Risk.ppt

- Количество слайдов: 45

Prerequisites Almost essential Consumption and Uncertainty Frank Cowell: Microeconomics November 2006 Risk MICROECONOMICS Principles and Analysis Frank Cowell

Prerequisites Almost essential Consumption and Uncertainty Frank Cowell: Microeconomics November 2006 Risk MICROECONOMICS Principles and Analysis Frank Cowell

Risk and uncertainty Frank Cowell: Microeconomics n n In dealing with uncertainty a lot can be done without introducing probability. Now we introduce a specific probability model u u n n This could be some kind of exogenous mechanism Could just involve individual’s perceptions Facilitates discussion of risk Introduces new way of modelling preferences

Risk and uncertainty Frank Cowell: Microeconomics n n In dealing with uncertainty a lot can be done without introducing probability. Now we introduce a specific probability model u u n n This could be some kind of exogenous mechanism Could just involve individual’s perceptions Facilitates discussion of risk Introduces new way of modelling preferences

Overview. . . Risk Frank Cowell: Microeconomics Probability An explicit tool for model building Risk comparisons Special Cases Lotteries

Overview. . . Risk Frank Cowell: Microeconomics Probability An explicit tool for model building Risk comparisons Special Cases Lotteries

Probability Frank Cowell: Microeconomics What type of probability model? Lottery n A number of reasonable versions: n government policy? Public observable u Public announced coin flip u Private objective emerges from structure of preferences. u Private subjective u n Need a way of appropriately representing probabilities in economic models.

Probability Frank Cowell: Microeconomics What type of probability model? Lottery n A number of reasonable versions: n government policy? Public observable u Public announced coin flip u Private objective emerges from structure of preferences. u Private subjective u n Need a way of appropriately representing probabilities in economic models.

Ingredients of a probability model Frank Cowell: Microeconomics n We need to define the support of the distribution u u n Distribution function F u u n The smallest closed set whose complement has probability zero Convenient way of specifying what is logically feasible (points in the support) and infeasible (other points). Represents probability in a convenient and general way. Encompass both discrete and continuous distributions. Discrete distributions can be represented as a vector Continuous distribution – usually specify density a collection of function Take some particular cases: examples

Ingredients of a probability model Frank Cowell: Microeconomics n We need to define the support of the distribution u u n Distribution function F u u n The smallest closed set whose complement has probability zero Convenient way of specifying what is logically feasible (points in the support) and infeasible (other points). Represents probability in a convenient and general way. Encompass both discrete and continuous distributions. Discrete distributions can be represented as a vector Continuous distribution – usually specify density a collection of function Take some particular cases: examples

Some examples Frank Cowell: Microeconomics n Begin with two cases of discrete distributions u u n Then a simple example of continuous distribution with bounded support u n #W = 2. Probability p of value x 0; probability 1–p of value x 1. #W = 5. Probability pi of value xi, i = 0, . . . , 4. The rectangular distribution – uniform density over an interval. Finally an example of continuous distribution with unbounded support

Some examples Frank Cowell: Microeconomics n Begin with two cases of discrete distributions u u n Then a simple example of continuous distribution with bounded support u n #W = 2. Probability p of value x 0; probability 1–p of value x 1. #W = 5. Probability pi of value xi, i = 0, . . . , 4. The rectangular distribution – uniform density over an interval. Finally an example of continuous distribution with unbounded support

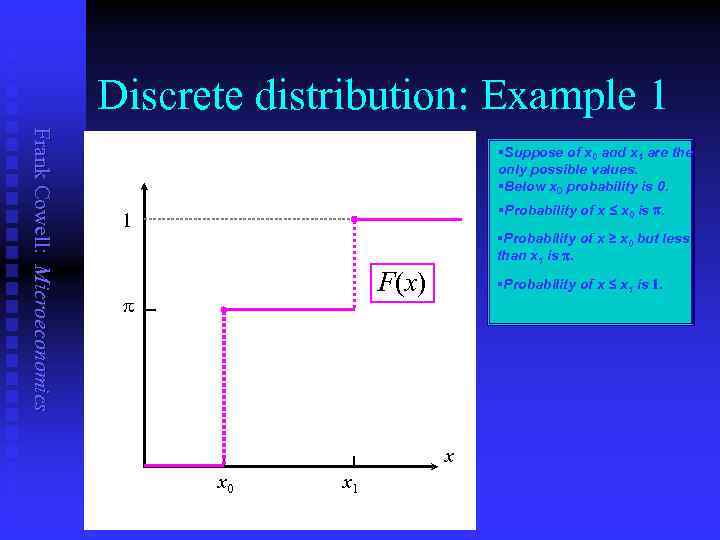

Discrete distribution: Example 1 Frank Cowell: Microeconomics §Suppose of x 0 and x 1 are the only possible values. §Below x 0 probability is 0. §Probability of x ≤ x 0 is p. 1 §Probability of x ≥ x 0 but less than x 1 is p. F(x) p §Probability of x ≤ x 1 is 1. x x 0 x 1

Discrete distribution: Example 1 Frank Cowell: Microeconomics §Suppose of x 0 and x 1 are the only possible values. §Below x 0 probability is 0. §Probability of x ≤ x 0 is p. 1 §Probability of x ≥ x 0 but less than x 1 is p. F(x) p §Probability of x ≤ x 1 is 1. x x 0 x 1

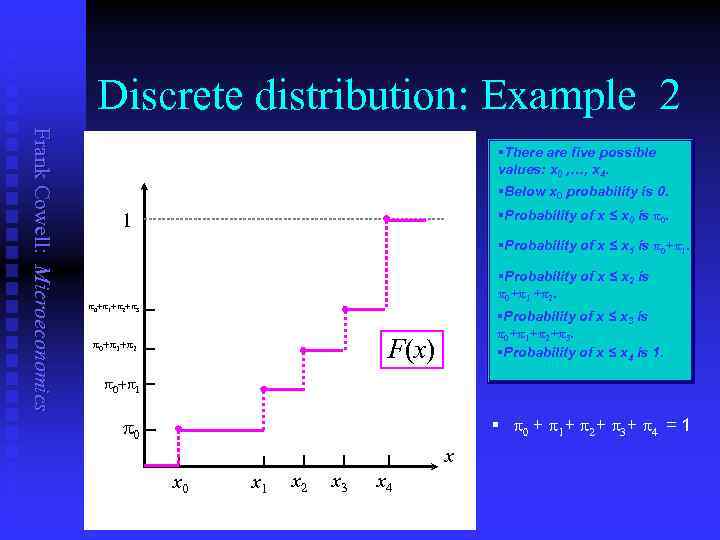

Discrete distribution: Example 2 Frank Cowell: Microeconomics §There are five possible values: x 0 , …, x 4. §Below x 0 probability is 0. §Probability of x ≤ x 0 is p 0. 1 §Probability of x ≤ x 1 is p 0+p 1. §Probability of x ≤ x 2 is p 0+p 1 +p 2. p 0+p 1+p 2+p 3 §Probability of x ≤ x 3 is p 0+p 1+p 2+p 3. §Probability of x ≤ x 4 is 1. F(x) p 0+p 1+p 2 p 0+p 1 § p 0 + p 1 + p 2 + p 3 + p 4 = 1 p 0 x x 0 x 1 x 2 x 3 x 4

Discrete distribution: Example 2 Frank Cowell: Microeconomics §There are five possible values: x 0 , …, x 4. §Below x 0 probability is 0. §Probability of x ≤ x 0 is p 0. 1 §Probability of x ≤ x 1 is p 0+p 1. §Probability of x ≤ x 2 is p 0+p 1 +p 2. p 0+p 1+p 2+p 3 §Probability of x ≤ x 3 is p 0+p 1+p 2+p 3. §Probability of x ≤ x 4 is 1. F(x) p 0+p 1+p 2 p 0+p 1 § p 0 + p 1 + p 2 + p 3 + p 4 = 1 p 0 x x 0 x 1 x 2 x 3 x 4

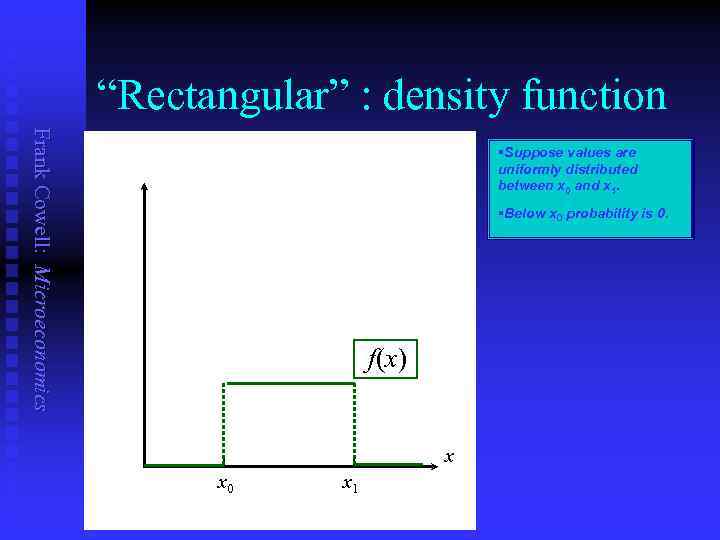

“Rectangular” : density function Frank Cowell: Microeconomics §Suppose values are uniformly distributed between x 0 and x 1. §Below x 0 probability is 0. f(x) x x 0 x 1

“Rectangular” : density function Frank Cowell: Microeconomics §Suppose values are uniformly distributed between x 0 and x 1. §Below x 0 probability is 0. f(x) x x 0 x 1

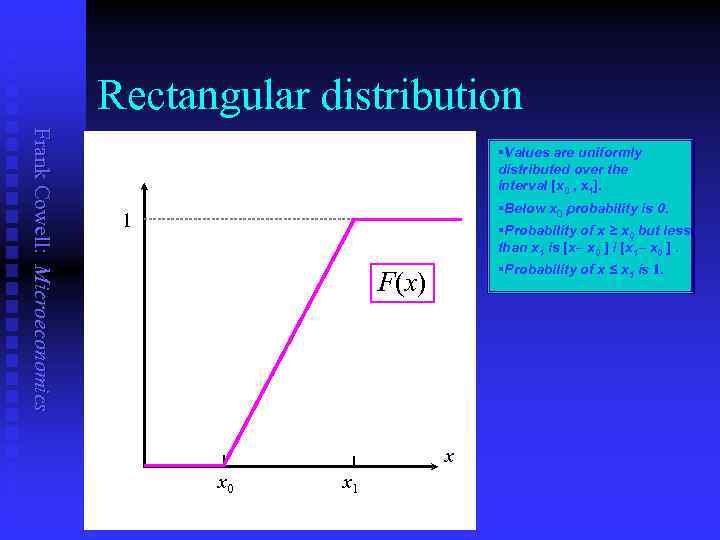

Rectangular distribution Frank Cowell: Microeconomics §Values are uniformly distributed over the interval [x 0 , x 1]. §Below x 0 probability is 0. §Probability of x ≥ x 0 but less than x 1 is [x x 0 ] / [x 1 x 0 ]. 1 §Probability of x ≤ x 1 is 1. F(x) x x 0 x 1

Rectangular distribution Frank Cowell: Microeconomics §Values are uniformly distributed over the interval [x 0 , x 1]. §Below x 0 probability is 0. §Probability of x ≥ x 0 but less than x 1 is [x x 0 ] / [x 1 x 0 ]. 1 §Probability of x ≤ x 1 is 1. F(x) x x 0 x 1

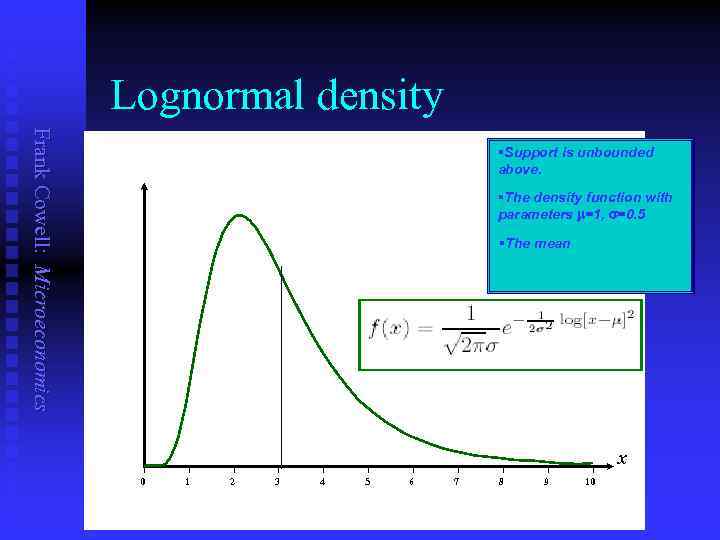

Lognormal density Frank Cowell: Microeconomics §Support is unbounded above. §The density function with parameters m=1, s=0. 5 §The mean x 0 1 2 3 4 5 6 7 8 9 10

Lognormal density Frank Cowell: Microeconomics §Support is unbounded above. §The density function with parameters m=1, s=0. 5 §The mean x 0 1 2 3 4 5 6 7 8 9 10

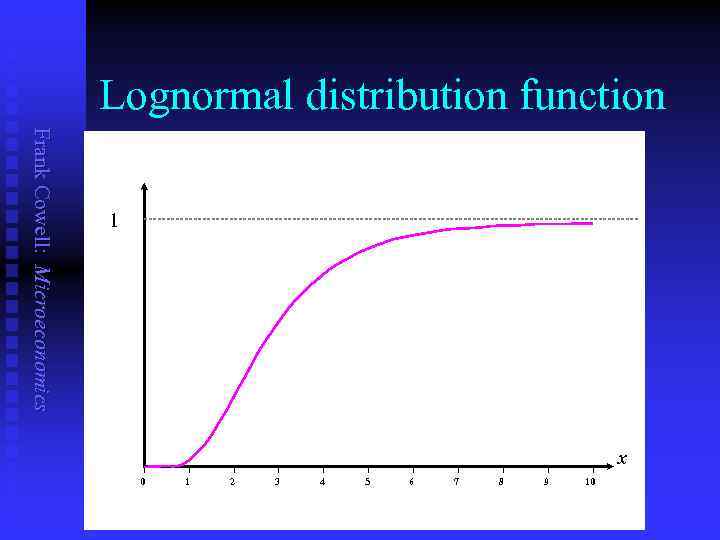

Lognormal distribution function Frank Cowell: Microeconomics 1 x 10 9 8 7 6 5 4 3 2 1 0

Lognormal distribution function Frank Cowell: Microeconomics 1 x 10 9 8 7 6 5 4 3 2 1 0

Overview. . . Risk Frank Cowell: Microeconomics Probability Shape of the ufunction and attitude to risk Risk comparisons Special Cases Lotteries

Overview. . . Risk Frank Cowell: Microeconomics Probability Shape of the ufunction and attitude to risk Risk comparisons Special Cases Lotteries

Risk aversion and the function u Frank Cowell: Microeconomics n n With a probability model it makes sense to discuss risk attitudes in terms of gambles Can do this in terms of properties of “felicity” or “cardinal utility” function u u u n n n Scale and origin of u are irrelevant But the curvature of u is important. We can capture this in more than one way We will investigate the standard approaches. . . and then introduce two useful definitions

Risk aversion and the function u Frank Cowell: Microeconomics n n With a probability model it makes sense to discuss risk attitudes in terms of gambles Can do this in terms of properties of “felicity” or “cardinal utility” function u u u n n n Scale and origin of u are irrelevant But the curvature of u is important. We can capture this in more than one way We will investigate the standard approaches. . . and then introduce two useful definitions

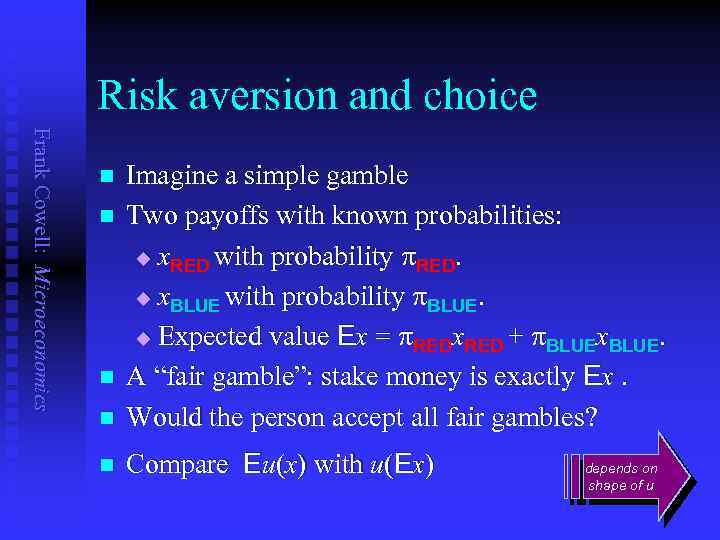

Risk aversion and choice Frank Cowell: Microeconomics n Imagine a simple gamble Two payoffs with known probabilities: u x. RED with probability p. RED. u x. BLUE with probability p. BLUE. u Expected value Ex = p. REDx. RED + p. BLUEx. BLUE. A “fair gamble”: stake money is exactly Ex. Would the person accept all fair gambles? n Compare Eu(x) with u(Ex) n n n depends on shape of u

Risk aversion and choice Frank Cowell: Microeconomics n Imagine a simple gamble Two payoffs with known probabilities: u x. RED with probability p. RED. u x. BLUE with probability p. BLUE. u Expected value Ex = p. REDx. RED + p. BLUEx. BLUE. A “fair gamble”: stake money is exactly Ex. Would the person accept all fair gambles? n Compare Eu(x) with u(Ex) n n n depends on shape of u

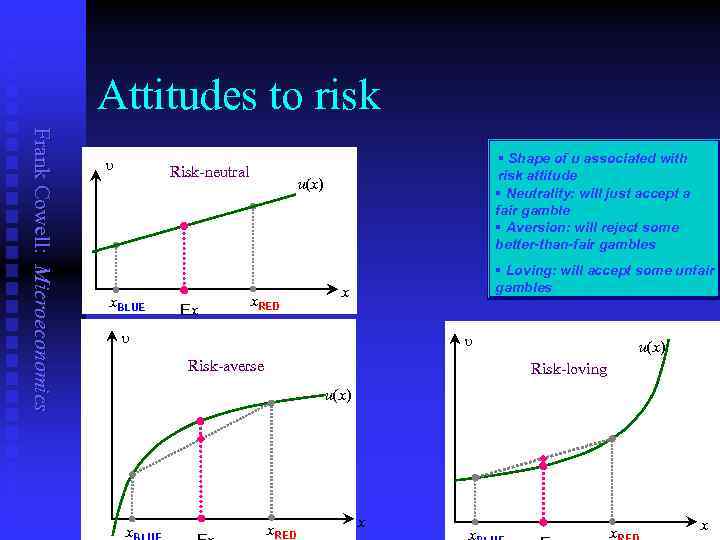

Attitudes to risk Frank Cowell: Microeconomics u Risk-neutral x. BLUE Ex § Shape of u associated with risk attitude § Neutrality: will just accept a fair gamble § Aversion: will reject some better-than-fair gambles u(x) x. RED § Loving: will accept some unfair gambles x u u Risk-averse u(x) Risk-loving u(x) x x. RED x x

Attitudes to risk Frank Cowell: Microeconomics u Risk-neutral x. BLUE Ex § Shape of u associated with risk attitude § Neutrality: will just accept a fair gamble § Aversion: will reject some better-than-fair gambles u(x) x. RED § Loving: will accept some unfair gambles x u u Risk-averse u(x) Risk-loving u(x) x x. RED x x

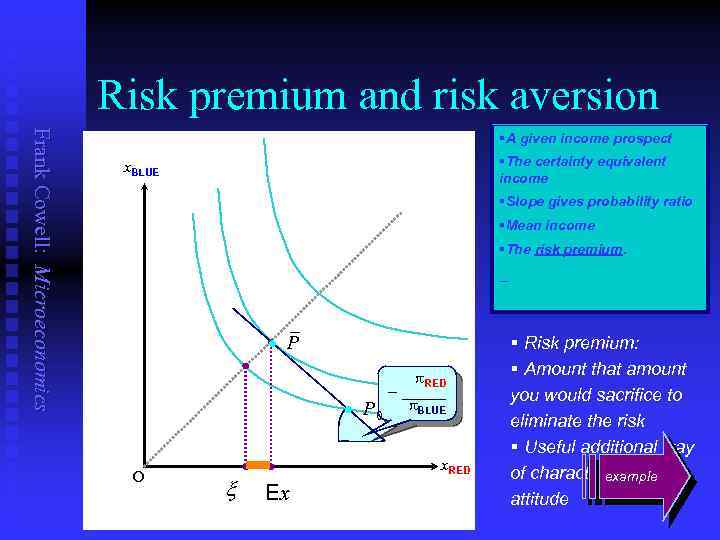

Risk premium and risk aversion Frank Cowell: Microeconomics §A given income prospect §The certainty equivalent income x. BLUE §Slope gives probability ratio §Mean income §The risk premium. _ – P P 0 O x p. RED – _____ p. BLUE x. RED Ex § Risk premium: § Amount that amount you would sacrifice to eliminate the risk § Useful additional way of characterising risk example attitude

Risk premium and risk aversion Frank Cowell: Microeconomics §A given income prospect §The certainty equivalent income x. BLUE §Slope gives probability ratio §Mean income §The risk premium. _ – P P 0 O x p. RED – _____ p. BLUE x. RED Ex § Risk premium: § Amount that amount you would sacrifice to eliminate the risk § Useful additional way of characterising risk example attitude

An example. . . Frank Cowell: Microeconomics Two-state model n Subjective probabilities (0. 25, 0. 75) n Single-commodity payoff in each case n

An example. . . Frank Cowell: Microeconomics Two-state model n Subjective probabilities (0. 25, 0. 75) n Single-commodity payoff in each case n

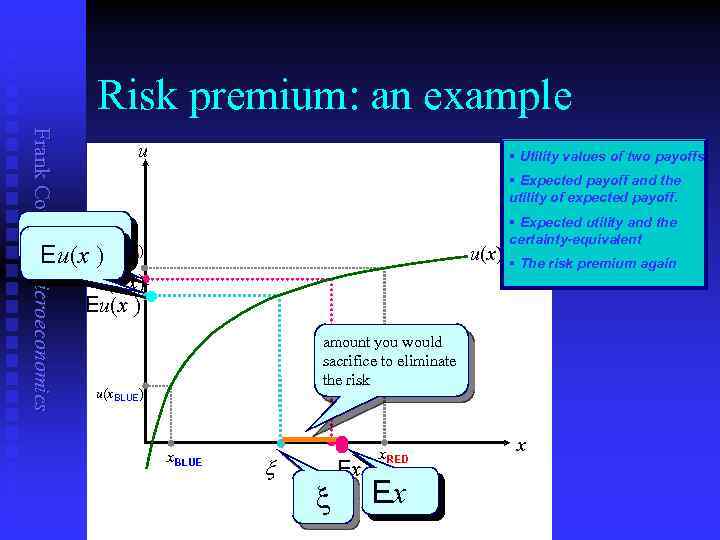

Risk premium: an example Frank Cowell: Microeconomics u § Utility values of two payoffs § Expected payoff and the utility of expected payoff. u(Ex) Eu(x )u(x u(x) RED) u(Ex) Eu(x ) § Expected utility and the certainty-equivalent § The risk premium again amount you would sacrifice to eliminate the risk u(x. BLUE) x. BLUE x x Ex x. RED Ex x

Risk premium: an example Frank Cowell: Microeconomics u § Utility values of two payoffs § Expected payoff and the utility of expected payoff. u(Ex) Eu(x )u(x u(x) RED) u(Ex) Eu(x ) § Expected utility and the certainty-equivalent § The risk premium again amount you would sacrifice to eliminate the risk u(x. BLUE) x. BLUE x x Ex x. RED Ex x

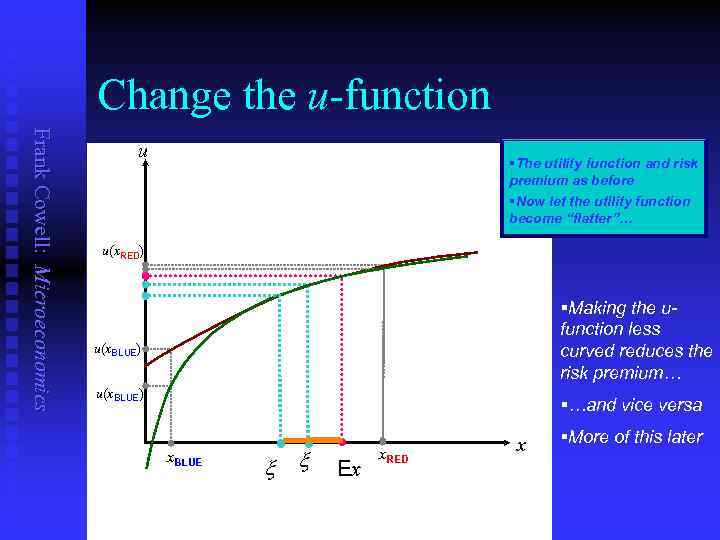

Change the u-function Frank Cowell: Microeconomics u §The utility function and risk premium as before §Now let the utility function become “flatter”… u(x. RED) §Making the ufunction less curved reduces the risk premium… u(x. BLUE) §…and vice versa x. BLUE x x Ex x. RED x §More of this later

Change the u-function Frank Cowell: Microeconomics u §The utility function and risk premium as before §Now let the utility function become “flatter”… u(x. RED) §Making the ufunction less curved reduces the risk premium… u(x. BLUE) §…and vice versa x. BLUE x x Ex x. RED x §More of this later

An index of risk aversion? Frank Cowell: Microeconomics n Risk aversion associated with shape of u u u n n n second derivative or “curvature” But could we summarise it in a simple index or measure? Then we could easily characterise one person as more/less risk averse than another There is more than one way of doing this

An index of risk aversion? Frank Cowell: Microeconomics n Risk aversion associated with shape of u u u n n n second derivative or “curvature” But could we summarise it in a simple index or measure? Then we could easily characterise one person as more/less risk averse than another There is more than one way of doing this

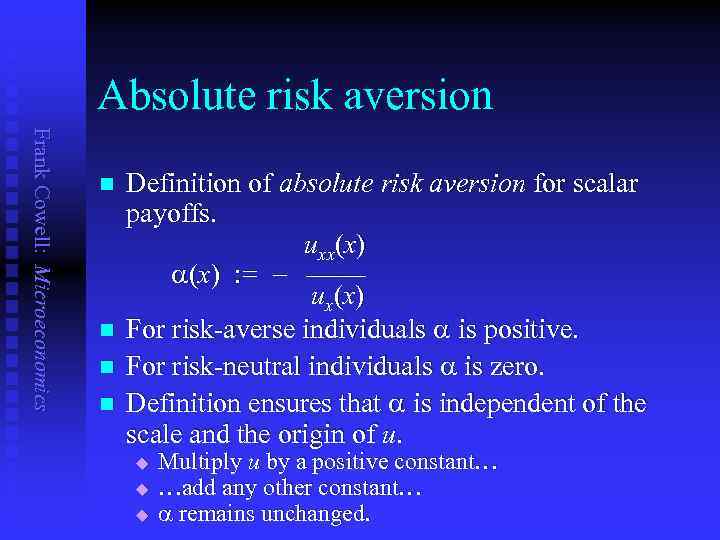

Absolute risk aversion Frank Cowell: Microeconomics n n Definition of absolute risk aversion for scalar payoffs. uxx (x) a(x) : = ux(x) For risk-averse individuals a is positive. For risk-neutral individuals a is zero. Definition ensures that a is independent of the scale and the origin of u. u u u Multiply u by a positive constant… …add any other constant… a remains unchanged.

Absolute risk aversion Frank Cowell: Microeconomics n n Definition of absolute risk aversion for scalar payoffs. uxx (x) a(x) : = ux(x) For risk-averse individuals a is positive. For risk-neutral individuals a is zero. Definition ensures that a is independent of the scale and the origin of u. u u u Multiply u by a positive constant… …add any other constant… a remains unchanged.

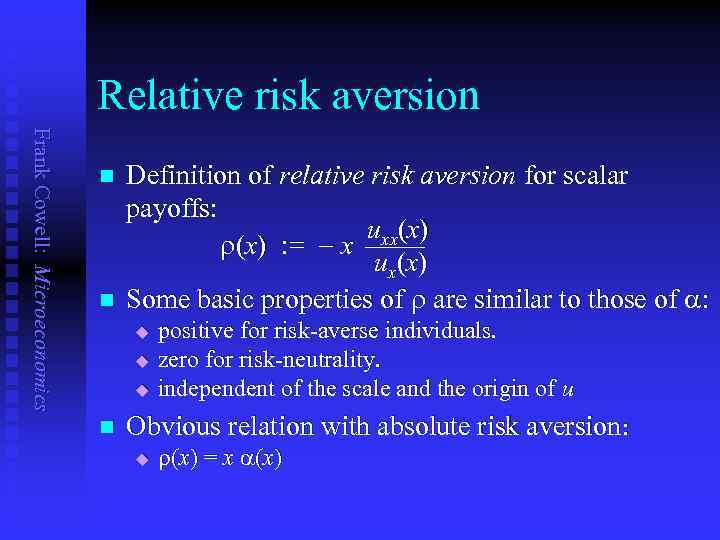

Relative risk aversion Frank Cowell: Microeconomics n n Definition of relative risk aversion for scalar payoffs: uxx(x) r(x) : = x ux(x) Some basic properties of r are similar to those of a: u u u n positive for risk-averse individuals. zero for risk-neutrality. independent of the scale and the origin of u Obvious relation with absolute risk aversion: u r(x) = x a(x)

Relative risk aversion Frank Cowell: Microeconomics n n Definition of relative risk aversion for scalar payoffs: uxx(x) r(x) : = x ux(x) Some basic properties of r are similar to those of a: u u u n positive for risk-averse individuals. zero for risk-neutrality. independent of the scale and the origin of u Obvious relation with absolute risk aversion: u r(x) = x a(x)

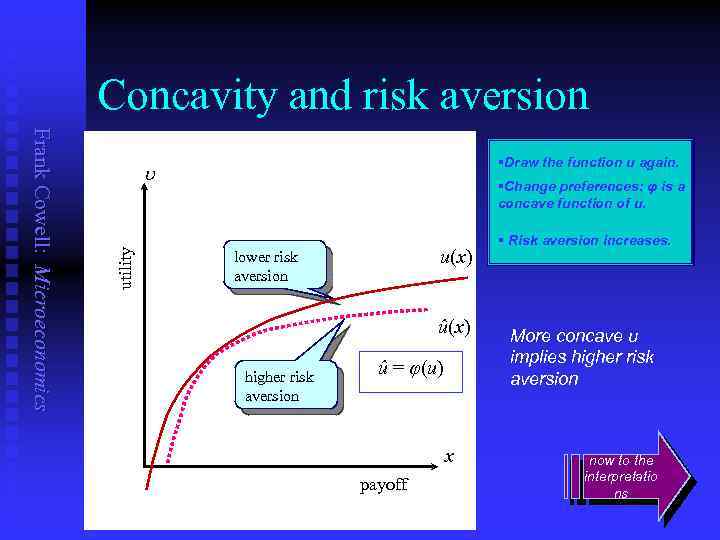

Concavity and risk aversion u utility Frank Cowell: Microeconomics §Draw the function u again. §Change preferences: φ is a concave function of u. u(x) lower risk aversion û(x) higher risk aversion û = φ(u) x payoff § Risk aversion increases. More concave u implies higher risk aversion now to the interpretatio ns

Concavity and risk aversion u utility Frank Cowell: Microeconomics §Draw the function u again. §Change preferences: φ is a concave function of u. u(x) lower risk aversion û(x) higher risk aversion û = φ(u) x payoff § Risk aversion increases. More concave u implies higher risk aversion now to the interpretatio ns

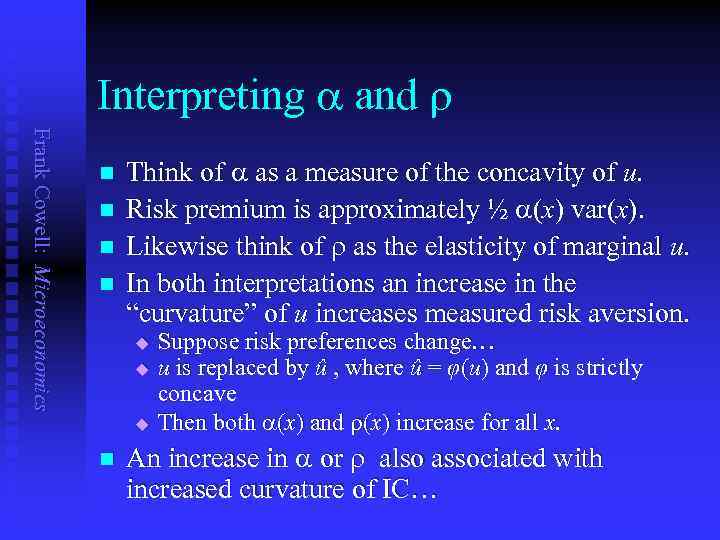

Interpreting a and r Frank Cowell: Microeconomics n n Think of a as a measure of the concavity of u. Risk premium is approximately ½ a(x) var(x). Likewise think of r as the elasticity of marginal u. In both interpretations an increase in the “curvature” of u increases measured risk aversion. u u u n Suppose risk preferences change… u is replaced by û , where û = φ(u) and φ is strictly concave Then both a(x) and r(x) increase for all x. An increase in a or r also associated with increased curvature of IC…

Interpreting a and r Frank Cowell: Microeconomics n n Think of a as a measure of the concavity of u. Risk premium is approximately ½ a(x) var(x). Likewise think of r as the elasticity of marginal u. In both interpretations an increase in the “curvature” of u increases measured risk aversion. u u u n Suppose risk preferences change… u is replaced by û , where û = φ(u) and φ is strictly concave Then both a(x) and r(x) increase for all x. An increase in a or r also associated with increased curvature of IC…

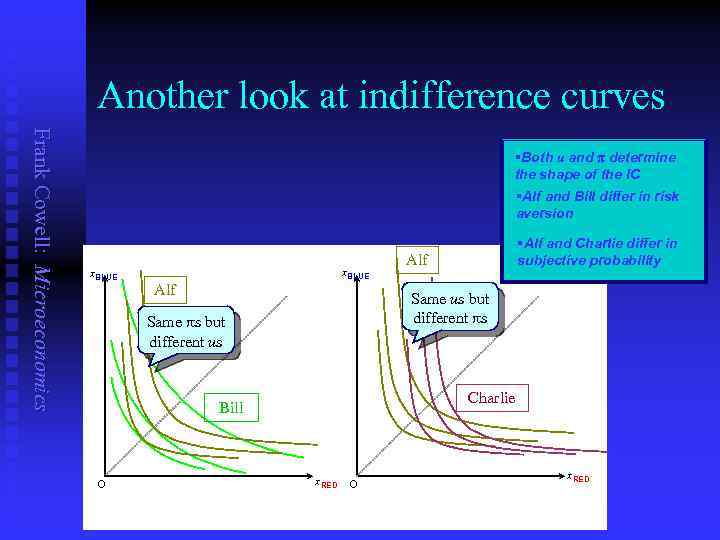

Another look at indifference curves Frank Cowell: Microeconomics §Both u and p determine the shape of the IC §Alf and Bill differ in risk aversion x. BLUE Alf Same us but different ps Same ps but different us Charlie Bill O §Alf and Charlie differ in subjective probability x. RED O x. RED

Another look at indifference curves Frank Cowell: Microeconomics §Both u and p determine the shape of the IC §Alf and Bill differ in risk aversion x. BLUE Alf Same us but different ps Same ps but different us Charlie Bill O §Alf and Charlie differ in subjective probability x. RED O x. RED

Overview. . . Risk Frank Cowell: Microeconomics Probability CARA and CRRA Risk comparisons Special Cases Lotteries

Overview. . . Risk Frank Cowell: Microeconomics Probability CARA and CRRA Risk comparisons Special Cases Lotteries

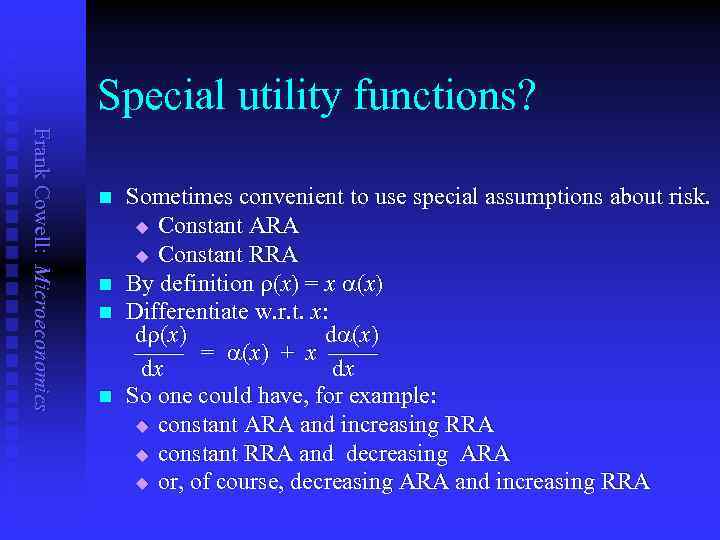

Special utility functions? Frank Cowell: Microeconomics n n Sometimes convenient to use special assumptions about risk. u Constant ARA u Constant RRA By definition r(x) = x a(x) Differentiate w. r. t. x: dr(x) da(x) = a(x) + x dx dx So one could have, for example: u constant ARA and increasing RRA u constant RRA and decreasing ARA u or, of course, decreasing ARA and increasing RRA

Special utility functions? Frank Cowell: Microeconomics n n Sometimes convenient to use special assumptions about risk. u Constant ARA u Constant RRA By definition r(x) = x a(x) Differentiate w. r. t. x: dr(x) da(x) = a(x) + x dx dx So one could have, for example: u constant ARA and increasing RRA u constant RRA and decreasing ARA u or, of course, decreasing ARA and increasing RRA

Special case 1: CARA Frank Cowell: Microeconomics n n n We take a special case of risk preferences Assume that a(x) = a for all x Felicity function must take the form 1 ax u(x) : = e a Constant Absolute Risk Aversion This induces a distinctive pattern of indifference curves. . .

Special case 1: CARA Frank Cowell: Microeconomics n n n We take a special case of risk preferences Assume that a(x) = a for all x Felicity function must take the form 1 ax u(x) : = e a Constant Absolute Risk Aversion This induces a distinctive pattern of indifference curves. . .

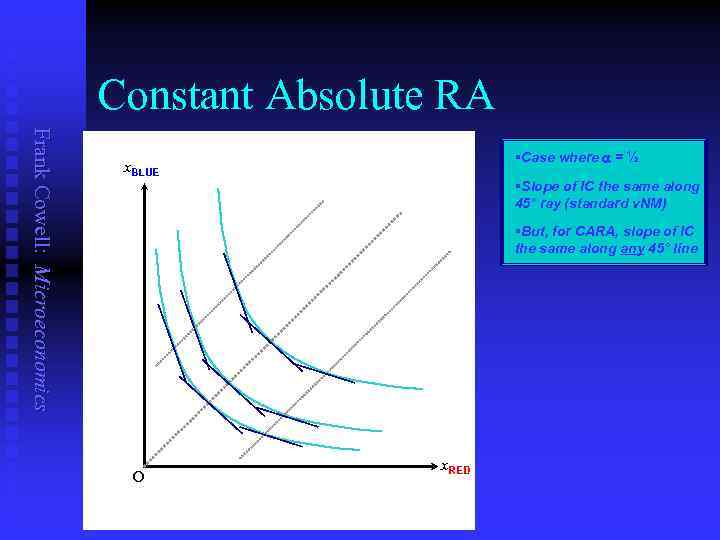

Constant Absolute RA Frank Cowell: Microeconomics §Case where a = ½ x. BLUE §Slope of IC the same along 45° ray (standard v. NM) §But, for CARA, slope of IC the same along any 45° line O x. RED

Constant Absolute RA Frank Cowell: Microeconomics §Case where a = ½ x. BLUE §Slope of IC the same along 45° ray (standard v. NM) §But, for CARA, slope of IC the same along any 45° line O x. RED

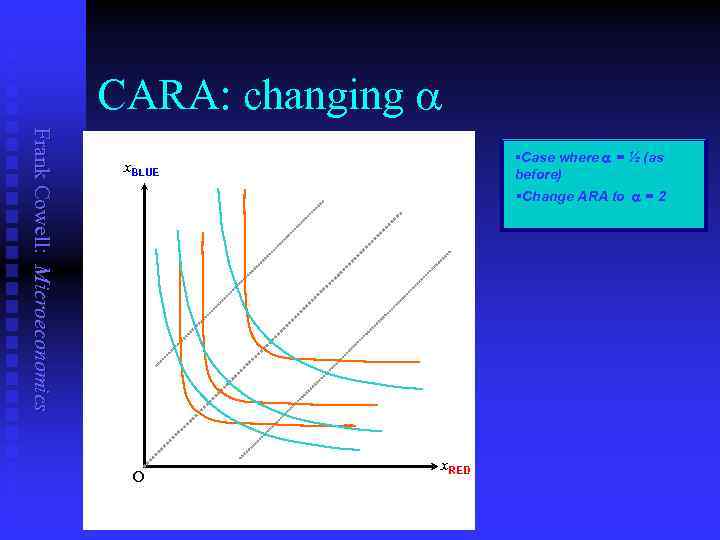

CARA: changing a Frank Cowell: Microeconomics §Case where a = ½ (as before) x. BLUE §Change ARA to a = 2 O x. RED

CARA: changing a Frank Cowell: Microeconomics §Case where a = ½ (as before) x. BLUE §Change ARA to a = 2 O x. RED

Special case 2: CRRA Frank Cowell: Microeconomics n n n Another important special case of risk preferences. Assume that r(x) = r for all x. Felicity function must take the form 1 u(x) : = x 1 r 1 r n n Constant Relative Risk Aversion Again induces a distinctive pattern of indifference curves. . .

Special case 2: CRRA Frank Cowell: Microeconomics n n n Another important special case of risk preferences. Assume that r(x) = r for all x. Felicity function must take the form 1 u(x) : = x 1 r 1 r n n Constant Relative Risk Aversion Again induces a distinctive pattern of indifference curves. . .

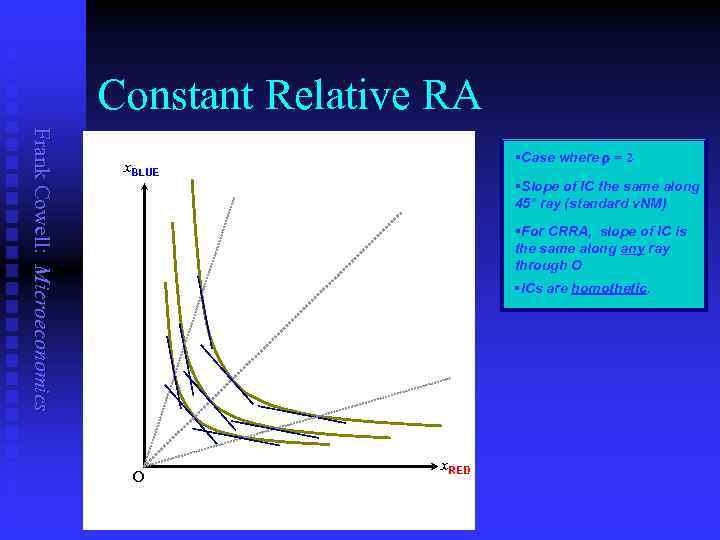

Constant Relative RA Frank Cowell: Microeconomics §Case where r = 2 x. BLUE §Slope of IC the same along 45° ray (standard v. NM) §For CRRA, slope of IC is the same along any ray through O §ICs are homothetic. O x. RED

Constant Relative RA Frank Cowell: Microeconomics §Case where r = 2 x. BLUE §Slope of IC the same along 45° ray (standard v. NM) §For CRRA, slope of IC is the same along any ray through O §ICs are homothetic. O x. RED

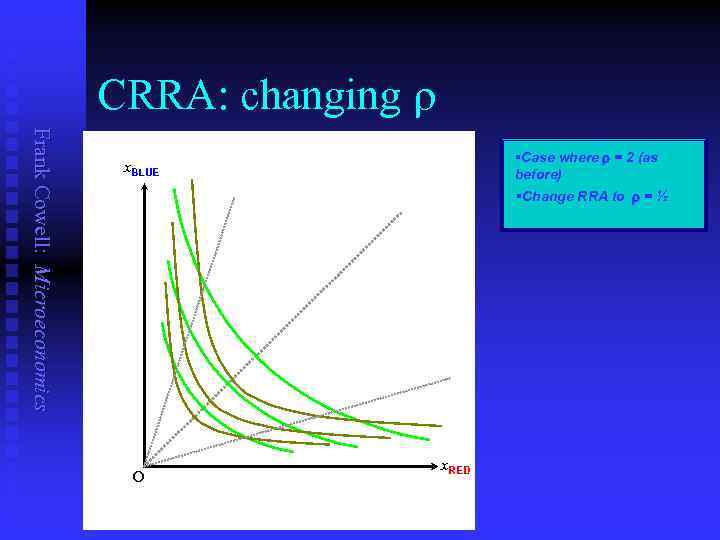

CRRA: changing r Frank Cowell: Microeconomics §Case where r = 2 (as before) x. BLUE §Change RRA to r = ½ O x. RED

CRRA: changing r Frank Cowell: Microeconomics §Case where r = 2 (as before) x. BLUE §Change RRA to r = ½ O x. RED

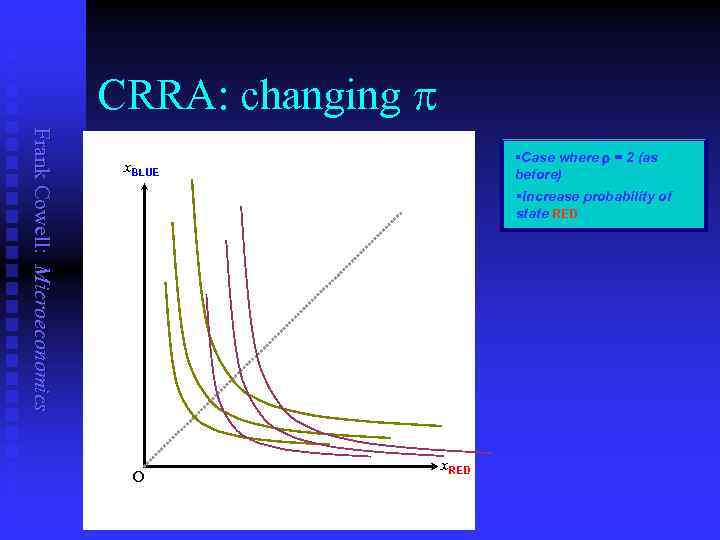

CRRA: changing p Frank Cowell: Microeconomics §Case where r = 2 (as before) x. BLUE §Increase probability of state RED O x. RED

CRRA: changing p Frank Cowell: Microeconomics §Case where r = 2 (as before) x. BLUE §Increase probability of state RED O x. RED

Overview. . . Risk Frank Cowell: Microeconomics Probability distributions as objects of choice Risk comparisons Special Cases Lotteries

Overview. . . Risk Frank Cowell: Microeconomics Probability distributions as objects of choice Risk comparisons Special Cases Lotteries

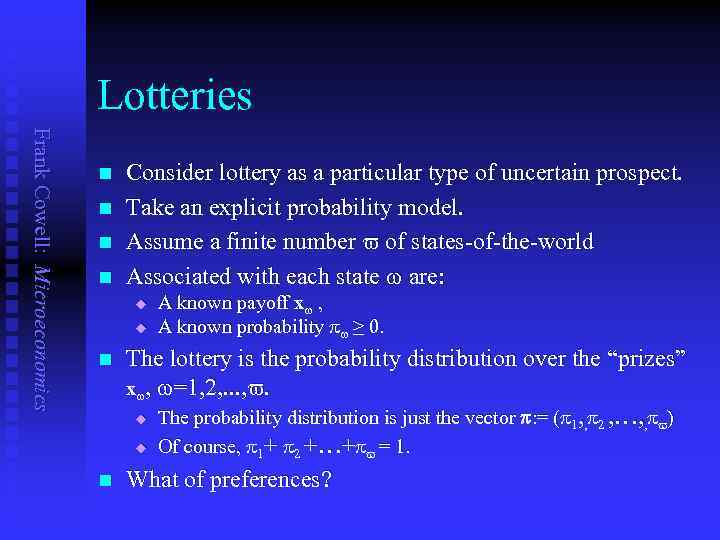

Lotteries Frank Cowell: Microeconomics n n Consider lottery as a particular type of uncertain prospect. Take an explicit probability model. Assume a finite number of states-of-the-world Associated with each state w are: u u n n A known payoff xw , A known probability pw ≥ 0. The lottery is the probability distribution over the “prizes” xw, w=1, 2, . . . , . ( u The probability distribution is just the vector p: = (p 1, , p 2 , …, , p ) u Of course, p 1 + p 2 +…+p = 1. What of preferences?

Lotteries Frank Cowell: Microeconomics n n Consider lottery as a particular type of uncertain prospect. Take an explicit probability model. Assume a finite number of states-of-the-world Associated with each state w are: u u n n A known payoff xw , A known probability pw ≥ 0. The lottery is the probability distribution over the “prizes” xw, w=1, 2, . . . , . ( u The probability distribution is just the vector p: = (p 1, , p 2 , …, , p ) u Of course, p 1 + p 2 +…+p = 1. What of preferences?

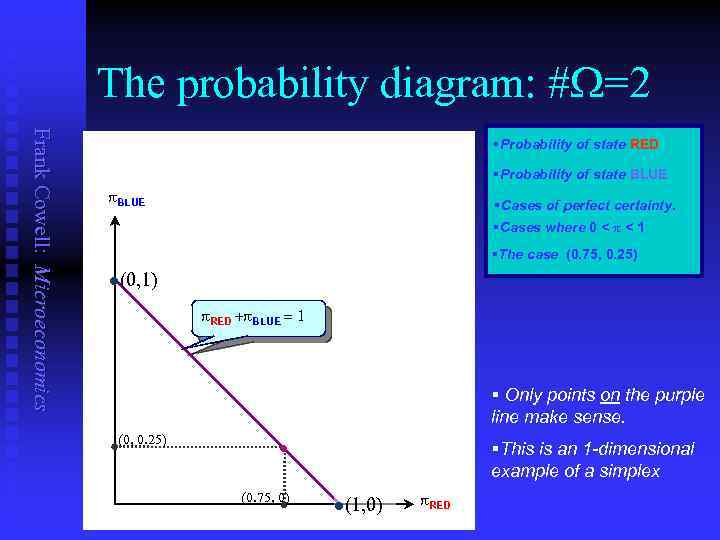

The probability diagram: #W=2 Frank Cowell: Microeconomics §Probability of state RED §Probability of state BLUE p. BLUE §Cases of perfect certainty. §Cases where 0 < p < 1 §The case (0. 75, 0. 25) l(0, 1) p. RED +p. BLUE = 1 § Only points on the purple line make sense. (0, 0. 25) • (0. 75, 0) §This is an 1 -dimensional example of a simplex l(1, 0) p. RED

The probability diagram: #W=2 Frank Cowell: Microeconomics §Probability of state RED §Probability of state BLUE p. BLUE §Cases of perfect certainty. §Cases where 0 < p < 1 §The case (0. 75, 0. 25) l(0, 1) p. RED +p. BLUE = 1 § Only points on the purple line make sense. (0, 0. 25) • (0. 75, 0) §This is an 1 -dimensional example of a simplex l(1, 0) p. RED

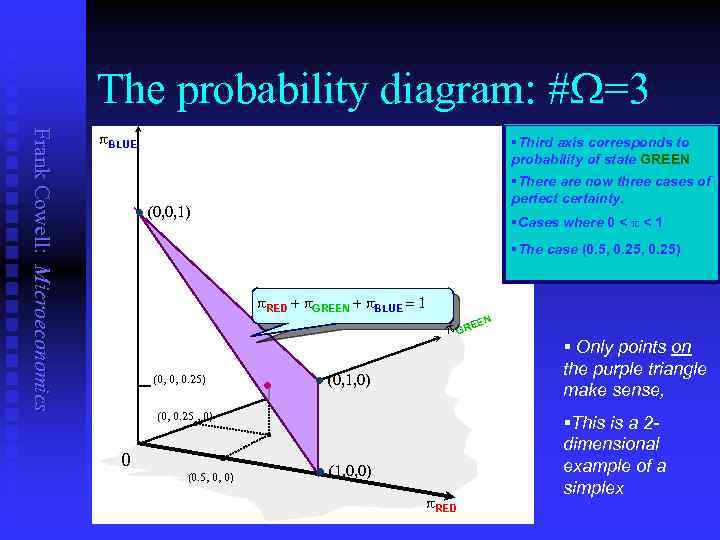

The probability diagram: #W=3 Frank Cowell: Microeconomics p. BLUE l §Third axis corresponds to probability of state GREEN §There are now three cases of perfect certainty. (0, 0, 1) §Cases where 0 < p < 1 §The case (0. 5, 0. 25) p. RED + p. GREEN + p. BLUE = 1 N p GREE (0, 0, 0. 25) • l (0, 1, 0) (0, 0. 25 , 0) 0 (0. 5, 0, 0) l (1, 0, 0) p. RED § Only points on the purple triangle make sense, §This is a 2 dimensional example of a simplex

The probability diagram: #W=3 Frank Cowell: Microeconomics p. BLUE l §Third axis corresponds to probability of state GREEN §There are now three cases of perfect certainty. (0, 0, 1) §Cases where 0 < p < 1 §The case (0. 5, 0. 25) p. RED + p. GREEN + p. BLUE = 1 N p GREE (0, 0, 0. 25) • l (0, 1, 0) (0, 0. 25 , 0) 0 (0. 5, 0, 0) l (1, 0, 0) p. RED § Only points on the purple triangle make sense, §This is a 2 dimensional example of a simplex

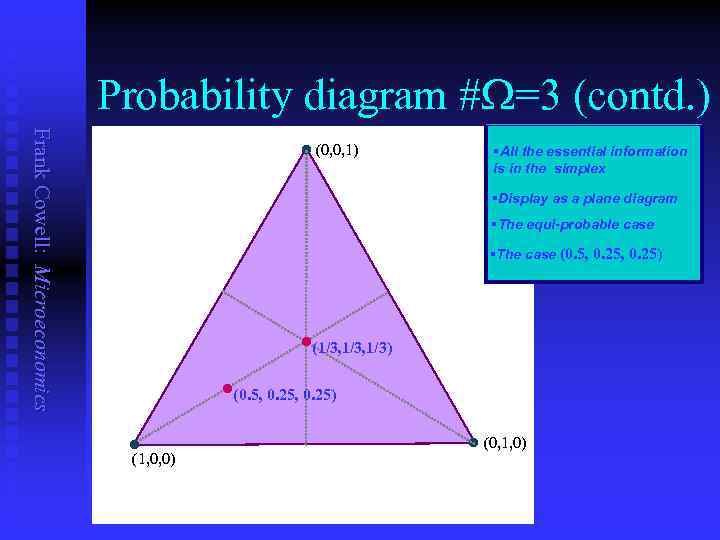

Probability diagram #W=3 (contd. ) Frank Cowell: Microeconomics l (0, 0, 1) §All the essential information is in the simplex §Display as a plane diagram §The equi-probable case §The case (0. 5, 0. 25) • (1/3, 1/3) • (0. 5, 0. 25) l . (1, 0, 0) l (0, 1, 0)

Probability diagram #W=3 (contd. ) Frank Cowell: Microeconomics l (0, 0, 1) §All the essential information is in the simplex §Display as a plane diagram §The equi-probable case §The case (0. 5, 0. 25) • (1/3, 1/3) • (0. 5, 0. 25) l . (1, 0, 0) l (0, 1, 0)

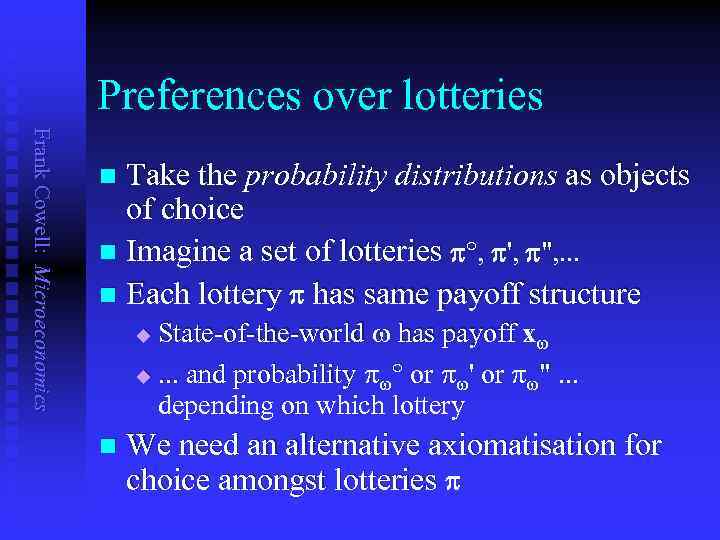

Preferences over lotteries Frank Cowell: Microeconomics Take the probability distributions as objects of choice n Imagine a set of lotteries p°, p', p", . . . n Each lottery p has same payoff structure n State-of-the-world w has payoff xw u. . . and probability pw° or pw' or pw". . . depending on which lottery u n We need an alternative axiomatisation for choice amongst lotteries p

Preferences over lotteries Frank Cowell: Microeconomics Take the probability distributions as objects of choice n Imagine a set of lotteries p°, p', p", . . . n Each lottery p has same payoff structure n State-of-the-world w has payoff xw u. . . and probability pw° or pw' or pw". . . depending on which lottery u n We need an alternative axiomatisation for choice amongst lotteries p

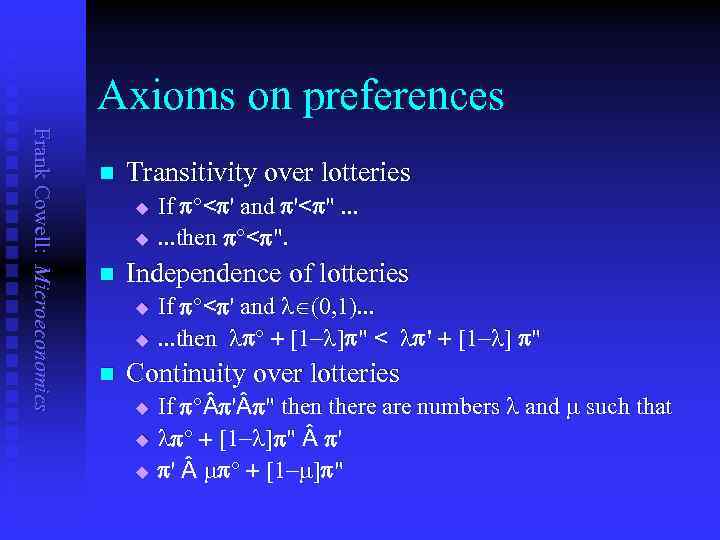

Axioms on preferences Frank Cowell: Microeconomics n Transitivity over lotteries u u n Independence of lotteries u u n If p°

Axioms on preferences Frank Cowell: Microeconomics n Transitivity over lotteries u u n Independence of lotteries u u n If p°

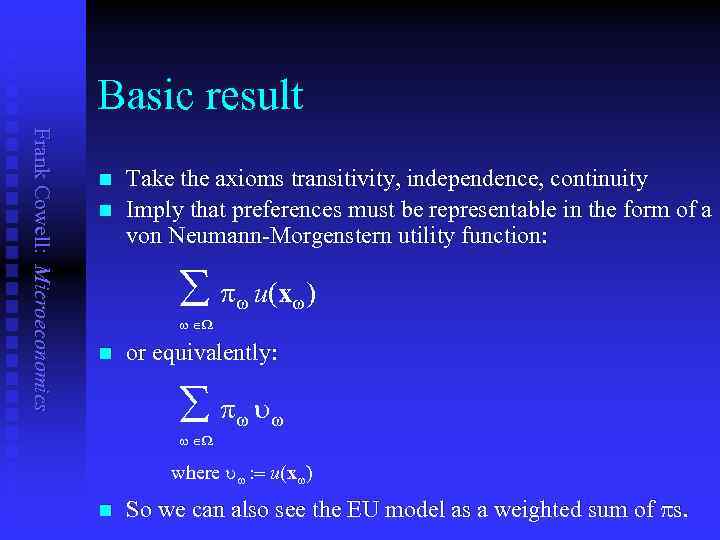

Basic result Frank Cowell: Microeconomics n n Take the axioms transitivity, independence, continuity Imply that preferences must be representable in the form of a von Neumann-Morgenstern utility function: å pw u(xw) w W n or equivalently: å p w uw w W where uw : = u(xw) n So we can also see the EU model as a weighted sum of ps.

Basic result Frank Cowell: Microeconomics n n Take the axioms transitivity, independence, continuity Imply that preferences must be representable in the form of a von Neumann-Morgenstern utility function: å pw u(xw) w W n or equivalently: å p w uw w W where uw : = u(xw) n So we can also see the EU model as a weighted sum of ps.

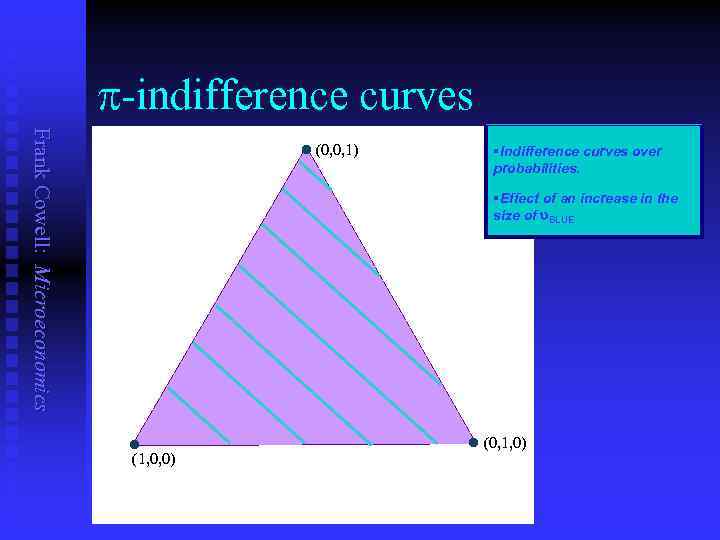

p-indifference curves Frank Cowell: Microeconomics l (0, 0, 1) §Indifference curves over probabilities. §Effect of an increase in the size of u. BLUE l . (1, 0, 0) l (0, 1, 0)

p-indifference curves Frank Cowell: Microeconomics l (0, 0, 1) §Indifference curves over probabilities. §Effect of an increase in the size of u. BLUE l . (1, 0, 0) l (0, 1, 0)

What next? Frank Cowell: Microeconomics Simple trading model under uncertainty n Consumer choice under uncertainty n Models of asset holding n Models of insurance n This is in the presentation Risk Taking n

What next? Frank Cowell: Microeconomics Simple trading model under uncertainty n Consumer choice under uncertainty n Models of asset holding n Models of insurance n This is in the presentation Risk Taking n