5ca02db591ac6366b4c57644efcce49a.ppt

- Количество слайдов: 22

Postal Automation: Initiatives, Transitions & Best Practices Part II

Postal Automation: Initiatives, Transitions & Best Practices Panel Members Jack Widener Director, Finishing and Distribution Newsweek Joe Schick Director, Postal Affairs Quad Graphics Rosa Fulton Executive Director, Flats Sequencing System United States Postal Service Marc Mc. Crery Manager, Operational Requirements & Integration United States Postal Service

Agenda q Flats Background § Flat Volume § Current Flat Operations q Delivery Vision q Flats Strategy § q Flats Sequencing System (FSS) Machine deployment and Schedule

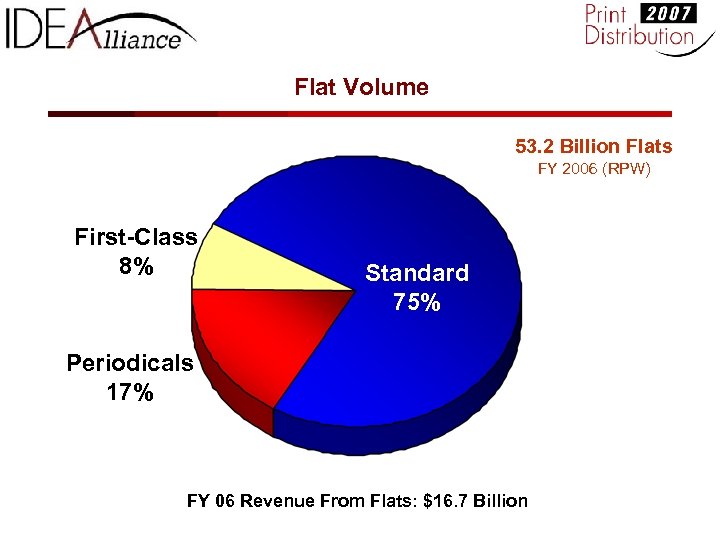

Flat Volume 53. 2 Billion Flats FY 2006 (RPW) First-Class 8% Standard 75% Periodicals 17% FY 06 Revenue From Flats: $16. 7 Billion

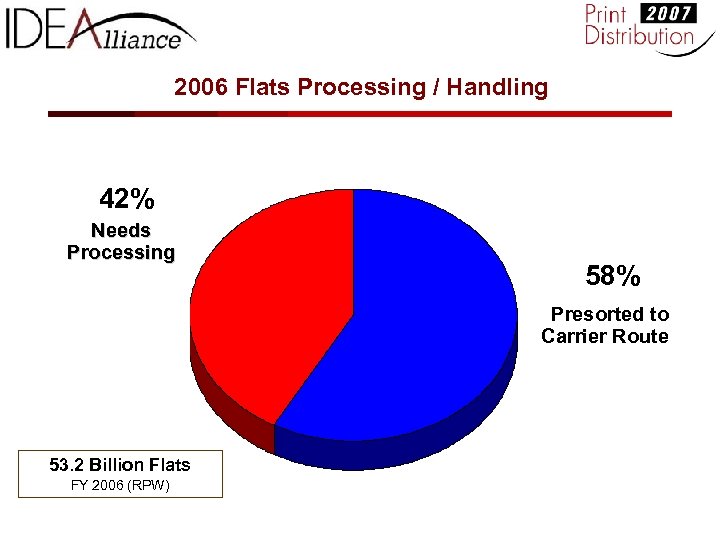

2006 Flats Processing / Handling 42% Needs Processing 58% Presorted to Carrier Route 53. 2 Billion Flats FY 2006 (RPW)

Today’s Flats Processing APPS • Flat Bundle Sorting AFSM 100 • Automated Tray Handling Systems (ATHS) • Automatic Induction (AI) UFSM 1000 • Auto Flats Feeder • Manual Keying 6

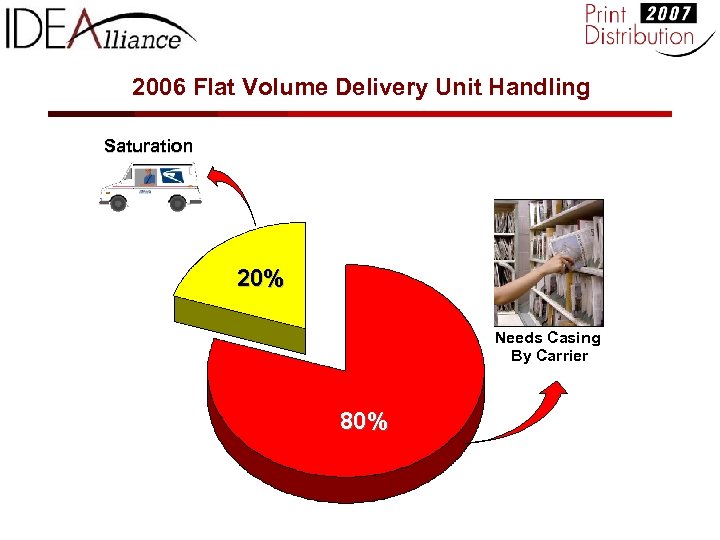

2006 Flat Volume Delivery Unit Handling Saturation 20% Needs Casing By Carrier 80%

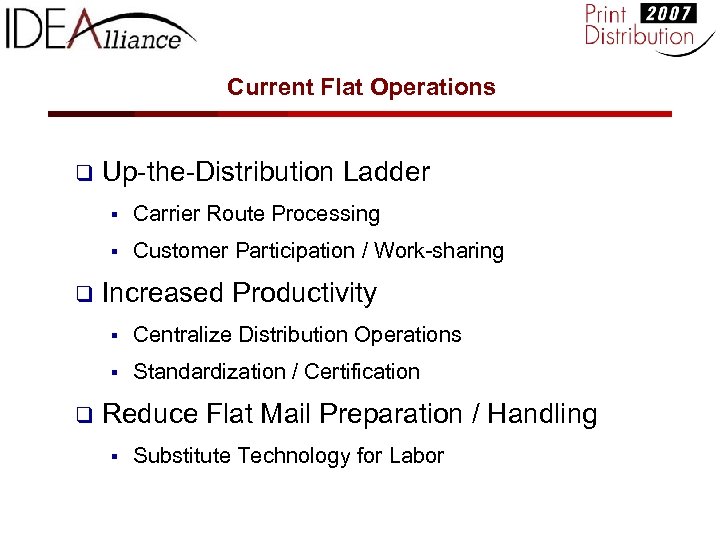

Current Flat Operations q Up-the-Distribution Ladder § § q Carrier Route Processing Customer Participation / Work-sharing Increased Productivity § § q Centralize Distribution Operations Standardization / Certification Reduce Flat Mail Preparation / Handling § Substitute Technology for Labor

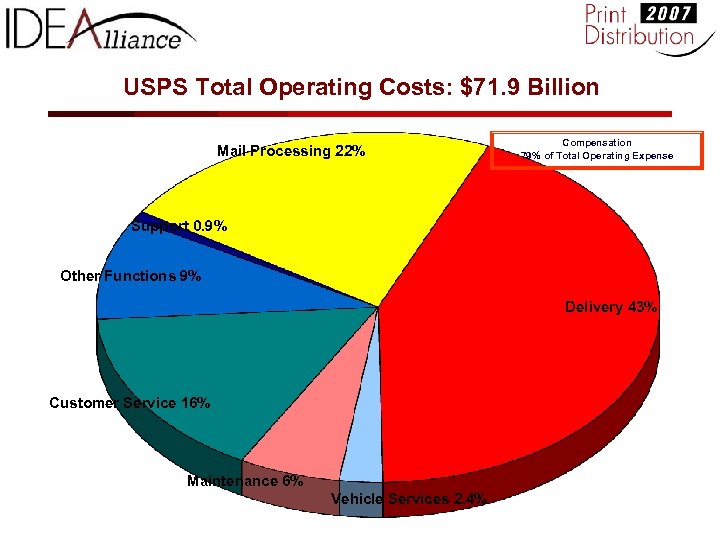

USPS Total Operating Costs: $71. 9 Billion Mail Processing 22% Compensation 79% of Total Operating Expense Support 0. 9% Other Functions 9% Delivery 43% Customer Service 16% Maintenance 6% Vehicle Services 2. 4%

Delivery Strategy q Letters and Flats Sorted Separately § DPS Letter Sorting Continues § Flats Sequencing in Delivery Point Order q Saturation Mail Continues q Reengineer Our Processes for Handling “Residue Volumes”

Delivery Vision q Minimize Carrier In-office Time § Substitute Technology for Manual Carrier Casing • q Benefit from Street Opportunities § § q Sequence Letters and Flats Carriers Start Street Delivery Earlier Consistent Delivery Times Manage Growth Optimize Routes Other Benefits § § § Delivery Day Visibility Capture Real Estate Opportunities Manage Vehicle Fleet

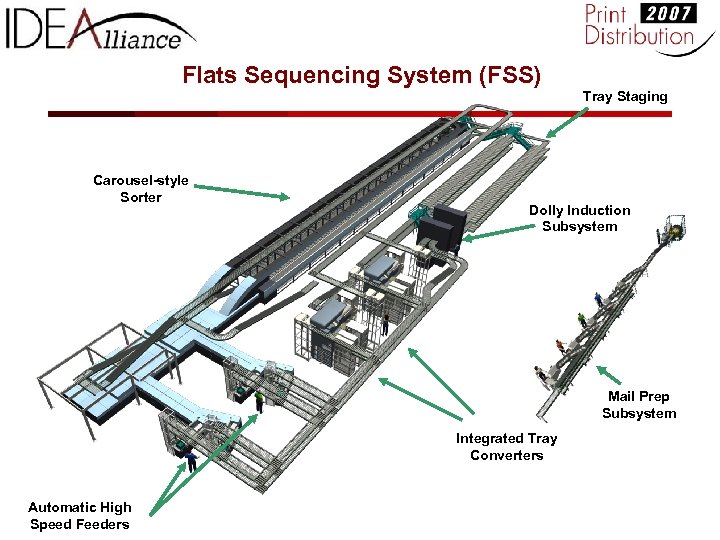

Flats Sequencing System (FSS) Tray Staging Carousel-style Sorter Dolly Induction Subsystem Mail Prep Subsystem Integrated Tray Converters Automatic High Speed Feeders

13

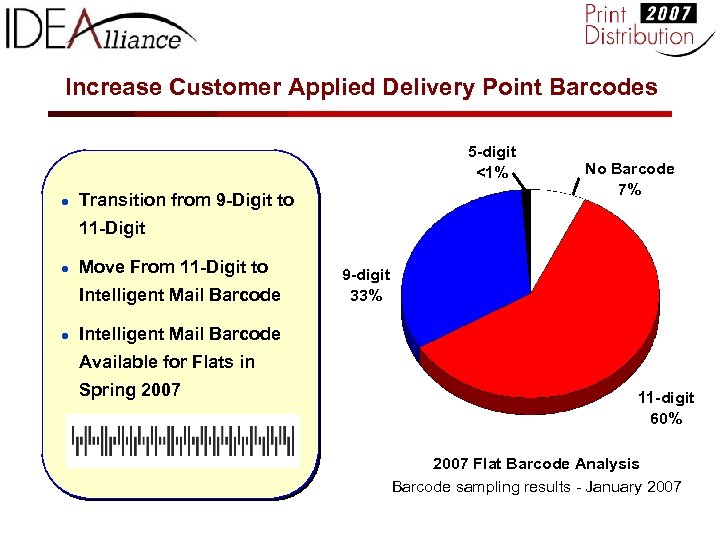

Increase Customer Applied Delivery Point Barcodes 5 -digit <1% ● Transition from 9 -Digit to No Barcode 7% 11 -Digit ● Move From 11 -Digit to Intelligent Mail Barcode ● 9 -digit 33% Intelligent Mail Barcode Available for Flats in Spring 2007 11 -digit 60% 2007 Flat Barcode Analysis Barcode sampling results - January 2007

Improve Address and Barcode Readability q Standard Destination Address Block q Address Construction Improvements § Font Size, Horizontal and Vertical Character Spacing, and Extraneous Information § Barcode Location q Reduce OCR Return Address Reading Conflicts q CASS Certification™ q DPV™ 15

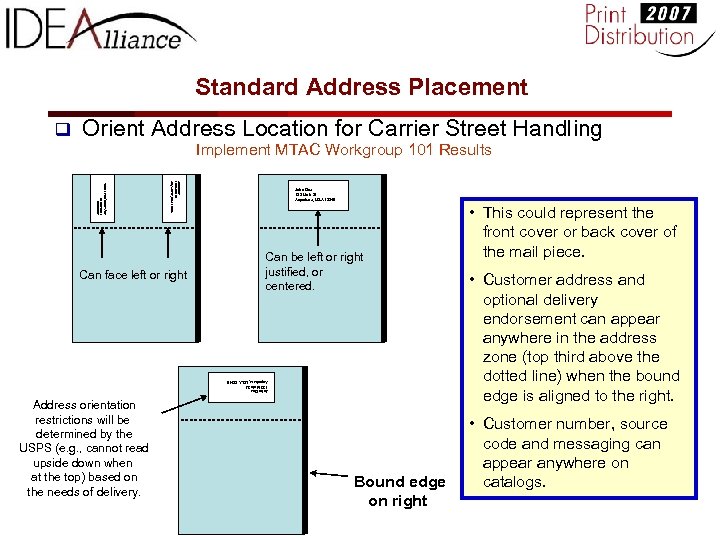

Standard Address Placement q Orient Address Location for Carrier Street Handling John Doe 123 Main St Anywhere, USA 12345 Implement MTAC Workgroup 101 Results Can face left or right John Doe 123 Main St Anywhere, USA 12345 Can be left or right justified, or centered. John Doe 123 Main St Anywhere, USA 12345 Address orientation restrictions will be determined by the USPS (e. g. , cannot read upside down when at the top) based on the needs of delivery. Bound edge on right • This could represent the front cover or back cover of the mail piece. • Customer address and optional delivery endorsement can appear anywhere in the address zone (top third above the dotted line) when the bound edge is aligned to the right. • Customer number, source code and messaging can appear anywhere on catalogs.

Maximizing Machine Efficiency q Match Mail Preparation Requirements to Processing Needs § q Packaging, package and container make-up Structure Rates to Support Sortation / Handling

Multi-phase Development / Deployment q Prototype – Indianapolis IN April 2006 q BOG Approval of 100 FSS Machines Dec 2006 q Pre-production Install – Dulles P & DC April 2007 q Pre-production – Live Operations Sept 2007 q Production First Article June 2008 q Phase 1 Deployment Begin Sept 2008 q Phase 1 Deployment End Sept 2010

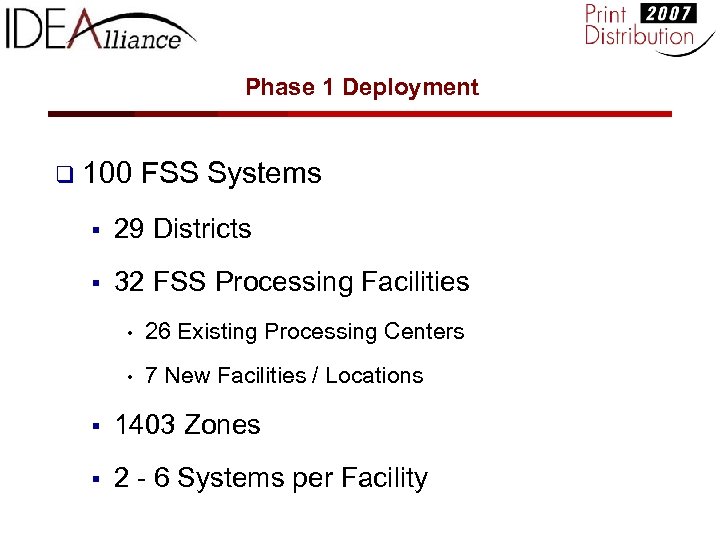

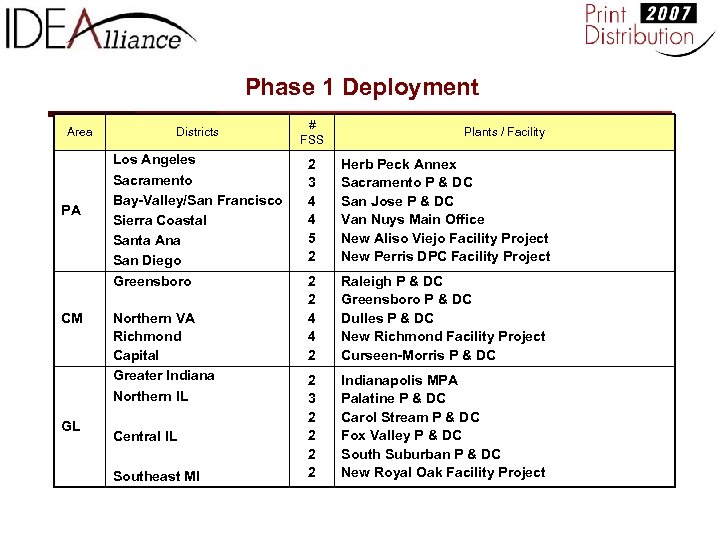

Phase 1 Deployment q 100 FSS Systems § 29 Districts § 32 FSS Processing Facilities • 26 Existing Processing Centers • 7 New Facilities / Locations § 1403 Zones § 2 - 6 Systems per Facility

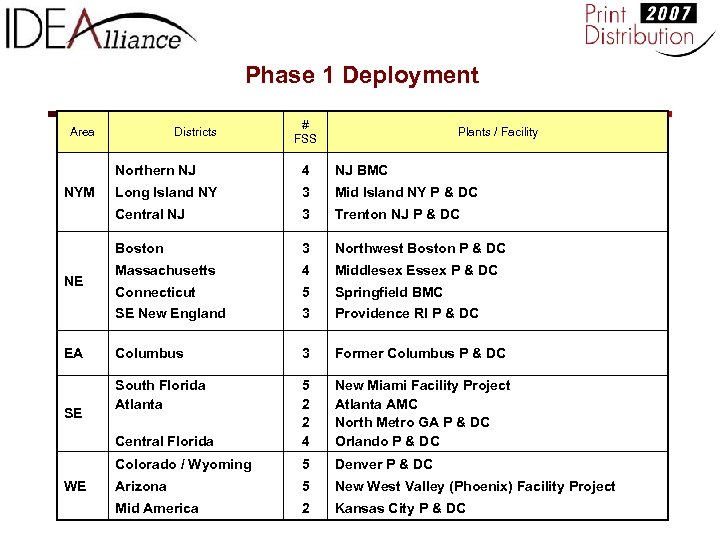

Phase 1 Deployment Area Districts # FSS Plants / Facility Northern NJ 3 Trenton NJ P & DC 3 Northwest Boston P & DC Massachusetts 4 Middlesex Essex P & DC Connecticut 5 Springfield BMC 3 Providence RI P & DC Columbus 3 Former Columbus P & DC South Florida Atlanta 5 2 2 4 New Miami Facility Project Atlanta AMC North Metro GA P & DC Orlando P & DC Colorado / Wyoming WE Mid Island NY P & DC Central Florida SE 3 SE New England EA Long Island NY Boston NE NJ BMC Central NJ NYM 4 5 Denver P & DC Arizona 5 New West Valley (Phoenix) Facility Project Mid America 2 Kansas City P & DC

Phase 1 Deployment Area PA CM GL Districts Los Angeles Sacramento Bay-Valley/San Francisco Sierra Coastal Santa Ana San Diego Greensboro Northern VA Richmond Capital Greater Indiana Northern IL Central IL Southeast MI # FSS Plants / Facility 2 3 4 4 5 2 Herb Peck Annex Sacramento P & DC San Jose P & DC Van Nuys Main Office New Aliso Viejo Facility Project New Perris DPC Facility Project 2 2 4 4 2 Raleigh P & DC Greensboro P & DC Dulles P & DC New Richmond Facility Project Curseen-Morris P & DC 2 3 2 2 Indianapolis MPA Palatine P & DC Carol Stream P & DC Fox Valley P & DC South Suburban P & DC New Royal Oak Facility Project

5ca02db591ac6366b4c57644efcce49a.ppt