f82d7d9faeb0ed7a084005a309e81a0c.ppt

- Количество слайдов: 32

Power. Point Presentations for Finance for Non-Financial Managers: Seventh Edition Prepared by Pierre Bergeron University of Ottawa Copyright © 2014 Nelson Education Ltd. 2– 1

Power. Point Presentations for Finance for Non-Financial Managers: Seventh Edition Prepared by Pierre Bergeron University of Ottawa Copyright © 2014 Nelson Education Ltd. 2– 1

CHAPTER 2 Accounting and Financial Statements Copyright © 2014 Nelson Education Ltd. 2– 2

CHAPTER 2 Accounting and Financial Statements Copyright © 2014 Nelson Education Ltd. 2– 2

Learning Objectives 1. Explain the activities related to bookkeeping. 2. Describe the accounting function and outline the four financial statements. 3. Examine the contents and the structure of the statement of income and the statement of comprehensive income, the statement of changes in equity, and the statement of financial position. 4. Understand the meaning of analysis in financial management. 5. Discuss the importance of decision making in financial management. 6. Analyze the contents and structure of financial statements prepared for NFP organizations. Copyright © 2014 Nelson Education Ltd. 2– 3

Learning Objectives 1. Explain the activities related to bookkeeping. 2. Describe the accounting function and outline the four financial statements. 3. Examine the contents and the structure of the statement of income and the statement of comprehensive income, the statement of changes in equity, and the statement of financial position. 4. Understand the meaning of analysis in financial management. 5. Discuss the importance of decision making in financial management. 6. Analyze the contents and structure of financial statements prepared for NFP organizations. Copyright © 2014 Nelson Education Ltd. 2– 3

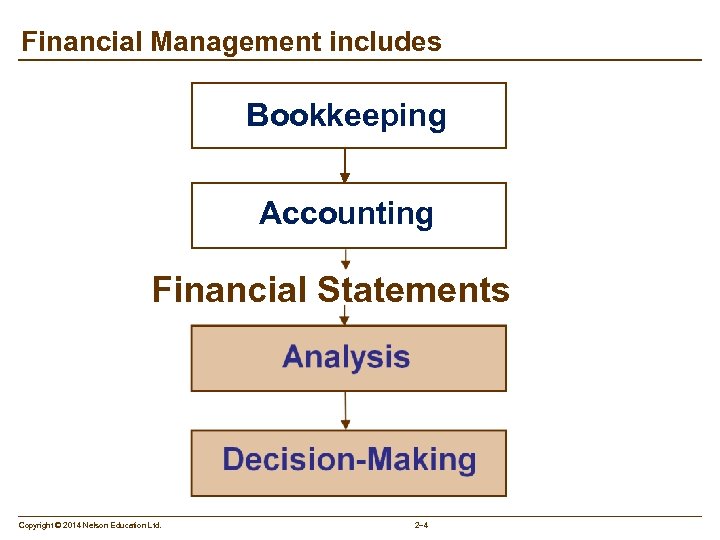

Financial Management includes Bookkeeping Accounting Financial Statements Copyright © 2014 Nelson Education Ltd. 2– 4

Financial Management includes Bookkeeping Accounting Financial Statements Copyright © 2014 Nelson Education Ltd. 2– 4

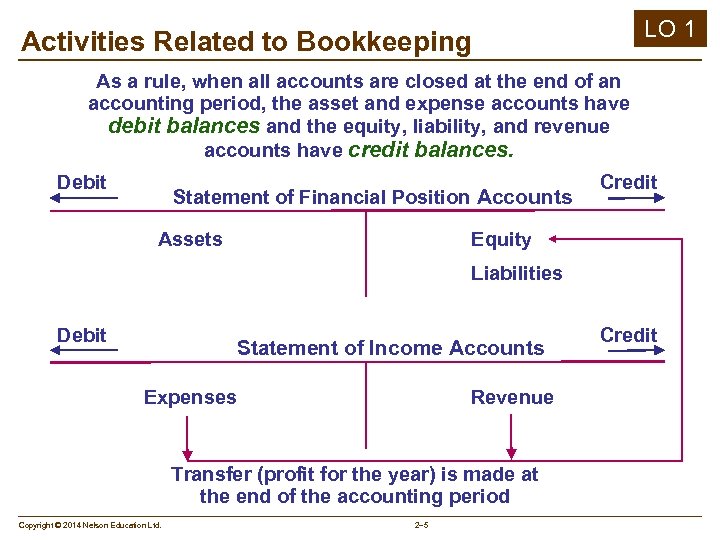

LO 1 Activities Related to Bookkeeping As a rule, when all accounts are closed at the end of an accounting period, the asset and expense accounts have debit balances and the equity, liability, and revenue accounts have credit balances. Debit Statement of Financial Position Accounts Assets Credit Equity Liabilities Debit Statement of Income Accounts Expenses Revenue Transfer (profit for the year) is made at the end of the accounting period Copyright © 2014 Nelson Education Ltd. 2– 5 Credit

LO 1 Activities Related to Bookkeeping As a rule, when all accounts are closed at the end of an accounting period, the asset and expense accounts have debit balances and the equity, liability, and revenue accounts have credit balances. Debit Statement of Financial Position Accounts Assets Credit Equity Liabilities Debit Statement of Income Accounts Expenses Revenue Transfer (profit for the year) is made at the end of the accounting period Copyright © 2014 Nelson Education Ltd. 2– 5 Credit

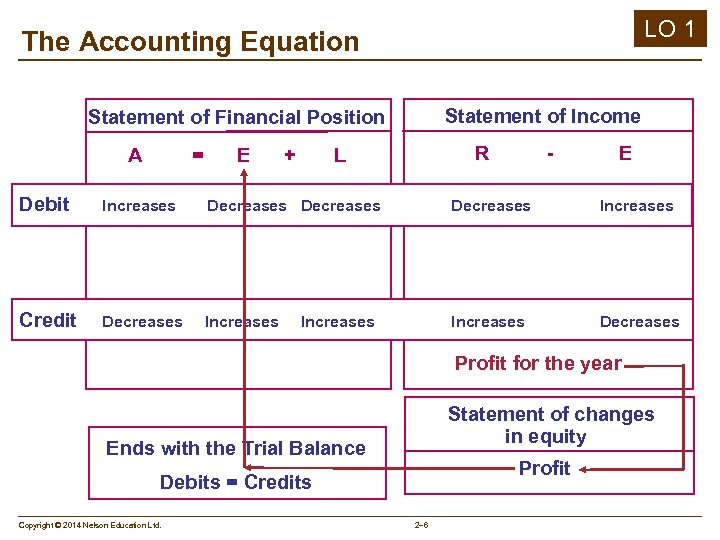

LO 1 The Accounting Equation Statement of Income Statement of Financial Position A = E + R L - E Debit Increases Decreases Increases Credit Decreases Increases Profit for the year Statement of changes in equity Ends with the Trial Balance Profit Debits = Credits Copyright © 2014 Nelson Education Ltd. 2– 6

LO 1 The Accounting Equation Statement of Income Statement of Financial Position A = E + R L - E Debit Increases Decreases Increases Credit Decreases Increases Profit for the year Statement of changes in equity Ends with the Trial Balance Profit Debits = Credits Copyright © 2014 Nelson Education Ltd. 2– 6

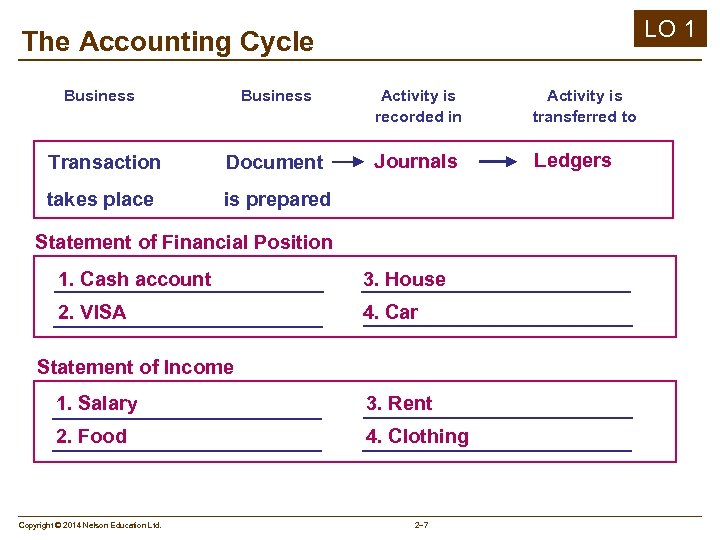

LO 1 The Accounting Cycle Business Activity is recorded in Activity is transferred to Transaction Document Journals Ledgers takes place is prepared Statement of Financial Position 1. Cash account 3. House 2. VISA 4. Car Statement of Income 1. Salary 3. Rent 2. Food 4. Clothing Copyright © 2014 Nelson Education Ltd. 2– 7

LO 1 The Accounting Cycle Business Activity is recorded in Activity is transferred to Transaction Document Journals Ledgers takes place is prepared Statement of Financial Position 1. Cash account 3. House 2. VISA 4. Car Statement of Income 1. Salary 3. Rent 2. Food 4. Clothing Copyright © 2014 Nelson Education Ltd. 2– 7

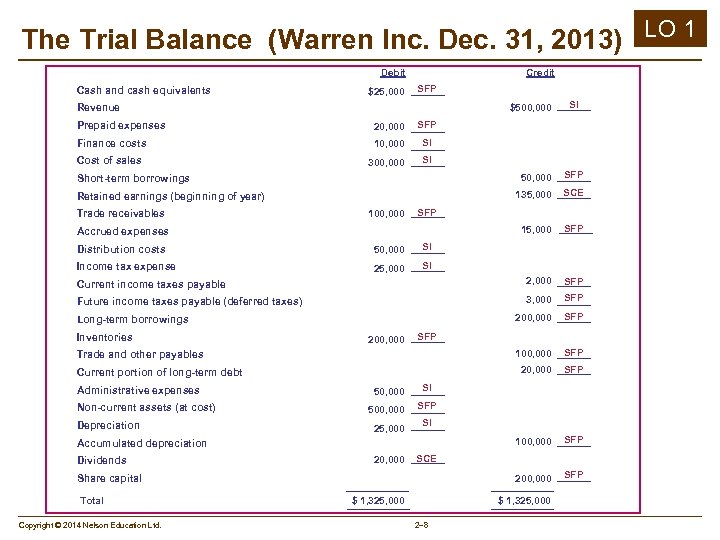

The Trial Balance (Warren Inc. Dec. 31, 2013) LO 1 Debit Cash and cash equivalents Credit SFP $25, 000 ______ SI $500, 000 ______ Revenue Finance costs SFP 20, 000 ______ SI 10, 000 ______ Cost of sales SI 300, 000 ______ Prepaid expenses SFP 50, 000 ______ Short-term borrowings SCE 135, 000 ______ Retained earnings (beginning of year) Trade receivables SFP 100, 000 ______ SFP 15, 000 ______ Accrued expenses Distribution costs SI 50, 000 ______ Income tax expense SI 25, 000 ______ Current income taxes payable 2, 000 ______ SFP Future income taxes payable (deferred taxes) SFP 3, 000 ______ SFP 200, 000 ______ Long-term borrowings Inventories SFP 200, 000 ______ SFP 100, 000 ______ Trade and other payables SFP 20, 000 ______ Current portion of long-term debt Administrative expenses Non-current assets (at cost) Depreciation SI 50, 000 ______ SFP 500, 000 ______ SI 25, 000 ______ Accumulated depreciation Dividends SCE 20, 000 ______ SFP 200, 000 ______ Share capital Total Copyright © 2014 Nelson Education Ltd. SFP 100, 000 ______ $ 1, 325, 000 2– 8

The Trial Balance (Warren Inc. Dec. 31, 2013) LO 1 Debit Cash and cash equivalents Credit SFP $25, 000 ______ SI $500, 000 ______ Revenue Finance costs SFP 20, 000 ______ SI 10, 000 ______ Cost of sales SI 300, 000 ______ Prepaid expenses SFP 50, 000 ______ Short-term borrowings SCE 135, 000 ______ Retained earnings (beginning of year) Trade receivables SFP 100, 000 ______ SFP 15, 000 ______ Accrued expenses Distribution costs SI 50, 000 ______ Income tax expense SI 25, 000 ______ Current income taxes payable 2, 000 ______ SFP Future income taxes payable (deferred taxes) SFP 3, 000 ______ SFP 200, 000 ______ Long-term borrowings Inventories SFP 200, 000 ______ SFP 100, 000 ______ Trade and other payables SFP 20, 000 ______ Current portion of long-term debt Administrative expenses Non-current assets (at cost) Depreciation SI 50, 000 ______ SFP 500, 000 ______ SI 25, 000 ______ Accumulated depreciation Dividends SCE 20, 000 ______ SFP 200, 000 ______ Share capital Total Copyright © 2014 Nelson Education Ltd. SFP 100, 000 ______ $ 1, 325, 000 2– 8

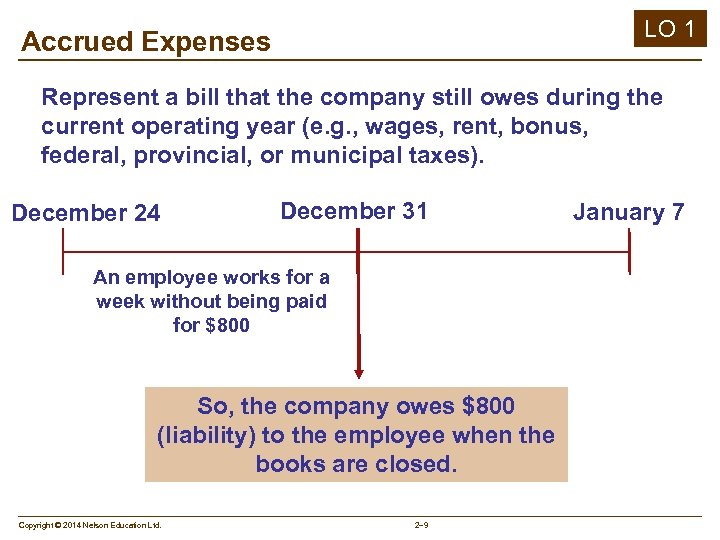

LO 1 Accrued Expenses Represent a bill that the company still owes during the current operating year (e. g. , wages, rent, bonus, federal, provincial, or municipal taxes). December 24 December 31 An employee works for a week without being paid for $800 So, the company owes $800 (liability) to the employee when the books are closed. Copyright © 2014 Nelson Education Ltd. 2– 9 January 7

LO 1 Accrued Expenses Represent a bill that the company still owes during the current operating year (e. g. , wages, rent, bonus, federal, provincial, or municipal taxes). December 24 December 31 An employee works for a week without being paid for $800 So, the company owes $800 (liability) to the employee when the books are closed. Copyright © 2014 Nelson Education Ltd. 2– 9 January 7

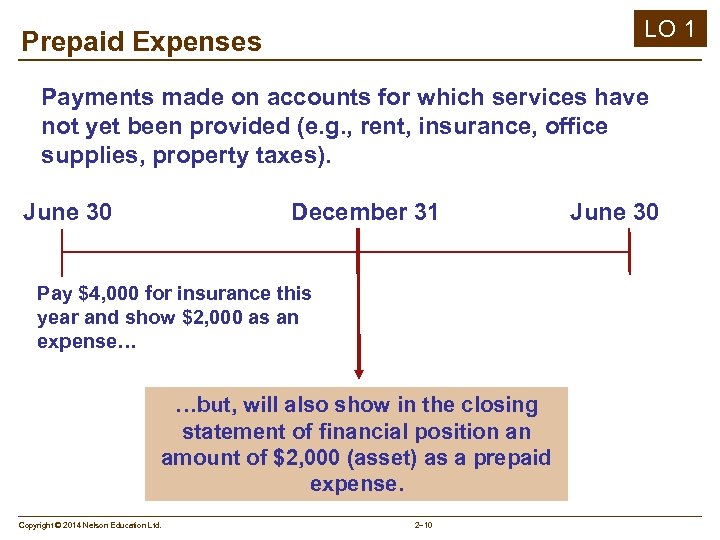

LO 1 Prepaid Expenses Payments made on accounts for which services have not yet been provided (e. g. , rent, insurance, office supplies, property taxes). June 30 December 31 Pay $4, 000 for insurance this year and show $2, 000 as an expense… …but, will also show in the closing statement of financial position an amount of $2, 000 (asset) as a prepaid expense. Copyright © 2014 Nelson Education Ltd. 2– 10 June 30

LO 1 Prepaid Expenses Payments made on accounts for which services have not yet been provided (e. g. , rent, insurance, office supplies, property taxes). June 30 December 31 Pay $4, 000 for insurance this year and show $2, 000 as an expense… …but, will also show in the closing statement of financial position an amount of $2, 000 (asset) as a prepaid expense. Copyright © 2014 Nelson Education Ltd. 2– 10 June 30

Accounting Function and Financial Statements LO 2 To determine the value or wealth of a business, look at the STATEMENT OF FINANCIAL POSITION (also known as the balance sheet) since it gives a reading of its financial position at a given point in time; it’s like a snapshot or an X-ray. Copyright © 2014 Nelson Education Ltd. 2– 11

Accounting Function and Financial Statements LO 2 To determine the value or wealth of a business, look at the STATEMENT OF FINANCIAL POSITION (also known as the balance sheet) since it gives a reading of its financial position at a given point in time; it’s like a snapshot or an X-ray. Copyright © 2014 Nelson Education Ltd. 2– 11

Accounting Function and Financial Statements LO 2 To determine the flow or wealth of a business, look at the STATEMENT OF INCOME (also known as the earnings statement, the statement of operations, and the profit and loss statement) since it shows the infusion of revenue and expenses between two accounting periods. Copyright © 2014 Nelson Education Ltd. 2– 12

Accounting Function and Financial Statements LO 2 To determine the flow or wealth of a business, look at the STATEMENT OF INCOME (also known as the earnings statement, the statement of operations, and the profit and loss statement) since it shows the infusion of revenue and expenses between two accounting periods. Copyright © 2014 Nelson Education Ltd. 2– 12

Accounting Function and Financial Statements To determine the accumulated wealth of a business, look at the STATEMENT OF CHANGES IN EQUITY (statement of retained earnings section) since it shows the amount paid to the shareholders and the amount retained in the business. Copyright © 2014 Nelson Education Ltd. 2– 13 LO 2

Accounting Function and Financial Statements To determine the accumulated wealth of a business, look at the STATEMENT OF CHANGES IN EQUITY (statement of retained earnings section) since it shows the amount paid to the shareholders and the amount retained in the business. Copyright © 2014 Nelson Education Ltd. 2– 13 LO 2

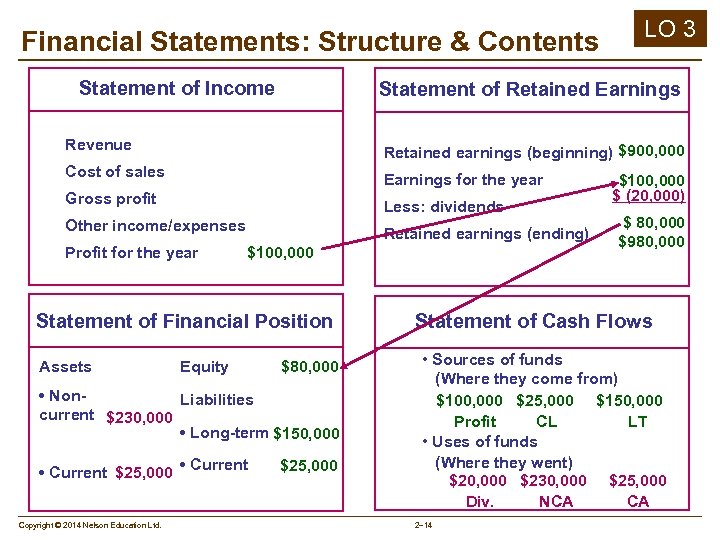

Financial Statements: Structure & Contents Statement of Income LO 3 Statement of Retained Earnings Revenue Retained earnings (beginning) $900, 000 Cost of sales Earnings for the year Gross profit Less: dividends Other income/expenses Retained earnings (ending) Profit for the year $100, 000 Statement of Financial Position Assets Equity $80, 000 • Non. Liabilities current $230, 000 • Long-term $150, 000 • Current $25, 000 • Current Copyright © 2014 Nelson Education Ltd. $25, 000 $100, 000 $ (20, 000) $ 80, 000 $980, 000 Statement of Cash Flows • Sources of funds (Where they come from) $100, 000 $25, 000 $150, 000 Profit CL LT • Uses of funds (Where they went) $20, 000 $230, 000 $25, 000 Div. NCA CA 2– 14

Financial Statements: Structure & Contents Statement of Income LO 3 Statement of Retained Earnings Revenue Retained earnings (beginning) $900, 000 Cost of sales Earnings for the year Gross profit Less: dividends Other income/expenses Retained earnings (ending) Profit for the year $100, 000 Statement of Financial Position Assets Equity $80, 000 • Non. Liabilities current $230, 000 • Long-term $150, 000 • Current $25, 000 • Current Copyright © 2014 Nelson Education Ltd. $25, 000 $100, 000 $ (20, 000) $ 80, 000 $980, 000 Statement of Cash Flows • Sources of funds (Where they come from) $100, 000 $25, 000 $150, 000 Profit CL LT • Uses of funds (Where they went) $20, 000 $230, 000 $25, 000 Div. NCA CA 2– 14

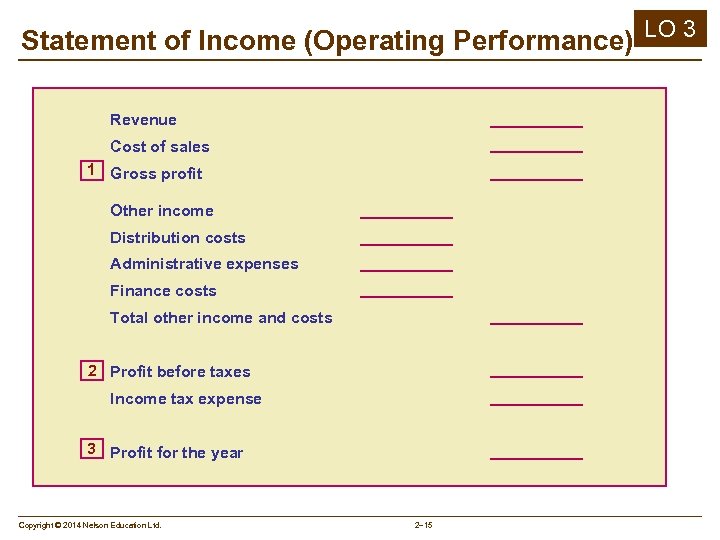

Statement of Income (Operating Performance) LO 3 Revenue Cost of sales 1 Gross profit Other income Distribution costs Administrative expenses Finance costs Total other income and costs 2 Profit before taxes Income tax expense 3 Profit for the year Copyright © 2014 Nelson Education Ltd. 2– 15

Statement of Income (Operating Performance) LO 3 Revenue Cost of sales 1 Gross profit Other income Distribution costs Administrative expenses Finance costs Total other income and costs 2 Profit before taxes Income tax expense 3 Profit for the year Copyright © 2014 Nelson Education Ltd. 2– 15

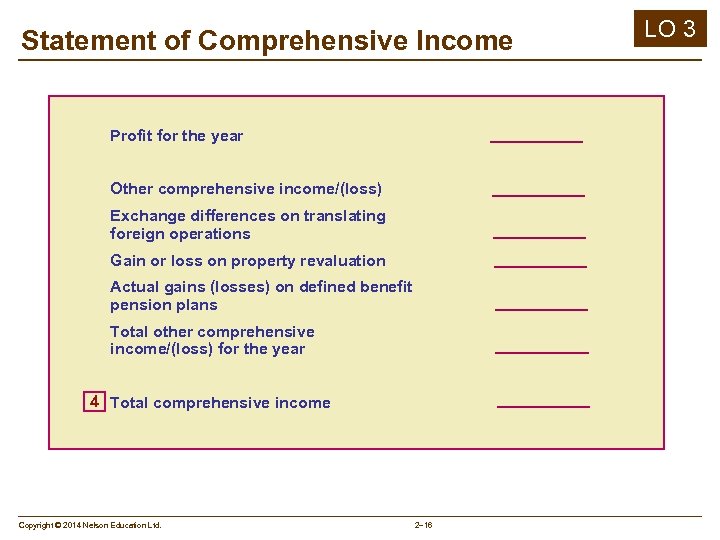

Statement of Comprehensive Income Profit for the year Other comprehensive income/(loss) Exchange differences on translating foreign operations Gain or loss on property revaluation Actual gains (losses) on defined benefit pension plans Total other comprehensive income/(loss) for the year 4 Total comprehensive income Copyright © 2014 Nelson Education Ltd. 2– 16 LO 3

Statement of Comprehensive Income Profit for the year Other comprehensive income/(loss) Exchange differences on translating foreign operations Gain or loss on property revaluation Actual gains (losses) on defined benefit pension plans Total other comprehensive income/(loss) for the year 4 Total comprehensive income Copyright © 2014 Nelson Education Ltd. 2– 16 LO 3

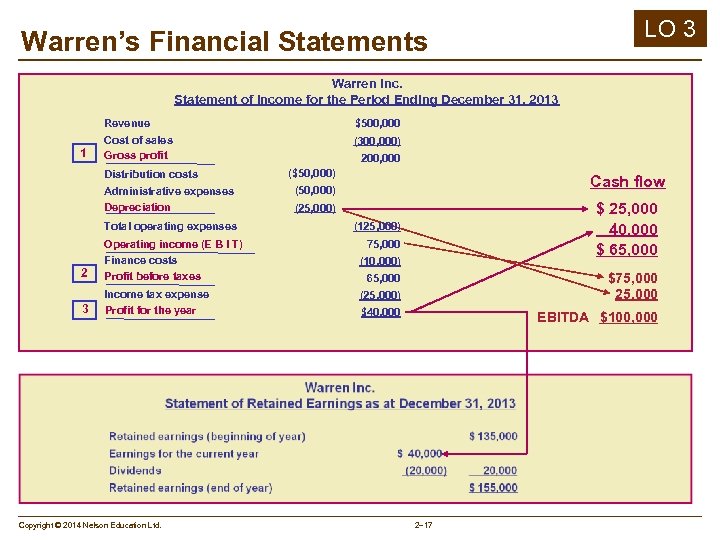

LO 3 Warren’s Financial Statements Warren Inc. Statement of Income for the Period Ending December 31, 2013 Revenue 1 $500, 000 Cost of sales Gross profit (300, 000) Distribution costs Administrative expenses Depreciation Total operating expenses 2 Operating income (E B I T) Finance costs Profit before taxes 3 Income tax expense Profit for the year Copyright © 2014 Nelson Education Ltd. 200, 000 ($50, 000) Cash flow (50, 000) $ 25, 000 40, 000 $ 65, 000 (25, 000) (125, 000) 75, 000 (10, 000) $75, 000 25, 000 65, 000 (25, 000) $40, 000 EBITDA $100, 000 2– 17

LO 3 Warren’s Financial Statements Warren Inc. Statement of Income for the Period Ending December 31, 2013 Revenue 1 $500, 000 Cost of sales Gross profit (300, 000) Distribution costs Administrative expenses Depreciation Total operating expenses 2 Operating income (E B I T) Finance costs Profit before taxes 3 Income tax expense Profit for the year Copyright © 2014 Nelson Education Ltd. 200, 000 ($50, 000) Cash flow (50, 000) $ 25, 000 40, 000 $ 65, 000 (25, 000) (125, 000) 75, 000 (10, 000) $75, 000 25, 000 65, 000 (25, 000) $40, 000 EBITDA $100, 000 2– 17

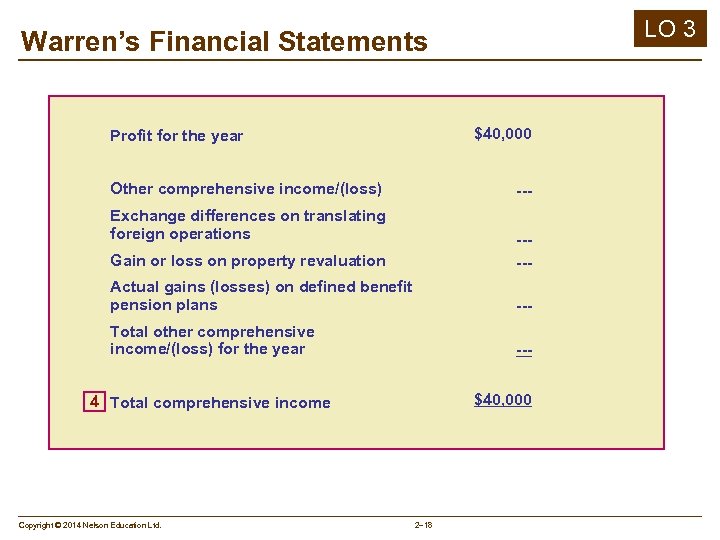

LO 3 Warren’s Financial Statements $40, 000 Profit for the year Other comprehensive income/(loss) --- Exchange differences on translating foreign operations Gain or loss on property revaluation ----- Actual gains (losses) on defined benefit pension plans --- Total other comprehensive income/(loss) for the year --$40, 000 4 Total comprehensive income Copyright © 2014 Nelson Education Ltd. 2– 18

LO 3 Warren’s Financial Statements $40, 000 Profit for the year Other comprehensive income/(loss) --- Exchange differences on translating foreign operations Gain or loss on property revaluation ----- Actual gains (losses) on defined benefit pension plans --- Total other comprehensive income/(loss) for the year --$40, 000 4 Total comprehensive income Copyright © 2014 Nelson Education Ltd. 2– 18

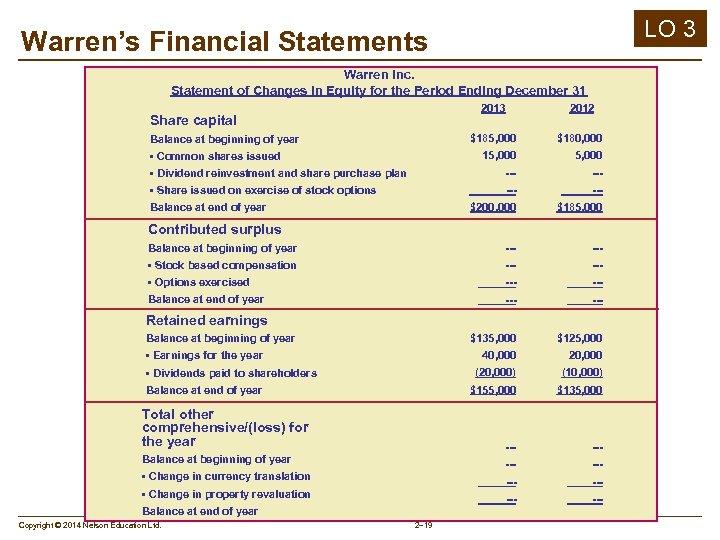

LO 3 Warren’s Financial Statements Warren Inc. Statement of Changes in Equity for the Period Ending December 31 2013 2012 $185, 000 $180, 000 15, 000 • Dividend reinvestment and share purchase plan --- • Share issued on exercise of stock options --- $200, 000 $185, 000 Balance at beginning of year --- • Stock based compensation --- • Options exercised --- Balance at end of year --- $135, 000 $125, 000 40, 000 20, 000 (20, 000) (10, 000) $155, 000 $135, 000 --- --- Share capital Balance at beginning of year • Common shares issued Balance at end of year Contributed surplus Retained earnings Balance at beginning of year • Earnings for the year • Dividends paid to shareholders Balance at end of year Total other comprehensive/(loss) for the year Balance at beginning of year • Change in currency translation • Change in property revaluation Balance at end of year Copyright © 2014 Nelson Education Ltd. 2– 19

LO 3 Warren’s Financial Statements Warren Inc. Statement of Changes in Equity for the Period Ending December 31 2013 2012 $185, 000 $180, 000 15, 000 • Dividend reinvestment and share purchase plan --- • Share issued on exercise of stock options --- $200, 000 $185, 000 Balance at beginning of year --- • Stock based compensation --- • Options exercised --- Balance at end of year --- $135, 000 $125, 000 40, 000 20, 000 (20, 000) (10, 000) $155, 000 $135, 000 --- --- Share capital Balance at beginning of year • Common shares issued Balance at end of year Contributed surplus Retained earnings Balance at beginning of year • Earnings for the year • Dividends paid to shareholders Balance at end of year Total other comprehensive/(loss) for the year Balance at beginning of year • Change in currency translation • Change in property revaluation Balance at end of year Copyright © 2014 Nelson Education Ltd. 2– 19

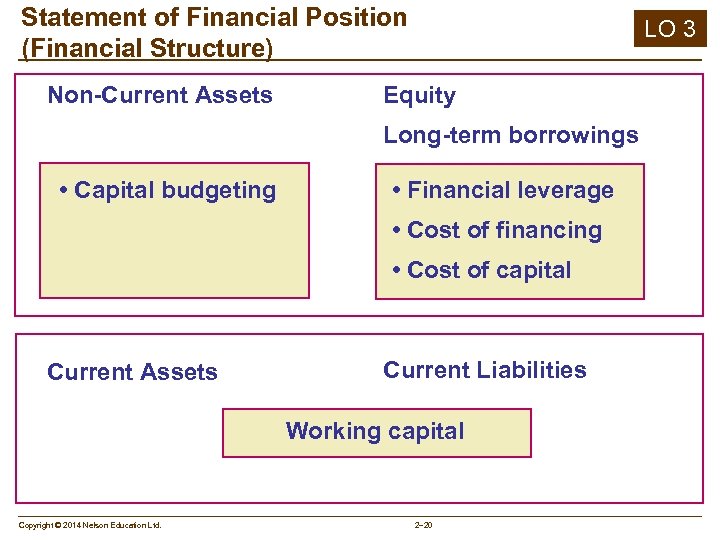

Statement of Financial Position (Financial Structure) Non-Current Assets LO 3 Equity Long-term borrowings • Capital budgeting • Financial leverage • Cost of financing • Cost of capital Current Assets Current Liabilities Working capital Copyright © 2014 Nelson Education Ltd. 2– 20

Statement of Financial Position (Financial Structure) Non-Current Assets LO 3 Equity Long-term borrowings • Capital budgeting • Financial leverage • Cost of financing • Cost of capital Current Assets Current Liabilities Working capital Copyright © 2014 Nelson Education Ltd. 2– 20

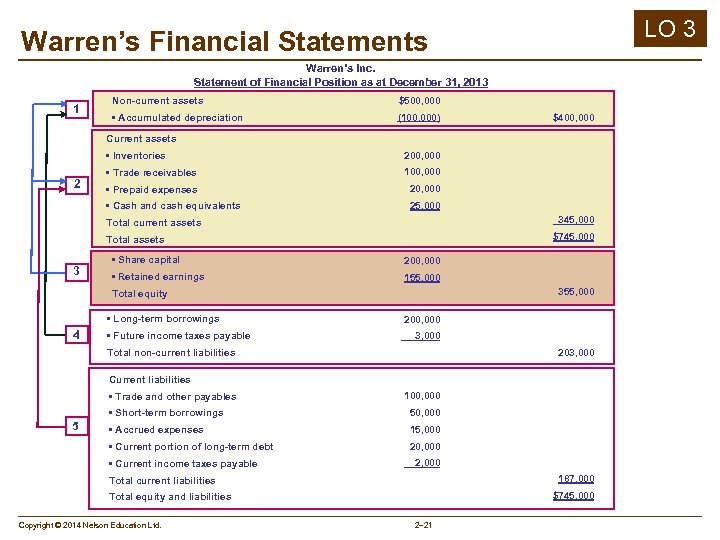

LO 3 Warren’s Financial Statements Warren’s Inc. Statement of Financial Position as at December 31, 2013 1 Non-current assets $500, 000 • Accumulated depreciation (100, 000) $400, 000 Current assets • Inventories • Trade receivables 100, 000 • Prepaid expenses 20, 000 • Cash and cash equivalents 2 200, 000 25, 000 345, 000 Total current assets $745, 000 Total assets 3 • Share capital 200, 000 • Retained earnings 155, 000 355, 000 Total equity • Long-term borrowings 4 • Future income taxes payable 200, 000 3, 000 Total non-current liabilities 203, 000 Current liabilities • Trade and other payables 100, 000 • Short-term borrowings 50, 000 • Accrued expenses 15, 000 • Current portion of long-term debt 5 20, 000 • Current income taxes payable 2, 000 187, 000 Total current liabilities $745, 000 Total equity and liabilities Copyright © 2014 Nelson Education Ltd. 2– 21

LO 3 Warren’s Financial Statements Warren’s Inc. Statement of Financial Position as at December 31, 2013 1 Non-current assets $500, 000 • Accumulated depreciation (100, 000) $400, 000 Current assets • Inventories • Trade receivables 100, 000 • Prepaid expenses 20, 000 • Cash and cash equivalents 2 200, 000 25, 000 345, 000 Total current assets $745, 000 Total assets 3 • Share capital 200, 000 • Retained earnings 155, 000 355, 000 Total equity • Long-term borrowings 4 • Future income taxes payable 200, 000 3, 000 Total non-current liabilities 203, 000 Current liabilities • Trade and other payables 100, 000 • Short-term borrowings 50, 000 • Accrued expenses 15, 000 • Current portion of long-term debt 5 20, 000 • Current income taxes payable 2, 000 187, 000 Total current liabilities $745, 000 Total equity and liabilities Copyright © 2014 Nelson Education Ltd. 2– 21

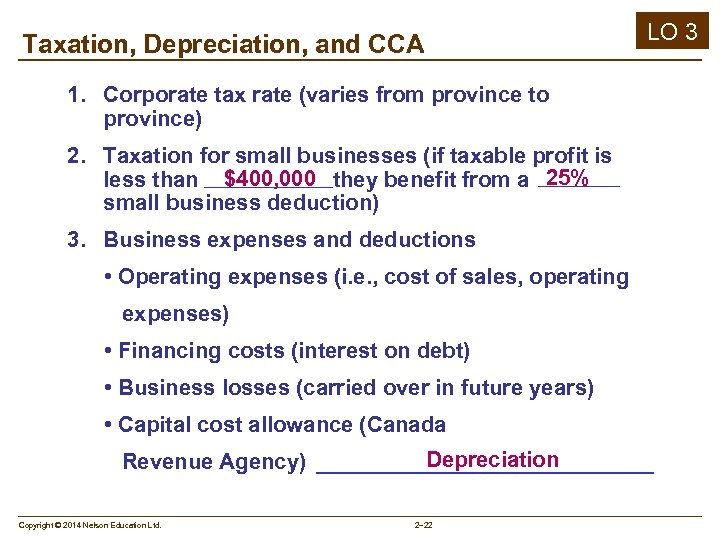

LO 3 Taxation, Depreciation, and CCA 1. Corporate tax rate (varies from province to province) 2. Taxation for small businesses (if taxable profit is less than $400, 000 they benefit from a 25% small business deduction) 3. Business expenses and deductions • Operating expenses (i. e. , cost of sales, operating expenses) • Financing costs (interest on debt) • Business losses (carried over in future years) • Capital cost allowance (Canada Revenue Agency) Copyright © 2014 Nelson Education Ltd. Depreciation 2– 22

LO 3 Taxation, Depreciation, and CCA 1. Corporate tax rate (varies from province to province) 2. Taxation for small businesses (if taxable profit is less than $400, 000 they benefit from a 25% small business deduction) 3. Business expenses and deductions • Operating expenses (i. e. , cost of sales, operating expenses) • Financing costs (interest on debt) • Business losses (carried over in future years) • Capital cost allowance (Canada Revenue Agency) Copyright © 2014 Nelson Education Ltd. Depreciation 2– 22

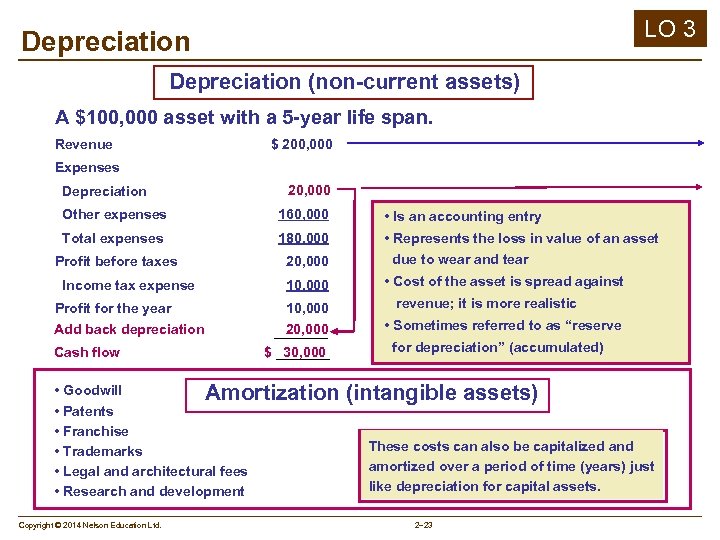

LO 3 Depreciation (non-current assets) A $100, 000 asset with a 5 -year life span. Revenue $ 200, 000 Expenses Depreciation 20, 000 Other expenses 160, 000 • Is an accounting entry Total expenses 180, 000 • Represents the loss in value of an asset Profit before taxes 20, 000 Income tax expense 10, 000 Profit for the year Add back depreciation 10, 000 20, 000 Cash flow $ 30, 000 • Goodwill Amortization • Patents • Franchise • Trademarks • Legal and architectural fees • Research and development Copyright © 2014 Nelson Education Ltd. due to wear and tear • Cost of the asset is spread against revenue; it is more realistic • Sometimes referred to as “reserve for depreciation” (accumulated) (intangible assets) These costs can also be capitalized and amortized over a period of time (years) just like depreciation for capital assets. 2– 23

LO 3 Depreciation (non-current assets) A $100, 000 asset with a 5 -year life span. Revenue $ 200, 000 Expenses Depreciation 20, 000 Other expenses 160, 000 • Is an accounting entry Total expenses 180, 000 • Represents the loss in value of an asset Profit before taxes 20, 000 Income tax expense 10, 000 Profit for the year Add back depreciation 10, 000 20, 000 Cash flow $ 30, 000 • Goodwill Amortization • Patents • Franchise • Trademarks • Legal and architectural fees • Research and development Copyright © 2014 Nelson Education Ltd. due to wear and tear • Cost of the asset is spread against revenue; it is more realistic • Sometimes referred to as “reserve for depreciation” (accumulated) (intangible assets) These costs can also be capitalized and amortized over a period of time (years) just like depreciation for capital assets. 2– 23

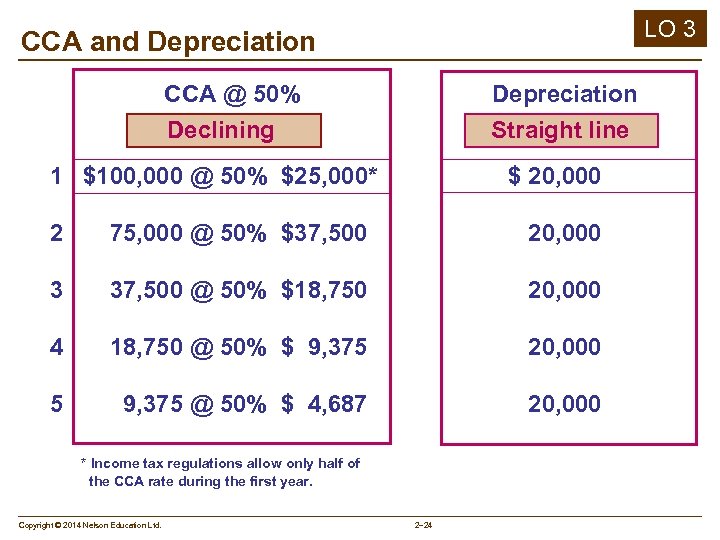

LO 3 CCA and Depreciation CCA @ 50% Depreciation Straight line Declining 1 $100, 000 @ 50% $25, 000* $ 20, 000 2 75, 000 @ 50% $37, 500 20, 000 3 37, 500 @ 50% $18, 750 20, 000 4 18, 750 @ 50% $ 9, 375 20, 000 5 9, 375 @ 50% $ 4, 687 20, 000 * Income tax regulations allow only half of the CCA rate during the first year. Copyright © 2014 Nelson Education Ltd. 2– 24

LO 3 CCA and Depreciation CCA @ 50% Depreciation Straight line Declining 1 $100, 000 @ 50% $25, 000* $ 20, 000 2 75, 000 @ 50% $37, 500 20, 000 3 37, 500 @ 50% $18, 750 20, 000 4 18, 750 @ 50% $ 9, 375 20, 000 5 9, 375 @ 50% $ 4, 687 20, 000 * Income tax regulations allow only half of the CCA rate during the first year. Copyright © 2014 Nelson Education Ltd. 2– 24

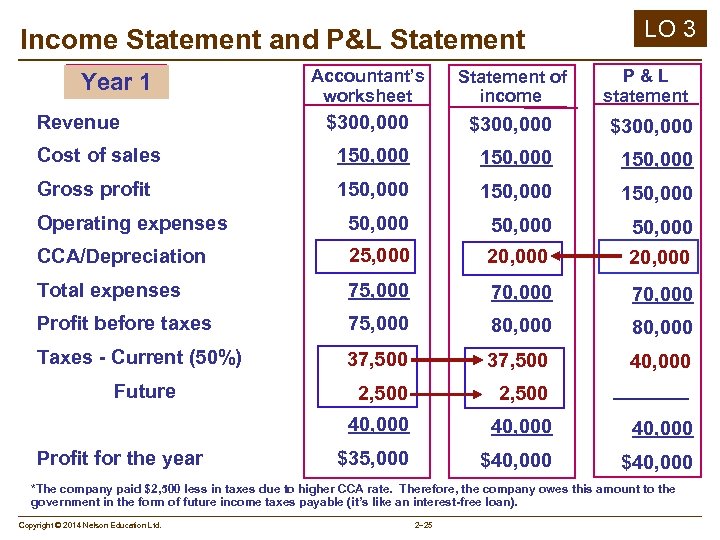

Income Statement and P&L Statement LO 3 P&L statement Accountant’s worksheet Statement of income $300, 000 Cost of sales 150, 000 Gross profit 150, 000 Operating expenses 50, 000 CCA/Depreciation 25, 000 20, 000 Total expenses 75, 000 70, 000 Profit before taxes 75, 000 80, 000 Taxes - Current (50%) 37, 500 40, 000 Future 2, 500 40, 000 $35, 000 $40, 000 Year 1 Revenue Profit for the year *The company paid $2, 500 less in taxes due to higher CCA rate. Therefore, the company owes this amount to the government in the form of future income taxes payable (it’s like an interest-free loan). Copyright © 2014 Nelson Education Ltd. 2– 25

Income Statement and P&L Statement LO 3 P&L statement Accountant’s worksheet Statement of income $300, 000 Cost of sales 150, 000 Gross profit 150, 000 Operating expenses 50, 000 CCA/Depreciation 25, 000 20, 000 Total expenses 75, 000 70, 000 Profit before taxes 75, 000 80, 000 Taxes - Current (50%) 37, 500 40, 000 Future 2, 500 40, 000 $35, 000 $40, 000 Year 1 Revenue Profit for the year *The company paid $2, 500 less in taxes due to higher CCA rate. Therefore, the company owes this amount to the government in the form of future income taxes payable (it’s like an interest-free loan). Copyright © 2014 Nelson Education Ltd. 2– 25

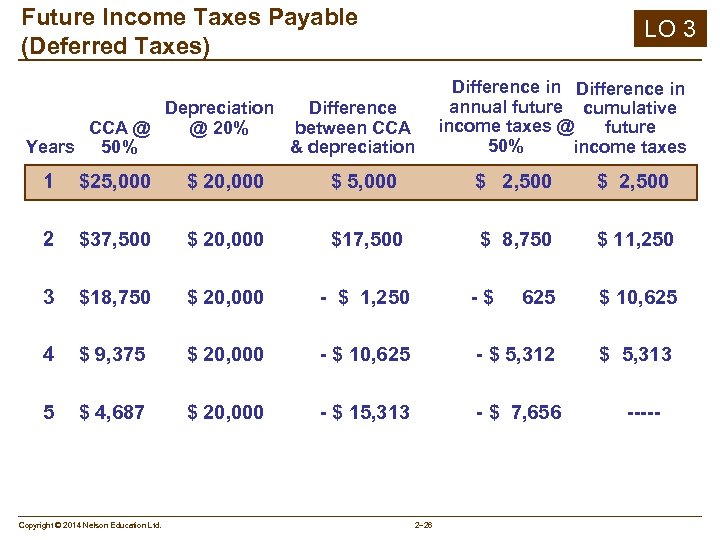

Future Income Taxes Payable (Deferred Taxes) LO 3 Depreciation Difference @ 20% between CCA @ & depreciation Years 50% Difference in annual future cumulative income taxes @ future 50% income taxes 1 $25, 000 $ 20, 000 $ 5, 000 $ 2, 500 2 $37, 500 $ 20, 000 $17, 500 $ 8, 750 $ 11, 250 3 $18, 750 $ 20, 000 - $ 1, 250 -$ 625 $ 10, 625 4 $ 9, 375 $ 20, 000 - $ 10, 625 - $ 5, 312 $ 5, 313 5 $ 4, 687 $ 20, 000 - $ 15, 313 - $ 7, 656 Copyright © 2014 Nelson Education Ltd. 2– 26 -----

Future Income Taxes Payable (Deferred Taxes) LO 3 Depreciation Difference @ 20% between CCA @ & depreciation Years 50% Difference in annual future cumulative income taxes @ future 50% income taxes 1 $25, 000 $ 20, 000 $ 5, 000 $ 2, 500 2 $37, 500 $ 20, 000 $17, 500 $ 8, 750 $ 11, 250 3 $18, 750 $ 20, 000 - $ 1, 250 -$ 625 $ 10, 625 4 $ 9, 375 $ 20, 000 - $ 10, 625 - $ 5, 312 $ 5, 313 5 $ 4, 687 $ 20, 000 - $ 15, 313 - $ 7, 656 Copyright © 2014 Nelson Education Ltd. 2– 26 -----

The Auditor’s Report LO 3 • Canadian corporate law requires: – every limited company appoint an auditor to represent shareholders and report to them annually on the company’s financial statements, expressing an opinion in writing as to their fairness and consistency

The Auditor’s Report LO 3 • Canadian corporate law requires: – every limited company appoint an auditor to represent shareholders and report to them annually on the company’s financial statements, expressing an opinion in writing as to their fairness and consistency

The Auditor’s Report LO 3 • In Canada, the auditor’s report has two paragraphs: 1. Scope of the examination (accounting procedures in use and tests of the accounting records); 2. Auditor’s opinion on the statements indicating that the financial statements present fairly the financial position of the company in accordance with Generally Accepted Accounting Principles (GAAP) applied on a basis consistent with that of the preceding year.

The Auditor’s Report LO 3 • In Canada, the auditor’s report has two paragraphs: 1. Scope of the examination (accounting procedures in use and tests of the accounting records); 2. Auditor’s opinion on the statements indicating that the financial statements present fairly the financial position of the company in accordance with Generally Accepted Accounting Principles (GAAP) applied on a basis consistent with that of the preceding year.

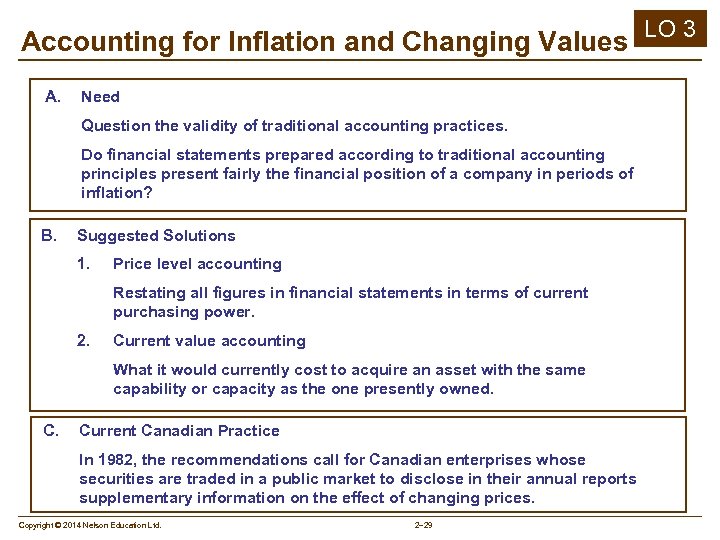

Accounting for Inflation and Changing Values LO 3 A. Need Question the validity of traditional accounting practices. Do financial statements prepared according to traditional accounting principles present fairly the financial position of a company in periods of inflation? B. Suggested Solutions 1. Price level accounting Restating all figures in financial statements in terms of current purchasing power. 2. Current value accounting What it would currently cost to acquire an asset with the same capability or capacity as the one presently owned. Current Canadian Practice In 1982, the recommendations call for Canadian enterprises whose securities are traded in a public market to disclose in their annual reports supplementary information on the effect of changing prices. Copyright © 2014 Nelson Education Ltd. 2– 29

Accounting for Inflation and Changing Values LO 3 A. Need Question the validity of traditional accounting practices. Do financial statements prepared according to traditional accounting principles present fairly the financial position of a company in periods of inflation? B. Suggested Solutions 1. Price level accounting Restating all figures in financial statements in terms of current purchasing power. 2. Current value accounting What it would currently cost to acquire an asset with the same capability or capacity as the one presently owned. Current Canadian Practice In 1982, the recommendations call for Canadian enterprises whose securities are traded in a public market to disclose in their annual reports supplementary information on the effect of changing prices. Copyright © 2014 Nelson Education Ltd. 2– 29

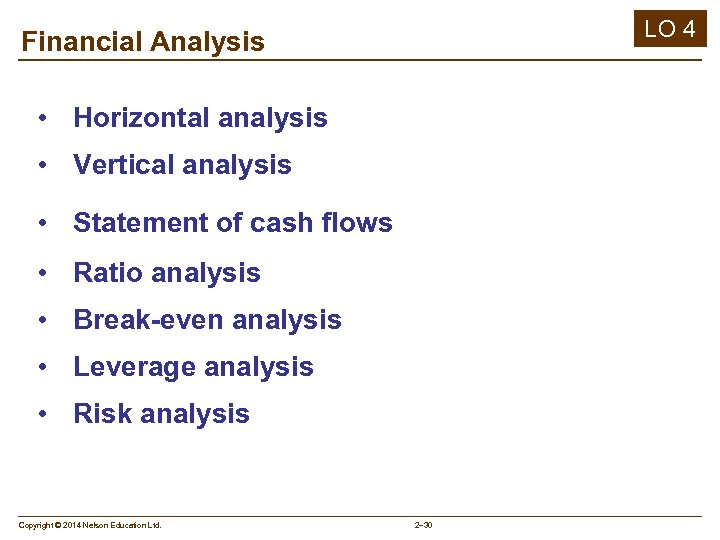

LO 4 Financial Analysis • Horizontal analysis • Vertical analysis • Statement of cash flows • Ratio analysis • Break-even analysis • Leverage analysis • Risk analysis Copyright © 2014 Nelson Education Ltd. 2– 30

LO 4 Financial Analysis • Horizontal analysis • Vertical analysis • Statement of cash flows • Ratio analysis • Break-even analysis • Leverage analysis • Risk analysis Copyright © 2014 Nelson Education Ltd. 2– 30

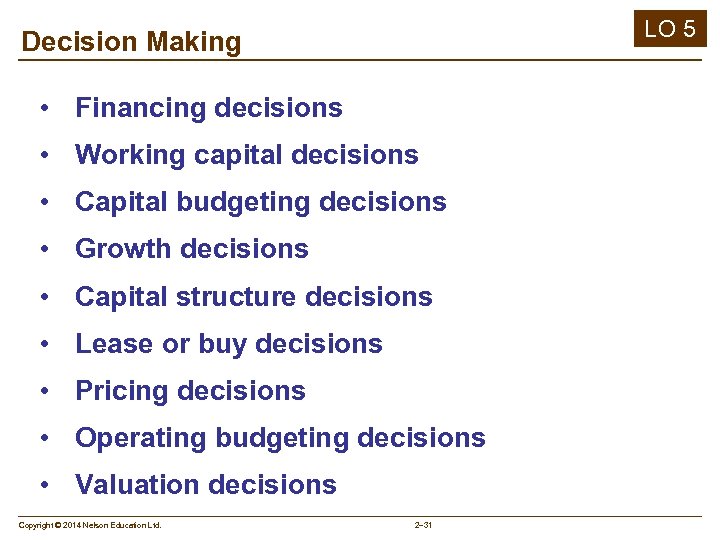

LO 5 Decision Making • Financing decisions • Working capital decisions • Capital budgeting decisions • Growth decisions • Capital structure decisions • Lease or buy decisions • Pricing decisions • Operating budgeting decisions • Valuation decisions Copyright © 2014 Nelson Education Ltd. 2– 31

LO 5 Decision Making • Financing decisions • Working capital decisions • Capital budgeting decisions • Growth decisions • Capital structure decisions • Lease or buy decisions • Pricing decisions • Operating budgeting decisions • Valuation decisions Copyright © 2014 Nelson Education Ltd. 2– 31

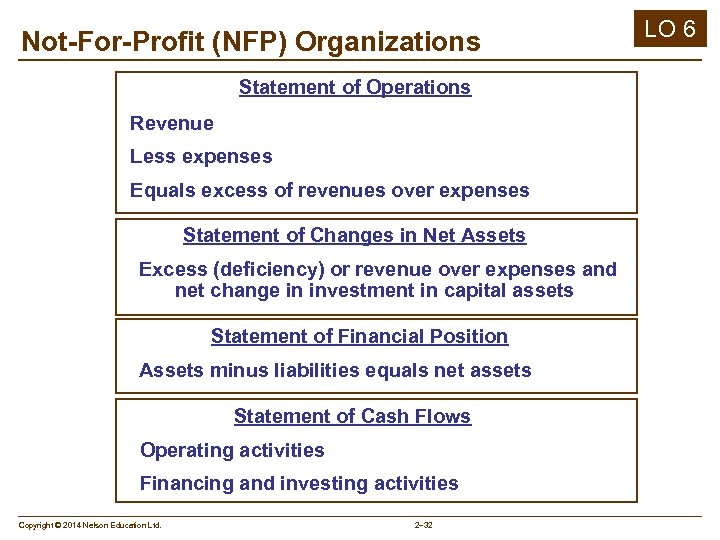

Not-For-Profit (NFP) Organizations Statement of Operations Revenue Less expenses Equals excess of revenues over expenses Statement of Changes in Net Assets Excess (deficiency) or revenue over expenses and net change in investment in capital assets Statement of Financial Position Assets minus liabilities equals net assets Statement of Cash Flows Operating activities Financing and investing activities Copyright © 2014 Nelson Education Ltd. 2– 32 LO 6

Not-For-Profit (NFP) Organizations Statement of Operations Revenue Less expenses Equals excess of revenues over expenses Statement of Changes in Net Assets Excess (deficiency) or revenue over expenses and net change in investment in capital assets Statement of Financial Position Assets minus liabilities equals net assets Statement of Cash Flows Operating activities Financing and investing activities Copyright © 2014 Nelson Education Ltd. 2– 32 LO 6