9eb360200e93913bb90156956e94f155.ppt

- Количество слайдов: 45

Premium Financing and Life Settlements Update Howard Sharfman President Schwartz Benefit Services, Inc. 312 -683 -7152 hsharfman@schwartzbrothers. com

Premium Financing and Life Settlements Update Howard Sharfman President Schwartz Benefit Services, Inc. 312 -683 -7152 hsharfman@schwartzbrothers. com

Legal & Tax Considerations There are several important issues that should be considered before entering into any of the following wealth transfer and charitable planning arrangements. A comprehensive examination of all relevant issues is beyond the scope of this presentation. Wealth transfer and charitable planning strategies have tax implications in a number of areas, including estate, gift, and income taxes. Wealth transfer and charitable planning participants must rely on their own legal and tax advisors to navigate through the various legal and tax issues associated with the following wealth transfer and charitable planning strategies. National Financial Partners and its affiliates do not give legal or tax advice. Pursuant to IRS Circular 230, we are providing you with the following notification: The information contained in this report is not intended to (and cannot) be used by anyone to avoid IRS penalties. This report supports the promotion and marketing of life insurance. You should seek advice based on your particular circumstances from an independent tax advisor.

Legal & Tax Considerations There are several important issues that should be considered before entering into any of the following wealth transfer and charitable planning arrangements. A comprehensive examination of all relevant issues is beyond the scope of this presentation. Wealth transfer and charitable planning strategies have tax implications in a number of areas, including estate, gift, and income taxes. Wealth transfer and charitable planning participants must rely on their own legal and tax advisors to navigate through the various legal and tax issues associated with the following wealth transfer and charitable planning strategies. National Financial Partners and its affiliates do not give legal or tax advice. Pursuant to IRS Circular 230, we are providing you with the following notification: The information contained in this report is not intended to (and cannot) be used by anyone to avoid IRS penalties. This report supports the promotion and marketing of life insurance. You should seek advice based on your particular circumstances from an independent tax advisor.

Disclosures Bond prices, yields, and availability are subject to change based upon market conditions. Insurance does not guarantee market value or protect against fluctuations in bond prices resulting from general market fluctuations. Interest from zero coupon securities is subject to taxes annually as ordinary income, even though no income is received. Municipal securities may be subject to federal alternative minimum tax (AMT). We do not provide legal or tax advice. Please contact your tax advisor regarding suitability of tax-exempt investments for your portfolio. The information in this report has been obtained from source considered to be reliable, but we do not guarantee that it is accurate or complete. This firm may have a position in the securities presented in this report and may buy or sell such securities in the course of our regular business.

Disclosures Bond prices, yields, and availability are subject to change based upon market conditions. Insurance does not guarantee market value or protect against fluctuations in bond prices resulting from general market fluctuations. Interest from zero coupon securities is subject to taxes annually as ordinary income, even though no income is received. Municipal securities may be subject to federal alternative minimum tax (AMT). We do not provide legal or tax advice. Please contact your tax advisor regarding suitability of tax-exempt investments for your portfolio. The information in this report has been obtained from source considered to be reliable, but we do not guarantee that it is accurate or complete. This firm may have a position in the securities presented in this report and may buy or sell such securities in the course of our regular business.

Disclosures } Virtually all investments have some degree of risk that you might lose some or all of your investment. It is important to remember that a bond investment’s return is linked to its credit as well as market changes. The higher the return, the higher the risk. Conversely, relatively safe investments offer relatively lower returns. } You should also be aware that if you sell a bond before it matures, you will receive the prevailing market price, which may be more or less than its original price. The value of bonds fluctuates with the market, varying in the opposite direction of movement in interest rates. } Some bonds offer special tax advantages. There is no state or local income tax on the interest from U. S. Treasury bonds. There is no federal income tax on the interest from most municipal bonds, and in many cases no state or local income tax, either. } Guarantees and benefits provided by life insurance products are subject to the claims paying ability of the issuing insurance company. } These examples are hypothetical and for illustrative purposes only. Past performance does not guarantee future results. Clients should review their specific situation with a financial professional before buying or selling bonds and life insurance products.

Disclosures } Virtually all investments have some degree of risk that you might lose some or all of your investment. It is important to remember that a bond investment’s return is linked to its credit as well as market changes. The higher the return, the higher the risk. Conversely, relatively safe investments offer relatively lower returns. } You should also be aware that if you sell a bond before it matures, you will receive the prevailing market price, which may be more or less than its original price. The value of bonds fluctuates with the market, varying in the opposite direction of movement in interest rates. } Some bonds offer special tax advantages. There is no state or local income tax on the interest from U. S. Treasury bonds. There is no federal income tax on the interest from most municipal bonds, and in many cases no state or local income tax, either. } Guarantees and benefits provided by life insurance products are subject to the claims paying ability of the issuing insurance company. } These examples are hypothetical and for illustrative purposes only. Past performance does not guarantee future results. Clients should review their specific situation with a financial professional before buying or selling bonds and life insurance products.

Development History The Supreme Court Case of Grigsby v. Russell (1911)

Development History The Supreme Court Case of Grigsby v. Russell (1911)

Development History “Life insurance has become in our days one of the best recognized forms of investment and selfcompelled saving. So far as reasonable safety permits, it is desirable to give to life policies the ordinary characteristics of property. ” ~ Justice Oliver Wendell Holmes

Development History “Life insurance has become in our days one of the best recognized forms of investment and selfcompelled saving. So far as reasonable safety permits, it is desirable to give to life policies the ordinary characteristics of property. ” ~ Justice Oliver Wendell Holmes

Life Settlements Generally an agreement between a policy owner and a purchaser for the sale of a policy

Life Settlements Generally an agreement between a policy owner and a purchaser for the sale of a policy

The Secondary Market Timeline 1985 -2008 No Market Viatical Settlements Private Settlement Buyers Few Institutional Buyers Growing Market with No Transparency Many New Institutional Players Transparency – More Regulation Auction Market Players More Efficient and Transparent Market The current market is valued at $30, 000, 000

The Secondary Market Timeline 1985 -2008 No Market Viatical Settlements Private Settlement Buyers Few Institutional Buyers Growing Market with No Transparency Many New Institutional Players Transparency – More Regulation Auction Market Players More Efficient and Transparent Market The current market is valued at $30, 000, 000

Why does the market for Life Settlements Exist? Investor / Buyer Motivations } } } } } Insurance Company Mispricing Underwriting Advocacy Need for Non-Correlated Investments Predictability in Large Numbers Easy Credit Markets Opportunity to Securitize (fee income) Growth of Hedge Funds/Alternative Investments Greed Pools of well priced life insurance have high IRR’s

Why does the market for Life Settlements Exist? Investor / Buyer Motivations } } } } } Insurance Company Mispricing Underwriting Advocacy Need for Non-Correlated Investments Predictability in Large Numbers Easy Credit Markets Opportunity to Securitize (fee income) Growth of Hedge Funds/Alternative Investments Greed Pools of well priced life insurance have high IRR’s

Why does the market for Life Settlements Exist? Policy Owner Motivations } Liquidity } Low CV Offers } Inefficient Market (ability to sell and replace) } Another Exit Strategy (besides death) } Changing Needs/No Longer Needed by Owner } Greed

Why does the market for Life Settlements Exist? Policy Owner Motivations } Liquidity } Low CV Offers } Inefficient Market (ability to sell and replace) } Another Exit Strategy (besides death) } Changing Needs/No Longer Needed by Owner } Greed

Why Insurance Companies Don’t Like Premium Finance and Life Settlements • • • Lapse-Sensitive Pricing Optics Towards Regulators and Lawmakers Insurable Interest Widows and Orphans, Not Investors Speculation Increased Fraud by Investors and Agents Age Spread Risking Tax-Free D. B. /Tax-Deferred CV Status Concern for Clients Greed

Why Insurance Companies Don’t Like Premium Finance and Life Settlements • • • Lapse-Sensitive Pricing Optics Towards Regulators and Lawmakers Insurable Interest Widows and Orphans, Not Investors Speculation Increased Fraud by Investors and Agents Age Spread Risking Tax-Free D. B. /Tax-Deferred CV Status Concern for Clients Greed

Who? Generally High Net Worth Individuals Age 65 +

Who? Generally High Net Worth Individuals Age 65 +

Players Broker: A Person who, on behalf of an Owner and for a fee, commission, offers to negotiate Life Settlement Contracts between an Owner and Provider. - NCOIL

Players Broker: A Person who, on behalf of an Owner and for a fee, commission, offers to negotiate Life Settlement Contracts between an Owner and Provider. - NCOIL

Players Provider: A Provider is a person, other than a seller, that enters into or effectuates a settlement contract.

Players Provider: A Provider is a person, other than a seller, that enters into or effectuates a settlement contract.

Players Financing Entity: A lender, purchaser of a policy or certificate from an entity that has direct ownership in a policy. Primary activity to the transaction is providing funds

Players Financing Entity: A lender, purchaser of a policy or certificate from an entity that has direct ownership in a policy. Primary activity to the transaction is providing funds

Due Diligence Process } In Force Ledger } Medical Records } Life Expectancy Reports

Due Diligence Process } In Force Ledger } Medical Records } Life Expectancy Reports

There may be Tax Issues Adjusted Tax Basis – Two Approaches • Net Premiums Approach • Cost of Insurance Approach

There may be Tax Issues Adjusted Tax Basis – Two Approaches • Net Premiums Approach • Cost of Insurance Approach

Tax Issues Proceeds from a life settlement transaction may be taxable under federal or state law to the extent the proceeds exceed the cost basis. The proceeds from a life settlement transaction may be subject to claims of creditors. The receipt of proceeds from a life settlement transaction may adversely impact eligibility for government benefits and entitlements. The amount received for the sale of the Policy may be impacted by the circumstances of the particular purchaser of the Policy, the insured’s life expectancy, future premiums, the death benefit, the terms of the Policy, and the current market for insurance policies, among other factors. The amount received for the sale of the policy may be more or less than what others might receive for the sale of a similar policy. There may be high fees associated with the sale of a Life settlement.

Tax Issues Proceeds from a life settlement transaction may be taxable under federal or state law to the extent the proceeds exceed the cost basis. The proceeds from a life settlement transaction may be subject to claims of creditors. The receipt of proceeds from a life settlement transaction may adversely impact eligibility for government benefits and entitlements. The amount received for the sale of the Policy may be impacted by the circumstances of the particular purchaser of the Policy, the insured’s life expectancy, future premiums, the death benefit, the terms of the Policy, and the current market for insurance policies, among other factors. The amount received for the sale of the policy may be more or less than what others might receive for the sale of a similar policy. There may be high fees associated with the sale of a Life settlement.

Adjusted Tax Basis Facts: Policy owner owns a universal life policy and pays an premium of $200 k for 10 years. The insurance carrier allocates $60 k of the premium to the cost of providing insurance protection.

Adjusted Tax Basis Facts: Policy owner owns a universal life policy and pays an premium of $200 k for 10 years. The insurance carrier allocates $60 k of the premium to the cost of providing insurance protection.

Net Premiums Approach } The taxpayer has a $2 M basis or investment in the life insurance policy } $200, 000 x 10 years

Net Premiums Approach } The taxpayer has a $2 M basis or investment in the life insurance policy } $200, 000 x 10 years

Cost of Insurance Approach } The taxpayer has a $1. 4 M basis in the policy } (($200, 000 - $60, 000)) x 10 years)

Cost of Insurance Approach } The taxpayer has a $1. 4 M basis in the policy } (($200, 000 - $60, 000)) x 10 years)

Adjusted Tax Basis - Summary } The cost of insurance approach produces a tax basis $600, 000 lower than the net premiums approach, potentially resulting in $600, 000 of additional taxable gain } No binding guidance on which approach to use.

Adjusted Tax Basis - Summary } The cost of insurance approach produces a tax basis $600, 000 lower than the net premiums approach, potentially resulting in $600, 000 of additional taxable gain } No binding guidance on which approach to use.

Settlements Done Right Know the Risks – Buyer/Marketplace/Interest Rates Understand the Tax Risks Demand Transparency – Understand the Money Trail Professional Tax, Legal, Insurance and Settlements Advice is Needed

Settlements Done Right Know the Risks – Buyer/Marketplace/Interest Rates Understand the Tax Risks Demand Transparency – Understand the Money Trail Professional Tax, Legal, Insurance and Settlements Advice is Needed

Premium Finance The Past, Present and Future

Premium Finance The Past, Present and Future

Premium Finance Timeline Prior to 1998 - Original Options (the start of the cat and mouse game) • Private Split Dollar • Traditional Premium Finance

Premium Finance Timeline Prior to 1998 - Original Options (the start of the cat and mouse game) • Private Split Dollar • Traditional Premium Finance

Premium Finance Timeline 1998 -2006 – (The Cat and Mouse Game): • • • Inducement by D. B. Financial Annuity Arbitrage Inducement by Cash 2 -Year Non-Recourse Change of Beneficial Interest Put Options

Premium Finance Timeline 1998 -2006 – (The Cat and Mouse Game): • • • Inducement by D. B. Financial Annuity Arbitrage Inducement by Cash 2 -Year Non-Recourse Change of Beneficial Interest Put Options

Premium Finance Timeline 2006+ Current Options – No Games: • Traditional Premium Finance • Private Split $ • Hybrid Financing

Premium Finance Timeline 2006+ Current Options – No Games: • Traditional Premium Finance • Private Split $ • Hybrid Financing

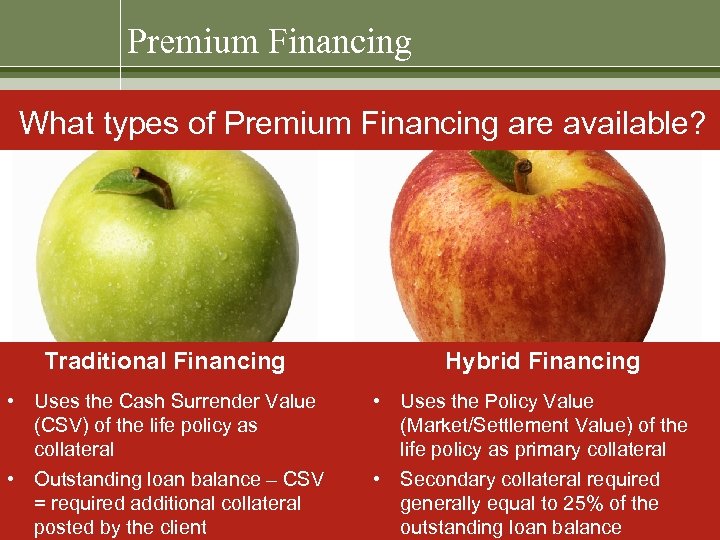

Premium Financing What types of Premium Financing are available? Traditional Financing • Uses the Cash Surrender Value (CSV) of the life policy as collateral • Outstanding loan balance – CSV = required additional collateral posted by the client Hybrid Financing • Uses the Policy Value (Market/Settlement Value) of the life policy as primary collateral • Secondary collateral required generally equal to 25% of the outstanding loan balance

Premium Financing What types of Premium Financing are available? Traditional Financing • Uses the Cash Surrender Value (CSV) of the life policy as collateral • Outstanding loan balance – CSV = required additional collateral posted by the client Hybrid Financing • Uses the Policy Value (Market/Settlement Value) of the life policy as primary collateral • Secondary collateral required generally equal to 25% of the outstanding loan balance

Other Financing } Lenders have created programs where an insured can borrow against the market value of their in-force life coverage. } May be an attractive alternative to a life settlement. • • • Client receives liquidity today Client life coverage remains in-force, not owned by a third-party investor. Client may use liquidity for the purchase of life insurance

Other Financing } Lenders have created programs where an insured can borrow against the market value of their in-force life coverage. } May be an attractive alternative to a life settlement. • • • Client receives liquidity today Client life coverage remains in-force, not owned by a third-party investor. Client may use liquidity for the purchase of life insurance

Premium Financing What are the Risks Associated with Premium Financing? • Financial Risk • Contractual Risk • Product Risk

Premium Financing What are the Risks Associated with Premium Financing? • Financial Risk • Contractual Risk • Product Risk

Financial Risk Additional Risks to Consider: } Collateral Issues } Formula Risk } Market Risk

Financial Risk Additional Risks to Consider: } Collateral Issues } Formula Risk } Market Risk

Insurance as an Asset Class Why Premium Finance? Why all the Fuss about Life Insurance? It is all about the IRR Life Insurance is an Asset Class

Insurance as an Asset Class Why Premium Finance? Why all the Fuss about Life Insurance? It is all about the IRR Life Insurance is an Asset Class

Insurance as an Asset Class } Provides a fixed sum that is predictable and defined } Provides greater certainty about the value of assets to be passed on to heirs } Potential for a high rate of return based on when mortality occurs } Provides liquidity in the event of an unexpected death

Insurance as an Asset Class } Provides a fixed sum that is predictable and defined } Provides greater certainty about the value of assets to be passed on to heirs } Potential for a high rate of return based on when mortality occurs } Provides liquidity in the event of an unexpected death

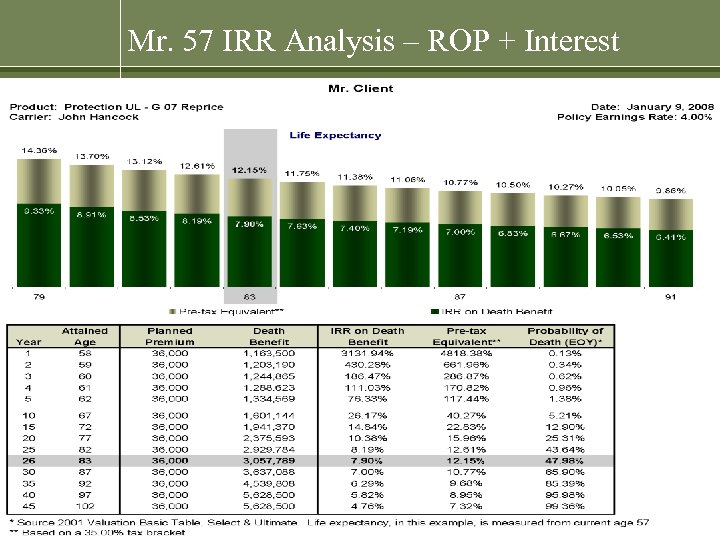

Mr. 57 IRR Analysis – ROP + Interest

Mr. 57 IRR Analysis – ROP + Interest

Capital Market’s Impact on Premium Financing And Life Settlements

Capital Market’s Impact on Premium Financing And Life Settlements

Risk

Risk

Capital Markets Where does the money come from? } } } Banks – Local & Global General Public Funders/Investors Private Equity Hedge Funds

Capital Markets Where does the money come from? } } } Banks – Local & Global General Public Funders/Investors Private Equity Hedge Funds

Changing marketplace in Capital Markets What happened to the premium financing market in April, 2008? } } } Available Capital Shrunk Inexperienced Capital Sources Became Unreliable Lack of Diversified and Committed Capital New Mortality Tables Carrier Scrutiny of Agents & Financials Concerns about Fraud and Insurable Interest

Changing marketplace in Capital Markets What happened to the premium financing market in April, 2008? } } } Available Capital Shrunk Inexperienced Capital Sources Became Unreliable Lack of Diversified and Committed Capital New Mortality Tables Carrier Scrutiny of Agents & Financials Concerns about Fraud and Insurable Interest

Life Expectancy Reports 2008 VBT Tables } } 20% Longer Mortality for Ages 70+ Drives the Value of Policies Down Less Arbitrage } } Carrier Pricing has Remained Flat or Increased The “BOX” has Shrunk

Life Expectancy Reports 2008 VBT Tables } } 20% Longer Mortality for Ages 70+ Drives the Value of Policies Down Less Arbitrage } } Carrier Pricing has Remained Flat or Increased The “BOX” has Shrunk

Pricing What other factors are used in pricing? } Lender always Assumes Worse Case Scenario of Default } Market Pricing vs. Model Pricing } Value = PV (DB) – PV (premiums)

Pricing What other factors are used in pricing? } Lender always Assumes Worse Case Scenario of Default } Market Pricing vs. Model Pricing } Value = PV (DB) – PV (premiums)

Pricing Current Considerations } } Haircuts on all Premium Finance Paper Concentration risk • • } } } Carriers Insured(s) Deaths of Non-US Citizens are Difficult to Track Same Sex Marriages - not Recognized in Some States Lack of Liquidity

Pricing Current Considerations } } Haircuts on all Premium Finance Paper Concentration risk • • } } } Carriers Insured(s) Deaths of Non-US Citizens are Difficult to Track Same Sex Marriages - not Recognized in Some States Lack of Liquidity

Changing marketplace with Carriers } Increased financial underwriting standards } Monitoring agents business to see what stays on the books } New forms required regarding source of funds and intent to sell } All products must adopt 2001 CSO tables by November 2008 } Capacity limitations. Generally internal retention only available.

Changing marketplace with Carriers } Increased financial underwriting standards } Monitoring agents business to see what stays on the books } New forms required regarding source of funds and intent to sell } All products must adopt 2001 CSO tables by November 2008 } Capacity limitations. Generally internal retention only available.

In summary: } The Life Settlement Market (done correctly) is Consumer Friendly } Advisors need to discuss the Settlement of Older Insurance Policies } Know the Risks – there Might Not be a Buyer } Understand the Tax Issues and Risks } Demand Transparency } Professional Tax, Legal, Insurance and Settlements Advice is Needed } Be Careful when Dealing with Seniors

In summary: } The Life Settlement Market (done correctly) is Consumer Friendly } Advisors need to discuss the Settlement of Older Insurance Policies } Know the Risks – there Might Not be a Buyer } Understand the Tax Issues and Risks } Demand Transparency } Professional Tax, Legal, Insurance and Settlements Advice is Needed } Be Careful when Dealing with Seniors

cont. The } } } New Rules In summary: High Net Worth Clients should Consider an Asset Allocation into well Priced, well Underwritten Life Insurance Review State Regulations Review the Application, full Disclosure Negotiate Settlement Commissions up front Whole Life and Prem. Financed Insurance Sell at Discount If it is Free it is FRAUD - No Non Recourse or Inducement (Money up Front) Hire an Expert

cont. The } } } New Rules In summary: High Net Worth Clients should Consider an Asset Allocation into well Priced, well Underwritten Life Insurance Review State Regulations Review the Application, full Disclosure Negotiate Settlement Commissions up front Whole Life and Prem. Financed Insurance Sell at Discount If it is Free it is FRAUD - No Non Recourse or Inducement (Money up Front) Hire an Expert

Thank you Howard Sharfman 312 -683 -7152 hsharfman@schwartzbrothers. com

Thank you Howard Sharfman 312 -683 -7152 hsharfman@schwartzbrothers. com