e1ba0fc7d99673e308ecdd6b866314cb.ppt

- Количество слайдов: 17

Præsentation for Danske Motorjournalister Torben V. Holm DONG Energy Sprogø, 16 august 2010

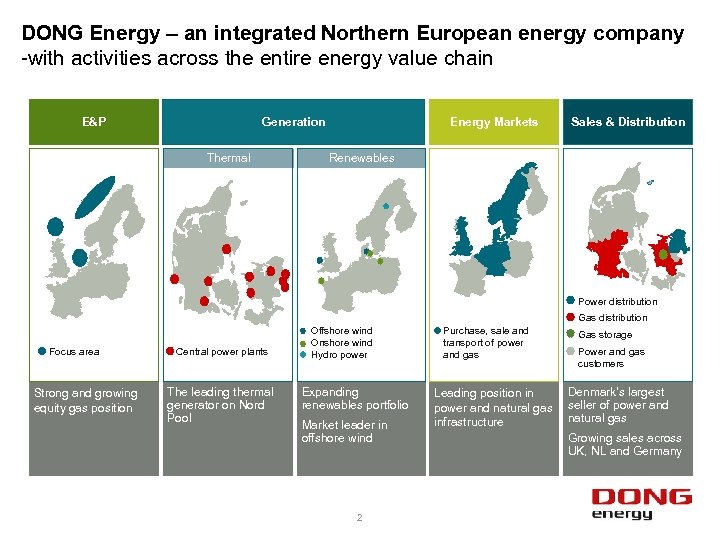

DONG Energy – an integrated Northern European energy company -with activities across the entire energy value chain E&P Generation Thermal Energy Markets Sales & Distribution Renewables Power distribution Gas distribution Focus area Strong and growing equity gas position Central power plants The leading thermal generator on Nord Pool Offshore wind Onshore wind Hydro power Expanding renewables portfolio Market leader in offshore wind 2 Purchase, sale and transport of power and gas Leading position in power and natural gas infrastructure Gas storage Power and gas customers Denmark's largest seller of power and natural gas Growing sales across UK, NL and Germany

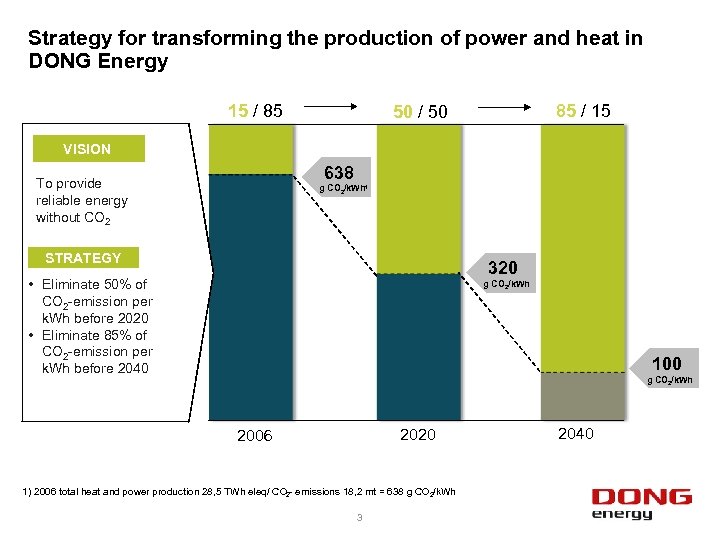

Strategy for transforming the production of power and heat in DONG Energy 15 / 85 85 / 15 50 / 50 VISION 638 To provide reliable energy without CO 2 g CO 2/k. Wh 1 STRATEGY 320 • Eliminate 50% of CO 2 -emission per k. Wh before 2020 • Eliminate 85% of CO 2 -emission per k. Wh before 2040 g CO 2/k. Wh 100 g CO 2/k. Wh 2020 2006 1) 2006 total heat and power production 28, 5 TWh eleq/ CO 2 - emissions 18, 2 mt = 638 g CO 2/k. Wh 3 2040

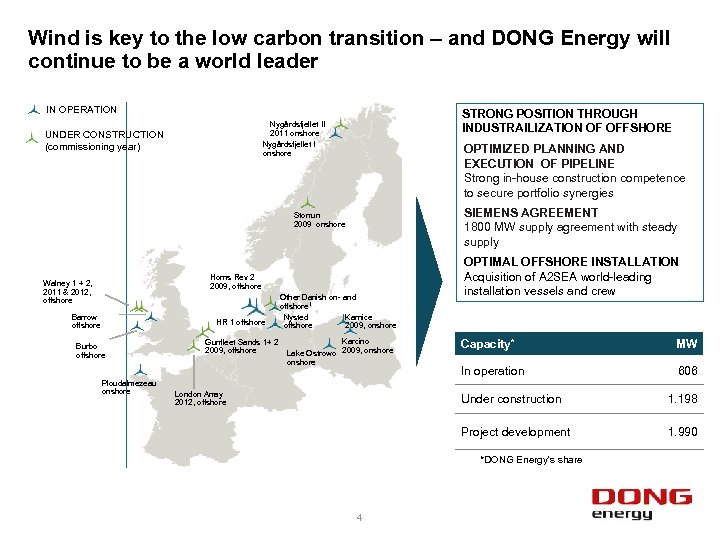

Wind is key to the low carbon transition – and DONG Energy will continue to be a world leader IN OPERATION STRONG POSITION THROUGH INDUSTRAILIZATION OF OFFSHORE Nygårdsfjellet II 2011 onshore Nygårdsfjellet I onshore UNDER CONSTRUCTION (commissioning year) OPTIMIZED PLANNING AND EXECUTION OF PIPELINE Strong in-house construction competence to secure portfolio synergies SIEMENS AGREEMENT 1800 MW supply agreement with steady supply Storrun 2009 onshore Horns Rev 2 2009, offshore Walney 1 + 2, 2011 & 2012, offshore Barrow offshore HR 1 offshore Burbo offshore Ploudalmezeau onshore Gunfleet Sands 1+ 2 2009, offshore Other Danish on- and offshore 1 Nysted Karnice offshore 2009, onshore Karcino Lake Ostrowo 2009, onshore London Array 2012, offshore OPTIMAL OFFSHORE INSTALLATION Acquisition of A 2 SEA world-leading installation vessels and crew Capacity* MW In operation 606 Under construction 1. 198 Project development 1. 990 *DONG Energy's share 4

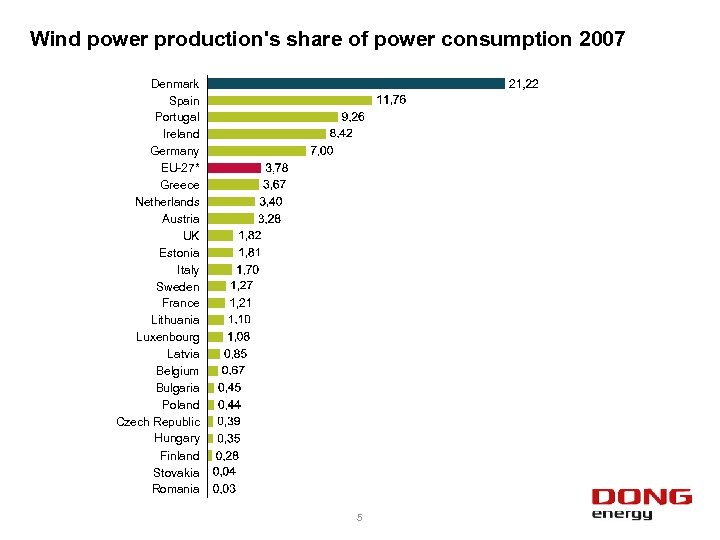

Wind power production's share of power consumption 2007 Denmark Spain Portugal Ireland Germany EU-27* Greece Netherlands Austria UK Estonia Italy Sweden France Lithuania Luxenbourg Latvia Belgium Bulgaria Poland Czech Republic Hungary Finland Stovakia Romania 5

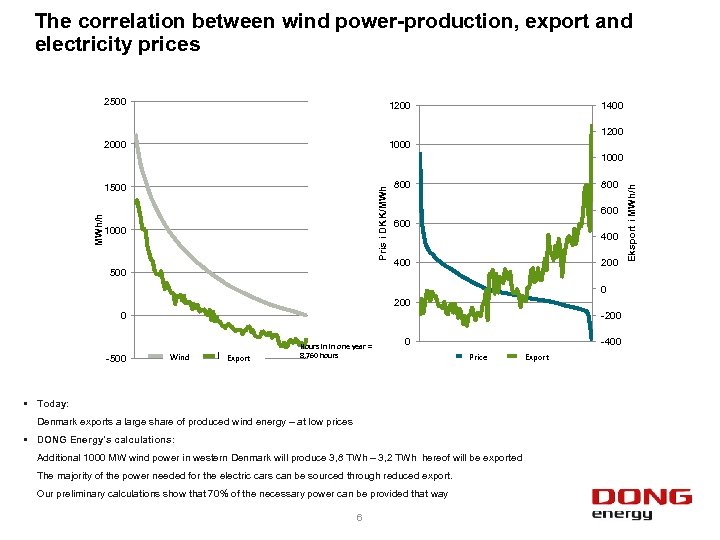

The correlation between wind power-production, export and electricity prices 2500 1200 1400 1200 2000 1000 Pris i DKK/MWh MWh/h 1500 1000 500 800 600 400 200 -200 0 -500 Vind Wind Eksport Export Hours in in one year = 8, 760 hours 0 -400 Pris Price § Today: Denmark exports a large share of produced wind energy – at low prices § DONG Energy's calculations: Additional 1000 MW wind power in western Denmark will produce 3, 8 TWh – 3, 2 TWh hereof will be exported The majority of the power needed for the electric cars can be sourced through reduced export. Our preliminary calculations show that 70% of the necessary power can be provided that way 6 Eksport Export Eksport i MWh/h 1000

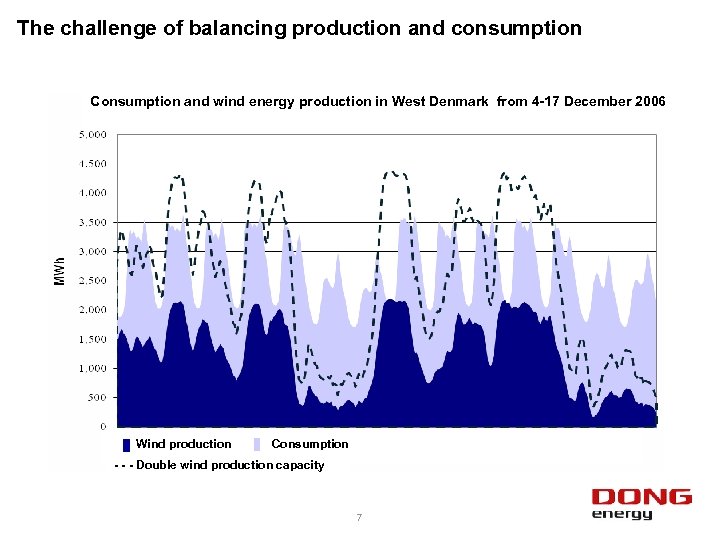

The challenge of balancing production and consumption Consumption and wind energy production in West Denmark from 4 -17 December 2006 Wind production Consumption - - - Double wind production capacity 7

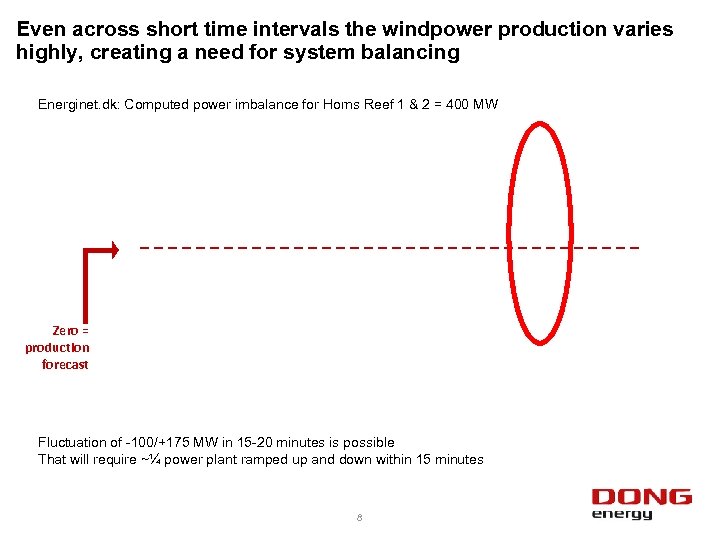

Even across short time intervals the windpower production varies highly, creating a need for system balancing Energinet. dk: Computed power imbalance for Horns Reef 1 & 2 = 400 MW Zero = production forecast Fluctuation of -100/+175 MW in 15 -20 minutes is possible That will require ~¼ power plant ramped up and down within 15 minutes 8

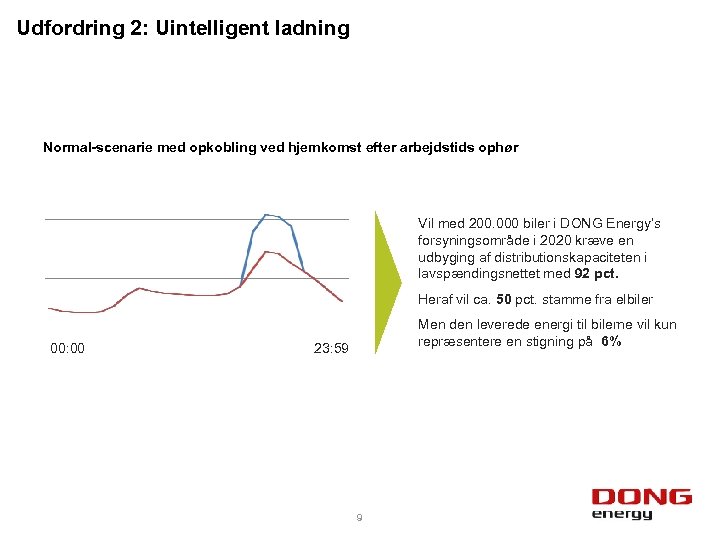

Udfordring 2: Uintelligent ladning Normal-scenarie med opkobling ved hjemkomst efter arbejdstids ophør Vil med 200. 000 biler i DONG Energy’s forsyningsområde i 2020 kræve en udbyging af distributionskapaciteten i lavspændingsnettet med 92 pct. Heraf vil ca. 50 pct. stamme fra elbiler 00: 00 Men den leverede energi til bilerne vil kun repræsentere en stigning på 6% 23: 59 9 9

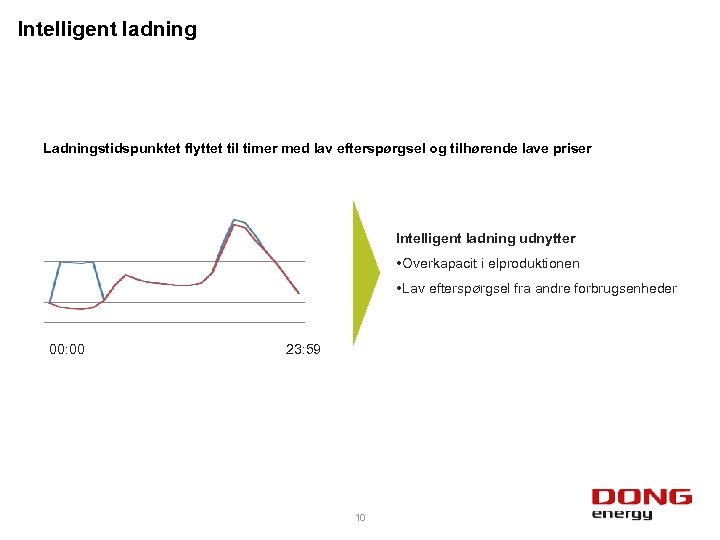

Intelligent ladning Ladningstidspunktet flyttet til timer med lav efterspørgsel og tilhørende lave priser Intelligent ladning udnytter • Overkapacit i elproduktionen • Lav efterspørgsel fra andre forbrugsenheder 00: 00 23: 59 10 10

Consequently, the goals for DONG Energy are … 1. To secure a more value-creating demand for electricity 2. To make sure that most charging takes place at price low-points (typically between 22 and 05) 3. To make sure that EV-operators and their customers are reasonably incentivised to behave rationally 11

Which means do we have ? § Tarif structure § § § distribution tarif fixed versus percentage based taxes on power Metering infratructure § § § Implementation costs Annual operational costs Car registration tax exemption for EV's (or subsidy) § But what about PHEV's § And what about a gradual change of taxation policy towards congestions taxes 12

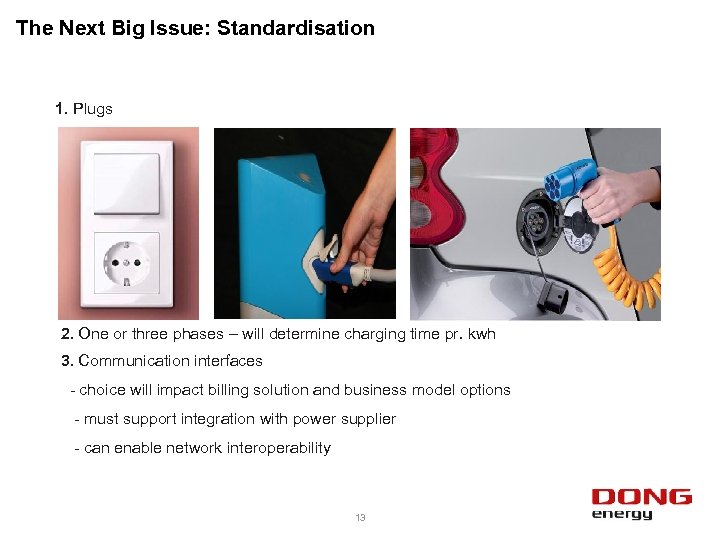

The Next Big Issue: Standardisation 1. Plugs 2. One or three phases – will determine charging time pr. kwh 3. Communication interfaces - choice will impact billing solution and business model options - must support integration with power supplier - can enable network interoperability 13

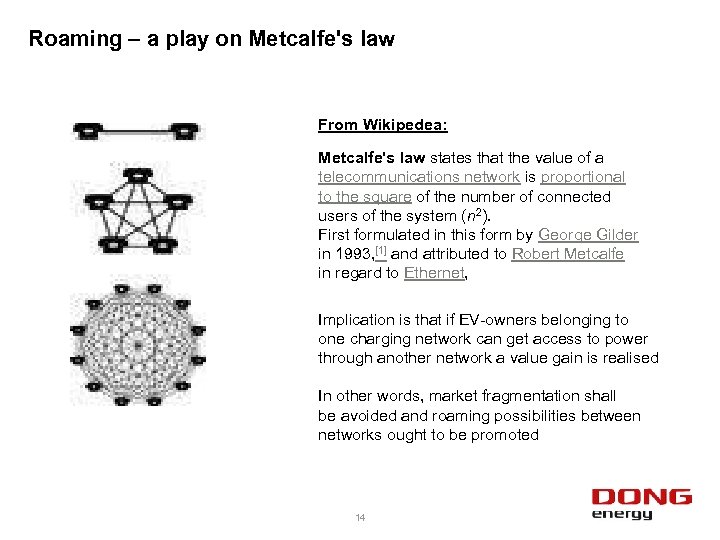

Roaming – a play on Metcalfe's law From Wikipedea: Metcalfe's law states that the value of a telecommunications network is proportional to the square of the number of connected users of the system (n 2). First formulated in this form by George Gilder in 1993, [1] and attributed to Robert Metcalfe in regard to Ethernet, Implication is that if EV-owners belonging to one charging network can get access to power through another network a value gain is realised In other words, market fragmentation shall be avoided and roaming possibilities between networks ought to be promoted 14

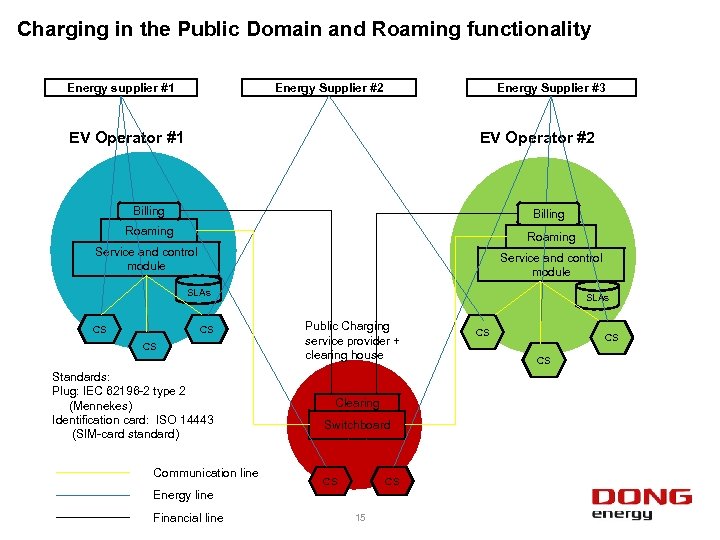

Charging in the Public Domain and Roaming functionality Energy supplier #1 Energy Supplier #2 Energy Supplier #3 EV Operator #1 EV Operator #2 Billing Roaming Service and control module SLAs CS CS CS Standards: Plug: IEC 62196 -2 type 2 (Mennekes) Identification card: ISO 14443 (SIM-card standard) Communication line SLAs Public Charging service provider + clearing house Clearing Switchboard CS CS Energy line Financial line 15 CS CS CS

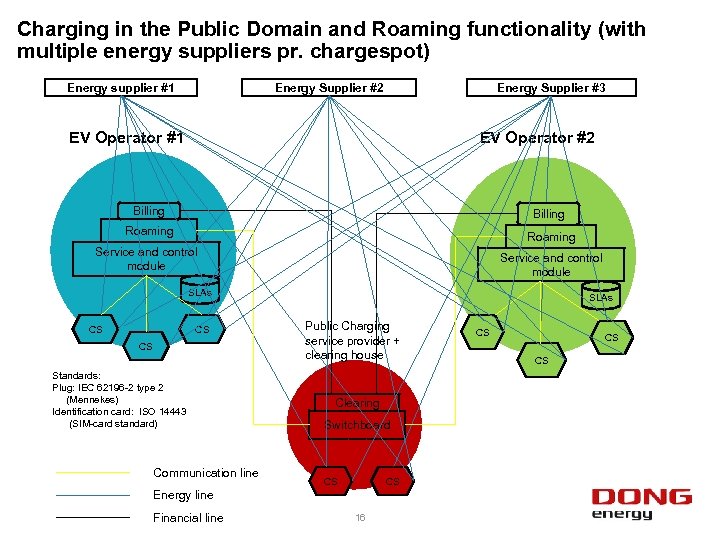

Charging in the Public Domain and Roaming functionality (with multiple energy suppliers pr. chargespot) Energy supplier #1 Energy Supplier #2 Energy Supplier #3 EV Operator #1 EV Operator #2 Billing Roaming Service and control module SLAs CS CS CS Standards: Plug: IEC 62196 -2 type 2 (Mennekes) Identification card: ISO 14443 (SIM-card standard) Communication line SLAs Public Charging service provider + clearing house Clearing Switchboard CS CS Energy line Financial line 16 CS CS CS

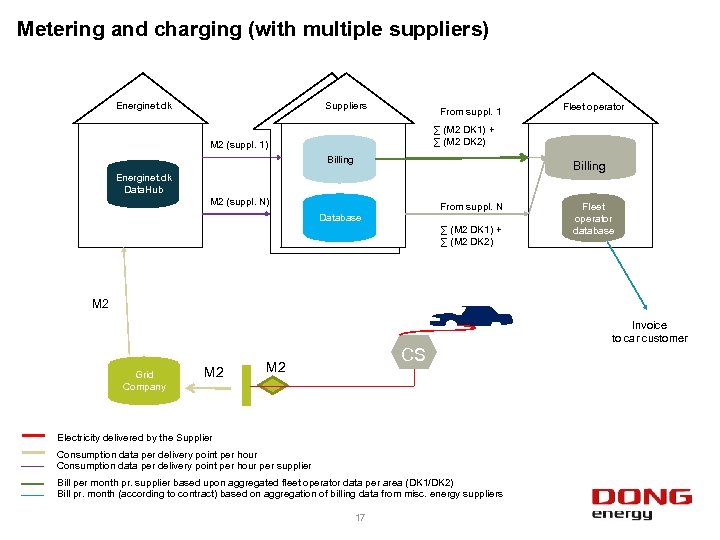

Metering and charging (with multiple suppliers) Energinet. dk Suppliers From suppl. 1 Fleet operator ∑ (M 2 DK 1) + ∑ (M 2 DK 2) M 2 (suppl. 1) Billing Energinet. dk Data. Hub M 2 (suppl. N) From suppl. N Database ∑ (M 2 DK 1) + ∑ (M 2 DK 2) Fleet operator database M 2 Grid Company M 2 CS M 2 Electricity delivered by the Supplier Consumption data per delivery point per hour per supplier Bill per month pr. supplier based upon aggregated fleet operator data per area (DK 1/DK 2) Bill pr. month (according to contract) based on aggregation of billing data from misc. energy suppliers 17 Invoice to car customer

e1ba0fc7d99673e308ecdd6b866314cb.ppt