5b569df35fb7340ee936a9d6e020d182.ppt

- Количество слайдов: 32

Price and Output Determination: Oligopoly Managerial Economics – Econ 340 Lecture 8 Christopher Michael Trent University © 2006 by Nelson, a division of Thomson Canada Limited 3/17/2018 1

Price and Output Determination: Oligopoly Managerial Economics – Econ 340 Lecture 8 Christopher Michael Trent University © 2006 by Nelson, a division of Thomson Canada Limited 3/17/2018 1

Topics • • • Cournot Oligopoly Collusion versus Competition Price Leadership Kinked Demand Curve Oligopolistic Rivalry and Game Theory © 2006 by Nelson, a division of Thomson Canada Limited 2

Topics • • • Cournot Oligopoly Collusion versus Competition Price Leadership Kinked Demand Curve Oligopolistic Rivalry and Game Theory © 2006 by Nelson, a division of Thomson Canada Limited 2

Overview • Oligopolistic Market Structures » Few Firms • Consequently, each firm must consider the reaction of rivals to price, production, or product decisions • These reactions are interrelated » Heterogeneous or Homogeneous Products • Example -- athletic shoe market » Nike has 47% of market » Reebok has 16% » Adidas has 7% © 2006 by Nelson, a division of Thomson Canada Limited 3

Overview • Oligopolistic Market Structures » Few Firms • Consequently, each firm must consider the reaction of rivals to price, production, or product decisions • These reactions are interrelated » Heterogeneous or Homogeneous Products • Example -- athletic shoe market » Nike has 47% of market » Reebok has 16% » Adidas has 7% © 2006 by Nelson, a division of Thomson Canada Limited 3

Nokia’s Challenge in Cell Phones • The market shares of oligopolists change. In 1998, the market leader in cell phones was Motorola with 25% market share and Nokia second with 20% • In 2002, leadership reversed: Nokia held 37% of the market and Motorola 17% • However, technology in phones is changing, bringing wireless web, photos, and other high-speed G 3 technologies • Entry of other firms and new products, such as Dell, Palm, NEC and Panasonic pose threats to Nokia’s profit margins • Nokia must decide whether or not to invest heavily in the 3 G technology for the future. • Being a leader in a oligopoly does not mean that you remain the leader for long. © 2006 by Nelson, a division of Thomson Canada Limited 4

Nokia’s Challenge in Cell Phones • The market shares of oligopolists change. In 1998, the market leader in cell phones was Motorola with 25% market share and Nokia second with 20% • In 2002, leadership reversed: Nokia held 37% of the market and Motorola 17% • However, technology in phones is changing, bringing wireless web, photos, and other high-speed G 3 technologies • Entry of other firms and new products, such as Dell, Palm, NEC and Panasonic pose threats to Nokia’s profit margins • Nokia must decide whether or not to invest heavily in the 3 G technology for the future. • Being a leader in a oligopoly does not mean that you remain the leader for long. © 2006 by Nelson, a division of Thomson Canada Limited 4

The Cournot Oligopoly • Models vary depending on assumptions of actions of rivals to pricing and output decisions. • Augustin Cournot (1838) created a model that is the basis of Competition Policy. Cournot » Relatively simple assumption: ignore the interdependency with rivals » This makes the math easy © 2006 by Nelson, a division of Thomson Canada Limited 5

The Cournot Oligopoly • Models vary depending on assumptions of actions of rivals to pricing and output decisions. • Augustin Cournot (1838) created a model that is the basis of Competition Policy. Cournot » Relatively simple assumption: ignore the interdependency with rivals » This makes the math easy © 2006 by Nelson, a division of Thomson Canada Limited 5

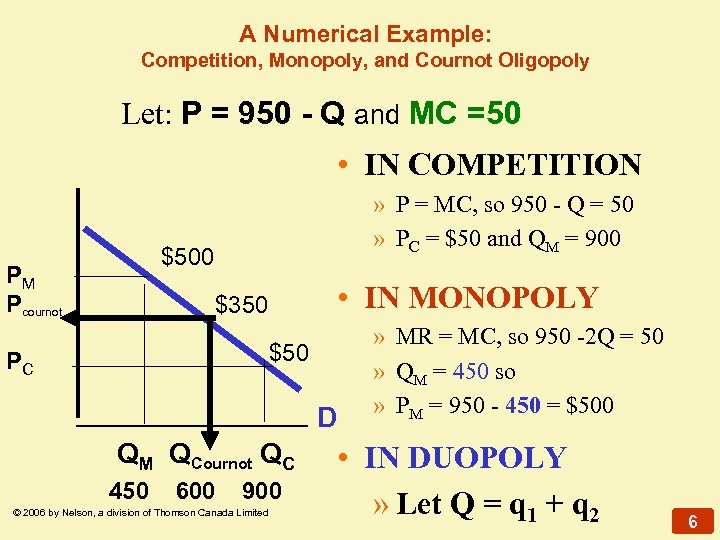

A Numerical Example: Competition, Monopoly, and Cournot Oligopoly Let: P = 950 - Q and MC =50 • IN COMPETITION » P = MC, so 950 - Q = 50 » PC = $50 and QM = 900 $500 PM Pcournot • IN MONOPOLY $350 $50 PC D QM QCournot QC 450 600 900 © 2006 by Nelson, a division of Thomson Canada Limited » MR = MC, so 950 -2 Q = 50 » QM = 450 so » PM = 950 - 450 = $500 • IN DUOPOLY » Let Q = q 1 + q 2 6

A Numerical Example: Competition, Monopoly, and Cournot Oligopoly Let: P = 950 - Q and MC =50 • IN COMPETITION » P = MC, so 950 - Q = 50 » PC = $50 and QM = 900 $500 PM Pcournot • IN MONOPOLY $350 $50 PC D QM QCournot QC 450 600 900 © 2006 by Nelson, a division of Thomson Canada Limited » MR = MC, so 950 -2 Q = 50 » QM = 450 so » PM = 950 - 450 = $500 • IN DUOPOLY » Let Q = q 1 + q 2 6

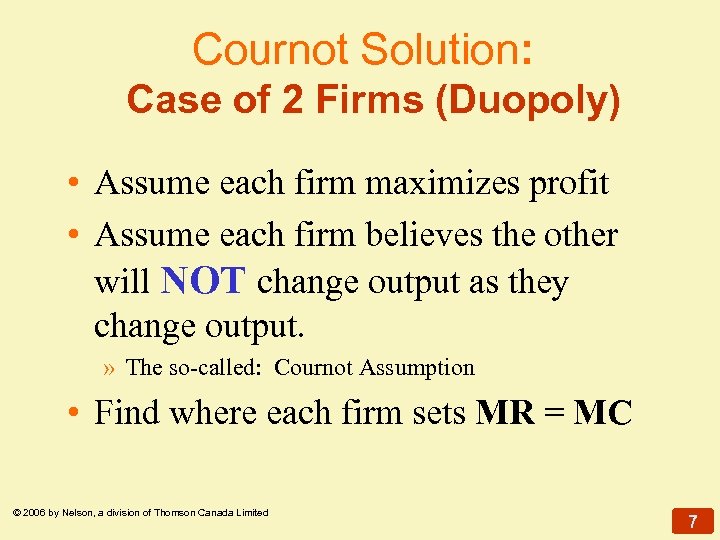

Cournot Solution: Case of 2 Firms (Duopoly) • Assume each firm maximizes profit • Assume each firm believes the other will NOT change output as they change output. » The so-called: Cournot Assumption • Find where each firm sets MR = MC © 2006 by Nelson, a division of Thomson Canada Limited 7

Cournot Solution: Case of 2 Firms (Duopoly) • Assume each firm maximizes profit • Assume each firm believes the other will NOT change output as they change output. » The so-called: Cournot Assumption • Find where each firm sets MR = MC © 2006 by Nelson, a division of Thomson Canada Limited 7

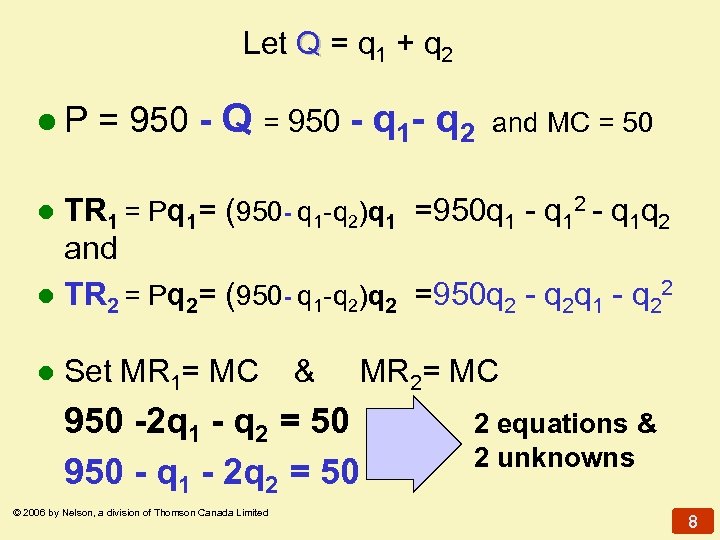

Let Q = q 1 + q 2 l. P = 950 - Q = 950 - q 1 - q 2 and MC = 50 TR 1 = Pq 1= (950 - q 1 -q 2)q 1 =950 q 1 - q 12 - q 1 q 2 and l TR 2 = Pq 2= (950 - q 1 -q 2)q 2 =950 q 2 - q 2 q 1 - q 22 l l Set MR 1= MC & 950 -2 q 1 - q 2 = 50 950 - q 1 - 2 q 2 = 50 © 2006 by Nelson, a division of Thomson Canada Limited MR 2= MC 2 equations & 2 unknowns 8

Let Q = q 1 + q 2 l. P = 950 - Q = 950 - q 1 - q 2 and MC = 50 TR 1 = Pq 1= (950 - q 1 -q 2)q 1 =950 q 1 - q 12 - q 1 q 2 and l TR 2 = Pq 2= (950 - q 1 -q 2)q 2 =950 q 2 - q 2 q 1 - q 22 l l Set MR 1= MC & 950 -2 q 1 - q 2 = 50 950 - q 1 - 2 q 2 = 50 © 2006 by Nelson, a division of Thomson Canada Limited MR 2= MC 2 equations & 2 unknowns 8

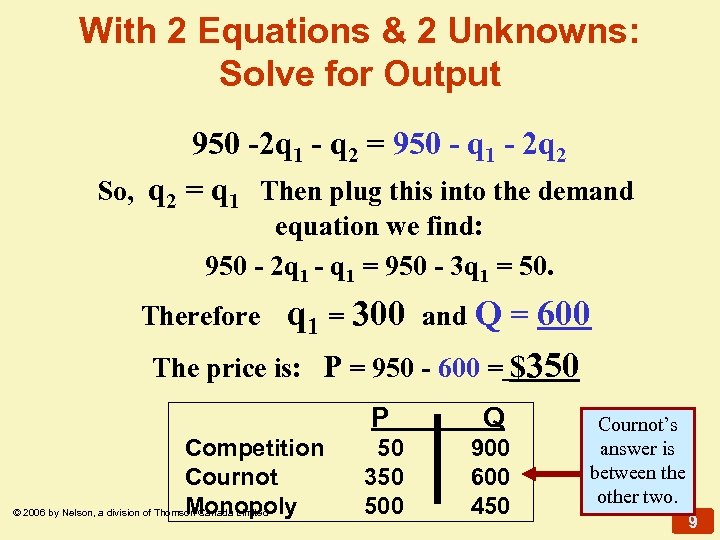

With 2 Equations & 2 Unknowns: Solve for Output 950 -2 q 1 - q 2 = 950 - q 1 - 2 q 2 So, q 2 = q 1 Then plug this into the demand equation we find: 950 - 2 q 1 - q 1 = 950 - 3 q 1 = 50. Therefore q 1 = 300 The price is: and Q = 600 P = 950 - 600 = $350 P Competition Cournot Monopoly © 2006 by Nelson, a division of Thomson Canada Limited Q 50 350 500 900 600 450 Cournot’s answer is between the other two. 9

With 2 Equations & 2 Unknowns: Solve for Output 950 -2 q 1 - q 2 = 950 - q 1 - 2 q 2 So, q 2 = q 1 Then plug this into the demand equation we find: 950 - 2 q 1 - q 1 = 950 - 3 q 1 = 50. Therefore q 1 = 300 The price is: and Q = 600 P = 950 - 600 = $350 P Competition Cournot Monopoly © 2006 by Nelson, a division of Thomson Canada Limited Q 50 350 500 900 600 450 Cournot’s answer is between the other two. 9

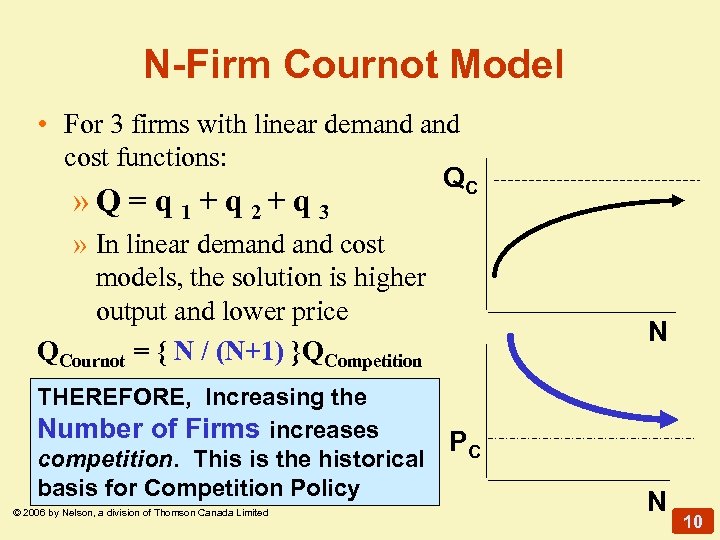

N-Firm Cournot Model • For 3 firms with linear demand cost functions: QC » Q = q 1 + q 2+ q 3 » In linear demand cost models, the solution is higher output and lower price QCournot = { N / (N+1) }QCompetition THEREFORE, Increasing the Number of Firms increases competition. This is the historical basis for Competition Policy © 2006 by Nelson, a division of Thomson Canada Limited N PC N 10

N-Firm Cournot Model • For 3 firms with linear demand cost functions: QC » Q = q 1 + q 2+ q 3 » In linear demand cost models, the solution is higher output and lower price QCournot = { N / (N+1) }QCompetition THEREFORE, Increasing the Number of Firms increases competition. This is the historical basis for Competition Policy © 2006 by Nelson, a division of Thomson Canada Limited N PC N 10

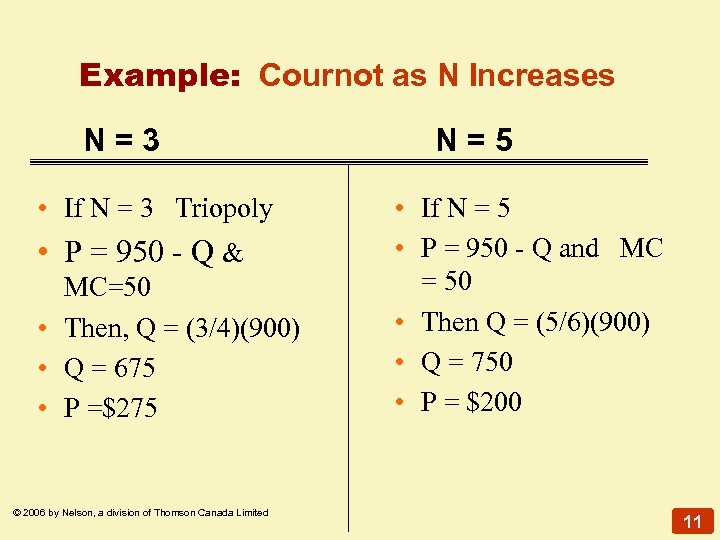

Example: Cournot as N Increases N=3 • If N = 3 Triopoly • P = 950 - Q & MC=50 • Then, Q = (3/4)(900) • Q = 675 • P =$275 © 2006 by Nelson, a division of Thomson Canada Limited N=5 • If N = 5 • P = 950 - Q and MC = 50 • Then Q = (5/6)(900) • Q = 750 • P = $200 11

Example: Cournot as N Increases N=3 • If N = 3 Triopoly • P = 950 - Q & MC=50 • Then, Q = (3/4)(900) • Q = 675 • P =$275 © 2006 by Nelson, a division of Thomson Canada Limited N=5 • If N = 5 • P = 950 - Q and MC = 50 • Then Q = (5/6)(900) • Q = 750 • P = $200 11

Collusion versus Competition? • Sometimes collusion succeeds • Sometimes forces of competition win out over collective action • When will collusion tend to succeed? » There are six factors that influence successful collusion as follows: © 2006 by Nelson, a division of Thomson Canada Limited 12

Collusion versus Competition? • Sometimes collusion succeeds • Sometimes forces of competition win out over collective action • When will collusion tend to succeed? » There are six factors that influence successful collusion as follows: © 2006 by Nelson, a division of Thomson Canada Limited 12

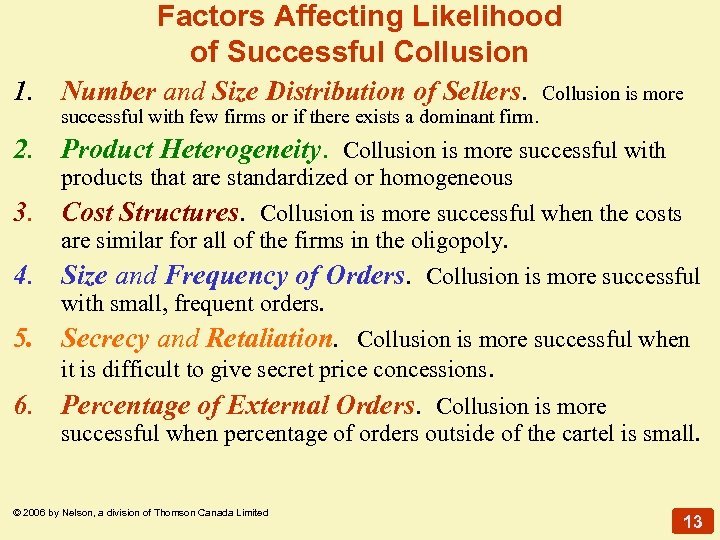

Factors Affecting Likelihood of Successful Collusion 1. Number and Size Distribution of Sellers. Collusion is more successful with few firms or if there exists a dominant firm. 2. Product Heterogeneity. Collusion is more successful with products that are standardized or homogeneous 3. Cost Structures. Collusion is more successful when the costs are similar for all of the firms in the oligopoly. 4. Size and Frequency of Orders. Collusion is more successful with small, frequent orders. 5. Secrecy and Retaliation. Collusion is more successful when it is difficult to give secret price concessions. 6. Percentage of External Orders. Collusion is more successful when percentage of orders outside of the cartel is small. © 2006 by Nelson, a division of Thomson Canada Limited 13

Factors Affecting Likelihood of Successful Collusion 1. Number and Size Distribution of Sellers. Collusion is more successful with few firms or if there exists a dominant firm. 2. Product Heterogeneity. Collusion is more successful with products that are standardized or homogeneous 3. Cost Structures. Collusion is more successful when the costs are similar for all of the firms in the oligopoly. 4. Size and Frequency of Orders. Collusion is more successful with small, frequent orders. 5. Secrecy and Retaliation. Collusion is more successful when it is difficult to give secret price concessions. 6. Percentage of External Orders. Collusion is more successful when percentage of orders outside of the cartel is small. © 2006 by Nelson, a division of Thomson Canada Limited 13

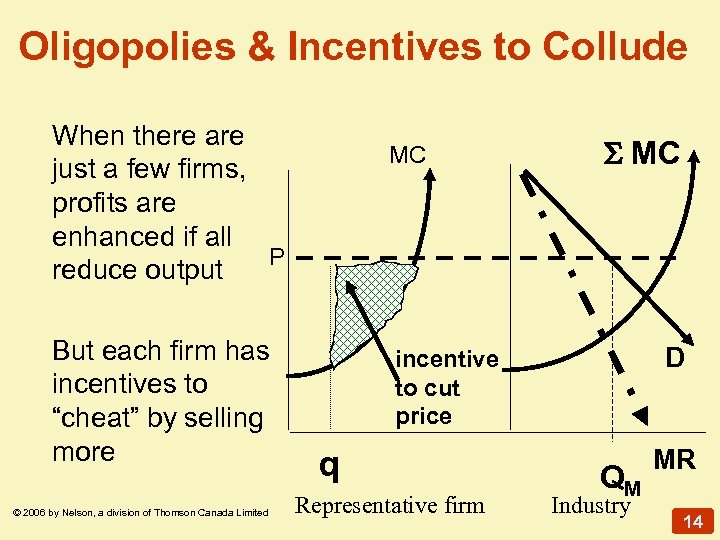

Oligopolies & Incentives to Collude When there are just a few firms, profits are enhanced if all P reduce output But each firm has incentives to “cheat” by selling more © 2006 by Nelson, a division of Thomson Canada Limited MC MC D incentive to cut price q Representative firm QM Industry MR 14

Oligopolies & Incentives to Collude When there are just a few firms, profits are enhanced if all P reduce output But each firm has incentives to “cheat” by selling more © 2006 by Nelson, a division of Thomson Canada Limited MC MC D incentive to cut price q Representative firm QM Industry MR 14

Examples of Cartels • Ocean Shipping • De Beers -- diamonds • OPEC - oil cartel, with Saudi Arabia making up 33% of the group’s exports • Siemens and Thompson-CSF -- airport radar systems • Major League Baseball © 2006 by Nelson, a division of Thomson Canada Limited 15

Examples of Cartels • Ocean Shipping • De Beers -- diamonds • OPEC - oil cartel, with Saudi Arabia making up 33% of the group’s exports • Siemens and Thompson-CSF -- airport radar systems • Major League Baseball © 2006 by Nelson, a division of Thomson Canada Limited 15

PRICE LEADERSHIP • Barometric: One (or a few firms) sets the price • One firm is unusually aware of changes in cost or demand conditions • The barometer firm senses changes first, or is the first to ANNOUNCE changes in its price list • Find barometric price leader when the conditions unsuitable to collusion & firm has good forecasting abilities or good management © 2006 by Nelson, a division of Thomson Canada Limited 16

PRICE LEADERSHIP • Barometric: One (or a few firms) sets the price • One firm is unusually aware of changes in cost or demand conditions • The barometer firm senses changes first, or is the first to ANNOUNCE changes in its price list • Find barometric price leader when the conditions unsuitable to collusion & firm has good forecasting abilities or good management © 2006 by Nelson, a division of Thomson Canada Limited 16

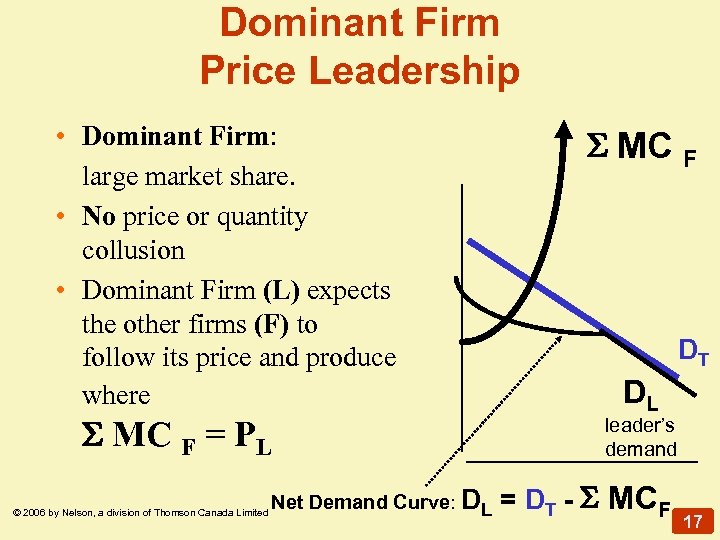

Dominant Firm Price Leadership • Dominant Firm: large market share. • No price or quantity collusion • Dominant Firm (L) expects the other firms (F) to follow its price and produce where MC F = PL © 2006 by Nelson, a division of Thomson Canada Limited Net Demand Curve: DL MC F DT DL leader’s demand = DT - MCF 17

Dominant Firm Price Leadership • Dominant Firm: large market share. • No price or quantity collusion • Dominant Firm (L) expects the other firms (F) to follow its price and produce where MC F = PL © 2006 by Nelson, a division of Thomson Canada Limited Net Demand Curve: DL MC F DT DL leader’s demand = DT - MCF 17

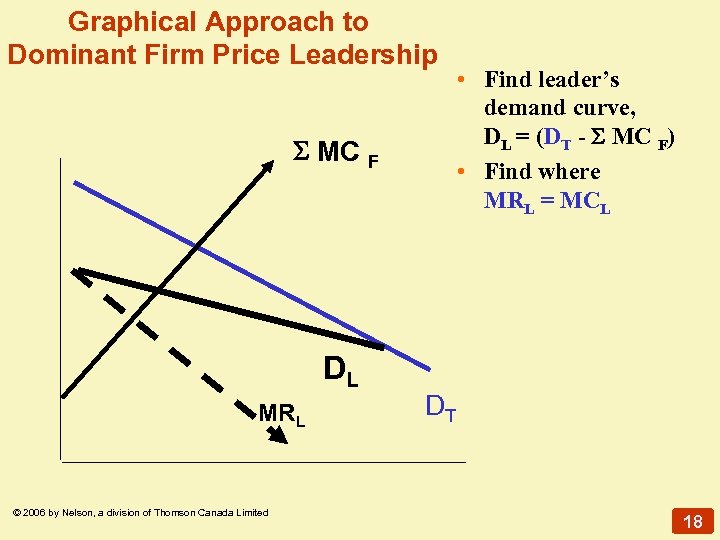

Graphical Approach to Dominant Firm Price Leadership MC DL MRL © 2006 by Nelson, a division of Thomson Canada Limited F • Find leader’s demand curve, DL = (DT - MC F) • Find where MRL = MCL DT 18

Graphical Approach to Dominant Firm Price Leadership MC DL MRL © 2006 by Nelson, a division of Thomson Canada Limited F • Find leader’s demand curve, DL = (DT - MC F) • Find where MRL = MCL DT 18

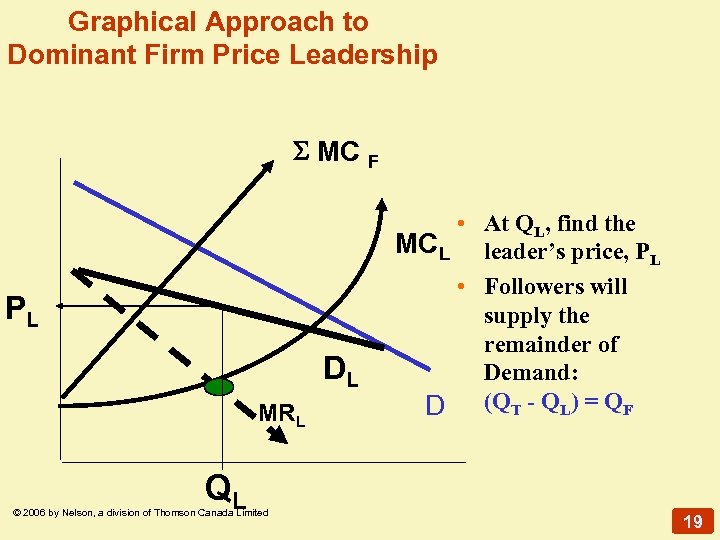

Graphical Approach to Dominant Firm Price Leadership MC PL DL MRL QL © 2006 by Nelson, a division of Thomson Canada Limited F • At QL, find the MCL leader’s price, PL • Followers will supply the remainder of Demand: D (QT - QL) = QF 19

Graphical Approach to Dominant Firm Price Leadership MC PL DL MRL QL © 2006 by Nelson, a division of Thomson Canada Limited F • At QL, find the MCL leader’s price, PL • Followers will supply the remainder of Demand: D (QT - QL) = QF 19

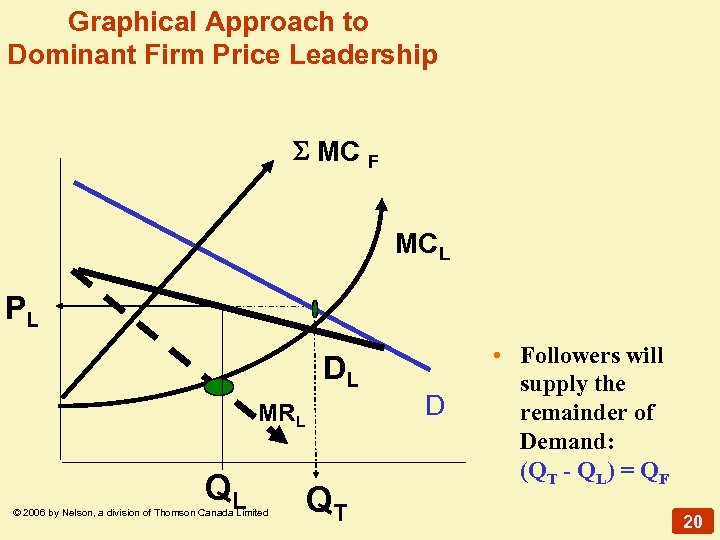

Graphical Approach to Dominant Firm Price Leadership MC F MCL PL DL MRL QL © 2006 by Nelson, a division of Thomson Canada Limited QT D • Followers will supply the remainder of Demand: (QT - QL) = QF 20

Graphical Approach to Dominant Firm Price Leadership MC F MCL PL DL MRL QL © 2006 by Nelson, a division of Thomson Canada Limited QT D • Followers will supply the remainder of Demand: (QT - QL) = QF 20

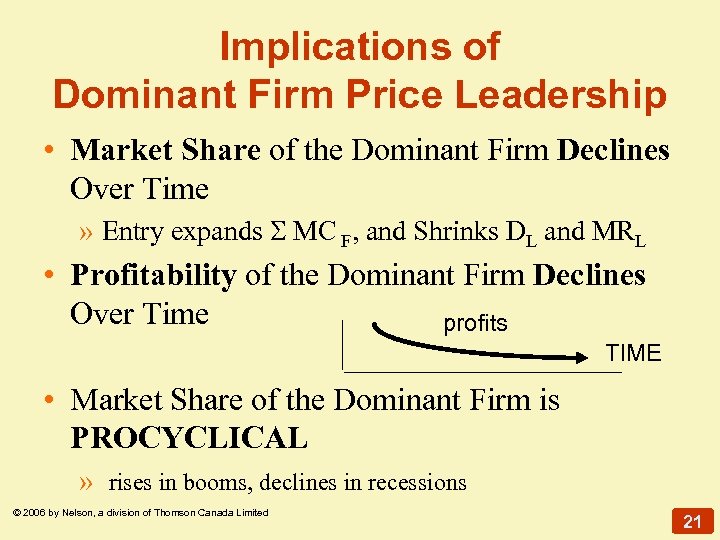

Implications of Dominant Firm Price Leadership • Market Share of the Dominant Firm Declines Over Time » Entry expands MC F, and Shrinks DL and MRL • Profitability of the Dominant Firm Declines Over Time profits TIME • Market Share of the Dominant Firm is PROCYCLICAL » rises in booms, declines in recessions © 2006 by Nelson, a division of Thomson Canada Limited 21

Implications of Dominant Firm Price Leadership • Market Share of the Dominant Firm Declines Over Time » Entry expands MC F, and Shrinks DL and MRL • Profitability of the Dominant Firm Declines Over Time profits TIME • Market Share of the Dominant Firm is PROCYCLICAL » rises in booms, declines in recessions © 2006 by Nelson, a division of Thomson Canada Limited 21

Numerical Example of Dominant Firm Price Leadership Aerotek is the leader, with 6 other firms, given the following: 1. P = 10, 000 – 10 QT is the market demand 2. QT = QL + QF is the sum of leader & followers 3. MCL = 100 + 3 QL and SMCF = 50 + 2 QF © 2006 by Nelson, a division of Thomson Canada Limited 22

Numerical Example of Dominant Firm Price Leadership Aerotek is the leader, with 6 other firms, given the following: 1. P = 10, 000 – 10 QT is the market demand 2. QT = QL + QF is the sum of leader & followers 3. MCL = 100 + 3 QL and SMCF = 50 + 2 QF © 2006 by Nelson, a division of Thomson Canada Limited 22

What is Aerotek’s Price and Quantity? • From 2, QL = QT – QF and From 1, QT = 1, 000 - 0. 1 P • Since followers sell at P=MC, From 3, P = 50 + 2 QF, which rearranged to be QF = 0. 5 P - 25 • So, QL = (1, 000 -. 1 P) – (0. 5 P - 25) = 1, 025 -0. 6 P, which can be rearranged to be P = 1, 708. 3 – 1. 67 QL • MRL = 1, 708. 3 – 3. 34 QL • And MRL = MCL where: 1, 708. 3 – 3. 34 QL = 100 + 3 QL • The optimal quantity for Aerotek, the leader is QL 254 • P = 1, 708. 3 – 1. 67 QL = 1, 708. 3 – 1. 67(254) $1, 284. © 2006 by Nelson, a division of Thomson Canada Limited 23

What is Aerotek’s Price and Quantity? • From 2, QL = QT – QF and From 1, QT = 1, 000 - 0. 1 P • Since followers sell at P=MC, From 3, P = 50 + 2 QF, which rearranged to be QF = 0. 5 P - 25 • So, QL = (1, 000 -. 1 P) – (0. 5 P - 25) = 1, 025 -0. 6 P, which can be rearranged to be P = 1, 708. 3 – 1. 67 QL • MRL = 1, 708. 3 – 3. 34 QL • And MRL = MCL where: 1, 708. 3 – 3. 34 QL = 100 + 3 QL • The optimal quantity for Aerotek, the leader is QL 254 • P = 1, 708. 3 – 1. 67 QL = 1, 708. 3 – 1. 67(254) $1, 284. © 2006 by Nelson, a division of Thomson Canada Limited 23

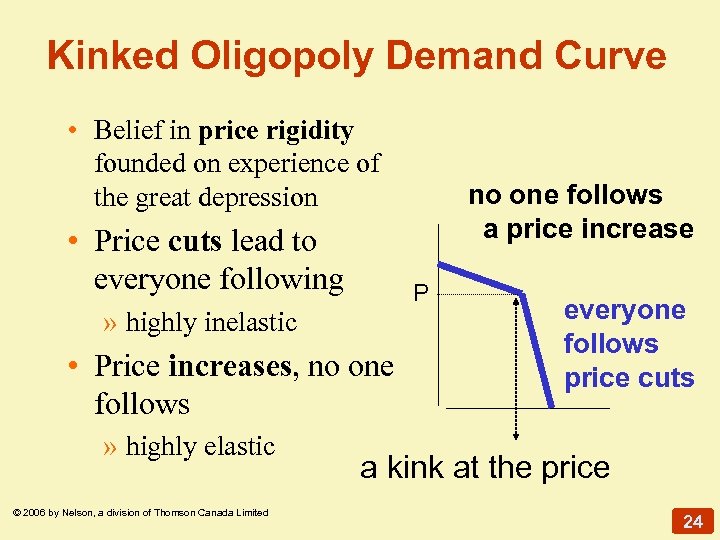

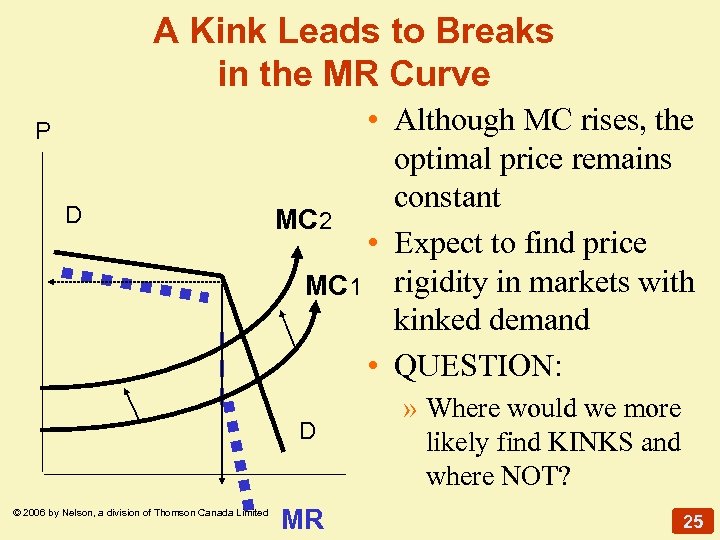

Kinked Oligopoly Demand Curve • Belief in price rigidity founded on experience of the great depression • Price cuts lead to everyone following P » highly inelastic • Price increases, no one follows » highly elastic © 2006 by Nelson, a division of Thomson Canada Limited no one follows a price increase everyone follows price cuts a kink at the price 24

Kinked Oligopoly Demand Curve • Belief in price rigidity founded on experience of the great depression • Price cuts lead to everyone following P » highly inelastic • Price increases, no one follows » highly elastic © 2006 by Nelson, a division of Thomson Canada Limited no one follows a price increase everyone follows price cuts a kink at the price 24

A Kink Leads to Breaks in the MR Curve P D • Although MC rises, the optimal price remains constant MC 2 • Expect to find price MC 1 rigidity in markets with kinked demand • QUESTION: D © 2006 by Nelson, a division of Thomson Canada Limited MR » Where would we more likely find KINKS and where NOT? 25

A Kink Leads to Breaks in the MR Curve P D • Although MC rises, the optimal price remains constant MC 2 • Expect to find price MC 1 rigidity in markets with kinked demand • QUESTION: D © 2006 by Nelson, a division of Thomson Canada Limited MR » Where would we more likely find KINKS and where NOT? 25

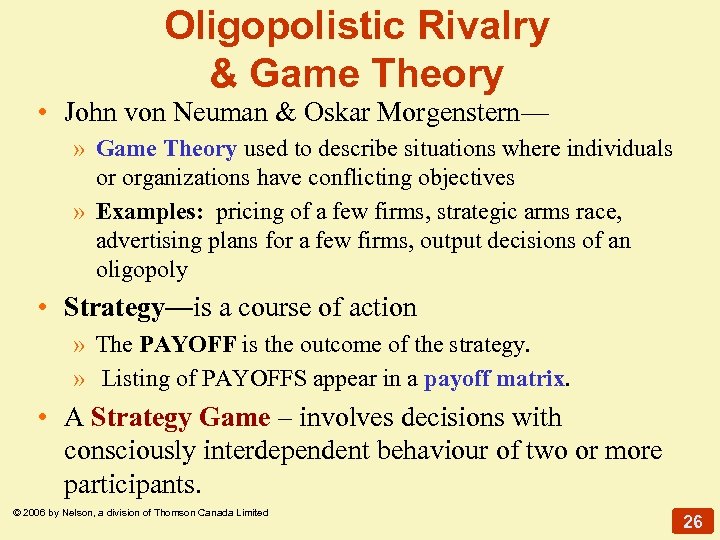

Oligopolistic Rivalry & Game Theory • John von Neuman & Oskar Morgenstern— » Game Theory used to describe situations where individuals or organizations have conflicting objectives » Examples: pricing of a few firms, strategic arms race, advertising plans for a few firms, output decisions of an oligopoly • Strategy—is a course of action » The PAYOFF is the outcome of the strategy. » Listing of PAYOFFS appear in a payoff matrix. • A Strategy Game – involves decisions with consciously interdependent behaviour of two or more participants. © 2006 by Nelson, a division of Thomson Canada Limited 26

Oligopolistic Rivalry & Game Theory • John von Neuman & Oskar Morgenstern— » Game Theory used to describe situations where individuals or organizations have conflicting objectives » Examples: pricing of a few firms, strategic arms race, advertising plans for a few firms, output decisions of an oligopoly • Strategy—is a course of action » The PAYOFF is the outcome of the strategy. » Listing of PAYOFFS appear in a payoff matrix. • A Strategy Game – involves decisions with consciously interdependent behaviour of two or more participants. © 2006 by Nelson, a division of Thomson Canada Limited 26

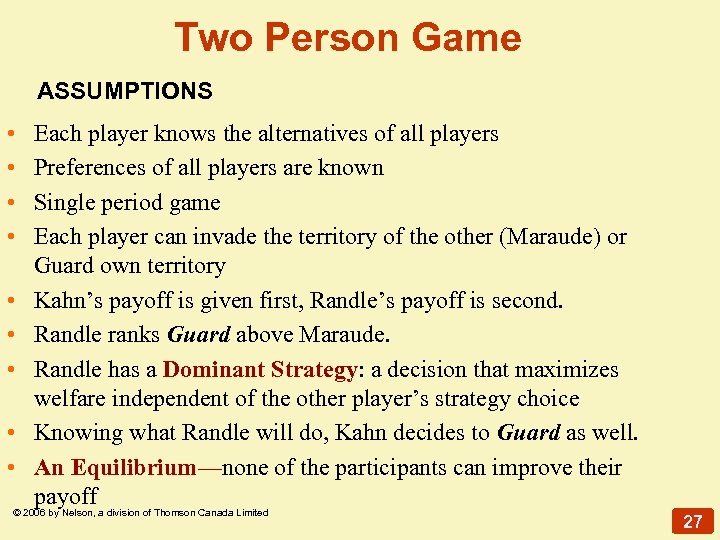

Two Person Game ASSUMPTIONS • • • Each player knows the alternatives of all players Preferences of all players are known Single period game Each player can invade the territory of the other (Maraude) or Guard own territory Kahn’s payoff is given first, Randle’s payoff is second. Randle ranks Guard above Maraude. Randle has a Dominant Strategy: a decision that maximizes welfare independent of the other player’s strategy choice Knowing what Randle will do, Kahn decides to Guard as well. An Equilibrium—none of the participants can improve their payoff © 2006 by Nelson, a division of Thomson Canada Limited 27

Two Person Game ASSUMPTIONS • • • Each player knows the alternatives of all players Preferences of all players are known Single period game Each player can invade the territory of the other (Maraude) or Guard own territory Kahn’s payoff is given first, Randle’s payoff is second. Randle ranks Guard above Maraude. Randle has a Dominant Strategy: a decision that maximizes welfare independent of the other player’s strategy choice Knowing what Randle will do, Kahn decides to Guard as well. An Equilibrium—none of the participants can improve their payoff © 2006 by Nelson, a division of Thomson Canada Limited 27

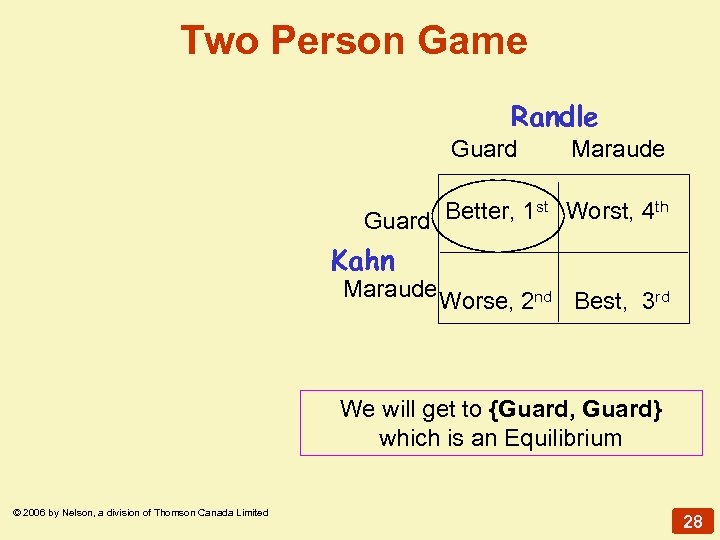

Two Person Game Randle Guard Maraude Better, 1 st Worst, 4 th Guard Kahn Maraude Worse, 2 nd Best, 3 rd We will get to {Guard, Guard} which is an Equilibrium © 2006 by Nelson, a division of Thomson Canada Limited 28

Two Person Game Randle Guard Maraude Better, 1 st Worst, 4 th Guard Kahn Maraude Worse, 2 nd Best, 3 rd We will get to {Guard, Guard} which is an Equilibrium © 2006 by Nelson, a division of Thomson Canada Limited 28

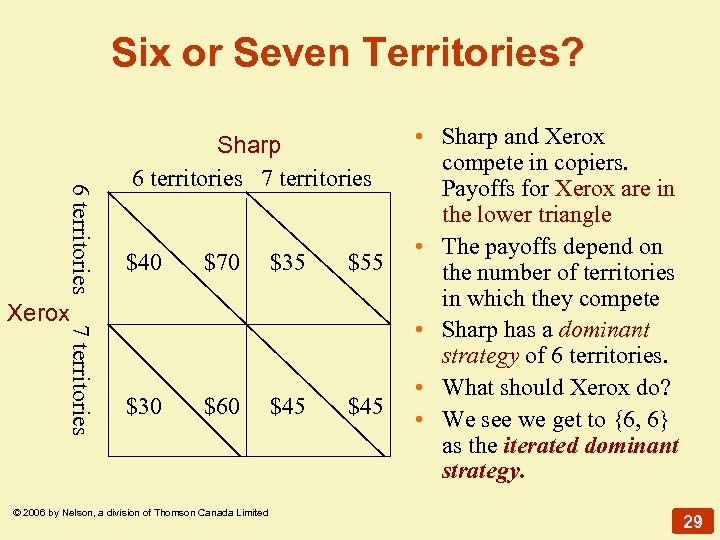

Six or Seven Territories? 6 territories Sharp 6 territories 7 territories $40 $70 $35 $55 $30 $60 $45 7 territories Xerox © 2006 by Nelson, a division of Thomson Canada Limited • Sharp and Xerox compete in copiers. Payoffs for Xerox are in the lower triangle • The payoffs depend on the number of territories in which they compete • Sharp has a dominant strategy of 6 territories. • What should Xerox do? • We see we get to {6, 6} as the iterated dominant strategy. 29

Six or Seven Territories? 6 territories Sharp 6 territories 7 territories $40 $70 $35 $55 $30 $60 $45 7 territories Xerox © 2006 by Nelson, a division of Thomson Canada Limited • Sharp and Xerox compete in copiers. Payoffs for Xerox are in the lower triangle • The payoffs depend on the number of territories in which they compete • Sharp has a dominant strategy of 6 territories. • What should Xerox do? • We see we get to {6, 6} as the iterated dominant strategy. 29

Other Strategic Games • These are viewed as single period, but businesses tend to be on-going, or multiple-period games • These are two-person games, but oligopolies often represent N-person games, where N is greater than 2 • Some games are zero-sum games in that what one player wins, the other player loses, like poker • Other games are non-zero sum games where the whole payoffs depend on strategy choices by all players. © 2006 by Nelson, a division of Thomson Canada Limited 30

Other Strategic Games • These are viewed as single period, but businesses tend to be on-going, or multiple-period games • These are two-person games, but oligopolies often represent N-person games, where N is greater than 2 • Some games are zero-sum games in that what one player wins, the other player loses, like poker • Other games are non-zero sum games where the whole payoffs depend on strategy choices by all players. © 2006 by Nelson, a division of Thomson Canada Limited 30

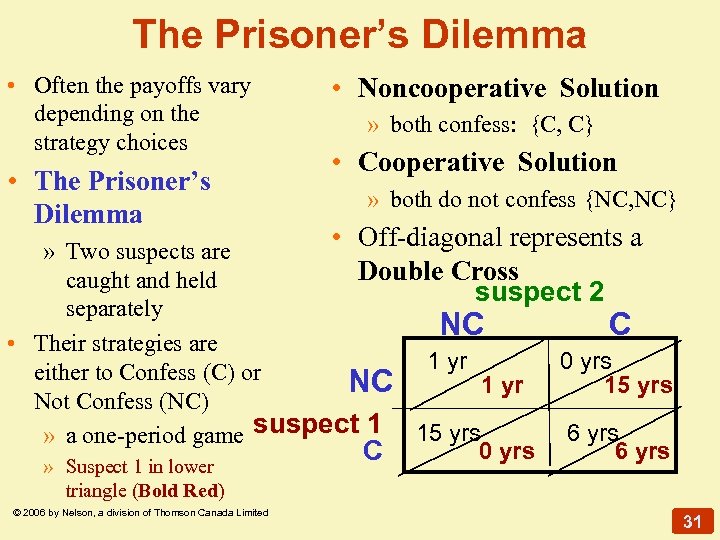

The Prisoner’s Dilemma • Often the payoffs vary depending on the strategy choices • The Prisoner’s Dilemma • Noncooperative Solution » both confess: {C, C} • Cooperative Solution » both do not confess {NC, NC} • Off-diagonal represents a » Two suspects are Double Cross caught and held suspect 2 separately NC C • Their strategies are 1 yr 0 yrs either to Confess (C) or NC 1 yr 15 yrs Not Confess (NC) 6 yrs » a one-period game suspect 1 15 yrs 0 yrs 6 yrs C » Suspect 1 in lower triangle (Bold Red) © 2006 by Nelson, a division of Thomson Canada Limited 31

The Prisoner’s Dilemma • Often the payoffs vary depending on the strategy choices • The Prisoner’s Dilemma • Noncooperative Solution » both confess: {C, C} • Cooperative Solution » both do not confess {NC, NC} • Off-diagonal represents a » Two suspects are Double Cross caught and held suspect 2 separately NC C • Their strategies are 1 yr 0 yrs either to Confess (C) or NC 1 yr 15 yrs Not Confess (NC) 6 yrs » a one-period game suspect 1 15 yrs 0 yrs 6 yrs C » Suspect 1 in lower triangle (Bold Red) © 2006 by Nelson, a division of Thomson Canada Limited 31

Paradox? • The Prisoner’s Dilemma highlights the situation where both parties would be best off if they cooperated • But the logic of their situation ends up with a non-cooperative solution • The solution to cooperation appears to be transforming a one-period game into a multiple-period game. • The actions you take now will then have consequences in future periods. © 2006 by Nelson, a division of Thomson Canada Limited 32

Paradox? • The Prisoner’s Dilemma highlights the situation where both parties would be best off if they cooperated • But the logic of their situation ends up with a non-cooperative solution • The solution to cooperation appears to be transforming a one-period game into a multiple-period game. • The actions you take now will then have consequences in future periods. © 2006 by Nelson, a division of Thomson Canada Limited 32