e185da861ba3c2437fc22aff5ea7a3cb.ppt

- Количество слайдов: 27

Preliminary Results 2003

Brian Whitty Group Chief Executive

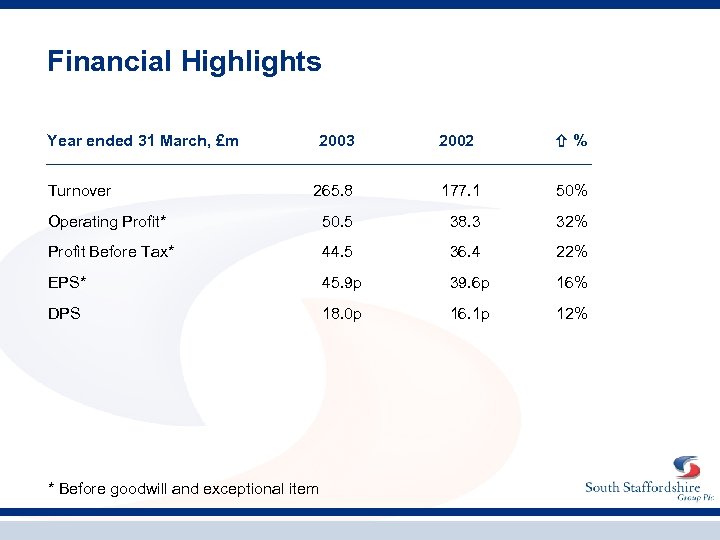

Financial Highlights Year ended 31 March, £m 2003 2002 % 265. 8 177. 1 50% Operating Profit* 50. 5 38. 3 32% Profit Before Tax* 44. 5 36. 4 22% EPS* 45. 9 p 39. 6 p 16% DPS 18. 0 p 16. 1 p 12% Turnover * Before goodwill and exceptional item

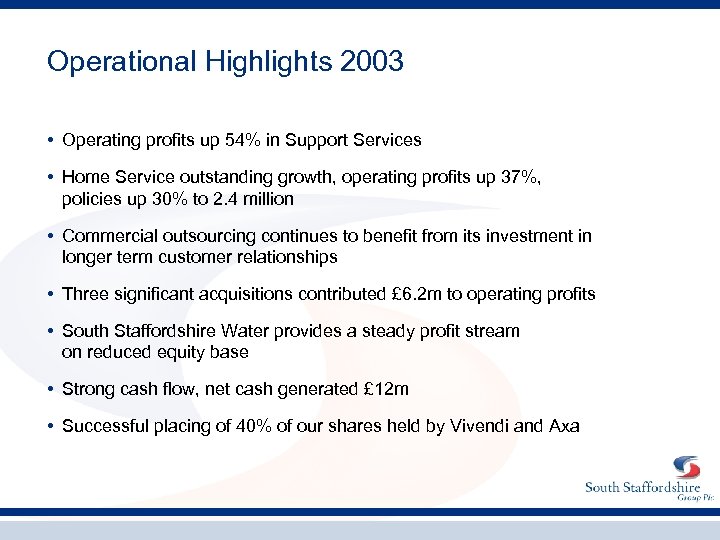

Operational Highlights 2003 • Operating profits up 54% in Support Services • Home Service outstanding growth, operating profits up 37%, policies up 30% to 2. 4 million • Commercial outsourcing continues to benefit from its investment in longer term customer relationships • Three significant acquisitions contributed £ 6. 2 m to operating profits • South Staffordshire Water provides a steady profit stream on reduced equity base • Strong cash flow, net cash generated £ 12 m • Successful placing of 40% of our shares held by Vivendi and Axa

Andrew Belk Group Finance Director

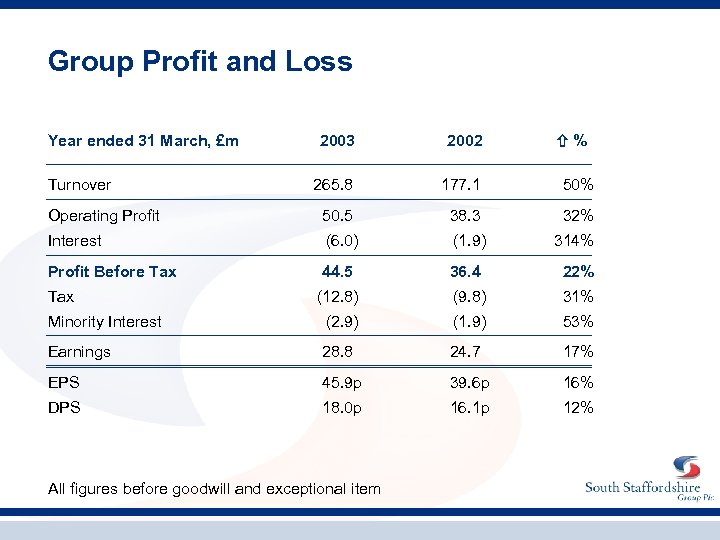

Group Profit and Loss Year ended 31 March, £m 2003 2002 265. 8 177. 1 50% Operating Profit 50. 5 38. 3 32% Interest (6. 0) (1. 9) 314% Profit Before Tax 44. 5 36. 4 22% (12. 8) (9. 8) 31% Minority Interest (2. 9) (1. 9) 53% Earnings 28. 8 24. 7 17% EPS 45. 9 p 39. 6 p 16% DPS 18. 0 p 16. 1 p 12% Turnover Tax All figures before goodwill and exceptional item %

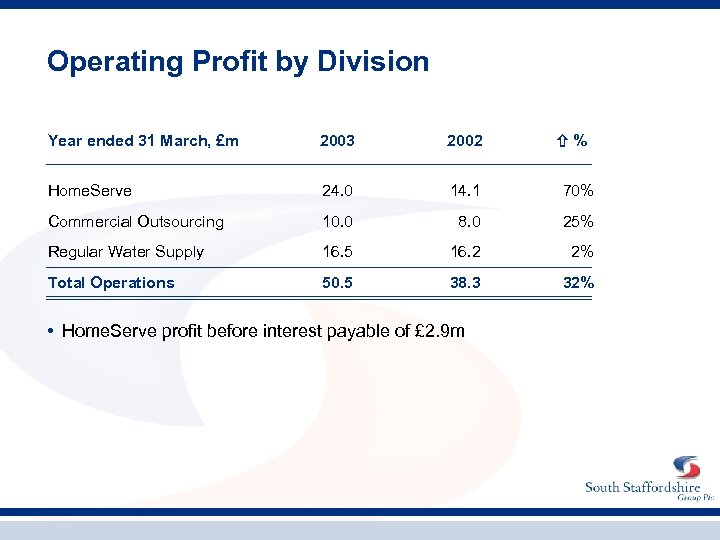

Operating Profit by Division Year ended 31 March, £m 2003 2002 Home. Serve 24. 0 14. 1 70% Commercial Outsourcing 10. 0 8. 0 25% Regular Water Supply 16. 5 16. 2 2% Total Operations 50. 5 38. 3 32% • Home. Serve profit before interest payable of £ 2. 9 m %

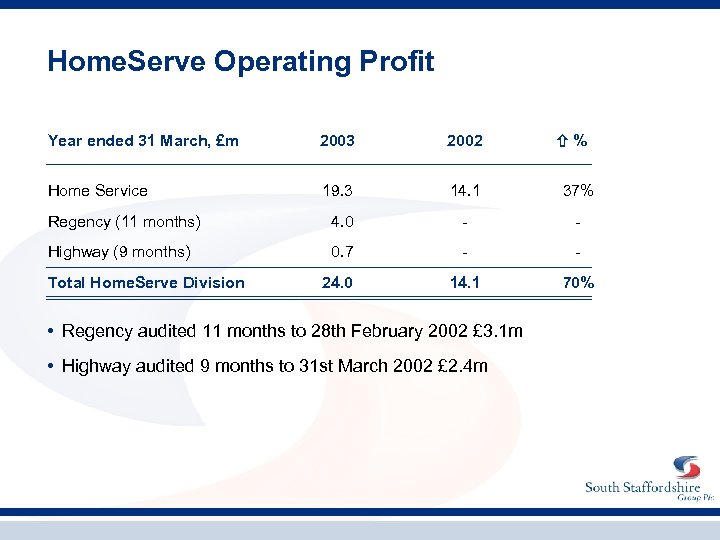

Home. Serve Operating Profit Year ended 31 March, £m 2003 2002 Home Service 19. 3 14. 1 37% Regency (11 months) 4. 0 - - Highway (9 months) 0. 7 - - 24. 0 14. 1 70% Total Home. Serve Division • Regency audited 11 months to 28 th February 2002 £ 3. 1 m • Highway audited 9 months to 31 st March 2002 £ 2. 4 m %

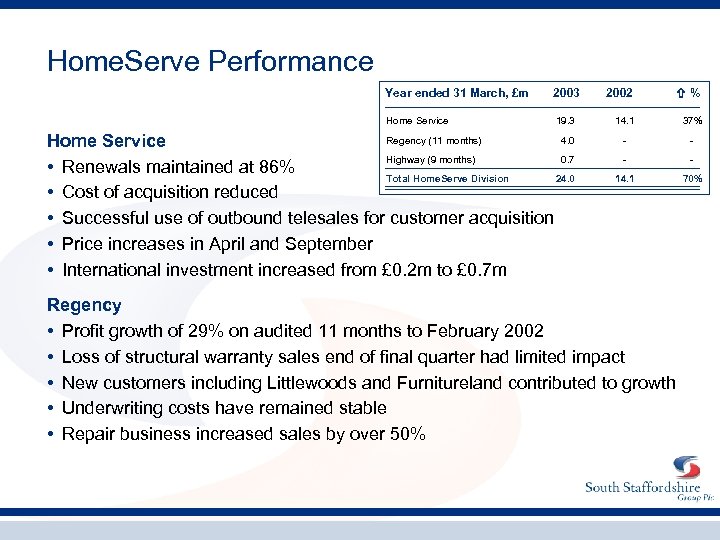

Home. Serve Performance Year ended 31 March, £m 2003 Home Service 19. 3 Regency (11 months) 4. 0 Home Service Highway (9 months) 0. 7 • Renewals maintained at 86% Total Home. Serve Division 24. 0 • Cost of acquisition reduced • Successful use of outbound telesales for customer acquisition • Price increases in April and September • International investment increased from £ 0. 2 m to £ 0. 7 m 2002 % 14. 1 37% - - 14. 1 70% Regency • Profit growth of 29% on audited 11 months to February 2002 • Loss of structural warranty sales end of final quarter had limited impact • New customers including Littlewoods and Furnitureland contributed to growth • Underwriting costs have remained stable • Repair business increased sales by over 50%

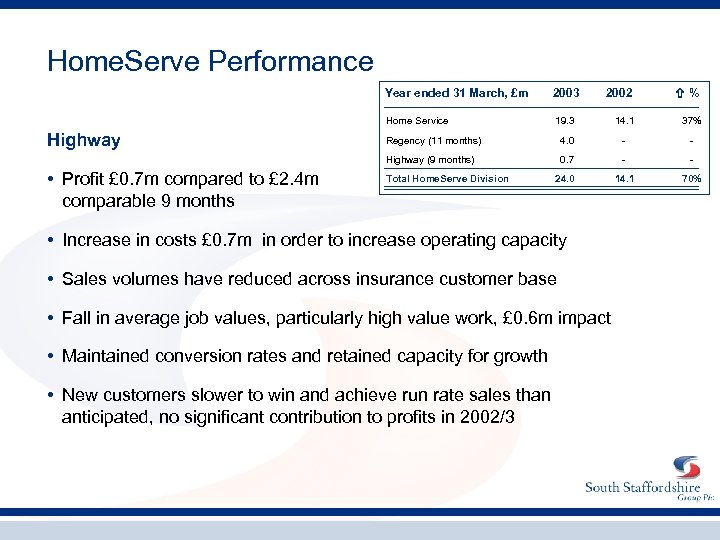

Home. Serve Performance Year ended 31 March, £m Home Service • Profit £ 0. 7 m compared to £ 2. 4 m comparable 9 months 2002 % 19. 3 14. 1 37% Regency (11 months) 4. 0 - - Highway (9 months) Highway 2003 0. 7 - - 24. 0 14. 1 70% Total Home. Serve Division • Increase in costs £ 0. 7 m in order to increase operating capacity • Sales volumes have reduced across insurance customer base • Fall in average job values, particularly high value work, £ 0. 6 m impact • Maintained conversion rates and retained capacity for growth • New customers slower to win and achieve run rate sales than anticipated, no significant contribution to profits in 2002/3

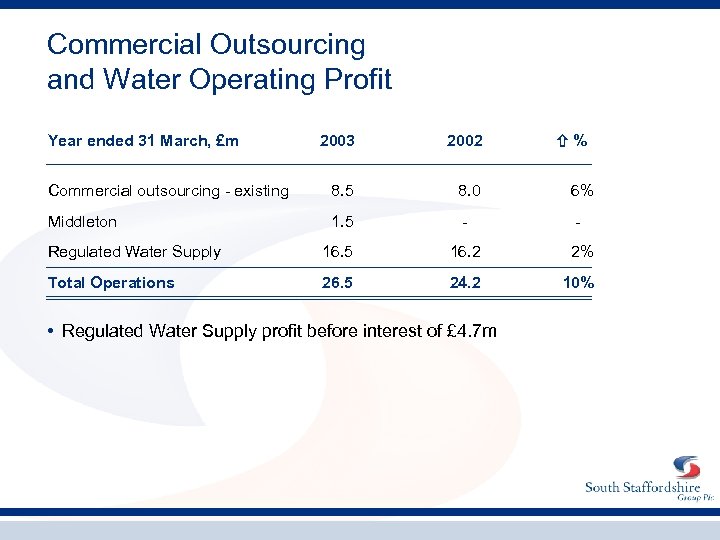

Commercial Outsourcing and Water Operating Profit Year ended 31 March, £m 2003 2002 Commercial outsourcing - existing 8. 5 8. 0 6% Middleton 1. 5 - - Regulated Water Supply 16. 5 16. 2 2% Total Operations 26. 5 24. 2 10% • Regulated Water Supply profit before interest of £ 4. 7 m %

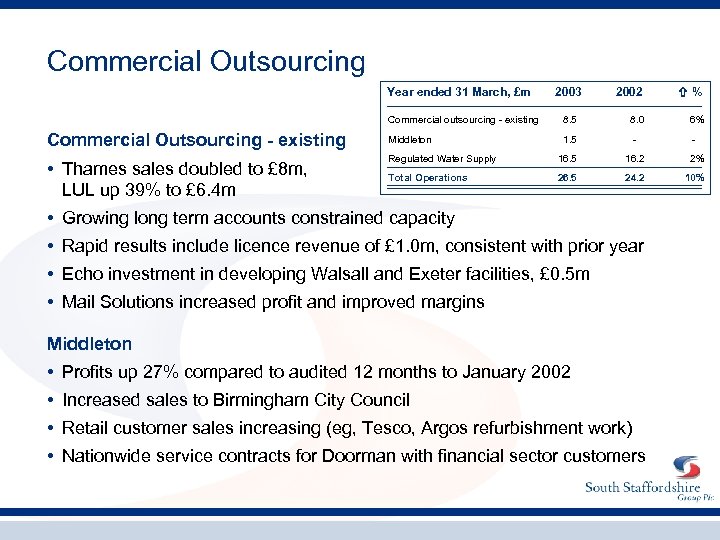

Commercial Outsourcing Year ended 31 March, £m 2003 2002 % Commercial outsourcing - existing Commercial Outsourcing - existing • Thames sales doubled to £ 8 m, LUL up 39% to £ 6. 4 m 8. 5 8. 0 6% Middleton 1. 5 - - Regulated Water Supply 16. 5 16. 2 2% Total Operations 26. 5 24. 2 10% • Growing long term accounts constrained capacity • Rapid results include licence revenue of £ 1. 0 m, consistent with prior year • Echo investment in developing Walsall and Exeter facilities, £ 0. 5 m • Mail Solutions increased profit and improved margins Middleton • Profits up 27% compared to audited 12 months to January 2002 • Increased sales to Birmingham City Council • Retail customer sales increasing (eg, Tesco, Argos refurbishment work) • Nationwide service contracts for Doorman with financial sector customers

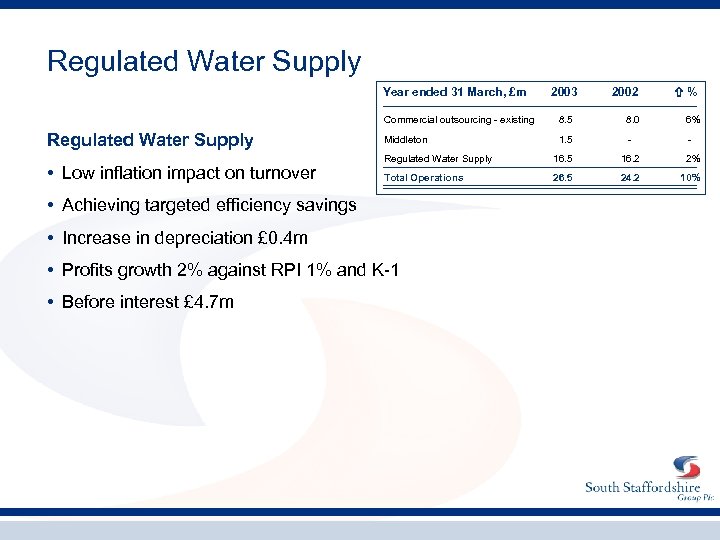

Regulated Water Supply Year ended 31 March, £m 2003 2002 % Commercial outsourcing - existing Regulated Water Supply • Low inflation impact on turnover 8. 5 8. 0 6% Middleton 1. 5 - - Regulated Water Supply 16. 5 16. 2 2% Total Operations 26. 5 24. 2 10% • Achieving targeted efficiency savings • Increase in depreciation £ 0. 4 m • Profits growth 2% against RPI 1% and K-1 • Before interest £ 4. 7 m

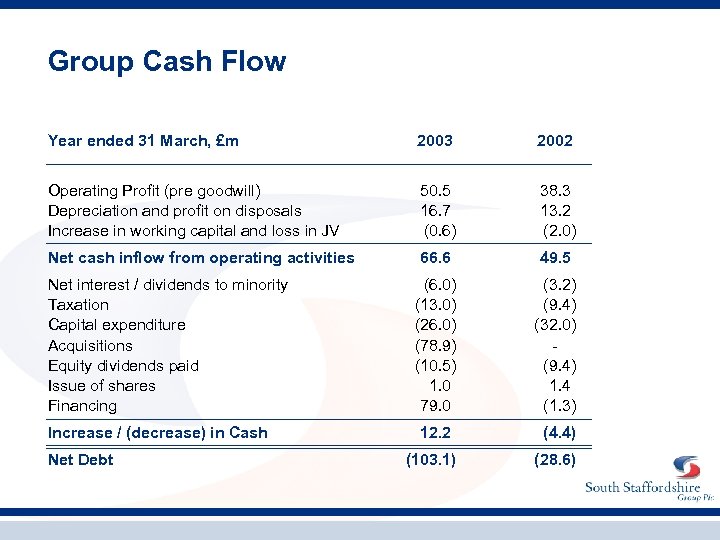

Group Cash Flow Year ended 31 March, £m 2003 2002 Operating Profit (pre goodwill) Depreciation and profit on disposals Increase in working capital and loss in JV 50. 5 16. 7 (0. 6) 38. 3 13. 2 (2. 0) Net cash inflow from operating activities 66. 6 49. 5 (6. 0) (13. 0) (26. 0) (78. 9) (10. 5) 1. 0 79. 0 (3. 2) (9. 4) (32. 0) (9. 4) 1. 4 (1. 3) 12. 2 (4. 4) (103. 1) (28. 6) Net interest / dividends to minority Taxation Capital expenditure Acquisitions Equity dividends paid Issue of shares Financing Increase / (decrease) in Cash Net Debt

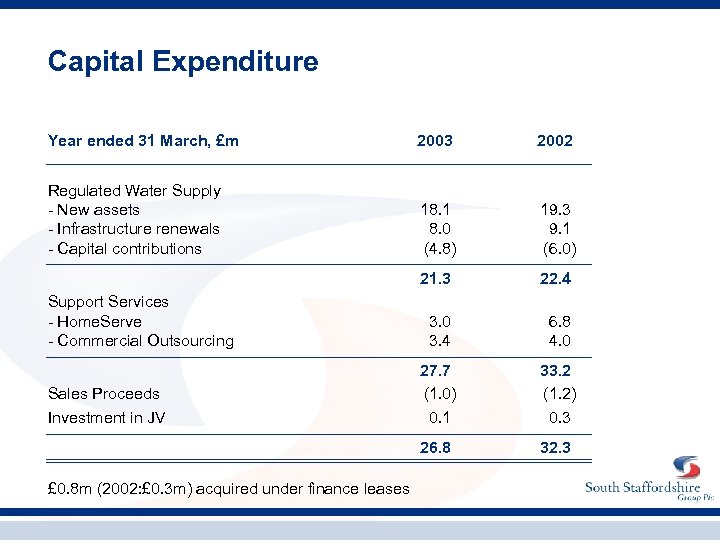

Capital Expenditure Year ended 31 March, £m 2003 2002 Regulated Water Supply - New assets - Infrastructure renewals - Capital contributions 18. 1 8. 0 (4. 8) 19. 3 9. 1 (6. 0) 21. 3 22. 4 3. 0 3. 4 6. 8 4. 0 27. 7 (1. 0) 0. 1 33. 2 (1. 2) 0. 3 26. 8 32. 3 Support Services - Home. Serve - Commercial Outsourcing Sales Proceeds Investment in JV £ 0. 8 m (2002: £ 0. 3 m) acquired under finance leases

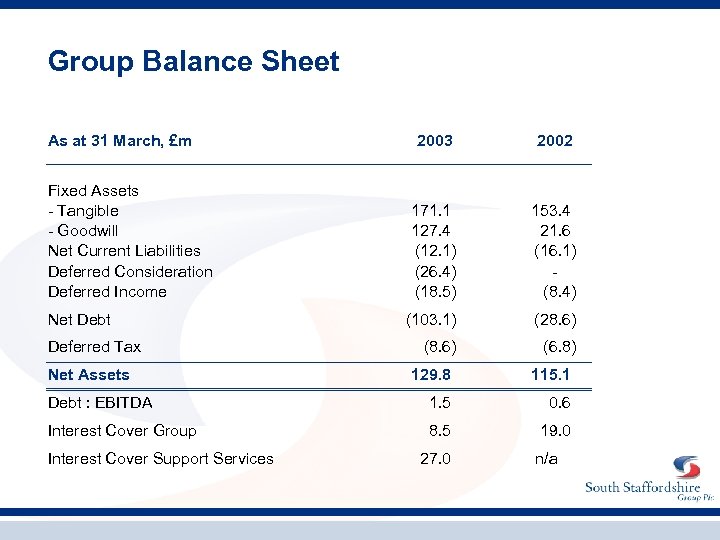

Group Balance Sheet As at 31 March, £m Fixed Assets - Tangible - Goodwill Net Current Liabilities Deferred Consideration Deferred Income Net Debt Deferred Tax Net Assets 2003 2002 171. 1 127. 4 (12. 1) (26. 4) (18. 5) 153. 4 21. 6 (16. 1) (8. 4) (103. 1) (28. 6) (6. 8) 129. 8 115. 1 Debt : EBITDA 1. 5 0. 6 Interest Cover Group 8. 5 19. 0 Interest Cover Support Services 27. 0 n/a

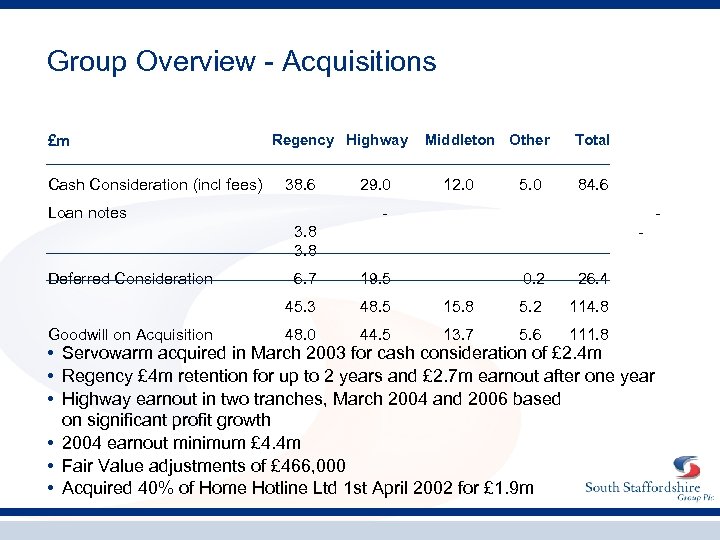

Group Overview - Acquisitions £m Cash Consideration (incl fees) Regency Highway 38. 6 Loan notes 29. 0 Middleton Other 12. 0 5. 0 Total 84. 6 - - 3. 8 Deferred Consideration 19. 5 45. 3 Goodwill on Acquisition 6. 7 48. 5 48. 0 44. 5 -0. 2 26. 4 15. 8 5. 2 114. 8 13. 7 5. 6 111. 8 • Servowarm acquired in March 2003 for cash consideration of £ 2. 4 m • Regency £ 4 m retention for up to 2 years and £ 2. 7 m earnout after one year • Highway earnout in two tranches, March 2004 and 2006 based on significant profit growth • 2004 earnout minimum £ 4. 4 m • Fair Value adjustments of £ 466, 000 • Acquired 40% of Home Hotline Ltd 1 st April 2002 for £ 1. 9 m

Brian Whitty Group Chief Executive

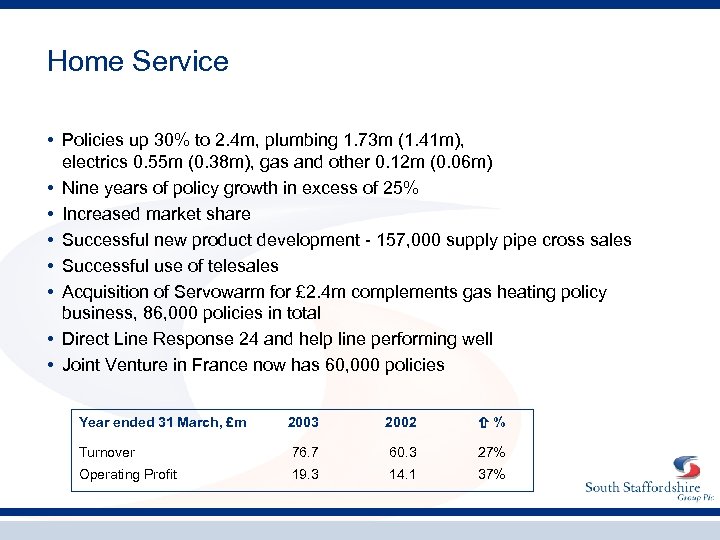

Home Service • Policies up 30% to 2. 4 m, plumbing 1. 73 m (1. 41 m), electrics 0. 55 m (0. 38 m), gas and other 0. 12 m (0. 06 m) • Nine years of policy growth in excess of 25% • Increased market share • Successful new product development - 157, 000 supply pipe cross sales • Successful use of telesales • Acquisition of Servowarm for £ 2. 4 m complements gas heating policy business, 86, 000 policies in total • Direct Line Response 24 and help line performing well • Joint Venture in France now has 60, 000 policies Year ended 31 March, £m 2003 2002 % Turnover 76. 7 60. 3 27% Operating Profit 19. 3 14. 1 37%

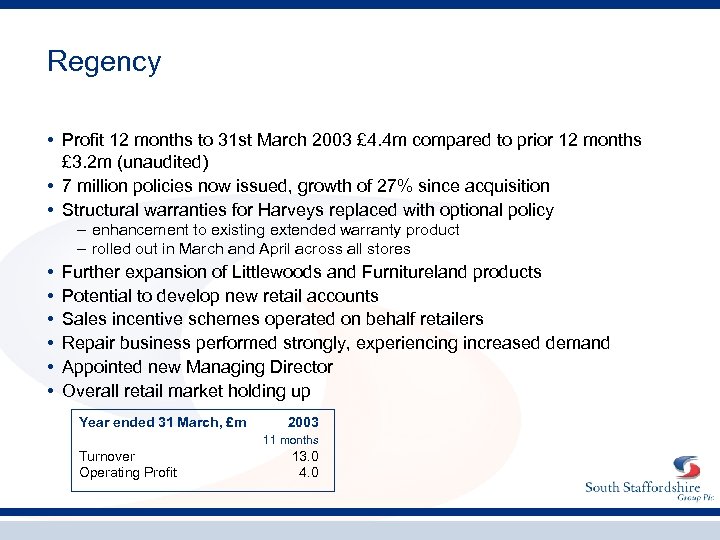

Regency • Profit 12 months to 31 st March 2003 £ 4. 4 m compared to prior 12 months £ 3. 2 m (unaudited) • 7 million policies now issued, growth of 27% since acquisition • Structural warranties for Harveys replaced with optional policy – enhancement to existing extended warranty product – rolled out in March and April across all stores • • • Further expansion of Littlewoods and Furnitureland products Potential to develop new retail accounts Sales incentive schemes operated on behalf retailers Repair business performed strongly, experiencing increased demand Appointed new Managing Director Overall retail market holding up Year ended 31 March, £m 2003 11 months Turnover Operating Profit 13. 0 4. 0

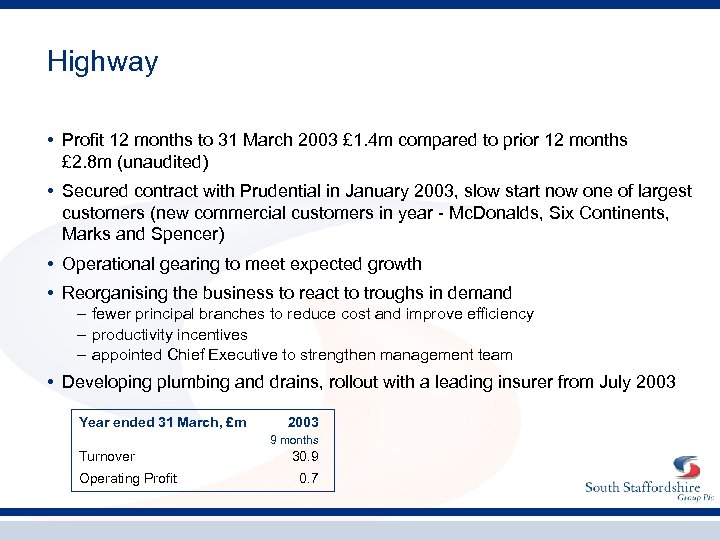

Highway • Profit 12 months to 31 March 2003 £ 1. 4 m compared to prior 12 months £ 2. 8 m (unaudited) • Secured contract with Prudential in January 2003, slow start now one of largest customers (new commercial customers in year - Mc. Donalds, Six Continents, Marks and Spencer) • Operational gearing to meet expected growth • Reorganising the business to react to troughs in demand – fewer principal branches to reduce cost and improve efficiency – productivity incentives – appointed Chief Executive to strengthen management team • Developing plumbing and drains, rollout with a leading insurer from July 2003 Year ended 31 March, £m 2003 9 months Turnover Operating Profit 30. 9 0. 7

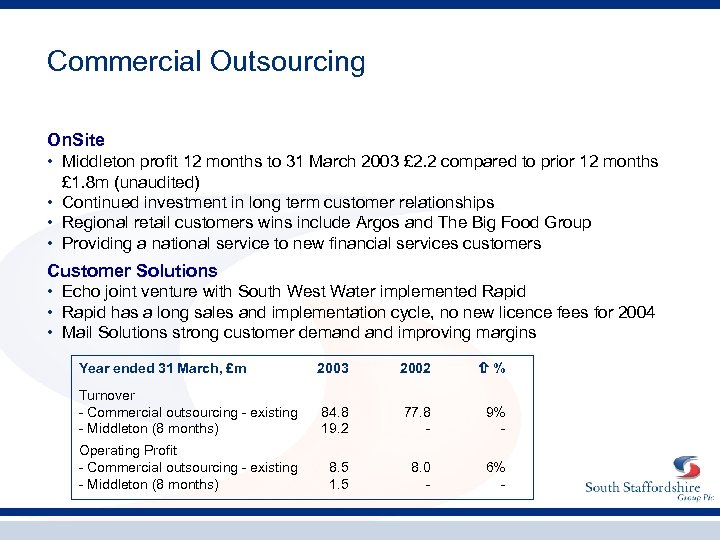

Commercial Outsourcing On. Site • Middleton profit 12 months to 31 March 2003 £ 2. 2 compared to prior 12 months £ 1. 8 m (unaudited) • Continued investment in long term customer relationships • Regional retail customers wins include Argos and The Big Food Group • Providing a national service to new financial services customers Customer Solutions • Echo joint venture with South West Water implemented Rapid • Rapid has a long sales and implementation cycle, no new licence fees for 2004 • Mail Solutions strong customer demand improving margins Year ended 31 March, £m 2003 2002 % Turnover - Commercial outsourcing - existing - Middleton (8 months) 84. 8 19. 2 77. 8 - 9% - Operating Profit - Commercial outsourcing - existing - Middleton (8 months) 8. 5 1. 5 8. 0 - 6% -

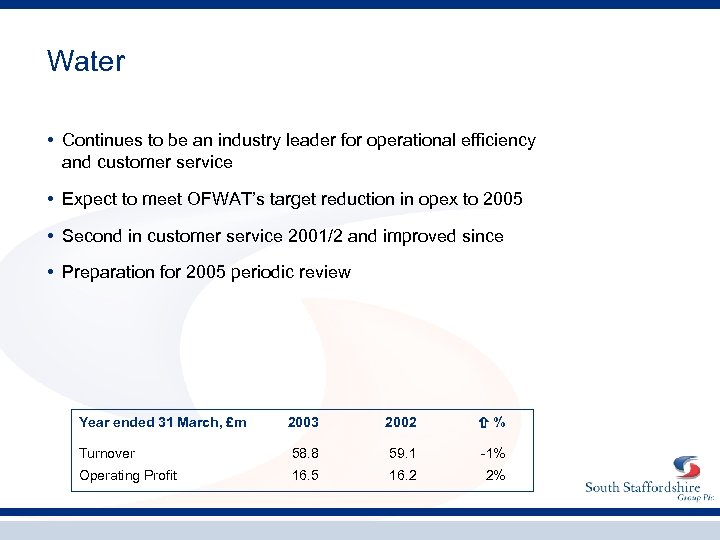

Water • Continues to be an industry leader for operational efficiency and customer service • Expect to meet OFWAT’s target reduction in opex to 2005 • Second in customer service 2001/2 and improved since • Preparation for 2005 periodic review Year ended 31 March, £m 2003 2002 % Turnover 58. 8 59. 1 -1% Operating Profit 16. 5 16. 2 2%

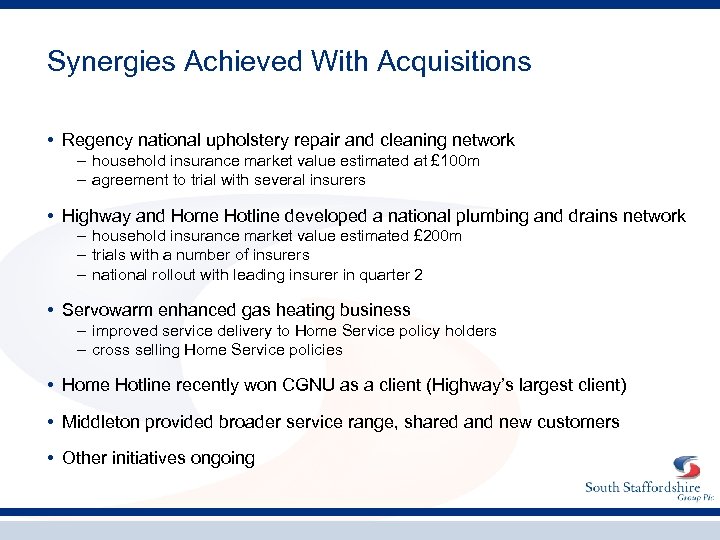

Synergies Achieved With Acquisitions • Regency national upholstery repair and cleaning network – household insurance market value estimated at £ 100 m – agreement to trial with several insurers • Highway and Home Hotline developed a national plumbing and drains network – household insurance market value estimated £ 200 m – trials with a number of insurers – national rollout with leading insurer in quarter 2 • Servowarm enhanced gas heating business – improved service delivery to Home Service policy holders – cross selling Home Service policies • Home Hotline recently won CGNU as a client (Highway’s largest client) • Middleton provided broader service range, shared and new customers • Other initiatives ongoing

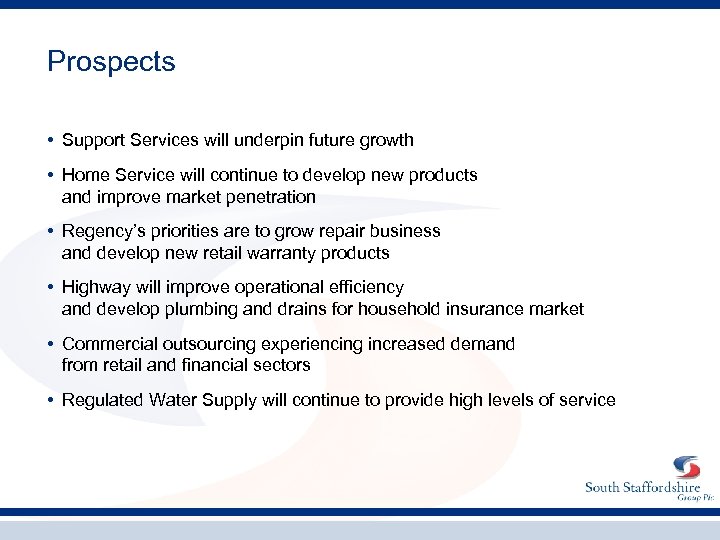

Prospects • Support Services will underpin future growth • Home Service will continue to develop new products and improve market penetration • Regency’s priorities are to grow repair business and develop new retail warranty products • Highway will improve operational efficiency and develop plumbing and drains for household insurance market • Commercial outsourcing experiencing increased demand from retail and financial sectors • Regulated Water Supply will continue to provide high levels of service

Appendices

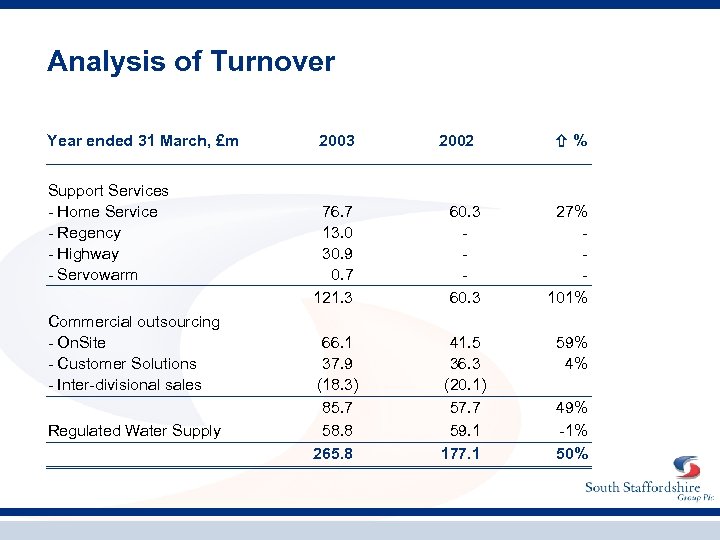

Analysis of Turnover Year ended 31 March, £m Support Services - Home Service - Regency - Highway - Servowarm Commercial outsourcing - On. Site - Customer Solutions - Inter-divisional sales Regulated Water Supply 2003 2002 % 76. 7 13. 0 30. 9 0. 7 121. 3 60. 3 27% 101% 66. 1 37. 9 (18. 3) 85. 7 58. 8 265. 8 41. 5 36. 3 (20. 1) 57. 7 59. 1 177. 1 59% 4% 49% -1% 50%

e185da861ba3c2437fc22aff5ea7a3cb.ppt