8ad65128e0f42f96fa09695bf3b0e3ef.ppt

- Количество слайдов: 27

Portugal Telecom Operators Workshop Amsterdam, 8 th November 2002 18/03/2018 10: 15

Topics PT Group Overview Key accounts Strategy FCCN – Experience at the National Level Dante – Experience at the International Level 18/03/2018 10: 15

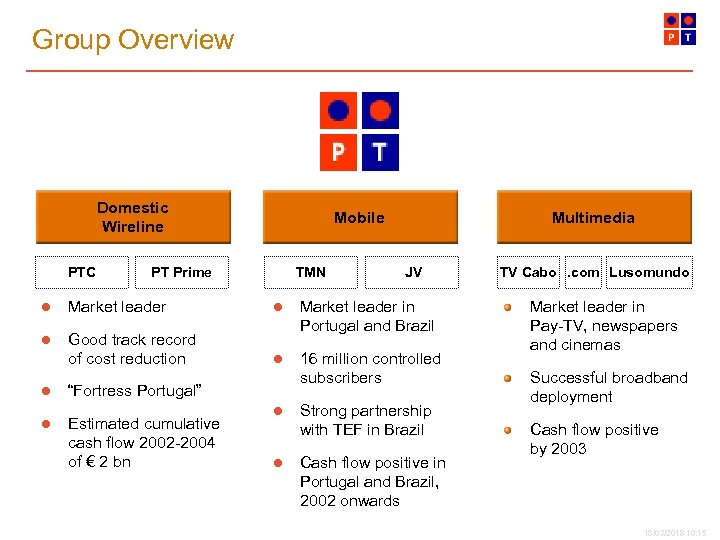

Group Overview Domestic Wireline PTC Mobile PT Prime TMN Multimedia JV l Market leader l l Good track record of cost reduction Market leader in Portugal and Brazil l 16 million controlled subscribers l l “Fortress Portugal” Estimated cumulative cash flow 2002 -2004 of € 2 bn l l Strong partnership with TEF in Brazil Cash flow positive in Portugal and Brazil, 2002 onwards TV Cabo. com Lusomundo Market leader in Pay-TV, newspapers and cinemas Successful broadband deployment Cash flow positive by 2003 18/03/2018 10: 15

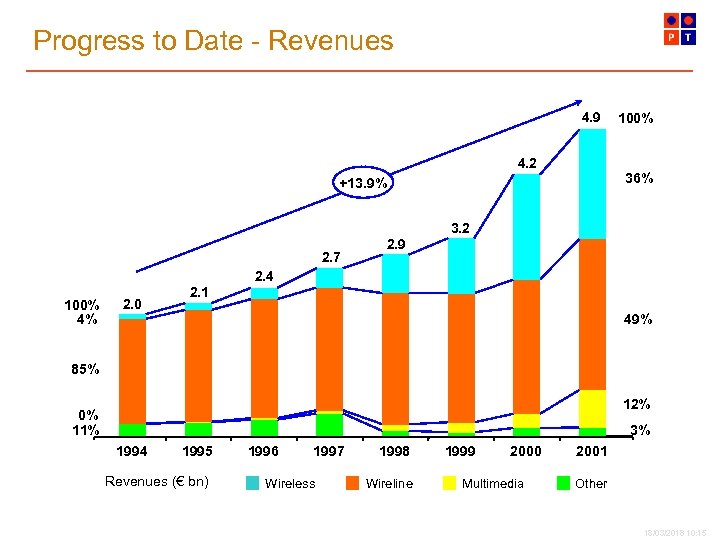

Progress to Date - Revenues 4. 9 4. 2 100% 36% +13. 9% 3. 2 2. 7 2. 9 2. 4 100% 4% 2. 0 2. 1 49% 85% 12% 0% 11% 3% 1994 1995 Revenues (€ bn) 1996 1997 Wireless 1998 Wireline 1999 2000 Multimedia 2001 Other 18/03/2018 10: 15

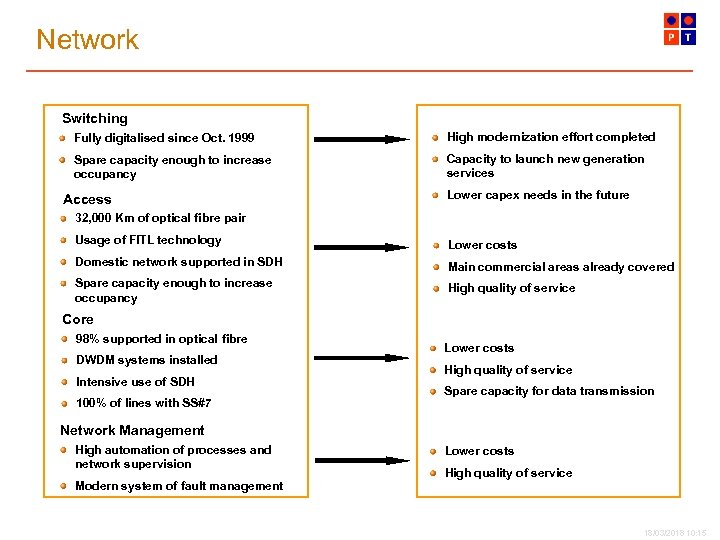

Network Switching Fully digitalised since Oct. 1999 High modernization effort completed Spare capacity enough to increase occupancy Capacity to launch new generation services Access Lower capex needs in the future 32, 000 Km of optical fibre pair Usage of FITL technology Lower costs Domestic network supported in SDH Main commercial areas already covered Spare capacity enough to increase occupancy High quality of service Core 98% supported in optical fibre DWDM systems installed Intensive use of SDH 100% of lines with SS#7 Lower costs High quality of service Spare capacity for data transmission Network Management High automation of processes and network supervision Modern system of fault management Lower costs High quality of service 18/03/2018 10: 15

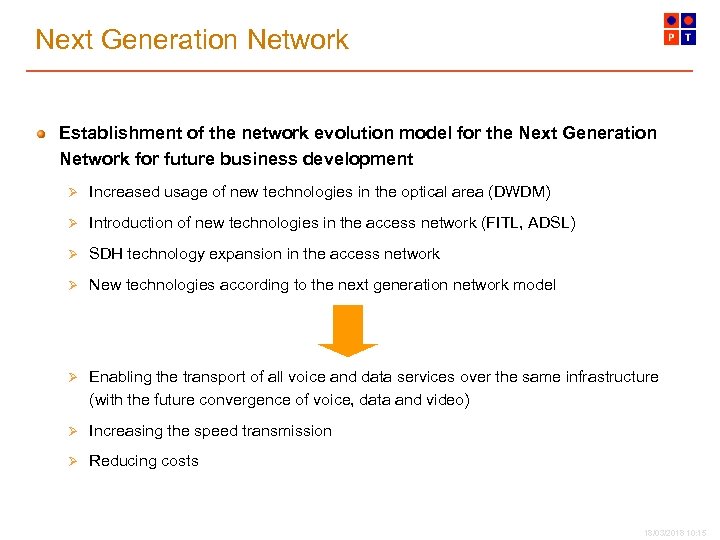

Next Generation Network Establishment of the network evolution model for the Next Generation Network for future business development Ø Increased usage of new technologies in the optical area (DWDM) Ø Introduction of new technologies in the access network (FITL, ADSL) Ø SDH technology expansion in the access network Ø New technologies according to the next generation network model Ø Enabling the transport of all voice and data services over the same infrastructure (with the future convergence of voice, data and video) Ø Increasing the speed transmission Ø Reducing costs 18/03/2018 10: 15

Prime 18/03/2018 10: 15

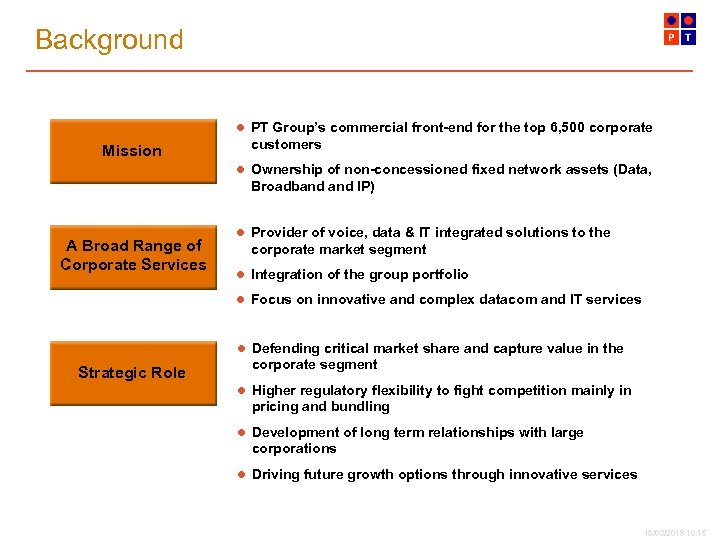

Background l PT Group’s commercial front-end for the top 6, 500 corporate Mission customers l Ownership of non-concessioned fixed network assets (Data, Broadband IP) A Broad Range of Corporate Services l Provider of voice, data & IT integrated solutions to the corporate market segment l Integration of the group portfolio l Focus on innovative and complex datacom and IT services l Defending critical market share and capture value in the Strategic Role corporate segment l Higher regulatory flexibility to fight competition mainly in pricing and bundling l Development of long term relationships with large corporations l Driving future growth options through innovative services 18/03/2018 10: 15

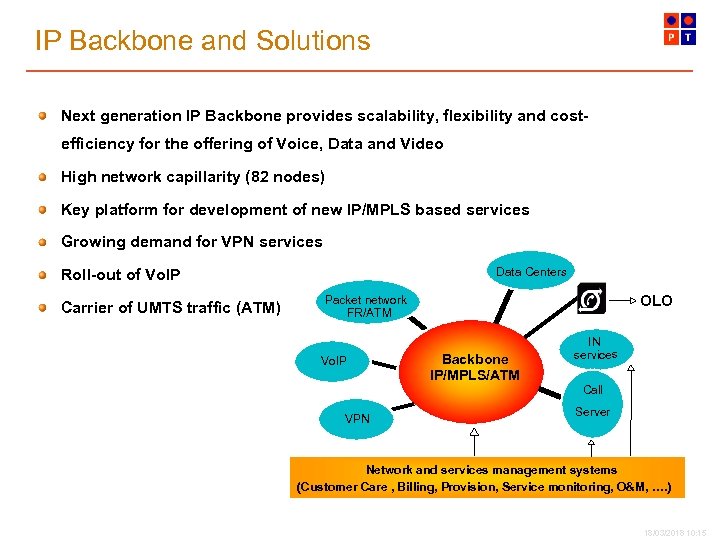

IP Backbone and Solutions Next generation IP Backbone provides scalability, flexibility and costefficiency for the offering of Voice, Data and Video High network capillarity (82 nodes) Key platform for development of new IP/MPLS based services Growing demand for VPN services Data Centers Roll-out of Vo. IP Carrier of UMTS traffic (ATM) OLO Packet network FR/ATM Vo. IP Backbone IP/MPLS/ATM IN services Call VPN Server Network and services management systems (Customer Care , Billing, Provision, Service monitoring, O&M, …. ) 18/03/2018 10: 15

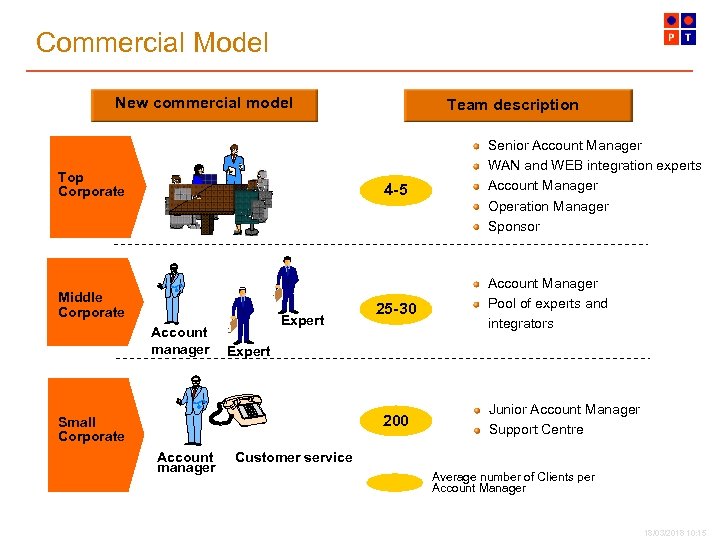

Commercial Model New commercial model Top Corporate Team description 4 -5 Middle Corporate Account manager Expert 25 -30 Account Manager Pool of experts and integrators Expert 200 Small Corporate Account manager Senior Account Manager WAN and WEB integration experts Account Manager Operation Manager Sponsor Junior Account Manager Support Centre Customer service Average number of Clients per Account Manager 18/03/2018 10: 15

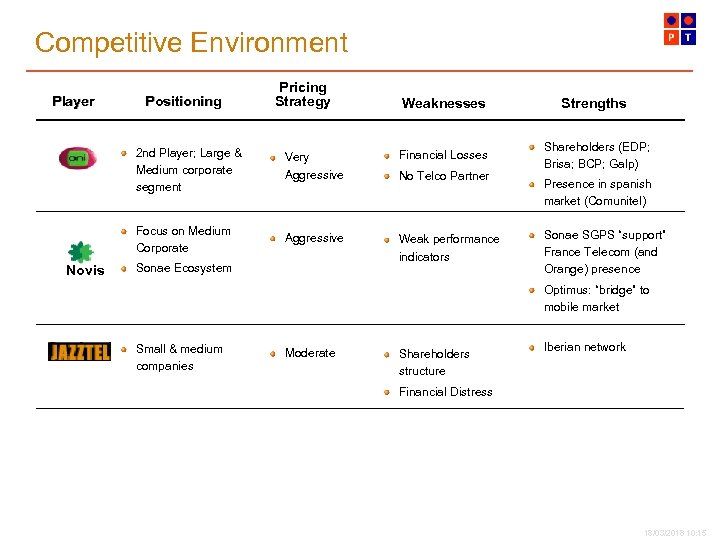

Competitive Environment Player Positioning Pricing Strategy Weaknesses 2 nd Player; Large & Medium corporate segment Financial Losses Focus on Medium Corporate Novis Very Aggressive Weak performance indicators Sonae Ecosystem No Telco Partner Strengths Shareholders (EDP; Brisa; BCP; Galp) Presence in spanish market (Comunitel) Sonae SGPS “support” France Telecom (and Orange) presence Optimus: “bridge” to mobile market Small & medium companies Moderate Shareholders structure Iberian network Financial Distress 18/03/2018 10: 15

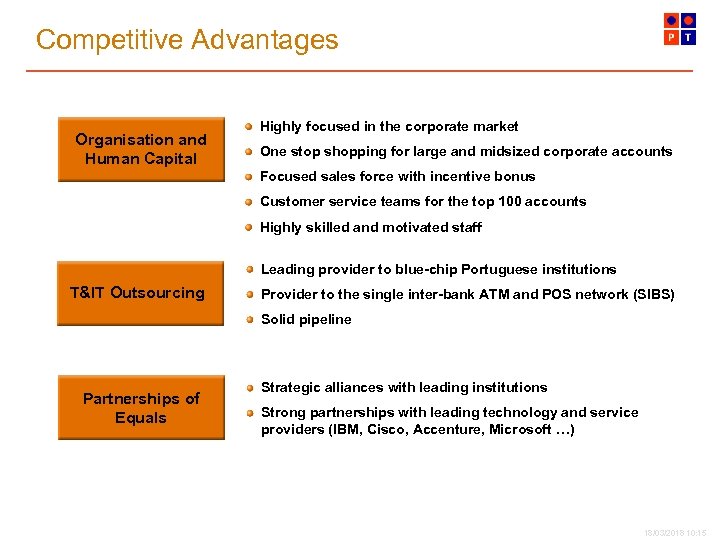

Competitive Advantages Organisation and Human Capital Highly focused in the corporate market One stop shopping for large and midsized corporate accounts Focused sales force with incentive bonus Customer service teams for the top 100 accounts Highly skilled and motivated staff Leading provider to blue-chip Portuguese institutions T&IT Outsourcing Provider to the single inter-bank ATM and POS network (SIBS) Solid pipeline Partnerships of Equals Strategic alliances with leading institutions Strong partnerships with leading technology and service providers (IBM, Cisco, Accenture, Microsoft …) 18/03/2018 10: 15

![FCCN [NREN] Relations with PT Network and Technology development Existing Network Future Developments 18/03/2018 FCCN [NREN] Relations with PT Network and Technology development Existing Network Future Developments 18/03/2018](https://present5.com/presentation/8ad65128e0f42f96fa09695bf3b0e3ef/image-13.jpg)

FCCN [NREN] Relations with PT Network and Technology development Existing Network Future Developments 18/03/2018 10: 15

FCCN - Relations with PT Key Account relationship : Dedicated account management team with technical experts and leaded by senior account manager; Customer Service – 365 x 24; Partnership Projects : 1999 -2001 - Project RIAXO – ATM Trial - Goals Develop cooperation between Research Community and ATM service provider (PT) Equipment Testing (ATM switches and ATM boards) Know-How acquisition in Advanced High Bandwidth services with Qo. S 18/03/2018 10: 15

FCCN - Relations with PT 2002 – MOU Portugal-Brasil Partnership between FCCN, RNP, PT and Embratel Interconnection Lisbon-Rio 2 Mbit/s Customer with very demanding requirements and focused on Information Society: - Technical level : * Short Delivery lead time and complex configuration: (eg: schools network - 8. 500 ISDN lines with CUG in 2 years); * Quality of Service – High Availability ; - Commercial Level: * Focus on the highest bandwidth for the lowest price; 18/03/2018 10: 15

FCCN - Network and Technology development Up to 1996 - digital circuits up to 2 Mbps; 1996 – High bandwidth services – up to 34 Mbps; 1999 - ATM services- up to 155 Mbps; 2002 – Lambda service - 1, 25 Gbps; 18/03/2018 10: 15

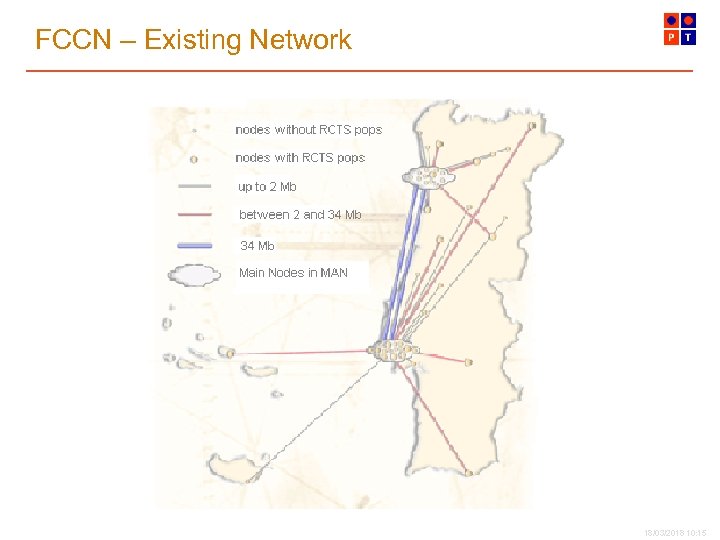

FCCN – Existing Network RCTS – Science, Technology and Society Network : - Campus : * 44 sites - ATM; * 50 sites – digital circuits / VPN-IP; - Schools, Libraries: 11. 500 ISDN lines ; 15 POP´s - 110 ISDN Primary Access ; 18/03/2018 10: 15

FCCN – Existing Network 18/03/2018 10: 15

FCCN – Future Developments Schools’ Network – migration from ISDN to ADSL access with high-end requirements; Campus’ Network – Higher Bandwidth deployment; 18/03/2018 10: 15

Dante – International Connectivity Network and Technology development Existing Network Future Developments 18/03/2018 10: 15

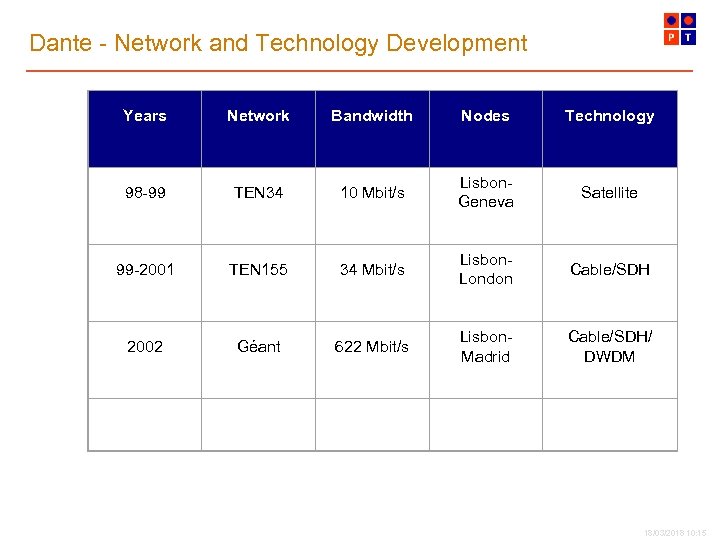

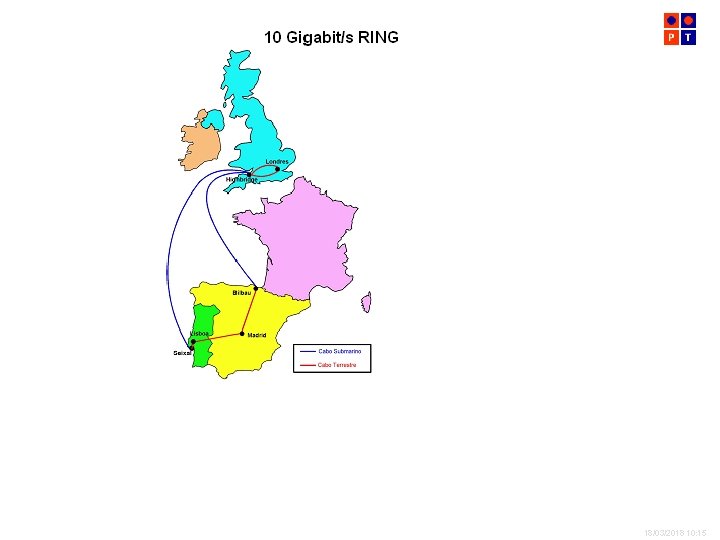

Dante - Network and Technology Development Years Network Bandwidth Nodes Technology 98 -99 TEN 34 10 Mbit/s Lisbon. Geneva Satellite 99 -2001 TEN 155 34 Mbit/s Lisbon. London Cable/SDH 2002 Géant 622 Mbit/s Lisbon. Madrid Cable/SDH/ DWDM 18/03/2018 10: 15

18/03/2018 10: 15

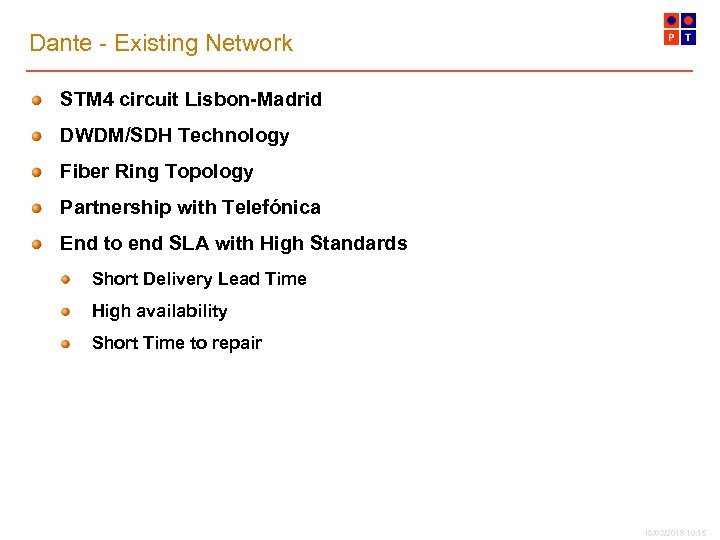

Dante - Existing Network STM 4 circuit Lisbon-Madrid DWDM/SDH Technology Fiber Ring Topology Partnership with Telefónica End to end SLA with High Standards Short Delivery Lead Time High availability Short Time to repair 18/03/2018 10: 15

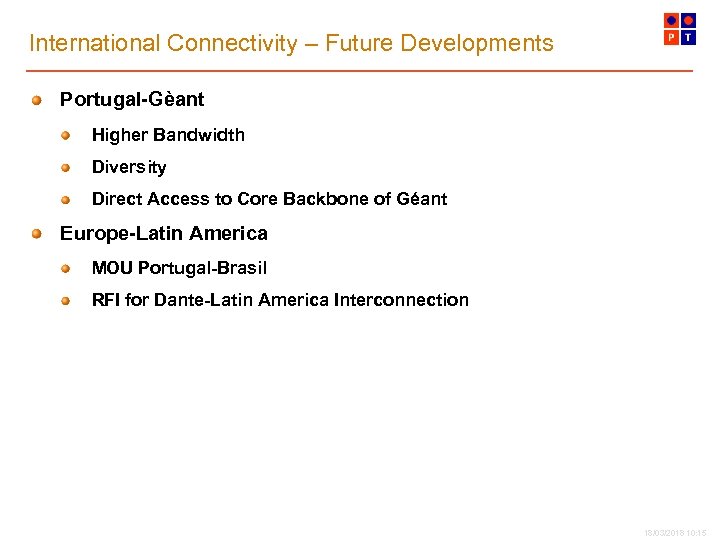

International Connectivity – Future Developments Portugal-Gèant Higher Bandwidth Diversity Direct Access to Core Backbone of Géant Europe-Latin America MOU Portugal-Brasil RFI for Dante-Latin America Interconnection 18/03/2018 10: 15

18/03/2018 10: 15

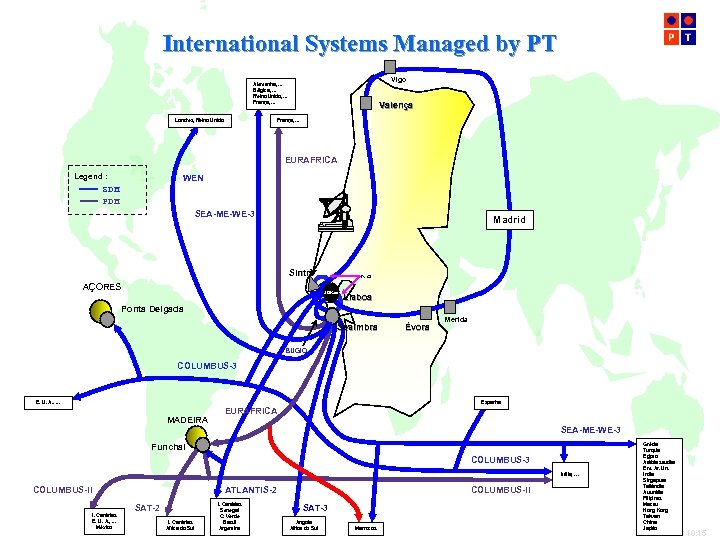

International Systems Managed by PT Vigo Alemanha, . . . Bélgica, . . . Reino Unido, . . . França, . . . Londres, Reino Unido Valença França, . . . EURAFRICA Legend : WEN SDH PDH SEA-ME-WE-3 Madrid Sintra AÇORES F. O. 50 Km Lisboa Ponta Delgada Sesimbra Évora Merida BUGIO COLUMBUS-3 E. U. A. . . MADEIRA Espanha EURAFRICA SEA-ME-WE-3 Funchal COLUMBUS-3 Itália, … COLUMBUS-II I. Canárias E. U. A. , . . . México ATLANTIS-2 SAT-2 I. Canárias África do Sul I. Canárias Senegal C. Verde Brasil Argentina COLUMBUS-II SAT-3 Angola África do Sul Marrocos Grécia Turquia Egipto Arábia saudita Em. Ar. Un. Índia Singapura Tailândia Austrália Filipinas Macau Hong Kong Taiwan China Japão 18/03/2018 10: 15

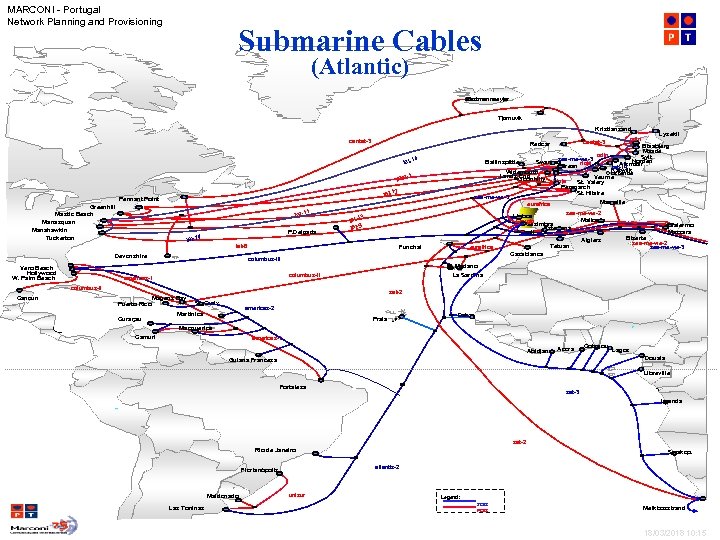

MARCONI - Portugal Network Planning and Provisioning Submarine Cables (Atlantic) Vestmannaeyjar Tjornuvik Kristiansand cantat-3 tat-12 1 tat-1 P. Delgada tat-14 Devonshire Vero Beach Hollywood W. Palm Beach 3 tat-1 tat-9 tat-8 Funchal Puerto Rico Magens Bay Curaçau sea-me-we-2 Lisboa Mallorca bugio Sesimbra Estepona Conil Algiers Tetuan Casablanca mat-2 Palermo Mazzara Bizerte sea-me-we-2 sea-me-we-3 El Medano La Sardina columbus-II Cancun eurafrica columbus-III americas-1 Lysekil Ballinspittle 1 ptat- Greenhill Mastic Beach Manasquan Manahawkin Tuckerton odin Blaabjerg Maade odin Sylt sea-me-we-3 Norden Swansea rioja Alkmaar Brean tat-14 Katwijk Widemouth Oostende Lands End Veurne Goonhilly rioja St. Valery Penmarch St. Hilaire sea-me-we-3 Marseille eurafrica 4 tat-1 Pennant Point cantat-3 Redcar sat-2 St. Croix americas-2 Martinica Praia Dakar Macqueripe Camuri americas-1 Abidjan Accra Cotonou Lagos Douala Guiana Francesa Libreville Fortaleza sat-3 Luanda sat-2 Rio de Janeiro atlantis-2 Florianópolis Maldonado Las Toninas Swakop. unisur Legend : SDH PDH Melkbosstrand 18/03/2018 10: 15

8ad65128e0f42f96fa09695bf3b0e3ef.ppt