d14390446d7ba0f4bdddab39392d2269.ppt

- Количество слайдов: 31

Preparing for Solvency II : case study for a multinational reinsurer Presented by Michel M. Dacorogna International Insurance Symposium, CPI-Workshop, Johannesburg, South Africa, February 2, 2007

Preparing for Solvency II : case study for a multinational reinsurer Presented by Michel M. Dacorogna International Insurance Symposium, CPI-Workshop, Johannesburg, South Africa, February 2, 2007

© Converium Outline Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 1 ¢ New context for the industry and new solvency regulation ¢ Use of internal models and DFA ¢ How to optimize a reinsurance cover ¢ Case study: multi-lines and cat covers ¢ Conclusion

© Converium Outline Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 1 ¢ New context for the industry and new solvency regulation ¢ Use of internal models and DFA ¢ How to optimize a reinsurance cover ¢ Case study: multi-lines and cat covers ¢ Conclusion

© Converium A Changing environment Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 2 ¢ Environment of the insurance industry in the European Union has undergone fundamental changes in the past few years. ¢ Deregulation in the 90 ies gave the insurance companies more freedom and independence: ¢ New Opportunities ¢ New challenges and increased self-responsibility ¢ Insurance companies and regulatory authorities are equally affected by the changes. ¢ In-force regulations are only partly successful (insolvency of Mannheimer!). ¢ Under the name “Solvency II”, a new supervisory framework is being developed on a European level.

© Converium A Changing environment Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 2 ¢ Environment of the insurance industry in the European Union has undergone fundamental changes in the past few years. ¢ Deregulation in the 90 ies gave the insurance companies more freedom and independence: ¢ New Opportunities ¢ New challenges and increased self-responsibility ¢ Insurance companies and regulatory authorities are equally affected by the changes. ¢ In-force regulations are only partly successful (insolvency of Mannheimer!). ¢ Under the name “Solvency II”, a new supervisory framework is being developed on a European level.

© Converium Why new solvency regulations ? ¢ Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 3 In-force solvability rules have a number of deficiencies. Examples: ¢ Premium-based methods hardly reflect the true risk. Factor-based methods are unable to adequately take into account complex forms of risk transfer. ¢ Investment risks is not included in the required solvency. ¢ Dependencies between assets and liabilities or between lines of business are not taken into account. ¢ ¢ As a result, there is an unrealistic or wrong estimation of capital levels. On the other hand, insurers already have technically mature methods for risk analysis and capital allocation. ¢ Moreover: Because of different regulations, there are opportunities for regulatory arbitrage between banking and insurance industry (e. g. credit insurance).

© Converium Why new solvency regulations ? ¢ Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 3 In-force solvability rules have a number of deficiencies. Examples: ¢ Premium-based methods hardly reflect the true risk. Factor-based methods are unable to adequately take into account complex forms of risk transfer. ¢ Investment risks is not included in the required solvency. ¢ Dependencies between assets and liabilities or between lines of business are not taken into account. ¢ ¢ As a result, there is an unrealistic or wrong estimation of capital levels. On the other hand, insurers already have technically mature methods for risk analysis and capital allocation. ¢ Moreover: Because of different regulations, there are opportunities for regulatory arbitrage between banking and insurance industry (e. g. credit insurance).

Solvency II: Key elements 3 -pillar structure, Pillar 1 © Converium Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 4 Quantitative requirements ¢ Solvency capital shall be derived from the actual total risk and shall essentially correspond to the economic risk capital. ¢ Market-based valuation approach (‚mark-to-market‘). ¢ Distinction between minimum and target solvency capital. ¢ Minimum capital determined by a simple standard model. ¢ Target capital can be determined by internal risk models. Supervisory system shall favor the use of such models. ¢ Interplay of assets and liabilities shall be taken into account (ALM).

Solvency II: Key elements 3 -pillar structure, Pillar 1 © Converium Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 4 Quantitative requirements ¢ Solvency capital shall be derived from the actual total risk and shall essentially correspond to the economic risk capital. ¢ Market-based valuation approach (‚mark-to-market‘). ¢ Distinction between minimum and target solvency capital. ¢ Minimum capital determined by a simple standard model. ¢ Target capital can be determined by internal risk models. Supervisory system shall favor the use of such models. ¢ Interplay of assets and liabilities shall be taken into account (ALM).

Solvency II: Key elements 3 -pillar structure, Pillar 2 © Converium Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 5 Supervisory process and internal risk management ¢ Insurance companies shall be made responsible for implementing risk management processes. Examples: ¢ Actuarial principles regarding reserving practice ¢ Asset Liability Management (ALM) ¢ Supervisory processes are guided by capital requirements and the actual capital margin (capital which counts towards meeting requirements). ¢ Supervisory process shall be more guided by the individual risk profile of a single company. ¢ Intervention zone between minimal and target solvency capital, within which the supervisory authority can intervene before the company falls short of the minimum solvability capital.

Solvency II: Key elements 3 -pillar structure, Pillar 2 © Converium Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 5 Supervisory process and internal risk management ¢ Insurance companies shall be made responsible for implementing risk management processes. Examples: ¢ Actuarial principles regarding reserving practice ¢ Asset Liability Management (ALM) ¢ Supervisory processes are guided by capital requirements and the actual capital margin (capital which counts towards meeting requirements). ¢ Supervisory process shall be more guided by the individual risk profile of a single company. ¢ Intervention zone between minimal and target solvency capital, within which the supervisory authority can intervene before the company falls short of the minimum solvability capital.

Solvency II: Key elements 3 -pillar structure, Pillar 3 © Converium Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 6 Market transparency and discipline ¢ Aimed at increasing transparency in the insurance industry. ¢ The goal of the disclosure of the actual risk and return situation is an increase of the market transparency that shall lead to an increased market discipline. ¢ Strongly follows Basel II and future IFRS guidelines. ¢ Remark: The EU Commission seems to be aware of the dangers that increased disclosure requirements can have (e. g. capital drain in the case of a deterioration of the risk situation of an insurance company).

Solvency II: Key elements 3 -pillar structure, Pillar 3 © Converium Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 6 Market transparency and discipline ¢ Aimed at increasing transparency in the insurance industry. ¢ The goal of the disclosure of the actual risk and return situation is an increase of the market transparency that shall lead to an increased market discipline. ¢ Strongly follows Basel II and future IFRS guidelines. ¢ Remark: The EU Commission seems to be aware of the dangers that increased disclosure requirements can have (e. g. capital drain in the case of a deterioration of the risk situation of an insurance company).

© Converium Context of Solvency II ¢ Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 7 Solvency II is part of a changing regulatory environment: ¢ Basel II (regulatory framework for banks) ¢ IFRS (International Financial Reporting Standard, currently under development) ¢ Solvency II is an European project: ¢ Solvency II is initiated and driven by the EU Commission. Solvency II is developed in close cooperation with national supervisors and international professional bodies (e. g. actuaries). ¢ Solvency II is an ambitious project: ¢ Aims at a risk-based determination of adequate capital levels. ¢ Solvency II is still under development. In force by 200 X or 20 XX only.

© Converium Context of Solvency II ¢ Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 7 Solvency II is part of a changing regulatory environment: ¢ Basel II (regulatory framework for banks) ¢ IFRS (International Financial Reporting Standard, currently under development) ¢ Solvency II is an European project: ¢ Solvency II is initiated and driven by the EU Commission. Solvency II is developed in close cooperation with national supervisors and international professional bodies (e. g. actuaries). ¢ Solvency II is an ambitious project: ¢ Aims at a risk-based determination of adequate capital levels. ¢ Solvency II is still under development. In force by 200 X or 20 XX only.

© Converium The Swiss Solvency Test Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 8 ¢ In May 2003, the Swiss Federal Office for Private Insurers (FOPI) together with the Swiss insurance industry launched the SST project. ¢ The aim of the project was to elaborate a risk-based solvency regulation. ¢ For once, the Swiss were faster than the rest of Europe!: ¢ initial concept in December 2003 ¢ further refined up to May 2004 ¢ Field-test runs with 45 insurers (90% of the market) in 2005 ¢ Insurance Supervision Act became legally binding as of 2006 ¢ Full SST calculation for small insurers and Reinsurers by 2008 ¢ After a transition period of five years the solvency targets have to be met by 1 January 2011.

© Converium The Swiss Solvency Test Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 8 ¢ In May 2003, the Swiss Federal Office for Private Insurers (FOPI) together with the Swiss insurance industry launched the SST project. ¢ The aim of the project was to elaborate a risk-based solvency regulation. ¢ For once, the Swiss were faster than the rest of Europe!: ¢ initial concept in December 2003 ¢ further refined up to May 2004 ¢ Field-test runs with 45 insurers (90% of the market) in 2005 ¢ Insurance Supervision Act became legally binding as of 2006 ¢ Full SST calculation for small insurers and Reinsurers by 2008 ¢ After a transition period of five years the solvency targets have to be met by 1 January 2011.

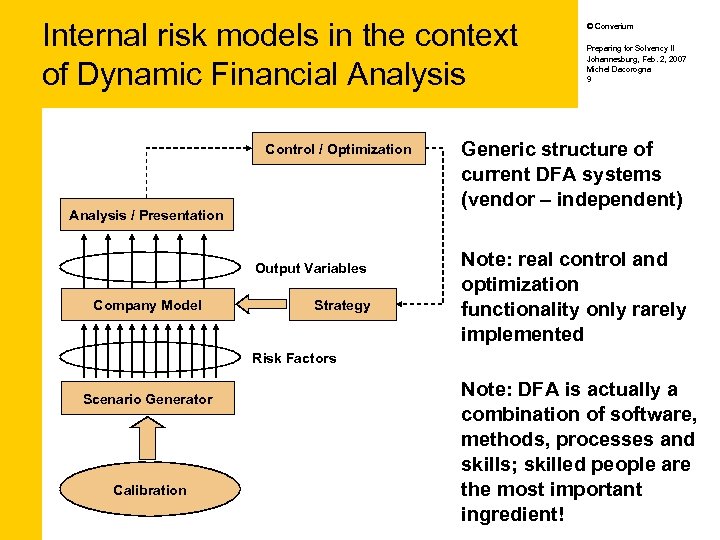

Internal risk models in the context of Dynamic Financial Analysis Control / Optimization Analysis / Presentation Output Variables Company Model Strategy © Converium Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 9 Generic structure of current DFA systems (vendor – independent) Note: real control and optimization functionality only rarely implemented Risk Factors Scenario Generator Calibration Note: DFA is actually a combination of software, methods, processes and skills; skilled people are the most important ingredient!

Internal risk models in the context of Dynamic Financial Analysis Control / Optimization Analysis / Presentation Output Variables Company Model Strategy © Converium Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 9 Generic structure of current DFA systems (vendor – independent) Note: real control and optimization functionality only rarely implemented Risk Factors Scenario Generator Calibration Note: DFA is actually a combination of software, methods, processes and skills; skilled people are the most important ingredient!

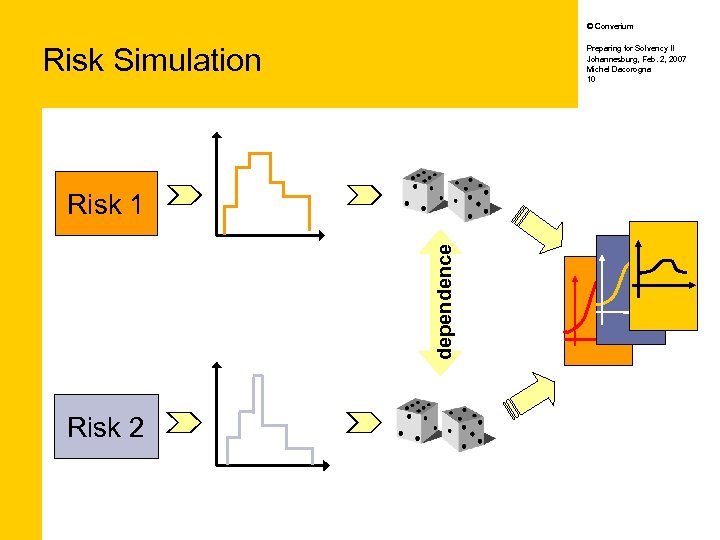

© Converium Risk Simulation Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 10 dependence Risk 1 Risk 2

© Converium Risk Simulation Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 10 dependence Risk 1 Risk 2

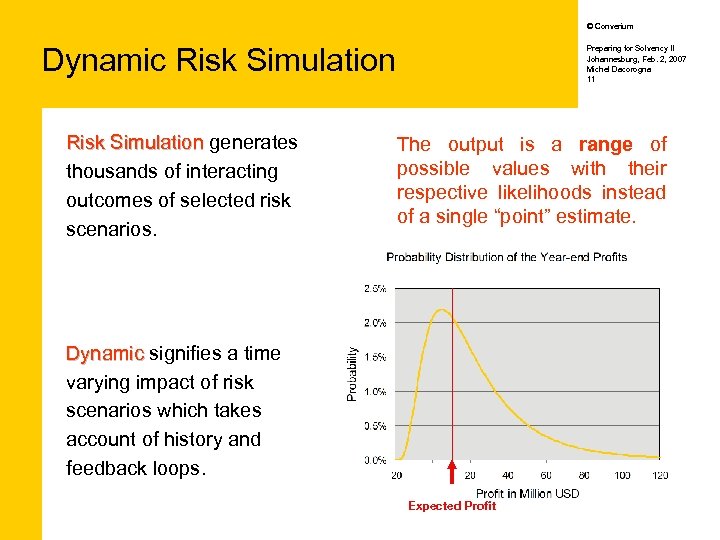

© Converium Dynamic Risk Simulation generates thousands of interacting outcomes of selected risk scenarios. Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 11 The output is a range of possible values with their respective likelihoods instead of a single “point” estimate. Dynamic signifies a time varying impact of risk scenarios which takes account of history and feedback loops. Expected Profit

© Converium Dynamic Risk Simulation generates thousands of interacting outcomes of selected risk scenarios. Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 11 The output is a range of possible values with their respective likelihoods instead of a single “point” estimate. Dynamic signifies a time varying impact of risk scenarios which takes account of history and feedback loops. Expected Profit

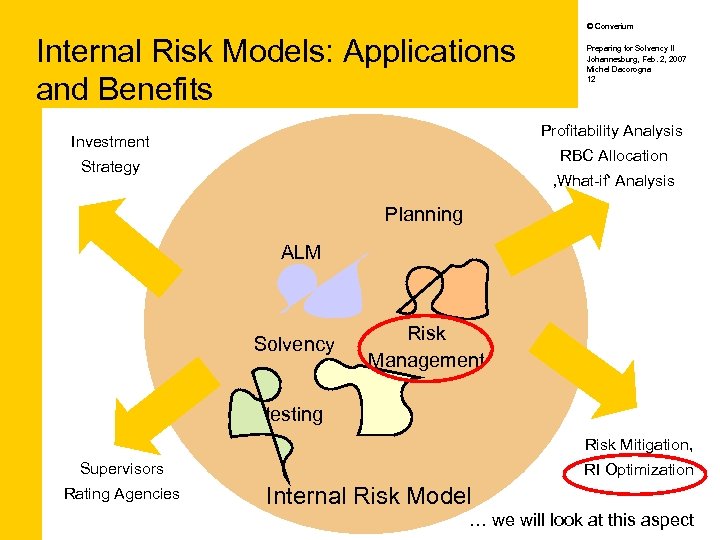

© Converium Internal Risk Models: Applications and Benefits Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 12 Profitability Analysis Investment RBC Allocation Strategy ‚What-if‘ Analysis Planning ALM Solvency Risk Management testing Risk Mitigation, Supervisors Rating Agencies RI Optimization Internal Risk Model … we will look at this aspect

© Converium Internal Risk Models: Applications and Benefits Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 12 Profitability Analysis Investment RBC Allocation Strategy ‚What-if‘ Analysis Planning ALM Solvency Risk Management testing Risk Mitigation, Supervisors Rating Agencies RI Optimization Internal Risk Model … we will look at this aspect

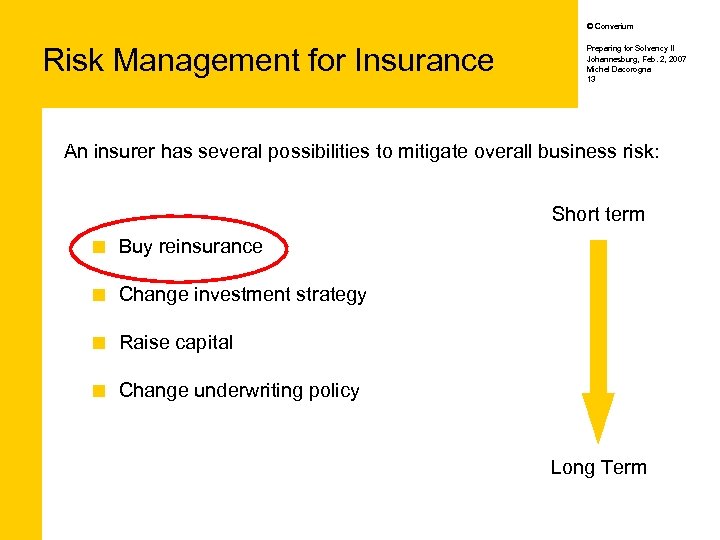

© Converium Risk Management for Insurance Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 13 An insurer has several possibilities to mitigate overall business risk: Short term ¢ Buy reinsurance ¢ Change investment strategy ¢ Raise capital ¢ Change underwriting policy Long Term

© Converium Risk Management for Insurance Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 13 An insurer has several possibilities to mitigate overall business risk: Short term ¢ Buy reinsurance ¢ Change investment strategy ¢ Raise capital ¢ Change underwriting policy Long Term

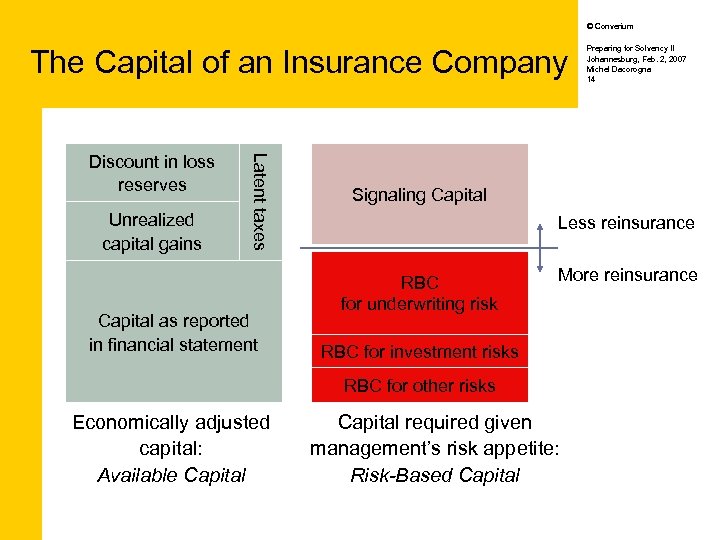

© Converium The Capital of an Insurance Company Unrealized capital gains Latent taxes Discount in loss reserves Capital as reported in financial statement Signaling Capital Less reinsurance RBC for underwriting risk More reinsurance RBC for investment risks RBC for other risks Economically adjusted capital: Available Capital Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 14 Capital required given management’s risk appetite: Risk-Based Capital

© Converium The Capital of an Insurance Company Unrealized capital gains Latent taxes Discount in loss reserves Capital as reported in financial statement Signaling Capital Less reinsurance RBC for underwriting risk More reinsurance RBC for investment risks RBC for other risks Economically adjusted capital: Available Capital Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 14 Capital required given management’s risk appetite: Risk-Based Capital

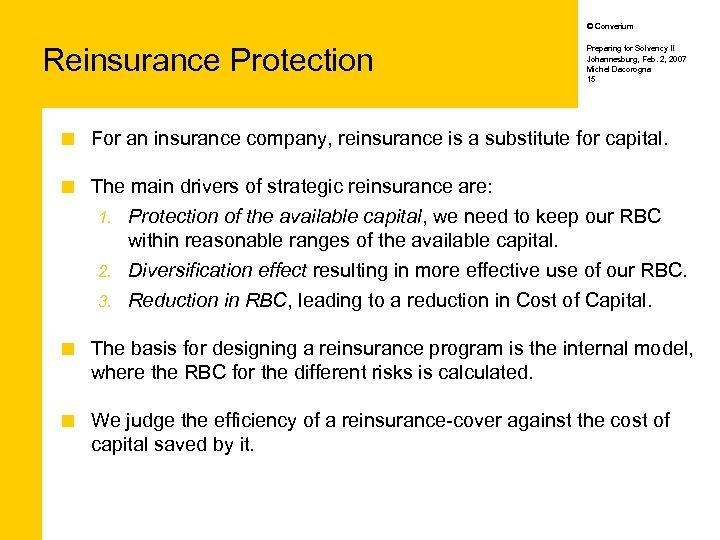

© Converium Reinsurance Protection Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 15 ¢ For an insurance company, reinsurance is a substitute for capital. ¢ The main drivers of strategic reinsurance are: 1. Protection of the available capital, we need to keep our RBC within reasonable ranges of the available capital. 2. Diversification effect resulting in more effective use of our RBC. 3. Reduction in RBC, leading to a reduction in Cost of Capital. ¢ The basis for designing a reinsurance program is the internal model, where the RBC for the different risks is calculated. ¢ We judge the efficiency of a reinsurance-cover against the cost of capital saved by it.

© Converium Reinsurance Protection Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 15 ¢ For an insurance company, reinsurance is a substitute for capital. ¢ The main drivers of strategic reinsurance are: 1. Protection of the available capital, we need to keep our RBC within reasonable ranges of the available capital. 2. Diversification effect resulting in more effective use of our RBC. 3. Reduction in RBC, leading to a reduction in Cost of Capital. ¢ The basis for designing a reinsurance program is the internal model, where the RBC for the different risks is calculated. ¢ We judge the efficiency of a reinsurance-cover against the cost of capital saved by it.

© Converium An Economic View on Reinsurance Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 16 ¢ Conventionally, reinsurance premiums are perceived as isolated costs related to the reduction of insurance risk. Accordingly, recoveries and premiums should balance on the long run. ¢ However, this view misses the fact that reinsurance is a substitute for risk capital. ¢ Risk capital is not for free. Investors expect an adequate return on their investment. By substituting risk capital, reinsurance thus is lowering capital costs. ¢ The basic idea: Reinsurance should be structured to leverage reinsurance premiums and capital costs optimally, which means reinsurance should be structured to minimize the total cost of capital and reinsurance.

© Converium An Economic View on Reinsurance Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 16 ¢ Conventionally, reinsurance premiums are perceived as isolated costs related to the reduction of insurance risk. Accordingly, recoveries and premiums should balance on the long run. ¢ However, this view misses the fact that reinsurance is a substitute for risk capital. ¢ Risk capital is not for free. Investors expect an adequate return on their investment. By substituting risk capital, reinsurance thus is lowering capital costs. ¢ The basic idea: Reinsurance should be structured to leverage reinsurance premiums and capital costs optimally, which means reinsurance should be structured to minimize the total cost of capital and reinsurance.

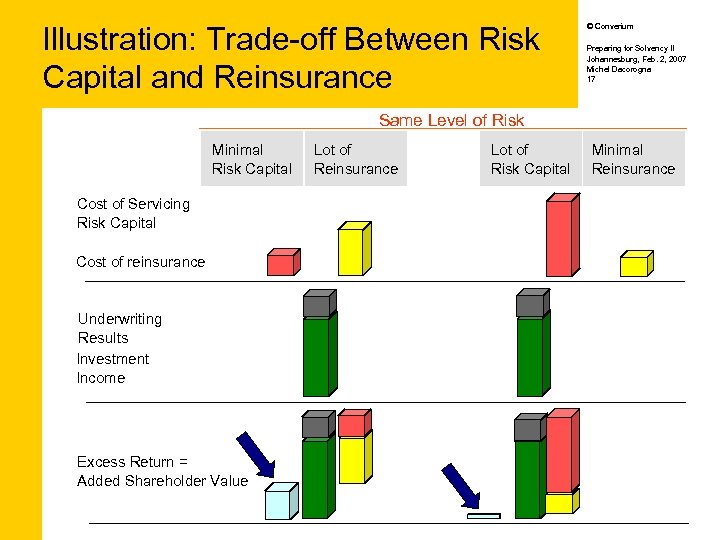

Illustration: Trade-off Between Risk Capital and Reinsurance © Converium Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 17 Same Level of Risk Minimal Risk Capital Cost of Servicing Risk Capital Cost of reinsurance Underwriting Results Investment Income Excess Return = Added Shareholder Value Lot of Reinsurance Lot of Risk Capital Minimal Reinsurance

Illustration: Trade-off Between Risk Capital and Reinsurance © Converium Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 17 Same Level of Risk Minimal Risk Capital Cost of Servicing Risk Capital Cost of reinsurance Underwriting Results Investment Income Excess Return = Added Shareholder Value Lot of Reinsurance Lot of Risk Capital Minimal Reinsurance

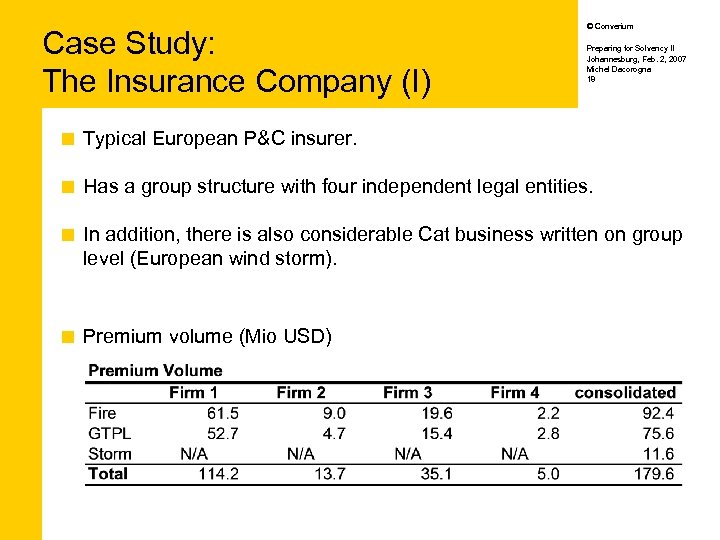

Case Study: The Insurance Company (I) © Converium Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 18 ¢ Typical European P&C insurer. ¢ Has a group structure with four independent legal entities. ¢ In addition, there is also considerable Cat business written on group level (European wind storm). ¢ Premium volume (Mio USD)

Case Study: The Insurance Company (I) © Converium Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 18 ¢ Typical European P&C insurer. ¢ Has a group structure with four independent legal entities. ¢ In addition, there is also considerable Cat business written on group level (European wind storm). ¢ Premium volume (Mio USD)

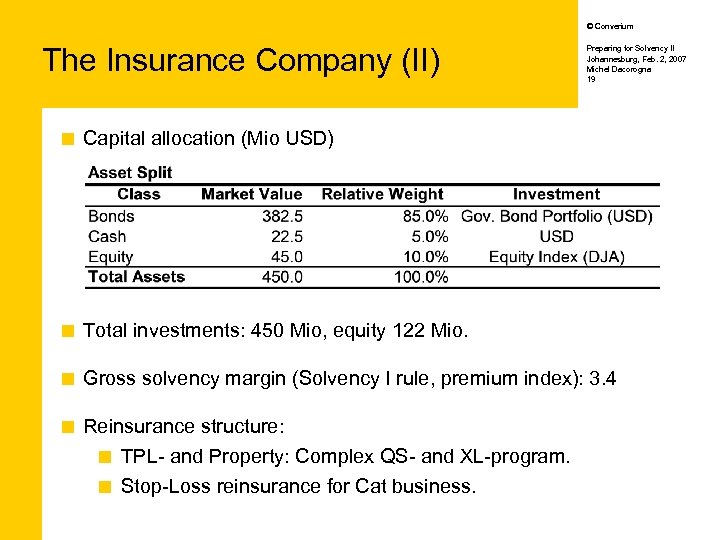

© Converium The Insurance Company (II) Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 19 ¢ Capital allocation (Mio USD) ¢ Total investments: 450 Mio, equity 122 Mio. ¢ Gross solvency margin (Solvency I rule, premium index): 3. 4 ¢ Reinsurance structure: ¢ TPL- and Property: Complex QS- and XL-program. ¢ Stop-Loss reinsurance for Cat business.

© Converium The Insurance Company (II) Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 19 ¢ Capital allocation (Mio USD) ¢ Total investments: 450 Mio, equity 122 Mio. ¢ Gross solvency margin (Solvency I rule, premium index): 3. 4 ¢ Reinsurance structure: ¢ TPL- and Property: Complex QS- and XL-program. ¢ Stop-Loss reinsurance for Cat business.

© Converium The Problem Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 20 ¢ Declining profitability during the last few years ¢ What is the economic value of the written business? ¢ Complex and not transparent reinsurance program ¢ What is the total risk on group level? ¢ How efficient is the reinsurance program? ¢ Is there a possibility to keep more risk on the balance sheet, is it possible to make better use of the risk capital? ¢ What is the expected solvency margin over the next four years if premiums grow by 4% p. a. ? Is this growth sustainable? ¢ Cat business ¢ The volatility grew constantly over the past few years. ¢ Is it possible to optimize the reinsurance program?

© Converium The Problem Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 20 ¢ Declining profitability during the last few years ¢ What is the economic value of the written business? ¢ Complex and not transparent reinsurance program ¢ What is the total risk on group level? ¢ How efficient is the reinsurance program? ¢ Is there a possibility to keep more risk on the balance sheet, is it possible to make better use of the risk capital? ¢ What is the expected solvency margin over the next four years if premiums grow by 4% p. a. ? Is this growth sustainable? ¢ Cat business ¢ The volatility grew constantly over the past few years. ¢ Is it possible to optimize the reinsurance program?

© Converium Economic value of written business Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 21 ¢ The Goal: Assessment of economical value and efficiency of existing reinsurance cover. ¢ Return measure ¢ Expected NPV of net underwriting result including cost of capital. ¢ Risk measure ¢ Expected Shortfall of NPV of net underwriting result, again including cost of capital. ¢ Time horizon: 1 year (underwriting year)

© Converium Economic value of written business Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 21 ¢ The Goal: Assessment of economical value and efficiency of existing reinsurance cover. ¢ Return measure ¢ Expected NPV of net underwriting result including cost of capital. ¢ Risk measure ¢ Expected Shortfall of NPV of net underwriting result, again including cost of capital. ¢ Time horizon: 1 year (underwriting year)

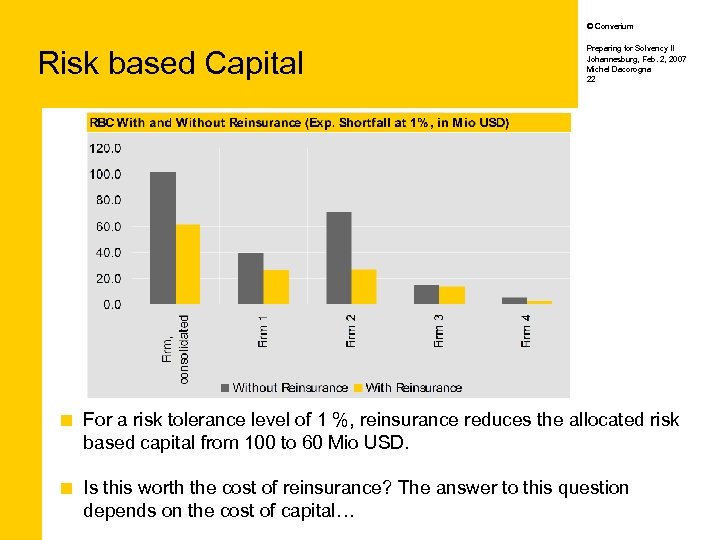

© Converium Risk based Capital Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 22 ¢ For a risk tolerance level of 1 %, reinsurance reduces the allocated risk based capital from 100 to 60 Mio USD. ¢ Is this worth the cost of reinsurance? The answer to this question depends on the cost of capital…

© Converium Risk based Capital Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 22 ¢ For a risk tolerance level of 1 %, reinsurance reduces the allocated risk based capital from 100 to 60 Mio USD. ¢ Is this worth the cost of reinsurance? The answer to this question depends on the cost of capital…

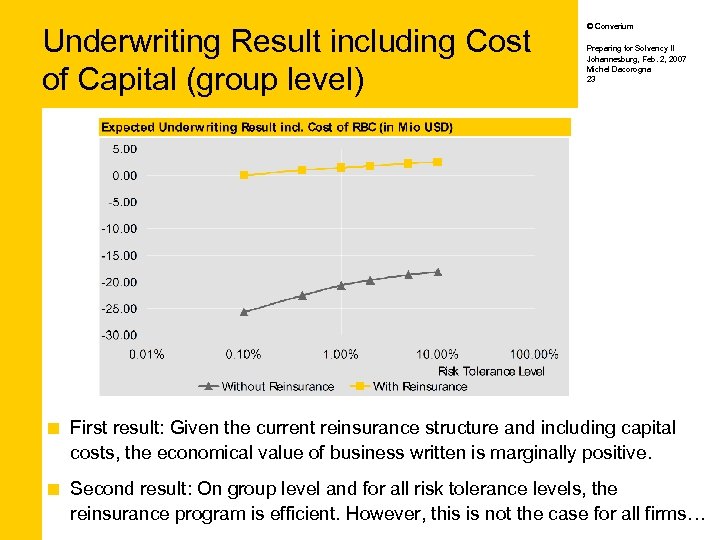

Underwriting Result including Cost of Capital (group level) © Converium Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 23 ¢ First result: Given the current reinsurance structure and including capital costs, the economical value of business written is marginally positive. ¢ Second result: On group level and for all risk tolerance levels, the reinsurance program is efficient. However, this is not the case for all firms…

Underwriting Result including Cost of Capital (group level) © Converium Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 23 ¢ First result: Given the current reinsurance structure and including capital costs, the economical value of business written is marginally positive. ¢ Second result: On group level and for all risk tolerance levels, the reinsurance program is efficient. However, this is not the case for all firms…

© Converium Optimization of Cat reinsurance ¢ Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 24 The existing Cat cover was not performing satisfactory during the last few years: ¢ ¢ In years with large claims (e. g. 1999, Lothar), the cover was not sufficient. ¢ ¢ In years with low to moderate claim experience, the reinsurance structure did not bring any or only partial relief. Reinsurance costs are perceived as too high for this limited use. Reinsurance strategy ¢ Increase of priority and limit of cover. ¢ For example: 200% xs 200% instead of 85% xs 125%. ¢ Result: Lower reinsurance premiums and higher economical value of reinsurance program.

© Converium Optimization of Cat reinsurance ¢ Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 24 The existing Cat cover was not performing satisfactory during the last few years: ¢ ¢ In years with large claims (e. g. 1999, Lothar), the cover was not sufficient. ¢ ¢ In years with low to moderate claim experience, the reinsurance structure did not bring any or only partial relief. Reinsurance costs are perceived as too high for this limited use. Reinsurance strategy ¢ Increase of priority and limit of cover. ¢ For example: 200% xs 200% instead of 85% xs 125%. ¢ Result: Lower reinsurance premiums and higher economical value of reinsurance program.

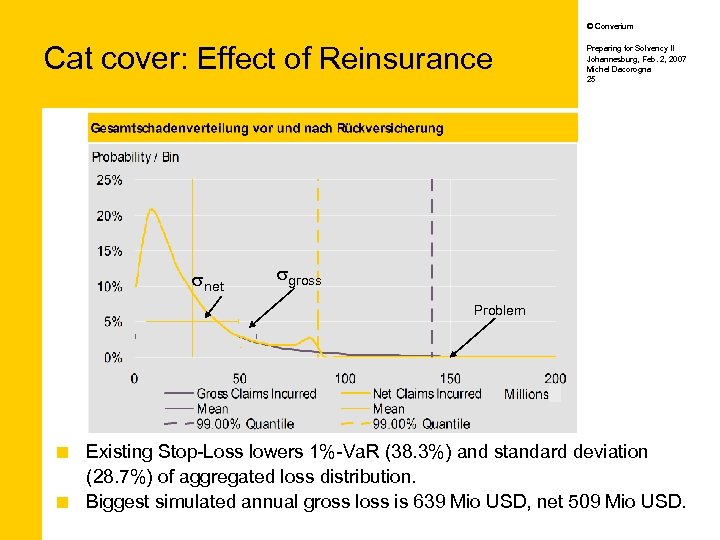

© Converium Cat cover: Effect of Reinsurance snet Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 25 sgross Problem Existing Stop-Loss lowers 1%-Va. R (38. 3%) and standard deviation (28. 7%) of aggregated loss distribution. ¢ Biggest simulated annual gross loss is 639 Mio USD, net 509 Mio USD. ¢

© Converium Cat cover: Effect of Reinsurance snet Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 25 sgross Problem Existing Stop-Loss lowers 1%-Va. R (38. 3%) and standard deviation (28. 7%) of aggregated loss distribution. ¢ Biggest simulated annual gross loss is 639 Mio USD, net 509 Mio USD. ¢

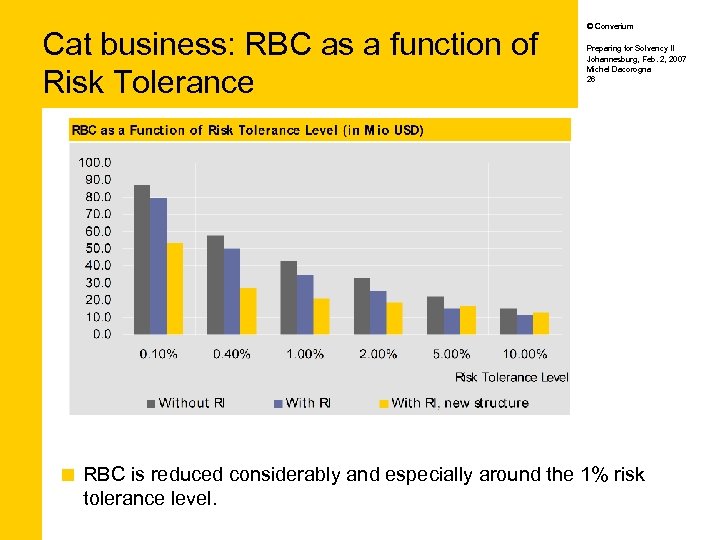

Cat business: RBC as a function of Risk Tolerance ¢ © Converium Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 26 RBC is reduced considerably and especially around the 1% risk tolerance level.

Cat business: RBC as a function of Risk Tolerance ¢ © Converium Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 26 RBC is reduced considerably and especially around the 1% risk tolerance level.

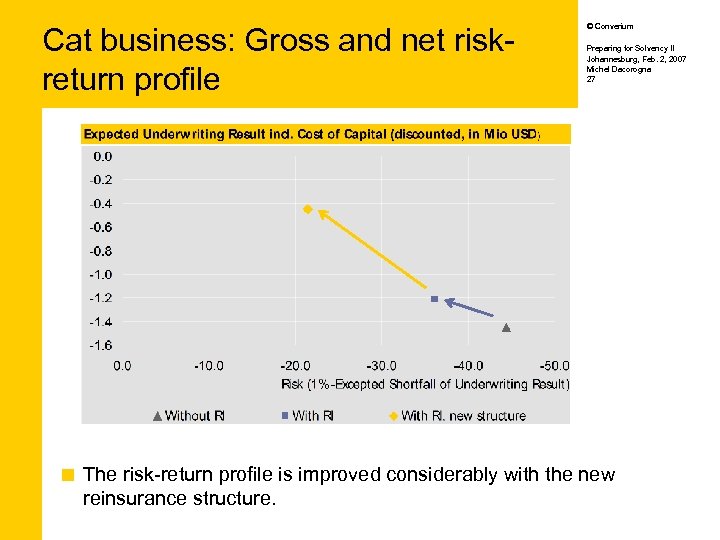

Cat business: Gross and net riskreturn profile ¢ © Converium Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 27 The risk-return profile is improved considerably with the new reinsurance structure.

Cat business: Gross and net riskreturn profile ¢ © Converium Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 27 The risk-return profile is improved considerably with the new reinsurance structure.

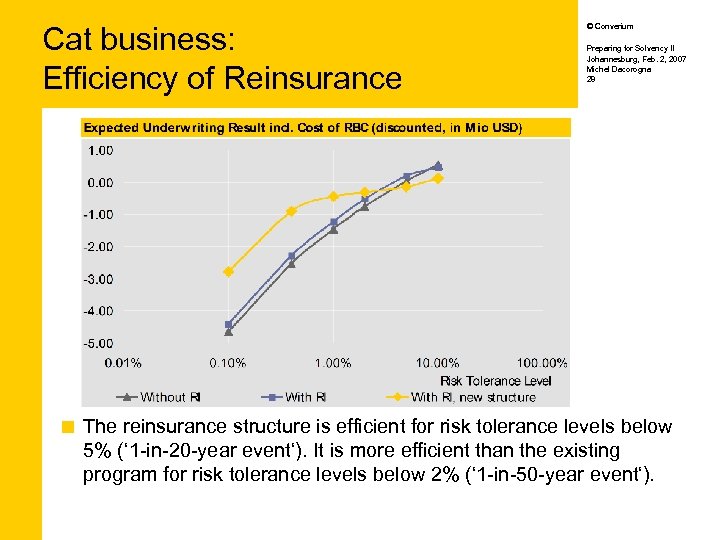

Cat business: Efficiency of Reinsurance ¢ © Converium Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 28 The reinsurance structure is efficient for risk tolerance levels below 5% (‘ 1 -in-20 -year event‘). It is more efficient than the existing program for risk tolerance levels below 2% (‘ 1 -in-50 -year event‘).

Cat business: Efficiency of Reinsurance ¢ © Converium Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 28 The reinsurance structure is efficient for risk tolerance levels below 5% (‘ 1 -in-20 -year event‘). It is more efficient than the existing program for risk tolerance levels below 2% (‘ 1 -in-50 -year event‘).

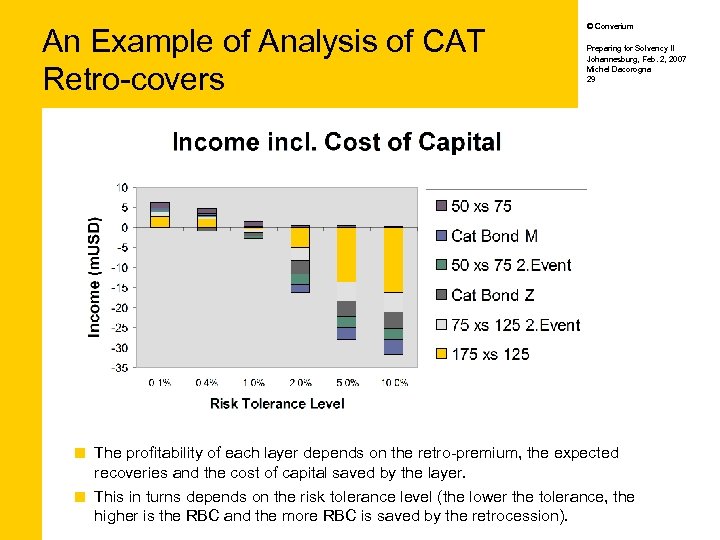

An Example of Analysis of CAT Retro-covers © Converium Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 29 ¢ The profitability of each layer depends on the retro-premium, the expected recoveries and the cost of capital saved by the layer. ¢ This in turns depends on the risk tolerance level (the lower the tolerance, the higher is the RBC and the more RBC is saved by the retrocession).

An Example of Analysis of CAT Retro-covers © Converium Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 29 ¢ The profitability of each layer depends on the retro-premium, the expected recoveries and the cost of capital saved by the layer. ¢ This in turns depends on the risk tolerance level (the lower the tolerance, the higher is the RBC and the more RBC is saved by the retrocession).

© Converium Conclusion Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 30 ¢ The approach combines financial analysis and risk modeling and is in line with the spirit of the new solvency regulations. ¢ It is a quantitative tool that allows to assess the overall risk of an insurance company. ¢ It allows to assess the economic value of different strategies. ¢ Thus, it helps design optimal risk mitigating strategies. ¢ It needs good data and a fair amount of modeling efforts.

© Converium Conclusion Preparing for Solvency II Johannesburg, Feb. 2, 2007 Michel Dacorogna 30 ¢ The approach combines financial analysis and risk modeling and is in line with the spirit of the new solvency regulations. ¢ It is a quantitative tool that allows to assess the overall risk of an insurance company. ¢ It allows to assess the economic value of different strategies. ¢ Thus, it helps design optimal risk mitigating strategies. ¢ It needs good data and a fair amount of modeling efforts.