ad45b7bf90c1ab4c07ea2271d9a0fce4.ppt

- Количество слайдов: 45

Pricewaterhouse. Coop ers Credit Derivatives: Understanding the Impact on Financial Statements David Lukach, Partner Chip Currie, Senior Manager Structured Finance Group

Pricewaterhouse. Coop ers Credit Derivatives: Understanding the Impact on Financial Statements David Lukach, Partner Chip Currie, Senior Manager Structured Finance Group

Agenda • Objectives • Analyzing financial statements to assess credit derivatives • Ground rules of FAS 133 • Credit derivatives used for credit risk management • Investments in credit linked notes (CLNs) • Special Purpose Vehicles / Special Purpose Entities • FASB’s SPE consolidation project 1

Agenda • Objectives • Analyzing financial statements to assess credit derivatives • Ground rules of FAS 133 • Credit derivatives used for credit risk management • Investments in credit linked notes (CLNs) • Special Purpose Vehicles / Special Purpose Entities • FASB’s SPE consolidation project 1

Objectives

Objectives

Objectives • Understand how financial statements are affected by credit derivatives • The accounting treatment of credit derivatives • Special Purpose Vehicles • FASB Consolidation Project 3

Objectives • Understand how financial statements are affected by credit derivatives • The accounting treatment of credit derivatives • Special Purpose Vehicles • FASB Consolidation Project 3

Analyzing financial statements to assess credit derivatives

Analyzing financial statements to assess credit derivatives

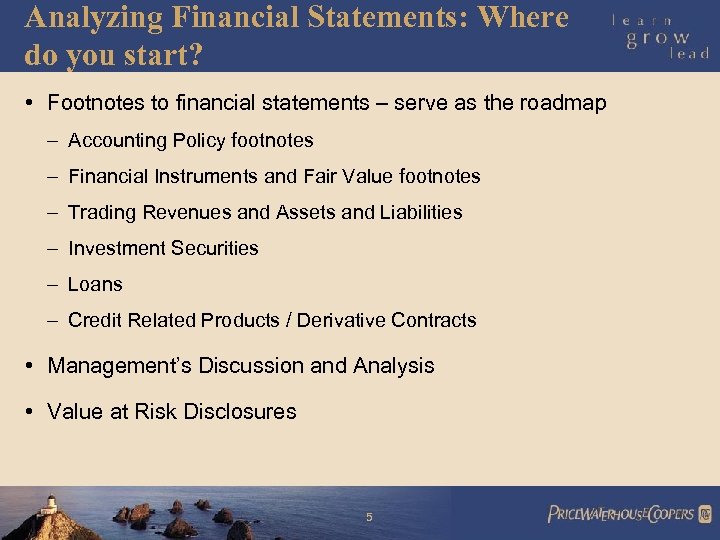

Analyzing Financial Statements: Where do you start? • Footnotes to financial statements – serve as the roadmap – Accounting Policy footnotes – Financial Instruments and Fair Value footnotes – Trading Revenues and Assets and Liabilities – Investment Securities – Loans – Credit Related Products / Derivative Contracts • Management’s Discussion and Analysis • Value at Risk Disclosures 5

Analyzing Financial Statements: Where do you start? • Footnotes to financial statements – serve as the roadmap – Accounting Policy footnotes – Financial Instruments and Fair Value footnotes – Trading Revenues and Assets and Liabilities – Investment Securities – Loans – Credit Related Products / Derivative Contracts • Management’s Discussion and Analysis • Value at Risk Disclosures 5

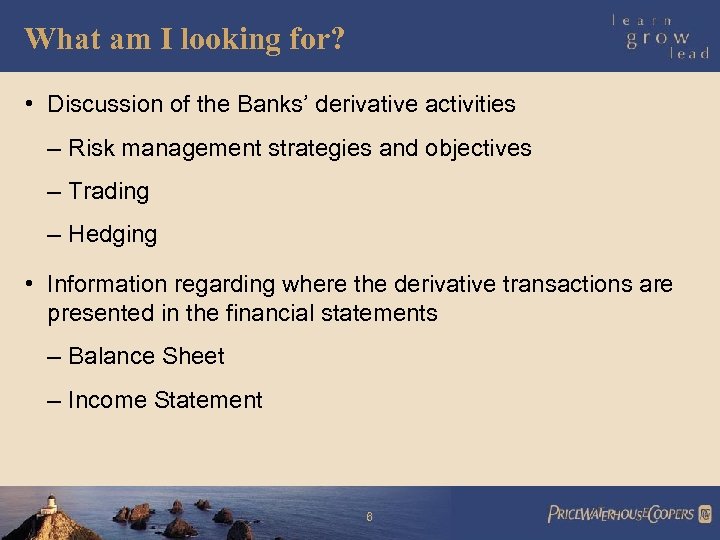

What am I looking for? • Discussion of the Banks’ derivative activities – Risk management strategies and objectives – Trading – Hedging • Information regarding where the derivative transactions are presented in the financial statements – Balance Sheet – Income Statement 6

What am I looking for? • Discussion of the Banks’ derivative activities – Risk management strategies and objectives – Trading – Hedging • Information regarding where the derivative transactions are presented in the financial statements – Balance Sheet – Income Statement 6

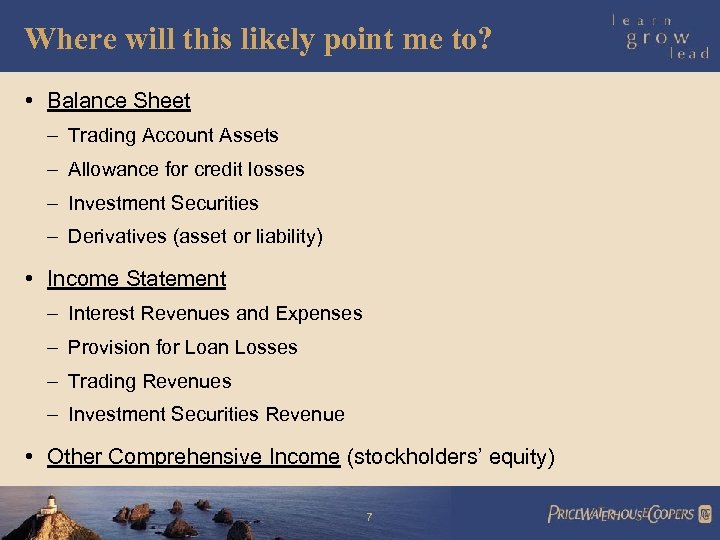

Where will this likely point me to? • Balance Sheet – Trading Account Assets – Allowance for credit losses – Investment Securities – Derivatives (asset or liability) • Income Statement – Interest Revenues and Expenses – Provision for Loan Losses – Trading Revenues – Investment Securities Revenue • Other Comprehensive Income (stockholders’ equity) 7

Where will this likely point me to? • Balance Sheet – Trading Account Assets – Allowance for credit losses – Investment Securities – Derivatives (asset or liability) • Income Statement – Interest Revenues and Expenses – Provision for Loan Losses – Trading Revenues – Investment Securities Revenue • Other Comprehensive Income (stockholders’ equity) 7

Ground rules of FAS 133

Ground rules of FAS 133

Credit Products • Most credit products are considered derivatives subject to the requirements of FAS 133 – Credit Default Swaps – Total Return Swaps • Financial guarantees contacts are not considered derivatives 9

Credit Products • Most credit products are considered derivatives subject to the requirements of FAS 133 – Credit Default Swaps – Total Return Swaps • Financial guarantees contacts are not considered derivatives 9

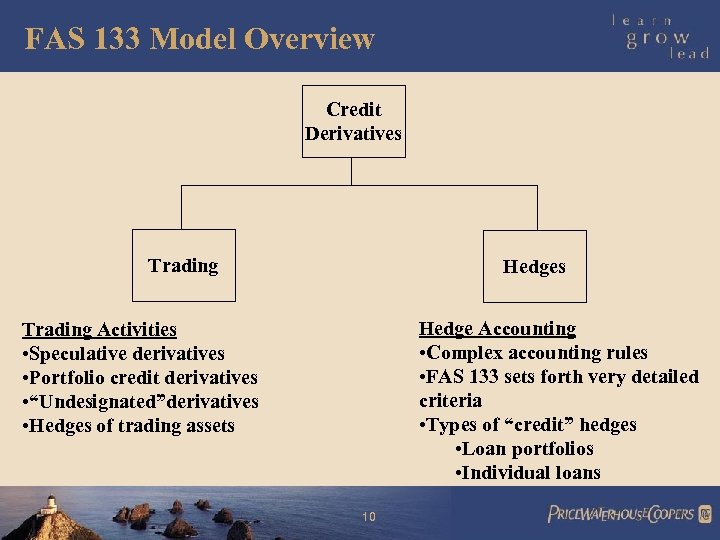

FAS 133 Model Overview Credit Derivatives Trading Hedges Hedge Accounting • Complex accounting rules • FAS 133 sets forth very detailed criteria • Types of “credit” hedges • Loan portfolios • Individual loans Trading Activities • Speculative derivatives • Portfolio credit derivatives • “Undesignated”derivatives • Hedges of trading assets 10

FAS 133 Model Overview Credit Derivatives Trading Hedges Hedge Accounting • Complex accounting rules • FAS 133 sets forth very detailed criteria • Types of “credit” hedges • Loan portfolios • Individual loans Trading Activities • Speculative derivatives • Portfolio credit derivatives • “Undesignated”derivatives • Hedges of trading assets 10

Why is getting hedge accounting important? • Hedge accounting allows the Bank to match the timing of recognition of gains and losses on the derivative with timing of recognition of gains and losses on the hedged item – Loss on loan – Gain on derivative • Reduces income statement volatility • Reflects the economics of the transaction 11

Why is getting hedge accounting important? • Hedge accounting allows the Bank to match the timing of recognition of gains and losses on the derivative with timing of recognition of gains and losses on the hedged item – Loss on loan – Gain on derivative • Reduces income statement volatility • Reflects the economics of the transaction 11

Why is getting hedge accounting important? • Trading activities are recorded at fair value with changes in fair value reflected in the income statement • Gain on derivative is recorded in earnings when its market value increases • Loss on loan is recognized when it is measurable and probable • Timing mismatch derived from loan losses vs. derivative MTM 12

Why is getting hedge accounting important? • Trading activities are recorded at fair value with changes in fair value reflected in the income statement • Gain on derivative is recorded in earnings when its market value increases • Loss on loan is recognized when it is measurable and probable • Timing mismatch derived from loan losses vs. derivative MTM 12

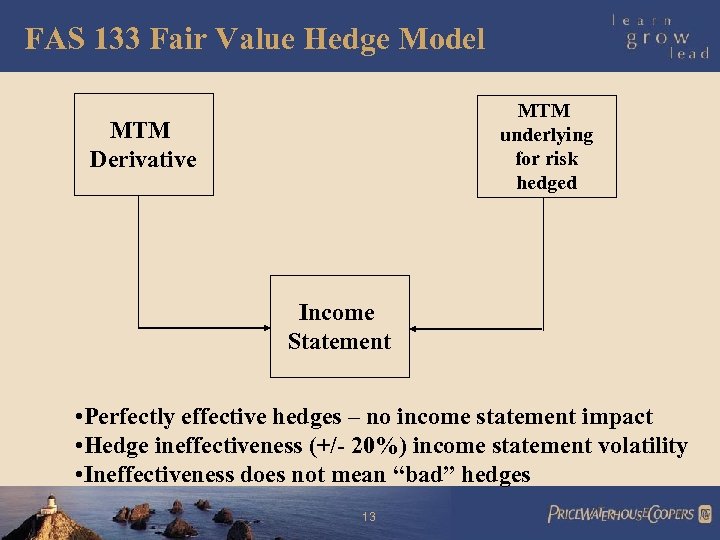

FAS 133 Fair Value Hedge Model MTM underlying for risk hedged MTM Derivative Income Statement • Perfectly effective hedges – no income statement impact • Hedge ineffectiveness (+/- 20%) income statement volatility • Ineffectiveness does not mean “bad” hedges 13

FAS 133 Fair Value Hedge Model MTM underlying for risk hedged MTM Derivative Income Statement • Perfectly effective hedges – no income statement impact • Hedge ineffectiveness (+/- 20%) income statement volatility • Ineffectiveness does not mean “bad” hedges 13

FAS 133 Fair value hedge model involves changes to traditional loan accounting • Hedged loans are no longer held at amortized cost • Loan balances are adjusted for changes in fair value attributable to the hedged risk : – Interest rate risk – Credit risk • When loans are hedged the traditional model for loan loss reserves (allowance for loan losses) is modified – Balance Sheet: Loans adjusted, in part, to fair value (loans) – Income Statement: Changes in fair value recorded in P&L (provision for loan loss or trading) • Change in the fair value of the derivative is recorded in P&L 14

FAS 133 Fair value hedge model involves changes to traditional loan accounting • Hedged loans are no longer held at amortized cost • Loan balances are adjusted for changes in fair value attributable to the hedged risk : – Interest rate risk – Credit risk • When loans are hedged the traditional model for loan loss reserves (allowance for loan losses) is modified – Balance Sheet: Loans adjusted, in part, to fair value (loans) – Income Statement: Changes in fair value recorded in P&L (provision for loan loss or trading) • Change in the fair value of the derivative is recorded in P&L 14

Credit derivatives used for credit risk management

Credit derivatives used for credit risk management

Using credit derivatives Frequently banks use credit derivatives: • to hedge risks inherent in their loan portfolio • to diversify credit risk = synthetic portfolio management • to obtain regulatory capital relief 16

Using credit derivatives Frequently banks use credit derivatives: • to hedge risks inherent in their loan portfolio • to diversify credit risk = synthetic portfolio management • to obtain regulatory capital relief 16

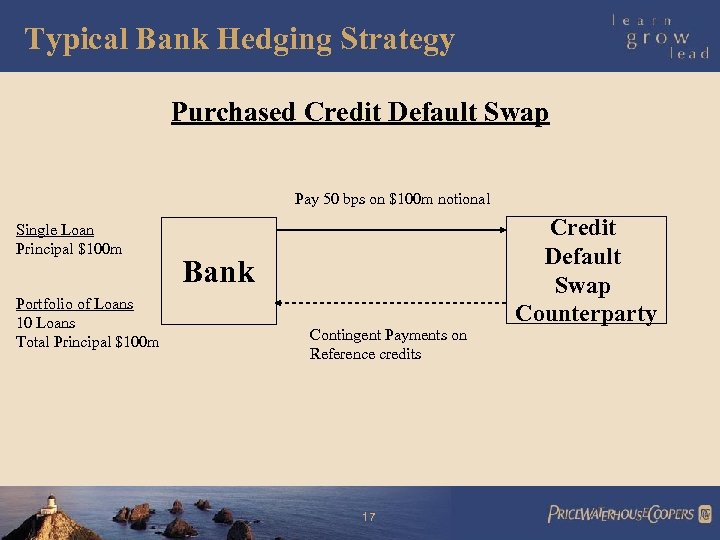

Typical Bank Hedging Strategy Purchased Credit Default Swap Pay 50 bps on $100 m notional Single Loan Principal $100 m Portfolio of Loans 10 Loans Total Principal $100 m Bank Contingent Payments on Reference credits 17 Credit Default Swap Counterparty

Typical Bank Hedging Strategy Purchased Credit Default Swap Pay 50 bps on $100 m notional Single Loan Principal $100 m Portfolio of Loans 10 Loans Total Principal $100 m Bank Contingent Payments on Reference credits 17 Credit Default Swap Counterparty

Hedging – A few of the requirements • In order to achieve hedge accounting, the bank must demonstrate that the changes in the fair value of the derivative is “highly effective” at offsetting changes in the fair value of the hedged credit spread – Definition of highly effective: 80% - 125% ratio of: › Change in fair value of derivative vs. › Change in fair value of the hedged loan relating to credit risk 18

Hedging – A few of the requirements • In order to achieve hedge accounting, the bank must demonstrate that the changes in the fair value of the derivative is “highly effective” at offsetting changes in the fair value of the hedged credit spread – Definition of highly effective: 80% - 125% ratio of: › Change in fair value of derivative vs. › Change in fair value of the hedged loan relating to credit risk 18

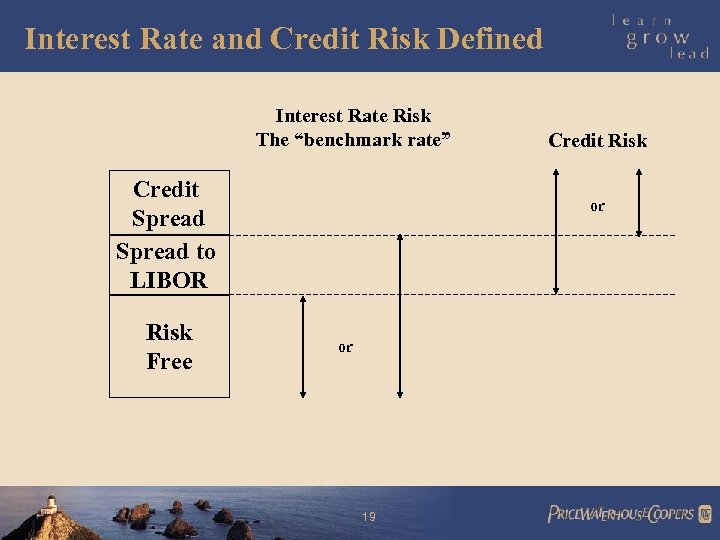

Interest Rate and Credit Risk Defined Interest Rate Risk The “benchmark rate” Credit Spread to LIBOR Risk Free Credit Risk or or 19

Interest Rate and Credit Risk Defined Interest Rate Risk The “benchmark rate” Credit Spread to LIBOR Risk Free Credit Risk or or 19

Hedge accounting issues • Difficult to get hedge accounting for a portfolio of loans using a credit derivative (not homogeneous) – A portfolio must have similar risks – Credit risks of different borrowers generally are not highly correlated • Can not get hedge accounting for CDS hedging the risk of undrawn loan commitments (difficult to demonstrate probability) • Banks are finding it difficult to demonstrate that single name credit derivatives are effective at hedging a loan – Differences in credit default swap spreads vs. FASB proscribed method of calculating change in fair value due to credit risk 20

Hedge accounting issues • Difficult to get hedge accounting for a portfolio of loans using a credit derivative (not homogeneous) – A portfolio must have similar risks – Credit risks of different borrowers generally are not highly correlated • Can not get hedge accounting for CDS hedging the risk of undrawn loan commitments (difficult to demonstrate probability) • Banks are finding it difficult to demonstrate that single name credit derivatives are effective at hedging a loan – Differences in credit default swap spreads vs. FASB proscribed method of calculating change in fair value due to credit risk 20

Hedge accounting issues • Key Point: Even if hedges qualify for hedge accounting, ineffectiveness is recorded in earnings – Some level of income statement volatility – For example, 80% offset = 20% inefficiency (can be a gain or loss) 21

Hedge accounting issues • Key Point: Even if hedges qualify for hedge accounting, ineffectiveness is recorded in earnings – Some level of income statement volatility – For example, 80% offset = 20% inefficiency (can be a gain or loss) 21

What if the CDS Does Not Qualify for Hedge Accounting? • All derivatives must be reported at FV • All changes in FV must be reflected in current earnings when they occur • Income statement volatility due to immediate recognition of changes in FV of CDS • Bank is not permitted to reflect changes in FV of loan unless it qualifies as a hedging relationship 22

What if the CDS Does Not Qualify for Hedge Accounting? • All derivatives must be reported at FV • All changes in FV must be reflected in current earnings when they occur • Income statement volatility due to immediate recognition of changes in FV of CDS • Bank is not permitted to reflect changes in FV of loan unless it qualifies as a hedging relationship 22

Key Derivatives Disclosures • FAS 133 changed disclosure requirements • Certain information is no longer required as many readers found the information to be irrelevant – Notional values – Average fair values • Must disclose the amount of ineffectiveness in hedging relationships: – Evaluate the Company’s hedging relationships – Isolate the impact of any ineffectiveness recorded in the income statement – Disclosure may be at a very high level 23

Key Derivatives Disclosures • FAS 133 changed disclosure requirements • Certain information is no longer required as many readers found the information to be irrelevant – Notional values – Average fair values • Must disclose the amount of ineffectiveness in hedging relationships: – Evaluate the Company’s hedging relationships – Isolate the impact of any ineffectiveness recorded in the income statement – Disclosure may be at a very high level 23

Key Points • Income statement volatility is unavoidable – CDS will not be a perfect hedge • Trading activity is not necessarily speculative – Some economic hedges will not qualify for hedge accounting 24

Key Points • Income statement volatility is unavoidable – CDS will not be a perfect hedge • Trading activity is not necessarily speculative – Some economic hedges will not qualify for hedge accounting 24

Key Points • Qualitative information is important – Where do I look ? • MD&A and Footnotes – Risk Management Strategy – VAR Disclosures – Accounting Policy footnote • Balance Sheet • Income Statement 25

Key Points • Qualitative information is important – Where do I look ? • MD&A and Footnotes – Risk Management Strategy – VAR Disclosures – Accounting Policy footnote • Balance Sheet • Income Statement 25

Investments in credit linked notes

Investments in credit linked notes

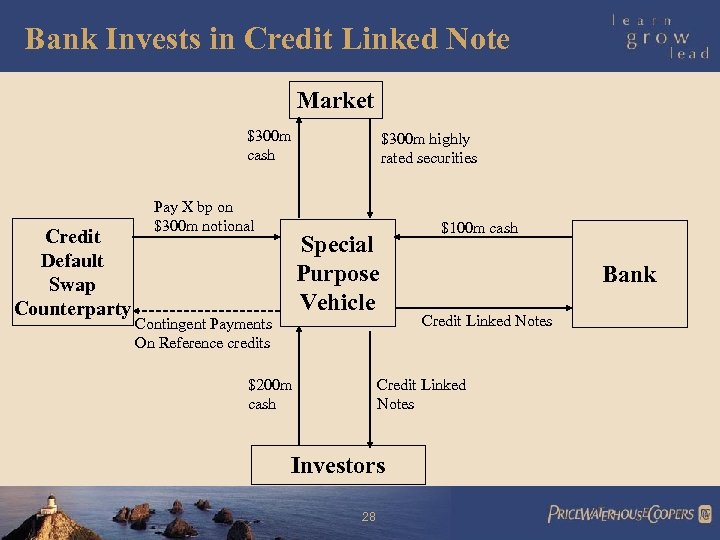

Credit Linked Notes (“CLNs”) • CLNs are debt instruments whose repayment of principal and/or interest are contingent upon the credit performance of specifically identified reference assets • CLNs can be issued directly by an institution or created synthetically (as illustrated in the following slide) • A CLN investment can provide a bank with specifically tailored credit risks/returns • Banks invest in CLNs to help diversify their credit portfolio • Banks also issue CLNs to help hedge their credit portfolio • Investing in CLNs or issuing CLNs can cause income statement volatility under FAS 133 27

Credit Linked Notes (“CLNs”) • CLNs are debt instruments whose repayment of principal and/or interest are contingent upon the credit performance of specifically identified reference assets • CLNs can be issued directly by an institution or created synthetically (as illustrated in the following slide) • A CLN investment can provide a bank with specifically tailored credit risks/returns • Banks invest in CLNs to help diversify their credit portfolio • Banks also issue CLNs to help hedge their credit portfolio • Investing in CLNs or issuing CLNs can cause income statement volatility under FAS 133 27

Bank Invests in Credit Linked Note Market $300 m cash Credit Default Swap Counterparty Pay X bp on $300 m notional $300 m highly rated securities Special Purpose Vehicle Contingent Payments On Reference credits $200 m cash $100 m cash Bank Credit Linked Notes Investors 28

Bank Invests in Credit Linked Note Market $300 m cash Credit Default Swap Counterparty Pay X bp on $300 m notional $300 m highly rated securities Special Purpose Vehicle Contingent Payments On Reference credits $200 m cash $100 m cash Bank Credit Linked Notes Investors 28

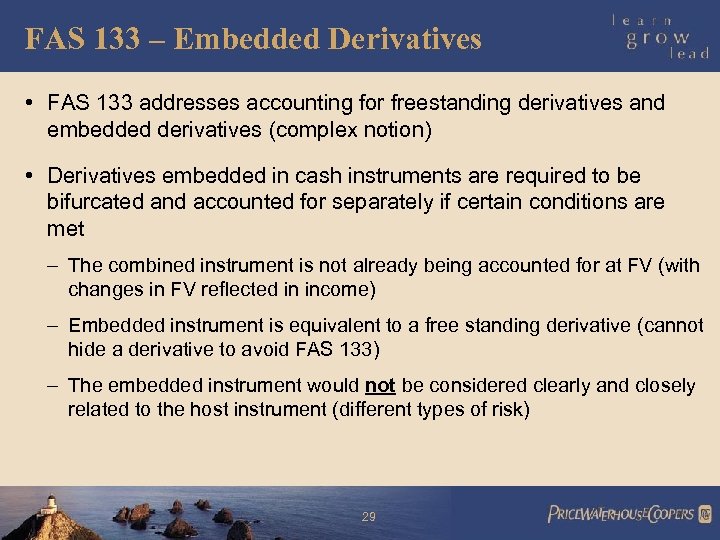

FAS 133 – Embedded Derivatives • FAS 133 addresses accounting for freestanding derivatives and embedded derivatives (complex notion) • Derivatives embedded in cash instruments are required to be bifurcated and accounted for separately if certain conditions are met – The combined instrument is not already being accounted for at FV (with changes in FV reflected in income) – Embedded instrument is equivalent to a free standing derivative (cannot hide a derivative to avoid FAS 133) – The embedded instrument would not be considered clearly and closely related to the host instrument (different types of risk) 29

FAS 133 – Embedded Derivatives • FAS 133 addresses accounting for freestanding derivatives and embedded derivatives (complex notion) • Derivatives embedded in cash instruments are required to be bifurcated and accounted for separately if certain conditions are met – The combined instrument is not already being accounted for at FV (with changes in FV reflected in income) – Embedded instrument is equivalent to a free standing derivative (cannot hide a derivative to avoid FAS 133) – The embedded instrument would not be considered clearly and closely related to the host instrument (different types of risk) 29

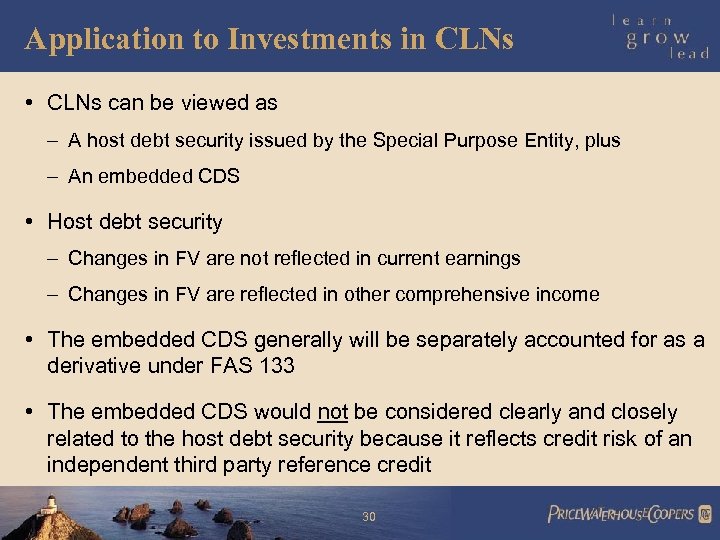

Application to Investments in CLNs • CLNs can be viewed as – A host debt security issued by the Special Purpose Entity, plus – An embedded CDS • Host debt security – Changes in FV are not reflected in current earnings – Changes in FV are reflected in other comprehensive income • The embedded CDS generally will be separately accounted for as a derivative under FAS 133 • The embedded CDS would not be considered clearly and closely related to the host debt security because it reflects credit risk of an independent third party reference credit 30

Application to Investments in CLNs • CLNs can be viewed as – A host debt security issued by the Special Purpose Entity, plus – An embedded CDS • Host debt security – Changes in FV are not reflected in current earnings – Changes in FV are reflected in other comprehensive income • The embedded CDS generally will be separately accounted for as a derivative under FAS 133 • The embedded CDS would not be considered clearly and closely related to the host debt security because it reflects credit risk of an independent third party reference credit 30

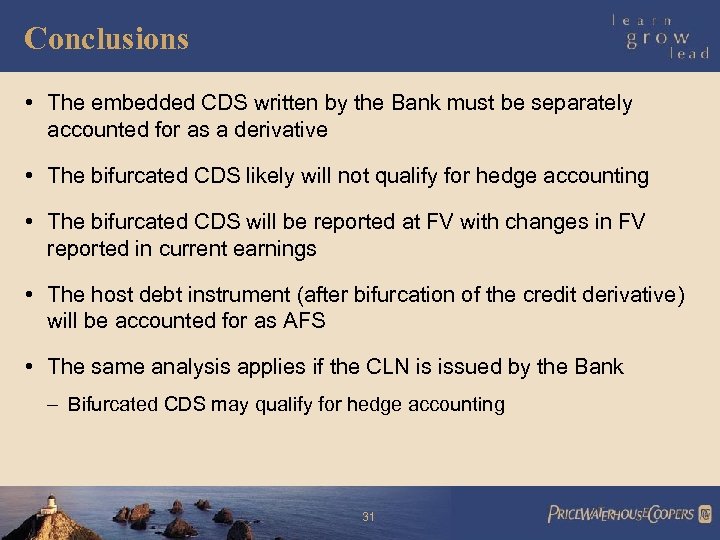

Conclusions • The embedded CDS written by the Bank must be separately accounted for as a derivative • The bifurcated CDS likely will not qualify for hedge accounting • The bifurcated CDS will be reported at FV with changes in FV reported in current earnings • The host debt instrument (after bifurcation of the credit derivative) will be accounted for as AFS • The same analysis applies if the CLN is issued by the Bank – Bifurcated CDS may qualify for hedge accounting 31

Conclusions • The embedded CDS written by the Bank must be separately accounted for as a derivative • The bifurcated CDS likely will not qualify for hedge accounting • The bifurcated CDS will be reported at FV with changes in FV reported in current earnings • The host debt instrument (after bifurcation of the credit derivative) will be accounted for as AFS • The same analysis applies if the CLN is issued by the Bank – Bifurcated CDS may qualify for hedge accounting 31

Special Purpose Vehicles / Special Purpose Entities

Special Purpose Vehicles / Special Purpose Entities

What is an SPE? • No clear definition in the accounting literature for an SPE • Generally it is a entity established for a limited purpose to benefit an individual or an entity – Investing in specified assets – Securitizing risks • Can be structured in a variety of legal forms – Corporations – Trusts – Partnerships – Limited Liability Companies 33

What is an SPE? • No clear definition in the accounting literature for an SPE • Generally it is a entity established for a limited purpose to benefit an individual or an entity – Investing in specified assets – Securitizing risks • Can be structured in a variety of legal forms – Corporations – Trusts – Partnerships – Limited Liability Companies 33

Why do people use SPEs? • They are frequently utilized to legally isolate specific assets and liabilities • SPEs can efficiently allocate risks to multiple market participants (Synthetic CLOs) • SPEs can also be used to tailor or customize risks ( to create specific risk profiles) • Obtain access to different sectors of the market – Insurance companies – Hedge funds 34

Why do people use SPEs? • They are frequently utilized to legally isolate specific assets and liabilities • SPEs can efficiently allocate risks to multiple market participants (Synthetic CLOs) • SPEs can also be used to tailor or customize risks ( to create specific risk profiles) • Obtain access to different sectors of the market – Insurance companies – Hedge funds 34

Consolidation of SPEs • Who should consolidate a SPE? • Consolidation vs. non-consolidation of SPEs impacts the balance sheet of the bank • Potential impact on the income statement from consolidation of an SPE • Consolidation of the SPE may not invalidate the business purpose of the SPE (achieve credit risk reduction) 35

Consolidation of SPEs • Who should consolidate a SPE? • Consolidation vs. non-consolidation of SPEs impacts the balance sheet of the bank • Potential impact on the income statement from consolidation of an SPE • Consolidation of the SPE may not invalidate the business purpose of the SPE (achieve credit risk reduction) 35

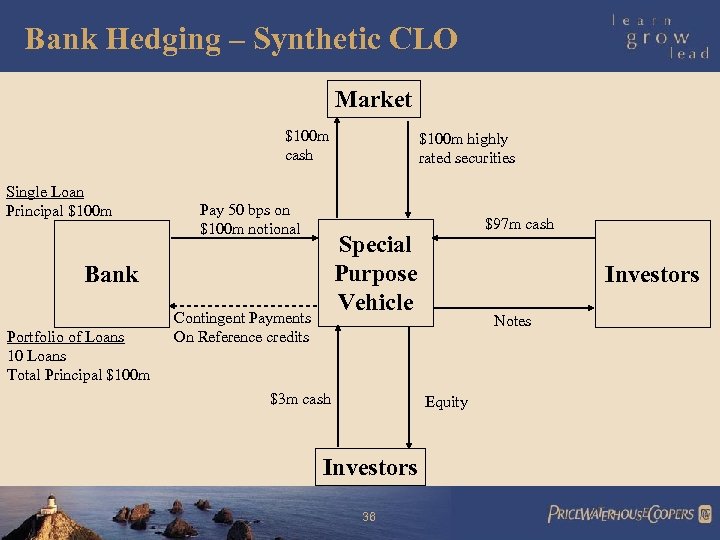

Bank Hedging – Synthetic CLO Market $100 m cash Single Loan Principal $100 m Pay 50 bps on $100 m notional $97 m cash Special Purpose Vehicle Bank Portfolio of Loans 10 Loans Total Principal $100 m highly rated securities Contingent Payments On Reference credits $3 m cash Investors Notes Equity Investors 36

Bank Hedging – Synthetic CLO Market $100 m cash Single Loan Principal $100 m Pay 50 bps on $100 m notional $97 m cash Special Purpose Vehicle Bank Portfolio of Loans 10 Loans Total Principal $100 m highly rated securities Contingent Payments On Reference credits $3 m cash Investors Notes Equity Investors 36

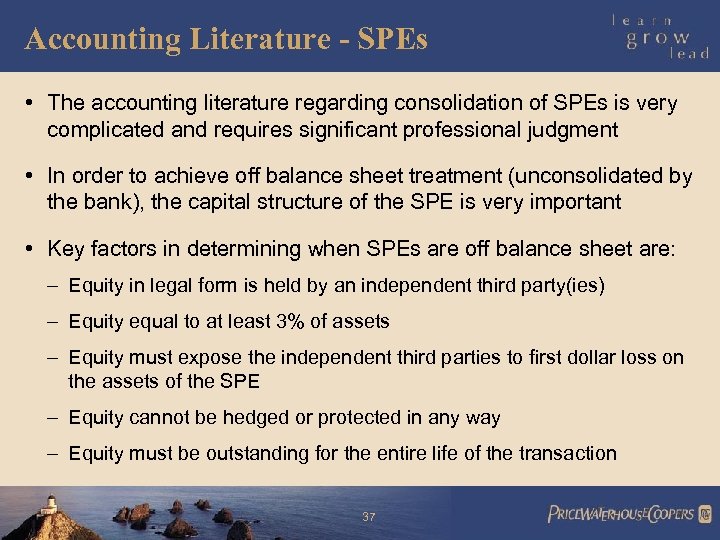

Accounting Literature - SPEs • The accounting literature regarding consolidation of SPEs is very complicated and requires significant professional judgment • In order to achieve off balance sheet treatment (unconsolidated by the bank), the capital structure of the SPE is very important • Key factors in determining when SPEs are off balance sheet are: – Equity in legal form is held by an independent third party(ies) – Equity equal to at least 3% of assets – Equity must expose the independent third parties to first dollar loss on the assets of the SPE – Equity cannot be hedged or protected in any way – Equity must be outstanding for the entire life of the transaction 37

Accounting Literature - SPEs • The accounting literature regarding consolidation of SPEs is very complicated and requires significant professional judgment • In order to achieve off balance sheet treatment (unconsolidated by the bank), the capital structure of the SPE is very important • Key factors in determining when SPEs are off balance sheet are: – Equity in legal form is held by an independent third party(ies) – Equity equal to at least 3% of assets – Equity must expose the independent third parties to first dollar loss on the assets of the SPE – Equity cannot be hedged or protected in any way – Equity must be outstanding for the entire life of the transaction 37

What if this SPE is consolidated? • If a bank consolidated a synthetic CLO SPE, it would be reflected in the consolidated financial statements of the bank – Assets owned by the SPE (highly rated securities) – The notes issued by the SPE – Embedded derivative in notes issued by SPE – Equity of the SPE (minority interest) • Primary impact is a balance sheet “gross-up” – Assets of SPE – Liability and equity issued by SPE 38

What if this SPE is consolidated? • If a bank consolidated a synthetic CLO SPE, it would be reflected in the consolidated financial statements of the bank – Assets owned by the SPE (highly rated securities) – The notes issued by the SPE – Embedded derivative in notes issued by SPE – Equity of the SPE (minority interest) • Primary impact is a balance sheet “gross-up” – Assets of SPE – Liability and equity issued by SPE 38

What if this SPE is not consolidated? • Bank would account for the CDS • The same methodology as for a freestanding CDS (a derivative) 39

What if this SPE is not consolidated? • Bank would account for the CDS • The same methodology as for a freestanding CDS (a derivative) 39

FASB SPE consolidation project

FASB SPE consolidation project

History/Motivation • For a number of years the FASB has been working on developing a new consolidation project for Special Purpose Entities (1982) • In light of recent events the FASB is “fast tracking” issuance of an interpretation to existing consolidation literature 41

History/Motivation • For a number of years the FASB has been working on developing a new consolidation project for Special Purpose Entities (1982) • In light of recent events the FASB is “fast tracking” issuance of an interpretation to existing consolidation literature 41

When is it coming? • Final interpretation is expected to be issued by August 1, 2002 • The interpretation will be immediately effective for transactions completed after issuance • Accounting for SPEs established prior to the issuance of new guidance will be impacted – In fiscal years beginning after December 15, 2002 – No grandfathering of old transactions – Ability to revise SPEs – Calendar year companies apply new rules on 1/1/03 42

When is it coming? • Final interpretation is expected to be issued by August 1, 2002 • The interpretation will be immediately effective for transactions completed after issuance • Accounting for SPEs established prior to the issuance of new guidance will be impacted – In fiscal years beginning after December 15, 2002 – No grandfathering of old transactions – Ability to revise SPEs – Calendar year companies apply new rules on 1/1/03 42

Expected changes to existing GAAP model • Minimum acceptable legal form equity to keep SPE off balance sheet will increase from 3% to 10% • SPEs which do not have sufficient legal form equity will be consolidated by the “primary beneficiary” – Similar to the sponsor concept that exists today • Provide more guidance on how to define a primary beneficiary • Primary beneficiary = Bank who transfers credit risk 43

Expected changes to existing GAAP model • Minimum acceptable legal form equity to keep SPE off balance sheet will increase from 3% to 10% • SPEs which do not have sufficient legal form equity will be consolidated by the “primary beneficiary” – Similar to the sponsor concept that exists today • Provide more guidance on how to define a primary beneficiary • Primary beneficiary = Bank who transfers credit risk 43

Summary • New model will be effective for structures completed after its issuance • For calendar year companies, new rules will apply to all SPEs as of January 1, 2003 • Current SPEs – Revise or modify – if possible to meet the requirements of the new rules – Terminate SPEs – Consolidate SPEs if new GAAP requirements for off balance sheet are not met › Restatement of prior year financial statements will not be required › Adoption through cumulative change in accounting principal 44

Summary • New model will be effective for structures completed after its issuance • For calendar year companies, new rules will apply to all SPEs as of January 1, 2003 • Current SPEs – Revise or modify – if possible to meet the requirements of the new rules – Terminate SPEs – Consolidate SPEs if new GAAP requirements for off balance sheet are not met › Restatement of prior year financial statements will not be required › Adoption through cumulative change in accounting principal 44