c03ac27ee82cd969968643abf565709a.ppt

- Количество слайдов: 23

POWER MARKET ECONOMICS Deregulation: Socio-economical and Technical Issues Inés Romero Navarro January 2004 Lund University, SWEDEN Inés Romero Navarro, IEA. LTH INDUSTRIAL ELECTRICAL ENGINEERING AND AUTOMATION

POWER MARKET ECONOMICS Deregulation: Socio-economical and Technical Issues Inés Romero Navarro January 2004 Lund University, SWEDEN Inés Romero Navarro, IEA. LTH INDUSTRIAL ELECTRICAL ENGINEERING AND AUTOMATION

Outline • • • Introduction Engineers vs. Economists Market Architecture Market Design Conclusions Inés Romero Navarro, IEA. LTH

Outline • • • Introduction Engineers vs. Economists Market Architecture Market Design Conclusions Inés Romero Navarro, IEA. LTH

Introduction I • Last century-power structure was constituted by large utilities, governed by market monopolies • Today - competitive markets, deregulation or re-estructuring • Electricity objective: ’Ensure delivery of energy to customers with high reliability and high quality contain, but optimizing the use of available resources’ • Reliability is today a popular term! – – Reliability levels The influence of the re-estructuring process on reliability levels Investments in generation and transmission Enough installed capacity Inés Romero Navarro, IEA. LTH

Introduction I • Last century-power structure was constituted by large utilities, governed by market monopolies • Today - competitive markets, deregulation or re-estructuring • Electricity objective: ’Ensure delivery of energy to customers with high reliability and high quality contain, but optimizing the use of available resources’ • Reliability is today a popular term! – – Reliability levels The influence of the re-estructuring process on reliability levels Investments in generation and transmission Enough installed capacity Inés Romero Navarro, IEA. LTH

Introduction II • Power Systems and Power Markets – lack of reliability (elasticity of demand investments) – lack of sufficient capability (investments) – lack of coordination and communication • Deregulation has increased the complexity to design and manage the power system. . . • but It is not the main cause of the low reliability levels in today’s networks Inés Romero Navarro, IEA. LTH

Introduction II • Power Systems and Power Markets – lack of reliability (elasticity of demand investments) – lack of sufficient capability (investments) – lack of coordination and communication • Deregulation has increased the complexity to design and manage the power system. . . • but It is not the main cause of the low reliability levels in today’s networks Inés Romero Navarro, IEA. LTH

Engineering vs. Economics I • Power Market combines power system and market economic fields. Optimal power market performance requires experts in both fields • Experiences show lack of cooperation = Failure in the Market Design – – • Economists look at power as a common tradable good main challenge: maximize profit for both buyers and sellers Engineers focus on technical aspects (reliability, quality) forget about the competitive nature of product traded in the stock market Engineers + economic advise – Wrong assumption: ‘Power is comparable to other common transaction’ – Failure: Maximize market profit without considering the main constraints that threat power delivery • California Summer 2000 opens a discussion about Ethics Inés Romero Navarro, IEA. LTH

Engineering vs. Economics I • Power Market combines power system and market economic fields. Optimal power market performance requires experts in both fields • Experiences show lack of cooperation = Failure in the Market Design – – • Economists look at power as a common tradable good main challenge: maximize profit for both buyers and sellers Engineers focus on technical aspects (reliability, quality) forget about the competitive nature of product traded in the stock market Engineers + economic advise – Wrong assumption: ‘Power is comparable to other common transaction’ – Failure: Maximize market profit without considering the main constraints that threat power delivery • California Summer 2000 opens a discussion about Ethics Inés Romero Navarro, IEA. LTH

Market Architecture (MA) • • Regulated and Deregulated services Bilateral and Centralized Markets Forward and Real Time Markets Customer Response Inés Romero Navarro, IEA. LTH

Market Architecture (MA) • • Regulated and Deregulated services Bilateral and Centralized Markets Forward and Real Time Markets Customer Response Inés Romero Navarro, IEA. LTH

Re/deregulated Services • Ancillary Services (AS) and System Operator (SO) – SO responsible to maintain system balanced: supply equal demand • • frequency and voltage control monopoly on the reactive power market – AS are fully regulated, coordinated by SO, and benefit to the entire market • Unit Commitment (UC) and Congestion Management (CM) – UC is handled by the generation side – CM is handled by SO (Revenues) • Risk Management and Forward Markets (FM) • Transmission and Distribution – Natural monopolies – New line – decision from either SO or a private company • Retail Competition – Retailing services are related to financial transactions and sending out bills – Green power, reliability level - benefit of retail competition Inés Romero Navarro, IEA. LTH

Re/deregulated Services • Ancillary Services (AS) and System Operator (SO) – SO responsible to maintain system balanced: supply equal demand • • frequency and voltage control monopoly on the reactive power market – AS are fully regulated, coordinated by SO, and benefit to the entire market • Unit Commitment (UC) and Congestion Management (CM) – UC is handled by the generation side – CM is handled by SO (Revenues) • Risk Management and Forward Markets (FM) • Transmission and Distribution – Natural monopolies – New line – decision from either SO or a private company • Retail Competition – Retailing services are related to financial transactions and sending out bills – Green power, reliability level - benefit of retail competition Inés Romero Navarro, IEA. LTH

Cen/decentralized Design • Bilateral vs. centralized exchanges and pools – Define the role of SO • • Small role = market power from private parties (bilateral exchanges) Large Role = inefficiency of non-profit organizations – Bilateral markets are slow. • • • Problems to handle Unit Commitment and Congestion Management Lack of transparent information Exchanges vs. pools – Exchanges are inefficient. Lack of reliability and coordination – Pools induces gaming and inefficiencies caused by side payments • Locational Pricing – Energy prices differ by location (congestion limits) = locational pricing – They are competitive and unique, (supply and demand) Inés Romero Navarro, IEA. LTH

Cen/decentralized Design • Bilateral vs. centralized exchanges and pools – Define the role of SO • • Small role = market power from private parties (bilateral exchanges) Large Role = inefficiency of non-profit organizations – Bilateral markets are slow. • • • Problems to handle Unit Commitment and Congestion Management Lack of transparent information Exchanges vs. pools – Exchanges are inefficient. Lack of reliability and coordination – Pools induces gaming and inefficiencies caused by side payments • Locational Pricing – Energy prices differ by location (congestion limits) = locational pricing – They are competitive and unique, (supply and demand) Inés Romero Navarro, IEA. LTH

Forward and RT Markets • Trading power involves a sequence of overlapping markets, forward and real time markets – – • Forward markets are settled by long-term contracts Sold up to 1 -2 years Covering from several years to the day before real time Financial markets The SO is responsible for the DA- and RT- markets – DA-market is handled in the form of exchanges or pools – The market is operated as auctions Inés Romero Navarro, IEA. LTH

Forward and RT Markets • Trading power involves a sequence of overlapping markets, forward and real time markets – – • Forward markets are settled by long-term contracts Sold up to 1 -2 years Covering from several years to the day before real time Financial markets The SO is responsible for the DA- and RT- markets – DA-market is handled in the form of exchanges or pools – The market is operated as auctions Inés Romero Navarro, IEA. LTH

Customer Response • Electricity marginal cost of production highly fluctuates and so does the delivery cost • Real-time metering to measure fluctuations is limited at residential, commercial and industrial levels • Customers lack information on continuous real-time prices. Low customer response to prices = Lack of demand elasticity • Lack o demand elasticity = supply and demand curves may fail to intersect. SO is forced to set the price • Today, all the markets operate in this way Inés Romero Navarro, IEA. LTH

Customer Response • Electricity marginal cost of production highly fluctuates and so does the delivery cost • Real-time metering to measure fluctuations is limited at residential, commercial and industrial levels • Customers lack information on continuous real-time prices. Low customer response to prices = Lack of demand elasticity • Lack o demand elasticity = supply and demand curves may fail to intersect. SO is forced to set the price • Today, all the markets operate in this way Inés Romero Navarro, IEA. LTH

Power Market Design (MD) • • Congestion Pricing Refunds and Taxing Ancillary Services Market for Operating Reserves Market Power and Gaming Reliability and Investment Policy Requirements for Installed Capacity Inés Romero Navarro, IEA. LTH

Power Market Design (MD) • • Congestion Pricing Refunds and Taxing Ancillary Services Market for Operating Reserves Market Power and Gaming Reliability and Investment Policy Requirements for Installed Capacity Inés Romero Navarro, IEA. LTH

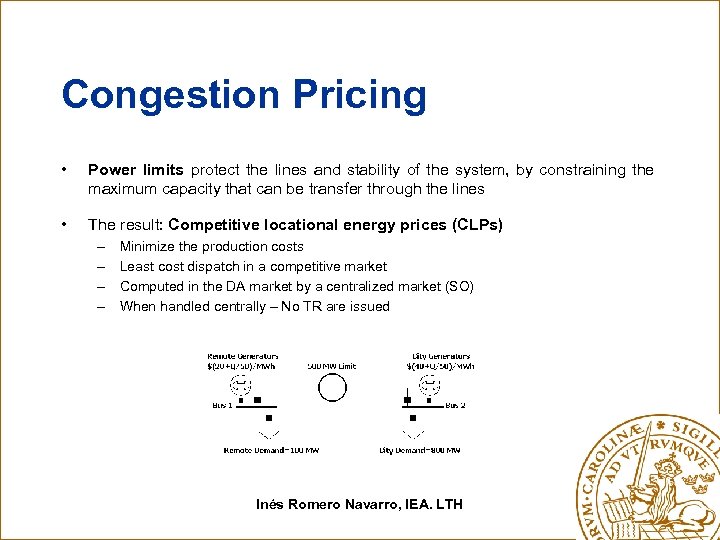

Congestion Pricing • Power limits protect the lines and stability of the system, by constraining the maximum capacity that can be transfer through the lines • The result: Competitive locational energy prices (CLPs) – – Minimize the production costs Least cost dispatch in a competitive market Computed in the DA market by a centralized market (SO) When handled centrally – No TR are issued Inés Romero Navarro, IEA. LTH

Congestion Pricing • Power limits protect the lines and stability of the system, by constraining the maximum capacity that can be transfer through the lines • The result: Competitive locational energy prices (CLPs) – – Minimize the production costs Least cost dispatch in a competitive market Computed in the DA market by a centralized market (SO) When handled centrally – No TR are issued Inés Romero Navarro, IEA. LTH

Refunds and Taxing • SO charges for various services and uses of the system – PRICES- to encourage the efficient use of system facilities – TAXES- to raise funds to pay for the facilities and various services • Efficiency charging - efficient pricing for as many services and externalities as possible (lines, losses, reactive power, generator ramping) • Prices determined by competition or by the system operator • Energy taxes are regulators to motivate/reduce the consumption of a specific type of energy – renewable energies, clean and green energies – Customers response (ecological food market) Inés Romero Navarro, IEA. LTH

Refunds and Taxing • SO charges for various services and uses of the system – PRICES- to encourage the efficient use of system facilities – TAXES- to raise funds to pay for the facilities and various services • Efficiency charging - efficient pricing for as many services and externalities as possible (lines, losses, reactive power, generator ramping) • Prices determined by competition or by the system operator • Energy taxes are regulators to motivate/reduce the consumption of a specific type of energy – renewable energies, clean and green energies – Customers response (ecological food market) Inés Romero Navarro, IEA. LTH

Ancillary Services • Frequency and Voltage Support – Frequency stability and power balancing - provided by regulation and frequency response services; – Market for trading reactive power (SO) • Black-start Capability – extreme failures, full or partial blackouts – Re-start the system requires generators with black-start capability • Transmission Security – ‘keep the grid operating’- SO (transmission rights or energy bids in the DA) – Re-scheduling differences between the DA and RT markets • Economic Dispatch – ‘use of generators to minimize the cost of production’ – DA and RT markets are important in order to dispatch economically • Trading Enforcement – ‘metering of power flows between all trades and the common grid and setting accounts with traders who deviate’- SO Inés Romero Navarro, IEA. LTH

Ancillary Services • Frequency and Voltage Support – Frequency stability and power balancing - provided by regulation and frequency response services; – Market for trading reactive power (SO) • Black-start Capability – extreme failures, full or partial blackouts – Re-start the system requires generators with black-start capability • Transmission Security – ‘keep the grid operating’- SO (transmission rights or energy bids in the DA) – Re-scheduling differences between the DA and RT markets • Economic Dispatch – ‘use of generators to minimize the cost of production’ – DA and RT markets are important in order to dispatch economically • Trading Enforcement – ‘metering of power flows between all trades and the common grid and setting accounts with traders who deviate’- SO Inés Romero Navarro, IEA. LTH

Market for Operating Reserves • Spinning reserve (SR) – ‘increase in the output that a generator/load can provide in ten minutes (load)’ – Regulation, 30 minutes non-spinning reserves, and ten-minute reserves (gas turbines) • Expensive – Total SR = largest amount of power that can be lost under a single contingency – total cost of SR depends on cost of the energy provided when the reserves are called on, and chance to be called – ‘Capacity-bid scoring is efficient’ • Non optimal bids = inefficient dispatch (market estimates) – Gaming Inés Romero Navarro, IEA. LTH

Market for Operating Reserves • Spinning reserve (SR) – ‘increase in the output that a generator/load can provide in ten minutes (load)’ – Regulation, 30 minutes non-spinning reserves, and ten-minute reserves (gas turbines) • Expensive – Total SR = largest amount of power that can be lost under a single contingency – total cost of SR depends on cost of the energy provided when the reserves are called on, and chance to be called – ‘Capacity-bid scoring is efficient’ • Non optimal bids = inefficient dispatch (market estimates) – Gaming Inés Romero Navarro, IEA. LTH

Market Power I - Introduction • Ability to affect the market price, resulting in a profitable action for the supplier/s, and in a market price away from the competitive levels • Monopoly Power: benefits from the market power are for the sellers /suppliers = Prices higher than the competitive ones – – • A supplier withholds power = higher prices and an inefficient market Profit to the actor but also other suppliers. Wealth Transfer Problem: supply curves are often vertical or almost vertical = Measure the Markup Market protection to ensure that the bid that raises the price may not set the price Monopsony Power: benefits from the market power are for the customers – Holding out the demand/bidding a price that is lower than the power’s marginal value – TSOs exercise it by withholding interruptible load or controlling imports/exports Inés Romero Navarro, IEA. LTH

Market Power I - Introduction • Ability to affect the market price, resulting in a profitable action for the supplier/s, and in a market price away from the competitive levels • Monopoly Power: benefits from the market power are for the sellers /suppliers = Prices higher than the competitive ones – – • A supplier withholds power = higher prices and an inefficient market Profit to the actor but also other suppliers. Wealth Transfer Problem: supply curves are often vertical or almost vertical = Measure the Markup Market protection to ensure that the bid that raises the price may not set the price Monopsony Power: benefits from the market power are for the customers – Holding out the demand/bidding a price that is lower than the power’s marginal value – TSOs exercise it by withholding interruptible load or controlling imports/exports Inés Romero Navarro, IEA. LTH

Market Power II - Gaming • Market power is exercised in RT. Never in forward markets • However, any exercise of market power in the RT market will be reflected in the future forward markets since their price is directly derived from the RT price = GAMING • High spot prices motivate more suppliers to act in the market – regulators will start taking restriction actions = Threat of Entry – restrictions hold down prices and participation Inés Romero Navarro, IEA. LTH

Market Power II - Gaming • Market power is exercised in RT. Never in forward markets • However, any exercise of market power in the RT market will be reflected in the future forward markets since their price is directly derived from the RT price = GAMING • High spot prices motivate more suppliers to act in the market – regulators will start taking restriction actions = Threat of Entry – restrictions hold down prices and participation Inés Romero Navarro, IEA. LTH

Market Power III - Solutions • Competition, monitoring and enforcement of the market are necessary to control the exercise of market power • High demand elasticity and low supplier concentration is desired – Access to RT prices • If the demand of elasticity is failing, which other factors are maintaining the competitive response of the market? – forward contracts and obligation of suppliers (controlled by policy) – uncertainty of the demand which causes supply-curve bidding Inés Romero Navarro, IEA. LTH

Market Power III - Solutions • Competition, monitoring and enforcement of the market are necessary to control the exercise of market power • High demand elasticity and low supplier concentration is desired – Access to RT prices • If the demand of elasticity is failing, which other factors are maintaining the competitive response of the market? – forward contracts and obligation of suppliers (controlled by policy) – uncertainty of the demand which causes supply-curve bidding Inés Romero Navarro, IEA. LTH

Reliability & Investment Policy I • Reliability refers to security to deliver power to customers – Importance at all levels • • • Incentive investments- establishing new policies and rewarding Reliability market for customers (elasticity of demand) Motivate renewable and green investments – Reliability, price spikes and investments determined by regulatory policies • If supply not equal to demand, the market cannot determine a price – Traditional markets - enough installed generation capacity - high costs Gen. – Today – shedding load or by fixing a high price – Best solution: increase demand elasticity • The minimal price intervention that would produce a reasonable level of reliability is known as value-of-lost-load (VOLL) pricing –(Regulator) Inés Romero Navarro, IEA. LTH

Reliability & Investment Policy I • Reliability refers to security to deliver power to customers – Importance at all levels • • • Incentive investments- establishing new policies and rewarding Reliability market for customers (elasticity of demand) Motivate renewable and green investments – Reliability, price spikes and investments determined by regulatory policies • If supply not equal to demand, the market cannot determine a price – Traditional markets - enough installed generation capacity - high costs Gen. – Today – shedding load or by fixing a high price – Best solution: increase demand elasticity • The minimal price intervention that would produce a reasonable level of reliability is known as value-of-lost-load (VOLL) pricing –(Regulator) Inés Romero Navarro, IEA. LTH

Reliability & Investment Policy II • Profit is the key to encourage investment – High prices induce investments = increase Installed Capacity – Short-run competitive prices induce right level of investment and reliability – Side effects of the reliability policy: • • • Infrequent high price peaks -risk for investors (Risk Premium) Extremely high prices facilitate the exercise of market power. Long-run investments – Generators sell in FM. Suppliers/customers buy in FM or RT • Preference: forward market -lock a price and avoid the volatility of the spot market- – long-term and spot prices must be close to each other • • High spot prices will influence long-term prices (investment long-term market) Low spot prices will influence long-term prices (investment RT market) Inés Romero Navarro, IEA. LTH

Reliability & Investment Policy II • Profit is the key to encourage investment – High prices induce investments = increase Installed Capacity – Short-run competitive prices induce right level of investment and reliability – Side effects of the reliability policy: • • • Infrequent high price peaks -risk for investors (Risk Premium) Extremely high prices facilitate the exercise of market power. Long-run investments – Generators sell in FM. Suppliers/customers buy in FM or RT • Preference: forward market -lock a price and avoid the volatility of the spot market- – long-term and spot prices must be close to each other • • High spot prices will influence long-term prices (investment long-term market) Low spot prices will influence long-term prices (investment RT market) Inés Romero Navarro, IEA. LTH

Requirements for Installed Capacity • Optimal level of installed capacity (Icap) – acceptable number of hours of load shedding around one day every ten years, reliability of the generators, and variations of the load, • • • spare capacity - neighborhood of 118% of expected peak load Individual requirements for installed capacity The Individual requirements are met by either purchasing generation or by contracting for its use. Penalties: – To any load-serving utility that fails to own or contract for the required capacity – To generators that fail the contract Inés Romero Navarro, IEA. LTH

Requirements for Installed Capacity • Optimal level of installed capacity (Icap) – acceptable number of hours of load shedding around one day every ten years, reliability of the generators, and variations of the load, • • • spare capacity - neighborhood of 118% of expected peak load Individual requirements for installed capacity The Individual requirements are met by either purchasing generation or by contracting for its use. Penalties: – To any load-serving utility that fails to own or contract for the required capacity – To generators that fail the contract Inés Romero Navarro, IEA. LTH

Conclusions • The famous break down in California market 2000 – Market characterized by low profits and lack of an investment policy – 1990 s increase of load in the Western region – Compromised available capacity • Results – – – – Extremely high prices (172 $/MWh in August 2000 vs. 58$/MWh in May) Lack of price control - lack of customer response Exercise of market power Shortages - lack of reliability Bankruptcy or insolvency of large companies Losses for investors, Unemployment High costs for customers Inés Romero Navarro, IEA. LTH

Conclusions • The famous break down in California market 2000 – Market characterized by low profits and lack of an investment policy – 1990 s increase of load in the Western region – Compromised available capacity • Results – – – – Extremely high prices (172 $/MWh in August 2000 vs. 58$/MWh in May) Lack of price control - lack of customer response Exercise of market power Shortages - lack of reliability Bankruptcy or insolvency of large companies Losses for investors, Unemployment High costs for customers Inés Romero Navarro, IEA. LTH

Questions ? Inés Romero Navarro, IEA. LTH

Questions ? Inés Romero Navarro, IEA. LTH