619c98e8da26561faa928ef70ad52f4f.ppt

- Количество слайдов: 28

Preparing for the Uncertain Future of Derivatives Servicing Presenter: Thomas Dinneny Managing Director Global Derivative Services Technology J. P. Morgan

Preparing for the Uncertain Future of Derivatives Servicing Presenter: Thomas Dinneny Managing Director Global Derivative Services Technology J. P. Morgan

Preparing for the Uncertain Future of Derivatives Servicing Agenda Regulatory Changes Affecting the OTC Derivatives Industry Impact of Regulatory Changes on the OTC Derivatives Market GDS Strategy

Preparing for the Uncertain Future of Derivatives Servicing Agenda Regulatory Changes Affecting the OTC Derivatives Industry Impact of Regulatory Changes on the OTC Derivatives Market GDS Strategy

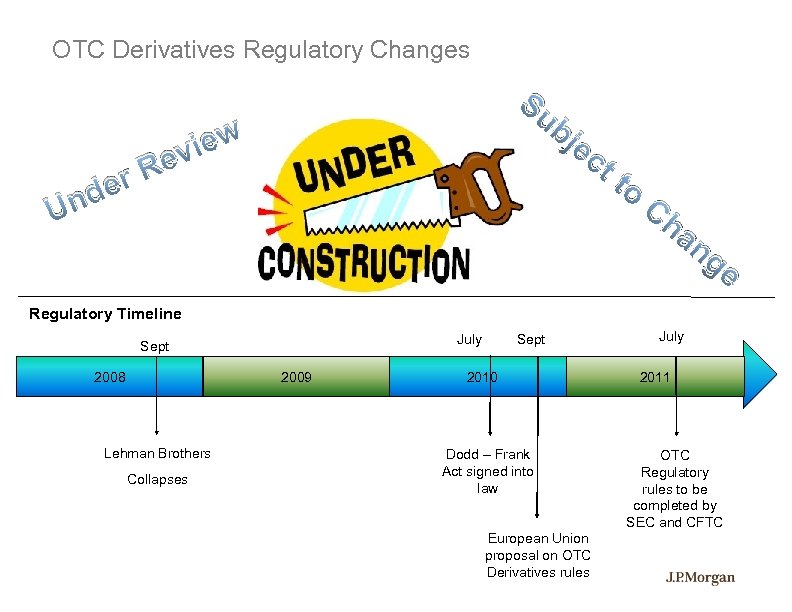

OTC Derivatives Regulatory Changes U iew ev r. R de n Su bj ec tt o Ch an ge Regulatory Timeline July Sept 2008 2009 Lehman Brothers Collapses 2010 Dodd – Frank Act signed into law European Union proposal on OTC Derivatives rules July 2011 OTC Regulatory rules to be completed by SEC and CFTC

OTC Derivatives Regulatory Changes U iew ev r. R de n Su bj ec tt o Ch an ge Regulatory Timeline July Sept 2008 2009 Lehman Brothers Collapses 2010 Dodd – Frank Act signed into law European Union proposal on OTC Derivatives rules July 2011 OTC Regulatory rules to be completed by SEC and CFTC

Dodd-Frank Act Highlights Central clearing of standardized derivative contracts Registration of swap dealers and major swap participants Margin requirements for uncleared transactions Reporting to central repositories for OTC Derivatives trades Volcker Rule – restricts proprietary trading for banks Limits on bank ownership of clearinghouses 360 -day period for SEC and CFTC to define the rules for implementation 296 Days until deadline of July 15, 2011

Dodd-Frank Act Highlights Central clearing of standardized derivative contracts Registration of swap dealers and major swap participants Margin requirements for uncleared transactions Reporting to central repositories for OTC Derivatives trades Volcker Rule – restricts proprietary trading for banks Limits on bank ownership of clearinghouses 360 -day period for SEC and CFTC to define the rules for implementation 296 Days until deadline of July 15, 2011

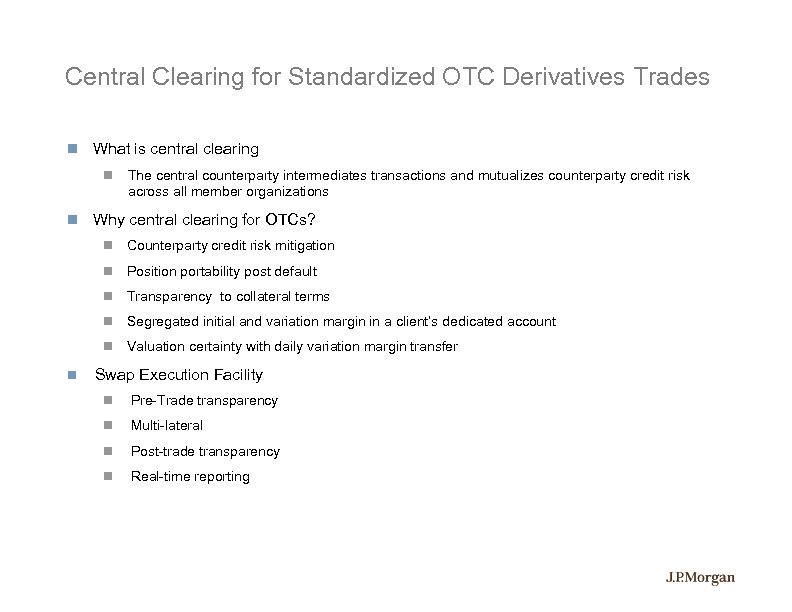

Central Clearing for Standardized OTC Derivatives Trades What is central clearing The central counterparty intermediates transactions and mutualizes counterparty credit risk across all member organizations Why central clearing for OTCs? Position portability post default Transparency to collateral terms Segregated initial and variation margin in a client’s dedicated account Counterparty credit risk mitigation Valuation certainty with daily variation margin transfer Swap Execution Facility Pre-Trade transparency Multi-lateral Post-trade transparency Real-time reporting

Central Clearing for Standardized OTC Derivatives Trades What is central clearing The central counterparty intermediates transactions and mutualizes counterparty credit risk across all member organizations Why central clearing for OTCs? Position portability post default Transparency to collateral terms Segregated initial and variation margin in a client’s dedicated account Counterparty credit risk mitigation Valuation certainty with daily variation margin transfer Swap Execution Facility Pre-Trade transparency Multi-lateral Post-trade transparency Real-time reporting

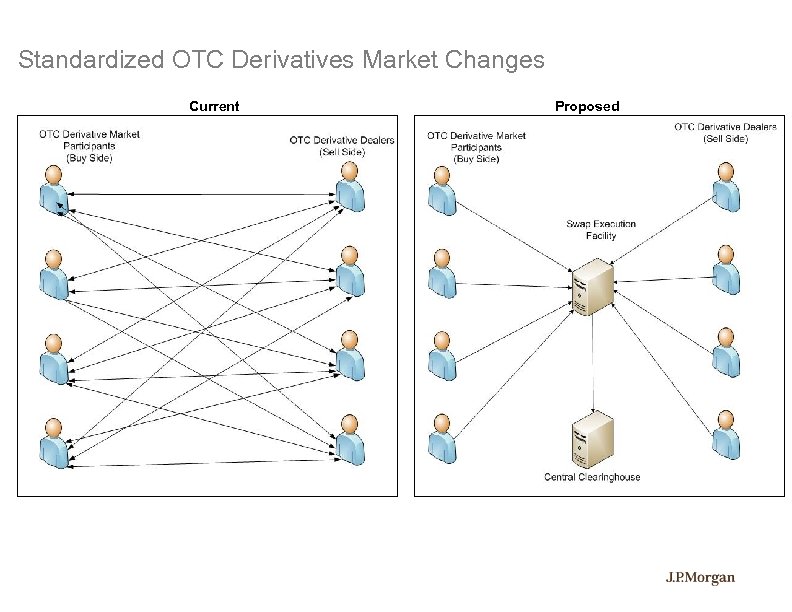

Standardized OTC Derivatives Market Changes Current Proposed

Standardized OTC Derivatives Market Changes Current Proposed

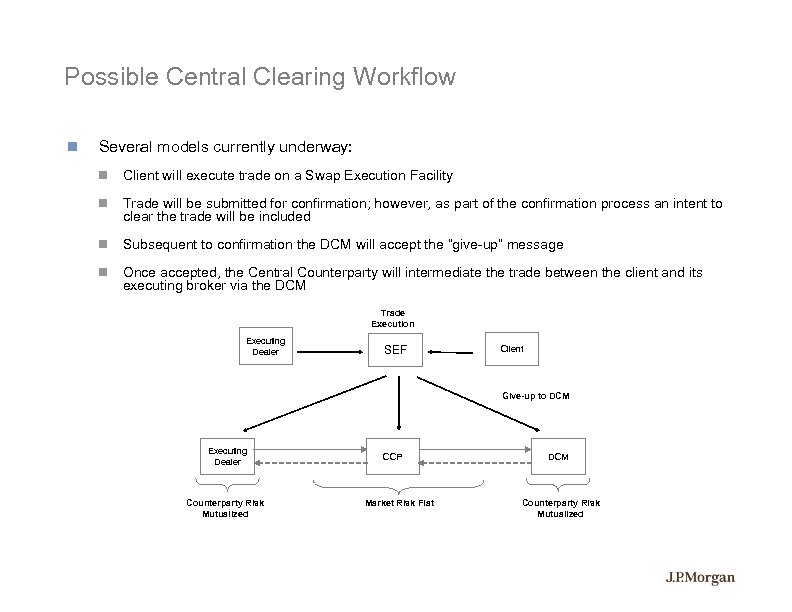

Possible Central Clearing Workflow Several models currently underway: Client will execute trade on a Swap Execution Facility Trade will be submitted for confirmation; however, as part of the confirmation process an intent to clear the trade will be included Subsequent to confirmation the DCM will accept the “give-up” message Once accepted, the Central Counterparty will intermediate the trade between the client and its executing broker via the DCM Trade Execution Executing Dealer SEF Client Give-up to DCM Executing Dealer Counterparty Risk Mutualized CCP Market Risk Flat DCM Counterparty Risk Mutualized

Possible Central Clearing Workflow Several models currently underway: Client will execute trade on a Swap Execution Facility Trade will be submitted for confirmation; however, as part of the confirmation process an intent to clear the trade will be included Subsequent to confirmation the DCM will accept the “give-up” message Once accepted, the Central Counterparty will intermediate the trade between the client and its executing broker via the DCM Trade Execution Executing Dealer SEF Client Give-up to DCM Executing Dealer Counterparty Risk Mutualized CCP Market Risk Flat DCM Counterparty Risk Mutualized

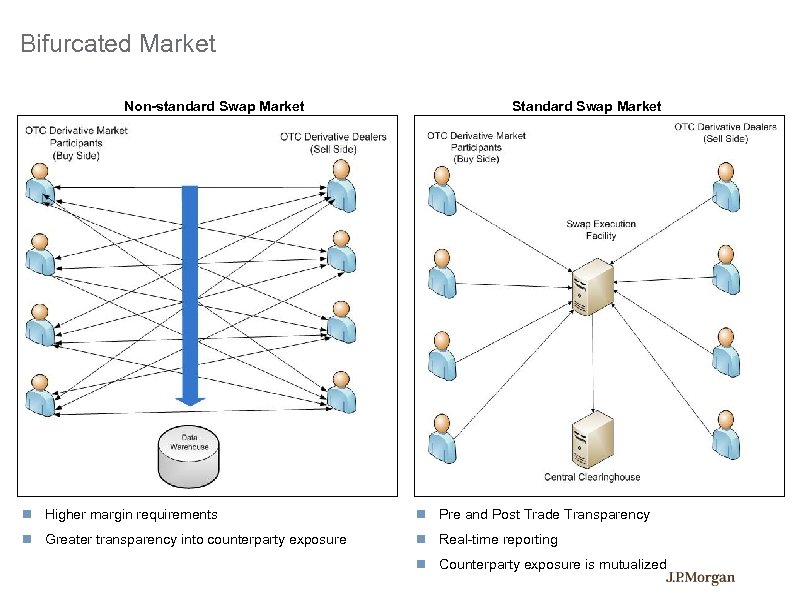

Bifurcated Market Non-standard Swap Market Standard Swap Market Higher margin requirements Pre and Post Trade Transparency Greater transparency into counterparty exposure Real-time reporting Counterparty exposure is mutualized

Bifurcated Market Non-standard Swap Market Standard Swap Market Higher margin requirements Pre and Post Trade Transparency Greater transparency into counterparty exposure Real-time reporting Counterparty exposure is mutualized

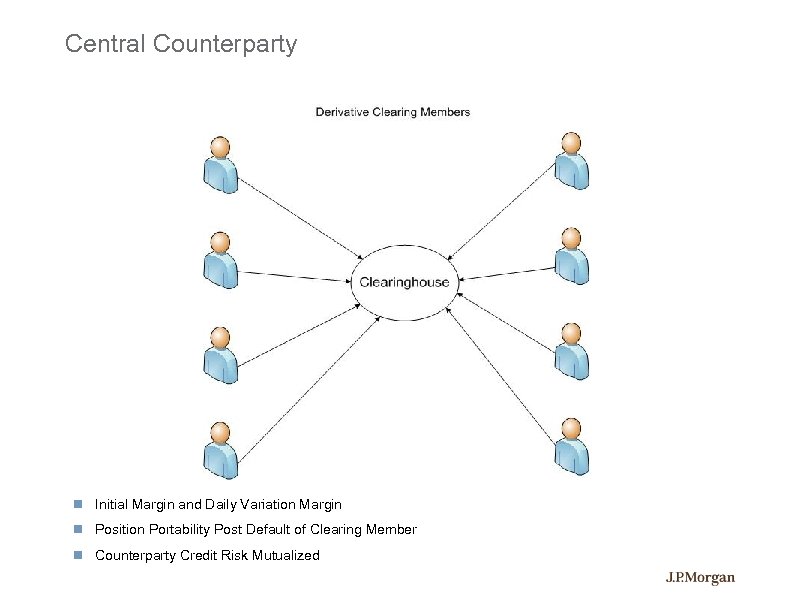

Central Counterparty Initial Margin and Daily Variation Margin Position Portability Post Default of Clearing Member Counterparty Credit Risk Mutualized

Central Counterparty Initial Margin and Daily Variation Margin Position Portability Post Default of Clearing Member Counterparty Credit Risk Mutualized

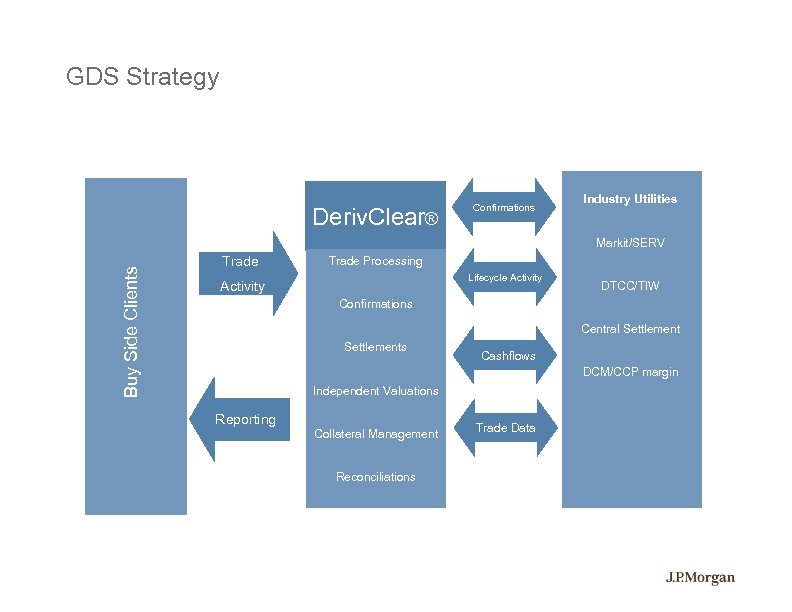

GDS Strategy Deriv. Clear® Confirmations Industry Utilities Buy Side Clients Markit/SERV Trade Processing Lifecycle Activity DTCC/TIW Confirmations Central Settlements Cashflows DCM/CCP margin Independent Valuations Reporting Collateral Management Reconciliations Trade Data

GDS Strategy Deriv. Clear® Confirmations Industry Utilities Buy Side Clients Markit/SERV Trade Processing Lifecycle Activity DTCC/TIW Confirmations Central Settlements Cashflows DCM/CCP margin Independent Valuations Reporting Collateral Management Reconciliations Trade Data

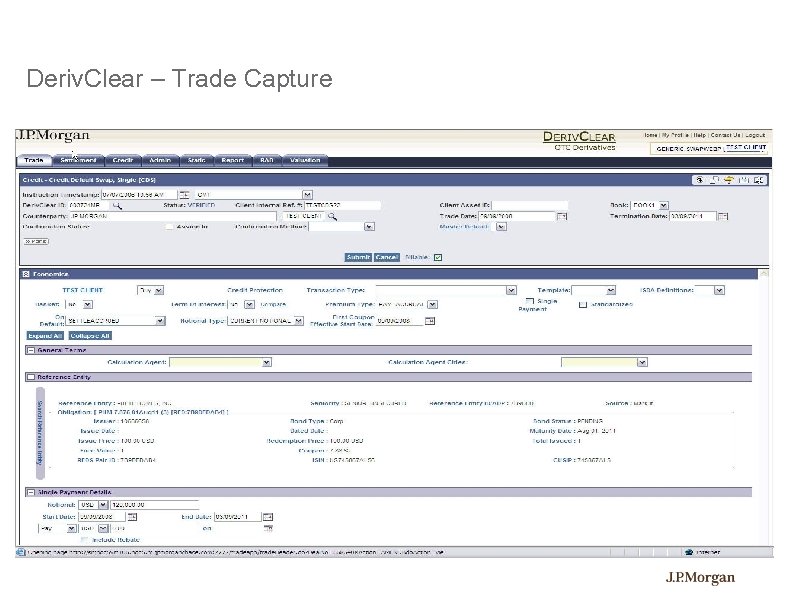

Deriv. Clear – Trade Capture The Goal Receive and process client trades with no manual intervention by J. P. Morgan Operations personnel The Challenges Connectivity with clients Standard Message formats Minimum data requirements Common reference data Product coverage The Solution Deriv. Clear – Electronic Trade Capture

Deriv. Clear – Trade Capture The Goal Receive and process client trades with no manual intervention by J. P. Morgan Operations personnel The Challenges Connectivity with clients Standard Message formats Minimum data requirements Common reference data Product coverage The Solution Deriv. Clear – Electronic Trade Capture

Standard Message formats Proprietary spreadsheet format Fp. ML - IBML Bloomberg – future state Challenges Versioning – upgrading to new versions/formats Client specific data Changing Standards

Standard Message formats Proprietary spreadsheet format Fp. ML - IBML Bloomberg – future state Challenges Versioning – upgrading to new versions/formats Client specific data Changing Standards

Connectivity with Clients Loosely coupled Manual Trade Capture through the web interface Spreadsheet/CSV file upload through the web interface SFTP files Tightly Coupled Web Service Interface MQ Interface SWIFT Messages

Connectivity with Clients Loosely coupled Manual Trade Capture through the web interface Spreadsheet/CSV file upload through the web interface SFTP files Tightly Coupled Web Service Interface MQ Interface SWIFT Messages

Minimum Data Requirements Client systems have varying degree of support for Derivatives Data requirements are different based on services provided i. e. , Pricing requires less data than confirmations Defaulting Application level defaulting Master confirmations Trade templates Product Coverage High volume flow products have the greatest return 34 products across Credit, Rates, Equities, Commodities and FX

Minimum Data Requirements Client systems have varying degree of support for Derivatives Data requirements are different based on services provided i. e. , Pricing requires less data than confirmations Defaulting Application level defaulting Master confirmations Trade templates Product Coverage High volume flow products have the greatest return 34 products across Credit, Rates, Equities, Commodities and FX

Confirmations and Settlements Confirmations Automated interface to Mark. It Trade Manager Direct links with DTCC Lifecycle Management Settlements Cashflow calculation CLS settlements interface Netting

Confirmations and Settlements Confirmations Automated interface to Mark. It Trade Manager Direct links with DTCC Lifecycle Management Settlements Cashflow calculation CLS settlements interface Netting

Independent Valuations, Collateral Management and Reconciliations Independent Valuations Ability to calculate independent valuations for most products Links to Third Party Valuation Providers (e. g. , Mark. It, Super D, Reech, Pricing Direct) Pre-NAV validation nd flexible tolerance rules Collateral Management Currently feeding valuations to DCM Product integration planned over the next 12 -18 months Reconciliations Internal system to system reconciliations using Artemis Interface to Mark. It Port. Rec File feeds to Tri. Optima

Independent Valuations, Collateral Management and Reconciliations Independent Valuations Ability to calculate independent valuations for most products Links to Third Party Valuation Providers (e. g. , Mark. It, Super D, Reech, Pricing Direct) Pre-NAV validation nd flexible tolerance rules Collateral Management Currently feeding valuations to DCM Product integration planned over the next 12 -18 months Reconciliations Internal system to system reconciliations using Artemis Interface to Mark. It Port. Rec File feeds to Tri. Optima

Scalability Load-balanced web-server farm Multiple Calypso data servers Oracle RAC database

Scalability Load-balanced web-server farm Multiple Calypso data servers Oracle RAC database

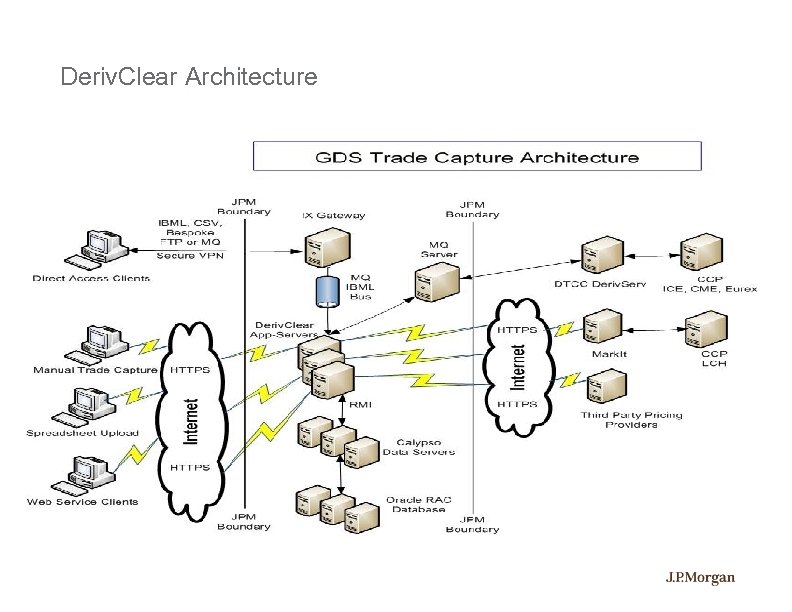

Deriv. Clear Architecture

Deriv. Clear Architecture

Deriv. Clear – Trade Capture

Deriv. Clear – Trade Capture

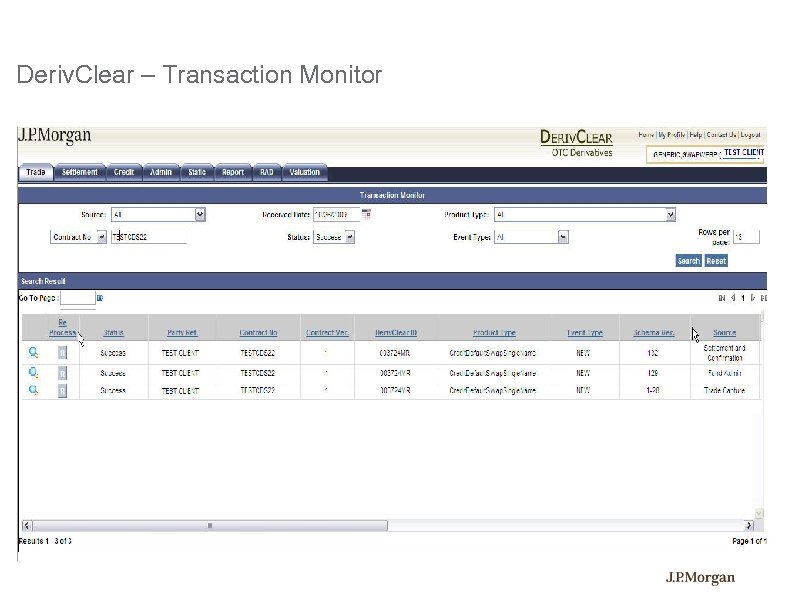

Deriv. Clear – Transaction Monitor

Deriv. Clear – Transaction Monitor

Deriv. Clear – Background Developed over a period of 5 years Grew along with industry change agenda DTCC Electronic Confirmations - 2003 DTCC TIW - 2007 DTCC Pay/Rec and Central Settlements - 2007 Global support team – US, UK, India Support for Credit, Rates, Equity, Commodities and FX Products

Deriv. Clear – Background Developed over a period of 5 years Grew along with industry change agenda DTCC Electronic Confirmations - 2003 DTCC TIW - 2007 DTCC Pay/Rec and Central Settlements - 2007 Global support team – US, UK, India Support for Credit, Rates, Equity, Commodities and FX Products

Keys to Success Choose the right solution for the organization High volumes with strong tech capabilities – Tightly coupled option – SWIFT Messaging – IBML through IX – Requires ongoing support from both tech organizations Low volume with limited tech capabilities – Loosely coupled option – Manual trade entry – Spreadsheet upload – Limited tech support required Partnership between Tech and Ops Organizations Questions?

Keys to Success Choose the right solution for the organization High volumes with strong tech capabilities – Tightly coupled option – SWIFT Messaging – IBML through IX – Requires ongoing support from both tech organizations Low volume with limited tech capabilities – Loosely coupled option – Manual trade entry – Spreadsheet upload – Limited tech support required Partnership between Tech and Ops Organizations Questions?

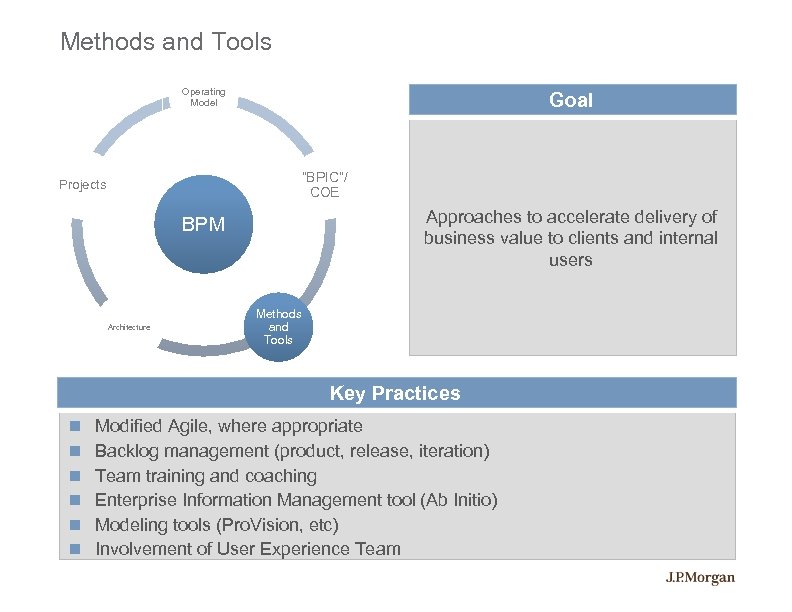

Methods and Tools Operating Model Goal “BPIC”/ COE Projects Approaches to accelerate delivery of business value to clients and internal users BPM Architecture Methods and Tools Key Practices Modified Agile, where appropriate Backlog management (product, release, iteration) Team training and coaching Enterprise Information Management tool (Ab Initio) Modeling tools (Pro. Vision, etc) Involvement of User Experience Team

Methods and Tools Operating Model Goal “BPIC”/ COE Projects Approaches to accelerate delivery of business value to clients and internal users BPM Architecture Methods and Tools Key Practices Modified Agile, where appropriate Backlog management (product, release, iteration) Team training and coaching Enterprise Information Management tool (Ab Initio) Modeling tools (Pro. Vision, etc) Involvement of User Experience Team

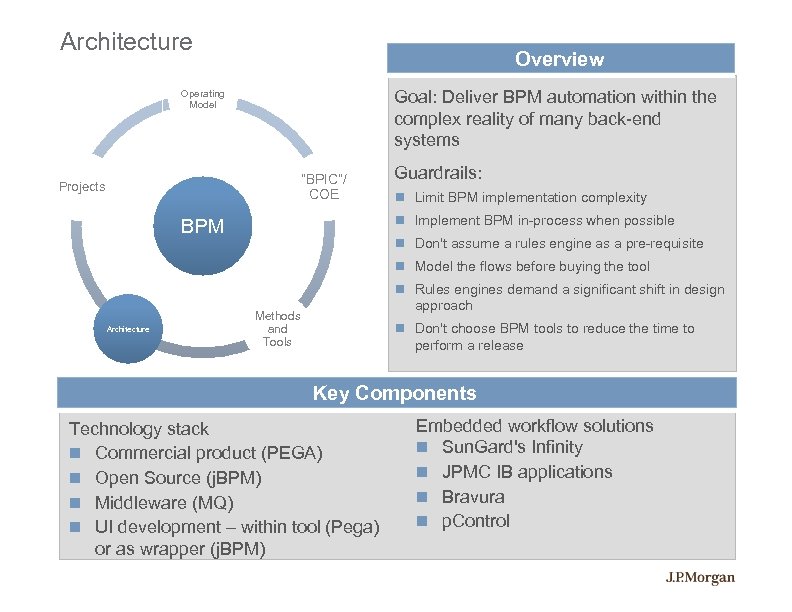

Architecture Overview Goal: Deliver BPM automation within the complex reality of many back-end systems Operating Model “BPIC”/ COE Projects Guardrails: Limit BPM implementation complexity Implement BPM in-process when possible BPM Don't assume a rules engine as a pre-requisite Model the flows before buying the tool Architecture Rules engines demand a significant shift in design approach Methods and Tools Don't choose BPM tools to reduce the time to perform a release Key Components Technology stack Commercial product (PEGA) Open Source (j. BPM) Middleware (MQ) UI development – within tool (Pega) or as wrapper (j. BPM) Embedded workflow solutions Sun. Gard's Infinity JPMC IB applications Bravura p. Control

Architecture Overview Goal: Deliver BPM automation within the complex reality of many back-end systems Operating Model “BPIC”/ COE Projects Guardrails: Limit BPM implementation complexity Implement BPM in-process when possible BPM Don't assume a rules engine as a pre-requisite Model the flows before buying the tool Architecture Rules engines demand a significant shift in design approach Methods and Tools Don't choose BPM tools to reduce the time to perform a release Key Components Technology stack Commercial product (PEGA) Open Source (j. BPM) Middleware (MQ) UI development – within tool (Pega) or as wrapper (j. BPM) Embedded workflow solutions Sun. Gard's Infinity JPMC IB applications Bravura p. Control

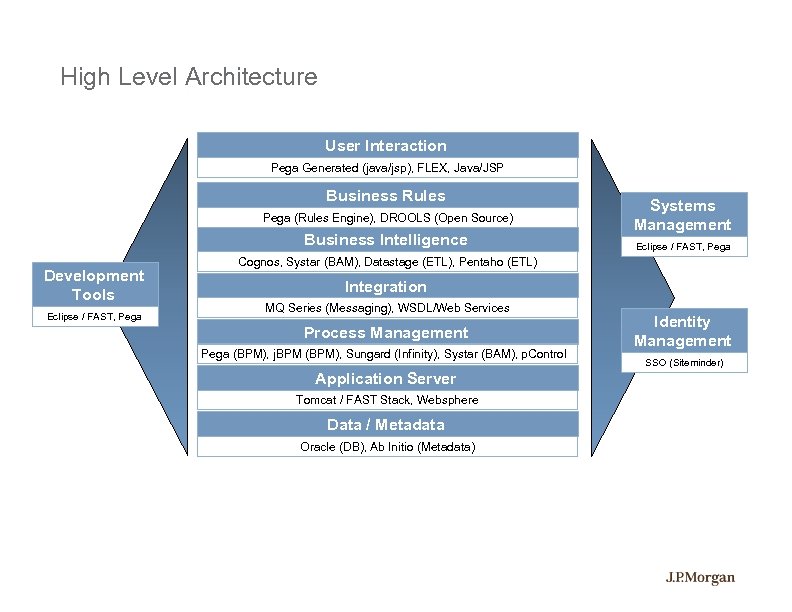

High Level Architecture User Interaction Pega Generated (java/jsp), FLEX, Java/JSP Business Rules Pega (Rules Engine), DROOLS (Open Source) Business Intelligence Development Tools Eclipse / FAST, Pega Systems Management Eclipse / FAST, Pega Cognos, Systar (BAM), Datastage (ETL), Pentaho (ETL) Integration MQ Series (Messaging), WSDL/Web Services Process Management Pega (BPM), j. BPM (BPM), Sungard (Infinity), Systar (BAM), p. Control Application Server Tomcat / FAST Stack, Websphere Data / Metadata Oracle (DB), Ab Initio (Metadata) Identity Management SSO (Siteminder)

High Level Architecture User Interaction Pega Generated (java/jsp), FLEX, Java/JSP Business Rules Pega (Rules Engine), DROOLS (Open Source) Business Intelligence Development Tools Eclipse / FAST, Pega Systems Management Eclipse / FAST, Pega Cognos, Systar (BAM), Datastage (ETL), Pentaho (ETL) Integration MQ Series (Messaging), WSDL/Web Services Process Management Pega (BPM), j. BPM (BPM), Sungard (Infinity), Systar (BAM), p. Control Application Server Tomcat / FAST Stack, Websphere Data / Metadata Oracle (DB), Ab Initio (Metadata) Identity Management SSO (Siteminder)

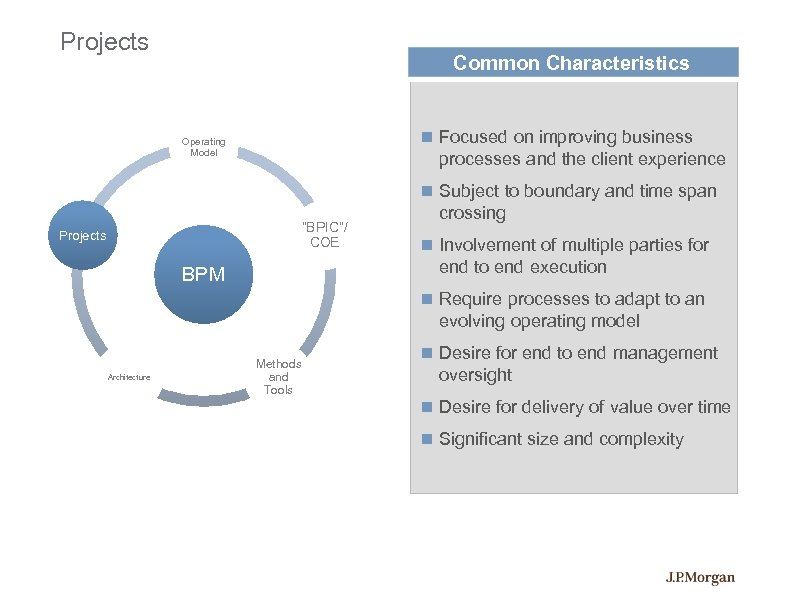

Projects Common Characteristics Focused on improving business Operating Model processes and the client experience Subject to boundary and time span “BPIC”/ COE Projects crossing Involvement of multiple parties for end to end execution BPM Require processes to adapt to an evolving operating model Architecture Methods and Tools Desire for end to end management oversight Desire for delivery of value over time Significant size and complexity

Projects Common Characteristics Focused on improving business Operating Model processes and the client experience Subject to boundary and time span “BPIC”/ COE Projects crossing Involvement of multiple parties for end to end execution BPM Require processes to adapt to an evolving operating model Architecture Methods and Tools Desire for end to end management oversight Desire for delivery of value over time Significant size and complexity

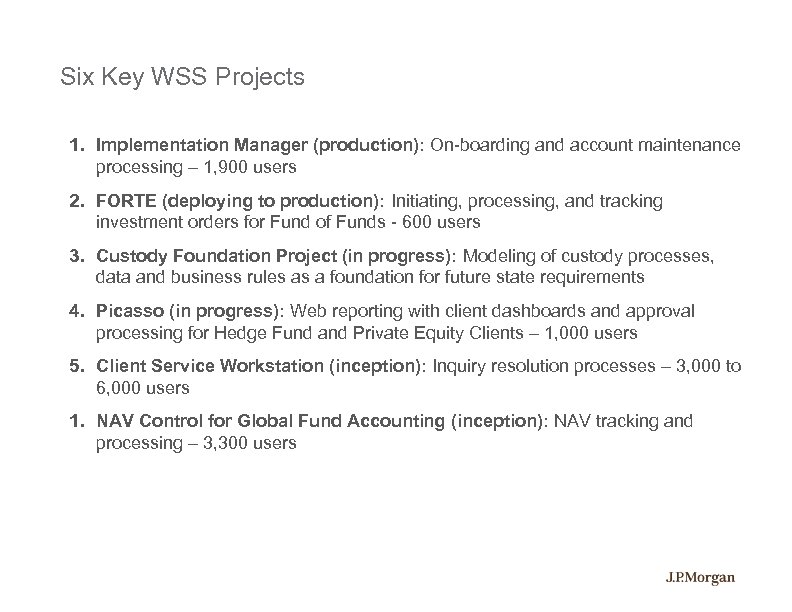

Six Key WSS Projects 1. Implementation Manager (production): On-boarding and account maintenance processing – 1, 900 users 2. FORTE (deploying to production): Initiating, processing, and tracking investment orders for Fund of Funds - 600 users 3. Custody Foundation Project (in progress): Modeling of custody processes, data and business rules as a foundation for future state requirements 4. Picasso (in progress): Web reporting with client dashboards and approval processing for Hedge Fund and Private Equity Clients – 1, 000 users 5. Client Service Workstation (inception): Inquiry resolution processes – 3, 000 to 6, 000 users 1. NAV Control for Global Fund Accounting (inception): NAV tracking and processing – 3, 300 users

Six Key WSS Projects 1. Implementation Manager (production): On-boarding and account maintenance processing – 1, 900 users 2. FORTE (deploying to production): Initiating, processing, and tracking investment orders for Fund of Funds - 600 users 3. Custody Foundation Project (in progress): Modeling of custody processes, data and business rules as a foundation for future state requirements 4. Picasso (in progress): Web reporting with client dashboards and approval processing for Hedge Fund and Private Equity Clients – 1, 000 users 5. Client Service Workstation (inception): Inquiry resolution processes – 3, 000 to 6, 000 users 1. NAV Control for Global Fund Accounting (inception): NAV tracking and processing – 3, 300 users

Wrap Up Key Takeaways Expansion of BPM as a strategic competency requires an evolutionary approach supported by a roadmap Processes will evolve and change - project delivery methods and solutions need to be adaptable Projects of the size and complexity in our environment need interim delivery of value and constant business validation BPM initiatives cannot succeed with tools and methods alone – other key elements include: A process and performance driven mindset Strong business involvement Executive alignment Questions?

Wrap Up Key Takeaways Expansion of BPM as a strategic competency requires an evolutionary approach supported by a roadmap Processes will evolve and change - project delivery methods and solutions need to be adaptable Projects of the size and complexity in our environment need interim delivery of value and constant business validation BPM initiatives cannot succeed with tools and methods alone – other key elements include: A process and performance driven mindset Strong business involvement Executive alignment Questions?