fed0367c1358b3b4dd779a4caf66cf88.ppt

- Количество слайдов: 15

Predicting peaks and troughs in real house prices: a probit approach LIME Workshop Brussels, 8 December 2011 Paul van den Noord 1

Predicting peaks and troughs in real house prices: a probit approach LIME Workshop Brussels, 8 December 2011 Paul van den Noord 1

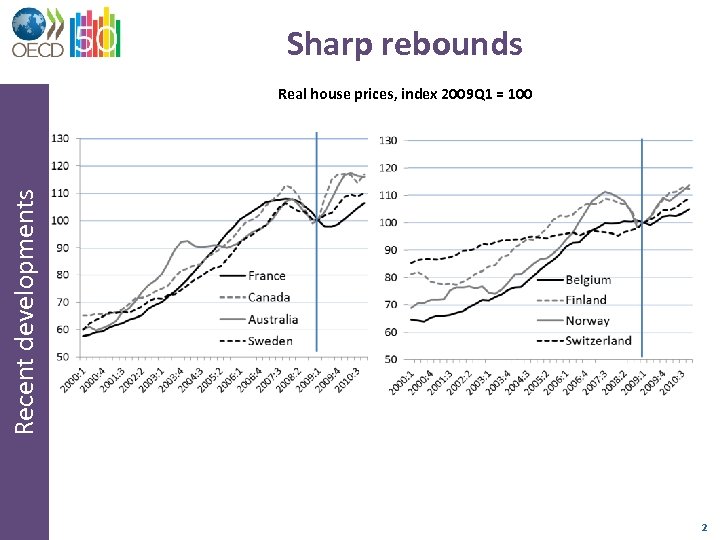

Sharp rebounds Recent developments Real house prices, index 2009 Q 1 = 100 2

Sharp rebounds Recent developments Real house prices, index 2009 Q 1 = 100 2

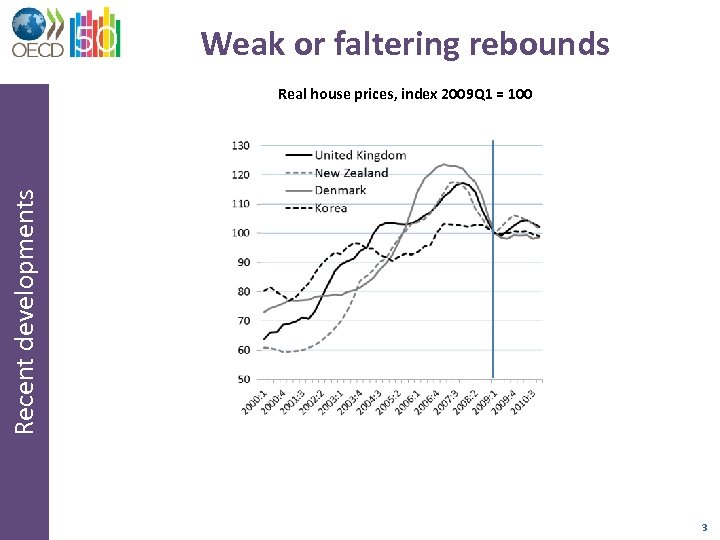

Weak or faltering rebounds Recent developments Real house prices, index 2009 Q 1 = 100 3

Weak or faltering rebounds Recent developments Real house prices, index 2009 Q 1 = 100 3

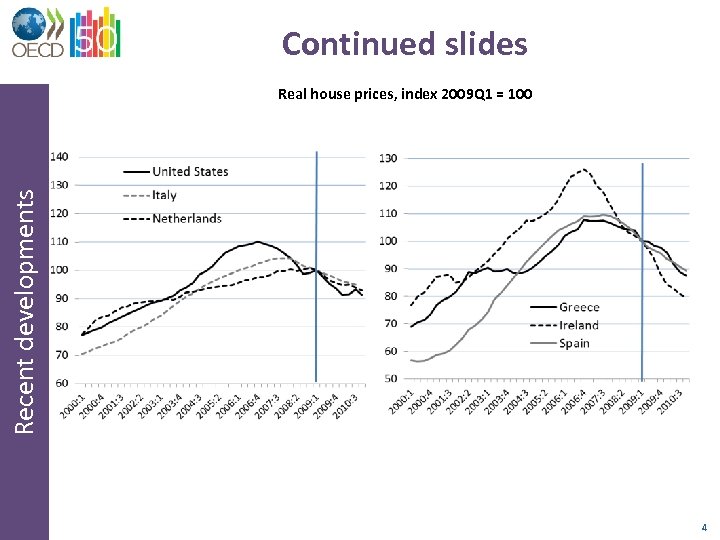

Continued slides Recent developments Real house prices, index 2009 Q 1 = 100 4

Continued slides Recent developments Real house prices, index 2009 Q 1 = 100 4

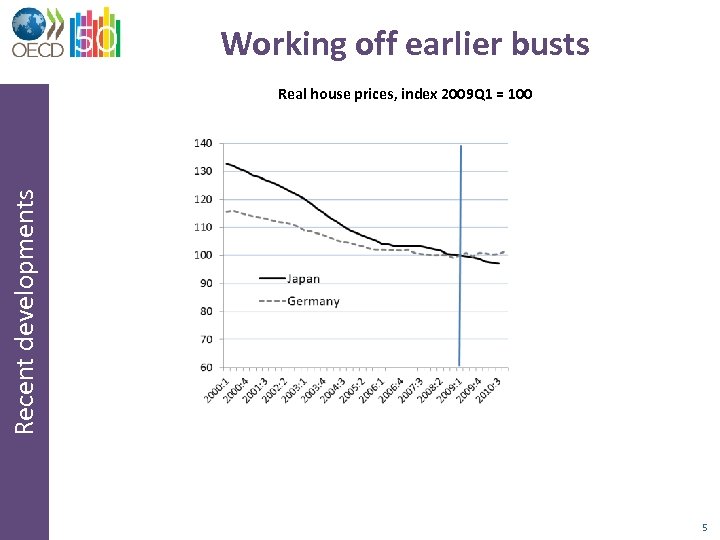

Working off earlier busts Recent developments Real house prices, index 2009 Q 1 = 100 5

Working off earlier busts Recent developments Real house prices, index 2009 Q 1 = 100 5

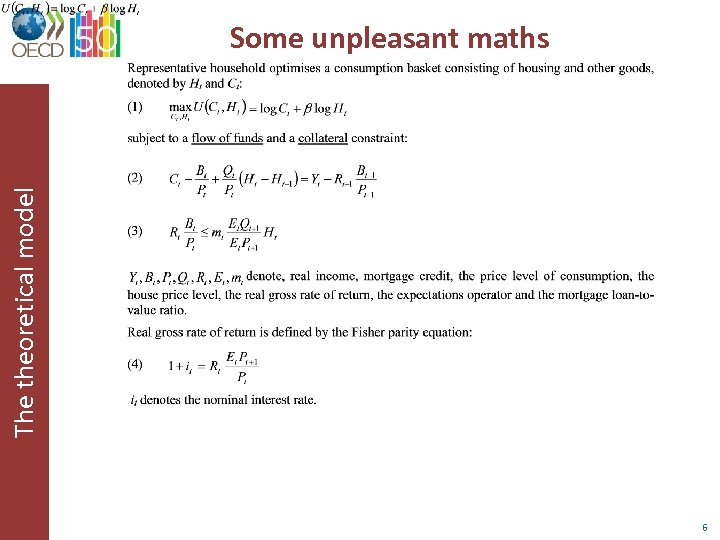

The theoretical model Some unpleasant maths 6

The theoretical model Some unpleasant maths 6

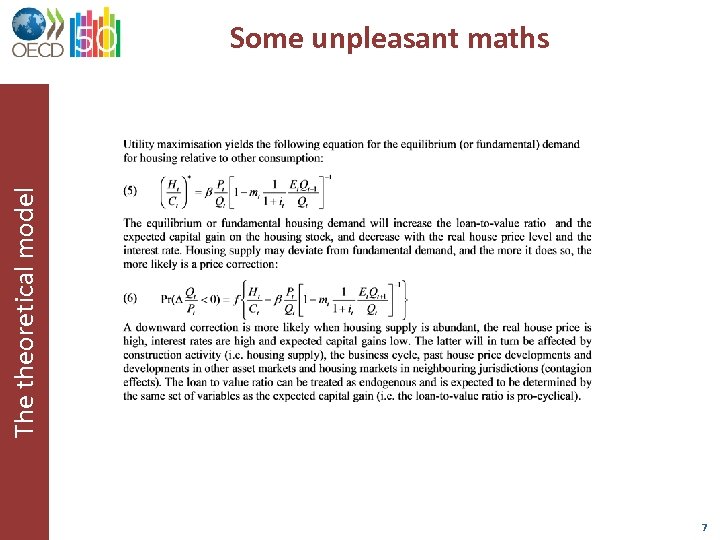

The theoretical model Some unpleasant maths 7

The theoretical model Some unpleasant maths 7

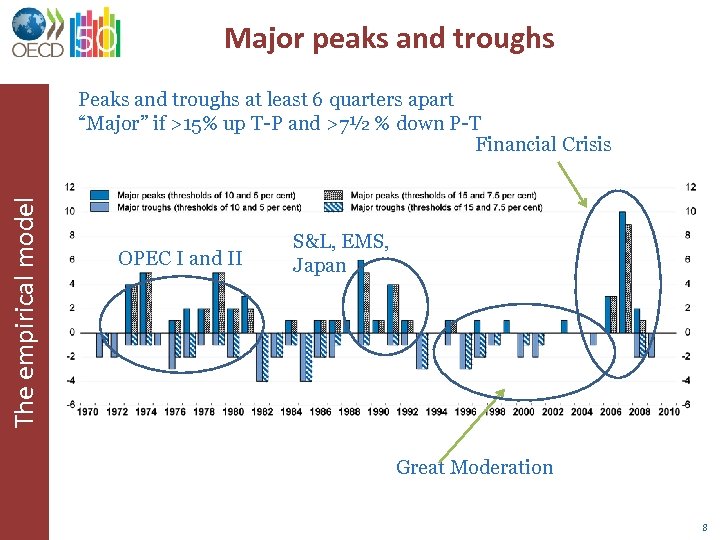

Major peaks and troughs The empirical model Peaks and troughs at least 6 quarters apart “Major” if >15% up T-P and >7½ % down P-T Financial Crisis OPEC I and II S&L, EMS, Japan Great Moderation 8

Major peaks and troughs The empirical model Peaks and troughs at least 6 quarters apart “Major” if >15% up T-P and >7½ % down P-T Financial Crisis OPEC I and II S&L, EMS, Japan Great Moderation 8

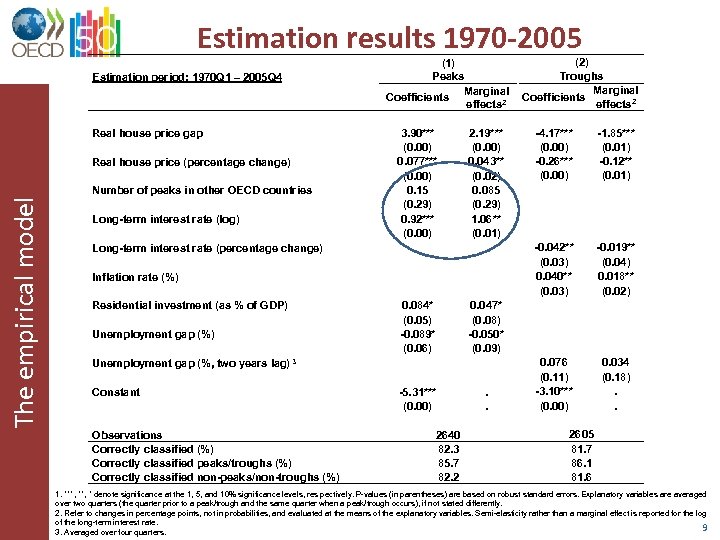

Estimation results 1970 -2005 Estimation period: 1970 Q 1 – 2005 Q 4 Real house price gap The empirical model Real house price (percentage change) Number of peaks in other OECD countries Long-term interest rate (log) (1) Peaks Marginal Coefficients effects 2 2. 19*** (0. 00) 0. 043** (0. 02) 0. 085 (0. 29) 1. 06** (0. 01) Inflation rate (%) Unemployment gap (%) 0. 084* (0. 05) -0. 089* (0. 06) Observations Correctly classified (%) Correctly classified peaks/troughs (%) Correctly classified non-peaks/non-troughs (%) -1. 85*** (0. 01) -0. 12** (0. 01) -0. 019** (0. 04) 0. 018** (0. 02) 0. 076 (0. 11) -3. 10*** (0. 00) 0. 034 (0. 18). . 0. 047* (0. 08) -0. 050* (0. 09) Unemployment gap (%, two years lag) 3 Constant -4. 17*** (0. 00) -0. 26*** (0. 00) -0. 042** (0. 03) 0. 040** (0. 03) 3. 90*** (0. 00) 0. 077*** (0. 00) 0. 15 (0. 29) 0. 92*** (0. 00) Long-term interest rate (percentage change) Residential investment (as % of GDP) (2) Troughs Marginal Coefficients effects 2 -5. 31*** (0. 00) 2640 82. 3 85. 7 82. 2 . . 2605 81. 7 86. 1 81. 6 1. ***, * denote significance at the 1, 5, and 10% significance levels, res pectively. P-values (in parentheses) are based on robust standard errors. Explanatory variables are averaged over two quarters (the quarter prior to a peak/trough and the same quarter when a peak/trough occurs), if not stated differently. 2. Refer to changes in percentage points, not in probabilities, and evaluated at the means of the explanatory variables. Semi-elasticity rather than a marginal effect is reported for the log of the long-term interest rate. 9 3. Averaged over four quarters.

Estimation results 1970 -2005 Estimation period: 1970 Q 1 – 2005 Q 4 Real house price gap The empirical model Real house price (percentage change) Number of peaks in other OECD countries Long-term interest rate (log) (1) Peaks Marginal Coefficients effects 2 2. 19*** (0. 00) 0. 043** (0. 02) 0. 085 (0. 29) 1. 06** (0. 01) Inflation rate (%) Unemployment gap (%) 0. 084* (0. 05) -0. 089* (0. 06) Observations Correctly classified (%) Correctly classified peaks/troughs (%) Correctly classified non-peaks/non-troughs (%) -1. 85*** (0. 01) -0. 12** (0. 01) -0. 019** (0. 04) 0. 018** (0. 02) 0. 076 (0. 11) -3. 10*** (0. 00) 0. 034 (0. 18). . 0. 047* (0. 08) -0. 050* (0. 09) Unemployment gap (%, two years lag) 3 Constant -4. 17*** (0. 00) -0. 26*** (0. 00) -0. 042** (0. 03) 0. 040** (0. 03) 3. 90*** (0. 00) 0. 077*** (0. 00) 0. 15 (0. 29) 0. 92*** (0. 00) Long-term interest rate (percentage change) Residential investment (as % of GDP) (2) Troughs Marginal Coefficients effects 2 -5. 31*** (0. 00) 2640 82. 3 85. 7 82. 2 . . 2605 81. 7 86. 1 81. 6 1. ***, * denote significance at the 1, 5, and 10% significance levels, res pectively. P-values (in parentheses) are based on robust standard errors. Explanatory variables are averaged over two quarters (the quarter prior to a peak/trough and the same quarter when a peak/trough occurs), if not stated differently. 2. Refer to changes in percentage points, not in probabilities, and evaluated at the means of the explanatory variables. Semi-elasticity rather than a marginal effect is reported for the log of the long-term interest rate. 9 3. Averaged over four quarters.

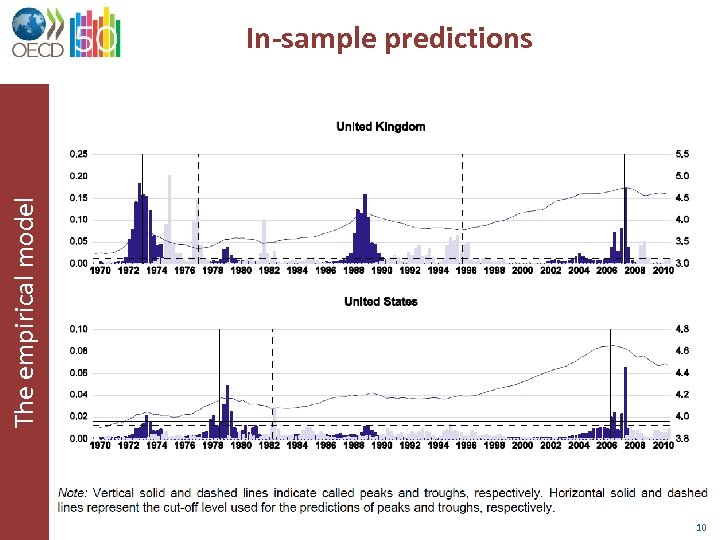

The empirical model In-sample predictions 10

The empirical model In-sample predictions 10

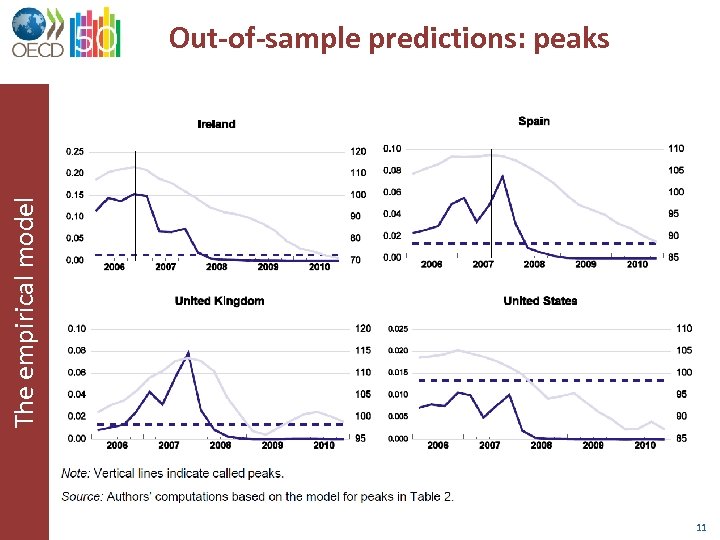

The empirical model Out-of-sample predictions: peaks 11

The empirical model Out-of-sample predictions: peaks 11

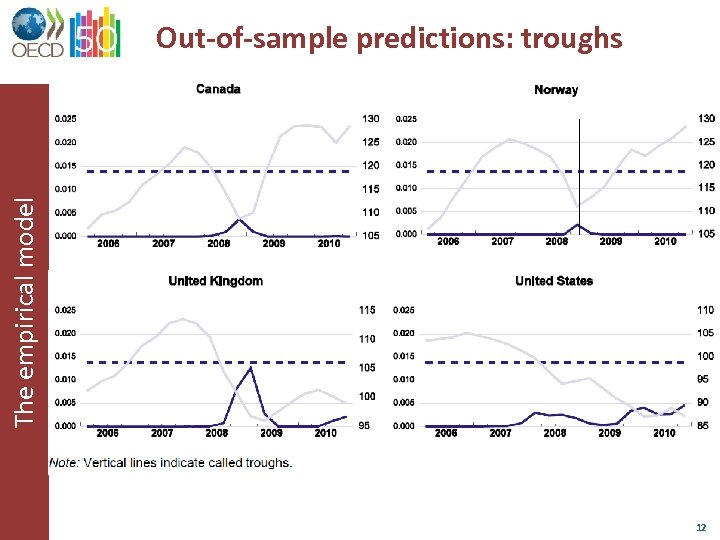

The empirical model Out-of-sample predictions: troughs 12

The empirical model Out-of-sample predictions: troughs 12

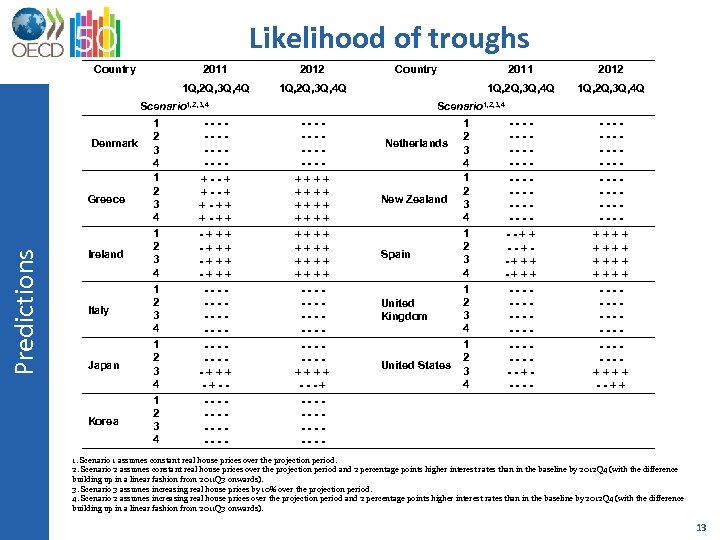

Likelihood of troughs Country 2011 2012 1 Q, 2 Q, 3 Q, 4 Q Country 1 Q, 2 Q, 3 Q, 4 Q Denmark Predictions Greece Ireland Italy Japan Korea 1 2 3 4 1 2 3 4 ------+--+ +-++ -+++ ----------+++ -+------- 2012 1 Q, 2 Q, 3 Q, 4 Q Scenario 1, 2, 3, 4 2011 1 Q, 2 Q, 3 Q, 4 Q Scenario 1, 2, 3, 4 ------++++ ++++ ---------++++ -------- Netherlands New Zealand Spain United Kingdom United States 1 2 3 4 1 2 3 4 -------------++ --+-+++ ----------+------------++++ ---------++++ --++ 1. Scenario 1 assumes constant real house prices over the projection period. 2. Scenario 2 assumes constant real house prices over the projection period and 2 percentage points higher interest rates than in the baseline by 2012 Q 4 (with the difference building up in a linear fashion from 2011 Q 3 onwards). 3. Scenario 3 assumes increasing real house prices by 10% over the projection period. 4. Scenario 2 assumes increasing real house prices over the projection period and 2 percentage points higher interest rates than in the baseline by 2012 Q 4 (with the difference building up in a linear fashion from 2011 Q 3 onwards). 13

Likelihood of troughs Country 2011 2012 1 Q, 2 Q, 3 Q, 4 Q Country 1 Q, 2 Q, 3 Q, 4 Q Denmark Predictions Greece Ireland Italy Japan Korea 1 2 3 4 1 2 3 4 ------+--+ +-++ -+++ ----------+++ -+------- 2012 1 Q, 2 Q, 3 Q, 4 Q Scenario 1, 2, 3, 4 2011 1 Q, 2 Q, 3 Q, 4 Q Scenario 1, 2, 3, 4 ------++++ ++++ ---------++++ -------- Netherlands New Zealand Spain United Kingdom United States 1 2 3 4 1 2 3 4 -------------++ --+-+++ ----------+------------++++ ---------++++ --++ 1. Scenario 1 assumes constant real house prices over the projection period. 2. Scenario 2 assumes constant real house prices over the projection period and 2 percentage points higher interest rates than in the baseline by 2012 Q 4 (with the difference building up in a linear fashion from 2011 Q 3 onwards). 3. Scenario 3 assumes increasing real house prices by 10% over the projection period. 4. Scenario 2 assumes increasing real house prices over the projection period and 2 percentage points higher interest rates than in the baseline by 2012 Q 4 (with the difference building up in a linear fashion from 2011 Q 3 onwards). 13

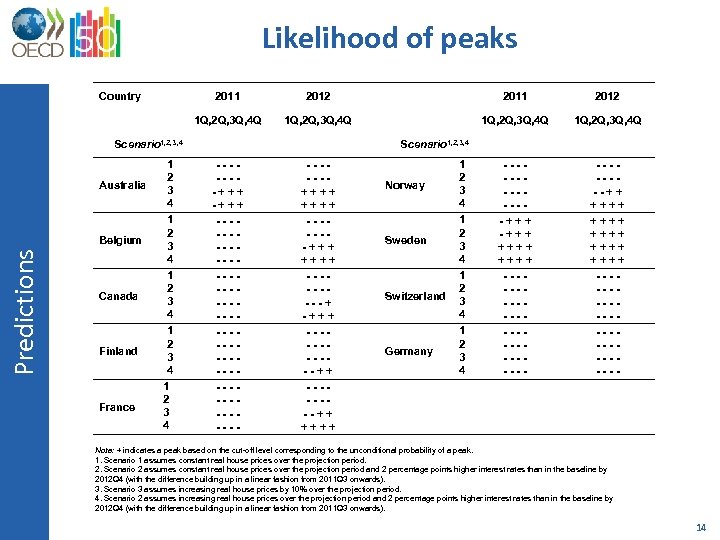

Likelihood of peaks Country 2011 2012 1 Q, 2 Q, 3 Q, 4 Q -------+++ ++++ -------------++ ++++ ++++ ------------- Scenario 1, 2, 3, 4 Australia Predictions Belgium Canada Finland France 1 2 3 4 1 2 3 4 Scenario 1, 2, 3, 4 -------+++ -------------------------++++ -------+++ ++++ -----+ -+++ ------++ ++++ Norway Sweden Switzerland Germany 1 2 3 4 Note: + indicates a peak based on the cut-off level corresponding to the unconditional probability of a peak. 1. Scenario 1 assumes constant real house prices over the projection period. 2. Scenario 2 assumes constant real house prices over the projection period and 2 percentage points higher interest rates than in the baseline by 2012 Q 4 (with the difference building up in a linear fashion from 2011 Q 3 onwards). 3. Scenario 3 assumes increasing real house prices by 10% over the projection period. 4. Scenario 2 assumes increasing real house prices over the projection period and 2 percentage points higher interest rates than in the baseline by 2012 Q 4 (with the difference building up in a linear fashion from 2011 Q 3 onwards). 14

Likelihood of peaks Country 2011 2012 1 Q, 2 Q, 3 Q, 4 Q -------+++ ++++ -------------++ ++++ ++++ ------------- Scenario 1, 2, 3, 4 Australia Predictions Belgium Canada Finland France 1 2 3 4 1 2 3 4 Scenario 1, 2, 3, 4 -------+++ -------------------------++++ -------+++ ++++ -----+ -+++ ------++ ++++ Norway Sweden Switzerland Germany 1 2 3 4 Note: + indicates a peak based on the cut-off level corresponding to the unconditional probability of a peak. 1. Scenario 1 assumes constant real house prices over the projection period. 2. Scenario 2 assumes constant real house prices over the projection period and 2 percentage points higher interest rates than in the baseline by 2012 Q 4 (with the difference building up in a linear fashion from 2011 Q 3 onwards). 3. Scenario 3 assumes increasing real house prices by 10% over the projection period. 4. Scenario 2 assumes increasing real house prices over the projection period and 2 percentage points higher interest rates than in the baseline by 2012 Q 4 (with the difference building up in a linear fashion from 2011 Q 3 onwards). 14

The results Forecasts 1. Downturns ending? United States*, United Kingdom†, Italy†, Denmark†, Greece**, Ireland**, Korea†, Netherlands†, New Zealand†, Spain** 2. Rebounds ending? France*, Canada*, Australia*, Belgium*, Finland*, Norway*, Sweden** , Switzerland † 3. Long-term declines ending ? Japan* , Germany** ______ † No * Yes after a further fall (rise) in real prices ** Also at current real prices Source: Authors’ calculations. 15

The results Forecasts 1. Downturns ending? United States*, United Kingdom†, Italy†, Denmark†, Greece**, Ireland**, Korea†, Netherlands†, New Zealand†, Spain** 2. Rebounds ending? France*, Canada*, Australia*, Belgium*, Finland*, Norway*, Sweden** , Switzerland † 3. Long-term declines ending ? Japan* , Germany** ______ † No * Yes after a further fall (rise) in real prices ** Also at current real prices Source: Authors’ calculations. 15