a7c5f8b151578178ca9e3c6451438245.ppt

- Количество слайдов: 18

Price Ceilings, Price Floors, and Excise Taxes Governments & markets

Price Ceilings, Price Floors, and Excise Taxes Governments & markets

Price ceiling: A price above which it is illegal to charge. Binding price ceiling: A price ceiling set below the equilibrium price. Governments & markets

Price ceiling: A price above which it is illegal to charge. Binding price ceiling: A price ceiling set below the equilibrium price. Governments & markets

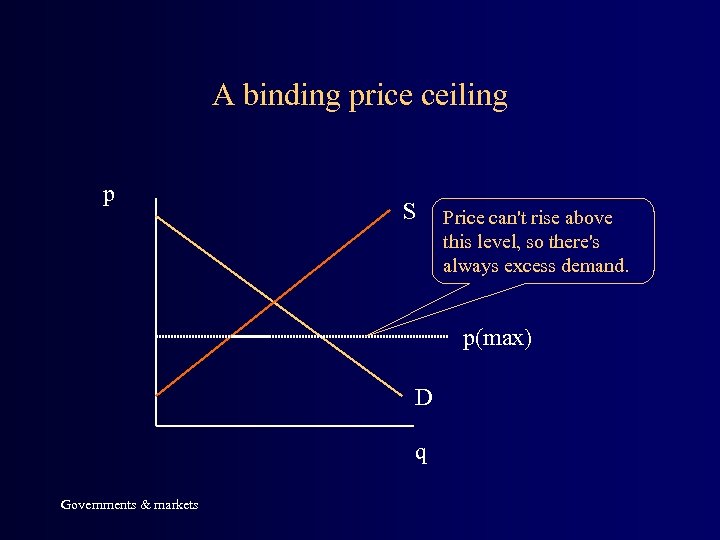

A binding price ceiling p S Price can't rise above this level, so there's always excess demand. p(max) D q Governments & markets

A binding price ceiling p S Price can't rise above this level, so there's always excess demand. p(max) D q Governments & markets

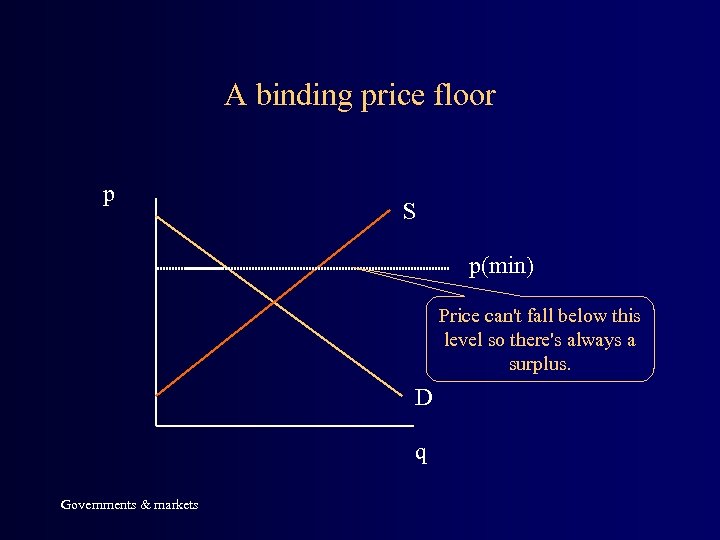

A binding price floor p S p(min) Price can't fall below this level so there's always a surplus. D q Governments & markets

A binding price floor p S p(min) Price can't fall below this level so there's always a surplus. D q Governments & markets

Binding price ceilings lead to shortages (excess demand). Binding price floors lead to surpluses (excess supply). Governments & markets

Binding price ceilings lead to shortages (excess demand). Binding price floors lead to surpluses (excess supply). Governments & markets

Additional examples: Rent control Minimum wage laws Minimum agricultural prices Governments & markets

Additional examples: Rent control Minimum wage laws Minimum agricultural prices Governments & markets

AN IMPORTANT TAX PROBLEM Suppose the market for cigarettes is in equilibrium. Suppose the State of Michigan, in its wisdom, decides to impose a tax of $1 per pack on the sale of cigarettes. How does the tax affect the market for cigarettes? Governments & markets

AN IMPORTANT TAX PROBLEM Suppose the market for cigarettes is in equilibrium. Suppose the State of Michigan, in its wisdom, decides to impose a tax of $1 per pack on the sale of cigarettes. How does the tax affect the market for cigarettes? Governments & markets

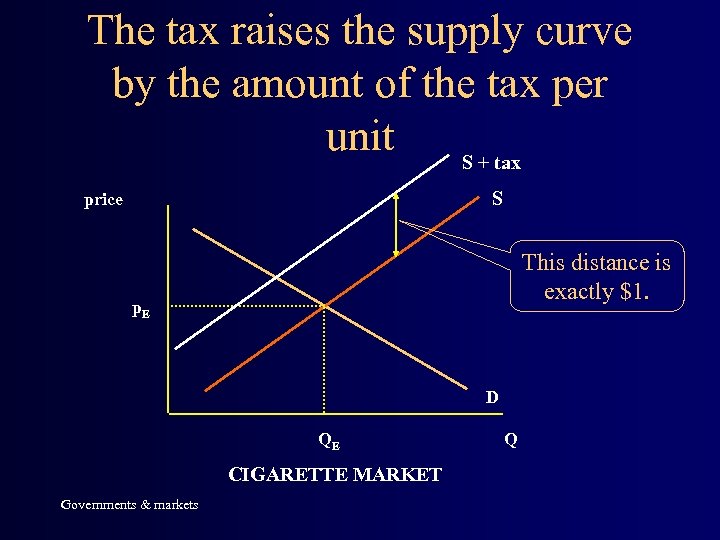

This kind of tax can be analyzed as if it were an input price increase. The tax is similar to having to pay a higher price for some input (government services? ). The tax will raise the supply curve by the amount of the tax per unit. Governments & markets

This kind of tax can be analyzed as if it were an input price increase. The tax is similar to having to pay a higher price for some input (government services? ). The tax will raise the supply curve by the amount of the tax per unit. Governments & markets

The tax raises the supply curve by the amount of the tax per unit S + tax S price This distance is exactly $1. p. E D QE CIGARETTE MARKET Governments & markets Q

The tax raises the supply curve by the amount of the tax per unit S + tax S price This distance is exactly $1. p. E D QE CIGARETTE MARKET Governments & markets Q

The reason the supply curve shifts up by exactly the amount of the tax is that price would have to rise by the full amount of the tax to induce cigarette suppliers to supply the amount they supplied before the tax. Governments & markets

The reason the supply curve shifts up by exactly the amount of the tax is that price would have to rise by the full amount of the tax to induce cigarette suppliers to supply the amount they supplied before the tax. Governments & markets

But price will rise by less than the amount of the tax, as the following diagram shows. Go to hidden slide Governments & markets

But price will rise by less than the amount of the tax, as the following diagram shows. Go to hidden slide Governments & markets

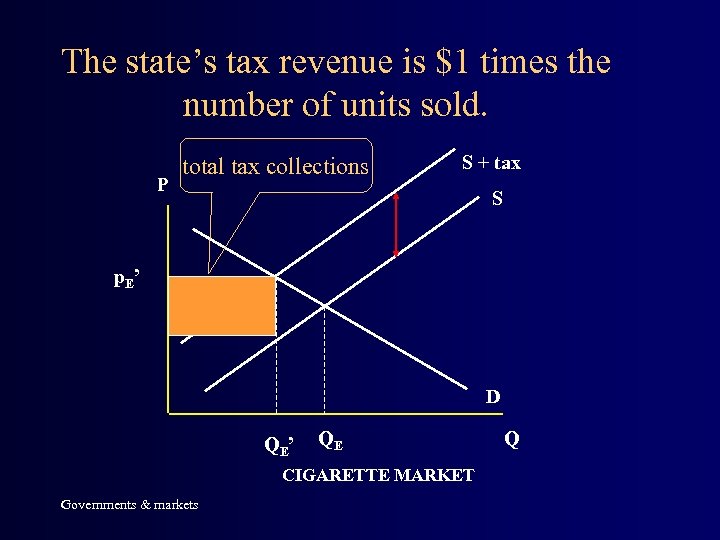

The state’s tax revenue is $1 times the number of units sold. P total tax collections S + tax S p. E’ D QE’ QE CIGARETTE MARKET Governments & markets Q

The state’s tax revenue is $1 times the number of units sold. P total tax collections S + tax S p. E’ D QE’ QE CIGARETTE MARKET Governments & markets Q

Tax Burden The tax burden on consumers is the part of the tax paid by consumers in terms of higher prices. The tax burden on sellers is the part of the tax paid by firms in terms of lower receipts. Governments & markets

Tax Burden The tax burden on consumers is the part of the tax paid by consumers in terms of higher prices. The tax burden on sellers is the part of the tax paid by firms in terms of lower receipts. Governments & markets

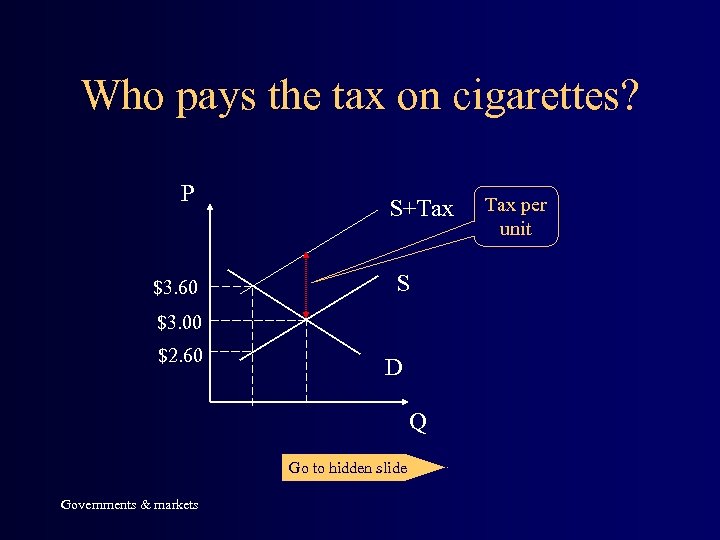

Who pays the tax on cigarettes? P $3. 60 S+Tax S $3. 00 $2. 60 D Q Go to hidden slide Governments & markets Tax per unit

Who pays the tax on cigarettes? P $3. 60 S+Tax S $3. 00 $2. 60 D Q Go to hidden slide Governments & markets Tax per unit

Tax burden on each is determined by the elasticities of supply and demand. Governments & markets

Tax burden on each is determined by the elasticities of supply and demand. Governments & markets

Given the demand curve, more elastic (flatter) supply means greater tax burden for consumers. Given the supply curve, more elastic (flatter) demand means greater tax burden for sellers. [Hint: Don't try to memorize these statements. Instead, make sure you can figure out each case. ] Governments & markets

Given the demand curve, more elastic (flatter) supply means greater tax burden for consumers. Given the supply curve, more elastic (flatter) demand means greater tax burden for sellers. [Hint: Don't try to memorize these statements. Instead, make sure you can figure out each case. ] Governments & markets

Elasticity also determines the state's tax revenue. For example: 1) The more inelastic is the demand curve, the greater will be the state’s tax revenue. 2) The more inelastic is the supply curve, the greater will be the state’s tax revenue. Governments & markets

Elasticity also determines the state's tax revenue. For example: 1) The more inelastic is the demand curve, the greater will be the state’s tax revenue. 2) The more inelastic is the supply curve, the greater will be the state’s tax revenue. Governments & markets

The next (hidden) slide shows these principles for different elasticities of demand. When demand is more elastic: Price rises less. There's relatively more burden on sellers. The state takes in less revenue. Go to hidden slide Governments & markets

The next (hidden) slide shows these principles for different elasticities of demand. When demand is more elastic: Price rises less. There's relatively more burden on sellers. The state takes in less revenue. Go to hidden slide Governments & markets