8d5324cc089a4b5d9e2ea8df58687a2e.ppt

- Количество слайдов: 93

Preview of 3 Unique Tools to Drive Broker Interest Jason Crane Division Vice President, Central Region Transamerica Retirement Services The Ritz-Carlton, South Beach – Miami • June 7 -9, 2006

What to do when your client says… “We just want a 401(k) with a match. ” “I think we have an Investment Policy Statement. Let me see if I can find it. ” “I know it’s a simple solution, but am I really diversified with one fund? ? ? ” Transamerica TPA Forum • Transamerica Retirement Services 2

3 Unique Tools “Plus 15” Participation Guarantee Transamerica Fiduciary Risk Management Transamerica Idex Asset Allocation Funds – a refreshing approach to Asset Allocation! Transamerica TPA Forum • Transamerica Retirement Services 3

The Transamerica Plus 15 SM Participation Guarantee For many employers, motivating employees to participate in a company-sponsored retirement plan can be a challenge • The majority rely on education and communication materials to raise interest in the plan • Industry studies suggest, however, that a combination of specific plan provisions, features and educational tools can greatly increase a plan’s participation rate • Plus 15 SM combines industry know-how with the latest research to assist clients in achieving growth in participation – we guarantee it. Transamerica TPA Forum • Transamerica Retirement Services 4

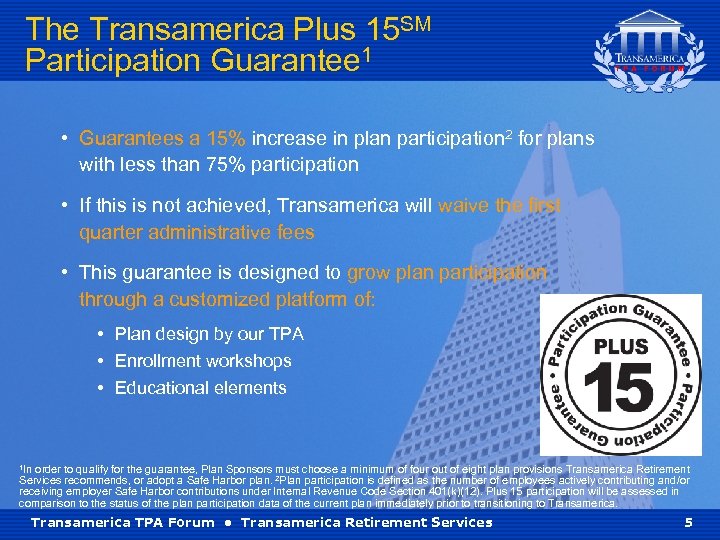

The Transamerica Plus 15 SM Participation Guarantee 1 • Guarantees a 15% increase in plan participation 2 for plans with less than 75% participation • If this is not achieved, Transamerica will waive the first quarter administrative fees • This guarantee is designed to grow plan participation through a customized platform of: • Plan design by our TPA • Enrollment workshops • Educational elements 1 In order to qualify for the guarantee, Plan Sponsors must choose a minimum of four out of eight plan provisions Transamerica Retirement Services recommends, or adopt a Safe Harbor plan. 2 Plan participation is defined as the number of employees actively contributing and/or receiving employer Safe Harbor contributions under Internal Revenue Code Section 401(k)(12). Plus 15 participation will be assessed in comparison to the status of the plan participation data of the current plan immediately prior to transitioning to Transamerica TPA Forum • Transamerica Retirement Services 5

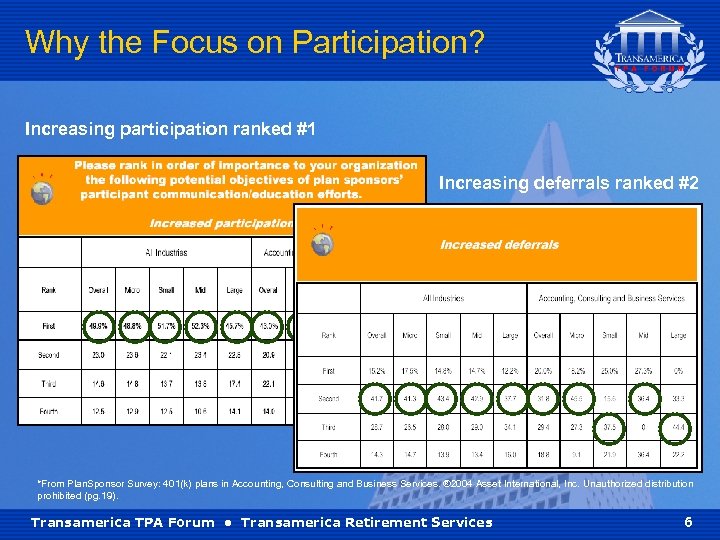

Why the Focus on Participation? Increasing participation ranked #1 Increasing deferrals ranked #2 *From Plan. Sponsor Survey: 401(k) plans in Accounting, Consulting and Business Services. ® 2004 Asset International, Inc. Unauthorized distribution prohibited (pg. 19). Transamerica TPA Forum • Transamerica Retirement Services 6

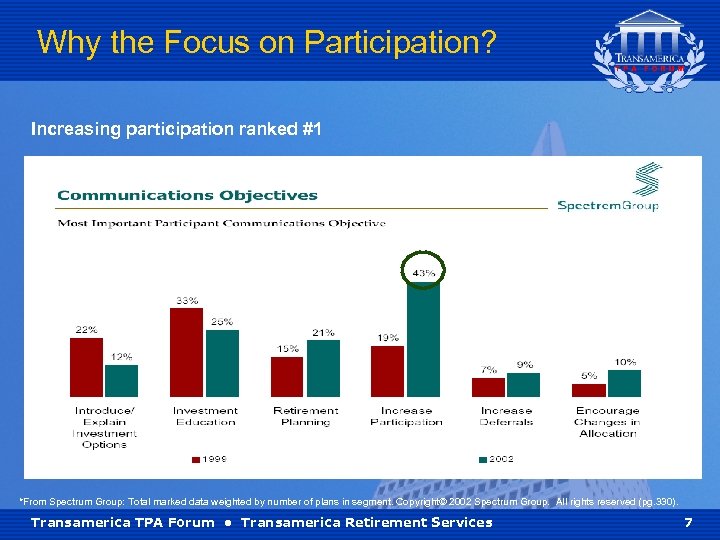

Why the Focus on Participation? Increasing participation ranked #1 *From Spectrum Group: Total marked data weighted by number of plans in segment. Copyright© 2002 Spectrum Group. All rights reserved (pg. 330). Transamerica TPA Forum • Transamerica Retirement Services 7

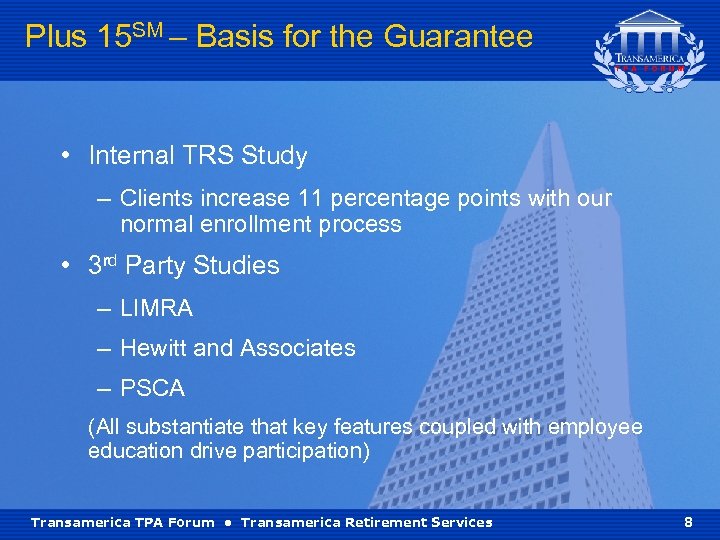

Plus 15 SM – Basis for the Guarantee • Internal TRS Study – Clients increase 11 percentage points with our normal enrollment process • 3 rd Party Studies – LIMRA – Hewitt and Associates – PSCA (All substantiate that key features coupled with employee education drive participation) Transamerica TPA Forum • Transamerica Retirement Services 8

Plus 15 SM - Requirements • Prior Plan Participation must be less than 75% • 100% of eligible non-participating employees must attend a Standard Enrollment Workshop • No material decrease in benefits • Must provide TRS with current participation data • Must select 4 of the following features: Transamerica TPA Forum • Transamerica Retirement Services 9

Plus 15 SM – Select 4 • • • Online enrollment Loan provision Automatic enrollment Fewer than 20 investment options Add/Improve Employer Match Shorten vesting schedule Target maturity funds/Asset Allocation Funds Customized participant education program Advice Solutions OR Adopt a Safe Harbor Plan Provision Transamerica TPA Forum • Transamerica Retirement Services 10

What Does Plus 15 Accomplish? 1. Gives our partners a credible platform to marry plan design and EE communications with the common thread of participation. 2. Focuses Plan Design “Analytics” on – Employee Benefit Plans vs. – Plans designed for business owners and Key employees 3. Focuses Attention on our Enrollment Services – Guaranteeing Results 4. Unique in the Marketplace Transamerica TPA Forum • Transamerica Retirement Services 11

Fiduciary Risk Management Transamerica TPA Forum • Transamerica Retirement Services 12

Fiduciary Responsibility – ERISA Responsibility can be generally divided into 2 categories: 1. Administration of the plan 2. Management of plan assets Transamerica TPA Forum • Transamerica Retirement Services 13

A Framework for… …meeting your client’s Fiduciary Responsibilities The Fiduciary Planning Kit Ensure clients have the ability to demonstrate process! • Reasons for selecting current provider • Plan design objectives • Investment Policy Process • Education/Communication provided • General compliance items Transamerica TPA Forum • Transamerica Retirement Services 14

The Transamerica Solution Step 4 – The Investment Process 1. Model Investment Policy Statement 2. Transamerica Investment Monitoring Process (TIM) 3. Quarterly Scorecards 4. Third Party Certification from SPIAS 5. Full Plan Sponsor Level Investment Advice (Ibbotson) Transamerica TPA Forum • Transamerica Retirement Services 15

Management of Plan Assets The 3 levels of responsibility for investment fiduciaries: 1. The investment menu, in the aggregate, must constitute a “broad range” of investment choices. 2. All investment vehicles must be prudently selected and monitored. 3. Investments must be appropriate for the plan’s participants. Transamerica TPA Forum • Transamerica Retirement Services 16

Management of Plan Assets Most plan sponsors know that they have a fiduciary duty to select and “monitor” the investments in their retirement plan. ERISA Requires a plan sponsor to - Select Investments with the Care, Skill, Prudence, and Diligence under the circumstances then prevailing that a prudent man acting in like capacity and familiar with such matters would use in the conduct of an enterprise of a like character and with like aims. ERISA 404(a)(1). Prudence is a Product of Process! – Focus should be on a prudent process, not investment results Transamerica TPA Forum • Transamerica Retirement Services 17

Some Observations • The Bar has been set quite high! – Do employers have the capability of acting with “Care, Skill, Prudence, and Diligence…that a prudent man acting in like capacity and familiar with such matters…”? – How many plan sponsors do you think have a Formal Investment Policy? – Of those who do, how many do you think diligently follow it? • An IPS in place, without the means with which to support it, isn’t prudent! Transamerica TPA Forum • Transamerica Retirement Services 18

Investment Policy Statement For the Record • ERISA does not require that every plan have a written Investment Policy Statement • However, every plan should have an investment policy Transamerica’s Model Investment Policy Statement • Model IPS drafted by Fred Reish • Using the framework of the PSCA Model IPS • Specifically designed to integrate the Transamerica Investment Selection & Monitoring Process (TIM) Transamerica TPA Forum • Transamerica Retirement Services 19

The TIM Process • Clearly articulates the “Process” by which funds are Scored • Evaluates all funds on our Investment Platform • Easy to understand Scoring System • Utilizing Data from Lipper, Thompson, Morning. Star & S & P • Scorecard published to the Web Quarterly • If Model IPS has been integrated, TIM is the supporting process Transamerica TPA Forum • Transamerica Retirement Services 20

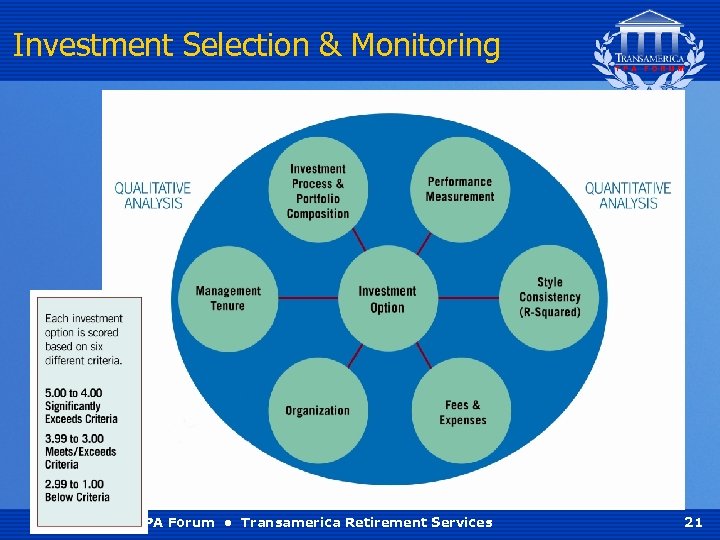

Investment Selection & Monitoring Transamerica TPA Forum • Transamerica Retirement Services 21

The Scorecard Quantitative Analysis ü 45% Performance Measurement • Absolute • Risk Adjusted ü 10% Style Consistency ü 10% Fees & Expenses Qualitative Analysis ü 10% Investment Process & Portfolio Composition ü 15% Management Tenure ü 10% Organization Transamerica TPA Forum • Transamerica Retirement Services 22

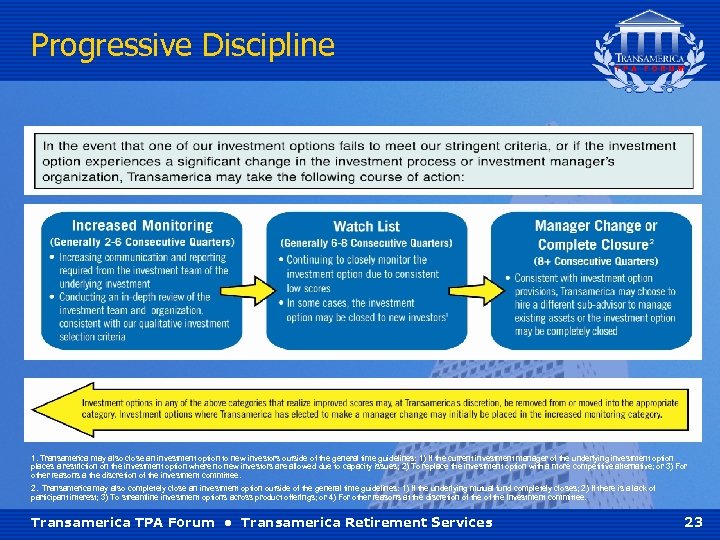

Progressive Discipline 1. Transamerica may also close an investment option to new investors outside of the general time guidelines: 1) If the current investment manager of the underlying investment option places a restriction on the investment option where no new investors are allowed due to capacity issues; 2) To replace the investment option with a more competitive alternative; or 3) For other reasons a the discretion of the investment committee. 2. Transamerica may also completely close an investment option outside of the general time guidelines: 1) If the underlying mutual fund completely closes; 2) If there is a lack of participant interest; 3) To streamline investment options across product offerings; or 4) For other reasons at the discretion of the Investment committee. Transamerica TPA Forum • Transamerica Retirement Services 23

3 rd Party Process Endorsement Standard & Poor’s Analytical Services (SPIAS) ü Industry-leading ü Independent ü Highly Regarded Verify Objectivity Regarding ü Process ü Outcome Transamerica TPA Forum • Transamerica Retirement Services 24

The Transamerica Solution Ibbotson & Assoc. • Selects Investments on a Plan Level • Accepts fiduciary responsibility with respect to the selected investment options. Transamerica TPA Forum • Transamerica Retirement Services 25

The Transamerica Solution ABC Brokerage Services Model IPS Transamerica TPA Forum • Transamerica Retirement Services 26

Lifestyle Funds Key Ingredient for Fiduciary Risk Management Target Maturity – Manage to a Target Retirement Date – Vanguard Target Maturity Funds Asset Allocation – Transamerica IDEX Asset Allocation Portfolios Transamerica TPA Forum • Transamerica Retirement Services 27

Investor Behavior Transamerica TPA Forum • Transamerica Retirement Services 28

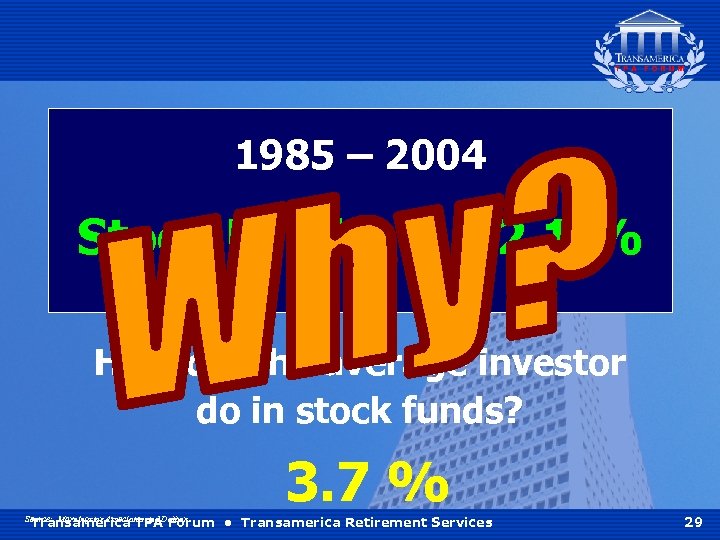

1985 – 2004 Stock Funds = 12. 1 % How did the average investor do in stock funds? 3. 7 % Transamerica TPA Forum • Transamerica Retirement Services Source: Morningstar Associates and Dalbar 29

Many people invest the same way they drive in traffic. Transamerica TPA Forum • Transamerica Retirement Services 30

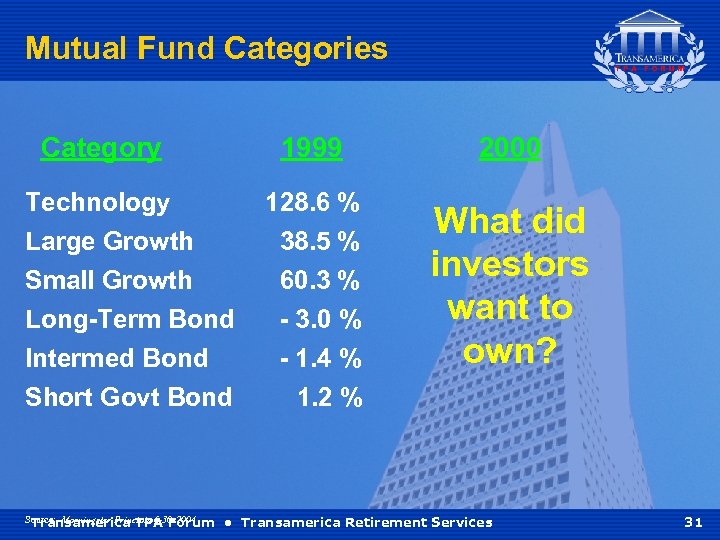

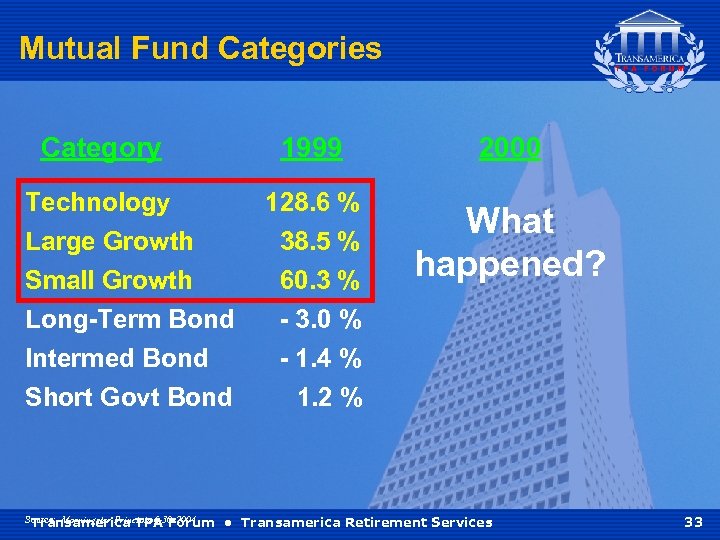

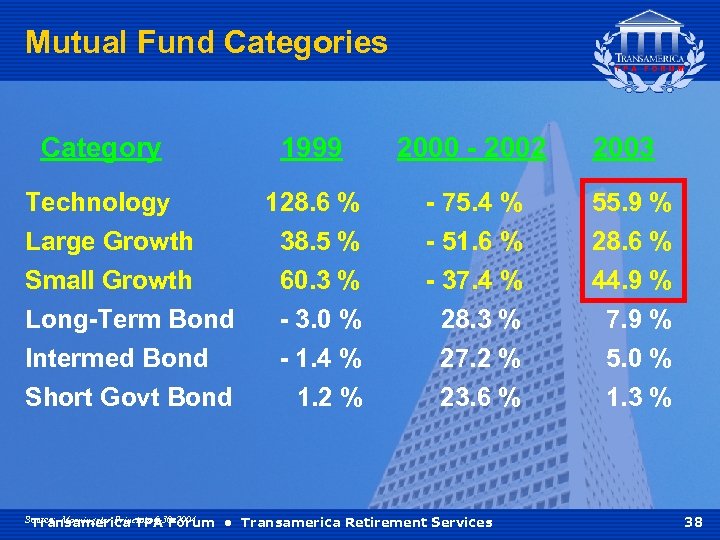

Mutual Fund Categories Category 1999 Technology Large Growth Small Growth Long-Term Bond Intermed Bond Short Govt Bond Source: Morningstar Principia 6 -30 -2004 Transamerica TPA Forum 2000 128. 6 % 38. 5 % 60. 3 % - 3. 0 % - 1. 4 % 1. 2 % What did investors want to own? • Transamerica Retirement Services 31

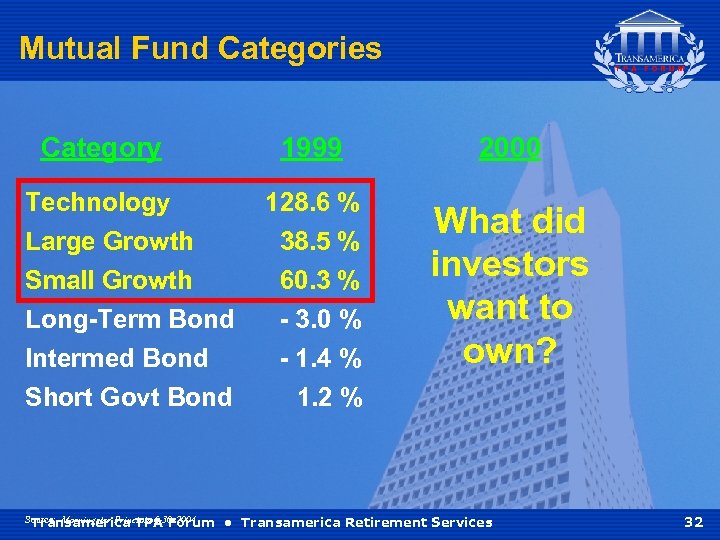

Mutual Fund Categories Category 1999 Technology Large Growth Small Growth Long-Term Bond Intermed Bond Short Govt Bond Source: Morningstar Principia 6 -30 -2004 Transamerica TPA Forum 2000 128. 6 % 38. 5 % 60. 3 % - 3. 0 % - 1. 4 % 1. 2 % What did investors want to own? • Transamerica Retirement Services 32

Mutual Fund Categories Category 1999 Technology Large Growth Small Growth Long-Term Bond Intermed Bond Short Govt Bond Source: Morningstar Principia 6 -30 -2004 Transamerica TPA Forum 2000 128. 6 % 38. 5 % 60. 3 % - 3. 0 % - 1. 4 % 1. 2 % What happened? • Transamerica Retirement Services 33

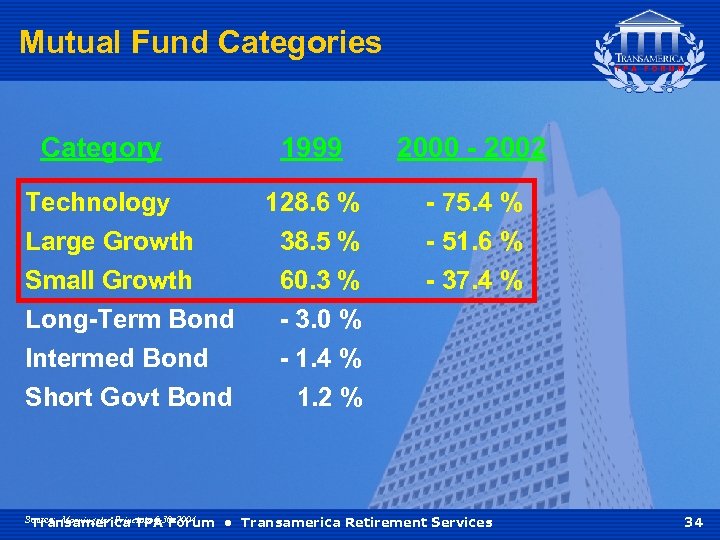

Mutual Fund Categories Category 1999 Technology Large Growth Small Growth Long-Term Bond Intermed Bond Short Govt Bond Source: Morningstar Principia 6 -30 -2004 Transamerica TPA Forum 2000 - 2002 128. 6 % 38. 5 % 60. 3 % - 3. 0 % - 1. 4 % 1. 2 % - 75. 4 % - 51. 6 % - 37. 4 % • Transamerica Retirement Services 34

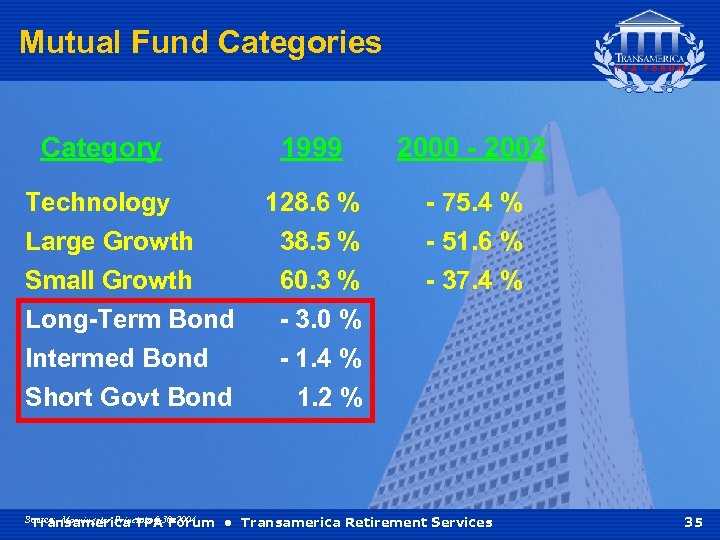

Mutual Fund Categories Category 1999 Technology Large Growth Small Growth Long-Term Bond Intermed Bond Short Govt Bond Source: Morningstar Principia 6 -30 -2004 Transamerica TPA Forum 2000 - 2002 128. 6 % 38. 5 % 60. 3 % - 3. 0 % - 1. 4 % 1. 2 % - 75. 4 % - 51. 6 % - 37. 4 % • Transamerica Retirement Services 35

Mutual Fund Categories Category 1999 Technology Large Growth Small Growth Long-Term Bond Intermed Bond Short Govt Bond Source: Morningstar Principia 6 -30 -2004 Transamerica TPA Forum 2000 - 2002 128. 6 % 38. 5 % 60. 3 % - 3. 0 % - 1. 4 % 1. 2 % - 75. 4 % - 51. 6 % - 37. 4 % 28. 3 % 27. 2 % 23. 6 % • Transamerica Retirement Services 2003 What did investors want to own now? 36

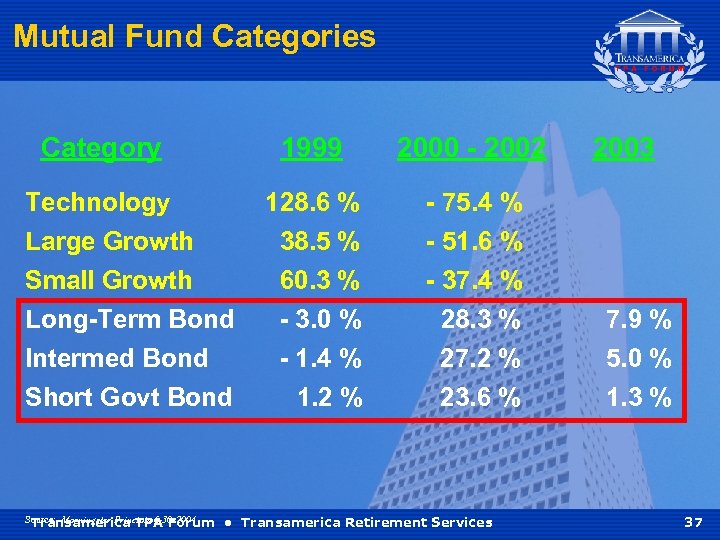

Mutual Fund Categories Category 1999 Technology Large Growth Small Growth Long-Term Bond Intermed Bond Short Govt Bond Source: Morningstar Principia 6 -30 -2004 Transamerica TPA Forum 2000 - 2002 128. 6 % 38. 5 % 60. 3 % - 3. 0 % - 1. 4 % 1. 2 % - 75. 4 % - 51. 6 % - 37. 4 % 28. 3 % 27. 2 % 23. 6 % • Transamerica Retirement Services 2003 7. 9 % 5. 0 % 1. 3 % 37

Mutual Fund Categories Category 1999 Technology Large Growth Small Growth Long-Term Bond Intermed Bond Short Govt Bond Source: Morningstar Principia 6 -30 -2004 Transamerica TPA Forum 2000 - 2002 128. 6 % 38. 5 % 60. 3 % - 3. 0 % - 1. 4 % 1. 2 % - 75. 4 % - 51. 6 % - 37. 4 % 28. 3 % 27. 2 % 23. 6 % • Transamerica Retirement Services 2003 55. 9 % 28. 6 % 44. 9 % 7. 9 % 5. 0 % 1. 3 % 38

Transamerica TPA Forum • Transamerica Retirement Services 39

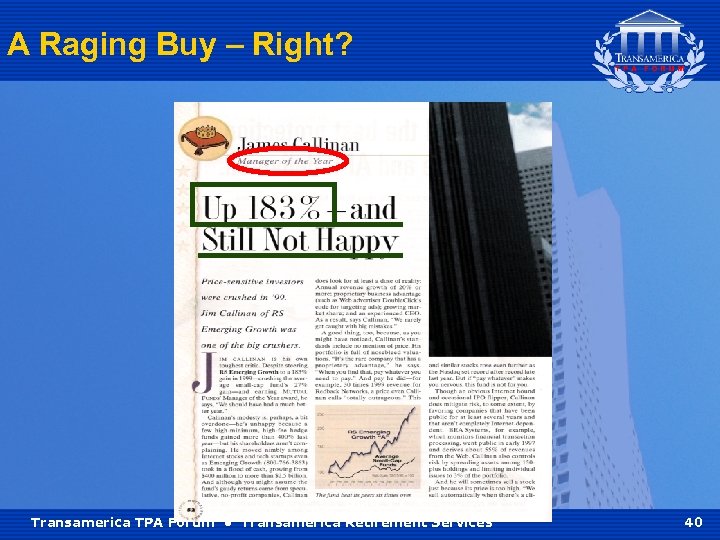

A Raging Buy – Right? Transamerica TPA Forum • Transamerica Retirement Services 40

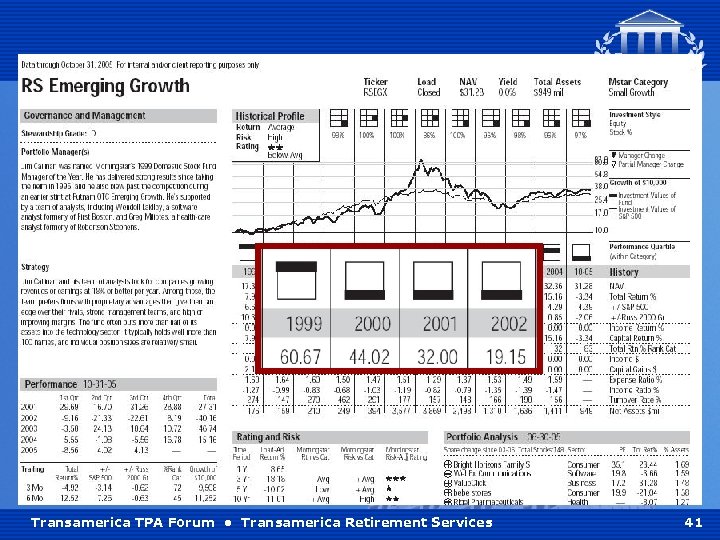

Transamerica TPA Forum • Transamerica Retirement Services 41

Unique Talent of the Individual Investor 1998 1999 Got In Transamerica TPA Forum • Transamerica Retirement Services 42

Unique Talent of the Individual Investor 1998 1999 2000 2001 2002 2003 Got Out Transamerica TPA Forum • Transamerica Retirement Services Source: Big Charts 43

Benjamin Graham “The investor’s chief problem and even his worst enemy is likely to be himself. ” There has got to be a better way! Transamerica TPA Forum • Transamerica Retirement Services 44

in Theory For broker-dealer use only. Not to be shown to the public.

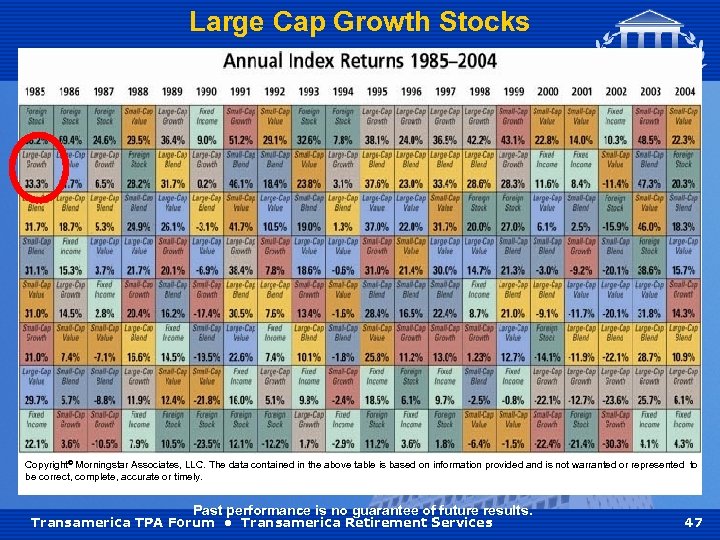

Fundamental Premise Different asset classes and investment categories behave differently over time. Transamerica TPA Forum • Transamerica Retirement Services 46

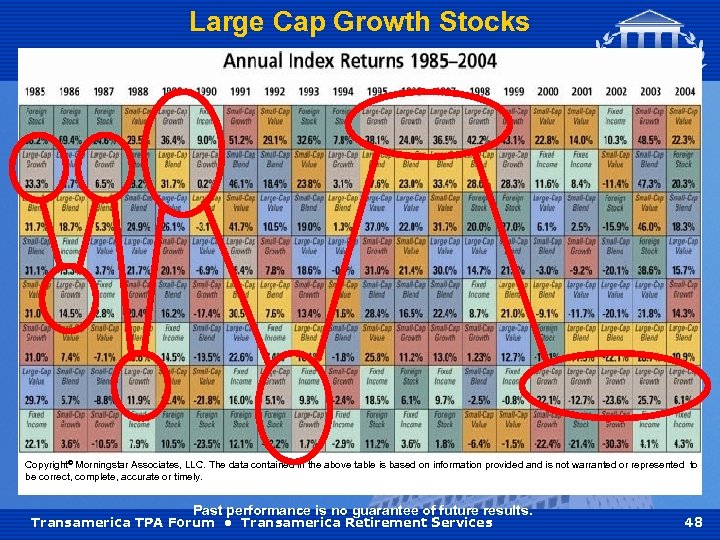

Large Cap Growth Stocks Copyright© Morningstar Associates, LLC. The data contained in the above table is based on information provided and is not warranted or represented to be correct, complete, accurate or timely. Past performance is no guarantee of future results. Transamerica TPA Forum • Transamerica Retirement Services 47

Large Cap Growth Stocks Copyright© Morningstar Associates, LLC. The data contained in the above table is based on information provided and is not warranted or represented to be correct, complete, accurate or timely. Past performance is no guarantee of future results. Transamerica TPA Forum • Transamerica Retirement Services 48

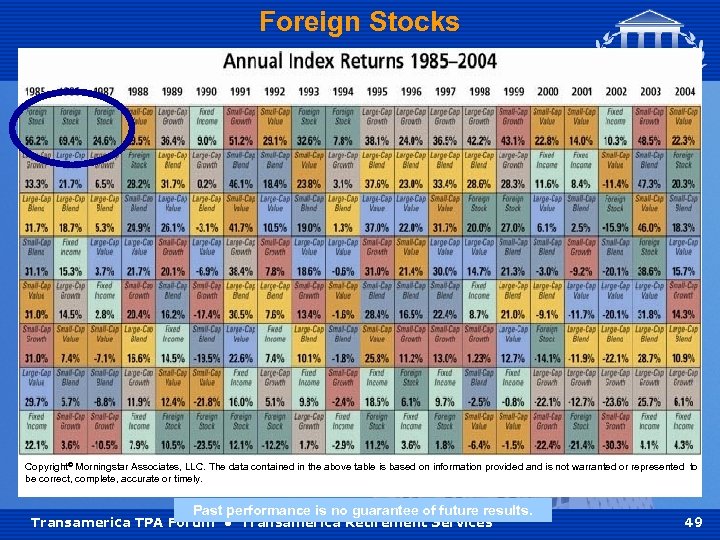

Foreign Stocks Copyright© Morningstar Associates, LLC. The data contained in the above table is based on information provided and is not warranted or represented to be correct, complete, accurate or timely. Past performance is no guarantee of future results. Transamerica TPA Forum • Transamerica Retirement Services 49

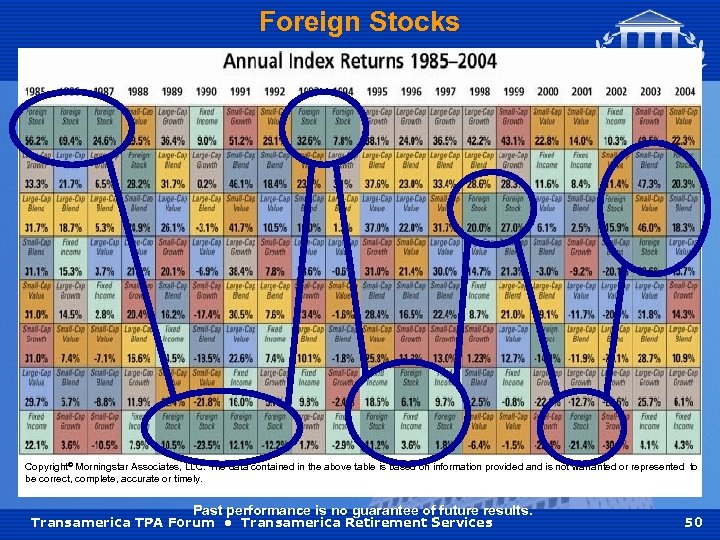

Foreign Stocks Copyright© Morningstar Associates, LLC. The data contained in the above table is based on information provided and is not warranted or represented to be correct, complete, accurate or timely. Past performance is no guarantee of future results. Transamerica TPA Forum • Transamerica Retirement Services 50

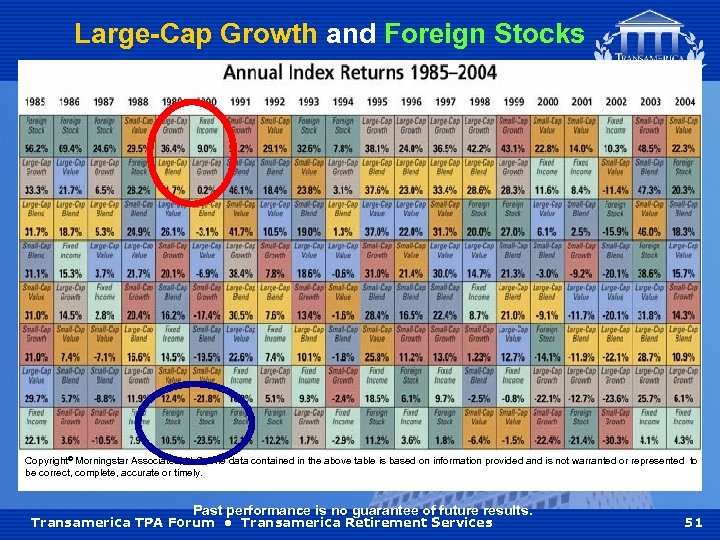

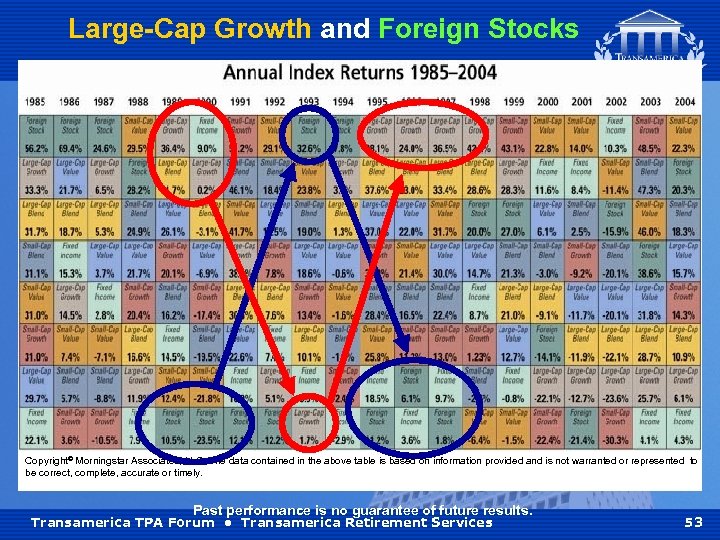

Large-Cap Growth and Foreign Stocks Copyright© Morningstar Associates, LLC. The data contained in the above table is based on information provided and is not warranted or represented to be correct, complete, accurate or timely. Past performance is no guarantee of future results. Transamerica TPA Forum • Transamerica Retirement Services 51

Large-Cap Growth and Foreign Stocks Copyright© Morningstar Associates, LLC. The data contained in the above table is based on information provided and is not warranted or represented to be correct, complete, accurate or timely. Past performance is no guarantee of future results. Transamerica TPA Forum • Transamerica Retirement Services 52

Large-Cap Growth and Foreign Stocks Copyright© Morningstar Associates, LLC. The data contained in the above table is based on information provided and is not warranted or represented to be correct, complete, accurate or timely. Past performance is no guarantee of future results. Transamerica TPA Forum • Transamerica Retirement Services 53

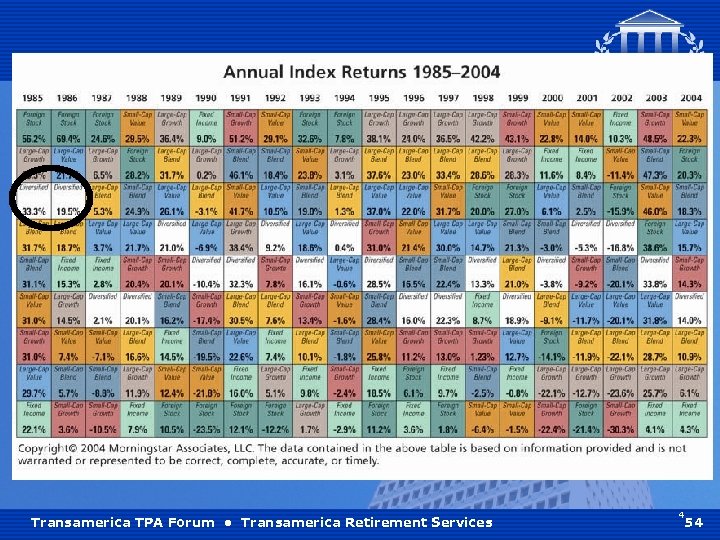

Transamerica TPA Forum • Transamerica Retirement Services 4 54

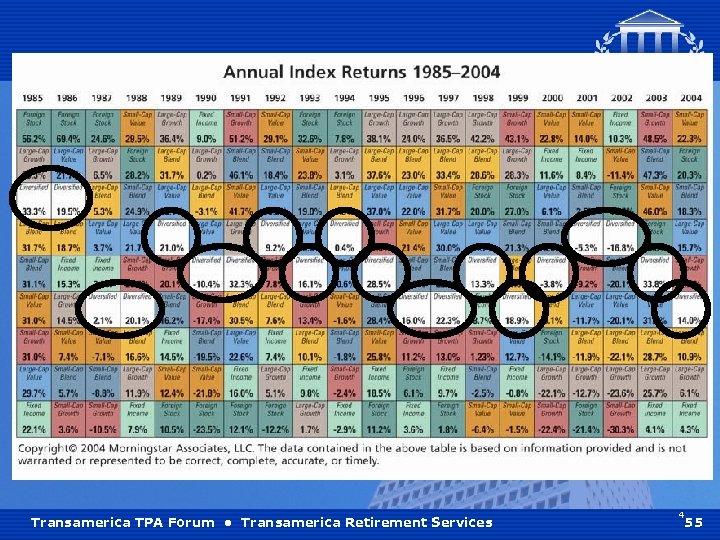

Transamerica TPA Forum • Transamerica Retirement Services 4 55

in Practice For broker-dealer use only. Not to be shown to the public.

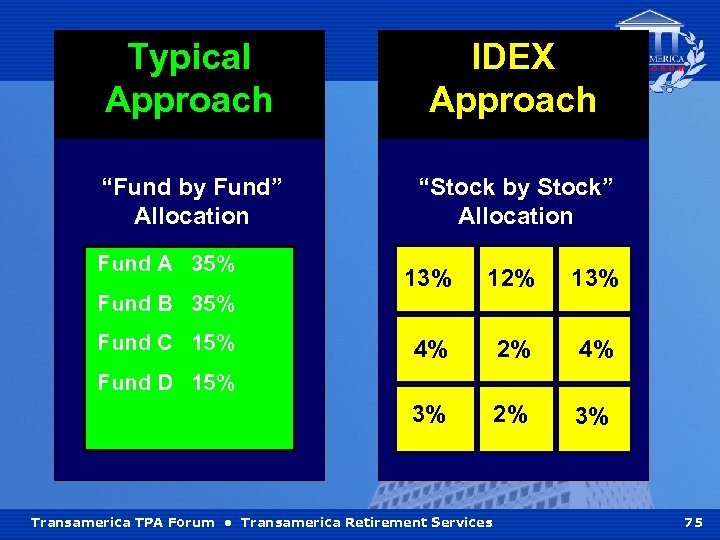

2 Different Approaches to Asset Allocation Funds Allocate “Fund-by-Fund” vs. Allocate “Stock-by-Stock” What’s the difference? Transamerica TPA Forum • Transamerica Retirement Services 57

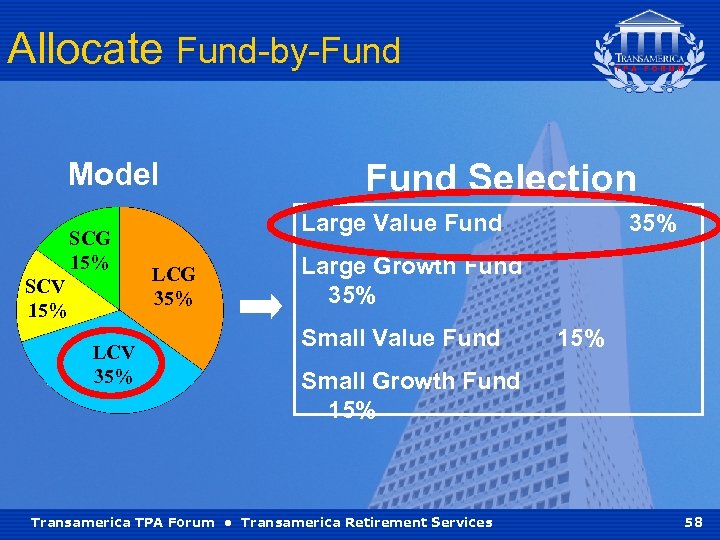

Allocate Fund-by-Fund Model SCG 15% SCV 15% LCV 35% Fund Selection Large Value Fund LCG 35% Large Growth Fund 35% Small Value Fund 15% Small Growth Fund 15% Transamerica TPA Forum • Transamerica Retirement Services 58

For a LCV fund, what percentage of fund assets would you expect to be invested in LCV stocks? Transamerica TPA Forum • Transamerica Retirement Services 59

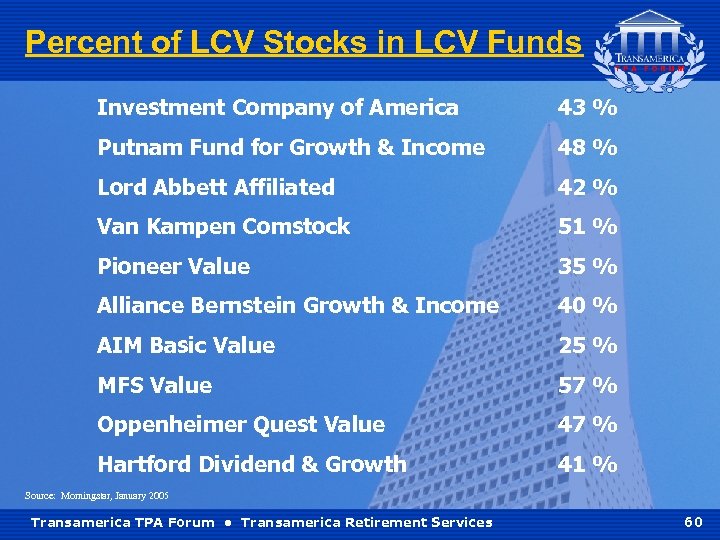

Percent of LCV Stocks in LCV Funds Investment Company of America 43 % Putnam Fund for Growth & Income 48 % Lord Abbett Affiliated 42 % Van Kampen Comstock 51 % Pioneer Value 35 % Alliance Bernstein Growth & Income 40 % AIM Basic Value 25 % MFS Value 57 % Oppenheimer Quest Value 47 % Hartford Dividend & Growth 41 % Source: Morningstar, January 2005 Transamerica TPA Forum • Transamerica Retirement Services 60

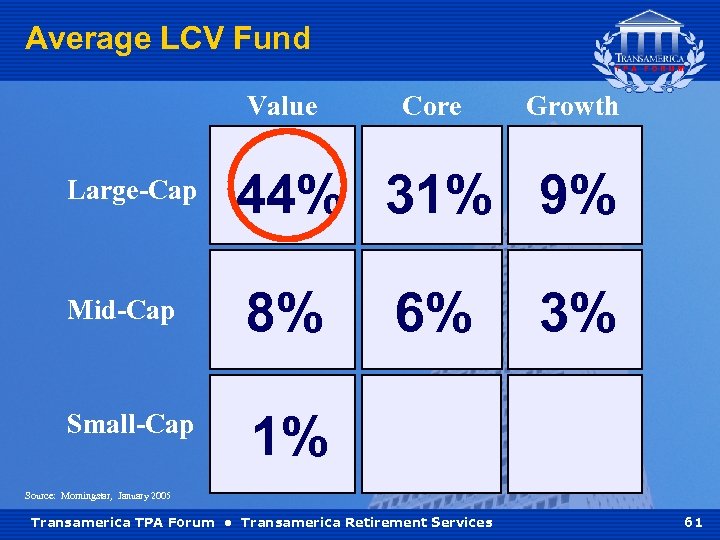

Average LCV Fund Value Large-Cap Core Growth 44% 31% 9% Mid-Cap 8% Small-Cap 6% 3% 1% Source: Morningstar, January 2005 Transamerica TPA Forum • Transamerica Retirement Services 61

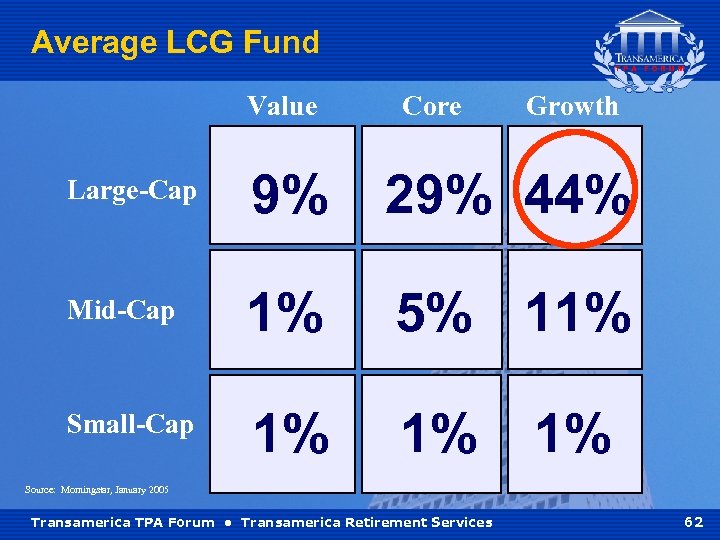

Average LCG Fund Value Core Growth Large-Cap 9% 29% 44% Mid-Cap 1% 5% 11% Small-Cap 1% 1% 1% Source: Morningstar, January 2005 Transamerica TPA Forum • Transamerica Retirement Services 62

What’s the point? Funds are not style pure! So what happens when you allocate fund-by-fund? Transamerica TPA Forum • Transamerica Retirement Services 63

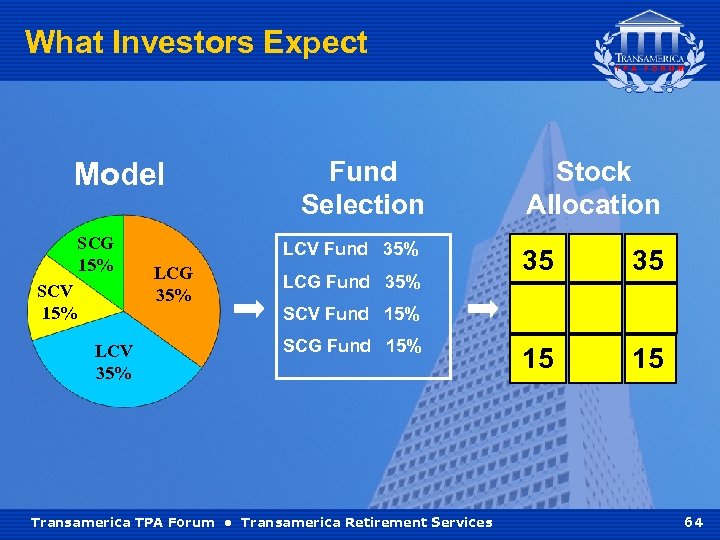

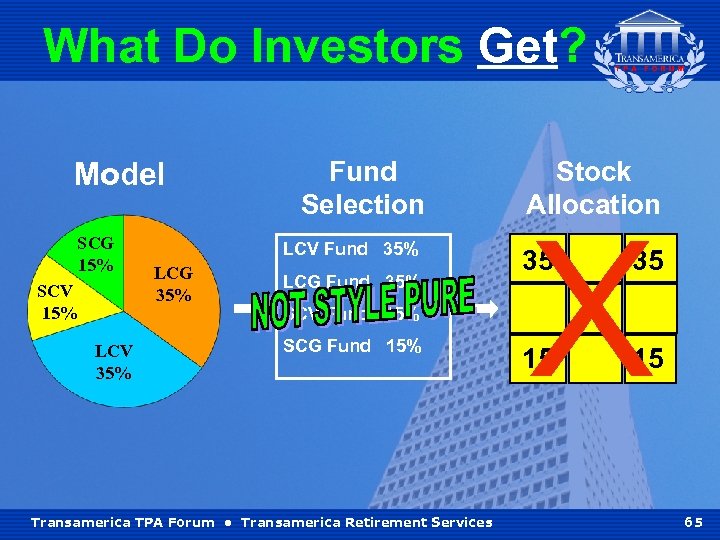

What Investors Expect Model SCG 15% SCV 15% LCV 35% Fund Selection LCV Fund 35% LCG Fund 35% Stock Allocation 35 35 15 15 SCV Fund 15% SCG Fund 15% Transamerica TPA Forum • Transamerica Retirement Services 64

What Do Investors Get? Model SCG 15% SCV 15% LCV 35% Fund Selection LCV Fund 35% LCG Fund 35% SCV Fund 15% SCG Fund 15% Transamerica TPA Forum • Transamerica Retirement Services Stock Allocation X 35 35 15 15 65

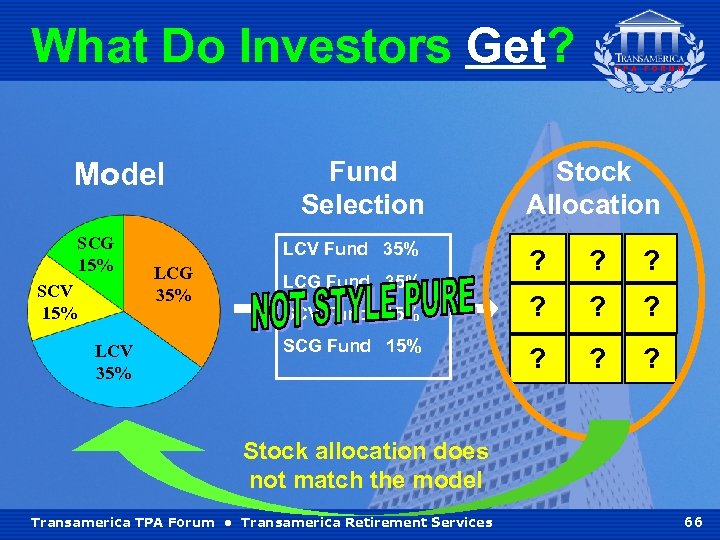

What Do Investors Get? Model SCG 15% SCV 15% LCV 35% Fund Selection LCV Fund 35% LCG Fund 35% SCV Fund 15% SCG Fund 15% Stock Allocation ? ? ? Stock allocation does not match the model Transamerica TPA Forum • Transamerica Retirement Services 66

How do you create an accurate asset allocation plan when there’s no “Style Box Discipline”? Transamerica TPA Forum • Transamerica Retirement Services 67

Build a diversified portfolio “stock-bystock” instead of “fund-by-fund” But How? Transamerica TPA Forum • Transamerica Retirement Services 68

Transamerica TPA Forum • Transamerica Retirement Services 69

Morningstar Associates 1. They have analytic tools to determine the style box for individual stocks. Transamerica TPA Forum • Transamerica Retirement Services 70

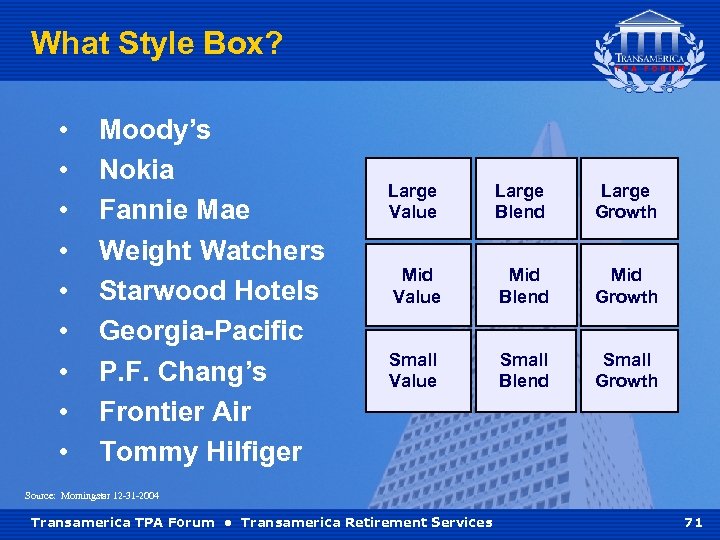

What Style Box? • • • Moody’s Nokia Fannie Mae Weight Watchers Starwood Hotels Georgia-Pacific P. F. Chang’s Frontier Air Tommy Hilfiger Large Value Large Blend Large Growth Mid Value Mid Blend Mid Growth Small Value Small Blend Small Growth Source: Morningstar 12 -31 -2004 Transamerica TPA Forum • Transamerica Retirement Services 71

Morningstar Associates 2. They have the analytic tools and experience to select diverse managers whose styles complement each other. Transamerica TPA Forum • Transamerica Retirement Services 72

Morningstar Associates 3. They have the tools to balance the stock style boxes inside the funds rather than just rebalancing the funds. Transamerica TPA Forum • Transamerica Retirement Services 73

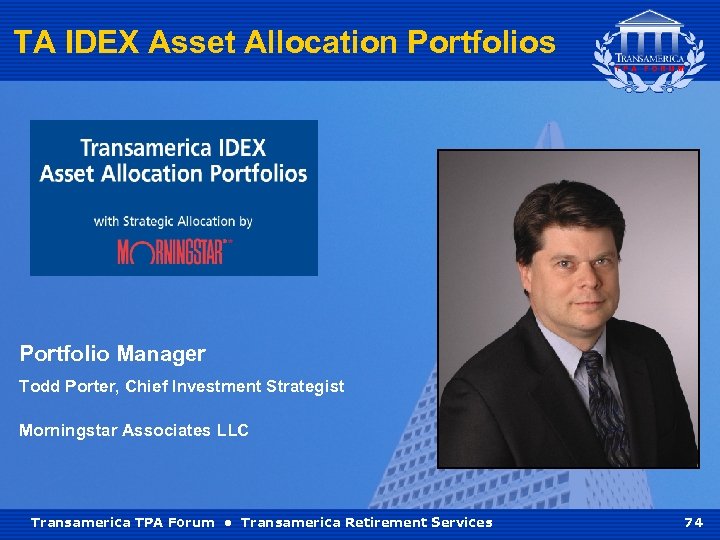

TA IDEX Asset Allocation Portfolios Portfolio Manager Todd Porter, Chief Investment Strategist Morningstar Associates LLC Transamerica TPA Forum • Transamerica Retirement Services 74

Typical Approach IDEX Approach “Fund by Fund” Allocation “Stock by Stock” Allocation Fund A 35% Fund C 15% 12% 13% 4% 2% 4% 3% Fund B 35% 13% 2% 3% Fund D 15% Transamerica TPA Forum • Transamerica Retirement Services 75

TA IDEX Asset Allocation • Four portfolios Transamerica TPA Forum • Transamerica Retirement Services 76

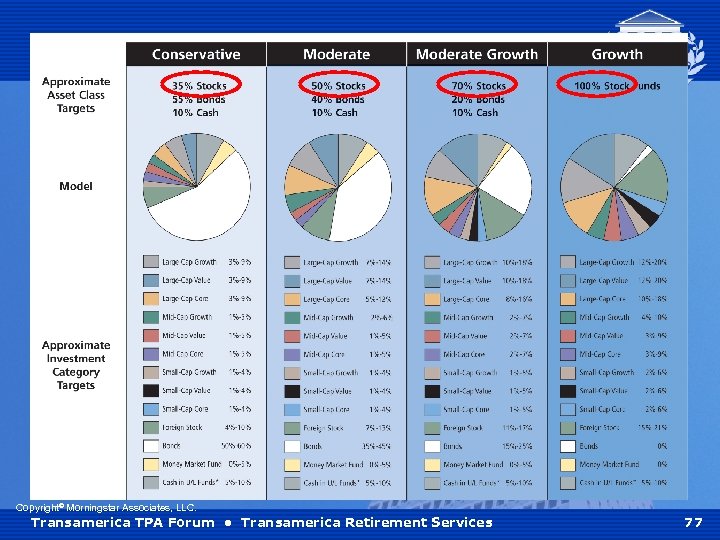

Copyright© Morningstar Associates, LLC. Transamerica TPA Forum • Transamerica Retirement Services 77

TA IDEX Asset Allocation • Four portfolios • Multiple managers inside each Asset Allocation Portfolio Transamerica TPA Forum • Transamerica Retirement Services 78

Transamerica TPA Forum • Transamerica Retirement Services 79

TA IDEX Asset Allocation • Four portfolios • Multiple managers • Build portfolios stock-by-stock Transamerica TPA Forum • Transamerica Retirement Services 80

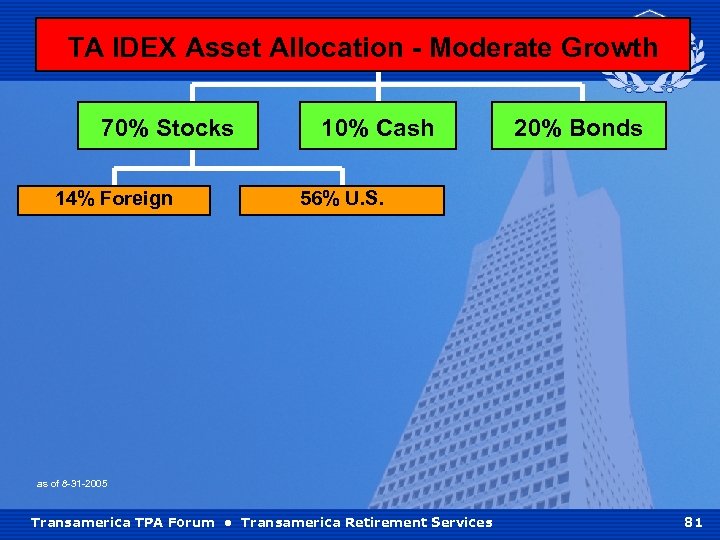

TA IDEX Asset Allocation - Moderate Growth 70% Stocks 14% Foreign 10% Cash 20% Bonds 56% U. S. as of 8 -31 -2005 Transamerica TPA Forum • Transamerica Retirement Services 81

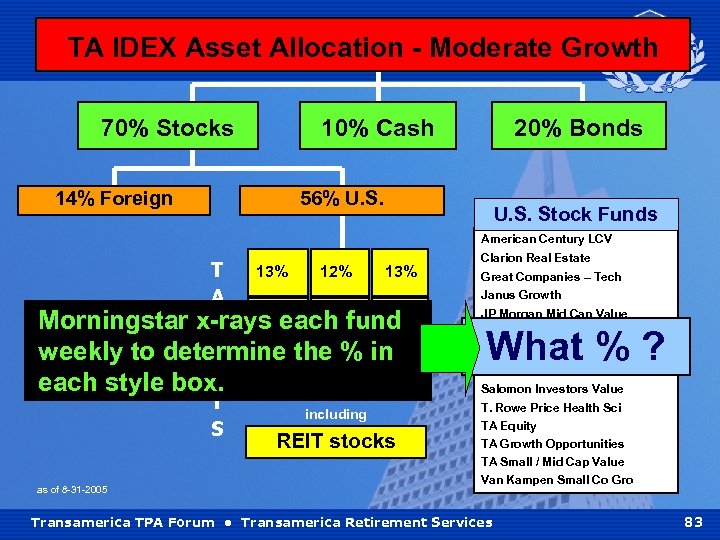

TA IDEX Asset Allocation - Moderate Growth 70% Stocks 10% Cash 14% Foreign 20% Bonds 56% U. S. Stock Funds American Century LCV T A R G E T S as of 8 -31 -2005 13% 12% 13% Clarion Real Estate Great Companies – Tech Janus Growth 4% 2% 4% JP Morgan Mid Cap Value What % ? Marsico Growth Mercury Large Cap Value 3% 2% 3% Salomon All Cap Salomon Investors Value including REIT stocks T. Rowe Price Health Sci TA Equity TA Growth Opportunities TA Small / Mid Cap Value Van Kampen Small Co Gro Transamerica TPA Forum • Transamerica Retirement Services 82

TA IDEX Asset Allocation - Moderate Growth 70% Stocks 14% Foreign 10% Cash 20% Bonds 56% U. S. Stock Funds American Century LCV 13% 12% 13% T A 4% 2% 4% Morningstar x-rays each fund R G weekly to determine the % in 3% 2% 3% E each style box. T including S REIT stocks as of 8 -31 -2005 Clarion Real Estate Great Companies – Tech Janus Growth JP Morgan Mid Cap Value What % ? Marsico Growth Mercury Large Cap Value Salomon All Cap Salomon Investors Value T. Rowe Price Health Sci TA Equity TA Growth Opportunities TA Small / Mid Cap Value Van Kampen Small Co Gro Transamerica TPA Forum • Transamerica Retirement Services 83

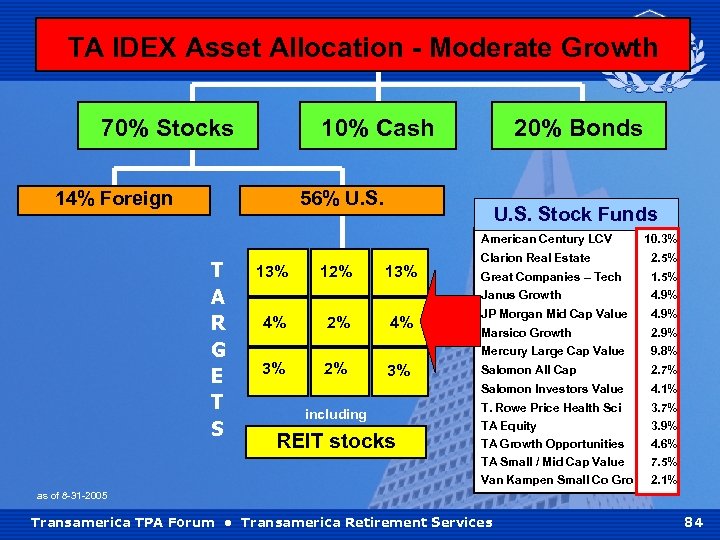

TA IDEX Asset Allocation - Moderate Growth 70% Stocks 10% Cash 14% Foreign 20% Bonds 56% U. S. Stock Funds American Century LCV T A R G E T S 10. 3% 2% 4% 3% including REIT stocks 1. 5% 4. 9% JP Morgan Mid Cap Value 4. 9% Marsico Growth 2. 9% 9. 8% Salomon All Cap 2. 7% Salomon Investors Value 3% 2% 13% Great Companies – Tech Mercury Large Cap Value 4% 12% 2. 5% Janus Growth 13% Clarion Real Estate 4. 1% T. Rowe Price Health Sci 3. 7% TA Equity TA Growth Opportunities TA Small / Mid Cap Value Van Kampen Small Co Gro 3. 9% 4. 6% 7. 5% 2. 1% as of 8 -31 -2005 Transamerica TPA Forum • Transamerica Retirement Services 84

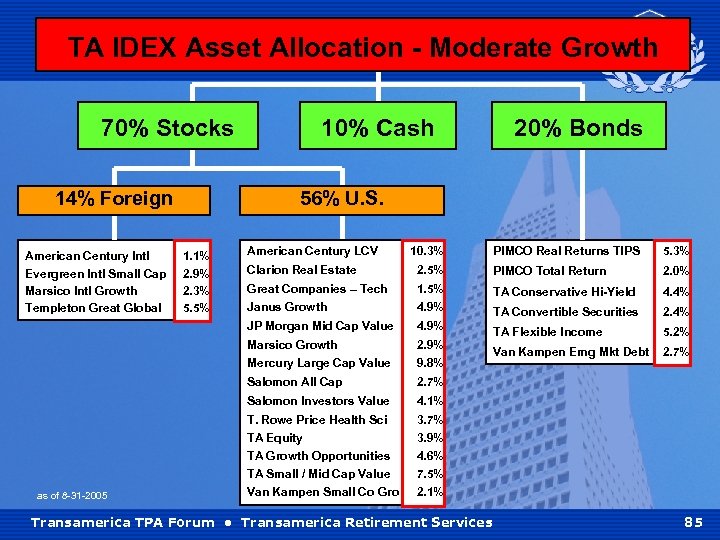

TA IDEX Asset Allocation - Moderate Growth 70% Stocks 10% Cash 14% Foreign American Century Intl Evergreen Intl Small Cap Marsico Intl Growth Templeton Great Global 56% U. S. 1. 1% 2. 9% 2. 3% 5. 5% American Century LCV Clarion Real 12% Estate 13% 10. 3% 13%2. 5% PIMCO Real Returns TIPS 5. 3% PIMCO Total Return 2. 0% Great Companies – Tech 1. 5% TA Conservative Hi-Yield 4. 4% Janus Growth 4. 9% TA Convertible Securities 2. 4% TA Flexible Income 5. 2% Van Kampen Emg Mkt Debt 2. 7% 2% 4% 4. 9% JP 4% Morgan Mid Cap Value Marsico Growth 2. 9% Mercury Large Cap Value 9. 8% Salomon All Cap 2. 7% 3% 2% 3% Salomon Investors Value including T. Rowe Price Health Sci REIT stocks as of 8 -31 -2005 20% Bonds TA Equity TA Growth Opportunities TA Small / Mid Cap Value Van Kampen Small Co Gro 4. 1% 3. 7% 3. 9% 4. 6% 7. 5% 2. 1% Transamerica TPA Forum • Transamerica Retirement Services 85

TA IDEX Asset Allocation What about rebalancing? Transamerica TPA Forum • Transamerica Retirement Services 86

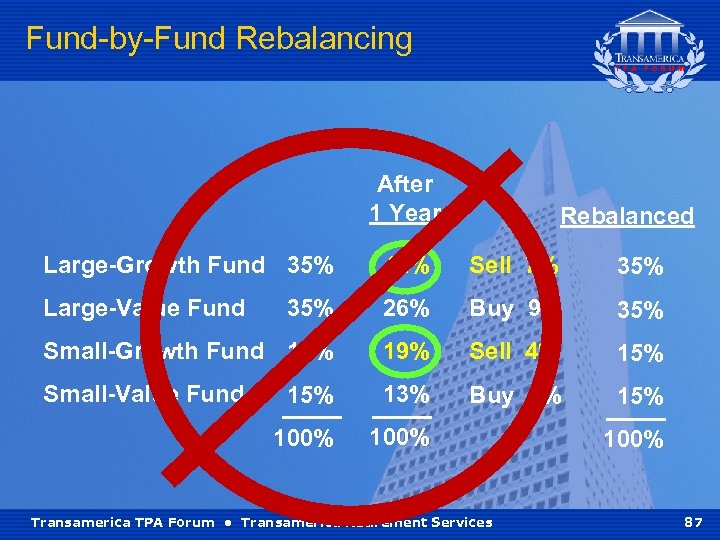

Fund-by-Fund Rebalancing After 1 Year Rebalanced Large-Growth Fund 35% 42% Sell 7% 35% Large-Value Fund 35% 26% Buy 9% 35% Small-Growth Fund 15% 19% Sell 4% 15% Small-Value Fund 15% 13% Buy 2% 15% 100% Transamerica TPA Forum • Transamerica Retirement Services 100% 87

Continuous Balancing • Every stock & bond position is downloaded to Morningstar every night. • Analyze for style drift & stock overlap. • New money received each day is invested in underweighted positions. • Makes use of dollar-cost averaging concepts at the portfolio level without requiring existing investors to make additional investments. Transamerica TPA Forum • Transamerica Retirement Services 88

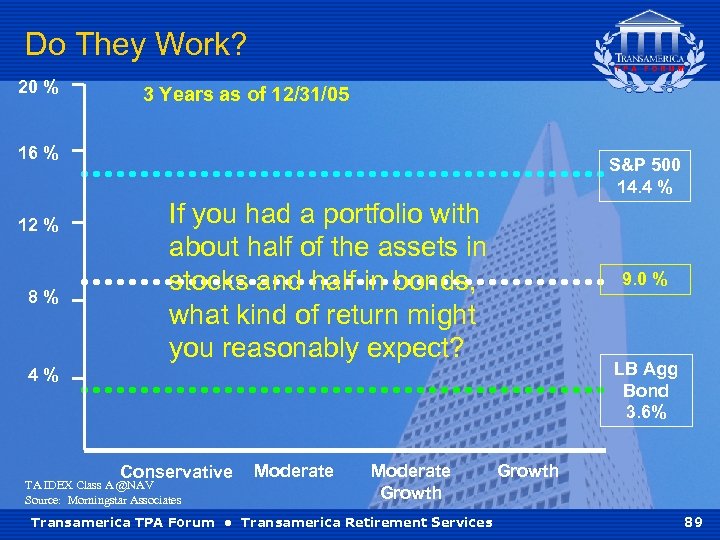

Do They Work? 20 % 3 Years as of 12/31/05 16 % 12 % 8% S&P 500 14. 4 % If you had a portfolio with about half of the assets in stocks and half in bonds, what kind of return might you reasonably expect? 9. 0 % LB Agg Bond 3. 6% 4% Conservative TA IDEX Class A @NAV Source: Morningstar Associates Moderate Growth Transamerica TPA Forum • Transamerica Retirement Services Growth 89

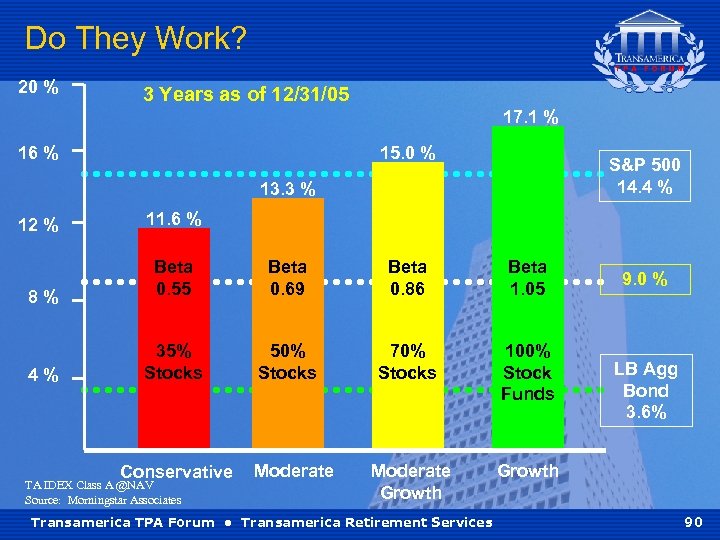

Do They Work? 20 % 3 Years as of 12/31/05 17. 1 % 16 % 15. 0 % S&P 500 14. 4 % 13. 3 % 12 % 11. 6 % 8% Beta 0. 55 Beta 0. 69 Beta 0. 86 Beta 1. 05 4% 35% Stocks 50% Stocks 70% Stocks 100% Stock Funds Moderate Growth Conservative TA IDEX Class A @NAV Source: Morningstar Associates Moderate Transamerica TPA Forum • Transamerica Retirement Services 9. 0 % LB Agg Bond 3. 6% 90

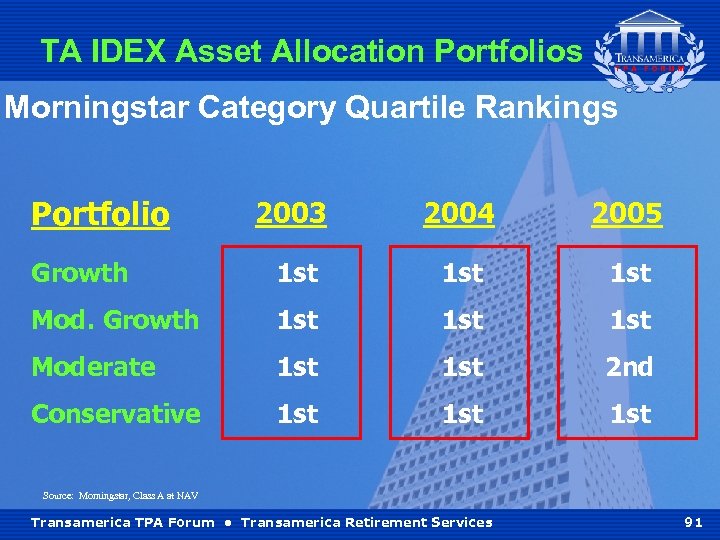

TA IDEX Asset Allocation Portfolios Morningstar Category Quartile Rankings Portfolio 2003 2004 2005 Growth 1 st 1 st Moderate 1 st 2 nd Conservative 1 st 1 st Source: Morningstar, Class A at NAV Transamerica TPA Forum • Transamerica Retirement Services 91

Transamerica IDEX Asset Allocation Portfolios • Multiple managers • Morningstar • Build portfolios stock-by-stock Transamerica TPA Forum • Transamerica Retirement Services 92

3 Unique Tools • “Plus 15” Participation Guarantee • Transamerica Fiduciary Process • A refreshing approach to Asset Allocation Funds Transamerica Idex Asset Allocation Funds Transamerica TPA Forum • Transamerica Retirement Services 93

8d5324cc089a4b5d9e2ea8df58687a2e.ppt