a8d383ea6e98b5dd138c582659512d16.ppt

- Количество слайдов: 15

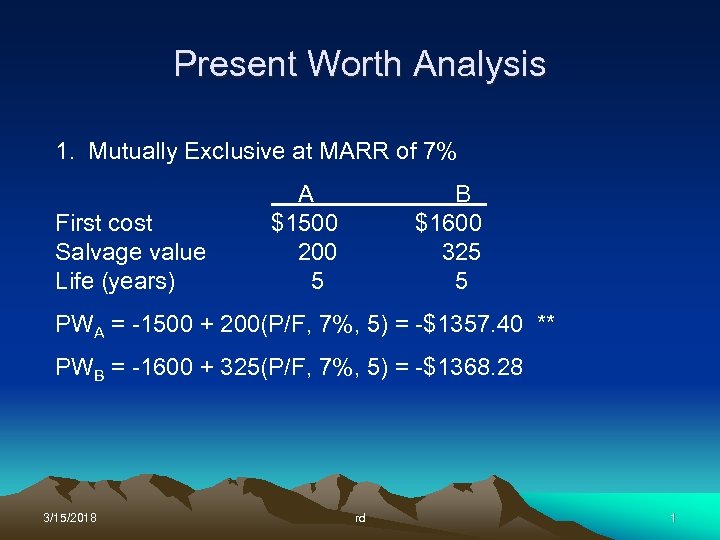

Present Worth Analysis 1. Mutually Exclusive at MARR of 7% First cost Salvage value Life (years) A $1500 200 5 B $1600 325 5 PWA = -1500 + 200(P/F, 7%, 5) = -$1357. 40 ** PWB = -1600 + 325(P/F, 7%, 5) = -$1368. 28 3/15/2018 rd 1

Present Worth Analysis 1. Mutually Exclusive at MARR of 7% First cost Salvage value Life (years) A $1500 200 5 B $1600 325 5 PWA = -1500 + 200(P/F, 7%, 5) = -$1357. 40 ** PWB = -1600 + 325(P/F, 7%, 5) = -$1368. 28 3/15/2018 rd 1

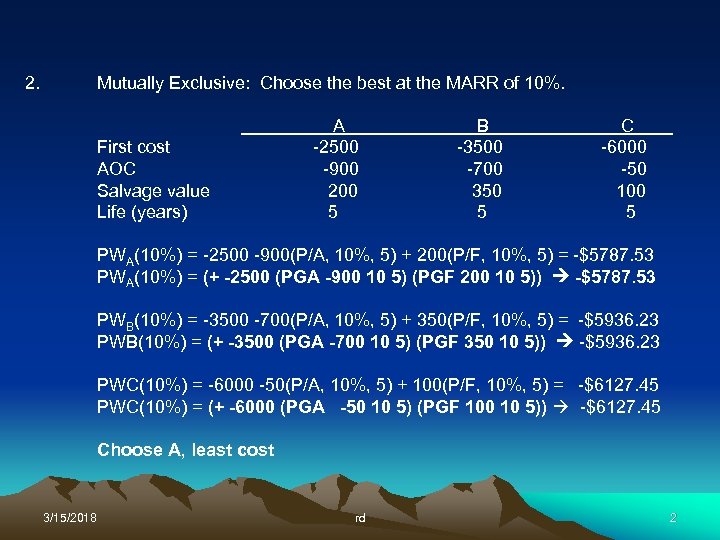

2. Mutually Exclusive: Choose the best at the MARR of 10%. First cost AOC Salvage value Life (years) A -2500 -900 200 5 B -3500 -700 350 5 C -6000 -50 100 5 PWA(10%) = -2500 -900(P/A, 10%, 5) + 200(P/F, 10%, 5) = -$5787. 53 PWA(10%) = (+ -2500 (PGA -900 10 5) (PGF 200 10 5)) -$5787. 53 PWB(10%) = -3500 -700(P/A, 10%, 5) + 350(P/F, 10%, 5) = -$5936. 23 PWB(10%) = (+ -3500 (PGA -700 10 5) (PGF 350 10 5)) -$5936. 23 PWC(10%) = -6000 -50(P/A, 10%, 5) + 100(P/F, 10%, 5) = -$6127. 45 PWC(10%) = (+ -6000 (PGA -50 10 5) (PGF 100 10 5)) -$6127. 45 Choose A, least cost 3/15/2018 rd 2

2. Mutually Exclusive: Choose the best at the MARR of 10%. First cost AOC Salvage value Life (years) A -2500 -900 200 5 B -3500 -700 350 5 C -6000 -50 100 5 PWA(10%) = -2500 -900(P/A, 10%, 5) + 200(P/F, 10%, 5) = -$5787. 53 PWA(10%) = (+ -2500 (PGA -900 10 5) (PGF 200 10 5)) -$5787. 53 PWB(10%) = -3500 -700(P/A, 10%, 5) + 350(P/F, 10%, 5) = -$5936. 23 PWB(10%) = (+ -3500 (PGA -700 10 5) (PGF 350 10 5)) -$5936. 23 PWC(10%) = -6000 -50(P/A, 10%, 5) + 100(P/F, 10%, 5) = -$6127. 45 PWC(10%) = (+ -6000 (PGA -50 10 5) (PGF 100 10 5)) -$6127. 45 Choose A, least cost 3/15/2018 rd 2

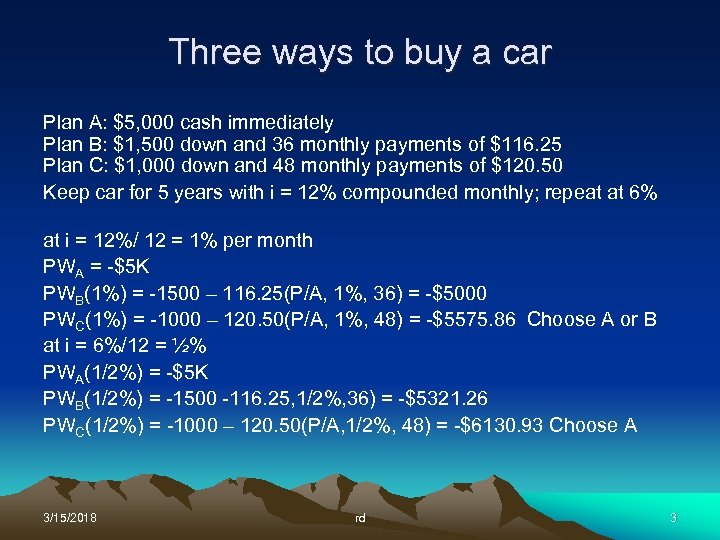

Three ways to buy a car Plan A: $5, 000 cash immediately Plan B: $1, 500 down and 36 monthly payments of $116. 25 Plan C: $1, 000 down and 48 monthly payments of $120. 50 Keep car for 5 years with i = 12% compounded monthly; repeat at 6% at i = 12%/ 12 = 1% per month PWA = -$5 K PWB(1%) = -1500 – 116. 25(P/A, 1%, 36) = -$5000 PWC(1%) = -1000 – 120. 50(P/A, 1%, 48) = -$5575. 86 Choose A or B at i = 6%/12 = ½% PWA(1/2%) = -$5 K PWB(1/2%) = -1500 -116. 25, 1/2%, 36) = -$5321. 26 PWC(1/2%) = -1000 – 120. 50(P/A, 1/2%, 48) = -$6130. 93 Choose A 3/15/2018 rd 3

Three ways to buy a car Plan A: $5, 000 cash immediately Plan B: $1, 500 down and 36 monthly payments of $116. 25 Plan C: $1, 000 down and 48 monthly payments of $120. 50 Keep car for 5 years with i = 12% compounded monthly; repeat at 6% at i = 12%/ 12 = 1% per month PWA = -$5 K PWB(1%) = -1500 – 116. 25(P/A, 1%, 36) = -$5000 PWC(1%) = -1000 – 120. 50(P/A, 1%, 48) = -$5575. 86 Choose A or B at i = 6%/12 = ½% PWA(1/2%) = -$5 K PWB(1/2%) = -1500 -116. 25, 1/2%, 36) = -$5321. 26 PWC(1/2%) = -1000 – 120. 50(P/A, 1/2%, 48) = -$6130. 93 Choose A 3/15/2018 rd 3

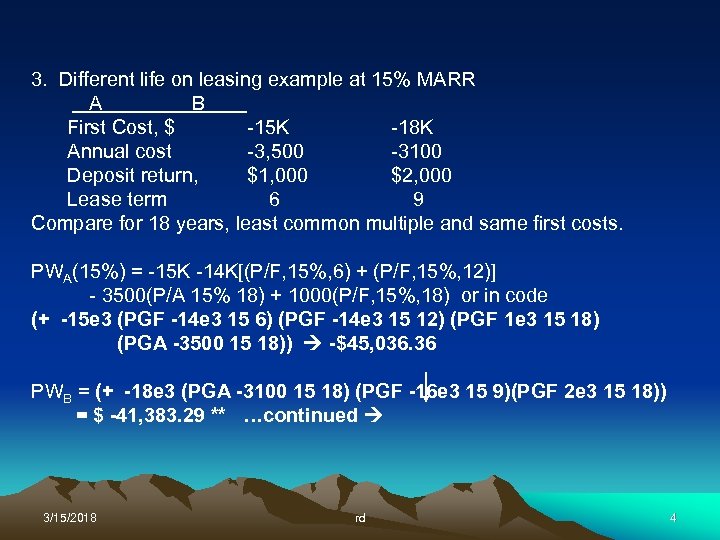

3. Different life on leasing example at 15% MARR A B First Cost, $ -15 K -18 K Annual cost -3, 500 -3100 Deposit return, $1, 000 $2, 000 Lease term 6 9 Compare for 18 years, least common multiple and same first costs. PWA(15%) = -15 K -14 K[(P/F, 15%, 6) + (P/F, 15%, 12)] - 3500(P/A 15% 18) + 1000(P/F, 15%, 18) or in code (+ -15 e 3 (PGF -14 e 3 15 6) (PGF -14 e 3 15 12) (PGF 1 e 3 15 18) (PGA -3500 15 18)) -$45, 036. 36 PWB = (+ -18 e 3 (PGA -3100 15 18) (PGF -16 e 3 15 9)(PGF 2 e 3 15 18)) = $ -41, 383. 29 ** …continued 3/15/2018 rd 4

3. Different life on leasing example at 15% MARR A B First Cost, $ -15 K -18 K Annual cost -3, 500 -3100 Deposit return, $1, 000 $2, 000 Lease term 6 9 Compare for 18 years, least common multiple and same first costs. PWA(15%) = -15 K -14 K[(P/F, 15%, 6) + (P/F, 15%, 12)] - 3500(P/A 15% 18) + 1000(P/F, 15%, 18) or in code (+ -15 e 3 (PGF -14 e 3 15 6) (PGF -14 e 3 15 12) (PGF 1 e 3 15 18) (PGA -3500 15 18)) -$45, 036. 36 PWB = (+ -18 e 3 (PGA -3100 15 18) (PGF -16 e 3 15 9)(PGF 2 e 3 15 18)) = $ -41, 383. 29 ** …continued 3/15/2018 rd 4

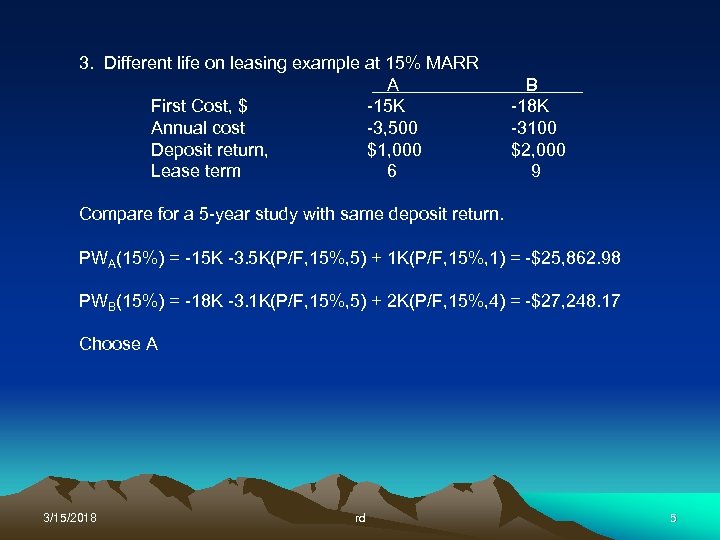

3. Different life on leasing example at 15% MARR A First Cost, $ -15 K Annual cost -3, 500 Deposit return, $1, 000 Lease term 6 B -18 K -3100 $2, 000 9 Compare for a 5 -year study with same deposit return. PWA(15%) = -15 K -3. 5 K(P/F, 15%, 5) + 1 K(P/F, 15%, 1) = -$25, 862. 98 PWB(15%) = -18 K -3. 1 K(P/F, 15%, 5) + 2 K(P/F, 15%, 4) = -$27, 248. 17 Choose A 3/15/2018 rd 5

3. Different life on leasing example at 15% MARR A First Cost, $ -15 K Annual cost -3, 500 Deposit return, $1, 000 Lease term 6 B -18 K -3100 $2, 000 9 Compare for a 5 -year study with same deposit return. PWA(15%) = -15 K -3. 5 K(P/F, 15%, 5) + 1 K(P/F, 15%, 1) = -$25, 862. 98 PWB(15%) = -18 K -3. 1 K(P/F, 15%, 5) + 2 K(P/F, 15%, 4) = -$27, 248. 17 Choose A 3/15/2018 rd 5

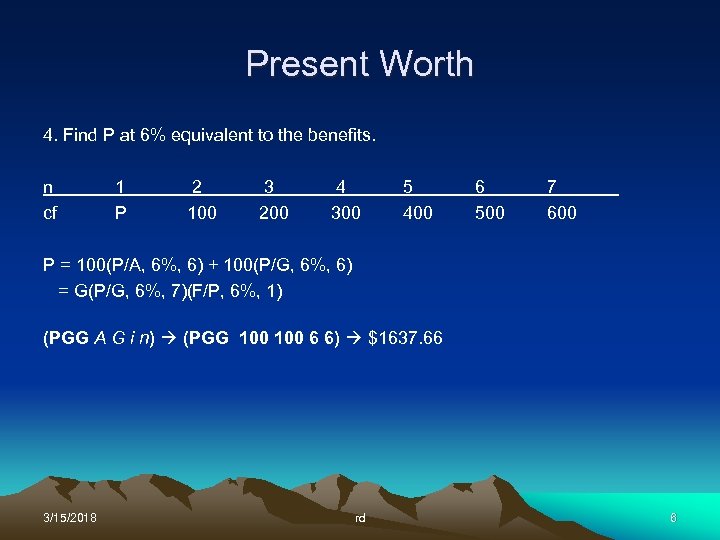

Present Worth 4. Find P at 6% equivalent to the benefits. n cf 1 P 2 100 3 200 4 300 5 400 6 500 7 600 P = 100(P/A, 6%, 6) + 100(P/G, 6%, 6) = G(P/G, 6%, 7)(F/P, 6%, 1) (PGG A G i n) (PGG 100 6 6) $1637. 66 3/15/2018 rd 6

Present Worth 4. Find P at 6% equivalent to the benefits. n cf 1 P 2 100 3 200 4 300 5 400 6 500 7 600 P = 100(P/A, 6%, 6) + 100(P/G, 6%, 6) = G(P/G, 6%, 7)(F/P, 6%, 1) (PGG A G i n) (PGG 100 6 6) $1637. 66 3/15/2018 rd 6

![Capitalized Costs P = A[(1 + i)n -1] / [i(1 + i)n] As n Capitalized Costs P = A[(1 + i)n -1] / [i(1 + i)n] As n](https://present5.com/presentation/a8d383ea6e98b5dd138c582659512d16/image-7.jpg) Capitalized Costs P = A[(1 + i)n -1] / [i(1 + i)n] As n infinity, P A/i PW = CC = A/i or A = CC * i = Pi $10, 000 at 10% can generate $1000 per year in perpetuity … N P 3/15/2018 rd 7

Capitalized Costs P = A[(1 + i)n -1] / [i(1 + i)n] As n infinity, P A/i PW = CC = A/i or A = CC * i = Pi $10, 000 at 10% can generate $1000 per year in perpetuity … N P 3/15/2018 rd 7

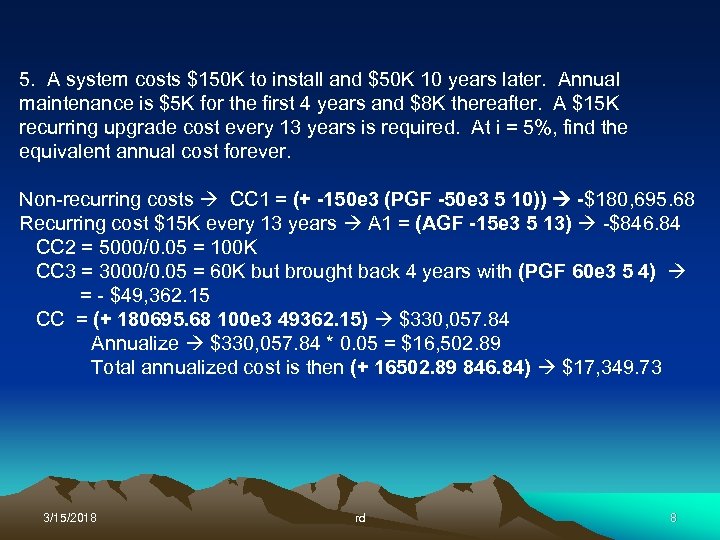

5. A system costs $150 K to install and $50 K 10 years later. Annual maintenance is $5 K for the first 4 years and $8 K thereafter. A $15 K recurring upgrade cost every 13 years is required. At i = 5%, find the equivalent annual cost forever. Non-recurring costs CC 1 = (+ -150 e 3 (PGF -50 e 3 5 10)) -$180, 695. 68 Recurring cost $15 K every 13 years A 1 = (AGF -15 e 3 5 13) -$846. 84 CC 2 = 5000/0. 05 = 100 K CC 3 = 3000/0. 05 = 60 K but brought back 4 years with (PGF 60 e 3 5 4) = - $49, 362. 15 CC = (+ 180695. 68 100 e 3 49362. 15) $330, 057. 84 Annualize $330, 057. 84 * 0. 05 = $16, 502. 89 Total annualized cost is then (+ 16502. 89 846. 84) $17, 349. 73 3/15/2018 rd 8

5. A system costs $150 K to install and $50 K 10 years later. Annual maintenance is $5 K for the first 4 years and $8 K thereafter. A $15 K recurring upgrade cost every 13 years is required. At i = 5%, find the equivalent annual cost forever. Non-recurring costs CC 1 = (+ -150 e 3 (PGF -50 e 3 5 10)) -$180, 695. 68 Recurring cost $15 K every 13 years A 1 = (AGF -15 e 3 5 13) -$846. 84 CC 2 = 5000/0. 05 = 100 K CC 3 = 3000/0. 05 = 60 K but brought back 4 years with (PGF 60 e 3 5 4) = - $49, 362. 15 CC = (+ 180695. 68 100 e 3 49362. 15) $330, 057. 84 Annualize $330, 057. 84 * 0. 05 = $16, 502. 89 Total annualized cost is then (+ 16502. 89 846. 84) $17, 349. 73 3/15/2018 rd 8

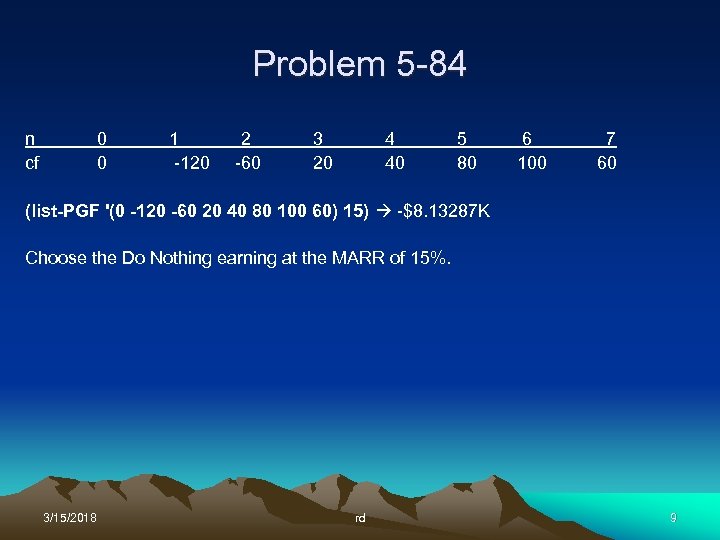

Problem 5 -84 n cf 0 0 1 -120 2 -60 3 20 4 40 5 80 6 100 7 60 (list-PGF '(0 -120 -60 20 40 80 100 60) 15) -$8. 13287 K Choose the Do Nothing earning at the MARR of 15%. 3/15/2018 rd 9

Problem 5 -84 n cf 0 0 1 -120 2 -60 3 20 4 40 5 80 6 100 7 60 (list-PGF '(0 -120 -60 20 40 80 100 60) 15) -$8. 13287 K Choose the Do Nothing earning at the MARR of 15%. 3/15/2018 rd 9

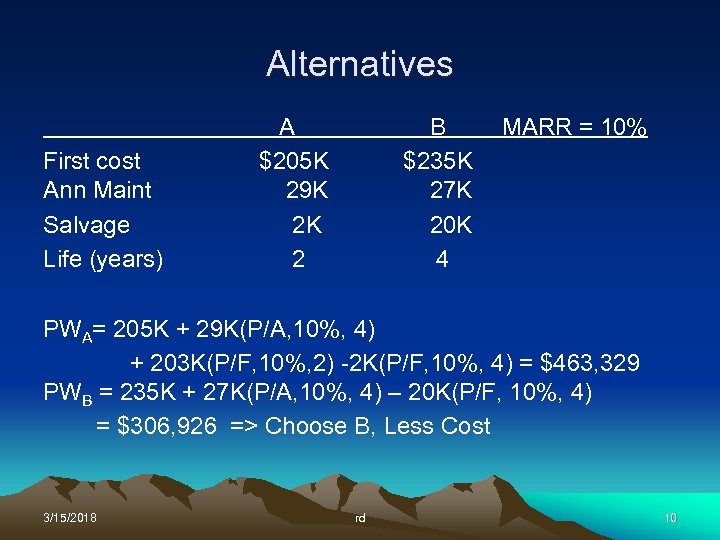

Alternatives First cost Ann Maint Salvage Life (years) A $205 K 29 K 2 K 2 B $235 K 27 K 20 K 4 MARR = 10% PWA= 205 K + 29 K(P/A, 10%, 4) + 203 K(P/F, 10%, 2) -2 K(P/F, 10%, 4) = $463, 329 PWB = 235 K + 27 K(P/A, 10%, 4) – 20 K(P/F, 10%, 4) = $306, 926 => Choose B, Less Cost 3/15/2018 rd 10

Alternatives First cost Ann Maint Salvage Life (years) A $205 K 29 K 2 K 2 B $235 K 27 K 20 K 4 MARR = 10% PWA= 205 K + 29 K(P/A, 10%, 4) + 203 K(P/F, 10%, 2) -2 K(P/F, 10%, 4) = $463, 329 PWB = 235 K + 27 K(P/A, 10%, 4) – 20 K(P/F, 10%, 4) = $306, 926 => Choose B, Less Cost 3/15/2018 rd 10

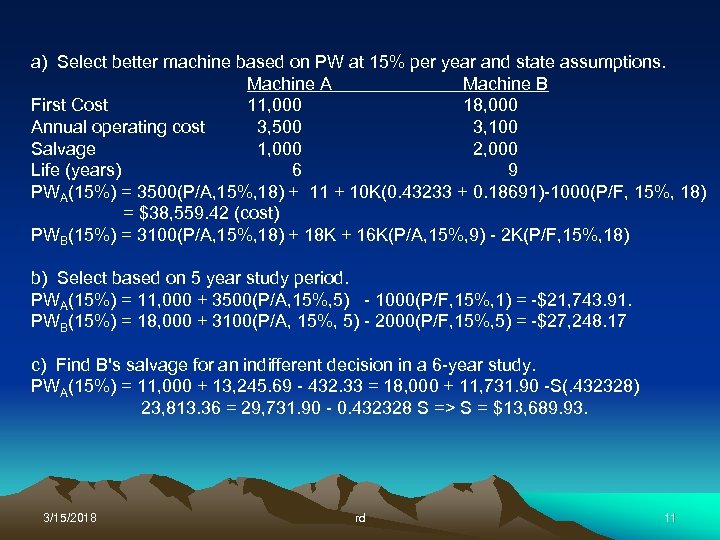

a) Select better machine based on PW at 15% per year and state assumptions. Machine A Machine B First Cost 11, 000 18, 000 Annual operating cost 3, 500 3, 100 Salvage 1, 000 2, 000 Life (years) 6 9 PWA(15%) = 3500(P/A, 15%, 18) + 11 + 10 K(0. 43233 + 0. 18691)-1000(P/F, 15%, 18) = $38, 559. 42 (cost) PWB(15%) = 3100(P/A, 15%, 18) + 18 K + 16 K(P/A, 15%, 9) - 2 K(P/F, 15%, 18) b) Select based on 5 year study period. PWA(15%) = 11, 000 + 3500(P/A, 15%, 5) - 1000(P/F, 15%, 1) = -$21, 743. 91. PWB(15%) = 18, 000 + 3100(P/A, 15%, 5) - 2000(P/F, 15%, 5) = -$27, 248. 17 c) Find B's salvage for an indifferent decision in a 6 -year study. PWA(15%) = 11, 000 + 13, 245. 69 - 432. 33 = 18, 000 + 11, 731. 90 -S(. 432328) 23, 813. 36 = 29, 731. 90 - 0. 432328 S => S = $13, 689. 93. 3/15/2018 rd 11

a) Select better machine based on PW at 15% per year and state assumptions. Machine A Machine B First Cost 11, 000 18, 000 Annual operating cost 3, 500 3, 100 Salvage 1, 000 2, 000 Life (years) 6 9 PWA(15%) = 3500(P/A, 15%, 18) + 11 + 10 K(0. 43233 + 0. 18691)-1000(P/F, 15%, 18) = $38, 559. 42 (cost) PWB(15%) = 3100(P/A, 15%, 18) + 18 K + 16 K(P/A, 15%, 9) - 2 K(P/F, 15%, 18) b) Select based on 5 year study period. PWA(15%) = 11, 000 + 3500(P/A, 15%, 5) - 1000(P/F, 15%, 1) = -$21, 743. 91. PWB(15%) = 18, 000 + 3100(P/A, 15%, 5) - 2000(P/F, 15%, 5) = -$27, 248. 17 c) Find B's salvage for an indifferent decision in a 6 -year study. PWA(15%) = 11, 000 + 13, 245. 69 - 432. 33 = 18, 000 + 11, 731. 90 -S(. 432328) 23, 813. 36 = 29, 731. 90 - 0. 432328 S => S = $13, 689. 93. 3/15/2018 rd 11

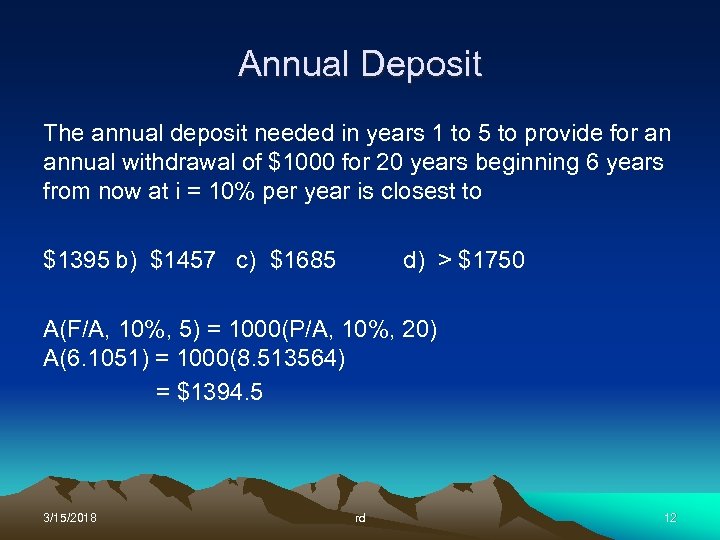

Annual Deposit The annual deposit needed in years 1 to 5 to provide for an annual withdrawal of $1000 for 20 years beginning 6 years from now at i = 10% per year is closest to $1395 b) $1457 c) $1685 d) > $1750 A(F/A, 10%, 5) = 1000(P/A, 10%, 20) A(6. 1051) = 1000(8. 513564) = $1394. 5 3/15/2018 rd 12

Annual Deposit The annual deposit needed in years 1 to 5 to provide for an annual withdrawal of $1000 for 20 years beginning 6 years from now at i = 10% per year is closest to $1395 b) $1457 c) $1685 d) > $1750 A(F/A, 10%, 5) = 1000(P/A, 10%, 20) A(6. 1051) = 1000(8. 513564) = $1394. 5 3/15/2018 rd 12

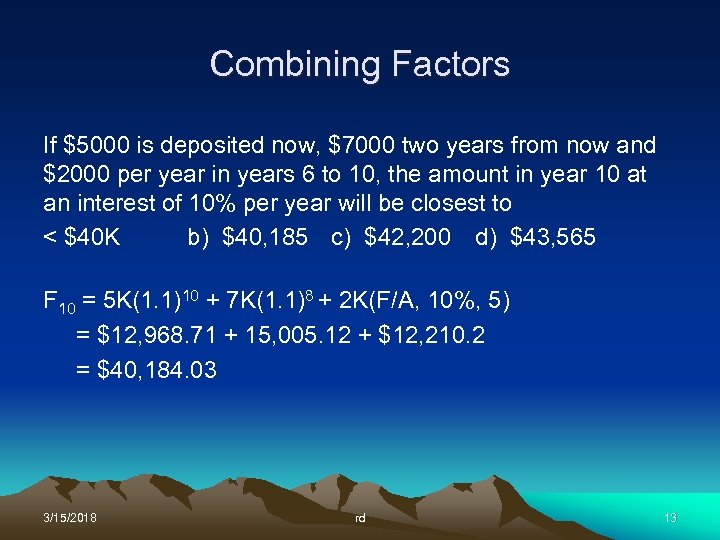

Combining Factors If $5000 is deposited now, $7000 two years from now and $2000 per year in years 6 to 10, the amount in year 10 at an interest of 10% per year will be closest to < $40 K b) $40, 185 c) $42, 200 d) $43, 565 F 10 = 5 K(1. 1)10 + 7 K(1. 1)8 + 2 K(F/A, 10%, 5) = $12, 968. 71 + 15, 005. 12 + $12, 210. 2 = $40, 184. 03 3/15/2018 rd 13

Combining Factors If $5000 is deposited now, $7000 two years from now and $2000 per year in years 6 to 10, the amount in year 10 at an interest of 10% per year will be closest to < $40 K b) $40, 185 c) $42, 200 d) $43, 565 F 10 = 5 K(1. 1)10 + 7 K(1. 1)8 + 2 K(F/A, 10%, 5) = $12, 968. 71 + 15, 005. 12 + $12, 210. 2 = $40, 184. 03 3/15/2018 rd 13

Perpetuity With interest at 8% compounded annually, how much money is needed to provide a perpetual income of $14, 316 per year? P = (/ 14316 0. 08) $178, 950 3/15/2018 rd 14

Perpetuity With interest at 8% compounded annually, how much money is needed to provide a perpetual income of $14, 316 per year? P = (/ 14316 0. 08) $178, 950 3/15/2018 rd 14

Education You want to deposit $8, 000 per year for 4 years of your child's education on the 18 th birthday. Today is your child's first birthday. At 12% interest , how much to deposit today? a) $24, 298 b) $3538 c) $32, 000 d) $3963 3/15/2018 rd 15

Education You want to deposit $8, 000 per year for 4 years of your child's education on the 18 th birthday. Today is your child's first birthday. At 12% interest , how much to deposit today? a) $24, 298 b) $3538 c) $32, 000 d) $3963 3/15/2018 rd 15