c6f86b5971451662fb1bb2df9e16b546.ppt

- Количество слайдов: 38

Press Conference Acquisition of 50% in Koramic Roofing Vienna, January 10, 2003

Press Conference Acquisition of 50% in Koramic Roofing Vienna, January 10, 2003

Important Strategic Development § Acquisition of 50% share in Koramic Roofing § Full take-over planned (call options) § Creation of 2 nd core business

Important Strategic Development § Acquisition of 50% share in Koramic Roofing § Full take-over planned (call options) § Creation of 2 nd core business

Wienerberger Expansion Strategy New Products e. g. Roofing Existing Products Brick projects in our existing markets Existing Markets Russia, Romania, Bosnia, etc. New Markets

Wienerberger Expansion Strategy New Products e. g. Roofing Existing Products Brick projects in our existing markets Existing Markets Russia, Romania, Bosnia, etc. New Markets

Development of Second Core Business § Complement to existing core brick business § In existing markets § Use of synergies and growth potential § Attractive industry § In which market leadership in Europe can be reached

Development of Second Core Business § Complement to existing core brick business § In existing markets § Use of synergies and growth potential § Attractive industry § In which market leadership in Europe can be reached

Clay Roof Tile Industry Characteristics n Over 50% renovation –less cyclical due to less dependency on housing starts n Increasing market shares – growth segment! n Consolidation process well advanced n Large supplier radius (600 – 800 km) n High EBITDA margins: 30% - 45% n Low maintenance capex

Clay Roof Tile Industry Characteristics n Over 50% renovation –less cyclical due to less dependency on housing starts n Increasing market shares – growth segment! n Consolidation process well advanced n Large supplier radius (600 – 800 km) n High EBITDA margins: 30% - 45% n Low maintenance capex

Synergies between Bricks and Roof Tiles § Sales Ø Complementary product Ø Used in housing construction Ø Similar distribution channels Ø Similar customers/decision-makers Ø Marketing story § Production Ø Raw materials Ø Technology Ø Approvals/environment § Administration

Synergies between Bricks and Roof Tiles § Sales Ø Complementary product Ø Used in housing construction Ø Similar distribution channels Ø Similar customers/decision-makers Ø Marketing story § Production Ø Raw materials Ø Technology Ø Approvals/environment § Administration

Transaction Summary n Acquisition of Koramic's Clay Roof Tile Business in 2 steps Ø 1 st step: 50 -50 JV between Wienerberger and Koramic Ø € 211. 5 million cash for 50% stake (debt-free) Ø 2 nd step: call options to buy out Koramic on predefined terms n Creation of second core business in brick-related area n EPS enhancing transaction for Wienerberger from year one on pre-goodwill basis

Transaction Summary n Acquisition of Koramic's Clay Roof Tile Business in 2 steps Ø 1 st step: 50 -50 JV between Wienerberger and Koramic Ø € 211. 5 million cash for 50% stake (debt-free) Ø 2 nd step: call options to buy out Koramic on predefined terms n Creation of second core business in brick-related area n EPS enhancing transaction for Wienerberger from year one on pre-goodwill basis

Strategic Implications n Strong strategic fit with bricks Ø n Synergy potential by integration with bricks Strong geographic complementarity with Wienerberger’s existing roofing operations Ø Switzerland (100%), JVs Bramac and Tondach Gleinstätten n Added growth opportunities in roofing n Wienerberger is European leader in bricks (#1) and tiles (#2)

Strategic Implications n Strong strategic fit with bricks Ø n Synergy potential by integration with bricks Strong geographic complementarity with Wienerberger’s existing roofing operations Ø Switzerland (100%), JVs Bramac and Tondach Gleinstätten n Added growth opportunities in roofing n Wienerberger is European leader in bricks (#1) and tiles (#2)

Why Joint-venture? n Smooth transition from Koramic to Wienerberger n Wienerberger benefits from Koramic know-how in clay roof tile industry n Wienerberger maintains financial latitude for further development of bricks business

Why Joint-venture? n Smooth transition from Koramic to Wienerberger n Wienerberger benefits from Koramic know-how in clay roof tile industry n Wienerberger maintains financial latitude for further development of bricks business

Organization of Joint-venture n CEO: Heimo Scheuch (Wienerberger COO NW Europe) n Management Team (Board): Ø CEO: Heimo Scheuch Ø CFO: Willy van Riet Ø COO: Johann Windisch Ø CTO: Karel Wuyts n President of Supervisory Board: Christian Dumolin (President of Koramic Building Products NV) n Integration for best possible use of synergies

Organization of Joint-venture n CEO: Heimo Scheuch (Wienerberger COO NW Europe) n Management Team (Board): Ø CEO: Heimo Scheuch Ø CFO: Willy van Riet Ø COO: Johann Windisch Ø CTO: Karel Wuyts n President of Supervisory Board: Christian Dumolin (President of Koramic Building Products NV) n Integration for best possible use of synergies

Koramic Roofing

Koramic Roofing

Koramic Roofing A Unique Opportunity n European network Ø Outstanding geographical complement to Wienerberger roofing activities in Switzerland (100%) and East Europe (JVs) Ø Perfect addition to Wienerberger brick activities in Northwest Europe Ø Necessary critical mass to participate in consolidation of Germany industry n State-of-the art plants (€ 110 mill. capex in 2002) n High profitability with strong market positions in Belgium, Netherlands and France n Growth opportunities: export, Germany, East Europe

Koramic Roofing A Unique Opportunity n European network Ø Outstanding geographical complement to Wienerberger roofing activities in Switzerland (100%) and East Europe (JVs) Ø Perfect addition to Wienerberger brick activities in Northwest Europe Ø Necessary critical mass to participate in consolidation of Germany industry n State-of-the art plants (€ 110 mill. capex in 2002) n High profitability with strong market positions in Belgium, Netherlands and France n Growth opportunities: export, Germany, East Europe

Product Range n 120 years of experience in clay roofing tile business n Broad product range Ø Clay roof tiles and accessories (flat/beaver + moulded tiles) Ø All sizes, shapes and colors Ø New range of large tiles Ø High quality ensures wear-resistance and durability of surface n Adapted to local tastes of customers and architects throughout Europe n Close cooperation with architects and distributors

Product Range n 120 years of experience in clay roofing tile business n Broad product range Ø Clay roof tiles and accessories (flat/beaver + moulded tiles) Ø All sizes, shapes and colors Ø New range of large tiles Ø High quality ensures wear-resistance and durability of surface n Adapted to local tastes of customers and architects throughout Europe n Close cooperation with architects and distributors

Products

Products

Applications

Applications

Market Positions Koramic Roofing n Belgium: Nr. 1 (in consolidated market) n Netherlands: Nr. 1 (in consolidated market) n France: Nr. 4 (after three large producers) n Germany: n. a. (small position with 2 locations, in total over 20 producers) n Poland Nr. 1 (in consolidated market) n Estonia Nr. 1 (in consolidated market)

Market Positions Koramic Roofing n Belgium: Nr. 1 (in consolidated market) n Netherlands: Nr. 1 (in consolidated market) n France: Nr. 4 (after three large producers) n Germany: n. a. (small position with 2 locations, in total over 20 producers) n Poland Nr. 1 (in consolidated market) n Estonia Nr. 1 (in consolidated market)

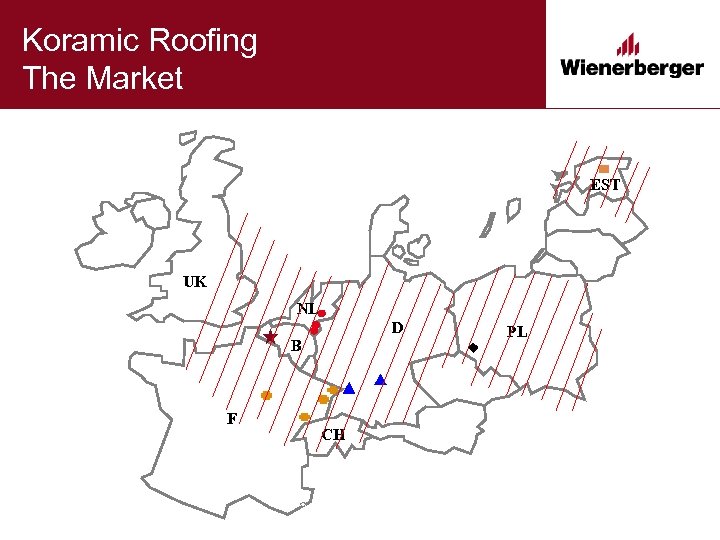

Koramic Roofing The Market EST UK NL D B F CH PL

Koramic Roofing The Market EST UK NL D B F CH PL

Koramic Roofing Belgium n 2 Sites in Kortrijk Ø Aalbeke: 2 moulded tile lines: 1987 and 1998 + 1 flat/beaver tile line: 1968 Ø Moeskroen: 1 moulded tile line: 1996 n Expansion of flat/beaver tile line planned for 2003 n Capacity: 87 mill. units n Nr. 1 Position in clay roofing tiles n Strategy: Ø Increase strong market position Ø Integration of bricks and roofing tiles

Koramic Roofing Belgium n 2 Sites in Kortrijk Ø Aalbeke: 2 moulded tile lines: 1987 and 1998 + 1 flat/beaver tile line: 1968 Ø Moeskroen: 1 moulded tile line: 1996 n Expansion of flat/beaver tile line planned for 2003 n Capacity: 87 mill. units n Nr. 1 Position in clay roofing tiles n Strategy: Ø Increase strong market position Ø Integration of bricks and roofing tiles

Koramic Roofing Netherlands n 3 Sites in eastern Netherlands Ø Tegelen: 1 moulded tile line, new site (2001) Ø Jeka: Ø Narvik: 1 moulded tile line (1989) 1 moulded tile line, new line (2002) n Capacity: 47 mill. units n Nr. 1 Position in clay roofing tiles n Strategy: Ø Increase strong market position in the Netherlands Ø Expand exports Ø Integration of bricks and roofing tiles

Koramic Roofing Netherlands n 3 Sites in eastern Netherlands Ø Tegelen: 1 moulded tile line, new site (2001) Ø Jeka: Ø Narvik: 1 moulded tile line (1989) 1 moulded tile line, new line (2002) n Capacity: 47 mill. units n Nr. 1 Position in clay roofing tiles n Strategy: Ø Increase strong market position in the Netherlands Ø Expand exports Ø Integration of bricks and roofing tiles

Koramic Roofing France n 4 Sites in eastern France Ø Bisch (2 moulded tile lines, 1979 and 1999) Ø Migeon (3 moulded tile lines, 1975, 1989 and 1998) Ø Aleonard (1 flat/beaver tile line, 2000, niche product) Ø Bouxwiller (1 flat/beaver tile line, 1980) n Capacity: 89 mill. units n Nr. 4 Position in clay roofing tiles n Strategy: Ø Increase strong market position in east and north France Ø Integration of bricks and roofing tiles

Koramic Roofing France n 4 Sites in eastern France Ø Bisch (2 moulded tile lines, 1979 and 1999) Ø Migeon (3 moulded tile lines, 1975, 1989 and 1998) Ø Aleonard (1 flat/beaver tile line, 2000, niche product) Ø Bouxwiller (1 flat/beaver tile line, 1980) n Capacity: 89 mill. units n Nr. 4 Position in clay roofing tiles n Strategy: Ø Increase strong market position in east and north France Ø Integration of bricks and roofing tiles

Koramic Roofing Estonia n 1 Site Ø Aseri (1 moulded tile line) n Capacity: 5 mill. units n Nr. 1 Position (sole producer in Estonia) n Higher share of production is exported n Strategy: Ø Increase strong market position and exports Ø Integration of bricks and roofing tiles

Koramic Roofing Estonia n 1 Site Ø Aseri (1 moulded tile line) n Capacity: 5 mill. units n Nr. 1 Position (sole producer in Estonia) n Higher share of production is exported n Strategy: Ø Increase strong market position and exports Ø Integration of bricks and roofing tiles

Koramic Roofing Germany n 2 Sites Ø Mühlacker (Baden-Württemberg): 1 moulded tile line (1985) Ø Langenzenn (Nürnberg): 1 moulded tile line (2000) n flat/beaver tile line in Langenzenn planned (2003) n Capacity: 50 mill. units n Low share in strongly fragmented market (flat/beaver market) n Strategy: Ø Integration of bricks and roofing tiles Ø Turn-around Ø Participate in market consolidation

Koramic Roofing Germany n 2 Sites Ø Mühlacker (Baden-Württemberg): 1 moulded tile line (1985) Ø Langenzenn (Nürnberg): 1 moulded tile line (2000) n flat/beaver tile line in Langenzenn planned (2003) n Capacity: 50 mill. units n Low share in strongly fragmented market (flat/beaver market) n Strategy: Ø Integration of bricks and roofing tiles Ø Turn-around Ø Participate in market consolidation

Koramic Roofing Poland n 1 Site Ø Kunice (southwest Poland): 2 flat/beaver tile lines (1993 and 1994) and 1 new moulded tile line (2002) n Capacity: 57 mill. units n Nr. 1 Position in clay roof tiles n Strategy: Ø Full capacity use of new moulded tile line Ø Integration of bricks and roofing tiles Ø Expand strong market position (investment)

Koramic Roofing Poland n 1 Site Ø Kunice (southwest Poland): 2 flat/beaver tile lines (1993 and 1994) and 1 new moulded tile line (2002) n Capacity: 57 mill. units n Nr. 1 Position in clay roof tiles n Strategy: Ø Full capacity use of new moulded tile line Ø Integration of bricks and roofing tiles Ø Expand strong market position (investment)

Industrial Concept for use of Synergies § Sales Ø Ø Ø Joint marketing concept Strong market presence Linkage of products Strengthening of sales Common distribution channels (logistics) § Cost-savings Ø Ø Ø Leaner organization Administration IT

Industrial Concept for use of Synergies § Sales Ø Ø Ø Joint marketing concept Strong market presence Linkage of products Strengthening of sales Common distribution channels (logistics) § Cost-savings Ø Ø Ø Leaner organization Administration IT

European Clay Roof Tile Industry

European Clay Roof Tile Industry

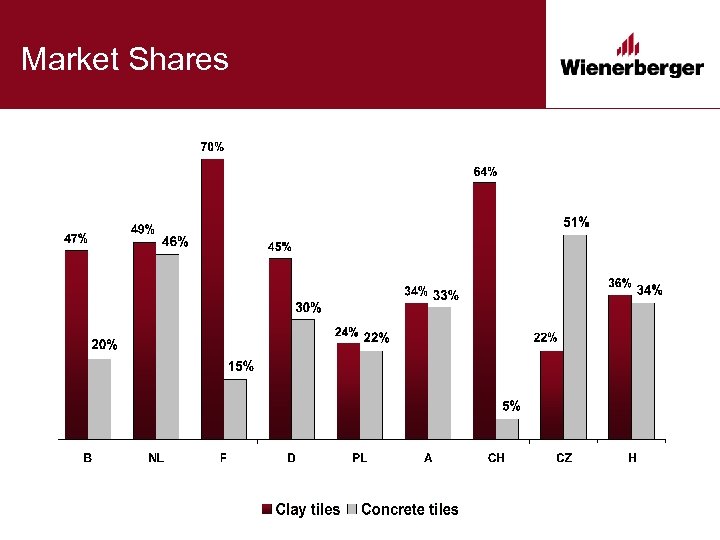

European Roof Tile Markets Leading Product (clay vs. concrete): Clay tiles Concrete tiles Ø Clay is preferred product of consumers and is gaining market share over concrete

European Roof Tile Markets Leading Product (clay vs. concrete): Clay tiles Concrete tiles Ø Clay is preferred product of consumers and is gaining market share over concrete

Market Shares

Market Shares

European Producers n Lafarge Ø n Imerys Ø n Nr. 2 in France, (Spain/Italy) Creaton Ø n Nr. 1 in France, (Spain) Saint Gobain Ø n Clay + Concrete, Nr. 1 in Europe Nr. 1 in Germany, international presence only in exports Eternit Ø Fiber cement + Concrete in UK and Germany

European Producers n Lafarge Ø n Imerys Ø n Nr. 2 in France, (Spain/Italy) Creaton Ø n Nr. 1 in France, (Spain) Saint Gobain Ø n Clay + Concrete, Nr. 1 in Europe Nr. 1 in Germany, international presence only in exports Eternit Ø Fiber cement + Concrete in UK and Germany

Market Positions Wienerberger Roofing Activities § Nr. 1 in Switzerland § Nr. 1 in Austria, Hungary, Czech Republic, Slovakia, Croatia, and Slovenia Ø with clay and concrete tiles via Tondach Gleinstätten and Bramac joint ventures

Market Positions Wienerberger Roofing Activities § Nr. 1 in Switzerland § Nr. 1 in Austria, Hungary, Czech Republic, Slovakia, Croatia, and Slovenia Ø with clay and concrete tiles via Tondach Gleinstätten and Bramac joint ventures

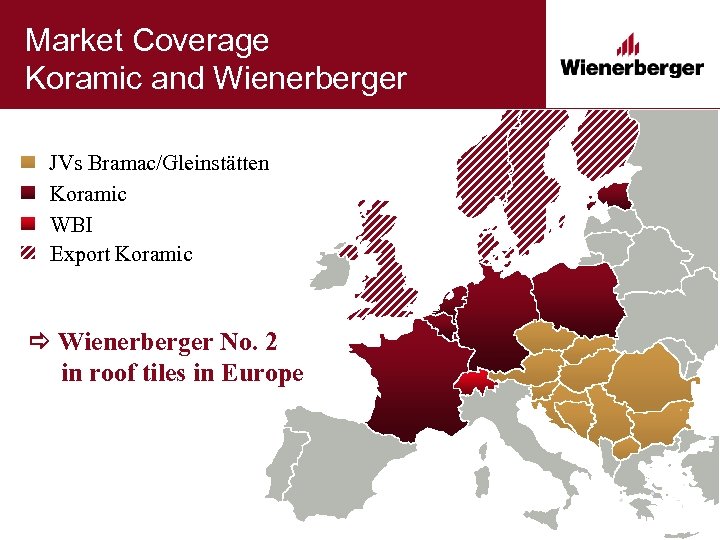

Market Coverage Koramic and Wienerberger JVs Bramac/Gleinstätten Koramic WBI Export Koramic Wienerberger No. 2 in roof tiles in Europe

Market Coverage Koramic and Wienerberger JVs Bramac/Gleinstätten Koramic WBI Export Koramic Wienerberger No. 2 in roof tiles in Europe

Financials

Financials

Key Financial Data Koramic Roofing 1) Adjusted for non-recurring income and expenses

Key Financial Data Koramic Roofing 1) Adjusted for non-recurring income and expenses

Purchase Price n 100% Koramic Roofing is valued at € 423 million Ø € 211, 5 million for 50% stake n Capex of € 110 million for 2 new plants and 1 full reconstruction by Koramic (included in purchase price), in 2002 finalized n Benefits accruing from recent investments to be reflected in earnings of coming years n Financing through external borrowing

Purchase Price n 100% Koramic Roofing is valued at € 423 million Ø € 211, 5 million for 50% stake n Capex of € 110 million for 2 new plants and 1 full reconstruction by Koramic (included in purchase price), in 2002 finalized n Benefits accruing from recent investments to be reflected in earnings of coming years n Financing through external borrowing

Financial Impact on Wienerberger n Proportional consolidation (50%) as of January 1, 2003 n EPS enhancing transaction from year one on pre-goodwill basis n Attractive CFROI n Wienerberger maintains financial flexibility: Ø Pro-forma Gearing 2003: 90 – 100% Ø Interest Cover 2003: > 3 x

Financial Impact on Wienerberger n Proportional consolidation (50%) as of January 1, 2003 n EPS enhancing transaction from year one on pre-goodwill basis n Attractive CFROI n Wienerberger maintains financial flexibility: Ø Pro-forma Gearing 2003: 90 – 100% Ø Interest Cover 2003: > 3 x

Independent Decision Process n Approval of transaction by independent members of Supervisory Board (excl. Koramic representatives) n Fairness Opinion by UBS Warburg on financial terms of transaction

Independent Decision Process n Approval of transaction by independent members of Supervisory Board (excl. Koramic representatives) n Fairness Opinion by UBS Warburg on financial terms of transaction

Summary

Summary

Strategic Implications for Wienerberger n Development of second core business n Clay roofing tiles: attractive business and excellent addition to Wienerberger n Koramic Roofing offers unique opportunity to gain leading European position in related area n 2 -Step transaction optimal for Wienerberger 1. Transfer of know how 2. Financing 3. Risk minimization

Strategic Implications for Wienerberger n Development of second core business n Clay roofing tiles: attractive business and excellent addition to Wienerberger n Koramic Roofing offers unique opportunity to gain leading European position in related area n 2 -Step transaction optimal for Wienerberger 1. Transfer of know how 2. Financing 3. Risk minimization

Our Mission Building Value for Investors, Customers and Employees Wienerberger Investor Relations Wienerberger AG, A-1100 Vienna, Wienerbergstrasse 11 T +43 1 60192 - 463, F +43 1 60192 - 466 investor@wienerberger. com | www. wienerberger. com

Our Mission Building Value for Investors, Customers and Employees Wienerberger Investor Relations Wienerberger AG, A-1100 Vienna, Wienerbergstrasse 11 T +43 1 60192 - 463, F +43 1 60192 - 466 investor@wienerberger. com | www. wienerberger. com