624386615f98e45dbfe3537fbfd65ac9.ppt

- Количество слайдов: 23

PPP in Baltic States Mitigating Project Risks by Insurance Mark Courtneidge November 2006 Aon Limited is authorised and regulated by the Financial Services Authority in respect of insurance mediation activities only

Presenter • Mark Courtneidge BA(Hons), FCII, AIRM - Director • 29 years in insurance industry, 12 at Aon • Is responsible for the risk and insurance aspects of numerous projects in the UK and overseas – – • Project Allenby and Connaught UK Immigration and Prison Services A 130 A 55 Much of Mark’s vast experience has been gained within in house risk management

Aon London PPP Experience • UK – Approx 350 projects – All sectors – Concessionaires/Authority/Financiers • Overseas – South Africa – Japan – Poland – Holland – USA

Aon Worldwide • Primary Activities – – Risk Indentification & Analysis Risk Transfer & Management Insurance Solutions Claims & Loss Solutions • Corporate Numbers – – 120 countries 550 offices 46, 000 FTEs 9, 8 Bln USD revenue (‘ 05)

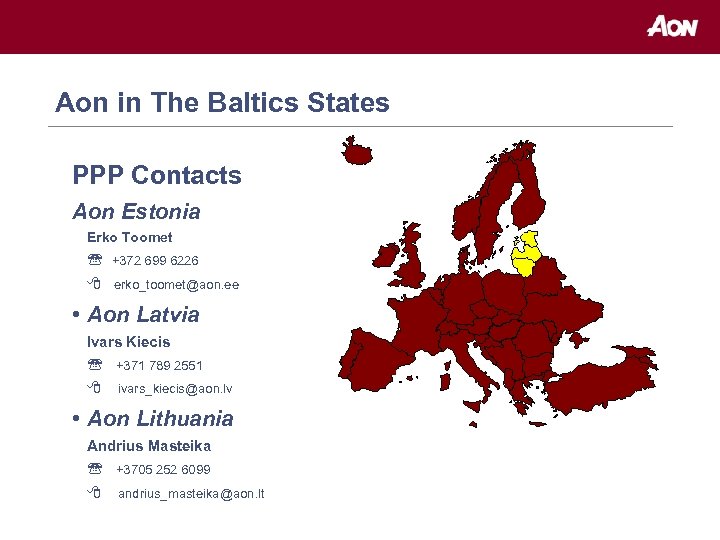

Aon in The Baltics States PPP Contacts Aon Estonia Erko Toomet +372 699 6226 erko_toomet@aon. ee • Aon Latvia Ivars Kiecis +371 789 2551 ivars_kiecis@aon. lv • Aon Lithuania Andrius Masteika +3705 252 6099 andrius_masteika@aon. lt

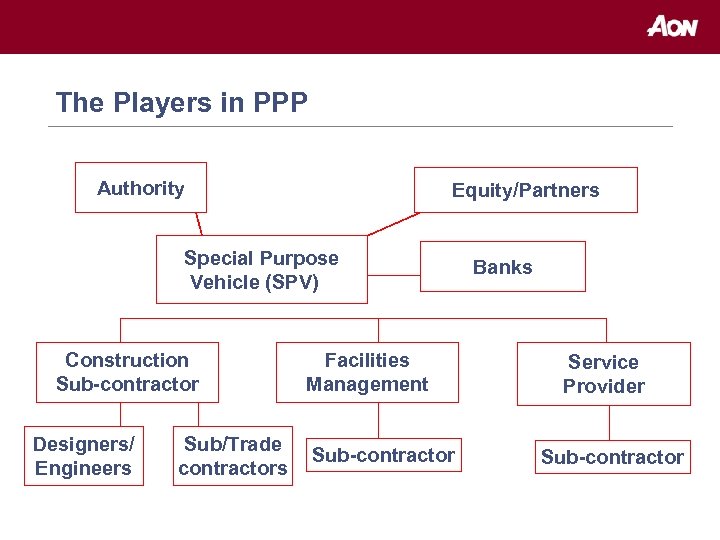

The Players in PPP Authority Equity/Partners Special Purpose Vehicle (SPV) Construction Sub-contractor Designers/ Engineers Sub/Trade contractors Facilities Management Sub-contractor Banks Service Provider Sub-contractor

Insurance as a Risk Management Tool • Identify Risk • Quantify Risk • Manage Risk: – Avoid – Control – Transfer: Insurance

Why Insure in PPP • SPV balance sheet/cash flow protection • Bank’s comfort and protection of their loan • Authority’s comfort that SPV can continue to operate in event of “defined” losses • Debate on PPP is risk transfer - Insurance provides this

Core Insurances Construction Phase • Contract Works • Construction Plant • Existing Assets • Marine Transit (Cargo) • Advanced Loss of Profits (works and cargo) • Third Party Liability • Professional Indemnity • Employers Liability • Motor

Core Insurances Operation Phase • Material Damage • Business Interruption • Third Party Liability • Employers Liability • Motor

Other Insurances • Environmental Impairment (Gradual) • Latent Defects (New Assets) • Directors & Officers Liability • Crime • Archaeological Finds • Keyman

Insurance Programme Design • Conformity with agreed requirements of – Concessionaire (SPV) – Authority – Financiers – Sub contractors • Broad Coverage • Insurer Security • Competitive Premiums • Longevity of Programme

PPP Contract/Loan Agreement Insurance Structure • Insurance Administration – To effect insurance – What if insurance is not available – Special Requirements of Authority &/or Banks • Details of Minimum Insurance Requirements – Construction Phase – Operational Phase

Special Requirements of Authorities &/or Banks • Non-vitiation • Subrogation waivers • Cross liability clauses • Loss payee requirements • Notification of changes • Minimum cancellation periods • Joint Named Insured • Acceptable Insurers Security • Brokers Letter of Undertaking • Third Party Claims Handling Rights • Right not to reinstate

Things To Watch Out For • Involving Insurance advisers too late • Unclear risk allocation and insurance requirements • Unrealistic insurance advice • Have all risks been fully considered and priced – eg. “As new” values on existing structures • Construction to Operation Gap • Are Changes catered for

Aon PPP Services Concessions • Risk Analysis • Advice on Contractual Risk Management • Risk and Insurance Negotiations • Design Insurance Programme • Place and Service Insurance Programme

Aon PPP Services Financiers & Authorities • Risk Analysis • Advice on Contractual Risk Management • Advice on Insurance Requirements • Risk and Insurance Negotiations • Audit Insurance Programme • Ongoing Monitoring

Aon Approach • Teamwork – Non adversarial – Experienced – Focused, project specific • Philosophy – Proactive – Practical • Worksteps – In depth knowledge of Project – In depth knowledge of Players – Risk matrix – Contract advice and negotiation

A 130 • Two separate phases • Construction plus 5 years minimum period • Cross class programme • Single Insurer Panel all classes Works DSU TPL Operational MD/BI/TPL EL Crime

HET • Specialist/unique vehicles • War zones risk – Vehicles – Drivers • Consequential loss on vehicles

Aspire • GBP 1 billion existing assets • GBP 1 billion new/refurbishment values • 11 year construction • Multiple sites • Project PI

South Tees • Major existing assets • Major new build • Multiple handovers • Multiple decants • Latent defects • Major variation order

Contact Should you require any further detailed information pertaining to any points in this presentation, please contact Aon’s offices in the Baltic Countries, and/or: Mark Courtneidge Natural Resources & Construction, London Tel: 44 207 086 4311 Mob: 44 7899668030 Email: mark. courtneidge@aon. co. uk Jaap Veenenbos Risk Consulting CEE Tel: 31 104487954 Mob: 31655798912 Email: Jaap_Veenenbos@aon. nl

624386615f98e45dbfe3537fbfd65ac9.ppt