1daa2157dcc8e8b2b2d53312a7466c26.ppt

- Количество слайдов: 18

Preliminary Results for the year ended 30 June 2005

Preliminary Results for the year ended 30 June 2005

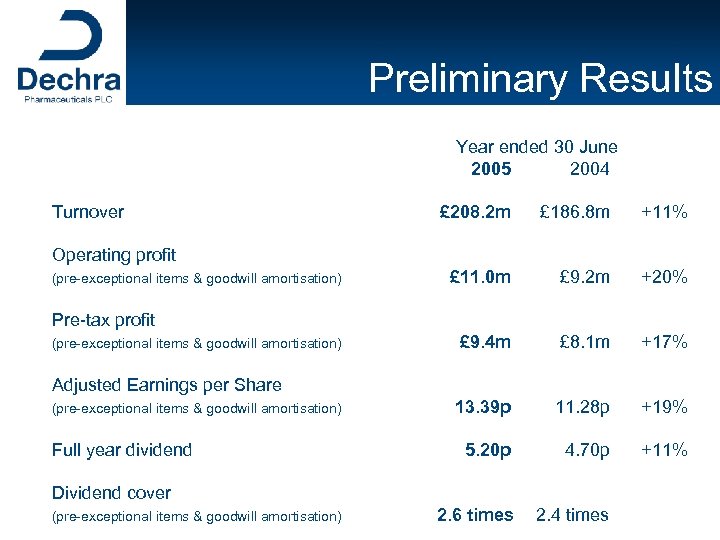

Preliminary Results Year ended 30 June 2005 2004 Turnover £ 208. 2 m £ 186. 8 m +11% £ 11. 0 m £ 9. 2 m +20% £ 9. 4 m £ 8. 1 m +17% 13. 39 p 11. 28 p +19% 5. 20 p 4. 70 p +11% 2. 6 times 2. 4 times Operating profit (pre-exceptional items & goodwill amortisation) Pre-tax profit (pre-exceptional items & goodwill amortisation) Adjusted Earnings per Share (pre-exceptional items & goodwill amortisation) Full year dividend Dividend cover (pre-exceptional items & goodwill amortisation)

Preliminary Results Year ended 30 June 2005 2004 Turnover £ 208. 2 m £ 186. 8 m +11% £ 11. 0 m £ 9. 2 m +20% £ 9. 4 m £ 8. 1 m +17% 13. 39 p 11. 28 p +19% 5. 20 p 4. 70 p +11% 2. 6 times 2. 4 times Operating profit (pre-exceptional items & goodwill amortisation) Pre-tax profit (pre-exceptional items & goodwill amortisation) Adjusted Earnings per Share (pre-exceptional items & goodwill amortisation) Full year dividend Dividend cover (pre-exceptional items & goodwill amortisation)

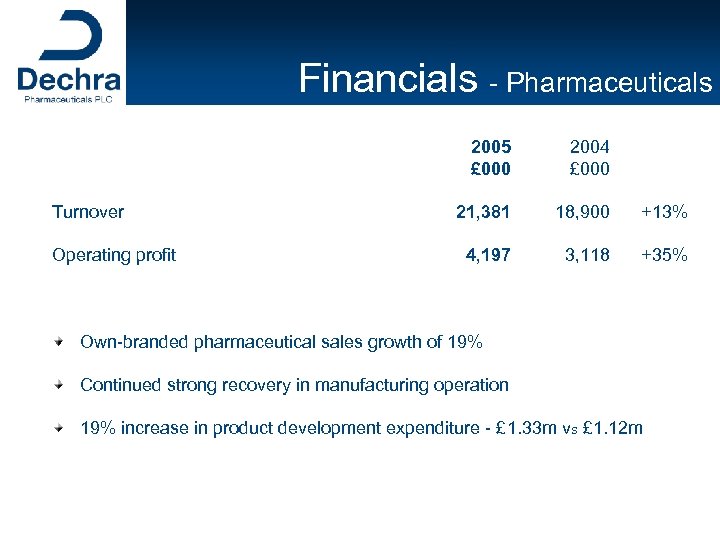

Financials - Pharmaceuticals 2005 £ 000 Turnover Operating profit 2004 £ 000 21, 381 18, 900 +13% 4, 197 3, 118 +35% Own-branded pharmaceutical sales growth of 19% Continued strong recovery in manufacturing operation 19% increase in product development expenditure - £ 1. 33 m vs £ 1. 12 m

Financials - Pharmaceuticals 2005 £ 000 Turnover Operating profit 2004 £ 000 21, 381 18, 900 +13% 4, 197 3, 118 +35% Own-branded pharmaceutical sales growth of 19% Continued strong recovery in manufacturing operation 19% increase in product development expenditure - £ 1. 33 m vs £ 1. 12 m

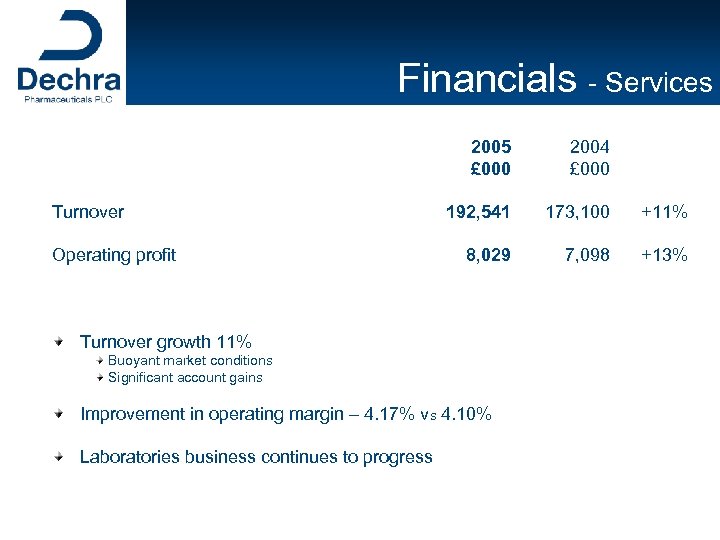

Financials - Services 2005 £ 000 Turnover Operating profit 2004 £ 000 192, 541 173, 100 +11% 8, 029 7, 098 +13% Turnover growth 11% Buoyant market conditions Significant account gains Improvement in operating margin – 4. 17% vs 4. 10% Laboratories business continues to progress

Financials - Services 2005 £ 000 Turnover Operating profit 2004 £ 000 192, 541 173, 100 +11% 8, 029 7, 098 +13% Turnover growth 11% Buoyant market conditions Significant account gains Improvement in operating margin – 4. 17% vs 4. 10% Laboratories business continues to progress

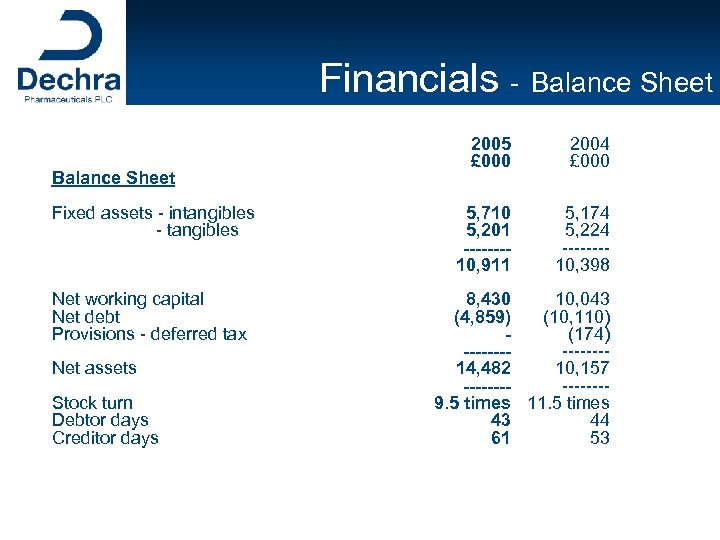

Financials - Balance Sheet Fixed assets - intangibles - tangibles Net working capital Net debt Provisions - deferred tax Net assets Stock turn Debtor days Creditor days 2005 £ 000 2004 £ 000 5, 710 5, 201 -------10, 911 5, 174 5, 224 -------10, 398 8, 430 10, 043 (4, 859) (10, 110) (174) -------14, 482 10, 157 -------9. 5 times 11. 5 times 43 44 61 53

Financials - Balance Sheet Fixed assets - intangibles - tangibles Net working capital Net debt Provisions - deferred tax Net assets Stock turn Debtor days Creditor days 2005 £ 000 2004 £ 000 5, 710 5, 201 -------10, 911 5, 174 5, 224 -------10, 398 8, 430 10, 043 (4, 859) (10, 110) (174) -------14, 482 10, 157 -------9. 5 times 11. 5 times 43 44 61 53

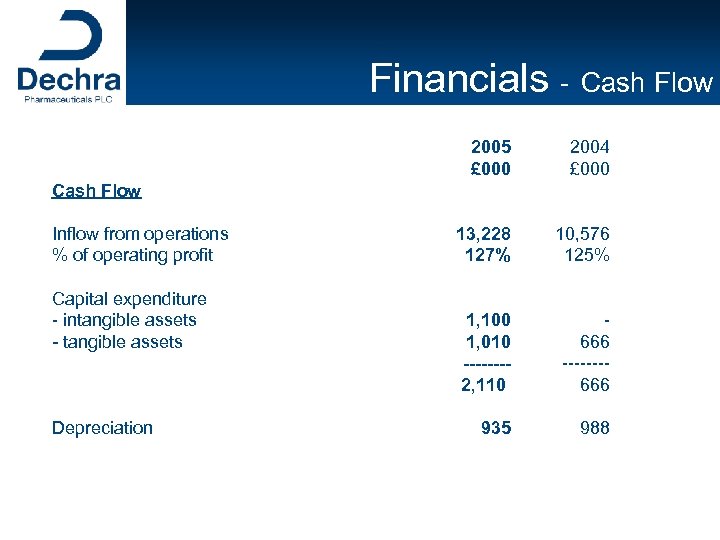

Financials - Cash Flow 2005 £ 000 2004 £ 000 13, 228 127% 10, 576 125% 1, 100 1, 010 -------2, 110 666 -------666 935 988 Cash Flow Inflow from operations % of operating profit Capital expenditure - intangible assets - tangible assets Depreciation

Financials - Cash Flow 2005 £ 000 2004 £ 000 13, 228 127% 10, 576 125% 1, 100 1, 010 -------2, 110 666 -------666 935 988 Cash Flow Inflow from operations % of operating profit Capital expenditure - intangible assets - tangible assets Depreciation

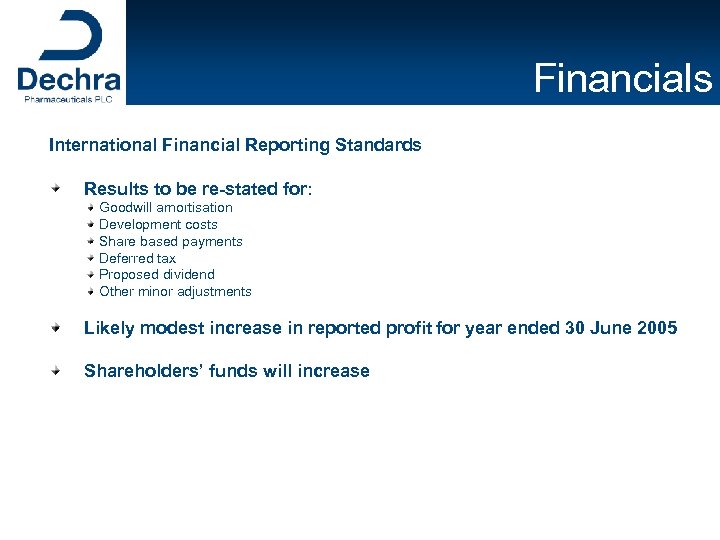

Financials International Financial Reporting Standards Results to be re-stated for: Goodwill amortisation Development costs Share based payments Deferred tax Proposed dividend Other minor adjustments Likely modest increase in reported profit for year ended 30 June 2005 Shareholders’ funds will increase

Financials International Financial Reporting Standards Results to be re-stated for: Goodwill amortisation Development costs Share based payments Deferred tax Proposed dividend Other minor adjustments Likely modest increase in reported profit for year ended 30 June 2005 Shareholders’ funds will increase

Preliminary Results Business Review 2005

Preliminary Results Business Review 2005

Developments New head of Product Development and Regulatory Affairs appointed US national – relocated to UK Broad experience of US and EU Regulatory bodies Knowledge already proving invaluable Vetivex® licenses acquired Immediate market share gains Leverage of the brand through new products Marketing agreements Orion Pharma : Vetoryl® and Felimazole® in Nordics Veterinaria : Vetoryl®, Felimazole® and Equipalazone® in Switzerland Vétoquinol : Vetoryl® and Felimazole® in Canada Intervet : renewal of Equipalazone® in Germany

Developments New head of Product Development and Regulatory Affairs appointed US national – relocated to UK Broad experience of US and EU Regulatory bodies Knowledge already proving invaluable Vetivex® licenses acquired Immediate market share gains Leverage of the brand through new products Marketing agreements Orion Pharma : Vetoryl® and Felimazole® in Nordics Veterinaria : Vetoryl®, Felimazole® and Equipalazone® in Switzerland Vétoquinol : Vetoryl® and Felimazole® in Canada Intervet : renewal of Equipalazone® in Germany

Pharmaceutical Development Vetoryl® Expedited review granted in USA - efficacy and safety sections submitted Mutual recognition submitted for EU New blister packs approved in UK New low dose (30 mg) approved in UK Development of 10 mg maintenance dose commenced Dossier submitted to Canadian authorities Felimazole® Expedited review granted in USA - field trials commencing 2. 5 mg approved in UK Dossier submitted to Canadian authorities

Pharmaceutical Development Vetoryl® Expedited review granted in USA - efficacy and safety sections submitted Mutual recognition submitted for EU New blister packs approved in UK New low dose (30 mg) approved in UK Development of 10 mg maintenance dose commenced Dossier submitted to Canadian authorities Felimazole® Expedited review granted in USA - field trials commencing 2. 5 mg approved in UK Dossier submitted to Canadian authorities

Pharmaceutical Development Urilin® First generic license in UK First entrant in £ 1. 9 million UK market Thyroxyl Profit share joint venture with USA patent holders, Geo. Pharma, Inc. Unique oral solution and tablets Launched in USA July 2005 Easier and improved dosing Favourable results on comparative trials with brand leader EU opportunities being explored as part of the worldwide marketing agreement Ovuplant® I. P. owned by Peptech UK licensed Mutual recognition commenced

Pharmaceutical Development Urilin® First generic license in UK First entrant in £ 1. 9 million UK market Thyroxyl Profit share joint venture with USA patent holders, Geo. Pharma, Inc. Unique oral solution and tablets Launched in USA July 2005 Easier and improved dosing Favourable results on comparative trials with brand leader EU opportunities being explored as part of the worldwide marketing agreement Ovuplant® I. P. owned by Peptech UK licensed Mutual recognition commenced

Pharmaceuticals - Sales & Marketing Branded veterinary licensed pharma portfolio + 19% Own developed and branded products performed well Vetoryl® +36% Felimazole® +71% Instruments & consumables Sales +12% Key distributor relationships reflect part of growth UK distribution agreement with Zi Medical Direct mail business - pdq

Pharmaceuticals - Sales & Marketing Branded veterinary licensed pharma portfolio + 19% Own developed and branded products performed well Vetoryl® +36% Felimazole® +71% Instruments & consumables Sales +12% Key distributor relationships reflect part of growth UK distribution agreement with Zi Medical Direct mail business - pdq

Pharmaceuticals - DVP (USA) American market largest in the world - 10 times UK US fledgling operation established April 2005 Located in Kansas City – centre of US animal health President and National Sales Manager appointed Thyroxyl Oral Solution launched July 2005 Unique liquid formulation Dechra Veterinary Products established in USA prior to launch of key products Distribution agreements reached Increasing Brand awareness

Pharmaceuticals - DVP (USA) American market largest in the world - 10 times UK US fledgling operation established April 2005 Located in Kansas City – centre of US animal health President and National Sales Manager appointed Thyroxyl Oral Solution launched July 2005 Unique liquid formulation Dechra Veterinary Products established in USA prior to launch of key products Distribution agreements reached Increasing Brand awareness

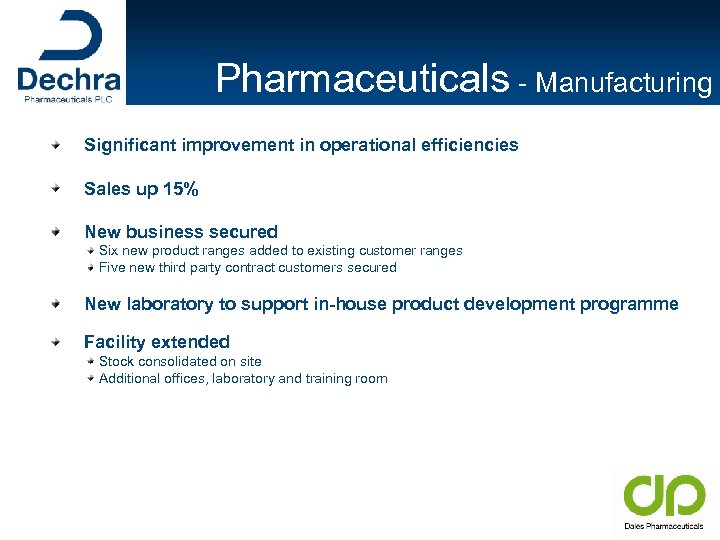

Pharmaceuticals - Manufacturing Significant improvement in operational efficiencies Sales up 15% New business secured Six new product ranges added to existing customer ranges Five new third party contract customers secured New laboratory to support in-house product development programme Facility extended Stock consolidated on site Additional offices, laboratory and training room

Pharmaceuticals - Manufacturing Significant improvement in operational efficiencies Sales up 15% New business secured Six new product ranges added to existing customer ranges Five new third party contract customers secured New laboratory to support in-house product development programme Facility extended Stock consolidated on site Additional offices, laboratory and training room

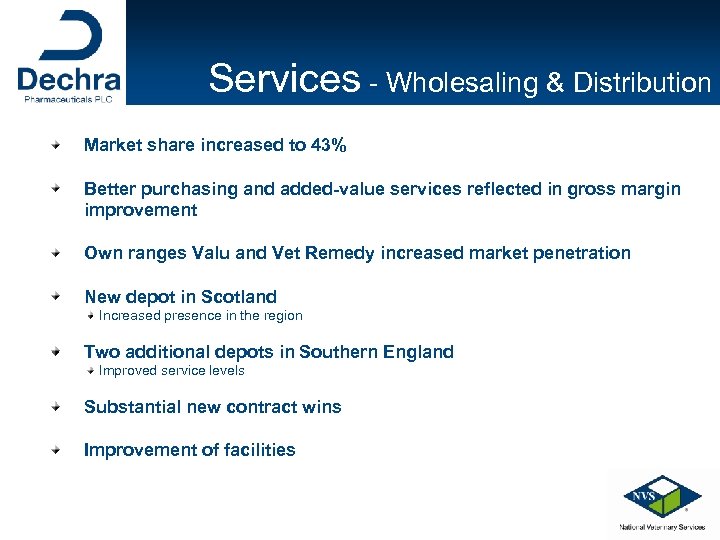

Services - Wholesaling & Distribution Market share increased to 43% Better purchasing and added-value services reflected in gross margin improvement Own ranges Valu and Vet Remedy increased market penetration New depot in Scotland Increased presence in the region Two additional depots in Southern England Improved service levels Substantial new contract wins Improvement of facilities

Services - Wholesaling & Distribution Market share increased to 43% Better purchasing and added-value services reflected in gross margin improvement Own ranges Valu and Vet Remedy increased market penetration New depot in Scotland Increased presence in the region Two additional depots in Southern England Improved service levels Substantial new contract wins Improvement of facilities

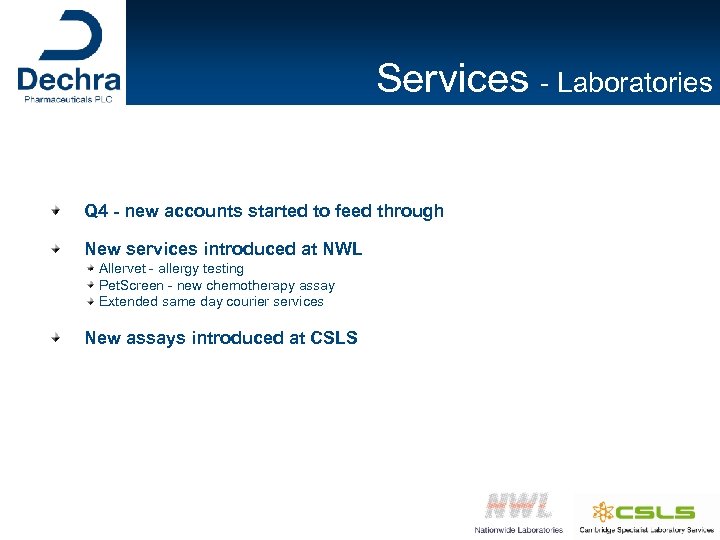

Services - Laboratories Q 4 - new accounts started to feed through New services introduced at NWL Allervet - allergy testing Pet. Screen - new chemotherapy assay Extended same day courier services New assays introduced at CSLS

Services - Laboratories Q 4 - new accounts started to feed through New services introduced at NWL Allervet - allergy testing Pet. Screen - new chemotherapy assay Extended same day courier services New assays introduced at CSLS

Prospects Business continues to perform in-line with management expectations US launch of Thyroxyl - provides opportunity to build market presence in American endocrinology market ahead of launch of Vetoryl® and Felimazole® Strategic alliances and agreements provide solid foundation to drive international business Pursuing further partnerships with human pharma and veterinary healthcare creating additional global opportunities Group focused to achieve further market penetration and profitability

Prospects Business continues to perform in-line with management expectations US launch of Thyroxyl - provides opportunity to build market presence in American endocrinology market ahead of launch of Vetoryl® and Felimazole® Strategic alliances and agreements provide solid foundation to drive international business Pursuing further partnerships with human pharma and veterinary healthcare creating additional global opportunities Group focused to achieve further market penetration and profitability

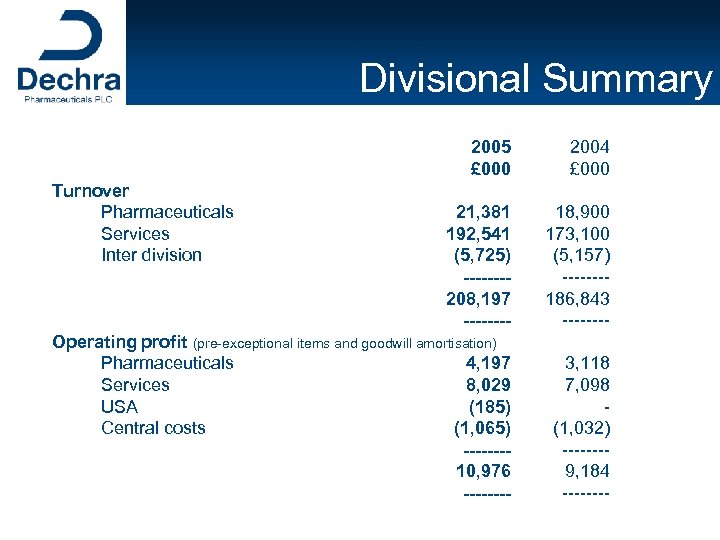

Divisional Summary 2005 £ 000 2004 £ 000 21, 381 192, 541 (5, 725) -------208, 197 ---- 18, 900 173, 100 (5, 157) -------186, 843 ---- Operating profit (pre-exceptional items and goodwill amortisation) Pharmaceuticals 4, 197 Services 8, 029 USA (185) Central costs (1, 065) -------10, 976 ---- 3, 118 7, 098 (1, 032) -------9, 184 ---- Turnover Pharmaceuticals Services Inter division

Divisional Summary 2005 £ 000 2004 £ 000 21, 381 192, 541 (5, 725) -------208, 197 ---- 18, 900 173, 100 (5, 157) -------186, 843 ---- Operating profit (pre-exceptional items and goodwill amortisation) Pharmaceuticals 4, 197 Services 8, 029 USA (185) Central costs (1, 065) -------10, 976 ---- 3, 118 7, 098 (1, 032) -------9, 184 ---- Turnover Pharmaceuticals Services Inter division