество слайдов: 58

PRICING POLICY & STRATEGIC THINKING MBA NCCU Managerial Economics Jack Wu

PRICING POLICY

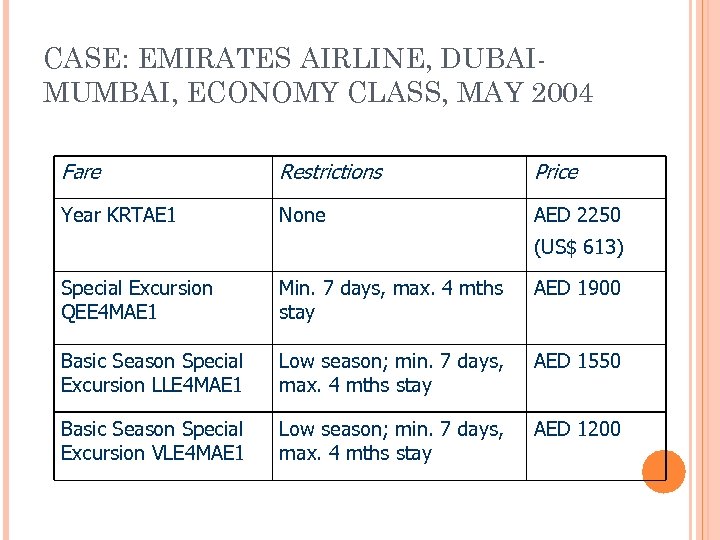

CASE: EMIRATES AIRLINE, DUBAIMUMBAI, ECONOMY CLASS, MAY 2004 Fare Restrictions Price Year KRTAE 1 None AED 2250 (US$ 613) Special Excursion QEE 4 MAE 1 Min. 7 days, max. 4 mths stay AED 1900 Basic Season Special Excursion LLE 4 MAE 1 Low season; min. 7 days, max. 4 mths stay AED 1550 Basic Season Special Excursion VLE 4 MAE 1 Low season; min. 7 days, max. 4 mths stay AED 1200

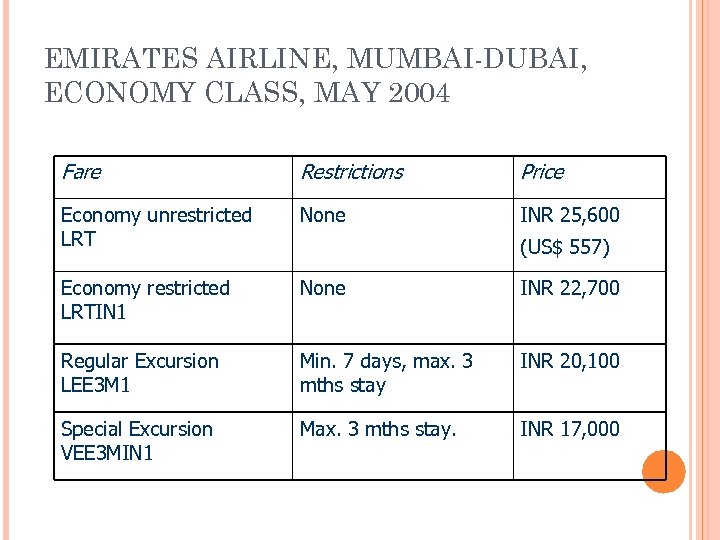

EMIRATES AIRLINE, MUMBAI-DUBAI, ECONOMY CLASS, MAY 2004 Fare Restrictions Price Economy unrestricted LRT None INR 25, 600 Economy restricted LRTIN 1 None INR 22, 700 Regular Excursion LEE 3 M 1 Min. 7 days, max. 3 mths stay INR 20, 100 Special Excursion VEE 3 MIN 1 Max. 3 mths stay. INR 17, 000 (US$ 557)

EMIRATES AIRLINE Why does Emirates charge lower fare for passengers originating from Mumbai? How is this discrimination possible?

PRICING POLICY uniform pricing complete price discrimination direct segment discrimination indirect segment discrimination bundling

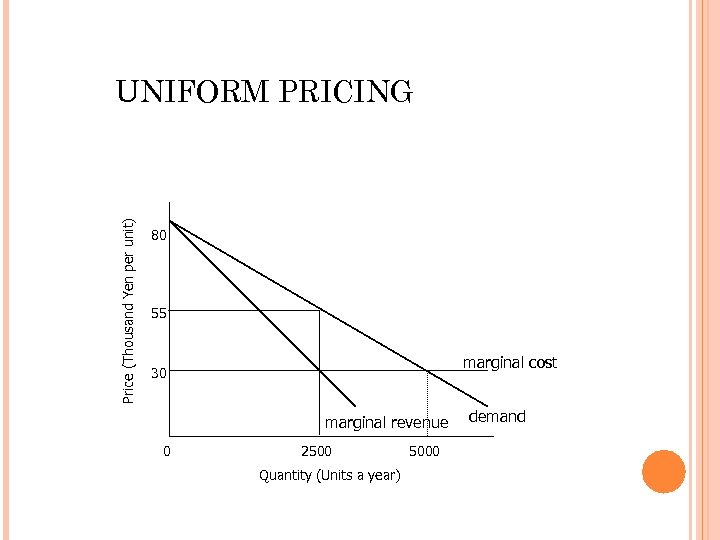

Price (Thousand Yen per unit) UNIFORM PRICING 80 55 marginal cost 30 marginal revenue 0 2500 Quantity (Units a year) 5000 demand

UNIFORM PRICING: PROFIT MAXIMUM MR = MC Equivalently, set the incremental margin percentage equal to the inverse of absolute value of price elasticity of demand, (price - MC) / price = -1/e

PRICE ELASTICITY always set price so that demand is elastic if demand more elastic, then lower incremental margin percentage (IM%) e = -2 IM% = 1/2 q e = -1. 5 IM% = 2/3

PRICING PRIVATE-LABEL COLA Suppose that Wal. Mart learns that demand for private-label cola is less elastic than the demand for Coca Cola. Should Wal. Mart set a higher price for private-label cola?

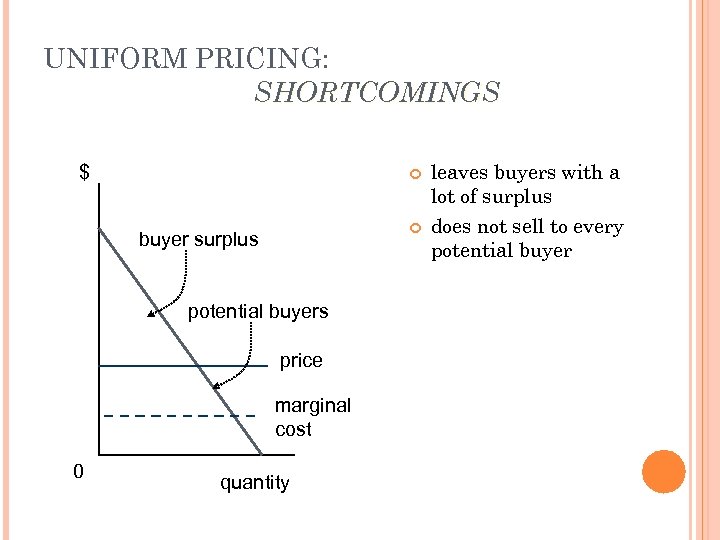

UNIFORM PRICING: SHORTCOMINGS buyer surplus potential buyers price marginal cost 0 quantity leaves buyers with a lot of surplus $ does not sell to every potential buyer

COMPLETE PRICE DISCRIMINATION price each unit at buyer’s benefit and sell quantity where MB = MC maximum profit -- theoretical ideal different from MR = MC implementation: must know entire marginal benefit and marginal cost curves

COMPLETE PRICE DISCRIMINATION: PRACTICE bargaining auctions

DIRECT SEGMENT DISCRIMINATION, I price by segment implementation fixed identifiable characteristic --- basic for segmentation no re-sale

DIRECT SEGMENT DISCRIMINATION, II simple case: uniform price within each segment IM% = -1/e for segment with more elastic demand, then lower incremental margin percentage (IM%)

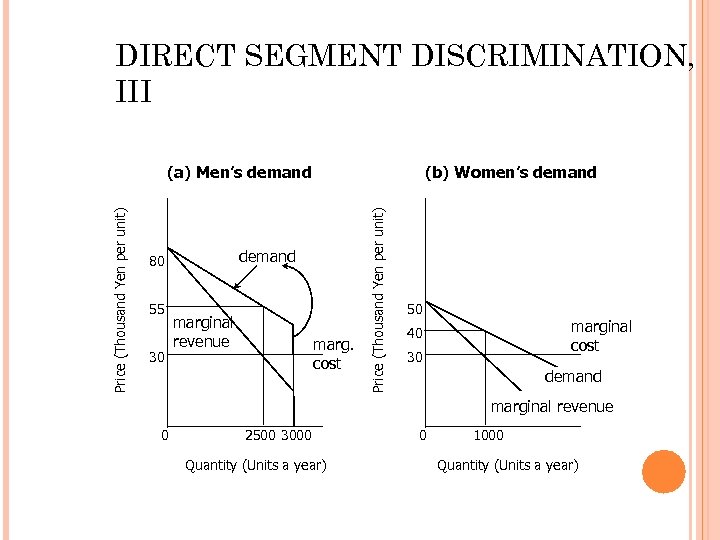

DIRECT SEGMENT DISCRIMINATION, III demand 80 55 30 (b) Women’s demand marginal revenue marg. cost Price (Thousand Yen per unit) (a) Men’s demand 50 marginal cost 40 30 demand marginal revenue 0 2500 3000 Quantity (Units a year) 0 1000 Quantity (Units a year)

NYNEX TELEPHONE SERVICE New York City residential -- $16/month business -- $23/month How is discrimination possible?

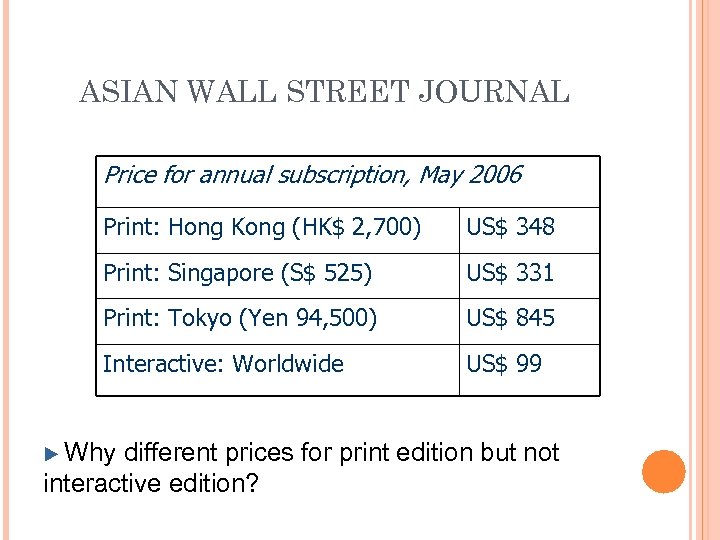

ASIAN WALL STREET JOURNAL Price for annual subscription, May 2006 Print: Hong Kong (HK$ 2, 700) US$ 348 Print: Singapore (S$ 525) US$ 331 Print: Tokyo (Yen 94, 500) US$ 845 Interactive: Worldwide US$ 99 u Why different prices for print edition but not interactive edition?

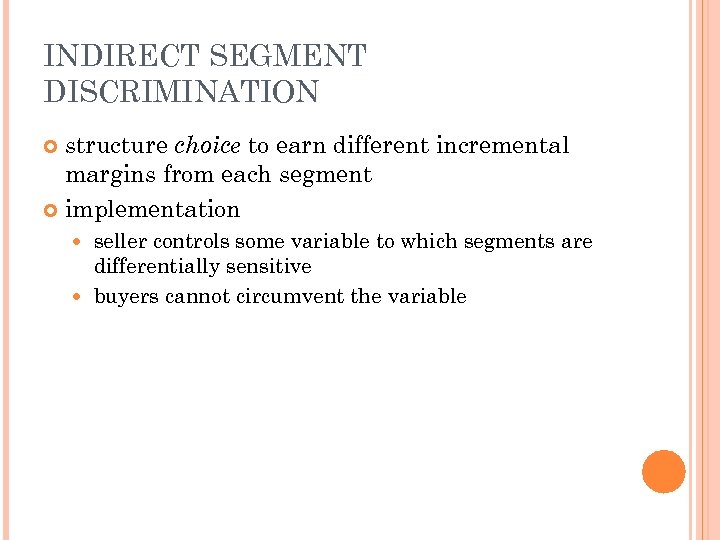

INDIRECT SEGMENT DISCRIMINATION structure choice to earn different incremental margins from each segment implementation seller controls some variable to which segments are differentially sensitive buyers cannot circumvent the variable

AIR TRAVEL: BENEFITS

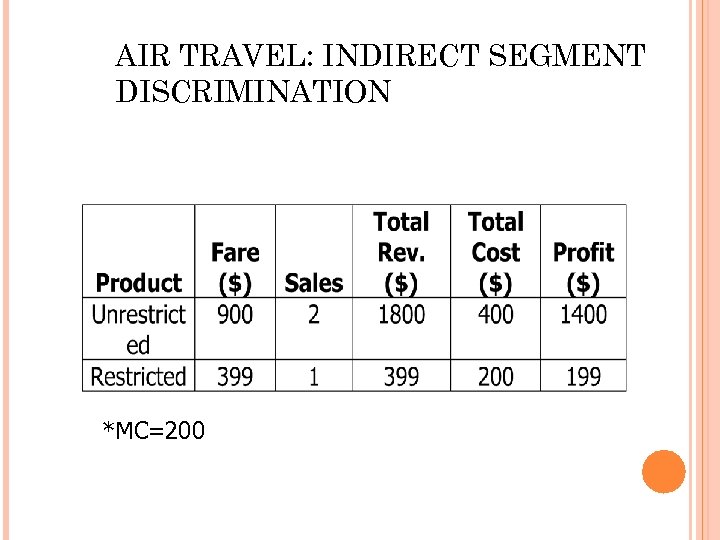

AIR TRAVEL: INDIRECT SEGMENT DISCRIMINATION *MC=200

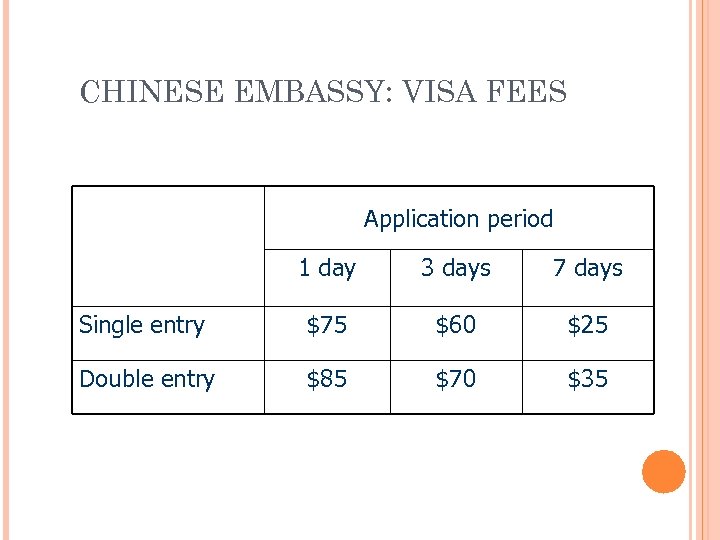

CHINESE EMBASSY: VISA FEES Application period 1 day 3 days 7 days Single entry $75 $60 $25 Double entry $85 $70 $35

PRICING POLICIES: RANKING

BUNDLING strategy pure bundling mixed bundling

CABLE TELEVISION: BENEFITS

PURE OR MIXED BUNDLING What is the profit-maximizing pricing policy if marginal cost per channel = 0 marginal cost per channel = $5

PURE OR MIXED BUNDLING Generally, if item is costless, no loss from giving it to every consumer --> pure bundling; if item is costly, then should avoid providing it to low-benefit users --> use mixed bundling to screen out low-benefit users. Mixed bundling is form of indirect segment discrimination structured choice between bundle and separates

STRATEGIC THINKING

CASE: COKE VS. PEPSI, 1999 Nov. 16: Coca-Cola raised price 7% Nov. 22: Pepsi raised price 6. 9% “Coke and Pepsi will move now from price-based competition to marketingbased competition”, Andrew Conway, Morgan Stanley

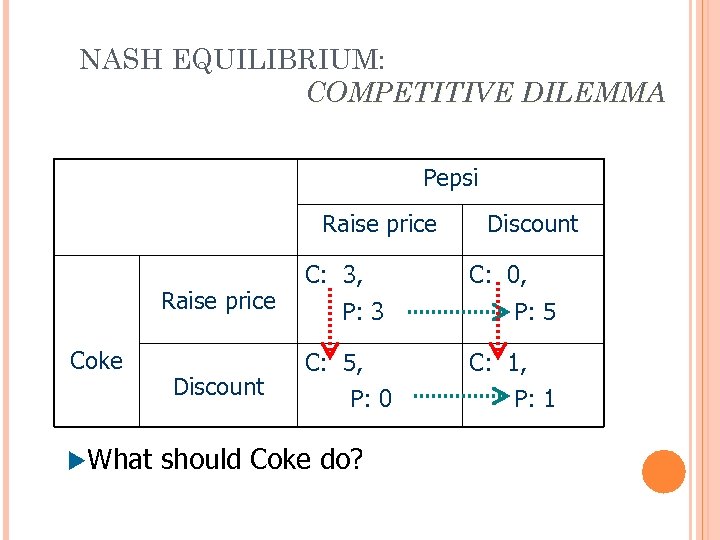

COMPETITIVE DILEMMA What should Coke do?

STRATEGIC SITUATIONS parties actively consider the interactions with one another in making decisions game theory -- set of ideas and principles to guide strategic thinking simultaneous actions: strategic form sequential actions: extensive form

DOMINATED STRATEGY generates worse consequences than another strategy, regardless of the choices of the other parties never use dominated strategy

NASH EQUILIBRIUM Given that the other players choose their Nash equilibrium strategies, each party prefers its own Nash equilibrium strategy • No one is willing to deviate unilaterally from a Nash equilibrium

SOLVING FOR NASH EQUILIBRIUM eliminate dominated strategies, then check remaining cells “arrow” technique

NASH EQUILIBRIUM: COMPETITIVE DILEMMA Pepsi Raise price Coke u. What Discount C: 3, P: 3 C: 5, P: 0 should Coke do? Discount C: 0, P: 5 C: 1, P: 1

COKE AND PEPSI GAME Nash equilibrium: for both parties, “raise price” is dominated by “discount”. but discounting is bad for both -- if only they could agree somehow to raise price. Coke and Pepsi stuck in this situation for four years until November 1999.

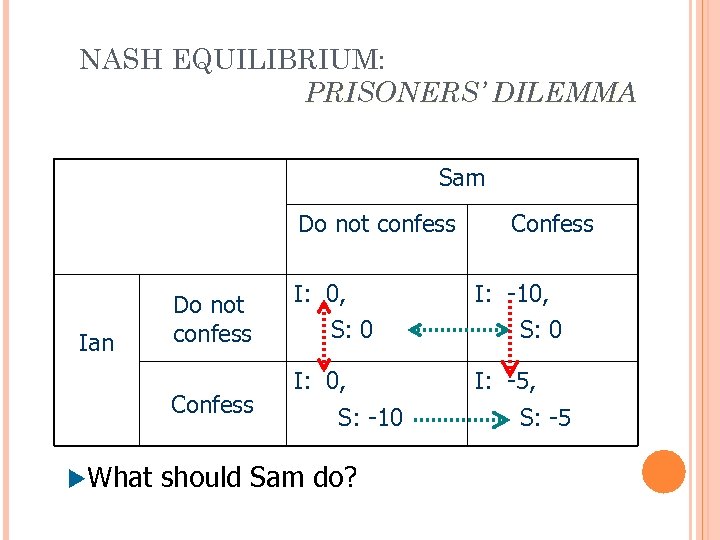

NASH EQUILIBRIUM: PRISONERS’ DILEMMA Sam Do not confess Ian Do not confess Confess u. What I: 0, S: 0 I: 0, S: -10 should Sam do? Confess I: -10, S: 0 I: -5, S: -5

WHERE TO ADVERTISE? No Nash equilibrium in pure strategies

RANDOMIZED STRATEGIES choose among pure strategies according to probabilities must be unpredictable Example: where to advertise _ We. com: ½ NBA and ½ NHL _ Competitor. com: ½ NBA and ½ NHL

RANDOMIZED STRATEGIES: RETAIL PRICE COMPETITION Pricing trade-off: high price to extract buyer surplus of loyal customers low price to get store switchers Solution: randomized discounts

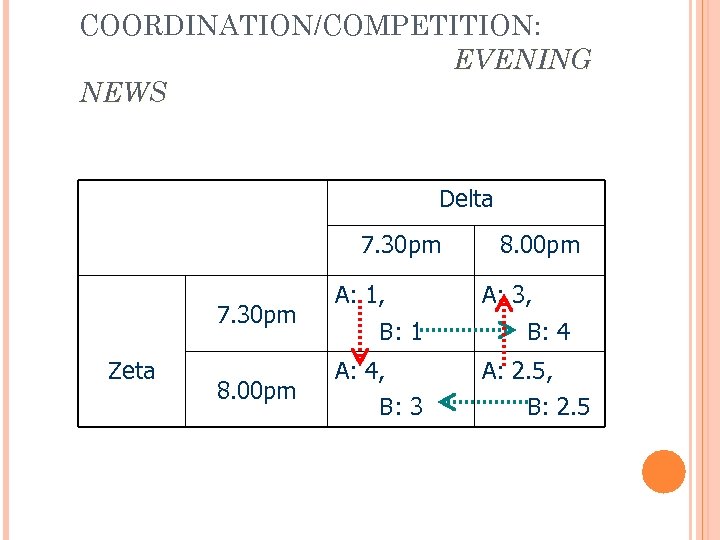

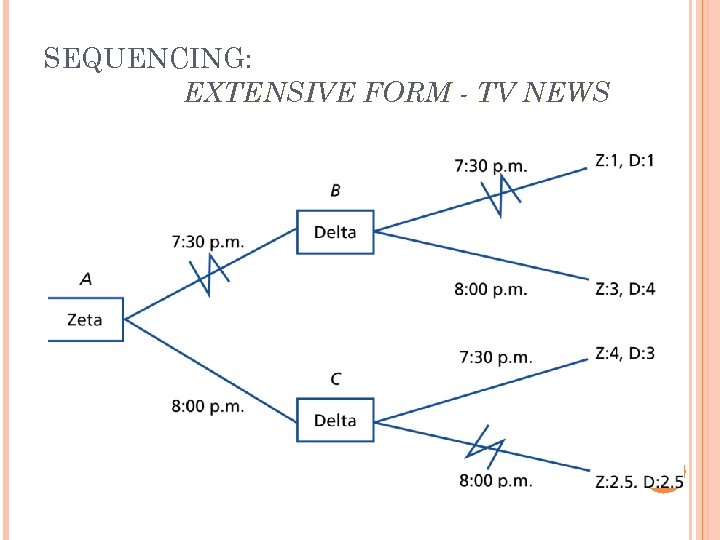

COORDINATION/COMPETITION: EVENING NEWS Delta 7. 30 pm Zeta 8. 00 pm A: 1, B: 1 A: 4, B: 3 8. 00 pm A: 3, B: 4 A: 2. 5, B: 2. 5

COORDINATION AND COMPETITION Prime time for news is 8: 0 pm; second best is 7: 30 pm; since audience is limited, get maximum viewership if two channels schedule at different times. Question: which station gets 8: 0 pm? Situation has elements of coordination -- avoiding same time slot competition -- getting the 8: 0 pm slot

ZERO/POSITIVE SUM zero-sum games: pure competition -- one party better off only if other is worse off positive-sum games: coordination -- both can be better off or both worse off co-opetition: competition and coordination

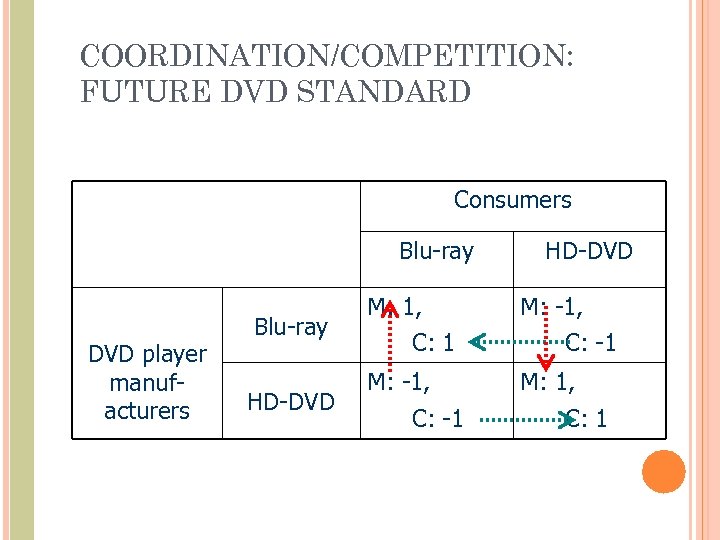

COORDINATION/COMPETITION: FUTURE DVD STANDARD Consumers Blu-ray DVD player manufacturers Blu-ray HD-DVD M: 1, C: 1 M: -1, C: -1 HD-DVD M: -1, C: -1 M: 1, C: 1

COORDINATION/COMPETITION: FOCAL POINT Single Nash equilibrium - clear focal point Multiple Nash equilibria - look for focal point to see which one to play

SEQUENCING Game in extensive form – sequence of moves: nodes branches outcomes

EXTENSIVE FORM: EQUILIBRIUM backward induction q final nodes intermediate nodes initial node

SEQUENCING: EXTENSIVE FORM - TV NEWS

STRATEGIC MOVE Action to influence beliefs or actions of other parties in a favorable way • credibility first mover advantage – second mover advantage –

EXAMPLES Examples: Evening TV news -- both stations want to move first: which one can? Use strategic move, eg, contracts with advertisers to deliver news at 8 pm. Famous Chinese general: after crossing a river, burnt his ships -- strategic move to force soldiers to fight harder. Issue: Is the move credible? Will it convince the other players? Advantage doesn’t always go to first mover; In war, better to see opponent’s move, and then take action, eg is enemy moving south or north? new product category -- let competitor test the market and educate the customers

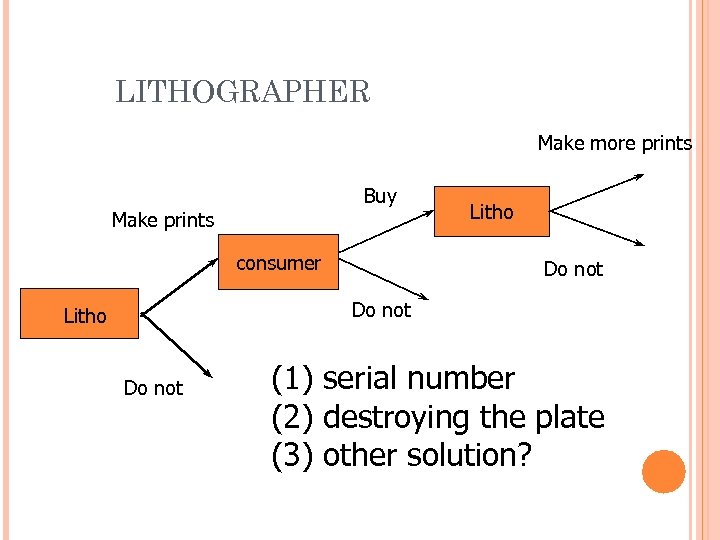

LITHOGRAPHER Make more prints Buy Make prints consumer Litho Do not (1) serial number (2) destroying the plate (3) other solution?

CONDITIONAL STRATEGIC MOVES Threats – if it succeeds, then it needn’t be carried out Promises – if it succeeds, then it needn’t be carried out Ideal strategic move doesn’t impose costs

MORGAN STANLEY: “SHAREHOLDER RIGHTS PLAN” If any party acquires 10% or more of company’s shares, other shareholders get right to buy additional shares at 50% discount. Impact on hostile bidder?

SHAREHOLDER RIGHTS PLAN This shareholder rights plan is a threat to potential bidders: most hostile bidders begin with small stake; with shareholder rights plan, if bidder acquires more than 10%, then rights triggered, and bidder will be diluted. Nickname: poison pill. Actually works against shareholder rights -- by entrenching existing management.

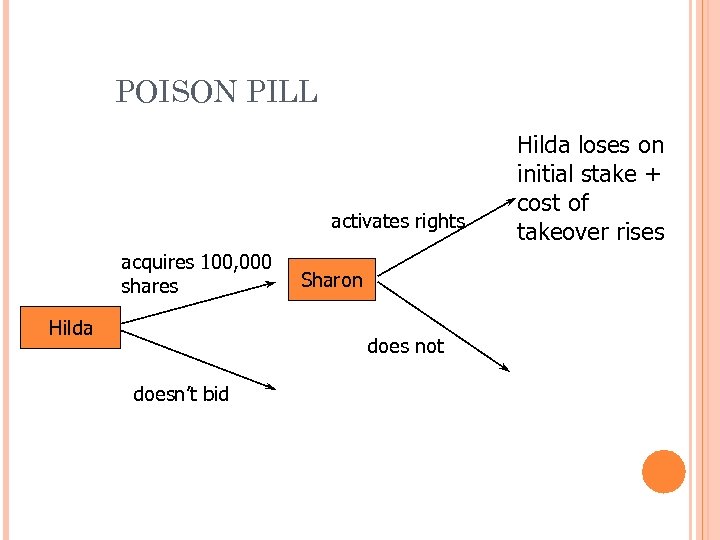

POISON PILL activates rights acquires 100, 000 shares Hilda Sharon does not doesn’t bid Hilda loses on initial stake + cost of takeover rises

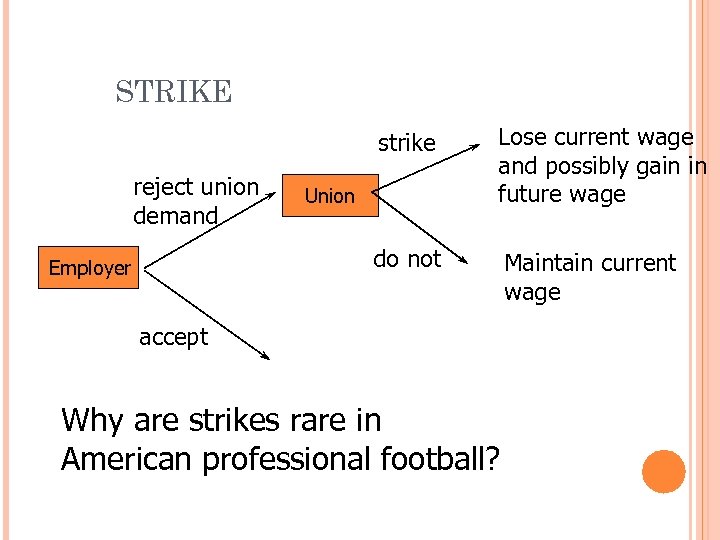

STRIKE strike do not reject union demand Employer Lose current wage and possibly gain in future wage Maintain current wage Union accept Why are strikes rare in American professional football?

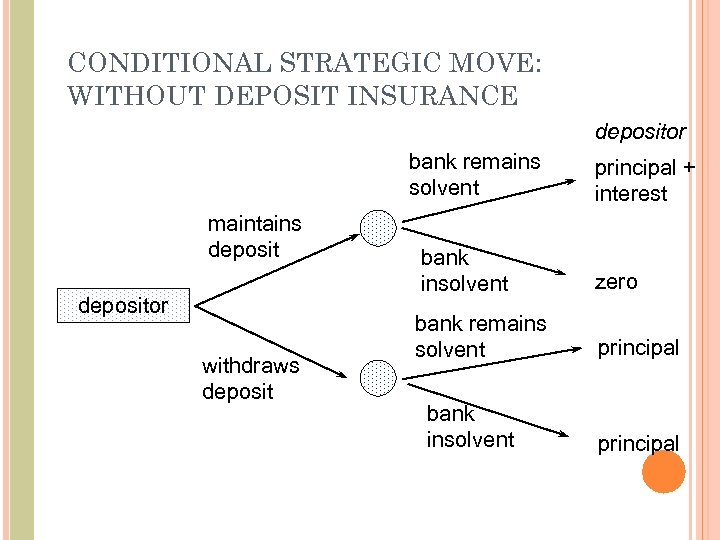

CONDITIONAL STRATEGIC MOVE: WITHOUT DEPOSIT INSURANCE depositor bank remains solvent maintains depositor withdraws deposit principal + interest bank insolvent zero bank remains solvent principal bank insolvent principal

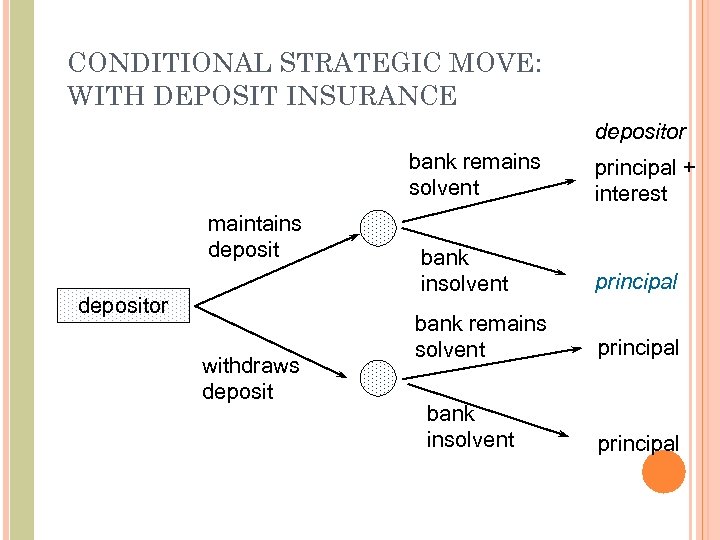

CONDITIONAL STRATEGIC MOVE: WITH DEPOSIT INSURANCE depositor bank remains solvent maintains depositor withdraws deposit principal + interest bank insolvent principal bank remains solvent principal bank insolvent principal

3292aa96c5ef1cc2b5bc6890a5fb4532.ppt