0296c8d60662a5aee68020e83140f3bc.ppt

- Количество слайдов: 38

Preference Prevention and Defense Sunday, March 17, 2013 IECA – March 17 -19, 2013 © 2013 by Francis J. Lawall, Esquire. All rights reserved

Preference Prevention and Defense Sunday, March 17, 2013 IECA – March 17 -19, 2013 © 2013 by Francis J. Lawall, Esquire. All rights reserved

Materials Presented by: Francis J. Lawall, Esquire Pepper Hamilton LLP 3000 Two Logan Square 18 th & Arch Streets Philadelphia, PA 19103 -2799 lawallf@pepperlaw. com These materials, including the examples set forth herein, do not constitute legal advice and are for illustrative and discussion purposes only.

Materials Presented by: Francis J. Lawall, Esquire Pepper Hamilton LLP 3000 Two Logan Square 18 th & Arch Streets Philadelphia, PA 19103 -2799 lawallf@pepperlaw. com These materials, including the examples set forth herein, do not constitute legal advice and are for illustrative and discussion purposes only.

What is a Preference? • Preferences are statutorily created causes of action in bankruptcy that are designed to ensure that similarly situated creditors are given equal treatment. • The purpose of preference avoidance is to: − Stop the race to the courthouse; − Prevent the dismemberment of the debtor; − Provide for the equitable distribution to all creditors; and − Recover all isolated transactions and insider dealing 3

What is a Preference? • Preferences are statutorily created causes of action in bankruptcy that are designed to ensure that similarly situated creditors are given equal treatment. • The purpose of preference avoidance is to: − Stop the race to the courthouse; − Prevent the dismemberment of the debtor; − Provide for the equitable distribution to all creditors; and − Recover all isolated transactions and insider dealing 3

Elements of a Preference 11 U. S. C. § 547(b) • • • Any transfer of an interest of the debtor To or for the benefit of a creditor On antecedent debt Made while the debtor is insolvent Within 90 days prior to the date of the bankruptcy case is filed or within 1 year for “insiders” • That enable creditor to receive more than it would under Chapter 7 4

Elements of a Preference 11 U. S. C. § 547(b) • • • Any transfer of an interest of the debtor To or for the benefit of a creditor On antecedent debt Made while the debtor is insolvent Within 90 days prior to the date of the bankruptcy case is filed or within 1 year for “insiders” • That enable creditor to receive more than it would under Chapter 7 4

Closer Look at the Elements 5

Closer Look at the Elements 5

Transfer • Transfer – can be any reduction in the debtor’s estate • Examples: − The payment of money − Transfer of security interest − Transfer of an account receivable − A guarantee of obligations 6

Transfer • Transfer – can be any reduction in the debtor’s estate • Examples: − The payment of money − Transfer of security interest − Transfer of an account receivable − A guarantee of obligations 6

Property of the Debtor • Payments made by third parties on behalf of the debtor do not diminish the debtor’s property 7

Property of the Debtor • Payments made by third parties on behalf of the debtor do not diminish the debtor’s property 7

To or For the Benefit of a Creditor • The creditor must receive some benefit, direct or indirect, in order for the transfer to be a preference • A debtor’s payment to a third party for the benefit of a creditor is a benefit to the creditor 8

To or For the Benefit of a Creditor • The creditor must receive some benefit, direct or indirect, in order for the transfer to be a preference • A debtor’s payment to a third party for the benefit of a creditor is a benefit to the creditor 8

On Account of an Antecedent Debt • A debt is owed as soon goods are shipped • “COD” or “CIA” payments, is on a concurrent or simultaneous debt, and therefore never made on account of a past debt • Prepayment or advance payments for goods or services are not on account of an antecedent debt 9

On Account of an Antecedent Debt • A debt is owed as soon goods are shipped • “COD” or “CIA” payments, is on a concurrent or simultaneous debt, and therefore never made on account of a past debt • Prepayment or advance payments for goods or services are not on account of an antecedent debt 9

Made While the Debtor is Insolvent • Insolvency depends on when the transfer was made, not the date of the bankruptcy filing • Insolvency = Net Worth • Balance Sheet Test: Liabilities > Assets 10

Made While the Debtor is Insolvent • Insolvency depends on when the transfer was made, not the date of the bankruptcy filing • Insolvency = Net Worth • Balance Sheet Test: Liabilities > Assets 10

90 Days Prior to the Bankruptcy Filing • Preferences only apply to transfers or payments made within the 90 days prior to bankruptcy • 90 -day period excludes the petition date • If the 90 -day period ends on a Saturday, Sunday or legal holiday, it is not extended • If the creditor is an “insider, ” the reach back period is one year 11

90 Days Prior to the Bankruptcy Filing • Preferences only apply to transfers or payments made within the 90 days prior to bankruptcy • 90 -day period excludes the petition date • If the 90 -day period ends on a Saturday, Sunday or legal holiday, it is not extended • If the creditor is an “insider, ” the reach back period is one year 11

Allowing the Creditor to Receive More Than In a Chapter 7 • Did the creditor receive more in the 90 -day period than it would have received in a Chapter 7 liquidation? • Secured and unsecured creditors get treated differently • In a Chapter 7: − an unsecured creditor would probably receive less than 100% − a secured creditor is usually entitled to full payment 12

Allowing the Creditor to Receive More Than In a Chapter 7 • Did the creditor receive more in the 90 -day period than it would have received in a Chapter 7 liquidation? • Secured and unsecured creditors get treated differently • In a Chapter 7: − an unsecured creditor would probably receive less than 100% − a secured creditor is usually entitled to full payment 12

Preference Defenses and Exceptions 13

Preference Defenses and Exceptions 13

Contemporaneous Exchange • Applies when both parties intend that the performance by both parties occur at virtually the same time • A defendant must prove intent and that the transfer was, in fact, substantially contemporaneous • Examples: COD, CIA or wire transfer payments 14

Contemporaneous Exchange • Applies when both parties intend that the performance by both parties occur at virtually the same time • A defendant must prove intent and that the transfer was, in fact, substantially contemporaneous • Examples: COD, CIA or wire transfer payments 14

Ordinary Course of Business (OCB) • A defendant must prove: − the transaction occurred in the ordinary course of business or financial affairs of the debtor − The payment was in the ordinary terms established by the creditor and the debtor; OR − The transaction occurred within the ordinary terms within the industry − OCB is very fact specific. Courts generally look at timing, amount of payment, method of payment, and the circumstances surrounding payment 15

Ordinary Course of Business (OCB) • A defendant must prove: − the transaction occurred in the ordinary course of business or financial affairs of the debtor − The payment was in the ordinary terms established by the creditor and the debtor; OR − The transaction occurred within the ordinary terms within the industry − OCB is very fact specific. Courts generally look at timing, amount of payment, method of payment, and the circumstances surrounding payment 15

Subsequent New Value • To the extend a creditor subsequently replenishes the estate by providing new value that remains unpaid • No preference liability if the creditor proves: − After such transfer, the creditor gave new value to the debtor • Not paid for by an otherwise unavoidable transfer 16

Subsequent New Value • To the extend a creditor subsequently replenishes the estate by providing new value that remains unpaid • No preference liability if the creditor proves: − After such transfer, the creditor gave new value to the debtor • Not paid for by an otherwise unavoidable transfer 16

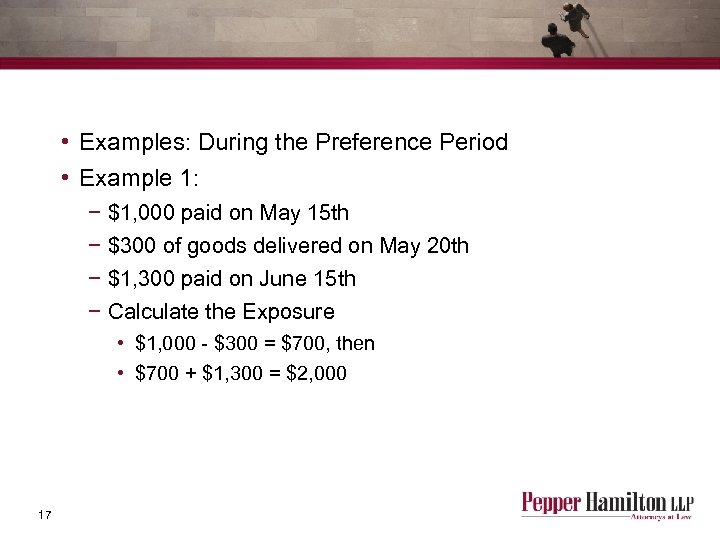

• Examples: During the Preference Period • Example 1: − $1, 000 paid on May 15 th − $300 of goods delivered on May 20 th − $1, 300 paid on June 15 th − Calculate the Exposure • $1, 000 - $300 = $700, then • $700 + $1, 300 = $2, 000 17

• Examples: During the Preference Period • Example 1: − $1, 000 paid on May 15 th − $300 of goods delivered on May 20 th − $1, 300 paid on June 15 th − Calculate the Exposure • $1, 000 - $300 = $700, then • $700 + $1, 300 = $2, 000 17

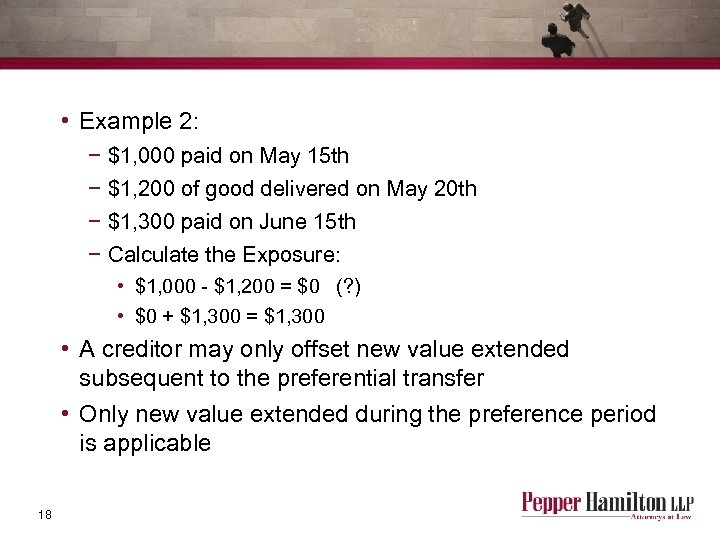

• Example 2: − $1, 000 paid on May 15 th − $1, 200 of good delivered on May 20 th − $1, 300 paid on June 15 th − Calculate the Exposure: • $1, 000 - $1, 200 = $0 (? ) • $0 + $1, 300 = $1, 300 • A creditor may only offset new value extended subsequent to the preferential transfer • Only new value extended during the preference period is applicable 18

• Example 2: − $1, 000 paid on May 15 th − $1, 200 of good delivered on May 20 th − $1, 300 paid on June 15 th − Calculate the Exposure: • $1, 000 - $1, 200 = $0 (? ) • $0 + $1, 300 = $1, 300 • A creditor may only offset new value extended subsequent to the preferential transfer • Only new value extended during the preference period is applicable 18

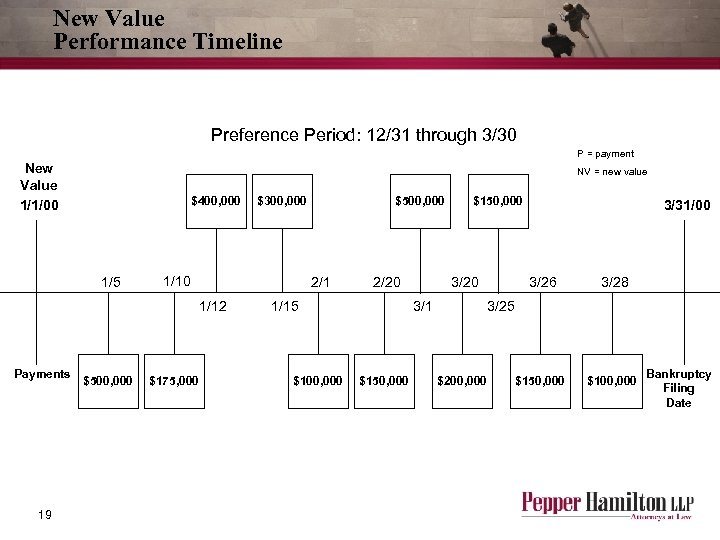

New Value Performance Timeline Preference Period: 12/31 through 3/30 P = payment New Value 1/1/00 NV = new value $400, 000 1/5 1/10 19 $500, 000 $175, 000 $500, 000 2/1 1/12 Payments $300, 000 2/20 1/15 $100, 000 $150, 000 3/20 3/1 $150, 000 3/31/00 3/26 3/28 $150, 000 $100, 000 3/25 $200, 000 Bankruptcy Filing Date

New Value Performance Timeline Preference Period: 12/31 through 3/30 P = payment New Value 1/1/00 NV = new value $400, 000 1/5 1/10 19 $500, 000 $175, 000 $500, 000 2/1 1/12 Payments $300, 000 2/20 1/15 $100, 000 $150, 000 3/20 3/1 $150, 000 3/31/00 3/26 3/28 $150, 000 $100, 000 3/25 $200, 000 Bankruptcy Filing Date

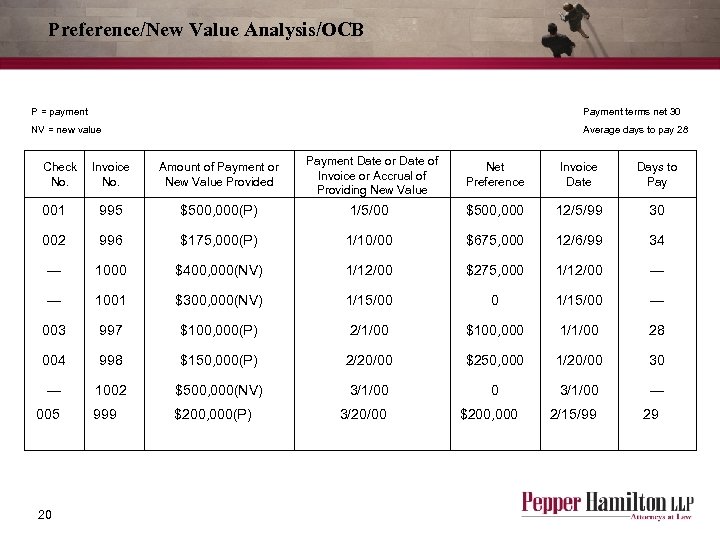

Preference/New Value Analysis/OCB P = payment Payment terms net 30 NV = new value Average days to pay 28 Check Invoice No. Amount of Payment or New Value Provided Payment Date or Date of Invoice or Accrual of Providing New Value Net Preference Invoice Date Days to Pay 001 995 $500, 000(P) 1/5/00 $500, 000 12/5/99 30 002 996 $175, 000(P) 1/10/00 $675, 000 12/6/99 34 — 1000 $400, 000(NV) 1/12/00 $275, 000 1/12/00 — — 1001 $300, 000(NV) 1/15/00 0 1/15/00 — 003 997 $100, 000(P) 2/1/00 $100, 000 1/1/00 28 004 998 $150, 000(P) 2/20/00 $250, 000 1/20/00 30 — 1002 $500, 000(NV) 3/1/00 0 3/1/00 — 999 $200, 000(P) 005 20 3/20/00 $200, 000 2/15/99 29

Preference/New Value Analysis/OCB P = payment Payment terms net 30 NV = new value Average days to pay 28 Check Invoice No. Amount of Payment or New Value Provided Payment Date or Date of Invoice or Accrual of Providing New Value Net Preference Invoice Date Days to Pay 001 995 $500, 000(P) 1/5/00 $500, 000 12/5/99 30 002 996 $175, 000(P) 1/10/00 $675, 000 12/6/99 34 — 1000 $400, 000(NV) 1/12/00 $275, 000 1/12/00 — — 1001 $300, 000(NV) 1/15/00 0 1/15/00 — 003 997 $100, 000(P) 2/1/00 $100, 000 1/1/00 28 004 998 $150, 000(P) 2/20/00 $250, 000 1/20/00 30 — 1002 $500, 000(NV) 3/1/00 0 3/1/00 — 999 $200, 000(P) 005 20 3/20/00 $200, 000 2/15/99 29

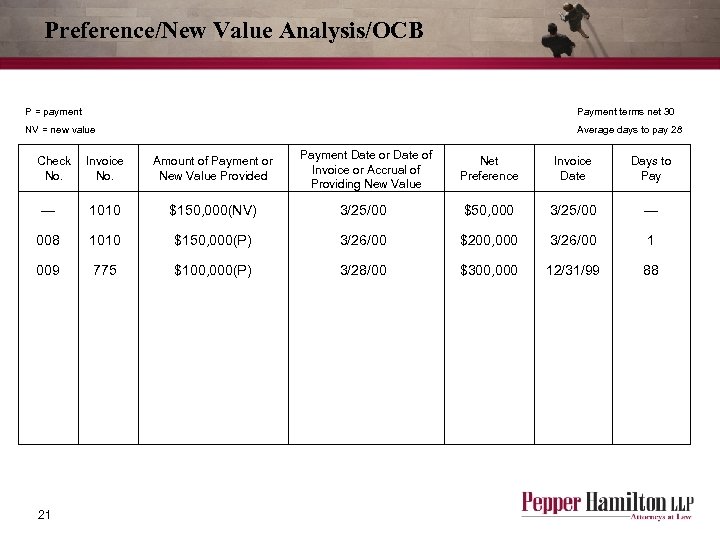

Preference/New Value Analysis/OCB P = payment Payment terms net 30 NV = new value Average days to pay 28 Check Invoice No. Amount of Payment or New Value Provided Payment Date or Date of Invoice or Accrual of Providing New Value Net Preference Invoice Date Days to Pay — 1010 $150, 000(NV) 3/25/00 $50, 000 3/25/00 — 008 1010 $150, 000(P) 3/26/00 $200, 000 3/26/00 1 009 775 $100, 000(P) 3/28/00 $300, 000 12/31/99 88 21

Preference/New Value Analysis/OCB P = payment Payment terms net 30 NV = new value Average days to pay 28 Check Invoice No. Amount of Payment or New Value Provided Payment Date or Date of Invoice or Accrual of Providing New Value Net Preference Invoice Date Days to Pay — 1010 $150, 000(NV) 3/25/00 $50, 000 3/25/00 — 008 1010 $150, 000(P) 3/26/00 $200, 000 3/26/00 1 009 775 $100, 000(P) 3/28/00 $300, 000 12/31/99 88 21

Mere Conduit • A trustee may only recover a preferential transfer from the initial transferee or the entity for whose benefit such transfer was made, i. e. , the party who ultimately received the payment 22

Mere Conduit • A trustee may only recover a preferential transfer from the initial transferee or the entity for whose benefit such transfer was made, i. e. , the party who ultimately received the payment 22

Improvement in Position Test • Two Primary Applications: − Fully Secured Creditor – a creditor whose loan is fully secured throughout the preference period and acquires an interest in new collateral to secure an old debt is insulated from an “improvement in position” preference claim − Setoff Application – preference may be recoverable from a creditor for a setoff taken by that creditor prior to the bankruptcy filing. Did the setoff improve the creditor’s position, or, did it reduce the amount of the debt owed to the creditor in the 90 -day period? 23

Improvement in Position Test • Two Primary Applications: − Fully Secured Creditor – a creditor whose loan is fully secured throughout the preference period and acquires an interest in new collateral to secure an old debt is insulated from an “improvement in position” preference claim − Setoff Application – preference may be recoverable from a creditor for a setoff taken by that creditor prior to the bankruptcy filing. Did the setoff improve the creditor’s position, or, did it reduce the amount of the debt owed to the creditor in the 90 -day period? 23

Minimize Preference Exposure • • • Cash in advance of delivery Obtain security interest in product delivered Letter of credit Maintain prior credit terms Establish and communicate specific criteria for converting a customer from credit to COD • Analyze whether transaction can be structured to fit into “safe harbor exemptions” (explained in detail in subsequent slides) 24

Minimize Preference Exposure • • • Cash in advance of delivery Obtain security interest in product delivered Letter of credit Maintain prior credit terms Establish and communicate specific criteria for converting a customer from credit to COD • Analyze whether transaction can be structured to fit into “safe harbor exemptions” (explained in detail in subsequent slides) 24

Additional Points • Can one payment during the preference period qualify as OCB? Look at the contract terms, other agreed upon terms or the usual payment terms in the industry. Bohm v. Golden Knitting Mills, Inc. (In re: Forman Enters. ), 293 B. R. 848 (Bankr. W. D. Pa. 2003) • Can you assert a statutory oil or gas lien? • In re: Kiwi International Air Lines, Inc. , 344 F. 3 d 311 (3 d. Cir. 2003) (assumption of contracts under § 365 barred the preference claims by the debtor or trustee) • Keep in mind negotiating critical vendor status and protecting transfers during the preference period • If new value is later paid as a 503(b)(9) claim, is it still new value? 25

Additional Points • Can one payment during the preference period qualify as OCB? Look at the contract terms, other agreed upon terms or the usual payment terms in the industry. Bohm v. Golden Knitting Mills, Inc. (In re: Forman Enters. ), 293 B. R. 848 (Bankr. W. D. Pa. 2003) • Can you assert a statutory oil or gas lien? • In re: Kiwi International Air Lines, Inc. , 344 F. 3 d 311 (3 d. Cir. 2003) (assumption of contracts under § 365 barred the preference claims by the debtor or trustee) • Keep in mind negotiating critical vendor status and protecting transfers during the preference period • If new value is later paid as a 503(b)(9) claim, is it still new value? 25

Avoidance Actions • Creditor may not use new value defense claim if estate pays for the new value under § 503(b)(9) • TI Acquisition, LLC v. Southern Polymer, Inc. (In re TI Acquisition, LLC), 429 B. R. 377 (Bankr. N. D. Ga. 2010) − Creditor supplied debtor with $300 k in goods within 20 days of the bankruptcy petition − Debtor made payments totaling $280 k within the preference period − Court granted supplier with § 503(b)(9) administrative expense priority for $300 k claim − Debtor sued supplier to avoid the $280 k in payments − Court found that the effect of a § 503(b)(9) payment is the same as reclamation of goods. Case law denies new value credit for reclaimed goods because the estate is not enhanced by the goods − Court also found that it would be inequitable to allow creditor to use new value defense where creditor has been paid in full by the estate 26

Avoidance Actions • Creditor may not use new value defense claim if estate pays for the new value under § 503(b)(9) • TI Acquisition, LLC v. Southern Polymer, Inc. (In re TI Acquisition, LLC), 429 B. R. 377 (Bankr. N. D. Ga. 2010) − Creditor supplied debtor with $300 k in goods within 20 days of the bankruptcy petition − Debtor made payments totaling $280 k within the preference period − Court granted supplier with § 503(b)(9) administrative expense priority for $300 k claim − Debtor sued supplier to avoid the $280 k in payments − Court found that the effect of a § 503(b)(9) payment is the same as reclamation of goods. Case law denies new value credit for reclaimed goods because the estate is not enhanced by the goods − Court also found that it would be inequitable to allow creditor to use new value defense where creditor has been paid in full by the estate 26

Avoidance Actions • Pleadings Requirements: − Rule 8(a) of the Fed. R. Civ. Proc. − Bell Atlantic Corp. v. Twombly, 550 U. S. 544 (2007): • A plaintiff needs to plead more than labels and conclusions • A formulaic recitation of the elements of a cause of action will not do • A plaintiff needs to plead enough factual content that allows the court to draw reasonable inference that the defendant is liable for the misconduct alleged − Ashcroft v. Iqbal, 129 S. Ct. 1937 (U. S. 2009): • Conclusory statements are unacceptable and factual allegations are necessary • Enough facts need to be pled to raise a reasonable expectation that discovery will reveal evidence of the necessary elements 27

Avoidance Actions • Pleadings Requirements: − Rule 8(a) of the Fed. R. Civ. Proc. − Bell Atlantic Corp. v. Twombly, 550 U. S. 544 (2007): • A plaintiff needs to plead more than labels and conclusions • A formulaic recitation of the elements of a cause of action will not do • A plaintiff needs to plead enough factual content that allows the court to draw reasonable inference that the defendant is liable for the misconduct alleged − Ashcroft v. Iqbal, 129 S. Ct. 1937 (U. S. 2009): • Conclusory statements are unacceptable and factual allegations are necessary • Enough facts need to be pled to raise a reasonable expectation that discovery will reveal evidence of the necessary elements 27

Avoidance Actions • Aggregate Transfer must be total at least $5, 850. See 11 U. S. C. § 547(c)(9) • Venue: For cases in Delaware, the Plaintiff must also meet venue standards under 28 USC § 1409(b) − See also Dynamerica Mfg. LLC v. Johnson Oil Co. , LLC, 2010 Bankr. Lexis 1384 (Bankr. D. Del. May 10, 2010) (court held that § 1409(b) restricted venue to the district in which the defendant resided for proceedings to recover money or property from a non-insider of less than $ 10, 950) • NOTE: Since the Dynamerica decision, the threshold amount in § 1409(b) has been increased to $11, 725 28

Avoidance Actions • Aggregate Transfer must be total at least $5, 850. See 11 U. S. C. § 547(c)(9) • Venue: For cases in Delaware, the Plaintiff must also meet venue standards under 28 USC § 1409(b) − See also Dynamerica Mfg. LLC v. Johnson Oil Co. , LLC, 2010 Bankr. Lexis 1384 (Bankr. D. Del. May 10, 2010) (court held that § 1409(b) restricted venue to the district in which the defendant resided for proceedings to recover money or property from a non-insider of less than $ 10, 950) • NOTE: Since the Dynamerica decision, the threshold amount in § 1409(b) has been increased to $11, 725 28

Safe Harbor Provisions (Exception to Preference/Avoidance Liability) 29

Safe Harbor Provisions (Exception to Preference/Avoidance Liability) 29

What are the Safe Harbor Provisions? − Section 546 of the Bankruptcy Code, specifically, subparts (e), (f), and (g), provide various forms of transactions with a complete defense to avoidance/preference claims brought pursuant to enumerated sections of the Bankruptcy Code, including: Sections 544, 545, 547, and 548(a)(1)(B) and (b) − In essence, safe harbor provisions function as affirmative defenses, exempting eligible transactions that otherwise constitute avoidable claims from liability due to practical and economic policy concerns − Generally speaking, Section 546’s safe harbors exempt transactions common to the commodities and securities trading industry, including transactions in connection with securities contracts, commodities contracts, repurchase agreements, swap agreements, and forward contracts − Legislative history indicates that Congress created these exceptions to help prevent significant negative market impact from arising from the insolvency of a single commodities or securities firm 30

What are the Safe Harbor Provisions? − Section 546 of the Bankruptcy Code, specifically, subparts (e), (f), and (g), provide various forms of transactions with a complete defense to avoidance/preference claims brought pursuant to enumerated sections of the Bankruptcy Code, including: Sections 544, 545, 547, and 548(a)(1)(B) and (b) − In essence, safe harbor provisions function as affirmative defenses, exempting eligible transactions that otherwise constitute avoidable claims from liability due to practical and economic policy concerns − Generally speaking, Section 546’s safe harbors exempt transactions common to the commodities and securities trading industry, including transactions in connection with securities contracts, commodities contracts, repurchase agreements, swap agreements, and forward contracts − Legislative history indicates that Congress created these exceptions to help prevent significant negative market impact from arising from the insolvency of a single commodities or securities firm 30

Text and Operation of Section 546, subparts (e), (f), and (g) • The operation of the safe harbors can be broken down operationally as follows, with each subpart offering a complete defense to Sections 544, 545, 547 and 548(a)(1)(B) and (b) − Section 546(e) exempts transfers that are margin payments, settlement payments, or transfers in connection with securities contracts, commodities contracts, or forward contracts, if such transfers were “made by or to (or for the benefit of) a commodity broker, forward contract merchant, stockbroker, financial institution, financial participant, or securities clearing agency” − Section 546(f) exempts transfers “made by or to (or for the benefit of) a repo participant or financial participant, in connection with a repurchase agreement” − Section 546(g) exempts transfers “made by or to (or for the benefit of) a swap participant or financial participant, under or in connection with any swap agreement” 31

Text and Operation of Section 546, subparts (e), (f), and (g) • The operation of the safe harbors can be broken down operationally as follows, with each subpart offering a complete defense to Sections 544, 545, 547 and 548(a)(1)(B) and (b) − Section 546(e) exempts transfers that are margin payments, settlement payments, or transfers in connection with securities contracts, commodities contracts, or forward contracts, if such transfers were “made by or to (or for the benefit of) a commodity broker, forward contract merchant, stockbroker, financial institution, financial participant, or securities clearing agency” − Section 546(f) exempts transfers “made by or to (or for the benefit of) a repo participant or financial participant, in connection with a repurchase agreement” − Section 546(g) exempts transfers “made by or to (or for the benefit of) a swap participant or financial participant, under or in connection with any swap agreement” 31

Text and Operation of Section 546, subparts (e), (f), and (g) • Additionally, subsections (e), (f), and (g) each require that the transfer have occurred pre-bankruptcy • The Bankruptcy Code expressly defines each of the agreements, payment types, and entities required for application of the safe harbor defenses above, i. e. , forward contract, swap agreement, margin payment, or commodity broker, etc. are defined terms. See 11 U. S. C. § 101 32

Text and Operation of Section 546, subparts (e), (f), and (g) • Additionally, subsections (e), (f), and (g) each require that the transfer have occurred pre-bankruptcy • The Bankruptcy Code expressly defines each of the agreements, payment types, and entities required for application of the safe harbor defenses above, i. e. , forward contract, swap agreement, margin payment, or commodity broker, etc. are defined terms. See 11 U. S. C. § 101 32

Representative Cases • Lightfoot v. MXEnergy Elec. , Inc. (In re MBS Mgmt. Servs. , Inc. , 690 F. 3 d 352 (5 th Cir. 2012) − − Creditor provided electrical power for apartment complexes managed by debtor Less than 90 days before its bankruptcy filing, the debtor paid creditor $150 k Trustee initiated a preference action under Section 547(d) to avoid the payment Creditor stipulated that the payment met all the elements of a preference payment under Section 547(b)—but argued that the payment was within the safe harbor for “forward contracts” under Section 546(e) − The trustee argued that the contract was not a forward contract, because “it contained neither a specific quantity [to be purchased]. . . nor specific delivery dates” and lacked an express “maturity date” − Relying on the statutory language alone, the Fifth Circuit found that specific quantities, delivery dates, and express maturity dates are not required − Ultimately, the Fifth Circuit held that Section 546(e) applied, reasoning that the contract was a forward contract because it was for the purchase, sale, or transfer of a commodity and didn’t schedule delivery until more than two days after execution (i. e. , express maturity date not required, but contract must require delivery more than two days after execution) 33

Representative Cases • Lightfoot v. MXEnergy Elec. , Inc. (In re MBS Mgmt. Servs. , Inc. , 690 F. 3 d 352 (5 th Cir. 2012) − − Creditor provided electrical power for apartment complexes managed by debtor Less than 90 days before its bankruptcy filing, the debtor paid creditor $150 k Trustee initiated a preference action under Section 547(d) to avoid the payment Creditor stipulated that the payment met all the elements of a preference payment under Section 547(b)—but argued that the payment was within the safe harbor for “forward contracts” under Section 546(e) − The trustee argued that the contract was not a forward contract, because “it contained neither a specific quantity [to be purchased]. . . nor specific delivery dates” and lacked an express “maturity date” − Relying on the statutory language alone, the Fifth Circuit found that specific quantities, delivery dates, and express maturity dates are not required − Ultimately, the Fifth Circuit held that Section 546(e) applied, reasoning that the contract was a forward contract because it was for the purchase, sale, or transfer of a commodity and didn’t schedule delivery until more than two days after execution (i. e. , express maturity date not required, but contract must require delivery more than two days after execution) 33

Representative Cases • Buchwald v. Williams Energy Mtg. & Trading Co. (In re Magnesium Corp. of Am. ), 460 B. R. 360 (Bankr. S. D. N. Y. 2011) − Creditor supplied natural gas that debtor consumed in its production process − Trustee brought a preference action to recover millions in payments made by debtor to creditor immediately prior to bankruptcy − Creditor argued for safe harbor protection under Section 546(e), asserting the payments were “settlement payments” to a “forward contract merchant” − The court found that a forward contract merchant is one that buys, sells, or trades in the forward contract business for profit, and does not include end users or producers − The court declined to grant creditor summary judgment and remanded for additional factual development, finding that if the creditor had sold debtor its own gas and not gas acquired from third parties as part of its trading business, the creditor could not be a forward contract merchant 34

Representative Cases • Buchwald v. Williams Energy Mtg. & Trading Co. (In re Magnesium Corp. of Am. ), 460 B. R. 360 (Bankr. S. D. N. Y. 2011) − Creditor supplied natural gas that debtor consumed in its production process − Trustee brought a preference action to recover millions in payments made by debtor to creditor immediately prior to bankruptcy − Creditor argued for safe harbor protection under Section 546(e), asserting the payments were “settlement payments” to a “forward contract merchant” − The court found that a forward contract merchant is one that buys, sells, or trades in the forward contract business for profit, and does not include end users or producers − The court declined to grant creditor summary judgment and remanded for additional factual development, finding that if the creditor had sold debtor its own gas and not gas acquired from third parties as part of its trading business, the creditor could not be a forward contract merchant 34

Representative Cases • Hutson v. E. I. Du Pont De Nemours & Co. (In re Nat’l Gas Dist. , LLC), 556 F. 3 d 247 (4 th Cir. 2009) − During the year prior to its bankruptcy, debtor entered into several gas contracts with fixed prices for specified periods and for which performance commenced more than two days after execution. The contracts were not purchased or transferred on any exchange − The Chapter 11 trustee commenced adversary proceedings pursuant to Sections 548(a) and 550(a) to avoid the contracts and transfers of gas, claiming the contracts and transfers of gas were fraudulent because they were made for less than market value − The customers responded that the contracts were protected from avoidance by Section 546(d), because the transfers were made by or to a swap participant in connection with a “commodity forward agreement, ” a form of swap agreement under Section 546(g) − The Fourth Circuit reversed the bankruptcy court’s finding for the trustee, ruling that established case law dictated that commodity forward agreements did not have to be traded in a financial market and were permitted to involve actual delivery − The Fourth Circuit also disagreed that the contracts were “simple supply contracts, ” and instead concluded that the terms of the contract were part of the customers’ efforts to hedge against the risk of price fluctuations. Thus the contracts were swap agreements 35

Representative Cases • Hutson v. E. I. Du Pont De Nemours & Co. (In re Nat’l Gas Dist. , LLC), 556 F. 3 d 247 (4 th Cir. 2009) − During the year prior to its bankruptcy, debtor entered into several gas contracts with fixed prices for specified periods and for which performance commenced more than two days after execution. The contracts were not purchased or transferred on any exchange − The Chapter 11 trustee commenced adversary proceedings pursuant to Sections 548(a) and 550(a) to avoid the contracts and transfers of gas, claiming the contracts and transfers of gas were fraudulent because they were made for less than market value − The customers responded that the contracts were protected from avoidance by Section 546(d), because the transfers were made by or to a swap participant in connection with a “commodity forward agreement, ” a form of swap agreement under Section 546(g) − The Fourth Circuit reversed the bankruptcy court’s finding for the trustee, ruling that established case law dictated that commodity forward agreements did not have to be traded in a financial market and were permitted to involve actual delivery − The Fourth Circuit also disagreed that the contracts were “simple supply contracts, ” and instead concluded that the terms of the contract were part of the customers’ efforts to hedge against the risk of price fluctuations. Thus the contracts were swap agreements 35

Other Characteristics of Safe Harbor Transactions • Safe harbor provisions cover transfers of property or property interests, not “obligations. ” See, e. g. , Lehman Brothers Holdings, Inc. v. JPMorgan Chase Bank, N. A. (In re Lehman Brothers Holdings, Inc. ), 469 B. R. 415, 450 (Bankr. S. D. N. Y. 2012) (holding that guarantees are obligations and thus not eligible for safe harbor protection); Geltzer v. Mooney (In re Mac. Menamin’s Grill Ltd. ), 450 B. R. 414, 428 -31 (Bankr S. D. N. Y. 2011) (finding that liens are transfers of property subject to the safe harbor provisions but incurrence of loan obligations is not) • Safe harbors provisions do not apply to transfers “with actual intent to. . . defraud” under Section 548(a)(1)(A). See § 546(e), (f), (g) • However, state law fraudulent conveyance actions under Section 544 and constructive fraud actions under Section 548(a)(1)(B) are shielded by the safe harbors 36

Other Characteristics of Safe Harbor Transactions • Safe harbor provisions cover transfers of property or property interests, not “obligations. ” See, e. g. , Lehman Brothers Holdings, Inc. v. JPMorgan Chase Bank, N. A. (In re Lehman Brothers Holdings, Inc. ), 469 B. R. 415, 450 (Bankr. S. D. N. Y. 2012) (holding that guarantees are obligations and thus not eligible for safe harbor protection); Geltzer v. Mooney (In re Mac. Menamin’s Grill Ltd. ), 450 B. R. 414, 428 -31 (Bankr S. D. N. Y. 2011) (finding that liens are transfers of property subject to the safe harbor provisions but incurrence of loan obligations is not) • Safe harbors provisions do not apply to transfers “with actual intent to. . . defraud” under Section 548(a)(1)(A). See § 546(e), (f), (g) • However, state law fraudulent conveyance actions under Section 544 and constructive fraud actions under Section 548(a)(1)(B) are shielded by the safe harbors 36

Other Characteristics of Safe Harbor Transactions • Safe harbors are not defenses to all common law claims embraced by statutory language. See In re Lehman Brothers Holdings, Inc. , 469 B. R. at 450 (“[T]he safe harbors of section 546(e). . . are not so exalted as to trump and preemptively block every other legal theory that a creative adversary might choose to employ when seeking relief from conduct of a market participant that is outside the norms of ordinary market behavior. . ”) 37

Other Characteristics of Safe Harbor Transactions • Safe harbors are not defenses to all common law claims embraced by statutory language. See In re Lehman Brothers Holdings, Inc. , 469 B. R. at 450 (“[T]he safe harbors of section 546(e). . . are not so exalted as to trump and preemptively block every other legal theory that a creative adversary might choose to employ when seeking relief from conduct of a market participant that is outside the norms of ordinary market behavior. . ”) 37

Questions & Answers

Questions & Answers