21e93e2b8893b9c2c0a8937a9c75f7ce.ppt

- Количество слайдов: 182

Prepared & Presented By : Stuart Tugman, CLU, Ch. FC, FLMI, AEP

Disclosure This seminar is for continuing education purposes only. It is intended to be accurate and authoritative in regard to the subject matter covered. It is presented with the understanding that I am not engaged in rendering legal or tax advice. The sales concepts we’ll discuss are for informational purposes only.

Disclosure While this seminar discusses general tax aspects of planning with insurance, we make no representations as to suitability for individual clients. Interested parties should be strongly encouraged to seek separate tax and legal advice before implementing a plan of the type described in this presentation.

Disclosure Illustration numbers are for educational purposes only and represent case studies of how to analyze products prior to sale to the client. Hypothetical illustrations, projected premiums and death benefits are based on the interest rate, mortality charges and other expenses illustrated in the life insurance policy used in this example are from a highly rated company. They are not guaranteed.

Disclosure Variable products are sold by prospectus. Consider the investment objectives, risks, and charges and expenses of the investment company carefully before investing. The prospectus contains this and other information about the investment company.

Disclosure For illustration simplicity and due to the fact that the personal exemption values will change annually, some references to the 2012 Taxpayer Relief Act reflect a $5, 000 personal exemption value for the Estate, Generation Skip and Gift Tax and do not take into consideration the inflation factors for 2012 and 2013 and the increased tax rate for 2013.

Disclosure The inflation factor for 2012 increased the exemption to $5, 120, 000. The inflation factor for 2013 increased the exemption to $5, 250, 000. The 2012 tax rate = 35 % The 2013 tax rate = 40%

IRS Circular 230 Disclosure This material was prepared to support the promotion and marketing of life insurance products. The continuing education was filed through The Lincoln Financial Group®. The Lincoln Financial Group, affiliates, distributors, and their respective employees, representatives, and/or insurance agents do not provide tax, accounting, or legal advice.

IRS Circular 230 Disclosure Any tax statements contained herein were not intended or written to be used, and cannot be used for the purpose of avoiding U. S. federal, state or local tax penalties. Your Clients should consult their own independent tax advisor as to any tax, accounting or legal statements made herein

TAXPAYER RELIEF ACT. . ESTATE TAX • THE PERSONAL EXEMPTION REMAINS AT $5, 000 AND IS INCREASED BY ANNUAL INFLATION… 2013 = $5, 250, 000 • THE TAX RATE IS INCREASED TO 40 %. • BOTH ALSO APPLY TO GIFT AND GENERATION SKIP TAXES.

2012 TAXPAYER RELIEF ACT. . ESTATE TAX • UNIFIED THE ESTATE, GIFT AND GENERATION SKIP TAX WITH COMMON EXEMPTIONS AND RATES. • MADE PERMANENT THE MAXIMUM EXEMPTION GIFTS MADE BY 12/31/2012.

2012 TAXPAYER RELIEF ACT. . ESTATE TAX • THE SPOUSAL EXEMPTION PORTABILITY CONCEPT IS RETAINED AND THE UNUSED PORTION IS MADE PERMANENT.

2012 TAXPAYER RELIEF ACT. . ESTATE TAX • FEDERAL GIFT TAX ANNUAL EXCLUSION IS INCREASED TO $14, 000 FOR 2013. • FEDERAL GIFT TAX ANNUAL EXCLUSION FOR NON-CITIZEN SPOUSE IS INCREASED TO $143, 000 FOR 2013.

2012 TAXPAYER RELIEF ACT. . INCOME TAX • THE SO CALLED “BUSH TAX CUT” RATES ARE RETAINED FOR SINGLE TAXPAYERS MAKING $399, 999 AND JT FILERS MAKING $449, 999. THE CAPITAL GAINS AND QUALIFIED DIVIDEND TAX RATE REMAINS @ 15%. FOR INCOMES ABOVE THOSE AMOUNTS, THE TOP INCOME TAX RATE IS 39. 6% AND THE TOP CAPITAL GAINS AND QUALIFIED DIVIDEND RATE IS INCREASED TO 20 %.

2012 TAXPAYER RELIEF ACT. . OTHER TAX ITEMS • SOCIAL SECURITY PAYROLL TAX GOES TO 6. 2% FROM 4. 2%. • CHILD TAX CREDIT PLUS A COLLEGE TUTION TAX CREDIT OF UP TO $2, 500 IS EXTENDED FOR 5 YEARS. • SOCIAL SECURITY MAXIMUM COMPENSATION $113, 700.

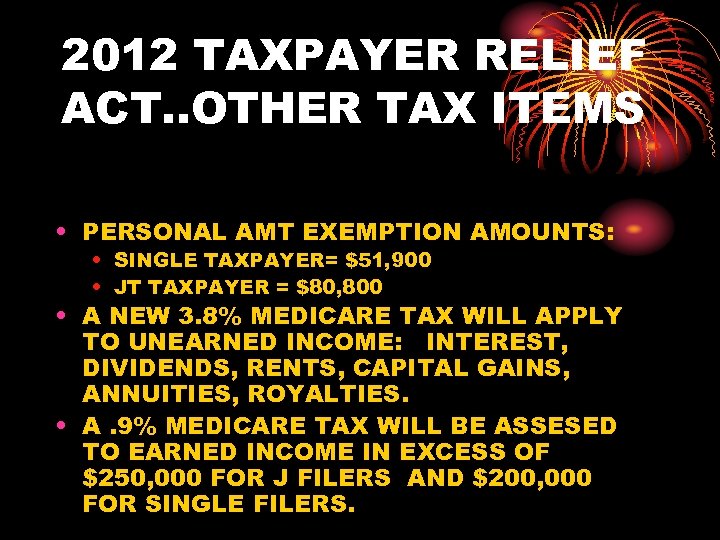

2012 TAXPAYER RELIEF ACT. . OTHER TAX ITEMS • PERSONAL AMT EXEMPTION AMOUNTS: • SINGLE TAXPAYER= $51, 900 • JT TAXPAYER = $80, 800 • A NEW 3. 8% MEDICARE TAX WILL APPLY TO UNEARNED INCOME: INTEREST, DIVIDENDS, RENTS, CAPITAL GAINS, ANNUITIES, ROYALTIES. • A. 9% MEDICARE TAX WILL BE ASSESED TO EARNED INCOME IN EXCESS OF $250, 000 FOR J FILERS AND $200, 000 FOR SINGLE FILERS.

NOW, TO THE SEMINAR… WE WILL REVIEW 10 CLIENTS WITH DIFFERENT OBJECTIVES AND PRESENT A “BEST CASE” TRUST/CONCEPT SOLUTION. . BUT FIRST, A BRIEF DISCUSSION OF “TRUSTS”

TRUST • A TRUST MAY BE COMPARED TO A “FENCE” ARROUND A PIECE OF PROPERTY. IT PROTECTS THE PROPERTY INSIDE THE FENCE FROM OUTSIDERS AND ALLOWS THOSE WITH ACCESS THROUGH THE “GATE” IN THE FENCE TO ENJOY THE BENEFITS OF THE PROPERTY WITHIN.

Trusts in General • Definition • An arrangement whereby one person, the trustee, holds legal title to property for the benefit of someone else, the beneficiary. That other person, the beneficiary, has equitable title to the property.

Trusts in General • Purposes • To supply one or more missing elements that are essential to the proper care, management and use of the property in the trust: • Physical capacity • Mental competence • Prudence • Maturity • Experience • Interest in the management of property

Trusts in General • Purposes (cont’d) • To manage income taxes and save estate taxes when necessary. • To take advantage of the ease and privacy of property transfer at death • To save administration expenses

Irrevocable Trust • Uses • To remove the property from the gross estate so that it will not be subject to the federal estate tax • To relieve the grantor of the management of the property during his lifetime • To provide experience in property management for heirs after the death of the grantor

CLIENT OBJECTIVE # 1 • WITH EQUAL OWNERSHIP INTEREST BY HUSBAND WIFE, IN MOST ESTATE ASSETS TOTALING $12, 000, CLIENT WANTS TO TAKE FULL ADVANTAGE OF THE EXEMPTION AMOUNT FOR HIMSELF AND HIS SPOUSE, REGARDLESS OF WHO IS FIRST-TO-DIE.

CLIENT OBJECTIVE # 1 • WANTS FUTURE CREDITOR PROTECTION FOR ESTATE ASSETS. • ASSETS HAVE A GREAT POTENTIAL FOR FUTURE VALUE GROWTH. WANTS THAT ASSET VALUE GROWTH, AFTER FIRST DEATH, KEPT OUTSIDE OF THE NEXT TAXABLE ESTATE.

Credit Shelter Trust -also called… • Credit Trust • Shelter Trust • Exemption Equivalent Trust

Exemption Equivalent Trust • Purposes • To take full advantage of the unified credit at the death of the first spouse to die. • To provide the surviving spouse with the use of the property and its income without causing the value of that property to be in the taxable estate at that spouse’s eventual death.

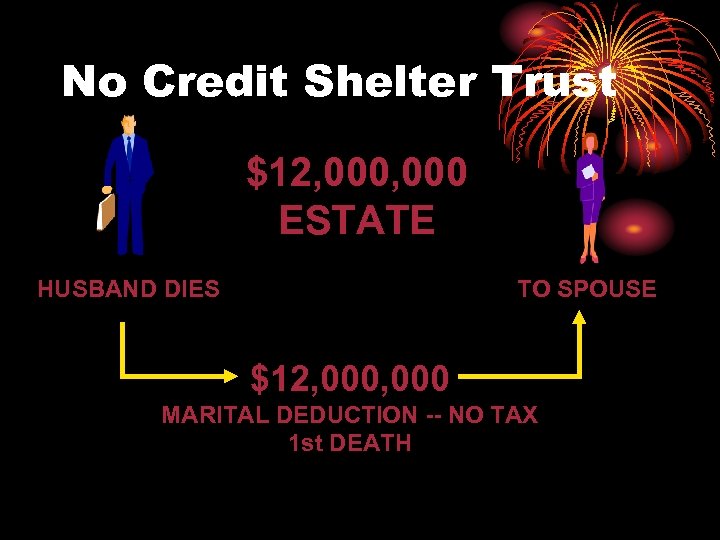

No Credit Shelter Trust $12, 000 ESTATE HUSBAND DIES TO SPOUSE $12, 000 MARITAL DEDUCTION -- NO TAX 1 st DEATH

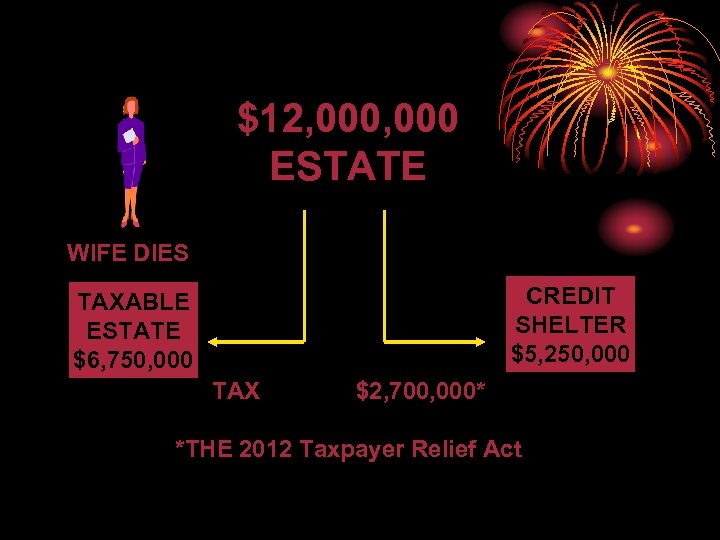

$12, 000 ESTATE WIFE DIES CREDIT SHELTER $5, 250, 000 TAXABLE ESTATE $6, 750, 000 TAX $2, 700, 000* *THE 2012 Taxpayer Relief Act

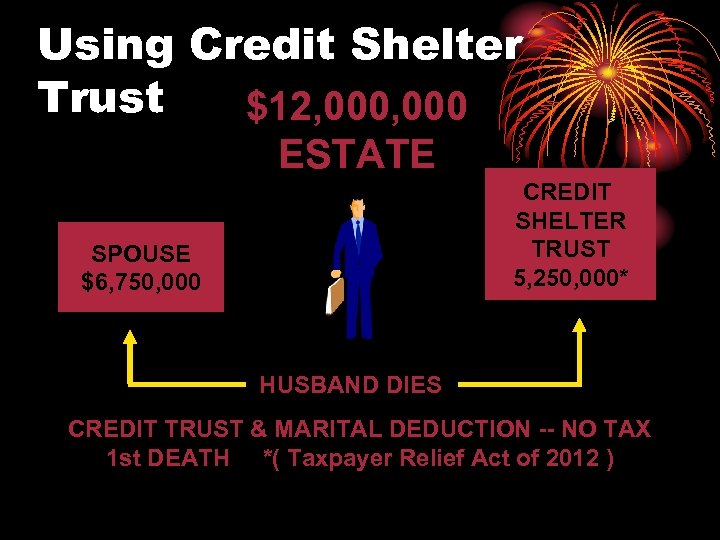

Using Credit Shelter Trust $12, 000 ESTATE CREDIT SHELTER TRUST 5, 250, 000* SPOUSE $6, 750, 000 HUSBAND DIES CREDIT TRUST & MARITAL DEDUCTION -- NO TAX 1 st DEATH *( Taxpayer Relief Act of 2012 )

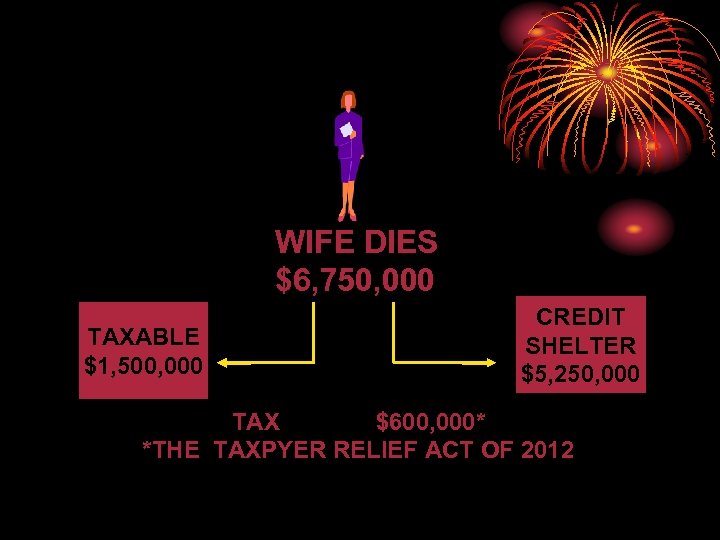

WIFE DIES $6, 750, 000 TAXABLE $1, 500, 000 CREDIT SHELTER $5, 250, 000 TAX $600, 000* *THE TAXPYER RELIEF ACT OF 2012

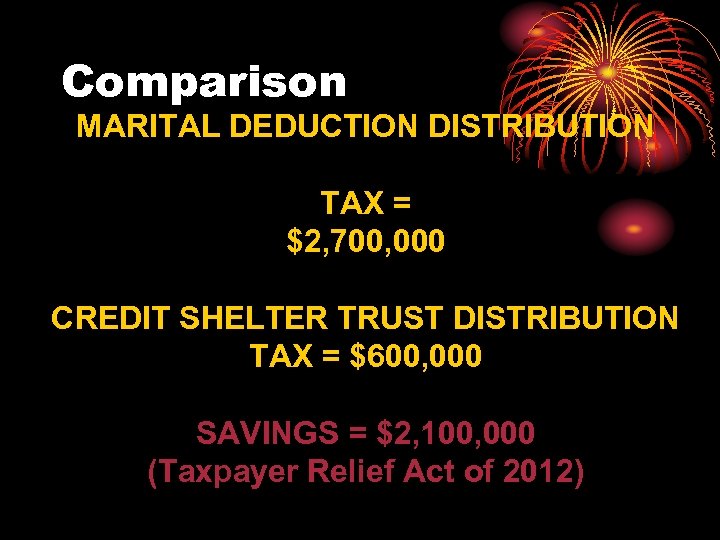

Comparison MARITAL DEDUCTION DISTRIBUTION TAX = $2, 700, 000 CREDIT SHELTER TRUST DISTRIBUTION TAX = $600, 000 SAVINGS = $2, 100, 000 (Taxpayer Relief Act of 2012)

THE QUESTION ALWAYS: “IS THE SURVIVING SPOUSE HAPPY WITH THIS STRUCTURED DISTRIBUTION PLAN ? ”

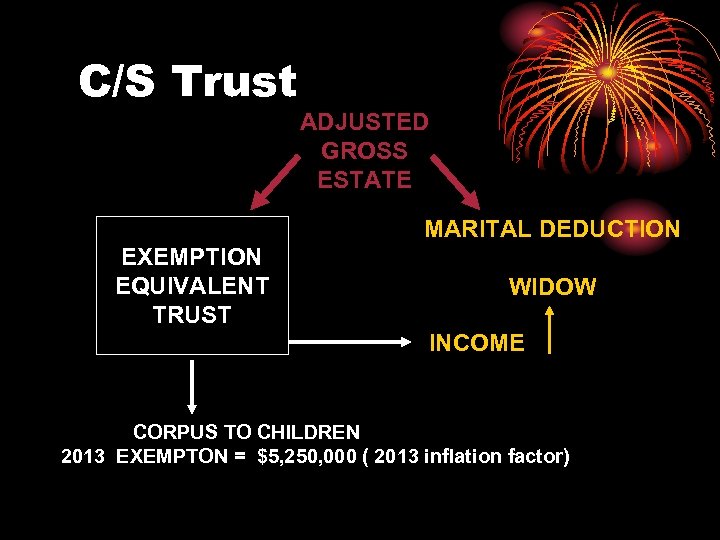

C/S Trust ADJUSTED GROSS ESTATE MARITAL DEDUCTION EXEMPTION EQUIVALENT TRUST WIDOW INCOME CORPUS TO CHILDREN 2013 EXEMPTON = $5, 250, 000 ( 2013 inflation factor)

CLIENT OBJECTIVE # 2 • CLIENT OWNS MAJORITY OF ASSET VALUES AND IS UNWILLING TO TRANSFER ANY ASSET OWNERSHIP TO SPOUSE. • CONCERNED IF HUSBAND DIES FIRST AND WANTS HIS EXEMPTION VALUE TO BE AVAILABLE FOR HER USE AT HER EVENTUAL DEATH.

Spousal Exemption Portability Concept • FROM THE 2010 “TAX ACT” AND RETAINED BY THE “ 2012 AMERICAN TAXPAYER RELIEF ACT”……. . ALLOWS THE “FIRST SPOUSE-TO-DIE” TO PASS THE VALUE OF THE ESTATE TAX PERSONAL EXEMPTION ($5, 000)* TO THE SURVIVING SPOUSE.

Spousal Portability Concept… Advantages: • SIMPLE TO USE …. BUT DOES REQUIRE THE FILING OF AN ESTATE TAX RETURN, REGARDLESS OF THE SIZE OF THE ESTATE. • NO OUTRIGHT OWNERSHIP OF PROPERTY REQUIREMENT. (GREAT POTENTIAL ADVANTAGE OVER C S T)

Spousal Portability Concept… Advantages: • SURVIVING SPOUSE MAY USE DECEASED SPOUSE’S CREDIT IN A LIFETIME GIFT OR AT 2 ND DEATH. . BUT, NOT FOR GENERATION SKIP TAX PLANNING.

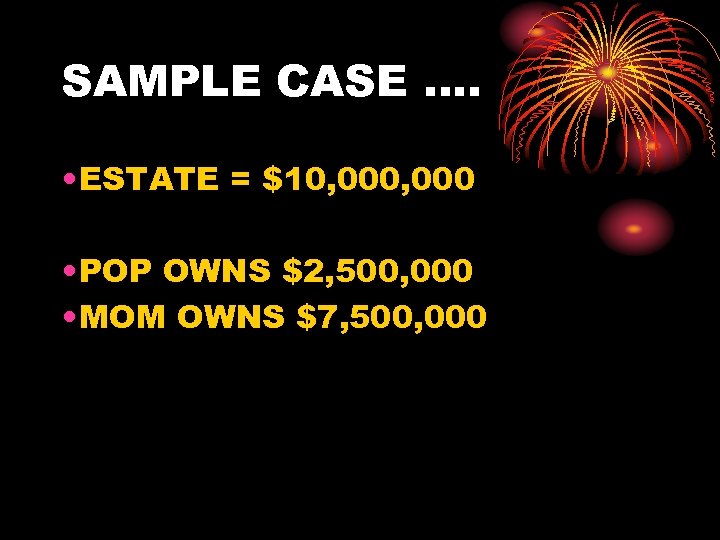

SAMPLE CASE …. • ESTATE = $10, 000 • POP OWNS $2, 500, 000 • MOM OWNS $7, 500, 000

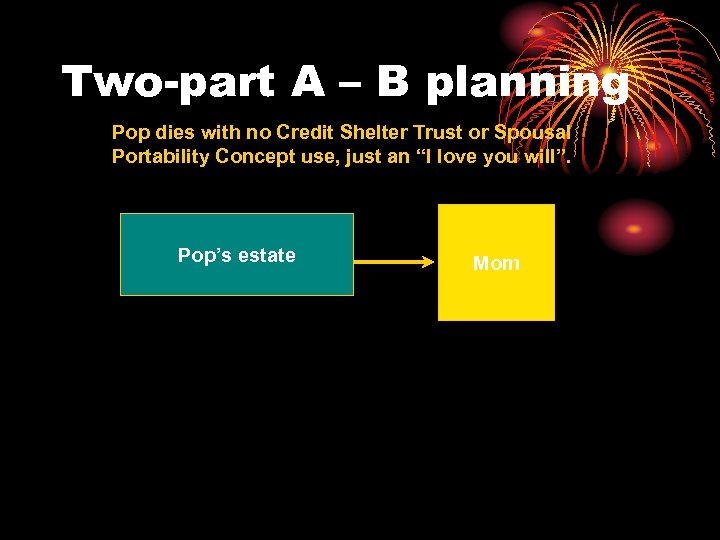

Two-part A – B planning Pop dies with no Credit Shelter Trust or Spousal Portability Concept use, just an “I love you will”. Pop’s estate Mom

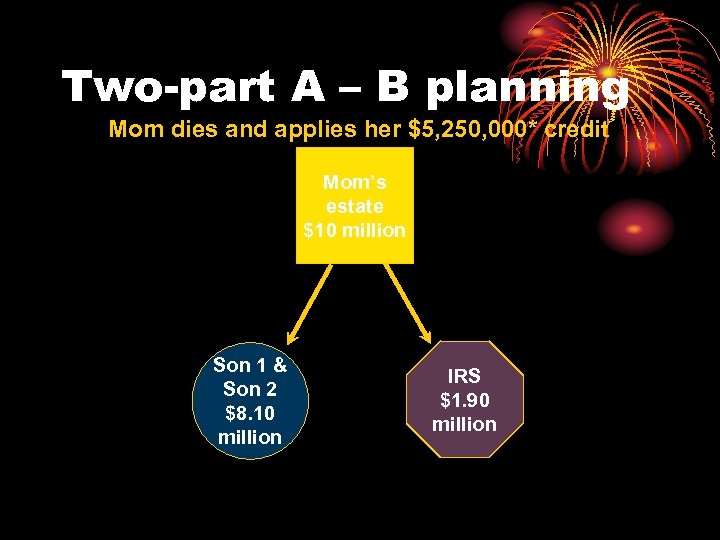

Two-part A – B planning Mom dies and applies her $5, 250, 000* credit Mom’s estate $10 million Son 1 & Son 2 $8. 10 million IRS $1. 90 million

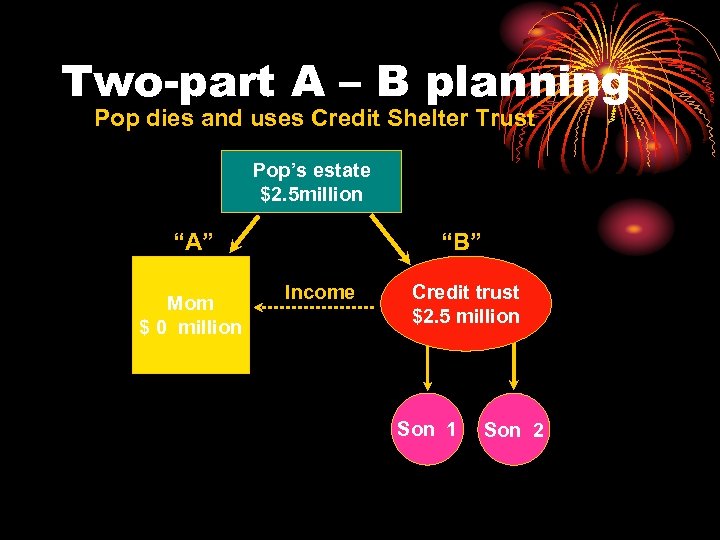

Two-part A – B planning Pop dies and uses Credit Shelter Trust Pop’s estate $2. 5 million “A” Mom $ 0 million “B” Income Credit trust $2. 5 million Son 1 Son 2

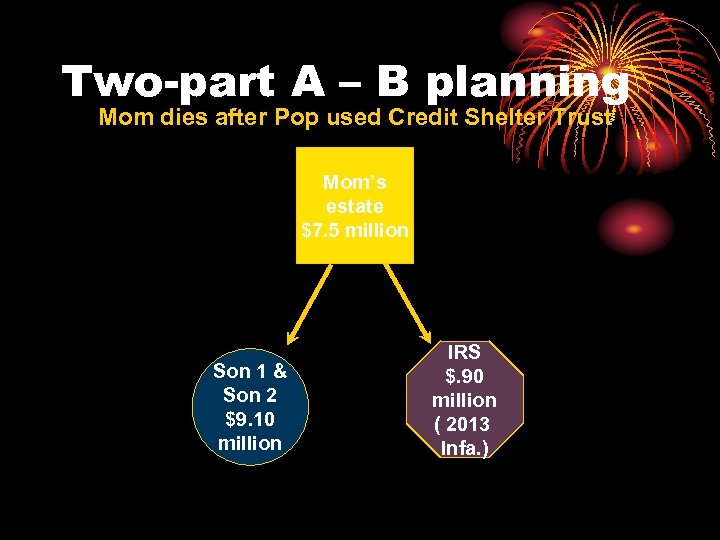

Two-part A – B planning Mom dies after Pop used Credit Shelter Trust Mom’s estate $7. 5 million Son 1 & Son 2 $9. 10 million IRS $. 90 million ( 2013 Infa. )

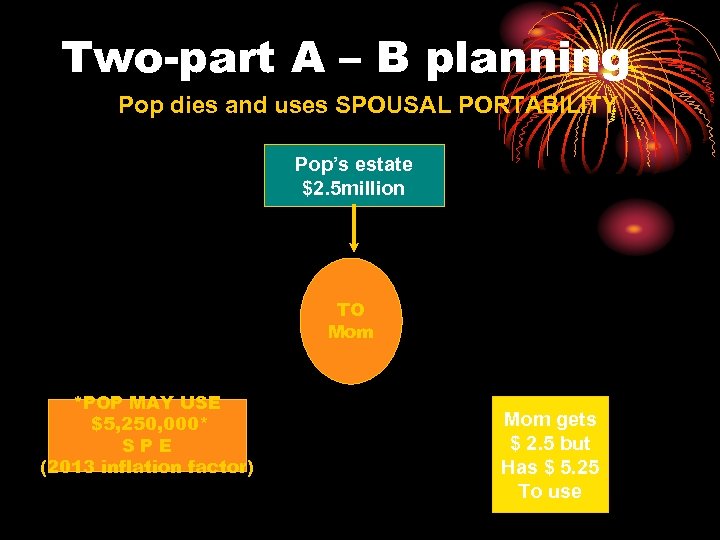

Two-part A – B planning Pop dies and uses SPOUSAL PORTABILITY Pop’s estate $2. 5 million TO Mom *POP MAY USE $5, 250, 000* SPE (2013 inflation factor) Mom gets $ 2. 5 but Has $ 5. 25 To use

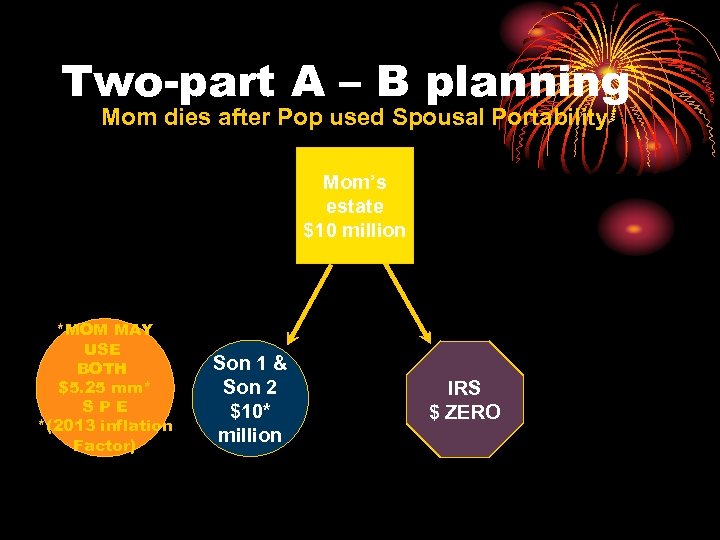

Two-part A – B planning Mom dies after Pop used Spousal Portability Mom’s estate $10 million *MOM MAY USE BOTH $5. 25 mm* SPE *(2013 inflation Factor) Son 1 & Son 2 $10* million IRS $ ZERO

IMPORTANT DISTINCTIONS BETWEEN THE C S T & THE S E P C 1. THE C S T HAS A PROPERTY OWNERSHIP REQUIREMENT. TO PUT $5, 250, 000 INTO A C S T YOU MUST HAVE OUTRIGHT OWNERSHIP OF PROPERTY WORTH $5, 250, 000. THE S E P C HAS NO PROPERTY OWNERSHIP REQUIREMENTS. THE FULL $5, 250, 000 MAY BE PASSED TO THE SURVIVING SPOUSE REGARDLESS OF THE DECEASED’S ESTATE SIZE.

DISTINCTIONS 2. THE C S T IS MORE COMPLEX AND REQUIRES THE EXECUTION OF A TRUST BY AN ATTORNEY. THE S E P C IS SIMPLE AND REQUIRES ONLY THE FILING OF AN ESTATE TAX RETURN BY THE ESTATE OF THE FIRST-SPOUSE-TODIE.

DISTINCTIONS: 3. THE C S T PROVIDES CREDITOR PROTECTION FOR THE ASSETS PLACED INTO THE TRUST. THE S E P C PROVIDES NO CREDITOR PROTECTION. THE ASSETS BECOME THE PROPERTY OF THE SURVIVING SPOUSE AND THUS, SUBJECT TO THE CLAIMS OF CREDITORS.

DISTINCTIONS: 4. THE C S T PROVIDES PROTECTION OF FUTURE ASSET VALUE GROWTH FROM BEING INCLUDED IN THE SURVIVING SPOUSE’S ESTATE FOR ESTATE TAX CALCULATION PURPOSES. THE S E P C PROVIDES NO SUCH PROTECTION. FUTURE ASSET VALUE GROWTH WILL BE SUBJECT TO CALCULATION FOR POTENTIAL ESTATE TAX.

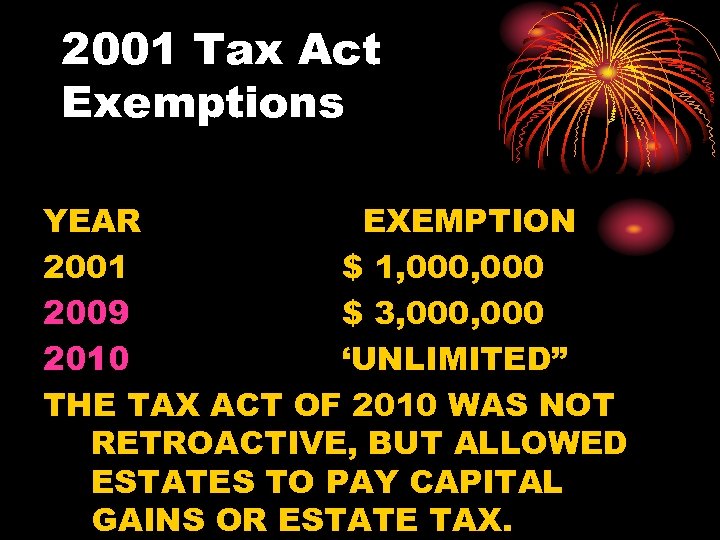

2001 Tax Act Exemptions YEAR EXEMPTION 2001 $ 1, 000 2009 $ 3, 000 2010 ‘UNLIMITED” THE TAX ACT OF 2010 WAS NOT RETROACTIVE, BUT ALLOWED ESTATES TO PAY CAPITAL GAINS OR ESTATE TAX.

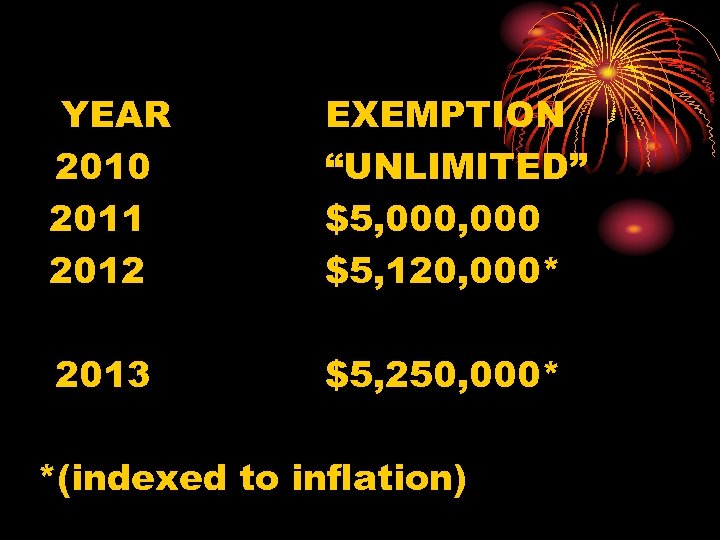

YEAR 2010 2011 2012 EXEMPTION “UNLIMITED” $5, 000 $5, 120, 000* 2013 $5, 250, 000* *(indexed to inflation)

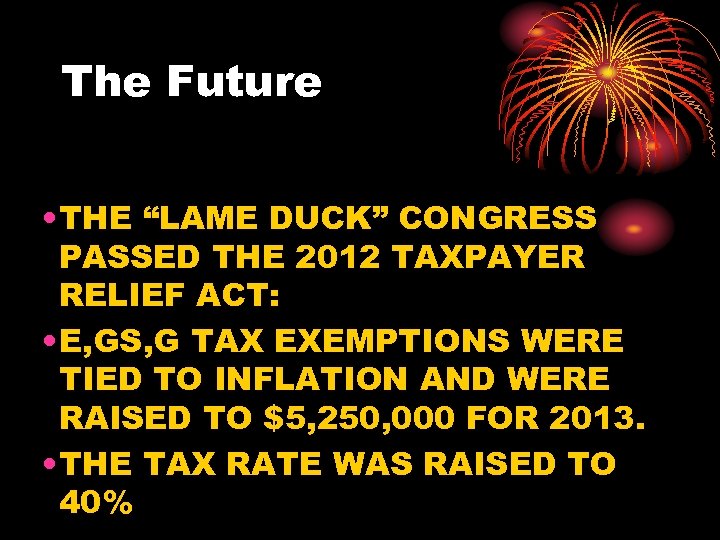

The Future • THE “LAME DUCK” CONGRESS PASSED THE 2012 TAXPAYER RELIEF ACT: • E, GS, G TAX EXEMPTIONS WERE TIED TO INFLATION AND WERE RAISED TO $5, 250, 000 FOR 2013. • THE TAX RATE WAS RAISED TO 40%

CLIENT OBJECTIVE # 3 WEALTHY CLIENT WISHES TO “CAPTURE FOREVER” THE “$5, 000 EXEMPTION” FOR HIMSELF AND HIS SPOUSE BECAUSE HE FEARS THAT A FUTURE NEW CONGRESS WILL REDUCE THE EXEMPTION AMOUNT AT SOME FUTURE TIME.

2013 This Year We Know That The Lifetime Exemption Is $5, 250, 000 For A Single Person & $10, 500, 000 For A Married Couple 62

2013 – LIFE TIME GIVING What Does The Average Client Want? To Give Their Assets Away (FOR TAX PURPOSES) But Retain As Much Control As Possible 63

2013 - LIFE TIME GIVING Can We Structure A Gift So That A Married Couple Can Take Advantage Of The Lifetime Exemption For 2013 And Still Retain Some Control Over The Assets? Yes… !! 64

2013 - LIFE TIME GIVING Consider Having Each Spouse Make A Gift To A Trust Established For The Other Spouse And Children Essentially, A QTIP Without The Election ! 65

2013 - LIFE TIME GIVING Trust Could Purchase $5 Million Of Life Insurance On Grantor/Spouse To Enhance Income Assets for the Surviving Spouse. MUST: Avoid Reciprocal Trust Rule. 66

2013 - LIFE TIME GIVING Potential Trust Terms Income Distributions To Spouse Each Year • Required If QTIP Election Is Made • Could Be Discretionary For Non-QTIP • Other Beneficiaries Could Receive Income 67

2013 - LIFE TIME GIVING Wife Uses Her 5 Million Lifetime Exemption Wife Creates An Irrevocable Trust For The Husband With A $5 Million Gift, With Remainder Held For Children Trust Gives Independent Trustee Broad Discretion To Make Distributions To Husband For Health, Maintenance And Support. 68

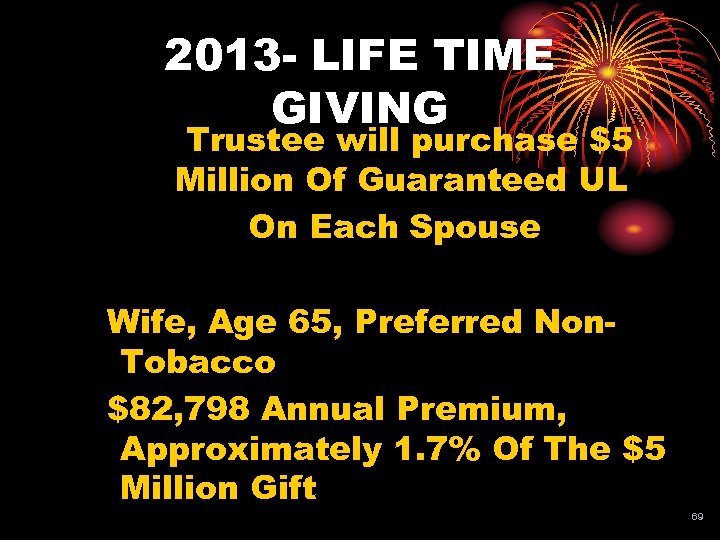

2013 - LIFE TIME GIVING Trustee will purchase $5 Million Of Guaranteed UL On Each Spouse Wife, Age 65, Preferred Non. Tobacco $82, 798 Annual Premium, Approximately 1. 7% Of The $5 Million Gift 69

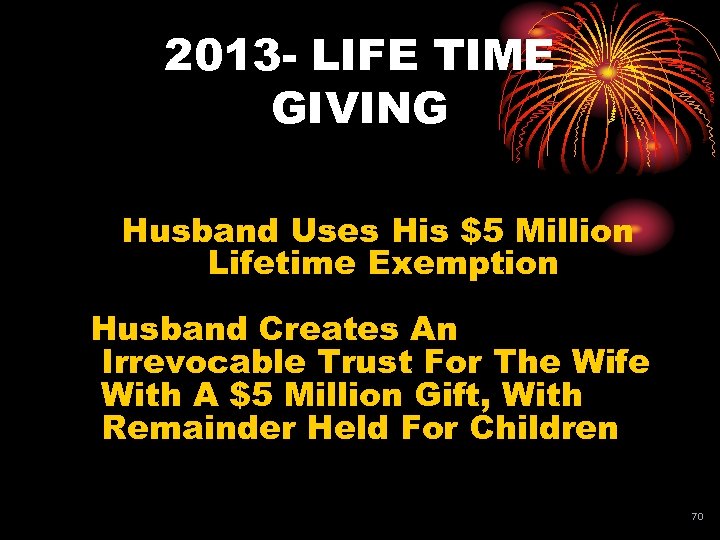

2013 - LIFE TIME GIVING Husband Uses His $5 Million Lifetime Exemption Husband Creates An Irrevocable Trust For The Wife With A $5 Million Gift, With Remainder Held For Children 70

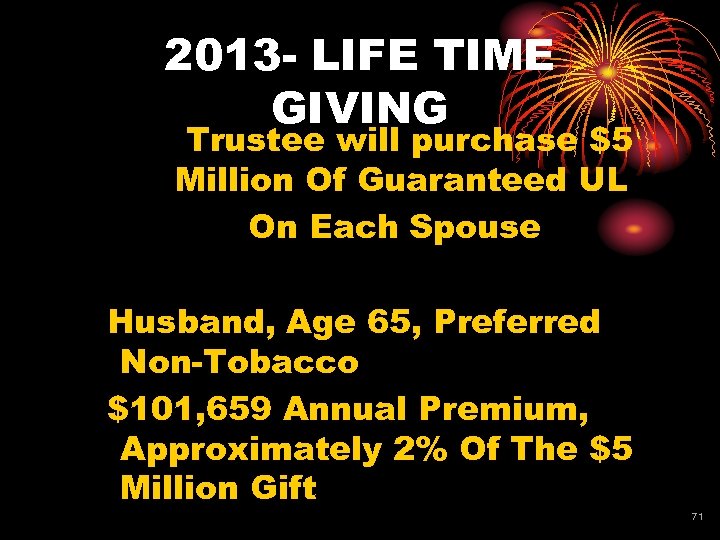

2013 - LIFE TIME GIVING Trustee will purchase $5 Million Of Guaranteed UL On Each Spouse Husband, Age 65, Preferred Non-Tobacco $101, 659 Annual Premium, Approximately 2% Of The $5 Million Gift 71

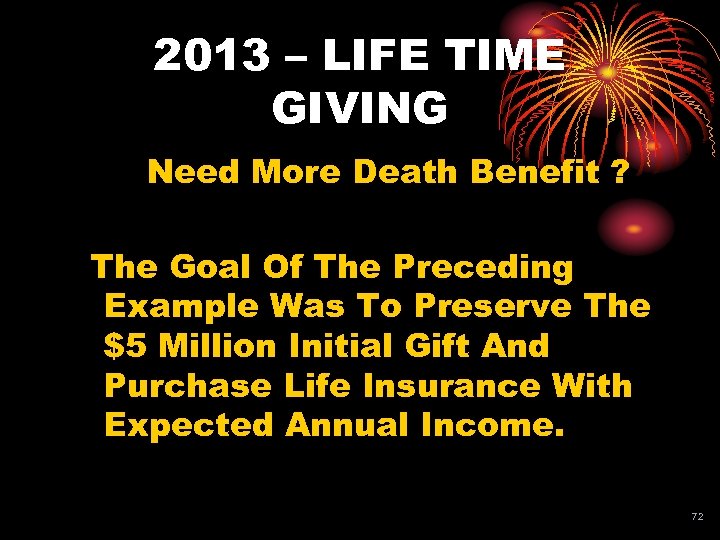

2013 – LIFE TIME GIVING Need More Death Benefit ? The Goal Of The Preceding Example Was To Preserve The $5 Million Initial Gift And Purchase Life Insurance With Expected Annual Income. 72

2013 – LIFE TIME GIVING Need More Death Benefit ? For Higher Net Worth Clients The $5 Million Gift Can Be Leveraged To Purchase More Life Insurance. 73

2013 – LIFE TIME GIVING Need More Death Benefit Wife, 65 Preferred Non. Tobacco, (one Co GUL will provide) $11, 583, 858 Death Benefit From 20 Annual Premiums Of $250, 000. ($5 Million Total Premiums). 74

CLIENT OBJECTIVE # 4 OLDER CLIENT WITH A SUBSTANTIAL FAMILY BUSINESS WISHES TO IMMEDIATELY TRANSFER MOST OF THE VALUE OF THAT BUSINESS INTEREST TO HIS SON …….

CLIENT OBJECTIVE # 4 ……. WITHOUT LOSING CONTROL OF THE BUSINESS AND STILL RECEIVE AN ANNUAL INCOME STREAM FROM THE ASSET.

How It Works • Parents set up an FLP • Parents contribute assets (appreciating property) to FLP Family Limited Partnership

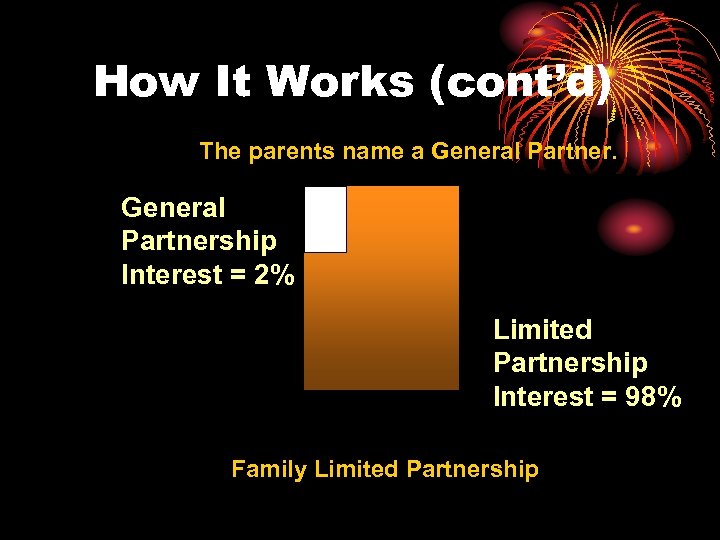

How It Works (cont’d) The parents name a General Partnership Interest = 2% Limited Partnership Interest = 98% Family Limited Partnership

How It Works (cont’d) • Transferor retains 1 to 10% GP interest and begins to transfer LP interests • Discounts for lack of marketability and lack of control may be taken on LP interests gifted

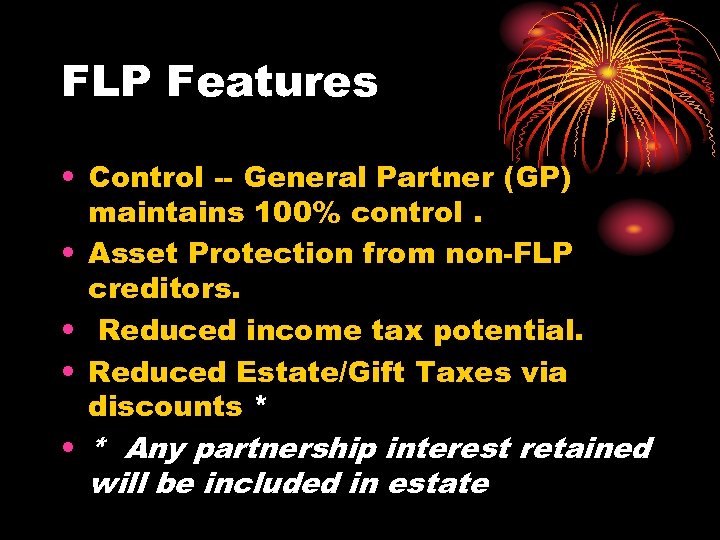

FLP Features • Control -- General Partner (GP) maintains 100% control. • Asset Protection from non-FLP creditors. • Reduced income tax potential. • Reduced Estate/Gift Taxes via discounts * • * Any partnership interest retained will be included in estate

Do Discounts Work?

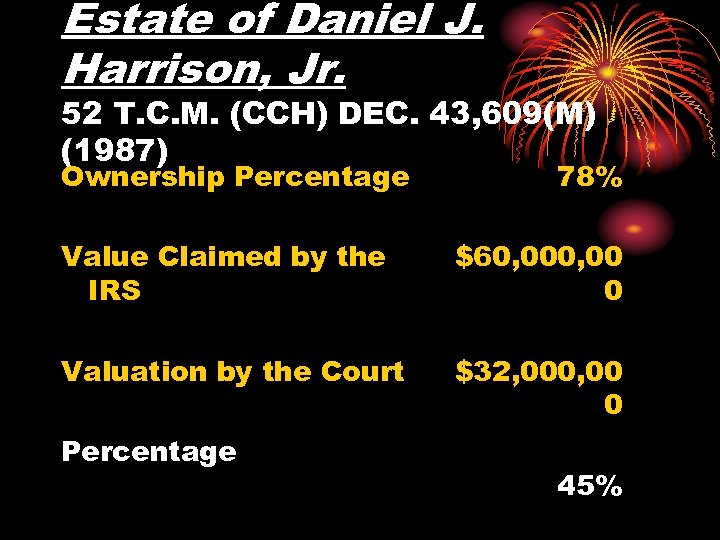

Estate of Daniel J. Harrison, Jr. 52 T. C. M. (CCH) DEC. 43, 609(M) (1987) Ownership Percentage 78% Value Claimed by the IRS $60, 00 0 Valuation by the Court $32, 000, 00 0 Percentage 45%

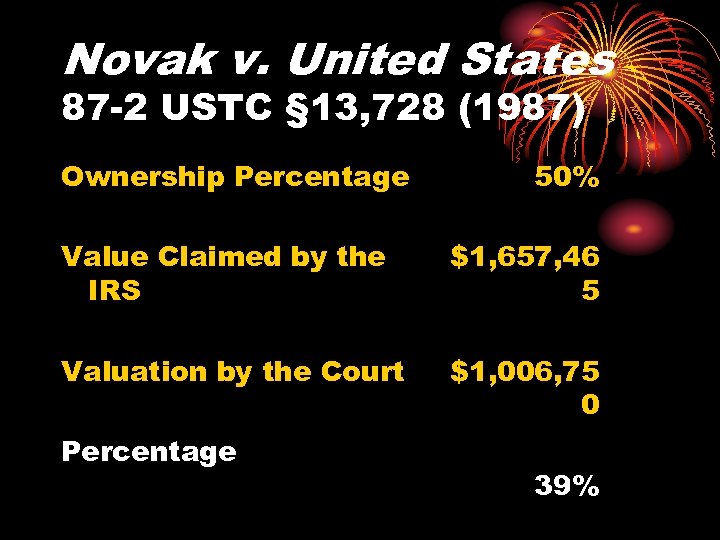

Novak v. United States 87 -2 USTC § 13, 728 (1987) Ownership Percentage 50% Value Claimed by the IRS $1, 657, 46 5 Valuation by the Court $1, 006, 75 0 Percentage 39%

FLP PROVIDES THE CLIENT WITH: • RETAINED CONTROL OF THE BUSINESS AS GENERAL PARTNERS. • INCOME STREAM, AS NEEDED, FOR FINANCIAL SECURITY. • REMOVAL, BY GIFT, OF THE MAJORITY OF THE ASSET VALUE FROM THE TAXABLE ESTATE.

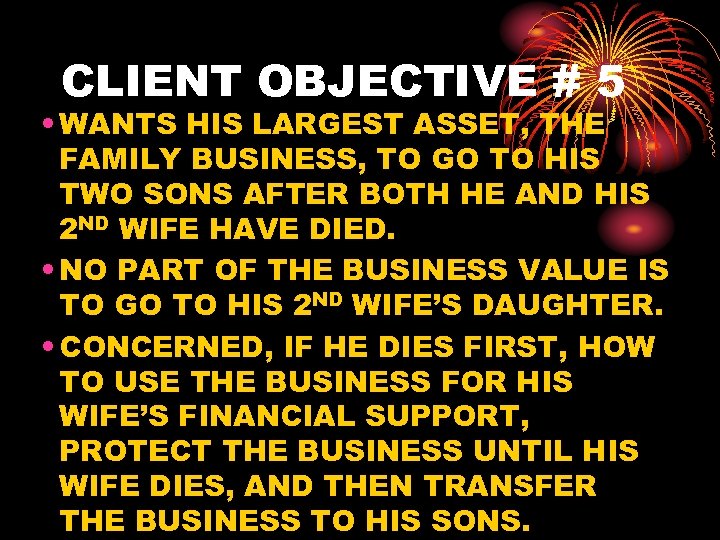

CLIENT OBJECTIVE # 5 • WANTS HIS LARGEST ASSET, THE FAMILY BUSINESS, TO GO TO HIS TWO SONS AFTER BOTH HE AND HIS 2 ND WIFE HAVE DIED. • NO PART OF THE BUSINESS VALUE IS TO GO TO HIS 2 ND WIFE’S DAUGHTER. • CONCERNED, IF HE DIES FIRST, HOW TO USE THE BUSINESS FOR HIS WIFE’S FINANCIAL SUPPORT, PROTECT THE BUSINESS UNTIL HIS WIFE DIES, AND THEN TRANSFER THE BUSINESS TO HIS SONS.

Qualified Terminable Interest Property Trust …. “QTIP” Trust • What It Is ? • Property passed in trust with the surviving spouse having a terminable interest, but established in such a way, to qualify the property for the marital deduction.

“QTIP” Trust • When to Use: • When the property is needed to support the surviving spouse AND • When eventual distribution of property is to be controlled by the grantor

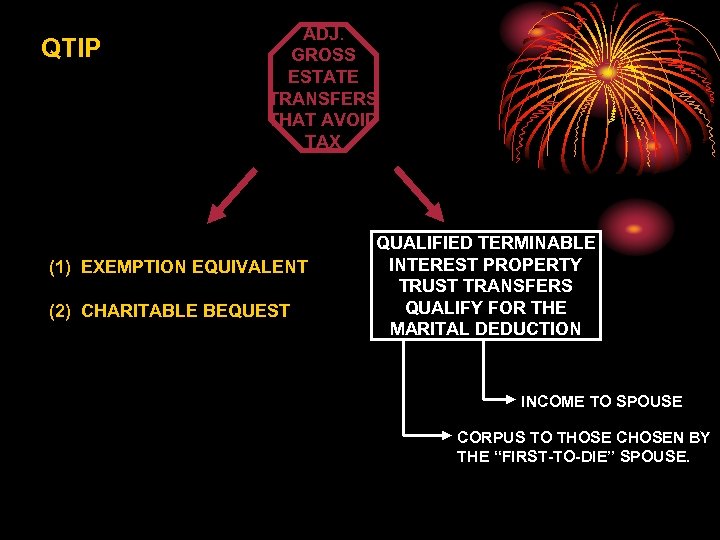

QTIP ADJ. GROSS ESTATE TRANSFERS THAT AVOID TAX (1) EXEMPTION EQUIVALENT (2) CHARITABLE BEQUEST QUALIFIED TERMINABLE INTEREST PROPERTY TRUST TRANSFERS QUALIFY FOR THE MARITAL DEDUCTION INCOME TO SPOUSE CORPUS TO THOSE CHOSEN BY THE “FIRST-TO-DIE” SPOUSE.

QTIP -- Purpose • Provide surviving spouse with the use of the property during life • Allow the deceased spouse to control eventual distribution of the property at the death of “second-to-die”.

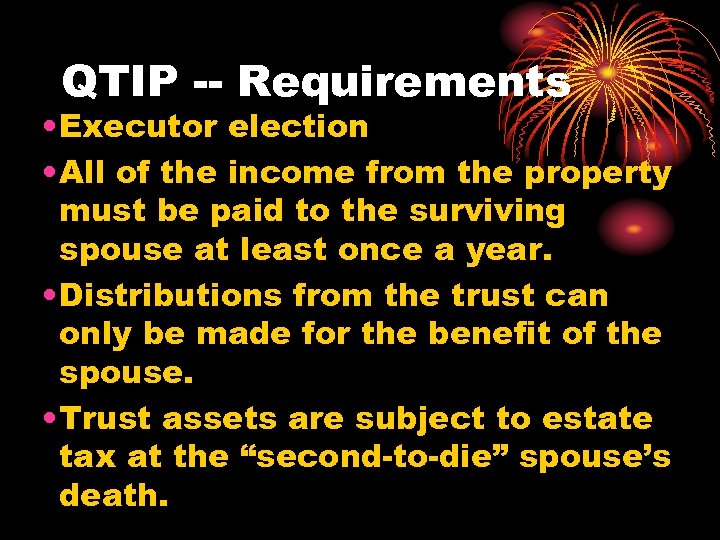

QTIP -- Requirements • Executor election • All of the income from the property must be paid to the surviving spouse at least once a year. • Distributions from the trust can only be made for the benefit of the spouse. • Trust assets are subject to estate tax at the “second-to-die” spouse’s death.

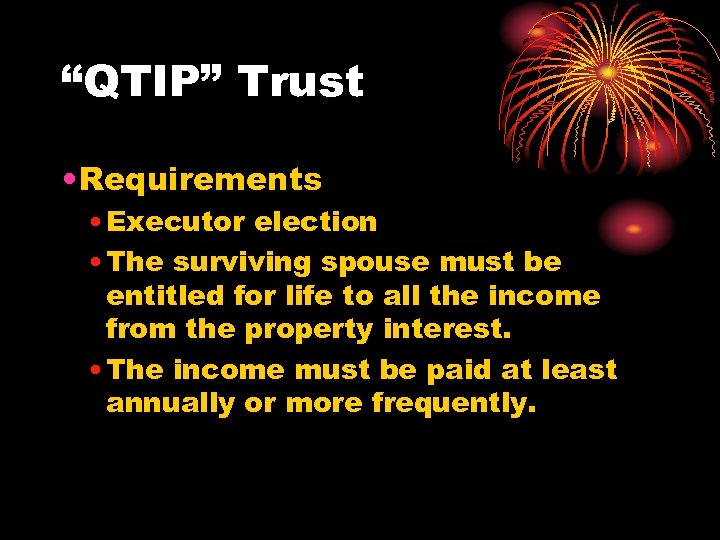

“QTIP” Trust • Requirements • Executor election • The surviving spouse must be entitled for life to all the income from the property interest. • The income must be paid at least annually or more frequently.

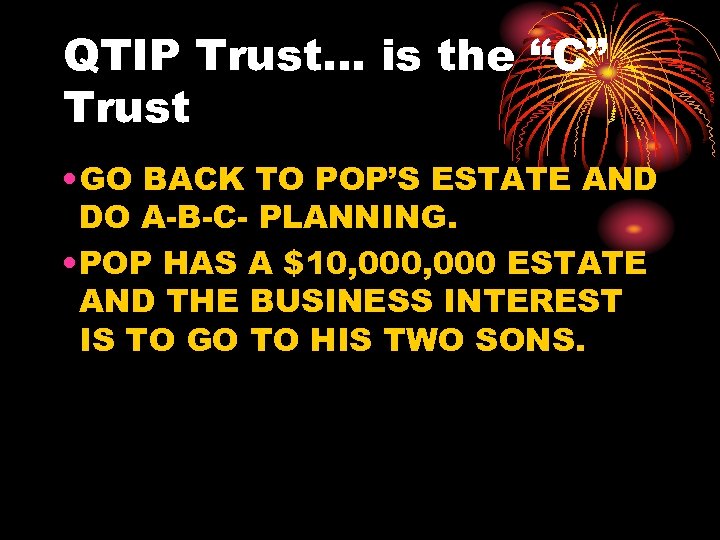

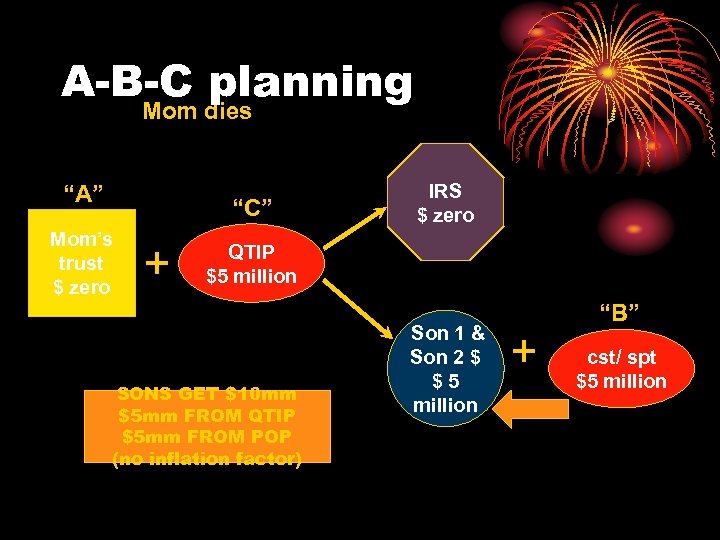

QTIP Trust… is the “C” Trust • GO BACK TO POP’S ESTATE AND DO A-B-C- PLANNING. • POP HAS A $10, 000 ESTATE AND THE BUSINESS INTEREST IS TO GO TO HIS TWO SONS.

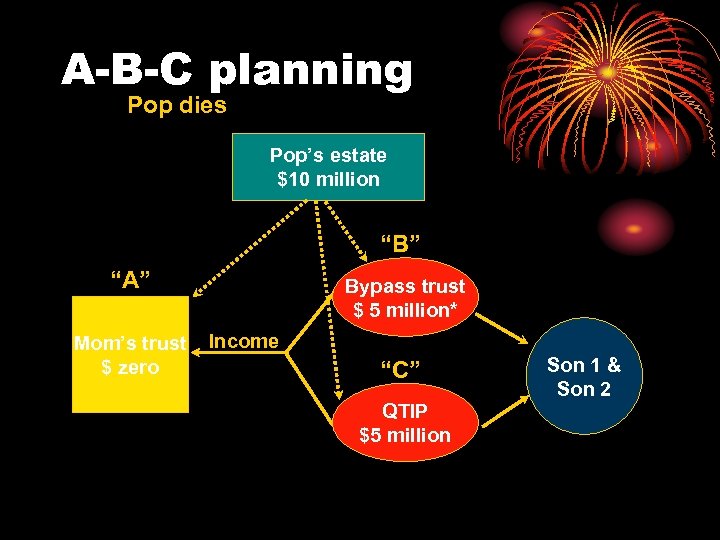

A-B-C planning Pop dies Pop’s estate $10 million “B” “A” Mom’s trust $ zero Bypass trust $ 5 million* Income “C” QTIP $5 million Son 1 & Son 2

A-B-C planning Mom dies “A” “C” Mom’s trust $ zero + IRS $ zero QTIP $5 million SONS GET $10 mm $5 mm FROM QTIP $5 mm FROM POP (no inflation factor) Son 1 & Son 2 $ $5 million + “B” cst/ spt $5 million

CLIENT OBJECTIVE # 6 • WANT TO TRANSFER THE PERSONAL AND SEASONAL RESIDENCE TO THE “NEXT GENERATION” THROUGH THE USE OF THE PERSONAL EXEMPTION AND THUS, WANT TO USE AS LITTLE OF THE EXEMPTION VALUE AS IS POSSIBLE. IN OTHER WORDS DISCOUNT THE VALUE OF THE RESIDENCES TO THE EXTENT POSSIBLE.

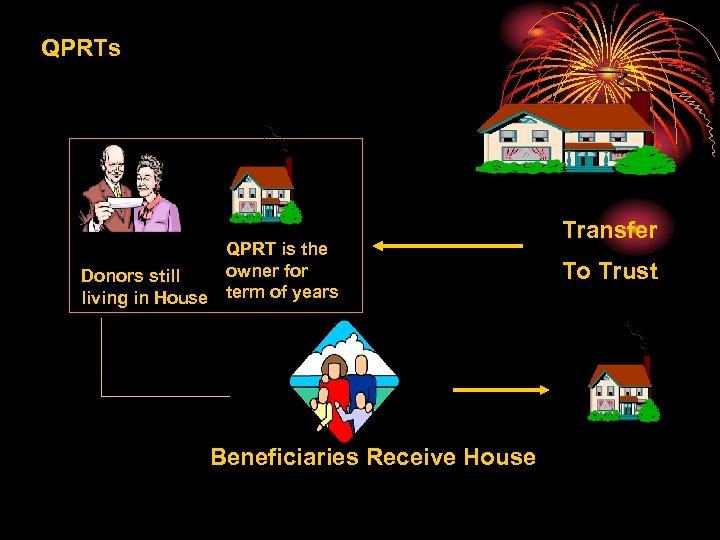

Qualified Personal Residence Trusts (QPRTs) • QPRTs allow the transfer of a “Personal Residence” to heirs at reduced Gift Tax cost while the parents retain the right to live in the house for a specific term of years.

Qualified Personal Residence Trusts (QPRTs) • Gift Value is determined at the time of the transfer to the trust, based on the split value remainder interest (IRC § 2702)

QPRTs QPRT is the owner for Donors still living in House term of years Beneficiaries Receive House Transfer To Trust

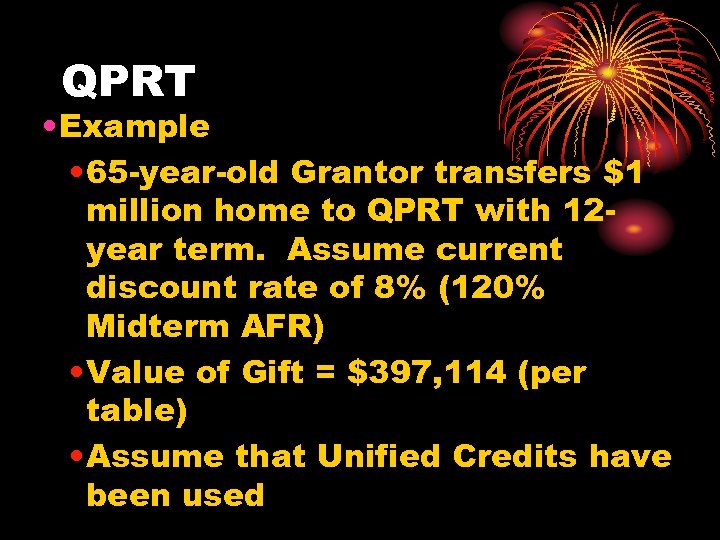

QPRT • Example • 65 -year-old Grantor transfers $1 million home to QPRT with 12 year term. Assume current discount rate of 8% (120% Midterm AFR) • Value of Gift = $397, 114 (per table) • Assume that Unified Credits have been used

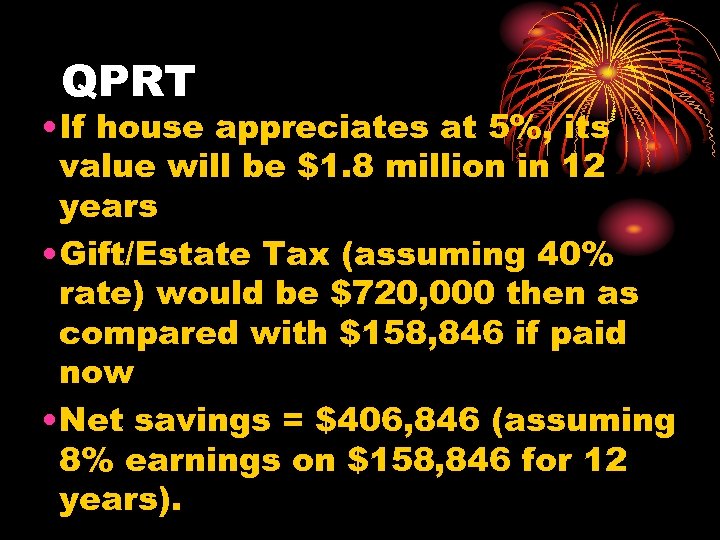

QPRT • If house appreciates at 5%, its value will be $1. 8 million in 12 years • Gift/Estate Tax (assuming 40% rate) would be $720, 000 then as compared with $158, 846 if paid now • Net savings = $406, 846 (assuming 8% earnings on $158, 846 for 12 years).

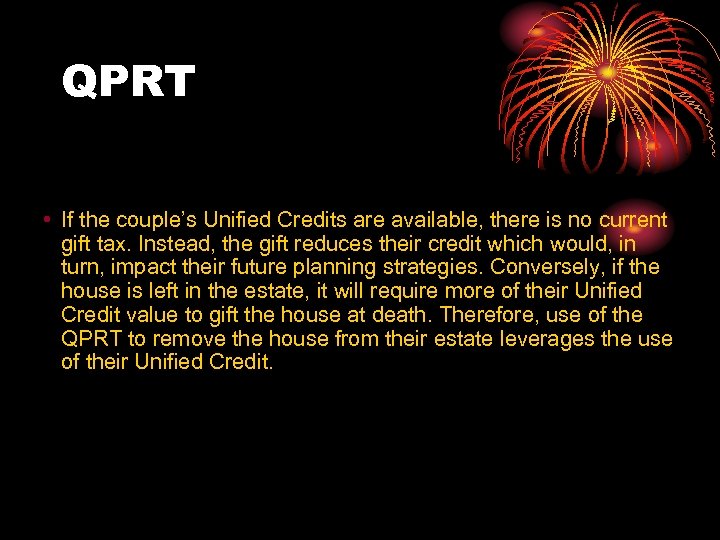

QPRT • If the couple’s Unified Credits are available, there is no current gift tax. Instead, the gift reduces their credit which would, in turn, impact their future planning strategies. Conversely, if the house is left in the estate, it will require more of their Unified Credit value to gift the house at death. Therefore, use of the QPRT to remove the house from their estate leverages the use of their Unified Credit.

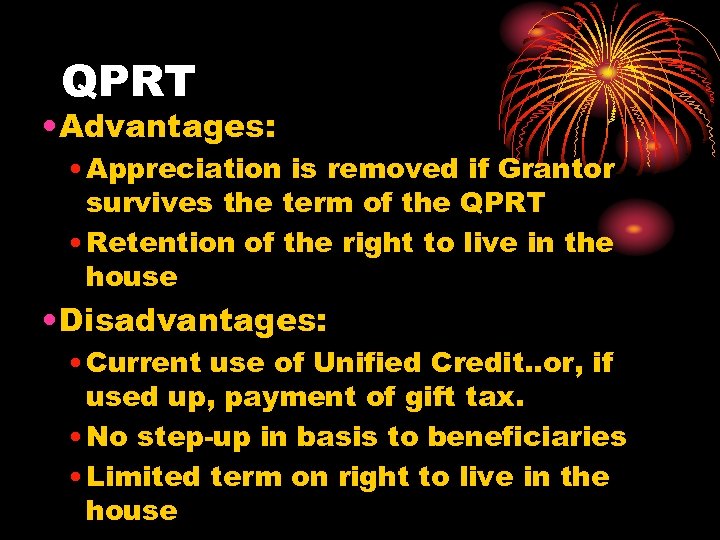

QPRT • Advantages: • Appreciation is removed if Grantor survives the term of the QPRT • Retention of the right to live in the house • Disadvantages: • Current use of Unified Credit. . or, if used up, payment of gift tax. • No step-up in basis to beneficiaries • Limited term on right to live in the house

CLIENT OBJECTIVE # 7 • CLIENT IS MARRIED TO A NONCITIZEN SPOUSE WHO WILL NOT ACQUIRE U. S. CITIZENSHIP IN THE FORESEEABLE FUTURE. • WANTS TO QUALIFY ASSET DISTRIBUTION FOR THE MARITAL DEDUCTION AT HIS DEATH.

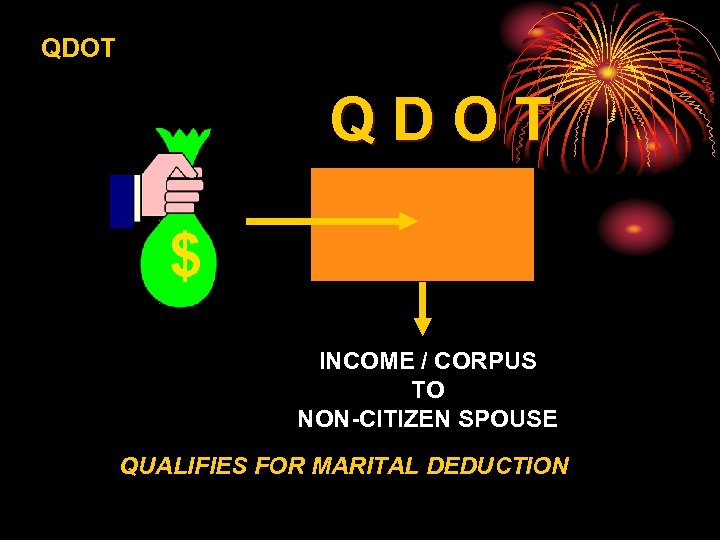

QDOT • QUALIFIED DOMESTIC OWNERSHIP TRUST

Non-citizen Spouse • No marital deduction qualification • Annual exempt gift = $143, 000* * 2013 Inflation adjusted value.

QDOT • The trust meet the same requirements for the marital deduction as a trust for the benefit of a citizen spouse. • It can be a QTIP trust. • All distributions must be made to the spouse or to spouse’s estate.

QDOT -- Requirements • At least one trustee must be an individual who is a U. S. citizen or a domestic corporation. (If assets exceed $2 million, trustee must be a bank or furnish a bond equal to 65% of the trust value. ) • For distributions, the trustee must have the right to withhold for tax.

QDOT DECEASED SPOUSE QDOT $ INCOME / CORPUS TO NON-CITIZEN SPOUSE QUALIFIES FOR MARITAL DEDUCTION

CLIENT OBJECTIVE # 8 • CLIENT HAS A GENUINE INTEREST IN LEAVING A SUBSTANCIAL AMOUNT TO A SPECIFIC CHARITY/CHARITIES. • HAS A CURRENT NEED FOR THE INCOME GENERATED FROM THE ASSETS TO MAINTAIN HIS LIFE STYLE.

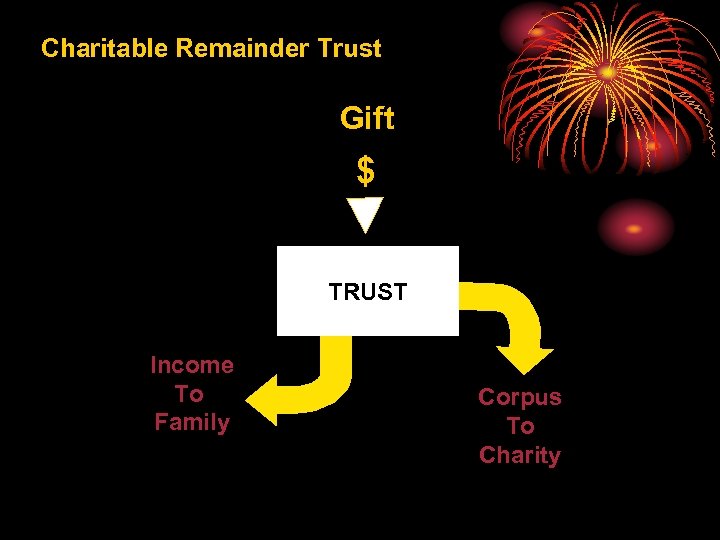

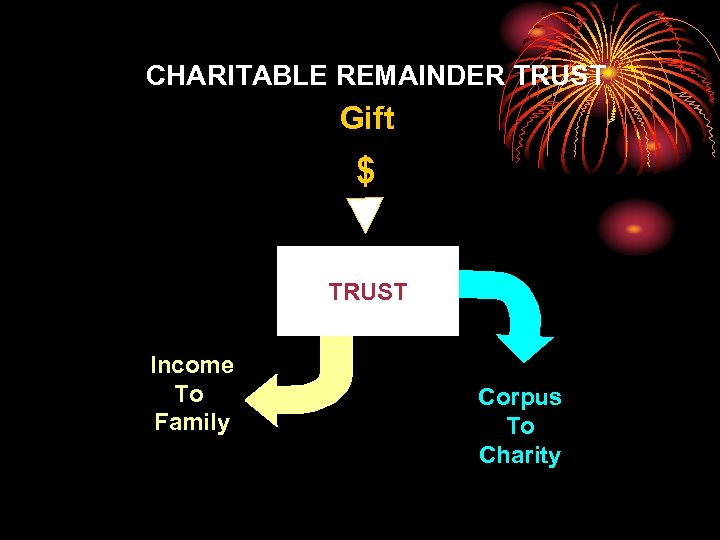

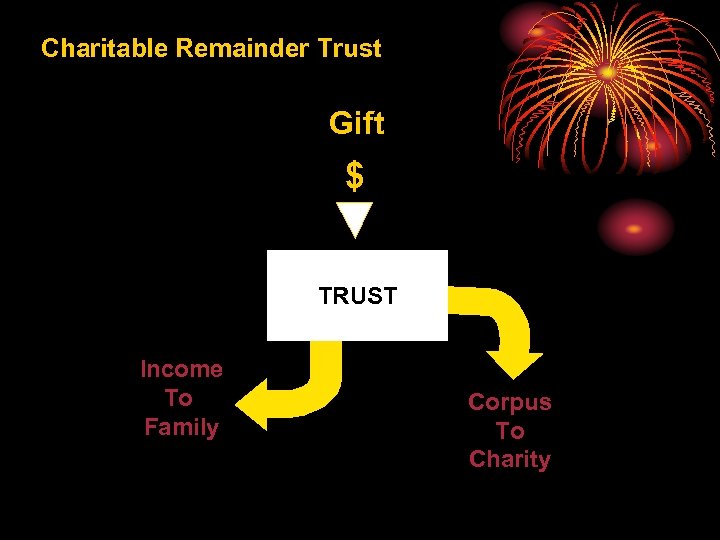

Charitable Remainder Trust Gift $ TRUST Income To Family Corpus To Charity

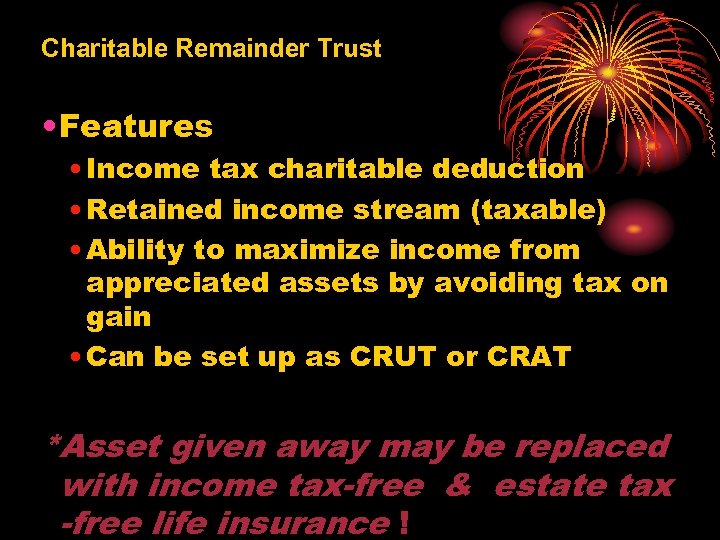

Charitable Remainder Trusts • Features: • Income Tax charitable deduction • Retained income stream (taxable) • Ability to maximize income from appreciated assets by avoiding tax on gain • Can be set up as CRUT or CRAT * Asset given to charity can be replaced with income/estate taxfree life insurance!

Charitable Remainder Trusts (cont’d) • Nim. CRUT -- provides lesser of net income or a fixed percentage of trust corpus • If no net income in a year, no payout • missed payouts are “made up” in future years from income in excess of percentage payout • a good tool for retirement planning and an unstable economy.

Charitable Remainder Trusts (cont’d) • Unitrust (CRUT) • Set percentage annual payout • Requires annual valuation • Allows future contributions • Annuity Trust (CRAT) • Set dollar annual payout • Valued only at inception • No future contributions Minimum 5% annual payout req.

Charitable Remainder Trusts (cont’d) • Either a CRAT or a CRUT provides a charitable income tax deduction based on present value of the charity’s remainder interest, so longer time of higher payout to family = lower deduction. • The deduction is generally limited to 30% of the taxpayer’s AGI, and is available in the year of contribution (Plus 5 yr. carry over)

CHARITABLE REMAINDER TRUST Gift $ TRUST Income To Family Corpus To Charity

CASE FACTS • Mom 72 / Dad 71 • Four children -- • Two boys totally involved in the family business. • Two girls -- married and not in the family business. • Actual case prior to time of $5, 000 exemptions.

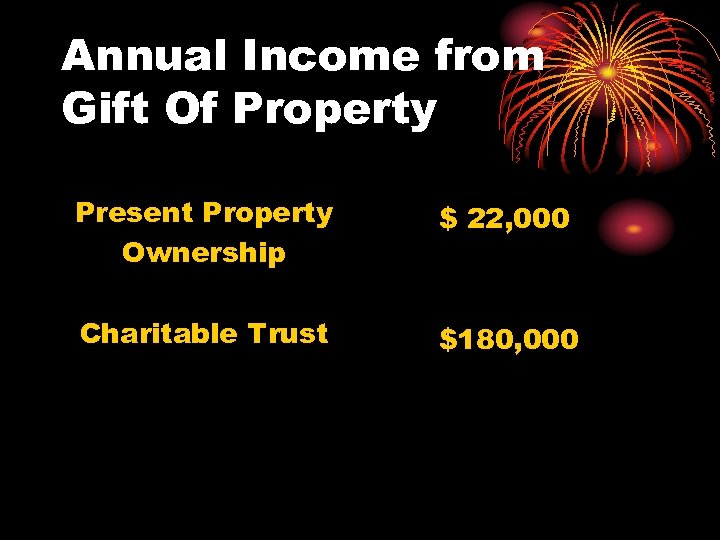

CASE FACTS. . ASSETS • FAMILY BUSINESS = $500, 000 • RESIDENCE & PERSONAL ASSETS = $1, 500, 000++ (very little life ins. ) • MOST SIGNIFICANT ASSET COMES FROM A $1, 500 INVESTMENT MADE SOME 30 YEARS AGO. PRESENT VALUE IN EXCESS OF $7, 000 (WHICH GENERATES AN ANNUAL INCOME OF APX. $22, 000. ) • GROSS ESTATE = $9, 000 ++

OBJECTIVES • Mom and Pop want to retire. • Wish to transfer family business to the sons, but concerned about “how” to do it and what to give to the daughters. • Need additional income for retirement. (have no ret. plan) • Want to minimize estate taxes.

OBJECTIVES • Must be cost effective for taxes that have to be paid. • Genuine benevolent interest in several local charitable and educational organizations.

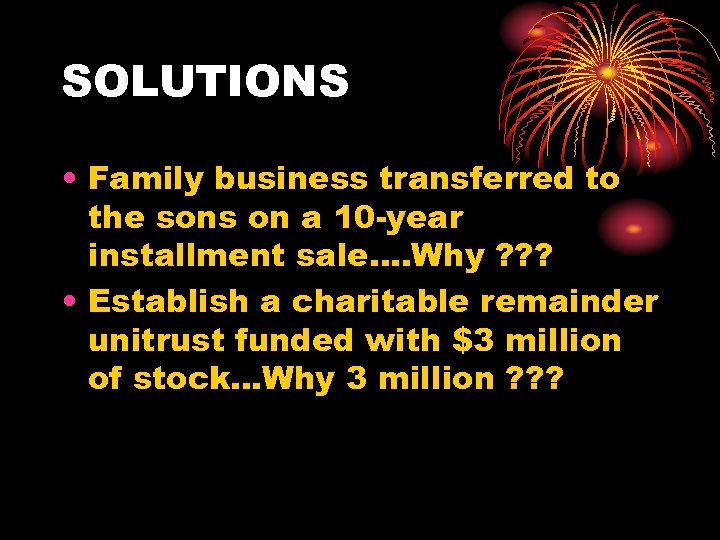

SOLUTIONS • Family business transferred to the sons on a 10 -year installment sale…. Why ? ? ? • Establish a charitable remainder unitrust funded with $3 million of stock…Why 3 million ? ? ?

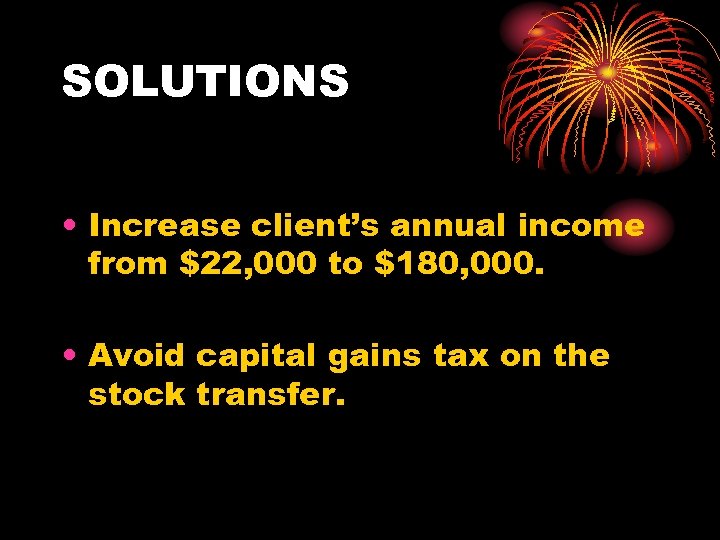

SOLUTIONS • Increase client’s annual income from $22, 000 to $180, 000. • Avoid capital gains tax on the stock transfer.

Annual Income from Gift Of Property Present Property Ownership $ 22, 000 Charitable Trust $180, 000

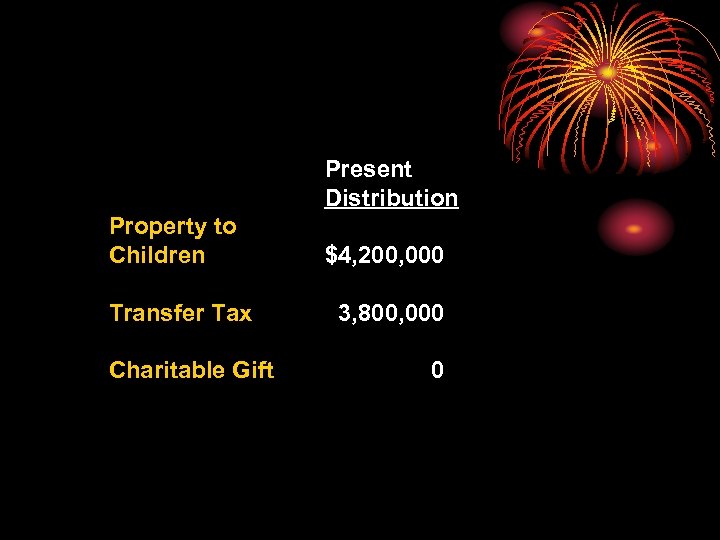

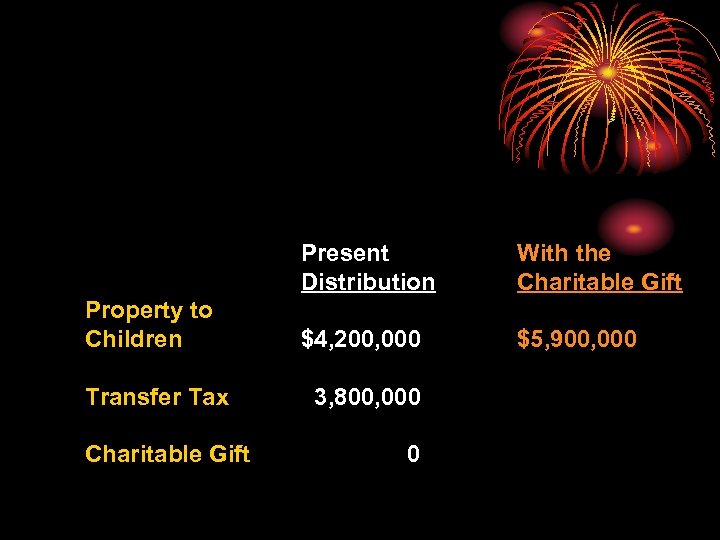

Present Distribution Property to Children Transfer Tax Charitable Gift $4, 200, 000 3, 800, 000 0

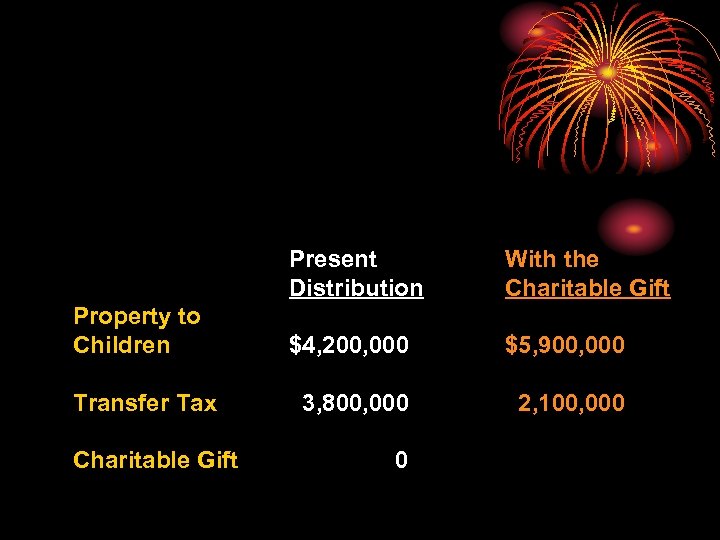

Present Distribution Property to Children Transfer Tax Charitable Gift With the Charitable Gift $4, 200, 000 $5, 900, 000 3, 800, 000 0

Present Distribution Property to Children Transfer Tax Charitable Gift With the Charitable Gift $4, 200, 000 $5, 900, 000 3, 800, 000 2, 100, 000 0

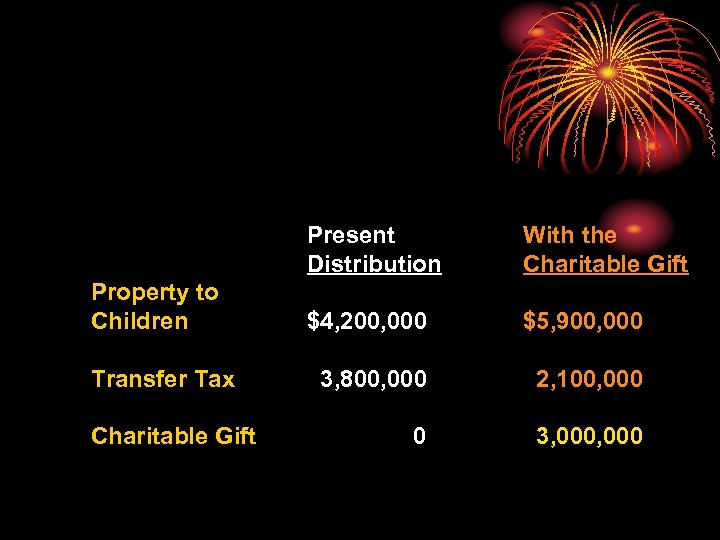

Present Distribution Property to Children Transfer Tax Charitable Gift With the Charitable Gift $4, 200, 000 $5, 900, 000 3, 800, 000 2, 100, 000 0 3, 000

WEALTH REPLACEMENT TRUST THE GIFT OF THE STOCK TO THE CRT HAS LEFT THE CHILDREN WITH $3, 000 LESS TO INHERIT. THAT IS REPLACED WITH LIFE INSURANCE IN AN ILIT.

Establish an irrevocable trust -- wealth replacement trust -- to buy insurance on Mom and Pop. What did we recommend ? ? $3, 000 second to die on Mom & Pop

What did they buy ? ? ? $2, 000 second-to-die $ 500, 000 on Mom $ 500, 000 on Pop Why ? ?

CLIENT OBJECTIVE # 9 • CLIENTS ARE UNINSURABLE. • WANTS TO REDUCE THE ESTATE TAX AND ALSO GET FULL “USE” OF THE VALUE OF HIS ASSETS. • WANTS TO BENEFIT HIS CHILDREN, GRANDCHILDREN & GREAT GRANDCHILDREN TO THE EXTENT POSSIBLE.

Uninsurable Clients Charitable Giving Plans

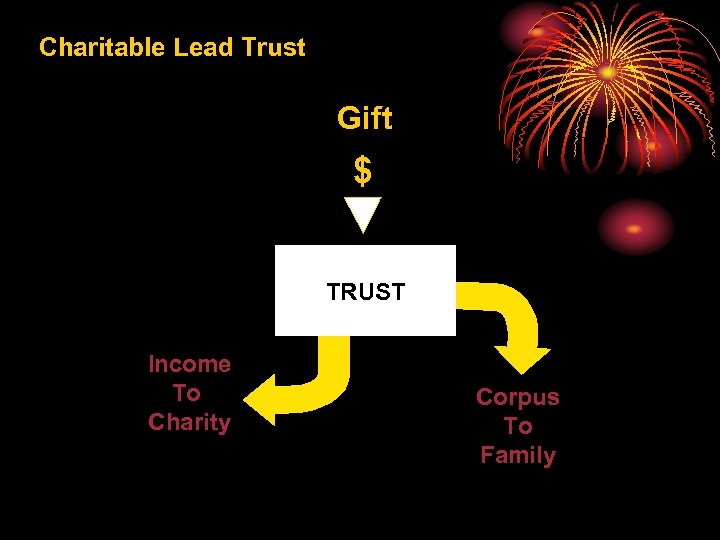

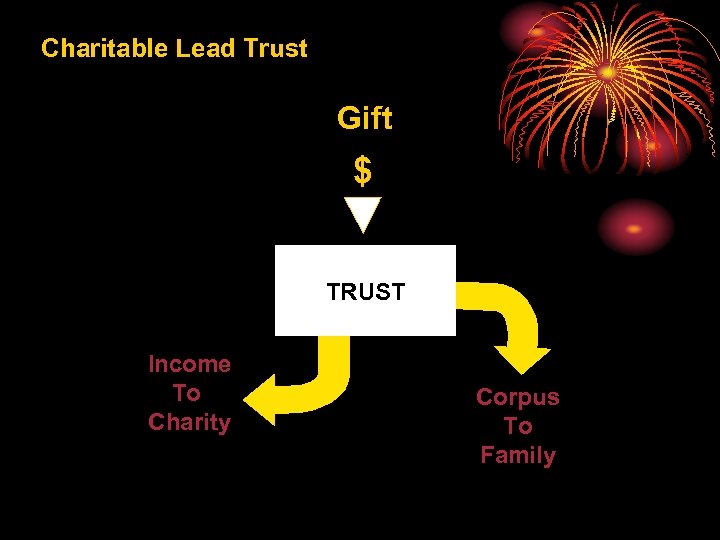

Charitable Lead Trust Gift $ TRUST Income To Charity Corpus To Family

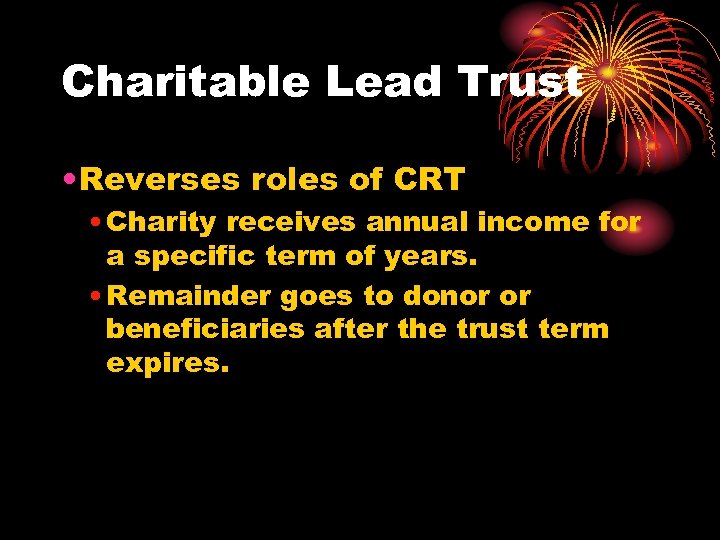

Charitable Lead Trust • Reverses roles of CRT • Charity receives annual income for term of years. • Remainder to donor or beneficiaries after the trust term expires.

Case facts • Grandparents -- 83 and 80 Both totally uninsurable • Children -- Mr. 60/Mrs. 58 • Grandchildren -- 35 and 33 • Great-Grandchildren -- 7, 5, 3 & 2 • Again actual case prior to $5, 000 exemptions.

Case facts cont’d • Grandparents have an estate of approximately $25 million but not very liquid. Consists mostly of appreciated real estate and a few securities. • Each child has an estate of about $7 million.

Objectives • Minimize the taxes at grandparents’ death. • Maximize the use of property for the parents. • Maximize distribution of property to the children, grandchildren and great-grandchildren.

Solutions • Consider a charitable remainder trust for the benefit of the children. • Consider a charitable lead trust for the benefit of the grandchildren and great-grandchildren.

Charitable Remainder Trust Gift $ TRUST Income To Family Corpus To Charity

Charitable Remainder Trust • Features • Income tax charitable deduction • Retained income stream (taxable) • Ability to maximize income from appreciated assets by avoiding tax on gain • Can be set up as CRUT or CRAT *Asset given away may be replaced with income tax-free & estate tax -free life insurance !

Charitable Lead Trust Gift $ TRUST Income To Charity Corpus To Family

Charitable Lead Trust • Reverses roles of CRT • Charity receives annual income for a specific term of years. • Remainder goes to donor or beneficiaries after the trust term expires.

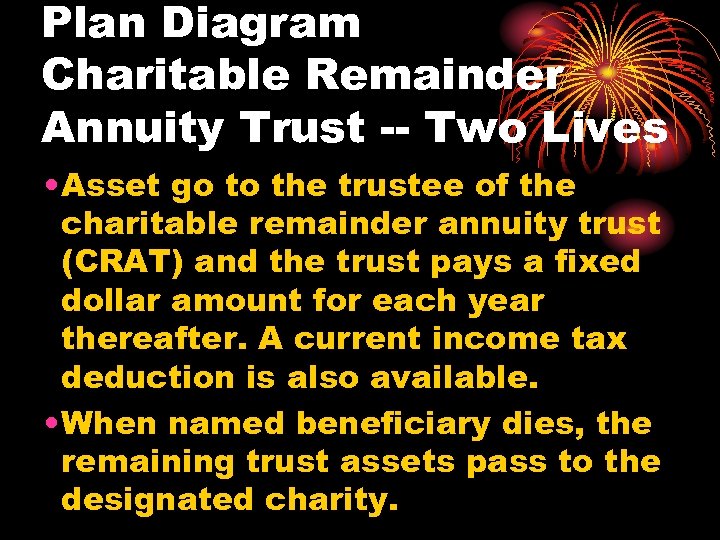

Plan Diagram Charitable Remainder Annuity Trust -- Two Lives • Asset go to the trustee of the charitable remainder annuity trust (CRAT) and the trust pays a fixed dollar amount for each year thereafter. A current income tax deduction is also available. • When named beneficiary dies, the remaining trust assets pass to the designated charity.

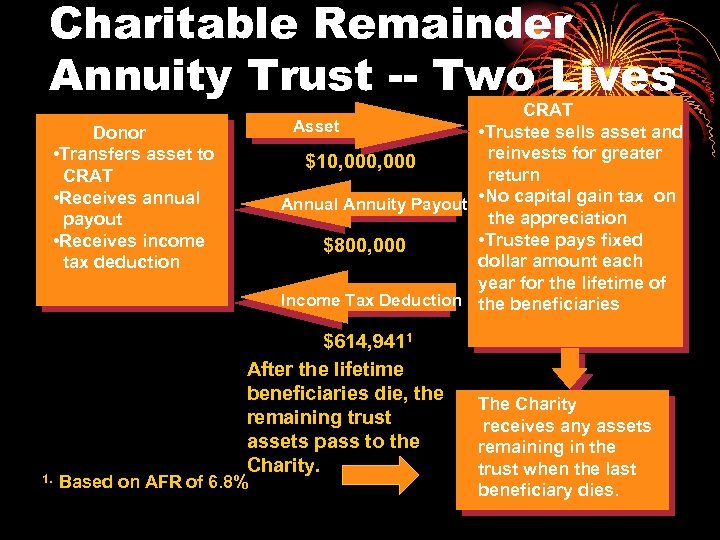

Charitable Remainder Annuity Trust -- Two Lives CRAT Asset • Trustee sells asset and reinvests for greater $10, 000 return Annual Annuity Payout • No capital gain tax on the appreciation • Trustee pays fixed $800, 000 dollar amount each year for the lifetime of Income Tax Deduction the beneficiaries Donor • Transfers asset to CRAT • Receives annual payout • Receives income tax deduction 1. $614, 9411 After the lifetime beneficiaries die, the remaining trust assets pass to the Charity. Based on AFR of 6. 8% The Charity receives any assets remaining in the trust when the last beneficiary dies.

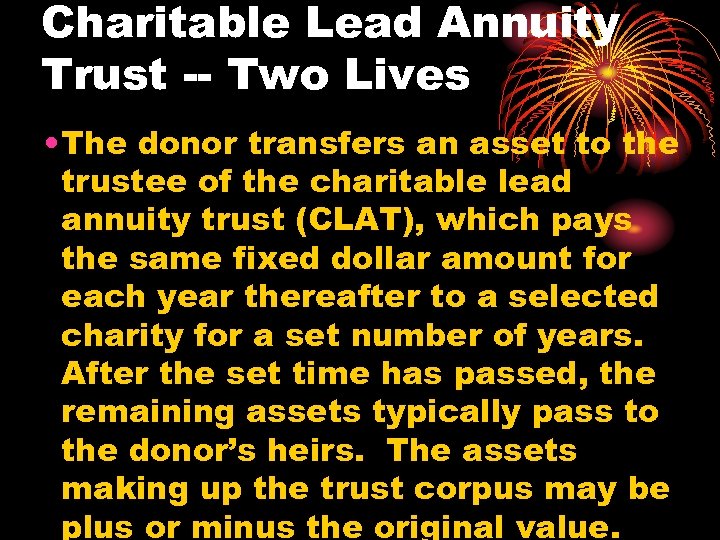

Charitable Lead Annuity Trust -- Two Lives • The donor transfers an asset to the trustee of the charitable lead annuity trust (CLAT), which pays the same fixed dollar amount for each year thereafter to a selected charity for a set number of years. After the set time has passed, the remaining assets typically pass to the donor’s heirs. The assets making up the trust corpus may be plus or minus the original value.

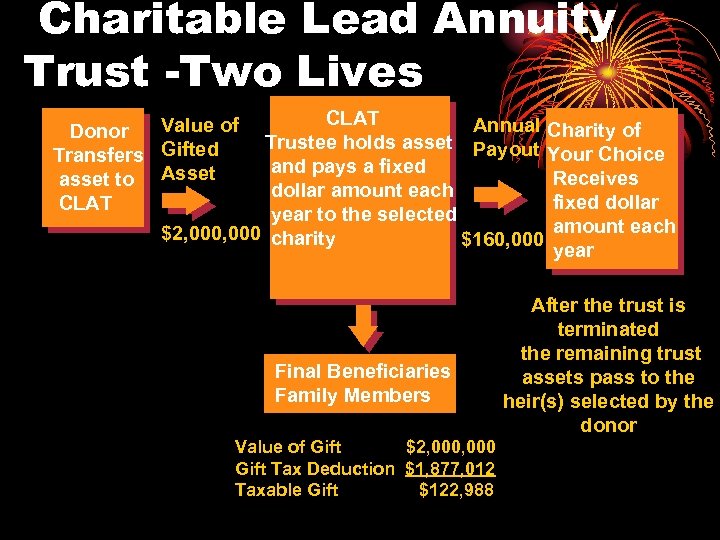

Charitable Lead Annuity Trust -Two Lives CLAT Value of Annual Charity of Donor Trustee holds asset Payout Your Choice Transfers Gifted and pays a fixed Receives asset to Asset dollar amount each fixed dollar CLAT year to the selected amount each $2, 000 charity $160, 000 year Final Beneficiaries Family Members Value of Gift $2, 000 Gift Tax Deduction $1, 877, 012 Taxable Gift $122, 988 After the trust is terminated the remaining trust assets pass to the heir(s) selected by the donor

Wealth Replacement Trust • The combination of a charitable remainder annuity trust (CRAT) and an asset replacement insurance trust can greatly benefit your heirs and your favorite charity.

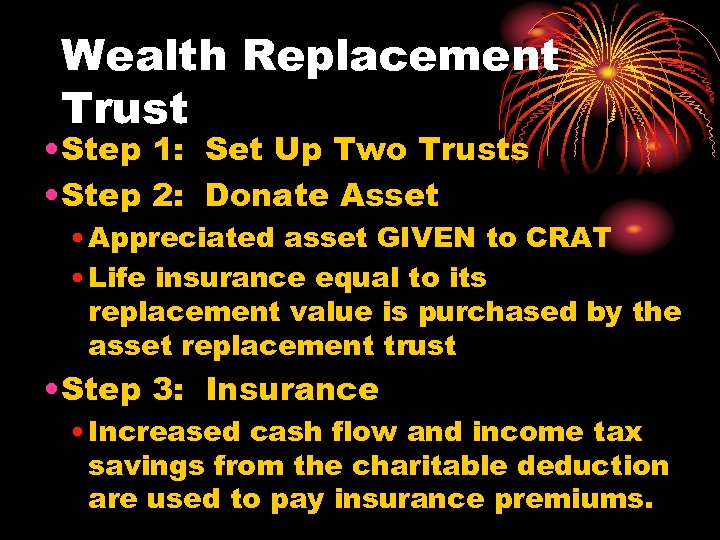

Wealth Replacement Trust • Step 1: Set Up Two Trusts • Step 2: Donate Asset • Appreciated asset GIVEN to CRAT • Life insurance equal to its replacement value is purchased by the asset replacement trust • Step 3: Insurance • Increased cash flow and income tax savings from the charitable deduction are used to pay insurance premiums.

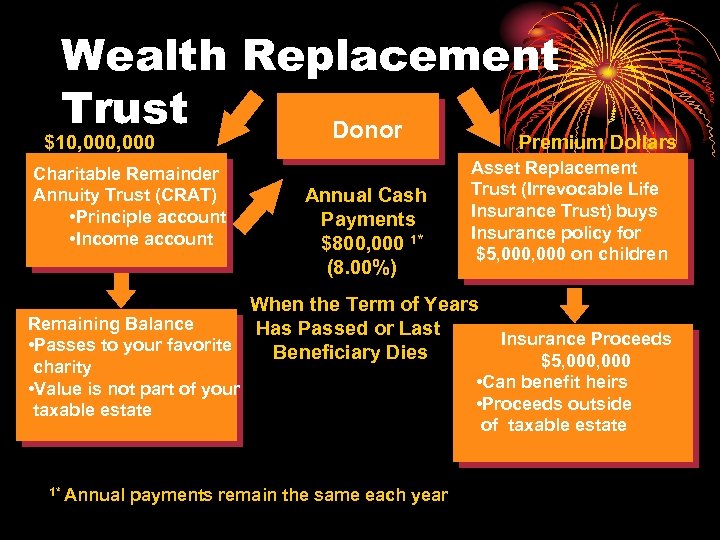

Wealth Replacement Trust Donor $10, 000 Charitable Remainder Annuity Trust (CRAT) • Principle account • Income account Premium Dollars Annual Cash Payments $800, 000 1* (8. 00%) Asset Replacement Trust (Irrevocable Life Insurance Trust) buys Insurance policy for $5, 000 on children When the Term of Years Remaining Balance Has Passed or Last • Passes to your favorite Beneficiary Dies charity • Value is not part of your taxable estate 1* Annual payments remain the same each year Insurance Proceeds $5, 000 • Can benefit heirs • Proceeds outside of taxable estate

CLIENT OBJECTIVE # 10 • NEEDS ADDITIONAL INSURANCE FOR ESTATE LIQUIDITY FUNDING. • WANTS TO EQUALIZE INHERITANCE FOR HIS STEPDAUGHTER SINCE HIS SONS WILL GET THE FAMILY BUSINESS.

Potential Solution: Irrevocable Life Insurance Trust ILIT

Irrevocable Life Insurance Trust Gifts Grantor

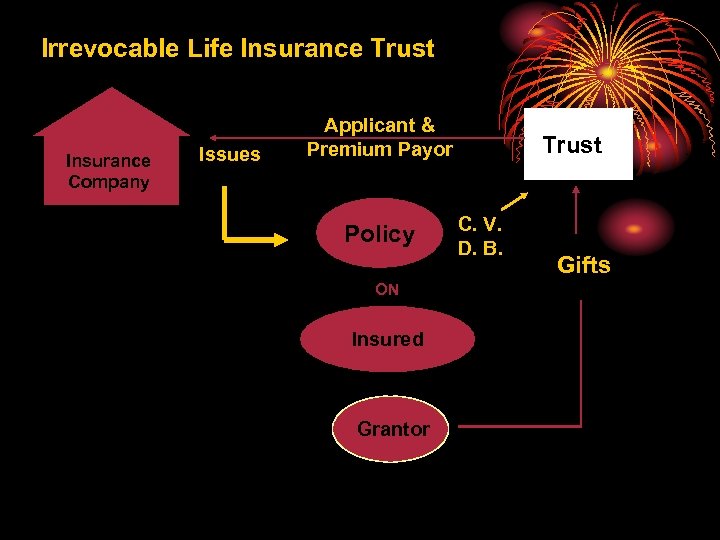

Irrevocable Life Insurance Trust Insurance Company Issues Applicant & Premium Payor Policy ON Insured Grantor Trust C. V. D. B. Gifts

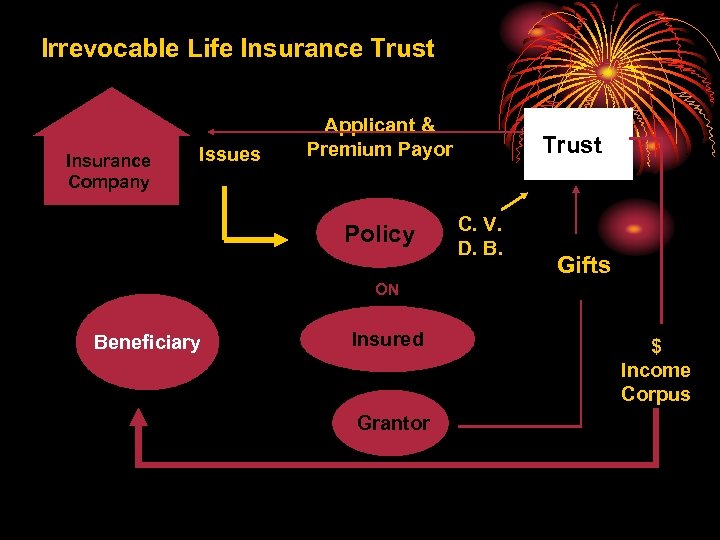

Irrevocable Life Insurance Trust Insurance Company Issues Applicant & Premium Payor Policy Trust C. V. D. B. Gifts ON Beneficiary Insured Grantor $ Income Corpus

INCOME TAX FREE Section 101(a) ESTATE TAX FREE Section 2042

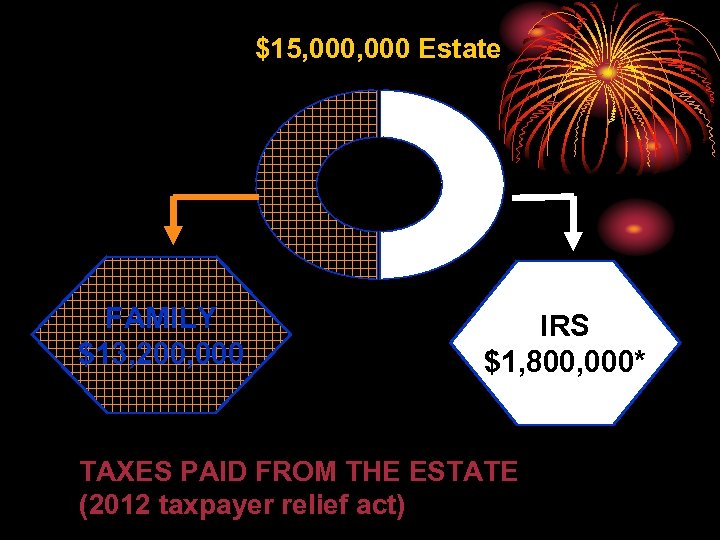

$15, 000 Estate FAMILY $13, 200, 000 IRS $1, 800, 000* TAXES PAID FROM THE ESTATE (2012 taxpayer relief act)

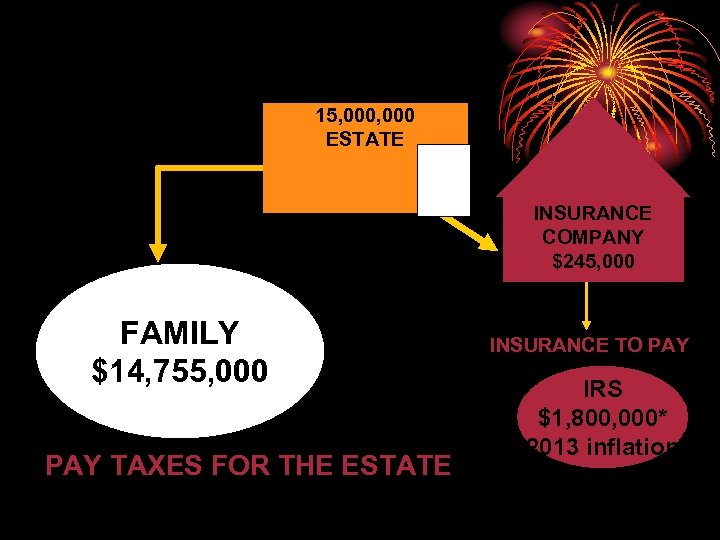

15, 000 ESTATE INSURANCE COMPANY $245, 000 FAMILY $14, 755, 000 PAY TAXES FOR THE ESTATE INSURANCE TO PAY IRS $1, 800, 000* 2013 inflation

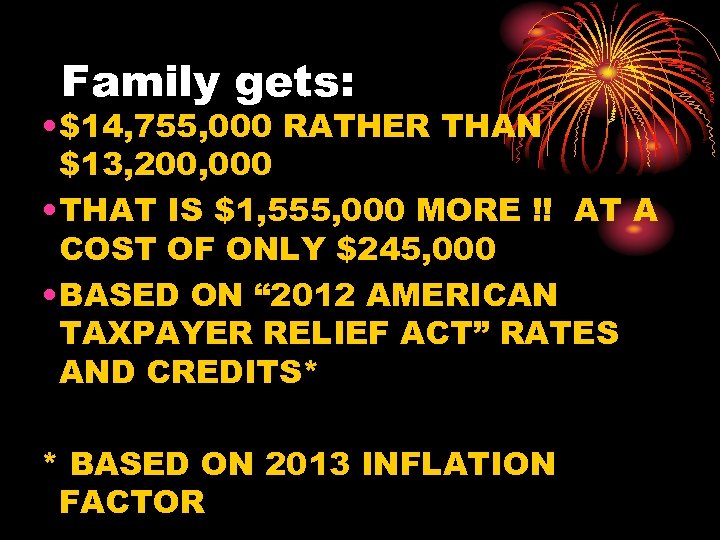

Family gets: • $14, 755, 000 RATHER THAN $13, 200, 000 • THAT IS $1, 555, 000 MORE !! AT A COST OF ONLY $245, 000 • BASED ON “ 2012 AMERICAN TAXPAYER RELIEF ACT” RATES AND CREDITS* * BASED ON 2013 INFLATION FACTOR

Irrevocable Trust Ownership • Advantages • Third-party influence • Disadvantages • Gifting restrictions • Challenges • 5 x 5 restrictions for present interest gifts.

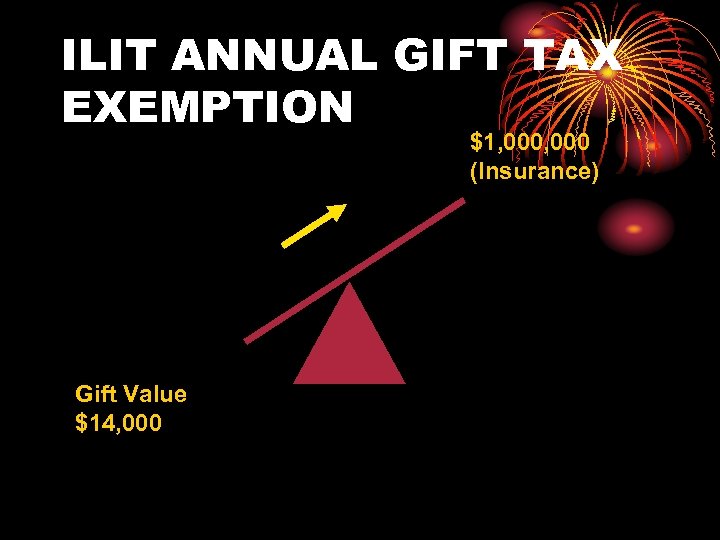

ILIT ANNUAL GIFT TAX EXEMPTION $1, 000 (Insurance) Gift Value $14, 000

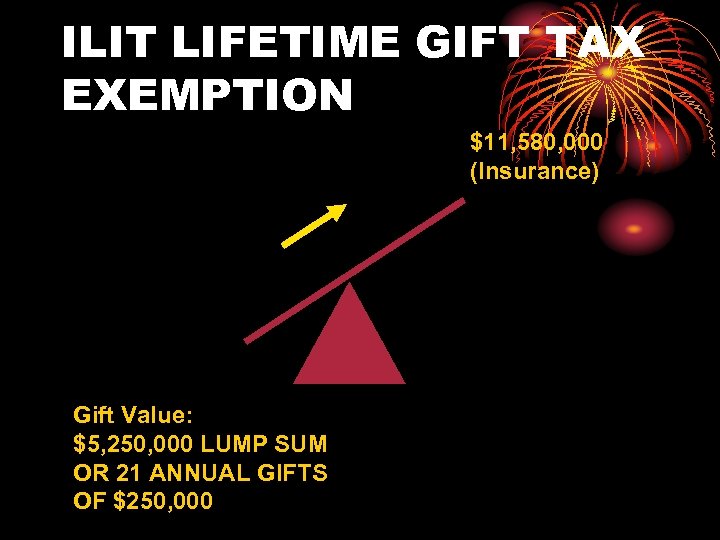

ILIT LIFETIME GIFT TAX EXEMPTION $11, 580, 000 (Insurance) Gift Value: $5, 250, 000 LUMP SUM OR 21 ANNUAL GIFTS OF $250, 000

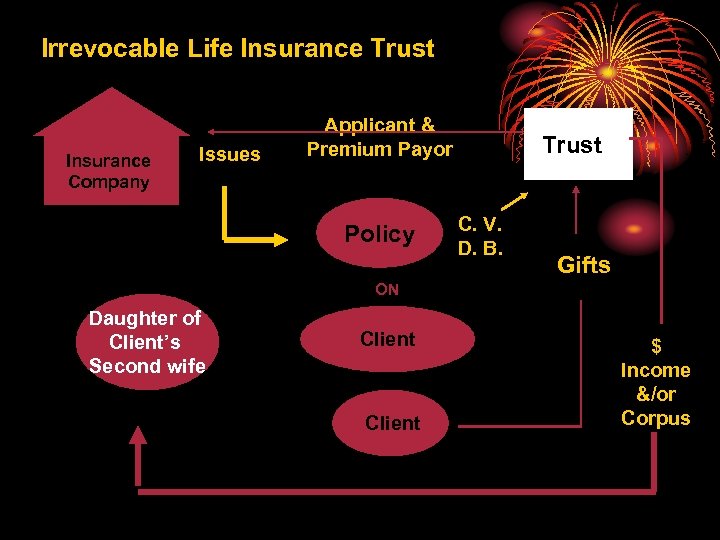

Irrevocable Life Insurance Trust Insurance Company Issues Applicant & Premium Payor Policy Trust C. V. D. B. Gifts ON Daughter of Client’s Second wife Client $ Income &/or Corpus

Important Recent Legislative Activity • Headrick -- 93 T. C. No. 18 • Leder -- 89 T. C. No. 20 1987 • Cristofani -- 97 T. C. 74 1991 • Waters -- T. C. Memo 1994 -194 67 T. C. M. • Nepstad -- A 3 -89 -54 -- U. S. D. C. in ND • Perry -- 59 T. C. M. 65 1990

Estate of Headrick vs. Commissioner • TAX COURT -- 1989 • 6 th CIRCUIT COURT -- 1990

Headrick Case • Mr. Headrick Gifts to Trust • Trustee Applies for Policy • Trustee Is Owner & Beneficiary • Insured Gifts Premium Dollars • Insured Dies Within 3 Years

Estate of Leder vs. Commissioner • TAX COURT -- 1987 • 10 th CIRCUIT APPEALS COURT -- 1989

Leder Case • Mrs. Leder Buys Policy on Her Husband • Trust is Established • Policy Gifted to Trust • Premiums paid by Split Dollar Between Corporation and Trust

Leder Case • Mr. Leder Dies Within Three Years of Policy Issue • Tax Court Holds for the Estate • 10 th Circuit Court of Appeals Holds for the Estate • REASON: Mr. Leder Never Had Incident of Ownership

Estate of Maria Cristofani vs. Commissioner • 1992 TAX COURT CASE, RULING INVOLVES: – Contingent Remainder Interest Beneficiaries and Their Crummey Powers

Waters Case • The WRONG way to do it ! ! • This is a North Carolina case and deals with the gift of a policy within three years of the insured’s death.

Waters Case • WATERS IS DIVORCED • COURT DECREE REQUIRES HE PROVIDE THE FORMER MRS. WATERS WITH LIFE INSURANCE ON MR. WATERS LIFE. • HE DECIDES TO USE AN EXISTING INSURANCE POLICY. • HE DIES WITH A YEAR.

Waters Case • PROCEEDS ARE IN HIS ESTATE (3 YR RULE UNDER IRC SEC. 2035) • PROCEEDS ARE PAID TO MRS. WATERS. • GUESS HOW SHE RESPONDS TO THE EXECUTOR’S REQUEST TO LET THE ESTATE HAVE THE INSURANCE PROCEEDS TO HELP PAY THE ESTATE TAX…

Q&A Thank You!

21e93e2b8893b9c2c0a8937a9c75f7ce.ppt