e88ebd0057a3a604eb58834489bf0395.ppt

- Количество слайдов: 35

Practice in managing risk. Case studies – petroleum & energy industry 10 jubileuszowa konferencja POLRISK 2017 Maja Šušteršič, M. Sc. , October 24 th, 2017

Practice in managing risk. Case studies – petroleum & energy industry 10 jubileuszowa konferencja POLRISK 2017 Maja Šušteršič, M. Sc. , October 24 th, 2017

Contents 1. 2. 3. 4. 5. The Petrol Group Organisation today Development of insurance risk management Working with broker Conclusions 2

Contents 1. 2. 3. 4. 5. The Petrol Group Organisation today Development of insurance risk management Working with broker Conclusions 2

1. THE PETROL GROUP

1. THE PETROL GROUP

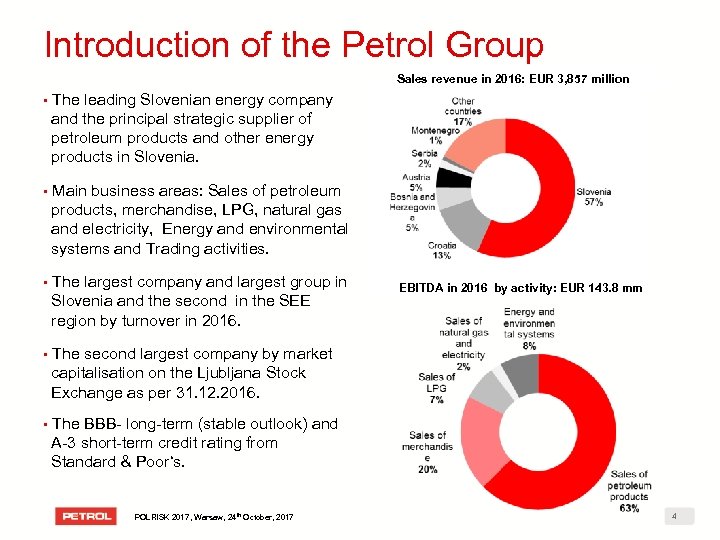

Introduction of the Petrol Group Sales revenue in 2016: EUR 3, 857 million § The leading Slovenian energy company and the principal strategic supplier of petroleum products and other energy products in Slovenia. § Main business areas: Sales of petroleum products, merchandise, LPG, natural gas and electricity, Energy and environmental systems and Trading activities. § The largest company and largest group in Slovenia and the second in the SEE region by turnover in 2016. § The second largest company by market capitalisation on the Ljubljana Stock Exchange as per 31. 12. 2016. § The BBB- long-term (stable outlook) and A-3 short-term credit rating from Standard & Poor‘s. POLRISK 2017, Warsaw, 24 th October, 2017 EBITDA in 2016 by activity: EUR 143. 8 mm 4

Introduction of the Petrol Group Sales revenue in 2016: EUR 3, 857 million § The leading Slovenian energy company and the principal strategic supplier of petroleum products and other energy products in Slovenia. § Main business areas: Sales of petroleum products, merchandise, LPG, natural gas and electricity, Energy and environmental systems and Trading activities. § The largest company and largest group in Slovenia and the second in the SEE region by turnover in 2016. § The second largest company by market capitalisation on the Ljubljana Stock Exchange as per 31. 12. 2016. § The BBB- long-term (stable outlook) and A-3 short-term credit rating from Standard & Poor‘s. POLRISK 2017, Warsaw, 24 th October, 2017 EBITDA in 2016 by activity: EUR 143. 8 mm 4

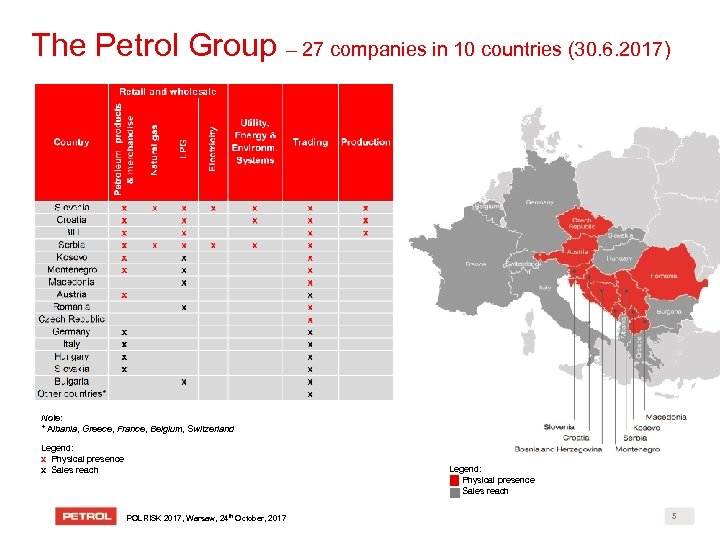

The Petrol Group – 27 companies in 10 countries (30. 6. 2017) Note: * Albania, Greece, France, Belgium, Switzerland Legend: x Physical presence x Sales reach Legend: Physical presence Sales reach POLRISK 2017, Warsaw, 24 th October, 2017 5

The Petrol Group – 27 companies in 10 countries (30. 6. 2017) Note: * Albania, Greece, France, Belgium, Switzerland Legend: x Physical presence x Sales reach Legend: Physical presence Sales reach POLRISK 2017, Warsaw, 24 th October, 2017 5

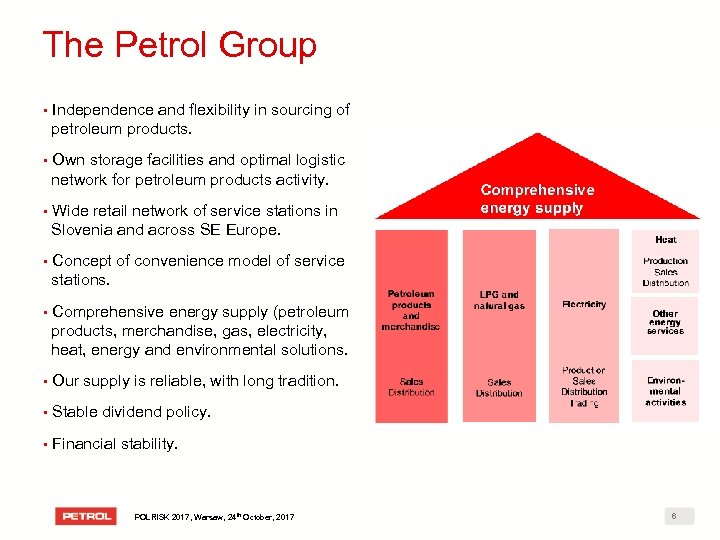

The Petrol Group § Independence and flexibility in sourcing of petroleum products. § Own storage facilities and optimal logistic network for petroleum products activity. § Wide retail network of service stations in Slovenia and across SE Europe. § Concept of convenience model of service stations. § Comprehensive energy supply (petroleum products, merchandise, gas, electricity, heat, energy and environmental solutions. § Our supply is reliable, with long tradition. § Stable dividend policy. § Financial stability. POLRISK 2017, Warsaw, 24 th October, 2017 6

The Petrol Group § Independence and flexibility in sourcing of petroleum products. § Own storage facilities and optimal logistic network for petroleum products activity. § Wide retail network of service stations in Slovenia and across SE Europe. § Concept of convenience model of service stations. § Comprehensive energy supply (petroleum products, merchandise, gas, electricity, heat, energy and environmental solutions. § Our supply is reliable, with long tradition. § Stable dividend policy. § Financial stability. POLRISK 2017, Warsaw, 24 th October, 2017 6

The Petrol Group – Petroleum products sale § 3. 2 million tons of petroleum products sold in 2016 § 93% of service stations are company owned. § Market share by number of service stations: § § § #1 in Slovenia with 57%; #2 in Croatia with 12%; #6 in Bosnia & Herzegovina with 3%; #10 in Serbia with 0. 8%; #3 in Montenegro with 9%; #6 in Kosovo with 1% (source: Petrol). POLRISK 2017, Warsaw, 24 th October, 2017 7

The Petrol Group – Petroleum products sale § 3. 2 million tons of petroleum products sold in 2016 § 93% of service stations are company owned. § Market share by number of service stations: § § § #1 in Slovenia with 57%; #2 in Croatia with 12%; #6 in Bosnia & Herzegovina with 3%; #10 in Serbia with 0. 8%; #3 in Montenegro with 9%; #6 in Kosovo with 1% (source: Petrol). POLRISK 2017, Warsaw, 24 th October, 2017 7

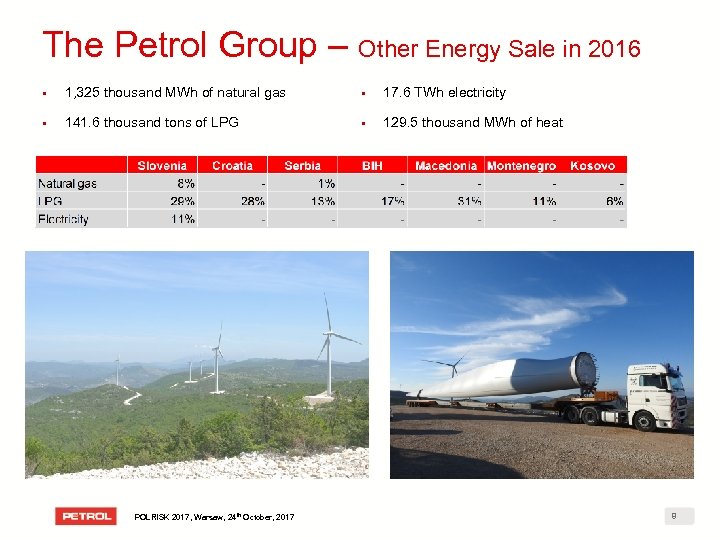

The Petrol Group – Other Energy Sale in 2016 § 1, 325 thousand MWh of natural gas § 17. 6 TWh electricity § 141. 6 thousand tons of LPG § 129. 5 thousand MWh of heat POLRISK 2017, Warsaw, 24 th October, 2017 8

The Petrol Group – Other Energy Sale in 2016 § 1, 325 thousand MWh of natural gas § 17. 6 TWh electricity § 141. 6 thousand tons of LPG § 129. 5 thousand MWh of heat POLRISK 2017, Warsaw, 24 th October, 2017 8

Key Strategic Orientations Petrol‘s mission Through a comprehensive range of modern energy and environmental solutions, the Petrol Group will continue to ensure a reliable, economical and environmentally friendly supply and help build a low-carbon society in co-operation with its partners. Petrol‘s vision to become a leading regional player in energy and energy-related services in terms of revenue, § to be recognised as a major provider of smart solutions for homes, mobility and business, § to use innovativeness and digital solutions to develop successful new business models and partnerships, § to provide an excellent user experience and increase the number of items sold per customer. § Strategic orientations – strategic themes Balance between stable operations and development aimed at addressing new challenges. Higher sales and transition to new business models. Process efficiency and risk management. POLRISK 2017, Warsaw, 24 th October, 2017 9

Key Strategic Orientations Petrol‘s mission Through a comprehensive range of modern energy and environmental solutions, the Petrol Group will continue to ensure a reliable, economical and environmentally friendly supply and help build a low-carbon society in co-operation with its partners. Petrol‘s vision to become a leading regional player in energy and energy-related services in terms of revenue, § to be recognised as a major provider of smart solutions for homes, mobility and business, § to use innovativeness and digital solutions to develop successful new business models and partnerships, § to provide an excellent user experience and increase the number of items sold per customer. § Strategic orientations – strategic themes Balance between stable operations and development aimed at addressing new challenges. Higher sales and transition to new business models. Process efficiency and risk management. POLRISK 2017, Warsaw, 24 th October, 2017 9

2. ORGANISATIO N

2. ORGANISATIO N

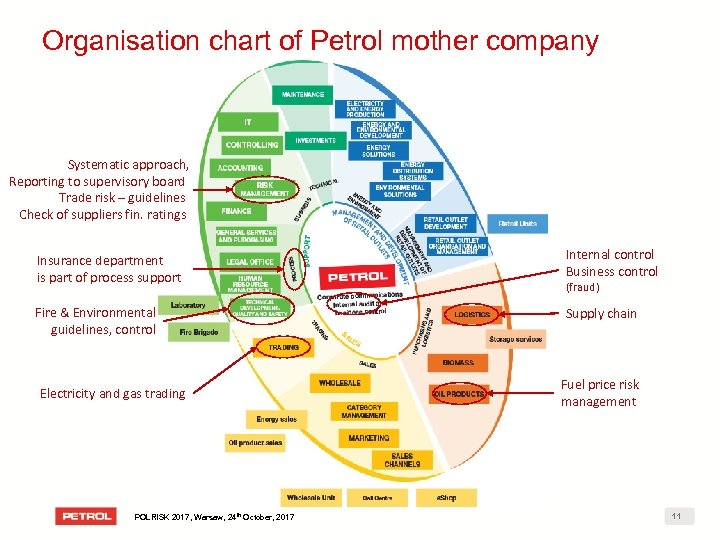

Organisation chart of Petrol mother company Systematic approach, Reporting to supervisory board Trade risk – guidelines Check of suppliers fin. ratings Insurance department is part of process support Internal control Business control Fire & Environmental guidelines, control Supply chain Electricity and gas trading POLRISK 2017, Warsaw, 24 th October, 2017 (fraud) Fuel price risk management 11

Organisation chart of Petrol mother company Systematic approach, Reporting to supervisory board Trade risk – guidelines Check of suppliers fin. ratings Insurance department is part of process support Internal control Business control Fire & Environmental guidelines, control Supply chain Electricity and gas trading POLRISK 2017, Warsaw, 24 th October, 2017 (fraud) Fuel price risk management 11

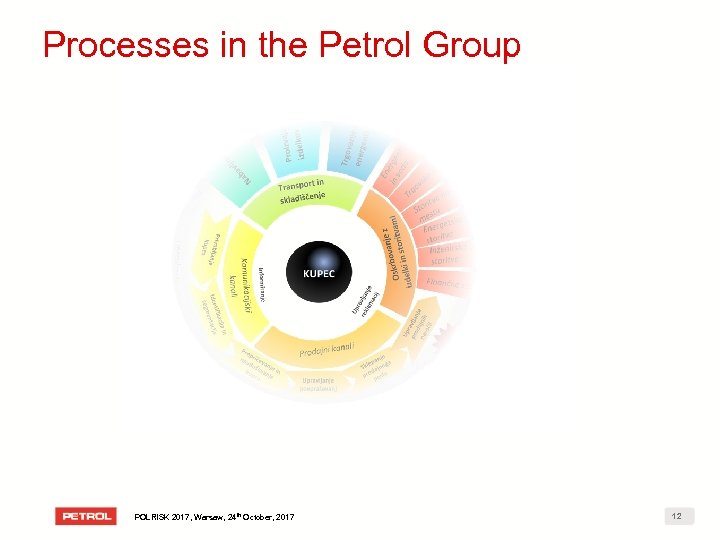

Processes in the Petrol Group POLRISK 2017, Warsaw, 24 th October, 2017 12

Processes in the Petrol Group POLRISK 2017, Warsaw, 24 th October, 2017 12

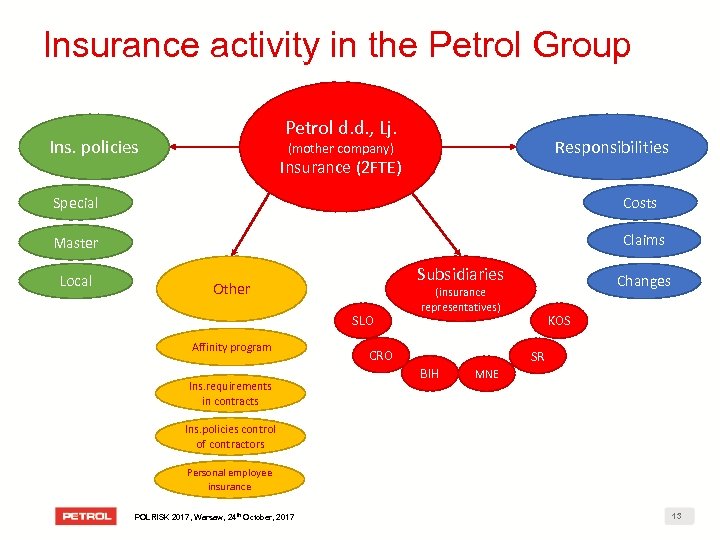

Insurance activity in the Petrol Group Petrol d. d. , Lj. Ins. policies Responsibilities (mother company) Insurance (2 FTE) Special Costs Master Claims Local Subsidiaries Other SLO Affinity program Ins. requirements in contracts Changes (insurance representatives) CRO KOS SR BIH MNE Ins. policies control of contractors Personal employee insurance POLRISK 2017, Warsaw, 24 th October, 2017 13

Insurance activity in the Petrol Group Petrol d. d. , Lj. Ins. policies Responsibilities (mother company) Insurance (2 FTE) Special Costs Master Claims Local Subsidiaries Other SLO Affinity program Ins. requirements in contracts Changes (insurance representatives) CRO KOS SR BIH MNE Ins. policies control of contractors Personal employee insurance POLRISK 2017, Warsaw, 24 th October, 2017 13

3. Development of insurance risk management

3. Development of insurance risk management

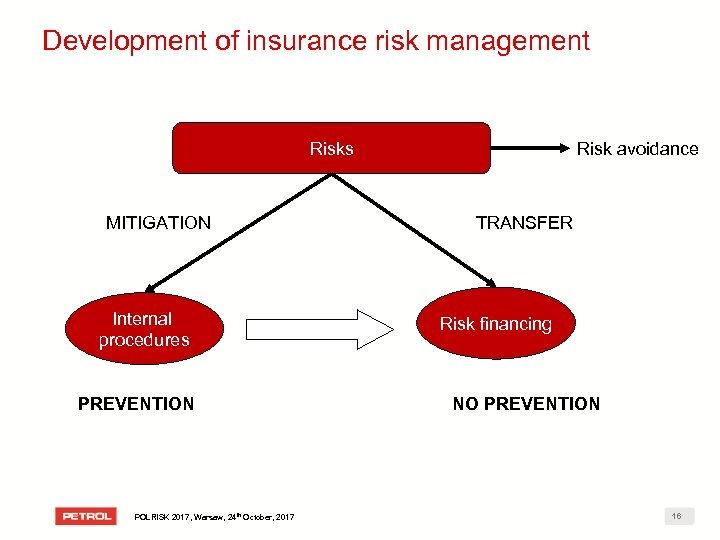

Development of insurance risk management Risk avoidance Risks MITIGATION Internal procedures PREVENTION POLRISK 2017, Warsaw, 24 th October, 2017 TRANSFER Risk financing NO PREVENTION 16

Development of insurance risk management Risk avoidance Risks MITIGATION Internal procedures PREVENTION POLRISK 2017, Warsaw, 24 th October, 2017 TRANSFER Risk financing NO PREVENTION 16

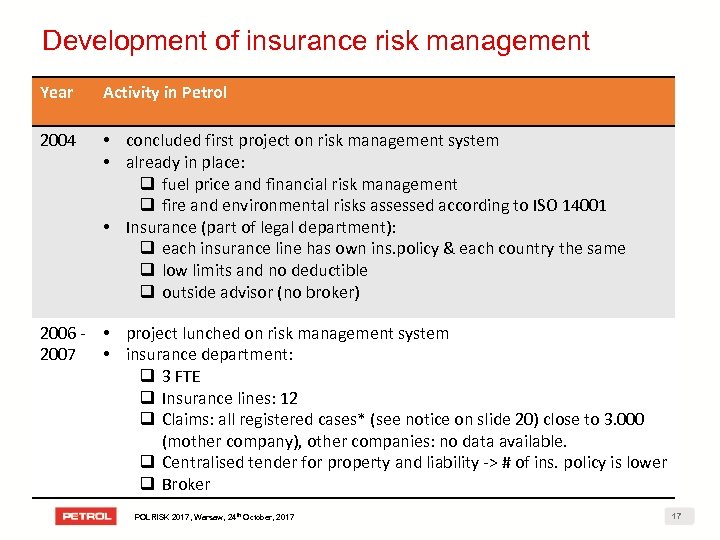

Development of insurance risk management Year Activity in Petrol 2004 • concluded first project on risk management system • already in place: q fuel price and financial risk management q fire and environmental risks assessed according to ISO 14001 • Insurance (part of legal department): q each insurance line has own ins. policy & each country the same q low limits and no deductible q outside advisor (no broker) 2006 - • project lunched on risk management system 2007 • insurance department: q 3 FTE q Insurance lines: 12 q Claims: all registered cases* (see notice on slide 20) close to 3. 000 (mother company), other companies: no data available. q Centralised tender for property and liability -> # of ins. policy is lower q Broker POLRISK 2017, Warsaw, 24 th October, 2017 17

Development of insurance risk management Year Activity in Petrol 2004 • concluded first project on risk management system • already in place: q fuel price and financial risk management q fire and environmental risks assessed according to ISO 14001 • Insurance (part of legal department): q each insurance line has own ins. policy & each country the same q low limits and no deductible q outside advisor (no broker) 2006 - • project lunched on risk management system 2007 • insurance department: q 3 FTE q Insurance lines: 12 q Claims: all registered cases* (see notice on slide 20) close to 3. 000 (mother company), other companies: no data available. q Centralised tender for property and liability -> # of ins. policy is lower q Broker POLRISK 2017, Warsaw, 24 th October, 2017 17

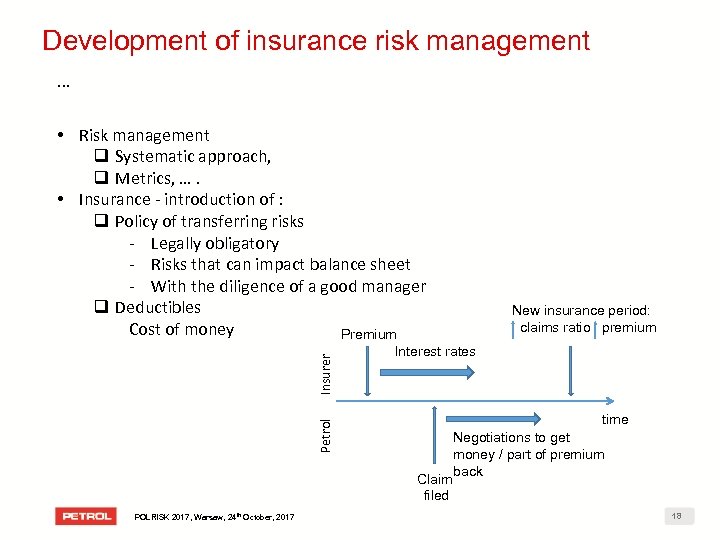

Development of insurance risk management … time Claim filed POLRISK 2017, Warsaw, 24 th October, 2017 New insurance period: claims ratio premium Interest rates Petrol Insurer • Risk management q Systematic approach, q Metrics, …. • Insurance - introduction of : q Policy of transferring risks - Legally obligatory - Risks that can impact balance sheet - With the diligence of a good manager q Deductibles Cost of money Premium Negotiations to get money / part of premium back 18

Development of insurance risk management … time Claim filed POLRISK 2017, Warsaw, 24 th October, 2017 New insurance period: claims ratio premium Interest rates Petrol Insurer • Risk management q Systematic approach, q Metrics, …. • Insurance - introduction of : q Policy of transferring risks - Legally obligatory - Risks that can impact balance sheet - With the diligence of a good manager q Deductibles Cost of money Premium Negotiations to get money / part of premium back 18

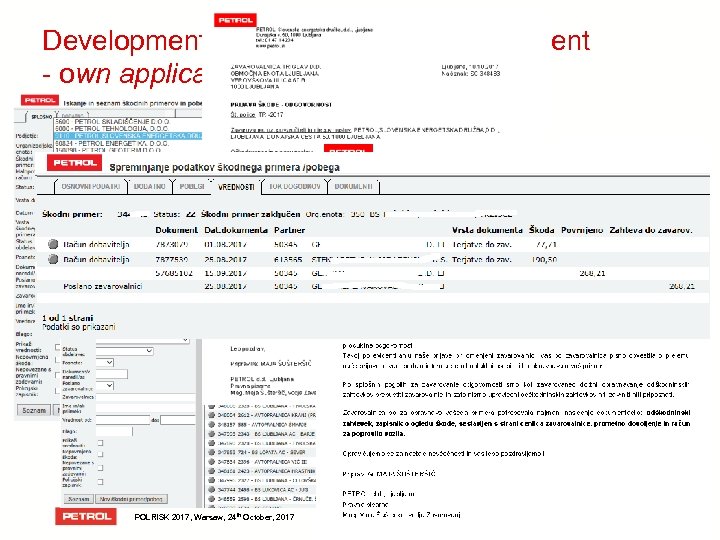

Development of insurance risk management … • Risk management q Systematic approach, q Metrics, …. • Insurance - introduction of : q Policy of transferring risks q Deductibles q Claims application - Better analytics - Understanding of claims - Control and immediate reaction – improvements how to manage risk on the operational level - Independence (broker, insurer) - Negotiation position POLRISK 2017, Warsaw, 24 th October, 2017 19

Development of insurance risk management … • Risk management q Systematic approach, q Metrics, …. • Insurance - introduction of : q Policy of transferring risks q Deductibles q Claims application - Better analytics - Understanding of claims - Control and immediate reaction – improvements how to manage risk on the operational level - Independence (broker, insurer) - Negotiation position POLRISK 2017, Warsaw, 24 th October, 2017 19

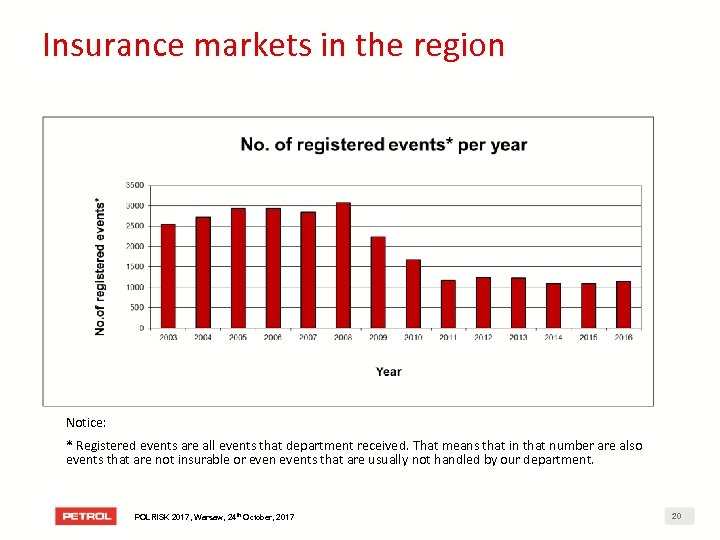

Insurance markets in the region Notice: * Registered events are all events that department received. That means that in that number are also events that are not insurable or events that are usually not handled by our department. POLRISK 2017, Warsaw, 24 th October, 2017 20

Insurance markets in the region Notice: * Registered events are all events that department received. That means that in that number are also events that are not insurable or events that are usually not handled by our department. POLRISK 2017, Warsaw, 24 th October, 2017 20

Development of insurance risk management - own application for claims management POLRISK 2017, Warsaw, 24 th October, 2017 21

Development of insurance risk management - own application for claims management POLRISK 2017, Warsaw, 24 th October, 2017 21

Development of insurance risk management - own application for claims management POLRISK 2017, Warsaw, 24 th October, 2017 22

Development of insurance risk management - own application for claims management POLRISK 2017, Warsaw, 24 th October, 2017 22

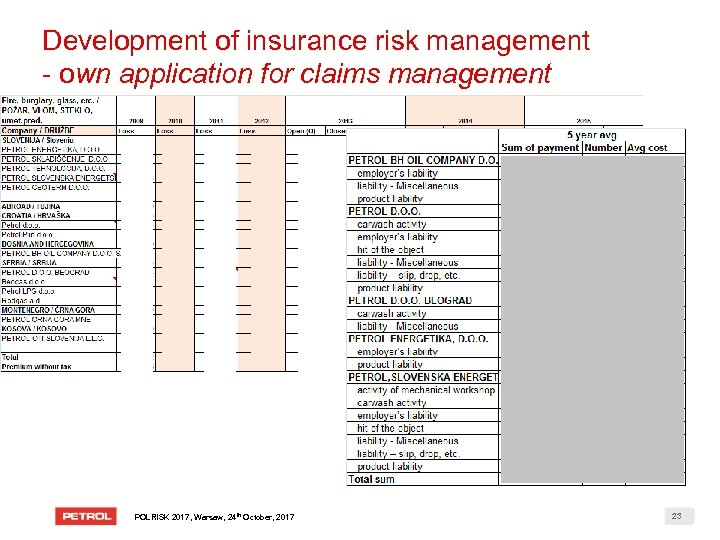

Development of insurance risk management - own application for claims management POLRISK 2017, Warsaw, 24 th October, 2017 23

Development of insurance risk management - own application for claims management POLRISK 2017, Warsaw, 24 th October, 2017 23

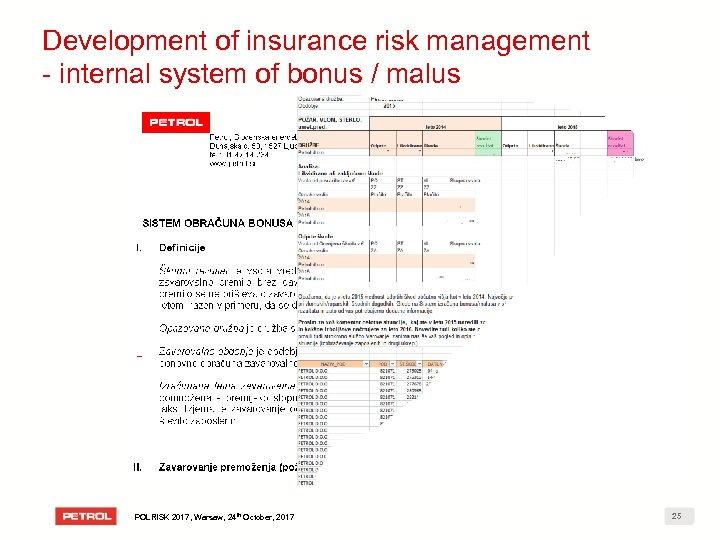

Development of insurance risk management … • Risk management q Systematic approach, q Metrics, …. • Insurance - introduction of : q Policy of transferring risks q Deductibles q Claims application, q Regular meetings with retail & warehouses – risk awareness, q Internal policies and instructions, q Internal system of bonus / malus – risk improvement approach POLRISK 2017, Warsaw, 24 th October, 2017 24

Development of insurance risk management … • Risk management q Systematic approach, q Metrics, …. • Insurance - introduction of : q Policy of transferring risks q Deductibles q Claims application, q Regular meetings with retail & warehouses – risk awareness, q Internal policies and instructions, q Internal system of bonus / malus – risk improvement approach POLRISK 2017, Warsaw, 24 th October, 2017 24

Development of insurance risk management - internal system of bonus / malus POLRISK 2017, Warsaw, 24 th October, 2017 25

Development of insurance risk management - internal system of bonus / malus POLRISK 2017, Warsaw, 24 th October, 2017 25

Development of insurance risk management … • Risk management q Systematic approach, q Metrics, …. • Insurance - introduction of : q Policy of transferring risks q Deductibles q Claims application q Regular meetings with retail & warehouses – risk awareness q Internal policies and instructions q Internal system of bonus / malus – risk improvement approach q BCP (pandemic flu, fuel logistics) – understanding what insurance coverage we need for PDBI q Rising awareness of risks in contracts Guarantee OR product liability insurance Liability (contract, damage) vs. Liability insurance clause q Benchmarking (ins. program) & researching/learning by others incidents POLRISK 2017, Warsaw, 24 th October, 2017 26

Development of insurance risk management … • Risk management q Systematic approach, q Metrics, …. • Insurance - introduction of : q Policy of transferring risks q Deductibles q Claims application q Regular meetings with retail & warehouses – risk awareness q Internal policies and instructions q Internal system of bonus / malus – risk improvement approach q BCP (pandemic flu, fuel logistics) – understanding what insurance coverage we need for PDBI q Rising awareness of risks in contracts Guarantee OR product liability insurance Liability (contract, damage) vs. Liability insurance clause q Benchmarking (ins. program) & researching/learning by others incidents POLRISK 2017, Warsaw, 24 th October, 2017 26

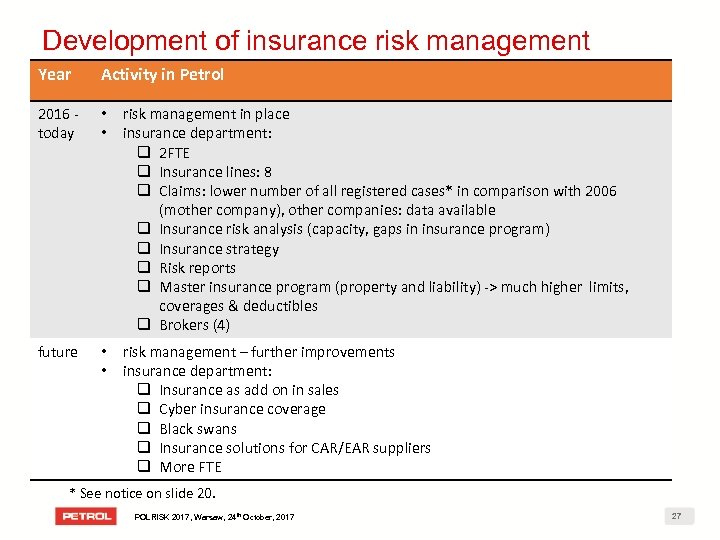

Development of insurance risk management Year Activity in Petrol 2016 today • • risk management in place insurance department: q 2 FTE q Insurance lines: 8 q Claims: lower number of all registered cases* in comparison with 2006 (mother company), other companies: data available q Insurance risk analysis (capacity, gaps in insurance program) q Insurance strategy q Risk reports q Master insurance program (property and liability) -> much higher limits, coverages & deductibles q Brokers (4) future • • risk management – further improvements insurance department: q Insurance as add on in sales q Cyber insurance coverage q Black swans q Insurance solutions for CAR/EAR suppliers q More FTE * See notice on slide 20. POLRISK 2017, Warsaw, 24 th October, 2017 27

Development of insurance risk management Year Activity in Petrol 2016 today • • risk management in place insurance department: q 2 FTE q Insurance lines: 8 q Claims: lower number of all registered cases* in comparison with 2006 (mother company), other companies: data available q Insurance risk analysis (capacity, gaps in insurance program) q Insurance strategy q Risk reports q Master insurance program (property and liability) -> much higher limits, coverages & deductibles q Brokers (4) future • • risk management – further improvements insurance department: q Insurance as add on in sales q Cyber insurance coverage q Black swans q Insurance solutions for CAR/EAR suppliers q More FTE * See notice on slide 20. POLRISK 2017, Warsaw, 24 th October, 2017 27

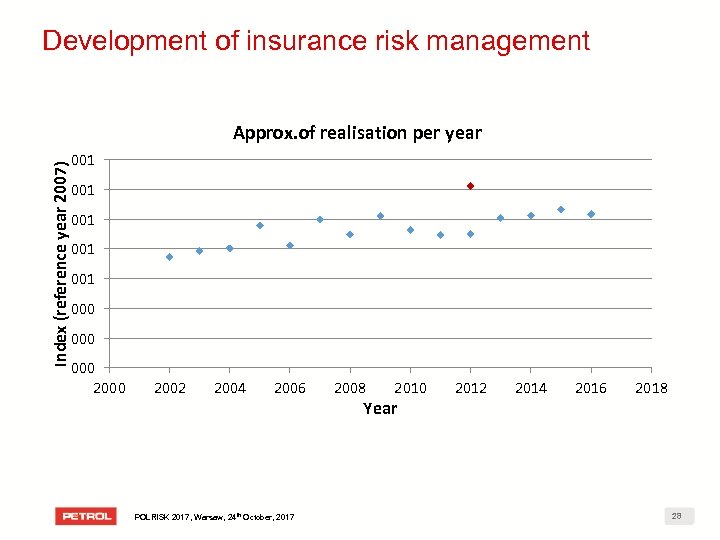

Development of insurance risk management Index (reference year 2007) Approx. of realisation per year 001 001 001 000 000 2002 2004 2006 POLRISK 2017, Warsaw, 24 th October, 2017 2008 2010 Year 2012 2014 2016 2018 28

Development of insurance risk management Index (reference year 2007) Approx. of realisation per year 001 001 001 000 000 2002 2004 2006 POLRISK 2017, Warsaw, 24 th October, 2017 2008 2010 Year 2012 2014 2016 2018 28

4. WORKING WITH BROKER

4. WORKING WITH BROKER

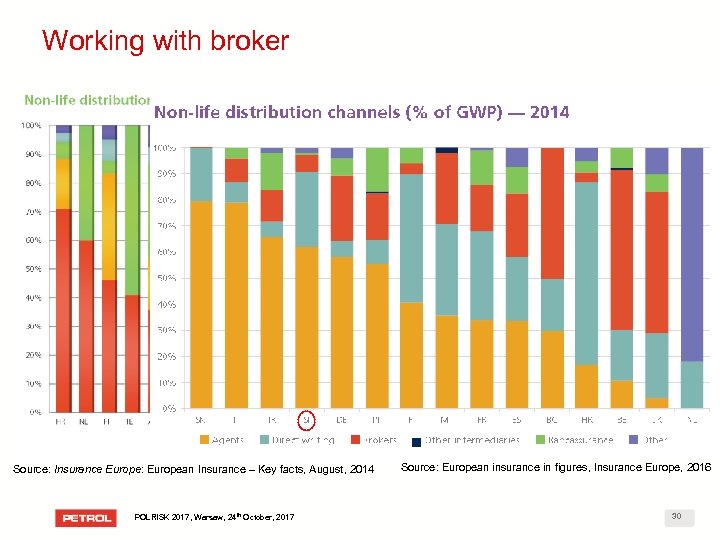

Working with broker Source: Insurance Europe: European Insurance – Key facts, August, 2014 POLRISK 2017, Warsaw, 24 th October, 2017 Source: European insurance in figures, Insurance Europe, 2016 30

Working with broker Source: Insurance Europe: European Insurance – Key facts, August, 2014 POLRISK 2017, Warsaw, 24 th October, 2017 Source: European insurance in figures, Insurance Europe, 2016 30

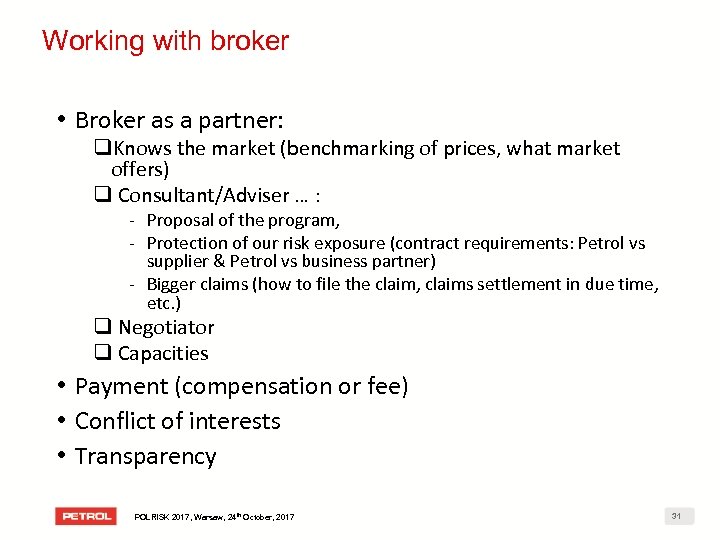

Working with broker • Broker as a partner: q. Knows the market (benchmarking of prices, what market offers) q Consultant/Adviser … : - Proposal of the program, - Protection of our risk exposure (contract requirements: Petrol vs supplier & Petrol vs business partner) - Bigger claims (how to file the claim, claims settlement in due time, etc. ) q Negotiator q Capacities • Payment (compensation or fee) • Conflict of interests • Transparency POLRISK 2017, Warsaw, 24 th October, 2017 31

Working with broker • Broker as a partner: q. Knows the market (benchmarking of prices, what market offers) q Consultant/Adviser … : - Proposal of the program, - Protection of our risk exposure (contract requirements: Petrol vs supplier & Petrol vs business partner) - Bigger claims (how to file the claim, claims settlement in due time, etc. ) q Negotiator q Capacities • Payment (compensation or fee) • Conflict of interests • Transparency POLRISK 2017, Warsaw, 24 th October, 2017 31

Working with broker • Do the tender. • Express what you expect from broker. What tasks should be done Professional experience Soft skills • Ask for full transparency and disclosure of all sources of income for insurance intermediary in connection with business done with you. (problem is reinsurance part) • Work on your professionalism as well. • Be involved. POLRISK 2017, Warsaw, 24 th October, 2017 32

Working with broker • Do the tender. • Express what you expect from broker. What tasks should be done Professional experience Soft skills • Ask for full transparency and disclosure of all sources of income for insurance intermediary in connection with business done with you. (problem is reinsurance part) • Work on your professionalism as well. • Be involved. POLRISK 2017, Warsaw, 24 th October, 2017 32

5. CONCLUSION S

5. CONCLUSION S

Conclusions • You will get as much as you are prepared to devote your time to insurance risk management. • Big/medium companies: Broker alone can not solve your problem, he needs insurance manager. • Medium/small companies: Broker can be your insurance manager. At the end of the day: You are a decision taker, be also a creator. POLRISK 2017, Warsaw, 24 th October, 2017 34

Conclusions • You will get as much as you are prepared to devote your time to insurance risk management. • Big/medium companies: Broker alone can not solve your problem, he needs insurance manager. • Medium/small companies: Broker can be your insurance manager. At the end of the day: You are a decision taker, be also a creator. POLRISK 2017, Warsaw, 24 th October, 2017 34

Q&A Petrol d. d. , Ljubljana Maja Šušteršič, M. Sc. Head of Insurance maja. sustersic@petrol. si +386 31 66 88 04 POLRISK 2017, Warsaw, 24 th October, 2017 35

Q&A Petrol d. d. , Ljubljana Maja Šušteršič, M. Sc. Head of Insurance maja. sustersic@petrol. si +386 31 66 88 04 POLRISK 2017, Warsaw, 24 th October, 2017 35

Recommended reading: AIRMIC guidelines: – Efficiency of Business Insurance, 2014 – Broker Tender Guide, 2015 POLRISK 2017, Warsaw, 24 th October, 2017 36

Recommended reading: AIRMIC guidelines: – Efficiency of Business Insurance, 2014 – Broker Tender Guide, 2015 POLRISK 2017, Warsaw, 24 th October, 2017 36