010e4249bff3394d1976e8cbf84fe847.ppt

- Количество слайдов: 40

Preliminary definitions ~Capital structure question -what is it? Capital structure question -the theories ~Traditional view ~Modigliani-Miller MM - propositions I and II (no taxes) ~Modigliani-Miller MM - propositions I and II (with taxes) Modigliani-Miller: More Realism ~Financial Distress and Bankruptcy

Preliminary definitions ~Capital structure question -what is it? Capital structure question -the theories ~Traditional view ~Modigliani-Miller MM - propositions I and II (no taxes) ~Modigliani-Miller MM - propositions I and II (with taxes) Modigliani-Miller: More Realism ~Financial Distress and Bankruptcy

Investments: Spot and Derivative Markets K. Cuthbertson and D. Nitzsche CHAPTER 11: excluding Section 11. 4 (Dividend Policy) and Appendices

Investments: Spot and Derivative Markets K. Cuthbertson and D. Nitzsche CHAPTER 11: excluding Section 11. 4 (Dividend Policy) and Appendices

SO, VALUE OF THE FIRM IS: V = Y / WACC Hold the firm’s cash flows constant (and for ever) (Also, assume Y is independent of capital structure) CAPITAL STRUCTURE QUESTION Can we alter WACC (and hence V) by altering the mix of debt and equity finance ? Example. $100 total in debt and equity. Do we gain by moving from 20% debt/80% equity finance, to 70% debt-30% equity finance ? - done by issuing more $50 more in bonds and using the proceeds to buy-back $50 of outstanding shares.

SO, VALUE OF THE FIRM IS: V = Y / WACC Hold the firm’s cash flows constant (and for ever) (Also, assume Y is independent of capital structure) CAPITAL STRUCTURE QUESTION Can we alter WACC (and hence V) by altering the mix of debt and equity finance ? Example. $100 total in debt and equity. Do we gain by moving from 20% debt/80% equity finance, to 70% debt-30% equity finance ? - done by issuing more $50 more in bonds and using the proceeds to buy-back $50 of outstanding shares.

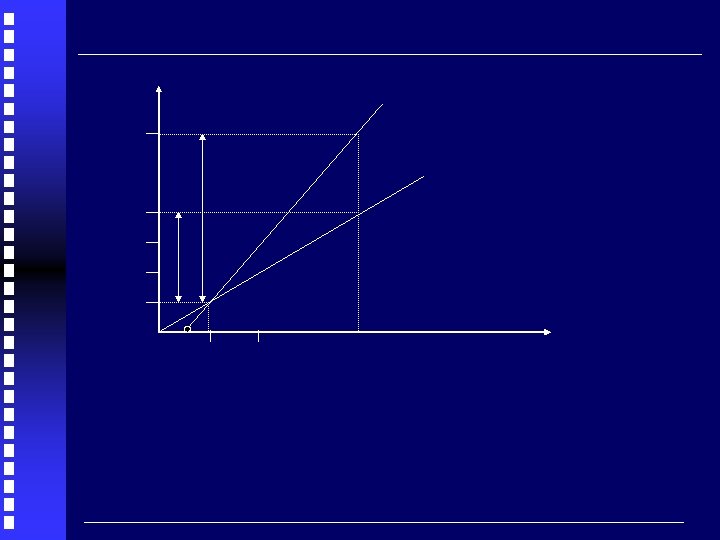

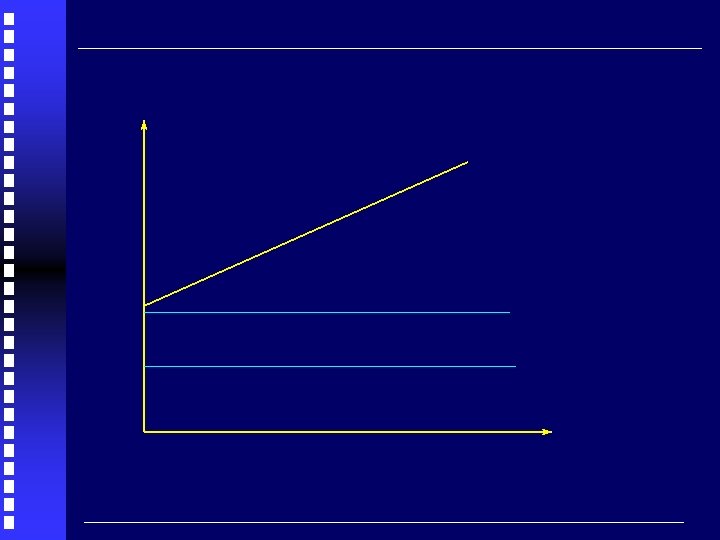

As you increase the proportion of ‘cheap’ debt (and initially the required return on equity remains constant ) then WACC will fall and hence V will rise. After a certain debt level (e. g. 70%) the equity holders will require a higher return because of increased ‘risk’. This will raise the WACC and V will begin to fall. Hence: There is a particular level for the debt-equity ratio which will maximise the value of the firm.

As you increase the proportion of ‘cheap’ debt (and initially the required return on equity remains constant ) then WACC will fall and hence V will rise. After a certain debt level (e. g. 70%) the equity holders will require a higher return because of increased ‘risk’. This will raise the WACC and V will begin to fall. Hence: There is a particular level for the debt-equity ratio which will maximise the value of the firm.

MM PROPOSITION I (NO TAXES)

MM PROPOSITION I (NO TAXES)

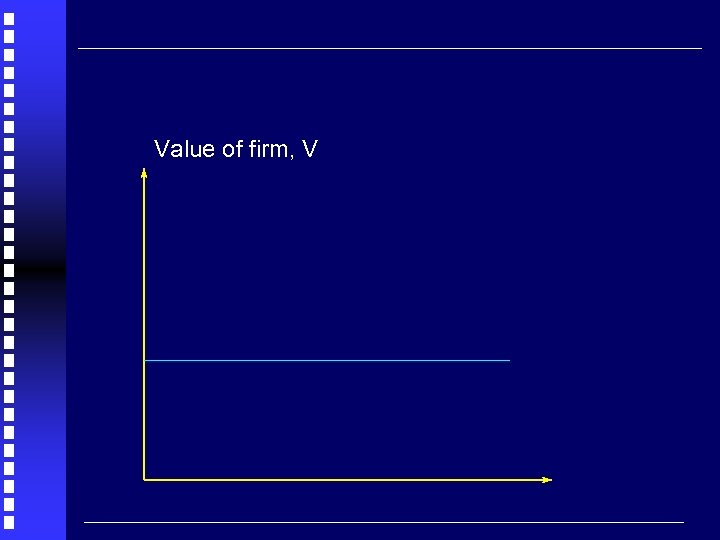

Value of firm, V

Value of firm, V

TRADITIONAL VIEW There is a debt-equity mix which minimises the WACC and hence maximises the firm’s market value. MM : ‘PROPOSITION I ’: NO TAXES The WACC and the value of the firm V are both independent of the debt-equity mix (used in financing the firm’s activities)

TRADITIONAL VIEW There is a debt-equity mix which minimises the WACC and hence maximises the firm’s market value. MM : ‘PROPOSITION I ’: NO TAXES The WACC and the value of the firm V are both independent of the debt-equity mix (used in financing the firm’s activities)

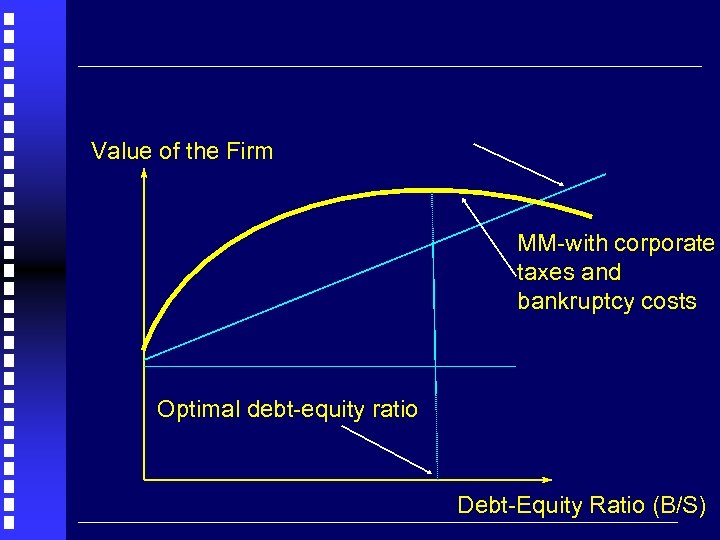

Value of the Firm MM-with corporate taxes and bankruptcy costs Optimal debt-equity ratio Debt-Equity Ratio (B/S)

Value of the Firm MM-with corporate taxes and bankruptcy costs Optimal debt-equity ratio Debt-Equity Ratio (B/S)

Perceived probability and costs of distress depends on; the greater the variability in earnings, the higher the risk of liquidation or ‘distress’ costs of distress will be lower the greater the liquidity and marketability of the firm’s assets the probability and costs of distress are lower, the higher the proportion of variable to fixed costs (e. g. can you quickly reduce staffing costs)

Perceived probability and costs of distress depends on; the greater the variability in earnings, the higher the risk of liquidation or ‘distress’ costs of distress will be lower the greater the liquidity and marketability of the firm’s assets the probability and costs of distress are lower, the higher the proportion of variable to fixed costs (e. g. can you quickly reduce staffing costs)

Shareholders may persuade managers of ‘near bankrupt’ firm to undertake highly risky projects. - ‘go-for-broke’ strategy - this worries bondholders advertising firm (with few tangible assets as security) versus leisure firm(with hotels to sell off, to repay bondholders). The latter has a higher ‘debt capacity’ than the former. Managers keep debt levels low to get the benefit of an ‘option to expand’ into profitable projects.

Shareholders may persuade managers of ‘near bankrupt’ firm to undertake highly risky projects. - ‘go-for-broke’ strategy - this worries bondholders advertising firm (with few tangible assets as security) versus leisure firm(with hotels to sell off, to repay bondholders). The latter has a higher ‘debt capacity’ than the former. Managers keep debt levels low to get the benefit of an ‘option to expand’ into profitable projects.

FI and venture capitalists might ‘force’ a particular (non-optimal) capital structure on firms. (i. e. correspondent banking relationships and venture capitalists on the board - with their preferred debt-equity mix) When in financial distress, ‘restructuring is often decided by a diverse group of creditors (usually a consortium of banks ) - e. g. Eurotunnel in 1990 s and British Telecom in 2000

FI and venture capitalists might ‘force’ a particular (non-optimal) capital structure on firms. (i. e. correspondent banking relationships and venture capitalists on the board - with their preferred debt-equity mix) When in financial distress, ‘restructuring is often decided by a diverse group of creditors (usually a consortium of banks ) - e. g. Eurotunnel in 1990 s and British Telecom in 2000