b9c0d01e57773f2eb8110899e4970e69.ppt

- Количество слайдов: 16

Presentation on SWAVALAMBAN NEW PENSION SCHEME PRESENTED BY RAM SEVAK SEVA SANSTHAN, MANJU NIVASH SANDALPUR MORE PATEL COLONY GALI NO-03 NEAR RS GAS AGENCY KHUMRAR GUMTI PATNA-6, CONTACT-Mr. MUKESH- 8294905788

SWAVALAMBAN / NPS LITE What is Swavalamban / NPS LITE ? A New Pension Scheme NPS was initially for Government By employees, and was later extended to all citizens of India. Recognizing the need to provide income security to Government of India For marginal income earners and to people All citizens of from economically disadvantaged unorganized sector sections of society, a scheme has been As part of the Government's initiative towards „Financial Inclusion‟, The Finance Minister has announced a new scheme called “Swavalamban” to encourage subscribers to take the all important step of saving for their old age, where Govt. of India will also contribute Rs 1000 per year to the pension account. *

Government of India and PFRDA.

Objective Of Swavalamaban / New Pension Scheme Is to Make provision of Old age pension for the people of unorganized sector from the Age of 60 Years till life.

FEATURES OF SWAVLAMBAN / NPS LITE • It is voluntary • It is simple • It is affordable Investment can be as low as Rs 100 • It is –Uniform-single investment plan • It is safe-it is regulated by PFRDA • It is a Pension Scheme for Subscribers • It is based on Defined Contribution System • It is Flexible and Transparent system. • It is portable-can be operated from anywhere in India • It is based on market based returns over long term

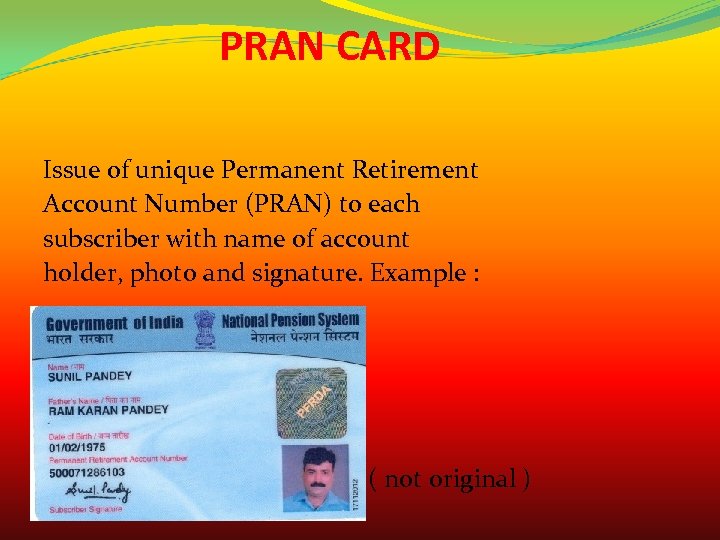

PRAN CARD Issue of unique Permanent Retirement Account Number (PRAN) to each subscriber with name of account holder, photo and signature. Example : ( not original )

Eligibility to join NPS Eligibility conditions for enrolment/opening account: • Aged between 18 and 60 years, and • Not a member of Employees Provident Fund and Miscellaneous Provisions Act 1952 and/or any scheme for pension

Govt. of India- contribution Govt. of India Contribution of Rs 1000 every year till Financial Year 2017 -18 in your PRAN card. Eligibility for Govt. contribution: • Minimum of Rs. 1, 000 and a maximum of Rs. 12, 000 per annum of contribution by you in your PRAN card.

Pension on investing At the age of 60 Years : ( a ) The subscriber can withdraw 60% as lump sum, and 40% will have to be annuitized to ensure a minimum pension of Rs. 1, 000 per month; ( b ) In case 40% of the corpus is not sufficient to buy an annuity of Rs 1000/- pm, the commutation portion can be reduced to that extent.

vesting In case of death of the subscriber the entire money can be withdrawn by his heirs immediately, without annuitizing any portion of the corpus OR they can also opt for annuity provided the fund available is sufficient to provide an annuity of Rs 1000/- pm.

Corpus in Swavalamban The contributions, net of charges, would be converted to Units depending on the NAV and credited to subscriber’s account. The corpus would be value of the units to the credit of the member. A statement of account of entire transactions and the market value of the corpus will be sent to subscribers, once a year.

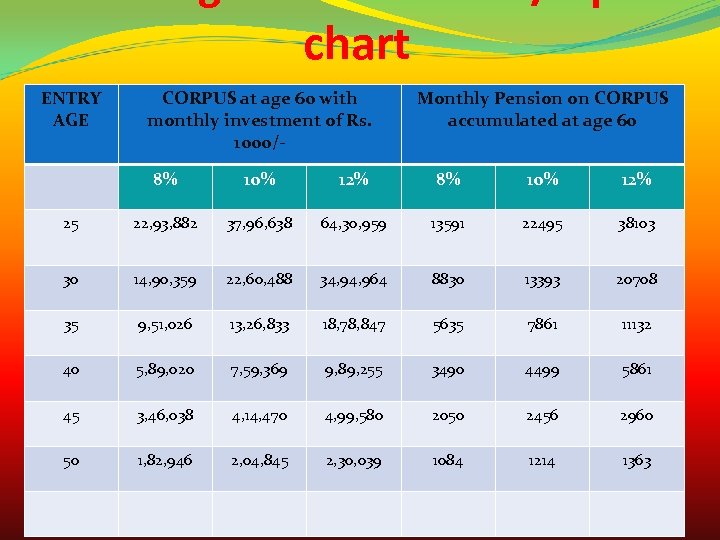

chart ENTRY AGE CORPUS at age 60 with monthly investment of Rs. 1000/- Monthly Pension on CORPUS accumulated at age 60 8% 10% 12% 25 22, 93, 882 37, 96, 638 64, 30, 959 13591 22495 38103 30 14, 90, 359 22, 60, 488 34, 964 8830 13393 20708 35 9, 51, 026 13, 26, 833 18, 78, 847 5635 7861 11132 40 5, 89, 020 7, 59, 369 9, 89, 255 3490 4499 5861 45 3, 46, 038 4, 14, 470 4, 99, 580 2050 2456 2960 50 1, 82, 946 2, 04, 845 2, 30, 039 1084 1214 1363

How to join the nps scheme To join Swavalamban, the Subscriber should. . • Complete the requisite subscription form. • Comply KYC norms like: Affix colored photograph Provide photo-identity, Proof of residence Age proof. ● Remittance of contribution along with form

WHY JOIN NPS WITH GREATS YOU GET YOUR PRAN CARD 100/- DEPOSIT IN YOUR PRAN CARD NO TENSION OF FILLING FORMS NO TENSION OF BIG QUES SERVICE AT YOUR DOOR STEP MOST OF ALL YOU CAN EARN HANDSOMELY BY JUST PROMOTING SUCH NOBLE CAUSE

Steps to Earn Give all Your KYC documents (self attested) Fill your NPS Lite Form Pay Rs. 800/- to Great Life Marketing Make your PRAN card Promote others the benefits of PRAN Rs 100/- will be deposited in your PRAN card

Projected income 4096 * 200 = 8 LACS APP. + GOLD / DIAMNOND MATCHING BONUS

b9c0d01e57773f2eb8110899e4970e69.ppt