457499f5202086d2441a028eb3fa7e5f.ppt

- Количество слайдов: 31

PREPARING FOR ISO 55000 Presentation by: Irene Muasya GRC Professional Thursday, 7 th September 2017 Uphold public interest

Presentation agenda q. Asset Management Failures q. What is ISO 55000? q. Principles of Asset Management q. Starting on the Right Foot q. Certification to ISO 55001

Asset Management Failures Eight Kenyan firms, Chase Bank, Imperial Bank, CMC, Uchumi, Mumias, Kenya Airways, National Bank and Trans. Century made a combined loss of Kshs. 264. 3 billion with Kshs. 179. 5 billion made by KQ alone. These firms are.

Kenyan Examples

Kenyan Examples

Kenyan Examples

Kenyan Examples

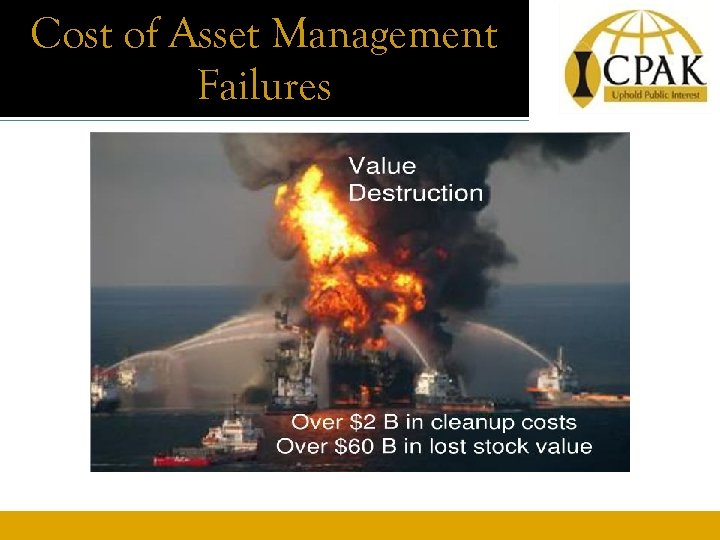

Cost of Asset Management Failures

What is ISO 55000 It’s a series of Asset Management standards made up of three standards: Ø ISO 55000: 2014 Asset management – Overview, principles and terminology (Why) Ø ISO 55001: 2014 Asset management – Management Systems – Requirements (What) Ø ISO 55002: 2014 Guidelines for the application of ISO 55001(How) It is an improvement of PAS 55

Why ISO Certification? Regulatory Compliance – implementation as directed by an economic or safety regulator. Contribution to Due Diligence – implementation as directed by the Board to demonstrate due diligence. Marketing strategy – implementation to obtain a certification to place on marketing material. Competitive advantage – holistic implementation to achieve a wide range of benefits to the organisation.

Why ISO Certification?

Why ISO Certification?

Benefits of ISO 55001 Certification Asset Management Policy Recognition –the ISO logos are well known and recognized and therefore deliver the credibility desired by the organisation seeking certification. Quality – the obligation to comply with the full ISO requirements ensure quality. Independence –organisations accredited via the ISO framework are subject to strict controls to prevent conflicts of interest.

Applicability of ISO 55000 ISO 55001 is applicable to anything that has potential or actual value to an organisation. That value can be financial or non-financial. This means that intangible assets such as software and intellectual property can also be managed in a way that meets recognized asset management standards.

Fundamental principles of Asset Management Ø Value -Assets exist to provide value to the organization and its stakeholders. Ø Alignment-requires line of sight from organizational objectives through to tactical plans and measures. Ø Leadership -requires management to take the lead and show commitment. Ø Assurance – that assets will fulfill their required purpose

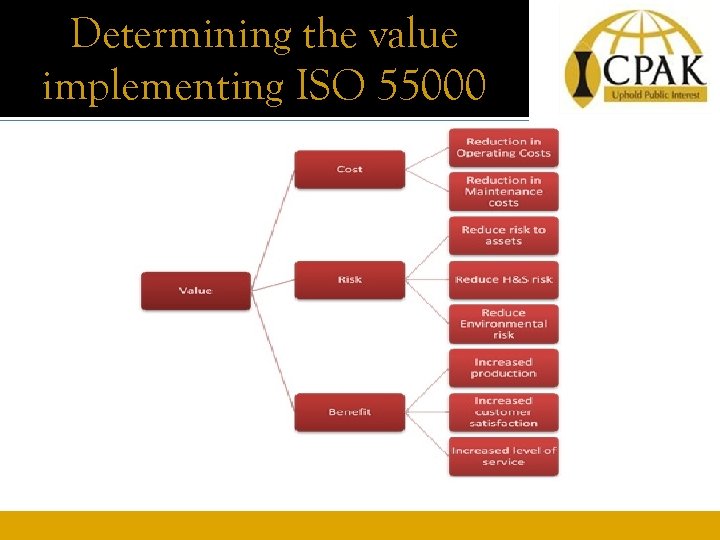

Determining the value implementing ISO 55000

Starting on the right foot 1. Leadership buy in 2. Get input from stakeholders on what benefits they expect 3. Get alignment internally 4. Determine your approach to compliance with the standard • Certification. • Compliance. • Alignment.

Starting on the right foot 5. Get agreement that funding and resources will be required for this initiative 6. Build a roadmap for the journey. This can be determined through an ISO 55000 readiness assessment.

Starting on the right foot

ISO 55000 Readiness Assessment Asset Management Policy To gain an understanding of where the major gaps in your asset management system are. This could be done internally or externally and should provide you with a high-level assessment of your organisations level of maturity and whether it will be feasible to embark on the journey. The readiness assessment will typically assess the existence and level of application of the foundation documents and should give you an opinion on where to start.

Maturity Assessment Asset Management Policy 1. Innocent – Not recognized the need, no commitment to progress it 2. Aware- Recognized the need and has intent to progress it 3. Developing- Progressed with credible and resourced plans in place. 4. Competent- Systematically and consistently achieves requirements 5. Optimizing- systematically and consistently optimizing its asset management practice 6. Excellent- Employs leading practices and achieves maximum value from the management of its assets

Components of an Asset Management System 1. Asset management policy -direction as formally expressed by top management 2. Asset Management Objectives - the “results to be achieved” or the aims/ goals/targets for asset management 3. Strategic Asset Management Plan (SAMP)-to capture asset management objectives that link the organizational objectives. 4. Asset Management Plans - specifies the activities, resources and timescales required for an individual asset, or a grouping of assets, to achieve the organisation’s asset management objectives

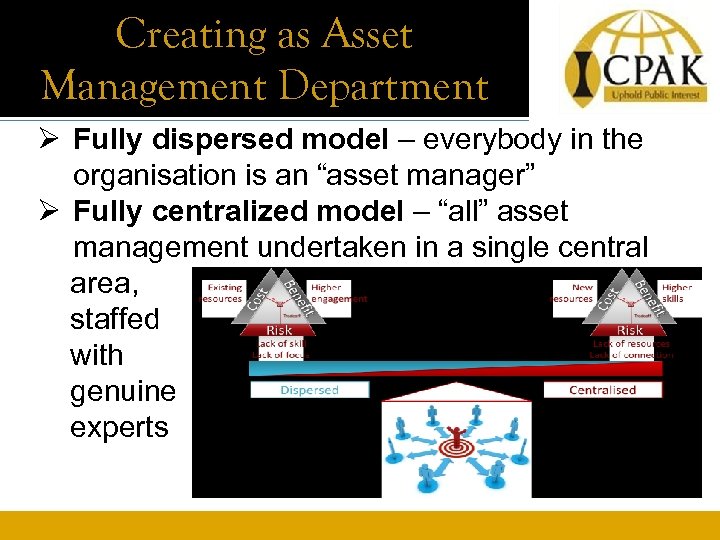

Creating as Asset Management Department Ø Fully dispersed model – everybody in the organisation is an “asset manager” Ø Fully centralized model – “all” asset management undertaken in a single central area, staffed with genuine experts

Finding an Asset Management Champion There must be a “visible champion” amongst top management and they must have sufficient control over the asset management resources to drive the system forward.

Asset Management Culture Organisations that are good at asset management don’t just let things happen – they make them happen. And when events do occur that are outside their control, they are already prepared for them, and have contingency plans, systems and processes in place to deal with them.

Risk Management Process Every organisation considering implementing ISO 55000 needs to have a clear process for identifying and managing risks. Every asset management decision, including selection of processes, needs to balance the competing factors of performance, cost and risk.

Detailed Gap Assessment Asset Management Policy Ø Develop the asset management system Ø Detailed gap assessment Two options are: • Internal assessment using Self. Assessment Methodology • External Assessment using consultants Ideally, you would want to use a Certified Asset Management Assessor (Internal or External)

Certification Process Asset Management Policy Ø Select an ISO 55001 certification scheme Ø Locate a conformity assessment body CAB – check with your conformity assessment accreditation body Ø Final Certification Audit This is ultimately a pass/ fail exercise, where you either do or do not achieve the requirements for certification.

Subsequent Audits Asset Management Policy Follow-up audit –in 3 -12 months to ensure minor non-conformities identified during the certification audit have been rectified Surveillance audit – on-going routine audit to ensure continued compliance, usually on a 1 -2 year cycle. Re-certification audit – a full repeat of the certification audit, usually 3 -4 yrs. NB: These are in addition to your on-going internal auditing

Conclusion Asset Management Policy The keys to success in Certification are: Ø Keep the business case in mind (both benefits and likely resources) Ø Select a certification scheme that is appropriate to that business case, Ø Find a CAB that is accredited and can offer an audit team with the right credentials, experience and personality to work effectively with your organisation Ø Include resources for risk-mitigating assessments in your journey and Ø Consider engaging external expertise to guide you on this journey

Questions……. . Asset Management Policy

457499f5202086d2441a028eb3fa7e5f.ppt