422dc19231082d663e69eefca644fdd2.ppt

- Количество слайдов: 54

Power. Point to accompany Chapter 8 Monopoly Markets

Power. Point to accompany Chapter 8 Monopoly Markets

Learning Objectives 1. Define monopoly. 2. Explain the four main reasons why monopolies arise. 3. Explain how a monopoly determines price and output. 4. Use a graph to illustrate how a monopoly affects economic surplus. 5. Discuss government policies towards a monopoly. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

Learning Objectives 1. Define monopoly. 2. Explain the four main reasons why monopolies arise. 3. Explain how a monopoly determines price and output. 4. Use a graph to illustrate how a monopoly affects economic surplus. 5. Discuss government policies towards a monopoly. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

Austar rules the regions Australian Pay TV industry is dominated by three players: Foxtel, Optus TV and Austar is the sole provider of Pay TV in rural Australia, i. e. : one of a few firms in Australia enjoying the benefits of being a monopoly. § Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

Austar rules the regions Australian Pay TV industry is dominated by three players: Foxtel, Optus TV and Austar is the sole provider of Pay TV in rural Australia, i. e. : one of a few firms in Australia enjoying the benefits of being a monopoly. § Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

LEARNING OBJECTIVE 1 Is any firm ever really a monopoly? § Monopoly: The only seller of a good or service that does not have a close substitute. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

LEARNING OBJECTIVE 1 Is any firm ever really a monopoly? § Monopoly: The only seller of a good or service that does not have a close substitute. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

MAKING THE 8. 1 CONNECTION The End of the Singapore Education Bonanza At one time, Perth universities earned large profits by exporting education to Singapore. However, many new rivals entered the industry, and now the large profits initially earned are a thing of the past. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

MAKING THE 8. 1 CONNECTION The End of the Singapore Education Bonanza At one time, Perth universities earned large profits by exporting education to Singapore. However, many new rivals entered the industry, and now the large profits initially earned are a thing of the past. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

LEARNING OBJECTIVE 2 Where do monopolies come from? § Monopolies emerge due to a lack of competition created by barriers to entry. § The four main reasons for high barriers to entry are: 1. Government blocks the entry of more than one firm into a market. 2. One firm has control of a key resource material necessary to produce a good. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

LEARNING OBJECTIVE 2 Where do monopolies come from? § Monopolies emerge due to a lack of competition created by barriers to entry. § The four main reasons for high barriers to entry are: 1. Government blocks the entry of more than one firm into a market. 2. One firm has control of a key resource material necessary to produce a good. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

LEARNING OBJECTIVE 2 Where do monopolies come from? 3. There are important network externalities in supplying the good or service. 4. Economies of scale are so large that one firm has a natural monopoly. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

LEARNING OBJECTIVE 2 Where do monopolies come from? 3. There are important network externalities in supplying the good or service. 4. Economies of scale are so large that one firm has a natural monopoly. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

LEARNING OBJECTIVE 2 Where do monopolies come from? 1. Government blocks entry in two main ways: i. By granting a patent or copyright to an individual or firm, which gives the exclusive right to produce a product or service for a period of time. ii. By granting a firm a public franchise, which makes it the exclusive legal provider of a good or service. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

LEARNING OBJECTIVE 2 Where do monopolies come from? 1. Government blocks entry in two main ways: i. By granting a patent or copyright to an individual or firm, which gives the exclusive right to produce a product or service for a period of time. ii. By granting a firm a public franchise, which makes it the exclusive legal provider of a good or service. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

LEARNING OBJECTIVE 2 Where do monopolies come from? 2. Another way for a firm to become a monopoly is by controlling a key resource. § This happens infrequently because most resources are widely available from a variety of suppliers. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

LEARNING OBJECTIVE 2 Where do monopolies come from? 2. Another way for a firm to become a monopoly is by controlling a key resource. § This happens infrequently because most resources are widely available from a variety of suppliers. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

MAKING THE 8. 2 CONNECTION Are Diamond (Profits) Forever? The De Beers Diamond Monopoly De Beers promoted the sentimental value of diamonds as a way to maintain its position in the diamond market. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

MAKING THE 8. 2 CONNECTION Are Diamond (Profits) Forever? The De Beers Diamond Monopoly De Beers promoted the sentimental value of diamonds as a way to maintain its position in the diamond market. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

LEARNING OBJECTIVE 2 Where do monopolies come from? 3. Network externalities: These exist when the usefulness of a product increases with the number of consumers who use it. § Network externalities can set off a virtuous cycle: if a firm can attract enough customers initially, it can then attract more customers, which attracts even more customers, and so on. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

LEARNING OBJECTIVE 2 Where do monopolies come from? 3. Network externalities: These exist when the usefulness of a product increases with the number of consumers who use it. § Network externalities can set off a virtuous cycle: if a firm can attract enough customers initially, it can then attract more customers, which attracts even more customers, and so on. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

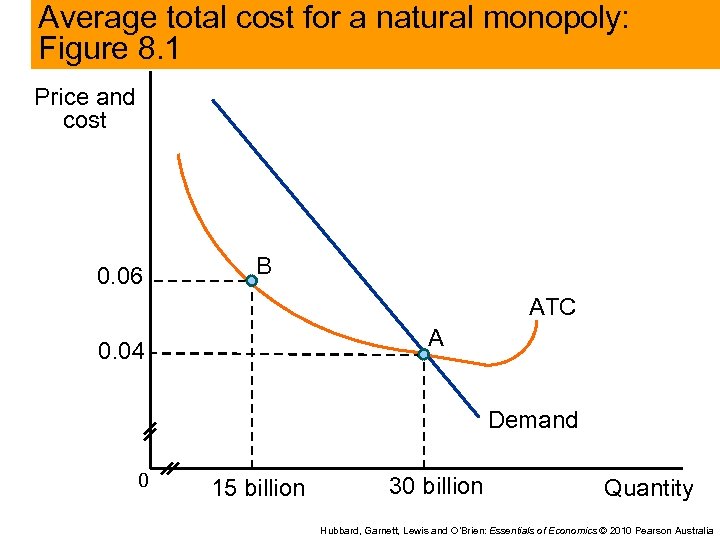

LEARNING OBJECTIVE 2 Where do monopolies come from? 4. Natural monopoly: A situation in which economies of scale are so large that one firm can supply the entire market at a lower average total cost than can two or more firms. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

LEARNING OBJECTIVE 2 Where do monopolies come from? 4. Natural monopoly: A situation in which economies of scale are so large that one firm can supply the entire market at a lower average total cost than can two or more firms. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

Average total cost for a natural monopoly: Figure 8. 1 Price and cost 0. 06 B ATC A 0. 04 Demand 0 15 billion 30 billion Quantity Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

Average total cost for a natural monopoly: Figure 8. 1 Price and cost 0. 06 B ATC A 0. 04 Demand 0 15 billion 30 billion Quantity Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

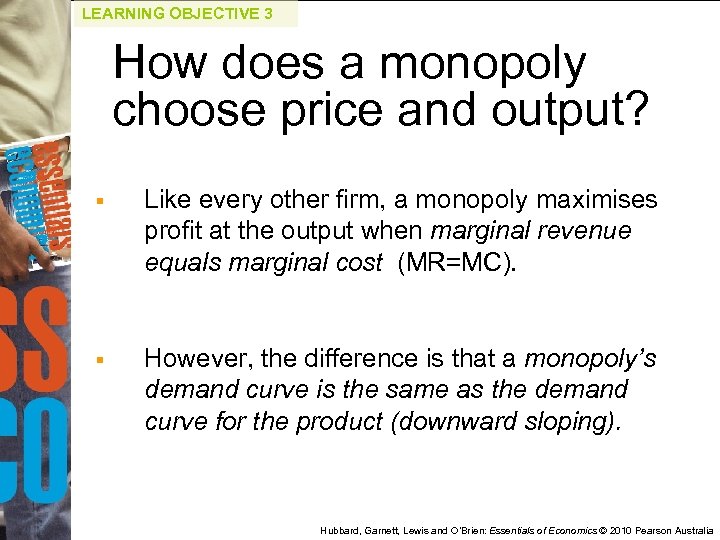

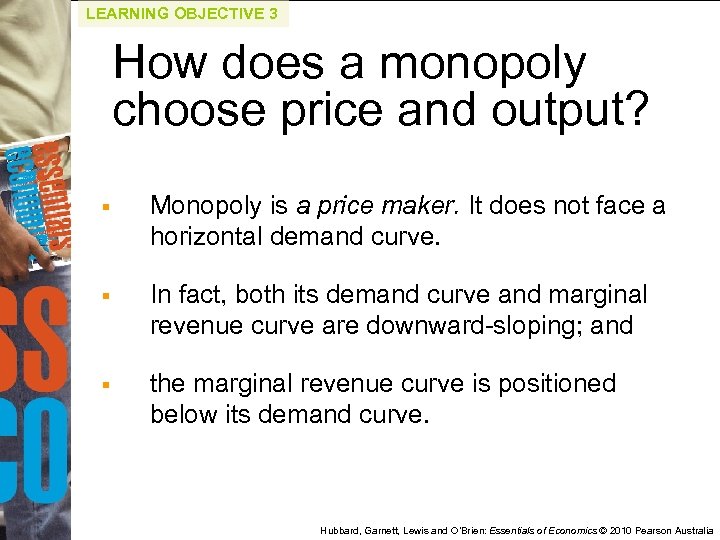

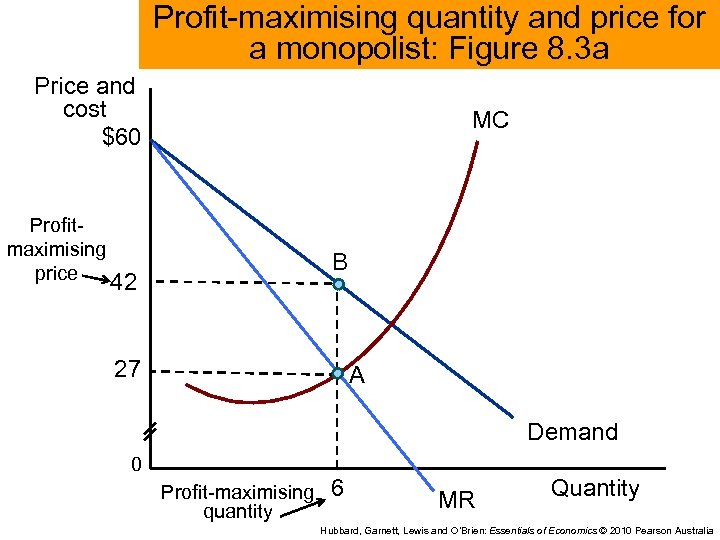

LEARNING OBJECTIVE 3 How does a monopoly choose price and output? § Like every other firm, a monopoly maximises profit at the output when marginal revenue equals marginal cost (MR=MC). § However, the difference is that a monopoly’s demand curve is the same as the demand curve for the product (downward sloping). Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

LEARNING OBJECTIVE 3 How does a monopoly choose price and output? § Like every other firm, a monopoly maximises profit at the output when marginal revenue equals marginal cost (MR=MC). § However, the difference is that a monopoly’s demand curve is the same as the demand curve for the product (downward sloping). Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

LEARNING OBJECTIVE 3 How does a monopoly choose price and output? § Monopoly is a price maker. It does not face a horizontal demand curve. § In fact, both its demand curve and marginal revenue curve are downward-sloping; and § the marginal revenue curve is positioned below its demand curve. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

LEARNING OBJECTIVE 3 How does a monopoly choose price and output? § Monopoly is a price maker. It does not face a horizontal demand curve. § In fact, both its demand curve and marginal revenue curve are downward-sloping; and § the marginal revenue curve is positioned below its demand curve. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

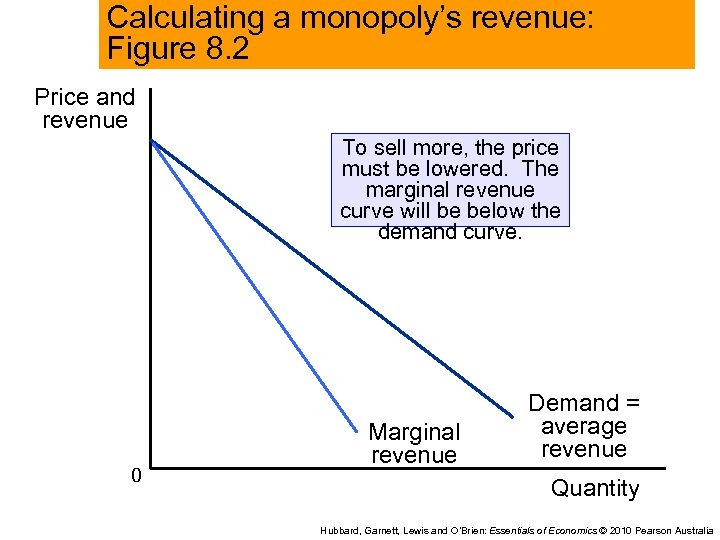

Calculating a monopoly’s revenue: Figure 8. 2 Price and revenue To sell more, the price must be lowered. The marginal revenue curve will be below the demand curve. 0 Marginal revenue Demand = average revenue Quantity Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

Calculating a monopoly’s revenue: Figure 8. 2 Price and revenue To sell more, the price must be lowered. The marginal revenue curve will be below the demand curve. 0 Marginal revenue Demand = average revenue Quantity Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

Profit-maximising quantity and price for a monopolist: Figure 8. 3 a Price and cost $60 MC Profitmaximising price 42 B 27 A Demand 0 Profit-maximising quantity 6 MR Quantity Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

Profit-maximising quantity and price for a monopolist: Figure 8. 3 a Price and cost $60 MC Profitmaximising price 42 B 27 A Demand 0 Profit-maximising quantity 6 MR Quantity Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

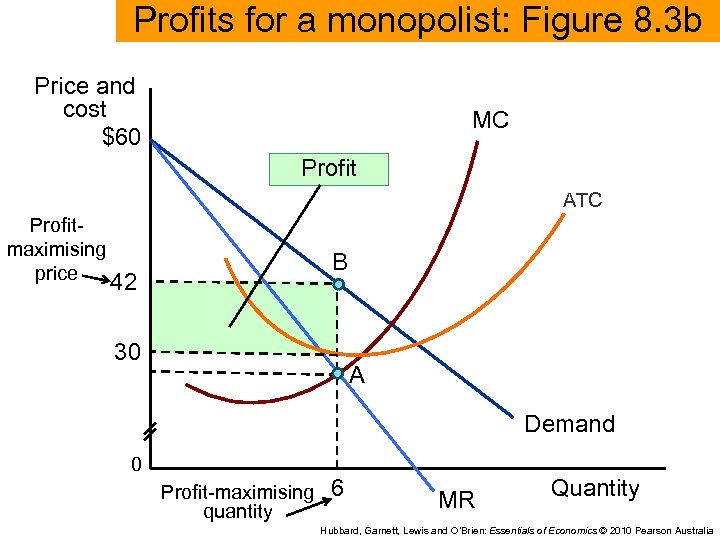

Profits for a monopolist: Figure 8. 3 b Price and cost $60 MC Profit ATC Profitmaximising price 42 B 30 A Demand 0 Profit-maximising quantity 6 MR Quantity Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

Profits for a monopolist: Figure 8. 3 b Price and cost $60 MC Profit ATC Profitmaximising price 42 B 30 A Demand 0 Profit-maximising quantity 6 MR Quantity Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

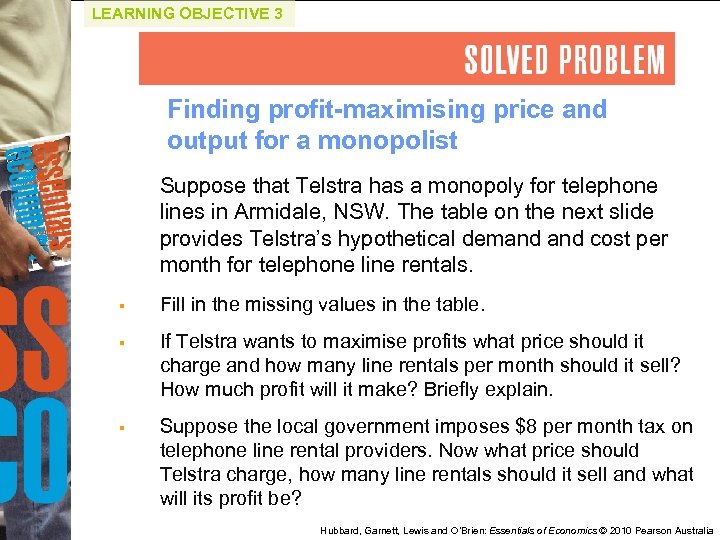

LEARNING OBJECTIVE 3 Finding profit-maximising price and output for a monopolist Suppose that Telstra has a monopoly for telephone lines in Armidale, NSW. The table on the next slide provides Telstra’s hypothetical demand cost per month for telephone line rentals. § Fill in the missing values in the table. § If Telstra wants to maximise profits what price should it charge and how many line rentals per month should it sell? How much profit will it make? Briefly explain. § Suppose the local government imposes $8 per month tax on telephone line rental providers. Now what price should Telstra charge, how many line rentals should it sell and what will its profit be? Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

LEARNING OBJECTIVE 3 Finding profit-maximising price and output for a monopolist Suppose that Telstra has a monopoly for telephone lines in Armidale, NSW. The table on the next slide provides Telstra’s hypothetical demand cost per month for telephone line rentals. § Fill in the missing values in the table. § If Telstra wants to maximise profits what price should it charge and how many line rentals per month should it sell? How much profit will it make? Briefly explain. § Suppose the local government imposes $8 per month tax on telephone line rental providers. Now what price should Telstra charge, how many line rentals should it sell and what will its profit be? Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

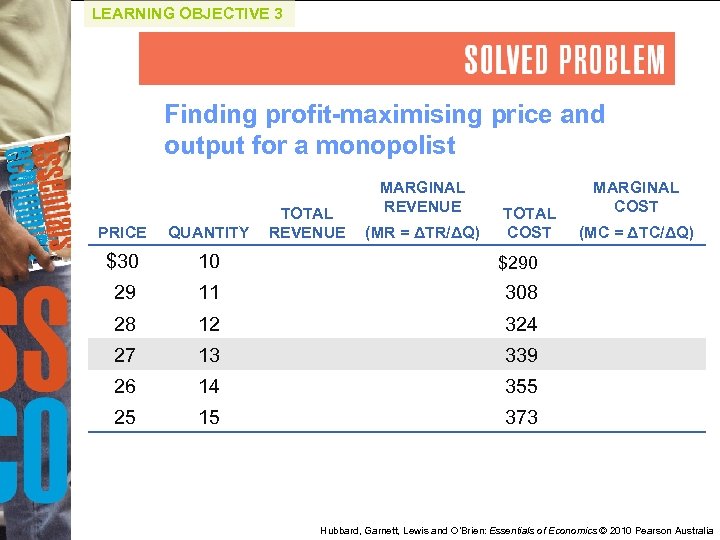

LEARNING OBJECTIVE 3 Finding profit-maximising price and output for a monopolist TOTAL REVENUE MARGINAL REVENUE (MR = ΔTR/ΔQ) TOTAL COST PRICE QUANTITY $30 10 $290 29 11 308 28 12 324 27 13 339 26 14 355 25 15 MARGINAL COST (MC = ΔTC/ΔQ) 373 Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

LEARNING OBJECTIVE 3 Finding profit-maximising price and output for a monopolist TOTAL REVENUE MARGINAL REVENUE (MR = ΔTR/ΔQ) TOTAL COST PRICE QUANTITY $30 10 $290 29 11 308 28 12 324 27 13 339 26 14 355 25 15 MARGINAL COST (MC = ΔTC/ΔQ) 373 Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

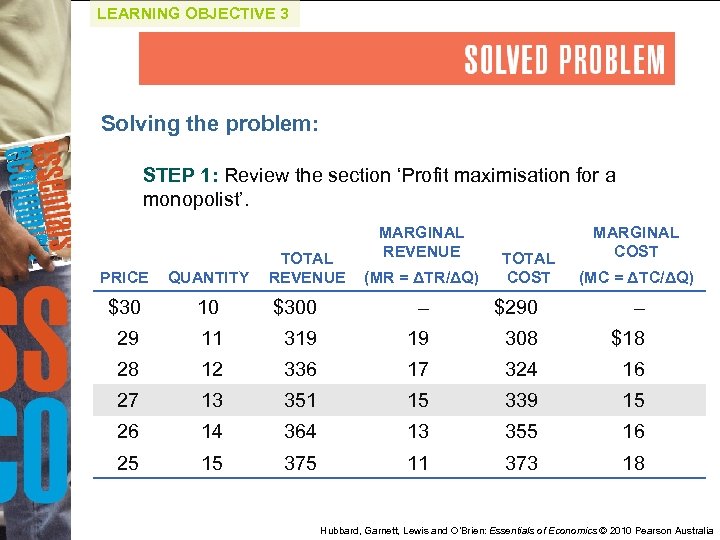

LEARNING OBJECTIVE 3 Solving the problem: STEP 1: Review the section ‘Profit maximisation for a monopolist’. TOTAL REVENUE MARGINAL REVENUE (MR = ΔTR/ΔQ) TOTAL COST MARGINAL COST PRICE QUANTITY (MC = ΔTC/ΔQ) $30 10 $300 – $290 – 29 11 319 19 308 $18 28 12 336 17 324 16 27 13 351 15 339 15 26 14 364 13 355 16 25 15 375 11 373 18 Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

LEARNING OBJECTIVE 3 Solving the problem: STEP 1: Review the section ‘Profit maximisation for a monopolist’. TOTAL REVENUE MARGINAL REVENUE (MR = ΔTR/ΔQ) TOTAL COST MARGINAL COST PRICE QUANTITY (MC = ΔTC/ΔQ) $30 10 $300 – $290 – 29 11 319 19 308 $18 28 12 336 17 324 16 27 13 351 15 339 15 26 14 364 13 355 16 25 15 375 11 373 18 Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

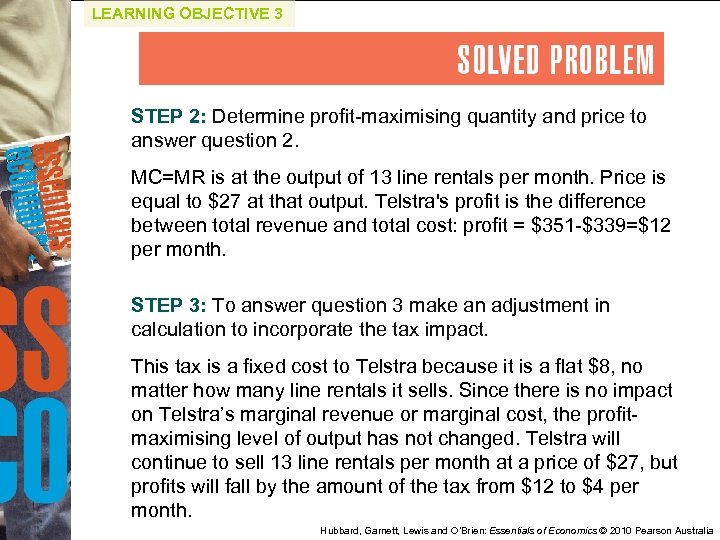

LEARNING OBJECTIVE 3 STEP 2: Determine profit-maximising quantity and price to answer question 2. MC=MR is at the output of 13 line rentals per month. Price is equal to $27 at that output. Telstra's profit is the difference between total revenue and total cost: profit = $351 -$339=$12 per month. STEP 3: To answer question 3 make an adjustment in calculation to incorporate the tax impact. This tax is a fixed cost to Telstra because it is a flat $8, no matter how many line rentals it sells. Since there is no impact on Telstra’s marginal revenue or marginal cost, the profitmaximising level of output has not changed. Telstra will continue to sell 13 line rentals per month at a price of $27, but profits will fall by the amount of the tax from $12 to $4 per month. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

LEARNING OBJECTIVE 3 STEP 2: Determine profit-maximising quantity and price to answer question 2. MC=MR is at the output of 13 line rentals per month. Price is equal to $27 at that output. Telstra's profit is the difference between total revenue and total cost: profit = $351 -$339=$12 per month. STEP 3: To answer question 3 make an adjustment in calculation to incorporate the tax impact. This tax is a fixed cost to Telstra because it is a flat $8, no matter how many line rentals it sells. Since there is no impact on Telstra’s marginal revenue or marginal cost, the profitmaximising level of output has not changed. Telstra will continue to sell 13 line rentals per month at a price of $27, but profits will fall by the amount of the tax from $12 to $4 per month. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

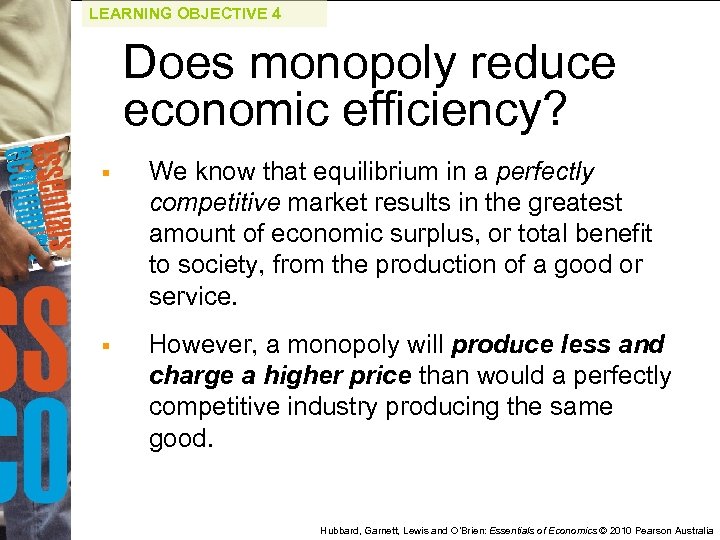

LEARNING OBJECTIVE 4 Does monopoly reduce economic efficiency? § We know that equilibrium in a perfectly competitive market results in the greatest amount of economic surplus, or total benefit to society, from the production of a good or service. § However, a monopoly will produce less and charge a higher price than would a perfectly competitive industry producing the same good. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

LEARNING OBJECTIVE 4 Does monopoly reduce economic efficiency? § We know that equilibrium in a perfectly competitive market results in the greatest amount of economic surplus, or total benefit to society, from the production of a good or service. § However, a monopoly will produce less and charge a higher price than would a perfectly competitive industry producing the same good. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

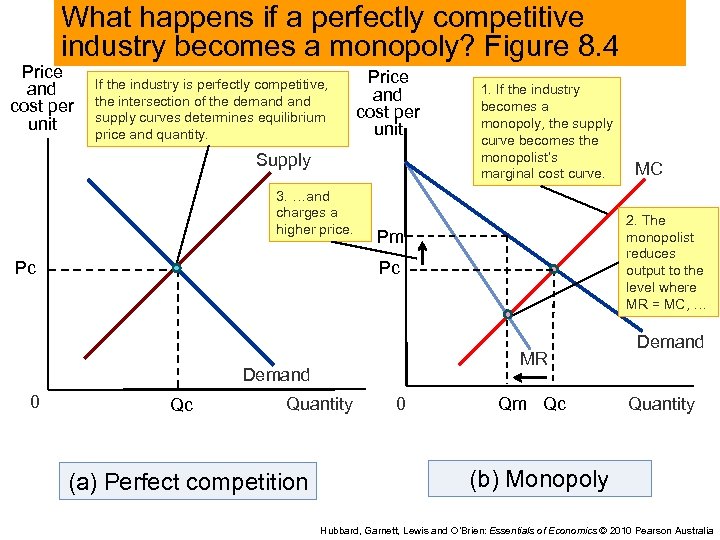

What happens if a perfectly competitive industry becomes a monopoly? Figure 8. 4 Price and cost per unit If the industry is perfectly competitive, the intersection of the demand supply curves determines equilibrium price and quantity. Price and cost per unit Supply 3. …and charges a higher price. Pc Pc Qc MR Quantity (a) Perfect competition 0 MC 2. The monopolist reduces output to the level where MR = MC, … Pm Demand 0 1. If the industry becomes a monopoly, the supply curve becomes the monopolist’s marginal cost curve. Qm Qc Demand Quantity (b) Monopoly Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

What happens if a perfectly competitive industry becomes a monopoly? Figure 8. 4 Price and cost per unit If the industry is perfectly competitive, the intersection of the demand supply curves determines equilibrium price and quantity. Price and cost per unit Supply 3. …and charges a higher price. Pc Pc Qc MR Quantity (a) Perfect competition 0 MC 2. The monopolist reduces output to the level where MR = MC, … Pm Demand 0 1. If the industry becomes a monopoly, the supply curve becomes the monopolist’s marginal cost curve. Qm Qc Demand Quantity (b) Monopoly Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

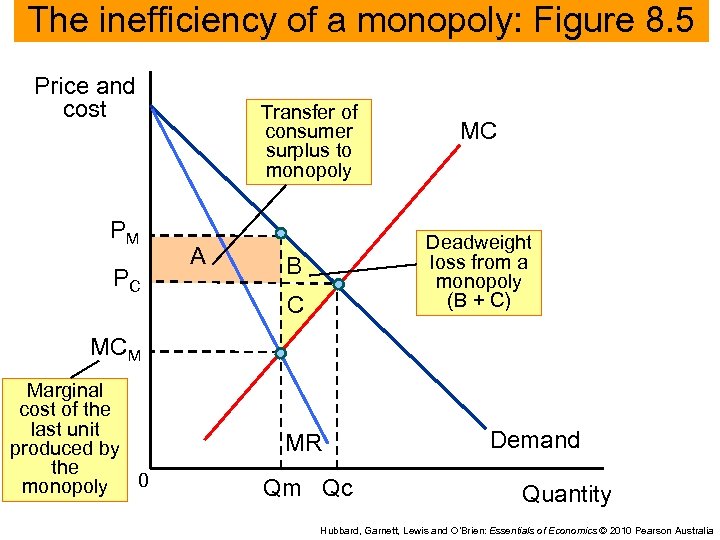

LEARNING OBJECTIVE 4 Does monopoly reduce economic efficiency? § The effects of monopoly can be summarised as follows: 1. Monopoly causes a reduction in consumer surplus. 2. Monopoly causes an increase in producer surplus. 3. Monopoly causes a deadweight loss, which represents a reduction in economic efficiency; (allocative inefficiency occurs). Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

LEARNING OBJECTIVE 4 Does monopoly reduce economic efficiency? § The effects of monopoly can be summarised as follows: 1. Monopoly causes a reduction in consumer surplus. 2. Monopoly causes an increase in producer surplus. 3. Monopoly causes a deadweight loss, which represents a reduction in economic efficiency; (allocative inefficiency occurs). Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

The inefficiency of a monopoly: Figure 8. 5 Price and cost PM PC Transfer of consumer surplus to monopoly A MC Deadweight loss from a monopoly (B + C) B C MCM Marginal cost of the last unit produced by the monopoly 0 MR Qm Qc Demand Quantity Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

The inefficiency of a monopoly: Figure 8. 5 Price and cost PM PC Transfer of consumer surplus to monopoly A MC Deadweight loss from a monopoly (B + C) B C MCM Marginal cost of the last unit produced by the monopoly 0 MR Qm Qc Demand Quantity Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

LEARNING OBJECTIVE 4 Does monopoly reduce economic efficiency? Market power and technological change § Market power: The ability of a firm to charge a price greater than marginal cost. § The introduction of new products requires firms to spend funds on research and development. Because firms with market power are more likely to earn economic profits, they are also more likely to introduce new products. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

LEARNING OBJECTIVE 4 Does monopoly reduce economic efficiency? Market power and technological change § Market power: The ability of a firm to charge a price greater than marginal cost. § The introduction of new products requires firms to spend funds on research and development. Because firms with market power are more likely to earn economic profits, they are also more likely to introduce new products. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

LEARNING OBJECTIVE 5 Government policy toward monopoly § Collusion: An agreement among firms to charge the same price, or to otherwise not compete. § In Australia, trade practices laws are used to deal with monopolies, collusion and other forms of anti -competitive behaviour. § The laws usually make it illegal for large firms with market power to collude, and firms wishing to merge or take over another firm must apply for permission to do so. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

LEARNING OBJECTIVE 5 Government policy toward monopoly § Collusion: An agreement among firms to charge the same price, or to otherwise not compete. § In Australia, trade practices laws are used to deal with monopolies, collusion and other forms of anti -competitive behaviour. § The laws usually make it illegal for large firms with market power to collude, and firms wishing to merge or take over another firm must apply for permission to do so. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

LEARNING OBJECTIVE 5 Government policy toward monopoly § In Australia, competitive behaviour is monitored by the Australian Competition and Consumer Commission (ACCC). § The major regulatory law regarding trade practices is the Trade Practices Act 1974. It covers the following key areas: § Anti-competitive agreements, such as price fixing. § Exclusive dealing, such as (i) market sharing arrangements; and (ii) third line forcing. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

LEARNING OBJECTIVE 5 Government policy toward monopoly § In Australia, competitive behaviour is monitored by the Australian Competition and Consumer Commission (ACCC). § The major regulatory law regarding trade practices is the Trade Practices Act 1974. It covers the following key areas: § Anti-competitive agreements, such as price fixing. § Exclusive dealing, such as (i) market sharing arrangements; and (ii) third line forcing. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

LEARNING OBJECTIVE 5 Government policy toward monopoly § Misuse of market power, such as predatory pricing. § Boycotts, such as an agreement between some suppliers and purchasers not to supply to, or purchase from, a particular firm or competitor. § Resale price maintenance. § Unconscionable and misleading conduct, such as deceiving people into signing contracts that they do not understand. § Product safety and reliability. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

LEARNING OBJECTIVE 5 Government policy toward monopoly § Misuse of market power, such as predatory pricing. § Boycotts, such as an agreement between some suppliers and purchasers not to supply to, or purchase from, a particular firm or competitor. § Resale price maintenance. § Unconscionable and misleading conduct, such as deceiving people into signing contracts that they do not understand. § Product safety and reliability. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

MAKING THE 8. 3 CONNECTION Anti-competitive behaviour in the cardboard box industry Collusion between cardboard box producers raised the prices of many products for consumers. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

MAKING THE 8. 3 CONNECTION Anti-competitive behaviour in the cardboard box industry Collusion between cardboard box producers raised the prices of many products for consumers. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

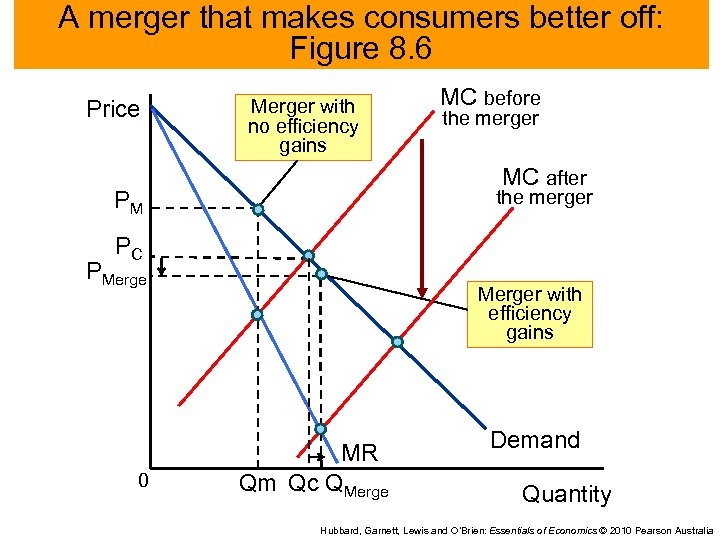

LEARNING OBJECTIVE 5 Government policy toward monopoly § Horizontal merger: A merger between firms in the same industry. § Vertical merger: A merger between firms at different stages of production of a good. § Mergers: The trade-off between market power and efficiency § Sometimes a merged firm is more efficient and has lower costs, and other times it does not. § The ACCC has the task to evaluate each individual case. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

LEARNING OBJECTIVE 5 Government policy toward monopoly § Horizontal merger: A merger between firms in the same industry. § Vertical merger: A merger between firms at different stages of production of a good. § Mergers: The trade-off between market power and efficiency § Sometimes a merged firm is more efficient and has lower costs, and other times it does not. § The ACCC has the task to evaluate each individual case. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

A merger that makes consumers better off: Figure 8. 6 Price Merger with no efficiency gains MC before the merger MC after PM the merger PC PMerge 0 Merger with efficiency gains MR Qm Qc QMerge Demand Quantity Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

A merger that makes consumers better off: Figure 8. 6 Price Merger with no efficiency gains MC before the merger MC after PM the merger PC PMerge 0 Merger with efficiency gains MR Qm Qc QMerge Demand Quantity Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

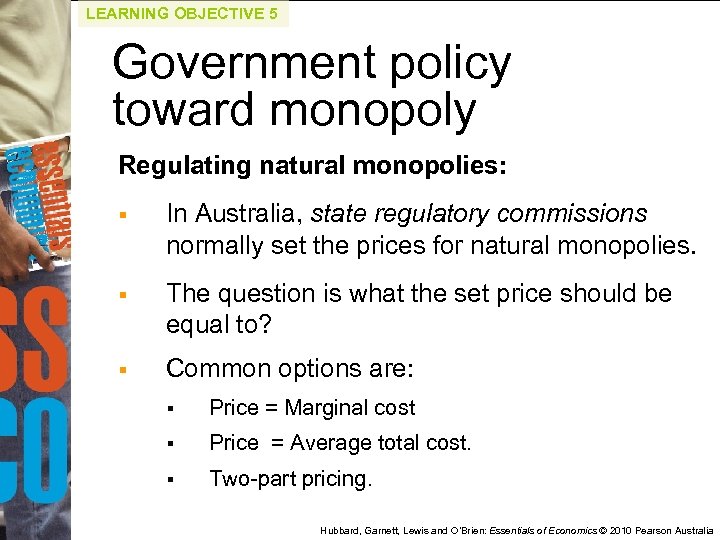

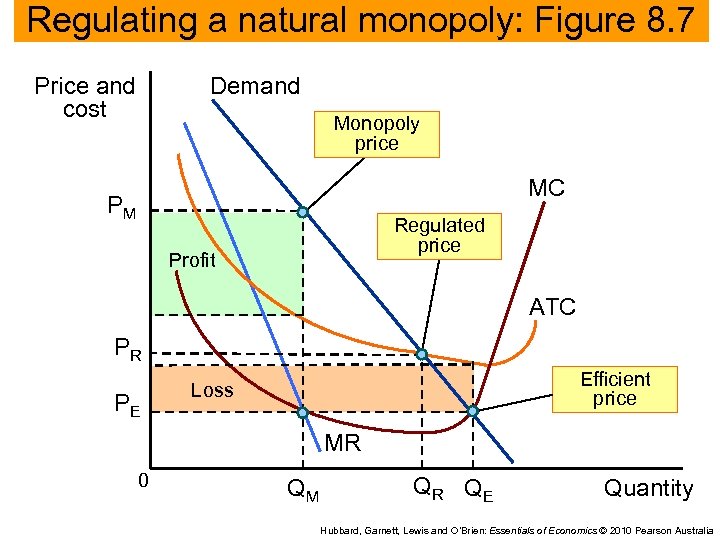

LEARNING OBJECTIVE 5 Government policy toward monopoly Regulating natural monopolies: § In Australia, state regulatory commissions normally set the prices for natural monopolies. § The question is what the set price should be equal to? § Common options are: § Price = Marginal cost § Price = Average total cost. § Two-part pricing. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

LEARNING OBJECTIVE 5 Government policy toward monopoly Regulating natural monopolies: § In Australia, state regulatory commissions normally set the prices for natural monopolies. § The question is what the set price should be equal to? § Common options are: § Price = Marginal cost § Price = Average total cost. § Two-part pricing. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

Regulating a natural monopoly: Figure 8. 7 Price and cost Demand Monopoly price MC PM Regulated price Profit ATC PR PE Efficient price Loss MR 0 QM QR QE Quantity Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

Regulating a natural monopoly: Figure 8. 7 Price and cost Demand Monopoly price MC PM Regulated price Profit ATC PR PE Efficient price Loss MR 0 QM QR QE Quantity Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

An Inside Look Monopoly in the Pay TV industry: The C 7 case Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

An Inside Look Monopoly in the Pay TV industry: The C 7 case Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

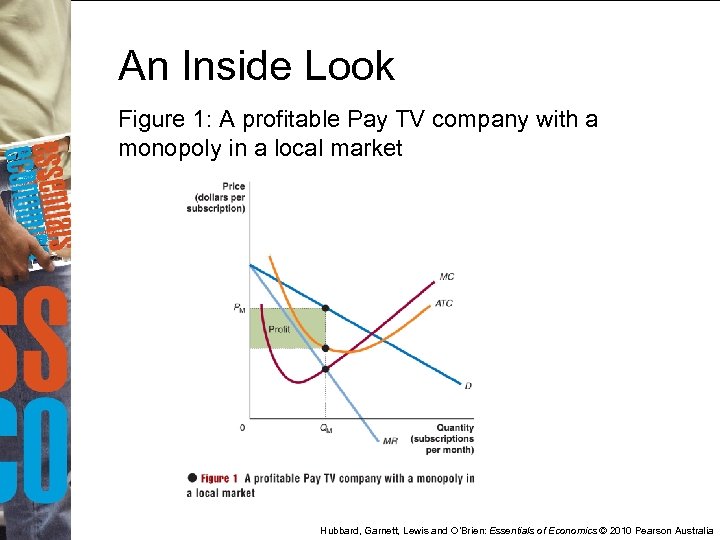

An Inside Look Figure 1: A profitable Pay TV company with a monopoly in a local market Insert Figure 1 from page 245, as large as possible while retaining clarity Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

An Inside Look Figure 1: A profitable Pay TV company with a monopoly in a local market Insert Figure 1 from page 245, as large as possible while retaining clarity Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

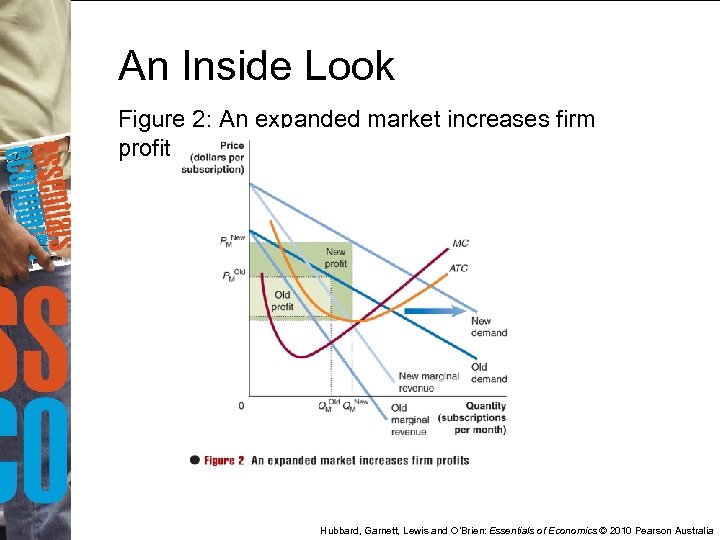

An Inside Look Figure 2: An expanded market increases firm profit Insert Figure 2 from page 245, as large as possible while retaining clarity Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

An Inside Look Figure 2: An expanded market increases firm profit Insert Figure 2 from page 245, as large as possible while retaining clarity Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

Key Terms § Collusion § Natural monopoly § Copyright § § Horizontal merger Network externalities § Patent § Public franchise § Vertical merger § § Market power Monopoly Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

Key Terms § Collusion § Natural monopoly § Copyright § § Horizontal merger Network externalities § Patent § Public franchise § Vertical merger § § Market power Monopoly Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

Get Thinking! The common argument circulated by the Australian media that petrol prices are high because of, among other things, collusion between large petrol distributors. Do you think this might be the case? If so, why has the ACCC not taken decisive action to counteract it? Find the report of the ACCC inquiry into the price of unleaded petrol published 18 December 2007 at: http: //www. accc. gov. au Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

Get Thinking! The common argument circulated by the Australian media that petrol prices are high because of, among other things, collusion between large petrol distributors. Do you think this might be the case? If so, why has the ACCC not taken decisive action to counteract it? Find the report of the ACCC inquiry into the price of unleaded petrol published 18 December 2007 at: http: //www. accc. gov. au Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

APPENDIX Price discrimination § Price discrimination: Charging different customers different prices for the same product when the price differences are not due to differences in production costs. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

APPENDIX Price discrimination § Price discrimination: Charging different customers different prices for the same product when the price differences are not due to differences in production costs. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

APPENDIX Price discrimination § There are three requirements for successful price discrimination: • A firm must possess a market power. • The firm must know what different consumers are willing to pay • The firm must be able to divide (segment) the market for the product. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

APPENDIX Price discrimination § There are three requirements for successful price discrimination: • A firm must possess a market power. • The firm must know what different consumers are willing to pay • The firm must be able to divide (segment) the market for the product. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

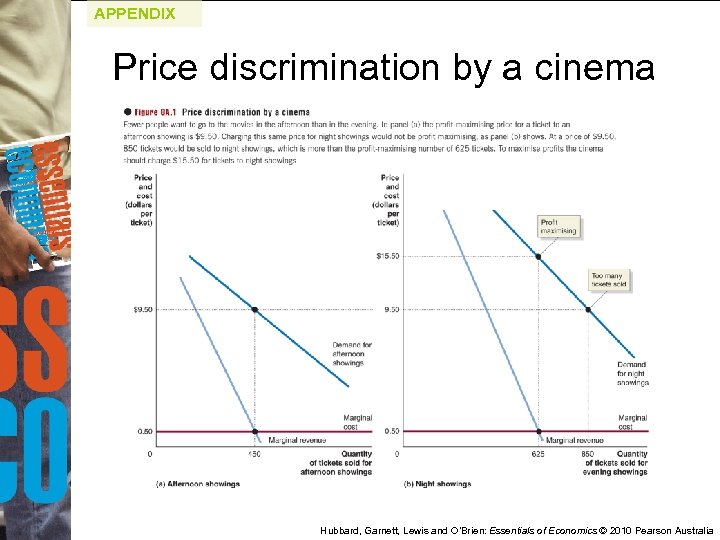

APPENDIX Price discrimination by a cinema Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

APPENDIX Price discrimination by a cinema Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

APPENDIX Price discrimination § Airlines: The kings of price discrimination • • Holiday travellers - more price elastic • Economy, business and first class • Day and time • § Business travellers - more price inelastic Season Yield management: continually adjusting prices to take into account fluctuations in demand Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

APPENDIX Price discrimination § Airlines: The kings of price discrimination • • Holiday travellers - more price elastic • Economy, business and first class • Day and time • § Business travellers - more price inelastic Season Yield management: continually adjusting prices to take into account fluctuations in demand Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

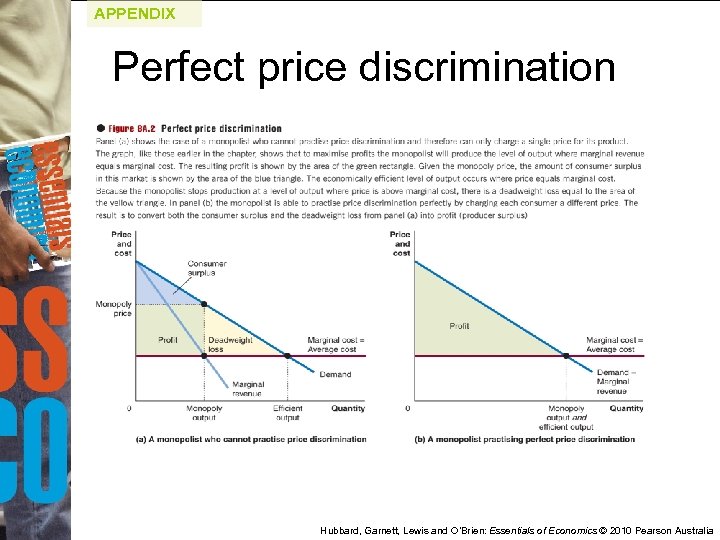

APPENDIX Price discrimination § Perfect price discrimination: This occurs when each consumer has to pay a price equal to the consumer’s maximum willingness to pay (no consumer surplus). § Two key outcomes of price discrimination are: • Firm profits increase • Consumer surplus decreases Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

APPENDIX Price discrimination § Perfect price discrimination: This occurs when each consumer has to pay a price equal to the consumer’s maximum willingness to pay (no consumer surplus). § Two key outcomes of price discrimination are: • Firm profits increase • Consumer surplus decreases Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

APPENDIX Perfect price discrimination Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

APPENDIX Perfect price discrimination Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

Check Your Knowledge Q 1. In which of the following situations can a firm be considered a monopoly? a. When a firm is surrounded by other firms that produce close substitutes. b. When a firm can ignore the actions of all other firms. c. When a firm uses other firms’ prices in order to price its products. d. When barriers to entry are eliminated. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

Check Your Knowledge Q 1. In which of the following situations can a firm be considered a monopoly? a. When a firm is surrounded by other firms that produce close substitutes. b. When a firm can ignore the actions of all other firms. c. When a firm uses other firms’ prices in order to price its products. d. When barriers to entry are eliminated. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

Check Your Knowledge Q 1. In which of the following situations can a firm be considered a monopoly? a. When a firm is surrounded by other firms that produce close substitutes. b. When a firm can ignore the actions of all other firms. c. When a firm uses other firms’ prices in order to price its products. d. When barriers to entry are eliminated. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

Check Your Knowledge Q 1. In which of the following situations can a firm be considered a monopoly? a. When a firm is surrounded by other firms that produce close substitutes. b. When a firm can ignore the actions of all other firms. c. When a firm uses other firms’ prices in order to price its products. d. When barriers to entry are eliminated. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

Check Your Knowledge Q 2. If cost conditions are such that competition leads to higher costs and higher prices, how should the market in question be characterised? a. As a perfectly competitive market. b. As a monopolistically competitive market. c. As an oligopoly. d. As a natural monopoly. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

Check Your Knowledge Q 2. If cost conditions are such that competition leads to higher costs and higher prices, how should the market in question be characterised? a. As a perfectly competitive market. b. As a monopolistically competitive market. c. As an oligopoly. d. As a natural monopoly. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

Check Your Knowledge Q 2. If cost conditions are such that competition leads to higher costs and higher prices, how should the market in question be characterised? a. As a perfectly competitive market. b. As a monopolistically competitive market. c. As an oligopoly. d. As a natural monopoly. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

Check Your Knowledge Q 2. If cost conditions are such that competition leads to higher costs and higher prices, how should the market in question be characterised? a. As a perfectly competitive market. b. As a monopolistically competitive market. c. As an oligopoly. d. As a natural monopoly. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

Check Your Knowledge Q 3. Refer to the figure below. How much is the amount of profit when the firm serves six subscribers per month? a. (42 – 27) x 6 b. (42 – 30) x 6 c. (30 – 27) x 6 d. $42. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

Check Your Knowledge Q 3. Refer to the figure below. How much is the amount of profit when the firm serves six subscribers per month? a. (42 – 27) x 6 b. (42 – 30) x 6 c. (30 – 27) x 6 d. $42. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

Check Your Knowledge Q 3. Refer to the figure below. How much is the amount of profit when the firm serves six subscribers per month? a. (42 – 27) x 6 b. (42 – 30) x 6 c. (30 – 27) x 6 d. $42. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

Check Your Knowledge Q 3. Refer to the figure below. How much is the amount of profit when the firm serves six subscribers per month? a. (42 – 27) x 6 b. (42 – 30) x 6 c. (30 – 27) x 6 d. $42. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

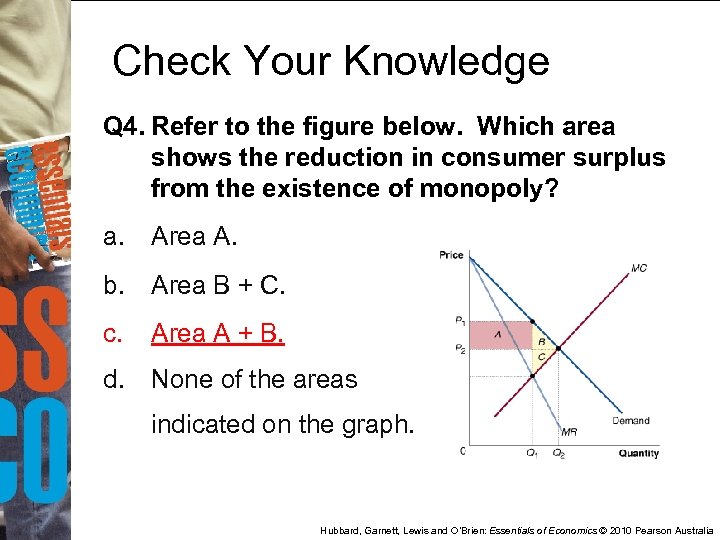

Check Your Knowledge Q 4. Refer to the figure below. Which area shows the reduction in consumer surplus from the existence of monopoly? a. Area A. b. Area B + C. c. Area A + B. d. None of the areas indicated on the graph. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

Check Your Knowledge Q 4. Refer to the figure below. Which area shows the reduction in consumer surplus from the existence of monopoly? a. Area A. b. Area B + C. c. Area A + B. d. None of the areas indicated on the graph. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

Check Your Knowledge Q 4. Refer to the figure below. Which area shows the reduction in consumer surplus from the existence of monopoly? a. Area A. b. Area B + C. c. Area A + B. d. None of the areas indicated on the graph. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia

Check Your Knowledge Q 4. Refer to the figure below. Which area shows the reduction in consumer surplus from the existence of monopoly? a. Area A. b. Area B + C. c. Area A + B. d. None of the areas indicated on the graph. Hubbard, Garnett, Lewis and O’Brien: Essentials of Economics © 2010 Pearson Australia