Press Meet Q 1 2010 Performance 1

Press Meet Q 1 2010 Performance 1

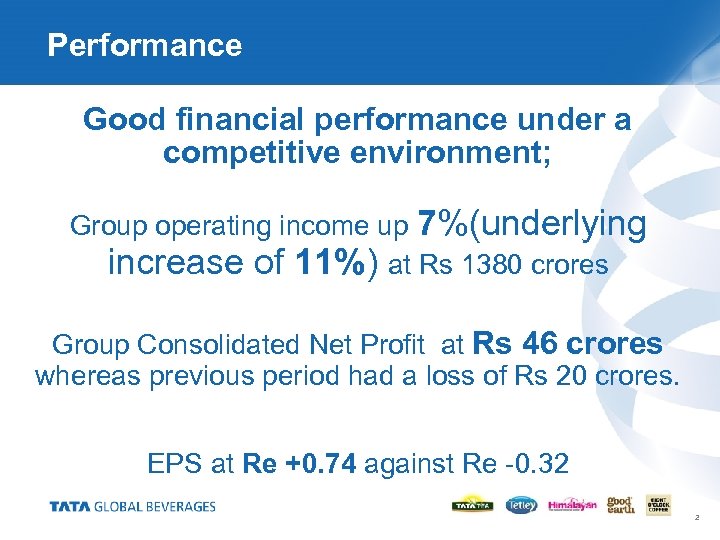

Performance Good financial performance under a competitive environment; Group operating income up 7%(underlying increase of 11%) at Rs 1380 crores Group Consolidated Net Profit at Rs 46 crores whereas previous period had a loss of Rs 20 crores. EPS at Re +0. 74 against Re -0. 32 2

Performance Good financial performance under a competitive environment; Group operating income up 7%(underlying increase of 11%) at Rs 1380 crores Group Consolidated Net Profit at Rs 46 crores whereas previous period had a loss of Rs 20 crores. EPS at Re +0. 74 against Re -0. 32 2

Performance Comments • Regional Performance • USA • EOC volumes marginally lower and costs surge • Canada • Tetley Brand investment commences • Strong Performance in Market • GB • Good-earth Launch • Lead market share gains achieved. • South Asia • Retailer consolidation. • Strong Profit performance while volumes are stressed • Jaago Re success continues • EME • Investment and Growth in T!ON • Tetley Middle East Launch • APAC • Impact of Russia JV • Forex benefit improves sales • Organisation Initiatives • Region reorganises • Additional Investment behind NPD agenda • Market Impact • Sterling / dollar weakness • Lower Fx translation 3

Performance Comments • Regional Performance • USA • EOC volumes marginally lower and costs surge • Canada • Tetley Brand investment commences • Strong Performance in Market • GB • Good-earth Launch • Lead market share gains achieved. • South Asia • Retailer consolidation. • Strong Profit performance while volumes are stressed • Jaago Re success continues • EME • Investment and Growth in T!ON • Tetley Middle East Launch • APAC • Impact of Russia JV • Forex benefit improves sales • Organisation Initiatives • Region reorganises • Additional Investment behind NPD agenda • Market Impact • Sterling / dollar weakness • Lower Fx translation 3

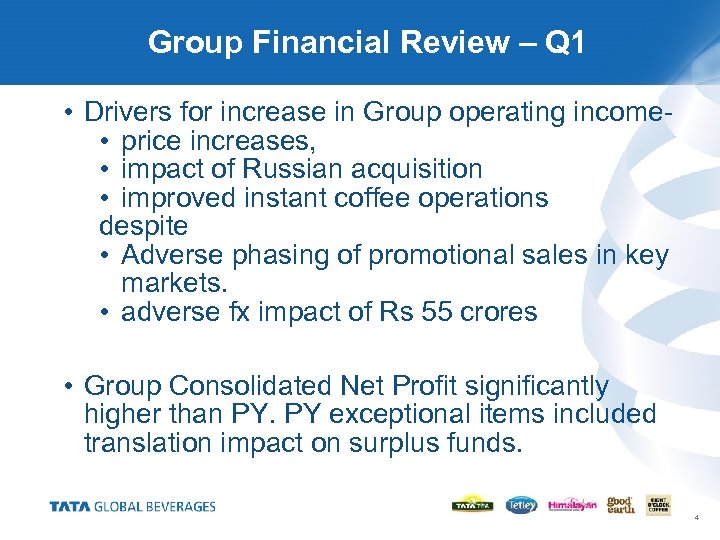

Group Financial Review – Q 1 • Drivers for increase in Group operating income • price increases, • impact of Russian acquisition • improved instant coffee operations despite • Adverse phasing of promotional sales in key markets. • adverse fx impact of Rs 55 crores • Group Consolidated Net Profit significantly higher than PY. PY exceptional items included translation impact on surplus funds. 4

Group Financial Review – Q 1 • Drivers for increase in Group operating income • price increases, • impact of Russian acquisition • improved instant coffee operations despite • Adverse phasing of promotional sales in key markets. • adverse fx impact of Rs 55 crores • Group Consolidated Net Profit significantly higher than PY. PY exceptional items included translation impact on surplus funds. 4

Group Financial Review – Q 1 • Profit before exceptional items impacted by • increased commodity costs for the quarter (tea costs now show signs of softening) • investments behind NPD. • Advertising investments to support brands • EPS at Re 0. 74 against a loss of Re 0. 32 mainly due to the absence of translational impact on surplus funds. 5

Group Financial Review – Q 1 • Profit before exceptional items impacted by • increased commodity costs for the quarter (tea costs now show signs of softening) • investments behind NPD. • Advertising investments to support brands • EPS at Re 0. 74 against a loss of Re 0. 32 mainly due to the absence of translational impact on surplus funds. 5

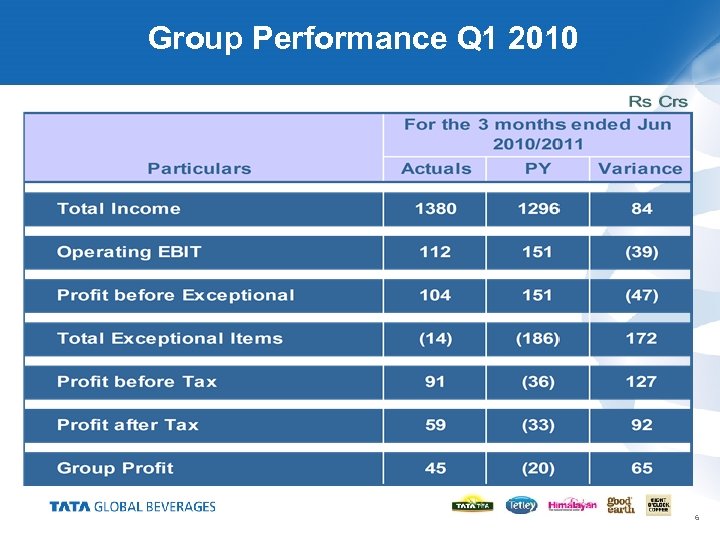

Group Performance Q 1 2010 6

Group Performance Q 1 2010 6

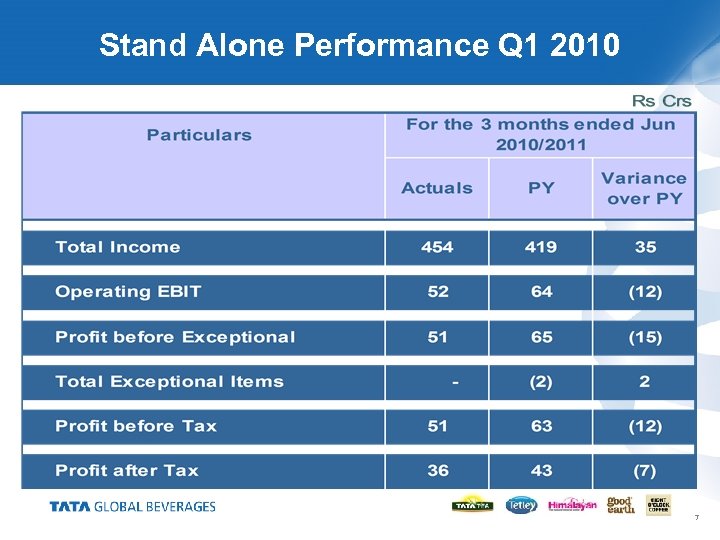

Stand Alone Performance Q 1 2010 7

Stand Alone Performance Q 1 2010 7

Thank You 8

Thank You 8