2c854f5ace65871d9e4451e26bbb1a21.ppt

- Количество слайдов: 59

PRESENTATION TO THE PORTFOLIO COMMITTEE ON TRANSPORT Annual Performance Plan 2016/17 – 2018/19 6 April 2016 #2474075

PRESENTATION TO THE PORTFOLIO COMMITTEE ON TRANSPORT Annual Performance Plan 2016/17 – 2018/19 6 April 2016 #2474075

MANDATE • Responsible for proclaimed national road network • Toll and Non-Toll network • Maintain, upgrade, operate, rehabilitate and fund national roads • Levy tolls to service toll roads • Advise the Minister on road related matters • Create public value 2

MANDATE • Responsible for proclaimed national road network • Toll and Non-Toll network • Maintain, upgrade, operate, rehabilitate and fund national roads • Levy tolls to service toll roads • Advise the Minister on road related matters • Create public value 2

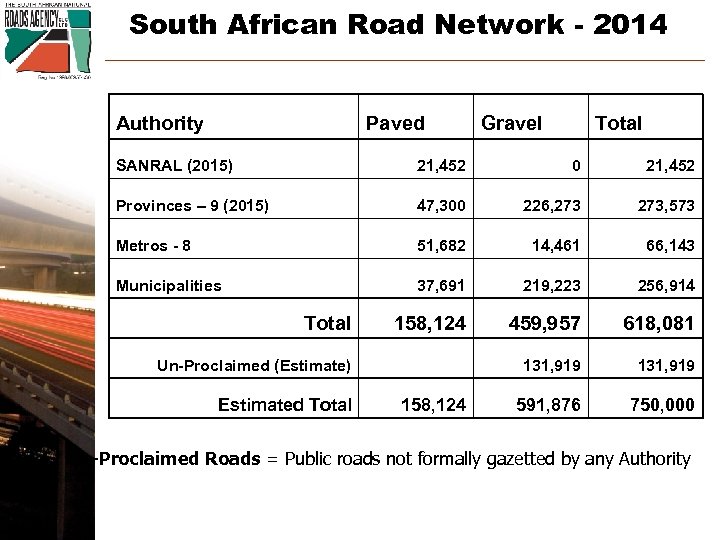

South African Road Network - 2014 Authority Paved Gravel Total SANRAL (2015) 21, 452 0 21, 452 Provinces – 9 (2015) 47, 300 226, 273, 573 Metros - 8 51, 682 14, 461 66, 143 Municipalities 37, 691 219, 223 256, 914 158, 124 459, 957 618, 081 131, 919 591, 876 750, 000 Total Un-Proclaimed (Estimate) Estimated Total 158, 124 Un-Proclaimed Roads = Public roads not formally gazetted by any Authority 3

South African Road Network - 2014 Authority Paved Gravel Total SANRAL (2015) 21, 452 0 21, 452 Provinces – 9 (2015) 47, 300 226, 273, 573 Metros - 8 51, 682 14, 461 66, 143 Municipalities 37, 691 219, 223 256, 914 158, 124 459, 957 618, 081 131, 919 591, 876 750, 000 Total Un-Proclaimed (Estimate) Estimated Total 158, 124 Un-Proclaimed Roads = Public roads not formally gazetted by any Authority 3

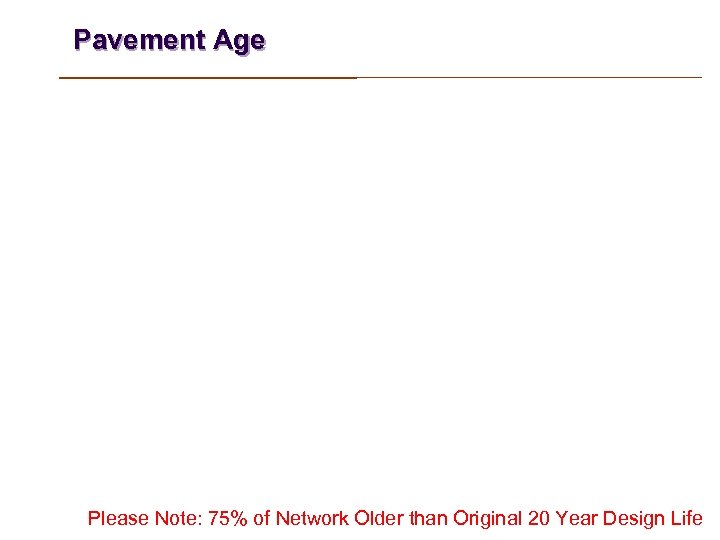

Pavement Age Please Note: 75% of Network Older than Original 20 Year Design Life

Pavement Age Please Note: 75% of Network Older than Original 20 Year Design Life

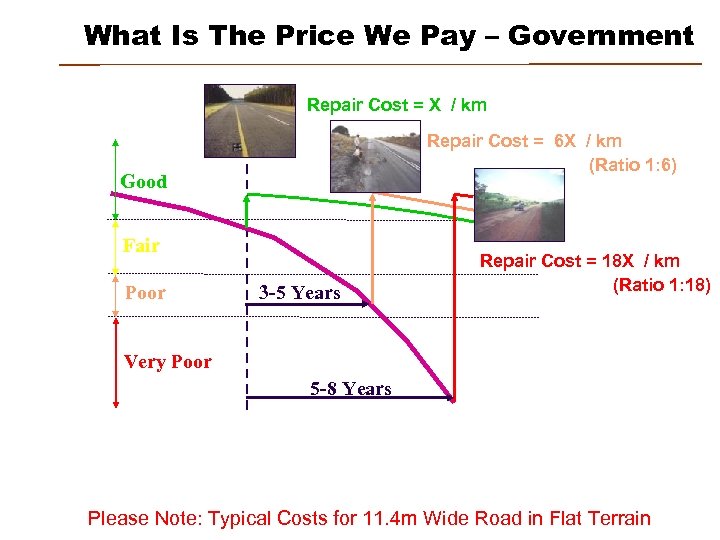

What Is The Price We Pay – Government Repair Cost = X / km Repair Cost = 6 X / km (Ratio 1: 6) Good Fair Poor 3 -5 Years Repair Cost = 18 X / km (Ratio 1: 18) Very Poor 5 -8 Years Please Note: Typical Costs for 11. 4 m Wide Road in Flat Terrain

What Is The Price We Pay – Government Repair Cost = X / km Repair Cost = 6 X / km (Ratio 1: 6) Good Fair Poor 3 -5 Years Repair Cost = 18 X / km (Ratio 1: 18) Very Poor 5 -8 Years Please Note: Typical Costs for 11. 4 m Wide Road in Flat Terrain

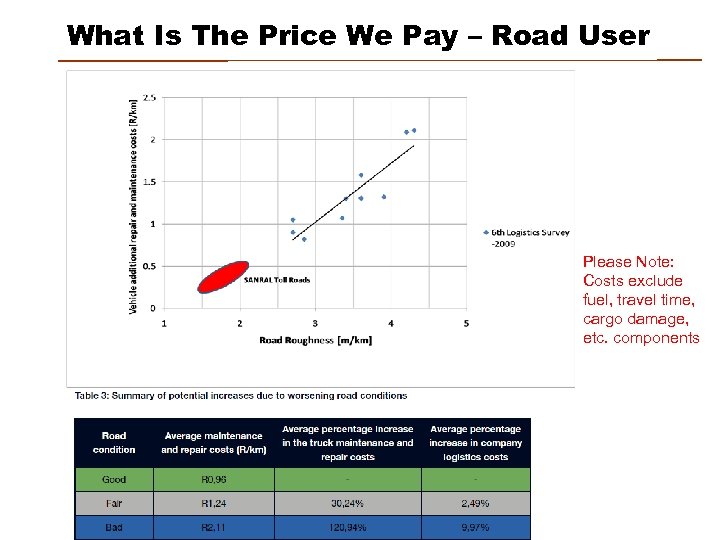

What Is The Price We Pay – Road User Please Note: Costs exclude fuel, travel time, cargo damage, etc. components

What Is The Price We Pay – Road User Please Note: Costs exclude fuel, travel time, cargo damage, etc. components

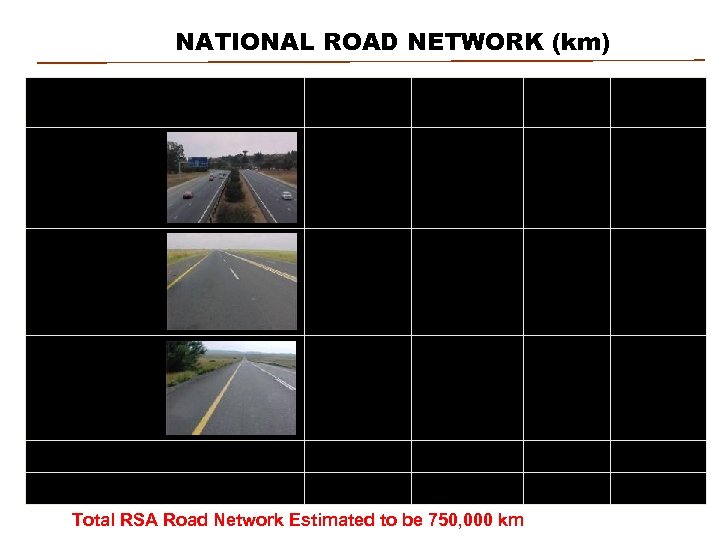

NATIONAL ROAD NETWORK (km) Description Non Toll Agency Toll BOT Total 610 520 443 1 573 11 299 240 550 2 -Lane Single 18 151 1013 605 19 769 Total 18 772 1 832 1 288 21 892 86% 8% 6% Dual Carriageway 4 -Lane Undivided % of SANRAL Network Total RSA Road Network Estimated to be 750, 000 km

NATIONAL ROAD NETWORK (km) Description Non Toll Agency Toll BOT Total 610 520 443 1 573 11 299 240 550 2 -Lane Single 18 151 1013 605 19 769 Total 18 772 1 832 1 288 21 892 86% 8% 6% Dual Carriageway 4 -Lane Undivided % of SANRAL Network Total RSA Road Network Estimated to be 750, 000 km

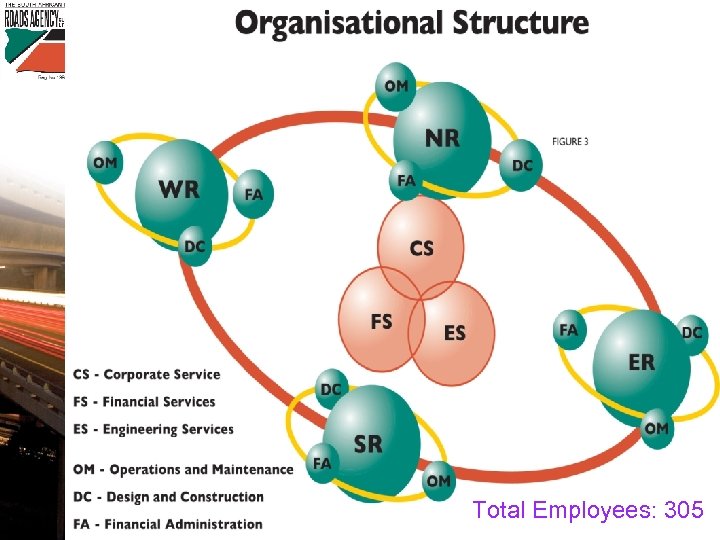

8 Total Employees: 305 8

8 Total Employees: 305 8

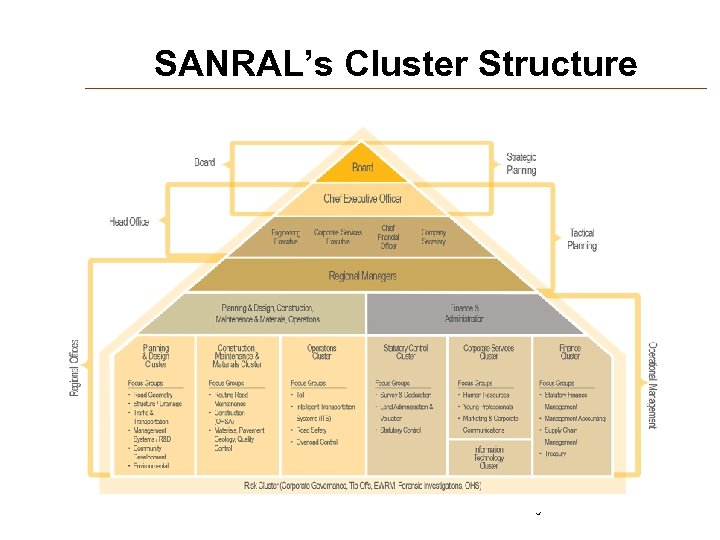

SANRAL’s Cluster Structure 9

SANRAL’s Cluster Structure 9

NATIONAL ROAD NETWORK GROWTH (km) 10

NATIONAL ROAD NETWORK GROWTH (km) 10

SANRAL Budget Need vs Allocation

SANRAL Budget Need vs Allocation

12

12

13

13

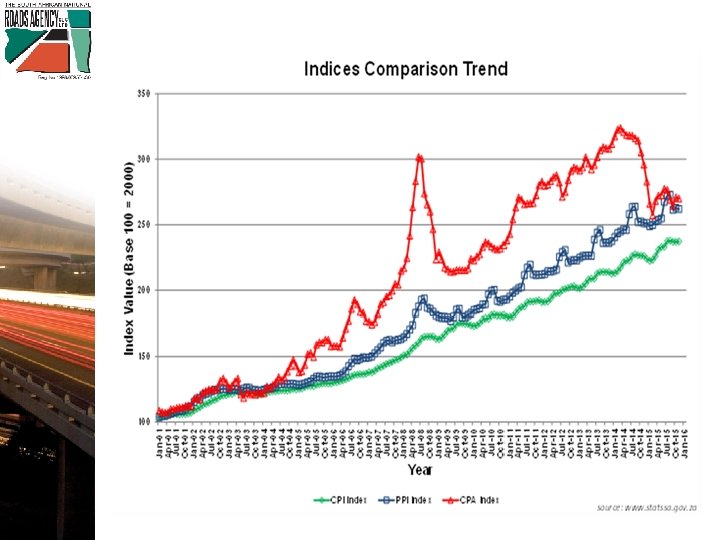

Note: The implication of No New Toll Roads and no additional budget (R 11. 89 bn per year additional over 10 years) from National Treasury will be far reaching for the national road network and the road users. If the decision is made that all the required Expansion requirements must be constructed over 10 year period, using the existing non-toll budget, the impact of this approach will be disastrous on the condition of the rest of the non toll road network, since remaining budget available can only cover routine maintenance needs.

Note: The implication of No New Toll Roads and no additional budget (R 11. 89 bn per year additional over 10 years) from National Treasury will be far reaching for the national road network and the road users. If the decision is made that all the required Expansion requirements must be constructed over 10 year period, using the existing non-toll budget, the impact of this approach will be disastrous on the condition of the rest of the non toll road network, since remaining budget available can only cover routine maintenance needs.

Note: Allowing planned Expansions to proceed as Toll Roads or increasing allocation to SANRAL by additional R 11. 89 bn per year over 10 years, will have far reaching positive impact for the national road network and the road users. If Expansions can be funded through toll or increased non toll allocation to SANRAL, the length of non-toll network to be maintained using existing non-toll budget, will immediately decrease by 2, 000 km, resulting in more budget being available to address maintenance and strengthening requirements.

Note: Allowing planned Expansions to proceed as Toll Roads or increasing allocation to SANRAL by additional R 11. 89 bn per year over 10 years, will have far reaching positive impact for the national road network and the road users. If Expansions can be funded through toll or increased non toll allocation to SANRAL, the length of non-toll network to be maintained using existing non-toll budget, will immediately decrease by 2, 000 km, resulting in more budget being available to address maintenance and strengthening requirements.

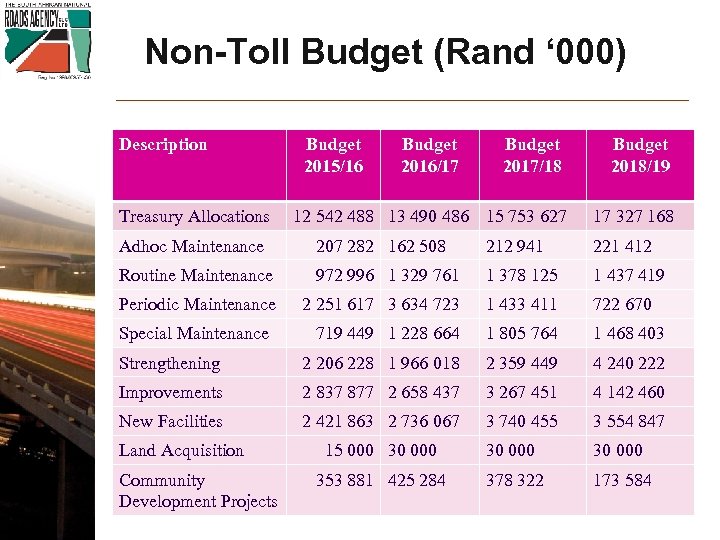

Non-Toll Budget (Rand ‘ 000) Description Treasury Allocations Budget 2015/16 Budget 2016/17 Budget 2017/18 Budget 2018/19 12 542 488 13 490 486 15 753 627 17 327 168 Adhoc Maintenance 207 282 162 508 212 941 221 412 Routine Maintenance 972 996 1 329 761 1 378 125 1 437 419 Periodic Maintenance 2 251 617 3 634 723 1 433 411 722 670 719 449 1 228 664 1 805 764 1 468 403 Strengthening 2 206 228 1 966 018 2 359 449 4 240 222 Improvements 2 837 877 2 658 437 3 267 451 4 142 460 New Facilities 2 421 863 2 736 067 3 740 455 3 554 847 15 000 30 000 353 881 425 284 378 322 173 584 Special Maintenance Land Acquisition Community Development Projects 16

Non-Toll Budget (Rand ‘ 000) Description Treasury Allocations Budget 2015/16 Budget 2016/17 Budget 2017/18 Budget 2018/19 12 542 488 13 490 486 15 753 627 17 327 168 Adhoc Maintenance 207 282 162 508 212 941 221 412 Routine Maintenance 972 996 1 329 761 1 378 125 1 437 419 Periodic Maintenance 2 251 617 3 634 723 1 433 411 722 670 719 449 1 228 664 1 805 764 1 468 403 Strengthening 2 206 228 1 966 018 2 359 449 4 240 222 Improvements 2 837 877 2 658 437 3 267 451 4 142 460 New Facilities 2 421 863 2 736 067 3 740 455 3 554 847 15 000 30 000 353 881 425 284 378 322 173 584 Special Maintenance Land Acquisition Community Development Projects 16

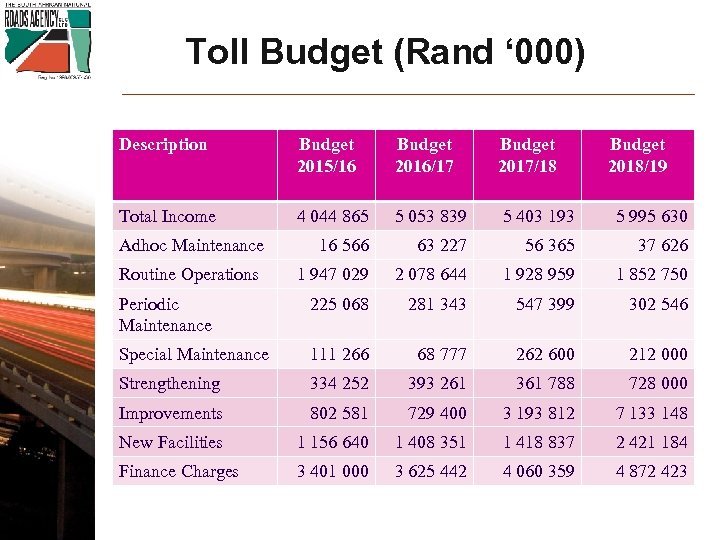

Toll Budget (Rand ‘ 000) Description Budget 2015/16 Budget 2016/17 Budget 2017/18 Budget 2018/19 Total Income 4 044 865 5 053 839 5 403 193 5 995 630 Adhoc Maintenance 16 566 63 227 56 365 37 626 Routine Operations 1 947 029 2 078 644 1 928 959 1 852 750 Periodic Maintenance 225 068 281 343 547 399 302 546 Special Maintenance 111 266 68 777 262 600 212 000 Strengthening 334 252 393 261 361 788 728 000 Improvements 802 581 729 400 3 193 812 7 133 148 New Facilities 1 156 640 1 408 351 1 418 837 2 421 184 Finance Charges 3 401 000 3 625 442 4 060 359 4 872 423 17

Toll Budget (Rand ‘ 000) Description Budget 2015/16 Budget 2016/17 Budget 2017/18 Budget 2018/19 Total Income 4 044 865 5 053 839 5 403 193 5 995 630 Adhoc Maintenance 16 566 63 227 56 365 37 626 Routine Operations 1 947 029 2 078 644 1 928 959 1 852 750 Periodic Maintenance 225 068 281 343 547 399 302 546 Special Maintenance 111 266 68 777 262 600 212 000 Strengthening 334 252 393 261 361 788 728 000 Improvements 802 581 729 400 3 193 812 7 133 148 New Facilities 1 156 640 1 408 351 1 418 837 2 421 184 Finance Charges 3 401 000 3 625 442 4 060 359 4 872 423 17

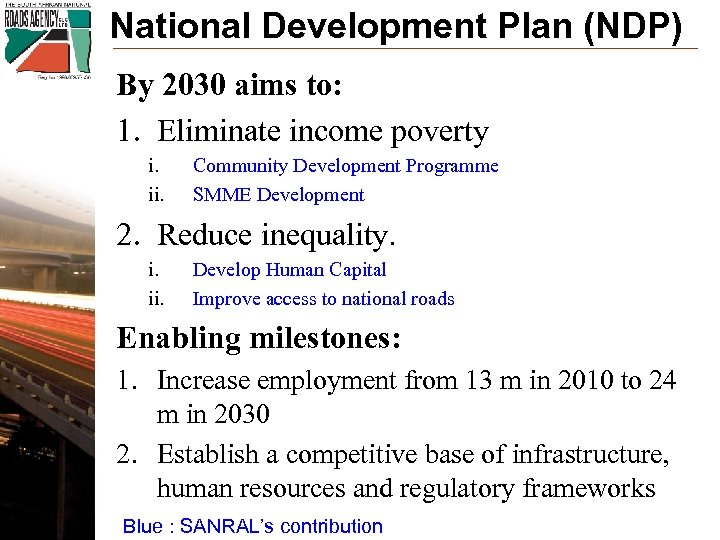

National Development Plan (NDP) By 2030 aims to: 1. Eliminate income poverty i. ii. Community Development Programme SMME Development 2. Reduce inequality. i. ii. Develop Human Capital Improve access to national roads Enabling milestones: 1. Increase employment from 13 m in 2010 to 24 m in 2030 2. Establish a competitive base of infrastructure, human resources and regulatory frameworks Blue : SANRAL’s contribution 18

National Development Plan (NDP) By 2030 aims to: 1. Eliminate income poverty i. ii. Community Development Programme SMME Development 2. Reduce inequality. i. ii. Develop Human Capital Improve access to national roads Enabling milestones: 1. Increase employment from 13 m in 2010 to 24 m in 2030 2. Establish a competitive base of infrastructure, human resources and regulatory frameworks Blue : SANRAL’s contribution 18

NDP: Critical Actions Public infrastructure investment at 10% of GDP (total 30% of GDP in 2030), financed through tariffs, PPPs, taxes, loans and focused on transport, energy and water. - toll roads Transport: - Upgrade the Durban-Gauteng freight corridor - (De Beers Pass) - Expand capacity of coal, iron ore and manganese lines - Build the N 2 through the Eastern Cape - Wild Coast (construction of bridges to commence in 3 rd Quarter 2016) - Public transport infrastructure and systems, including the renewal of commuter rail fleet, supported by enhanced links with road-based services. 19 Blue : SANRAL’s contribution

NDP: Critical Actions Public infrastructure investment at 10% of GDP (total 30% of GDP in 2030), financed through tariffs, PPPs, taxes, loans and focused on transport, energy and water. - toll roads Transport: - Upgrade the Durban-Gauteng freight corridor - (De Beers Pass) - Expand capacity of coal, iron ore and manganese lines - Build the N 2 through the Eastern Cape - Wild Coast (construction of bridges to commence in 3 rd Quarter 2016) - Public transport infrastructure and systems, including the renewal of commuter rail fleet, supported by enhanced links with road-based services. 19 Blue : SANRAL’s contribution

MTSF: 14 Outcomes (2014) 1. 2. 3. 4. 5. 6. Quality basic education A long and healthy life for all South Africans All people in South Africa are and feel safe Decent employment through inclusive growth Skilled and capable workforce to support an inclusive growth path An efficient, competitive and responsive economic infrastructure network 7. Vibrant, equitable, sustainable rural communities contributing towards food security for all 8. Sustainable human settlements and improved quality of household life 9. Responsive, accountable, effective and efficient local government 10. Protect and enhance our environmental assets and natural resources 11. Create a better South Africa, a better Africa and a better world 12. An efficient, effective and development oriented public service 13. A comprehensive, responsive and sustainable social protection system 14. A diverse, socially cohesive society with a common national identity 20

MTSF: 14 Outcomes (2014) 1. 2. 3. 4. 5. 6. Quality basic education A long and healthy life for all South Africans All people in South Africa are and feel safe Decent employment through inclusive growth Skilled and capable workforce to support an inclusive growth path An efficient, competitive and responsive economic infrastructure network 7. Vibrant, equitable, sustainable rural communities contributing towards food security for all 8. Sustainable human settlements and improved quality of household life 9. Responsive, accountable, effective and efficient local government 10. Protect and enhance our environmental assets and natural resources 11. Create a better South Africa, a better Africa and a better world 12. An efficient, effective and development oriented public service 13. A comprehensive, responsive and sustainable social protection system 14. A diverse, socially cohesive society with a common national identity 20

Alignment With Minister’s Performance Agreement 1. Maintenance, Strategic Expansion, Operational Efficiency of Transport Infrastructure: Through SANRAL’s non-toll and toll projects on the national road network 2. SIP 2: N 3 De Beers Pass – Responses of comments received from the public on the draft EIR being collated for submission to the Minister of Transport (MTSF: SANRAL commences work in 2015) 3. SIP 3: Wild Coast Project: work on bridges expected to commence in November 2016 (MTSF: Wild Coast - SANRAL to have commenced construction of bridges in 2014) 4. Integrated National Transport Plan: SANRAL has submitted comments. The additions relating to PICC and SIP projects are being reviewed for comments. 5. Decent employment opportunities: Through SANRAL’s projects and SMME empowerment 6. Comprehensive rural development: Through SANRAL’s projects in rural areas and access to national roads through Community Development Projects 7. Protect and enhance environmental assets and natural resources: 21 Through SANRAL’s environmental policies on projects

Alignment With Minister’s Performance Agreement 1. Maintenance, Strategic Expansion, Operational Efficiency of Transport Infrastructure: Through SANRAL’s non-toll and toll projects on the national road network 2. SIP 2: N 3 De Beers Pass – Responses of comments received from the public on the draft EIR being collated for submission to the Minister of Transport (MTSF: SANRAL commences work in 2015) 3. SIP 3: Wild Coast Project: work on bridges expected to commence in November 2016 (MTSF: Wild Coast - SANRAL to have commenced construction of bridges in 2014) 4. Integrated National Transport Plan: SANRAL has submitted comments. The additions relating to PICC and SIP projects are being reviewed for comments. 5. Decent employment opportunities: Through SANRAL’s projects and SMME empowerment 6. Comprehensive rural development: Through SANRAL’s projects in rural areas and access to national roads through Community Development Projects 7. Protect and enhance environmental assets and natural resources: 21 Through SANRAL’s environmental policies on projects

Nine Point Plan (SONA 2016) Cannot have an efficient economy or social cohesion without good roads 1. Resolving the energy challenge • SANRAL projects being done energy efficiently and with responsible and sustainable environmental practice 2. Revitalising agriculture and the agro-processing value chain • Provision of effective road transport infrastructure 3. Advancing beneficiation or adding value to the mineral wealth 4. More effective implementation of a higher impact Industrial Policy Action Plan • Provision of effective road transport infrastructure 5. Encouraging private sector investment • Toll road portfolio including PPPs 6. Moderating workplace conflict In blue: SANRAL’s contribution In grey: Not directly applicable 22

Nine Point Plan (SONA 2016) Cannot have an efficient economy or social cohesion without good roads 1. Resolving the energy challenge • SANRAL projects being done energy efficiently and with responsible and sustainable environmental practice 2. Revitalising agriculture and the agro-processing value chain • Provision of effective road transport infrastructure 3. Advancing beneficiation or adding value to the mineral wealth 4. More effective implementation of a higher impact Industrial Policy Action Plan • Provision of effective road transport infrastructure 5. Encouraging private sector investment • Toll road portfolio including PPPs 6. Moderating workplace conflict In blue: SANRAL’s contribution In grey: Not directly applicable 22

Nine Point Plan 7. Unlocking the potential of SMMEs, cooperatives, township and rural enterprises • SANRAL projects target: - SMME empowerment including women and youth - Job creation and training on the job - Community development: projects – access roads, pedestrian bridges - Skills development – scholarships, bursaries, internships 8. State reform and boosting the role of SOCs, ICT infrastructure or broadband roll-out, water, sanitation and transport infrastructure. • Continuing to deliver as an SOC • Effective and efficient delivery of the national road infrastructure • Intelligent Transport Systems (ICT) 9. Operation Phakisa, which is aimed at growing the ocean economy and other sectors. • Egress/access to ports and beyond In blue: SANRAL’s contribution 23

Nine Point Plan 7. Unlocking the potential of SMMEs, cooperatives, township and rural enterprises • SANRAL projects target: - SMME empowerment including women and youth - Job creation and training on the job - Community development: projects – access roads, pedestrian bridges - Skills development – scholarships, bursaries, internships 8. State reform and boosting the role of SOCs, ICT infrastructure or broadband roll-out, water, sanitation and transport infrastructure. • Continuing to deliver as an SOC • Effective and efficient delivery of the national road infrastructure • Intelligent Transport Systems (ICT) 9. Operation Phakisa, which is aimed at growing the ocean economy and other sectors. • Egress/access to ports and beyond In blue: SANRAL’s contribution 23

SANRAL: Strategic Outcomes Oriented Goals § Ensure an efficient, competitive and responsive national road network (MTSF Outcome 6: An efficient, competitive and responsive economic infrastructure network) § Ensure improved road safety on the national road network (MTSF Outcome 3: All people in SA are and feel safe) § Ensure improved rural access to the national road network (MTSF Outcome 7: Vibrant, equitable and sustainable rural communities) (MTSF Outcome 8: Sustainable human settlements and improved quality of household life) § Ensure sound environmental management and sustainable practice on the national road network (MTSF Outcome 10: Environmental assets and natural resources that are well protected and continually enhanced) § Ensure decent employment opportunities, transformation and empowerment (MTSF Outcome 4: Decent employment through inclusive economic growth) (MTSF Outcome 5: Skilled, capable workforce to support inclusive growth path) § An efficient, effective and development oriented national roads agency 24 (MTSF Outcome 12: An efficient, effective, development oriented public service)

SANRAL: Strategic Outcomes Oriented Goals § Ensure an efficient, competitive and responsive national road network (MTSF Outcome 6: An efficient, competitive and responsive economic infrastructure network) § Ensure improved road safety on the national road network (MTSF Outcome 3: All people in SA are and feel safe) § Ensure improved rural access to the national road network (MTSF Outcome 7: Vibrant, equitable and sustainable rural communities) (MTSF Outcome 8: Sustainable human settlements and improved quality of household life) § Ensure sound environmental management and sustainable practice on the national road network (MTSF Outcome 10: Environmental assets and natural resources that are well protected and continually enhanced) § Ensure decent employment opportunities, transformation and empowerment (MTSF Outcome 4: Decent employment through inclusive economic growth) (MTSF Outcome 5: Skilled, capable workforce to support inclusive growth path) § An efficient, effective and development oriented national roads agency 24 (MTSF Outcome 12: An efficient, effective, development oriented public service)

STRATEGIC OBJECTIVES 1. Manage the national road network effectively and efficiently 2. Provide safe roads 3. Carry out Government’s targeted programmes 4. Co-operative working relationships with all spheres of Government and the SADC member countries 5. Maintain good governance practice 6. Maintain financial sustainability 7. Pursue research, innovation and best practice 8. Safeguard SANRAL’s reputation 9. Pursue and maintain environmental sustainability and best practice 25

STRATEGIC OBJECTIVES 1. Manage the national road network effectively and efficiently 2. Provide safe roads 3. Carry out Government’s targeted programmes 4. Co-operative working relationships with all spheres of Government and the SADC member countries 5. Maintain good governance practice 6. Maintain financial sustainability 7. Pursue research, innovation and best practice 8. Safeguard SANRAL’s reputation 9. Pursue and maintain environmental sustainability and best practice 25

ANNUAL PERFORMANCE PLAN 2016/17 – 2018/19 (Summary) Measures performance against targets linked directly to Strategic Objectives 1. Manage the national road network effectively and efficiently • • Road condition indices Maintenance and capital projects kilometres SIP Projects Traffic information 2. Provide safe roads • • • Projects in pedestrian hazardous locations Road safety audits in design phase Road Safety education programmes 26

ANNUAL PERFORMANCE PLAN 2016/17 – 2018/19 (Summary) Measures performance against targets linked directly to Strategic Objectives 1. Manage the national road network effectively and efficiently • • Road condition indices Maintenance and capital projects kilometres SIP Projects Traffic information 2. Provide safe roads • • • Projects in pedestrian hazardous locations Road safety audits in design phase Road Safety education programmes 26

ANNUAL PERFORMANCE PLAN 2016/17 – 2018/19 CONT’D 3. Carry out Government’s targeted programmes • • Empowerment through award of contracts Job creation SMME Development of Human Capital • Internal & External: employment equity, scholarships, bursaries, internships • Community Development projects 4. Cooperative working relationships with all spheres of Government and the SADC member countries • • COTO approvals Incident Management System across the country Work done through ASANRA: norms and standards Cooperation on the Botswana bridge 27

ANNUAL PERFORMANCE PLAN 2016/17 – 2018/19 CONT’D 3. Carry out Government’s targeted programmes • • Empowerment through award of contracts Job creation SMME Development of Human Capital • Internal & External: employment equity, scholarships, bursaries, internships • Community Development projects 4. Cooperative working relationships with all spheres of Government and the SADC member countries • • COTO approvals Incident Management System across the country Work done through ASANRA: norms and standards Cooperation on the Botswana bridge 27

ANNUAL PERFORMANCE PLAN 2016/17 – 2018/19 CONT’D 5. Maintain good governance practice • Prevention of Fraud and Corruption – Fraud hotline (Unqualified audit reports over the years) 6. Maintain financial sustainability • • Private sector investment index Expenditure efficiency – overheads 7. Pursue research, innovation and best practice 5. 6. Road Design software Pedestrian behaviour 28

ANNUAL PERFORMANCE PLAN 2016/17 – 2018/19 CONT’D 5. Maintain good governance practice • Prevention of Fraud and Corruption – Fraud hotline (Unqualified audit reports over the years) 6. Maintain financial sustainability • • Private sector investment index Expenditure efficiency – overheads 7. Pursue research, innovation and best practice 5. 6. Road Design software Pedestrian behaviour 28

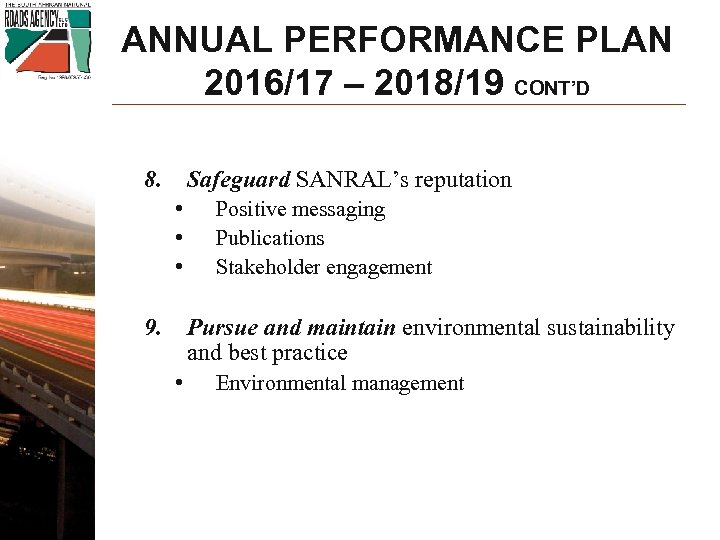

ANNUAL PERFORMANCE PLAN 2016/17 – 2018/19 CONT’D 8. Safeguard SANRAL’s reputation • • • 9. Positive messaging Publications Stakeholder engagement Pursue and maintain environmental sustainability and best practice • Environmental management 29

ANNUAL PERFORMANCE PLAN 2016/17 – 2018/19 CONT’D 8. Safeguard SANRAL’s reputation • • • 9. Positive messaging Publications Stakeholder engagement Pursue and maintain environmental sustainability and best practice • Environmental management 29

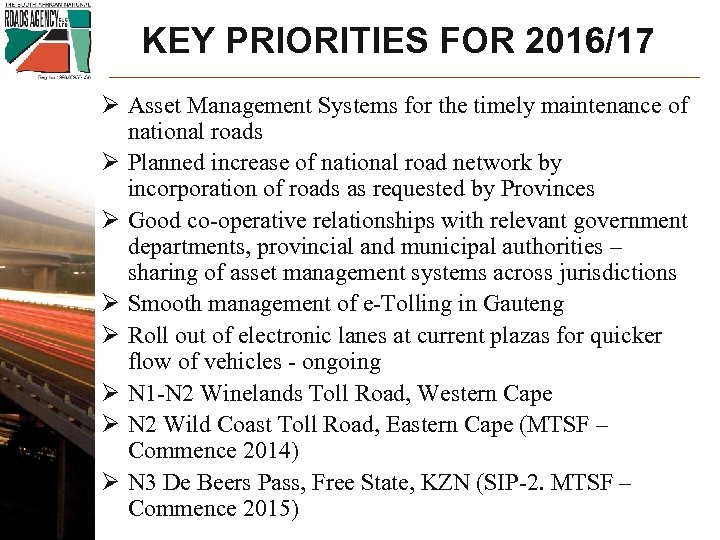

KEY PRIORITIES FOR 2016/17 Ø Asset Management Systems for the timely maintenance of national roads Ø Planned increase of national road network by incorporation of roads as requested by Provinces Ø Good co-operative relationships with relevant government departments, provincial and municipal authorities – sharing of asset management systems across jurisdictions Ø Smooth management of e-Tolling in Gauteng Ø Roll out of electronic lanes at current plazas for quicker flow of vehicles - ongoing Ø N 1 -N 2 Winelands Toll Road, Western Cape Ø N 2 Wild Coast Toll Road, Eastern Cape (MTSF – Commence 2014) Ø N 3 De Beers Pass, Free State, KZN (SIP-2. MTSF – Commence 2015) 30

KEY PRIORITIES FOR 2016/17 Ø Asset Management Systems for the timely maintenance of national roads Ø Planned increase of national road network by incorporation of roads as requested by Provinces Ø Good co-operative relationships with relevant government departments, provincial and municipal authorities – sharing of asset management systems across jurisdictions Ø Smooth management of e-Tolling in Gauteng Ø Roll out of electronic lanes at current plazas for quicker flow of vehicles - ongoing Ø N 1 -N 2 Winelands Toll Road, Western Cape Ø N 2 Wild Coast Toll Road, Eastern Cape (MTSF – Commence 2014) Ø N 3 De Beers Pass, Free State, KZN (SIP-2. MTSF – Commence 2015) 30

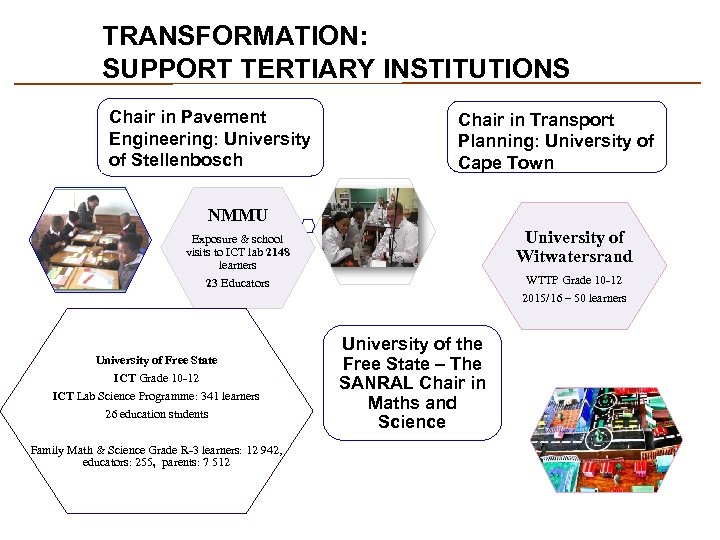

TRANSFORMATION: SUPPORT TERTIARY INSTITUTIONS Chair in Pavement Engineering: University of Stellenbosch Chair in Transport Planning: University of Cape Town NMMU University of Witwatersrand Exposure & school visits to ICT lab 2148 learners 23 Educators WTTP Grade 10 -12 2015/16 – 50 learners University of Free State ICT Grade 10 -12 ICT Lab Science Programme: 341 learners 26 education students Family Math & Science Grade R-3 learners: 12 942, educators: 255, parents: 7 512 University of the Free State – The SANRAL Chair in Maths and Science

TRANSFORMATION: SUPPORT TERTIARY INSTITUTIONS Chair in Pavement Engineering: University of Stellenbosch Chair in Transport Planning: University of Cape Town NMMU University of Witwatersrand Exposure & school visits to ICT lab 2148 learners 23 Educators WTTP Grade 10 -12 2015/16 – 50 learners University of Free State ICT Grade 10 -12 ICT Lab Science Programme: 341 learners 26 education students Family Math & Science Grade R-3 learners: 12 942, educators: 255, parents: 7 512 University of the Free State – The SANRAL Chair in Maths and Science

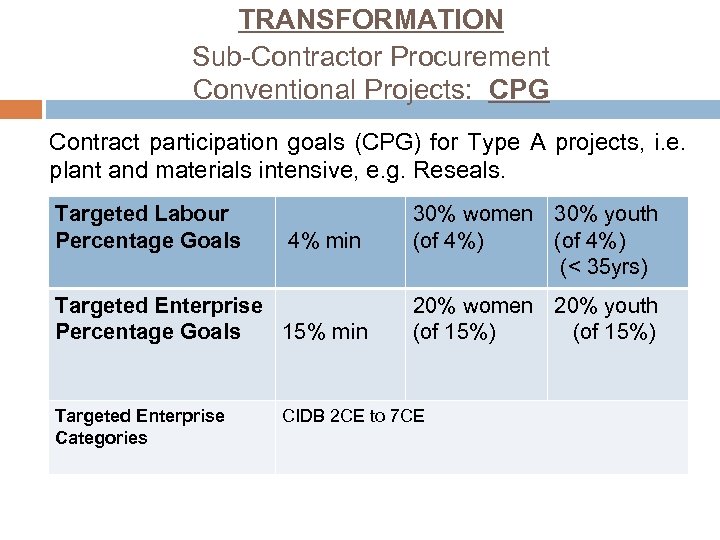

TRANSFORMATION Sub-Contractor Procurement Conventional Projects: CPG Contract participation goals (CPG) for Type A projects, i. e. plant and materials intensive, e. g. Reseals. Targeted Labour Percentage Goals 4% min 30% women 30% youth (of 4%) (˂ 35 yrs) Targeted Enterprise Percentage Goals 15% min 20% women 20% youth (of 15%) Targeted Enterprise Categories CIDB 2 CE to 7 CE

TRANSFORMATION Sub-Contractor Procurement Conventional Projects: CPG Contract participation goals (CPG) for Type A projects, i. e. plant and materials intensive, e. g. Reseals. Targeted Labour Percentage Goals 4% min 30% women 30% youth (of 4%) (˂ 35 yrs) Targeted Enterprise Percentage Goals 15% min 20% women 20% youth (of 15%) Targeted Enterprise Categories CIDB 2 CE to 7 CE

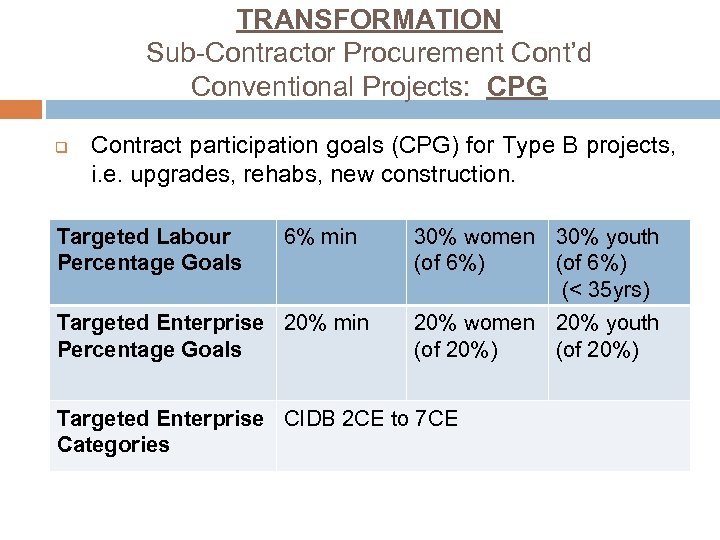

TRANSFORMATION Sub-Contractor Procurement Cont’d Conventional Projects: CPG q Contract participation goals (CPG) for Type B projects, i. e. upgrades, rehabs, new construction. Targeted Labour Percentage Goals 6% min Targeted Enterprise 20% min Percentage Goals 30% women 30% youth (of 6%) (˂ 35 yrs) 20% women 20% youth (of 20%) Targeted Enterprise CIDB 2 CE to 7 CE Categories

TRANSFORMATION Sub-Contractor Procurement Cont’d Conventional Projects: CPG q Contract participation goals (CPG) for Type B projects, i. e. upgrades, rehabs, new construction. Targeted Labour Percentage Goals 6% min Targeted Enterprise 20% min Percentage Goals 30% women 30% youth (of 6%) (˂ 35 yrs) 20% women 20% youth (of 20%) Targeted Enterprise CIDB 2 CE to 7 CE Categories

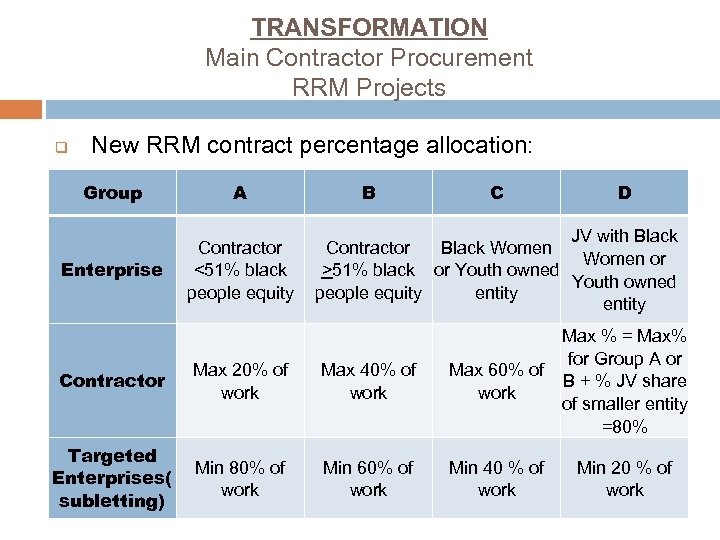

TRANSFORMATION Main Contractor Procurement RRM Projects q New RRM contract percentage allocation: Group A Enterprise Contractor <51% black people equity B C D JV with Black Contractor Black Women or >51% black or Youth owned people equity entity Contractor Max 20% of work Max 40% of work Max % = Max% for Group A or Max 60% of B + % JV share work of smaller entity =80% Targeted Enterprises( subletting) Min 80% of work Min 60% of work Min 40 % of work Min 20 % of work

TRANSFORMATION Main Contractor Procurement RRM Projects q New RRM contract percentage allocation: Group A Enterprise Contractor <51% black people equity B C D JV with Black Contractor Black Women or >51% black or Youth owned people equity entity Contractor Max 20% of work Max 40% of work Max % = Max% for Group A or Max 60% of B + % JV share work of smaller entity =80% Targeted Enterprises( subletting) Min 80% of work Min 60% of work Min 40 % of work Min 20 % of work

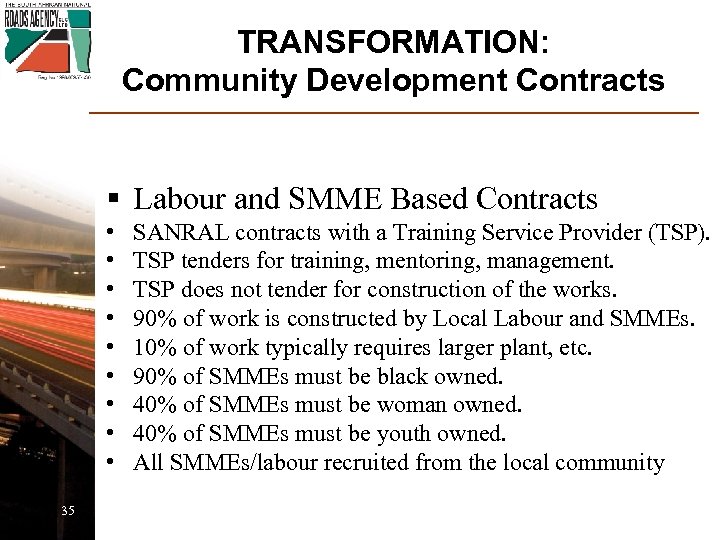

TRANSFORMATION: Community Development Contracts § Labour and SMME Based Contracts • • • 35 SANRAL contracts with a Training Service Provider (TSP). TSP tenders for training, mentoring, management. TSP does not tender for construction of the works. 90% of work is constructed by Local Labour and SMMEs. 10% of work typically requires larger plant, etc. 90% of SMMEs must be black owned. 40% of SMMEs must be woman owned. 40% of SMMEs must be youth owned. All SMMEs/labour recruited from the local community 35

TRANSFORMATION: Community Development Contracts § Labour and SMME Based Contracts • • • 35 SANRAL contracts with a Training Service Provider (TSP). TSP tenders for training, mentoring, management. TSP does not tender for construction of the works. 90% of work is constructed by Local Labour and SMMEs. 10% of work typically requires larger plant, etc. 90% of SMMEs must be black owned. 40% of SMMEs must be woman owned. 40% of SMMEs must be youth owned. All SMMEs/labour recruited from the local community 35

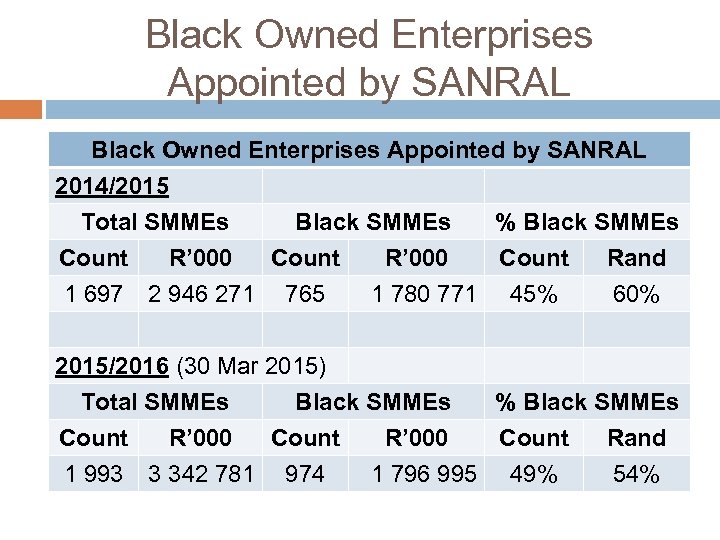

Black Owned Enterprises Appointed by SANRAL 2014/2015 Total SMMEs Black SMMEs % Black SMMEs Count R’ 000 Count Rand 1 697 2 946 271 765 1 780 771 45% 60% 2015/2016 (30 Mar 2015) Total SMMEs Black SMMEs % Black SMMEs Count R’ 000 Count Rand 1 993 3 342 781 974 1 796 995 49% 54%

Black Owned Enterprises Appointed by SANRAL 2014/2015 Total SMMEs Black SMMEs % Black SMMEs Count R’ 000 Count Rand 1 697 2 946 271 765 1 780 771 45% 60% 2015/2016 (30 Mar 2015) Total SMMEs Black SMMEs % Black SMMEs Count R’ 000 Count Rand 1 993 3 342 781 974 1 796 995 49% 54%

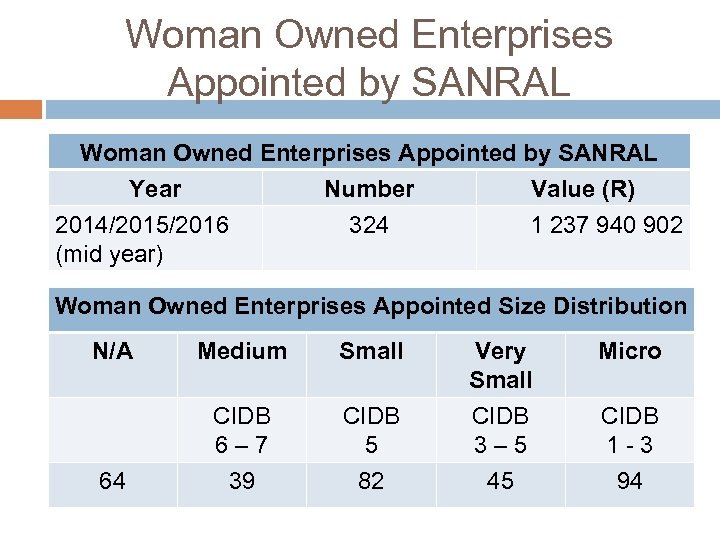

Woman Owned Enterprises Appointed by SANRAL Year Number 2014/2015/2016 (mid year) Value (R) 324 1 237 940 902 Woman Owned Enterprises Appointed Size Distribution N/A Small Very Small Micro CIDB 6– 7 64 Medium CIDB 5 CIDB 3– 5 CIDB 1 -3 39 82 45 94

Woman Owned Enterprises Appointed by SANRAL Year Number 2014/2015/2016 (mid year) Value (R) 324 1 237 940 902 Woman Owned Enterprises Appointed Size Distribution N/A Small Very Small Micro CIDB 6– 7 64 Medium CIDB 5 CIDB 3– 5 CIDB 1 -3 39 82 45 94

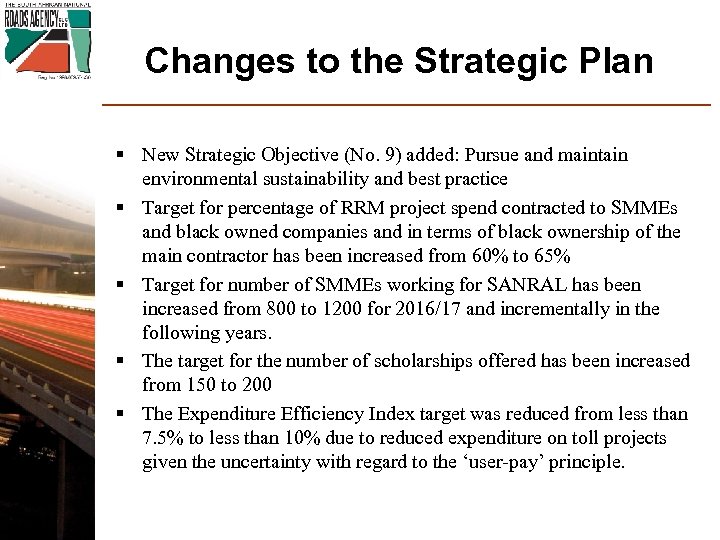

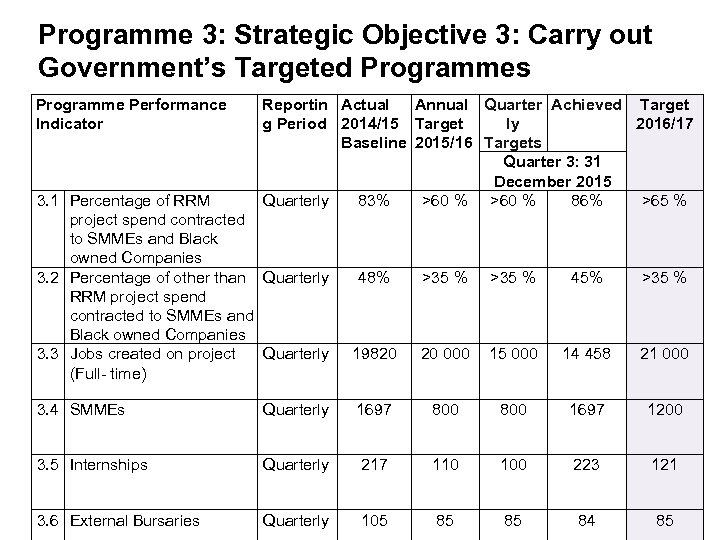

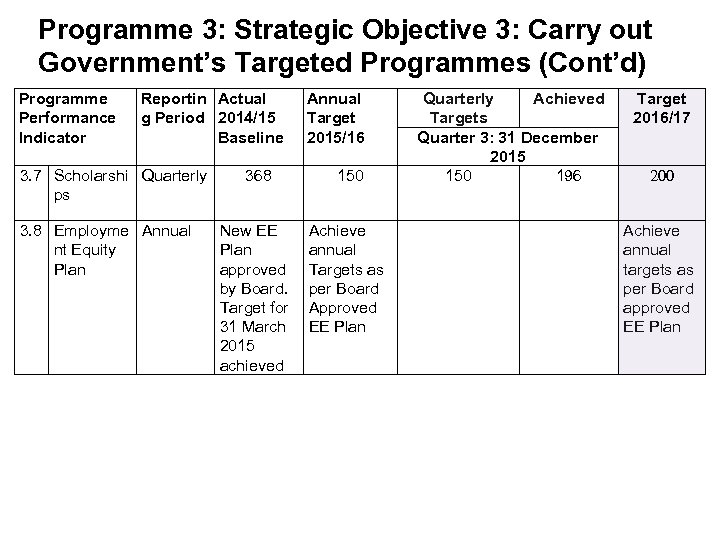

Changes to the Strategic Plan § New Strategic Objective (No. 9) added: Pursue and maintain environmental sustainability and best practice § Target for percentage of RRM project spend contracted to SMMEs and black owned companies and in terms of black ownership of the main contractor has been increased from 60% to 65% § Target for number of SMMEs working for SANRAL has been increased from 800 to 1200 for 2016/17 and incrementally in the following years. § The target for the number of scholarships offered has been increased from 150 to 200 § The Expenditure Efficiency Index target was reduced from less than 7. 5% to less than 10% due to reduced expenditure on toll projects given the uncertainty with regard to the ‘user-pay’ principle. 38

Changes to the Strategic Plan § New Strategic Objective (No. 9) added: Pursue and maintain environmental sustainability and best practice § Target for percentage of RRM project spend contracted to SMMEs and black owned companies and in terms of black ownership of the main contractor has been increased from 60% to 65% § Target for number of SMMEs working for SANRAL has been increased from 800 to 1200 for 2016/17 and incrementally in the following years. § The target for the number of scholarships offered has been increased from 150 to 200 § The Expenditure Efficiency Index target was reduced from less than 7. 5% to less than 10% due to reduced expenditure on toll projects given the uncertainty with regard to the ‘user-pay’ principle. 38

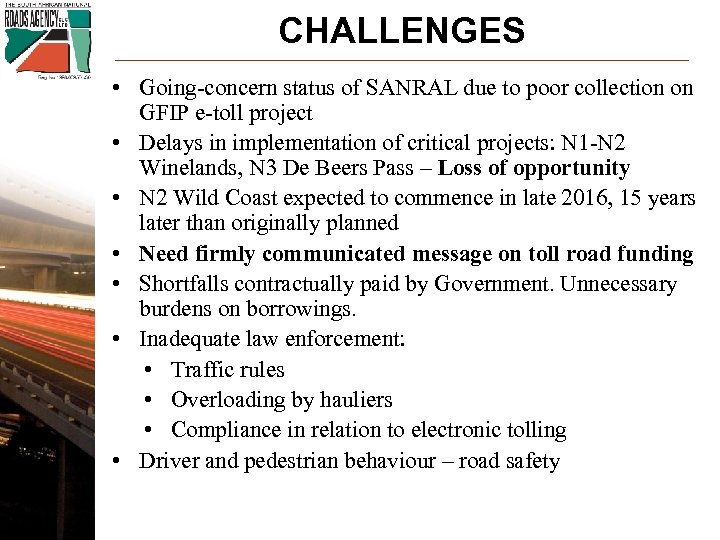

CHALLENGES • Going-concern status of SANRAL due to poor collection on GFIP e-toll project • Delays in implementation of critical projects: N 1 -N 2 Winelands, N 3 De Beers Pass – Loss of opportunity • N 2 Wild Coast expected to commence in late 2016, 15 years later than originally planned • Need firmly communicated message on toll road funding • Shortfalls contractually paid by Government. Unnecessary burdens on borrowings. • Inadequate law enforcement: • Traffic rules • Overloading by hauliers • Compliance in relation to electronic tolling • Driver and pedestrian behaviour – road safety 39

CHALLENGES • Going-concern status of SANRAL due to poor collection on GFIP e-toll project • Delays in implementation of critical projects: N 1 -N 2 Winelands, N 3 De Beers Pass – Loss of opportunity • N 2 Wild Coast expected to commence in late 2016, 15 years later than originally planned • Need firmly communicated message on toll road funding • Shortfalls contractually paid by Government. Unnecessary burdens on borrowings. • Inadequate law enforcement: • Traffic rules • Overloading by hauliers • Compliance in relation to electronic tolling • Driver and pedestrian behaviour – road safety 39

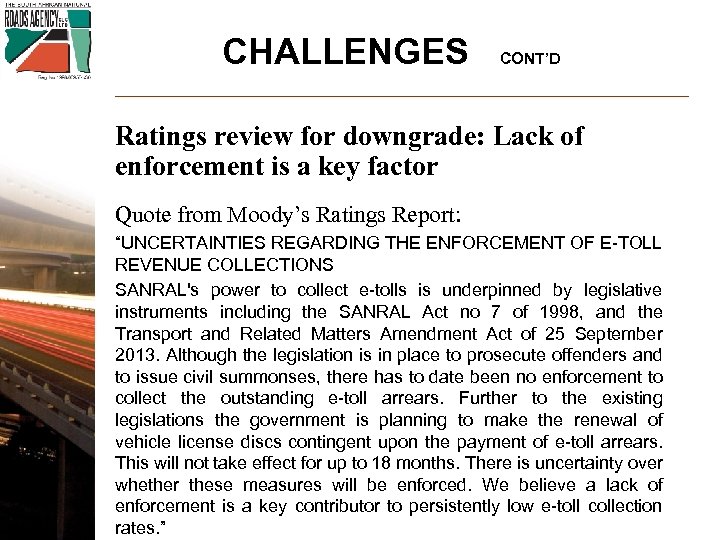

CHALLENGES CONT’D Ratings review for downgrade: Lack of enforcement is a key factor Quote from Moody’s Ratings Report: “UNCERTAINTIES REGARDING THE ENFORCEMENT OF E-TOLL REVENUE COLLECTIONS SANRAL's power to collect e-tolls is underpinned by legislative instruments including the SANRAL Act no 7 of 1998, and the Transport and Related Matters Amendment Act of 25 September 2013. Although the legislation is in place to prosecute offenders and to issue civil summonses, there has to date been no enforcement to collect the outstanding e-toll arrears. Further to the existing legislations the government is planning to make the renewal of vehicle license discs contingent upon the payment of e-toll arrears. This will not take effect for up to 18 months. There is uncertainty over whether these measures will be enforced. We believe a lack of enforcement is a key contributor to persistently low e-toll collection rates. ” 40

CHALLENGES CONT’D Ratings review for downgrade: Lack of enforcement is a key factor Quote from Moody’s Ratings Report: “UNCERTAINTIES REGARDING THE ENFORCEMENT OF E-TOLL REVENUE COLLECTIONS SANRAL's power to collect e-tolls is underpinned by legislative instruments including the SANRAL Act no 7 of 1998, and the Transport and Related Matters Amendment Act of 25 September 2013. Although the legislation is in place to prosecute offenders and to issue civil summonses, there has to date been no enforcement to collect the outstanding e-toll arrears. Further to the existing legislations the government is planning to make the renewal of vehicle license discs contingent upon the payment of e-toll arrears. This will not take effect for up to 18 months. There is uncertainty over whether these measures will be enforced. We believe a lack of enforcement is a key contributor to persistently low e-toll collection rates. ” 40

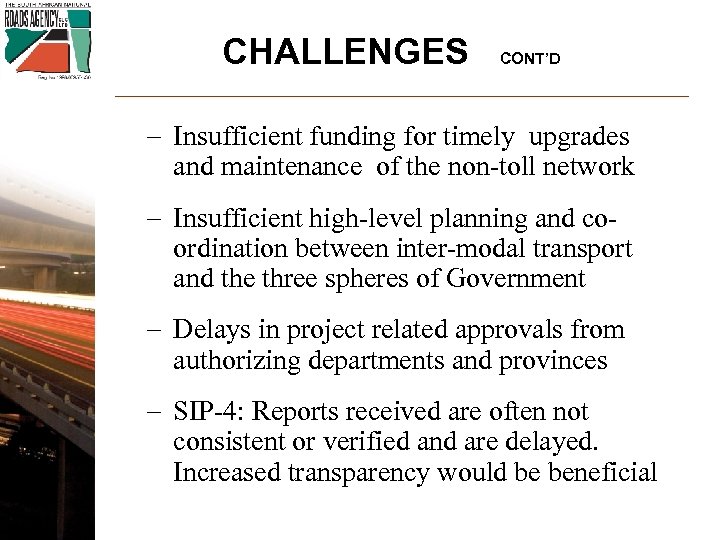

CHALLENGES CONT’D - Insufficient funding for timely upgrades and maintenance of the non-toll network - Insufficient high-level planning and coordination between inter-modal transport and the three spheres of Government - Delays in project related approvals from authorizing departments and provinces - SIP-4: Reports received are often not consistent or verified and are delayed. Increased transparency would be beneficial 41

CHALLENGES CONT’D - Insufficient funding for timely upgrades and maintenance of the non-toll network - Insufficient high-level planning and coordination between inter-modal transport and the three spheres of Government - Delays in project related approvals from authorizing departments and provinces - SIP-4: Reports received are often not consistent or verified and are delayed. Increased transparency would be beneficial 41

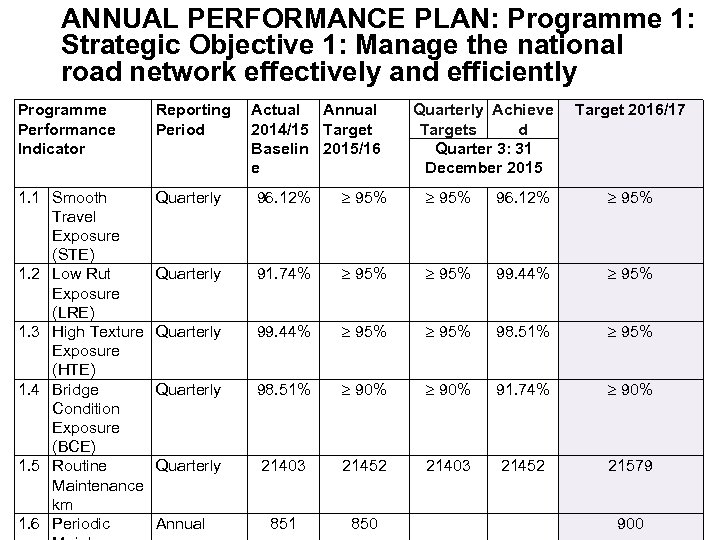

ANNUAL PERFORMANCE PLAN: Programme 1: Strategic Objective 1: Manage the national road network effectively and efficiently Programme Performance Indicator Reporting Actual Annual Period 2014/15 Target Baselin 2015/16 e 1. 1 Smooth Travel Exposure (STE) 1. 2 Low Rut Exposure (LRE) 1. 3 High Texture Exposure (HTE) 1. 4 Bridge Condition Exposure (BCE) 1. 5 Routine Maintenance km 1. 6 Periodic Quarterly 96. 12% 95% Quarterly 91. 74% 95% 99. 44% 95% Quarterly 99. 44% 95% 98. 51% 95% Quarterly 98. 51% 90% 91. 74% 90% Quarterly 21403 21452 21579 851 850 Annual Quarterly Achieve Targets d Quarter 3: 31 December 2015 Target 2016/17 900

ANNUAL PERFORMANCE PLAN: Programme 1: Strategic Objective 1: Manage the national road network effectively and efficiently Programme Performance Indicator Reporting Actual Annual Period 2014/15 Target Baselin 2015/16 e 1. 1 Smooth Travel Exposure (STE) 1. 2 Low Rut Exposure (LRE) 1. 3 High Texture Exposure (HTE) 1. 4 Bridge Condition Exposure (BCE) 1. 5 Routine Maintenance km 1. 6 Periodic Quarterly 96. 12% 95% Quarterly 91. 74% 95% 99. 44% 95% Quarterly 99. 44% 95% 98. 51% 95% Quarterly 98. 51% 90% 91. 74% 90% Quarterly 21403 21452 21579 851 850 Annual Quarterly Achieve Targets d Quarter 3: 31 December 2015 Target 2016/17 900

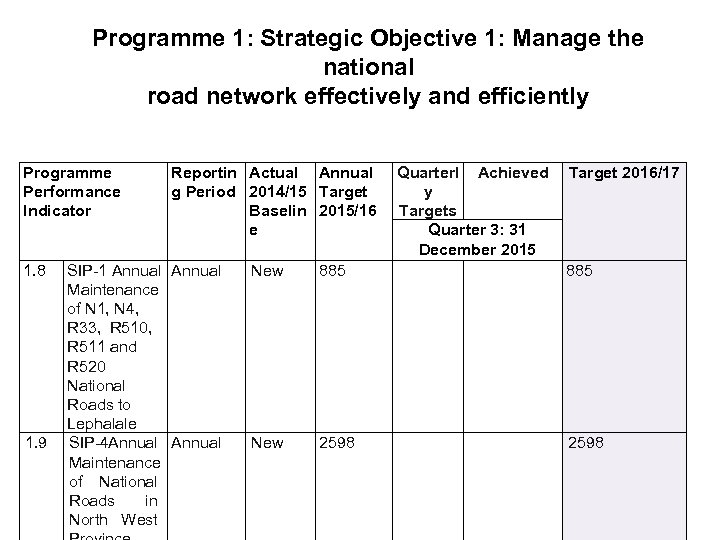

Programme 1: Strategic Objective 1: Manage the national road network effectively and efficiently Programme Performance Indicator 1. 8 1. 9 Reportin Actual Annual g Period 2014/15 Target Baselin 2015/16 e SIP-1 Annual Maintenance of N 1, N 4, R 33, R 510, R 511 and R 520 National Roads to Lephalale SIP-4 Annual Maintenance of National Roads in North West Quarterl Achieved y Targets Quarter 3: 31 December 2015 Target 2016/17 New 885 New 2598

Programme 1: Strategic Objective 1: Manage the national road network effectively and efficiently Programme Performance Indicator 1. 8 1. 9 Reportin Actual Annual g Period 2014/15 Target Baselin 2015/16 e SIP-1 Annual Maintenance of N 1, N 4, R 33, R 510, R 511 and R 520 National Roads to Lephalale SIP-4 Annual Maintenance of National Roads in North West Quarterl Achieved y Targets Quarter 3: 31 December 2015 Target 2016/17 New 885 New 2598

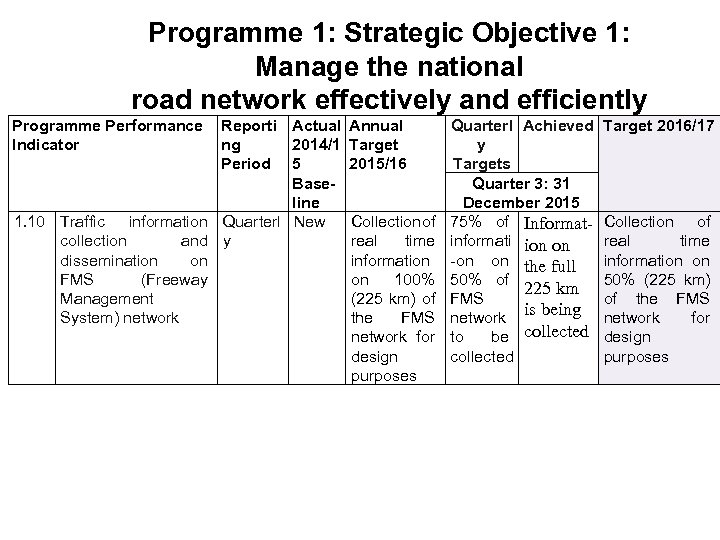

Programme 1: Strategic Objective 1: Manage the national road network effectively and efficiently Programme Performance Reporti Actual Annual Indicator ng 2014/1 Target Period 5 2015/16 Baseline 1. 10 Traffic information Quarterl New Collection of collection and y real time dissemination on information FMS (Freeway on 100% Management (225 km) of System) network the FMS network for design purposes Quarterl Achieved y Targets Quarter 3: 31 December 2015 75% of Informati ion on -on on the full 50% of 225 km FMS network is being to be collected Target 2016/17 Collection of real time information on 50% (225 km) of the FMS network for design purposes

Programme 1: Strategic Objective 1: Manage the national road network effectively and efficiently Programme Performance Reporti Actual Annual Indicator ng 2014/1 Target Period 5 2015/16 Baseline 1. 10 Traffic information Quarterl New Collection of collection and y real time dissemination on information FMS (Freeway on 100% Management (225 km) of System) network the FMS network for design purposes Quarterl Achieved y Targets Quarter 3: 31 December 2015 75% of Informati ion on -on on the full 50% of 225 km FMS network is being to be collected Target 2016/17 Collection of real time information on 50% (225 km) of the FMS network for design purposes

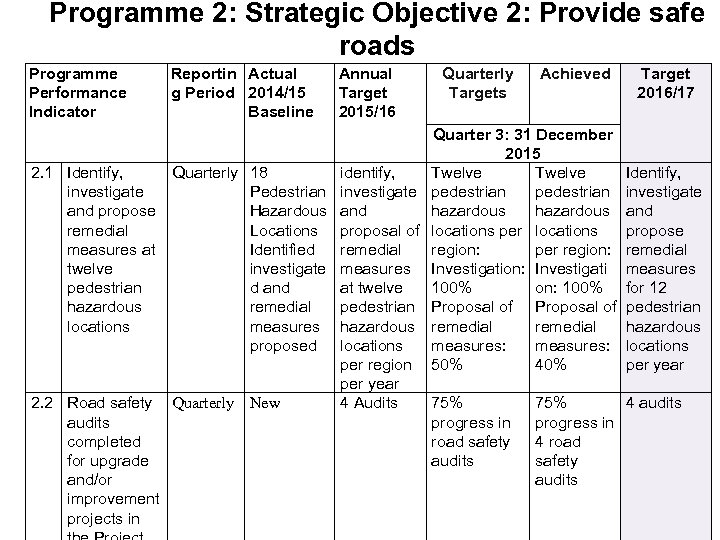

Programme 2: Strategic Objective 2: Provide safe roads Programme Performance Indicator 2. 1 Identify, investigate and propose remedial measures at twelve pedestrian hazardous locations 2. 2 Road safety audits completed for upgrade and/or improvement projects in Reportin Actual g Period 2014/15 Baseline Annual Target 2015/16 Quarterly Targets Achieved Quarter 3: 31 December 2015 Quarterly 18 identify, Twelve Pedestrian investigate pedestrian Hazardous and hazardous Locations proposal of locations per locations Identified remedial region: per region: investigate measures Investigation: Investigati d and at twelve 100% on: 100% remedial pedestrian Proposal of measures hazardous remedial proposed locations measures: per region 50% 40% per year Quarterly New 4 Audits 75% progress in road safety 4 road audits safety audits Target 2016/17 Identify, investigate and propose remedial measures for 12 pedestrian hazardous locations per year 4 audits

Programme 2: Strategic Objective 2: Provide safe roads Programme Performance Indicator 2. 1 Identify, investigate and propose remedial measures at twelve pedestrian hazardous locations 2. 2 Road safety audits completed for upgrade and/or improvement projects in Reportin Actual g Period 2014/15 Baseline Annual Target 2015/16 Quarterly Targets Achieved Quarter 3: 31 December 2015 Quarterly 18 identify, Twelve Pedestrian investigate pedestrian Hazardous and hazardous Locations proposal of locations per locations Identified remedial region: per region: investigate measures Investigation: Investigati d and at twelve 100% on: 100% remedial pedestrian Proposal of measures hazardous remedial proposed locations measures: per region 50% 40% per year Quarterly New 4 Audits 75% progress in road safety 4 road audits safety audits Target 2016/17 Identify, investigate and propose remedial measures for 12 pedestrian hazardous locations per year 4 audits

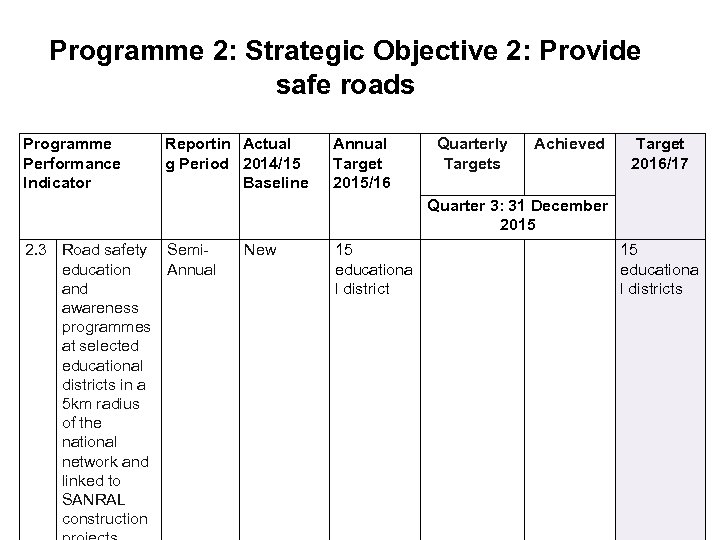

Programme 2: Strategic Objective 2: Provide safe roads Programme Performance Indicator Reportin Actual g Period 2014/15 Baseline Annual Target 2015/16 Quarterly Targets Achieved Target 2016/17 Quarter 3: 31 December 2015 2. 3 Road safety Semieducation Annual and awareness programmes at selected educational districts in a 5 km radius of the national network and linked to SANRAL construction New 15 educationa l districts

Programme 2: Strategic Objective 2: Provide safe roads Programme Performance Indicator Reportin Actual g Period 2014/15 Baseline Annual Target 2015/16 Quarterly Targets Achieved Target 2016/17 Quarter 3: 31 December 2015 2. 3 Road safety Semieducation Annual and awareness programmes at selected educational districts in a 5 km radius of the national network and linked to SANRAL construction New 15 educationa l districts

Programme 3: Strategic Objective 3: Carry out Government’s Targeted Programmes Programme Performance Indicator Reportin Actual Annual Quarter Achieved Target g Period 2014/15 Target ly 2016/17 Baseline 2015/16 Targets Quarter 3: 31 December 2015 Quarterly 83% >60 % 86% >65 % 3. 1 Percentage of RRM project spend contracted to SMMEs and Black owned Companies 3. 2 Percentage of other than Quarterly RRM project spend contracted to SMMEs and Black owned Companies 3. 3 Jobs created on project Quarterly (Full- time) 48% >35 % 45% >35 % 19820 20 000 15 000 14 458 21 000 3. 4 SMMEs Quarterly 1697 800 1697 1200 3. 5 Internships Quarterly 217 110 100 223 121 3. 6 External Bursaries Quarterly 105 85 85 84 85

Programme 3: Strategic Objective 3: Carry out Government’s Targeted Programmes Programme Performance Indicator Reportin Actual Annual Quarter Achieved Target g Period 2014/15 Target ly 2016/17 Baseline 2015/16 Targets Quarter 3: 31 December 2015 Quarterly 83% >60 % 86% >65 % 3. 1 Percentage of RRM project spend contracted to SMMEs and Black owned Companies 3. 2 Percentage of other than Quarterly RRM project spend contracted to SMMEs and Black owned Companies 3. 3 Jobs created on project Quarterly (Full- time) 48% >35 % 45% >35 % 19820 20 000 15 000 14 458 21 000 3. 4 SMMEs Quarterly 1697 800 1697 1200 3. 5 Internships Quarterly 217 110 100 223 121 3. 6 External Bursaries Quarterly 105 85 85 84 85

Programme 3: Strategic Objective 3: Carry out Government’s Targeted Programmes (Cont’d) Programme Performance Indicator Reportin Actual g Period 2014/15 Baseline 3. 7 Scholarshi Quarterly ps 3. 8 Employme Annual nt Equity Plan Annual Target 2015/16 368 150 New EE Plan approved by Board. Target for 31 March 2015 achieved Achieve annual Targets as per Board Approved EE Plan Quarterly Achieved Targets Quarter 3: 31 December 2015 150 196 Target 2016/17 200 Achieve annual targets as per Board approved EE Plan

Programme 3: Strategic Objective 3: Carry out Government’s Targeted Programmes (Cont’d) Programme Performance Indicator Reportin Actual g Period 2014/15 Baseline 3. 7 Scholarshi Quarterly ps 3. 8 Employme Annual nt Equity Plan Annual Target 2015/16 368 150 New EE Plan approved by Board. Target for 31 March 2015 achieved Achieve annual Targets as per Board Approved EE Plan Quarterly Achieved Targets Quarter 3: 31 December 2015 150 196 Target 2016/17 200 Achieve annual targets as per Board approved EE Plan

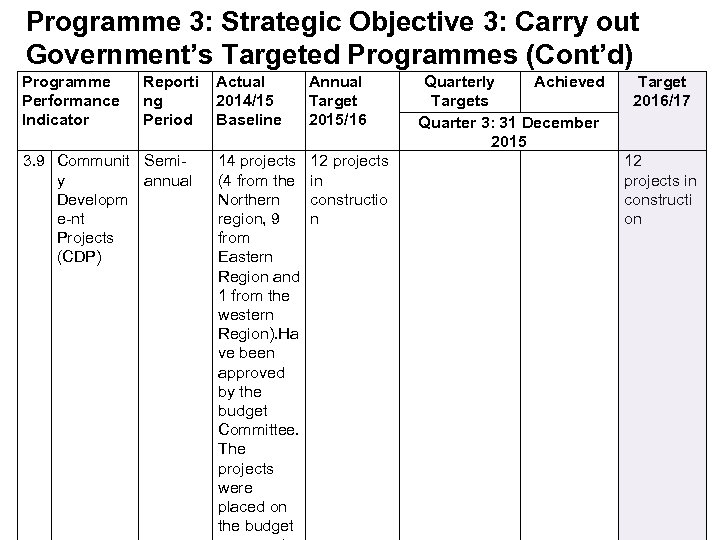

Programme 3: Strategic Objective 3: Carry out Government’s Targeted Programmes (Cont’d) Programme Performance Indicator Reporti ng Period 3. 9 Communit Semiy annual Developm e-nt Projects (CDP) Actual 2014/15 Baseline Annual Target 2015/16 14 projects (4 from the Northern region, 9 from Eastern Region and 1 from the western Region). Ha ve been approved by the budget Committee. The projects were placed on the budget 12 projects in constructio n Quarterly Achieved Targets Quarter 3: 31 December 2015 Target 2016/17 12 projects in constructi on

Programme 3: Strategic Objective 3: Carry out Government’s Targeted Programmes (Cont’d) Programme Performance Indicator Reporti ng Period 3. 9 Communit Semiy annual Developm e-nt Projects (CDP) Actual 2014/15 Baseline Annual Target 2015/16 14 projects (4 from the Northern region, 9 from Eastern Region and 1 from the western Region). Ha ve been approved by the budget Committee. The projects were placed on the budget 12 projects in constructio n Quarterly Achieved Targets Quarter 3: 31 December 2015 Target 2016/17 12 projects in constructi on

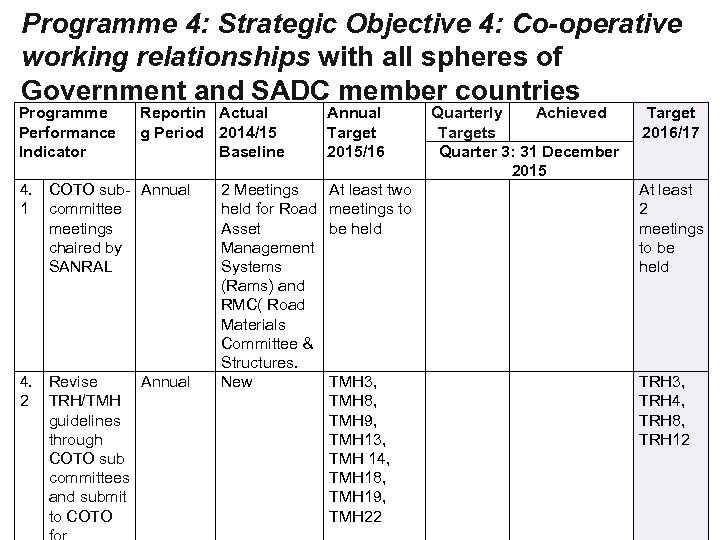

Programme 4: Strategic Objective 4: Co-operative working relationships with all spheres of Government and SADC member countries Programme Performance Indicator Reportin Actual g Period 2014/15 Baseline 4. COTO sub- Annual 1 committee meetings chaired by SANRAL 4. Revise Annual 2 TRH/TMH guidelines through COTO sub committees and submit to COTO 2 Meetings held for Road Asset Management Systems (Rams) and RMC( Road Materials Committee & Structures. New Annual Target 2015/16 Quarterly Achieved Targets Quarter 3: 31 December 2015 Target 2016/17 At least two meetings to be held At least 2 meetings to be held TMH 3, TMH 8, TMH 9, TMH 13, TMH 14, TMH 18, TMH 19, TMH 22 TRH 3, TRH 4, TRH 8, TRH 12

Programme 4: Strategic Objective 4: Co-operative working relationships with all spheres of Government and SADC member countries Programme Performance Indicator Reportin Actual g Period 2014/15 Baseline 4. COTO sub- Annual 1 committee meetings chaired by SANRAL 4. Revise Annual 2 TRH/TMH guidelines through COTO sub committees and submit to COTO 2 Meetings held for Road Asset Management Systems (Rams) and RMC( Road Materials Committee & Structures. New Annual Target 2015/16 Quarterly Achieved Targets Quarter 3: 31 December 2015 Target 2016/17 At least two meetings to be held At least 2 meetings to be held TMH 3, TMH 8, TMH 9, TMH 13, TMH 14, TMH 18, TMH 19, TMH 22 TRH 3, TRH 4, TRH 8, TRH 12

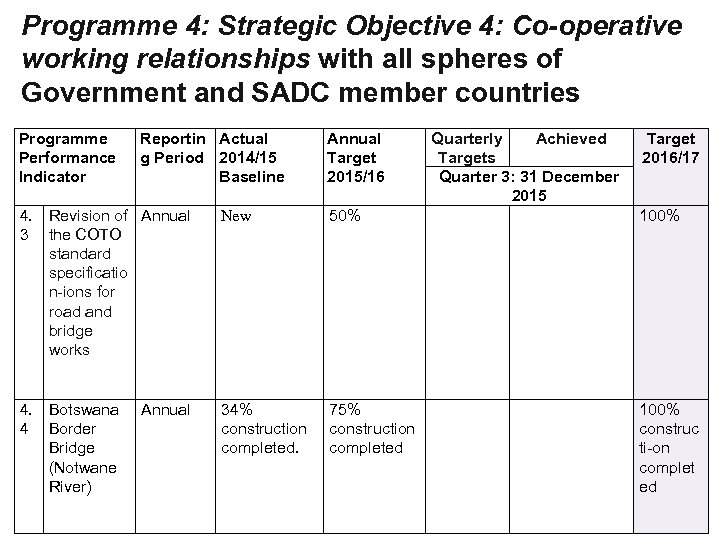

Programme 4: Strategic Objective 4: Co-operative working relationships with all spheres of Government and SADC member countries Programme Performance Indicator Reportin Actual g Period 2014/15 Baseline Annual Target 2015/16 Quarterly Achieved Targets Quarter 3: 31 December 2015 Target 2016/17 4. Revision of Annual 3 the COTO standard specificatio n-ions for road and bridge works New 50% 100% 4. Botswana 4 Border Bridge (Notwane River) 34% construction completed. 75% construction completed 100% construc ti-on complet ed Annual

Programme 4: Strategic Objective 4: Co-operative working relationships with all spheres of Government and SADC member countries Programme Performance Indicator Reportin Actual g Period 2014/15 Baseline Annual Target 2015/16 Quarterly Achieved Targets Quarter 3: 31 December 2015 Target 2016/17 4. Revision of Annual 3 the COTO standard specificatio n-ions for road and bridge works New 50% 100% 4. Botswana 4 Border Bridge (Notwane River) 34% construction completed. 75% construction completed 100% construc ti-on complet ed Annual

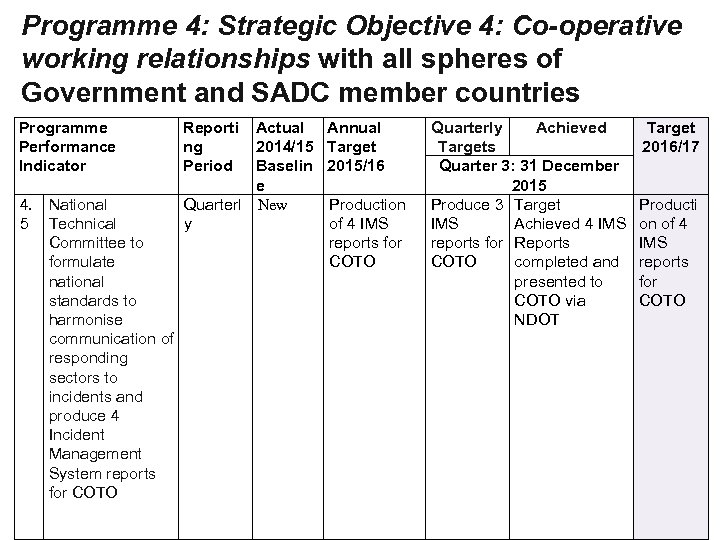

Programme 4: Strategic Objective 4: Co-operative working relationships with all spheres of Government and SADC member countries Programme Performance Indicator 4. National 5 Technical Committee to formulate national standards to harmonise communication of responding sectors to incidents and produce 4 Incident Management System reports for COTO Reporti ng Period Actual 2014/15 Baselin e Quarterl New y Annual Target 2015/16 Production of 4 IMS reports for COTO Quarterly Achieved Targets Quarter 3: 31 December 2015 Produce 3 Target IMS Achieved 4 IMS reports for Reports COTO completed and presented to COTO via NDOT Target 2016/17 Producti on of 4 IMS reports for COTO

Programme 4: Strategic Objective 4: Co-operative working relationships with all spheres of Government and SADC member countries Programme Performance Indicator 4. National 5 Technical Committee to formulate national standards to harmonise communication of responding sectors to incidents and produce 4 Incident Management System reports for COTO Reporti ng Period Actual 2014/15 Baselin e Quarterl New y Annual Target 2015/16 Production of 4 IMS reports for COTO Quarterly Achieved Targets Quarter 3: 31 December 2015 Produce 3 Target IMS Achieved 4 IMS reports for Reports COTO completed and presented to COTO via NDOT Target 2016/17 Producti on of 4 IMS reports for COTO

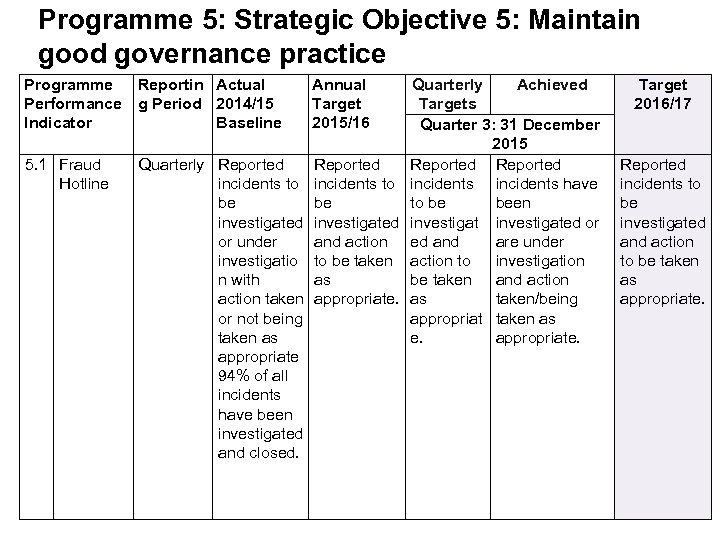

Programme 5: Strategic Objective 5: Maintain good governance practice Programme Reportin Actual Performance g Period 2014/15 Indicator Baseline 5. 1 Fraud Hotline Quarterly Reported incidents to be investigated or under investigatio n with action taken or not being taken as appropriate 94% of all incidents have been investigated and closed. Annual Target 2015/16 Quarterly Achieved Targets Quarter 3: 31 December 2015 Reported incidents to incidents have be to be been investigated or and action ed and are under to be taken action to investigation as be taken and action appropriate. as taken/being appropriat taken as e. appropriate. Target 2016/17 Reported incidents to be investigated and action to be taken as appropriate.

Programme 5: Strategic Objective 5: Maintain good governance practice Programme Reportin Actual Performance g Period 2014/15 Indicator Baseline 5. 1 Fraud Hotline Quarterly Reported incidents to be investigated or under investigatio n with action taken or not being taken as appropriate 94% of all incidents have been investigated and closed. Annual Target 2015/16 Quarterly Achieved Targets Quarter 3: 31 December 2015 Reported incidents to incidents have be to be been investigated or and action ed and are under to be taken action to investigation as be taken and action appropriate. as taken/being appropriat taken as e. appropriate. Target 2016/17 Reported incidents to be investigated and action to be taken as appropriate.

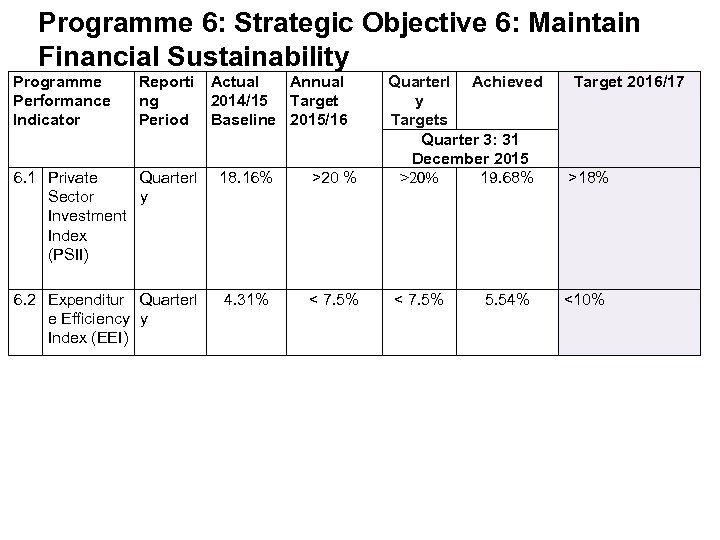

Programme 6: Strategic Objective 6: Maintain Financial Sustainability Programme Performance Indicator Reporti Actual Annual ng 2014/15 Target Period Baseline 2015/16 6. 1 Private Quarterl Sector y Investment Index (PSII) 18. 16% >20 % 6. 2 Expenditur Quarterl e Efficiency y Index (EEI) 4. 31% < 7. 5% Quarterl Achieved y Targets Quarter 3: 31 December 2015 >20% 19. 68% < 7. 5% 5. 54% Target 2016/17 >18% <10%

Programme 6: Strategic Objective 6: Maintain Financial Sustainability Programme Performance Indicator Reporti Actual Annual ng 2014/15 Target Period Baseline 2015/16 6. 1 Private Quarterl Sector y Investment Index (PSII) 18. 16% >20 % 6. 2 Expenditur Quarterl e Efficiency y Index (EEI) 4. 31% < 7. 5% Quarterl Achieved y Targets Quarter 3: 31 December 2015 >20% 19. 68% < 7. 5% 5. 54% Target 2016/17 >18% <10%

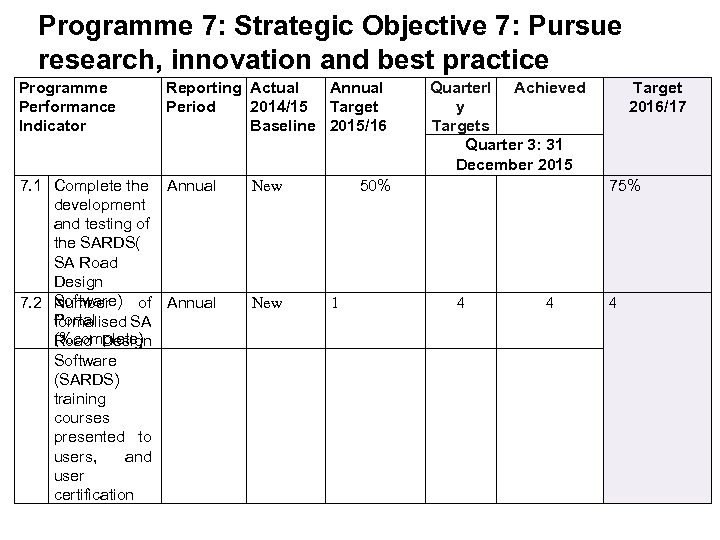

Programme 7: Strategic Objective 7: Pursue research, innovation and best practice Programme Performance Indicator Reporting Actual Annual Period 2014/15 Target Baseline 2015/16 7. 1 Complete the Annual development and testing of the SARDS( SA Road Design 7. 2 Software) of Annual Number Portal formalised SA (%complete) Road Design Software (SARDS) training courses presented to users, and user certification 50% New Quarterl Achieved y Targets Quarter 3: 31 December 2015 1 Target 2016/17 75% 4 4 4

Programme 7: Strategic Objective 7: Pursue research, innovation and best practice Programme Performance Indicator Reporting Actual Annual Period 2014/15 Target Baseline 2015/16 7. 1 Complete the Annual development and testing of the SARDS( SA Road Design 7. 2 Software) of Annual Number Portal formalised SA (%complete) Road Design Software (SARDS) training courses presented to users, and user certification 50% New Quarterl Achieved y Targets Quarter 3: 31 December 2015 1 Target 2016/17 75% 4 4 4

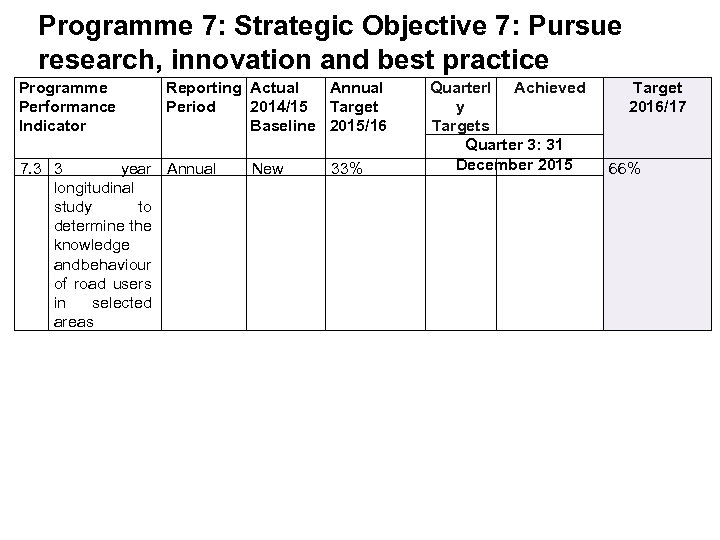

Programme 7: Strategic Objective 7: Pursue research, innovation and best practice Programme Performance Indicator Reporting Actual Annual Period 2014/15 Target Baseline 2015/16 7. 3 3 year Annual longitudinal study to determine the knowledge and behaviour of road users in selected areas New 33% Quarterl Achieved y Targets Quarter 3: 31 December 2015 Target 2016/17 66%

Programme 7: Strategic Objective 7: Pursue research, innovation and best practice Programme Performance Indicator Reporting Actual Annual Period 2014/15 Target Baseline 2015/16 7. 3 3 year Annual longitudinal study to determine the knowledge and behaviour of road users in selected areas New 33% Quarterl Achieved y Targets Quarter 3: 31 December 2015 Target 2016/17 66%

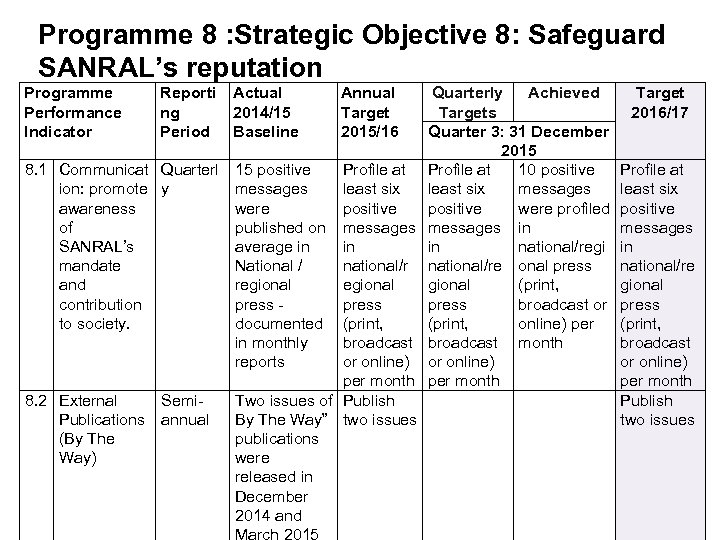

Programme 8 : Strategic Objective 8: Safeguard SANRAL’s reputation Programme Performance Indicator Reporti ng Period Actual 2014/15 Baseline Annual Target 2015/16 Quarterly Achieved Targets Quarter 3: 31 December 2015 8. 1 Communicat Quarterl 15 positive Profile at 10 positive ion: promote y messages least six messages awareness were positive were profiled of published on messages in SANRAL’s average in in in national/regi mandate National / national/re onal press and regional (print, contribution press broadcast or to society. documented (print, online) per in monthly broadcast month reports or online) per month 8. 2 External Semi. Two issues of Publish Publications annual By The Way” two issues (By The publications Way) were released in December 2014 and Target 2016/17 Profile at least six positive messages in national/re gional press (print, broadcast or online) per month Publish two issues

Programme 8 : Strategic Objective 8: Safeguard SANRAL’s reputation Programme Performance Indicator Reporti ng Period Actual 2014/15 Baseline Annual Target 2015/16 Quarterly Achieved Targets Quarter 3: 31 December 2015 8. 1 Communicat Quarterl 15 positive Profile at 10 positive ion: promote y messages least six messages awareness were positive were profiled of published on messages in SANRAL’s average in in in national/regi mandate National / national/re onal press and regional (print, contribution press broadcast or to society. documented (print, online) per in monthly broadcast month reports or online) per month 8. 2 External Semi. Two issues of Publish Publications annual By The Way” two issues (By The publications Way) were released in December 2014 and Target 2016/17 Profile at least six positive messages in national/re gional press (print, broadcast or online) per month Publish two issues

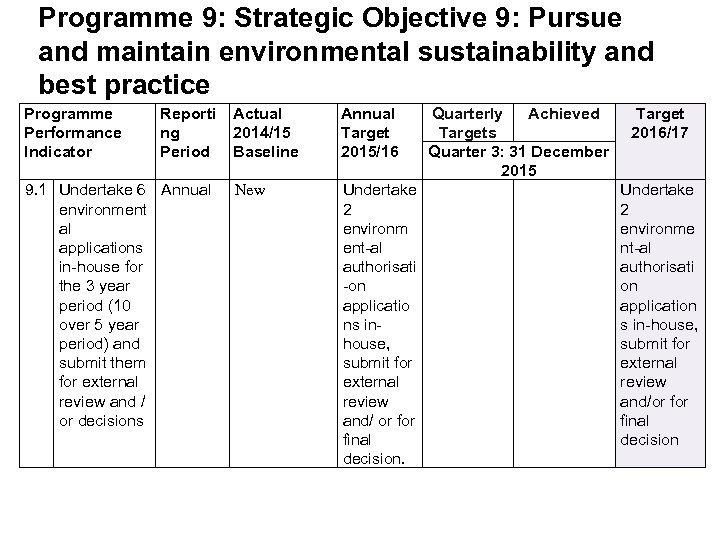

Programme 9: Strategic Objective 9: Pursue and maintain environmental sustainability and best practice Programme Performance Indicator Reporti ng Period 9. 1 Undertake 6 Annual environment al applications in-house for the 3 year period (10 over 5 year period) and submit them for external review and / or decisions Actual 2014/15 Baseline Annual Target 2015/16 New Undertake 2 environm ent-al authorisati -on applicatio ns inhouse, submit for external review and/ or final decision. Quarterly Achieved Targets Quarter 3: 31 December 2015 Target 2016/17 Undertake 2 environme nt-al authorisati on application s in-house, submit for external review and/or final decision

Programme 9: Strategic Objective 9: Pursue and maintain environmental sustainability and best practice Programme Performance Indicator Reporti ng Period 9. 1 Undertake 6 Annual environment al applications in-house for the 3 year period (10 over 5 year period) and submit them for external review and / or decisions Actual 2014/15 Baseline Annual Target 2015/16 New Undertake 2 environm ent-al authorisati -on applicatio ns inhouse, submit for external review and/ or final decision. Quarterly Achieved Targets Quarter 3: 31 December 2015 Target 2016/17 Undertake 2 environme nt-al authorisati on application s in-house, submit for external review and/or final decision

Thank you! ØSANRAL Ø 48 Tambotie Avenue ØVal de Grace ØPretoria Ø 0184 ØPO Box 415 ØPretoria Ø 0001 ØTelephone: +27 12 8448 000 ØFax: +27 12 8448200 Nazir Alli Inge Mulder Alice Mathew alli@nra. co. a mulderi@nra. co. za mathewa@nra. co. za FRAUD HOTLINE: 0800 204 558 Website: www. sanral. co. za

Thank you! ØSANRAL Ø 48 Tambotie Avenue ØVal de Grace ØPretoria Ø 0184 ØPO Box 415 ØPretoria Ø 0001 ØTelephone: +27 12 8448 000 ØFax: +27 12 8448200 Nazir Alli Inge Mulder Alice Mathew alli@nra. co. a mulderi@nra. co. za mathewa@nra. co. za FRAUD HOTLINE: 0800 204 558 Website: www. sanral. co. za