price_discrimination[1].pptx

- Количество слайдов: 16

Price discrimination

Price discrimination

Price discrimination • Price discrimination is the practice of charging a different price for the same good or service. • There are three types of price discrimination – first-degree, second-degree, and third-degree price discrimination.

Price discrimination • Price discrimination is the practice of charging a different price for the same good or service. • There are three types of price discrimination – first-degree, second-degree, and third-degree price discrimination.

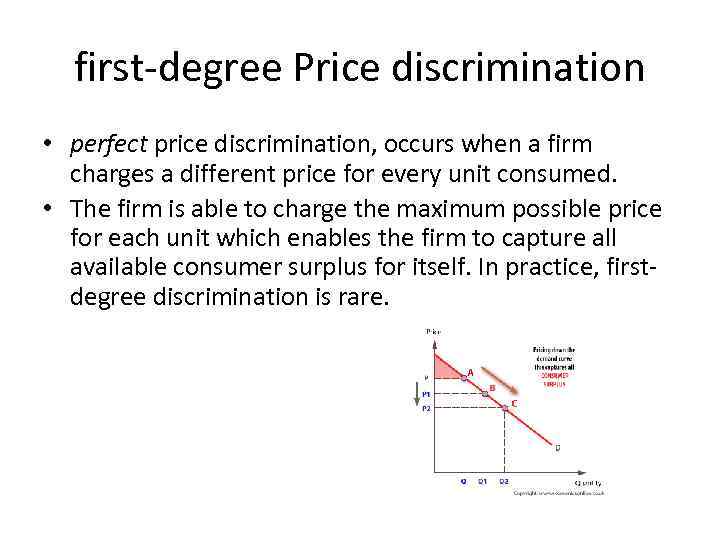

first-degree Price discrimination • perfect price discrimination, occurs when a firm charges a different price for every unit consumed. • The firm is able to charge the maximum possible price for each unit which enables the firm to capture all available consumer surplus for itself. In practice, firstdegree discrimination is rare.

first-degree Price discrimination • perfect price discrimination, occurs when a firm charges a different price for every unit consumed. • The firm is able to charge the maximum possible price for each unit which enables the firm to capture all available consumer surplus for itself. In practice, firstdegree discrimination is rare.

2 nd-degree Price discrimination • This involves charging different prices depending upon the quantity consumed. • E. g. • after 10 minutes phone calls become cheaper. • 1. 5 gigabyte free internet by reload of rm 30.

2 nd-degree Price discrimination • This involves charging different prices depending upon the quantity consumed. • E. g. • after 10 minutes phone calls become cheaper. • 1. 5 gigabyte free internet by reload of rm 30.

3 rd-degree Price discrimination • This involves charging different prices to different groups of people. • E. g. • Students are given special discount in cinema, zoo, or water park. • OAPs (old age pensioner) can get cheaper bus ticket or flight. • Splitting the market into peak and off peak use is very common and occurs with gas, electricity, and telephone supply, as well as gym membership and parking charges.

3 rd-degree Price discrimination • This involves charging different prices to different groups of people. • E. g. • Students are given special discount in cinema, zoo, or water park. • OAPs (old age pensioner) can get cheaper bus ticket or flight. • Splitting the market into peak and off peak use is very common and occurs with gas, electricity, and telephone supply, as well as gym membership and parking charges.

Conditions Necessary for Price Discrimination • The firm must be able to identify different market segments, such as domestic users and industrial users. • Different segments must have different price elasticity of demand (PEDs). a group like adults, PED is inelastic – the price will be higher, For groups like students prices will be lower because there demand is elastic • Markets must be kept separate, either by time, physical distance and nature of use, such as Microsoft Office ‘Schools’ edition which is only available to educational institutions, at a lower price. • There must be no seepage/penetration between the two markets, which means that a consumer cannot purchase at the low price in the elastic sub -market, and then re-sell to other consumers in the inelastic sub-market, at a higher price. • The firm must have some degree of monopoly power. If a firm has exclusive ownership of a scarce resource, such as Microsoft owning the Windows operating system brand, it has monopoly power over this resource and is the only firm that can use it.

Conditions Necessary for Price Discrimination • The firm must be able to identify different market segments, such as domestic users and industrial users. • Different segments must have different price elasticity of demand (PEDs). a group like adults, PED is inelastic – the price will be higher, For groups like students prices will be lower because there demand is elastic • Markets must be kept separate, either by time, physical distance and nature of use, such as Microsoft Office ‘Schools’ edition which is only available to educational institutions, at a lower price. • There must be no seepage/penetration between the two markets, which means that a consumer cannot purchase at the low price in the elastic sub -market, and then re-sell to other consumers in the inelastic sub-market, at a higher price. • The firm must have some degree of monopoly power. If a firm has exclusive ownership of a scarce resource, such as Microsoft owning the Windows operating system brand, it has monopoly power over this resource and is the only firm that can use it.

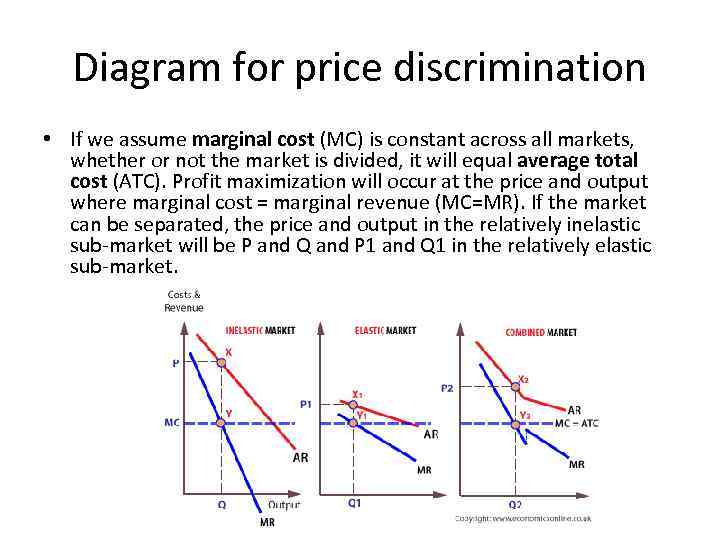

Diagram for price discrimination • If we assume marginal cost (MC) is constant across all markets, whether or not the market is divided, it will equal average total cost (ATC). Profit maximization will occur at the price and output where marginal cost = marginal revenue (MC=MR). If the market can be separated, the price and output in the relatively inelastic sub-market will be P and Q and P 1 and Q 1 in the relatively elastic sub-market.

Diagram for price discrimination • If we assume marginal cost (MC) is constant across all markets, whether or not the market is divided, it will equal average total cost (ATC). Profit maximization will occur at the price and output where marginal cost = marginal revenue (MC=MR). If the market can be separated, the price and output in the relatively inelastic sub-market will be P and Q and P 1 and Q 1 in the relatively elastic sub-market.

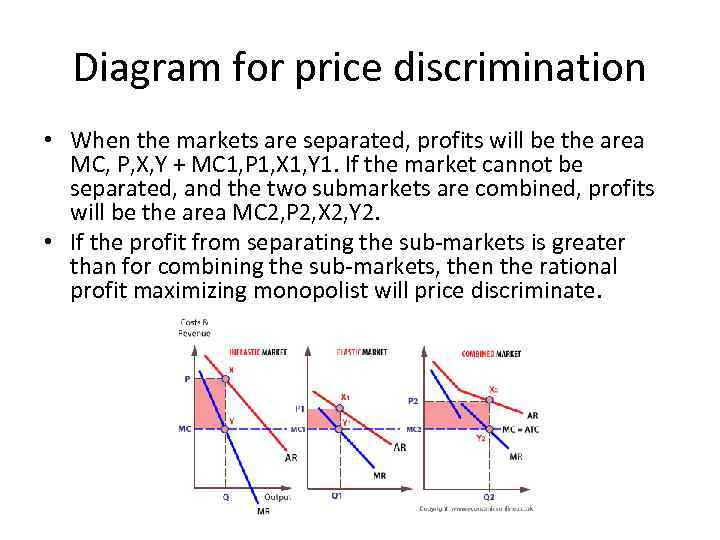

Diagram for price discrimination • When the markets are separated, profits will be the area MC, P, X, Y + MC 1, P 1, X 1, Y 1. If the market cannot be separated, and the two submarkets are combined, profits will be the area MC 2, P 2, X 2, Y 2. • If the profit from separating the sub-markets is greater than for combining the sub-markets, then the rational profit maximizing monopolist will price discriminate.

Diagram for price discrimination • When the markets are separated, profits will be the area MC, P, X, Y + MC 1, P 1, X 1, Y 1. If the market cannot be separated, and the two submarkets are combined, profits will be the area MC 2, P 2, X 2, Y 2. • If the profit from separating the sub-markets is greater than for combining the sub-markets, then the rational profit maximizing monopolist will price discriminate.

Advantages of Price Discrimination • Firms will be able to increase revenue. This will enable some firms to stay in business who otherwise would have made a loss. For example price discrimination is important for train companies who offer different prices for peak and off peak. • Increased revenues can be used for research and development which benefit consumers • Some consumers will benefit from lower fares. E. G. old people benefit from lower train companies, old people are more likely to be poor.

Advantages of Price Discrimination • Firms will be able to increase revenue. This will enable some firms to stay in business who otherwise would have made a loss. For example price discrimination is important for train companies who offer different prices for peak and off peak. • Increased revenues can be used for research and development which benefit consumers • Some consumers will benefit from lower fares. E. G. old people benefit from lower train companies, old people are more likely to be poor.

Disadvantages of Price Discrimination • Some consumers will end up paying higher prices. These higher prices are likely to be allocatively inefficient because P > MC. • Decline in consumer surplus. • Those who pay higher prices may not be the poorest. E. g. adults could be unemployed, OAPs well off. • There may be administration costs in separating the markets. • Profits from price discrimination could be used to finance predatory pricing.

Disadvantages of Price Discrimination • Some consumers will end up paying higher prices. These higher prices are likely to be allocatively inefficient because P > MC. • Decline in consumer surplus. • Those who pay higher prices may not be the poorest. E. g. adults could be unemployed, OAPs well off. • There may be administration costs in separating the markets. • Profits from price discrimination could be used to finance predatory pricing.

Example of price discrimination • Airline travel and time of departure : • Airlines charge different prices depending on the season and day of the week. During the peak holiday season in August and Easter, the price will be higher because demand is greater and more inelastic. Flights which occur during the week e. g. Mon to Fri, will be more expensive because these are typically taken by business travellers. If you stay for over the weekend, the price will be lower, as business travellers will not want to stay over the weekend, just to get a cheaper flight. I often go to New York for a week in October. For a flight from Mon to Fri, the price quoted is usually around £ 1, 500. If I change dates to leaving or arriving on the weekend, the price falls to £ 450.

Example of price discrimination • Airline travel and time of departure : • Airlines charge different prices depending on the season and day of the week. During the peak holiday season in August and Easter, the price will be higher because demand is greater and more inelastic. Flights which occur during the week e. g. Mon to Fri, will be more expensive because these are typically taken by business travellers. If you stay for over the weekend, the price will be lower, as business travellers will not want to stay over the weekend, just to get a cheaper flight. I often go to New York for a week in October. For a flight from Mon to Fri, the price quoted is usually around £ 1, 500. If I change dates to leaving or arriving on the weekend, the price falls to £ 450.

Example of price discrimination • Coupons: Firms often give coupons to selected consumers. For example, Tesco may send coupons to regular customers to get special offers, e. g. 20% off selected items. These coupons are often highly targeted to your spending habits. e. g. if you average weekly shopping bill is £ 50, Tesco may send you a £ 10 off voucher if you spend over £ 70. This is an indirect way of segmenting the market. Someone walking into the shop cannot benefit from the lower prices. It is also a clever marketing ploy to get people to come back.

Example of price discrimination • Coupons: Firms often give coupons to selected consumers. For example, Tesco may send coupons to regular customers to get special offers, e. g. 20% off selected items. These coupons are often highly targeted to your spending habits. e. g. if you average weekly shopping bill is £ 50, Tesco may send you a £ 10 off voucher if you spend over £ 70. This is an indirect way of segmenting the market. Someone walking into the shop cannot benefit from the lower prices. It is also a clever marketing ploy to get people to come back.

Example of price discrimination • Age discount: A popular way to segment the market is by age category, e. g. students and OAPs often get discounts, such as 10% off. For rail travel, people with rail cards can get upto 33% off. The popularity of age discounts is that it is relatively easy to segment the market (you just need to prove your age). Also, different age groups generally have different elasticities of demand. Students and OAPs have lower income than working adults and so are more sensitive to changes in price.

Example of price discrimination • Age discount: A popular way to segment the market is by age category, e. g. students and OAPs often get discounts, such as 10% off. For rail travel, people with rail cards can get upto 33% off. The popularity of age discounts is that it is relatively easy to segment the market (you just need to prove your age). Also, different age groups generally have different elasticities of demand. Students and OAPs have lower income than working adults and so are more sensitive to changes in price.

Example of price discrimination • Quantity Purchased: For electricity, consumers get charged different tariffs depending on the quantity consumed. The first 100 units of electricity consumed are charged at a higher tariff, e. g. 25 p k. Wh. After this first 100 units, consumers get charged a lower rate. The logic is that the first 100 units of electricity are essential, and therefore demand is more inelastic. However, after the first 100 units of electricity, your demand is less essential so you become more price sensitive. Therefore, the electricity company charge a lower rate.

Example of price discrimination • Quantity Purchased: For electricity, consumers get charged different tariffs depending on the quantity consumed. The first 100 units of electricity consumed are charged at a higher tariff, e. g. 25 p k. Wh. After this first 100 units, consumers get charged a lower rate. The logic is that the first 100 units of electricity are essential, and therefore demand is more inelastic. However, after the first 100 units of electricity, your demand is less essential so you become more price sensitive. Therefore, the electricity company charge a lower rate.

Example of price discrimination • Choosing your seat early: Airplanes offer numerous ways to charge different prices for variations on a plane ticket. For example, if you want to choose your seat, you can pay a premium of £ 30. This is not strictly price discrimination because it becomes a slightly different product. But, it is a way of extracting higher prices from those who want to pay for extras.

Example of price discrimination • Choosing your seat early: Airplanes offer numerous ways to charge different prices for variations on a plane ticket. For example, if you want to choose your seat, you can pay a premium of £ 30. This is not strictly price discrimination because it becomes a slightly different product. But, it is a way of extracting higher prices from those who want to pay for extras.

Example of price discrimination • Loyalty cards • Loyalty card for Mc. Cafe: by buying coffee in mc café you are given a loyalty card so that it requires you to purchase 3 coffee in order to get fourth one for free.

Example of price discrimination • Loyalty cards • Loyalty card for Mc. Cafe: by buying coffee in mc café you are given a loyalty card so that it requires you to purchase 3 coffee in order to get fourth one for free.