386ea163a0dd5baf7a6597fca4342aec.ppt

- Количество слайдов: 39

Power Summit – 2008, Kathmandu Developer’s perspectives; Road Ahead for Hydro Power Project implementation in Nepal

Power Summit – 2008, Kathmandu Developer’s perspectives; Road Ahead for Hydro Power Project implementation in Nepal

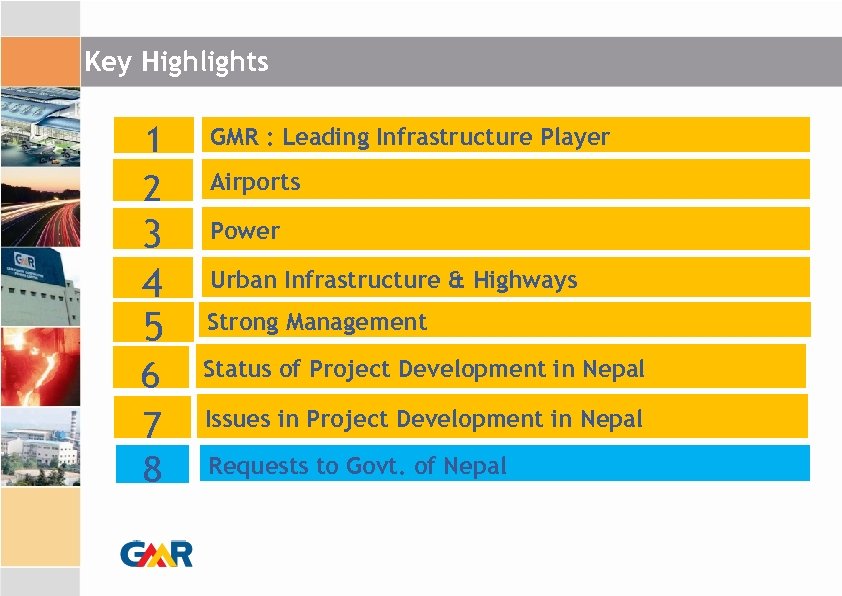

Key Highlights 1 2 GMR : Leading Infrastructure Player 3 4 5 Power 6 7 8 Airports Urban Infrastructure & Highways Strong Management Status of Project Development in Nepal Issues in Project Development in Nepal Requests to Govt. of Nepal

Key Highlights 1 2 GMR : Leading Infrastructure Player 3 4 5 Power 6 7 8 Airports Urban Infrastructure & Highways Strong Management Status of Project Development in Nepal Issues in Project Development in Nepal Requests to Govt. of Nepal

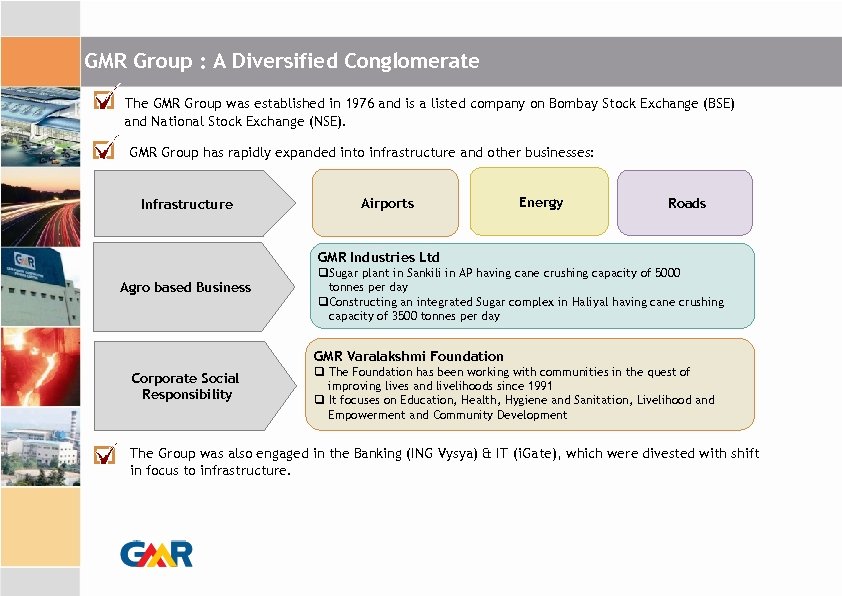

GMR Group : A Diversified Conglomerate The GMR Group was established in 1976 and is a listed company on Bombay Stock Exchange (BSE) and National Stock Exchange (NSE). GMR Group has rapidly expanded into infrastructure and other businesses: Infrastructure Airports Energy Roads GMR Industries Ltd Agro based Business q. Sugar plant in Sankili in AP having cane crushing capacity of 5000 tonnes per day q. Constructing an integrated Sugar complex in Haliyal having cane crushing capacity of 3500 tonnes per day GMR Varalakshmi Foundation Corporate Social Responsibility q The Foundation has been working with communities in the quest of improving lives and livelihoods since 1991 q It focuses on Education, Health, Hygiene and Sanitation, Livelihood and Empowerment and Community Development The Group was also engaged in the Banking (ING Vysya) & IT (i. Gate), which were divested with shift in focus to infrastructure.

GMR Group : A Diversified Conglomerate The GMR Group was established in 1976 and is a listed company on Bombay Stock Exchange (BSE) and National Stock Exchange (NSE). GMR Group has rapidly expanded into infrastructure and other businesses: Infrastructure Airports Energy Roads GMR Industries Ltd Agro based Business q. Sugar plant in Sankili in AP having cane crushing capacity of 5000 tonnes per day q. Constructing an integrated Sugar complex in Haliyal having cane crushing capacity of 3500 tonnes per day GMR Varalakshmi Foundation Corporate Social Responsibility q The Foundation has been working with communities in the quest of improving lives and livelihoods since 1991 q It focuses on Education, Health, Hygiene and Sanitation, Livelihood and Empowerment and Community Development The Group was also engaged in the Banking (ING Vysya) & IT (i. Gate), which were divested with shift in focus to infrastructure.

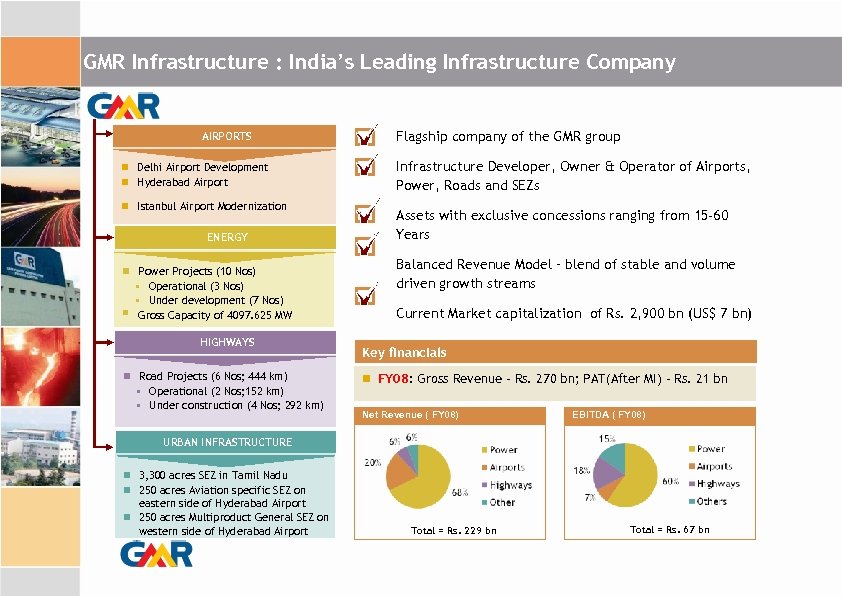

GMR Infrastructure : India’s Leading Infrastructure Company AIRPORTS Delhi Airport Development Hyderabad Airport Istanbul Airport Modernization ENERGY Power Projects (10 Nos) § Operational (3 Nos) § Under development (7 Nos) Gross Capacity of 4097. 625 MW § HIGHWAYS Road Projects (6 Nos; 444 km) § Operational (2 Nos; 152 km) § Under construction (4 Nos; 292 km) Flagship company of the GMR group Infrastructure Developer, Owner & Operator of Airports, Power, Roads and SEZs Assets with exclusive concessions ranging from 15 -60 Years Balanced Revenue Model – blend of stable and volume driven growth streams Current Market capitalization of Rs. 2, 900 bn (US$ 7 bn) Key financials FY 08: Gross Revenue – Rs. 270 bn; PAT(After MI) – Rs. 21 bn Net Revenue ( FY 08) EBITDA ( FY 08) URBAN INFRASTRUCTURE 3, 300 acres SEZ in Tamil Nadu 250 acres Aviation specific SEZ on eastern side of Hyderabad Airport 250 acres Multiproduct General SEZ on western side of Hyderabad Airport Total = Rs. 229 bn Total = Rs. 67 bn

GMR Infrastructure : India’s Leading Infrastructure Company AIRPORTS Delhi Airport Development Hyderabad Airport Istanbul Airport Modernization ENERGY Power Projects (10 Nos) § Operational (3 Nos) § Under development (7 Nos) Gross Capacity of 4097. 625 MW § HIGHWAYS Road Projects (6 Nos; 444 km) § Operational (2 Nos; 152 km) § Under construction (4 Nos; 292 km) Flagship company of the GMR group Infrastructure Developer, Owner & Operator of Airports, Power, Roads and SEZs Assets with exclusive concessions ranging from 15 -60 Years Balanced Revenue Model – blend of stable and volume driven growth streams Current Market capitalization of Rs. 2, 900 bn (US$ 7 bn) Key financials FY 08: Gross Revenue – Rs. 270 bn; PAT(After MI) – Rs. 21 bn Net Revenue ( FY 08) EBITDA ( FY 08) URBAN INFRASTRUCTURE 3, 300 acres SEZ in Tamil Nadu 250 acres Aviation specific SEZ on eastern side of Hyderabad Airport 250 acres Multiproduct General SEZ on western side of Hyderabad Airport Total = Rs. 229 bn Total = Rs. 67 bn

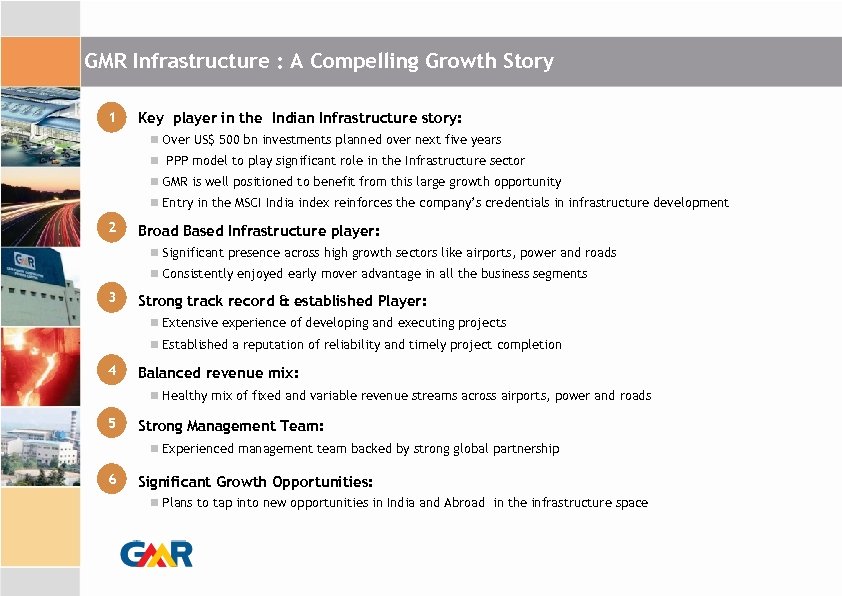

GMR Infrastructure : A Compelling Growth Story 1 Key player in the Indian Infrastructure story: Over US$ 500 bn investments planned over next five years PPP model to play significant role in the Infrastructure sector GMR is well positioned to benefit from this large growth opportunity Entry in the MSCI India index reinforces the company’s credentials in infrastructure development 2 Broad Based Infrastructure player: Significant presence across high growth sectors like airports, power and roads Consistently enjoyed early mover advantage in all the business segments 3 Strong track record & established Player: Extensive experience of developing and executing projects Established a reputation of reliability and timely project completion 4 Balanced revenue mix: Healthy mix of fixed and variable revenue streams across airports, power and roads 5 Strong Management Team: Experienced management team backed by strong global partnership 6 Significant Growth Opportunities: Plans to tap into new opportunities in India and Abroad in the infrastructure space

GMR Infrastructure : A Compelling Growth Story 1 Key player in the Indian Infrastructure story: Over US$ 500 bn investments planned over next five years PPP model to play significant role in the Infrastructure sector GMR is well positioned to benefit from this large growth opportunity Entry in the MSCI India index reinforces the company’s credentials in infrastructure development 2 Broad Based Infrastructure player: Significant presence across high growth sectors like airports, power and roads Consistently enjoyed early mover advantage in all the business segments 3 Strong track record & established Player: Extensive experience of developing and executing projects Established a reputation of reliability and timely project completion 4 Balanced revenue mix: Healthy mix of fixed and variable revenue streams across airports, power and roads 5 Strong Management Team: Experienced management team backed by strong global partnership 6 Significant Growth Opportunities: Plans to tap into new opportunities in India and Abroad in the infrastructure space

Key Highlights 1 2 GMR : Leading Infrastructure Player 3 4 5 Power 6 7 8 Airports Urban Infrastructure & Highways Strong Management Status of Project Development in Nepal Issues in Project Development in Nepal Requests to Govt. of Nepal

Key Highlights 1 2 GMR : Leading Infrastructure Player 3 4 5 Power 6 7 8 Airports Urban Infrastructure & Highways Strong Management Status of Project Development in Nepal Issues in Project Development in Nepal Requests to Govt. of Nepal

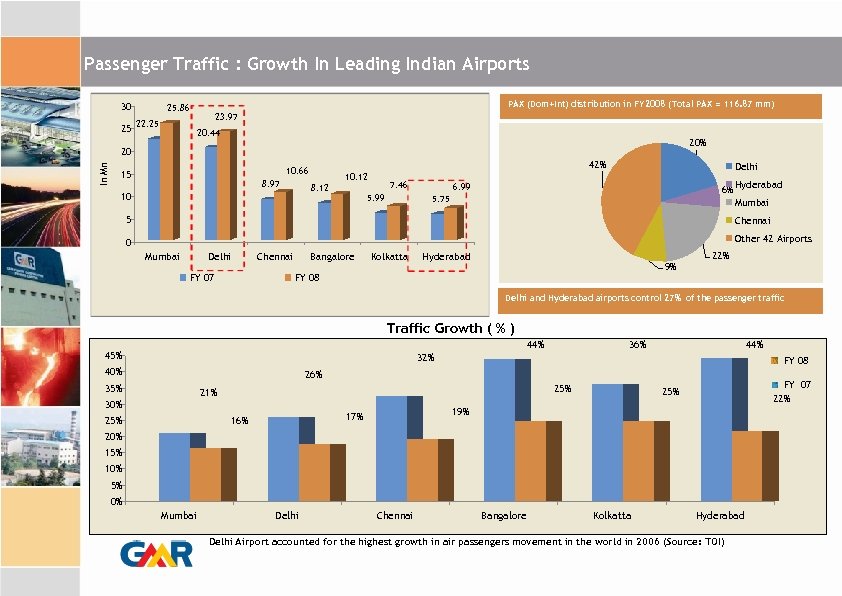

Passenger Traffic : Growth In Leading Indian Airports 30 PAX (Dom+Int) distribution in FY 2008 (Total PAX = 116. 87 mm) 25. 86 23. 97 25 22. 25 20. 44 20% In Mn 20 42% 10. 66 15 8. 97 10. 12 8. 12 10 7. 46 5. 99 Delhi 6. 99 6% 5. 75 Hyderabad Mumbai 5 Chennai 0 Other 42 Airports Mumbai Delhi Chennai FY 07 Bangalore Kolkatta Hyderabad 9% FY 08 22% Delhi and Hyderabad airports control 27% of the passenger traffic Traffic Growth ( % ) 44% 45% 36% 44% 32% 40% FY 08 26% 35% 21% 30% 19% 17% 16% 25% FY 07 22% 25% 20% 15% 10% 5% 0% Mumbai Delhi Chennai Bangalore Kolkatta Hyderabad Delhi Airport accounted for the highest growth in air passengers movement in the world in 2006 (Source: TOI)

Passenger Traffic : Growth In Leading Indian Airports 30 PAX (Dom+Int) distribution in FY 2008 (Total PAX = 116. 87 mm) 25. 86 23. 97 25 22. 25 20. 44 20% In Mn 20 42% 10. 66 15 8. 97 10. 12 8. 12 10 7. 46 5. 99 Delhi 6. 99 6% 5. 75 Hyderabad Mumbai 5 Chennai 0 Other 42 Airports Mumbai Delhi Chennai FY 07 Bangalore Kolkatta Hyderabad 9% FY 08 22% Delhi and Hyderabad airports control 27% of the passenger traffic Traffic Growth ( % ) 44% 45% 36% 44% 32% 40% FY 08 26% 35% 21% 30% 19% 17% 16% 25% FY 07 22% 25% 20% 15% 10% 5% 0% Mumbai Delhi Chennai Bangalore Kolkatta Hyderabad Delhi Airport accounted for the highest growth in air passengers movement in the world in 2006 (Source: TOI)

Delhi International Airport: Modernization and development of one of the busiest airports in the sub-continent Project Overview Financing Plan (Phase I) Consortium Partners

Delhi International Airport: Modernization and development of one of the busiest airports in the sub-continent Project Overview Financing Plan (Phase I) Consortium Partners

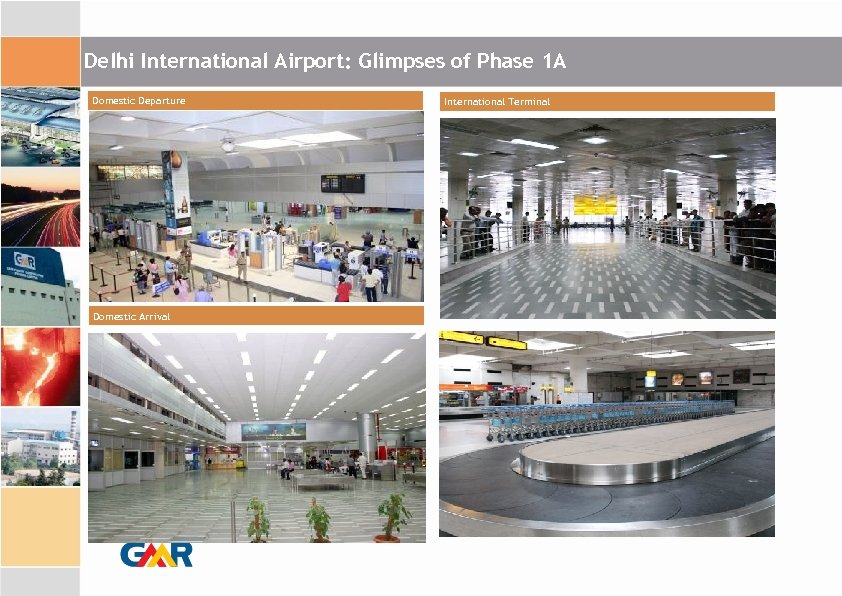

Delhi International Airport: Glimpses of Phase 1 A Domestic Departure Domestic Arrival International Terminal

Delhi International Airport: Glimpses of Phase 1 A Domestic Departure Domestic Arrival International Terminal

Delhi International Airport: Glimpses of Phase 1 B Terminal 3

Delhi International Airport: Glimpses of Phase 1 B Terminal 3

Hyderabad International Airport: Development of fastest growing airport in India Project overview Consortium partners Catchment area Hyderabad International Airport Hyderabad Phase I Development completed. . . Uniquely positioned to capitalize on the current growth Emergence of Hyderabad as a major IT& ITe. S destination Centrally located with respect to India, South-East Asia and Middle East Catchment area of 75 mm people Growth in the passenger traffic - 40% over the past 2 years (2005 -07) First Airport in the country to get ‘Leeds’ Certificate for leadership in Energy & Environmental Design Phase I Development completed on 23 rd March 2008 Source: AAI website, Company Airside & Landside works contractor: Larsen & Tubro

Hyderabad International Airport: Development of fastest growing airport in India Project overview Consortium partners Catchment area Hyderabad International Airport Hyderabad Phase I Development completed. . . Uniquely positioned to capitalize on the current growth Emergence of Hyderabad as a major IT& ITe. S destination Centrally located with respect to India, South-East Asia and Middle East Catchment area of 75 mm people Growth in the passenger traffic - 40% over the past 2 years (2005 -07) First Airport in the country to get ‘Leeds’ Certificate for leadership in Energy & Environmental Design Phase I Development completed on 23 rd March 2008 Source: AAI website, Company Airside & Landside works contractor: Larsen & Tubro

Hyderabad International Airport: Glimpses

Hyderabad International Airport: Glimpses

Hyderabad International Airport: Glimpses

Hyderabad International Airport: Glimpses

Hyderabad International Airport: Glimpses

Hyderabad International Airport: Glimpses

Sabiha Gokcen International Airport – Turkey Overview

Sabiha Gokcen International Airport – Turkey Overview

Sabiha Gokcen International Airport Development plan for the Sabiha Gokcen International Airport in Istanbul Car Park Area Existing Int’l + Domestic Terminal New International Terminal Hotel

Sabiha Gokcen International Airport Development plan for the Sabiha Gokcen International Airport in Istanbul Car Park Area Existing Int’l + Domestic Terminal New International Terminal Hotel

Sabiha Gokcen International Airport

Sabiha Gokcen International Airport

Key Highlights 1 2 GMR : Leading Infrastructure Player 3 4 5 Power 6 7 8 Airports Urban Infrastructure & Highways Strong Management Status of Project Development in Nepal Issues in Project Development in Nepal Requests to Govt. of Nepal

Key Highlights 1 2 GMR : Leading Infrastructure Player 3 4 5 Power 6 7 8 Airports Urban Infrastructure & Highways Strong Management Status of Project Development in Nepal Issues in Project Development in Nepal Requests to Govt. of Nepal

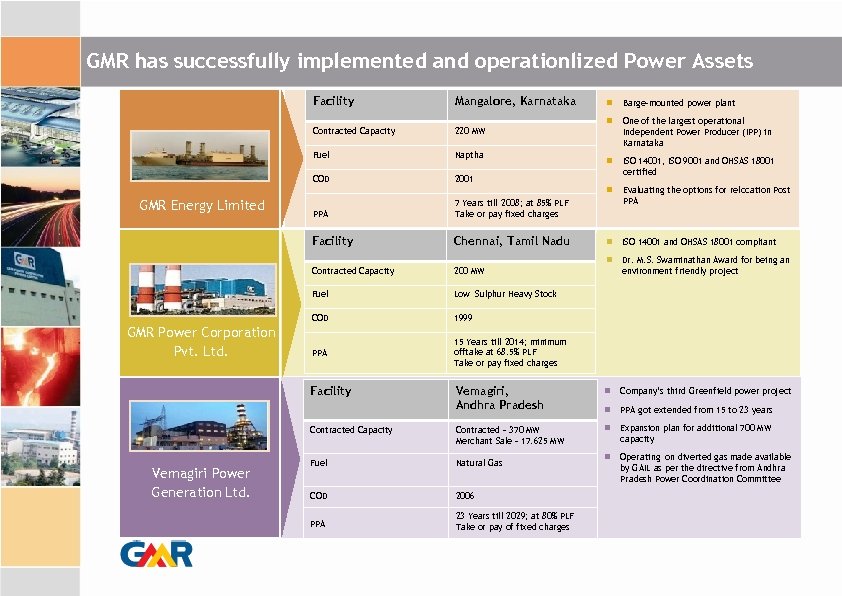

GMR has successfully implemented and operationlized Power Assets Facility Mangalore, Karnataka Contracted Capacity 220 MW Fuel Naptha COD 2001 PPA 7 Years till 2008; at 85% PLF Take or pay fixed charges Facility Chennai, Tamil Nadu Contracted Capacity 200 MW Fuel Low Sulphur Heavy Stock COD 1999 PPA 15 Years till 2014; minimum offtake at 68. 5% PLF Take or pay fixed charges One of the largest operational Independent Power Producer (IPP) in Karnataka ISO 14001, ISO 9001 and OHSAS 18001 certified Evaluating the options for relocation Post PPA ISO 14001 and OHSAS 18001 compliant Dr. M. S. Swaminathan Award for being an environment friendly project Vemagiri, Andhra Pradesh Company’s third Greenfield power project PPA got extended from 15 to 23 years Contracted Capacity GMR Power Corporation Pvt. Ltd. Barge-mounted power plant GMR Energy Limited Contracted – 370 MW Merchant Sale – 17. 625 MW Expansion plan for additional 700 MW capacity Fuel Natural Gas Operating on diverted gas made available by GAIL as per the directive from Andhra Pradesh Power Coordination Committee COD 2006 PPA 23 Years till 2029; at 80% PLF Take or pay of fixed charges Facility Vemagiri Power Generation Ltd.

GMR has successfully implemented and operationlized Power Assets Facility Mangalore, Karnataka Contracted Capacity 220 MW Fuel Naptha COD 2001 PPA 7 Years till 2008; at 85% PLF Take or pay fixed charges Facility Chennai, Tamil Nadu Contracted Capacity 200 MW Fuel Low Sulphur Heavy Stock COD 1999 PPA 15 Years till 2014; minimum offtake at 68. 5% PLF Take or pay fixed charges One of the largest operational Independent Power Producer (IPP) in Karnataka ISO 14001, ISO 9001 and OHSAS 18001 certified Evaluating the options for relocation Post PPA ISO 14001 and OHSAS 18001 compliant Dr. M. S. Swaminathan Award for being an environment friendly project Vemagiri, Andhra Pradesh Company’s third Greenfield power project PPA got extended from 15 to 23 years Contracted Capacity GMR Power Corporation Pvt. Ltd. Barge-mounted power plant GMR Energy Limited Contracted – 370 MW Merchant Sale – 17. 625 MW Expansion plan for additional 700 MW capacity Fuel Natural Gas Operating on diverted gas made available by GAIL as per the directive from Andhra Pradesh Power Coordination Committee COD 2006 PPA 23 Years till 2029; at 80% PLF Take or pay of fixed charges Facility Vemagiri Power Generation Ltd.

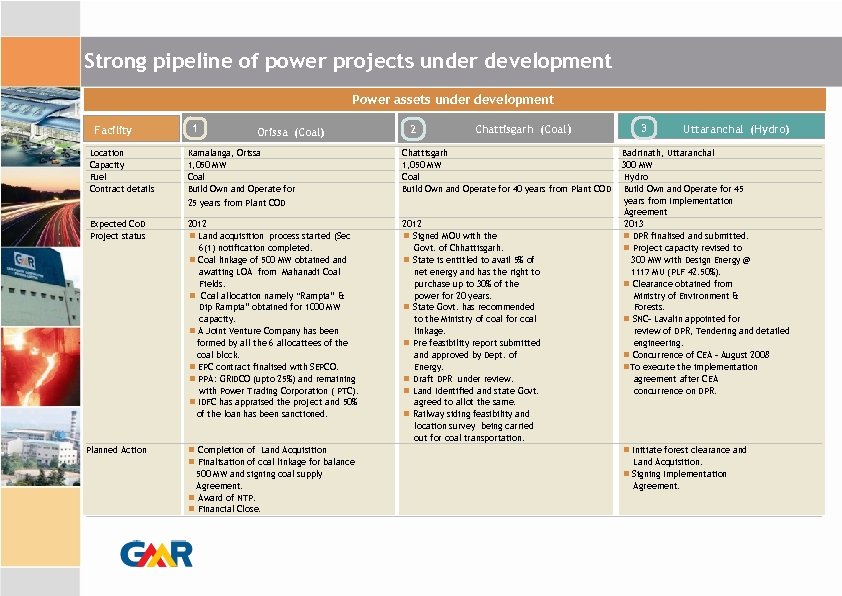

Strong pipeline of power projects under development Power assets under development Facility Location Capacity Fuel Contract details 1 Orissa (Coal) Kamalanga, Orissa 1, 050 MW Coal Build Own and Operate for 2 Chattisgarh (Coal ) Chattisgarh 1, 050 MW Coal Build Own and Operate for 40 years from Plant COD 25 years from Plant COD 2012 Signed MOU with the Govt. of Chhattisgarh. State is entitled to avail 5% of net energy and has the right to purchase up to 30% of the power for 20 years. State Govt. has recommended to the Ministry of coal for coal linkage. Pre feasibility report submitted and approved by Dept. of Energy. Draft DPR under review. Land Identified and state Govt. agreed to allot the same. Railway siding feasibility and location survey being carried out for coal transportation. 3 Uttaranchal (Hydro) Badrinath, Uttaranchal 300 MW Hydro Build Own and Operate for 45 years from Implementation Agreement 2013 DPR finalised and submitted. Project capacity revised to 300 MW with Design Energy @ 1117 MU (PLF 42. 50%). Clearance obtained from Ministry of Environment & Forests. SNC– Lavalin appointed for review of DPR, Tendering and detailed engineering. Concurrence of CEA – August 2008 To execute the implementation agreement after CEA concurrence on DPR. Expected Co. D Project status 2012 Land acquisition process started (Sec 6(1) notification completed. Coal linkage of 500 MW obtained and awaiting LOA from Mahanadi Coal Fields. Coal allocation namely “Rampia” & Dip Rampia” obtained for 1000 MW capacity. A Joint Venture Company has been formed by all the 6 allocattees of the coal block. EPC contract finalised with SEPCO. PPA: GRIDCO (upto 25%) and remaining with Power Trading Corporation ( PTC). IDFC has appraised the project and 50% of the loan has been sanctioned. Planned Action Completion of Land Acquisition Finalisation of coal linkage for balance Initiate forest clearance and 500 MW and signing coal supply Agreement. Award of NTP. Financial Close. Signing Implementation Land Acquisition. Agreement.

Strong pipeline of power projects under development Power assets under development Facility Location Capacity Fuel Contract details 1 Orissa (Coal) Kamalanga, Orissa 1, 050 MW Coal Build Own and Operate for 2 Chattisgarh (Coal ) Chattisgarh 1, 050 MW Coal Build Own and Operate for 40 years from Plant COD 25 years from Plant COD 2012 Signed MOU with the Govt. of Chhattisgarh. State is entitled to avail 5% of net energy and has the right to purchase up to 30% of the power for 20 years. State Govt. has recommended to the Ministry of coal for coal linkage. Pre feasibility report submitted and approved by Dept. of Energy. Draft DPR under review. Land Identified and state Govt. agreed to allot the same. Railway siding feasibility and location survey being carried out for coal transportation. 3 Uttaranchal (Hydro) Badrinath, Uttaranchal 300 MW Hydro Build Own and Operate for 45 years from Implementation Agreement 2013 DPR finalised and submitted. Project capacity revised to 300 MW with Design Energy @ 1117 MU (PLF 42. 50%). Clearance obtained from Ministry of Environment & Forests. SNC– Lavalin appointed for review of DPR, Tendering and detailed engineering. Concurrence of CEA – August 2008 To execute the implementation agreement after CEA concurrence on DPR. Expected Co. D Project status 2012 Land acquisition process started (Sec 6(1) notification completed. Coal linkage of 500 MW obtained and awaiting LOA from Mahanadi Coal Fields. Coal allocation namely “Rampia” & Dip Rampia” obtained for 1000 MW capacity. A Joint Venture Company has been formed by all the 6 allocattees of the coal block. EPC contract finalised with SEPCO. PPA: GRIDCO (upto 25%) and remaining with Power Trading Corporation ( PTC). IDFC has appraised the project and 50% of the loan has been sanctioned. Planned Action Completion of Land Acquisition Finalisation of coal linkage for balance Initiate forest clearance and 500 MW and signing coal supply Agreement. Award of NTP. Financial Close. Signing Implementation Land Acquisition. Agreement.

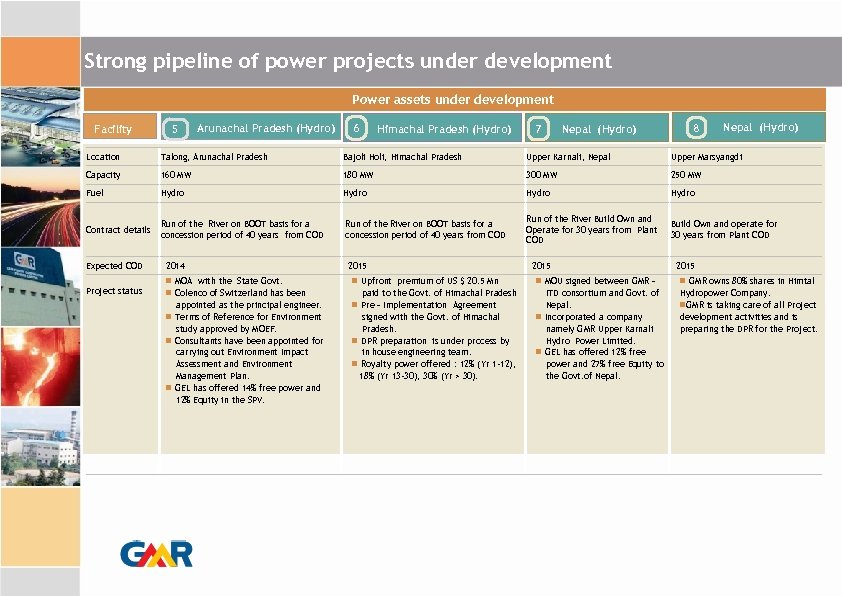

Strong pipeline of power projects under development Power assets under development Facility 5 Arunachal Pradesh (Hydro) 6 Himachal Pradesh (Hydro) 7 Nepal (Hydro) 8 Nepal (Hydro) Location Talong, Arunachal Pradesh Bajoli Holi, Himachal Pradesh Upper Karnali, Nepal Upper Marsyangdi Capacity 160 MW 180 MW 300 MW 250 MW Fuel Hydro Contract details Run of the River on BOOT basis for a concession period of 40 years from COD Run of the River Build Own and Operate for 30 years from Plant COD Build Own and operate for 30 years from Plant COD Expected COD 2014 Project status MOA with the State Govt. Colenco of Switzerland has been appointed as the principal engineer. Terms of Reference for Environment study approved by MOEF. Consultants have been appointed for carrying out Environment Impact Assessment and Environment Management Plan. GEL has offered 14% free power and 12% Equity in the SPV. Run of the River on BOOT basis for a concession period of 40 years from COD 2015 Upfront premium of US $ 20. 5 Mn MOU signed between GMR – paid to the Govt. of Himachal Pradesh Pre – Implementation Agreement signed with the Govt. of Himachal Pradesh. DPR preparation is under process by in house engineering team. Royalty power offered : 12% (Yr 1 -12), 18% (Yr 13 -30), 30% (Yr > 30). ITD consortium and Govt. of Nepal. Incorporated a company namely GMR Upper Karnali Hydro Power Limited. GEL has offered 12% free power and 27% free Equity to the Govt. of Nepal. 2015 GMR owns 80% shares in Himtal Hydropower Company. GMR is taking care of all Project development activities and is preparing the DPR for the Project.

Strong pipeline of power projects under development Power assets under development Facility 5 Arunachal Pradesh (Hydro) 6 Himachal Pradesh (Hydro) 7 Nepal (Hydro) 8 Nepal (Hydro) Location Talong, Arunachal Pradesh Bajoli Holi, Himachal Pradesh Upper Karnali, Nepal Upper Marsyangdi Capacity 160 MW 180 MW 300 MW 250 MW Fuel Hydro Contract details Run of the River on BOOT basis for a concession period of 40 years from COD Run of the River Build Own and Operate for 30 years from Plant COD Build Own and operate for 30 years from Plant COD Expected COD 2014 Project status MOA with the State Govt. Colenco of Switzerland has been appointed as the principal engineer. Terms of Reference for Environment study approved by MOEF. Consultants have been appointed for carrying out Environment Impact Assessment and Environment Management Plan. GEL has offered 14% free power and 12% Equity in the SPV. Run of the River on BOOT basis for a concession period of 40 years from COD 2015 Upfront premium of US $ 20. 5 Mn MOU signed between GMR – paid to the Govt. of Himachal Pradesh Pre – Implementation Agreement signed with the Govt. of Himachal Pradesh. DPR preparation is under process by in house engineering team. Royalty power offered : 12% (Yr 1 -12), 18% (Yr 13 -30), 30% (Yr > 30). ITD consortium and Govt. of Nepal. Incorporated a company namely GMR Upper Karnali Hydro Power Limited. GEL has offered 12% free power and 27% free Equity to the Govt. of Nepal. 2015 GMR owns 80% shares in Himtal Hydropower Company. GMR is taking care of all Project development activities and is preparing the DPR for the Project.

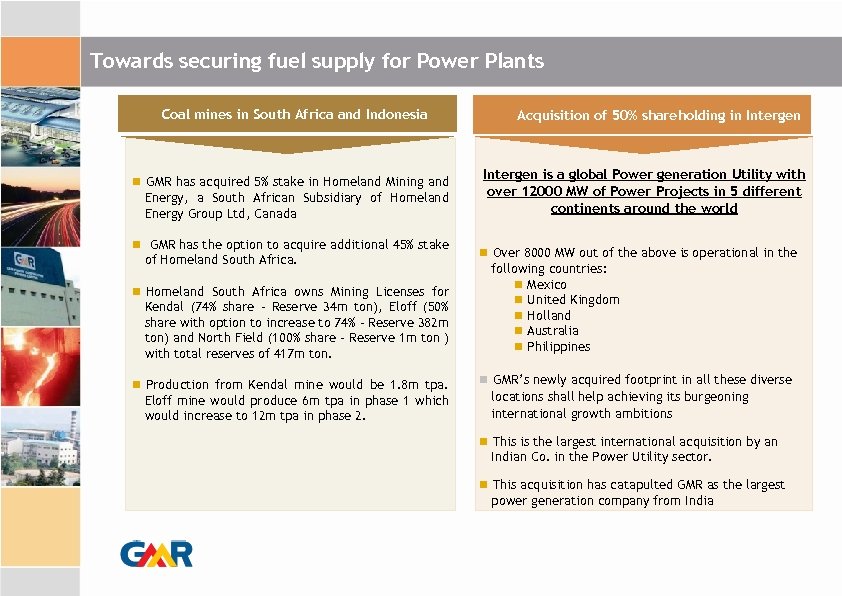

Towards securing fuel supply for Power Plants Coal mines in South Africa and Indonesia GMR has acquired 5% stake in Homeland Mining and Energy, a South African Subsidiary of Homeland Energy Group Ltd, Canada GMR has the option to acquire additional 45% stake of Homeland South Africa owns Mining Licenses for Kendal (74% share - Reserve 34 m ton), Eloff (50% share with option to increase to 74% - Reserve 382 m ton) and North Field (100% share – Reserve 1 m ton ) with total reserves of 417 m ton. Production from Kendal mine would be 1. 8 m tpa. Eloff mine would produce 6 m tpa in phase 1 which would increase to 12 m tpa in phase 2. Acquisition of 50% shareholding in Intergen is a global Power generation Utility with over 12000 MW of Power Projects in 5 different continents around the world Over 8000 MW out of the above is operational in the following countries: Mexico United Kingdom Holland Australia Philippines GMR’s newly acquired footprint in all these diverse locations shall help achieving its burgeoning international growth ambitions This is the largest international acquisition by an Indian Co. in the Power Utility sector. This acquisition has catapulted GMR as the largest power generation company from India

Towards securing fuel supply for Power Plants Coal mines in South Africa and Indonesia GMR has acquired 5% stake in Homeland Mining and Energy, a South African Subsidiary of Homeland Energy Group Ltd, Canada GMR has the option to acquire additional 45% stake of Homeland South Africa owns Mining Licenses for Kendal (74% share - Reserve 34 m ton), Eloff (50% share with option to increase to 74% - Reserve 382 m ton) and North Field (100% share – Reserve 1 m ton ) with total reserves of 417 m ton. Production from Kendal mine would be 1. 8 m tpa. Eloff mine would produce 6 m tpa in phase 1 which would increase to 12 m tpa in phase 2. Acquisition of 50% shareholding in Intergen is a global Power generation Utility with over 12000 MW of Power Projects in 5 different continents around the world Over 8000 MW out of the above is operational in the following countries: Mexico United Kingdom Holland Australia Philippines GMR’s newly acquired footprint in all these diverse locations shall help achieving its burgeoning international growth ambitions This is the largest international acquisition by an Indian Co. in the Power Utility sector. This acquisition has catapulted GMR as the largest power generation company from India

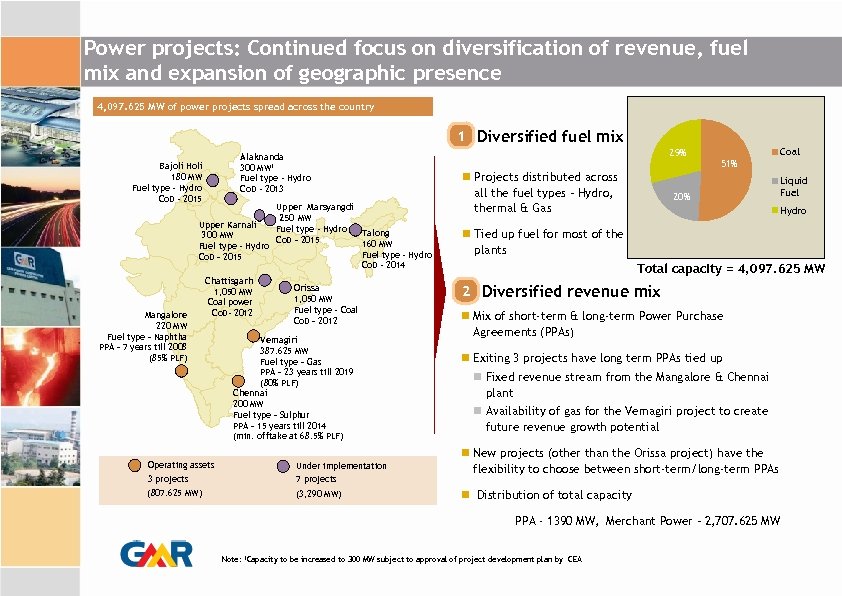

Power projects: Continued focus on diversification of revenue, fuel mix and expansion of geographic presence 4, 097. 625 MW of power projects spread across the country 1 Diversified fuel mix Alaknanda 300 MW 1 Fuel type - Hydro Co. D - 2013 Bajoli Holi 180 MW Fuel type - Hydro Co. D - 2015 Upper Marsyangdi 250 MW Upper Karnali Fuel type - Hydro Talong 300 MW Co. D – 2015 160 MW Fuel type - Hydro Co. D – 2015 Co. D - 2014 Mangalore 220 MW Fuel type – Naphtha PPA – 7 years till 2008 (85% PLF) Chattisgarh 1, 050 MW Coal power Co. D- 2012 Operating assets Orissa 1, 050 MW Fuel type - Coal Co. D – 2012 Vemagiri 387. 625 MW Fuel type – Gas PPA – 23 years till 2019 (80% PLF) Chennai 200 MW Fuel type – Sulphur PPA – 15 years till 2014 (min. offtake at 68. 5% PLF) 3 projects Under implementation 7 projects (807. 625 MW) (3, 290 MW) 29% Projects distributed across all the fuel types – Hydro, thermal & Gas Coal 51% 20% Liquid Fuel Hydro Tied up fuel for most of the plants Total capacity = 4, 097. 625 MW 2 Diversified revenue mix Mix of short-term & long-term Power Purchase Agreements (PPAs) Exiting 3 projects have long term PPAs tied up Fixed revenue stream from the Mangalore & Chennai plant Availability of gas for the Vemagiri project to create future revenue growth potential New projects (other than the Orissa project) have the flexibility to choose between short-term/long-term PPAs Distribution of total capacity PPA - 1390 MW, Merchant Power – 2, 707. 625 MW Note: 1 Capacity to be increased to 300 MW subject to approval of project development plan by CEA

Power projects: Continued focus on diversification of revenue, fuel mix and expansion of geographic presence 4, 097. 625 MW of power projects spread across the country 1 Diversified fuel mix Alaknanda 300 MW 1 Fuel type - Hydro Co. D - 2013 Bajoli Holi 180 MW Fuel type - Hydro Co. D - 2015 Upper Marsyangdi 250 MW Upper Karnali Fuel type - Hydro Talong 300 MW Co. D – 2015 160 MW Fuel type - Hydro Co. D – 2015 Co. D - 2014 Mangalore 220 MW Fuel type – Naphtha PPA – 7 years till 2008 (85% PLF) Chattisgarh 1, 050 MW Coal power Co. D- 2012 Operating assets Orissa 1, 050 MW Fuel type - Coal Co. D – 2012 Vemagiri 387. 625 MW Fuel type – Gas PPA – 23 years till 2019 (80% PLF) Chennai 200 MW Fuel type – Sulphur PPA – 15 years till 2014 (min. offtake at 68. 5% PLF) 3 projects Under implementation 7 projects (807. 625 MW) (3, 290 MW) 29% Projects distributed across all the fuel types – Hydro, thermal & Gas Coal 51% 20% Liquid Fuel Hydro Tied up fuel for most of the plants Total capacity = 4, 097. 625 MW 2 Diversified revenue mix Mix of short-term & long-term Power Purchase Agreements (PPAs) Exiting 3 projects have long term PPAs tied up Fixed revenue stream from the Mangalore & Chennai plant Availability of gas for the Vemagiri project to create future revenue growth potential New projects (other than the Orissa project) have the flexibility to choose between short-term/long-term PPAs Distribution of total capacity PPA - 1390 MW, Merchant Power – 2, 707. 625 MW Note: 1 Capacity to be increased to 300 MW subject to approval of project development plan by CEA

Key Highlights 1 2 GMR : Leading Infrastructure Player 3 4 5 Power 6 7 8 Airports Urban Infrastructure & Highways Strong Management Status of Project Development in Nepal Issues in Project Development in Nepal Requests to Govt. of Nepal

Key Highlights 1 2 GMR : Leading Infrastructure Player 3 4 5 Power 6 7 8 Airports Urban Infrastructure & Highways Strong Management Status of Project Development in Nepal Issues in Project Development in Nepal Requests to Govt. of Nepal

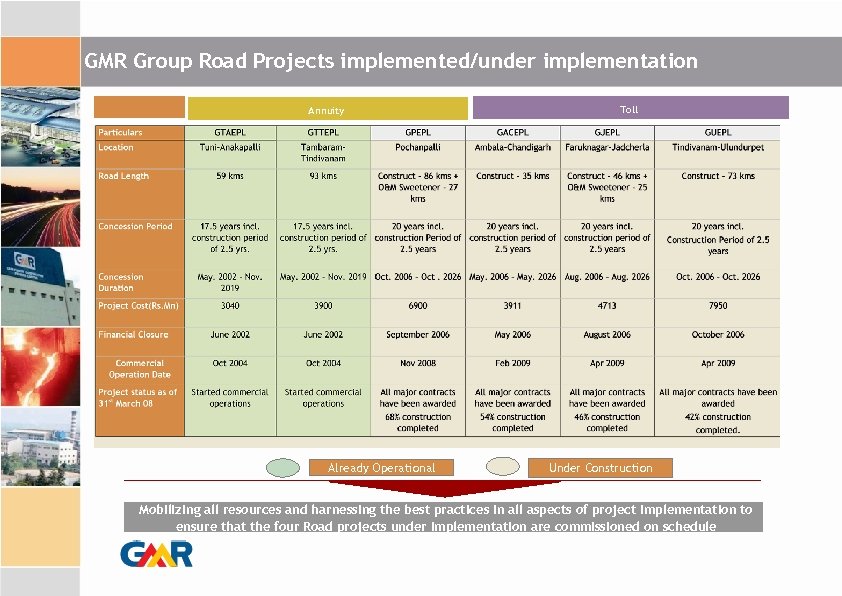

GMR Group Road Projects implemented/under implementation Annuity Already Operational Toll Under Construction Mobilizing all resources and harnessing the best practices in all aspects of project implementation to ensure that the four Road projects under implementation are commissioned on schedule

GMR Group Road Projects implemented/under implementation Annuity Already Operational Toll Under Construction Mobilizing all resources and harnessing the best practices in all aspects of project implementation to ensure that the four Road projects under implementation are commissioned on schedule

Progress of Construction Ambala – Chandigarh Road Pochanpalli Road Jadcherla Road Ulundurpeth Road

Progress of Construction Ambala – Chandigarh Road Pochanpalli Road Jadcherla Road Ulundurpeth Road

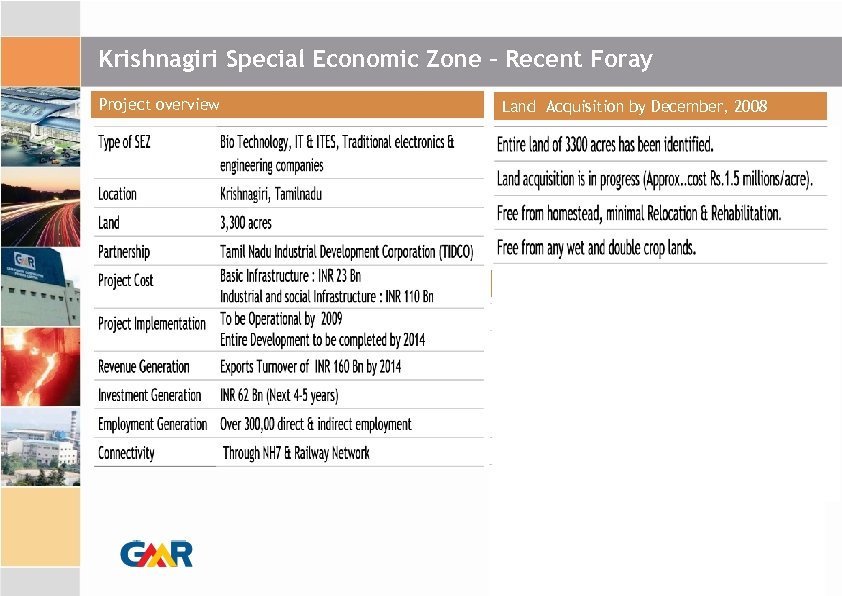

Krishnagiri Special Economic Zone – Recent Foray Project overview Land Acquisition by December, 2008 Planned Action for next 12 months

Krishnagiri Special Economic Zone – Recent Foray Project overview Land Acquisition by December, 2008 Planned Action for next 12 months

Key Highlights 1 2 GMR : Leading Infrastructure Player 3 4 5 Power 6 7 8 Airports Urban Infrastructure & Highways Strong Management Status of Project Development in Nepal Issues in Project Development in Nepal Requests to Govt. of Nepal

Key Highlights 1 2 GMR : Leading Infrastructure Player 3 4 5 Power 6 7 8 Airports Urban Infrastructure & Highways Strong Management Status of Project Development in Nepal Issues in Project Development in Nepal Requests to Govt. of Nepal

GMR has an experienced and dedicated team of individuals across hierarchy managing projects across sectors GMR Holding Board GMR Infra Board G. M. Rao Srinivas Bommidala GM Rao Group Chairman G Kiran Kumar K. Balasubramanian Chairman -Urban Infrastructure & Highways Chairman Airports Member Group Holding Board Srinivas Bommidala G. B. S. Raju G. Kiran Kumar B. V. Nageswara Rao K. Balasubramanian O B Raju Arun K. Thiagarajan GBS Raju B V N Rao P M Kumar Chairman – Corporate & International Business Chairman – Energy & Agro Member Group Holding Board K. R. Ramamoorthy Prakash G. Apte R. S. S. L. N. Bhaskarudu T. R. Prasad Udaya Holla Uday M. Chitale Management team Airport Energy B. S. Shantharaju – CEO Andrew Harrison – COO Shirish M Navlekar – CFO I Prabhakara Rao – VP – Project Development Urban Infrastructure & Highways Raajkumar – CEO Rajan Krishnan – COO G. K. Raghunandanan – CFO Ashutosh Agarwala – CFO D R Santhana Krishna – CFO G Subba Rao – President – Hydro Strategic Finance V Jayaraman – COO – Property Devlp. R. K Goel – VP – Transmission Phua chai Teck – VP - Planning & Develop Sudhir Mathur –Chief – Commcl. Officer Rajgopalsamy – CFO Ashish Basu – VP – Commercial & Contracts P Sripathy – Head -Project Mgmnt. I V Srinivas Rao – VP – Finance Corporate Services K V V Rao – Director & President S N Barde – VP – O & M V K Sharma – VP – Hydro Harvinder Manocha – Head Nepal Projects International Development O Bangaru Raju – COO - Strategic Initiatives & Central Procurement Y M Shivamurthy – President, Legal A, Subba Rao, EVP – CIG Ranjit Muregesan , CEO A. S. Cherukupalli, EVP – Company Sec. Madhu Terdal, EVP Vijay Vancheswar – Head, Corp. Comm. Cenk – CEO – Turkey P M Kumar - ED – Group Corporate Development R. Ram Mohan – EVP – GCM’s office

GMR has an experienced and dedicated team of individuals across hierarchy managing projects across sectors GMR Holding Board GMR Infra Board G. M. Rao Srinivas Bommidala GM Rao Group Chairman G Kiran Kumar K. Balasubramanian Chairman -Urban Infrastructure & Highways Chairman Airports Member Group Holding Board Srinivas Bommidala G. B. S. Raju G. Kiran Kumar B. V. Nageswara Rao K. Balasubramanian O B Raju Arun K. Thiagarajan GBS Raju B V N Rao P M Kumar Chairman – Corporate & International Business Chairman – Energy & Agro Member Group Holding Board K. R. Ramamoorthy Prakash G. Apte R. S. S. L. N. Bhaskarudu T. R. Prasad Udaya Holla Uday M. Chitale Management team Airport Energy B. S. Shantharaju – CEO Andrew Harrison – COO Shirish M Navlekar – CFO I Prabhakara Rao – VP – Project Development Urban Infrastructure & Highways Raajkumar – CEO Rajan Krishnan – COO G. K. Raghunandanan – CFO Ashutosh Agarwala – CFO D R Santhana Krishna – CFO G Subba Rao – President – Hydro Strategic Finance V Jayaraman – COO – Property Devlp. R. K Goel – VP – Transmission Phua chai Teck – VP - Planning & Develop Sudhir Mathur –Chief – Commcl. Officer Rajgopalsamy – CFO Ashish Basu – VP – Commercial & Contracts P Sripathy – Head -Project Mgmnt. I V Srinivas Rao – VP – Finance Corporate Services K V V Rao – Director & President S N Barde – VP – O & M V K Sharma – VP – Hydro Harvinder Manocha – Head Nepal Projects International Development O Bangaru Raju – COO - Strategic Initiatives & Central Procurement Y M Shivamurthy – President, Legal A, Subba Rao, EVP – CIG Ranjit Muregesan , CEO A. S. Cherukupalli, EVP – Company Sec. Madhu Terdal, EVP Vijay Vancheswar – Head, Corp. Comm. Cenk – CEO – Turkey P M Kumar - ED – Group Corporate Development R. Ram Mohan – EVP – GCM’s office

Key Highlights 1 2 GMR : Leading Infrastructure Player 3 4 5 Power 6 7 8 Airports Urban Infrastructure & Highways Strong Management Status of Project Development in Nepal Issues in Project Development in Nepal Requests to Govt. of Nepal

Key Highlights 1 2 GMR : Leading Infrastructure Player 3 4 5 Power 6 7 8 Airports Urban Infrastructure & Highways Strong Management Status of Project Development in Nepal Issues in Project Development in Nepal Requests to Govt. of Nepal

Status of Project Development in Nepal – 300 MW Upper Karnali HEP Project Mo. U executed with Mo. WR JVA executed with NEA Foreign Investment approval received from Dept. of Industries (Do. I), Govt. of Nepal JVC (Public Company) incorporated in Nepal Survey License obtained from Do. ED Certificate of commencement of operations obtained from Do. I Project establishment at Surkhet finalised Project team is in place; Engineering office operational at Kathmandu Site is presently inaccessible due to heavy rains and landslides EIA Consultants appointed – M/s Sch. EMS and data collection process started Public Consultations for To. R and Scoping documents are being taken up Topographical Survey agency finalised and activities will commence immediately after monsoon DPR preparation started; Review of past studies undertaken by NEA (through CIWEC) are on CSR activities are being taken up after the current year monsoon At the time of DPR and Investigations stage itself

Status of Project Development in Nepal – 300 MW Upper Karnali HEP Project Mo. U executed with Mo. WR JVA executed with NEA Foreign Investment approval received from Dept. of Industries (Do. I), Govt. of Nepal JVC (Public Company) incorporated in Nepal Survey License obtained from Do. ED Certificate of commencement of operations obtained from Do. I Project establishment at Surkhet finalised Project team is in place; Engineering office operational at Kathmandu Site is presently inaccessible due to heavy rains and landslides EIA Consultants appointed – M/s Sch. EMS and data collection process started Public Consultations for To. R and Scoping documents are being taken up Topographical Survey agency finalised and activities will commence immediately after monsoon DPR preparation started; Review of past studies undertaken by NEA (through CIWEC) are on CSR activities are being taken up after the current year monsoon At the time of DPR and Investigations stage itself

Status of Project Development in Nepal – 250 MW Upper Marsyangdi HEP 80% shareholding taken over in Himtal Hydro Power Company Project site establishments are in place: Project team in place; Engineering office operational at Kathmandu Offices at Syange (Powerhouse site) & Taal (River diversion site) are operational Site is presently inaccessible due to heavy rains and landslides Project access road from Besisahar to Syange – washed away due to heavy monsoon Site visits are being undertaken through trekking and through helicopter at times Topographical Survey completed and geo-technical Investigations are underway Both these are being undertaken through local agencies in Nepal EIA Consultants - M/s Sch. EMS from Nepal ; Data collection process completed Approval of To. R & Scoping documents for revised capacity of 250 MW is expected shortly Approval process was delayed due to approval from ACAP / Wild life Board Project layout finalised and Engineering activities have started CSR activities are being taken up after the current year monsoon At the time of DPR and Investigations stage itself

Status of Project Development in Nepal – 250 MW Upper Marsyangdi HEP 80% shareholding taken over in Himtal Hydro Power Company Project site establishments are in place: Project team in place; Engineering office operational at Kathmandu Offices at Syange (Powerhouse site) & Taal (River diversion site) are operational Site is presently inaccessible due to heavy rains and landslides Project access road from Besisahar to Syange – washed away due to heavy monsoon Site visits are being undertaken through trekking and through helicopter at times Topographical Survey completed and geo-technical Investigations are underway Both these are being undertaken through local agencies in Nepal EIA Consultants - M/s Sch. EMS from Nepal ; Data collection process completed Approval of To. R & Scoping documents for revised capacity of 250 MW is expected shortly Approval process was delayed due to approval from ACAP / Wild life Board Project layout finalised and Engineering activities have started CSR activities are being taken up after the current year monsoon At the time of DPR and Investigations stage itself

Key Highlights 1 2 GMR : Leading Infrastructure Player 3 4 5 Power 6 7 8 Airports Urban Infrastructure & Highways Strong Management Status of Project Development in Nepal Issues in Project Development in Nepal Requests to Govt. of Nepal

Key Highlights 1 2 GMR : Leading Infrastructure Player 3 4 5 Power 6 7 8 Airports Urban Infrastructure & Highways Strong Management Status of Project Development in Nepal Issues in Project Development in Nepal Requests to Govt. of Nepal

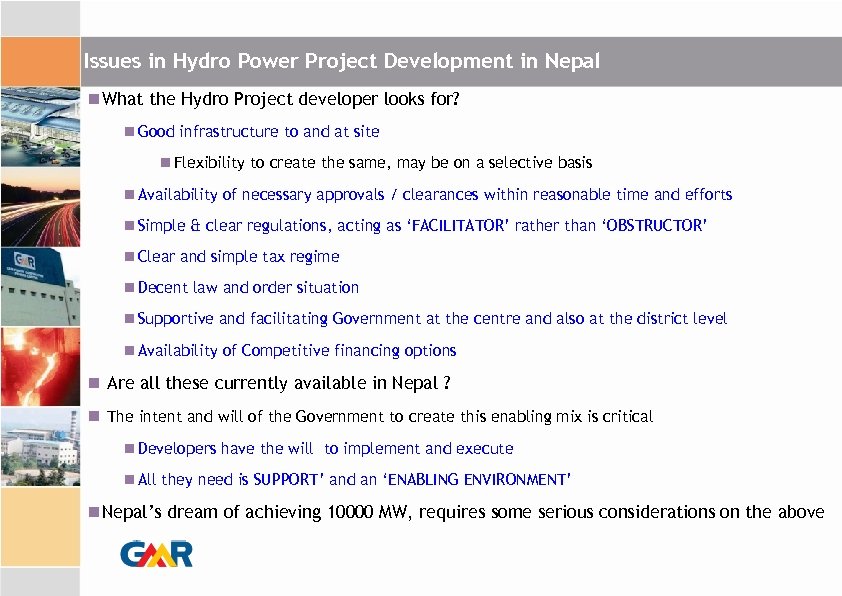

Issues in Hydro Power Project Development in Nepal What the Hydro Project developer looks for? Good infrastructure to and at site Flexibility to create the same, may be on a selective basis Availability of necessary approvals / clearances within reasonable time and efforts Simple & clear regulations, acting as ‘FACILITATOR’ rather than ‘OBSTRUCTOR’ Clear and simple tax regime Decent law and order situation Supportive and facilitating Government at the centre and also at the district level Availability of Competitive financing options Are all these currently available in Nepal ? The intent and will of the Government to create this enabling mix is critical Developers have the will to implement and execute All they need is SUPPORT’ and an ‘ENABLING ENVIRONMENT’ Nepal’s dream of achieving 10000 MW, requires some serious considerations on the above

Issues in Hydro Power Project Development in Nepal What the Hydro Project developer looks for? Good infrastructure to and at site Flexibility to create the same, may be on a selective basis Availability of necessary approvals / clearances within reasonable time and efforts Simple & clear regulations, acting as ‘FACILITATOR’ rather than ‘OBSTRUCTOR’ Clear and simple tax regime Decent law and order situation Supportive and facilitating Government at the centre and also at the district level Availability of Competitive financing options Are all these currently available in Nepal ? The intent and will of the Government to create this enabling mix is critical Developers have the will to implement and execute All they need is SUPPORT’ and an ‘ENABLING ENVIRONMENT’ Nepal’s dream of achieving 10000 MW, requires some serious considerations on the above

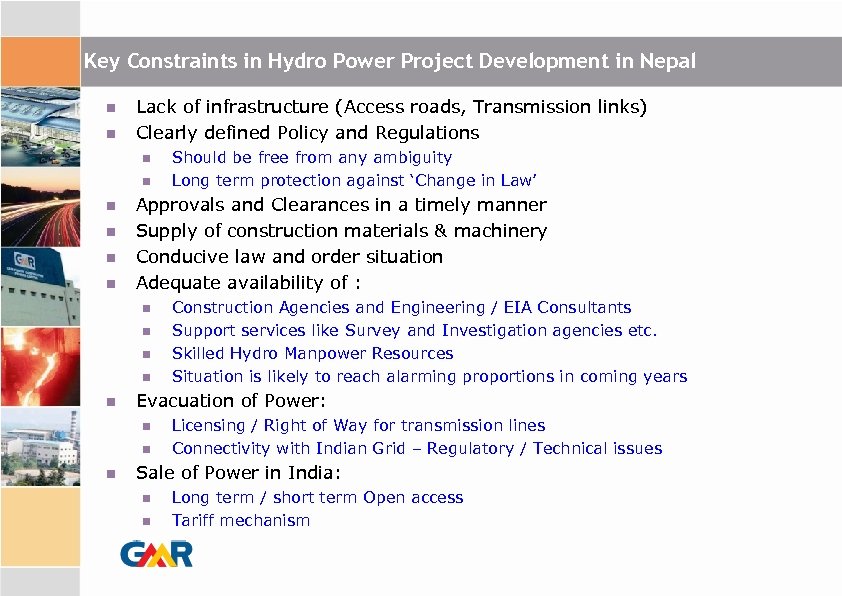

Key Constraints in Hydro Power Project Development in Nepal Lack of infrastructure (Access roads, Transmission links) Clearly defined Policy and Regulations Approvals and Clearances in a timely manner Supply of construction materials & machinery Conducive law and order situation Adequate availability of : Construction Agencies and Engineering / EIA Consultants Support services like Survey and Investigation agencies etc. Skilled Hydro Manpower Resources Situation is likely to reach alarming proportions in coming years Evacuation of Power: Should be free from any ambiguity Long term protection against ‘Change in Law’ Licensing / Right of Way for transmission lines Connectivity with Indian Grid – Regulatory / Technical issues Sale of Power in India: Long term / short term Open access Tariff mechanism

Key Constraints in Hydro Power Project Development in Nepal Lack of infrastructure (Access roads, Transmission links) Clearly defined Policy and Regulations Approvals and Clearances in a timely manner Supply of construction materials & machinery Conducive law and order situation Adequate availability of : Construction Agencies and Engineering / EIA Consultants Support services like Survey and Investigation agencies etc. Skilled Hydro Manpower Resources Situation is likely to reach alarming proportions in coming years Evacuation of Power: Should be free from any ambiguity Long term protection against ‘Change in Law’ Licensing / Right of Way for transmission lines Connectivity with Indian Grid – Regulatory / Technical issues Sale of Power in India: Long term / short term Open access Tariff mechanism

Key Highlights 1 2 GMR : Leading Infrastructure Player 3 4 5 Power 6 7 8 Airports Urban Infrastructure & Highways Strong Management Status of Project Development in Nepal Issues in Project Development in Nepal Requests to Govt. of Nepal

Key Highlights 1 2 GMR : Leading Infrastructure Player 3 4 5 Power 6 7 8 Airports Urban Infrastructure & Highways Strong Management Status of Project Development in Nepal Issues in Project Development in Nepal Requests to Govt. of Nepal

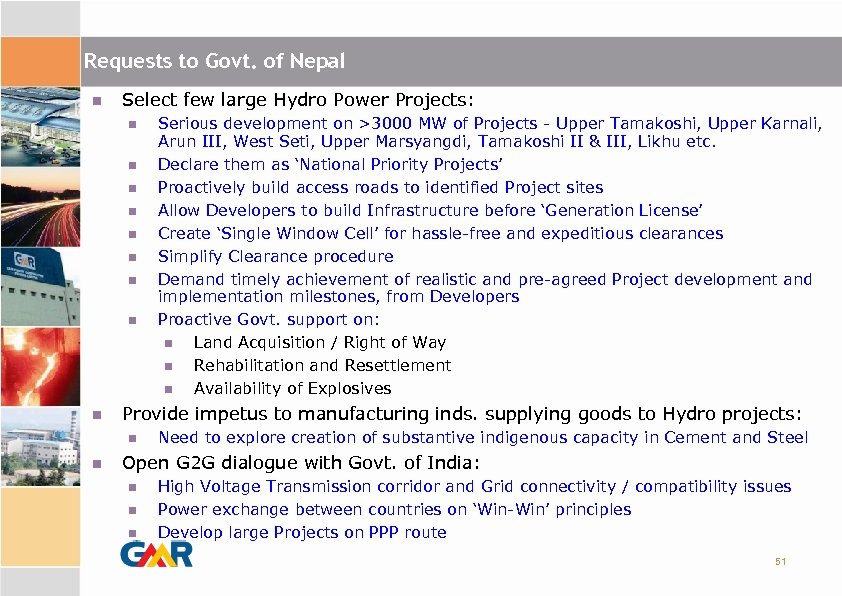

Requests to Govt. of Nepal Select few large Hydro Power Projects: Provide impetus to manufacturing inds. supplying goods to Hydro projects: Serious development on >3000 MW of Projects - Upper Tamakoshi, Upper Karnali, Arun III, West Seti, Upper Marsyangdi, Tamakoshi II & III, Likhu etc. Declare them as ‘National Priority Projects’ Proactively build access roads to identified Project sites Allow Developers to build Infrastructure before ‘Generation License’ Create ‘Single Window Cell’ for hassle-free and expeditious clearances Simplify Clearance procedure Demand timely achievement of realistic and pre-agreed Project development and implementation milestones, from Developers Proactive Govt. support on: Land Acquisition / Right of Way Rehabilitation and Resettlement Availability of Explosives Need to explore creation of substantive indigenous capacity in Cement and Steel Open G 2 G dialogue with Govt. of India: High Voltage Transmission corridor and Grid connectivity / compatibility issues Power exchange between countries on ‘Win-Win’ principles Develop large Projects on PPP route 51

Requests to Govt. of Nepal Select few large Hydro Power Projects: Provide impetus to manufacturing inds. supplying goods to Hydro projects: Serious development on >3000 MW of Projects - Upper Tamakoshi, Upper Karnali, Arun III, West Seti, Upper Marsyangdi, Tamakoshi II & III, Likhu etc. Declare them as ‘National Priority Projects’ Proactively build access roads to identified Project sites Allow Developers to build Infrastructure before ‘Generation License’ Create ‘Single Window Cell’ for hassle-free and expeditious clearances Simplify Clearance procedure Demand timely achievement of realistic and pre-agreed Project development and implementation milestones, from Developers Proactive Govt. support on: Land Acquisition / Right of Way Rehabilitation and Resettlement Availability of Explosives Need to explore creation of substantive indigenous capacity in Cement and Steel Open G 2 G dialogue with Govt. of India: High Voltage Transmission corridor and Grid connectivity / compatibility issues Power exchange between countries on ‘Win-Win’ principles Develop large Projects on PPP route 51

Requests to Govt. of Nepal Licensing policy: Provide Fiscal benefits to improve ‘Investor Confidence’: Integrated Basin development - Preference for developers of large Projects for additional projects in the same basin: Why not look at ‘Swiss Challenge’ route for such projects? VAT exemption – already proposed in current year budget – a Welcome step Restore Tax holiday provisions in Hydro Power Liberalize dividend repatriation provisions foreign investment Generation License period – increase to 45 years Deferment of royalty to improve financeability of long gestation Projects Provide incentives to local industries in all areas of Hydro Power Support services Local Civil Contractors and Equipment suppliers, Survey and Investigation agencies, Transport and logistics service providers Provide nation-wide boost to technical education To promote young Nepalese Engineers Simplify banking regulations Clarity and consistency in Customs and import policies Strengthen Legal, accounting and taxation system Consultations with IPPs in framing Acts, policies for Power sector 51

Requests to Govt. of Nepal Licensing policy: Provide Fiscal benefits to improve ‘Investor Confidence’: Integrated Basin development - Preference for developers of large Projects for additional projects in the same basin: Why not look at ‘Swiss Challenge’ route for such projects? VAT exemption – already proposed in current year budget – a Welcome step Restore Tax holiday provisions in Hydro Power Liberalize dividend repatriation provisions foreign investment Generation License period – increase to 45 years Deferment of royalty to improve financeability of long gestation Projects Provide incentives to local industries in all areas of Hydro Power Support services Local Civil Contractors and Equipment suppliers, Survey and Investigation agencies, Transport and logistics service providers Provide nation-wide boost to technical education To promote young Nepalese Engineers Simplify banking regulations Clarity and consistency in Customs and import policies Strengthen Legal, accounting and taxation system Consultations with IPPs in framing Acts, policies for Power sector 51

Thank You

Thank You