01b6dbedaf68716f27677b00684d6335.ppt

- Количество слайдов: 27

Powered to Fly High IR meeting – June’ 2010 Slide no. 1

Powered to Fly High IR meeting – June’ 2010 Slide no. 1

Structure of presentation q TVS Group q Industry outlook q TVSM : Poised for quality growth IR meeting – June’ 2010 Slide no. 2

Structure of presentation q TVS Group q Industry outlook q TVSM : Poised for quality growth IR meeting – June’ 2010 Slide no. 2

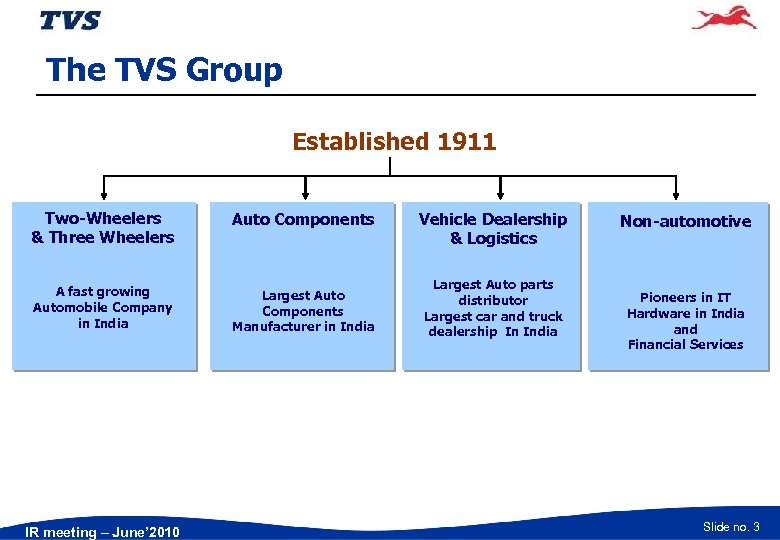

The TVS Group Established 1911 Two-Wheelers & Three Wheelers Auto Components A fast growing Automobile Company in India Largest Auto Components Manufacturer in India IR meeting – June’ 2010 Vehicle Dealership & Logistics Largest Auto parts distributor Largest car and truck dealership In India Non-automotive Pioneers in IT Hardware in India and Financial Services Slide no. 3

The TVS Group Established 1911 Two-Wheelers & Three Wheelers Auto Components A fast growing Automobile Company in India Largest Auto Components Manufacturer in India IR meeting – June’ 2010 Vehicle Dealership & Logistics Largest Auto parts distributor Largest car and truck dealership In India Non-automotive Pioneers in IT Hardware in India and Financial Services Slide no. 3

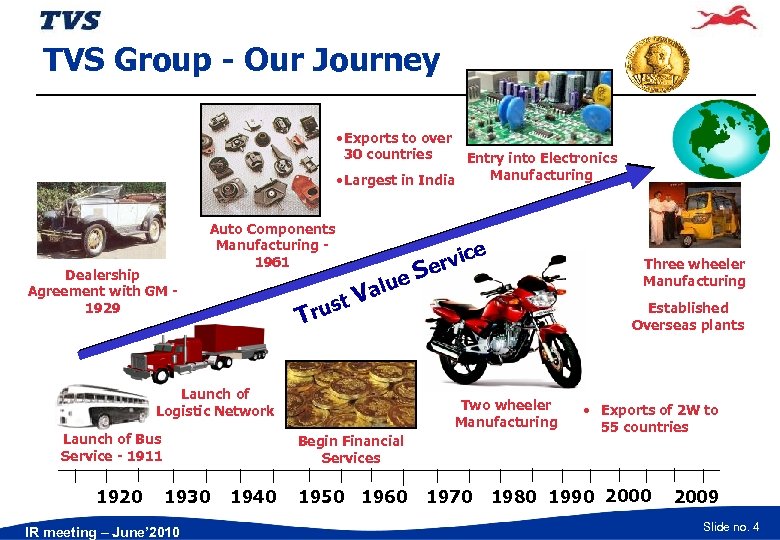

TVS Group - Our Journey • Exports to over 30 countries Entry into Electronics Manufacturing • Largest in India Dealership Agreement with GM 1929 Auto Components Manufacturing 1961 t rus T e e alu V Launch of Logistic Network Launch of Bus Service - 1911 1920 ic erv S Established Overseas plants Two wheeler Manufacturing Begin Financial Services 1930 IR meeting – June’ 2010 1940 Three wheeler Manufacturing 1950 1960 1970 • Exports of 2 W to 55 countries 1980 1990 2009 Slide no. 4

TVS Group - Our Journey • Exports to over 30 countries Entry into Electronics Manufacturing • Largest in India Dealership Agreement with GM 1929 Auto Components Manufacturing 1961 t rus T e e alu V Launch of Logistic Network Launch of Bus Service - 1911 1920 ic erv S Established Overseas plants Two wheeler Manufacturing Begin Financial Services 1930 IR meeting – June’ 2010 1940 Three wheeler Manufacturing 1950 1960 1970 • Exports of 2 W to 55 countries 1980 1990 2009 Slide no. 4

TVS Group - Awards & Recognition q Deming Quality Award C C C q Sundaram Clayton Brakes India TVS Motor Company Sundaram Brake Linings Lucas-TVS Japan Quality Medal C Sundaram Clayton q TPM Excellence awards C C Sundram Fasteners Brakes India TVS Motor Company Sundaram Auto Components Ltd IR meeting – June’ 2010 Slide no. 5

TVS Group - Awards & Recognition q Deming Quality Award C C C q Sundaram Clayton Brakes India TVS Motor Company Sundaram Brake Linings Lucas-TVS Japan Quality Medal C Sundaram Clayton q TPM Excellence awards C C Sundram Fasteners Brakes India TVS Motor Company Sundaram Auto Components Ltd IR meeting – June’ 2010 Slide no. 5

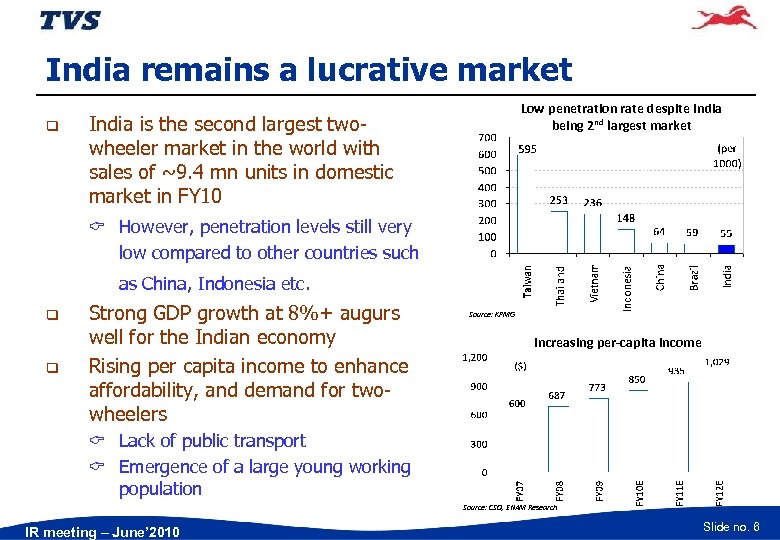

India remains a lucrative market q Low penetration rate despite India being 2 nd largest market India is the second largest twowheeler market in the world with sales of ~9. 4 mn units in domestic market in FY 10 C However, penetration levels still very low compared to other countries such as China, Indonesia etc. q q Strong GDP growth at 8%+ augurs well for the Indian economy Rising per capita income to enhance affordability, and demand for twowheelers Source: KPMG Increasing per-capita income C Lack of public transport C Emergence of a large young working population Source: CSO, ENAM Research IR meeting – June’ 2010 Slide no. 6

India remains a lucrative market q Low penetration rate despite India being 2 nd largest market India is the second largest twowheeler market in the world with sales of ~9. 4 mn units in domestic market in FY 10 C However, penetration levels still very low compared to other countries such as China, Indonesia etc. q q Strong GDP growth at 8%+ augurs well for the Indian economy Rising per capita income to enhance affordability, and demand for twowheelers Source: KPMG Increasing per-capita income C Lack of public transport C Emergence of a large young working population Source: CSO, ENAM Research IR meeting – June’ 2010 Slide no. 6

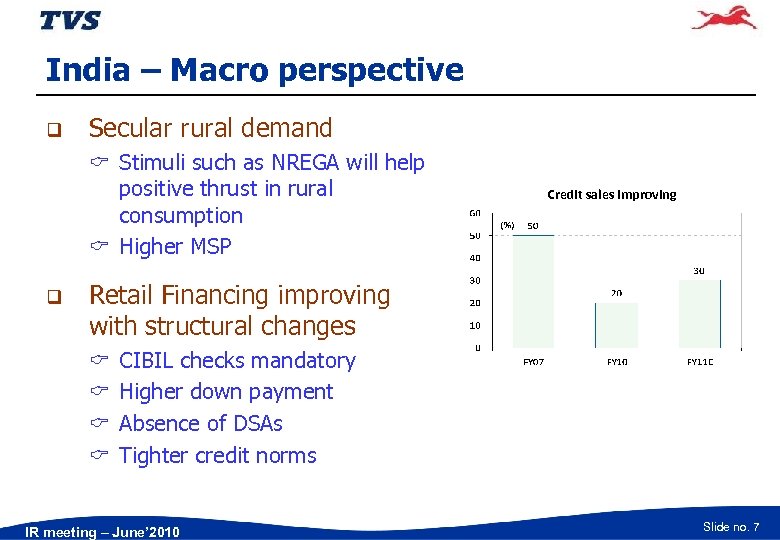

India – Macro perspective q Secular rural demand C Stimuli such as NREGA will help positive thrust in rural consumption C Higher MSP q Credit sales improving Retail Financing improving with structural changes C C CIBIL checks mandatory Higher down payment Absence of DSAs Tighter credit norms IR meeting – June’ 2010 Slide no. 7

India – Macro perspective q Secular rural demand C Stimuli such as NREGA will help positive thrust in rural consumption C Higher MSP q Credit sales improving Retail Financing improving with structural changes C C CIBIL checks mandatory Higher down payment Absence of DSAs Tighter credit norms IR meeting – June’ 2010 Slide no. 7

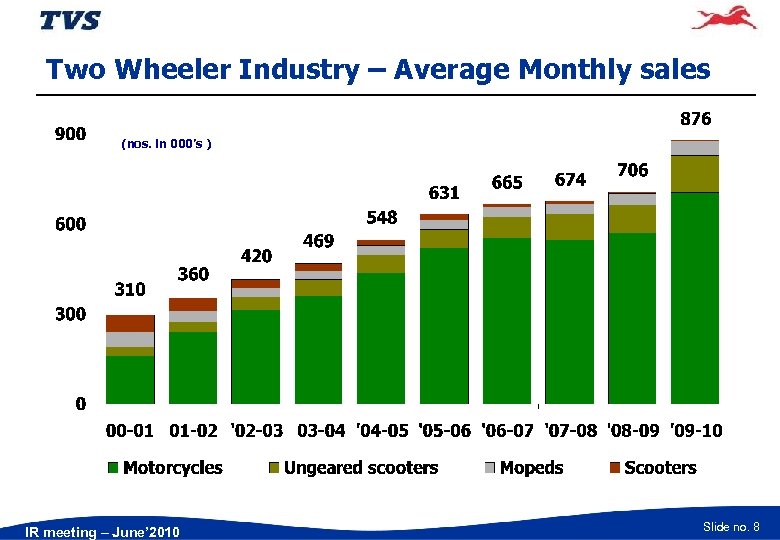

Two Wheeler Industry – Average Monthly sales (nos. in 000’s ) IR meeting – June’ 2010 Slide no. 8

Two Wheeler Industry – Average Monthly sales (nos. in 000’s ) IR meeting – June’ 2010 Slide no. 8

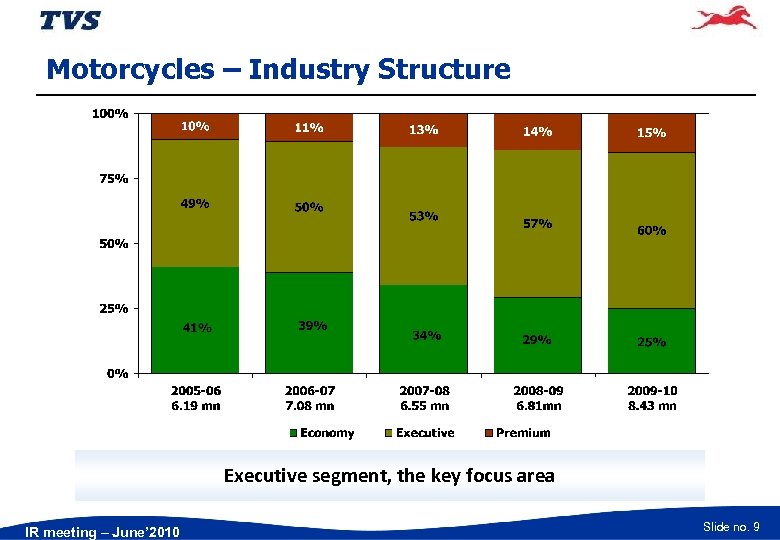

Motorcycles – Industry Structure Executive segment, the key focus area IR meeting – June’ 2010 Slide no. 9

Motorcycles – Industry Structure Executive segment, the key focus area IR meeting – June’ 2010 Slide no. 9

TVSM – poised for Quality growth IR meeting – June’ 2010 Slide no. 10

TVSM – poised for Quality growth IR meeting – June’ 2010 Slide no. 10

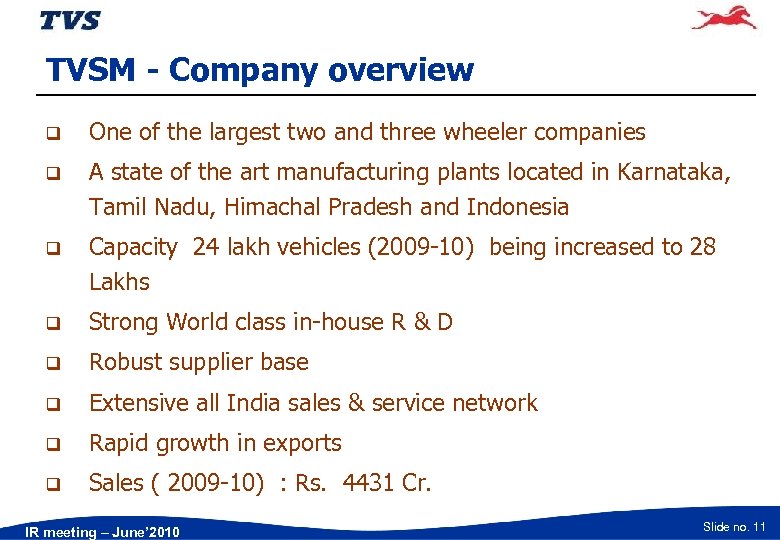

TVSM - Company overview q One of the largest two and three wheeler companies q A state of the art manufacturing plants located in Karnataka, Tamil Nadu, Himachal Pradesh and Indonesia q Capacity 24 lakh vehicles (2009 -10) being increased to 28 Lakhs q Strong World class in-house R & D q Robust supplier base q Extensive all India sales & service network q Rapid growth in exports q Sales ( 2009 -10) : Rs. 4431 Cr. IR meeting – June’ 2010 Slide no. 11

TVSM - Company overview q One of the largest two and three wheeler companies q A state of the art manufacturing plants located in Karnataka, Tamil Nadu, Himachal Pradesh and Indonesia q Capacity 24 lakh vehicles (2009 -10) being increased to 28 Lakhs q Strong World class in-house R & D q Robust supplier base q Extensive all India sales & service network q Rapid growth in exports q Sales ( 2009 -10) : Rs. 4431 Cr. IR meeting – June’ 2010 Slide no. 11

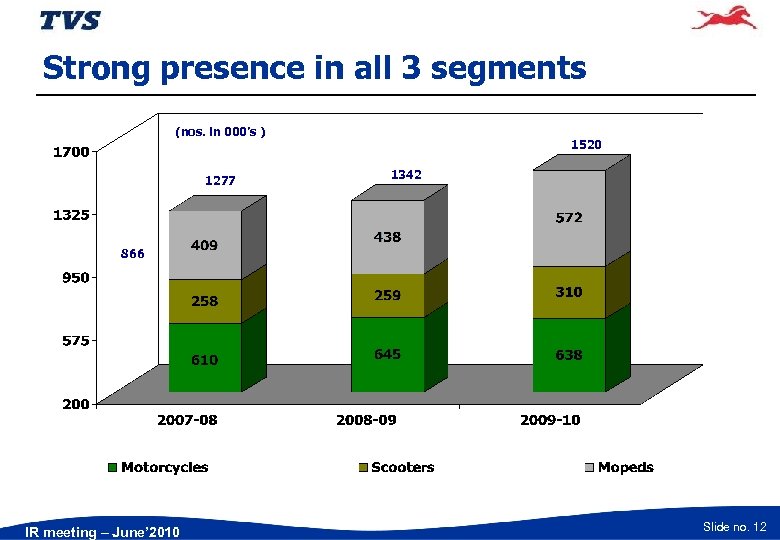

Strong presence in all 3 segments (nos. in 000’s ) 1277 1520 1342 866 IR meeting – June’ 2010 Slide no. 12

Strong presence in all 3 segments (nos. in 000’s ) 1277 1520 1342 866 IR meeting – June’ 2010 Slide no. 12

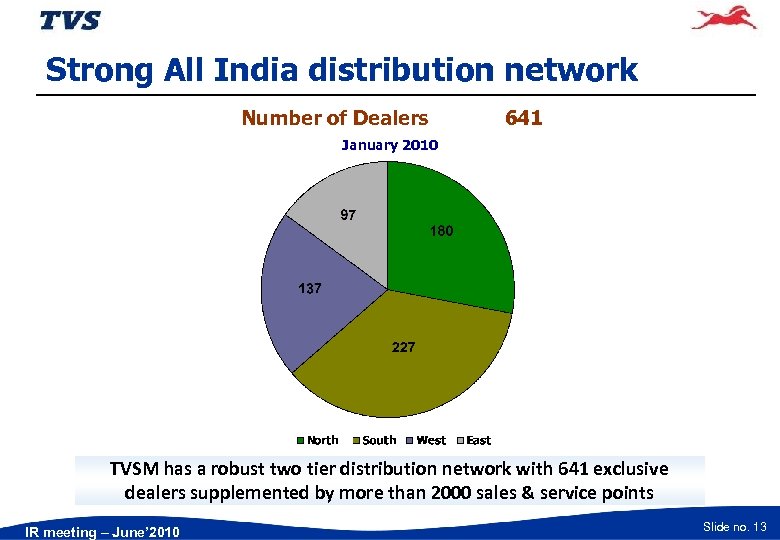

Strong All India distribution network Number of Dealers 641 January 2010 TVSM has a robust two tier distribution network with 641 exclusive dealers supplemented by more than 2000 sales & service points IR meeting – June’ 2010 Slide no. 13

Strong All India distribution network Number of Dealers 641 January 2010 TVSM has a robust two tier distribution network with 641 exclusive dealers supplemented by more than 2000 sales & service points IR meeting – June’ 2010 Slide no. 13

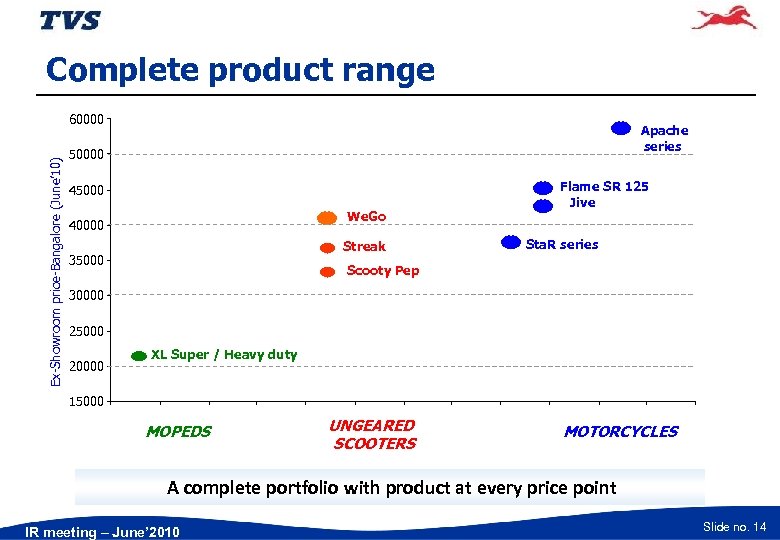

Complete product range Ex-Showroom price-Bangalore (June’ 10) 60000 Apache series 50000 45000 We. Go 40000 Streak 35000 Flame SR 125 Jive Sta. R series Scooty Pep 30000 25000 20000 XL Super / Heavy duty 15000 MOPEDS UNGEARED SCOOTERS MOTORCYCLES A complete portfolio with product at every price point IR meeting – June’ 2010 Slide no. 14

Complete product range Ex-Showroom price-Bangalore (June’ 10) 60000 Apache series 50000 45000 We. Go 40000 Streak 35000 Flame SR 125 Jive Sta. R series Scooty Pep 30000 25000 20000 XL Super / Heavy duty 15000 MOPEDS UNGEARED SCOOTERS MOTORCYCLES A complete portfolio with product at every price point IR meeting – June’ 2010 Slide no. 14

TVS Jive – 110 cc q q q India’s first auto clutch motorcycle Launched in April’ 10 with pan-India availability by June/ July’ 10 Positioned in the Executive segment, which accounts for 60%+ of the motorcycle market C Initial response very satisfactory. IR meeting – June’ 2010 Slide no. 15

TVS Jive – 110 cc q q q India’s first auto clutch motorcycle Launched in April’ 10 with pan-India availability by June/ July’ 10 Positioned in the Executive segment, which accounts for 60%+ of the motorcycle market C Initial response very satisfactory. IR meeting – June’ 2010 Slide no. 15

TVS Apache RTR – 180 cc IR meeting – June’ 2010 Slide no. 16

TVS Apache RTR – 180 cc IR meeting – June’ 2010 Slide no. 16

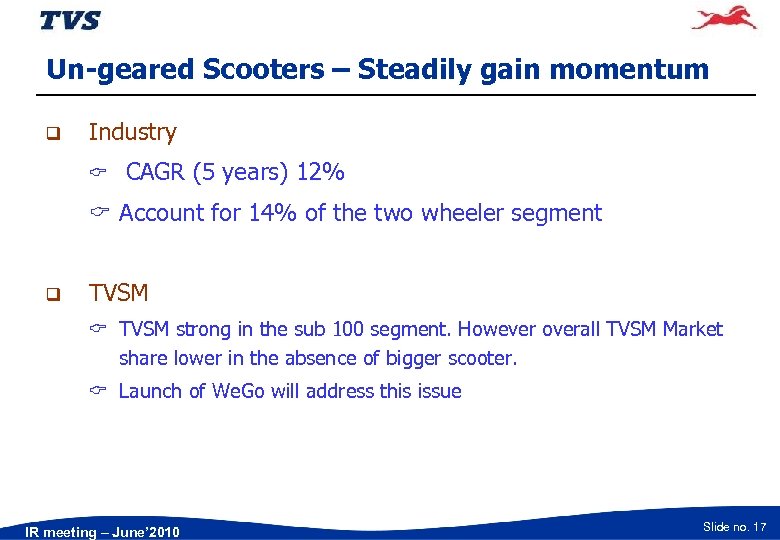

Un-geared Scooters – Steadily gain momentum q Industry C CAGR (5 years) 12% C Account for 14% of the two wheeler segment q TVSM C TVSM strong in the sub 100 segment. However overall TVSM Market share lower in the absence of bigger scooter. C Launch of We. Go will address this issue IR meeting – June’ 2010 Slide no. 17

Un-geared Scooters – Steadily gain momentum q Industry C CAGR (5 years) 12% C Account for 14% of the two wheeler segment q TVSM C TVSM strong in the sub 100 segment. However overall TVSM Market share lower in the absence of bigger scooter. C Launch of We. Go will address this issue IR meeting – June’ 2010 Slide no. 17

Under seat storage illumination Self glow ignition key ring Now visible in the dark No more fumbling in the dark Best Design of the year 2008 New 90 cc engine More power for that zippy ride Overdrive awards Cell phone charger Get charged on the move! Patented EZ center stand Trendy decals A vibrant & stylish look IR meeting – June’ 2010 No huffing. No puffing. Park effortlessly Slide no. 18

Under seat storage illumination Self glow ignition key ring Now visible in the dark No more fumbling in the dark Best Design of the year 2008 New 90 cc engine More power for that zippy ride Overdrive awards Cell phone charger Get charged on the move! Patented EZ center stand Trendy decals A vibrant & stylish look IR meeting – June’ 2010 No huffing. No puffing. Park effortlessly Slide no. 18

Scooty Streak Launched in Sept 2008 With 6 never before features, and leading edge styling IR meeting – June’ 2010 Slide no. 19

Scooty Streak Launched in Sept 2008 With 6 never before features, and leading edge styling IR meeting – June’ 2010 Slide no. 19

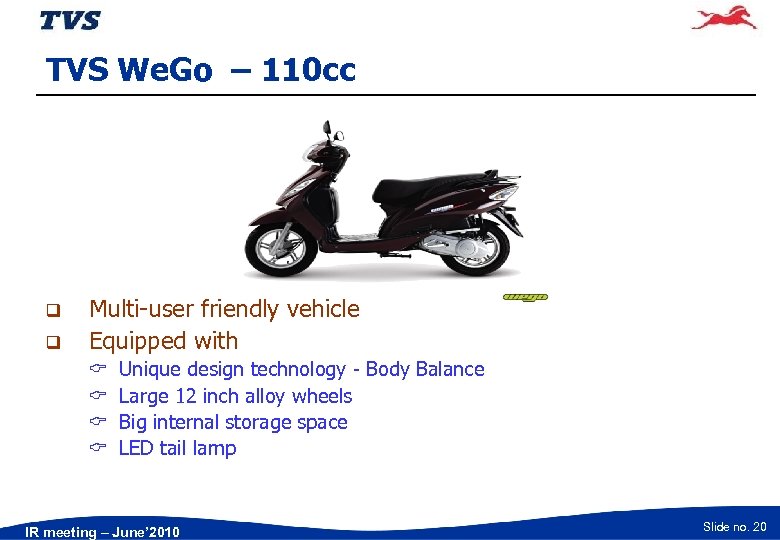

TVS We. Go – 110 cc q q Multi-user friendly vehicle Equipped with C C Unique design technology - Body Balance Large 12 inch alloy wheels Big internal storage space LED tail lamp IR meeting – June’ 2010 Slide no. 20

TVS We. Go – 110 cc q q Multi-user friendly vehicle Equipped with C C Unique design technology - Body Balance Large 12 inch alloy wheels Big internal storage space LED tail lamp IR meeting – June’ 2010 Slide no. 20

The stylish TVS KING IR meeting – June’ 2010 Slide no. 21

The stylish TVS KING IR meeting – June’ 2010 Slide no. 21

The stylish TVS KING q q q TVS entered the 3 W market towards the end of FY 08, with TVS-King engineered with ‘best in class’ features. Achieved average monthly Sales of 2500 nos in April/May ‘ 2010 q Large potential for exports. q Target of 50, 000 units in FY 11 (14, 700 units in FY 10) IR meeting – June’ 2010 Slide no. 22

The stylish TVS KING q q q TVS entered the 3 W market towards the end of FY 08, with TVS-King engineered with ‘best in class’ features. Achieved average monthly Sales of 2500 nos in April/May ‘ 2010 q Large potential for exports. q Target of 50, 000 units in FY 11 (14, 700 units in FY 10) IR meeting – June’ 2010 Slide no. 22

Indonesia – The emerging opportunity TVS Neo q q q Third largest market in the world with volumes over 6 mn units p. a. TVS has a local assembly plant with a capacity of 0. 3 mn units p. a. Launched TVS Neo , TVS Rockz and Apache in the Indonesian market IR meeting – June’ 2010 Slide no. 23

Indonesia – The emerging opportunity TVS Neo q q q Third largest market in the world with volumes over 6 mn units p. a. TVS has a local assembly plant with a capacity of 0. 3 mn units p. a. Launched TVS Neo , TVS Rockz and Apache in the Indonesian market IR meeting – June’ 2010 Slide no. 23

Awards in Indonesia IR meeting – June’ 2010 Slide no. 24

Awards in Indonesia IR meeting – June’ 2010 Slide no. 24

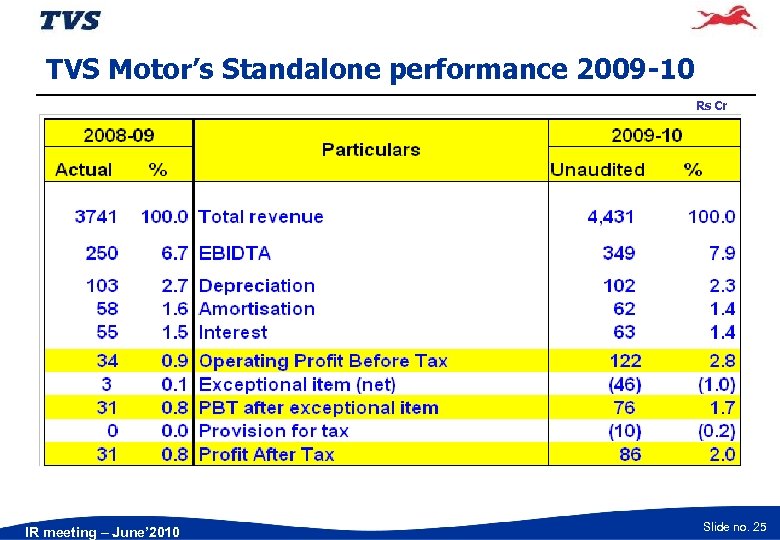

TVS Motor’s Standalone performance 2009 -10 Rs Cr IR meeting – June’ 2010 Slide no. 25

TVS Motor’s Standalone performance 2009 -10 Rs Cr IR meeting – June’ 2010 Slide no. 25

Summary q Long term growth prospects for the industry are attractive q TVSM poised to grow C C q Significantly improved/ superior product quality C C q Strong innovation and faster upgrades Strong brands that resonate with their customers Exports will be a significant growth engine Entry into three wheeler has enhanced product portfolio New products across segments, will strengthen TVS’ presence and lead to market share gains Improved product mix likely to increase realizations and profitability Focused efforts to reduce cost will improve profitability C Strong free-cash flow expected IR meeting – June’ 2010 Slide no. 26

Summary q Long term growth prospects for the industry are attractive q TVSM poised to grow C C q Significantly improved/ superior product quality C C q Strong innovation and faster upgrades Strong brands that resonate with their customers Exports will be a significant growth engine Entry into three wheeler has enhanced product portfolio New products across segments, will strengthen TVS’ presence and lead to market share gains Improved product mix likely to increase realizations and profitability Focused efforts to reduce cost will improve profitability C Strong free-cash flow expected IR meeting – June’ 2010 Slide no. 26

Thank you No part of this presentation is to be circulated, quoted, or reproduced for any distribution without prior written approval from TVS Motor Company Limited, PB 4, Harita, Hosur-635109, Tamilnadu, India. Certain parts of this presentation describing estimates and future plans may be “forward looking statements” within the meaning of applicable laws and regulations. Actual results might differ materially from those either expressed or implied. This material is not a complete record of the discussion. IR meeting – June’ 2010 Slide no. 27

Thank you No part of this presentation is to be circulated, quoted, or reproduced for any distribution without prior written approval from TVS Motor Company Limited, PB 4, Harita, Hosur-635109, Tamilnadu, India. Certain parts of this presentation describing estimates and future plans may be “forward looking statements” within the meaning of applicable laws and regulations. Actual results might differ materially from those either expressed or implied. This material is not a complete record of the discussion. IR meeting – June’ 2010 Slide no. 27