ecea6c7e47e8b1feb0d4372c932db0fd.ppt

- Количество слайдов: 17

Present Worth I Economic basis to evaluate engineering projects

Time Management ¡ The expected time to deliver this module is 50 minutes. 20 minutes are reserved for team practices and exercises and 30 minutes for lecture.

Learning Objective I After this class the students should be able to: ¡ Define present worth, state its standard assumptions, and use it to measure the economic attractiveness of a project or an alternative.

Situation & Solution ¡ Equivalence can be applied to cash flows that occur at different times, but which equivalent measure should be calculated and how should it be evaluated? Often the solution is to calculate a time 0 equivalent value or a present worth.

Warm-up (Reflection) If the monthly inflation rate expected for this year is 0. 5%. Which will be annual inflation rate expected? Each team is invited to answer this question and list the reasons that justify their respective answers. (5 minutes)

Warm-up (Example 1) Booker Lee expects a $10, 000 bonus when the product his team is developing is marketed in 4 years. He will invest in a money market fund that earns 8% per year. He plans to use the money as a down payment on a house, or to start a business, or for traveling during retirement. Assume these occur 10, 20, and 40 years, respectively, after he receives the bonus. At 8%, what equivalent values can be calculated? Which one is most meaningful? Least meaningful? ¡ Each team is invited to reflect about this question, draw cash flow diagrams, try to speculate some possible answers, and give explanation about its respective answers. (10 minutes)

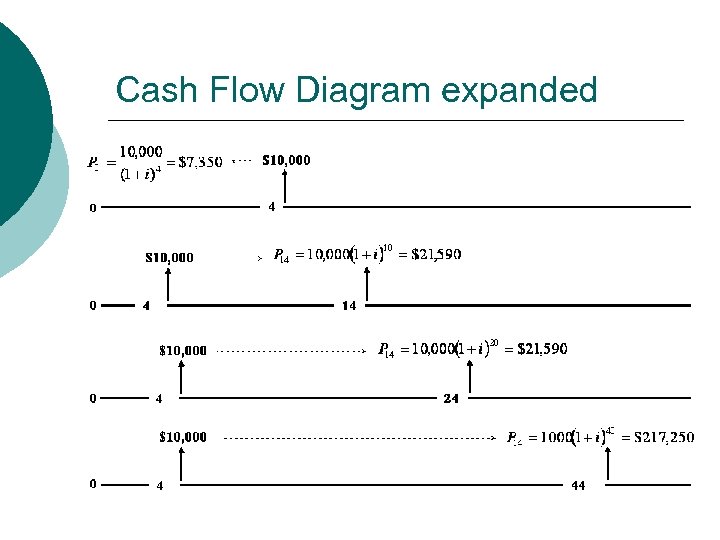

Cash Flow Diagram expanded

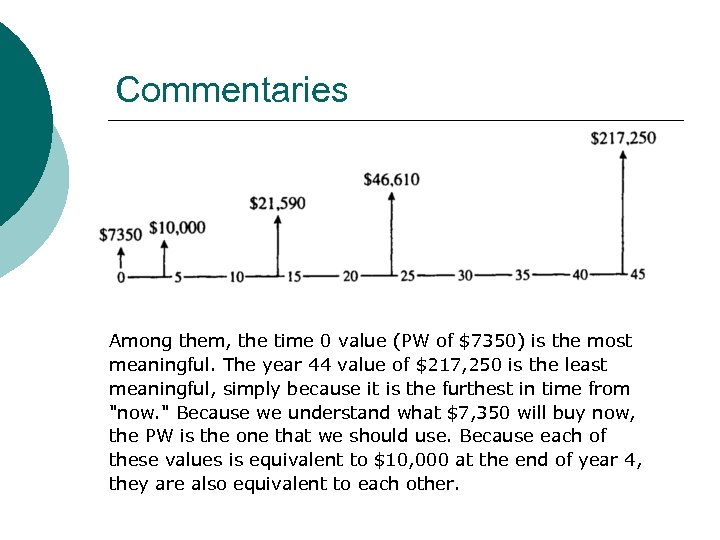

Solution ¡ P 0 = 10, 000(P/F, 8%, 4) = 10, 000 x. 7350 = $7350 ¡ F 14 = 10, 000(F/P, 8%, 10) = 10, 000 x 2. 159 = $21, 590 ¡ F 24 = 10, 000(F/P, 8%, 20) = 10, 000 x. 4. 661 = $46, 610 ¡ F 44 = 10, 000 (F/P, 8%, 40) = 10, 000 x 21. 725 = $217, 250

Commentaries Among them, the time 0 value (PW of $7350) is the most meaningful. The year 44 value of $217, 250 is the least meaningful, simply because it is the furthest in time from "now. " Because we understand what $7, 350 will buy now, the PW is the one that we should use. Because each of these values is equivalent to $10, 000 at the end of year 4, they are also equivalent to each other.

Present worth definition ¡ Present worth (PW) is the equivalent value at time 0 of a set of cash flows.

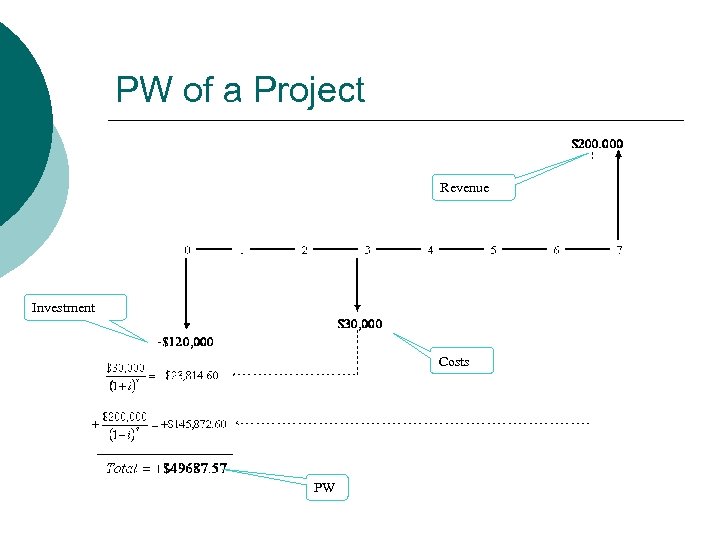

PW of a Project Revenue Investment Costs PW

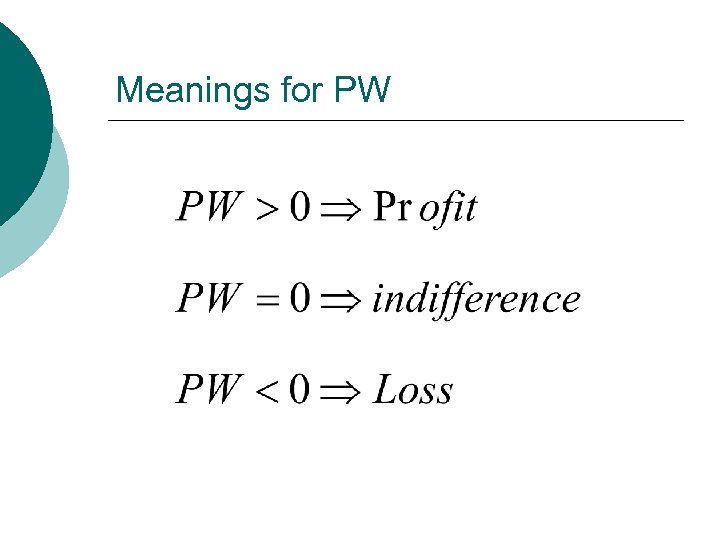

What PW means? ¡ After analyze the cash flow diagram from the slide 15, each team is invited explain what the PW means? (5 minutes)

Meanings for PW

Standard assumptions 1. 2. 3. 4. Cash flows occur at the end of the period, except for first costs and pre payments like insurance and leases. Cash flows are known, certain values. Known, certain values are deterministic values. The interest rate, i, is given. The problem's horizon or study period, N, is given.

Utilizations of Present Worth ¡ ¡ ¡ (1) setting a price to buy or sell a project or an alternative; (2) evaluating an investment or project where the price to invest or the first cost is given; and (3) calculating an equivalent value for an irregular series of cash flows.

Homework ¡ ¡ George, a graduating civil engineering student, is offered a job at a remote construction project overseas. If George is still with the project when it is completed at the end of year 5, he will receive a bonus of $100, 000. His discount rate is 12%. What is the present worth of the bonus? (Use the Excel software) Graph the answer for discount rates ranging from 0% to 20%. (Simulate in the Excel software)

Reference ¡ “Engineering Economic: Appling Theory to Practice” Ted G. Eschenbach Oxford University Press 2002 Chapter 5

ecea6c7e47e8b1feb0d4372c932db0fd.ppt