464b48afb369f56e69dc5aea78584d0b.ppt

- Количество слайдов: 17

Price Discovery in Cap-and. Trade Markets for Fisheries Christopher M. Anderson (joint work with Jon G. Sutinen) University of Rhode Island (Visiting UAA Fall 2007) Funded by Rhode Island Sea Grant

Price Discovery in Cap-and. Trade Markets for Fisheries Christopher M. Anderson (joint work with Jon G. Sutinen) University of Rhode Island (Visiting UAA Fall 2007) Funded by Rhode Island Sea Grant

New Markets • Cap-and-trade systems create brand new assets – Market must identify prices • New asset markets are prone to volatility and speculation – IPO stock prices fluctuate considerably – Experimental asset markets demonstrate speculative bubble-crash cycles

New Markets • Cap-and-trade systems create brand new assets – Market must identify prices • New asset markets are prone to volatility and speculation – IPO stock prices fluctuate considerably – Experimental asset markets demonstrate speculative bubble-crash cycles

Volatility is Bad • Speculation can raise prices artificially • Poor price signals lead to poor participation and capitalization decisions • Puts at risk substantial portions of harvesters’ wealth – May support consolidation if larger operators can better diversify risk • Leads to political opposition to marketbased management

Volatility is Bad • Speculation can raise prices artificially • Poor price signals lead to poor participation and capitalization decisions • Puts at risk substantial portions of harvesters’ wealth – May support consolidation if larger operators can better diversify risk • Leads to political opposition to marketbased management

Improving Price Discovery • The rules of trade can be chosen to facilitate faster price discovery – Who may trade, when, how much, how often – What is traded, and what is the currency – How trade is facilitated by market • Do you really need designer markets? – Theory doesn’t say yes – In practice, know different institutions provide different incentives for revealing information • Have different price discovery properties

Improving Price Discovery • The rules of trade can be chosen to facilitate faster price discovery – Who may trade, when, how much, how often – What is traded, and what is the currency – How trade is facilitated by market • Do you really need designer markets? – Theory doesn’t say yes – In practice, know different institutions provide different incentives for revealing information • Have different price discovery properties

Why Experimental Testbedding? • Controlled test of predictions of economic models underlying proposed regulatory mechanisms • Cheaply and quickly evaluate economic properties of proposed program elements – Supply, demand profit functions are known, making possible precise comparisons of efficiency and other criteria – Results can be replicated, following scientific method – Identify flaws or potential issues in proposals before implementation and high-value or irreversible decisions are made – Differences among market designs not informed by theory, but loom large in determining outcomes – Past experience with FCC auctions, and water and pollution permit markets (and AK crab rationalization!) indicates experiments can improve field outcomes

Why Experimental Testbedding? • Controlled test of predictions of economic models underlying proposed regulatory mechanisms • Cheaply and quickly evaluate economic properties of proposed program elements – Supply, demand profit functions are known, making possible precise comparisons of efficiency and other criteria – Results can be replicated, following scientific method – Identify flaws or potential issues in proposals before implementation and high-value or irreversible decisions are made – Differences among market designs not informed by theory, but loom large in determining outcomes – Past experience with FCC auctions, and water and pollution permit markets (and AK crab rationalization!) indicates experiments can improve field outcomes

Motivating Case • Transferable trap certificate program in RI lobster fishery – 280 owner-operated vessels – Regulated by limited access, but allowed access at the same level – Stock decreasing due to unknown factors, and overfishing

Motivating Case • Transferable trap certificate program in RI lobster fishery – 280 owner-operated vessels – Regulated by limited access, but allowed access at the same level – Stock decreasing due to unknown factors, and overfishing

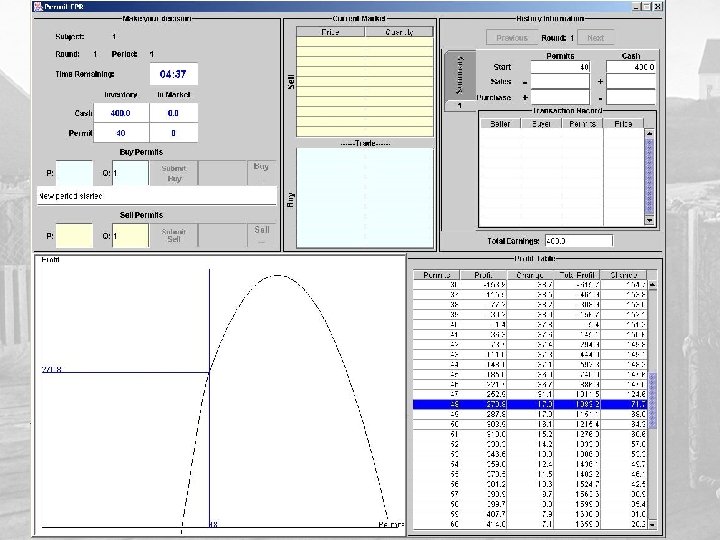

Experimental Design • 12 -14 student subjects earn profit (from fishing) based on the allowance held – Profit functions roughly based on 2001 medium-large operation • Allowance = ‘Permit’ – An entitlement to fish a fixed number of traps • Permit has life of 4 periods – Trade allowance during each period – Profit determined by allowance held at end of period • Stock assumed to be in steady state under TAC • Trade using a double auction • Series of 4 periods repeated three times • Subjects’ earnings paid to them in cash – Average $23, range $11 -$33 for about 2 hours

Experimental Design • 12 -14 student subjects earn profit (from fishing) based on the allowance held – Profit functions roughly based on 2001 medium-large operation • Allowance = ‘Permit’ – An entitlement to fish a fixed number of traps • Permit has life of 4 periods – Trade allowance during each period – Profit determined by allowance held at end of period • Stock assumed to be in steady state under TAC • Trade using a double auction • Series of 4 periods repeated three times • Subjects’ earnings paid to them in cash – Average $23, range $11 -$33 for about 2 hours

Results • Prices only weakly reflect marginal value of allowance – Evidence for speculative bubbles • Subjects reported within-period speculating • Weak bubble-shaped price patterns across periods

Results • Prices only weakly reflect marginal value of allowance – Evidence for speculative bubbles • Subjects reported within-period speculating • Weak bubble-shaped price patterns across periods

Results • Prices only weakly reflect marginal value of allowance – Evidence for speculative bubbles • Subjects reported within-period speculating • Bubble-shaped price patterns across periods – Price discovery is very hard • Noisy market with large number of trades • Parallels FL, NZ experience where price discovery was poor and many fishers became unhappy with program

Results • Prices only weakly reflect marginal value of allowance – Evidence for speculative bubbles • Subjects reported within-period speculating • Bubble-shaped price patterns across periods – Price discovery is very hard • Noisy market with large number of trades • Parallels FL, NZ experience where price discovery was poor and many fishers became unhappy with program

Market with Initial Lease • In first round of trading, allow only leasing – Trades do not carry over from one period to the next

Market with Initial Lease • In first round of trading, allow only leasing – Trades do not carry over from one period to the next

What Have We Learned? • In cap-and-trade markets: – Newly created asset markets can be highly volatile – Initial lease periods facilitate price discovery • Rules of trade do affect outcomes – Policymakers must include institutional effects in analysis of new policies – Value of past experiences may be limited to institution • Identify institution which works well, rather than restricting on which does not – Provides new degree of freedom for controlling outcomes

What Have We Learned? • In cap-and-trade markets: – Newly created asset markets can be highly volatile – Initial lease periods facilitate price discovery • Rules of trade do affect outcomes – Policymakers must include institutional effects in analysis of new policies – Value of past experiences may be limited to institution • Identify institution which works well, rather than restricting on which does not – Provides new degree of freedom for controlling outcomes

Market Design Elements • Pre-trading price signals – Leasing periods, or auctions • Multi-market – Simultaneous markets for joint or substitute products – Simultaneous lease markets – Two-pie systems • What is traded: Leases, poundage, shares, inputs • What is the currency: Money, catch shares • Experiments can be useful in assessing institutions – Policy analysts need new tool because no received theory – Experiments may be “best available science”

Market Design Elements • Pre-trading price signals – Leasing periods, or auctions • Multi-market – Simultaneous markets for joint or substitute products – Simultaneous lease markets – Two-pie systems • What is traded: Leases, poundage, shares, inputs • What is the currency: Money, catch shares • Experiments can be useful in assessing institutions – Policy analysts need new tool because no received theory – Experiments may be “best available science”