2441dddbe41efbadf02db95c17f7f5c6.ppt

- Количество слайдов: 94

Power Exchange Operations S. C. Saxena National Load Despatch Center

Power Exchange Operations S. C. Saxena National Load Despatch Center

Presentation Outline • Review of Fundamentals • Power Exchanges – Concepts – Implementation in India • Regulatory Framework • Procedures for Collective Transactions • Congestion Management – Market Splitting – Sharing of Available Margins amongst the Power Exchanges • Experience Gained in India • Trading of Renewable Energy Certificates in the Power Exchanges • Taking the Markets to the Next Level – Proposal For Evening Market – Sub-Hourly (15 – Minute) Market in Power Exchange • Recent International Experience 2

Presentation Outline • Review of Fundamentals • Power Exchanges – Concepts – Implementation in India • Regulatory Framework • Procedures for Collective Transactions • Congestion Management – Market Splitting – Sharing of Available Margins amongst the Power Exchanges • Experience Gained in India • Trading of Renewable Energy Certificates in the Power Exchanges • Taking the Markets to the Next Level – Proposal For Evening Market – Sub-Hourly (15 – Minute) Market in Power Exchange • Recent International Experience 2

Review of Fundamentals

Review of Fundamentals

Market • A mechanism through which buyers and sellers interact to determine prices and exchange goods and services • Entire set of conditions surrounding production, transport and distribution of a product • Size determined by geography, transport, costs, etc. 4

Market • A mechanism through which buyers and sellers interact to determine prices and exchange goods and services • Entire set of conditions surrounding production, transport and distribution of a product • Size determined by geography, transport, costs, etc. 4

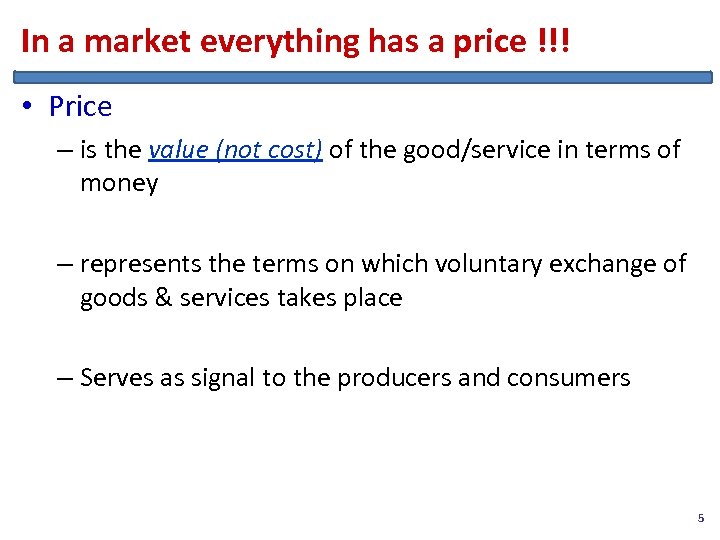

In a market everything has a price !!! • Price – is the value (not cost) of the good/service in terms of money – represents the terms on which voluntary exchange of goods & services takes place – Serves as signal to the producers and consumers 5

In a market everything has a price !!! • Price – is the value (not cost) of the good/service in terms of money – represents the terms on which voluntary exchange of goods & services takes place – Serves as signal to the producers and consumers 5

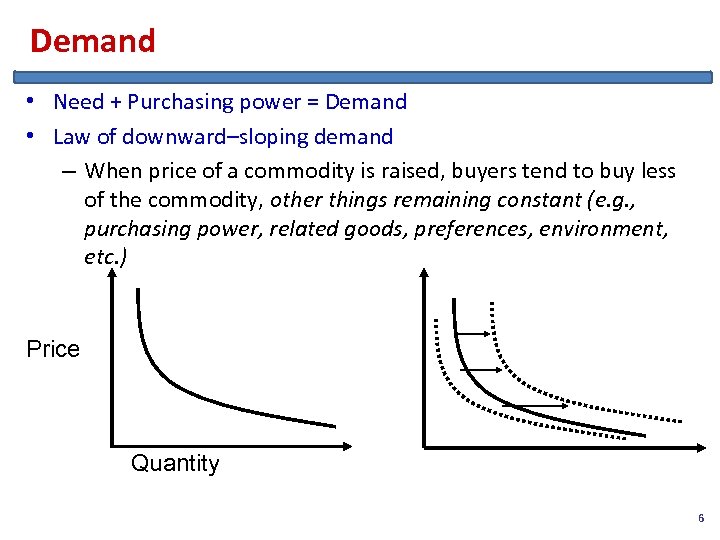

Demand • Need + Purchasing power = Demand • Law of downward–sloping demand – When price of a commodity is raised, buyers tend to buy less of the commodity, other things remaining constant (e. g. , purchasing power, related goods, preferences, environment, etc. ) Price Quantity 6

Demand • Need + Purchasing power = Demand • Law of downward–sloping demand – When price of a commodity is raised, buyers tend to buy less of the commodity, other things remaining constant (e. g. , purchasing power, related goods, preferences, environment, etc. ) Price Quantity 6

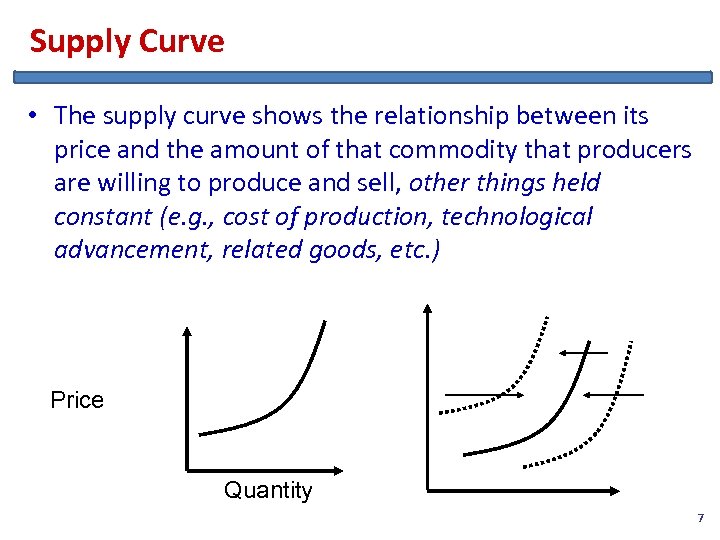

Supply Curve • The supply curve shows the relationship between its price and the amount of that commodity that producers are willing to produce and sell, other things held constant (e. g. , cost of production, technological advancement, related goods, etc. ) Price Quantity 7

Supply Curve • The supply curve shows the relationship between its price and the amount of that commodity that producers are willing to produce and sell, other things held constant (e. g. , cost of production, technological advancement, related goods, etc. ) Price Quantity 7

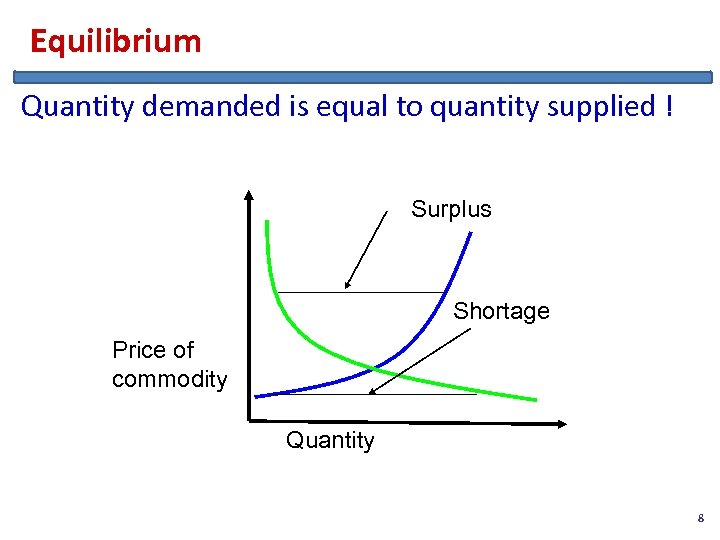

Equilibrium Quantity demanded is equal to quantity supplied ! Surplus Shortage Price of commodity Quantity 8

Equilibrium Quantity demanded is equal to quantity supplied ! Surplus Shortage Price of commodity Quantity 8

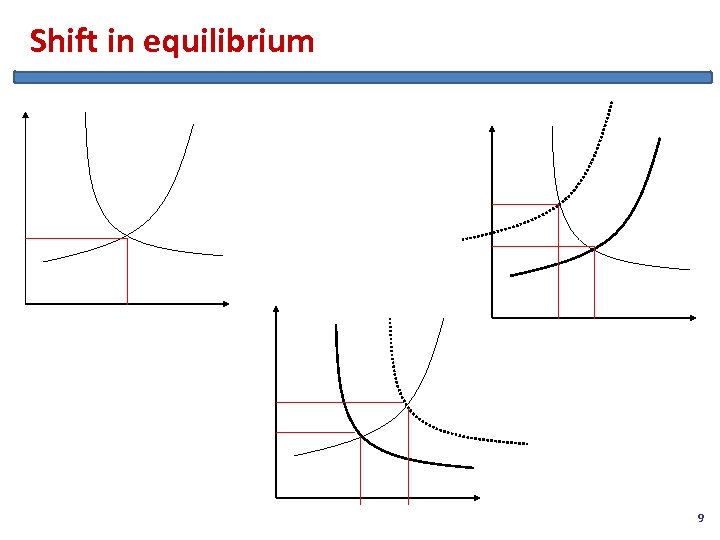

Shift in equilibrium 9

Shift in equilibrium 9

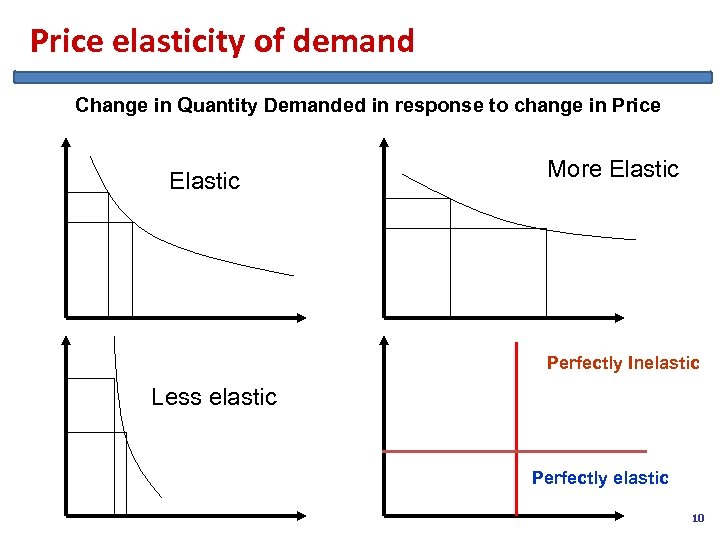

Price elasticity of demand Change in Quantity Demanded in response to change in Price Elastic More Elastic Perfectly Inelastic Less elastic Perfectly elastic 10

Price elasticity of demand Change in Quantity Demanded in response to change in Price Elastic More Elastic Perfectly Inelastic Less elastic Perfectly elastic 10

Power Exchanges: Concepts

Power Exchanges: Concepts

Bilateral (OTC) Markets • Common price through a co-operative approach • Major Concerns – – Price Discovery – Price Discrimination – Liquidity – Transaction Costs 12

Bilateral (OTC) Markets • Common price through a co-operative approach • Major Concerns – – Price Discovery – Price Discrimination – Liquidity – Transaction Costs 12

Power Exchanges - Definition • An electricity Power Exchange provides a spot market, mainly day-ahead, for electricity, which like any other market matches demand supply for each time block, while providing a public price index 13

Power Exchanges - Definition • An electricity Power Exchange provides a spot market, mainly day-ahead, for electricity, which like any other market matches demand supply for each time block, while providing a public price index 13

Power Exchange – Characteristics (1) • A Market Place – Voluntary or Mandatory – Anonymous auction platform – Neutral • Liquidity – A competitive wholesale spot trading arrangement • Energy Only Markets – Do not account for any technical constraints or capacity payments • Bids – Sale Bid – Quantum and Minimum price – Buy Bid – Quantum and Maximum price 14

Power Exchange – Characteristics (1) • A Market Place – Voluntary or Mandatory – Anonymous auction platform – Neutral • Liquidity – A competitive wholesale spot trading arrangement • Energy Only Markets – Do not account for any technical constraints or capacity payments • Bids – Sale Bid – Quantum and Minimum price – Buy Bid – Quantum and Maximum price 14

Power Exchange – Characteristics (2) • Price Discovery – Common price achieved through non co-operative approach – Price Discovery by matching of demand-supply – Price signals – Benchmark reference price • Congestion Management – Implicit Auction – Market Splitting 15

Power Exchange – Characteristics (2) • Price Discovery – Common price achieved through non co-operative approach – Price Discovery by matching of demand-supply – Price signals – Benchmark reference price • Congestion Management – Implicit Auction – Market Splitting 15

Power Exchange – Characteristics (3) • Standardized specifications – Contract structure • Robust Clearing & Settlement systems – Counter party credit risk absorbed • Risk Management – Payment Security – Standard margining system ØEliminates credit rating • Fair, Safe, orderly market – Rigorous financial standards and surveillance procedures 16

Power Exchange – Characteristics (3) • Standardized specifications – Contract structure • Robust Clearing & Settlement systems – Counter party credit risk absorbed • Risk Management – Payment Security – Standard margining system ØEliminates credit rating • Fair, Safe, orderly market – Rigorous financial standards and surveillance procedures 16

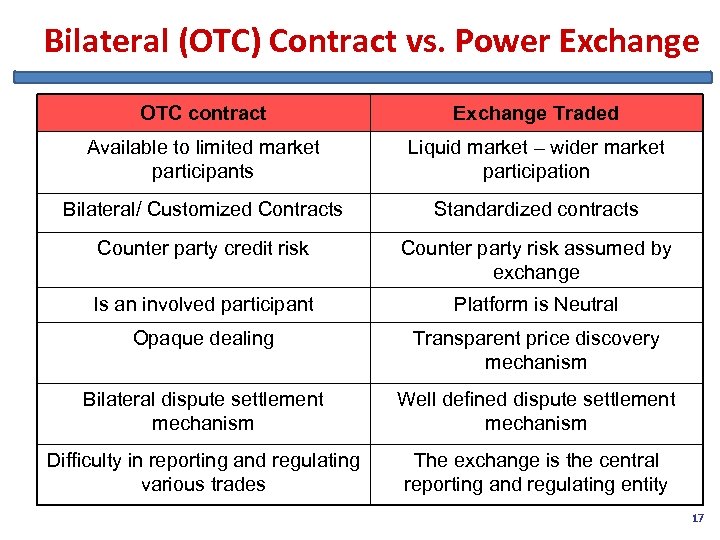

Bilateral (OTC) Contract vs. Power Exchange OTC contract Exchange Traded Available to limited market participants Liquid market – wider market participation Bilateral/ Customized Contracts Standardized contracts Counter party credit risk Counter party risk assumed by exchange Is an involved participant Platform is Neutral Opaque dealing Transparent price discovery mechanism Bilateral dispute settlement mechanism Well defined dispute settlement mechanism Difficulty in reporting and regulating various trades The exchange is the central reporting and regulating entity 17

Bilateral (OTC) Contract vs. Power Exchange OTC contract Exchange Traded Available to limited market participants Liquid market – wider market participation Bilateral/ Customized Contracts Standardized contracts Counter party credit risk Counter party risk assumed by exchange Is an involved participant Platform is Neutral Opaque dealing Transparent price discovery mechanism Bilateral dispute settlement mechanism Well defined dispute settlement mechanism Difficulty in reporting and regulating various trades The exchange is the central reporting and regulating entity 17

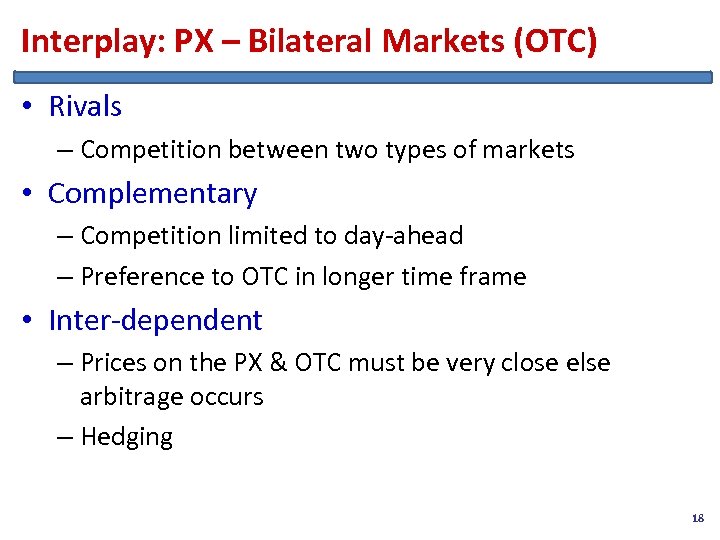

Interplay: PX – Bilateral Markets (OTC) • Rivals – Competition between two types of markets • Complementary – Competition limited to day-ahead – Preference to OTC in longer time frame • Inter-dependent – Prices on the PX & OTC must be very close else arbitrage occurs – Hedging 18

Interplay: PX – Bilateral Markets (OTC) • Rivals – Competition between two types of markets • Complementary – Competition limited to day-ahead – Preference to OTC in longer time frame • Inter-dependent – Prices on the PX & OTC must be very close else arbitrage occurs – Hedging 18

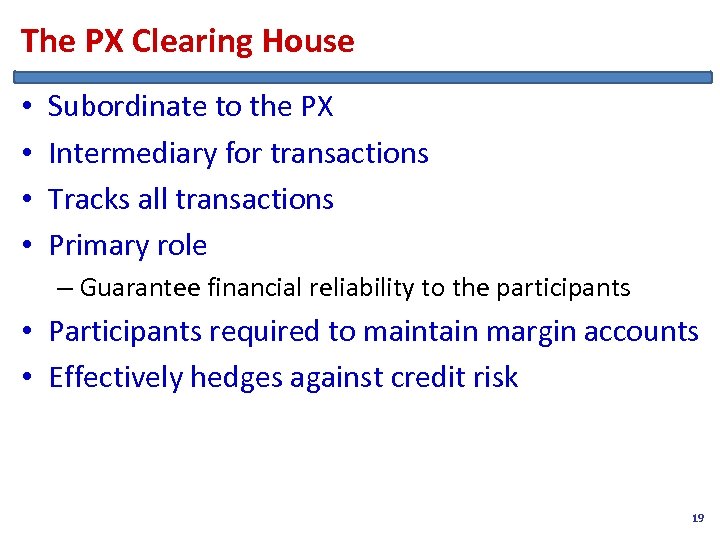

The PX Clearing House • • Subordinate to the PX Intermediary for transactions Tracks all transactions Primary role – Guarantee financial reliability to the participants • Participants required to maintain margin accounts • Effectively hedges against credit risk 19

The PX Clearing House • • Subordinate to the PX Intermediary for transactions Tracks all transactions Primary role – Guarantee financial reliability to the participants • Participants required to maintain margin accounts • Effectively hedges against credit risk 19

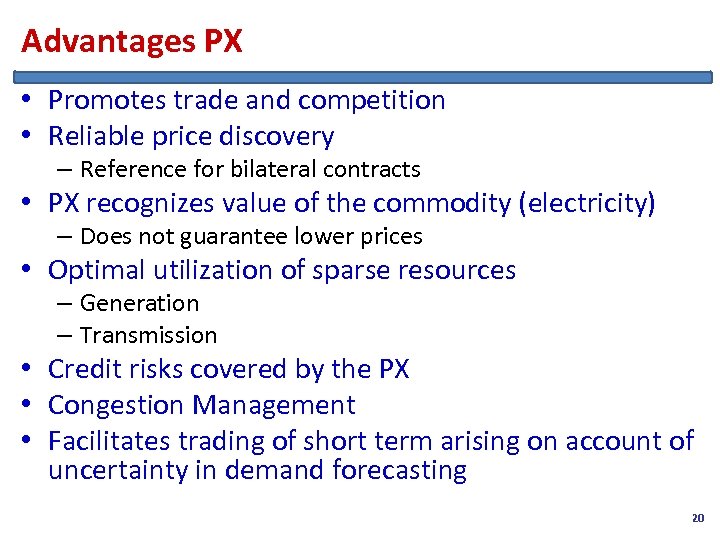

Advantages PX • Promotes trade and competition • Reliable price discovery – Reference for bilateral contracts • PX recognizes value of the commodity (electricity) – Does not guarantee lower prices • Optimal utilization of sparse resources – Generation – Transmission • Credit risks covered by the PX • Congestion Management • Facilitates trading of short term arising on account of uncertainty in demand forecasting 20

Advantages PX • Promotes trade and competition • Reliable price discovery – Reference for bilateral contracts • PX recognizes value of the commodity (electricity) – Does not guarantee lower prices • Optimal utilization of sparse resources – Generation – Transmission • Credit risks covered by the PX • Congestion Management • Facilitates trading of short term arising on account of uncertainty in demand forecasting 20

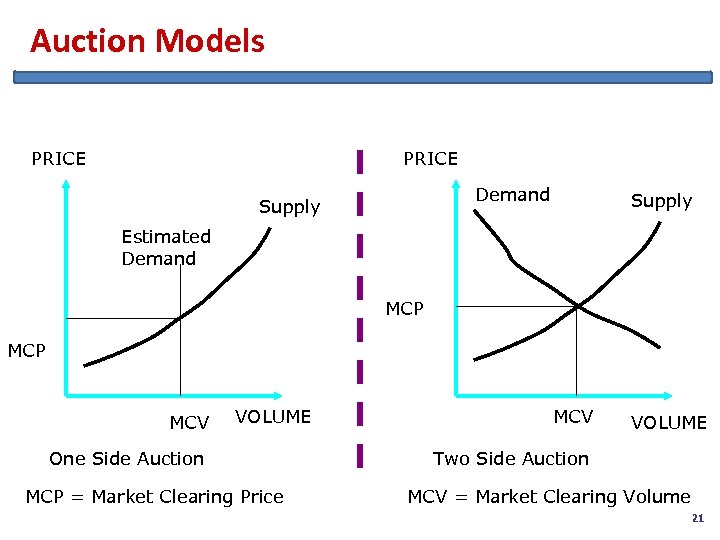

Auction Models PRICE Demand Supply Estimated Demand MCP MCV VOLUME One Side Auction MCP = Market Clearing Price MCV VOLUME Two Side Auction MCV = Market Clearing Volume 21

Auction Models PRICE Demand Supply Estimated Demand MCP MCV VOLUME One Side Auction MCP = Market Clearing Price MCV VOLUME Two Side Auction MCV = Market Clearing Volume 21

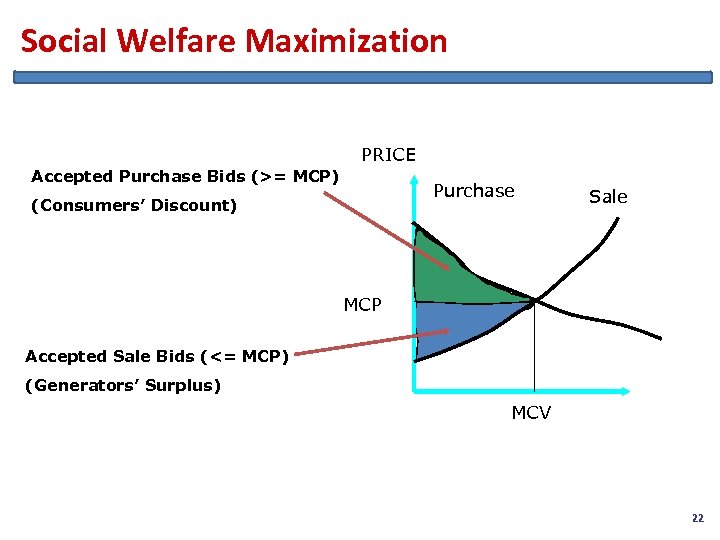

Social Welfare Maximization PRICE Accepted Purchase Bids (>= MCP) Purchase (Consumers’ Discount) Sale MCP Accepted Sale Bids (<= MCP) (Generators’ Surplus) MCV 22

Social Welfare Maximization PRICE Accepted Purchase Bids (>= MCP) Purchase (Consumers’ Discount) Sale MCP Accepted Sale Bids (<= MCP) (Generators’ Surplus) MCV 22

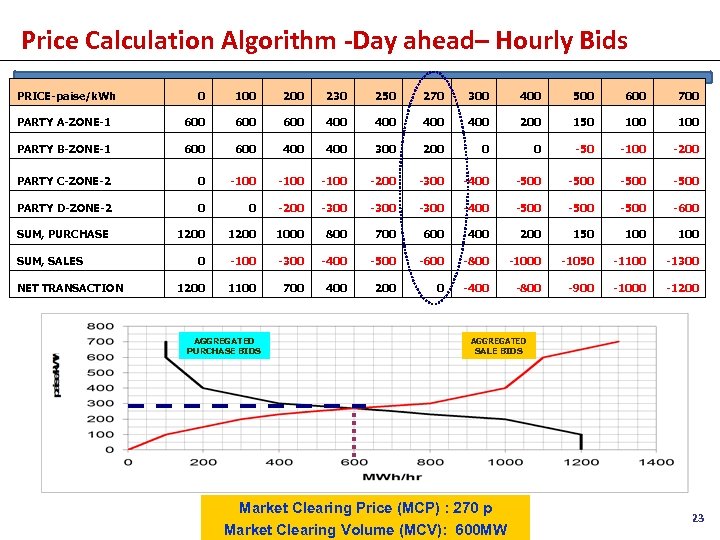

Price Calculation Algorithm -Day ahead– Hourly Bids PRICE-paise/k. Wh 0 100 230 250 270 300 400 500 600 700 PARTY A-ZONE-1 600 600 400 400 200 150 100 PARTY B-ZONE-1 600 400 300 200 0 0 -50 -100 -200 PARTY C-ZONE-2 0 -100 -200 -300 -400 -500 PARTY D-ZONE-2 0 0 -200 -300 -400 -500 -600 1200 1000 800 700 600 400 200 150 100 0 -100 -300 -400 -500 -600 -800 -1050 -1100 -1300 1200 1100 700 400 200 0 -400 -800 -900 -1000 -1200 SUM, PURCHASE SUM, SALES NET TRANSACTION AGGREGATED PURCHASE BIDS AGGREGATED SALE BIDS Market Clearing Price (MCP) : 270 p Market Clearing Volume (MCV): 600 MW 23

Price Calculation Algorithm -Day ahead– Hourly Bids PRICE-paise/k. Wh 0 100 230 250 270 300 400 500 600 700 PARTY A-ZONE-1 600 600 400 400 200 150 100 PARTY B-ZONE-1 600 400 300 200 0 0 -50 -100 -200 PARTY C-ZONE-2 0 -100 -200 -300 -400 -500 PARTY D-ZONE-2 0 0 -200 -300 -400 -500 -600 1200 1000 800 700 600 400 200 150 100 0 -100 -300 -400 -500 -600 -800 -1050 -1100 -1300 1200 1100 700 400 200 0 -400 -800 -900 -1000 -1200 SUM, PURCHASE SUM, SALES NET TRANSACTION AGGREGATED PURCHASE BIDS AGGREGATED SALE BIDS Market Clearing Price (MCP) : 270 p Market Clearing Volume (MCV): 600 MW 23

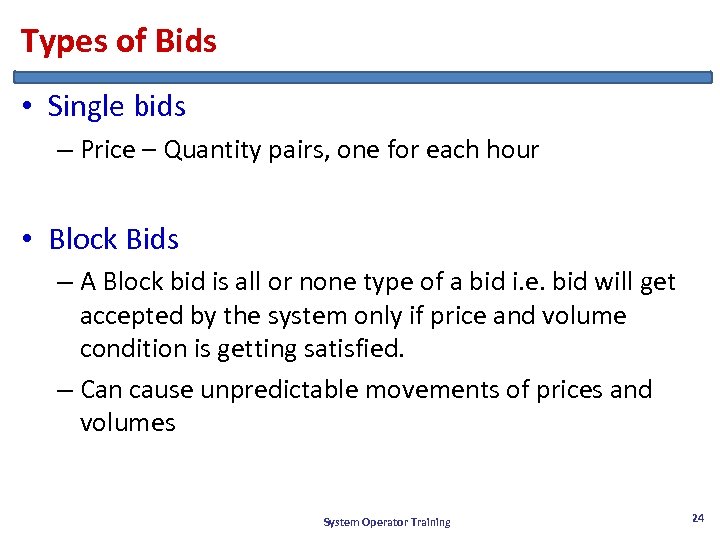

Types of Bids • Single bids – Price – Quantity pairs, one for each hour • Block Bids – A Block bid is all or none type of a bid i. e. bid will get accepted by the system only if price and volume condition is getting satisfied. – Can cause unpredictable movements of prices and volumes System Operator Training 24

Types of Bids • Single bids – Price – Quantity pairs, one for each hour • Block Bids – A Block bid is all or none type of a bid i. e. bid will get accepted by the system only if price and volume condition is getting satisfied. – Can cause unpredictable movements of prices and volumes System Operator Training 24

Power Exchange Implementation in India

Power Exchange Implementation in India

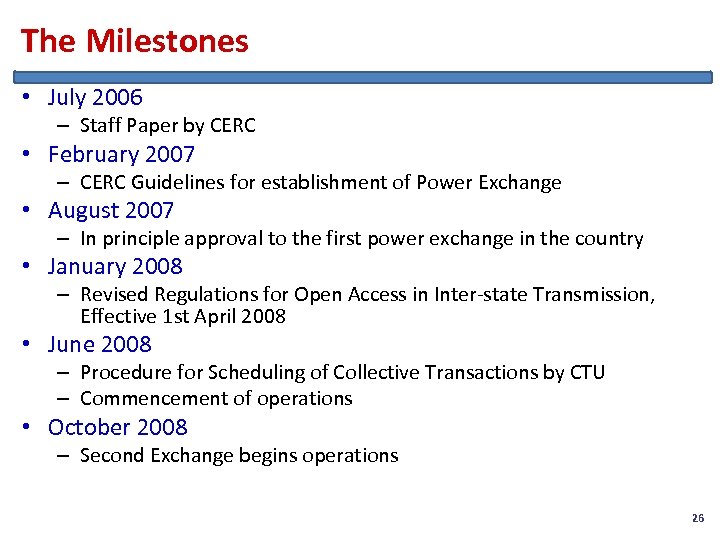

The Milestones • July 2006 – Staff Paper by CERC • February 2007 – CERC Guidelines for establishment of Power Exchange • August 2007 – In principle approval to the first power exchange in the country • January 2008 – Revised Regulations for Open Access in Inter-state Transmission, Effective 1 st April 2008 • June 2008 – Procedure for Scheduling of Collective Transactions by CTU – Commencement of operations • October 2008 – Second Exchange begins operations 26

The Milestones • July 2006 – Staff Paper by CERC • February 2007 – CERC Guidelines for establishment of Power Exchange • August 2007 – In principle approval to the first power exchange in the country • January 2008 – Revised Regulations for Open Access in Inter-state Transmission, Effective 1 st April 2008 • June 2008 – Procedure for Scheduling of Collective Transactions by CTU – Commencement of operations • October 2008 – Second Exchange begins operations 26

Power Exchange in India – Salient Features • Multiple Power Exchanges – Competition amongst Exchanges • • • Voluntary participation Double sided bidding Uniform pricing Day-ahead exchange Hourly bids Congestion management by market splitting 27

Power Exchange in India – Salient Features • Multiple Power Exchanges – Competition amongst Exchanges • • • Voluntary participation Double sided bidding Uniform pricing Day-ahead exchange Hourly bids Congestion management by market splitting 27

Regulatory Framework System Operator Training

Regulatory Framework System Operator Training

Regulator’s Approach • CERC Guidelines for setting up of a Power Exchange: “The general approach of the Commission is to allow operational freedom to the PX within an overall framework. The regulation would be minimal and restricted to requirements essential for preventing derailment/accidents and collusion. Private entrepreneurship would be allowed to play its role. The Commission shall keep away from governance of PX, which would be required to add value and provide quality service to the customers” NLDC 29

Regulator’s Approach • CERC Guidelines for setting up of a Power Exchange: “The general approach of the Commission is to allow operational freedom to the PX within an overall framework. The regulation would be minimal and restricted to requirements essential for preventing derailment/accidents and collusion. Private entrepreneurship would be allowed to play its role. The Commission shall keep away from governance of PX, which would be required to add value and provide quality service to the customers” NLDC 29

CERC Power Market Regulations, 2010 (1) • Scope & Extent – OTC Markets – Power Exchange Market – Other Power Exchange Markets ØDerivatives • Types of Contracts – Delivery based OTC Contracts – Financially settled electricity derivatives contracts transacted in OTC market – Delivery based contracts transacted on Exchange – REC Contracts – Capacity, Ancillary, Derivative based contracts (future) System Operator Training 30

CERC Power Market Regulations, 2010 (1) • Scope & Extent – OTC Markets – Power Exchange Market – Other Power Exchange Markets ØDerivatives • Types of Contracts – Delivery based OTC Contracts – Financially settled electricity derivatives contracts transacted in OTC market – Delivery based contracts transacted on Exchange – REC Contracts – Capacity, Ancillary, Derivative based contracts (future) System Operator Training 30

CERC Power Market Regulations, 2010 (2) • Prior to grant of permission to Power Exchange, CERC may examine – Type of contract (day ahead, term ahead etc); – Price Discovery methodology and matching rules proposed; – Transaction period – When transaction shall commence and for what tenure transaction session shall continue before delivery commences; – Risk Management mechanism ØMargining mechanism ØFinal Price Settlement mechanism – Delivery mechanism, delivery duration System Operator Training 31

CERC Power Market Regulations, 2010 (2) • Prior to grant of permission to Power Exchange, CERC may examine – Type of contract (day ahead, term ahead etc); – Price Discovery methodology and matching rules proposed; – Transaction period – When transaction shall commence and for what tenure transaction session shall continue before delivery commences; – Risk Management mechanism ØMargining mechanism ØFinal Price Settlement mechanism – Delivery mechanism, delivery duration System Operator Training 31

CERC Power Market Regulations, 2010 (3) Objectives of the Power Exchange (Regulation 10) • Ensure fair, neutral, efficient and robust price discovery • Provide extensive and quick price dissemination • Design standardised contracts and work towards increasing liquidity in such contracts – Explanation: Liquidity is a measure of ease of entering or exiting into a transaction (generally large transaction) with minimal impact in the market price of the transacted contract. System Operator Training 32

CERC Power Market Regulations, 2010 (3) Objectives of the Power Exchange (Regulation 10) • Ensure fair, neutral, efficient and robust price discovery • Provide extensive and quick price dissemination • Design standardised contracts and work towards increasing liquidity in such contracts – Explanation: Liquidity is a measure of ease of entering or exiting into a transaction (generally large transaction) with minimal impact in the market price of the transacted contract. System Operator Training 32

CERC Power Market Regulations, 2010 (4) Principles of Price Discovery (Regulation 11) • The economic principle of social welfare maximisation and to create buyer and seller surplus simultaneously during price discovery. • The bidding mechanism shall be double sided closed bid auction on a day ahead basis. • The price discovered for the unconstrained market shall be a uniform market clearing price for all buyers and sellers who are cleared • In case of congestion in transmission corridor, market splitting mechanism shall be adopted. • The delivery / drawl of power shall be considered at the regional periphery. System Operator Training 33

CERC Power Market Regulations, 2010 (4) Principles of Price Discovery (Regulation 11) • The economic principle of social welfare maximisation and to create buyer and seller surplus simultaneously during price discovery. • The bidding mechanism shall be double sided closed bid auction on a day ahead basis. • The price discovered for the unconstrained market shall be a uniform market clearing price for all buyers and sellers who are cleared • In case of congestion in transmission corridor, market splitting mechanism shall be adopted. • The delivery / drawl of power shall be considered at the regional periphery. System Operator Training 33

CERC Power Market Regulations, 2010 (5) • Other Provisions – Prudential Norms – Governance Issues – Ownership Patterns – Registration – Fees – Membership – Clearing House – Interface with System Operator Training 34

CERC Power Market Regulations, 2010 (5) • Other Provisions – Prudential Norms – Governance Issues – Ownership Patterns – Registration – Fees – Membership – Clearing House – Interface with System Operator Training 34

Open Access Regulations, 2008 • Earlier Regulations notified in February 2004 (amended in 2005) stand repealed • Covers Short Term Open Access Transactions only • Categories of Transactions – Bilateral – Collective Transactions discovered on a Power Exchange • Nodal Agency – Bilateral: RLDCs – Collective: NLDC

Open Access Regulations, 2008 • Earlier Regulations notified in February 2004 (amended in 2005) stand repealed • Covers Short Term Open Access Transactions only • Categories of Transactions – Bilateral – Collective Transactions discovered on a Power Exchange • Nodal Agency – Bilateral: RLDCs – Collective: NLDC

Open Access Regulations, 2008: Provisions For Collective Transactions • Transmission Charges – Shift from “Contract Path” to “Point of Connection” – Both buyers and sellers to pay – IR Links – no separate treatment • Transmission Losses – Applicable on both buyers and sellers • Disbursement of Transmission Charges – 25% retained by CTU – 75% to be credited to long-term customers

Open Access Regulations, 2008: Provisions For Collective Transactions • Transmission Charges – Shift from “Contract Path” to “Point of Connection” – Both buyers and sellers to pay – IR Links – no separate treatment • Transmission Losses – Applicable on both buyers and sellers • Disbursement of Transmission Charges – 25% retained by CTU – 75% to be credited to long-term customers

Open Access Regulations, 2008: Provisions For Collective Transactions • Thrust on Empowerment of SLDCs • SLDC Concurrence [Clause 8(2)] – NOC/Standing Clearance to be obtained by State Utilities/Intra-State Entities from the SLDC for trading through PX – SLDC to respond within 3 days – SLDCs may charge appropriate fee for such NOC/Standing Clearance (as per SERC or Rs. 5000 if notified by SERC)

Open Access Regulations, 2008: Provisions For Collective Transactions • Thrust on Empowerment of SLDCs • SLDC Concurrence [Clause 8(2)] – NOC/Standing Clearance to be obtained by State Utilities/Intra-State Entities from the SLDC for trading through PX – SLDC to respond within 3 days – SLDCs may charge appropriate fee for such NOC/Standing Clearance (as per SERC or Rs. 5000 if notified by SERC)

Procedures for Scheduling of Collective Transactions System Operator Training

Procedures for Scheduling of Collective Transactions System Operator Training

Eligibility Conditions • Entities scheduled by RLDCs – Deemed Regional Entity ØEntities whose metering and energy accounting done by RLDCs • Entities scheduled by SLDCs – SLDCs to assess TTC/ATC for their State system – Prior Consent from respective SLDCs – Standing Clearance / NOC • New Entities – To Satisfy conditions as laid down in IEGC – Obtain Prior Approval from RLDCs/SLDCs as per jurisdiction NLDC 39

Eligibility Conditions • Entities scheduled by RLDCs – Deemed Regional Entity ØEntities whose metering and energy accounting done by RLDCs • Entities scheduled by SLDCs – SLDCs to assess TTC/ATC for their State system – Prior Consent from respective SLDCs – Standing Clearance / NOC • New Entities – To Satisfy conditions as laid down in IEGC – Obtain Prior Approval from RLDCs/SLDCs as per jurisdiction NLDC 39

Commercial Conditions (1) • Charges for Collective Transactions payable to SLDCs – Transmission Charges: As per SERC, if notified or else Rs. 80/MWh – Operating Charges: Rs. 2, 000 per day for each point of transaction – Each point of injection and drawl to be counted separately by SLDCs – PX to settle SLDC charges directly with respective SLDC

Commercial Conditions (1) • Charges for Collective Transactions payable to SLDCs – Transmission Charges: As per SERC, if notified or else Rs. 80/MWh – Operating Charges: Rs. 2, 000 per day for each point of transaction – Each point of injection and drawl to be counted separately by SLDCs – PX to settle SLDC charges directly with respective SLDC

Commercial Conditions (2) • Charges for Collective Transactions payable to NLDC • Application Fee – @ Rs. 5, 000/-, payable by PX to NLDC at the time of application • Transmission Charges – Applicable for each point of injection and drawl – Charges for use of ISTS @ Rs. 100 per MWh • Operating Charges – @ Rs. 5, 000/- per day per group involved – Buyers and Sellers in a State to be clubbed into separate groups – Each group to be counted as a single entity by NLDC • Payment by PX to NLDC – Transmission and Operating Charges: By next working day – Preferred Mode: Electronic Fund Transfer

Commercial Conditions (2) • Charges for Collective Transactions payable to NLDC • Application Fee – @ Rs. 5, 000/-, payable by PX to NLDC at the time of application • Transmission Charges – Applicable for each point of injection and drawl – Charges for use of ISTS @ Rs. 100 per MWh • Operating Charges – @ Rs. 5, 000/- per day per group involved – Buyers and Sellers in a State to be clubbed into separate groups – Each group to be counted as a single entity by NLDC • Payment by PX to NLDC – Transmission and Operating Charges: By next working day – Preferred Mode: Electronic Fund Transfer

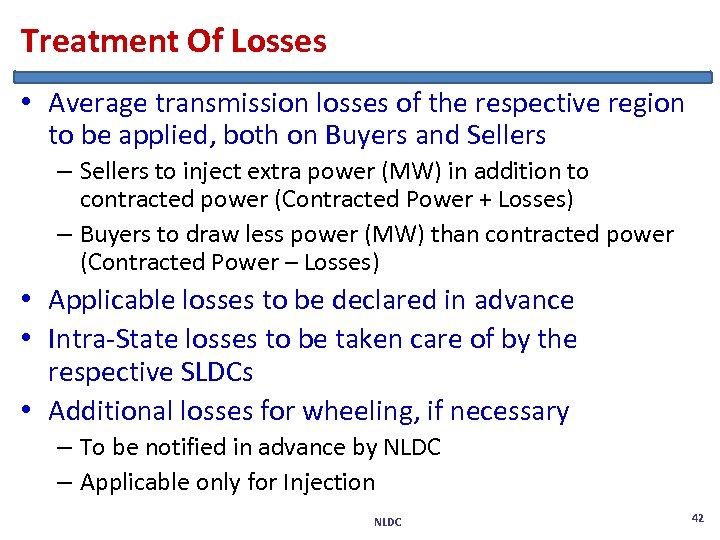

Treatment Of Losses • Average transmission losses of the respective region to be applied, both on Buyers and Sellers – Sellers to inject extra power (MW) in addition to contracted power (Contracted Power + Losses) – Buyers to draw less power (MW) than contracted power (Contracted Power – Losses) • Applicable losses to be declared in advance • Intra-State losses to be taken care of by the respective SLDCs • Additional losses for wheeling, if necessary – To be notified in advance by NLDC – Applicable only for Injection NLDC 42

Treatment Of Losses • Average transmission losses of the respective region to be applied, both on Buyers and Sellers – Sellers to inject extra power (MW) in addition to contracted power (Contracted Power + Losses) – Buyers to draw less power (MW) than contracted power (Contracted Power – Losses) • Applicable losses to be declared in advance • Intra-State losses to be taken care of by the respective SLDCs • Additional losses for wheeling, if necessary – To be notified in advance by NLDC – Applicable only for Injection NLDC 42

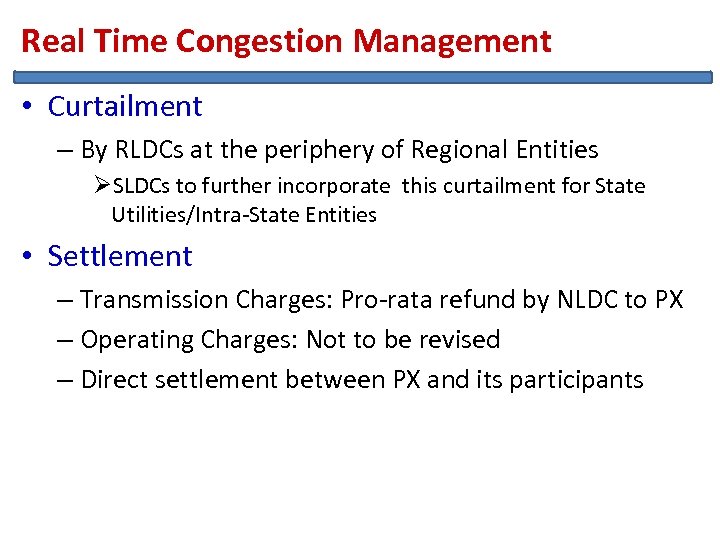

Real Time Congestion Management • Curtailment – By RLDCs at the periphery of Regional Entities ØSLDCs to further incorporate this curtailment for State Utilities/Intra-State Entities • Settlement – Transmission Charges: Pro-rata refund by NLDC to PX – Operating Charges: Not to be revised – Direct settlement between PX and its participants

Real Time Congestion Management • Curtailment – By RLDCs at the periphery of Regional Entities ØSLDCs to further incorporate this curtailment for State Utilities/Intra-State Entities • Settlement – Transmission Charges: Pro-rata refund by NLDC to PX – Operating Charges: Not to be revised – Direct settlement between PX and its participants

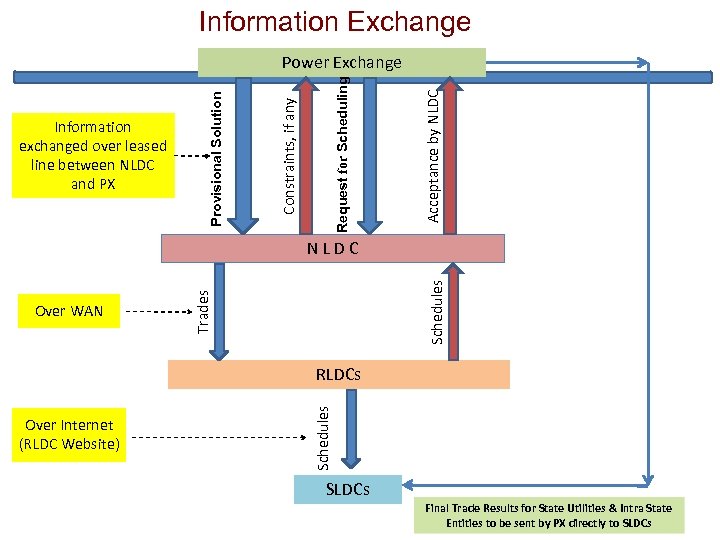

Information Exchange Acceptance by NLDC Request for Scheduling Constraints, if any Information exchanged over leased line between NLDC and PX Provisional Solution Power Exchange Trades Over WAN Schedules N L D C Over Internet (RLDC Website) Schedules RLDCs SLDCs Final Trade Results for State Utilities & Intra State Entities to be sent by PX directly to SLDCs

Information Exchange Acceptance by NLDC Request for Scheduling Constraints, if any Information exchanged over leased line between NLDC and PX Provisional Solution Power Exchange Trades Over WAN Schedules N L D C Over Internet (RLDC Website) Schedules RLDCs SLDCs Final Trade Results for State Utilities & Intra State Entities to be sent by PX directly to SLDCs

Congestion Management NLDC

Congestion Management NLDC

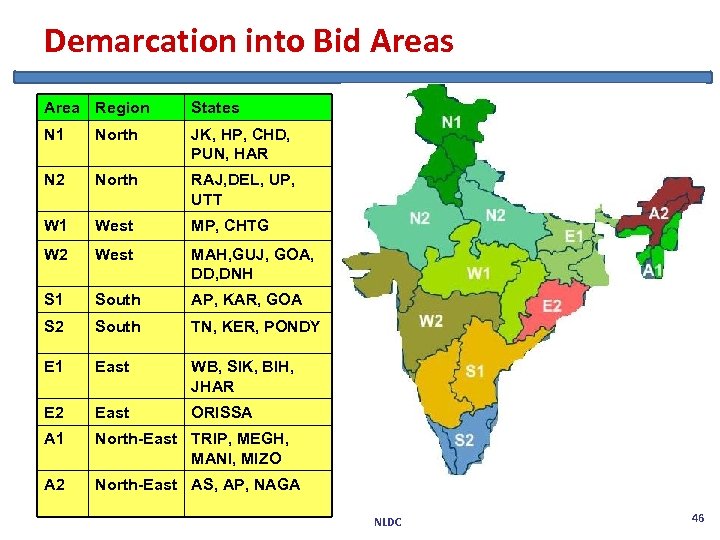

Demarcation into Bid Areas Area Region States N 1 North JK, HP, CHD, PUN, HAR N 2 North RAJ, DEL, UP, UTT W 1 West MP, CHTG W 2 West MAH, GUJ, GOA, DD, DNH S 1 South AP, KAR, GOA S 2 South TN, KER, PONDY E 1 East WB, SIK, BIH, JHAR E 2 East ORISSA A 1 North-East TRIP, MEGH, MANI, MIZO A 2 North-East AS, AP, NAGA NLDC 46

Demarcation into Bid Areas Area Region States N 1 North JK, HP, CHD, PUN, HAR N 2 North RAJ, DEL, UP, UTT W 1 West MP, CHTG W 2 West MAH, GUJ, GOA, DD, DNH S 1 South AP, KAR, GOA S 2 South TN, KER, PONDY E 1 East WB, SIK, BIH, JHAR E 2 East ORISSA A 1 North-East TRIP, MEGH, MANI, MIZO A 2 North-East AS, AP, NAGA NLDC 46

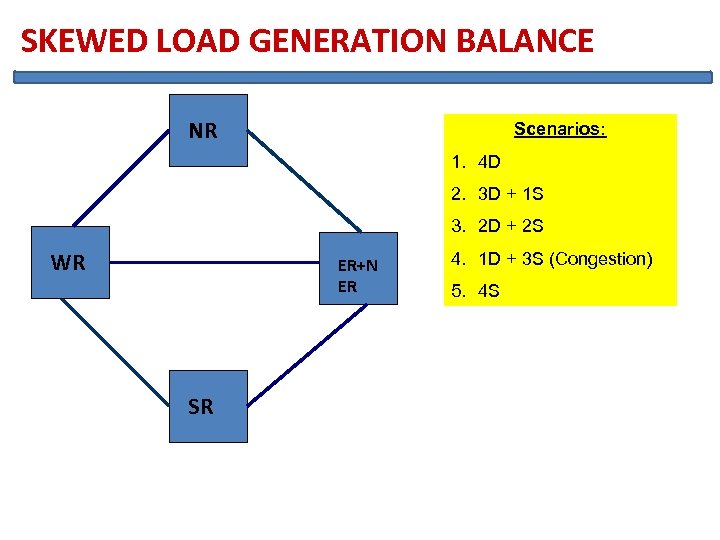

SKEWED LOAD GENERATION BALANCE NR Scenarios: 1. 4 D 2. 3 D + 1 S 3. 2 D + 2 S WR ER+N ER SR 4. 1 D + 3 S (Congestion) 5. 4 S

SKEWED LOAD GENERATION BALANCE NR Scenarios: 1. 4 D 2. 3 D + 1 S 3. 2 D + 2 S WR ER+N ER SR 4. 1 D + 3 S (Congestion) 5. 4 S

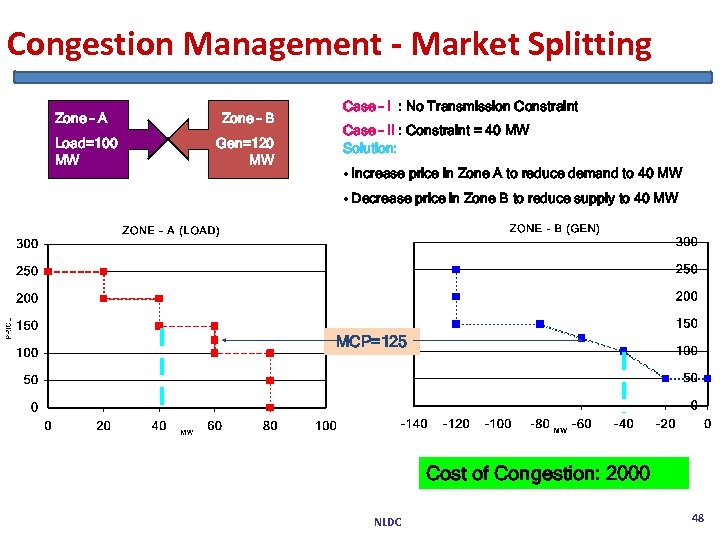

Congestion Management - Market Splitting Zone – A Load=100 MW Zone – B Gen=120 MW Case – I : No Transmission Constraint Case – II : Constraint = 40 MW Solution: • Increase price in Zone A to reduce demand to 40 MW • Decrease price in Zone B to reduce supply to 40 MW MCP=125 Cost of Congestion: 2000 NLDC 48

Congestion Management - Market Splitting Zone – A Load=100 MW Zone – B Gen=120 MW Case – I : No Transmission Constraint Case – II : Constraint = 40 MW Solution: • Increase price in Zone A to reduce demand to 40 MW • Decrease price in Zone B to reduce supply to 40 MW MCP=125 Cost of Congestion: 2000 NLDC 48

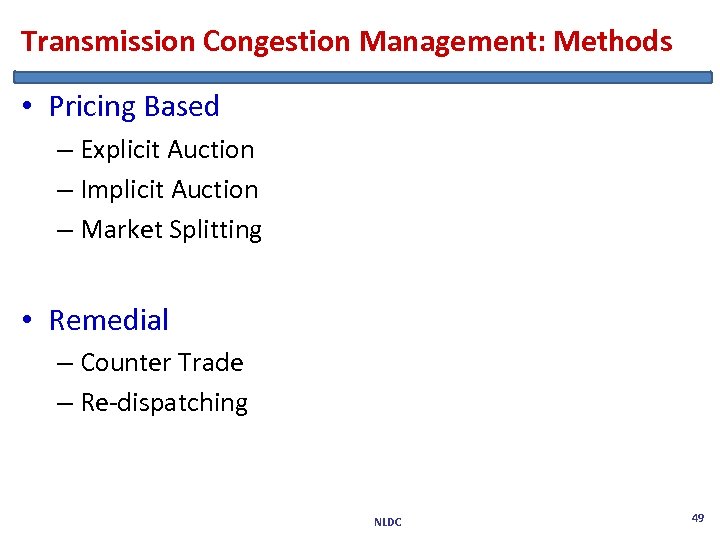

Transmission Congestion Management: Methods • Pricing Based – Explicit Auction – Implicit Auction – Market Splitting • Remedial – Counter Trade – Re-dispatching NLDC 49

Transmission Congestion Management: Methods • Pricing Based – Explicit Auction – Implicit Auction – Market Splitting • Remedial – Counter Trade – Re-dispatching NLDC 49

Congestion Management in Multi Exchange Scenario (1) • ISSUE – Sharing of available margins • Possible Methods – Priority Based Rules – Explicit Auction – Merging of Bids • Priority Based Rules ØLowest MCP ØHighest MCV ØHighest MCP X MCV ØMaximization of Social Welfare, consumer surplus, etc. ØMay not lead to an overall economy NLDC 50

Congestion Management in Multi Exchange Scenario (1) • ISSUE – Sharing of available margins • Possible Methods – Priority Based Rules – Explicit Auction – Merging of Bids • Priority Based Rules ØLowest MCP ØHighest MCV ØHighest MCP X MCV ØMaximization of Social Welfare, consumer surplus, etc. ØMay not lead to an overall economy NLDC 50

Congestion Management in Multi Exchanges Scenario (2) • Explicit Auctioning amongst Exchanges – Inter-dependencies in the Indian scenario – Difficult to implement • Merging of bids obtained by each Power Exchange – Equivalent to system operator interfacing with only one Exchange – Confidentiality issues • Pro – rata rationing of available margins – Simple to implement – Sub-optimal method – Possibility of over-estimation of capacity – Further complications ØArising out of inter-dependencies in the Indian scenario NLDC 51

Congestion Management in Multi Exchanges Scenario (2) • Explicit Auctioning amongst Exchanges – Inter-dependencies in the Indian scenario – Difficult to implement • Merging of bids obtained by each Power Exchange – Equivalent to system operator interfacing with only one Exchange – Confidentiality issues • Pro – rata rationing of available margins – Simple to implement – Sub-optimal method – Possibility of over-estimation of capacity – Further complications ØArising out of inter-dependencies in the Indian scenario NLDC 51

Implementation in India • Worldwide, one Power Exchange dealing with physical delivery in one market • Pro-rata sharing of available margins – Applied on cleared trade volumes on each area and each corridor – Interim arrangement – Debate on for a more optimal method NLDC 52

Implementation in India • Worldwide, one Power Exchange dealing with physical delivery in one market • Pro-rata sharing of available margins – Applied on cleared trade volumes on each area and each corridor – Interim arrangement – Debate on for a more optimal method NLDC 52

Discovery of Multiple Prices & Interplay • Prices discovered in Power Exchange – Reflection of anticipated UI price for the next day • Multiple Prices – Collective Transactions: ØTwo prices – one for each exchange – Two Grids – two UI Prices – In case of congestion, market split ØArea prices ØMultiple exchanges NLDC 53

Discovery of Multiple Prices & Interplay • Prices discovered in Power Exchange – Reflection of anticipated UI price for the next day • Multiple Prices – Collective Transactions: ØTwo prices – one for each exchange – Two Grids – two UI Prices – In case of congestion, market split ØArea prices ØMultiple exchanges NLDC 53

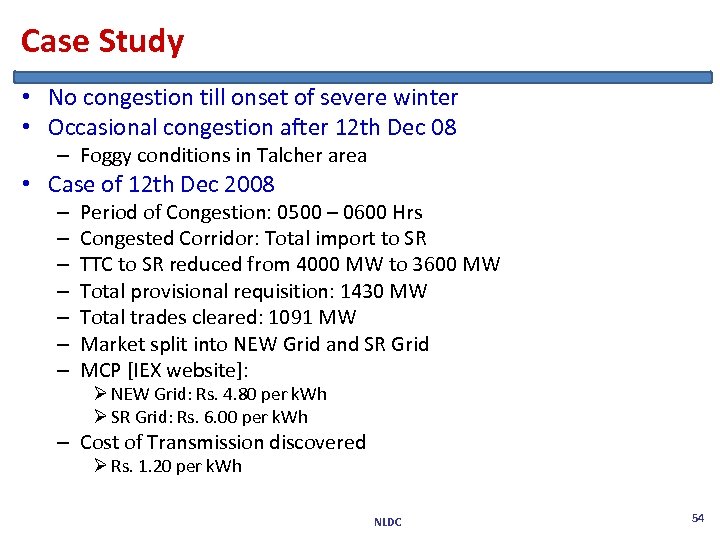

Case Study • No congestion till onset of severe winter • Occasional congestion after 12 th Dec 08 – Foggy conditions in Talcher area • Case of 12 th Dec 2008 – – – – Period of Congestion: 0500 – 0600 Hrs Congested Corridor: Total import to SR TTC to SR reduced from 4000 MW to 3600 MW Total provisional requisition: 1430 MW Total trades cleared: 1091 MW Market split into NEW Grid and SR Grid MCP [IEX website]: Ø NEW Grid: Rs. 4. 80 per k. Wh Ø SR Grid: Rs. 6. 00 per k. Wh – Cost of Transmission discovered Ø Rs. 1. 20 per k. Wh NLDC 54

Case Study • No congestion till onset of severe winter • Occasional congestion after 12 th Dec 08 – Foggy conditions in Talcher area • Case of 12 th Dec 2008 – – – – Period of Congestion: 0500 – 0600 Hrs Congested Corridor: Total import to SR TTC to SR reduced from 4000 MW to 3600 MW Total provisional requisition: 1430 MW Total trades cleared: 1091 MW Market split into NEW Grid and SR Grid MCP [IEX website]: Ø NEW Grid: Rs. 4. 80 per k. Wh Ø SR Grid: Rs. 6. 00 per k. Wh – Cost of Transmission discovered Ø Rs. 1. 20 per k. Wh NLDC 54

Experience Gained NLDC

Experience Gained NLDC

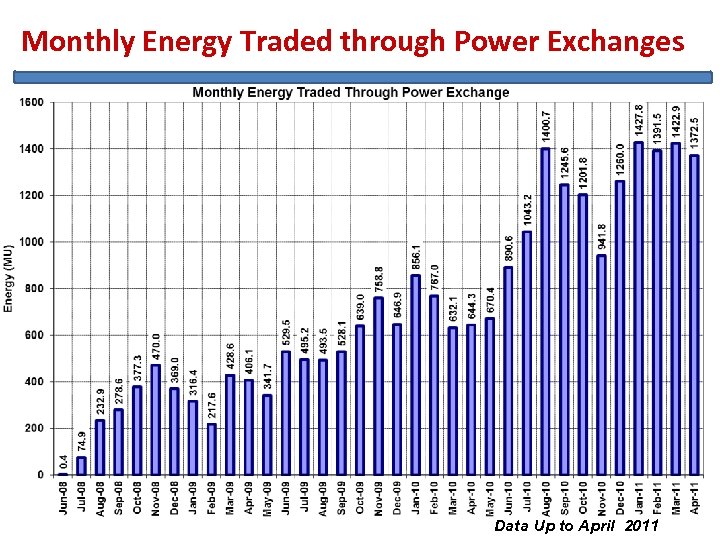

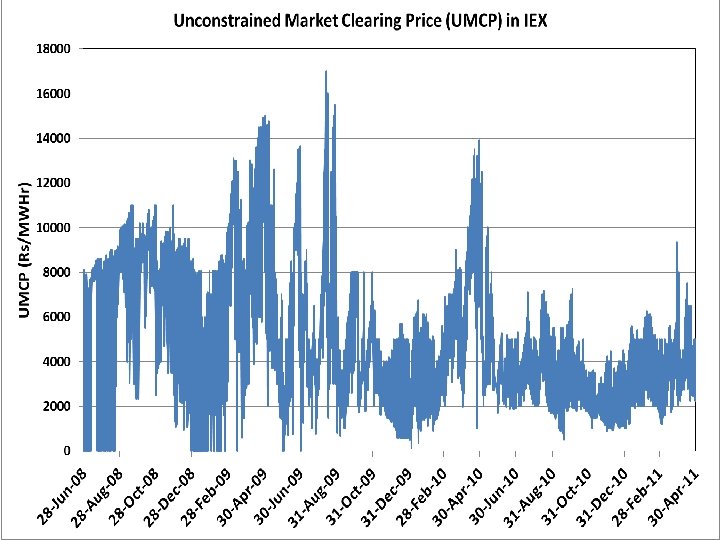

Monthly Energy Traded through Power Exchanges Data Up to April 2011

Monthly Energy Traded through Power Exchanges Data Up to April 2011

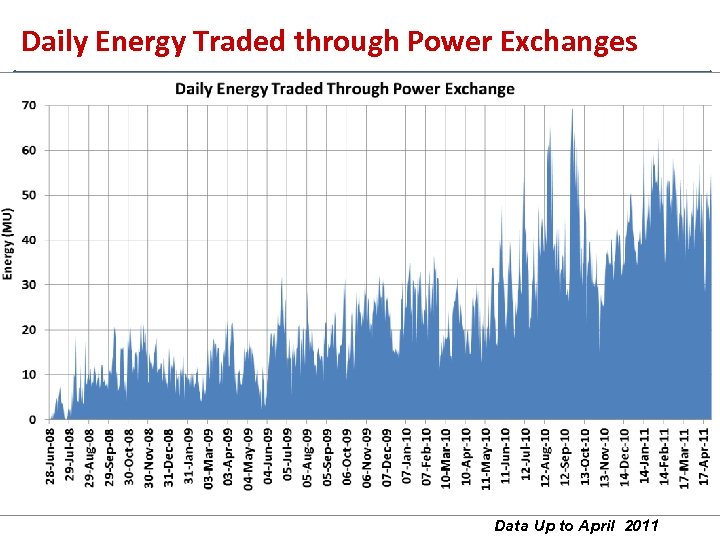

Daily Energy Traded through Power Exchanges Data Up to April 2011

Daily Energy Traded through Power Exchanges Data Up to April 2011

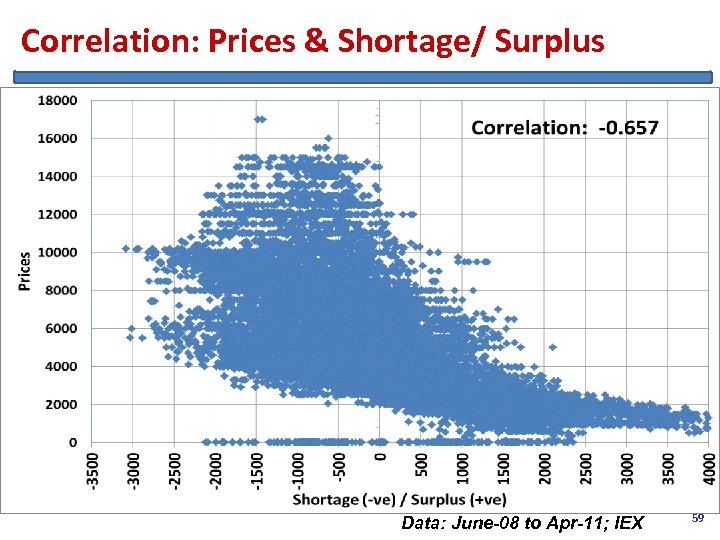

Correlation: Prices & Shortage/ Surplus Data: June-08 to Apr-11; IEX 59

Correlation: Prices & Shortage/ Surplus Data: June-08 to Apr-11; IEX 59

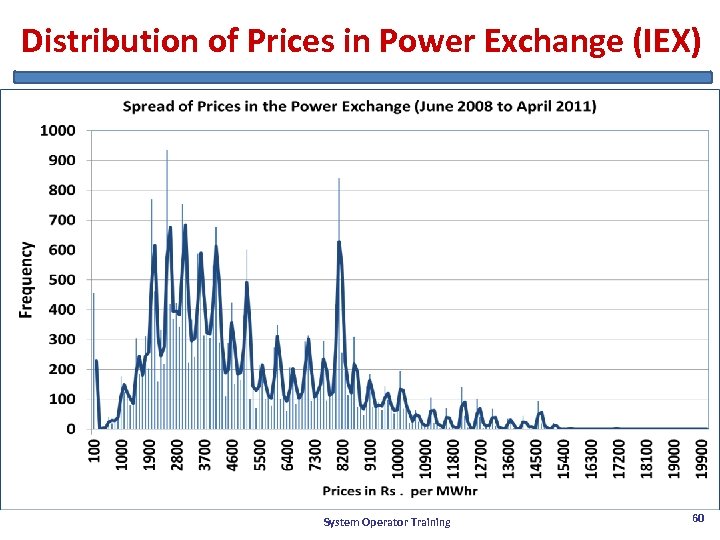

Distribution of Prices in Power Exchange (IEX) System Operator Training 60

Distribution of Prices in Power Exchange (IEX) System Operator Training 60

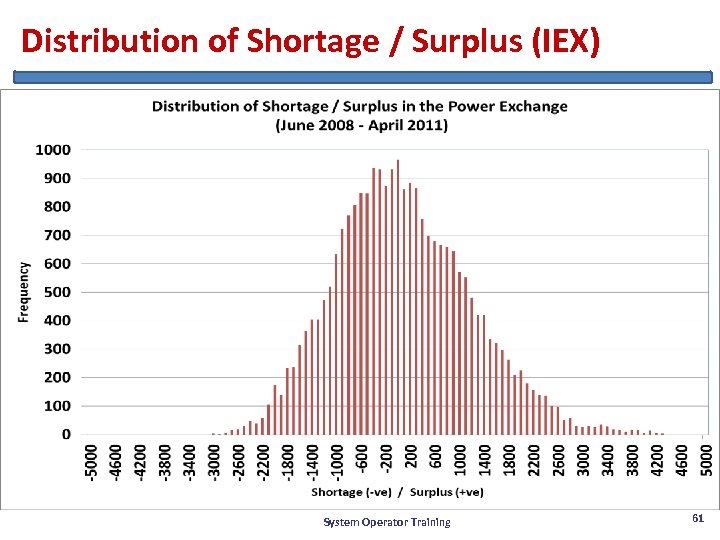

Distribution of Shortage / Surplus (IEX) System Operator Training 61

Distribution of Shortage / Surplus (IEX) System Operator Training 61

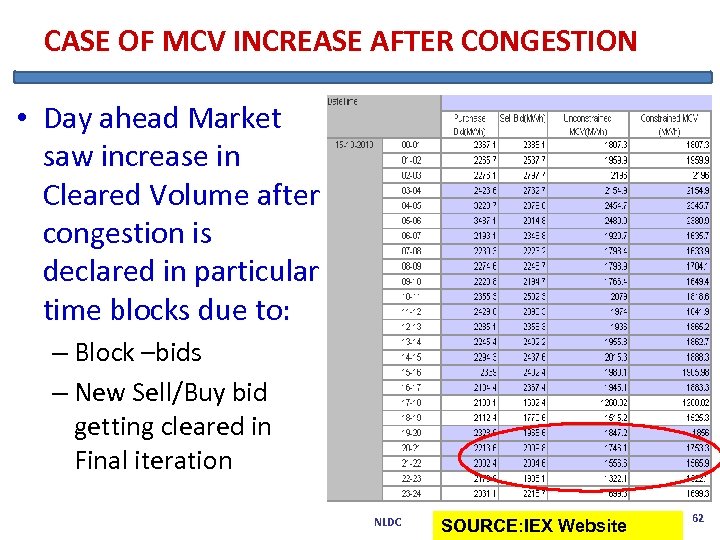

CASE OF MCV INCREASE AFTER CONGESTION • Day ahead Market saw increase in Cleared Volume after congestion is declared in particular time blocks due to: – Block –bids – New Sell/Buy bid getting cleared in Final iteration NLDC SOURCE: IEX Website 62

CASE OF MCV INCREASE AFTER CONGESTION • Day ahead Market saw increase in Cleared Volume after congestion is declared in particular time blocks due to: – Block –bids – New Sell/Buy bid getting cleared in Final iteration NLDC SOURCE: IEX Website 62

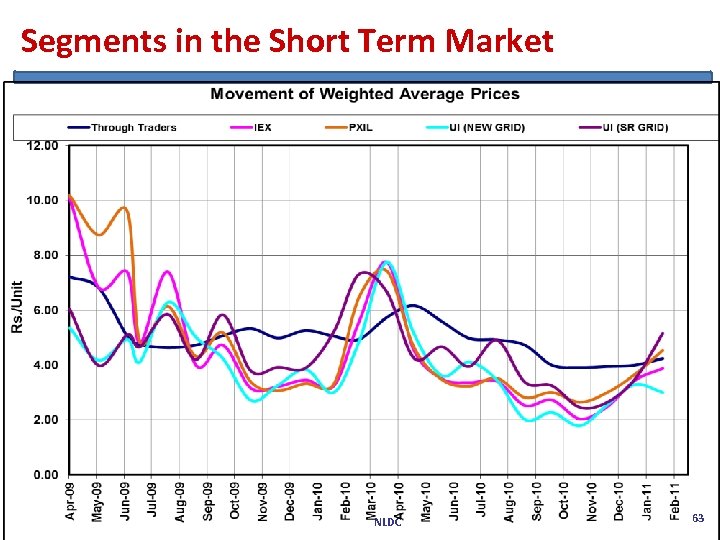

Segments in the Short Term Market NLDC 63

Segments in the Short Term Market NLDC 63

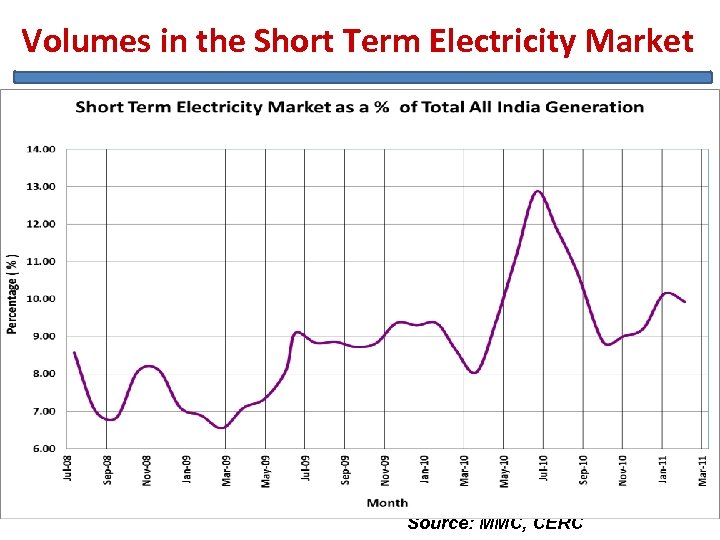

Volumes in the Short Term Electricity Market Source: MMC, CERC

Volumes in the Short Term Electricity Market Source: MMC, CERC

Renewable Energy Certificates (REC) NLDC

Renewable Energy Certificates (REC) NLDC

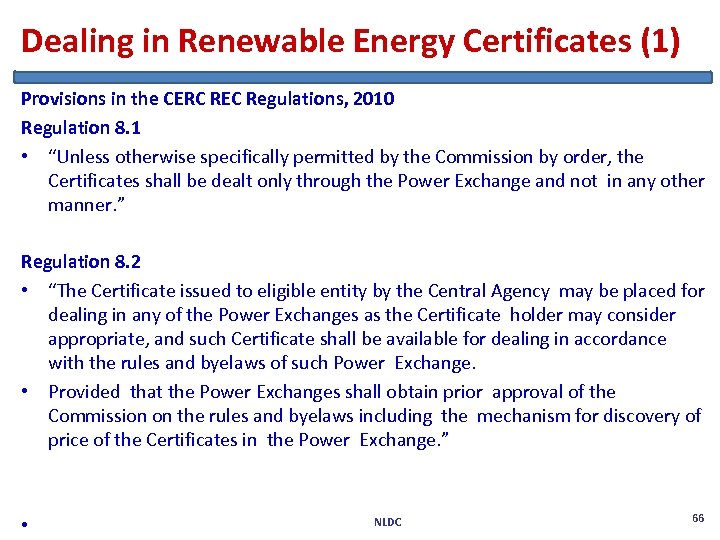

Dealing in Renewable Energy Certificates (1) Provisions in the CERC REC Regulations, 2010 Regulation 8. 1 • “Unless otherwise specifically permitted by the Commission by order, the Certificates shall be dealt only through the Power Exchange and not in any other manner. ” Regulation 8. 2 • “The Certificate issued to eligible entity by the Central Agency may be placed for dealing in any of the Power Exchanges as the Certificate holder may consider appropriate, and such Certificate shall be available for dealing in accordance with the rules and byelaws of such Power Exchange. • Provided that the Power Exchanges shall obtain prior approval of the Commission on the rules and byelaws including the mechanism for discovery of price of the Certificates in the Power Exchange. ” • NLDC 66

Dealing in Renewable Energy Certificates (1) Provisions in the CERC REC Regulations, 2010 Regulation 8. 1 • “Unless otherwise specifically permitted by the Commission by order, the Certificates shall be dealt only through the Power Exchange and not in any other manner. ” Regulation 8. 2 • “The Certificate issued to eligible entity by the Central Agency may be placed for dealing in any of the Power Exchanges as the Certificate holder may consider appropriate, and such Certificate shall be available for dealing in accordance with the rules and byelaws of such Power Exchange. • Provided that the Power Exchanges shall obtain prior approval of the Commission on the rules and byelaws including the mechanism for discovery of price of the Certificates in the Power Exchange. ” • NLDC 66

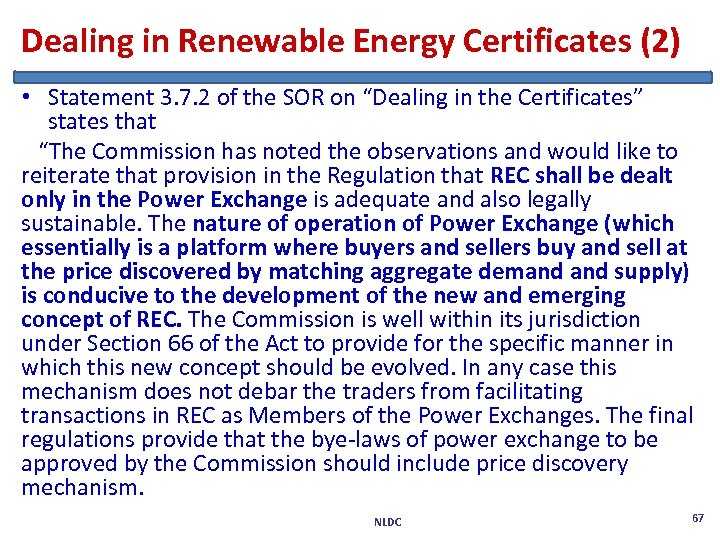

Dealing in Renewable Energy Certificates (2) • Statement 3. 7. 2 of the SOR on “Dealing in the Certificates” states that “The Commission has noted the observations and would like to reiterate that provision in the Regulation that REC shall be dealt only in the Power Exchange is adequate and also legally sustainable. The nature of operation of Power Exchange (which essentially is a platform where buyers and sellers buy and sell at the price discovered by matching aggregate demand supply) is conducive to the development of the new and emerging concept of REC. The Commission is well within its jurisdiction under Section 66 of the Act to provide for the specific manner in which this new concept should be evolved. In any case this mechanism does not debar the traders from facilitating transactions in REC as Members of the Power Exchanges. The final regulations provide that the bye-laws of power exchange to be approved by the Commission should include price discovery mechanism. NLDC 67

Dealing in Renewable Energy Certificates (2) • Statement 3. 7. 2 of the SOR on “Dealing in the Certificates” states that “The Commission has noted the observations and would like to reiterate that provision in the Regulation that REC shall be dealt only in the Power Exchange is adequate and also legally sustainable. The nature of operation of Power Exchange (which essentially is a platform where buyers and sellers buy and sell at the price discovered by matching aggregate demand supply) is conducive to the development of the new and emerging concept of REC. The Commission is well within its jurisdiction under Section 66 of the Act to provide for the specific manner in which this new concept should be evolved. In any case this mechanism does not debar the traders from facilitating transactions in REC as Members of the Power Exchanges. The final regulations provide that the bye-laws of power exchange to be approved by the Commission should include price discovery mechanism. NLDC 67

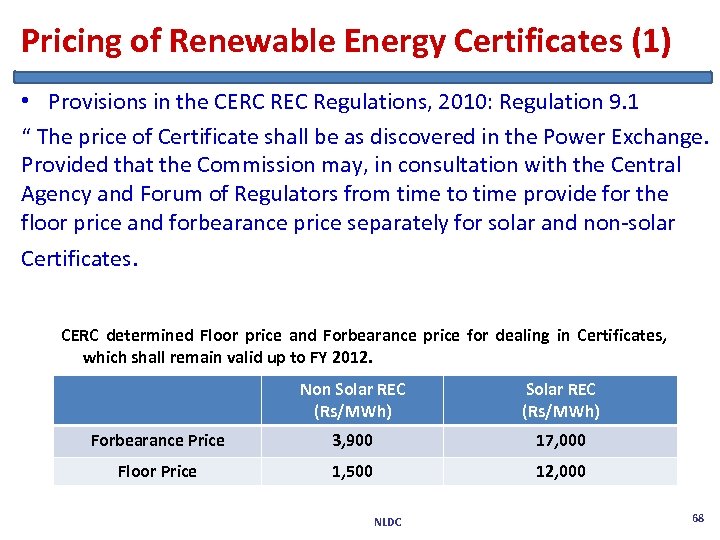

Pricing of Renewable Energy Certificates (1) • Provisions in the CERC REC Regulations, 2010: Regulation 9. 1 “ The price of Certificate shall be as discovered in the Power Exchange. Provided that the Commission may, in consultation with the Central Agency and Forum of Regulators from time to time provide for the floor price and forbearance price separately for solar and non-solar Certificates. CERC determined Floor price and Forbearance price for dealing in Certificates, which shall remain valid up to FY 2012. Non Solar REC (Rs/MWh) Forbearance Price 3, 900 17, 000 Floor Price 1, 50068 12, 000 NLDC 68

Pricing of Renewable Energy Certificates (1) • Provisions in the CERC REC Regulations, 2010: Regulation 9. 1 “ The price of Certificate shall be as discovered in the Power Exchange. Provided that the Commission may, in consultation with the Central Agency and Forum of Regulators from time to time provide for the floor price and forbearance price separately for solar and non-solar Certificates. CERC determined Floor price and Forbearance price for dealing in Certificates, which shall remain valid up to FY 2012. Non Solar REC (Rs/MWh) Forbearance Price 3, 900 17, 000 Floor Price 1, 50068 12, 000 NLDC 68

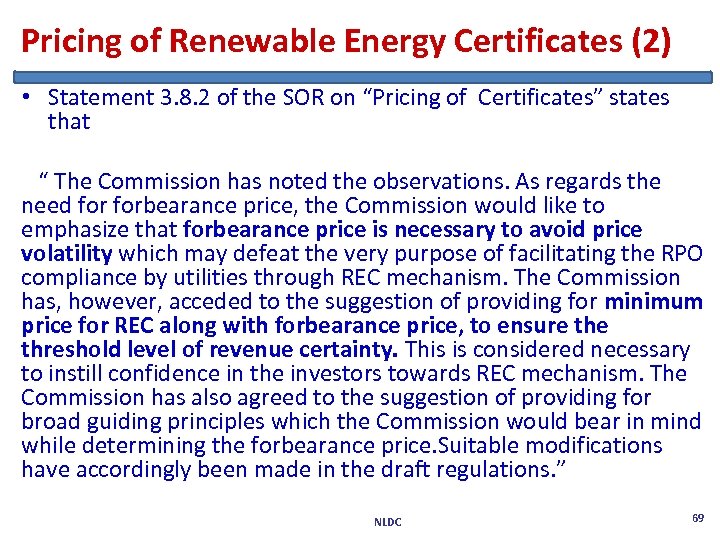

Pricing of Renewable Energy Certificates (2) • Statement 3. 8. 2 of the SOR on “Pricing of Certificates” states that “ The Commission has noted the observations. As regards the need forbearance price, the Commission would like to emphasize that forbearance price is necessary to avoid price volatility which may defeat the very purpose of facilitating the RPO compliance by utilities through REC mechanism. The Commission has, however, acceded to the suggestion of providing for minimum price for REC along with forbearance price, to ensure threshold level of revenue certainty. This is considered necessary to instill confidence in the investors towards REC mechanism. The Commission has also agreed to the suggestion of providing for broad guiding principles which the Commission would bear in mind while determining the forbearance price. Suitable modifications have accordingly been made in the draft regulations. ” NLDC 69

Pricing of Renewable Energy Certificates (2) • Statement 3. 8. 2 of the SOR on “Pricing of Certificates” states that “ The Commission has noted the observations. As regards the need forbearance price, the Commission would like to emphasize that forbearance price is necessary to avoid price volatility which may defeat the very purpose of facilitating the RPO compliance by utilities through REC mechanism. The Commission has, however, acceded to the suggestion of providing for minimum price for REC along with forbearance price, to ensure threshold level of revenue certainty. This is considered necessary to instill confidence in the investors towards REC mechanism. The Commission has also agreed to the suggestion of providing for broad guiding principles which the Commission would bear in mind while determining the forbearance price. Suitable modifications have accordingly been made in the draft regulations. ” NLDC 69

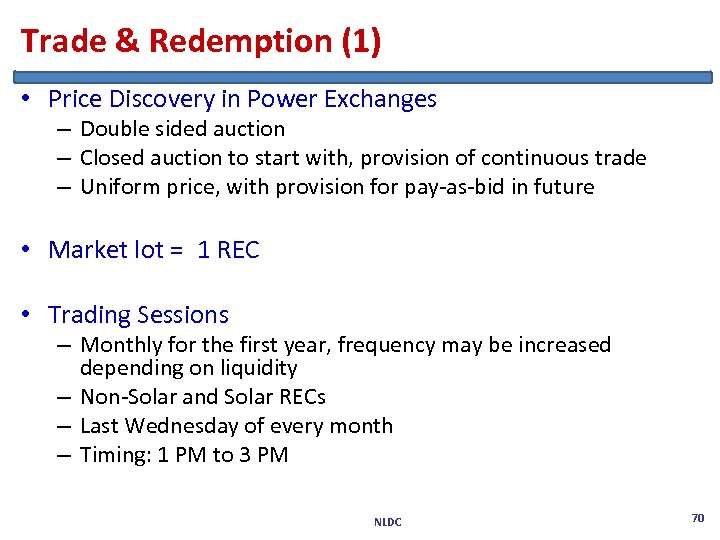

Trade & Redemption (1) • Price Discovery in Power Exchanges – Double sided auction – Closed auction to start with, provision of continuous trade – Uniform price, with provision for pay-as-bid in future • Market lot = 1 REC • Trading Sessions – Monthly for the first year, frequency may be increased depending on liquidity – Non-Solar and Solar RECs – Last Wednesday of every month – Timing: 1 PM to 3 PM NLDC 70

Trade & Redemption (1) • Price Discovery in Power Exchanges – Double sided auction – Closed auction to start with, provision of continuous trade – Uniform price, with provision for pay-as-bid in future • Market lot = 1 REC • Trading Sessions – Monthly for the first year, frequency may be increased depending on liquidity – Non-Solar and Solar RECs – Last Wednesday of every month – Timing: 1 PM to 3 PM NLDC 70

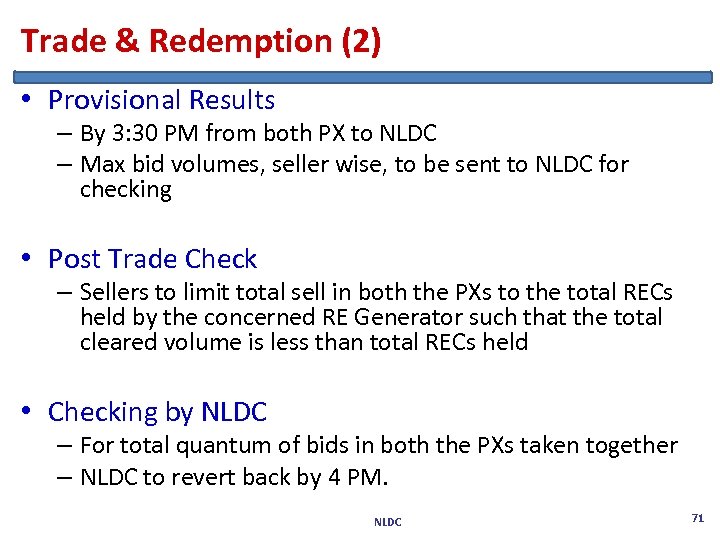

Trade & Redemption (2) • Provisional Results – By 3: 30 PM from both PX to NLDC – Max bid volumes, seller wise, to be sent to NLDC for checking • Post Trade Check – Sellers to limit total sell in both the PXs to the total RECs held by the concerned RE Generator such that the total cleared volume is less than total RECs held • Checking by NLDC – For total quantum of bids in both the PXs taken together – NLDC to revert back by 4 PM. NLDC 71

Trade & Redemption (2) • Provisional Results – By 3: 30 PM from both PX to NLDC – Max bid volumes, seller wise, to be sent to NLDC for checking • Post Trade Check – Sellers to limit total sell in both the PXs to the total RECs held by the concerned RE Generator such that the total cleared volume is less than total RECs held • Checking by NLDC – For total quantum of bids in both the PXs taken together – NLDC to revert back by 4 PM. NLDC 71

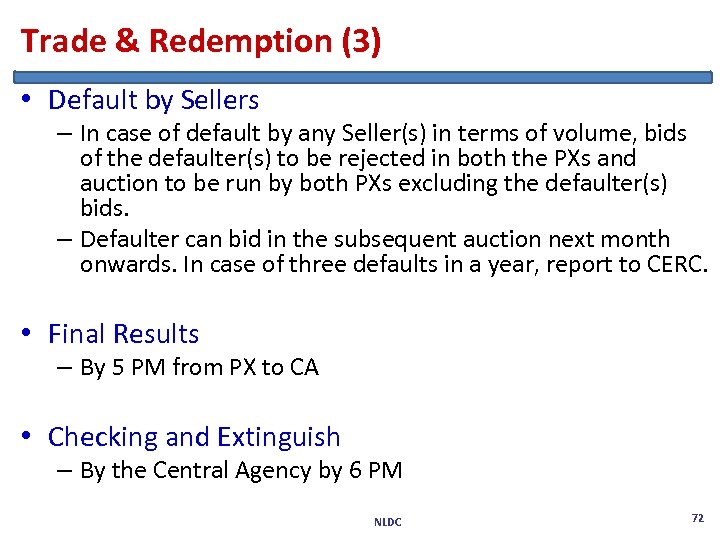

Trade & Redemption (3) • Default by Sellers – In case of default by any Seller(s) in terms of volume, bids of the defaulter(s) to be rejected in both the PXs and auction to be run by both PXs excluding the defaulter(s) bids. – Defaulter can bid in the subsequent auction next month onwards. In case of three defaults in a year, report to CERC. • Final Results – By 5 PM from PX to CA • Checking and Extinguish – By the Central Agency by 6 PM NLDC 72

Trade & Redemption (3) • Default by Sellers – In case of default by any Seller(s) in terms of volume, bids of the defaulter(s) to be rejected in both the PXs and auction to be run by both PXs excluding the defaulter(s) bids. – Defaulter can bid in the subsequent auction next month onwards. In case of three defaults in a year, report to CERC. • Final Results – By 5 PM from PX to CA • Checking and Extinguish – By the Central Agency by 6 PM NLDC 72

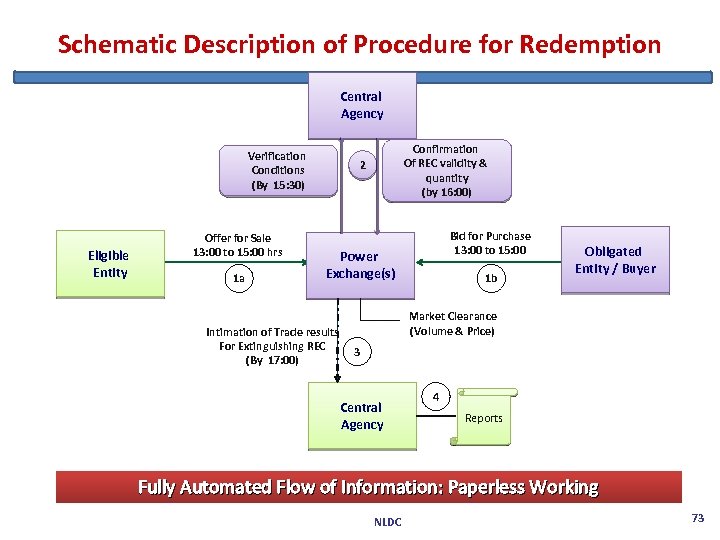

Schematic Description of Procedure for Redemption Central Agency Verification Conditions (By 15: 30) Eligible Entity Offer for Sale 13: 00 to 15: 00 hrs 1 a Confirmation Of REC validity & quantity (by 16: 00) 2 Bid for Purchase 13: 00 to 15: 00 Power Exchange(s) Intimation of Trade results For Extinguishing REC (By 17: 00) 1 b Obligated Entity / Buyer Market Clearance (Volume & Price) 3 Central Agency 4 Reports Fully Automated Flow of Information: Paperless Working NLDC 73

Schematic Description of Procedure for Redemption Central Agency Verification Conditions (By 15: 30) Eligible Entity Offer for Sale 13: 00 to 15: 00 hrs 1 a Confirmation Of REC validity & quantity (by 16: 00) 2 Bid for Purchase 13: 00 to 15: 00 Power Exchange(s) Intimation of Trade results For Extinguishing REC (By 17: 00) 1 b Obligated Entity / Buyer Market Clearance (Volume & Price) 3 Central Agency 4 Reports Fully Automated Flow of Information: Paperless Working NLDC 73

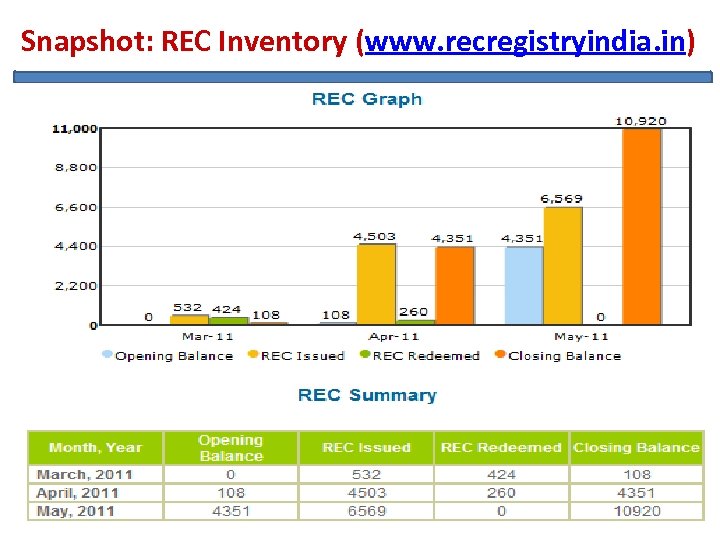

Snapshot: REC Inventory (www. recregistryindia. in) NLDC 74

Snapshot: REC Inventory (www. recregistryindia. in) NLDC 74

Information Dissemination • Central Agency Website: www. recregistryindia. in – List of Registered REC Holders – Total quantum valid RECs as on date, trend for the past • Trade Results – MCP and MCV on Power Exchange Websites Øwww. iexindia. com Øwww. powerexindia. com • List of REC Buyers, obligated entities: – PX to give monthly report to CERC/CA • List of seller defaulters: – PX Website / CA Website NLDC 75

Information Dissemination • Central Agency Website: www. recregistryindia. in – List of Registered REC Holders – Total quantum valid RECs as on date, trend for the past • Trade Results – MCP and MCV on Power Exchange Websites Øwww. iexindia. com Øwww. powerexindia. com • List of REC Buyers, obligated entities: – PX to give monthly report to CERC/CA • List of seller defaulters: – PX Website / CA Website NLDC 75

Moving to the Next Level: Some Issues under Discussion NLDC

Moving to the Next Level: Some Issues under Discussion NLDC

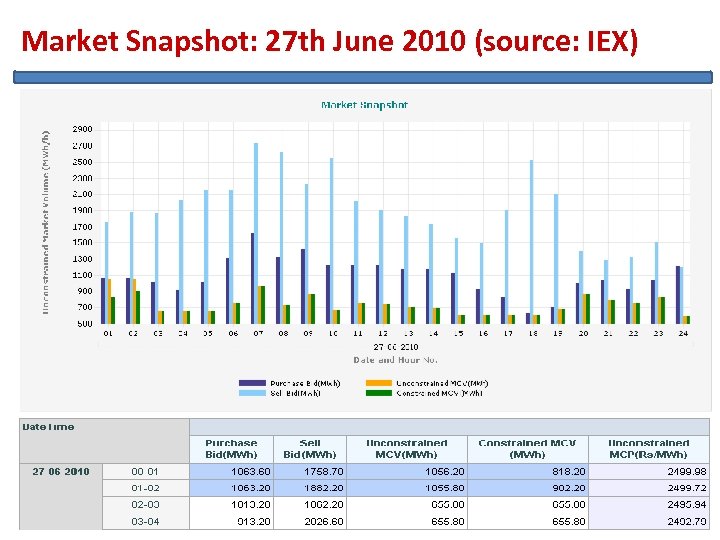

Market Snapshot: 27 th June 2010 (source: IEX)

Market Snapshot: 27 th June 2010 (source: IEX)

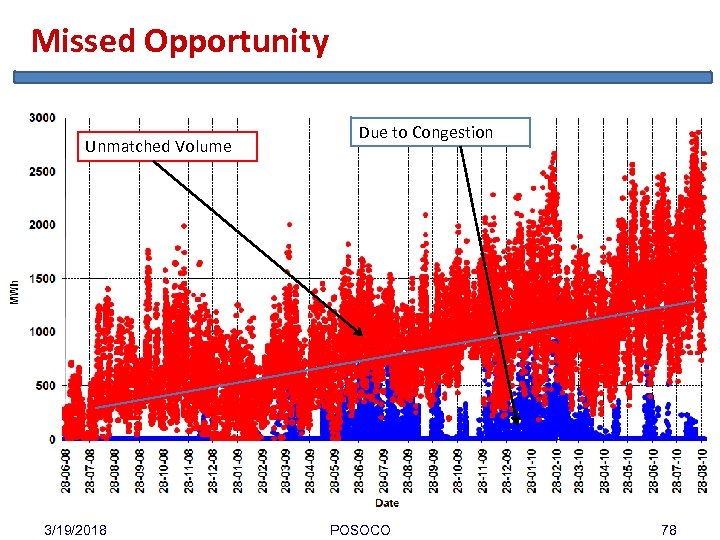

Missed Opportunity Unmatched Volume 3/19/2018 Due to Congestion POSOCO 78

Missed Opportunity Unmatched Volume 3/19/2018 Due to Congestion POSOCO 78

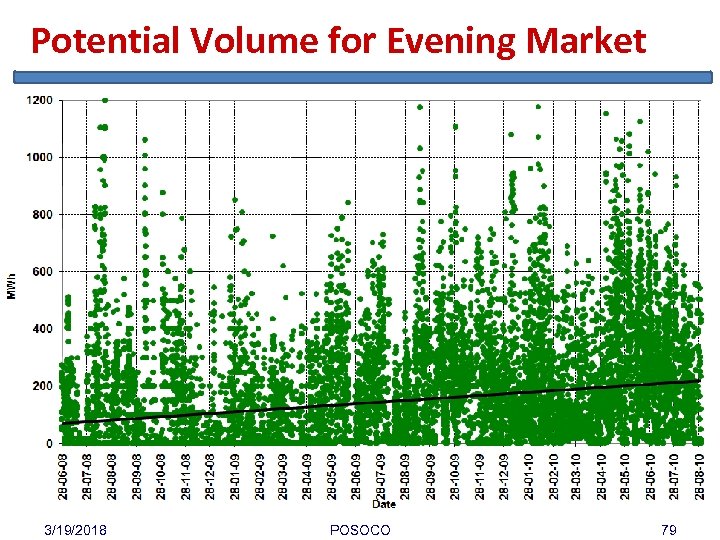

Potential Volume for Evening Market 3/19/2018 POSOCO 79

Potential Volume for Evening Market 3/19/2018 POSOCO 79

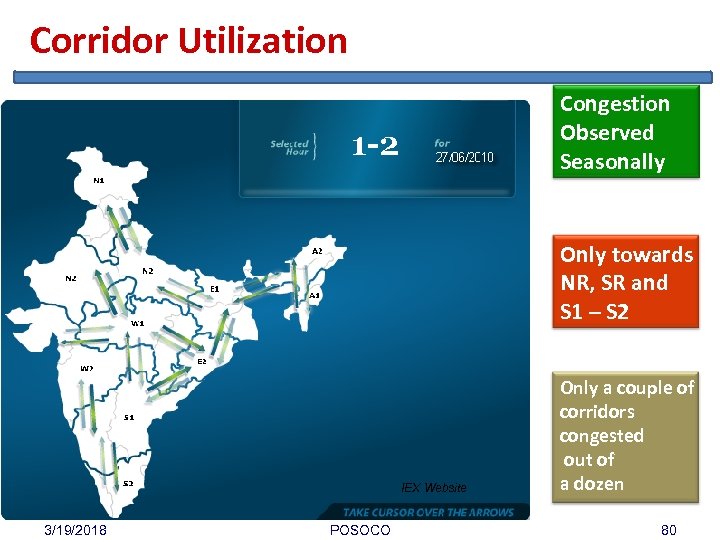

Corridor Utilization Congestion Observed Seasonally Only towards NR, SR and S 1 – S 2 IEX Website 3/19/2018 POSOCO Only a couple of corridors congested out of a dozen 80

Corridor Utilization Congestion Observed Seasonally Only towards NR, SR and S 1 – S 2 IEX Website 3/19/2018 POSOCO Only a couple of corridors congested out of a dozen 80

Prevailing Scenario • Shortages – Round the clock and in all regions • In many hours – Sale bids >> Purchase bids • Volume lost due to price mismatch is substantial • Congestion – – During some hours Only couple of corridors facing mild congestion Margins available on other corridors Market split by very low price difference !! • Need for an Evening Market in the Power Exchanges 3/19/2018 POSOCO 81

Prevailing Scenario • Shortages – Round the clock and in all regions • In many hours – Sale bids >> Purchase bids • Volume lost due to price mismatch is substantial • Congestion – – During some hours Only couple of corridors facing mild congestion Margins available on other corridors Market split by very low price difference !! • Need for an Evening Market in the Power Exchanges 3/19/2018 POSOCO 81

Advantages of the Proposed Evening Market • Consumers – More choice and satisfaction • Sellers – Another opportunity • Further optimization of the portfolio • Take a more informed position in the market • Better utilization of uncongested and under-utilized corridors • More economy and efficiency • Social welfare maximization • Change in strategy and an overall improvement • Likely that more volume is cleared • Movement to the next level 3/19/2018 POSOCO 82

Advantages of the Proposed Evening Market • Consumers – More choice and satisfaction • Sellers – Another opportunity • Further optimization of the portfolio • Take a more informed position in the market • Better utilization of uncongested and under-utilized corridors • More economy and efficiency • Social welfare maximization • Change in strategy and an overall improvement • Likely that more volume is cleared • Movement to the next level 3/19/2018 POSOCO 82

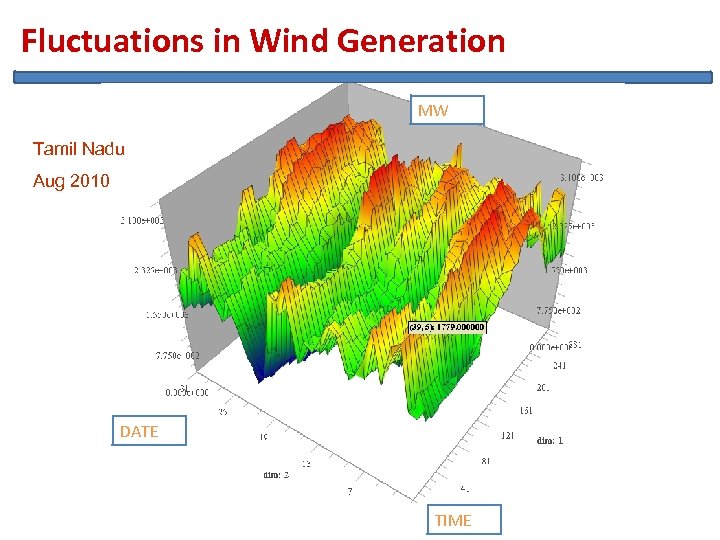

Fluctuations in Wind Generation MW Tamil Nadu Aug 2010 DATE TIME

Fluctuations in Wind Generation MW Tamil Nadu Aug 2010 DATE TIME

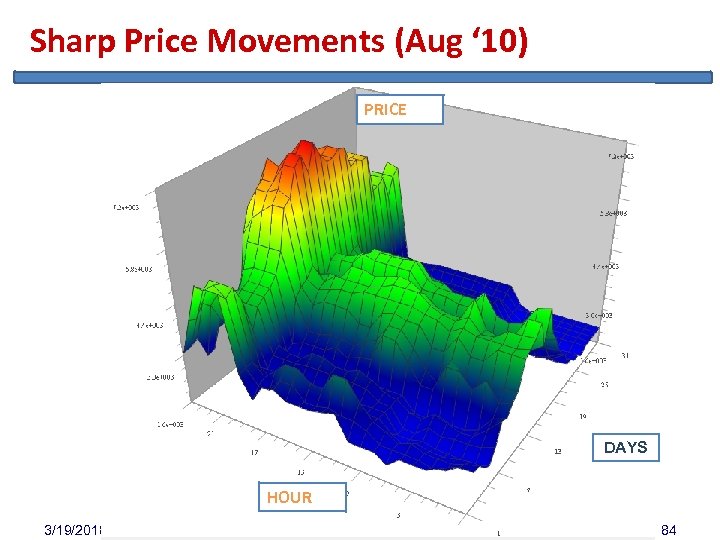

Sharp Price Movements (Aug ‘ 10) PRICE DAYS HOUR 3/19/2018 POSOCO 84

Sharp Price Movements (Aug ‘ 10) PRICE DAYS HOUR 3/19/2018 POSOCO 84

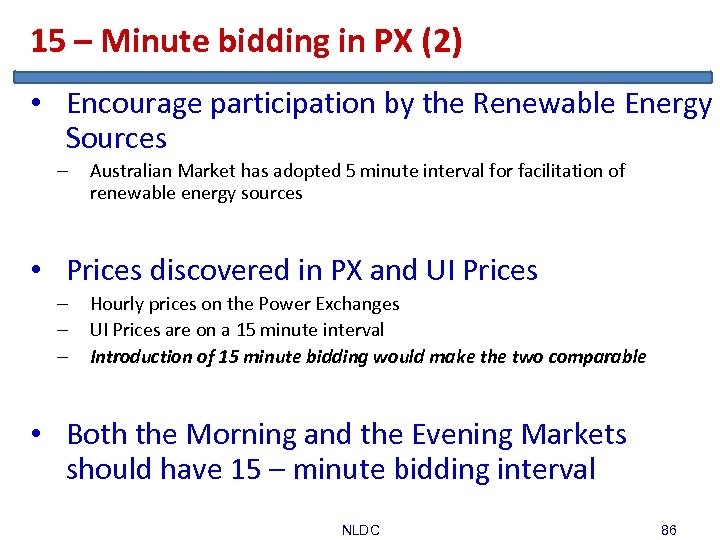

15 – Minute bidding in PX (1) • USP of the Indian Market Structure – 15 Minute Scheduling – 15 Minute Metering – 15 Minute Accounting • Ramping Rate – Hour boundary: high ramp rate (1000 MW) Ø Large Changes in HVDC set points (NEW – SR) in operation – 15 minute bidding Ø facilitate gradual ramping up and down Ø provide operational ease to the participants • Better portfolio management • Better management of imbalances – Deviations from the schedule NLDC 85

15 – Minute bidding in PX (1) • USP of the Indian Market Structure – 15 Minute Scheduling – 15 Minute Metering – 15 Minute Accounting • Ramping Rate – Hour boundary: high ramp rate (1000 MW) Ø Large Changes in HVDC set points (NEW – SR) in operation – 15 minute bidding Ø facilitate gradual ramping up and down Ø provide operational ease to the participants • Better portfolio management • Better management of imbalances – Deviations from the schedule NLDC 85

15 – Minute bidding in PX (2) • Encourage participation by the Renewable Energy Sources – Australian Market has adopted 5 minute interval for facilitation of renewable energy sources • Prices discovered in PX and UI Prices – – – Hourly prices on the Power Exchanges UI Prices are on a 15 minute interval Introduction of 15 minute bidding would make the two comparable • Both the Morning and the Evening Markets should have 15 – minute bidding interval NLDC 86

15 – Minute bidding in PX (2) • Encourage participation by the Renewable Energy Sources – Australian Market has adopted 5 minute interval for facilitation of renewable energy sources • Prices discovered in PX and UI Prices – – – Hourly prices on the Power Exchanges UI Prices are on a 15 minute interval Introduction of 15 minute bidding would make the two comparable • Both the Morning and the Evening Markets should have 15 – minute bidding interval NLDC 86

International Experience NLDC

International Experience NLDC

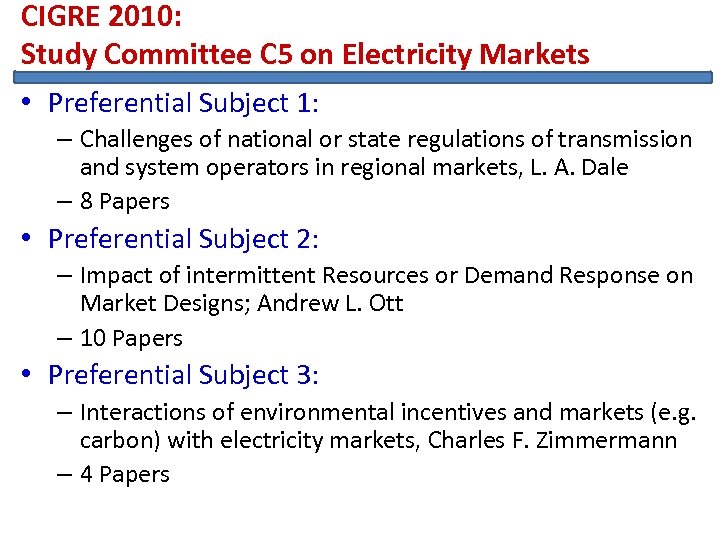

CIGRE 2010: Study Committee C 5 on Electricity Markets • Preferential Subject 1: – Challenges of national or state regulations of transmission and system operators in regional markets, L. A. Dale – 8 Papers • Preferential Subject 2: – Impact of intermittent Resources or Demand Response on Market Designs; Andrew L. Ott – 10 Papers • Preferential Subject 3: – Interactions of environmental incentives and markets (e. g. carbon) with electricity markets, Charles F. Zimmermann – 4 Papers

CIGRE 2010: Study Committee C 5 on Electricity Markets • Preferential Subject 1: – Challenges of national or state regulations of transmission and system operators in regional markets, L. A. Dale – 8 Papers • Preferential Subject 2: – Impact of intermittent Resources or Demand Response on Market Designs; Andrew L. Ott – 10 Papers • Preferential Subject 3: – Interactions of environmental incentives and markets (e. g. carbon) with electricity markets, Charles F. Zimmermann – 4 Papers

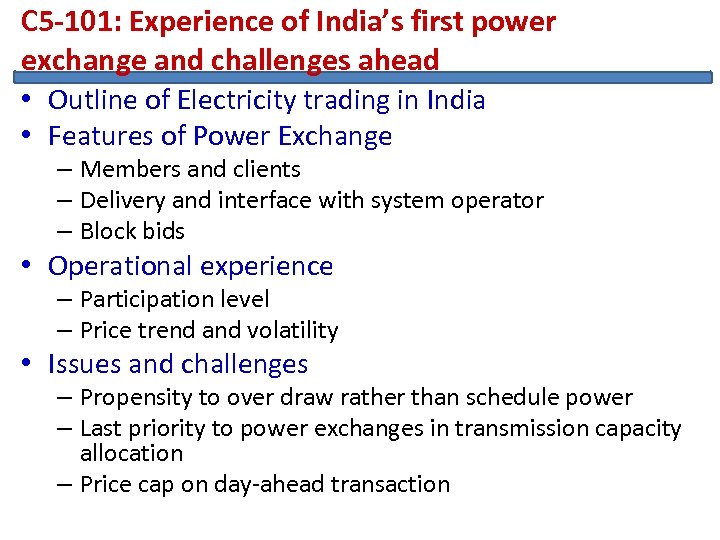

C 5 -101: Experience of India’s first power exchange and challenges ahead • Outline of Electricity trading in India • Features of Power Exchange – Members and clients – Delivery and interface with system operator – Block bids • Operational experience – Participation level – Price trend and volatility • Issues and challenges – Propensity to over draw rather than schedule power – Last priority to power exchanges in transmission capacity allocation – Price cap on day-ahead transaction

C 5 -101: Experience of India’s first power exchange and challenges ahead • Outline of Electricity trading in India • Features of Power Exchange – Members and clients – Delivery and interface with system operator – Block bids • Operational experience – Participation level – Price trend and volatility • Issues and challenges – Propensity to over draw rather than schedule power – Last priority to power exchanges in transmission capacity allocation – Price cap on day-ahead transaction

C 5 -102: Harmonization of cross border transmission capacity allocation within the Central West Europe region • Presentation of CWE Region (Belgium, France, Netherlands, Luxembourg and Germany) – harmonisation of the rules for allocating the transmission capacity within CWE • The establishment of the Joint Auction Office (JAO) • The scope of activities of the Joint auction office – allocating the daily capacity on the German borders – Operating the explicit daily auctions on Belgium borders – Coupling fallback – Collecting and sharing the congestion revenue for the TSOs • Harmonisation and improvement of the auction rules • Brief of CWE Market Coupling project

C 5 -102: Harmonization of cross border transmission capacity allocation within the Central West Europe region • Presentation of CWE Region (Belgium, France, Netherlands, Luxembourg and Germany) – harmonisation of the rules for allocating the transmission capacity within CWE • The establishment of the Joint Auction Office (JAO) • The scope of activities of the Joint auction office – allocating the daily capacity on the German borders – Operating the explicit daily auctions on Belgium borders – Coupling fallback – Collecting and sharing the congestion revenue for the TSOs • Harmonisation and improvement of the auction rules • Brief of CWE Market Coupling project

Attempt to Harmonize in Europe (C 5 -102) • • • • definitions, products to be auctioned, participation requirements, financial guarantees, firmness of both allocated capacities and nominated programs, definition of force majeure, bids format, time schedule of the auctions, compensation/reimbursement in case of reduction, payment modalities, secondary market principles (”use it or sell it”), responsibility of parties, the suspension/termination of contract conditions.

Attempt to Harmonize in Europe (C 5 -102) • • • • definitions, products to be auctioned, participation requirements, financial guarantees, firmness of both allocated capacities and nominated programs, definition of force majeure, bids format, time schedule of the auctions, compensation/reimbursement in case of reduction, payment modalities, secondary market principles (”use it or sell it”), responsibility of parties, the suspension/termination of contract conditions.

C 5 -106 : Czech and Slovak spot electricity market coupling on the basis of implicit capacity allocation • Daily transactions between the two market areas take place exclusively in the form of implicit auctions. • The implicit auction office is a virtual area in the information system of one of the market operators; it ensures that sell bids and buy bids in the two market areas are matched. • The virtual office is a part of both information systems, and the two market operators will alternate in performing the function of the virtual office. • Implicit auctions are based on the principle of price coupling; • In the event of capacity constraints at the interconnection point the market splits, and two prices are created. • In the event of transactions constrained due to congestion and market split, the price difference generates an implicit auction price that generates revenues allocated between the two transmission system operators.

C 5 -106 : Czech and Slovak spot electricity market coupling on the basis of implicit capacity allocation • Daily transactions between the two market areas take place exclusively in the form of implicit auctions. • The implicit auction office is a virtual area in the information system of one of the market operators; it ensures that sell bids and buy bids in the two market areas are matched. • The virtual office is a part of both information systems, and the two market operators will alternate in performing the function of the virtual office. • Implicit auctions are based on the principle of price coupling; • In the event of capacity constraints at the interconnection point the market splits, and two prices are created. • In the event of transactions constrained due to congestion and market split, the price difference generates an implicit auction price that generates revenues allocated between the two transmission system operators.

C 5 -107: Multiple power exchanges in India – a case study • Study of the experience gained from the operation of multiple power exchanges in a single physical delivery market in India • Salient features of PX implementation in India • Allocation of available transfer margins, • Congestion management • Interplay between the bilateral market, day-ahead market in Power Exchanges and the real time market. • Issues – – – – Multiplicity of price signals Regulatory overlap – forward price signals Regulatory uncertainty – price caps Transmission pricing & losses Balancing market guiding vector Available margins for the PXs Impact of block bids

C 5 -107: Multiple power exchanges in India – a case study • Study of the experience gained from the operation of multiple power exchanges in a single physical delivery market in India • Salient features of PX implementation in India • Allocation of available transfer margins, • Congestion management • Interplay between the bilateral market, day-ahead market in Power Exchanges and the real time market. • Issues – – – – Multiplicity of price signals Regulatory overlap – forward price signals Regulatory uncertainty – price caps Transmission pricing & losses Balancing market guiding vector Available margins for the PXs Impact of block bids

Thank You for your attention !! saxena. samir@gmail. com NLDC

Thank You for your attention !! saxena. samir@gmail. com NLDC