d09309fc2701fb882758572ecafd1a97.ppt

- Количество слайдов: 15

Precious Capital AG Keynote Address Outlook For 2011 -2015 Kenneth J. Gerbino Zurich, Switzerland Hotel Savoy Baur-en-Ville 14 April 2011

Precious Capital AG Keynote Address Outlook For 2011 -2015 Kenneth J. Gerbino Zurich, Switzerland Hotel Savoy Baur-en-Ville 14 April 2011

The Big Picture • • • No Deflation Debt Defaults Will be Met With Paper Money Austerity and Change Slow but Probable in U. S. & EUR Inflation In The Pipeline Interest Rates Must Go Up With Inflation Mid East Chaos and Confusion = Oil Price ? Gold and Silver Volatile But Financial Insurance Major Stock Markets: 5 Year Trading Range Sideways Oil Trending Higher as Well as Other Commodities

The Big Picture • • • No Deflation Debt Defaults Will be Met With Paper Money Austerity and Change Slow but Probable in U. S. & EUR Inflation In The Pipeline Interest Rates Must Go Up With Inflation Mid East Chaos and Confusion = Oil Price ? Gold and Silver Volatile But Financial Insurance Major Stock Markets: 5 Year Trading Range Sideways Oil Trending Higher as Well as Other Commodities

Major Influences • Banking Establishments Calling the Shots • Political Leaders Trapped From Past Policies • Money in The Pipeline = Inflation • Too Much Debt • World Oil Supply Cannot Keep Up With Demand - Peak Oil is Now. • Insanity vs. Sanity The Real Problem - Not Religion or Tribes in The Mid East

Major Influences • Banking Establishments Calling the Shots • Political Leaders Trapped From Past Policies • Money in The Pipeline = Inflation • Too Much Debt • World Oil Supply Cannot Keep Up With Demand - Peak Oil is Now. • Insanity vs. Sanity The Real Problem - Not Religion or Tribes in The Mid East

Predictive Tools The Data and Statistics That Follow Are Valuable As Future Investment Guidelines No Rocket Science Needed

Predictive Tools The Data and Statistics That Follow Are Valuable As Future Investment Guidelines No Rocket Science Needed

Real Interest Rates USA - 1. 4% UK - 3. 0% Germany - 1. 4% China - 2. 4% France - 1. 1% India - 1. 5% Implications: Bullish for Gold and Silver

Real Interest Rates USA - 1. 4% UK - 3. 0% Germany - 1. 4% China - 2. 4% France - 1. 1% India - 1. 5% Implications: Bullish for Gold and Silver

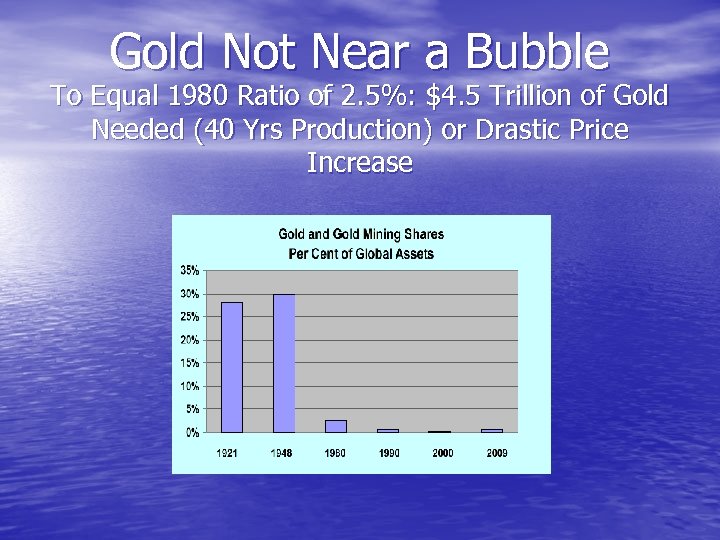

Gold Not Near a Bubble To Equal 1980 Ratio of 2. 5%: $4. 5 Trillion of Gold Needed (40 Yrs Production) or Drastic Price Increase

Gold Not Near a Bubble To Equal 1980 Ratio of 2. 5%: $4. 5 Trillion of Gold Needed (40 Yrs Production) or Drastic Price Increase

Gold Mining Stocks It Doesn’t Get Any Better Than This • Growth • Value • Inflation Hedge & Monetary Insurance Policy • Senior Producers Selling at Only 10. 2 x 2012 • • • Cash Flow. Seniors Growing at 28% - Next 3 Years Major Multiple Expansion Should be Expected Back Up the Truck

Gold Mining Stocks It Doesn’t Get Any Better Than This • Growth • Value • Inflation Hedge & Monetary Insurance Policy • Senior Producers Selling at Only 10. 2 x 2012 • • • Cash Flow. Seniors Growing at 28% - Next 3 Years Major Multiple Expansion Should be Expected Back Up the Truck

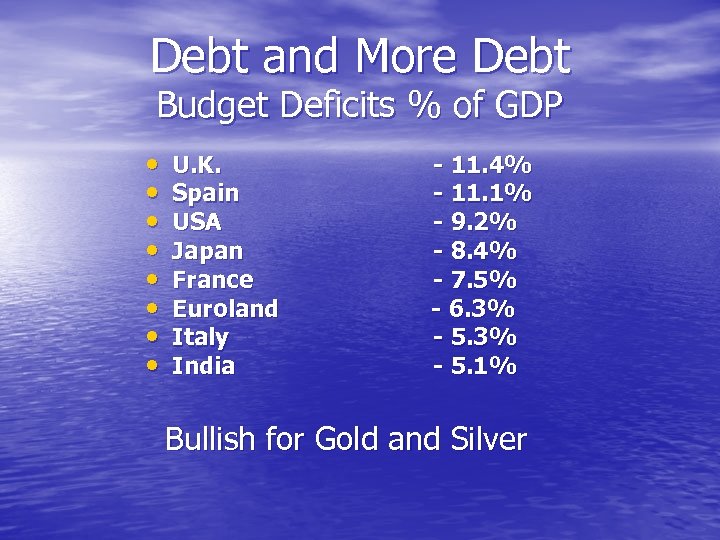

Debt and More Debt Budget Deficits % of GDP • • U. K. Spain USA Japan France Euroland Italy India - 11. 4% - 11. 1% - 9. 2% - 8. 4% - 7. 5% - 6. 3% - 5. 1% Bullish for Gold and Silver

Debt and More Debt Budget Deficits % of GDP • • U. K. Spain USA Japan France Euroland Italy India - 11. 4% - 11. 1% - 9. 2% - 8. 4% - 7. 5% - 6. 3% - 5. 1% Bullish for Gold and Silver

Money Supply Increases One Year • China • India • Brazil • USA • Switzerland • Euroland + 15. 6% + 13. 2% + 12. 9% + 9. 2% + 3. 0% Bullish for Gold and Silver

Money Supply Increases One Year • China • India • Brazil • USA • Switzerland • Euroland + 15. 6% + 13. 2% + 12. 9% + 9. 2% + 3. 0% Bullish for Gold and Silver

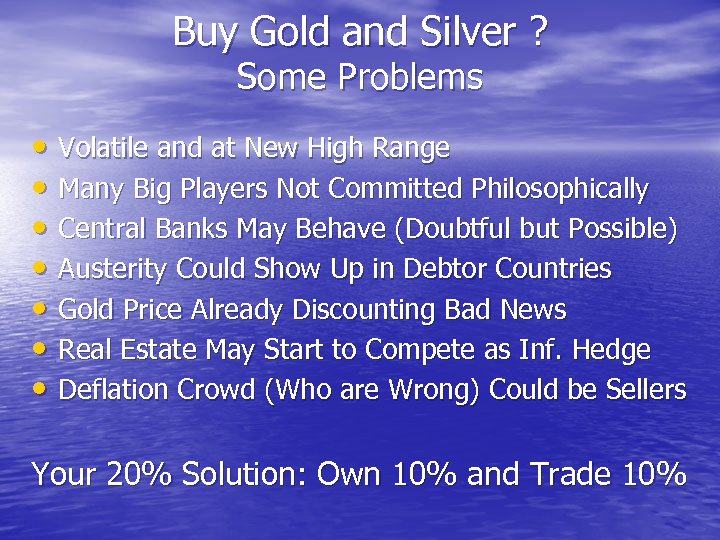

Buy Gold and Silver ? Some Problems • Volatile and at New High Range • Many Big Players Not Committed Philosophically • Central Banks May Behave (Doubtful but Possible) • Austerity Could Show Up in Debtor Countries • Gold Price Already Discounting Bad News • Real Estate May Start to Compete as Inf. Hedge • Deflation Crowd (Who are Wrong) Could be Sellers Your 20% Solution: Own 10% and Trade 10%

Buy Gold and Silver ? Some Problems • Volatile and at New High Range • Many Big Players Not Committed Philosophically • Central Banks May Behave (Doubtful but Possible) • Austerity Could Show Up in Debtor Countries • Gold Price Already Discounting Bad News • Real Estate May Start to Compete as Inf. Hedge • Deflation Crowd (Who are Wrong) Could be Sellers Your 20% Solution: Own 10% and Trade 10%

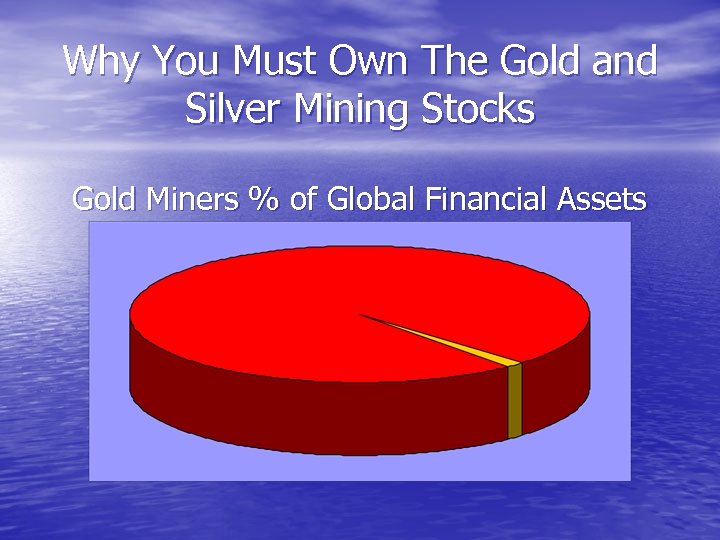

Why You Must Own The Gold and Silver Mining Stocks Gold Miners % of Global Financial Assets

Why You Must Own The Gold and Silver Mining Stocks Gold Miners % of Global Financial Assets

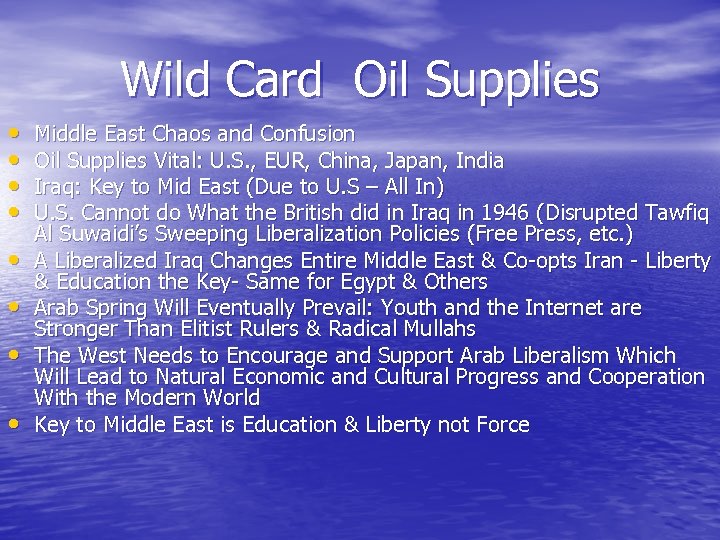

Wild Card Oil Supplies • • Middle East Chaos and Confusion Oil Supplies Vital: U. S. , EUR, China, Japan, India Iraq: Key to Mid East (Due to U. S – All In) U. S. Cannot do What the British did in Iraq in 1946 (Disrupted Tawfiq Al Suwaidi’s Sweeping Liberalization Policies (Free Press, etc. ) A Liberalized Iraq Changes Entire Middle East & Co-opts Iran - Liberty & Education the Key- Same for Egypt & Others Arab Spring Will Eventually Prevail: Youth and the Internet are Stronger Than Elitist Rulers & Radical Mullahs The West Needs to Encourage and Support Arab Liberalism Which Will Lead to Natural Economic and Cultural Progress and Cooperation With the Modern World Key to Middle East is Education & Liberty not Force

Wild Card Oil Supplies • • Middle East Chaos and Confusion Oil Supplies Vital: U. S. , EUR, China, Japan, India Iraq: Key to Mid East (Due to U. S – All In) U. S. Cannot do What the British did in Iraq in 1946 (Disrupted Tawfiq Al Suwaidi’s Sweeping Liberalization Policies (Free Press, etc. ) A Liberalized Iraq Changes Entire Middle East & Co-opts Iran - Liberty & Education the Key- Same for Egypt & Others Arab Spring Will Eventually Prevail: Youth and the Internet are Stronger Than Elitist Rulers & Radical Mullahs The West Needs to Encourage and Support Arab Liberalism Which Will Lead to Natural Economic and Cultural Progress and Cooperation With the Modern World Key to Middle East is Education & Liberty not Force

Summary • Too Much Debt • Too Much Paper Money • Too Much Waste • Too Much Speculation • Too Many Economic Fears • Treat Core Gold Holdings as Monetary Insurance • Not Investment The World is Not Going to End - It is Just Going to Get More Expensive

Summary • Too Much Debt • Too Much Paper Money • Too Much Waste • Too Much Speculation • Too Many Economic Fears • Treat Core Gold Holdings as Monetary Insurance • Not Investment The World is Not Going to End - It is Just Going to Get More Expensive

Conclusions • Own Monetary Insurance: Gold And Silver at Any Price: • • • Minimum: 10% Hold Long Term 10% Trade 5% in Bullion Coins 15% in Precious Metal Mining Stocks Accumulate Real Estate Expect Interest Rates to Rise Expect More Inflation Internationally U. S: Money Printing Will Continue Until After 2012 Election Selected Energy Stocks & Asian Growth Companies Good Investments Avoid Annuities and Longer Duration Bonds Buy Quality Industrial Stocks When Interest Rates Peak in 34 Years – For Now Be Conservative: Stop Loss Everything Own Quality Gold & Silver Mining Stocks & Mining Funds

Conclusions • Own Monetary Insurance: Gold And Silver at Any Price: • • • Minimum: 10% Hold Long Term 10% Trade 5% in Bullion Coins 15% in Precious Metal Mining Stocks Accumulate Real Estate Expect Interest Rates to Rise Expect More Inflation Internationally U. S: Money Printing Will Continue Until After 2012 Election Selected Energy Stocks & Asian Growth Companies Good Investments Avoid Annuities and Longer Duration Bonds Buy Quality Industrial Stocks When Interest Rates Peak in 34 Years – For Now Be Conservative: Stop Loss Everything Own Quality Gold & Silver Mining Stocks & Mining Funds

Thank You Kenneth J. Gerbino & Company Beverly Hills, California Gerbino Gold Group LLC www. kengerbino. com

Thank You Kenneth J. Gerbino & Company Beverly Hills, California Gerbino Gold Group LLC www. kengerbino. com