cc4785df415dab2fdc0e09686823a6c5.ppt

- Количество слайдов: 20

Practical and Business Implications of Basel 2 for UK Mortgage Lenders. Bruce T Porteous 29 April 2004 1

Important, but Exciting? 2

Basel Overview. l Basel 1 Objectives – Consistent minimum capital adequacy standard for banks worldwide. l Basel 2 Objectives – Better align capital with risk. • Regulatory capital arbitrage is harder. – Promote best risk management practice. l Timetable for Basel II – Basel Committee publishes final accord Summer 2004. – EU Capital Adequacy Directive adopted by end of 2005. – Transposition into national laws for implementation at 31/12/2006. – In practice, kicks in from 31/12/2008. 3

Basel II Overview. Key proposals: l 3 Pillar approach. l New capital charge for operational risk. l Market risk essentially unaltered. l Choice of basic versus advanced approaches. l Advanced approaches allow firms to hold less capital per unit of risk, versus basic approaches. l Waiver from basic methods requires a demonstration of threshold competency levels of: • Data volumes. • Quantitative risk management. • Systems and controls. 4

Pillar 1. l Minimum capital requirements. l Credit, Market, Operational. l Basic and advanced approaches. l Formulaic. 5

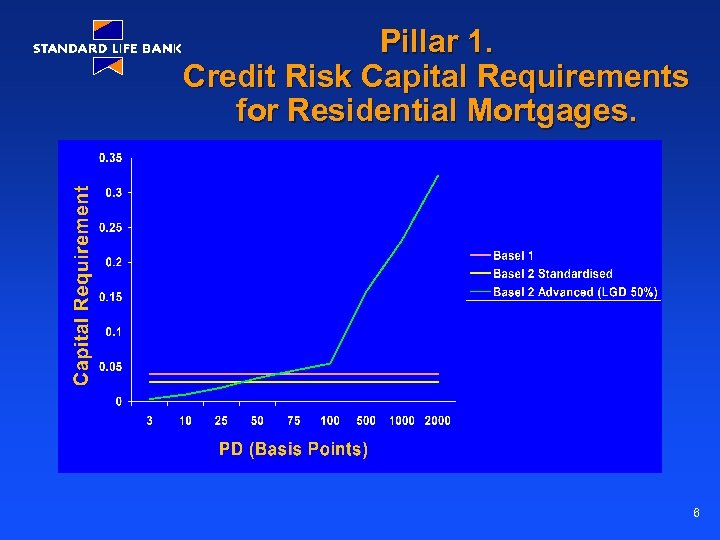

Pillar 1. Credit Risk Capital Requirements for Residential Mortgages. 6

Pillar 1. Practical Implications. l l l l Clear capital incentive to get onto advanced credit approaches. Operational risk still generally unclear. FSA waiver requirements (CP 189) look onerous, bureaucratic and unclear. Need to be compliant by 31/12/2004 (advanced retail credit). Big bank advantage (more resources and “data”). But capital win is mainly retail. Banks with clean data, good MIS, integrated IT systems should also be well placed. 7

Pillar 1. Practical Implications. l Can the FSA cope with all of the firms who want on the advanced train? l Can the big banks book their tickets in advance? 8

Pillar 2. Supervisory Review. l l l Qualitative requirements. Basel 2 embedded in business as usual risk management processes (e. g. underwriting decision). The “use test”. Appropriate systems in place to: – – l Measure risk. Monitor risk. Manage risk. Report risk. Consistency of approach across supervisory regimes? 9

Pillar 2. Supervisory Review. l l Quantitative requirements. ICA process in place and business as usual. – ICA ~ economic capital, but loosely defined. – Risk targets set (consistent with controls and risk profile). – ICA covers: • Risks not captured by Pillar 1. • Internal risks not covered (banking book market risk). • External risks not covered (business cycle). l Consistency of approach across supervisory regimes? 10

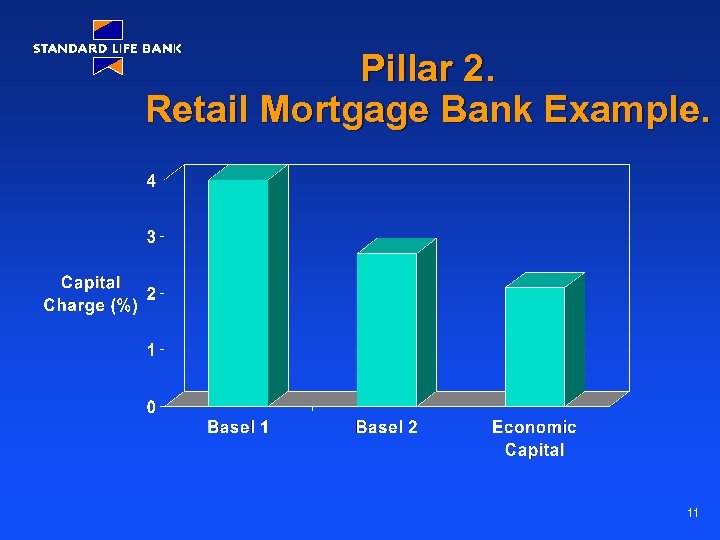

Pillar 2. Retail Mortgage Bank Example. 11

Pillar 3. l Risk exposures, risk assessment processes will be comparable across firms. l Market discipline will drive good practice. l Increased amount and frequency of disclosure. l Web based disclosure etc. 12

Securitisation. l l Basel 2 securitisation rules are still unclear and evolving. Under Basel 1, securitised mortgages require less capital than “on balance” sheet mortgages. Arbitrage possibility (plus additional funding source, of course). Some current business models securitise heavily. 13

Securitisation. l Basel 2 => – “on balance” sheet capital ~ securitised capital. l Securitisation allows Basel 2 benefits now. l Capital/funding management in the run up to Basel 2? l Long term future of RMB securities market? 14

Business Environment Impact. l Advanced approach banks will have a competitive advantage: – Higher ROC? – Cheaper mortgages? l Loan books of standardised firms may have more value to advanced banks (consolidation? ). l Retail business may become strategically more attractive (versus more risky types of banking activity). l Harder for new entrants, less innovation? 15

Demands on Lenders. l Increased workload: – Corporate governance, risk framework, internal reporting. – Data cleaning and analysis. IS impact. – Business as usual processes. – Interactions with FSA (waiver application). l l The market will expect the big banks to be on the advanced approaches. Most pressure on smaller firms. Can a standardised firm compete? 16

Costs and Benefits. l Costs. • • • l Group/Firm specific. Upgrade governance processes. Upgrade business processes. Data cleaning, consolidation and analysis. IS costs. Staff costs (numbers and skills). Benefits. • Best risk management practice. • Probable capital reduction benefit for retail lending. l Cost Benefit Analysis. • Likely to be favourable for mortgage lending. 17

Clear? 18

Conclusions. l Substantial and ongoing work by/from 31/12/2004 (for advanced credit risk approach). l Risk management should improve across the board. l More sophisticated (“big”? ) lenders favoured. l Increasing pressure on margins and smaller lenders. l Consolidation? l Future of securitisation markets? l End customers should win. 19

Questions? 20

cc4785df415dab2fdc0e09686823a6c5.ppt